Factors Affecting Fintech Adoption: A Systematic Literature Review

Abstract

1. Introduction

2. Literature Review

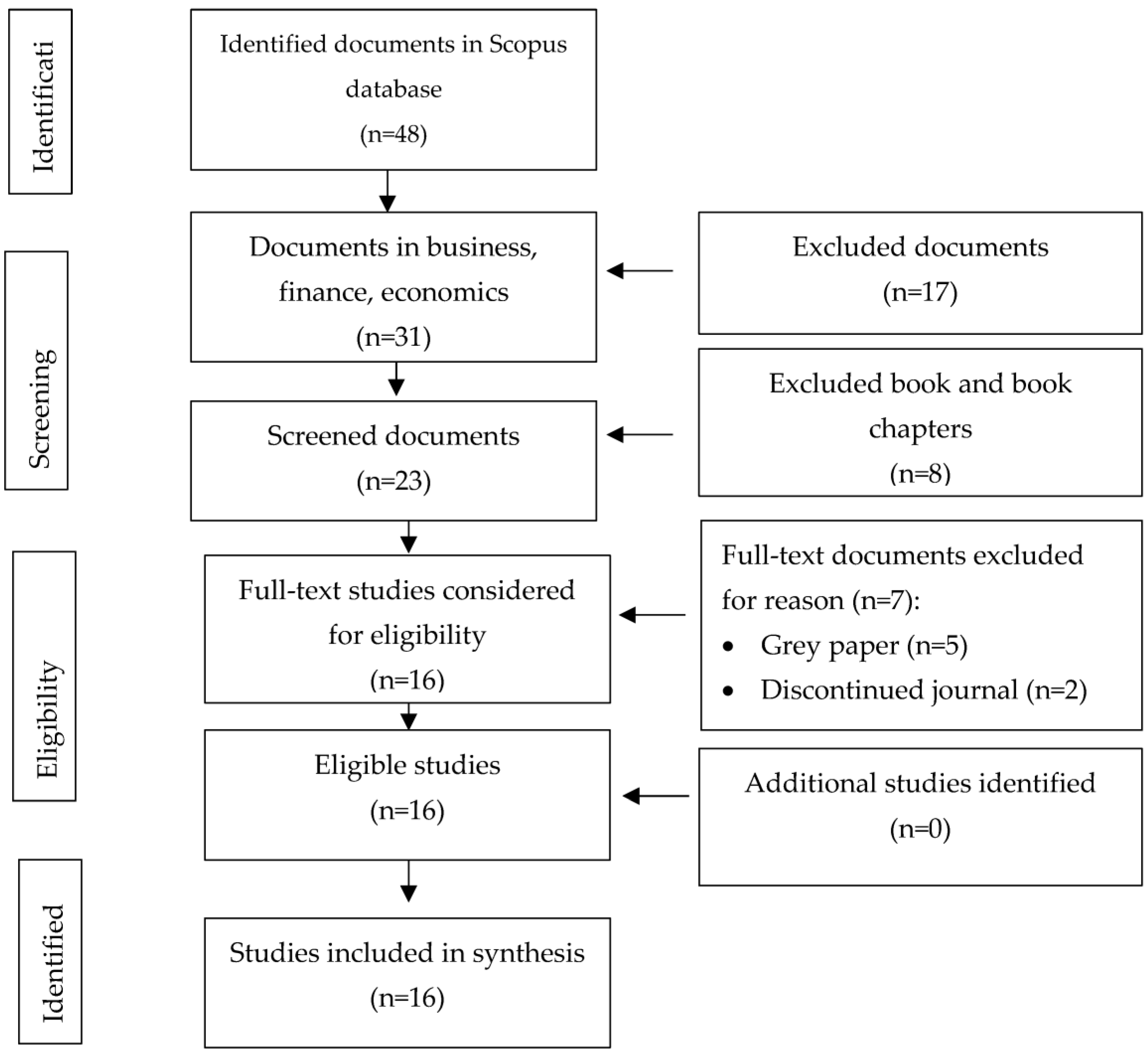

3. Materials and Methods

4. Results and Discussion

4.1. Publication Year

4.2. Journal and Publisher

4.3. Selected Paper

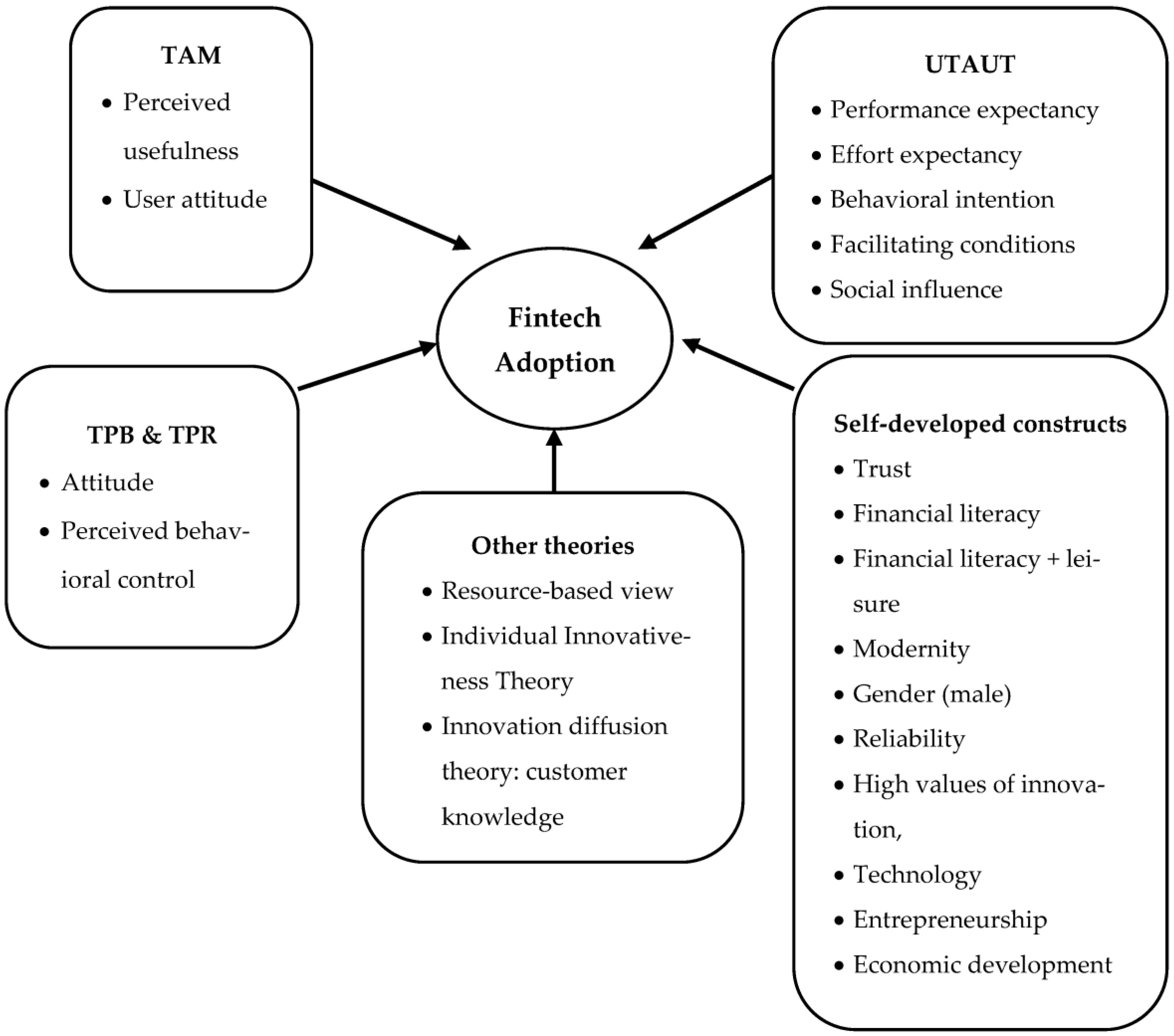

4.4. Determinants of Fintech Adoption

4.4.1. TAM-Related Determinants

| No | Authors | Title | Year | Method & Research Type | Theory | Country | Significant Independent Variables (Including Sign) |

|---|---|---|---|---|---|---|---|

| 1 | Ali et al. [38] | How perceived risk, benefit and trust determine user Fintech adoption: a new dimension for Islamic finance | 2021 | Quantitative & empirical | Theory of perceived risk (TPR), perceived benefit and trust | Pakistan | (+) User trust |

| 2 | Belanche et al. [33] | Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers | 2019 | Quantitative & empirical | Technology acceptance model (TAM) | North America, Britain, Portugal | (+) Consumers’ attitudes toward robo-advisors (+) Mass media (+) Interpersonal subjective norms |

| 3 | Chan et al. [39] | Towards an understanding of consumers’ FinTech adoption: the case of Open Banking | 2022 | Quantitative & empirical | Unified theory of acceptance and use of technology (UTAUT) | Australia | (+) Performance expectancy (+) Effort expectancy (+) Social influence (-) Perceived risk |

| 4 | Frederiks et al. [40] | The early bird catches the worm: The role of regulatory uncertainty in early adoption of blockchain’s cryptocurrency by fintech ventures | 2022 | Quantitative & empirical | Resource-based view | Cross-countries | (+) Regulatory uncertainty has a positive effect on NTBFs’ adoption of fintech (crypto) |

| 5 | Fu & Mishra [41] | Fintech in the time of COVID-19: Technological adoption during crises | 2022 | Quantitative & empirical | Not available | Cross-countries | (+) COVID-19 pandemic spread and lockdowns affect download finance app |

| 6 | Hasan et al. [34] | Evaluating Drivers of Fintech Adoption in The Netherlands | 2021 | Quantitative & empirical | TAM & VAM (value-based adoption model) | Netherland | (+) Perceived ease of use (+) Perceived usefulness (+) Safety (+) Trust |

| 7 | Huarng & Yu [42] | Causal complexity analysis for fintech adoption at the country level | 2022 | Quantitative & empirical | Not available | Cross-countries | Combination of the followings: (+) High values of innovation, (+) Technology (+) Entrepreneurship (+) Economic development |

| 8 | Jünger & Mietzner [43] | Banking goes digital: The adoption of FinTech services by German households | 2020 | Quantitative & empirical | Not available (self-developed) | Germany | (+) Perceived trust (+) Reliability (+) Transparency requirement (+) Financial literacy |

| 9 | Kakinuma [44] | Financial literacy and quality of life: a moderated mediation approach of fintech adoption and leisure | 2022 | Quantitative & empirical | Not available (self-developed) | Thailand | (+) Leisure (+) Financial literacy + leisure |

| 10 | Mazambani & Mutambara [45] | Predicting FinTech innovation adoption in South Africa: the case of cryptocurrency | 2020 | Quantitative & empirical | Theory of Planned Behavior (TPB) | South Africa | (+) Attitude (+) Perceived behavioral control |

| 11 | Ngo & Nguyen [37] | Consumer adoption intention toward FinTech services in a bank-based financial system in Vietnam | 2022 | Quantitative & empirical | TAM & innovation diffusion theory | Vietnam | (+) Customer latent needs for fintech service (+) Customer knowledge |

| 12 | Rahim et al. [46] | Measurement and structural modelling on factors of Islamic Fintech adoption among millennials in Malaysia | 2022 | Quantitative & empirical | UTAUT | Malaysia | (+) Behavioral intention (+) Facilitating conditions |

| 13 | Setiawan et al. [36] | User innovativeness and fintech adoption in Indonesia | 2021 | Quantitative & empirical | TAM, Institutional Theory (IT), and Individual Innovativeness Theory (IIT) | Indonesia | (+) Brand image (+) Fintech perceived usefulness (+) User attitude (+) Financial literacy (+) User innovativeness |

| 14 | Shubbangi Singh et al. [35] | What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model | 2020 | Quantitative & empirical | TAM, UTAUT, ServPerfand & WebQual 4.0 | (+) Perceived usefulness (-) social influence | |

| 15 | Solarz & Swacha-Lech [47] | Determinants of the adoption of innovative fintech services by millennials | 2021 | Quantitative & empirical | Not available (self-developed) | Poland | (+) H2: making decisions about choosing a financial institution based on the opinions about a financial institution in social media (+) H4: Modernity applied solutions (+) H7: Using a smartwatch is important (-) H10: age (+) H11: male, than female |

| 16 | Xie et al. [48] | Understanding fintech platform adoption: Impacts of perceived value and perceived risk | 2021 | Quantitative & empirical | UTAUT | China | (+) perceived value (-) perceived risk (+) social influence |

4.4.2. UTAUT-Related Determinants

4.4.3. TPB and TPR-Related Determinants

4.4.4. Other Theories

4.4.5. Self-Developed Constructs

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Baber, H. FinTech, Crowdfunding and Customer Retention in Islamic Banks. Vision 2020, 24, 260–268. [Google Scholar] [CrossRef]

- Zhang, B.Z.; Ashta, A.; Barton, M.E. Do FinTech and financial incumbents have different experiences and perspectives on the adoption of artificial intelligence? Strateg. Chang. 2021, 30, 223–234. [Google Scholar] [CrossRef]

- Hornuf, C.; Hornuf, L. The emergence of the global fintech market: Economic and technological determinants. Small Bus. Econ. 2019, 53, 81–105. [Google Scholar]

- Mackenzie, A. The Fintech Revolution. Lond. Bus. Sch. Rev. 2015, 26, 50–53. [Google Scholar] [CrossRef]

- Buchak, G.; Matvos, G.; Piskorski, T.; Seru, A. Fintech, regulatory arbitrage, and the rise of shadow banks. J. Financ. Econ. 2018, 130, 453–483. [Google Scholar] [CrossRef]

- Baber, H. Relevance of e-SERVQUAL for determining the quality of FinTech services. Int. J. Electron. Financ. 2019, 9, 257–267. [Google Scholar] [CrossRef]

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Takeda, A.; Ito, Y. A review of FinTech research. Int. J. Technol. Manag. 2021, 86, 67–88. [Google Scholar] [CrossRef]

- Hasan, R.; Hassan, M.K.; Aliyu, S. Fintech and Islamic Finance: Literature Review and Research Agenda. Int. J. Islam. Econ. Financ. 2020, 3, 75–94. [Google Scholar] [CrossRef]

- Alshater, M.M.; Saba, I.; Supriani, I.; Rabbani, M.R. Fintech in islamic finance literature: A review. Heliyon 2022, 8, e10385. [Google Scholar] [CrossRef]

- Okfalisa, O.; Mahyarni, M.; Anggraini, W.; Saeed, F.; Moshood, T.D.; Saktioto, S. Quadruple Helix Engagement: Reviews on Syariah Fintech Based SMEs Digitalization Readiness. Indones. J. Electr. Eng. Inform. 2022, 10, 112–122. [Google Scholar] [CrossRef]

- Utami, A.F.; Ekaputra, I.A.; Japutra, A. Adoption of FinTech Products: A Systematic Literature Review. J. Creat. Commun. 2021, 16, 233–248. [Google Scholar] [CrossRef]

- Oladapo, I.A.; Hamoudah, M.M.; Alam, M.M.; Olaopa, O.R.; Muda, R. Customers’ perceptions of FinTech adaptability in the Islamic banking sector: Comparative study on Malaysia and Saudi Arabia. J. Model. Manag. 2021, 17, 1241–1261. [Google Scholar] [CrossRef]

- Najib, M.; Ermawati, W.J.; Fahma, F.; Endri, E.; Suhartanto, D. Fintech in the small food business and its relation with open innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Milian, E.Z.; Spinola, M.d.M.; de Carvalho, M.M. Fintechs: A literature review and research agenda. Electron. Commer. Res. Appl. 2019, 34, 100833. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef]

- Bellucci, M.; Bianchi, D.C.; Manetti, G. Blockchain in accounting practice and research: Systematic literature review. Meditari Account. Res. 2022, 30, 121–146. [Google Scholar] [CrossRef]

- Singh, H.P.; Kumar, S. Working capital management: A literature review and research agenda. Qual. Res. Financ. Mark. 2014, 6, 173–197. [Google Scholar] [CrossRef]

- Aravindaraj, K.; Chinna, P.R. A systematic literature review of integration of industry 4.0 and warehouse management to achieve Sustainable Development Goals (SDGs). Clean. Logist. Supply Chain 2022, 5, 100072. [Google Scholar] [CrossRef]

- Singh, S.; Paul, J.; Dhir, S. Innovation implementation in Asia-Pacific countries: A review and research agenda. Asia Pac. Bus. Rev. 2021, 27, 180–208. [Google Scholar] [CrossRef]

- Sikandar, H.; Kohar, U.H.A. A systematic literature review of open innovation in small and medium enterprises in the past decade. Foresight 2022, 24, 742–756. [Google Scholar] [CrossRef]

- Khaw, T.Y.; Teoh, A.P.; Khalid, S.N.A.; Letchmunan, S. The impact of digital leadership on sustainable performance: A systematic literature review. J. Manag. Dev. 2022, 41, 514–534. [Google Scholar] [CrossRef]

- Joshi, A. Comparison Between Scopus & ISI Web of Science. J. Glob. Values 2016, VII, 1–11. [Google Scholar]

- Thomas, A.; Gupta, V. Tacit knowledge in organizations: Bibliometrics and a framework-based systematic review of antecedents, outcomes, theories, methods and future directions. J. Knowl. Manag. 2021, 26, 1014–1041. [Google Scholar] [CrossRef]

- Coetzee, J. Risk aversion and the adoption of Fintech by South African banks. Afr. J. Bus. Econ. Res. 2019, 14, 133–153. [Google Scholar] [CrossRef]

- Singh, R.; Malik, G.; Jain, V. FinTech effect: Measuring impact of FinTech adoption on banks’ profitability. Int. J. Manag. Pract. 2021, 14, 411–427. [Google Scholar] [CrossRef]

- Tripathy, A.K.; Jain, A. FinTech adoption: Strategy for customer retention. Strateg. Dir. 2020, 36, 47–49. [Google Scholar] [CrossRef]

- Young, D.; Young, J. Technology adoption: Impact of FinTech on financial inclusion of low-income households. Int. J. Electron. Financ. 2022, 11, 202–218. [Google Scholar] [CrossRef]

- Katyayani, J.; Varalakshmi, C. Influence of Consumer Profile on Adoption of Fintech Products with Reference to Vijayawada City, Ap. Int. J. Recent Technol. Eng. 2019, 7, 455–457. [Google Scholar]

- Noreen, M.; Mia, M.S.; Ghazali, Z.; Ahmed, F. Role of Government Policies to Fintech Adoption and Financial Inclusion: A Study in Pakistan. Univers. J. Account. Financ. 2022, 10, 37–46. [Google Scholar] [CrossRef]

- Cortegiani, A.; Ippolito, M.; Ingoglia, G.; Manca, A.; Cugusi, L.; Severin, A.; Strinzel, M.; Panzarella, V.; Campisi, G.; Manoj, L.; et al. Citations and metrics of journals discontinued from Scopus for publication concerns: The GhoS(t)copus Project. F1000Research 2020, 9, 415. [Google Scholar] [CrossRef] [PubMed]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef]

- Belanche, D.; Casaló, L.V.; Flavián, C. Artificial Intelligence in FinTech: Understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. 2019, 119, 1411–1430. [Google Scholar] [CrossRef]

- Hasan, R.; Ashfaq, M.; Shao, L. Evaluating Drivers of Fintech Adoption in the Netherlands. Glob. Bus. Rev. 2021, 1–14. [Google Scholar] [CrossRef]

- Singh, S.; Sahni, M.M.; Kovid, R.K. What drives FinTech adoption? A multi-method evaluation using an adapted technology acceptance model. Manag. Decis. 2020, 58, 1675–1697. [Google Scholar] [CrossRef]

- Setiawan, B.; Nugraha, D.P.; Irawan, A.; Nathan, R.J. User Innovativeness and Fintech Adoption in Indonesia. J. Open Innov. Technol. Mark. Complex. 2021, 7, 188. [Google Scholar] [CrossRef]

- Ngo, H.T.; Nguyen, L.T.H. Consumer adoption intention toward FinTech services in a bank-based financial system in Vietnam. J. Financ. Regul. Compliance 2022. [Google Scholar] [CrossRef]

- Ali, M.; Raza, S.A.; Khamis, B.; Puah, C.H.; Amin, H. How perceived risk, benefit and trust determine user Fintech adoption: A new dimension for Islamic finance. Foresight 2021, 23, 403–420. [Google Scholar] [CrossRef]

- Chan, R.; Troshani, I.; Hill, S.R.; Hoffmann, A. Towards an understanding of consumers’ FinTech adoption: The case of Open Banking. Int. J. Bank Mark. 2022, 40, 886–917. [Google Scholar] [CrossRef]

- Frederiks, A.J.; Costa, S.; Hulst, B.; Groen, A.J.; Costa, S.; Hulst, B.; Groen, A.J. The early bird catches the worm: The role of regulatory uncertainty in early adoption of blockchain’ s cryptocurrency by fintech ventures. J. Small Bus. Manag. 2022, 11, 1–34. [Google Scholar] [CrossRef]

- Fu, J.; Mishra, M. Fintech in the time of COVID−19: Technological adoption during crises. J. Financ. Intermediation 2022, 50, 100945. [Google Scholar] [CrossRef]

- Huarng, K.; Yu, T.H. Causal complexity analysis for fintech adoption at the country level. J. Bus. Res. 2022, 153, 228–234. [Google Scholar] [CrossRef]

- Jünger, M.; Mietzner, M. Banking goes digital: The adoption of FinTech services by German households. Financ. Res. Lett. 2020, 34, 101260. [Google Scholar] [CrossRef]

- Kakinuma, Y. Financial literacy and quality of life: A moderated mediation approach of fintech adoption and leisure. Int. J. Soc. Econ. 2022, 49, 1713–1726. [Google Scholar] [CrossRef]

- Mazambani, L.; Mutambara, E. Predicting FinTech innovation adoption in South Africa: The case of cryptocurrency. Afr. J. Econ. Manag. Stud. 2020, 11, 30–50. [Google Scholar] [CrossRef]

- Rahim, N.F.; Bakri, M.H.; Fianto, B.A.; Zainal, N.; Al Shami, S.A.H. Measurement and structural modelling on factors of Islamic Fintech adoption among millennials in Malaysia. J. Islam. Mark. 2022. [Google Scholar] [CrossRef]

- Solarz, M.; Swacha-Lech, M. Determinants of the Adoption of Innovative Fintech Services by Determinants of the Adoption of Innovative Fintech Services by Millennials. E&M Ekon. Manag. 2021, 24, 149–166. [Google Scholar] [CrossRef]

- Xie, J.; Ye, L.; Huang, W.; Ye, M. Understanding FinTech Platform Adoption: Impacts of Perceived Value and Perceived Risk. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1893–1911. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

| Journal Name | Best Scopus Quartile | Publisher |

|---|---|---|

| Journal of Financial Intermediation | Q1 | Academic Press Inc. |

| Journal of Business Research | Q1 | Elsevier Inc. |

| Finance Research Letters | Q1 | |

| African Journal of Economic and Management Studies | Q1 | Emerald Group Holdings Ltd. |

| Foresight | Q2 | |

| Industrial Management and Data Systems | Q1 | |

| International Journal of Bank Marketing | Q1 | |

| International Journal of Social Economics | Q2 | |

| Journal of Financial Regulation and Compliance | Q3 | |

| Journal of Islamic Marketing | Q2 | |

| Management Decision | Q1 | |

| Journal of Open Innovation: Technology, Market, and Complexity | Q1 | MDPI AG |

| Journal of Theoretical and Applied Electronic Commerce Research | Q2 | |

| Global Business Review | Q2 | Sage Publications India Pvt. Ltd. |

| Journal of Small Business Management | Q1 | Taylor and Francis Ltd. |

| E a M: Ekonomie a Management | Q1 | Technical University of Liberec |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Firmansyah, E.A.; Masri, M.; Anshari, M.; Besar, M.H.A. Factors Affecting Fintech Adoption: A Systematic Literature Review. FinTech 2023, 2, 21-33. https://doi.org/10.3390/fintech2010002

Firmansyah EA, Masri M, Anshari M, Besar MHA. Factors Affecting Fintech Adoption: A Systematic Literature Review. FinTech. 2023; 2(1):21-33. https://doi.org/10.3390/fintech2010002

Chicago/Turabian StyleFirmansyah, Egi Arvian, Masairol Masri, Muhammad Anshari, and Mohd Hairul Azrin Besar. 2023. "Factors Affecting Fintech Adoption: A Systematic Literature Review" FinTech 2, no. 1: 21-33. https://doi.org/10.3390/fintech2010002

APA StyleFirmansyah, E. A., Masri, M., Anshari, M., & Besar, M. H. A. (2023). Factors Affecting Fintech Adoption: A Systematic Literature Review. FinTech, 2(1), 21-33. https://doi.org/10.3390/fintech2010002