Correlations of ESG Ratings: A Signed Weighted Network Analysis

Abstract

1. Introduction

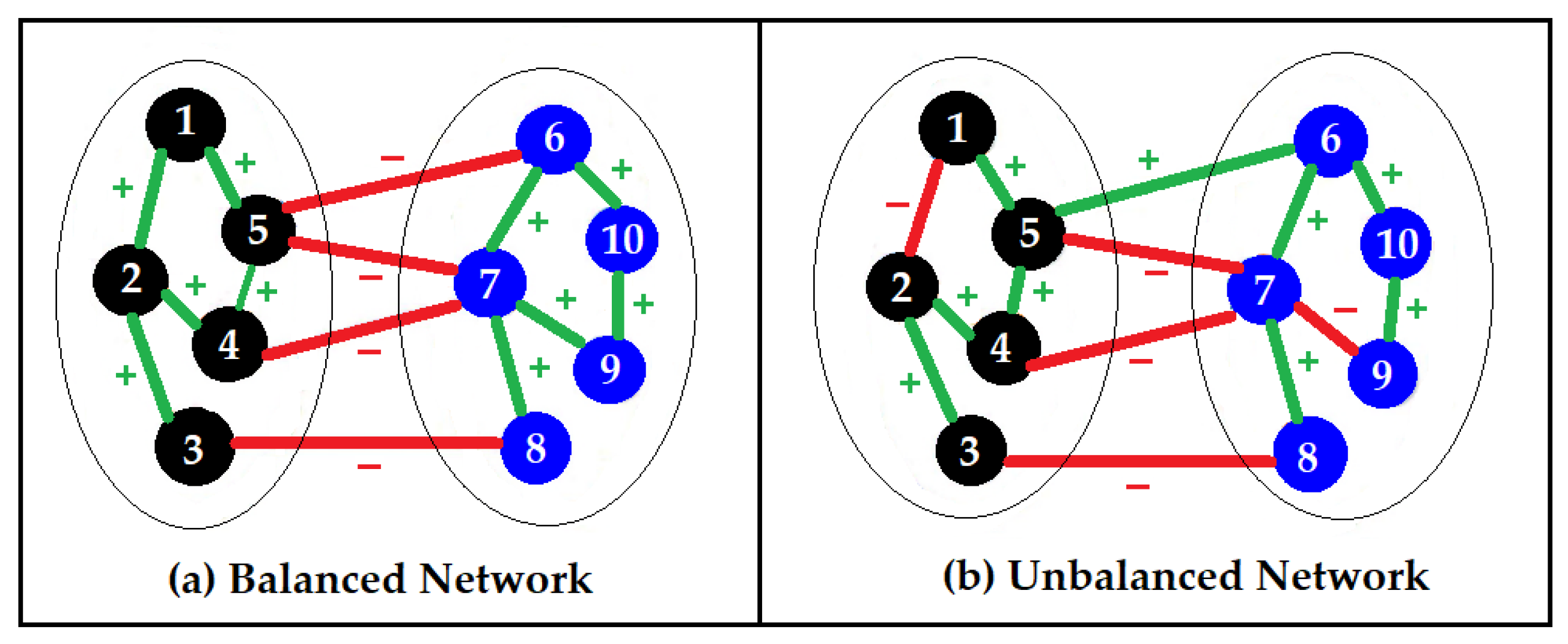

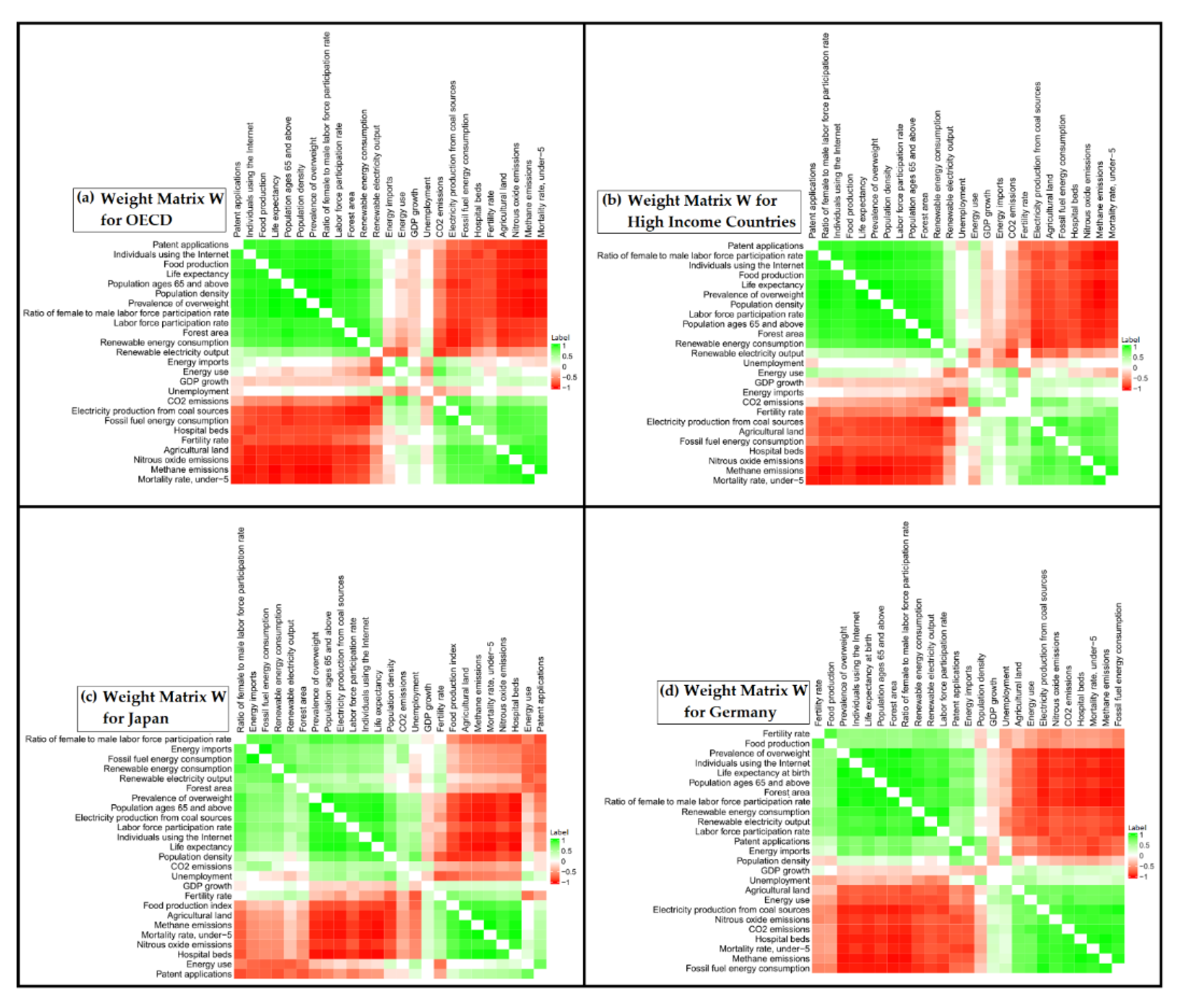

2. Materials and Methods

3. Results and Discussion

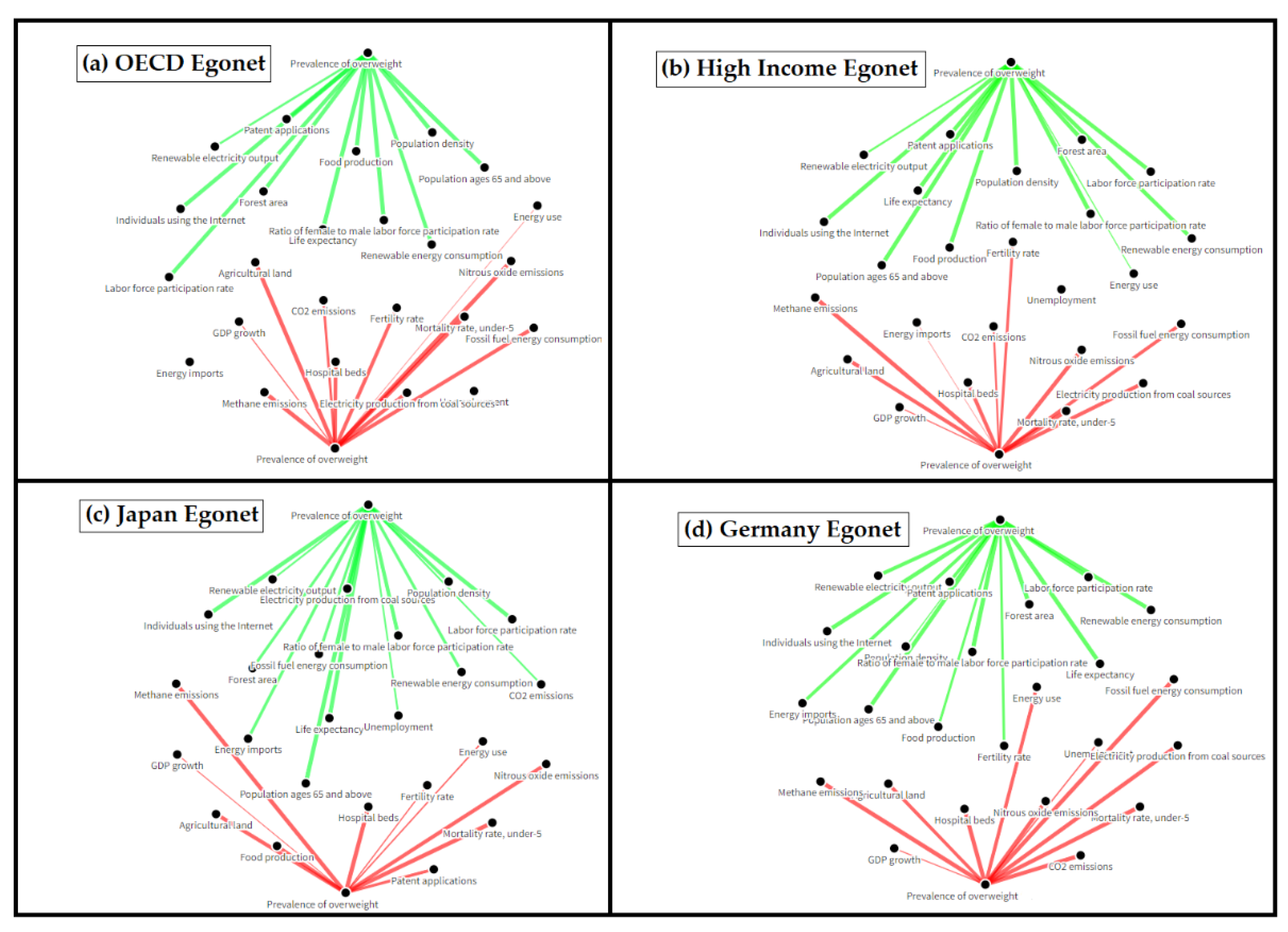

3.1. Local Analysis (Degree Centrality, Egonets)

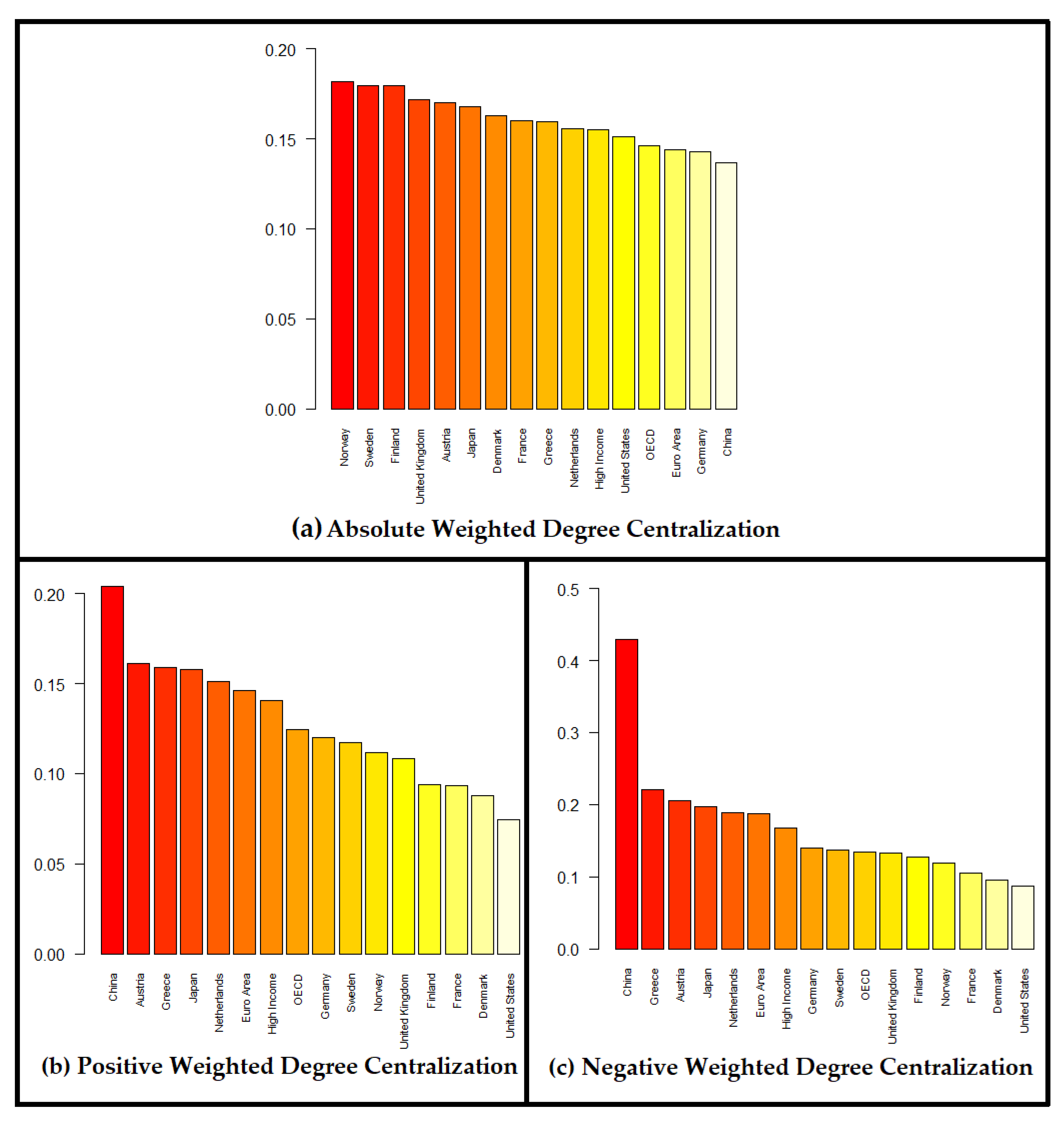

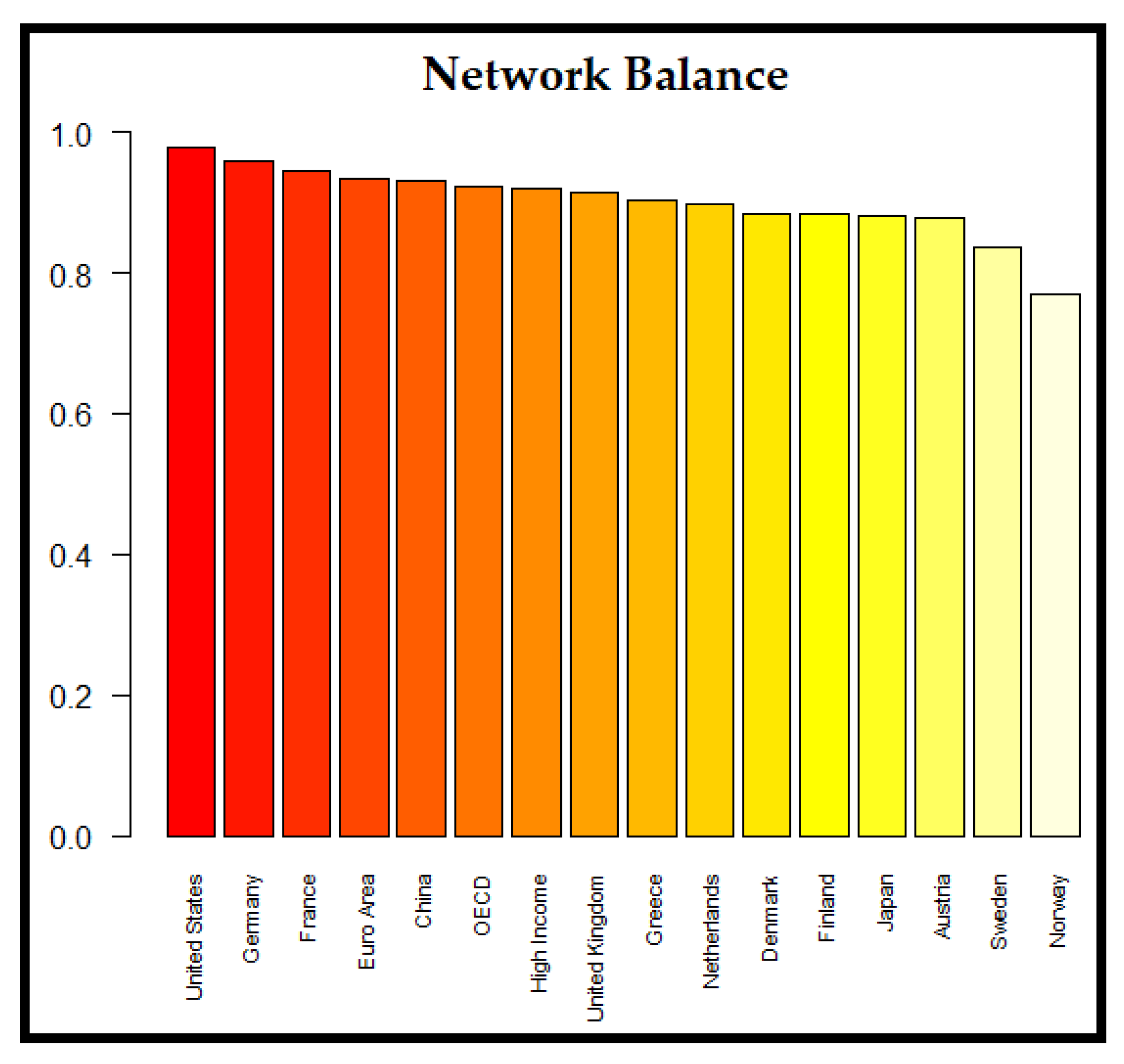

3.2. Global Analysis (Degree Centralization, Network Density, Network Balance)

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Positively and Negatively correlated ESG ratings (nodes) with the Prevalence of Overweight | |||

| Positively Correlated | Negatively Correlated | ||

| ESG rating(node) | Relative Frequency | ESG rating(node) | Relative Frequency |

| Life expectancy | 16/16 economies | Mortality rate under 5 | 16/16 economies |

| Individuals using the internet | 16/16 economies | Methane emissions | 15/16 economies |

| Population ages 65 and above | 16/16 economies | Nitrous oxide emissions | 15/16 economies |

| Ratio of female to male labor force participation rate | 15/16 economies | Agricultural land | 14/16 economies |

| Population density | 15/16 economies | Hospital beds | 14/16 economies |

| Forest area | 15/16 economies | Fossil fuel energy consumption | 13/16 economies |

| Renewable electricity output | 14/16 economies | Electricity production from coal sources | 13/16 economies |

| Renewable energy consumption | 14/16 economies | GDP growth | 13/16 economies |

| Patent applications | 12/16 economies | CO2 emissions | 11/16 economies |

| Labor force participation rate | 12/16 economies | Energy use | 8/16 economies |

| Food production | 10/16 economies | Fertility rate | 8/16 economies |

| Energy imports | 7/16 economies | Energy imports | 6/16 economies |

| Fertility rate | 7/16 economies | Unemployment | 6/16 economies |

| Energy use | 6/16 economies | Food production | 5/16 economies |

| CO2 emissions | 5/16 economies | Patent applications | 4/16 economies |

| Unemployment | 5/16 economies | Labor force participation rate | 4/16 economies |

| Fossil fuel energy consumption | 3/16 economies | Renewable energy consumption | 2/16 economies |

| Electricity production from coal sources | 3/16 economies | Population ages 65 and above | 1/16 economies |

| Methane emissions | 1/16 economies | Forest area | 1/16 economies |

| Agricultural land | 1/16 economies | Renewable electricity output | 1/16 economies |

| Hospital beds | 1/16 economies | Ratio of female to male labor force participation rate | 1/16 economies |

| GDP growth | 1/16 economies | ||

| Nitrous oxide emissions | 1/16 economies | ||

Appendix B

| Two negatively correlated Groups of ESG ratings (nodes) | |||

| Group A | Group B | ||

| ESG rating(node) | Relative Frequency | ESG rating(node) | Relative Frequency |

| Labor force participation rate | 14/16 economies | Mortality rate under 5 | 13/16 economies |

| Prevalence of overweight | 13/16 economies | Methane emissions | 12/16 economies |

| Life expectancy | 13/16 economies | Nitrous oxide emissions | 12/16 economies |

| Individuals using the internet | 13/16 economies | Agricultural land | 11/16 economies |

| Population ages 65 and above | 12/16 economies | Hospital beds | 10/16 economies |

| Population density | 12/16 economies | GDP growth | 10/16 economies |

| Forest Area | 12/16 economies | Fossil fuel energy consumption | 10/16 economies |

| Ratio of female to male labor force participation rate | 12/16 economies | Electricity production from coal sources | 9/16 economies |

| Renewable energy consumption | 11/16 economies | ||

| Patent applications | 11/16 economies | ||

| Energy imports | 10/16 economies | ||

| Renewable electricity output | 10/16 economies | ||

References

- Kenny, M.; Meadowcroft, J. Planning Sustainability, 2nd ed.; Routledge: London, UK, 2002. [Google Scholar]

- Artiach, T.; Lee, D.; Nelson, D.; Walker, J. The determinants of corporate sustainability performance. Account. Financ. 2010, 50, 31–51. [Google Scholar] [CrossRef]

- Governance & Accountability Institute. Sustainability Reports. Available online: https://www.ga-institute.com/fileadmin/ga_institute/images/FlashReports/2021/Russell-1000/G_A-Russell-Report-2021-Final.pdf?vgo_ee=NK5m02JiOOHgDiUUST7fBRwUnRnlmwiuCIJkd9A7F3A%3D (accessed on 12 August 2022).

- Amel-Zadeh, A.; Serafeim, G. Why and How Investors Use ESG Information: Evidence from a Global Survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Duuren, E.v.; Plantinga, A.; Scholtens, B. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. J. Bus. Ethics 2016, 138, 525–533. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar] [CrossRef]

- Principles for Responsible Investment. Available online: https://www.unpri.org/about-us/about-the-pri (accessed on 12 August 2022).

- Cerqueti, R.; Ciciretti, R.; Dalò, A.; Nicolosi, M. ESG investing: A chance to reduce systemic risk. J. Financ. Stab. 2021, 54, 100887. [Google Scholar] [CrossRef]

- Nofsinger, J.; Varma, A. Socially responsible funds and market crises. J. Bank. Financ. 2014, 48, 180–193. [Google Scholar] [CrossRef]

- Becchetti, L.; Ciciretti, R.; Dalò, A.; Herzel, S. Socially responsible and conventional investment funds: Performance comparison and the global financial crisis. Appl. Econ. 2015, 47, 2541–2562. [Google Scholar] [CrossRef]

- Nakai, M.; Yamaguchi, K.; Takeuchi, K. Can SRI funds better resist global financial crisis? Evidence from Japan. Int. Rev. Financ. Anal. 2016, 48, 12–20. [Google Scholar] [CrossRef]

- Hübel, B. Do markets value ESG risks in sovereign credit curves? Q. Rev. Econ. Financ. 2020, 85, 134–148. [Google Scholar] [CrossRef]

- Tang, M. Did ESG Ratings Help to Explain Changes in Sovereign CDS Spreads? MSCI Issue Brief 2017. Available online: https://www.msci.com/documents/10199/6d12ed0d-814a-4d36-a152-e8c4f175ad67 (accessed on 1 November 2022).

- Capelle-Blancard, G.; Crifo, P.; Diaye, M.-A.; Oueghlissi, R.; Scholtens, B. Sovereign bond yield spreads and sustainability: An empirical analysis of OECD countries. J. Bank. Financ. 2019, 98, 156–169. [Google Scholar] [CrossRef]

- Crifo, P.; Diaye, M.-A.; Oueghlissi, R. The effect of countries’ ESG ratings on their sovereign borrowing costs. Q. Rev. Econ. Financ. 2017, 66, 13–20. [Google Scholar] [CrossRef]

- Berg, F.; Kölbel, J.F.; Rigobon, R. Aggregate Confusion: The Divergence of ESG Ratings. Forthcom. Rev. Financ. 2019. [Google Scholar] [CrossRef]

- Bouyé, E.; Menville, D. The Convergence of Sovereign Environmental, Social and Governance Ratings. In Policy Research Working Paper; No. 9583; World Bank: Washington, DC, USA, 2021; Available online: https://openknowledge.worldbank.org/handle/10986/35291 (accessed on 1 November 2022).

- Newman, M.E.J. Networks, 2nd ed.; Oxford University Press: Oxford, UK, 2018. [Google Scholar]

- Lusseau, D.; Mancini, F. Income-based variation in Sustainable Development Goal interaction networks. Nat. Sustain. 2019, 2, 242–247. [Google Scholar] [CrossRef]

- Dawes, J.H. SDG interlinkage networks: Analysis, robustness, sensitivities, and hierarchies. World Dev. 2022, 149, 105693. [Google Scholar] [CrossRef]

- Barro, D.; Basso, A. Credit contagion in a network of firms with spatial interaction. Eur. J. Oper. Res. 2010, 205, 459–468. [Google Scholar] [CrossRef]

- Billio, M.; Getmansky, M.; Lo, A.W.; Pelizzon, L. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J. Financ. Econ. 2012, 104, 535–559. [Google Scholar] [CrossRef]

- Loepfe, L.; Cabrales, A.; Sánchez, A. Towards a Proper Assignment of Systemic Risk: The Combined Roles of Network Topology and Shock Characteristics. PLoS ONE 2013, 8, e77526. [Google Scholar] [CrossRef] [PubMed]

- Elliott, M.; Golub, B.; Jackson, M.O. Financial Networks and Contagion. Am. Econ. Rev. 2014, 104, 3115–3153. [Google Scholar] [CrossRef]

- Moghadam, H.; Mohammadi, T.; Kashani, M.; Shakeri, A. Complex networks analysis in Iran stock market: The application of centrality. Phys. A Stat. Mech. Its Appl. 2019, 531, 121800. [Google Scholar] [CrossRef]

- Chabot, M. Financial stability indices and financial network dynamics in Europe. Rev. Économique 2021, 72, 591–631. [Google Scholar] [CrossRef]

- Fornito, A.; Zalesky, A.; Bullmore, E. Fundamentals of Brain Network Analysis, 1st ed.; Academic Press: Cambridge, MA, USA, 2016. [Google Scholar]

- U.N. General Assembly. Transforming Our World: The 2030 Agenda for Sustainable Development 2015. Available online: https://sdgs.un.org/2030agenda (accessed on 5 November 2022).

- International Council for Science (ICSU); International Social Science Council (ISSC). Review of the Sustainable Development Goals: The Science Perspective; International Council for Science (ICSU): Paris, France, 2015; ISBN 978-0-930357-97-9. Available online: https://council.science/wp-content/uploads/2017/05/SDG-Report.pdf (accessed on 1 November 2022).

- Nilsson, M.; Griggs, D.; Visbeck, M. Policy: Map the interactions between Sustainable Development Goals. Nature 2016, 534, 320–322. [Google Scholar] [CrossRef]

- Independent Group of Scientists appointed by the Secretary-General. Global Sustainable Development Report 2019: The Future is Now–Science for Achieving Sustainable Development; United Nations: New York, NY, USA, 2019; Available online: https://sustainabledevelopment.un.org/content/documents/24797GSDR_report_2019.pdf (accessed on 1 November 2022).

- Le Blanc, D. Towards Integration at Last? The Sustainable Development Goals as a Network of Targets. Sustain. Dev. 2015, 23, 176–187. [Google Scholar] [CrossRef]

- Weitz, N.; Carlsen, H.; Nilsson, M.; Skånberg, K. Towards systemic and contextual priority setting for implementing the 2030 Agenda. Sustain. Sci. 2018, 13, 531–548. [Google Scholar] [CrossRef]

- Allen, C.; Metternicht, G.; Wiedmann, T. Prioritising SDG targets: Assessing baselines, gaps and interlinkages. Sustain. Sci. 2019, 14, 421–438. [Google Scholar] [CrossRef]

- Zhou, X.; Moinuddin, M. Sustainable Development Goals Interlinkages and Network Analysis a Practical Tool for SDG Integration and Policy Coherence; Institute for Global Environmental Strategies (IGES): Kanagawa, Japan, 2017; Available online: https://www.iges.or.jp/en/publication_documents/pub/researchreport/en/6026/IGES_Research+Report_SDG+Interlinkages_Publication.pdf (accessed on 1 November 2022).

- Sebestyén, V.; Bulla, M.; Rédey, Á.; Abonyi, J. Network model-based analysis of the goals, targets and indicators of sustainable development for strategic environmental assessment. J. Environ. Manag. 2019, 238, 126–135. [Google Scholar] [CrossRef]

- Putra, M.P.I.F.; Pradhan, P.; Kropp, J.P. A systematic analysis of Water-Energy-Food security nexus: A South Asian case study. Sci. Total Environ. 2020, 728, 138451. [Google Scholar] [CrossRef]

- Jing, Z.; Wang, J. Sustainable development evaluation of the society–economy–environment in a resource-based city of China: A complex network approach. J. Clean. Prod. 2020, 263, 121510. [Google Scholar] [CrossRef]

- Swain, R.B.; Ranganathan, S. Modeling interlinkages between sustainable development goals using network analysis. World Dev. 2021, 138, 105136. [Google Scholar] [CrossRef]

- Ospina-Forero, L.; Castañeda, G.; Guerrero, O.A. Estimating networks of sustainable development goals. Inf. Manag. 2022, 59, 103342. [Google Scholar] [CrossRef]

- Dörgő, G.; Sebestyén, V.; Abonyi, J. Evaluating the Interconnectedness of the Sustainable Development Goals Based on the Causality Analysis of Sustainability Indicators. Sustainability 2018, 10, 3766. [Google Scholar] [CrossRef]

- Laumann, F.; von Kügelgen, J.; Uehara, T.H.K.; Barahona, M. Complex interlinkages, key objectives, and nexuses among the Sustainable Development Goals and climate change: A network analysis. Lancet Planet. Health 2022, 6, 422–430. [Google Scholar] [CrossRef]

- World Bank. Available online: https://databank.worldbank.org/source/environment-social-and-governance?preview=on (accessed on 12 August 2022).

- Knuth, D. Two Notes on Notation. Am. Math. Mon. 1992, 99, 403–422. [Google Scholar] [CrossRef]

- Freeman, L. Centrality in social networks conceptual clarification. Soc. Netw. 1978, 1, 215–239. [Google Scholar] [CrossRef]

- Heider, F. Attitudes and Cognitive Organization. J. Psychol. 1946, 21, 107–112. [Google Scholar] [CrossRef] [PubMed]

- Heider, F. The Psychology of Interpersonal Relations, 1st ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1958. [Google Scholar]

- Harary, F. On the notion of balance of a signed graph. Mich. Math. J. 1953, 2, 143–146. [Google Scholar] [CrossRef]

- Cartwright, D.; Harary, F. Structural balance: A generalization of Heider’s theory. Psychol. Rev. 1956, 63, 277–293. [Google Scholar] [CrossRef]

- Facchetti, G.; Iacono, G.; Altafini, C. Computing global structural balance in large-scale signed social networks. Proc. Natl. Acad. Sci. USA 2011, 108, 20953–20958. [Google Scholar] [CrossRef]

- Aref, S.; Wilson, M. Measuring partial balance in signed networks. J. Complex Netw. 2018, 6, 566–595. [Google Scholar] [CrossRef]

- Signnet Package in R. Available online: https://cran.r-project.org/web/packages/signnet/index.html (accessed on 12 August 2022).

- CRAN. Available online: https://cran.r-project.org/ (accessed on 12 August 2022).

- Breslin, S. The ‘China model’ and the global crisis: From Friedrich List to a Chinese mode of governance? Int. Aff. 2011, 87, 1323–1343. [Google Scholar] [CrossRef]

- Zhu, X. Understanding China’s Growth: Past, Present, and Future. J. Econ. Perspect. 2012, 26, 103–124. [Google Scholar] [CrossRef]

- Baur, D.G.; McDermott, T.K. Is gold a safe haven? International evidence. J. Bank. Financ. 2010, 34, 1886–1898. [Google Scholar] [CrossRef]

- Reboredo, J.C. Is gold a hedge or safe haven against oil price movements? Resour. Policy 2013, 38, 130–137. [Google Scholar] [CrossRef]

- Baur, D.G.; Lucey, B.M. Is Gold a Hedge or a Safe Haven? An Analysis of Stocks, Bonds and Gold. Financ. Rev. 2010, 45, 217–229. [Google Scholar] [CrossRef]

- Hood, M.; Malik, F. Is gold the best hedge and a safe haven under changing stock market volatility? Rev. Financ. Econ. 2013, 22, 47–52. [Google Scholar] [CrossRef]

- Hillier, D.; Draper, P.; Faff, R. Do Precious Metals Shine? An Investment Perspective. Financ. Anal. J. 2006, 62, 98–106. [Google Scholar] [CrossRef]

- Dyhrberg, A.H. Hedging capabilities of bitcoin. Is it the virtual gold? Financ. Res. Lett. 2016, 16, 139–144. [Google Scholar] [CrossRef]

- Bouri, E.; Molnár, P.; Azzi, G.; Roubaud, D.; Hagfors, L.I. On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier? Financ. Res. Lett. 2017, 20, 192–198. [Google Scholar] [CrossRef]

- Ratner, M.; Chiu, C.C. Hedging stock sector risk with credit default swaps. Int. Rev. Financ. Anal. 2013, 30, 18–25. [Google Scholar] [CrossRef]

- Albert, R.; Jeong, H.; Barabási, A.L. Error and attack tolerance of complex networks. Nature 2000, 406, 378–382. [Google Scholar] [CrossRef] [PubMed]

- Gao, J.; Liu, Y.-Y.; D’Souza, R.; Barabási, A.-L. Target control of complex networks. Nat. Commun. 2014, 5, 5415. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.-Y.; Slotine, J.-J.; Barabási, A.-L. Controllability of complex networks. Nature 2011, 473, 167–173. [Google Scholar] [CrossRef]

- Henke, R.M.; Carls, G.S.; Short, M.E.; Pei, X.; Wang, S.; Moley, S.; Sullivan, M.; Goetzel, R.Z. The Relationship Between Health Risks and Health and Productivity Costs Among Employees at Pepsi Bottling Group. J. Occup. Environ. Med. 2010, 52, 519–527. [Google Scholar] [CrossRef]

- Fabius, R.; Phares, S. Companies That Promote a Culture of Health, Safety, and Wellbeing Outperform in the Marketplace. J. Occup. Enviromental Med. 2021, 63, 456–461. [Google Scholar] [CrossRef]

- Henke, R.M.; Goetzel, R.Z.; McHugh, J.; Isaac, F. Recent Experience In Health Promotion At Johnson & Johnson: Lower Health Spending, Strong Return On Investment. Health Aff. 2011, 30, 490–499. [Google Scholar] [CrossRef]

- Okunogbe, A.; Nugent, R.; Spencer, G.; Ralston, J.; Wilding, J. Economic impacts of overweight and obesity: Current and future estimates for eight countries. BMJ Glob. Health 2021, 6, e006351. [Google Scholar] [CrossRef]

- Mazhar, U.; Rehman, F. Productivity, obesity, and human capital: Panel data evidence. Econ. Hum. Biol. 2022, 44, 101096. [Google Scholar] [CrossRef]

- Goettler, A.; Grosse, A.; Sonntag, D. Productivity loss due to overweight and obesity: A systematic review of indirect costs. BMJ Open 2017, 7, e014632. [Google Scholar] [CrossRef]

- Williams, M.; Geli, P. ESG is not enough. It’s time to add an H. Fortune. 14 March 2022. Available online: https://fortune.com/2022/03/14/esg-is-not-enough-time-to-add-health-wellbeing-csr-workers-pandemic-leadership-geli-williams/ (accessed on 1 November 2022).

| Matrix | Name | Formula |

|---|---|---|

| Absolute weighted degree | ||

| Positive weighted degree | ||

| Negative weighted degree |

| Matrix | Name | Formula |

|---|---|---|

| Absolute weighted degree centrality | ||

| Positive weighted degree centrality | ||

| Negative weighted degree centrality |

| Matrix | Name | Formula |

|---|---|---|

| Absolute weighted degree centralization | ||

| Positive weighted degree centralization | ||

| Negative weighted degree centralization |

| Matrix | Name | Formula |

|---|---|---|

| Absolute weighted density | ||

| Positive weighted density | ||

| Negative weighted density |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ioannidis, E.; Tsoumaris, D.; Ntemkas, D.; Sarikeisoglou, I. Correlations of ESG Ratings: A Signed Weighted Network Analysis. AppliedMath 2022, 2, 638-658. https://doi.org/10.3390/appliedmath2040037

Ioannidis E, Tsoumaris D, Ntemkas D, Sarikeisoglou I. Correlations of ESG Ratings: A Signed Weighted Network Analysis. AppliedMath. 2022; 2(4):638-658. https://doi.org/10.3390/appliedmath2040037

Chicago/Turabian StyleIoannidis, Evangelos, Dimitrios Tsoumaris, Dimitrios Ntemkas, and Iordanis Sarikeisoglou. 2022. "Correlations of ESG Ratings: A Signed Weighted Network Analysis" AppliedMath 2, no. 4: 638-658. https://doi.org/10.3390/appliedmath2040037

APA StyleIoannidis, E., Tsoumaris, D., Ntemkas, D., & Sarikeisoglou, I. (2022). Correlations of ESG Ratings: A Signed Weighted Network Analysis. AppliedMath, 2(4), 638-658. https://doi.org/10.3390/appliedmath2040037