1. Introduction

Pricing models are approaches how organisations determine their prices of products or services; these models are based on factors such as costs, market demand, competition, and perceived value [

1].

Pricing models in the healthcare sector play a crucial role in determining how medical services are billed and reimbursed. These models also influence the affordability/costs of care provided to patients. Over the years, different pricing models have evolved to balance cost efficiency and patient satisfaction. Among the various models, the most common ones are the Fee-for-Service (FFS), Capitation, Value-Based Pricing (VBP), Bundled Payments, and Subscription-Based models.

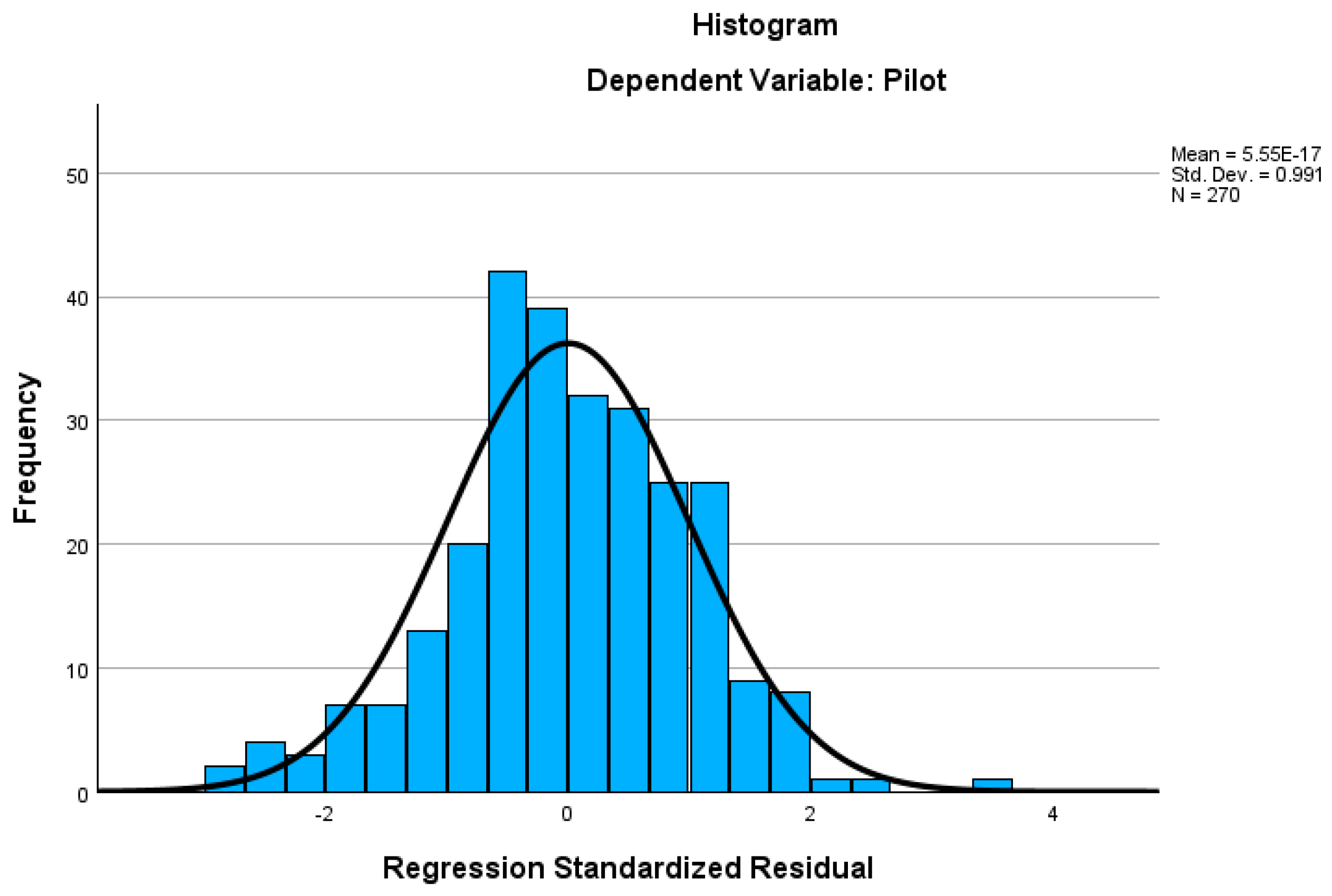

One of the most prevalent models in traditional healthcare is the Fee-for-Service (FFS) model. Under this system, healthcare providers are compensated for each individual service, test, or procedure. For example, a patient undergoing surgery would receive separate bills for the consultation, the procedure itself, the hospital stay, and post-operative care. This model ensures that providers are reimbursed to the full extent of the care given. Critics argue that it incentivises excessive service utilisation, resulting in inflated medical costs [

2].

The Capitation model offers a fixed, prepaid amount to healthcare providers per patient over a specific period regardless of the actual services utilised. While capitation encourages preventive care, there is concern that it might lead to under-treatment as providers may attempt to minimise services to stay within the budget [

3].

The Value-Based Pricing (VBP) model, also known as Pay-for-Performance (P4P), seeks to address inefficiencies in traditional healthcare pricing by linking provider reimbursement to patient health outcomes. Instead of paying for the quantity of services rendered, insurers reward healthcare providers for improving a patient`s health. A major challenge is the accurate measurement of a patient’s health [

4].

Another approach, the Bundled Payments model, consolidates multiple services into a single payment for an entire episode of care. For instance, a hospital may charge a fixed price for a knee replacement procedure that includes pre-operative consultations, surgery, rehabilitation, and follow-up visits. By reducing administrative complexity and bundled payments, it should lead to higher efficiency. However, it can be difficult to implement this model across multiple healthcare providers who need to agree on cost-sharing arrangements [

5].

With the rise of telemedicine, Subscription-Based models have gained popularity. This approach allows patients to pay a recurring fee (monthly or annually) for unlimited access to healthcare services. Telehealth companies offer subscription-based plans that grant members virtual consultations and preventive care. This model ensures predictable costs and enhanced accessibility, though it may not cover all medical procedures, requiring additional out-of-pocket expenses for specialised care [

6]. Predominant pricing models differ from country to country; see

Table 1. The Fee-for-Service model remains the most common in the United States.

As the financial sector moves forward, Artificial Intelligence (AI) fintech models are likely to play a greater role in future [

8]. AI in payment systems can be used for predictive analytics, fraud detection, and personalisation [

9]. For example, the benefits of AI-driven Subscription models include personalisation. Patients pay for what they use, making healthcare more affordable. In addition, there is cost efficiency in the sense that providers reduce administrative costs by optimising pricing in real time. Hopefully, this way, patients stay motivated to follow healthier habits when rewarded with lower fees. AI could also flag high-risk patients, helping insurers and clinics adjust their prices accordingly. AI could also track treatment progress, ensuring that payments only trigger when health outcomes improve (e.g., improved blood sugar levels for diabetics). It could go that far that a patient pays nothing if a prescribed therapy does not show expected results. This is a model that the medical trade may disagree with.

AI-driven pricing models must analyse various data to calculate subscription fees, namely the following:

Usage-Based Pricing: Subscription costs adjust based on the frequency of doctor visits, telehealth consultations, or prescription refills. Example: A patient who uses telehealth once a month pays less than someone who consults weekly;

Predictive Health Risk Assessment: AI evaluates a patient’s health history and lifestyle to predict future healthcare needs and adjust pricing accordingly. Example: A diabetic patient who actively manages his/her/their health may receive a lower subscription cost than one with unmanaged symptoms;

Tiered and Dynamic Pricing: AI can segment patients into different pricing categories based on their engagement and risk profile. Example: A fitness-conscious user with a wearable health device showing high activity levels should pay less for a healthcare plan;

Behaviour-Based Discounts: AI can track preventive care habits (e.g., regular exercises, diet tracking, medication adherence) and offer discounted subscription rates. Example: An app-linked smart scale or smartwatch can reward users who maintain a healthy weight or exercise regularly;

Adaptive Payment Plans: AI can detect financial hardship patterns and offer flexible payment plans for patients struggling with payments. Example: If a patient’s income fluctuates (e.g., freelancer), AI can adjust monthly fees accordingly.

There are already real-world applications in the form of telehealth platforms such as Teladoc and Babylon Health. Devices like the Apple Watch and Fitbit can potentially integrate with insurers for dynamic premium adjustments. AI-powered diabetes management apps (e.g., Livongo) can tailor subscription fees based on a patient’s engagement. PayZen is a fintech company specialising in providing “Care Now, Pay Later” (CNPL) solutions to address the growing challenge of medical debt in the United States. By leveraging AI, PayZen offers patients personalised, interest-free payment plans for their healthcare expenses, aiming to make medical treatments more accessible and affordable [

10] (FinMasters, 2023). This approach enhances the likelihood of repayment and increases acceptance rates among patients. In collaboration with Mastercard, PayZen introduced a Buy-Now-Pay-Later (BNPL) card specifically designed for medical expenses. This card, available in both physical and virtual forms, allows patients to manage their healthcare payments more flexibly [

10].

The BNPL model is widely used in retailing to make purchases more accessible by allowing consumers to split payments into instalments. Lupșa-Tătaru et al. [

11] in their article “Buy Now Pay Later—A Fad or a Reality?” concluded that it is not a fad but that there are overspending risks involved, especially for young consumers. BNPL might be a new concept in healthcare but in sectors like retailing, where it is most common, prices are often quoted in instalments per month instead of the full price.

All European countries struggle to finance healthcare [

12]. In countries where healthcare is “free” (e.g., Canada, Portugal, Romania, Spain), the quality is generally poor. In addition, “free healthcare” does not mean that healthcare is completely without cost; most systems are funded through income taxes (e.g., Portugal) or social (national health) insurance (e.g., France, Germany, Romania, Switzerland). For example, in Germany, one has to pay 14.6% of a normal (below EUR 5500 per month) income for national health plus an additional 3.6% for compulsory care insurance (equally shared with employer), which is still not enough, so the government is forced to subsidise [

13]. The BNPL model could be advisable for countries like France, Germany, and other European countries due to Europe’s economic challenges and healthcare accessibility issues. Europe’s “free” public healthcare system faces long waiting times due to resource constraints, leading many patients to seek private care. In addition, not all services are free, so patients have to co-finance, but high inflation and cost of living pressures have reduced their disposable incomes. Studies have shown that financial concerns prevent people from seeking timely medical care, leading to worse health outcomes and higher long-term costs [

14]. Implementing BNPL in Europe’s “free” healthcare sector could be a win–win solution by improving patient access to care, reducing financial stress, and supporting private healthcare providers in securing payments.

Free healthcare implies that medical services are provided at no direct cost to the patient at the point of use, often funded entirely through taxation. In contrast, universal healthcare refers to a system in which all citizens have access to necessary health services, but this access may still involve co-payments, insurance premiums, or other out-of-pocket costs, depending on the country’s model.

A BNPL (Buy Now Pay Later) model could be realistically applied in non-urgent, elective, and out-of-pocket medical services, where patients often face significant cost barriers. For key areas, see

Figure 1. These services are typically discretionary or not fully covered by insurance, making them more compatible with consumer financing models like BNPL.

Table 2 shows the difference between BNPL models in retailing and healthcare.

How AI could enhance BNPL in healthcare:

Personalised Payment Plans: AI customises repayment schedules based on income, medical history, and financial behaviour;

Real-Time Credit Scoring: AI analyses non-traditional financial data (e.g., spending habits, employment stability), for instance BNPL approvals;

Predictive Risk Assessment: AI detects potential overdue payments and proactively suggests adjustments (e.g., lower monthly payments);

Automated Fraud Detection: AI identifies high-risk transactions and prevents fraudulent BNPL applications.

Khezr et al. [

15] outlined how blockchain technology can revolutionise healthcare. One could imagine an integration with cryptocurrencies and smart contracts. AI could automate subscription pricing using blockchain-based smart contracts including wearable BNPL plans (AI analyses health data from smartwatches and fitness trackers to adjust payment options). Blockchain-powered BNPL will be secure and be decentralised medical financing with automatic payment tracking. By integrating these technologies, BNPL platforms can offer secure, transparent, and automated payment solutions while reducing fraud and operational costs. A potential addition could be the combination with the medical Internet of Things (IoT) as outlined by Sharma et al. [

16], which will not be further explored in the context of our research. The features of crypto and smart-contract BNPL are as follows:

Decentralised Payments: Patients can use stablecoins or healthcare-specific tokens to pay for medical services over time;

Smart Contract Automation: Self-executing contracts ensure automatic payments, refunds, and compliance based on pre-decentralised financing rules;

Transparent and Fraud-Proof Transactions: Blockchain records every BNPL transaction, reducing disputes and ensuring trust;

Lower Processing Fees: Eliminates intermediaries like banks, reducing transaction costs for both patients and providers.

However, there are three major challenges:

Cryptocurrency Volatility: Using stablecoins (e.g., EUR Tether, EURS) instead of volatile cryptocurrencies could be the answer. Even more secure would be a Fiat cryptocurrency as outlined by Salhout and Bechter [

17].

Regulatory Uncertainty: Boustani and Elisabetta [

18]. rightly asked, “How does a decentralized type of governance handle compliance and regulatory requirements? What happens if the majority of token owners in a decentralized voting system choose to abstain from voting for compliance upgrades or financial anti-money laundering requirements?” The answers can only lie in well-defined regulations regarding security and compliance. In other words, regulators must catch up and define clear rules. The deregulated community has to bite the bullet;

Adoption Barriers: One may encourage practitioners and other medical services providers to accept crypto payments but nobody can be forced. This is the real bottleneck of a successful implementation. Our field research looked deeper into these barriers.

The gap in existing literature on BNPL in healthcare is the lack of research on the intersection of consumer finance innovation (FinTech) and healthcare access, particularly within the context of decentralised finance, tokenisation, and AI-driven pricing models. While BNPL is well-studied in retail and increasingly in fintech contexts, its application in healthcare remains underexplored, especially regarding the perceptions and acceptance among medical professionals.

As healthcare systems worldwide explore digital transformation in financing models, innovations such as Buy-Now-Pay-Later (BNPL), blockchain, and AI-powered payment solutions offer new pathways for improving affordability and operational efficiency. However, the healthcare sector often exhibits resistance to adopting financial technologies that are already common in consumer markets. To better understand this phenomenon, this study adopted Innovation Resistance Theory (IRT) [

19] as a guiding framework. IRT highlights how individuals and institutions may resist innovations due to perceived risks, lack of familiarity, traditional values, or doubts about usefulness. Barriers are especially relevant in professional healthcare settings, where financial and ethical stakes are high. By applying IRT to the intersection of healthcare and fintech, this study sought to explain not only patterns of adoption but also the psychological and contextual barriers that inhibit technological integration in medical practice.

The research objectives of our research were thus:

To assess healthcare professionals’ perceptions and levels of awareness regarding blockchain and BNPL technologies as emerging tools for medical payment innovation;

To identify key psychological and structural barriers to the adoption of these technologies, using Innovation Resistance Theory (IRT) to examine constructs such as knowledge, risk, usage, and tradition-related resistance;

To explore the extent to which trust, openness to innovation, and perceived regulatory uncertainty influence willingness to pilot or adopt blockchain-based BNPL solutions in healthcare practice;

To investigate whether individual lifestyle characteristics and attitudes toward related technologies (e.g., AI) moderate acceptance, serving as indicators of digital readiness rather than core components of the conceptual framework.

2. Materials and Methods

Table 3 shows the mapping of each of our survey items to the corresponding Innovation Resistance Theory (IRT) construct. IRT includes six main types of barriers: Usage, Value, Risk, Tradition, Image, and Knowledge.

During the first quarter of 2025, 366 quantitative surveys were obtained from European practitioners and medical service providers. The aim of our field research was the evaluation of perceptions and state of knowledge regarding cryptocurrencies, blockchain, and smart contracts, see

Appendix A. In total, 366 responses were analysed. Out of the 366 persons, 203 (55.5%) were medical doctors. The remaining ones were other healthcare specialists such as administrators. The demographics of the sample are listed in

Table 4 and

Table 5.

We also asked some lifestyle questions about how they relax and how they keep their knowledge updated; see

Table 6 and

Table 7. By asking these questions, we explored whether a “modern” or tech-oriented lifestyle correlates with greater acceptance of digital innovations in healthcare. Venkatesh et al. [

20] found that technology adaptation correlates with tech-savviness and a more modern lifestyle.

The potential of cryptocurrencies and blockchains in financing healthcare is enormous, but the implementation depends on the people involved, especially on their perceptions; see

Figure 2. In our research approach, we followed Innovation Resistance Theory (IRT) [

19].

This study aimed to evaluate the perceptions, awareness, and acceptance of emerging blockchain-based financial technologies, specifically cryptocurrencies, smart contracts, and BNPL) models, among medical professionals. The objective was to understand the readiness and potential resistance within the healthcare sector to adopting decentralised payment systems. While blockchain and fintech innovations are increasingly discussed in healthcare finance (e.g., patient billing automation, transparent records, and decentralised insurance), the existing research has primarily focused on technical feasibility and institutional deployment. There is a gap in empirical studies assessing healthcare professionals’ attitudes toward these technologies. Few studies have explored how physicians and administrators perceive tokenised payment systems or BNPL solutions in clinical contexts. Addressing this gap is critical for evaluating the feasibility and ethical implications of integrating such technologies in patient care.

The survey items can be interpreted through the lens of Innovation Resistance Theory (IRT), which explains why individuals may resist adopting modern technologies despite potential benefits. Questions expressing distrust, age-related hesitation, or concern over regulatory uncertainty align with functional barriers (e.g., usage and risk) and psychological barriers (e.g., tradition and image) outlined in IRT. Items reflecting a lack of familiarity or perceived practitioner unawareness correspond to the knowledge barrier, a key precursor to resistance. Conversely, questions indicating curiosity, willingness to pilot new systems, or support for behaviour-based incentives demonstrate potential pathways to overcoming resistance through compatibility and perceived value. Overall, the responses can help identify which types of resistance dominate and what strategies may facilitate the acceptance of disruptive health technologies like AI, blockchain, and cryptocurrency-based payments.

4. Discussion and Implementation

Our findings are in line with previous research conducted by [

26] Govindarajan et al. in the sense that there are many barriers to fully accepting modern technologies such as cryptocurrencies in healthcare. AI is accepted as a force that will shape the years to come [

27,

28]. However, there are concerns about the legality of cryptocurrencies [

29,

30].

The observed reluctance among healthcare professionals to adopt cryptocurrency-based payment systems aligns with prior research on institutional resistance to financial innovation in highly regulated sectors. Studies have shown that healthcare organisations are particularly cautious in adopting unregulated technologies due to perceived risks around compliance, accountability, and data integrity [

31,

32]. Furthermore, regulatory uncertainty, such as in evolving guidelines under the EU’s MiCA framework, contributes to an environment where novel financial tools are met with scepticism [

33]. This resistance can also be understood through the lens of Innovation Resistance Theory, which highlights how risk and tradition barriers inhibit the uptake of technologies that diverge from established institutional practices [

19]. Additionally, empirical findings by [

25] McElheran et al. indicate that even in technologically advanced industries, AI and fintech adoption is often delayed by organisational inertia and legal ambiguity. Regulatory clarity and perceived legitimacy are essential for innovation acceptance in healthcare.

To fully integrate AI-powered BNPL with crypto payments and smart contracts, the system must include on-chain and off-chain components to ensure seamless financing, automation, and security. Below is a detailed breakdown of how it would work from a technical perspective.

System architecture and components:

AI-Powered Credit and Risk Assessment uses machine learning algorithms to analyse;

Patient’s financial history (bank accounts, crypto wallets, spending patterns);

On-chain activity (decentralised financing transactions, crypto staking, wallet balances);

Healthcare history (frequency of doctor visits, medical insurance claims);

The AI generation of a personalised BNPL plan with terms tailored to the risk profile.

Crypto staking is a process where cryptocurrency holders lock up a certain number of their digital assets in a specific blockchain network to support its operations such as validating transactions or securing the network. In return for staking their crypto, participants earn rewards (usually in the form of additional tokens or coins). This process is typically associated with Proof of Stake (PoS) and its variants, which are consensus mechanisms used by some cryptocurrencies.

A smart contract is created to manage the following:

Payment schedule (monthly or customised);

Crypto collateral requirements (if needed);

Automated penalties and rewards for early/late payments;

Instant fund distribution to healthcare providers;

Deployment on a public (e.g., Ethereum) or private (Hyperledger) blockchain;

Crypto payment processing and stablecoin integration.

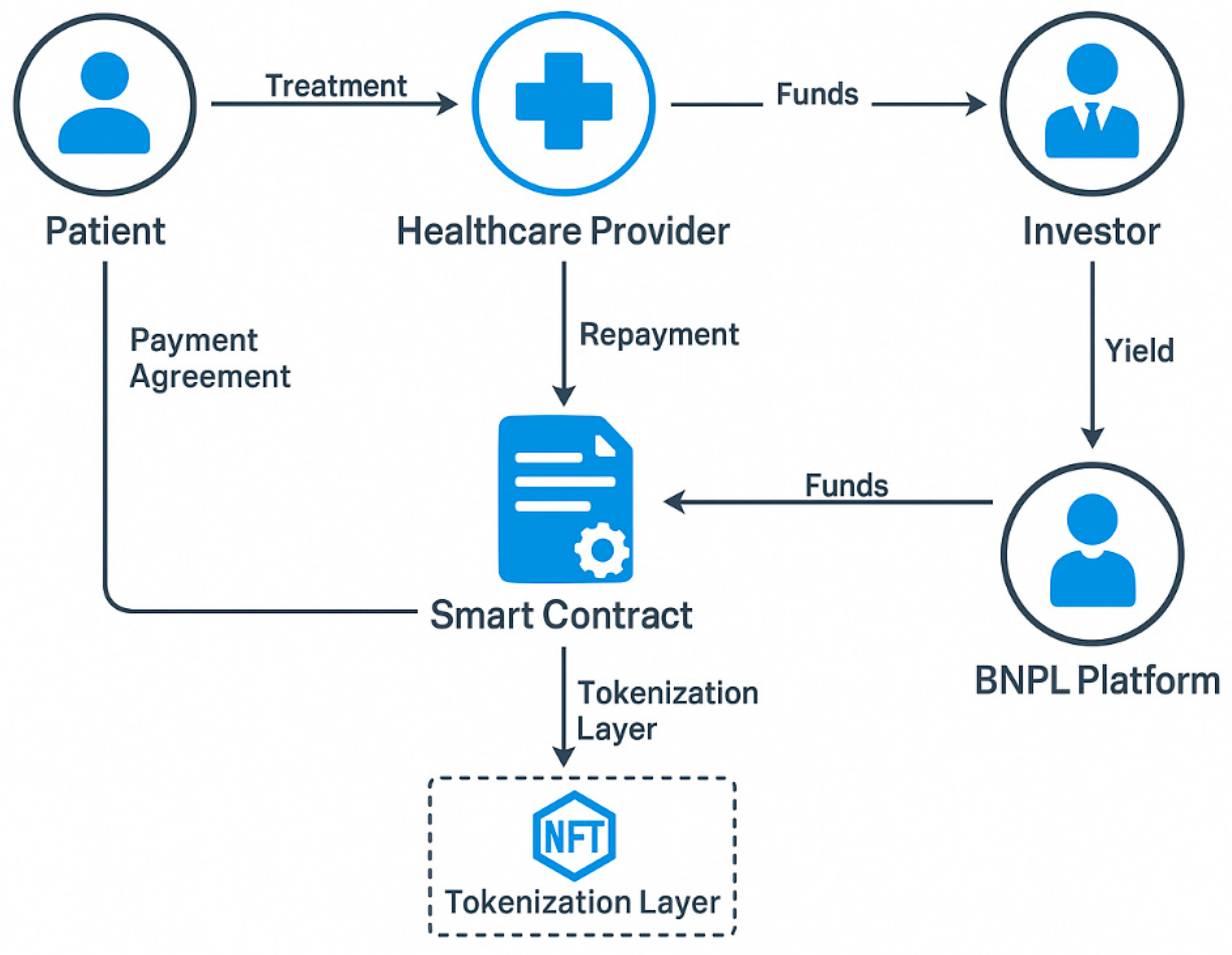

Healthcare BNPL could be tokenised into so-called NFTs (non-fungible tokens). Nunes et al. [

34] explored the potential applications of NFTs in healthcare, highlighting innovative solutions and challenges associated with integrating blockchain technology in the sector. As shown by [

35] Zhang et al., NFTs can effectively hedge against traditional financial assets when used as long positions. NFTs can hedge because these healthcare tokens are somewhat uncorrelated with mainstream markets. This diversification effect will reduce overall portfolio risk during traditional market downturns, assuming that the NFT market behaves independently or inversely.

Patients could tokenise BNPL agreements as NFTs for trading on decentralised financing lending platforms and investors could fund BNPL pools in return for yield from patient repayments. Healthcare providers could then use BNPL-backed assets as collateral.

Figure 6 illustrates a decentralised BNPL model in healthcare, where patients receive treatment from providers while entering a smart-contract-based repayment agreement. The smart contract manages the flow of funds between patients, providers, BNPL platforms, and investors with the option to tokenize the debt as NFTs for trade or collateral. This system leverages blockchain technology to automate, secure, and potentially decentralize healthcare financing.

The integration of tokenised BNPL agreements with decentralised financing lending pools can revolutionise healthcare financing by transforming patient debt into tradeable assets. This model allows investors to fund medical loans, hospitals to gain liquidity, and patients to access care without upfront costs. Tokenisation converts BNPL agreements into digital assets (NFTs or security tokens) recorded on a blockchain. These assets represent a patient’s outstanding medical balance and can be traded or used as collateral in decentralised finance lending markets. To implement tokenised BNPL for healthcare, it needs smart contracts that automate: loan issuance, payment tracking, default handling, and tokenisation. Tokenisation converts BNPL agreements into digital assets recorded on a blockchain. However, tokenising BNPL agreements in healthcare could introduce systemic financial risks like those seen in the 2008 US mortgage crisis. Just like mortgage-backed securities bundled subprime loans, tokenised BNPL agreements could be packaged and traded as financial assets. If healthcare BNPL debts are issued to high-risk patients who struggle to repay, these tokenised assets could become overvalued and unstable. A lack of regulation in tokenised debt markets could lead to predatory lending, where patients are offered BNPL without proper risk assessment. If speculative trading increases, healthcare debt could be treated like a financial commodity rather than a human necessity. However, there is a long way to go before this risk factor may come into play. A token economy in healthcare would involve the utilisation of blockchain-based tokens such as NFTs representing patient debt. These tokens would be tradeable, allowing investors to fund patient care by purchasing them in exchange for yield from future repayments. Sustainability would require transparent governance, regulatory compliance, and robust smart contracts to ensure trust. Additionally, patient data privacy must be protected through secure and anonymised token design. Long-term viability depends on the future adoption.

There were limitations in our study. We surveyed medical professionals but not health insurance providers. These may have a more forward-looking perspective; nor did we include government officials. Like any other technology, blockchains (or distributed server systems) have to prove that they become mainstream and are manageable. The acceptance and tradability of BNPL NFTs has not been evaluated.