The Role of Financial Sanctions and Financial Development Factors on Central Bank Digital Currency Implementation

Abstract

1. Introduction

| Themes | Significant Drivers | References |

|---|---|---|

| Economic developmental factors | High level of democracy, public confidence in governance, regulatory quality, income inequality, FDI inflow, young populations, urban societies | [13,14] |

| Financial factors | Higher levels of financial inclusion, net foreign assets, remittances, income | [11] |

| Cultural factors | High power distance, masculinity, and long-term orientation | [15] |

| A mix of one or more of the above factors | Government performance, inflation rate, economic inequality, technological literacy, anti-money laundering, and terrorist financing | [16,17] |

| CBDC Implications | Enhance the effectiveness of current monetary policy instruments, financial inclusion, financial stability, Inclusive welfare | [18,19,20,21] |

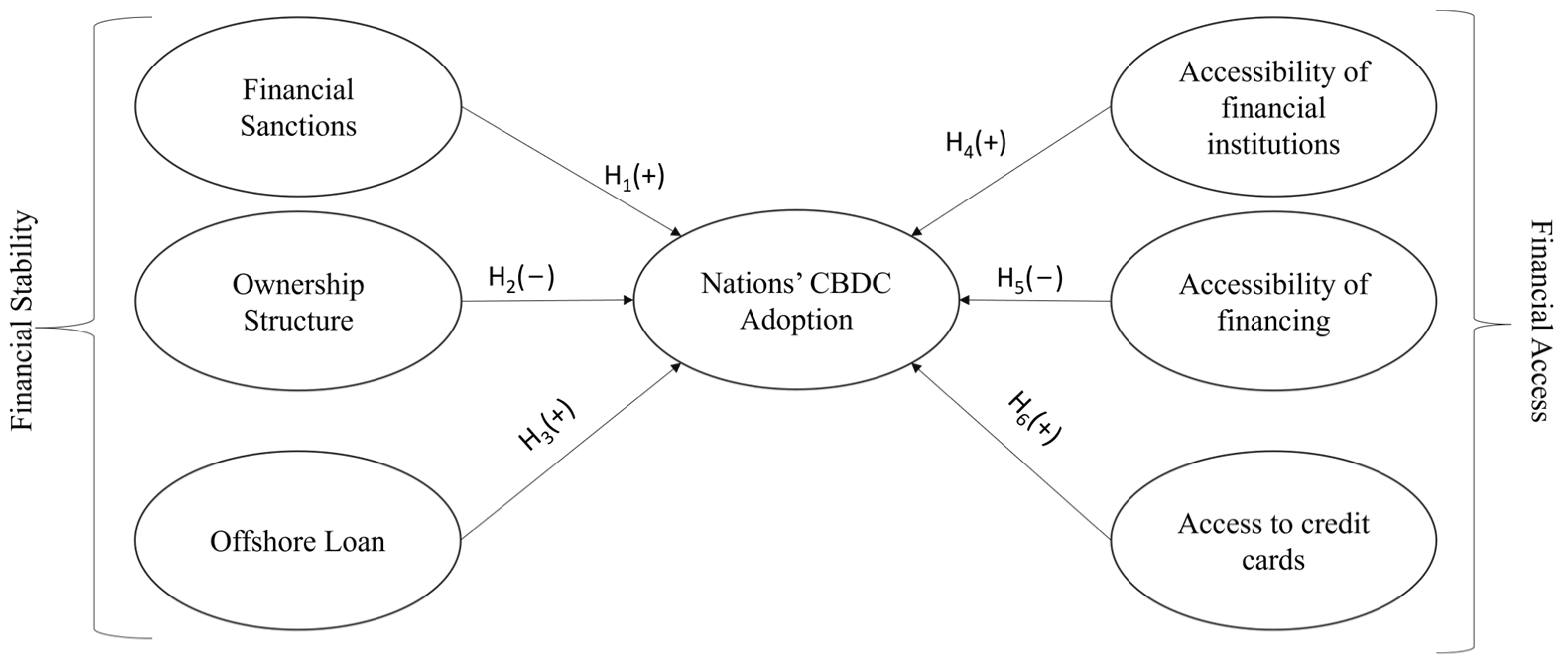

2. Conceptual Background and Hypothesis Development

2.1. Financial Stability

2.1.1. Financial Sanction

2.1.2. Ownership Structure

2.1.3. Offshore Loan

2.2. Access to Finance

2.2.1. Accessibility of Financial Institutions

2.2.2. Accessibility of Financing

3. Data and Methods

- Accessibility of financial institutions: this was measured as the percentage of respondents who neither deposited nor withdrew funds from their accounts in the past year, including those engaging in any form of digital payment.

- Availability of financing for firms: this is gauged by the percentage of firms that use banks to finance the acquisition of fixed assets.

- Access to credit cards: this variable was determined by the percentage of respondents who reported having credit cards.

- Offshore Loan: this is represented by the outstanding amount of debt securities held by offshore investors as a percentage of the GDP.

- Foreign investment: this variable is expressed as the percentage of foreign banks out of the total number of banks.

- Financial sanction: this variable captures the presence of global sanctions impacting financial stability.

4. Results

4.1. Analysis of Model Fit

4.2. Statistical Significance

5. Discussion and Directions for Future Research

5.1. Discussion

5.1.1. Central Bank Digital Currencies and Nations’ Financial Stability

5.1.2. Central Bank Digital Currencies and Nations’ Access to Finance

5.2. Practical Implications and Direction for Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Indicator Code in Our Study | Indicator Name | Definition | Source | Code at Source | |

|---|---|---|---|---|---|

| Access | FINA | Owns a credit card (% age 15+) | The percentage of respondents who report having a credit card. | Global Financial Inclusion (Global Findex) Database, World Bank | Global Findex fin7_t_d |

| Access | TRUS | Has an inactive account (% age 15+) | The percentage of respondents who report neither a deposit into nor a withdrawal from their account in the past year. This also includes making or receiving any digital payment. | Global Financial Inclusion (Global Findex) Database, World Bank | Global Findex fin9N_10N_t_d |

| Access | FIRMCR | Firms using banks to finance investments (%) | Percentage of firms using banks to finance purchases of fixed assets. | Enterprise Surveys, World Bank | GFDD.AI.28 |

| Stability | DEBT | Debt securities by offshore investors (amounts outstanding) to GDP (%) | The ratio of outstanding offshore bank loans to GDP. An offshore bank is a bank located outside the country of residence of the depositor, typically in a low-tax jurisdiction (or tax haven) that provides financial and legal advantages. | Debt Securities Statistics (DSS), Bank for International Settlements (BIS). International debt securities—all issuers. | GFDD.OI.09 |

| Stability | OWN | Foreign banks among total banks (%) | Percentage of the number of foreign-owned banks to the number of the total banks in an Economy. A foreign bank is a bank where foreigners own 50 percent or more of its shares. | CLAESSENS, S. and VAN HOREN, N. (2014), “Foreign Banks: Trends and Impact”, Journal of Money, Credit and Banking, 46: 295–326. [57] CLAESSENS, S. and VAN HOREN, N. (2015), “The Impact of the Global Financial Crisis on Banking Globalization”, DNB WP No. 459 [58] | GFDD.OI.15 |

| Stability | SANC | Global Sanction dummy (1 = sanction exists on the country, 0 = none) | We considered the imposition of sanctions by various countries and on other nations, including: U.S. OFAC Sanctions: These sanctions can be either broad-based or targeted, involving measures such as asset freezes and trade restrictions to achieve foreign policy and national security objectives. Financial sanctions enforced by the United Kingdom. Sanctions imposed by the United Nations Security Council. Sanctions imposed by the European Union (EU). | https://ofac.treasury.gov/sanctions-programs-and-country-information (accessed on 12 February 2024) https://www.sanctionsmap.eu/#/main?checked=40 (accessed on 12 February 2024) https://www.gov.uk/government/collections/financial-sanctions-regime-specific-consolidated-lists-and-releases (accessed on 12 February 2024) | SELF CREATED |

| CBDC | CBDC refers to the status of countries’ adoption of CBDC. We assigned a value of 1 for countries in the research stage, 2 for countries that have published proof of concept, and 3 for countries that have advanced to the pilot and launch stages of CBDC. | https://cbdctracker.org/ (accessed on 12 February 2024) | SELF CREATED |

References

- Vermeiren, M. The Crisis of US Monetary Hegemony and Global Economic Adjustment. Globalizations 2013, 10, 245–259. [Google Scholar] [CrossRef]

- Salvatore, D. The Euro, the Dollar, and the International Monetary System. J. Policy Model. 2000, 22, 407–415. [Google Scholar] [CrossRef]

- Congressional Research Service. The U.S. Dollar as the World’s Dominant Reserve Currency. 2022. Available online: https://crsreports.congress.gov/ (accessed on 1 January 2024).

- Weiss, C. Geopolitics and the U.S. Dollar’s Future as a Reserve Currency. Int. Financ. Discuss. Pap. 2022, 2022, 1–37. [Google Scholar] [CrossRef]

- U.S. Department of Treasury. The Treasury Sanctions Review. 2021. Available online: https://home.treasury.gov/ (accessed on 1 January 2024).

- Selden, Z. Economic Sanctions as Instruments of American Foreign Policy, 1st ed.; Bloomsbury Publishing: London, UK, 1999. [Google Scholar]

- U.S. Department of Justice. Office Of Public Affairs. Available online: https://www.justice.gov/opa/speech/deputy-assistant-attorney-general-eun-young-choi-delivers-keynote-remarks-gir-live (accessed on 1 January 2024).

- Sedrakyan, G.S. Ukraine War-Induced Sanctions against Russia: Consequences on Transition Economies. J. Policy Model. 2022, 44, 863–885. [Google Scholar] [CrossRef]

- Náñez Alonso, S.L.; Jorge-Vazquez, J.; Reier Forradellas, R.F. Detection of Financial Inclusion Vulnerable Rural Areas through an Access to Cash Index: Solutions Based on the Pharmacy Network and a CBDC. Evidence Based on Ávila (Spain). Sustainability 2020, 12, 7480. [Google Scholar] [CrossRef]

- Yang, Q.; Zheng, M.; Wang, Y. The Role of CBDC in Green Finance and Sustainable Development. Emerg. Mark. Financ. Trade 2023, 59, 4158–4173. [Google Scholar] [CrossRef]

- Dong, Z.; Umar, M.; Yousaf, U.B.; Muhammad, S. Determinants of Central Bank Digital Currency Adoption—A Study of 85 Countries. J. Econ. Policy Reform 2023, 1–15. [Google Scholar] [CrossRef]

- Cihak, M.; Demirguc-Kunt, A.; Feyen, E.H.B.; Levine, R.E. Benchmarking Financial Systems Around the World (English); World Bank Group: Washington, DC, USA, 2012; Available online: http://documents.worldbank.org/curated/en/868131468326381955/Benchmarking-financial-systems-around-the-world (accessed on 1 January 2024).

- Mohammed, M.A.; De-Pablos-Heredero, C.; Montes Botella, J.L. Exploring the Factors Affecting Countries’ Adoption of Blockchain-Enabled Central Bank Digital Currencies. Future Internet 2023, 15, 321. [Google Scholar] [CrossRef]

- Alfar, A.J.K.; Kumpamool, C.; Nguyen, D.T.K.; Ahmed, R. The Determinants of Issuing Central Bank Digital Currencies. Res. Int. Bus. Financ. 2023, 64, 101884. [Google Scholar] [CrossRef]

- Luu, H.N.; Do, D.D.; Pham, T.; Ho, V.X.; Dinh, Q.-A. Cultural Values and the Adoption of Central Bank Digital Currency. Appl. Econ. Lett. 2023, 30, 2024–2029. [Google Scholar] [CrossRef]

- Ngo, V.M.; Van Nguyen, P.; Nguyen, H.H.; Thi Tram, H.X.; Hoang, L.C. Governance and Monetary Policy Impacts on Public Acceptance of CBDC Adoption. Res. Int. Bus. Financ. 2023, 64, 101865. [Google Scholar] [CrossRef]

- Le, T.D.Q.; Tran, S.H.; Nguyen, D.T.; Ngo, T. The Degrees of Central Bank Digital Currency Adoption across Countries: A Preliminary Analysis. Econ. Bus. Lett. 2023, 12, 97–104. [Google Scholar] [CrossRef]

- Chen, H.; Siklos, P.L. Central Bank Digital Currency: A Review and Some Macro-Financial Implications. J. Financ. Stab. 2022, 60, 100985. [Google Scholar] [CrossRef]

- Tercero-Lucas, D. Central Bank Digital Currencies and Financial Stability in a Modern Monetary System. J. Financ. Stab. 2023, 69, 101188. [Google Scholar] [CrossRef]

- Maryaningsih, N.; Nazara, S.; Kacaribu, F.N.; Juhro, S.M. Central Bank Digital Currency: What Factors Determine Its Adoption? Bull. Monet. Econ. Bank. 2022, 25, 1–24. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Jagtiani, J. Fintech, Cryptocurrencies, and CBDC: Financial Structural Transformation in China. J. Int. Money Financ. 2022, 124, 102625. [Google Scholar] [CrossRef]

- Peksen, D.; Woo, B. Economic Sanctions and the Politics of IMF Lending. Int. Interact. 2018, 44, 681–708. [Google Scholar] [CrossRef]

- Caruso, R. The Impact of International Economic Sanctions on Trade: An Empirical Analysis. Peace Econ. Peace Sci. Public Policy 2003, 9. [Google Scholar] [CrossRef]

- Kaempfer, W.H.; Lowenberg, A.D. Chapter 27 The Political Economy of Economic Sanctions; Elsevier: Amsterdam, Netherland, 2007; pp. 867–911. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Martinez Peria, M.S. Banking Services for Everyone? Barriers to Bank Access and Use around the World. World Bank Econ. Rev. 2008, 22, 397–430. [Google Scholar] [CrossRef]

- Spendzharova, A.B. Banking Union under Construction: The Impact of Foreign Ownership and Domestic Bank Internationalization on European Union Member-States’ Regulatory Preferences in Banking Supervision. Rev. Int. Polit. Econ. 2014, 21, 949–979. [Google Scholar] [CrossRef]

- Luu, H.N.; Nguyen, C.P.; Nasir, M.A. Implications of Central Bank Digital Currency for Financial Stability: Evidence from the Global Banking Sector. J. Int. Financ. Mark. Inst. Money 2023, 89, 101864. [Google Scholar] [CrossRef]

- Grennes, T.; Caner, M.; Koehler-Geib, F. Finding the Tipping Point—When Sovereign Debt Turns Bad; Policy Research Working Papers; The World Bank: Washington, DC, USA, 2010. [Google Scholar] [CrossRef]

- International Monetary Fund. Building Strong Banks Through Surveillance and Resolution; International Monetary Fund: Washington, DC, USA, 2002. [Google Scholar] [CrossRef]

- Ahmed, J.; Mughal, M.; Martínez-Zarzoso, I. Sending Money Home: Transaction Cost and Remittances to Developing Countries. World Econ. 2021, 44, 2433–2459. [Google Scholar] [CrossRef]

- Bank of England. Central Bank Digital Currency Opportunities, Challenges and Design. 2020. Available online: https://www.bankofengland.co.uk/-/media/boe/files/paper/2020 (accessed on 1 January 2024).

- International Monetary Fund. Available online: https://www.imf.org/external/datamapper/LP@WEO/OEMDC/ADVEC/WEOWORLD/ARG (accessed on 12 February 2024).

- Didenko, A.N.; Buckley, R.P. Central Bank Digital Currencies as a Potential Response to Some Particularly Pacific Problems. Asia Pacific Law Rev. 2022, 30, 44–69. [Google Scholar] [CrossRef]

- Kochergin, D.A. Central Banks Digital Currencies: World Experience. Mirovaia Ekon. I Mezhdunarodnye Otnos. 2021, 65, 68–77. [Google Scholar] [CrossRef]

- Jabbar, A.; Geebren, A.; Hussain, Z.; Dani, S.; Ul-Durar, S. Investigating Individual Privacy within CBDC: A Privacy Calculus Perspective. Res. Int. Bus. Financ. 2023, 64, 101826. [Google Scholar] [CrossRef]

- Singh, S.; Gupta, S.; Kaur, S.; Sapra, S.; Kumar, V.; Sharma, M. The Quest for CBDC: Indentifying and Prioritising the Motivations for Launching Central Bank Digital Currencies in Emerging Countries. Qual. Quant. 2023, 57, 4493–4508. [Google Scholar] [CrossRef]

- Wronka, C. Central Bank Digital Currencies (CBDCs) and Their Potential Impact on Traditional Banking and Monetary Policy: An Initial Analysis. Digit. Financ. 2023, 5, 613–641. [Google Scholar] [CrossRef]

- Gawer, A.; Cusumano, M.A. Industry Platforms and Ecosystem Innovation. J. Prod. Innov. Manag. 2014, 31, 417–433. [Google Scholar] [CrossRef]

- Abdul-Muhmin, A.G.; Umar, Y.A. Credit Card Ownership and Usage Behaviour in Saudi Arabia: The Impact of Demographics and Attitudes toward Debt. J. Financ. Serv. Mark. 2007, 12, 219–234. [Google Scholar] [CrossRef]

- Gan, L.L.; Maysami, R.C.; Chye Koh, H. Singapore Credit Cardholders: Ownership, Usage Patterns, and Perceptions. J. Serv. Mark. 2008, 22, 267–279. [Google Scholar] [CrossRef]

- Harrell, F.E. Regression Modeling Strategies; Springer Series in Statistics; Springer International Publishing: Cham, Switzerland, 2015. [Google Scholar] [CrossRef]

- CBDC Tracker. Available online: https://cbdctracker.org/timeline (accessed on 15 June 2023).

- Atlantic Council. Available online: https://www.atlanticcouncil.org/cbdctracker/ (accessed on 17 January 2024).

- Xu, J. Developments and Implications of Central Bank Digital Currency: The Case of China E-CNY. Asian Econ. Policy Rev. 2022, 17, 235–250. [Google Scholar] [CrossRef]

- Crozet, M.; Hinz, J. Friendly Fire: The Trade Impact of the Russia Sanctions and Counter-Sanctions. Econ. Policy 2020, 35, 97–146. [Google Scholar] [CrossRef]

- EU Sanctions Map. Available online: https://www.sanctionsmap.eu/ (accessed on 17 January 2024).

- Gloria, E.V. Justifying Economic Coercion: The Discourse of Victimhood in China’s Unilateral Sanctions Policy. Pac. Rev. 2023, 36, 521–551. [Google Scholar] [CrossRef]

- Guo, L.; Wang, S.; Xu, N.Z. US Economic and Trade Sanctions against China: A Loss-Loss Confrontation. Econ. Polit. Stud. 2023, 11, 17–44. [Google Scholar] [CrossRef]

- Cohen, B.J. The Yuan Tomorrow? Evaluating China’s Currency Internationalisation Strategy. New Polit. Econ. 2012, 17, 361–371. [Google Scholar] [CrossRef]

- Wang, H. How to Understand China’s Approach to Central Bank Digital Currency? Comput. Law Secur. Rev. 2023, 50, 105788. [Google Scholar] [CrossRef]

- Wenker, K. Retail Central Bank Digital Currencies (CBDC), Disintermediation and Financial Privacy: The Case of the Bahamian Sand Dollar. FinTech 2022, 1, 345–361. [Google Scholar] [CrossRef]

- Alonso, S.L.N. Can Central Bank Digital Currencies Be Green and Sustainable? Green Financ. 2023, 5, 603–623. [Google Scholar] [CrossRef]

- Banerjee, S.; Sinha, M. Promoting Financial Inclusion through Central Bank Digital Currency: An Evaluation of Payment System Viability in India. Australas. Account. Bus. Financ. J. 2023, 17, 176–204. [Google Scholar] [CrossRef]

- Esoimeme, E. A Critical Analysis of the Effects of the Central Bank of Nigeria’s Digital Currency Named ENaira on Financial Inclusion and AML/CFT Measures. SSRN Electron. J. 2021. [Google Scholar] [CrossRef]

- Ahiabenu, K. A Comparative Study of the Design Frameworks of the Ghanaian and Nigerian Central Banks’ Digital Currencies (CBDC). FinTech 2022, 1, 235–249. [Google Scholar] [CrossRef]

- Sanchez-Roger, M.; Puyol-Antón, E. Digital Bank Runs: A Deep Neural Network Approach. Sustainability 2021, 13, 1513. [Google Scholar] [CrossRef]

- Claessens, S.; Van Horen, N. Foreign banks: Trends and impact. J. Money Credit. Bank. 2014, 46, 295–326. [Google Scholar] [CrossRef]

- Claessens, S.; Van Horen, N. The impact of the global financial crisis on banking globalization. IMF Econ. Rev. 2015, 63, 868–918. [Google Scholar] [CrossRef]

| Variables Description | Label | Value and Description | Variable Type | References |

|---|---|---|---|---|

| Country retail CBDC adoption | CBDC | Dependent variable | Ordinal | |

| Financial sanctions on nations | SANC | Positive | Dummy | [6,22,23,24] |

| Accessibility of financial institutions | ACC | Positive | Numeric | [25,32,33] |

| Availability of credit financing to firms | FIRMCR | Negative | Numeric | [36,37] |

| Offshore bank loans | DEBT | Positive | Numeric | [28,29,30] |

| Foreign-owned banks | OWN | Negative | Numeric | [25,26,27] |

| Credit card ownership | FINA | Positive | Numeric | [36] |

| Number of Obs | 40 | |||||

|---|---|---|---|---|---|---|

| Log−likelihood | −22.540485 | |||||

| LR chi2(6) | 28.03 | |||||

| Pseudo R2 | 0.3834 | |||||

| Prob > chi2 | 0.0001 | |||||

| CBDC | Coefficient | Std. err. | z | p > z | [95% Conf. Interval] | |

| SANC | 3.47084 | 1.791629 | 1.94 | 0.053 | −0.0406887 | 6.982369 |

| ACC | 0.3207459 | 0.1265858 | 2.53 | 0.011 | 0726422 | 0.5688495 |

| FIRMCR | −0.1253228 | 0.0428092 | −2.93 | 0.003 | −0.2092273 | −0.0414184 |

| DEBT | 0.1106195 | 0.051294 | 2.16 | 0.031 | 0.010085 | 0.211154 |

| OWN | −0.0001059 | 0.0249527 | −0.00 | 0.997 | −0.0490122 | 0.0488005 |

| FINA | 0.0881731 | 0.0329024 | 2.68 | 0.007 | 0.0236855 | 0.1526607 |

| /cut1 | 1.641014 | −1.512674 | 4.794701 | |||

| /cut2 | 3.959928 | 0.4491786 | 7.470678 | |||

| Coeff. p > z | Result | ||

|---|---|---|---|

| H1 | Financial sanction (SANC) → Adoption of retail CBDCs | (β = 3.47, p = 0.05) | Pass |

| H2 | Access to banks (ACC) → Adoption of retail CBDCs | (β = 0.32, p = 0.01) | Pass |

| H3 | Availability of credit financing to firms (FIRMCR) → Adoption of retail CBDCs | (β = −0.12, p = 0.003) | Pass |

| H4 | Offshore bank loans (DEBT) → Adoption of retail CBDCs | (β = 0.11, p = 0.03) | Pass |

| H5 | Foreign-owned banks (OWN) → Adoption of retail CBDCs | (β = −0.0001, p = 0.99) | Reject |

| H6 | Ownership of credit card (FINA) → Adoption of retail CBDCs | (β = 0.08, p = 0.007) | Pass |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohammed, M.A.; De-Pablos-Heredero, C.; Montes Botella, J.L. The Role of Financial Sanctions and Financial Development Factors on Central Bank Digital Currency Implementation. FinTech 2024, 3, 135-150. https://doi.org/10.3390/fintech3010009

Mohammed MA, De-Pablos-Heredero C, Montes Botella JL. The Role of Financial Sanctions and Financial Development Factors on Central Bank Digital Currency Implementation. FinTech. 2024; 3(1):135-150. https://doi.org/10.3390/fintech3010009

Chicago/Turabian StyleMohammed, Medina Ayta, Carmen De-Pablos-Heredero, and José Luis Montes Botella. 2024. "The Role of Financial Sanctions and Financial Development Factors on Central Bank Digital Currency Implementation" FinTech 3, no. 1: 135-150. https://doi.org/10.3390/fintech3010009

APA StyleMohammed, M. A., De-Pablos-Heredero, C., & Montes Botella, J. L. (2024). The Role of Financial Sanctions and Financial Development Factors on Central Bank Digital Currency Implementation. FinTech, 3(1), 135-150. https://doi.org/10.3390/fintech3010009