1. Introduction

1.1. Background and Overview

Risk management is a fundamental challenge that requires innovative strategies to mitigate potential threats and uncertainties. This challenge is heightened by the constantly evolving economic environment and the unpredictability of financial markets [

1,

2,

3]. Modern approaches are essential to effectively manage these risks, particularly in light of their increasing complexity.

Cooperative game theory, specifically the Shapley value, provides a systematic framework for addressing these issues by promoting equitable risk allocation and collaborative decision-making. Despite its theoretical promise, there is still a significant gap in translating cooperative game theory, particularly the Shapley value, into practical, workable techniques for real-world risk management. In areas such as financial portfolios and emergency logistics, where asymmetric contributions and cooperative incentives are crucial, existing methods often fail to methodically incorporate efficiency and fairness into risk or benefit allocation between participating entities, resulting in inefficiencies, disputes, or suboptimal outcomes. Motivated by these issues, our study suggests using the Shapley value from cooperative game theory to develop equitable, transparent, and mathematically sound risk attribution methodologies in portfolio management, as well as optimizing emergency facility placement. Our study aims to integrate the theoretical foundations of cooperative game theory with real-world risk management techniques by addressing fairness and decision accountability gaps, providing a robust methodology for enhancing choice quality in the face of uncertainty.

The Shapley value, introduced by Lloyd Shapley in 1953 [

4], is one of the single-valued solution concepts for coalitional games to answer the question, “How will the gains or costs be distributed among players participating in a game if a coalition is formed?”, and has emerged as a cornerstone in understanding efficient and fair distribution within cooperative space. In other words, the answer to that question primarily depends on the player’s expectations before entering the game.

The application of the Shapley value to risk management has proven valuable in mitigating and managing potential risks. By providing a systematic method for the fair allocation of risks and benefits among coalition members based on their individual contributions, the Shapley value ensures that no member is unfairly burdened or rewarded. This equitable allocation is crucial in addressing complex risk-related problems, enabling more balanced and effective management of uncertainties and decision-making processes. Over time, the Shapley value has evolved beyond its theoretical roots, finding practical applications in fields such as political science, economics, and, notably, risk management. For instance, it has been used to analyze banks’ systemic importance [

5], address the airport cost-sharing problem [

6], and solve production planning challenges [

7]. However, its full potential in addressing modern risk management issues, such as portfolio diversification and hazardous material logistics, remains underexplored.

Our study focuses on two key areas where Shapley value application can lead to more robust decision-making. The first area pertains to the financial sector, where we examine how risk can be managed in portfolio optimization. Specifically, we model a portfolio of assets as a cooperative game, where the securities in the portfolio aim to reduce the overall portfolio risk. The Shapley value allows investors to determine the exact contribution of each risky asset to the overall portfolio risk. The second area addresses emergency facility logistics, where we apply the Shapley value to a gradual coverage game to optimize the coverage of potential locations and minimize the risks associated with the storage and transportation of hazardous materials.

1.2. Literature Review

Managing risk and ensuring fair decision-making have become critical challenges in today’s financial and operational environments. While traditional risk management strategies such as diversification and hedging are commonly employed, they often lack transparency in the allocation of responsibilities and rewards to stakeholders. This gap has led researchers to explore cooperative game theory, particularly the Shapley value, as a framework for equitable and systematic resource and risk allocation.

The axiomatic fairness properties of the Shapley value, introduced by Shapley in 1953 [

4], have made it a cornerstone of cooperative game theory. Over the years, its application has expanded significantly, particularly in the fields of finance, banking and logistics. In finance, Dhule et al. [

8] utilized explainable machine learning algorithms combined with Shapley values to optimize retirement portfolio allocations, emphasizing risk transparency in decision-making. Similarly, Shapley value models have been employed to assess systemic risk among financial institutions, thereby enhancing macroprudential regulatory frameworks [

5]. Traditionally, Markowitz’s mean-variance (MV) approach [

1] has served as the foundation for portfolio optimization. However, the MV model does not account for the fair contribution of each asset to the overall portfolio risk.

Beyond finance, the Shapley value has found innovative applications in various fields. Zhou et al. [

9] proposed a modified Shapley value method to optimize revenue distribution in agricultural e-commerce supply chains. Similarly, Liu et al. [

10] applied modified Shapley models with fuzzy numbers to enhance logistics network optimization under uncertainty, demonstrating how both risk and logistical efficiency can be modeled simultaneously.

Adland et al. [

11] employed Shapley value analysis to examine the interconnections among risk factors in marine logistics and transportation safety, using marine insurance claims data. In a similar vein, Yang et al. [

12] utilized Shapley values to identify critical elements in freight-related incidents, focusing on their impact on logistics terminal design.

These studies collectively highlight the significant advantages of applying Shapley value approaches in both financial decision-making and operational logistics, fostering more equitable, transparent, and data-driven risk management strategies. Our study builds upon and expands prior research by systematically applying Shapley value techniques across these two domains, addressing the persistent challenge of equitable risk allocation in complex systems.

The remainder of this paper is structured as follows. In

Section 2, we introduce the concepts of mean-variance analysis and Shapley value theory.

Section 3 explores the Shapley value within the context of the coverage game and gradual coverage game.

Section 4 presents applications in portfolio management and the gradual coverage game. In

Section 5, we discuss the results of our analysis. Finally,

Section 6 concludes the study with observations and suggests potential directions for future research.

2. Shapley Value for Portfolio Management

2.1. Shapley Value

In 1953, Lloyd Shapley introduced the Shapley value, a single-valued solution concept for coalitional games, with the goal of determining a fair and just method for distributing gains or costs among players in a cooperative game. In such games, each player contributes to the coalition’s overall success, and the Shapley value seeks to allocate rewards or penalties based on each player’s contribution. The value takes into account every possible combination of participants to determine the average marginal contribution of each player across all possible coalition formation orders. Essentially, the Shapley value evaluates each player’s relevance by comparing the impact of their participation in a coalition on the outcome relative to other possible formations of the coalition. This section draws on the foundational works of cooperative game theory [

13,

14,

15].

Definition 1 ([

13]).

Let be a coalitional game and The i-th coordinate corresponds to the marginal contribution vector about σ for all and is defined as Definition 2 ([

13]).

The Shapley value of a coalitional game is the average of the marginal vectors of the game given by the formulaThen, is called the Shapley value of player i in game according to

Using Definition 1, the Formula (

2) can be rewritten as

Suppose

i is a player and

S is an arbitrary coalition that excludes player

i. How many permutations of

exist such that

? For

to be equal

S, the players in

S must enter the room before the player

i under the permutation

, followed by the player

i, with the remaining players in

entering afterward. The number of possible orderings for the players in

S is

, and the number of orderings for the players in

is

. As a result, the total number of permutations of

under which

is

. This leads to the conclusion that the Shapley value of a player

i can be computed as follows [

13]:

or

Note that and is the number of players in a coalition S, also .

The solution concept proposed by Shapley satisfies several properties that enable a fair division of profits among players in a coalition, assuming a grand coalition is formed. According to [

13],

the Shapley value satisfies additivity, anonymity, the dummy player property, and efficiency.While the Shapley value provides a theoretically sound method for fair allocation, its practical computation becomes increasingly difficult as the number of players grows. Calculating the accurate Shapley value requires analyzing each player’s marginal contribution across all possible coalitions, leading to a computational complexity that increases exponentially with the number of participants (specifically,

coalitions for

n players). To address this issue, several approximation techniques [

16,

17,

18,

19,

20] have been developed to estimate the Shapley value. Monte Carlo sampling techniques, in particular, provide high-quality approximations with significantly lower processing costs by randomly selecting a subset of coalitions and averaging the marginal contributions to approximate the Shapley value [

19,

20].

2.2. Mean-Variance Analysis

In 1952, Harry Markowitz introduced the Markowitz mean-variance (MV) model [

1], a fundamental concept in modern portfolio theory and asset pricing theory [

3]. The model is a portfolio optimization method that evaluates various portfolios composed of given securities and selects an efficient portfolio. An efficient portfolio is defined as one that offers the lowest level of risk (variance) for a given expected return (mean) or the highest expected return for a given level of risk. The MV model assumes that investors are rational and risk-averse, meaning they aim either to maximize the expected return of their portfolio for a given level of risk or to minimize their risk for a given expected return. However, for the purposes of this discussion, we will focus solely on risk minimization. The concepts presented in this section are based on the works of Markowitz [

1], Samuelson [

2], KOLM [

3], and Huang [

21].

2.2.1. Mathematical Formulation

Let

n denote the number of risky assets in a portfolio with returns

r assumed to be linearly independent. Here,

r represents an

n-dimensional random vector. Let

1 be an

n-dimensional vector of ones, and let

be an

vector of the expected returns for each asset in the portfolio.

Let

denote the

variance–covariance matrix of asset returns, which is a non-singular matrix:

Let denote an vector of asset volatilities (standard deviations), which corresponds to the square root of the diagonal elements of the variance–covariance matrix. Let w be an vector of portfolio weights, such that , where represents the weight of each asset i, i.e., the fraction of portfolio wealth allocated to asset i.

Portfolio Return:

with

We assume that the predicted returns of at least two risky assets differ. Additionally, we allow for short sales, meaning that we permit assets to have negative weights. Short selling, or “shorting”, is an investment technique in which the seller sells a product (such as a stock, bond, or commodity) that they do not own. The seller borrows the security from a broker or another investor, sells it at the current market price, and later repurchases it at a lower price to repay the lender. A frontier portfolio is one that lies on the efficient frontier, which represents the optimal risky portfolio. The efficient frontier, also known as the portfolio frontier, shows the highest expected return for a given level of risk (measured by volatility or standard deviation) and the lowest risk for a given expected return.

To determine the portfolio weight

w for a target mean return

, we consider the following optimization problem:

Using the Lagrange Multipliers approach [

21], define the Lagrangian,

where

and

are positive constants. Calculate the first-order criteria

where

is an

n vector of zeros. Since

is a positive definite matrix, the first-order criteria are necessary and sufficient for a global optimal solution. Solving for

w in terms of

, using (

8), we have

Substituting (

11) into (

9) and (

10), we have

and

Therefore, (

12) and (

13) in matrix form are

Let

,

and

, then

Since the inverse of a positive definite matrix is positive definite,

and

. We claim that

. To show this, note that

Since

is positive definite, the left-hand side of the above equation is strictly positive. Hence, the right-hand side is strictly positive. From the fact that

, we have

, or, equivalently,

. By solving (

14), we obtain

Since

, then

Substitute

and

into (

11) to obtain

Note that (

17) gives the unique set of portfolio weights for the frontier portfolio with a given expected rate of return

:

where

and

Thus, the optimal weights of the mean-variance efficient portfolios are represented as a linear function of the given level of the expected return of the portfolio,

. Note that the frontier portfolio (

18) has the expected return equal to

; that is,

Note that any portfolio that can be denoted by (

18) is a frontier portfolio. The set of all frontier portfolios is called the

portfolio frontier.

2.2.2. Variance of Optimal Portfolio with Return

We need to calculate the variance for the optimal weight. From the solution portfolio (

17),

has a minimum variance equal to

Transform to a matrix form

Let

and

, then

Substitute (

15) into (

22):

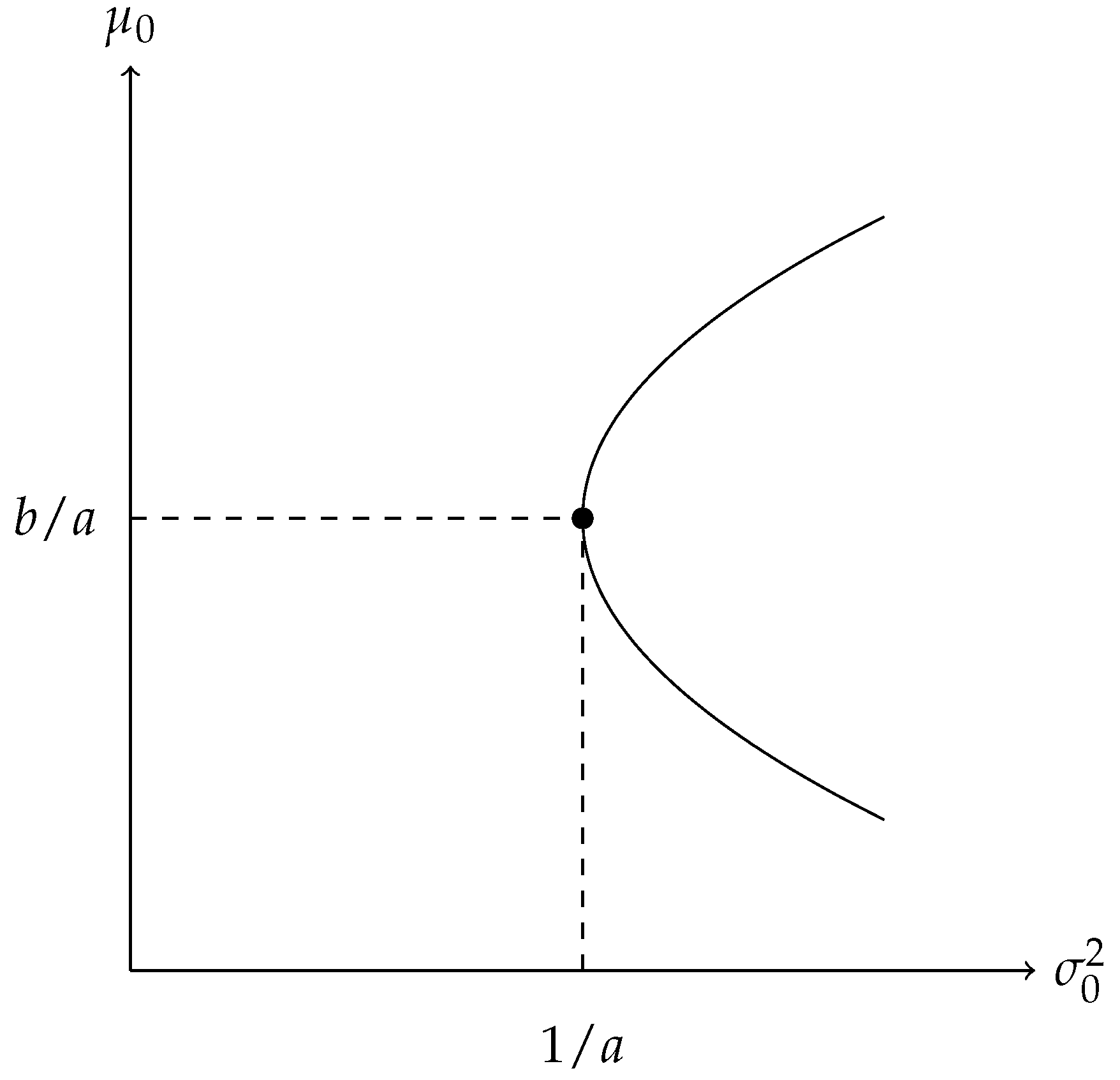

Equation (

24) is a parabola in variance-expected rate of return space with vertex

, as shown in

Figure 1.

The parabolic curve is formed by assuming different values for parameter

. The global minimum variance portfolio (GMVP) can be obtained by setting

so that

and

Correspondingly, from (

16),

and

. Substituting the value of the GMVP

and

, the weight vector that gives the GMVP is given as

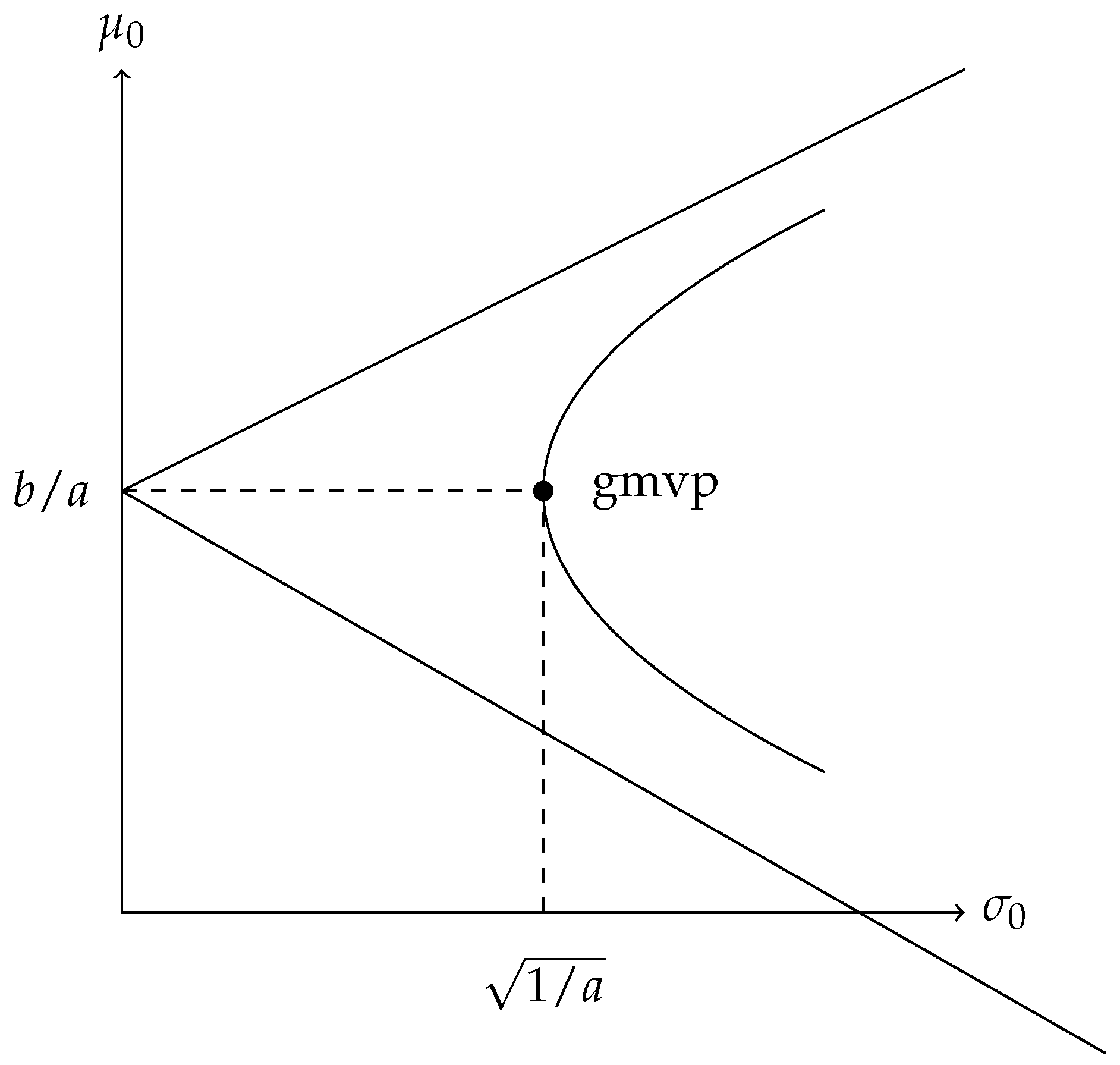

Equation (

24) can equivalently be written as

which is a hyperbola in the standard deviation-expected rate of return space with center

, as shown in

Figure 2. From all the possible portfolios, the portfolio with the minimum variance is at

.

2.2.3. Frontier Portfolios

Proposition 1 ([

21]).

The entire portfolio frontier can be derived by forming portfolios of the two frontier portfolios x and Proof. Choosing q arbitrarily as a frontier portfolio with an expected return .

From (

18), consider the following portfolio weights on

x (

19) and

y (

20): {

}, whose portfolio weights on risky assets are given as

That is, the portfolio {} on x and produces the frontier portfolio q. Since q is chosen arbitrarily, we have shown that the entire portfolio frontier can be derived by two frontier portfolios x and . □

Proposition 2 ([

21]).

The portfolio frontier can be formed as a linear combination of any two frontier portfolios. Proof. Let

and

be two distinct frontier portfolios. Since

, the expected returns on the two portfolios are not equal. Let

q represent a frontier portfolio formed by these two frontier portfolios. Then, there exists a real number

such that

Consider a portfolio of

and

with weights

and

, respectively. Since

and

are frontier portfolios, and from (

26), then

Thus, a portfolio frontier can be formed by any two distinct frontier portfolios. □

3. Shapley Value for Coverage Game

Given the challenges associated with hazardous materials storage and transportation, it is crucial to discuss the importance of mitigating risks through the optimization of emergency facility locations. Based on [

22], this section outlines a methodology that uses a gradual coverage game and the Shapley value to evaluate and select candidate sites for emergency facilities.

Consider the emergency facility placement problem for a certain region. Let us assume that the region is divided into

m zones, denoted as

, and let

represent the emergency demand vector for each zone. To locate an emergency facility, we choose

n zones, where

. Therefore,

represents the set of potential facility locations. If a location

can serve a zone

within a predetermined timeframe, then the location

i covers zone

j. The coverage matrix is denoted as

, where

Thus, the emergency facility location problem can be represented by the tetrad .

The coverage game

defined in [

23] is a special type of TU-game, where a coalition of prospective locations is valued based on the total demand it can satisfy. Specifically, the value of a coalition

S is given by

where

is the set of zones covered by at least one emergency unit in

S. Each zone is assumed to be covered by one emergency unit. The set of all coverage games over

is denoted by

.

The Shapley value was used in [

23] to solve the coverage game because the relevance of a potential location is primarily based on its marginal contribution to the existing locations. As shown in [

23], the Shapley value for the coverage game can be computed as

This expression indicates that the importance of location is determined by how much demand it can satisfy, assuming the demand in each zone is equally divided across the areas it covers.

The coverage game

can be represented as the summation of

m zone games. That is, we have

where in the zone game about zones

, denoted

, the needs of other zones are ignored. Specifically, for every

, the value of the coalition

S in the zone

j is given by

3.1. Gradual Coverage Game

The classic coverage model assumes that an incident area is either “covered” by an emergency facility within a specific distance or “not covered at all”. However, when dealing with hazardous waste, the responsiveness of an emergency facility is inversely proportional to the response time. This creates significant risks for neighboring regions, as slower response times can result in larger-scale consequences. In [

22], the authors propose a risk evaluation approach that considers the response time from the emergency facility to the incident’s location.

Let

and

represent the sets of potential locations for emergency facilities and incident sites, respectively. The partial coverage matrix can be defined as follows:

where

denotes the response time from

to

, and

and

represent the most and least desired response times, respectively. According to Equation (

29), location

j is fully covered by the facility

i when the response time

is less than

, partially covered when

is between

and

, and not covered at all when

exceeds

. The special case of Equation (

29), where

, was studied in [

23]. In this case, the coverage matrix

is a 0–1 matrix.

Define

as the highest risk at the incident site

j, representing the population at risk. The risk of establishing a facility at a potential location

i can then be calculated as

When the site

j is fully covered, the danger is minimized. However, when

j is not covered, the risk increases significantly. The utility of employing facility

i to respond to a site

j is defined as the decrease in risk and is expressed as follows:

In a cooperative game with transferable utility, a gradual coverage game for hazardous materials

was described in [

22], where

represents the set of potential sites for emergency facilities, and

is the characteristic function, defined as

where

is the set of incident locations that are at least partially covered by one facility located in

S. Denote the set of all gradual coverage games over

by

This game aims to assess the decrease in system rescue risk through a coalition of locations. As stated in [

22], at each incident site

j, the utility is evaluated by the maximum risk reduction achieved by the nearest facility, denoted as

, rather than by summing the utilities

, since the risk reduction cannot be accumulated due to time constraints.

Moreover, if

, meaning there is no difference between the most and the least desired response times, then for every

,

and consequently,

. Thus, we have

.

3.2. Shapley Value of the Gradual Coverage Game

By using the Shapley value, the objective is to rank the potential locations by importance based on their marginal contributions to the total emergency response performance. The emergency system manager can use this sequence to prioritize the construction of facilities at specific locations. Note that if many players have the same Shapley value, a random tie-breaking rule may be employed.

As highlighted in [

22], to determine the Shapley value of the gradual coverage game specified by Equation (

32), define a

j-th gradual zone game as an auxiliary game

for each

, as follows:

Notably, if the least and the most desired response times are equal, i.e.,

, then the

j-th zone game equals the

j-th gradual zone game. Consequently, we have

where

if

. Based on the additivity property of the Shapley value, we obtain the following decomposition:

Equation (

33) decomposes the Shapley value of the gradual coverage game into the sum of the Shapley values of the individual gradual zone games. To compute the Shapley value of each gradual zone game, we note that for each

,

corresponds to the generalized airport game model [

24]. Furthermore, if the utility values satisfy

then

is an airport game [

25]. According to [

25], for each

, the Shapley value is given by

Thus, rather than calculating the Shapley value of

directly from its definition, we can determine it using Equation (

33), by rearranging the individual cover vector

for each

, as shown in Equation (

34).

Similarly, Equation (

35) can be simplified as follows:

This expression is precisely the

j-th term of Equation (

28).

As noted in [

22], Equation (

35) can be explained as follows. Equation (

34) allows for a level-by-level distribution of utilities

among prospective sites. To distribute the portion

evenly among all prospective sites, we assume that each location contributes equally. Notably, only some sites

contribute to the portion

, so this portion is divided evenly among those sites. This process continues for the remaining portions, with the part

being distributed among all sites. After distributing these utilities, the location

i receives its Shapley value.

4. Results

4.1. Application in Portfolio Management

In this section, we model a portfolio of 10 different assets using Markowitz’s mean-variance model [

1,

26,

27] to determine the optimal asset weights that correspond to a high expected return and lower variance. The Shapley value is then employed to calculate the individual Shapley value for each asset. This ensures a fair distribution of risk among the assets (players) that make up the optimal mean-variance portfolio, such that each asset’s marginal contribution to the portfolio’s overall risk profile can be determined using the Shapley value, as given by Equation (

4).

The objective is to construct portfolios with the lowest variance for the highest possible returns. Using Equation (

25), we compute the frontier portfolios for a range of expected returns defined in the mean-variance space. The frontier portfolio with the lowest variance is the global minimum-variance portfolio.

Furthermore, we examine two specific cases:

- (a)

The global minimum-variance portfolio (GMVP).

- (b)

Portfolios for a given expected return.

To understand the application of the Shapley value and mean-variance analysis in the risk management of portfolio investments, we constructed a portfolio containing different types of assets using Yahoo Finance data [

28]. The data consist of 2678 daily nominal returns from historical prices of three Polish stocks from the Warsaw Stock Exchange (WSE), three Italian stocks from Borsa Italiana, two commodity ETFs, and two bond ETFs from January 2014 to April 2024.

- 1.

Polish Stocks:

- –

PKN.WA—PKN Orlen SA

- –

PKO.WA—PKO Bank Polski SA

- –

KGH.WA—KGHM Polska Miedź SA

- 2.

Italian Stocks:

- –

ENI.MI—Eni SpA

- –

ISP.MI—Intesa Sanpaolo SpA

- –

AZM.MI—A2A SpA

- 3.

Commodities:

- –

GLD—Gold (SPDR Gold Shares ETF)

- –

SLV—Silver (iShares Silver Trust ETF)

- 4.

Bonds:

- –

AGG—iShares Core U.S. Aggregate Bond ETF (representing the US bond market)

- –

TLT—iShares 20+ Year Treasury Bond ETF (representing long-term US Treasury bonds)

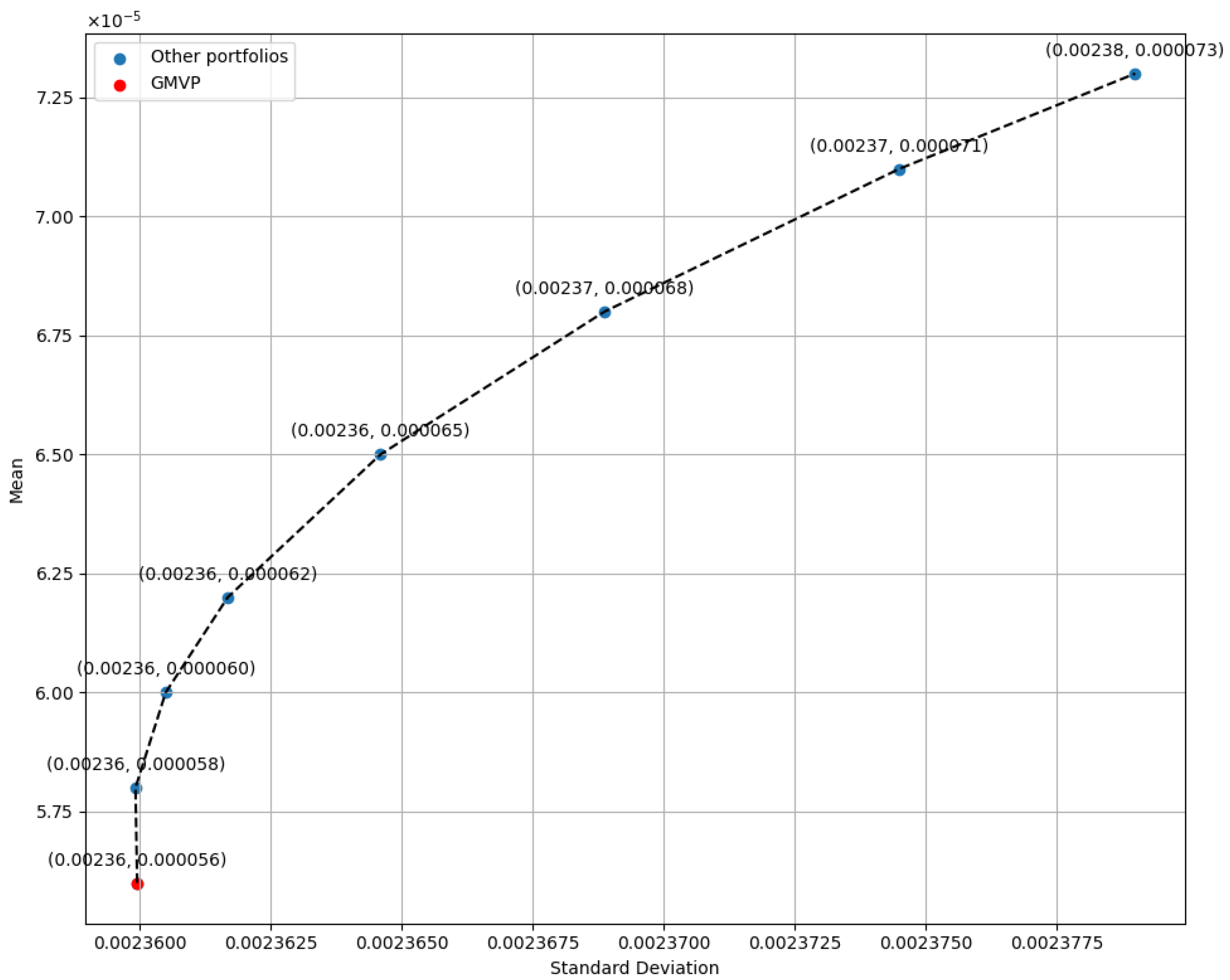

The summary statistics are shown in

Table 1. Using the data from Yahoo Finance, we computed the means and the variance–covariance matrix. Assuming an allowance for short sales, the frontier of mean-variance (MV) optimal portfolios is obtained from Equation (

25) for the expected returns presented in

Table 2, and the results are illustrated in

Figure 3.

According to

Table 2, it is observed that for higher expected returns, the risk associated with the optimal portfolios increases. This result aligns with the expectations of the mean-variance (MV) portfolio theory, which posits that higher returns are generally accompanied by higher risk.

Table 3 shows the optimal asset weights for portfolios along the portfolio frontier. These weights are computed using Equation (

17) to minimize portfolio variance for a given expected return. Some of the weights are negative, indicating a short position in those assets.

4.1.1. Global Minimum-Variance Portfolio (GMVP)

The expected return of the GMVP is given by

from Equation (

24), and the variance of the GMVP is

, where

and

. This makes it easier to calculate the Shapley value for assets in the GMVP, as described in [

27] and outlined below:

- (1)

Determine all subsets of assets in the set .

- (2)

For each subset , compute the variance–covariance matrix and .

- (3)

To calculate the variance of the GMVP for each subset

S, use the following formula:

- (4)

Using Equation (

4), the Shapley value for each asset

i in the GMVP is computed as

- (5)

Therefore, the sum of the Shapley values for all the assets in the GMVP is given by

The Shapley values for the GMVP assets are calculated using Equation (

37). These values are reported in

Table 4.

4.1.2. Portfolios for a Given Expected Return

For arbitrary expected returns, the Shapley value for the assets of all optimal mean-variance portfolios along the frontier can be developed. Since the variance of a frontier portfolio is determined by , the mean-variance efficient frontier depends on the given mean return .

In this case, as shown in [

27], the Shapley value is obtained as follows:

- (1)

Determine all subsets of assets in set .

- (2)

For each subset , compute the variance–covariance matrix and the expected return vector .

- (3)

Define an arbitrary set of required mean returns , where and are the quadratic forms for the entire set . Use the equation to calculate the frontier portfolio variance for each subset and for all mean returns .

- (4)

Using Equation (

4), the Shapley value for each asset

i in an optimal frontier portfolio subject to a given expected return

is calculated as

- (5)

Therefore, for a given expected return

, the sum of the Shapley values for all the assets in the optimal frontier portfolio is

From Equation (

38), given that efficient portfolios aim to minimize variance (risk)

for a given expected return (mean)

, the incremental risks

are non-positive for any asset

i and any set

S that does not include

i, as introduced by Samuelson [

2].

Note that

Table 3 depicts the optimal weight of each asset along the mean-variance efficient frontier for a given mean, calculated by minimizing portfolio variance. The Shapley values of portfolio assets on the MV frontier are computed using Equation (

38) and are reported in

Table 5. Some assets have negative Shapley values, indicating that they contribute lower risk to the portfolio. This is often the case with AGG, ENI.MI, GLD, ISP.MI, SLV, and TLT. On the other hand, positive Shapley values indicate that these assets enhance the risk along the optimal frontier, contributing to higher mean returns. Portfolio managers may use this information to make strategic decisions regarding asset selection and allocation, balancing risk and return according to their investment goals.

4.2. Application in Gradual Coverage Game

The model is designed to generate a sequence of potential locations and rank them according to their significance in descending order. This approach helps individuals or organizations make well-informed decisions when selecting locations for emergency facilities. Below is the pseudocode for the model implementation.

The steps for the implementation are as follows:

- (a)

Identify prospective facility locations, denoted as set .

- (b)

Define zones and associate each zone j with a vector , reflecting the risk or emergency demand level for each zone.

- (c)

Determine the response times

for each facility

i to cover each zone

j, and calculate the coverage matrix using Equation (

29).

- (d)

Calculate the risk

associated with each zone

j for each prospective facility location

i using Equation (

30), and the utility

of placing a facility at each location using Equation (

31).

- (e)

For each zone j, sort the utilities in ascending order as required.

- (f)

Calculate the gradual Shapley values

(as in Equation (

35)) for each location and its corresponding zone, using the sorted utilities, but return the results in the original utility order.

- (g)

Sum the values across all zones for each location. This gives the total Shapley value for each location.

- (h)

Rank the potential facility locations by their total Shapley values and allocate locations for facility placement to optimize coverage while minimizing risk.

This method ensures that prospective emergency facility locations are selected through a fair assessment of their contributions to total coverage, considering the varying levels of risk reduction provided by different zones. This aids in effective decision-making regarding emergency facility placement.

Furthermore, the Shapley value reflects each location’s contribution to the overall emergency response system. Due to the unavailability of real datasets, only a theoretical example of the application of these steps is presented below.

Let us consider a small city with 10 hazardous waste generation areas. We assume that , meaning that all the zones are prospective areas for locating emergency facilities and that the risk or emergency demand levels are equal across all zones. The least and most desired response times are 10 and 30 min, respectively. We generate the response times for each facility location to cover a zone using a random number generator function in Python 3.9.6.

The generated times range between 5 and 35 min, as shown in

Table 6. Below is the randomly generated emergency demand vector

:

We present partial calculations that help in obtaining the Shapley value for the prospective locations.

Table 7 shows the coverage matrix, while

Table 8 depicts the utility matrix. The

columns, where

, present the utilities

for using location

i to respond to site

j. These utilities were calculated based on Equation (

31). To apply Equation (

35), we order each of the

columns in ascending order and name the new columns as

, as shown in

Table 9.

Using Equation (

35), we calculate the Shapley values

for each location and the corresponding zone using the sorted utilities from

Table 9. The calculated Shapley values are shown in

Table 10. The values in

Table 11 represent the results from

Table 10 in the original utility order from

Table 8. Finally, using the data from

Table 11 and Equation (

33), we obtain the total Shapley value, which is presented in

Table 12.

5. Discussion

The weight of each asset in the GMVP portfolio is provided in the first row of

Table 3, while the expected return and the standard deviation for portfolio A in

Table 2 represent

and

, respectively, as the GMVP minimizes variance for the highest possible return. For the allocation, the majority of the weights are assigned to AGG, with a smaller portion of the portfolio invested in other assets. AZM.MI, ENI.MI, KGH.WA, SLV, and TLT have negative weights due to the allowance for short selling.

The standard deviations along with each asset’s share of the GMVP’s overall risk is shown in

Table 4. Specifically, AZM.MI has a Shapley value of

and contributes

of the GMVP risk, ENI.MI has a Shapley value of

and contributes

of the GMVP risk, ISP.MI has a Shapley value of

and contributes

of the GMVP risk, KGH.WA has a Shapley value of

and contributes

of the GMVP risk, PKN.WA has a Shapley value of

and contributes

of the GMVP risk, PKO.WA has a Shapley value of

and contributes

of the GMVP risk, SLV has a Shapley value of

and contributes

of the GMVP risk, AGG has a Shapley value of

, which means a reduction of

of the GMVP’s total risk exposure in terms of standard deviation, GLD has a Shapley value of

, indicating a reduction of

in risk, and TLT has a Shapley value of

, indicating a reduction of

in risk.

The Shapley values reveal each asset’s contribution to the overall risk of the GMVP. Assets with higher positive Shapley values, such as KGH.WA and AZM.MI, are significant contributors to portfolio risk. Identifying these assets helps risk managers understand which securities are driving the portfolio’s risk, and may highlight assets that require closer monitoring or hedging strategies. On the other hand, the negative Shapley values associated with assets like AGG, GLD, and TLT show that these assets help reduce the overall risk of the portfolio. These assets can be viewed as risk mitigators, and their inclusion in the portfolio may be a strategic decision to lower the total risk exposure of the GMVP.

Next, we obtained the Shapley values for the prospective emergency facility locations using the model. The locations are ranked in descending order based on their Shapley values, as shown in

Table 12. This ranking reflects each location’s contribution to the total risk reduction in hazardous materials/waste. Loc1, with the highest Shapley value, significantly contributes to the overall utility or performance across the various zones, outperforming all other locations.

6. Conclusions

This study addressed two main research questions: First, how can financial portfolio risk be fairly distributed across diverse assets? Second, how can we mitigate risk by optimizing the placement of emergency response facilities in different zones? We addressed these issues methodically and equitably, applying the Shapley value, a cooperative game-theoretic concept.

In the financial domain, we established that the Shapley value provides a clear and mathematically sound method to determine each asset’s marginal contribution to total portfolio risk. This method improves portfolio decision-making by distinguishing between risk-contributing and risk-mitigating assets, allowing better-informed asset selection and allocation. The Shapley-based gradual coverage approach, used in emergency facility planning, allows decision makers to prioritize facility locations based on their contribution to regional risk reduction, allowing more efficient and effective resource deployment in emergency logistics.

However, this work has limitations. Due to restricted access to real-world incident response datasets, the emergency logistics model was constructed using simulated data instead. Furthermore, both models operate under static settings that do not account for dynamic elements such as time-dependent risk or changing asset correlations.

Future research could broaden the framework in numerous directions. In finance, a dynamic time series adaptation of the Shapley value could detect periodic fluctuations in asset attitude, making it more relevant for real-time investment strategies. Integrating live geographic and temporal data streams into emergency planning could allow adaptive facility location in response to changing dangers. In addition, hybrid models that combine game theory and machine learning could improve decision-support tools in both areas.

From a practical point of view, the implications of our findings are substantial. Shapley value allocations can be used by financial professionals and regulators to justify asset selection, increase transparency, balance risk and return, and support risk audits. Similarly, municipal and national emergency response planners can use the gradual coverage model as a strategic tool to prioritize site selections based on marginal impact and assist in prioritizing limited infrastructure investments in managing hazardous materials or disaster-prone zones.

Author Contributions

Conceptualization, S.T.A. and O.A.; Methodology, S.T.A. and O.A.; Software, S.T.A. and O.A.; Validation, S.T.A. and O.A.; Formal analysis, S.T.A. and O.A.; Investigation, S.T.A., O.A. and K.O.; Resources, K.O.; Data curation, S.T.A. and O.A.; Writing—original draft, S.T.A. and O.A.; Writing—review and editing, S.T.A., O.A. and K.O.; Visualization, S.T.A. and O.A.; Funding acquisition, K.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

From Yahoo Finance [

28], we generated the historical prices of three Polish stocks from Warsaw Stock Exchange (WSE), three Italiana stocks from Borsa Italiana, two commodities ETFs, and two bond ETFs from January 2014 to April 2024. Where applicable, the algorithm used to generate the result on the generated data have been provided.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Markowits, H.M. Portfolio Selection. J. Financ. 1952, 7, 71–91. [Google Scholar]

- Samuelson, P.A. General Proof that Diversification Pays. J. Financ. Quant. Anal. 1967, 2, 1–13. [Google Scholar] [CrossRef]

- Kolm, P.N.; Tütüncü, R.; Fabozzi, F.J. 60 Years of Portfolio Optimization: Practical Challenges and Current Trends. Eur. J. Oper. Res. 2014, 234, 356–371. [Google Scholar] [CrossRef]

- Shapley, L.S. A Value for n-Person Games. In Contributions to the Theory of Games (AM-28), Volume II; Princeton University Press: Princeton, NJ, USA, 1953; pp. 307–318. [Google Scholar] [CrossRef]

- Tsatsaronis, K.; Tarashev, N.; Borio, C. Risk Attribution Using the Shapley Value: Methodology and Policy Applications. Rev. Financ. 2015, 20, 1189–1213. [Google Scholar] [CrossRef]

- Littlechild, S.C.; Owen, G. A Further Note on the Nucleous of the “Airport Game”. Int. J. Game Theory 1976, 5, 91–95. [Google Scholar] [CrossRef]

- Ramirez, D.; Landinez, D.; Consuegra, P.; García, J.; Quintana, L. A Cooperative Game Approach to a Production Planning Problem. In Proceedings of the Conference on a Cooperative Game Approach to a Production Planning Problem, Lisbon, Portugal, 10–12 January 2015; pp. 148–155. [Google Scholar] [CrossRef]

- Dhule, C.; Patharkar, D.; Negi, P.; Bhende, R. Retirement Portfolio Allocation Optimization Using Machine Learning With XAI. In Proceedings of the IEEE International Conference on Multi-Disciplinary Trends, Erode, India, 20–22 January 2025. [Google Scholar]

- Zhou, X.; Chi, L.; Li, J.; Xing, L.; Yang, L.; Wu, J.; Meng, H. A Study on Revenue Distribution of Chinese Agricultural E-Commerce Supply Chain Based on the Modified Shapley Value Method. Sustainability 2024, 16, 9023. [Google Scholar] [CrossRef]

- Liu, J.; Liu, M.; Hong, L.; Lin, Q. Improved Shapley Value with Trapezoidal Fuzzy Numbers and Its Application to the E-Commerce Logistics of Forest Products. Appl. Sci. 2025, 15, 444. [Google Scholar] [CrossRef]

- Adl, R.; Jia, H.; Lode, T.; Skontorp, J. The Value of Meteorological Data in Marine Risk Assessment. Reliab. Eng. Syst. Saf. 2021, 209, 107407. [Google Scholar]

- Yang, C.; Chen, M.; Yuan, Q. The Application of XGBoost and SHAP to Examining the Factors in Freight Truck-Related Crashes: An Exploratory Analysis. Accid. Anal. Prev. 2021, 163, 106418. [Google Scholar] [CrossRef] [PubMed]

- Branzei, R.; Dimitrov, D.; Tijs, S. Models in Cooperative Game Theory; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2008; Volume 556. [Google Scholar]

- Maschler, M.; Solan, E.; Zamir, S. Game Theory; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Algaba, E.; Fragnelli, V.; Sánchez-Soriano, J. Handbook of the Shapley Value; CRC Press: Boca Raton, FL, USA, 2019. [Google Scholar]

- Burgess, M.A.; Chapman, A.C. Approximating the Shapley Value Using Stratified Empirical Bernstein Sampling. In Proceedings of the Thirtieth International Joint Conference on Artificial Intelligence, Virtual, 19–26 August 2021; pp. 73–81. [Google Scholar] [CrossRef]

- Castro, J.; Gómez, D.; Molina, E.; Tejada, J. Improving polynomial estimation of the Shapley value by stratified random sampling with optimum allocation. Comput. Oper. Res. 2017, 82, 180–188. [Google Scholar] [CrossRef]

- Maleki, S.; Tran-Thanh, L.; Hines, G.; Rahwan, T.; Rogers, A. Bounding the Estimation Error of Sampling-based Shapley Value Approximation With/Without Stratifying. arXiv 2013, arXiv:1306.4265. [Google Scholar]

- Mitchell, R.; Cooper, J.; Frank, E.; Holmes, G. Sampling Permutations for Shapley Value Estimation. J. Mach. Learn. Res. 2022, 23, 43:1–46. [Google Scholar]

- Castro, J.; Gómez, D.; Tejada, J. Polynomial calculation of the Shapley value based on sampling. Comput. Oper. Res. 2009, 36, 1726–1730. [Google Scholar] [CrossRef]

- Huang, C.; Litzenberger, R.H. Foundations for Financial Economics; North-Holland: Amsterdam, The Netherlands, 1988. [Google Scholar]

- Ke, G.; Hu, X.-F.; Xue, X.-L. Using the Shapley Value to Mitigate the Emergency Rescue Risk for Hazardous Materials. Group Decis. Negot. 2022, 31, 137–152. [Google Scholar] [CrossRef]

- Fragnelli, V.; Gagliardo, S.; Gastaldi, F. A Game Theoretic Approach to an Emergency Units Location Problem; Springer: Cham, Switzerland, 2017; pp. 171–191. [Google Scholar] [CrossRef]

- Norde, H.; Fragnelli, V.; García-Jurado, I.; Patrone, F.; Tijs, S. Balancedness of Infrastructure Cost Games. Eur. J. Oper. Res. 2002, 136, 635–654. [Google Scholar] [CrossRef]

- Littlechild, S.C.; Owen, G. A Simple Expression for the Shapley Value in a Special Case. Manag. Sci. 1973, 20, 370–372. [Google Scholar] [CrossRef]

- Shalit, H. Using the Shapley Value of Stocks as Systematic Risk. J. Risk Financ. 2020, 21, 459–468. [Google Scholar] [CrossRef]

- Shalit, H. The Shapley Value Decomposition of Optimal Portfolios. Ann. Financ. 2020, 16, 1–16. [Google Scholar] [CrossRef]

- Yahoo Finance. Yahoo Finance Website. Available online: https://finance.yahoo.com/ (accessed on 25 March 2025).

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).