4.1. Implications of GCI for Financial Innovation

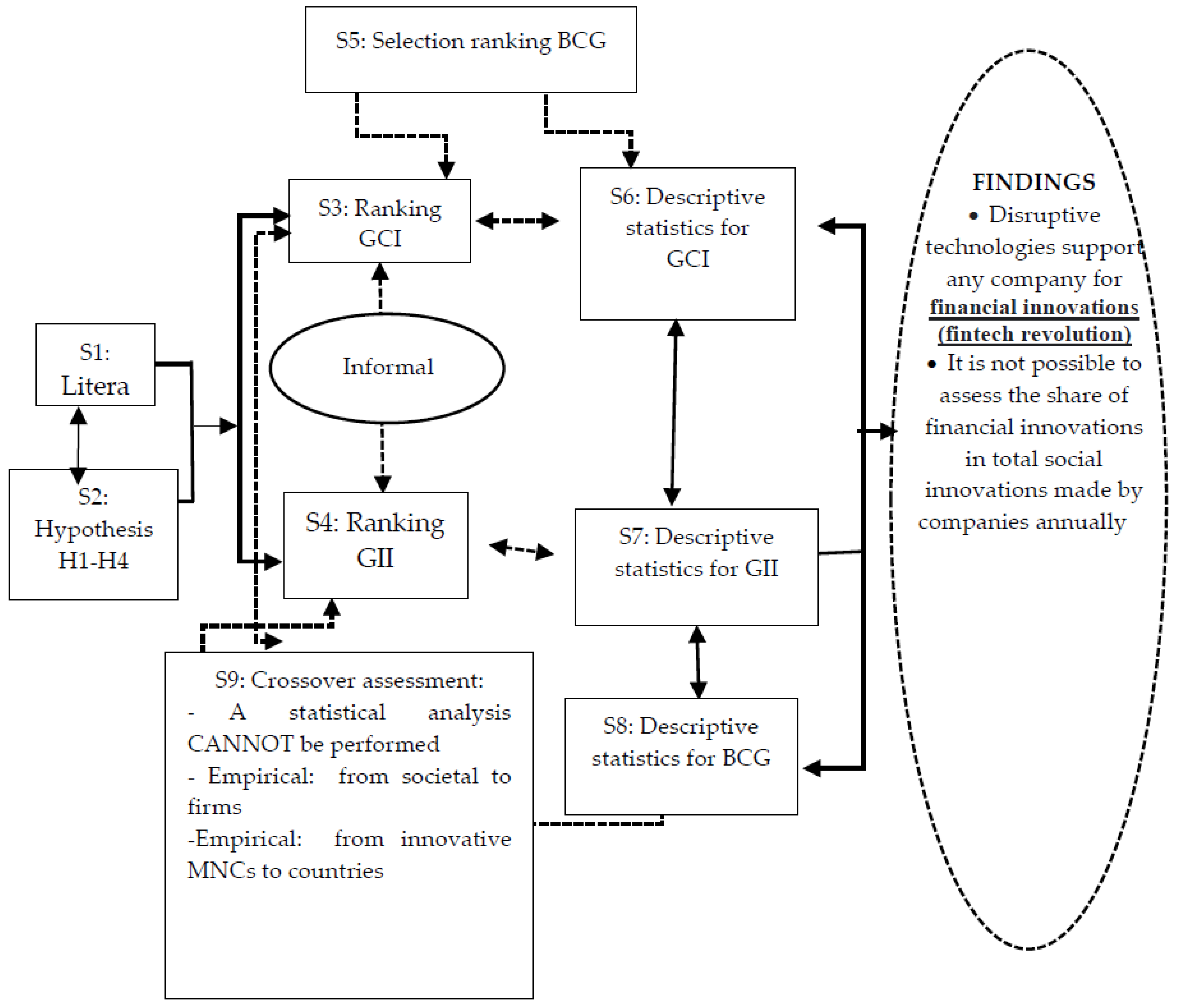

By “implications of the GCI for financial innovation” we mean that this ranking provides some useful, although partial, information for understanding and subsequently assessing (

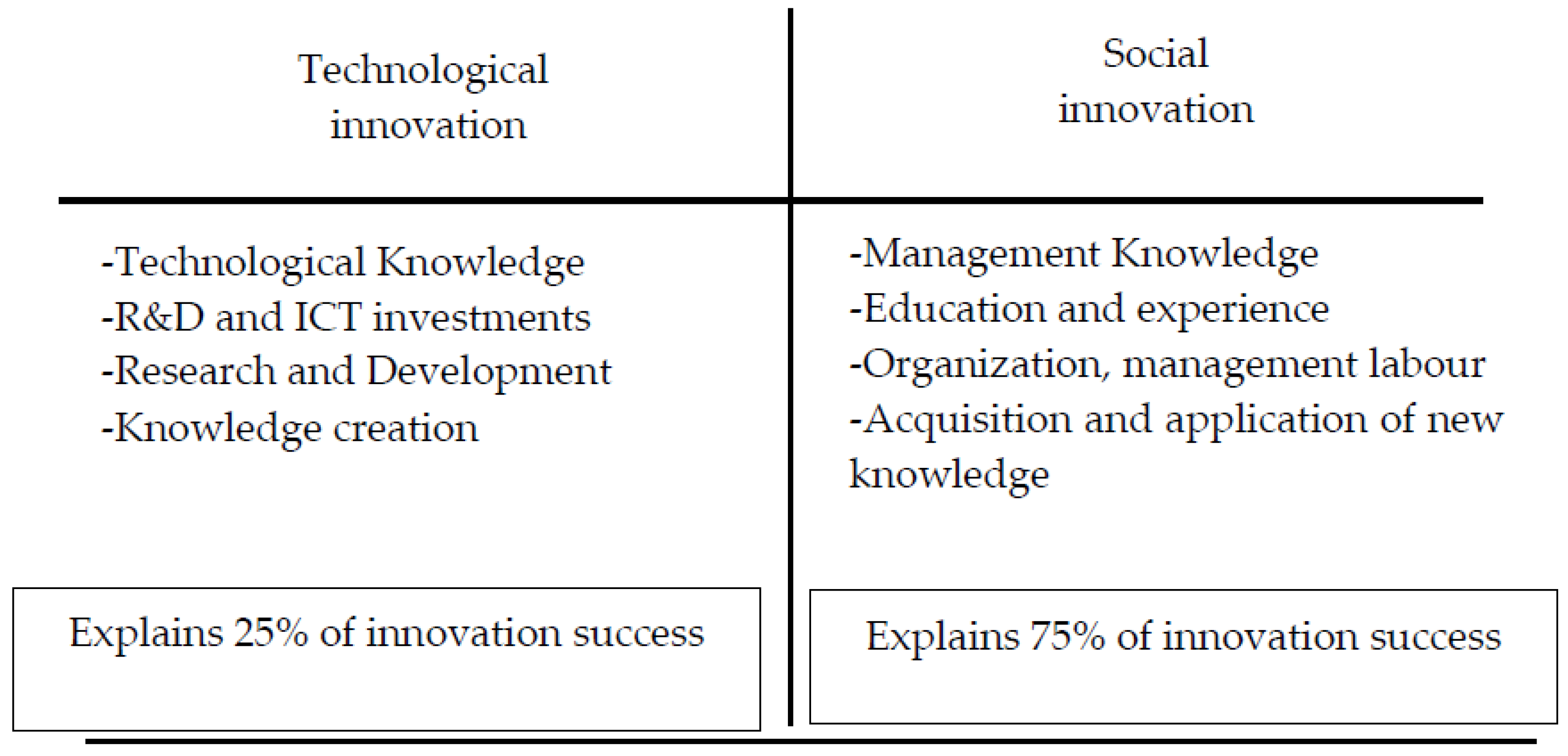

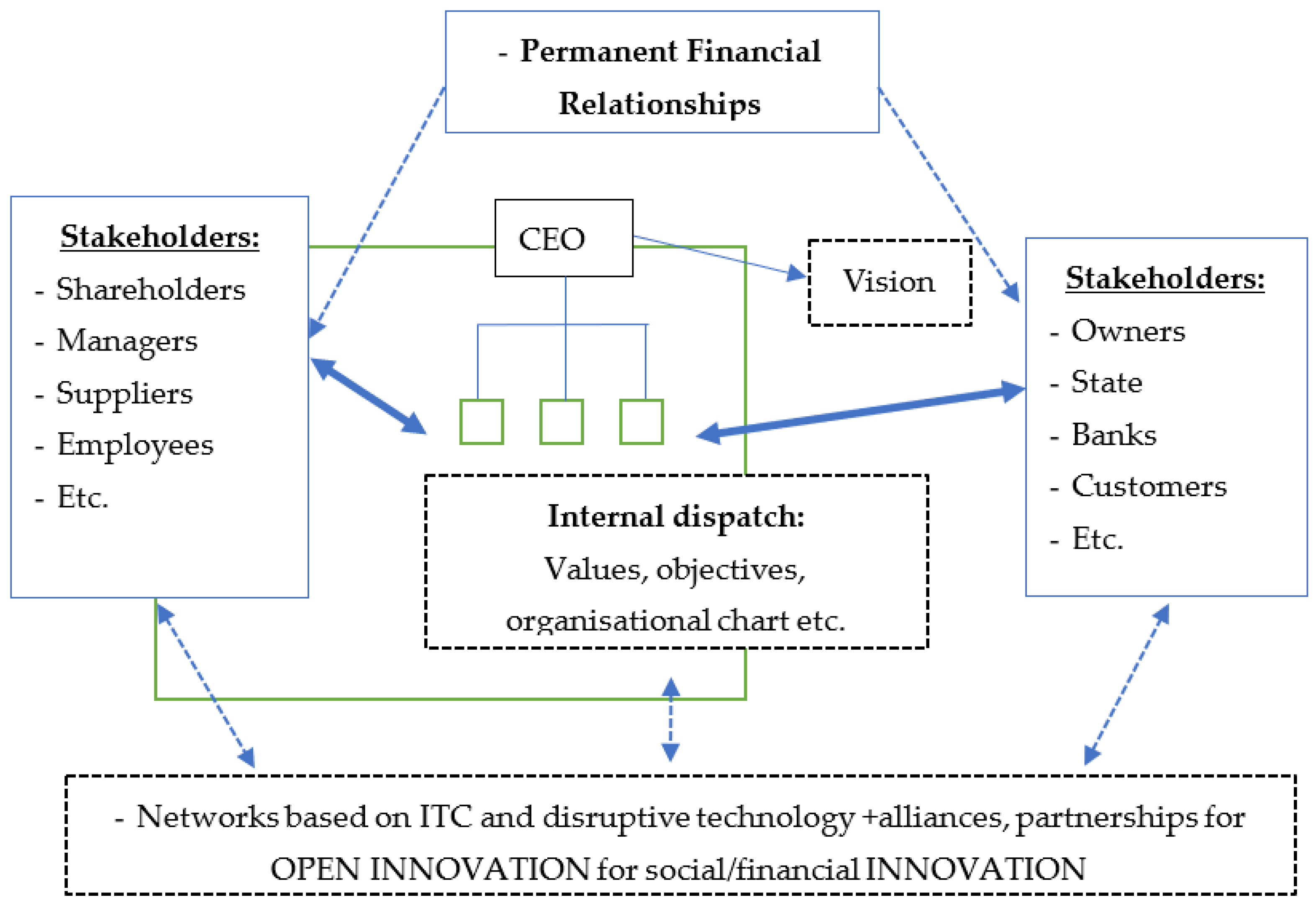

Section 5 of the study, Main Findings) innovative capacity at the firm level. Our assessment focuses on MNCs, as the realities of the last three decades in the global economy lead to the conclusion that these categorized organizations in particular have become the main vectors for technical and social innovation. As argued in [

57], medium and large firms have become essential for R&D and innovation, job creation, exports, revenues, productivity, and other critical indicators for competition in different markets. At the same time, our assessment, reasoning, and conclusions may also include, where appropriate, firms in the SME category (in high-tech sectors such as IT, telecommunications, etc., firms with a significant number of employees can quickly become highly innovative).

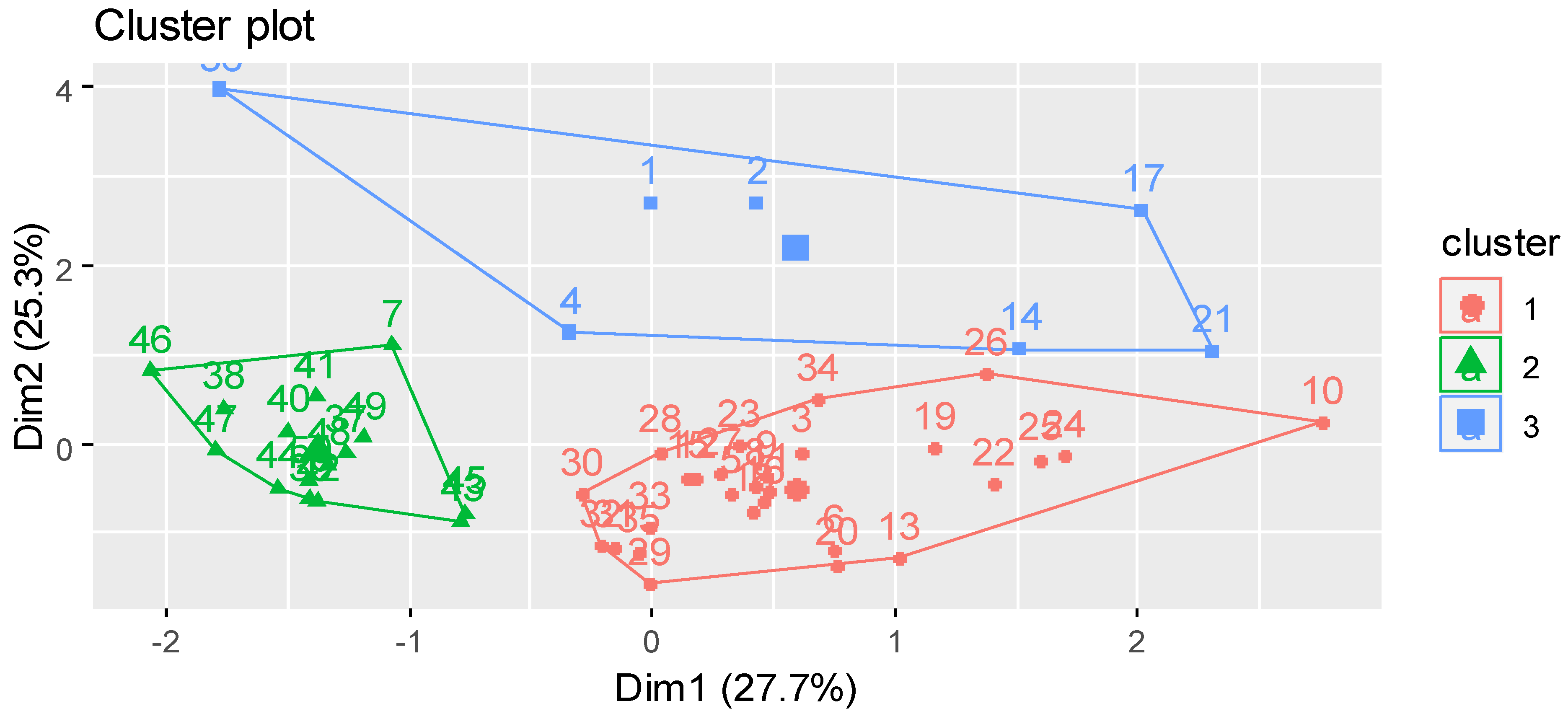

Based on this ranking (GCI), we conducted a comparative analysis at the time of 2009 and, respectively, 2019, trying to identify what are the main correlations and significant associations between the different sub-pillars of the ranking, as well as the extent to which these sub-pillars support the understanding of technical and social innovative activity at the firm level (from a microeconomic analysis perspective). As is well known, the GCI ranking is based on 12 main pillars (institution, infrastructure, ICT adoption, macro-economic stability, product market, business dynamism, innovation capability, etc.); countries are grouped by main ranking and by sub-pillars, based on a “score” expressed on a scale of 0–100 (the relative position of countries). In our analysis, we selected the number of seven variables that should show us, cumulatively, the innovative capacity at the country level (abbreviations used: social capital—SC; health and primary education—HPE; health–life expectancy—HLE; higher education and training—HET; mean years of schooling—MYS; extent of staff training—EST; cooperation in labor–employer relations—CLER; state of cluster development—SCD; university–industry collaboration in R&D—UIC-R&D; and multistakeholder collaboration—MC). In relation to the seven variables selected by the authors for the statistical evaluation of possible correlations in 2019 vs. 2009 (data resulting in tables starting from

Table 1,

Table 2,

Table 3,

Table 4,

Table 5,

Table 6,

Table 7,

Table 8 and

Table 9), we mention:

In the following, we summarize in

Table 1 and

Table 2 the “correlation matrix” for previously reported issues at the time of 2009 and 2019, respectively.

We present below the correlation matrix in SPSS for 2009 (

Table 1) and for 2019 (

Table 2). In the first half of the tables are the pairwise correlations between the seven variables included in the analysis for the 2 years (sub-pillars). In the second half of the table are the significance coefficients calculated for the correlation coefficients obtained (having different values in 2019 vs. 2009).

The methodology for calculating the GCI in 2019 has changed significantly compared to the one applied in 2009, which is why some sub-pillars in 2019 have different names from their 2009 counterpart, as they have taken in their content other elements/factors of the same nature (pillar HPE and HLE have different names, but both refer to human capital; similar to HET and MES; similar to innovative capacity, i.e., UIC-R&D and MC).

The selection of the seven sub-pillars was made based on the relevance/significance criteria they cumulatively provide on the factors determining technical and social innovative capacity at the firm level; the same relevance of the selection criterion was taken into account by empirically relating the information provided by GCI vs. GII (the latter is presented by us in the next subsection of the study). A second selection condition was given by the need to “cover” most of the 12 main pillars with the seven variables and which refer, at the same time, directly or indirectly, to R&D and innovation activity in firms. A total of 28 main countries of the world were selected (countries that are in the top positions in the ranking both at the time of 2009 and at the time of 2019; Switzerland, USA, Japan, Singapore, South Korea, Germany, Denmark, France, the Netherlands, UK, etc.; countries that are important in the global economy but have a more prudent/modest position in the ranking; countries such as Argentina, Brazil, China, India, Mexico, South Africa, etc.).

In both tables, we used some unitary underlining, respectively:

In each table, we marked in bold the significant correlations between the seven variables (this means statistically significant correlations; some sub-pillars help us to further understand the factors explaining the innovative capacity of the companies in the BCG ranking).

We marked in bold and italics in each table the sig. coefficients of significance greater than 0.05 between the seven variables, which indicate that there are no statistically significant correlations.

Taking into account the previous mentions, some conclusions of interest for our study can be drawn (which will then be correlated with the information shown by the GII ranking and the situation of the 50 companies in the BCG ranking):

The situation of insignificant correlations between the seven variables has changed significantly during the decade under analysis, i.e., in 2009, there were five correlations of this type, and in 2019, there were only two correlations of this type:

At the time of 2009, the realities of the following variables were insignificant:

- -

SC variable and CLER, SCD variable and UIC-R&D;

- -

HPE variable and EST, SCD;

- -

HET variable and SCD;

- -

EST variable and SCD;

- -

SCD variable and UIC-R&D.

At the time of 2009, a smaller number of the following variables were insignificant:

- -

HLE variable and EST;

- -

CLER variable and MC.

In addition, it is easy to notice that the association between variables recording insignificant correlations is completely different at the two moments of analysis (this means that different pillars of the GCI component advanced/evolved differently from one country to another and led to changes in position at both the pillar and ranking level in 2019 vs. 2009).

The situation of significant correlations between the seven variables has changed significantly over the decade analyzed, i.e., in 2009, there were three such correlations and in 2019, there were four such correlations:

- ✓

At the time of 2009, there were significant differences between the following variables:

- -

HPE and HET (0.748);

- -

EST and CLER (0.791);

- -

EST and UIC-R&D (0.800).

- ✓

At the time of 2019, there were significant realities between the following variables:

- -

EST and CLER (0.799);

- -

EST and MC (0.932);

- -

CLER and MC (0.738);

- -

SCD and MC (0.735).

From the data presented in

Table 1 and

Table 2, it is easy to see that the association between variables with significant correlations has changed significantly during the decade under analysis, 2019 vs. 2009. At the time of 2019, there were four statistically significant correlations between the seven variables compared to only three such correlations at the beginning of the period. These statistical correlation changes between the different variables/factors about which the GCI provides information derive from changes in the overall ranking and/or ranking of the pillars in the competitive position component. Such changes in terms of the ranking provided by the GCI for the world’s leading countries will then be analyzed, “cross-referenced”, with the main conclusions provided by the GII ranking (including performing an informal analysis, using main influencing factors, of some deductible aspects for the year 2020 vs. 2019 and 2010 vs. 2009, respectively) and the main conclusions provided by the BCG ranking for the 50 MNCs considered to be the most innovative in the world.

Next, based on the information provided by the same GCI ranking, we calculate and present synthetically the KMO and the Bartlett sphericity test (

Table 3 and

Table 4), as well as the Initial Eigenvalues associated with each factor before extraction, after extraction, and after rotation (

Table 5 and

Table 6).

Table 3 and

Table 4 present two indicators relevant to our study, namely the KMO (Kaiser–Meyer–Olkin) and the Bartlett sphericity test. The KMO varies between 0 and 1. A value close to 0 indicates that the sum of partial correlations is relatively high compared to the sum of correlations and a factor analysis is not indicated while a value close to 1 indicates that a factor analysis should produce distinct and reliable factors. A value above 0.5 is considered acceptable (

http://cda.psych.uiuc.edu/psychometrika_highly_cited_articles/kaiser_1974.pdf; accessed on 11 August 2023). In this case, the value is 0.627, so it is an acceptable value.

Bartlett’s test of sphericity is highly significant, the sig. value is less than 0.01, which means that the correlation matrix R is not an identical matrix. There are links between variables that could be included in our analysis based on the GCI ranking.

In the following table, applying the same tests based on data provided by the GCI at the time of 2019 leads to slightly higher values than at the time of 2009.

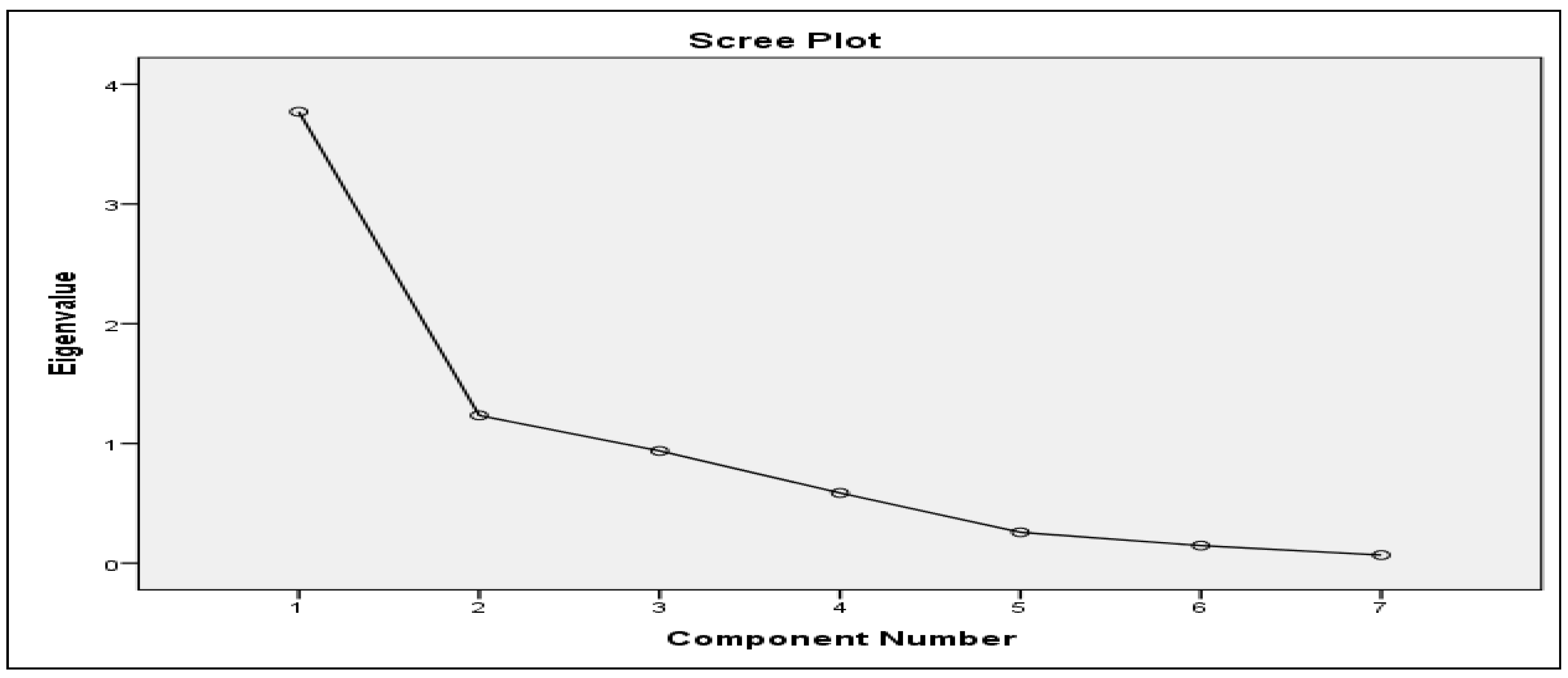

Table 5 and

Table 6 centralize the Initial Eigenvalues associated with each factor before extraction, after extraction, and after rotation. Before extraction, seven factors were identified corresponding to the seven variables included in the analysis. The initial values associated with each factor also show the weight of the explained variants. For example, at the time of 2009, the first factor explains 53.86% of the total variance and the second factor explains 17.623%. It can be seen that the first two factors together explain 71.48% of the total variance. After extraction, at the same time of 2009, only two factors remained as can be seen in

Table 5 (SPSS extracts—only factors that have values above 1). It can be seen that for the extracted factors, the values are identical to those before extraction. In the last part of the table are the Eigenvalues after rotation, before and after rotation; the first factor and the second factors keep their values.

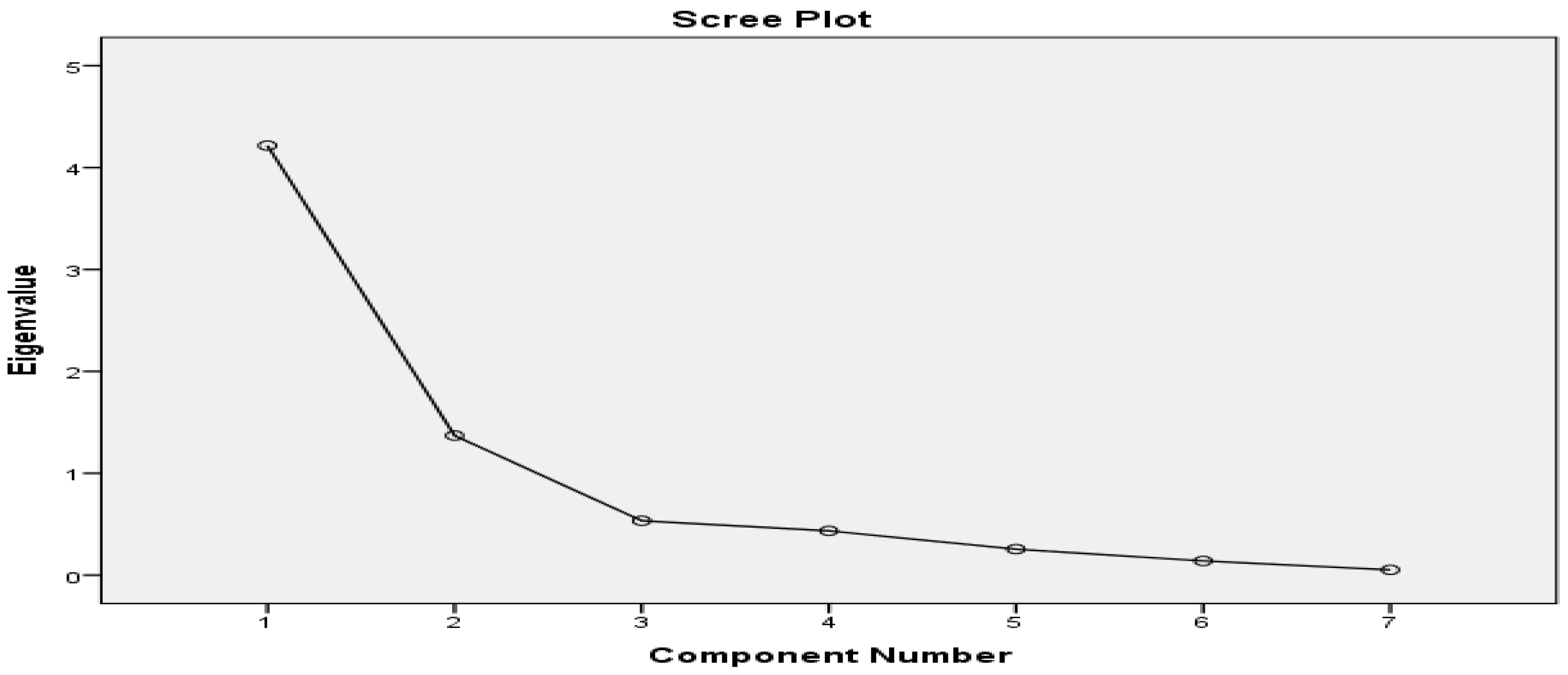

A more synthetic version of the analysis on the seven variables at the time of 2019 vs. 2009 can be obtained by plotting a Scree plot for the year 2009 (

Figure 3) and 2019 (

Figure 4).

From

Figure 3 and

Figure 4, it can be deduced that the main points of inference occur in variables 2 and 3, which means that education, employee training, and R&D investment are the main factors explaining innovative capacity at the country level. This preliminary conclusion has significance for the objective of our research, and we will analyze whether or not various elements related to education, training, and R&D are reflected in the methodology applied by BCG to establish the ranking of the 50 globally innovative companies.

The next step the authors used was to analyze the variables that were assigned in the first factor to see if there is some common theme. It can be seen that between the variable SCD, which has the highest loadings distributed in component 2, and the variable CLER, there is a certain relationship. Therefore, the variables allocated to the first component at the time of 2009 seem to fall under the same theme, namely education. All of them are related to the same aspect as follows: HET, UIC-R&D, EST, CLER, HPE, and SC.

Table 7 shows the matrix of rotated components, for the year 2009, then in

Table 8, the same data for the year 2019.

Factor loadings less than 0.5 were removed from the

Table 7. We can see that there are two components and most of the variables are distributed in the first component, except for two variables:

CLER and

SCD, which have been distributed in the second component. The variables are presented in the table in the order in which they were entered. A descending sort by load size places the variable

HET first, followed by

UIC-RD.

Factor loadings less than 0.4 were removed from the

Table 8. We can see that two components and four variables (EST, CLER, SCD, and MC) are distributed in the first and three variables (SC, HLE, and MYS/MC) are distributed in the second component.

The Multistakeholder_collaboration2019 variable is ranked first by the upload size. Therefore, it can be inferred that, although there have been some changes on the variables/factors explaining the innovative capacity of countries in 2019 vs. 2009, education, staff training, and collaboration with various categories of stakeholders remain essential for innovative capacity at the country level. Finally, the last stage of the authors’ analysis of the importance of the variables/factors on which the GCI ranking is based is presented at the time of 2019, as shown in

Table 9.

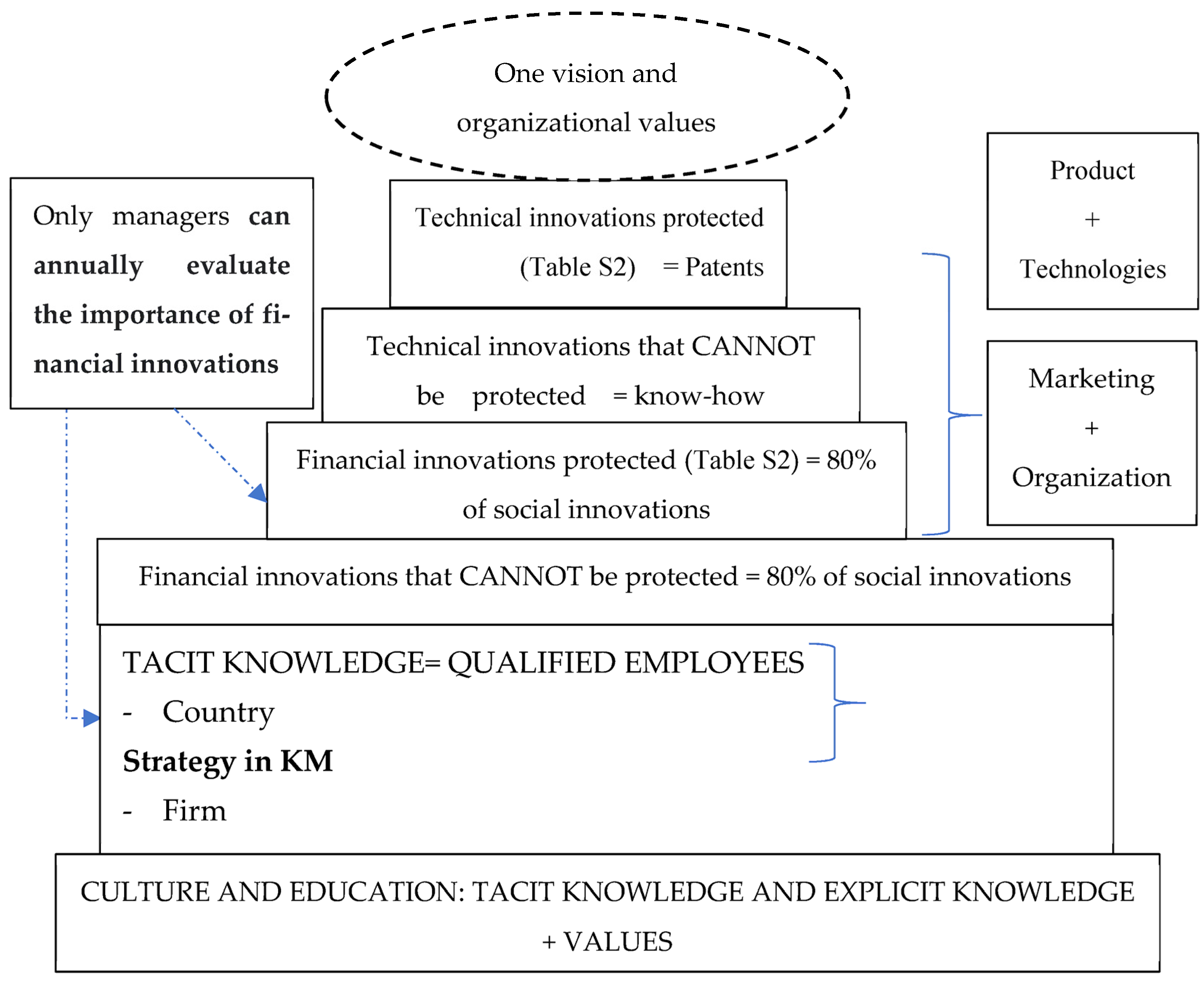

It can be seen that there have been some changes in 2019 in the distribution of variables by components compared to 2009; however, the conclusion remains that social capital, education, staff training, R&D activity, and collaboration with various categories of stakeholders remain the main factors conditioning the innovative capacity of countries. As we will see later (evaluation based on the top 50 BCG rankings [

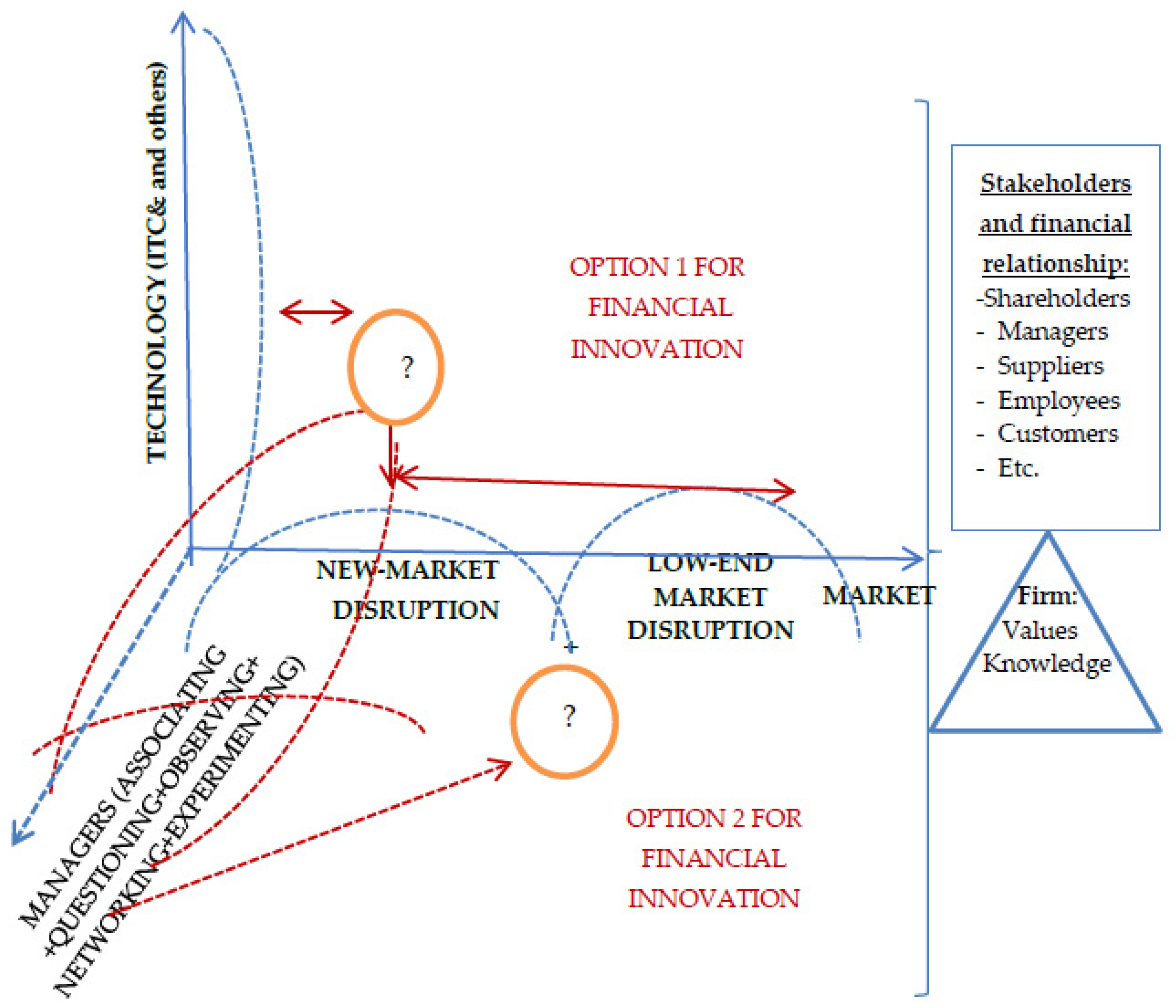

58]), employee education, investment in R&D, firms’ orientation towards open networks for innovation, staff training, organizational culture and/or social capital, collaboration between management and employees/trade unions, etc., are the main factors determining innovative capacity at the firm level. It is, however, extremely difficult to argue which would be the “common factors” that simultaneously explain innovative capacity at the firm and country level.

Next, we conduct an analysis based on the Global Innovation Index (GII) to further assess innovative capacity at the country level and the theoretical/hypothetical relationship between such rankings and innovative capacity at the firm level. Later (

Section 5 of the study, Main Findings), when we perform an in-depth analysis based on the BCG survey of the 50 most innovative companies internationally, we will try to “disentangle/separate” social/financial innovation from overall firm-level innovative capacity. Also, in the above sense, based on the information provided by the GCI and GII, we will then try to “cross-check” the results we arrive at on financial innovativeness as part of social innovation, both at the firm and country level.

4.2. Implications of GII for Financial Innovation

In order to understand and assess financial innovative capacity at the firm level (BCG Innovation Study), we further provide an assessment of innovative capacity (technical and social) at the level of major countries of the world. For this purpose, we will use the data provided by the GII ranking.

We use a data set of the Global Innovation Index (GII), sub-indexes, and components for 2010 and 2020; in the following table, we summarize the main variables selected for the analysis. In our study, we chose to assess the relationship between GII and firm-level innovative capacity at 2020 vs. 2010 in order to have a broader picture (4 years if information offered by GII and GCI is cumulated, respectively, 2010 vs. 2009 and 2020 vs. 2019) of the factors/variables determining technical, social, and other types of innovation at the country/firm level. In the

Table 10 we presented data description for this ranking (the name of each index is in bold).

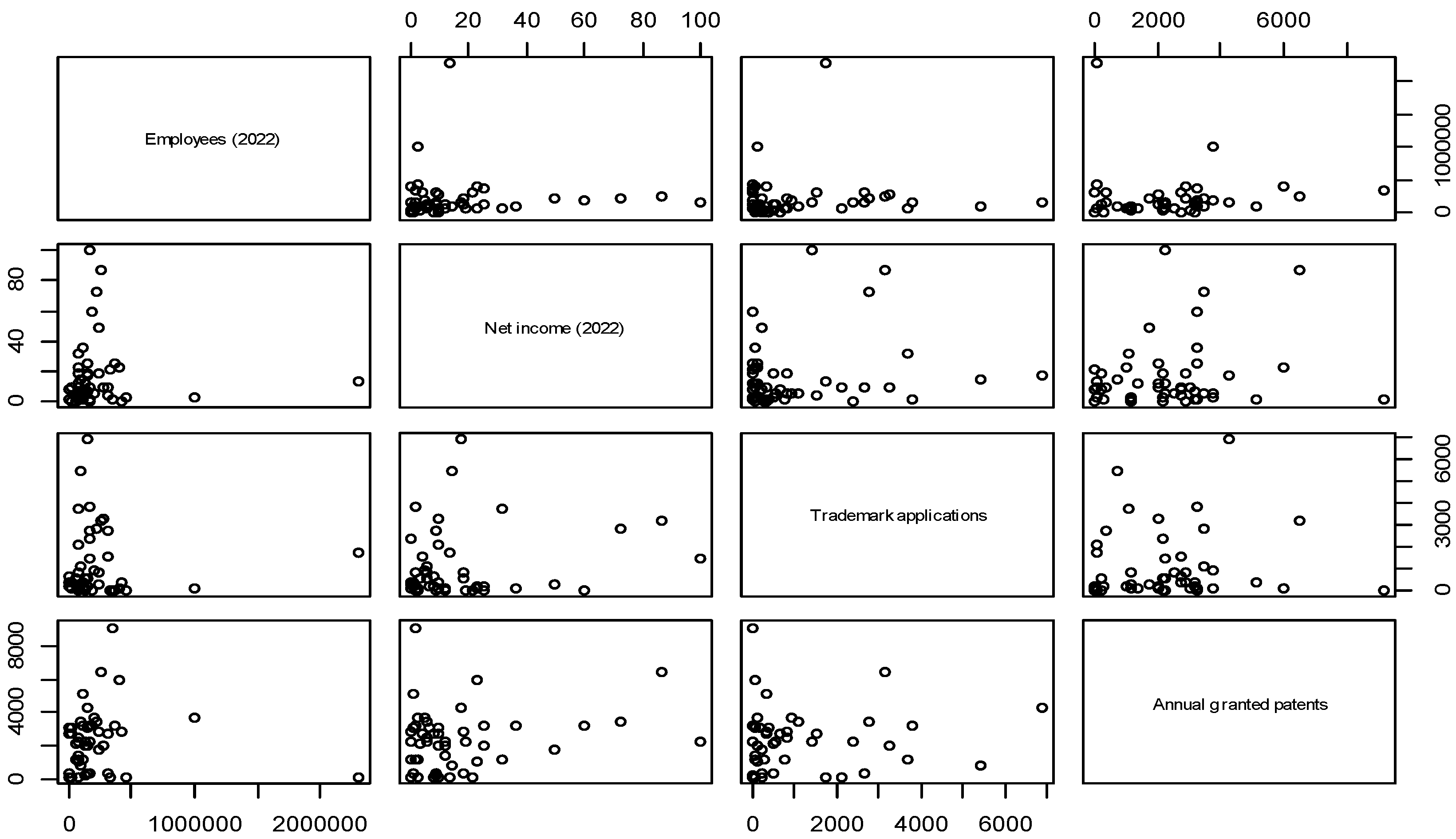

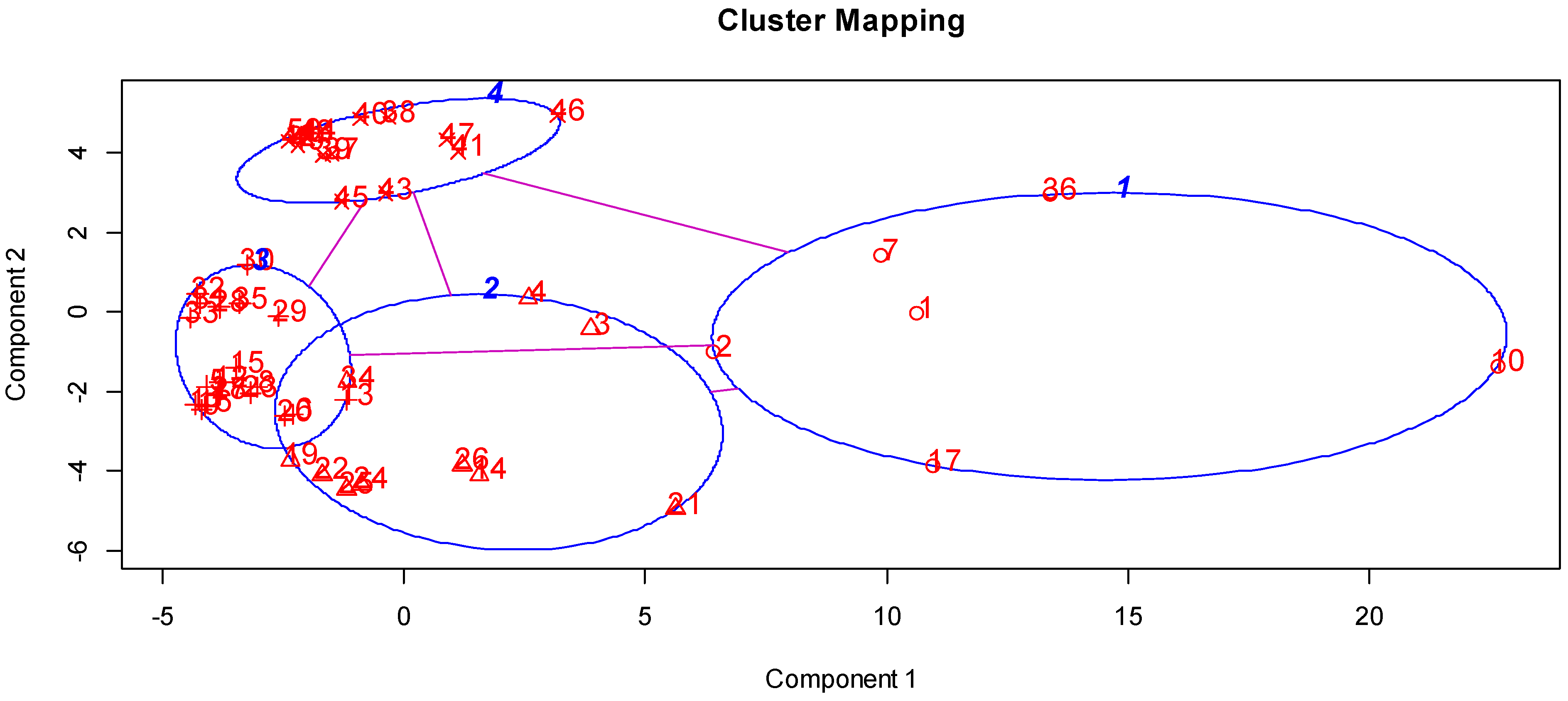

In order to determine the paternity of evolution, i.e., the central tendency and the variability of the components, we used a quantitative analysis using descriptive statistics. In the first step, we identified global patterns of evolution for all countries included in the index calculation. In the second step, we selected countries that scored above the world average on the GII and determined the central tendency and variability for these groups of countries. For the group of countries that scored above the world average, we performed a correlation analysis.

Table 11 summarizes descriptive statistics for the GII and selected components in 2010, both for all countries included in the index calculation and for the group of countries scoring above the world average.

Overall, the trend in innovation performance (GII) in 2010 remains somewhat constant, with a relatively normal distribution of values. The best performers are countries such as Switzerland, Sweden, Singapore, Hong Kong (SAR), China, Finland, Denmark, the United States of America, Canada, Netherlands, the United Kingdom, Iceland, Germany, Ireland, Israel, New Zealand, Korea, Rep, Luxembourg, Norway, Austria, Japan, Australia, France, Estonia, Belgium, Hungary, Qatar, etc., while the lowest performers are associated with countries such as Senegal, Swaziland, Venezuela, Cameroon, Tanzania, Pakistan, Uganda, Mali, Malawi, Rwanda, Nicaragua, Cambodia, Bolivia, Madagascar, Zambia, Syrian Arab Republic, Tajikistan, Cote d’Ivoire, Benin, Zimbabwe, Burkina Faso, Ethiopia, Niger, Yemen, Sudan, Algeria, etc. As we will see later (

Section 6, BCG ranking starting-point study), there are several European countries such as Sweden, Estonia, Belgium, Hungary, France, Finland, Denmark, etc., that are in good positions in the GII vs. GCI ranking, but do not have large/representative MNCs to include companies from these countries in the BCG ranking. How can this situation be explained? Also, in the sense mentioned, there are countries such as Qatar, Canada, New Zealand, etc., that do not have representative companies in the top tier of the innovation category that is summarized by the BCG study.

Among the selected components, the best scores were obtained in the infrastructure pillar on components such as ICT access and creative outputs (ICTs and business model creation, ICTs, and organizational model creation). In regards to business sophistication, notable performances were obtained regarding GERD performed by business enterprises (GERD financed by a business enterprise), but the importance of inter-firm cooperation through strategic alliances or joint ventures in innovation was rather low. The central trend towards the human capital and research pillar is also rather moderate, with a dispersed distribution of values across the board. The central tendency towards high-tech exports as a means of knowledge diffusion is also low, with a dispersed distribution of values.

In the group of countries performing above the world average in innovation, the central trend is relatively constant, but with a more dispersed distribution of variables. In this group, there is a noticeable trend towards a much stronger focus on infrastructure (through components such as ICT access and ICT use), business sophistication (GERD performed by a business and GERD financed by a business enterprise), and creative outputs (ICTs and business model creation; ICTs and organizational model creation). Also noteworthy is the increasing trend of knowledge diffusion, through high-tech exports and ICT service exports. However, the trend towards attracting external sources for research and development (GERD financed abroad) is less pronounced than the worldwide trend.

Table 12 illustrates the correlation matrix for the group of countries scoring above the world average in the GII, highlighting a number of significant influences that various components/variables have on innovation.

In 2010, in the group of countries scoring above the world average, innovation performance is positively and significantly associated with gross expenditure on R&D, infrastructure (ICT access and ICT use), and business sophistication. Also, a significant influence has been had by the creation of business and organizational models through the use of ICT, which are positively associated with R&D financed and carried out by firms and with access to ICT (which predominantly means common social innovations of which some may later prove to be disruptive in society). An insignificant influence was exerted by R&D financed abroad. In regards to joint ventures and strategic alliances, there is a positive association with the use of ICT and R&D activity carried out within firms, positively influencing overall innovation performance. Thus, based on the 2010 GII data, it is quite clear that some factors/variables related to the innovative capacity of an entity (gross expenditure on R&D, with infrastructure (ICT access and ICT use) and with business sophistication, a business model, alliances and open innovation in R&D activity, etc.) are simultaneously found at the level of countries and/or firms that are considered to be innovative. However, it is extremely difficult to quantify and argue to what extent the existing technical or social innovative capacity in firms conditions/determines the same innovative capacity in countries A, B, C, etc. This is because, according to the Forbes rankings for both 2010 and more recently in 2022 [

59], at the time of 2022, there were at least 2000 important/significant companies globally, yet the vast majority of them are far from making the BCG ranking, even if they also have quite good achievements on technical and social innovations. We analyzed 2010–2020 span time and there have been major changes in the number of companies and countries of origin that are included in the various international rankings (Forbes 2022; Fortune 2022; etc.). However, the dominance of US innovative capacity at the country and firm level remains; more recently, China and companies originating from this country have improved their international competitive capacity. In a few cases, we find companies that have a turnover of USD 2–10 billion or more (Gold Fields—South Africa; Grifols—Spain; Cencosud—Chile; Dexus—Australia; Ayala Corporation—Philippines; Fertiglobe—United Arab Emirates; etc.) have a good position in Forbes 2022 and come from countries that do not have an above-average position in the GCI and GII. Simply put, the world’s leading developed countries with relatively high GDP per capita dominate R&D activity (funding by firms as well as by the government) and perform better annually in terms of the number of patents, social innovations, financial innovations, etc.

Table 13 summarizes descriptive statistics for the GII and selected components in 2020, both for all countries included in the index calculation and for the group of countries scoring above the world average.

The trend for the Global Innovation Index in 2020 remains somewhat constant, close to the trend recorded in 2010 in terms of value distribution. The best performers are Switzerland, Sweden, the United States of America, the United Kingdom, the Netherlands, Denmark, Finland, Singapore, Germany, the Republic of Korea, Hong Kong, China, France, Israel, China, Ireland, Japan, Canada, Luxembourg, Austria, Norway, Iceland, Belgium, Australia, Estonia, the Czech Republic, New Zealand, Malta, Cyprus, Italy, Spain, and Portugal, while the lowest performances are associated with countries such as Bolivia, Guatemala, Ghana, Pakistan, Tajikistan, Cambodia, Malawi, Côte d’Ivoire, Lao People’s Democratic Republic, Uganda, Bangladesh, Madagascar, Nigeria, Burkina Faso, Cameroon, Zimbabwe, Algeria, Zambia, Mali, Mozambique, Togo, Benin, Ethiopia, Niger, Myanmar, Guinea, Yemen, etc. Of the selected components, the best scores were obtained in the

infrastructure pillar (on components such as ICT access and ICT use),

business sophistication (GERD financed by a business enterprise), and

creative outputs (ICTs and business model creation; ICTs and organizational model creation), while the central trend towards the

human capital and research pillar is still rather moderate, with a dispersed distribution of values across all situations. Also notable is the central trend of increasing high-tech exports, as a means of knowledge diffusion, but still with a dispersed distribution of values; this time, among the leaders are Malaysia, Vietnam, the Philippines, the Republic of Korea, China, and Singapore, together with the Czech Republic, France, Germany, etc. Together with other conclusions that can be drawn, it follows that the GCI and GII rankings are still largely dominated by the developed countries of the world by 2020. In a few cases, we will find, in 2020, companies that are globally significant [

41,

42] but come from countries that are well below the average GII ranking. Therefore, we see that there is a certain conditionality/correlation between existing technical and social capacity at the firm/company level and innovative capacity and/or competitive position at the country level. In the next part of the study (

Section 5), we address the same topic, but from the microeconomic perspective of analyzing financial innovations as part of social innovations at the firm/country level.

In the group of countries performing above the world average in GII (

Table 14), the central trend is relatively constant, but with a more dispersed distribution of variables. In this group, there is a perceptible trend towards a much stronger focus on infrastructure (through components such as ICT access and ICT use),

business sophistication (GERD financed by a business enterprise), and

creative outputs (ICTs and business model creation; ICTs and organizational model creation); at the same time, the central trend towards the

human capital and research pillar, although still moderate and rather spread, is more consistent than the global trend. The orientation towards attracting external sources for research and development (GERD financed abroad) should also be highlighted, with Israel, the Czech Republic, Austria, Iceland, Belgium, Sweden, Finland, etc., leading the way. Japan, Malaysia, China, Thailand, India, etc., have shown less interest in this direction. Last but not least, mobile app creation is showing a more consistent, albeit still dispersed, upward trend than the global trend.

In 2020, the innovation performance of the 53 countries scoring above the world average was positively and significantly associated mainly with resources invested in R&D activity, infrastructure, R&D activity carried out by firms, and especially the creation of new organizational models under the impact of ICT (the United States of America, Sweden, Finland, the Netherlands, Estonia, the United Kingdom, Denmark, Germany, Switzerland, Norway, Israel, Canada, Iceland, Singapore, Luxembourg, and Belgium). The creation of these new organizational models is positively and significantly associated with ICT use, cooperation through joint ventures and strategic alliances, and R&D activities carried out by firms. The conclusions that can be drawn from the GCI and GII rankings over the last 10 years largely confirm Porter’s concept of “the five forces” shaping competition at the level of industrial sectors and/or countries [

60].

In contrast to 2010, the role of strategic alliances, but especially R&D financed abroad, has increased. High-tech and medium-tech production is mainly supported by in-house R&D, and high-tech exports are positively associated with R&D financed by firms. Moreover, in 2020, the role, albeit still modest, of mobile technologies is being felt, which is positively associated with cooperation through JVs and strategic alliances.

Up to this point, our assessments have predominantly focused on the macro-economic perspective of country/firm-level innovation processes through the use of disruptive technologies. In the following sections of the study, we aim to focus the analysis on the same topic from a microeconomic perspective, i.e., with reference to the realities in different categories of firms (especially MNCs). In the innovative sense, we then aim to “intersect” the two perspectives of analysis in order to reach some clearer conclusions on the role/importance of disruptive/digital technologies in the case of financial innovations made by firms.

Returned

Returned