1. Introduction

In general, space activities are still often associated with governmental space agencies, such as NASA, ESA, ISRO, JAXA, CNSA, and others, and with public expenditures but less with business opportunities. While this governmental drive was indeed the case in the early stages of space activities, this concept has changed considerably after the 1970s. The moon landings contributed to an important transition moment, particularly by the well-known Apollo missions. These missions, driven by national prestige motivations, to a certain extent also ended the ‘Space Race’ between the USA and the (then) USSR and, therefore, this nation-driven competitive phase of space activities.

Indeed, the first significant space achievements were made by the USSR programs, launching the first satellite in space (Sputnik) in 1957 and the first human in space (Yuri Gagarin) in 1961. From a political prestige point of view, this was unacceptable for the USA (

Logsdon, 2010) which led to a retroactively bold announcement from President Kennedy at Rice University in 1961 of being the first nation to put a human on the moon before the end of the decade (

Launius, 1994).

As other spectacular space missions from a prestige perspective, such as a Mars landing, were at that moment in time not considered achievable in a politically reasonable timespan, this did not only end the aforementioned ‘Space Race’ but also considerably led to the reduction in government funding for space programs.

However, the space companies, having worked on these ambitious programs as contractors, had acquired, thanks to this government-funded phase, a considerable know-how. In order to continue business, they started space projects with their own financial means and debt financing, hence the growth of the commercial space era from approximately 1970 onwards once public funding after the successful moon landings rapidly started to decrease.

Another milestone is, as we call it nowadays, the growth of New Space, since approximately the year 2000, when creative and visionary entrepreneurs started to develop new approaches, with the help of equity funding (

Peeters, 2022).

At this point, we have to stress an important issue on the financial turnover of the space economy, which is reflected in different often diverging figures depending on the source consulted. It is, therefore, important to highlight a number of reasons why space turnover figures show such a broad divergence depending on the source.

First of all, due to the dual-use aspect of space (many space applications can be both used for civil as well as for military purposes, such as rocketry, earth observation, and precision navigation), figures related to these activities are, therefore, not or only partially published for military secrecy reasons. Several industry organizations and consulting companies, therefore, use different assumptions for the non-reported amounts which differ considerably and lead to large differences in the resulting reports and publications on figures on the space economy.

A second factor is the delimitation of space activities versus other alternative means. There is a strong interrelation between space and terrestrial communications, leading to enhanced quality and coverage. Determining, therefore, which part of telecommunications belongs to the space economy or to the traditional communication sector has led to different opinions on the boundaries between both and represent another source of divergence.

A third and very important factor which is often underestimated is the difference between space core activities (such as launchers and satellites, as well as space applications) and space-dependent activities. As an example, navigation systems built in cars would be useless without space signals, the same is applicable for many other areas such as aviation, drones, and even bank transactions and power supply (

Bruckardt, 2022). Adding these economic sectors or not changes the space business figures by a lot.

The space economy is growing, but forecasting this growth is not as easy as it is the case for vested products in view of increasingly novel applications, several of them unknown at this point in time (similar to, e.g., the impact of artificial intelligence, which was very underestimated as a market only one decade ago).

Once these aspects are at least clarified, we can dedicate our attention to the future of space business. In the context of the considerations of this, we shall address the concept of the democratization of space. Indeed, although for several decades space was, to a large extent, the privilege of a few wealthy space nations, New Space has considerably changed this concept and will continue to do so in the next decades, opening space business opportunities to emerging countries.

Lower launch costs as well as reduced costs of smallsats, often facilitated by standardized satellite platforms and kits, are now allowing several emerging countries to be part of the space ecosystem. Space-related knowledge is, therefore, no longer a question of prestige but rather a prerequisite to cope with the technological challenges of future industrialization.

In order to do so, this article will explore the basic differences between New Space and space commercialization and will further discuss on the access to space opportunities by emerging space nations, with the use of cheaper launchers and launch sites, as well as more affordable smallsats.

In the literature, related to this topic, several concepts are used in the context of emerging countries and space activities. In a concise report (

ESPI, 2021) studying the characteristics of nations in the space domain, a first distinction is made between

spacefaring and emerging spacefaring nations. The first category refers to the vested space powers having full capacity to independently produce, launch, and operate satellites.

Emerging spacefaring nations, on the other hand, are defined in the report as follows (

ESPI, 2021):

“countries that are increasing their efforts in the space domain, which are in the process of establishing broader autonomous capacities to access and operate in space and benefit from a variety of space activities”.

This basic approach has been supported by other authors pointing out the difference in terms of space presence and visibility to the general public of countries like Argentina, South Africa, Nigeria, Egypt, Unites Arabic Emirates (UAE), and Malaysia, just to mention a few, which have ongoing space activities but do not have (yet) the same reputation as spacefaring nations such as China, ESA, India, Japan, Russia, and the United States of America (

Dennerly, 2016). In discussing the role of emerging nations in sustainable development, a similar distinction can be found between these two main categories in other publications (

Scatteia et al., 2020).

In order to make a distinction between these emerging spacefaring nations, which already have a basic capability which they want to extend, and other emerging nations interested in space activities, in this article we will use the term emerging space nations for countries eager to become a player in the space ecosystem but do not have the right space capabilities or infrastructures yet.

It must be mentioned for completeness that, recently, authors have become increasingly aware of the fact that there is a need for clearer definitions, and holistic approaches are being proposed for discussion to clarify the distinction between the different categories of space-related nations (

Oniosun, 2025).

The main question we will address here in this article can, therefore, be summarized as follows: Why would emerging space nations endeavor to become emerging spacefaring nations?

2. The Evolution of the Space Economy

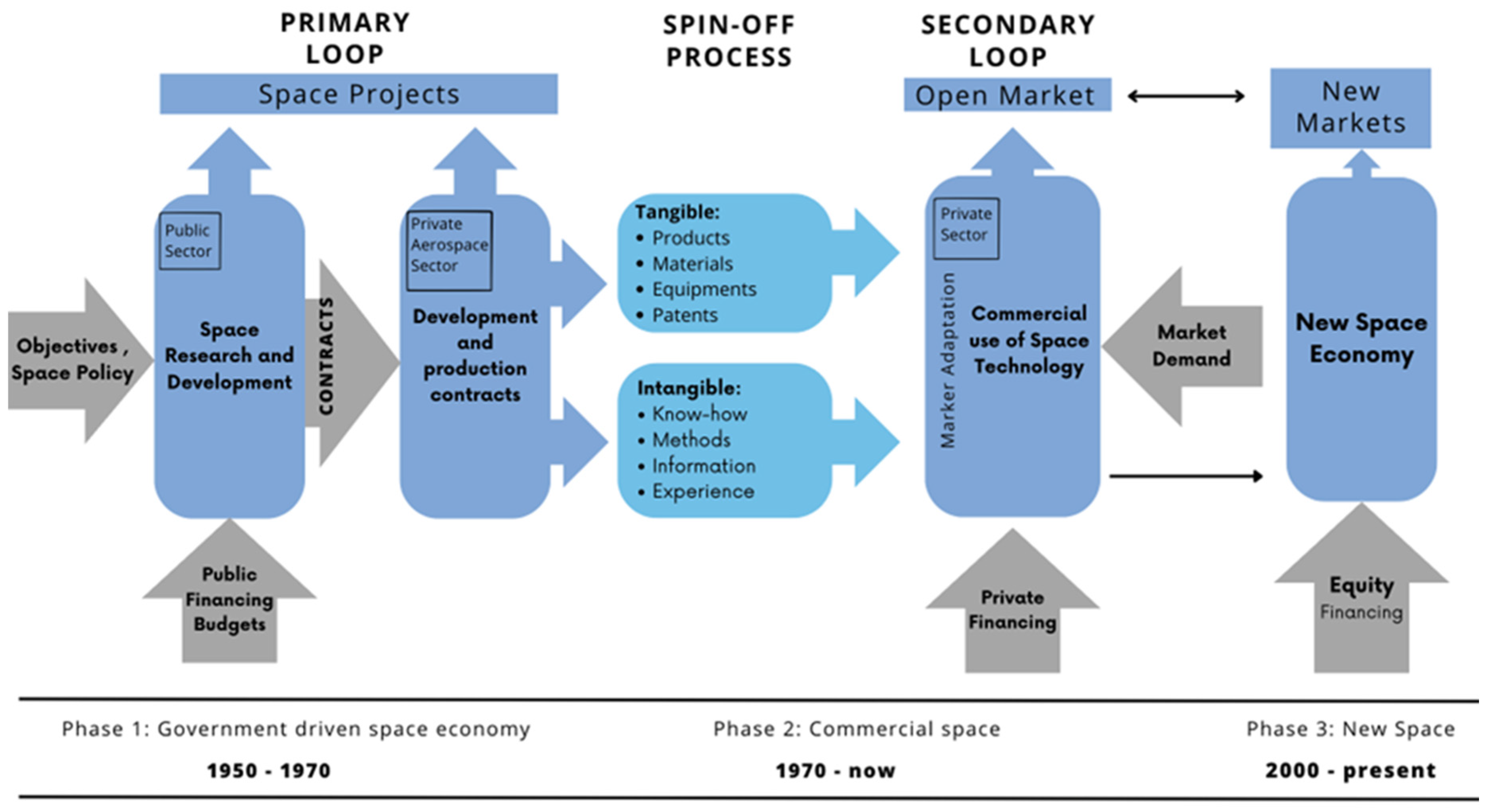

In broad terms we can describe the evolution of the space economy in three waves, as presented in

Figure 1, which will be explained hereafter.

Phase 1: The Government-driven space economy was driven by political and prestige motives from the spacefaring countries at that point in time, the USA and the (then) USSR. Generally, this phase is labeled as the ‘Space Race’ between these two nations, as they tried to reach a number of objectives first, before the other nation, for political prestige. Whereas the USSR succeeded to be first with the launch of Sputnik in 1957 and the first nation to put a human (Yuri Gagarin) in space on 12 April 1961, this led to a political motivated reaction of the USA.

In a letter dated 20 April 1961 to NASA (hence only some 6 weeks after the successful first human spaceflight from the USSR), U.S. President John Kennedy asked NASA to come up with a proposal for a spectacular mission (

Launius, 1994). This led to the famous announcement of the very ambitious Apollo program on 25 May 1961.

This program was considered in the USA as a national priority and considerable resources were mobilized in the first-place budgetary ones. Indeed, the US Congress approved without many objections and debated a budget of 25.4 billion USD for the Apollo program in 1961 (approximately 280 billion USD in present economic conditions) (

Olgun & Bayraktar, 2023;

Stine, 2009). We must comment here that approving such an expenditure was strongly facilitated by the expected growth of GDP at that time, which was indeed forecasted and realized at an average of some 5% yearly in the period 1961–1969 and made such budgetary expenses affordable (which is not the case anymore nowadays) (

Peeters & Ehrenfreund, 2025).

Evidently, this budget resulted in a considerable surge in hiring an adequate aerospace workforce during the Apollo program, which is estimated to be over 400,000 people, from which, besides 34,000 NASA employees, about 375,000 were employed by over 20,000 companies and universities in the USA. (

Turcat, 2008). After the main goals of the Apollo program were achieved with the moon landings, government space budgets dropped rapidly by a factor of more than 4 between 1966 and 1975, which strongly influenced the origin of the next phase.

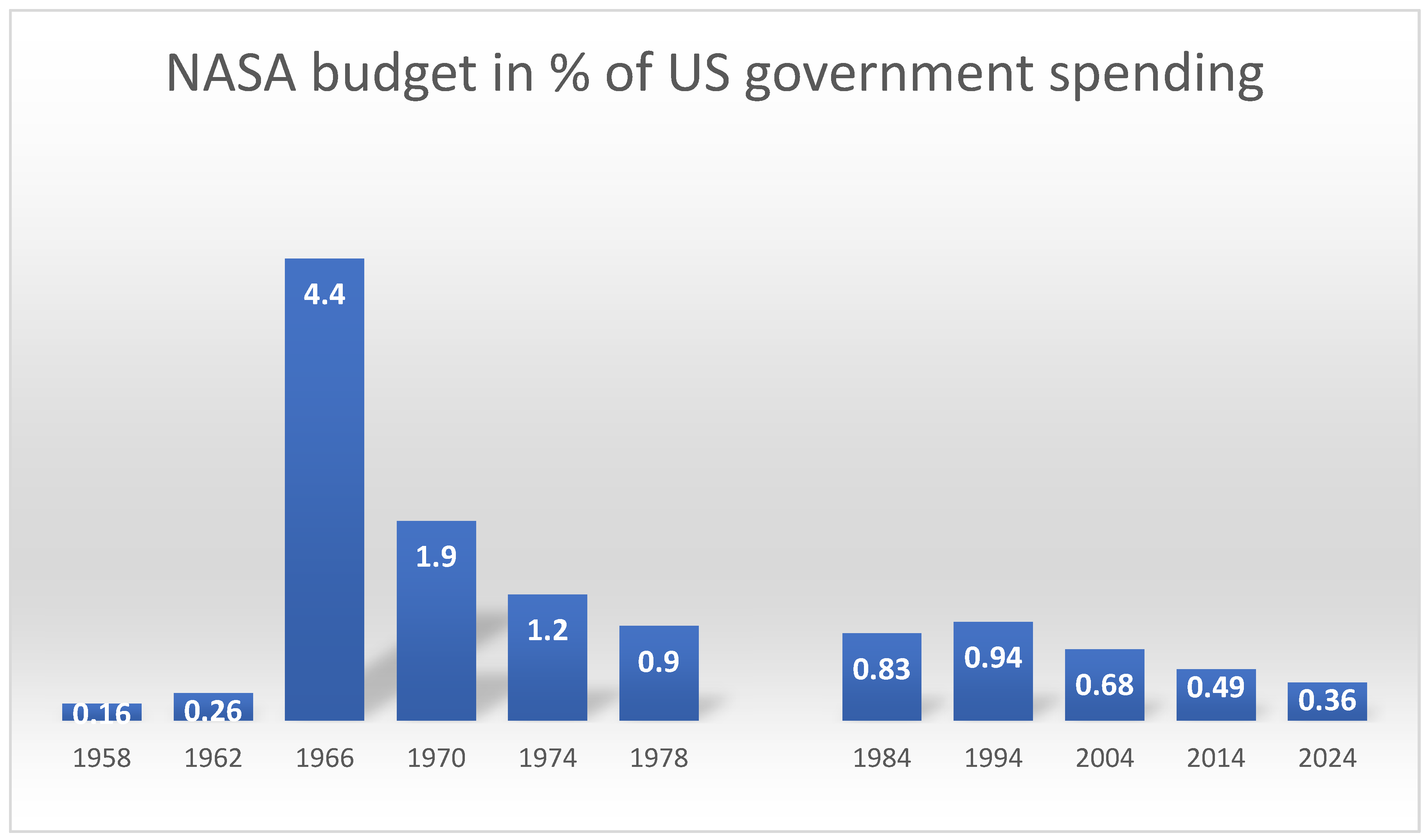

Phase 2: Commercial Space was directly linked to the first phase by the availability of relevant resources. We should also not forget that around that time, the same companies also worked on other defense-oriented, government programs in the areas of telecommunications and earth observations, which offered dual-use applications and resulted in additional turnover. Significant in that period was the drop in government spending, reflected in the decreasing evolution of the NASA budget after 1966, as illustrated in

Figure 2.

Note that for

Figure 2, the plotting starts in 1958 (first NASA budget), and intervals have been increased after 1978 due to relatively low fluctuations. The 2025 NASA budget is still under discussion but is likely to be reduced further under the present administration’s priorities in favor of entrepreneurial outsourcing.

Faced with this considerable drop in government funding after the moon landings, we saw first a phase of mergers and acquisitions, to allow a smaller number of space companies to be financially more robust. This allowed them to use the financial profits from the previous period and use their own funding, enhanced with debt funding, to initiate own activities. The first market identified were telecommunications and from the 1960s onwards communication satellites were placed in geostationary orbit.

This commercial transition was facilitated by the availability of a skilled workforce and also thanks to the experience with rigid requirements working for governmental and military programs before. In addition to this, a lot of the technologies were de-classified at the end of the previously described Space Race and could now be implemented in commercial projects.

Several authors have studied and defined this commercial process in detail from different perspectives, in particular, from a free market point of view (

Davidian, 2020). A concise description which reflects the use of private funding in the commercial space phase can be found in the U.S. National Space Policy of 2010 as follows:

“The term “commercial,” for the purposes of this policy, refers to space goods, services, or activities provided by private sector enterprises that bear a reasonable portion of the investment risk and responsibility for the activity, operate in accordance with typical market-based incentives for controlling cost and optimizing return on investment, and have the legal capacity to offer these goods or services to existing or potential nongovernmental customers.”

In order to illustrate this shift, the space economy during the first phase was about 100% governmental till 1970, whereas we see nowadays that government expenditure counts for some 25% of the space economy worldwide, with over 75% allocated to commercial space activities. We can safely assume that for the next few decades, such a form of co-existence will continue as government support for new endeavors will continue to exist in the future to support companies with R&D and precursor missions.

Phase 3: The New Space Economy contrasting with the ‘Traditional Space Economy’. We must state clearly that we are referring to a new way to execute space activities and not a substitution to other previous space activities. In order to illustrate this, a comparison is proposed between the traditional modus operandi of the space sector and the approach of New Space companies, as per

Table 1 (

Peeters, 2024).

New Space companies operate more on the basis of lower reliability and shorter design lifetimes. This results in considerable mass savings and, in particular, when operating in lower orbits, resulting in cost savings amongst others for the launch.

Risk acceptance is another important difference, whereby New Space entrepreneurs are taking the usual business risks whereas the traditional space sector, with a history to work in the frame of government contracts, are more risk adverse (

Musk, 2018). The different business approach is also the result of the differences in financing. Whereas the traditional space companies are operating with debt financing, New Space companies are operating with equity investors, taking a share in the company. This led to a proposed definition for the New Space economy as follows:

“Private companies, which act independent of governmental space policies and funding, targeting equity funding and promoting affordable access to space and novel space applications”.

Equity investors, such as Venture Capitalists, strongly believe in this New Space Economy. As an illustration, equity investments in Space start-ups were reported to be around 7.8 billion USD in 2024, which is a considerable growth compared to some 2 billion USD (BUSD) equity space investments in 2015 (

Bryce Tech, 2025).

We have to stress here that the three aforementioned waves are most typical for the timeframes indicated in

Figure 1 but will remain to co-exist in parallel for the near future. A distinction, however, is important for the consideration of the future growth of the space economy, which we will cover in a later chapter.

3. The Size of the Space Economy at Present and the Expected Growth

Up to a few years ago, space economy data were collected on the basis of the turnover of space companies, with additional figures from the governmental space budgets. As previously mentioned, the latter ones, in particular, the defense-related part, were not reported transparently by some countries or were only partially reported, excluding sensitive agencies having space assets (e.g., USA); the data vary depending on the approach of the analysts and the estimates of the missing data.

This approach changed in recent years, when the consulting firm McKinsey, among others, supporting the World Economic Forum (WEF), proposed a space economy figure based upon two pillars (

WEF, 2024):

The ‘Backbone’ space economy, covering the traditional space hardware and space services providers, e.g., in telecommunications, earth observation and navigation;

The ‘Reach’ space economy, which refers to markets which could not exist without the use of space data.

In particular, location-based PNT (Position, Navigation and Timing) applications are considered in the report to have a rapidly growing role in such fields as financial transactions, fleet management services, and supply chain tracking tools. (

Morgan Stanley, 2024).

This approach of the concept of Space Economy is now generally accepted and applied. Different sources show evident differences, as well due to the aforementioned different assumptions in government budgets and due to different perceptions on what is included in the reach part. However, those differences remain within statistically acceptable limits.

If we look, as an example, at the reported space economy figures in other sources for 2024, we find

We can, therefore, safely assume that, within a reasonable margin of error, the global space economy at present is in the order of 600 BUSD.

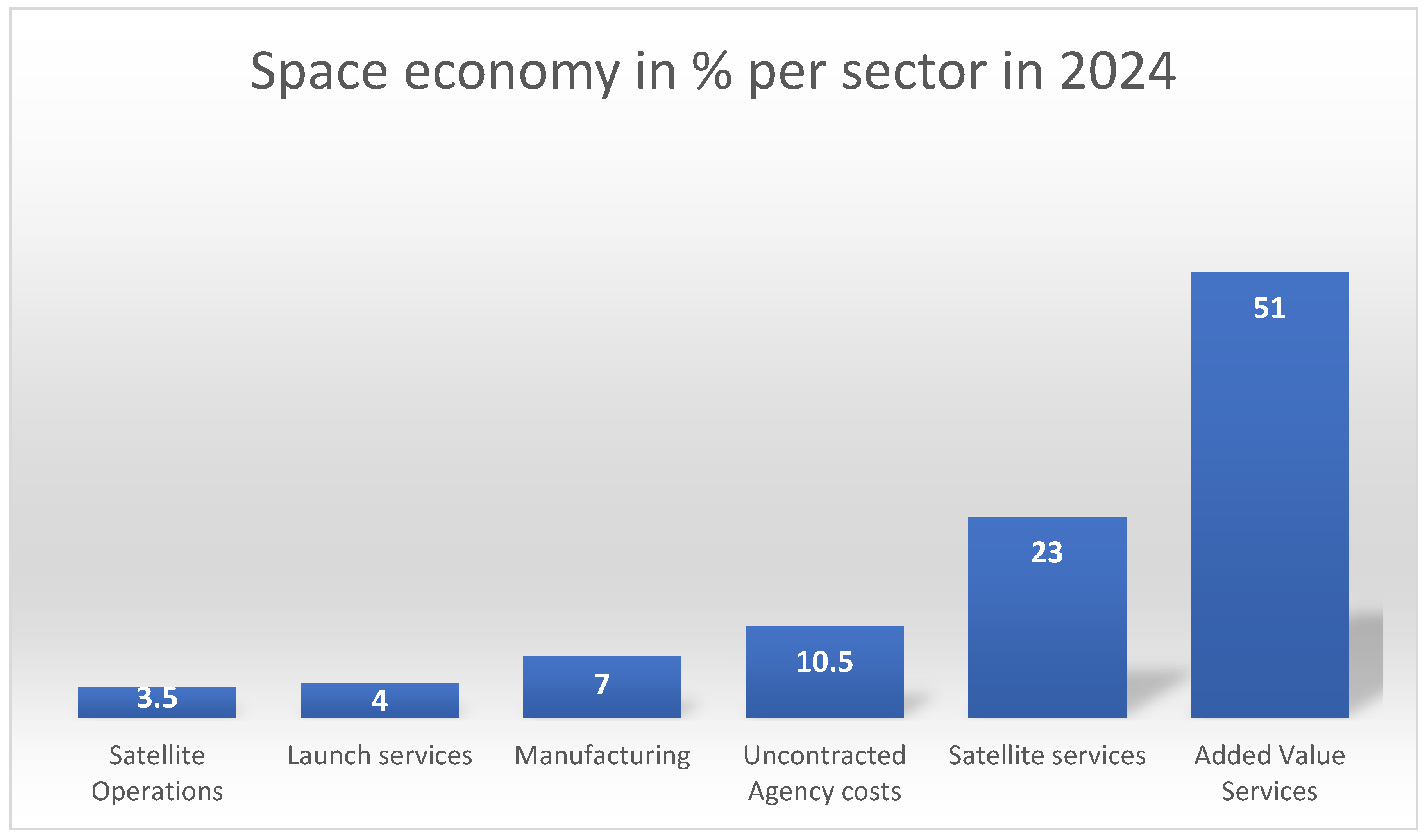

A distribution of the different sectors of the space economy is given in

Figure 3, based on these previously referred sources.

Based upon these figures, a few observations can be made as follows:

It may come to a surprise that pure space core activities (satellite manufacturing and launch activities) are only a fraction of the space economy (11%).

The real competitive market for commercial space companies is limited to 224 BUSD (

Novaspace, 2025).

Most agencies are procurement agencies and, therefore, issue contracts to companies, hence this ‘Uncontracted Agency’ percentage relates purely to internal and R&D costs of these agencies.

Hence, the commercial space sector is at present in the order of 77.5% of the total space economy.

The classification of the different segments in the space economy in

Figure 3 is based upon the area of application. It is important to note that other classification methods have recently proposed integrating policy and social elements in the classification approach. An example, using the SCP (Structure–Conduct–Performance) systematic approach introduces a model based upon supply/demand (

Pietrzak, 2025). Evidently, such emphasis on social and policy drivers can lead to different argumentations in view of the motivations of space emerging nations.

When it comes to forecasting attempts, there are sufficient arguments to allow for confidence in a credible growth of the space economy, such as

Increasing number of applications, particularly in the field of PNT (Positioning, Navigation and Timing) related to self-driving cars, drones, trucks, etc.

Direct communications between satellites and devices (so-called D2D, Direct to Device) without transmission stations.

Decreasing costs of launches due to serial productions, 3D-printing techniques, and re-usability.

Improved cost-effective production methods for smallsats by using off-the-shelve components such as solar panels and batteries.

Increasing application fields using smallsats in areas such as Earth Observation and IoT (Internet of Things) in lower orbits; therefore, providing better resolutions.

Increasing possibilities offered by the LEO (Low Earth Orbit) constellations, which only will become evident once the planned constellations are fully operational and are difficult to predict at present.

New concepts for VLEO (Very Low Earth Orbit) constellations in particular for Earth Observation.

Planned constellations for cyberattack protected communication networks, amongst others decided by the European states.

Increasing government budgets, particularly, in the field of dual-use applications. As an example, the worldwide government spending on space projects increased from 117 BUSD in 2023 to 135 BUSD in 2024 (

Novaspace, 2025) with an expected acceleration resulting from the planned US Golden Dome project.

An increasing number of exploration missions, estimated at 750 in the next decade (

Euroconsult, 2023).

An increasing number of smallsats, in particular, serving emerging space nations, providing country-specific solutions.

But, in the first place, several novel applications which will evolve from the private investments in space start-ups.

With all these different, sometimes interrelated, parameters, it is no surprise that diverging forecasts are being made based upon different assumptions.

Let us analyze a few of those forecasts. An interesting comparison of several estimates was compiled and published in 2020 (

IDA, 2020), comparing in the first place the assumed CAGR (Compound Annual Growth Rates) of the traditional space activities. The major results are represented in

Table 2.

We note immediately the effect of the assumed CAGR (Compound Annual Growth Rate), which in some cases was assumed to be rather optimistic. Indeed, more recent GDP growth forecasts of the International Monetary Fund (IMF) and the Congressional Budget Office (CBO) are predicting GDP growth of 2.8% yearly in the period 2026–2030 and 2.5% yearly in the period 2031–2035 (

IMF, 2024;

CBO, 2020).

Admittedly these figures are more positive for some countries (like India and China), and we may assume that space activities will grow faster than the overall GDP growth, still a CAGR growth assumed at that time by certain institutions was high. However, it is important to note that these figures were largely based upon extrapolation of known and extrapolated cislunar space endeavors such as asteroid mining, space tourism, and in-orbit servicing and manufacturing.

The new concept involving the economic effect on other sectors which are dependent on space data is, however, bringing in another dimension. With a reasonable assumption that such enabled activities will grow faster in future, WEF comes to an expected space economy figure of 1790 BUSD in 2040 (

WEF, 2024) as soon as 2035, as shown in

Table 3.

It is worthwhile to note here that this study (

WEF, 2024) also includes a sensitivity analysis in case of global changes in economic progress. Whereas approximately 1.8 trillion dollars (1.8 TUSD) is considered the base case, a pessimistic scenario comes to 1.4 TUSD in 2035, and an optimistic scenario could even lead to 2.3 TUSD in 2035 (

WEF, 2024).

Overall, we can safely assume that the space economy, composed of direct space activities and space-dependent activities, will grow from the present turnover in the order of 600 BUSD to a double, possibly even triple, figure in the next decade.

4. The New Space Effect on Emerging Space Nations

One of the reasons why New Space origins are often quoted to start around the year 2000 is the considerable changes in the launch economy, starting with the SpaceX Falcon family of (reusable) launchers. Indeed, the present commercial Falcon 9 launcher is able to supply large numbers of satellites (often called rideshare launches) in Low Earth Orbit (LEO) at a cost of 2720 USD/kg. This means a reduction in launch cost for satellites with a factor 20 compared to the launch cost of a shuttle (54,500 USD/kg). Other fully reusable launchers under development such as SpaceX Starship could even in future bring launch costs down with as much as two orders of magnitude, as low as in the order of 30 USD/kg (

Jones, 2018).

Another important evolution is the commercial micro-launchers presently under development. These launchers will not be able to bring the same mass in LEO in one launch but will have the advantage of bringing smallsats in accurate orbits (whereas the rideshare launches only target one specific orbit with limited correction possibilities).

One particular aspect requires particular attention in this context, namely, launch sites for micro-launchers. As already mentioned, the best location of a polar orbit LEO launch is evidently close to the poles. This gives a competitive advantage to emerging space countries close to the poles as the installations required to launch a smallsat are requiring only relatively low investments, at the same time raising a lot of visibility and the creation of a downstream technological know-how (operations, ground segment equipment, propellant production and handling, payload integration and verification…). This option is of particular interest for countries close to the South Pole as it reduces the number of maneuvers, hence reducing propellant and leading to cost savings.

In a polar orbit, a satellite travels from pole to pole while the earth rotates beneath it, allowing it to scan the entire globe over time. A sun-synchronous orbit (SSO) is a specific type of polar orbit that allows a satellite to pass over the same part of the Earth at the same local solar time each day. This consistent lighting condition is ideal for capturing clear, comparable images over time. These orbits are crucial for earth observation, environmental monitoring, and disaster response. Satellites in SSO can track changes in land use, monitor bushfires and floods, and support climate science by providing daily, time-consistent imagery. They are also vital tools for agriculture, helping farmers manage crops and resources with precision, and are, therefore, of paramount importance for, e.g., emerging space nations in the southern hemisphere.

An example of such a present site in operation in the southern hemisphere, as shown in

Figure 4, as an illustration of a high-visible space activity in an emerging space nation at a reasonable investment cost.

These elements relate to the aforementioned affordability factors in the definition of the New Space economy. It is, therefore, no surprise that analysts predict a rapid growth in spacefaring nations with several new countries joining this sector. A good example of how a country can rapidly develop in an important space nation is Indonesia, where a national Space Law was adopted in 2013, which has made Indonesia an important space player today (

Diana et al., 2025).

Although local circumstances and priorities prevail on a country-by-country basis and should be taken into consideration by the respective nations on a case-by-case basis, a successful stepwise approach could, as a generic template, look as follows:

Step 1: Convince national policy makers.

Establish a national space strategy plan.

Highlight the benefits for the specific country.

Organize national space events.

Step 2: Capacity building in the country

Introduce space-related aspects in STEM education.

Scholarships for students to space studies abroad.

Introduce CubeSat projects in universities.

Step 3: Grow a local ecosystem.

Create a space innovation fund (pre-seed).

Create a space ecosystem incubator.

Support a local university to create a CubeSat.

Appoint an advisory expert board.

Step 4: Establish a regulatory framework.

Ratify international treaties.

Join space initiatives such as Artemis (US coordinated) or ILRS (International Lunar Research Station, Chinese driven)

Establish a national space law or a space act.

Coordinate national space activities at a high political level.

Step 5: Create international awareness.

Join international space organizations such as IAF.

Organize international space events.

Envisage a national smallsat project.

The CubeSat aspect deserves special attention in the context of emerging space nations. The dimensions of CubeSats are standardized (10 × 10 × 10 cm cubes). One cube of these dimensions is called a 1U CubeSat. Several of these cubes can be joined. At present some 350 CubeSats are launched annually with the most popular 3U CubeSats (hence 3 units), although in the last two years the sizes are increasing up to 12U and even 16U satellites (

Kulu, 2024). The author, who keeps up a unique database, counted in 2024 88 nations that had launched a CubeSat (compared to 77 nations two years before). As an illustration related to emerging countries, 18 African countries are reported to have launched such satellites, the last one launched by Botswana in July 2025 (

Space Hubs Africa, 2025).

Several educational institutions have designed specialized university level CubeSats laboratories and curricula for amongst students from emerging space nations and are training future specialists of these countries, such as KIT (Kyuchi Institute of Technology) (

Polansky & Cho, 2016), MIT Media Lab (

Wood & Weigel, 2012) and the Chinese HOPE (for African students) and BRI (Belt Road Initiative, for South-Asian students) projects (

Lee et al., 2025).

They stress the different advantages as follows:

CubeSats can be produced relatively cheaply thanks to the increasing use of COTS (Commercial-Of-The-Shelf) space-proven components like batteries and solar panels.

Several parts can be produced by 3D printing.

Software can often be implemented via open source.

Several commercial kits are available at accessible prices providing the basic space-proven components and subsystems.

A CubeSat can be produced in a short period of time (e.g., in the frame of a doctoral program).

Transport costs of CubeSats, e.g., to testing facilities, are low.

Due to the standard dimensions the need for interface adapters is limited.

Launching a CubeSat is relatively cheap in a shared launch (and often even offered by Agencies free of charge in view of assisting educational efforts in emerging countries).

Evidently, the cost of producing a basic (1U) educational CubeSat will vary with the complexity of the payload but can be as low as 50,000–100,000 USD if produced by, e.g., a university with post-graduate students. Launch costs in LEO, using commercial launchers, are in the same order of magnitude, although launches as low as 10,000 USD per CubeSat have been registered (

Nervold et al., 2016).

Note that the standardized dimensions of CubeSats led to the availability of basic components such as the base platform and the different subsystems at competitive prices. Basic kits can even be ordered online from several suppliers and are, therefore, equivalent pricewise in each country. Similarly, no special adaptors are needed for integration in the launch vehicle due to this standardization. Overall, such figures are generally affordable and allow emerging nations to become in a short timeframe of a few years an emerging space nation, increasing their technological reputation. Several authors have therefore stated that CubeSats are contributing to the Democratization of space, particularly in the context of emerging nations (

Baiocchi & Welser, 2015)

However, full affordability for emerging nations only started to become obvious once launch costs were reducing thanks to the effects of the New Space companies such as SpaceX and the regular launch rhythms.

We have to note, however, that the term democratization has been used in the context of emerging space activities in a variety of forms. Some authors (

Baiocchi & Welser, 2015) consider the fact that also other players, such as space entrepreneurs were able to enter the market is a sign of democratization. Other authors (

Paat-Dahlstrom & Dahlstrom, 2020) stress the fact that space technology is now broadly and publicly available, allowing other countries to propose cheaper components. They consider this as an important democratization milestone.

Both views can be linked to the free market concept for space activities, as presented early in this process (

Connell, 2007), quoting Milton Friedman:

“The free market is the only mechanism that has ever been discovered for achieving participatory democracy”.

Already Gerard O’Neill, a visionary space enthusiast, pleaded in his work ‘The High Frontier’ (

O’Neill, 2019) to decouple the concept of democracy from economic liberalism and rather to think in terms of ‘Space for All’. It is this concept that is preferred and will be followed in this paper, decoupled from political and economic motives.

5. Findings and Suggestions for Further Work

5.1. Discussion

As mentioned before, the main point covered in this article is the question of why emerging countries should make efforts to become an emerging space nation.

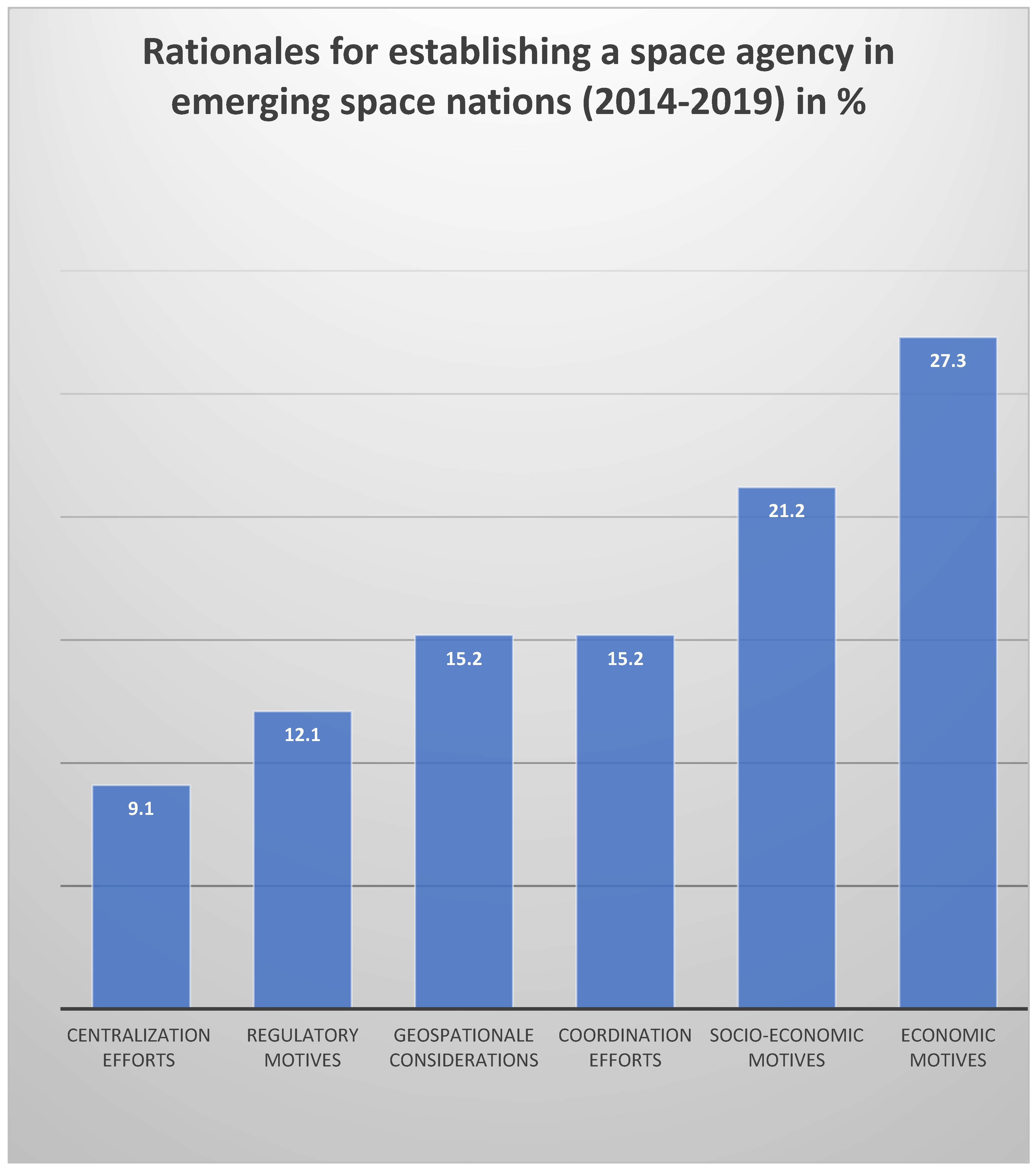

The first potential answer is economical/policy-related. A research team of GWU (George Washington University) analyzed the rationale behind the creation of 14 recent space agencies in emerging space countries. They considered six rationales as essential, namely (

Kommel et al., 2020),

Economic: Boosting the domestic economy.

Socioeconomic: Improving welfare in the country by using space data.

Coordination: Integrating national space activities between academia, industry and public institutions.

Centralization: Concentrating and streamlining innovation efforts.

Geopolitical: Participating in worldwide space activities.

Regulatory: Compliance with International law enhanced by national space acts.

An analysis between the recent space agencies led to a prioritization mapping as per

Figure 5.

Figure 5 shows that according to this study, economic and socioeconomic motivations generally prevailed for emerging nations to engage in the space sector by creating a national space agency.

A pragmatic approach (

SSC, 2025) develops this economic rationale with a return on investment (ROI) approach. Indeed, whereas direct economic return may not be evident in the short run, such return is evident when analyzing the figures in a mid-term perspective. In this context we can refer to the works by the BETA Institute in Strasbourg, France. Using a quantitative model, surveys were made in ESA countries and in Canada by the research team of BETA and reported by

Bach et al. (

2003), leading to the conclusion that the economic return of space activities was in the order of 2.9 for Europe and 3.2 for Canada. In other words, each USD (as a currency example) invested in space activities gave in the next decade a return of approximately 3 USD to the national GDP. It should be noted, in addition, that such return factors are higher in emerging countries, due to the creation of new business and the acquisition of new skills.

A systems approach of the evolution of the space sector points into the direction that geopolitical motives may play a higher role in the near future. The author (

Del Canto Viterale, 2025) analyzes the present repolarization process in the space sector which may lead to multipolar forces, besides the traditional space powers. From a policy point of view, he feels emerging space nations should consider and seize the opportunities arising from this present trend.

The aforementioned paper (

SSC, 2025) also correctly points out two longer-term elements:

Building the Next Generation of Space Professionals in order to ensure that next generations gain the necessary background to cope with future innovations.

Retain talent and avoid a brain drain to space nations by talented graduates, who often do not find satisfactory job opportunities in the country and feel forced to expatriate.

This latter element brings us to the aspect of local capacity building as besides these economic driven motives, the importance on general STEM education and capacity building in emerging countries deserves attention as a value-adding element, particularly in view of low-cost access to scientific and technological demonstration platforms (

Woellert et al., 2011).

Indeed, space, in general, motivates younger generations to pursue STEM-related further studies as space activities continue to inspire youngsters. Besides a wealth of visual material, available free of charge via outreach activities of space agencies, low-cost initiatives bring space close to classrooms by, e.g., ongoing programs to provide simple telescopes to schools in Africa (

Peeters, 2021).

Early authors have already pointed out the importance of space science education in order to avoid brain-drain effects in emerging countries (

Jasentulyana, 1995;

Kasturirangan, 1997). Unfortunately, this situation has not changed much leading to young and motivated space scientists being unsupported in their pursuit for careers in Europe, China or USA. Clearly, as long as there is no political stimulus to transition towards a spacefaring nation, this trend risks continuing.

The most important argument is harder to defend as it is longer-term oriented but probably the most paramount one. It relates to the concept of ‘commons’ as introduced by the Nobel prize (and only female economy recipient of the prize ever) winner Elinor Ostrom (

Ostrom, 1990). Space is gradually becoming a commodity, admittedly faster nowadays in developed countries but for sure soon in emerging countries as well. Without space data, similar to, e.g., electricity, society will come to a standstill in developed economies within days. According to a study (

ISU, 2019) navigation systems will not work, planes will have to make emergency landings, drones will not operate, power supply systems will collapse leading to electricity cuts and bank transactions, based upon space generated data stamps, will cease to operate. Even, less known to the general public, cash dispensers will not work anymore in the absence of space connections (

ISU, 2019).

Emerging countries, in general, need to consider this future reality and have to prepare themselves and the younger generations in their country to be part of this evolution. In the near future, no nation will be able to progress without having part of its workforce being able to master space applications.

We have to note here that, while there are no doubts about this evolution on earth, the practical implications will become even more invasive if outer space is considered as ‘global commons’ as some authors assume (

Pic et al., 2023). This is based upon the OECD definition that global commons are ‘natural assets outside national jurisdiction’ (

OECD, 2008, p. 228), similar to the oceans and Antarctica. Although this concept is presently a source of dispute, we can safely assume that it will play an increasing role, involving all nations worldwide.

Evidently, there are also arguments against the rationale to become an emerging space nation.

An often-quoted argument is that the space sector is already quite well structured, even with a risk of creating overcapacity. From this perspective the question has been frequently raised whether emerging countries should try to participate in this line of activities and develop themselves space business in their countries.

Leloglu and Kocaoglan (

2008) strongly contest this opinion and stress the importance of space technology as an essential element of innovation, at the same time referring to the macroeconomic studies that, in particular in the first phase of such development, the economic return is considerable.

Related to this is the argument that space activities are costly and would create an additional burden for the governments of countries with low GDP. This argument can be countered by the fast reduction in costs of basic space activities, like CubeSat developments which are within financial reach of each country. Already several decennia ago, it has been demonstrated that the limited investment cost of CubeSats by far was compensated by the gain in knowledge and capacity building in the emerging countries (

Woellert et al., 2011). In addition to this, we shall note that the perceived cost of CubeSats as since then considerably reduced by competitive offerings of commercial kits.

Also, the concern about complying with regulatory regimes shall not be overestimated. First of all, as pointed out, the present treaties may not be perfect and it can be discussed if they are fitting present commercial space activities, but they are internationally recognized and the principles stipulated are still valuable in terms of international law (

Dennerly, 2016). Signing these agreements will allow nations to participate in international fora such as COSPAR, UNCOPUOS and ITU. As the texts are well-respected and endorsed, there is little or no risk to sign and ratify those. It is the nation’s choice to add to this a national space act, but also such document does not need to be overcomplicated and is easy to construct with the help of recognized space lawyers.

5.2. Limitations

This paper has mainly concentrated on the economic aspects of participating in space activities from emerging spacefaring nations. From this perspective, it seems evident that from an affordability perspective, all nations, even with a limited GDP, can participate in basic space projects such as low-cost CubeSats. The positive impact on capacity building in the nation has been widely discussed and demonstrated, among others, by training students from these countries in institutions specialized in this abroad, in order to allow them afterwards to build up local capacity in their country of origin (

Polansky & Cho, 2016).

However, this economic and socioeconomic dimension, although considered as one of the main drivers for a nation to invest in space activities (

Kommel et al., 2020), needs to be augmented by a number of other considerations which are not part of this business-oriented paper.

There is no doubt that a different set of considerations will have to be taken into account, which need further examination.

The first aspect is policy oriented and has not been developed here. There is no doubt that each nation will need to evaluate if a step in this direction is compatible with national policy and strategy. The policy aspects go far beyond socioeconomic considerations and include less tangible, but equally important, drivers such as national prestige and security, just to mention a few (

Mosila, 2015). In particular, in very low GDP countries only the nation concerned can judge how the population will react to such objectives, if poverty and food production are paramount programmatic needs in the country.

Linked to this are also geopolitical considerations. As an example, we have referred to two upcoming space exploration initiatives, Artemis and ILRS, mainly driven by the USA and China. In both cases the term ‘like-minded’ is used for participating countries (

Ghouri, 2024) showing clearly the geopolitical dimensions. Evidently, no country in the world has been signing till now both agreements as a choice has to be made on the basis of foreign policy considerations.

A less obvious but valid factor is regarding regional beliefs and ethical considerations. Having space activities in remote areas for obvious risk considerations has led to collisions with local beliefs. An example is given (

Aganaba et al., 2025) on problems with a launch site in Australia and protests from the indigenous population. The authors therefore plead to consider this ethical aspect in advance by consulting traditional first populations well in advance, e.g., explaining potential prosperity and job opportunities for local staff (security, daily accommodation related activities, …).

In addition to this, also on space activities beyond Earth such cultural aspects have been discussed. As an example, for some religions the surface of the moon should not be altered considerably (

Capper, 2022) and discussions focus on the moon as World Heritage.

To illustrate that this point has been taken seriously, NASA organized a workshop on Artemis and ethical aspects (

NASA, 2023) which led to a series of communication actions and suggestions to be taken into consideration.

These important aspects, mainly policy or ethically oriented, were not considered in this paper as they will require extensive additional research by experts in this field. A few suggestions for such further studies are given in next section.

5.3. Suggestions for Further Work

In the context of these arguments and counterarguments, as well as limitations of this paper, a number of studies can be envisaged to further support this debate. A few suggestions are as follows:

Several publications have studied case studies in different countries such as UAE, Australia, Argentina, South Korea (

ESPI, 2021), Bolivia. Egypt, Lebanon, Singapore, Australia (

Scatteia et al., 2020). Obviously, the choice of these case studies was to compare several regions. What is missing are regional studies comparing countries in a specific region like Africa, South America or the Asian-Pacific. In addition, a criterium is missing on the status of space activities whereby different levels of development are mixed. Here again the holistic approaches as suggested (

Oniosun, 2025) to classify nations according to the levels of space involvement could be a good starting point.

Part of such study shall cover work performed at the academic level in these countries but shall also cover peripheral space activities, e.g., in the field of (mechanical) ground support equipment (commonly referred to as MGSE) for space activities. An example of such mapping was performed in the Baltic states which led to the creation of Space hubs in these countries (

Vooras et al., 2011).

Although there is no return obligation foreseen, there is a moral commitment of the leading countries (respectively, USA and China) to foster space activities in the participating nations signing these agreements.

Several countries have not reflected upon the usefulness of signing international space Treaties. Awareness of this could be a first step to interest policy makers in view of visibility at international level.

All studies in this area are based upon data from vested space nations (

Bach et al., 2003). There are strong indications that the economic return factor is considerably higher in nations entering the space economy, thanks to innovation effect, but no concrete data on this. Studies on the economic return of recent emerging spacefaring nations would surely provide a strong incentive to potential newcomers and a convincing argument for the respective governments. An evaluation of the potential economic effects, e.g., using the BETA methodology (

Bach et al., 2003) could be a fast but tangible return argument that could convince governments. In addition, it will provide excellent arguments in the original emerging spacefaring nation to justify increasing space expenditures. Closely linked to this is an analysis of-now-recognized spacefaring nations and how they evolved over time from emerging space nations to recognized global space competitor (

Wood & Weigel, 2012).

6. Conclusions

The space economy has evolved over the last decennia from a purely governmental endeavor towards a commercial business. Since New Space approaches were introduced after 2000, the cost for space projects has decreased to such an extent that it is now affordable to many nations, even with a limited GDP. At the time of drafting this article, over 80 countries have launched at least one satellite, and the number is growing yearly. An important catalyst to this is the reducing launch cost with a new generation of micro-launchers, as well as the standardization and resulting cost reduction to produce small satellites, particularly CubeSats (some 350 of those are presently launched yearly).

The worldwide space business market is, in general, assumed to grow to more than 1.5 Trillion USD by 2035, and there is no reason why emerging countries would not be able to become an active player in this market. Admittedly the vested spacefaring nations will continue to have a major share of this market, thanks to the accumulated know-how and past experience in the space sector. However, this does not exclude access to niche markets and participation in international projects such as Artemis and ILRS. Both initiatives should therefore be considered by emerging space nations as a catalyst for their country to become part of the space ecosystem.

There are, however, equally important reasons beyond economic ones to become a part of this space business, particularly in view of capacity building for the future technical workforce. Space applications will play an increasingly important role in the activities of each country in the world in the next decades and therefore each country needs to prepare, via STEM and higher education, its workforce to be able to operate in such environment. This paper, therefore, proposes a stepwise approach for emerging nations to become part of the space ecosystem, evidently to be tailored to a focus on national needs in each specific case. It also stresses the importance of such commitment in view of technical capacity building efforts and suggests further studies to reinforce this approach further.

An important aspect related to this are less tangible factors in each nation to engage in such endeavor. Such aspects can be of geopolitical nature, but also cultural barriers should be considered in advance, before going on this path.

Whereas the investments needed to become a spacefaring nation have considerably reduced over the last years, in addition to this the economic return shall not be ignored. Several studies have demonstrated that each investment in space brings at least a more than three times return to the national GDP in the mid-term (and considerably higher for emerging countries).

Having now the possibility to have a national smallsat built and launched for a budget as low as 50,000–100,000 USD is offering a unique opportunity to become part of the technological future and is within the reach of each country, this way preparing the national infrastructure to enter a space-driven era for the next decades.

Provided that there are no paramount hindrances, which can only be evaluated on a nation-based analysis, New Space in general, and new inclusive-based initiatives such as Artemis and ILRS, are providing at present excellent opportunities to become a spacefaring nation, also in emerging countries.