Abstract

The lockdown restrictions during the COVID-19 pandemic led to increased interest in Fintech and digital finance solutions, and it gave people an incentive to join the formal financial sector by owning a formal account. People became interested in information about Fintech and digital finance solutions, and it led them to search the Internet to obtain information about Fintech, digital finance, and financial inclusion. In this study, we investigate whether interest in Internet information about Fintech and digital finance led to interest in Internet information about financial inclusion during the COVID-19 pandemic. Using global data that capture interest over time, we found that interest in information about Fintech was greater in developed countries while interest in information about financial inclusion was greater in developing countries during the pandemic. Interest in Fintech information was strongly correlated with interest in financial inclusion information during the pandemic. Interest in Fintech information had a significant positive effect on interest in financial inclusion information during the pandemic. There is a unidirectional causality between interest in Fintech information and interest in financial inclusion information during the pandemic. The implication of these findings is that interest in Fintech information is an important determinant of interest in financial inclusion information.

Keywords:

information; digital finance; financial inclusion; Fintech; Internet; COVID-19; pandemic; financial technology; financial innovation; web search; Google Trends JEL Classification:

G2; G3; G16

1. Introduction

Financial exclusion is a major challenge in many countries. The World Bank estimates that more than two billion people are unbanked and lack access to safe, reliable, and affordable financial services [1]. The common causes of financial exclusion are high transaction costs, financial illiteracy, structural inequalities, irregular income, long distance to a bank, and regulatory frameworks that limit the integration of the entire population into the formal financial sector [2,3]. Policymakers and private sector agents can reduce levels of financial exclusion by introducing programs, policies, institutions, technologies, products, services, and activities that can be used to reach the financially excluded population and bring them into the formal financial system through the opening of a formal account, as this is the first step towards financial inclusion.

Financial inclusion is commonly defined as the access and use of formal financial services by members of a population [4]. Financial inclusion is a top policy priority in many countries. There has been a global campaign to use Fintech-enabled digital financial services to increase financial inclusion [4,5]. However, the effectiveness of Fintech and digital finance tools in accelerating financial inclusion depend on people’s acceptance of the digital financial services offered by Fintech and digital finance providers [6]. Many factors influence people’s acceptance of digital finance services. One such factor is people’s awareness, or lack of awareness, of the digital financial services offered by Fintech and digital finance providers [7,8,9], and we argue that one way to gauge the level of awareness about digital finance and Fintech tools is by assessing people’s interest in information about Fintech, digital finance, and financial inclusion on the Internet through their web search activity.

In 2020, the Internet recorded large volumes of web searches for information about Fintech, digital finance, and financial inclusion during the pandemic. Many people in different countries sought information on the Internet to learn about how to access their bank accounts remotely using Fintech and other digital channels for greater financial inclusion. Also, many people sought information on how to continue their everyday financial transactions using Fintech and digital finance channels during the pandemic-era lockdown. Given the increased interest in Internet information about Fintech, digital finance, and financial inclusion during the pandemic, there is a need to analyze the trend in global interest in Internet information about them during the COVID-19 pandemic. Understanding this interest during the pandemic can provide insight on whether interest in Fintech information leads to interest in financial inclusion information or whether interest in Fintech or digital finance information is correlated with interest in financial inclusion information. Such insight can inform policymaking by assisting policymakers in determining whether they should provide more information to the public about Fintech and digital finance activities so that such information can assist the public in making decisions on how to access and use available formal financial services towards greater financial inclusion.

In this paper, we assess the worldwide interest in Internet information about digital finance, Fintech, and financial inclusion during the COVID-19 pandemic. The pandemic is an important reference point because it led to the imposition of movement restrictions in many parts of the world [10], and it led to the greater use of digital technologies to support human activities during the first wave (coronavirus), the second wave (Delta variant), and the third wave (Omicron variant) of the pandemic [11,12]. The COVID-19 pandemic and the national lockdowns showed that when informal finance becomes less accessible due to lockdowns, people will turn to digital financial services offered by Fintech and digital finance providers to access their formal financial systems [13], and the lockdowns led to greater interest in Internet information about the Fintech and digital finance tools that can be used for financial inclusion purposes during the pandemic [14].

In the literature, there is much interest in the potential of digital finance and Fintech to increase the level of financial inclusion during the pandemic. Many policy reports, academic papers, and practitioner studies associate Fintech and digital finance solutions with greater financial inclusion during the pandemic (e.g., [8,14,15,16,17,18]). These studies show that Fintech and digital finance solutions can give people and businesses remote access to formal financial services during the pandemic. Although existing studies explore the role of Fintech and digital finance in increasing financial inclusion during the pandemic, most of these studies did not consider the role of Internet information in promoting financial inclusion during the pandemic. Existing studies also did not use real-world “interest over time” data to determine whether widespread interest in Internet information about digital finance and Fintech led to widespread interest in Internet information about financial inclusion during the pandemic. More importantly, these studies did not explore global interest in Internet information about financial inclusion, Fintech, and digital finance in terms of web searches for information about Fintech and digital finance and financial inclusion during the pandemic.

We empirically measured the levels of interest in Fintech, digital finance, and financial inclusion information to determine whether interest in Internet information about Fintech and digital finance led to interest in Internet information about financial inclusion. We use global interest over time data based on Google web searches during the pandemic. Using monthly data from January 2020 to December 2021 for 250 countries, we found that interest in Fintech information was strongly correlated with interest in financial inclusion information during the pandemic. There was a one-way causality between interest in Fintech information and interest in financial inclusion information during the pandemic, implying that greater interest in Fintech information caused greater interest in financial inclusion information. There was also a significant positive relationship between interest in Fintech information and interest in financial inclusion information.

Our study contributes to the existing literature in two ways. First, our study contribute to the literature that examine the role of information technology and the Internet in promoting financial inclusion (see, for example, [4,14,16,17,19,20,21]). Specifically, our study contributes to the literature by showing that interest in Internet information about Fintech led to interest in Internet information about financial inclusion. Second, our study examined the determinants of financial inclusion by showing that interest in Fintech information is a determinant of interest in financial inclusion information.

2. Literature Review

Our study contributes to the literature by examining the role of Fintech and digital finance in accelerating financial inclusion during the COVID-19 pandemic. The existing literature has documented evidence that Fintech and digital finance can enhance financial inclusion during the pandemic. For instance, ref. [22] examined the effect of Fintech on financial inclusion in sub-Saharan Africa during the 2011 to 2020 period and found that Fintech accelerated financial inclusion in the region. They found that a 1 percent increase in the number of people using a mobile phone led to a 0.67 percent increase in financial inclusion [23] examined the association between Fintech and social distancing during the COVID-19 pandemic. They analyzed 10 countries from March to June of 2020 and found that social distancing rules positively affected digital payments in some countries and had an adverse effect on digital payments in other countries [24] analyzed the effect of the COVID-19 pandemic on digital finance and Fintech adoption and found that the COVID-era lockdown led to a 24 to 32 percent increase in the daily downloads of Fintech and digital finance mobile applications [25], in their study, observed that Fintech helped to increase the speed of transactions and reduced the cost of digital payments during the COVID-19 pandemic [26] examined the impact of the COVID-19 pandemic on digital financial inclusion using 2021 data from the Global Findex Database indicators. They found that the use of digital financial services increased significantly during the COVID-19 pandemic and that the growth was due to digital payments that were enabled by Fintech [27] investigated the role of digital financial inclusion in bank stability during the COVID-19 pandemic. They found that digital financial inclusion improved bank stability by reducing the default risk of banks during the pandemic [28] assessed the use of Fintech channels for financial transactions during and after the COVID-19 pandemic in Bulgaria. They found that the major challenge of Fintech transactions in Bulgaria was the lack of awareness about existing Fintech products in the country.

Ref. [16] built an index to measure financial inclusion by combining traditional and digital financial inclusion indices. Their index reported a significant increase in digital financial services in the years preceding the COVID-19 pandemic. They stated that the pandemic had the potential to hasten progress in digital financial inclusion in the long term; however, this goal may be difficult to realize for countries with low access to digital financial inclusion since they spent more on health and economic support during the pandemic [18] analyzed the survey data of 500 potential Fintech service users in Jordan during the COVID-19 pandemic. The study found that the intention to use Fintech applications, such as mobile payments and banking applications, was affected by the users’ perceived benefits, trust, and social norms. However, the study found that the impact of the perceived technology risks on the use of Fintech applications was not significant [15] examined the effect of the COVID-19 pandemic on various digital financial services (DFS) and its subsequent impact on digital financial inclusion in India. They show that the pandemic had a positive effect on mobile banking, immediate payment services, and the Aadhaar-enabled payment system. However, the pandemic negatively affected debit card, credit card, national electronic fund transfer, and real-time gross settlement transactions while the impact of the pandemic on ATMs and POS transfers was neutral [14] investigated the impact of the COVID-19 pandemic on digital finance and Fintech adoption. They showed that the spread of the pandemic and related government lockdowns significantly increased the adoption of digital finance applications, particularly mobile applications. In another study, ref. [29] analyzed the role of Fintech in reducing the spread of COVID-19. They interviewed people with Fintech experience and found that better knowledge and perceptions of Fintech assisted in limiting the spread of the pandemic by limiting physical contact among people through the avoidance of contact payments methods [14] investigated the effect of the COVID-19 pandemic on the rate of Fintech and digital finance adoption using mobile application data from 74 nations. They showed that the pandemic and the lockdowns led to an increase in the rate of daily downloads of mobile finance applications by 24 and 32 percent in the sampled nations. They observed that approximately 316 million digital finance application downloads were recorded from the start of the pandemic.

In summary, the above studies showed that the use of Fintech and digital finance applications could increase the level of financial activity and increase the level of financial inclusion before and during the COVID-19 pandemic. However, the literature has not used “interest over time” data to investigate the relationship between Fintech, digital finance, and financial inclusion. No study has examined whether interest in Fintech and digital finance information stimulated interest in financial inclusion information during the pandemic. We fill this gap in the literature by examining the effect of interest in Fintech and digital finance information on interest in financial inclusion information.

3. Methodology

We collected monthly global data for three variables from Google Trends database. The countries examined are shown in Appendix A. The Google Trends database provides data that capture interest over time in specific keywords on the Internet. The data reflect the number of times people have searched for specific keywords at a given time or a location. We queried the Google Trends database by inserting the keywords “financial inclusion” into the database. The resulting data is termed “interest in financial inclusion information” data. We repeated the same procedure for the keywords “Fintech” and “digital finance”, and the resulting data are termed “interest in Fintech information” data and “interest in digital finance information” data, respectively. The database reports numbers (or counts) ranging from 0 to 100. These numbers represent the interest in a keyword relative to the highest point on the scale for a given region and time. The numbers captured the relative popularity count for “interest in financial inclusion information”, “interest in digital finance information”, and “interest in Fintech information”. A count of less than 50 indicates that web searches for a keyword are less popular. A count of 50 means that web searches for a keyword are half as popular as the peak terms. A count of 100 means that a term is at peak popularity. A score of 0 means there is not enough data for the term [3]. The variables used in this study are the “interest in financial inclusion information” variable, the “interest in Fintech information” variable, and the “interest in digital finance information” variable. These three variables were selected because many COVID-19 studies associated Fintech and digital finance with financial inclusion during the COVID-19 pandemic (see, for example, [14,15,16,17,18]). The sample period is a two-year period from January 2020 to December 2021 and for 250 countries.

Table 1 shows the monthly global data and the descriptive statistics. The descriptive statistics in Table 1 show that the mean and median values were higher for interest in Fintech information while interest in financial inclusion information reports the lowest mean and median values. Furthermore, we breakdown the monthly global data according to countries and we report the data for the top 20 countries that recorded the highest interest over time during the pandemic.

Table 1.

Descriptive statistics.

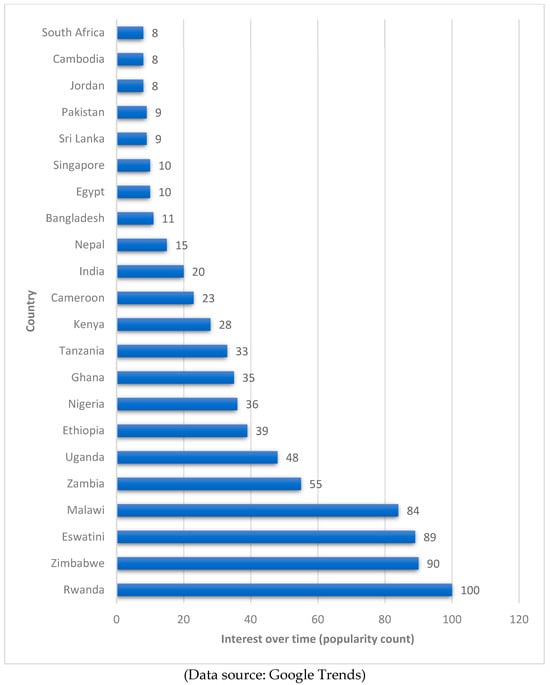

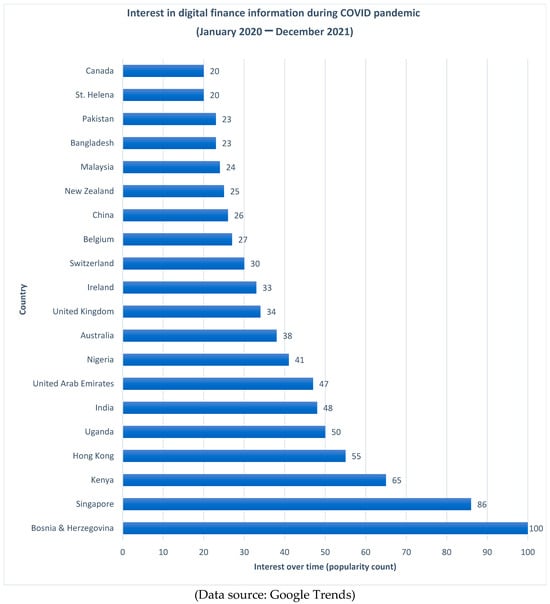

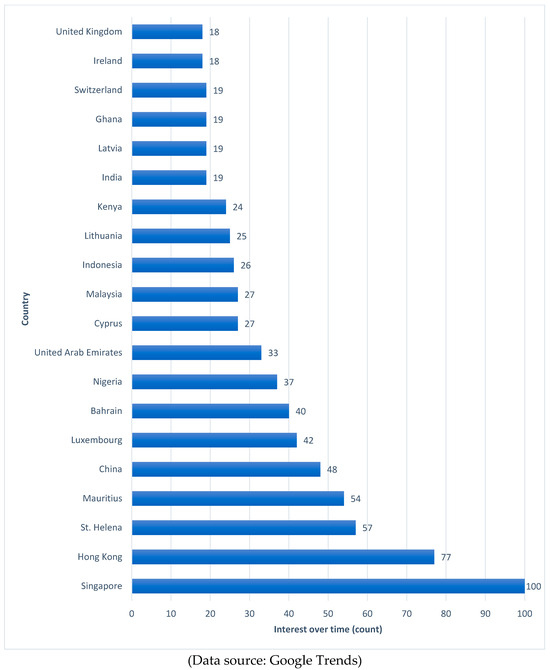

Figure 1 shows the top 20 countries with the highest “interest in financial inclusion information” during the COVID-19 pandemic. Interest in financial inclusion information during the pandemic exceeded the 50-count mark and indicates that web searches for information about financial inclusion was more popular in developing countries such as Zimbabwe, Uganda, Tanzania, Ghana, Nigeria, Eswatini, and Kenya. This result is consistent with the findings of [3]. Figure 2 shows the top 20 countries with the highest “interest in digital finance information” during the COVID-19 pandemic. It shows that interest in digital finance information during the pandemic exceeded the 50-count mark and implies that web searches for information about digital finance was more popular in Bosnia and Herzegovina, Singapore, Kenya, Hong Kong, Uganda, and India. Figure 3 shows the top 20 countries with the highest “interest in Fintech information” during the pandemic. It shows that interest in Fintech information during the pandemic exceeded the 50-count mark and implies that web searches for information about Fintech was more popular in developed countries such as Singapore, Hong Kong, St. Helena, Mauritius, and China. Finally, for the empirical analysis, we analyzed the data using correlation analysis, the pairwise Granger causality test, ordinary least squares regression estimation, and generalized method of moments estimation techniques.

Figure 1.

Interest in financial inclusion information during the COVID-19 pandemic (January 2020–December 2021).

Figure 2.

Interest in digital finance information during the COVID-19 pandemic (January 2020–December 2021).

Figure 3.

Interest in Fintech information during the COVID-19 pandemic (January 2020–December 2021).

4. Empirical Results

4.1. Graphical Analysis of Data Trends

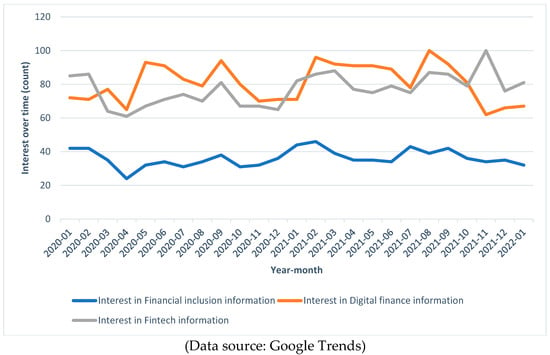

The graphical data in Figure 4 show that interest in Fintech and digital finance information had a higher popularity count than interest in financial inclusion information and this interest exceeded the 50-count mark. This suggests that interest in information about digital finance and Fintech was higher than interest in financial inclusion information during the COVID-19 pandemic. Interestingly, there was higher co-movement between interest in financial inclusion information, interest in digital finance information, and interest in Fintech information beginning in January 2021, which was a period that coincided with the second wave of the COVID-19 pandemic. This suggests that there was an association between interest in financial inclusion information, interest in digital finance information, and interest in Fintech information during the second wave of the COVID-19 pandemic.

Figure 4.

Interest in financial inclusion, Fintech, and digital finance information (January 2020–December 2021).

4.2. Correlation Analysis

The Pearson correlation results are reported in Table 2. It shows a significant positive correlation between interest in Fintech information and interest in financial inclusion information during the pandemic. These results indicate that people who were interested in Internet information about Fintech were also interested in Internet information about financial inclusion during the COVID-19 pandemic. This result is consistent with the findings of [22], who show that Fintech accelerated financial inclusion during the pandemic. Also, the correlation between interest in digital finance information and interest in financial inclusion information during the COVID-19 pandemic was positive but not significant. Similarly, the correlation between interest in Fintech information and interest in digital finance information during the COVID-19 pandemic was also positive but not significant. Overall, the correlation results suggest that interest in Fintech information was significantly associated with interest in financial inclusion information.

Table 2.

Pearson correlation matrix.

4.3. Granger Causality

4.3.1. Unit Root Test

We conducted a unit root test to check the stationarity of the time series data for the three variables to avoid spurious causation. We used the augmented Dickey–Fuller (ADF) unit root test to check for stationarity in the time series data for the three variables. The results are reported in Table 3, Table 4 and Table 5 while Table 6 presents a summary of the three ADF unit root tests.

Table 3.

Augmented Dickey–Fuller unit root test for the “interest in financial inclusion information” time series data.

Table 4.

Augmented Dickey–Fuller unit root test for the “interest in digital finance information” time series data.

Table 5.

Augmented Dickey–Fuller unit root test for the “interest in Fintech information” time series data.

Table 6.

Summary of the augmented Dickey–Fuller unit root test for the three variables.

In Table 3, the ADF unit root test shows that the “interest in financial inclusion information” time series data has a p-value of 0.056 which is greater than 5 percent and a t-value of −2.939. The p-value being greater than 5 percent indicates that the “interest in financial inclusion information” time series data has a unit root and is therefore non-stationary. As a result, we take the first difference in the time series data before conducting the Granger causality test.

In Table 4, the ADF unit root test shows that the “interest in digital finance information” time series data had a p-value of 0.055 which is greater than 5 percent and a t-value of −2.947. The p-value being greater than 5 percent indicates that the “interest in digital finance information” time series data has a unit root and is therefore non-stationary. As a result, we take the first difference in the time series data before conducting the Granger causality test.

In Table 5, the ADF unit root test shows that the “interest in Fintech information” time series data has a p-value of 0.035 which is less than 5 percent and a t-value of −3.178. The p-value being less than 5 percent indicates that the “interest in Fintech information” time series data did not have a unit root and is therefore stationary. Therefore, we did not need to take the first difference in the time series data before conducting the Granger causality test. A summary of the ADF results is presented in Table 6.

4.3.2. Granger Causality

Since the “interest in financial inclusion information” and the “interest in digital finance information” time series data are both non-stationary as shown in Table 3 and Table 4, we take the first difference in the two time series data before conducting the Granger causality test. The Granger causality test results are reported in Table 7, Table 8 and Table 9 while Table 10 presents a summary of the results.

Table 7.

Granger causality tests between interest in Fintech information and interest in financial inclusion information.

Table 8.

Granger causality tests between interest in Fintech information and interest in digital finance information.

Table 9.

Granger causality tests between interest in digital finance information and interest in financial inclusion information.

Table 10.

Pairwise Granger causality tests.

The Granger causality test in Table 7 reports a p-value of 0.016 which is less than 5 percent. This indicates that interest in Fintech information Granger cause (or lead to) interest in financial inclusion information during the COVID-19 pandemic. This implies that interest in Fintech information causes interest in financial inclusion information. This result is consistent with the findings of [22] who show that Fintech accelerated financial inclusion during the pandemic. However, there was no feedback causation because the p-value of 0.164 indicates that interest in financial inclusion information did not Granger cause interest in Fintech information during the COVID-19 pandemic. This implies that there was a one-way causation between interest in Fintech information and interest in financial inclusion information.

The Granger causality tests in Table 8 report a p-value of 0.159 which is greater than 5 percent. This indicates that there was no Granger causality between interest in Fintech information and interest in digital finance information during the COVID-19 pandemic. This indicates that interest in Fintech information did not Granger cause (or lead to) interest in digital finance information and vice versa during the COVID-19 pandemic. Also, there was no feedback causation found because the p-value of 0.721 indicates that interest in digital finance information did not Granger cause interest in Fintech information during the COVID-19 pandemic. This implies the absence of one-way or two-way causation between interest in Fintech information and interest in digital finance information.

Furthermore, the Granger causality tests in Table 9 report a p-value of 0.412 which is greater than 5 percent. This indicates that there was no Granger causality between interest in digital finance information and interest in financial inclusion information during the COVID-19 pandemic. This implies that interest in digital finance information did not Granger cause (or lead to) interest in financial inclusion information during the COVID-19 pandemic. Also, there was no feedback causation because the p-value of 0.405 indicates that interest in financial inclusion information did not Granger cause interest in digital finance information during the COVID-19 pandemic. This implies the absence of one-way or two-way causation between interest in financial inclusion information and interest in digital finance information. This result is inconsistent with the findings of [26] who show that digital financial services accelerated financial inclusion during the COVID-19 pandemic. A summary of the results is reported in Table 10.

4.3.3. Univariate OLS Regression as an Alternative Test for Causation Based on R-Squared

We ran an ordinary least squares (OLS) regression as an additional causality test. We performed this by specifying a univariate regression model as shown in Table 11. From the OLS regression results, we paid attention to the R-squared because the R-squared shows the predictive power of a model and implies a form of causation. Our goal in this section was to check whether the R-squared of the regression estimation confirmed the causation (or lack of causation) reported in the Granger causality test results in Table 10. The results in Table 11 show that the highest R-squared (29 percent) was reported in the model that estimated the effect of interest in Fintech on interest in financial inclusion. It show that interest in Fintech information predicted 29 percent of the interest in financial inclusion information. This result confirms the Granger causality results and suggests that interest in Fintech information caused interest in financial inclusion information. The other regression models report a negative R-squared which has no meaning.

Table 11.

Ordinary least squares (OLS) regression.

4.3.4. Univariate GMM Regression as an Alternative Test for Causation Based on R-Squared

We also ran a GMM regression as an additional causality test. We used GMM regression estimation to control for potential endogeneity in the data. In the GMM regression estimation, we used a lagged dependent variable as the GMM instrument. We again paid attention to the R-squared to check whether the R-squared of the GMM regression estimation confirmed the causation (or lack of causation) reported in the Granger causality test results in Table 10. The GMM results in Table 12 show that the highest R-squared (25 percent) was reported in the model that estimated the effect of interest in Fintech information on interest in financial inclusion information. The result shows that interest in Fintech information predicted 25 percent of the change in interest in financial inclusion information. This result confirmed the Granger causality results and suggested that interest in Fintech information caused interest in financial inclusion information. The other regression models report a negative R-squares which has no meaning.

Table 12.

Generalized method of moments (GMM) regression.

4.4. Effect of Interest in Digital Finance and Fintech Information on Interest in Financial Inclusion Information

Finally, we ran a multiple regression analysis using the OLS and GMM estimations in Table 13. The results show that the “interest in Fintech information” coefficient was positive and significant at the 1 percent level. This indicates that interest in information about Fintech led to a significant increase in interest in information about financial inclusion. This result is consistent with the findings of [22] who show that Fintech accelerated financial inclusion during the pandemic. Meanwhile, the “interest in digital finance information” coefficient are positive and insignificant. This indicates that interest in information about digital finance did not have a significant effect on interest in information about financial inclusion. This result is inconsistent with the findings of [26] who show that digital financial services accelerated financial inclusion during the COVID-19 pandemic.

Table 13.

Multiple regression analyses.

5. Conclusions

This study investigated whether interest in Fintech and digital finance information led to interest in financial inclusion information during the COVID-19 pandemic. We used Google Trends data over the COVID-19 pandemic period. We found evidence that interest in Fintech information was strongly correlated with interest in financial inclusion information. Also, there was a unidirectional causality between interest in Fintech information and interest in financial inclusion information. This implied that greater interest in Fintech information caused greater interest in financial inclusion information, while interest in financial inclusion information did not cause interest in Fintech information. The R-squared of the regression results also confirmed this result. There was no causality between interest in digital finance information and interest in financial inclusion information during the pandemic. The regression results showed that interest in information about Fintech led to a significant increase in interest in information about financial inclusion. The results showing that interest in information about Fintech led to interest in information about financial inclusion are interesting because they support the claim in the literature that Fintech plays a vital role in promoting financial inclusion. The implication of our findings is that interest in Fintech information is an important determinant of interest in financial inclusion information. It is recommended that policymakers and private sector agents should increase the amount of information available about Fintech solutions as it can provide people with more information about how to participate in the formal financial sector towards greater financial inclusion. There may be a need to embark on massive sensitization campaigns to inform citizens about the benefits of using Fintech and digital finance services. Such campaigns could be channeled through digital media, physical visits, and community engagements in urban and rural areas. Finally, the insights gained from our study should lead policymakers to disclose more information about their policy stance about Fintech growth and regulation so that people and organizations can have a level of certainty about the role and usefulness of Fintech for financial inclusion in society. The limitation of this study is that it focused on people’s “web-searches on the Internet” for Fintech, digital finance, and financial inclusion information. It may be argued that it is better to use actual Fintech and financial inclusion data rather than using interest over time data. Our response to such argument is that, since our study was focused on measuring interest over time, it seemed appropriate to use interest over time data rather than using the traditional Fintech, digital finance, and financial inclusion data. Future studies can extend our study by investigating whether interest in microfinance information leads to interest in financial inclusion information. Future studies could also examine the relationship between interest in Fintech information and interest in financial inclusion information during the 2008 global financial crisis.

Author Contributions

Conceptualization, P.K.O. and R.A.; methodology, P.K.O.; software, P.K.O.; literature review, D.M. and M.F.; writing—original draft preparation, P.K.O. and D.M.; writing, M.F. and R.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data used for this study are publicly available on the Google Trends database. The data can be found at the following link: https://trends.google.com/trends/, accessed on 1 December 2023.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

| Google Trends Search Category | Countries and Regions |

| Web search | Zimbabwe, Eswatini, Rwanda, Uganda, Zambia, Fiji, Nigeria, Ghana, Ethiopia, Tanzania, Kenya, India, Cameroon, Nepal, Bangladesh, Mauritius, Cambodia, Singapore, South Africa, Philippines, Pakistan, Lebanon, Sri Lanka, Jordan, Malaysia, Bolivia, Egypt, Hong Kong, United Arab Emirates, United Kingdom, Indonesia, Switzerland, Australia, South Korea, United States, Thailand, Netherlands, Canada, Vietnam, Saudi Arabia, Mexico, Norway, Germany, France, Spain, Japan, Russia, Iran, Brazil, Marshall Islands, Micronesia, Tonga, Vanuatu, Eritrea, Solomon Islands, Samoa, American Samoa, Lesotho, Papua New Guinea, Palau, Sierra Leone, Malawi, Bhutan, Guinea-Bissau, Greenland, Burundi, Seychelles, The Gambia, Mayotte, Liberia, Botswana, St. Vincent and the Grenadines, Namibia, Timor-Leste, Grenada, Suriname, St. Kitts and Nevis, Belize, Afghanistan, Senegal, Somalia, South Sudan, Dominica, Mozambique, Myanmar (Burma), Haiti, Djibouti, Barbados, St. Helena, Côte D’Ivoire, Jamaica, Guyana, Maldives, Cayman Islands, Congo—Brazzaville, Curaçao, Benin, Luxembourg, Gabon, French Guiana, Mongolia, St. Lucia, Togo, Macao, Tajikistan, Brunei, Burkina Faso, Mali, Angola, Sudan, Bahrain, Niger, Madagascar, Laos, Jersey, Tunisia, Albania, Trinidad and Tobago, Armenia, The Bahamas, Palestine, Qatar, Oman, Turkmenistan, Congo—Kinshasa, Honduras, Uzbekistan, Kuwait, Belgium, Bosnia and Herzegovina, Ireland, Cyprus, Moldova, Georgia, Yemen, Iraq, Kyrgyzstan, Peru, Malta, Morocco, Nicaragua, El Salvador, Algeria, Paraguay, Azerbaijan, New Zealand, Libya, Uruguay, Guatemala, Ecuador, Taiwan, Estonia, China, Denmark, Panama, Colombia, North Macedonia, Costa Rica, Portugal, Greece, Croatia, Austria, Sweden, Bulgaria, Syria, Dominican Republic, Belarus, Israel, Hungary, Kazakhstan, Lithuania, Finland, Argentina, Romania, Turkey, Italy, Czechia, Chile, Ukraine, Poland, Venezuela, Slovakia, Serbia, Aruba, Anguilla, Andorra, Antarctica, French Southern Territories, Antigua and Barbuda, Caribbean Netherlands, St. Barts, Bermuda, Bouvet Island, Central African Republic, Cocos (Keeling) Islands, Cook Islands, Comoros, Cape Verde, Cuba, Christmas Island, Western Sahara, Falkland Islands (Islas Malvinas), Faroe Islands, Guernsey, Gibraltar, Guinea, Guadeloupe, Equatorial Guinea, Guam, Heard and McDonald Islands, Isle of Man, British Indian Ocean Territory, Iceland, Kiribati, Liechtenstein, Latvia, St. Martin, Monaco, Montenegro, Northern Mariana Islands, Mauritania, Montserrat, Martinique, New Caledonia, Norfolk Island, Niue, Nauru, Pitcairn Islands, Puerto Rico, French Polynesia, South Georgia and South Sandwich Islands, Svalbard and Jan Mayen, San Marino, St. Pierre and Miquelon, Sao Tome and Principe, Slovenia, Sint Maarten, Turks and Caicos Islands, Chad, Tokelau, Tuvalu, U.S. Outlying Islands, Vatican City, British Virgin Islands, U.S. Virgin Islands, Wallis and Futuna, Kosovo. |

References

- Demirgüç-Kunt, A.; Klapper, L.; Singer, D.; Ansar, S.; Hess, J. Measuring Financial Inclusion, and the Fintech Revolution. In The Global Findex Database 2017; World Bank Group: Washington, DC, USA, 2017. [Google Scholar]

- Fintel, D.; Orthofer, A. Wealth inequality and financial inclusion: Evidence from South African tax and survey records. Econ. Model. 2020, 91, 568–578. [Google Scholar] [CrossRef]

- Ozili, P.K.; Mhlanga, D. Why is financial inclusion so popular? An analysis of development buzzwords. J. Int. Dev. 2024, 36, 231–253. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Thomas, H.; Hedrick-Wong, Y. How digital finance and fintech can improve financial inclusion. In Inclusive Growth: The Global Challenges of Social Inequality and Financial Inclusion; Emerald Publishing Limited: Bingley, UK, 2019; pp. 27–41. [Google Scholar]

- Singh, S.; Sahni, M.M.; Kovid, R.K. What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag. Decis. 2020, 58, 1675–1697. [Google Scholar] [CrossRef]

- Chong, T.-P.; Choo, K.-S.W.; Yip, Y.-S.; Chan, P.-Y.; The, H.-L.J.; Ng, S.-S. An adoption of fintech service in Malaysia. South East Asia J. Contemp. Bus. 2019, 18, 134–147. [Google Scholar]

- Ozili, P.K. Contesting digital finance for the poor. Digit. Policy Regul. Gov. 2020, 22, 135–151. [Google Scholar]

- Yan, C.; Siddik, A.B.; Akter, N.; Dong, Q. Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: The role of FinTech. Environ. Sci. Pollut. Res. 2021, 30, 61271–61289. [Google Scholar] [CrossRef]

- Ozili, P.K.; Arun, T. Spillover of COVID-19: Impact on the Global Economy. In Managing Inflation and Supply Chain Disruptions in the Global Economy; IGI Global: Hershey, PA, USA, 2023; pp. 41–61. [Google Scholar]

- Vargo, D.; Zhu, L.; Benwell, B.; Yan, Z. Digital technology use during COVID-19 pandemic: A rapid review. Hum. Behav. Emerg. Technol. 2021, 3, 13–24. [Google Scholar] [CrossRef]

- Papouli, E.; Chatzifotiou, S.; Tsairidis, C. The use of digital technology at home during the COVID-19 outbreak: Views of social work students in Greece. Soc. Work. Educ. 2020, 39, 1107–1115. [Google Scholar] [CrossRef]

- Kanungo, R.P.; Gupta, S. Financial inclusion through digitalisation of services for well-being. Technol. Forecast. Soc. Chang. 2021, 167, 120721. [Google Scholar] [CrossRef]

- Fu, J.; Mishra, M. Fintech in the time of COVID-19: Technological adoption during crises. J. Financ. Intermediat. 2022, 50, 100945. [Google Scholar] [CrossRef]

- Shafeeq, M.; Beg, S. A study to assess the impact of COVID-19 pandemic on digital financial services and digital financial inclusion in India. Afr. J. Account. Audit. Financ. 2021, 7, 326–345. [Google Scholar] [CrossRef]

- Sahay, M.R.; von Allmen, M.U.E.; Lahreche, M.A.; Khera, P.; Ogawa, M.S.; Bazarbash, M.; Beaton, M.K. The Promise of Fintech: Financial Inclusion in the Post COVID-19 Era; International Monetary Fund: Washington, DC, USA, 2020. [Google Scholar]

- Arner, D.W.; Barberis, J.N.; Walker, J.; Buckley, R.P.; Dahdal, A.M.; Zetzsche, D.A. Digital Finance & the COVID-19 Crisis; University of Hong Kong Faculty of Law Research Paper; Hong Kong University: Hong Kong, 2020; p. 17. [Google Scholar]

- Al Nawayseh, M.K. Fintech in COVID-19 and beyond: What factors are affecting customers’ choice of Fintech applications. J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar] [CrossRef]

- Senyo, P.K.; Osabutey, E.L.; Kan, K.A.S. Pathways to improving financial inclusion through mobile money: A fuzzy set qualitative comparative analysis. Inf. Technol. People 2021, 34, 1997–2017. [Google Scholar] [CrossRef]

- Philippon, T. On fintech and financial inclusion. Natl. Bur. Econ. Res. 2019, w26330. [Google Scholar] [CrossRef]

- Beck, T. Fintech, and Financial Inclusion: Opportunities and Pitfalls; ADBI Working Paper Series; Asian Development Bank Institute (ADBI): Tokyo, Japan, 2020; p. 1165. [Google Scholar]

- Djoufouet, W.F.; Pondie, T.M. Impacts of Fintech on Financial Inclusion: The Case of Sub-Saharan Africa. Copernic. J. Financ. Account. 2022, 11, 69–88. [Google Scholar] [CrossRef]

- Alber, N.; Dabour, M. The dynamic relationship between FinTech and social distancing under COVID-19 pandemic: Digital payments evidence. Int. J. Econ. Financ. 2020, 12, 11. [Google Scholar] [CrossRef]

- Fu, J.; Mishra, M. The Global Impact of COVID-19 on FinTech Adoption; Swiss Finance Institute Research Paper; Swiss Finance Institute: Zürich, Switzerland , 2020; pp. 20–38. [Google Scholar]

- Ahmad, N.W.; Bahari, N.; Ripain, N. COVID-19 Outbreak: The Influence on Digital Finance and Financial Inclusion. In Proceedings of the International Conference on Syariah & Law, Online, 6 April 2021; pp. 160–166. [Google Scholar]

- Dluhopolskyi, O.; Pakhnenko, O.; Lyeonov, S.; Semenog, A.; Artyukhova, N.; Cholewa-Wiktor, M.; Jastrzębski, W. Digital financial inclusion: COVID-19 impacts and opportunities. Sustainability 2023, 15, 2383. [Google Scholar] [CrossRef]

- Banna, H.; Hassan, M.K.; Ahmad, R.; Alam, M.R. Islamic banking stability amidst the COVID-19 pandemic: The role of digital financial inclusion. Int. J. Islam. Middle East. Financ. Manag. 2022, 15, 310–330. [Google Scholar] [CrossRef]

- Vasenska, I.; Dimitrov, P.; Koyundzhiyska-Davidkova, B.; Krastev, V.; Durana, P.; Poulaki, I. Financial transactions using Fintech during the COVID-19 crisis in Bulgaria. Risks 2021, 9, 48. [Google Scholar] [CrossRef]

- Abu Daqar, M.; Constantinovits, M.; Arqawi, S.; Daragmeh, A. The role of Fintech in predicting the spread of COVID-19. Banks Bank Syst. 2021, 16, 1–16. [Google Scholar] [CrossRef] [PubMed]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).