Abstract

The study evaluated factors influencing port users’ intentions to participate in Financial Technology (Fintech) in the ports of Ghana. The study used non-experimental quantitative correlational design and the Extended Unified Theory of the Acceptance and Use of Technology (UTAUT2) as the theoretical foundation to assess whether performance expectancy (PE), behavioral intention (BI), effort expectancy (EE), social influence (SI), facilitating conditions (FC), hedonic motivation (HM), price value (PV), and habit (HT) were predictors of the intention of port users to participate in a Fintech program with age as a moderating factor. The sample comprised 407 individuals who work in the port industry and are between 18 and 64 years old; these were randomly selected through the SurveyMonkey platform. The study used principal component analysis (PCA), confirmatory factor analysis, and structural equation modeling to analyze and report the results. Findings show that PE, EE, and HT were predictors of the behavioral intention of port users to participate in a Fintech in the maritime and ports in Ghana. FC, SI, HM, and PV values could not predict BI for port users to enroll on a Fintech program. Neither did age have a moderating effect on the predictors variable influence on behavioral intention. This study offers a deeper insight into the adoption of Fintech in the port industry and sub-Saharan Africa. The findings can help researchers explain the variations in the UTAUT2 theoretical framework predictions relative to different sectors and disciplines. Researchers who intend to use the UTAUT2 theoretical framework to influence port users BI to enroll in the Fintech program will now consider PE, EE, and HT the most effective adoption factors. From a practical perspective, the study will help managers and stakeholders in ports in Ghana and sub-Saharan Africa focus on the critical constructs as the first steps to implementing a Fintech program. On the other side, port users will also understand their role relative to performance expectancy, effort expectancy, and the habit to cultivate toward Fintech.

1. Introduction

The rise of financial technology (Fintech) has been a major trend in economies across the globe [1]. Beginning with mobile payments, money transfers, and online lending, to blockchain, cryptocurrencies, and crowdfunding, the broad concept of Fintech is about adopting new technologies in financial services [2]. Fintech signifies an innovative and emerging field, which has attracted attention from industry, academia, and investors. Fintech is recognized as a weak signal to the financial institution, nevertheless, with its speedily rising, impactful disruption in traditional financial institutions and it is a leading area where all financial institutions of any country pay attention to [3]. The concept of Fintech has gained prominence in many industries as it has become a tool for value and wealth creation. In emergent countries such as Ghana, Fintech is poised to speed up financial inclusion. Other such countries such as India have already embraced many components of Fintech and its earning profits [4]. In Africa, Ghana leads as the fastest growing digital market [5]. Other countries such as Nigeria, Kenya, and South Africa have also made some serious gains in Fintech [6]. Until recently, banks were the principal players in the financial services landscape but, as a result, entrepreneurial and technological advancements and new firm models have emerged, introducing new applicants such as start-ups and technology firms into the mix [7]. New Fintech firms, business models, and customer solutions are entering the sub-Saharan market at increasingly high rates [6]. This development has meaningfully changed how businesses and retail customers manage their finances. These new disruptive companies, as well as the components that contributed to it, are now commonly referred to as “Fintech” [7]. Ref. [8] defined Fintech as a game-changer and disruptive innovation that can shake up traditional financial markets. The world has witnessed the emergence of more than 12,000 huge established companies globally [9]. Investment in Fintech increased to USD19 bn in 2015 [10], and this elucidates the adoption of Fintech in the world. This growth has also impacted emerging economies, stimulating young entrepreneurs to use advanced technologies to achieve a market competitive edge [9]. In this regard, Fintech symbolizes a powerful element of the global entrepreneurial ecosystem, both for developed and emerging economies [11]. Fintech have several benefits to financial service users, Fintech providers, governments, and economies such as rising access to finance among poor as well as increasing aggregate expenditure for governments [12]. The challenges of Fintech are typically pinned on shortcomings such as corruption, infrastructure, regulation, skills shortage, and high expectations of the emerging middle class amongst others [6].

The maritime and ports industry contributes significantly to the economies of most countries in the world [13]. Nearly 80 percent in volume of global trade is carried by sea and over 70 percent of global trade by value are carried by sea and are handled by ports worldwide [14]. The maritime and ports industry therefore plays a crucial role in facilitating trade and creating value and wealth for most countries in the world. Several Fintech components such as blockchain and smart contracts, among others, have been implemented across industries including the maritime and ports industry [14,15,16,17,18,19,20,21], due to its potential to address the challenges of cargo delays and ship turnaround time and providing stakeholders in the maritime and ports sector with real-time information for trade facilitation. The gap identified in the literature can be aligned with the [22] who developed the transformational affordance framework (TAF) using a case study of Ghana’s paperless port digitization transformation and technology affordance theory. The authors reconceptualize the notion of digital platformization, which has largely focused on the private sector environment and addressed the literature gap from the public sector’s perspective on how digital platformization produces relational affordances for public sector transformation. Since Ghana leads as the fastest growing digital market [5], it was crucial that beyond assessing how digital platformization generates relational affordances for public sector transformations, we assessed the broad Fintech adoption factors on port users’ behavioral intentions in participating in a Fintech program in the maritime and ports industry using the Unified Theory of Acceptance and Use of Technology (UTAUT2) theoretical framework, which is currently missing in the literature [12,14,20,23,24,25,26]. To address this gap in the literature from the theoretical and empirical perspectives, we ask this broad question “what are the factors that influences port users’ behavioral intentions to participate in a Fintech”. In doing so, the paper seeks to make the following contributions. First, the UTAUT2 theoretical framework is extended to the maritime and ports industry to understand the specific factors that influences port users to enroll on a Fintech program, which is currently missing in the literature. Second, we provide empirical literature on the six predictors of UTAUT2 and their contributions to Fintech adoption in the maritime and ports industry to simulate some discussions among industry players on the key predictors of Fintech adoption in the sector. Third, the study contributes to the UTAUT2 theory from the maritime and ports perspective, which is a preferred technology adoption framework because UTAUT2 predicts behavioral intentions to adopt technology with 70% accuracy compared to other technology adoption theories [27]. Furthermore, over 5000 peer-reviewed articles have used UTAUT2 as a theoretical framework to understand factors that influence the adoption of new technologies [28].

The rest of the paper follows this order. Section 2 presents the literature review and theoretical foundation. Section 3 discusses the research methodology, as well as data collection and analysis processes. Section 4 presents the findings. Section 5 presents a discussion of the findings, recommendations, and the theoretical, practical, and policy implications. Finally, the last section concludes the paper and presents limitations and future research directions.

2. Literature Review

2.1. Empirical Review

In spite of the vast scope of the increasingly popular Fintech services market, there remains great potential for future growth in the maritime and ports sector [29]. Studies in Fintech in the maritime and ports sector have demonstrated the potential benefits and challenges of adoption. Evidence from the literature [13,14,30,31,32] that matter, the adoption of Fintech in the maritime and ports sector is crucial. Few studies in Africa and beyond have looked at various components of Fintech adoption in the maritime and ports industry. For instance, Ref. [6], explores the impact factors that affect the adoption of digital payment systems in sub-Saharan Africa. The authors demonstrated that there is the need to create enabling environments to jumpstart the adoption develop framework to guide implementers for digital payment systems. Ref. [26] developed the transformational affordance framework (TAF) using technology affordance theory and a case study from Ghana’s paperless port system to unpack how digital platformization strategy can facilitate public sector transformation. Furthermore, to address the challenges of adopting blockchain in shipping companies in [17], assess key factors influencing the integration of blockchain in shipping. The authors proved the most important criteria for the adoption of blockchain are the benefits of reducing bribery and fraud. To consolidate their findings, [21] emphasized that despite the immense benefits blockchain offer, the technology is mainly used in niche markets. The author believed that future research would determine a better understanding of the technology as well as the ability of industries and other sectors to adopt. According to [33], a seven-step process is used in the field of supply chain management to perform systematic literature reviews on BC technology. Another group of researchers, this time led by [34], looked into how the Newsvendor model—represented here by a BC system—had adopted technological advancements. The purpose of this paper was to shed light on how the incorporation of BC technology affects the optimal selection of inventory and the resulting maximization of profit. As an additional resource, [35] used a generic stochastic mode to evaluate SCM and the inherent design issues where a firm aims to increase the total expected discounted profit, by jointly managing block chain design, production and ordering decisions, and dynamic pricing and selling. There appear to be a paucity of literature on Fintech adoption in the maritime and ports sectors even though some components of Fintech on a low scale blockchain is being adopted in that sector.

Other sectors outside the domain of the maritime and ports industry have adopted Fintech as a financial inclusion tool. To mention just a few, Ref. [3] evaluated the effect of Fintech on traditional banking; Ref. [9] assessed the Fintech ecosystem as an influencer of young entrepreneurial intentions; Ref. [36] examined a path to sustainable development from a Fintech remittance perspective; Ref. [37] develops a model for the Fintech market in Ukraine; Ref. [38] investigated the role of Fintech in predicting the spread of COVID-19. Few of these studies [24,25,39,40,41,42] cited so far have used UTAUT2 to evaluate users of Fintech’s (in most cases Blockchain) intentions to enroll or participate in a Fintech program, and, more so, none of the papers have extended the UTAUT2 to the maritime and ports sector to understand port users’ behavioral intentions to adopt Fintech.

2.2. Theoretical Frameworks

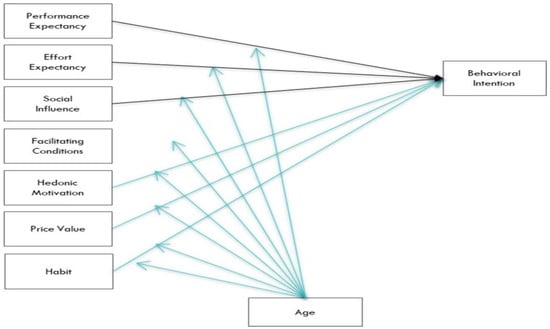

Over past years, studies in technology adoption have developed many theories and models to explain and determine the factors that drive technology adoption. This research aimed to identify the factors that affect port users’ propensity to adopt Fintech in the maritime and ports industry. The Extended Unified Theory of Acceptance and Use of Technology (UTAUT2) served as the study’s theoretical foundation. The UTAUT2 theoretical framework presents the structure, cognitive traits, technology attributes, and situational elements necessary to understand why and how individuals or organizations adopt Fintech [43,44,45]. The researcher used the UTAUT2 theoretical framework because it explains 70% of the difference in behavior intention and close to 50% in the usage [28]. As illustrated in Figure 1, UTAUT2 has seven predictor factors, three moderating variables (one used in this case), two criterion variables, ten relationships when moderating variables are not accounted for, and twenty-five relationships when moderating variables are accounted for [46]. UTAUT2 has seven predictor variables: performance expectation, effort expectation, social influence, enabling conditions, hedonic motivation, price value, and habit. Age, gender, and experience serve as moderating factors. The criterion variables consist of behavioral intention and use behavior. The current study used age as a moderating factor and behavioral intention as the dependent or endogenous variable.

Figure 1.

Authors own construct (2022) adapted from [27] UTAUT2 Theoretical Framework.

Unified Theory of Acceptance and Use of Technology

The Extended Unified Theory of Acceptance and Use of Technology (UTAUT2) was adapted as the underlining theoretical framework for this paper. The UTAUT2 theoretical framework is the revised version of the original UTAUT framework, which combined the following eight overlapping technology adoption theories: (a) Combined Theory of Planned Behavior and Technology Acceptance Model, (b) Theory of Reasoned Action, (c) Theory of Planned Behavior, (d) Technology Acceptance Model, (e) Innovation Diffusion Theory, (f) Motivational Model, (g) Model of Personal Computer Use, and (h) Social Cognitive Theory [27]. Ref. [27] revised the UTAUT theoretical framework to UTAUT2 to include the influence of social impact, hedonic benefits, end-user experience, and age on the technology adoption behavior of individuals in an organization. The eight theories mentioned above predicted technology adoption at a varied rate that fell between 17% and 53% compared to the eight theories that served as the basis of UTAUT; UTAUT2 theory predicted technology adoption behavior at a 70% accuracy rate. Ref. [46] affirms UTAUT2 is one of the most comprehensive technology adoption theories that explains an individual’s innovation adoption within an organization. The paper adapted performance expectancy (PE), effort expectancy (EE), social influence (SI), facilitating conditions (FC), hedonic motivation (HM), price value (PV) and habit (HT) as predictors, age as a moderating variable and behavioral intention (BI) to adopt Fintech as dependent variable.

Performance Expectancy (PE): Individuals use innovative technology because of the perceived benefits of the technology to their activities [47]. Performance expectancy measures the extent to which a user (in this case a port user) expects that using the technology will assist him or her to derive some gains in job performance [27]. Previous studies [46,48] have shown that PE is the strongest predictor of BI in technology adoption. This study therefore hypothesizes that:

H1.

PE positively influences BI of port users to enroll on Fintech Program.

Effort Expectancy (EE): PE measure the extent of ease of use of technology [27]. EE was the second strongest predictor of BIs [46,48]. The higher the effort required to execute tasks, the more effort expectancy became a delimiting factor [49]. EE is hypothesized as:

H2.

EE positively influences BIs of port users to enroll on Fintech Program.

Social Influence (SI): SI measures is the extent to which individuals perceived that essential people in their lives expected them to use the new technology [50]. Ref. [50] stressed that social influence might not significantly influence intentions in voluntary contexts. SI is hypothesized as:

H3.

SI positively influences BIs of port users to enroll on Fintech Program.

Facilitating Conditions (FC): FI measures the degree to which one believes that an organizational and technical infrastructure exists to support use of the system [50]. The supporting infrastructure includes training programs, internal and external communication plans, supporting technical staff among others [51]. The FC directly affected employees’ attitudes and significantly influenced behavioral intentions to use technology [51,52]. FC is hypothesized as:

H4.

FC positively influences BIs of port users to enroll on Fintech Program.

Hedonic Motivation (HM. Price Value (PV), Habit (HT): Ref. [27] defined HM as happiness or enjoyment resulting from using technology, which is significant in determining technology adoption rate. PV is the perceived trade-off between a piece of new knowledge and the cost of adopting the technology [53]. HT is behavior believed to be automatic due to repetitive actions over time [54,55]. Ref. [27] modeled habit as having a direct and indirect effect through behavioral intention. Hedonic motivation and price value predicted employees’ behavioral intentions to adopt technology in Ontario, Canada. Habit and effort expectancy had a more substantial positive impact on employees’ intention to adopt consumers’ IT tools. At the same time, hedonic motivation and price value were low predictors of behavioral intention for employees to use technology [51]. Habit was the most highly correlated construct to behavioral intention [46]. Firms could develop interventions such as sandboxes and private corporate networks that enable employees to experience technology, leading to HT development [46]. The effect of PV was less critical for innovative and early adopter employees who had the latest devices from the consumer market than laggards. The PV variable was also less significant for employees with a solid technology-to-task fit in their daily activities. This paper hypothesized that the three constructs of HM, PV, and HT are able to predict the BIs of employees to enroll in a Fintech program in the maritime and ports sector. HM is hypothesized as:

H5.

HM positively influences BIs of port users to enroll on Fintech Program.

PV is hypothesized as:

H6.

PV positively influences BIs of port users to enroll on Fintech Program.

Additionally, HT is hypothesized as:

H7.

HT positively influences BIs of port users to enroll on Fintech Program.

Moderating Effect of Age: The age construct moderates the effect of generational differences on BIs to adopt a technology [27,50]. UTAUT2 has been used extensively in explaining the adoption of technologies by individuals within an organization. Most studies used only a subset of the model constructs without the moderators [56,57,58]. Among the few studies that used age as a moderating variable, the literature shows a small negative effect on behavioral intention to adopt new technology [59]. Ref. [60] found that the age of citizens had a significant positive influence on their behavioral intention to adopt e-government services. Age moderated the relationships between effort expectancy, social influence, hedonic motivation, and behavioral intention [61]. Ref. [62] showed the statistical differences between age groups in adopting personal mobile devices in the educational setting. Ref. [63] found that age moderated the relationship between behavioral intention and price value, effort expectancy, hedonic motivation, and habit on the actual use of smartphones in the banking sector. Ref. [59] found that age was not significant in their study of factors influencing behavioral intentions to adopt new technology. The different results of the effect of age on behavioral intentions to adopt technology suggest that researchers must control for generational differences when studying technology adoption. The current studies hypothesized the moderating effect of “age” in predicting the behavioral intention of employees to enroll in the Fintech program in the Ghanaian workplace. The age of employees in the Ghanaian workforce ranges between 18 and 64 years [64]. This paper hypothesizes that:

H8.

The independent constructs (PE, EE, SI, FC, HM, PV and HT) positively influence BIs of port users to enroll on Fintech Program moderated by age.

Behavioral Intention (BI): BI reflects actual behaviors that factors can predict [65]. PE, EE, SI, FC, HM, PV, and HT predict BIs with 70% accuracy [27,48,56]. It was expected in this paper that BIs could be predicted by the predictors of port users’ decisions to enroll in the Fintech program in the maritime and ports sector in Ghana.

3. Methodology

This paper used quantitative non-experimental correlational research design to understand the factors influencing port users’ intentions to participate in Fintech programs. The current research adapted the survey instrument established by [27] which used a 7-point Likert scale to collect data from participants. The 7-point Likert scale was necessary to execute the Structural Equation Modeling [39]. Participants accessed the survey instrument through a third-party data collection platform (SurveyMonkey). SurveyMonkey used random sampling to select the participants based on the inclusion and exclusion criteria of the research. The study’s targeted population consisted of port users in the maritime and ports sector who were between 18 and 64. Considering that 80% of the adult population including the port and maritime industry owns at least one mobile device [66], the study assumes that 80% of the 2,584,625 (2,067,700) will serve as this research’s population. Statistical power analysis executed in G*Power 3.1.9.7 determined the minimum sample size of 407 required for the study. The power analysis estimations factored significance, effect size, and power as calculation criteria [67]. The sample size of 407 is higher than the sample sizes used in comparative studies [27,68,69,70]. We used the survey builder tool in SurveyMonkey (online platform) to create a questionnaire based on the survey instrument developed and validated by [27]. The researchers created a SurveyMonkey account and input the inclusion and exclusion criteria into the audience tool to determine the study’s sampling pool. The researchers used SurveyMonkey’s survey builder to create a survey with three major sections: the welcome and consent section, the screening section, and the survey statements section, which contained questions based on the UTAUT2 theoretical framework. At the beginning of the data collection period, members of the SurveyMonkey sampling pool received an invitation email describing the study and inviting them to participate in the survey by clicking on the embedded hyperlink. The embedded link led potential participants to a page with a welcome message and a consent form. Participants were required to click the “Agree to participate” button on the consent form in order to participate in the study. SurveyMonkey directed respondents to the screening page once they agreed to participate in the study. The screening page included four questions concerning (a) whether respondents were currently employed, (b) whether respondents were between the ages of 18 and 64, (c) whether respondents owned a personal computing or mobile device, and (d) whether respondents worked in the maritime and ports industry. If respondents answered “No” to any of the screening questions, SurveyMonkey terminated the survey and directed them to a thank-you page. The appreciation page informed participants of the reason for the study’s termination and thanked them for their participation. The final data sets of the study contained only responses from participants who voluntarily participated in the survey, met the inclusion criteria, were not excluded, and completed the questionnaire. Respondents could leave the survey at any time during the procedure.

The survey questionnaire consisted of 32 questions divided into nine sections. The first section contained four questions on demography information. The outstanding eight sections included 28 statements that captured participants’ responses using a seven-point Likert-type scale ranging from 1 (strongly disagree) to 7 (strongly agree). The Likert-type scale was used measured participants’ value judgments based on their attitudes, opinions, and dispositions toward the statements in that section [71]. Principal Component Analysis (PCA) in the Statistical Package for Social Sciences (SPSS) SPSS version 22 and Structural Equation Modeling (SEM) in Stata version16 were used to analyze the data collected.

4. Results

The study received 100% feedback from all the 407 respondents with unfiled questions. Out of the 407 respondents who took part in the survey, 117 (28.7%) accounted for female and 290 (71.3%) accounted for the male gender, suggesting the dominance in the number of males over females in the maritime and ports sector. The age group between 25 and 34 years recorded the highest percentage (61.9%), suggesting the prevalence of youth in the sampled population in the maritime and ports sector. On the education level, we recorded 14.3% for having a high school diploma, 13.5% for no certificate, 12.8% for bachelor’s degree, 12.3% for master’s degree, 11.3% for doctorate degree, and 9.8% for professional certificate. These findings suggest that the maritime and ports sector has seen some tremendous growth in education, despite the technical nature of the industry requiring expert knowledge.

4.1. Measurement of Constructs

The results obtained show a weighted average Bartlett’s test of sphericity score of 0.01 (sig < 0.05) and the weighted average KMO score (0.760) was an indicator of the suitability of the sample for factor analysis (see Table 1). Ref. [72] elucidated, the factor loading achieved a higher score greater than 0.7 for all components. The component matrix has all factor loading above the threshold except for SI and PV (see Table 1). The analysis confirmed twenty-five factors with a cumulative variance explained value of 82.978%, suggesting that a larger proportion of the variance is explained by the components.

Table 1.

Measurement of Constructs.

Convergent and discriminant validity was used to measure construct validity. A weighted Average Variance Extracted (AVE) score of 0.662 was accounted for which was greater than the threshold of 0.5 suggested by [73], demonstrating the presence of convergence validity. Furthermore, the weighted Composite Reliability (CR) score of 0.795 indicated the internal consistency of the 25 items used in computing the CR scores. Ref. [73] argue that a CR score of greater than 0.70 demonstrates the existence of convergence validity. An AVE value less than 0.5 compared to the inter-correlation of the dissimilar operationalized constructs (for, e.g., PE and EE) confirms the existence of discriminant validity according to [73] and this rule was not violated.

4.2. Goodness If Fix Indices

The hypothesized model generated fit indices of Root Mean Square Error of Approximation (RMSEA) = 0.084 (acceptable level of fitness), Comparative Fit Index (CFI) = 0.949 (ideal level of fitness), Tucker–Lewis Index (TLI) = 0.938 (ideal level of fitness). Goodness of fit indices measure the extent to which the data fit the model (see Table 2). Considering SEM path analysis executed, there were no violations of thresholds of the fix indices, as stated by [72].

Table 2.

Goodness of Fit.

4.3. Hypothesized Model Test Results

The output of the structural equation model revealed that the hypothesized constructs, including PE (β = 0.26, p < 0.000), EE (β = 0.45, p < 0.001) and HT (β = 0.51, p < 0.001), have a significant positive effect on the behavioral intention for employees to enroll in Fintech program. FC and HM could not explain and predict behavioral intentions for employees to enroll in Fintech program. Age could not moderate the prediction as initially hypothesized (see Table 3).

Table 3.

Hypotheses Test Results.

5. Discussions

Hypothesized Relationship: PE, EE, HM ≥ BI

The results show that PE predicted or explained BI at 0.22, thus demonstrating a 22% increase in BI at a change in PE. The result is consistent with [46,59], who demonstrated that PE was the strongest predictor for BI and, however, in this study PE was identified as the third strongest predictor of BIs in maritime and port users to enroll on a Fintech program. Refs. [47,80] argued that employees participate in the technology when there is a strong task-to-device fit. The authors further argued that technology increased employee performance and organizational productivity. EE is the second strongest predictor of BI, with a 43% contribution of port users’ behavioral intentions to enroll on a Fintech program. Whilst [47] found a contrasting indication that EE related to technology adoption negatively impacts performance expectancy and efficiency in task completion [46,59] demonstrated in their study that EE was the second strongest predictor of BI. The current study, however, rated EE as the second strongest predictor of maritime and port users’ behavioral intentions to enroll on a Fintech. Previous studies have demonstrated that HT was a predictor of BIs. The studies of [70] confirm that HT significantly affected the behavioral intention of academics in their workplace. Similar findings were accounted for in the studies of [63], who established a positive effect on teachers’ actual technology use that influenced educators’ and students’ BI to adopt and use mobile internet. Findings from this study of HT predictability on BI rates the construct the strongest predictor (45%) of BIs among all others. The implication is that maritime and port users are more likely to repeat their behavior to enroll in the Fintech program and repeat this action overtime [54,75].

Hypothesized Relationship of: SI, FC, HM, PV, and Age ≥ BI

Four variables (SI, FC, HM, and PV) failed to predict maritime and port users’ behavioral intentions to enroll on a Fintech program. The exiting literature [51,76] shows that FC is a predictor of employees’ attitudes and is significantly influenced by behavioral intentions to use technology; Ref. [46], however, found that FC did not predict users’ intentions to continue using health and fitness apps. The current study’s findings are consistent with [46], and therefore confirm the existence of there being no influence on BI by FC in the maritime and ports sectors. Ref. [81] found that HM predicted employees’ behavioral intentions to adopt technology in Ontario, Canada. Furthermore, HM was originally conceived by [27] as a predictor of BI because employees were required to determine more important satisfaction and stimulate some fun when performing a specified task using a technology that is less demanding than on a system that is difficult to use. The current study revealed a contrasting result that suggests HM could not predict the BIs of maritime and port users to enroll on a Fintech program in that sector. PV value followed a similar trend similar to HM that could not also predict BI. The studies of [76] support this position that the effect of PV was less critical for innovative and early adopter employees who had the latest devices from the consumer market than laggards. Relative to the current studies, PV could not explain or predict the behavioral intentions of maritime and port users to enroll on a Fintech program. It was also noticed that the moderating effect of age was nonexistent in predicting BIs on all the independent variables hypothesized. The lack of the moderating effect of age on BIs was evident in the studies of [59] who found a small negative effect on BIs to adopt new technology. A conflicting result from the study [60] suggests that age significantly influenced their behavioral intention to adopt e-government services. While [61] holds that age moderated the relationships between effort expectancy, social influence, hedonic motivation, and behavioral intention in their studies. The result of the moderating effect of age was absent in the current study, suggesting that age does not moderate the degree to which PE, EE, SI, FC, HM, PV, and HT predict maritime and port users’ BIs to enroll on a Fintech program in that sector.

6. Conclusions

Several studies have utilized the UTAUT2 to determine the predictability of the factors that influence the adoption of Fintech by BI. In this study, a significant positive correlation between PE and BI was discovered. However, it was one of the few constructs found to have a significant positive relationship between BIs and port users’ enrollment in the Fintech program in the maritime and ports industry. EE and HT were the other two constructs that positively influenced the BIs of employees in the maritime and ports industry to engage in the Fintech program. It was observed that current and relevant studies confirmed that EE contributed greatly to explaining BIs for port customers enrolling in the Fintech program. The study also concluded that SI, FC, HM, and PV were not predictors of BI, meaning that these predictors were unable to explain port users’ behavioral intentions to participate in the Fintech program in the maritime and ports industry. This position enables port and maritime policymakers to concentrate on the determinants that truly contribute to the adoption of Fintech, as well as study the implications of the unpredictability of the four other variables (SI, FC, HM, and PV).

7. Implication for Theory and Practice

The implications of this paper for theory and practice are linked to the identified research gaps. It was recognized that most research on Fintech was found in other disciplines rather than in the maritime and ports industry. Based on the researcher’s search of the literature, none of the studies had focused on broad Fintech adoption among the working class between 18 and 64 years in the maritime and ports sector. Additionally, none of the studies had used the UTAUT2 to understand the Ghanaian case relative to maritime and port users in that industry. From these perspectives, it was evident that there were literature gaps theoretically, empirically, and methodically. Theoretically, this study brings an understanding of the UTAUT2 framework in the context of the maritime and port users in Ghana. The implication is that the operational model with the three constructs (PE, EE, and HT) has become the main factor in predicting BIs specifically in the maritime and ports sector. In view of this, researchers have a guide to follow in extending this model to other jurisdictions. The empirical findings from the current study contribute to the ongoing debate on adopting Fintech in sub-Saharan Africa in the wake of the COVID-19 pandemic. Even though some firms adopted Fintech to curtail the spread of the virus and comply with the protocols established by governments, no policy guide was used to guide most organizations in adopting the Fintech strategies. Therefore, the findings from this paper will help managers or organizations in maritime and ports sectors and sub-Saharan Africa focus on the critical constructs as initial steps in implementing Fintech programs.

8. Recommendations

Since the maritime and ports sector plays a crucial role in the economies of most countries, Fintech providers, governments, and maritime and ports stakeholders have a wider market to facilitate trade and create wealth, and for that matter, the provision of Fintech infrastructure to facilitate Fintech adoption is critical. This is important because the findings from this study could not account for facilitating conditions as a predictor of behavioral intention of maritime and port users to adopt Fintech. The Maritime and Ports Authority in Ghana should consider the formulation of specific flexible Fintech policies that will promote the development.

Fintech services in the sector: Fintech providers in the maritime and ports sector should improve their services to motivate stakeholders in that sector to adopt Fintech programs.

9. Limitation of Research and Future Research Direction

The inclusion criteria of this research identified Ghanaians in the maritime and ports sector between the ages of 18 and 64. The inclusion criteria, as stated, limits potential participants who are temporarily based outside the maritime and ports sector but have enrolled on one or more Fintech programs. Future researchers can extend the population of the study to cover other sectors in Ghana to understand Fintech adoption factors. Conducting this research within the Ghanaian context particularly in the maritime and ports industry assumes the possible impact of cultural dimensions on the findings. This study, however, did not include any cultural dimension constructs that may impact the effect of PE, EE, SI, FC, HM, HT, and PV on the BI to adopt Fintech. Future researchers may include the cultural dimensions that are crucial to such societal and personal norms. The survey was not self-administered and as such, the online tool was also a limiting factor as it was difficult for the researcher to know whether all participants understood the questions. Exclusion of gender and years of experience moderating variables and the “Use Behavior” dependent variable of the UTAUT2 theoretical framework was also a limiting factor. Future studies may consider including gender and years of experience, which are likely to generate some exclusive findings specific to the maritime and ports industry. Even though the study setting was within maritime and ports’ working environments, the study’s theoretical framework was limited to only constructs related to individuals’ behavior. Future researchers may also investigate factors that accounted for the non-prediction of SI, FC, HM, and PV relative to the maritime and ports industry.

Author Contributions

Conceptualization, A.A.-B.; methodology A.A.-B. and D.K.B.; software, A.A.-B. and D.K.B.; validation, K.O.S., A.N.B. and L.O.-F.; formal analysis, A.A.-B. and D.K.B.; investigation, K.O.S., L.O.-F. and M.O.D.; resources, M.O.D.; data curation, D.K.B., A.N.B., L.O.-F. and K.O.S.; writing—A.A.-B. and D.K.B.; original draft preparation, A.A.-B.; writing—review and editing, A.A.-B. and D.K.B.; supervision, A.A.-B. and D.K.B.; project administration, A.A.-B. and D.K.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hasan, I.; Boreum, K.; Li, X. Financial Technologies and the Effectiveness of Monetary Policy Transmission. 2022. Available online: https://ssrn.com/abstract=3743203 (accessed on 12 September 2022).

- Allen, F.; Gu, X.; Jagtiani, J. A Survey of Fintech Research and Policy Discussion. Rev. Corp. Financ. 2020, 1, 259–339. [Google Scholar] [CrossRef]

- Idoko, J.C. Fintech and Its Effect on Traditional Financial Service Providers. Uniport J. Bus. Account. Financ. Manag. 2021, 12, 2. [Google Scholar]

- Huda, S.S.; Kabir, M.H.; Popy, N.N.; Saha, S. Innovation In Financial Services: The Case Of Bangladesh. Copernic. J. Financ. Account. 2020, 9, 31–56. [Google Scholar] [CrossRef]

- Geiger, M.; Trenczek, J.; Wacker, K.M. Understanding Economic Growth in Ghana in Comparative Perspective. Underst. Econ. Growth Ghana Comp. Perspect. 2019, 8699. [Google Scholar] [CrossRef]

- Soutter, L.; Ferguson, K.; Neubert, M. Digital Payments : Impact Factors and Mass Adoption in Sub-Saharan Africa. Technol. Innov. Manag. Rev. 2019, 9, 41–56. [Google Scholar] [CrossRef]

- Nelaturu, K.; Du, H.; Le, D. A Review of Blockchain in Fintech: Taxonomy, Challenges, and Future Directions. Cryptography 2022, 6, 18. [Google Scholar] [CrossRef]

- Priya, P.K.; Anusha, K. Fintech Issues and Challenges in India. Int. J. Recent Technol. Eng. 2021, 8, 904–908. [Google Scholar] [CrossRef]

- Festa, G.; Cuomo, M.T.; Ossorio, M. FinTech ecosystem as influencer of young entrepreneurial intentions: Empirical findings from Tunisia. J. Intellect. Cap. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Lee, I.; Jae, Y. Fintech : Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Berman, A.; Cano-Kollmann, M.; Mudambi, R. Innovation and entrepreneurial ecosystems: Fintech in the financial services industry. Rev. Manag. Sci. 2021, 16, 45–64. [Google Scholar] [CrossRef]

- Nizam, R.; Karim, Z.A.; Rahman, A.A. Financial inclusiveness and economic growth : New evidence using a threshold regression analysis. Econ. Res. Istraživanja 2020, 33, 1465–1484. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development (UNCTAD). Review of Martime Transport 2021; UNCTAD: Geneva, Switzerland, 2021. [Google Scholar]

- Boison, K.D.; Antwi-Boampong, A. Blockchain Ready Port Supply Chain Using Distributed Ledger. Nord. Balt. J. Inf. Commun. Technol. 2020, 1, 1–32. [Google Scholar] [CrossRef][Green Version]

- Hye, A.M.; Miraz, M.H.; Sharif, K.I.M.; Hassan, M.G. Factors Affecting Logistic Supply Chain Performance: Mediating Role of Block chain Adoption. Test Eng. Manag. 2020, 82, 9338–9348. [Google Scholar]

- Vairetti, C.; González-ramírez, R.G.; Maldonado, S.; Álvarez, C.; Voβ, S. Facilitating conditions for successful adoption of inter-organizational information systems in seaports Carla. Transp. Res. Part A 2019, 130, 333–350. [Google Scholar] [CrossRef]

- Ho, T.C.; Hsu, C.L. An Analysis of Key Factors Influencing Integration of Blockchain into Shipping Companies in Taiwan. J. Mar. Sci. Technol. 2020, 28, 1. [Google Scholar] [CrossRef]

- Yang, C. Maritime shipping digitalization : Blockchain-based technology applications, future improvements, and intention to use. Transp. Res. Part E 2019, 131, 108–117. [Google Scholar] [CrossRef]

- Tessmann, R.; Elbert, R. Multi-Sided Platforms in Competitive B2B Networks with Varying Governmental Influence—A Taxonomy of Port and Cargo Community System Business Models; Springer: Berlin/Heidelberg, Germany, 2022; ISBN 0123456789. [Google Scholar]

- Boison, D.K.; Antwi-Boampong, A.; Agbesi, S.; Agboh, D. A Framework for the Evaluation of Factors Affecting Smart Contract Adoption and Enforceability in Port Supply Chain Industry in Ghana. In Soft Computing: Theories and Applications; Kumar, R., Ahn, C.W., Sharma, T.K., Verma, O.P., Agarwal, A., Eds.; Springer: Singapore, 2022; pp. 957–969. [Google Scholar]

- Weernink, M.O.; van den Engh, W.; Francisconi, M.; Thorborg, F. The Blockchain Potential for Port Logistics. White Paper-Blockhain 2017. Available online: https://smartport.nl/wp-content/uploads/2017/10/White-Paper-Blockchain.pdf (accessed on 12 September 2022).

- Senyo, P.K.; Effah, J.; Osabutey, E.L.C. Digital platformisation as public sector transformation strategy: A case of Ghana’s paperless port. Technol. Forecast. Soc. Change 2021, 162, 120387. [Google Scholar] [CrossRef]

- Blay, A. Factors Influencing Employees’ Intention to Participate in a Bring Your Own Device Program in the Workplace: A Correlational Study in Ghana; Capella University: Minneapolis, MN, USA, 2022. [Google Scholar]

- Daka, G.C.; Phiri, J. Factors Driving the Adoption of E-banking Services Based on the UTAUT. Int. J. Bus. Manag. 2019, 14, 43. [Google Scholar] [CrossRef]

- Nur, T.; Panggabean, R.R. Factors Influencing the Adoption of Mobile Payment Method among Generation Z: The Extended UTAUT Approach. J. Account. Res. Organ. Econ. 2021, 4, 14–28. [Google Scholar] [CrossRef]

- Senyo, P.K.; Effah, J.; Osabutey, E.L.C. FinTech ecosystem practices shaping financial inclusion: The case of mobile money in Ghana. Eur. J. Inf. Syst. 2021, 31, 112–127. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.; Xu, X. Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef]

- Crawford, D. Predicting Bring Your Own Device Users’ Mobile Device Security Adoption: A Correlational Study; Capella University: Minneapolis, MN, USA, 2020. [Google Scholar]

- Yang, Y.; Ying, H.; Jin, Y.; Xu, X.; Chinese, T.; Kong, H.; Kong, H.; Administrative, S. To port or not to port ? Availability of exclusivity in the digital service market. Decis. Support Syst. 2021, 148, 113598. [Google Scholar] [CrossRef]

- Koh, L.; Dolgui, A.; Sarkis, J. Blockchain in transport and logistics-paradigms and transitions. Int. J. Prod. Res. 2020, 58, 2054–2062. [Google Scholar] [CrossRef]

- Kühn, O.; Jacob, A.; Schüller, M.C. Blockchain Adoption at German Logistics Service Providers. Proc. Hambg. Int. Conf. Logist. 2019, 27, 387–441. [Google Scholar] [CrossRef]

- Luisa, C. ICT implementation process model for logistics service providers. Ind. Manag. Data Syst. 2008, 113, 484–505. [Google Scholar] [CrossRef]

- Chang, A.; El-Rayes, N.; Shi, J. Blockchain Technology for Supply Chain Management: A Comprehensive Review. FinTech 2022, 1, 191–205. [Google Scholar] [CrossRef]

- Chang, J.; Katehakis, M.N.; Shi, J.; Yan, Z. Blockchain-empowered Newsvendor optimization. Int. J. Prod. Econ. 2021, 238, 108144. [Google Scholar] [CrossRef]

- Chang, J.; Katehakis, M.N.; Melamed, B.; Shi, J. Blockchain Design for Supply Chain Management. 2018. Available online: https://ssrn.com/abstract=3295440 (accessed on 12 September 2022).

- Hahm, H.; Subhanij, T.; Almeida, R. Finteching remittances in paradise: A path to sustainable development. Asia Pac. Policy Stud. 2021, 8, 435–453. [Google Scholar] [CrossRef]

- Bukhtiarova, A.; Hayriyan, A.; Bort, N.; Semenog, A. Modeling of FinTech market development (on the example of Ukraine). Innov. Mark. 2018, 14, 34–45. [Google Scholar] [CrossRef][Green Version]

- Daqar, M.; Constantinovits, M.; Arqawi, S.; Daragmeh, A. The role of Fintech in predicting the spread of COVID-19. Banks Bank Syst. 2021, 16, 1–16. [Google Scholar] [CrossRef]

- Bhardwaj, A.K.; Garg, A.; Gajpal, Y. Determinants of Blockchain Technology Adoption in Supply Chains by Small and Medium Enterprises (SMEs) in India. Math. Probl. Eng. 2021, 2021, 1–14. [Google Scholar] [CrossRef]

- Fosso, S.; Queiroz, M.M.; Trinchera, L. Dynamics between blockchain adoption determinants and supply chain performance: An empirical investigation. Int. J. Prod. Econ. 2020, 229, 107791. [Google Scholar] [CrossRef]

- Gao, K.; Shao, X. Adoption Research of the M-commerce Application Based on the Perspective of Supply Chain Management in Shipping Industry. Sch. Econ. Manag. 2018, 83, 839–845. [Google Scholar] [CrossRef]

- Daqar, M.A.M.A.; Arqawi, S.; Karsh, S.A. Fintech in the eyes of Millennials and Generation Z (the financial behavior and Fintech perception). Banks Bank Syst. 2020, 15, 20–28. [Google Scholar] [CrossRef]

- Chao, Z.; Borrelli, S.; Neupane, B.; Fennewald, J. Understanding user experience in bring your own device spaces in the library A case study of space planning and use at a large research university. Perform. Meas. Metr. 2019, 20, 201–212. [Google Scholar] [CrossRef]

- Javaid, M.; Haleem, A.; Pratap Singh, R.; Khan, S.; Suman, R. Blockchain technology applications for Industry 4.0: A literature-based review. Blockchain Res. Appl. 2021, 2, 100027. [Google Scholar] [CrossRef]

- Wang, S.; Zhang, C.; Kröse, B.; Hoof, H. Van Optimizing Adaptive Notifications in Mobile Health Interventions Systems : Reinforcement Learning from a Data-driven Behavioral Simulator. J. Med. Syst. 2021, 45, 1–8. [Google Scholar] [CrossRef]

- Tamilmani, K.; Rana, N.P.; Dwivedi, Y.K. Consumer Acceptance and Use of Information Technology: A Meta-Analytic Evaluation of UTAUT2. Inf. Syst. Front. 2020, 23, 987–1005. [Google Scholar] [CrossRef]

- Wang, X.; Weeger, A.; Gewald, H. Factors driving employee participation in corporate BYOD programs: A cross-national comparison from the perspective of future employees. Australas. J. Inf. Syst. 2017, 21, 1–22. [Google Scholar] [CrossRef]

- Weeger, A.; Wang, X.; Gewald, H.; Raisinghani, M.; Sanchez, O.; Grant, G.; Pittayachawan, S. Determinants of Intention to Participate in Corporate BYOD-Programs: The Case of Digital Natives. Inf. Syst. Front. 2020, 22, 203–219. [Google Scholar] [CrossRef]

- Novikova, S.A.; Sidorov, D.E.; Goncharuk, I.V. New Technologies of Business Processes in the Sphere of Customs Administration of Export-Import Transactions and Payments New Technologies of Business Processes in the Sphere of Customs Administration of Export-Import Transactions and Payments. IOP Conf. Ser. Mater. Sci. Eng. 2020, 753, 7. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. Acceptance of information technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Ouattara, A. Antecedents of Employees’ Behavioral Intentions Regarding Information Technology Consumerization. Ph.D. Thesis, Walden University, Minneapolis, MN, USA, 2017. [Google Scholar]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Blut, M.; Yee, A.; Chong, L.; Tsiga, Z.; Venkatesh, V.; Tech, V. Meta-Analysis Of The Unified Theory of Acceptance and Use of technology (UTAUT): Challenging its validity and charting A research agenda in the red ocean. JAIS-J. Assoc. Inf. Syst. 2021, 23, 13–95. [Google Scholar] [CrossRef]

- Kim, S.S.; Malhotra, N.K.; Narasimhan, S. Two competing perspectives on automatic use: A theoretical and empirical comparison. Inf. Syst. Res. 2005, 16, 418–432. [Google Scholar] [CrossRef]

- Abdalla, M.M.; Oliveira, L.G.L.; Azevedo, C.E.F.; Gonzalez, R.K. Quality in Qualitative Organizational Research: Types of triangulation as a methodological alternative. Adm. Ensino Pesqui. 2018, 19, 66–98. [Google Scholar] [CrossRef]

- Gupta, R.; Varma, S.; Bhardwaj, G. A Structural Equation Model to Assess the Factors Influencing Employee’ s Attitude & Intention to Adopt BYOD (Bring Your Own Device). Int. J. Recent Technol. Eng. 2019, 8, 6303–6308. [Google Scholar] [CrossRef]

- Vorakulpipat, C.; Sirapaisan, S.; Rattanalerdnusorn, E.; Savangsuk, V. A Policy-Based Framework for Preserving Confidentiality in BYOD Environments: A Review of Information Security Perspectives. Secur. Commun. Netw. 2017, 43, 25. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.L.T.; Xu, X. Unified Theory of Acceptance and Use of Technology: A Synthesis and the Road Ahead. J. Assoc. Inf. Syst. 2016, 17, 328–376. [Google Scholar] [CrossRef]

- Nordhoff, S.; Louw, T.; Innamaa, S.; Lehtonen, E.; Beuster, A.; Torrao, G.; Bjorvatn, A.; Kessel, T.; Malin, F.; Happee, R.; et al. Using the UTAUT2 model to explain public acceptance of conditionally automated (L3) cars : A questionnaire study among 9, 118 car drivers from eight European countries. Transp. Res. Part F Psychol. Behav. 2020, 74, 280–297. [Google Scholar] [CrossRef]

- Munyoka, W.; Maharaj, M. The effect of UTAUT2 moderator factors on citizens’ intention to adopt e-government: The case of two SADC countries. Probl. Perspect. Manag. 2017, 15, 115–123. [Google Scholar] [CrossRef]

- Chang, C.M.; Liu, L.W.; Huang, H.C.; Hsieh, H.H. Factors influencing online Hotel Booking: Extending UTAUT2 with age, Gender, and Experience as Moderators. Information 2019, 10, 281. [Google Scholar] [CrossRef]

- Nikolopoulou, K.; Gialamas, V.; Lavidas, K. Habit, hedonic motivation, performance expectancy and technological pedagogical knowledge affect teachers’ intention to use mobile internet. Comput. Educ. Open 2021, 2, 100041. [Google Scholar] [CrossRef]

- Ameen, N.; Willis, R. An analysis of the moderating effect of age on smartphone adoption and use in the United Arab Emirates. In Proceedings of the UK Academy for Information Systems Conference, Oxford, UK, 20–21 March 2018. [Google Scholar]

- Adeniran, A.; Ishaku, J.; Yusuf, A. Youth employment and labor market vulnerability in Ghana: Aggregate trends and determinants. In West African Youth Challenges and Opportunity Pathways; Springer: Berlin/Heidelberg, Germany, 2019; pp. 187–211. [Google Scholar] [CrossRef]

- Raman, A.; Don, Y. Preservice Teachers’ Acceptance of Learning Management Software: An Application of the UTAUT2 Model. Int. Educ. Stud. 2013, 6, 157. [Google Scholar] [CrossRef]

- Omondi, G. The State of Mobile in Ghana’s Tech Ecosystem. Mobile for Development. 2020. Available online: https://www.gsma.com/mobilefordevelopment/blog/the-state-of-mobile-in-ghanas-tech-ecosystem (accessed on 12 September 2022).

- Fowler-Amato, M.; LeeKeenan, K.; Warrington, A.; Nash, B.L.; Brady, R.B. Working Toward a Socially Just Future in the ELA Methods Class. J. Lit. Res. 2019, 51, 158–176. [Google Scholar] [CrossRef]

- Callies, K.; Noteboom, C.B.; Talley, D.; Wang, Y. Employee acceptance of employer control over personal devices—Research in Progress. Mid-West Assoc. Inf. Syst. 2019, 5. [Google Scholar]

- Hu, S.; Laxman, K.; Lee, K. Exploring factors affecting academics’ adoption of emerging mobile technologies-an extended UTAUT perspective. Educ. Inf. Technol. 2020, 25, 4615–4635. [Google Scholar] [CrossRef]

- Palanisamy, R.; Norman, A.A.; Mat Kiah, M.L. BYOD Policy Compliance: Risks and Strategies in Organizations. J. Comput. Inf. Syst. 2020, 62, 62–72. [Google Scholar] [CrossRef]

- Göb, R.; McCollin, C.; Ramalhoto, M.F. Ordinal Methodology in the Analysis of Likert Scales. Qual. Quant. 2007, 41, 601–626. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Hopkins, H.; Kuppelwieser, V. Partial least squares structural equation modeling (Pls-SEM): An emerging tool in business research. Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. This. 2016, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Pearson: Bergen, NJ, USA, 2010. [Google Scholar]

- Schumacker, R.E.; Lomax, R.G. A Beginner’s Guide to Structural Equation Modeling, 3rd ed.; Routledge: London, UK, 2010. [Google Scholar]

- Byrne, B.M. Structural Equation Modeling with AMOS: Basic Concepts Applications, and Programming, 2nd ed.; Taylor and Francis Group, LLC: Oxfordshire, UK, 2010. [Google Scholar]

- Kline, R.B. Principles and Practice of Structural Equation Modeling, 3rd ed.; Kenny, D.A., Little, T.D., Eds.; The Guilford Press: New York, NY, USA, 2011. [Google Scholar]

- McDonald, R.P.; Ho, M.H.R. Principles and practice in reporting structural equation analyses. Psychol. Methods 2002, 7, 64–82. [Google Scholar] [CrossRef] [PubMed]

- Mohajan, H.K. Two criteria for good measurements in research: Validity and reliability. Ann. Spiru Haret Univ. Econ. Ser. 2017, 17, 59–82. [Google Scholar] [CrossRef]

- Wang, J.; Wu, P.; Wang, X.; Shou, W. The outlook of blockchain technology for construction engineering management. Front. Eng. Manag. 2017, 4, 67. [Google Scholar] [CrossRef]

- Antwi-Boampong, A.; Boison, D.K.; Agbedoawu, J.; Doumbia, O.M.; Blay, A. Assessing Factors Influencing the Adoption of Technology in the Port Supply Chain Industry in the West African Sub-Region: A Case Study of Integrated Customs System in Ghana. 2022. Available online: https://ssrn.com/abstract=4178806 (accessed on 12 September 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).