Driving the Circular Economy Through Digital Servitization: Sustainable Business Models in the Maritime Sector

Abstract

1. Introduction

2. Sustainable Value Creation Concepts

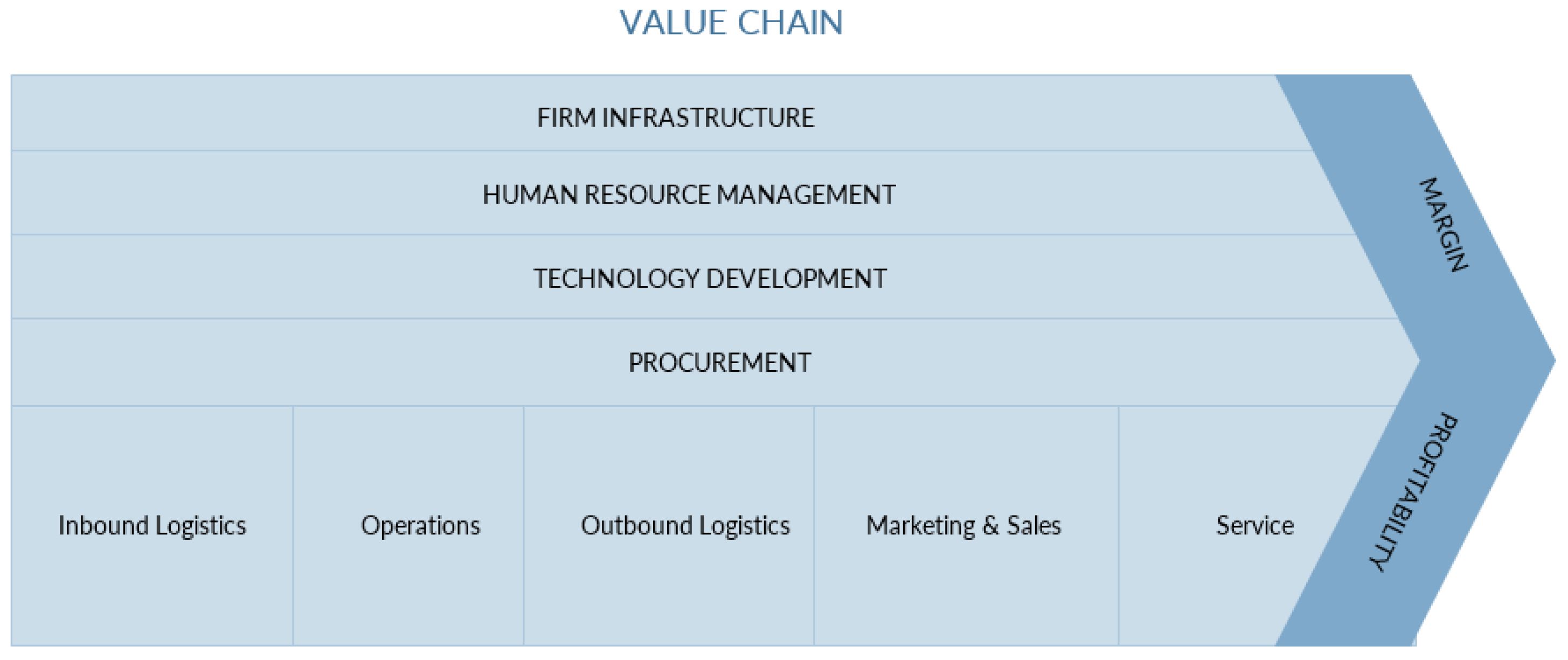

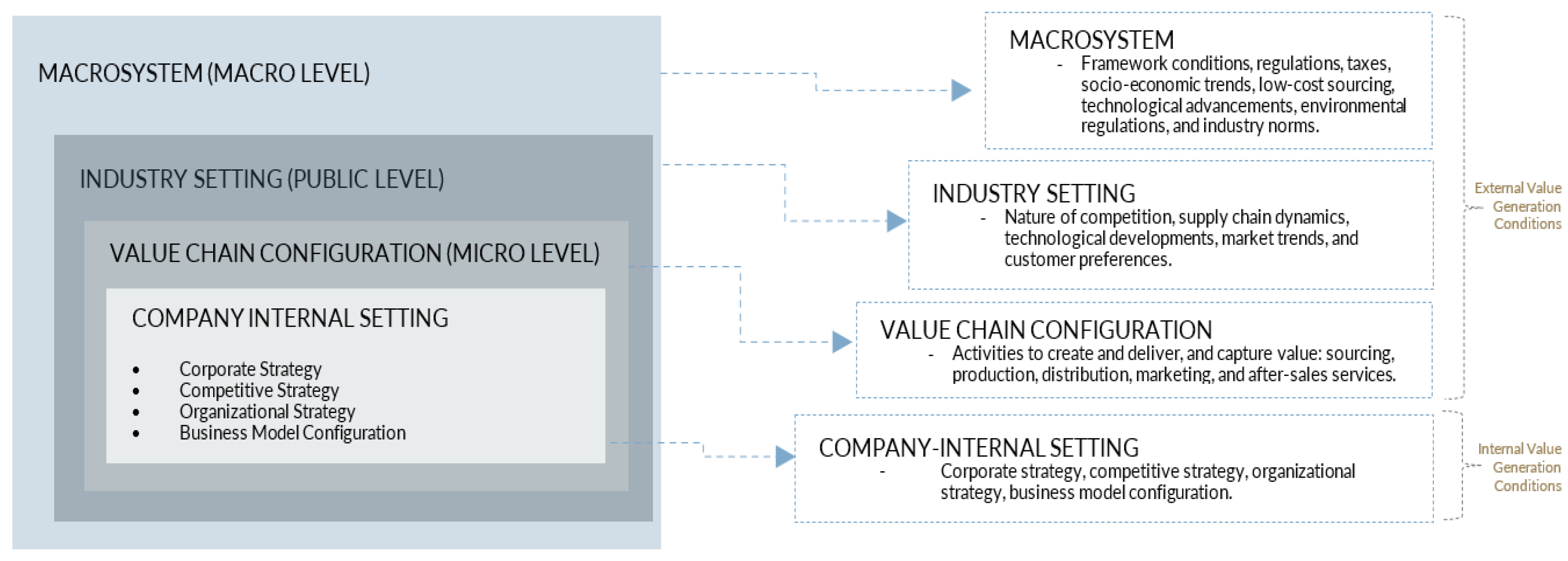

2.1. Evolution of the Value Chain Concept

- At the strategic (macro) level, value chain analysis helps determine a firm’s position within the market and identify key industry drivers.

- At the operational (micro) level, it involves examining the actual processes occurring within the firm, often referred to as operational management.

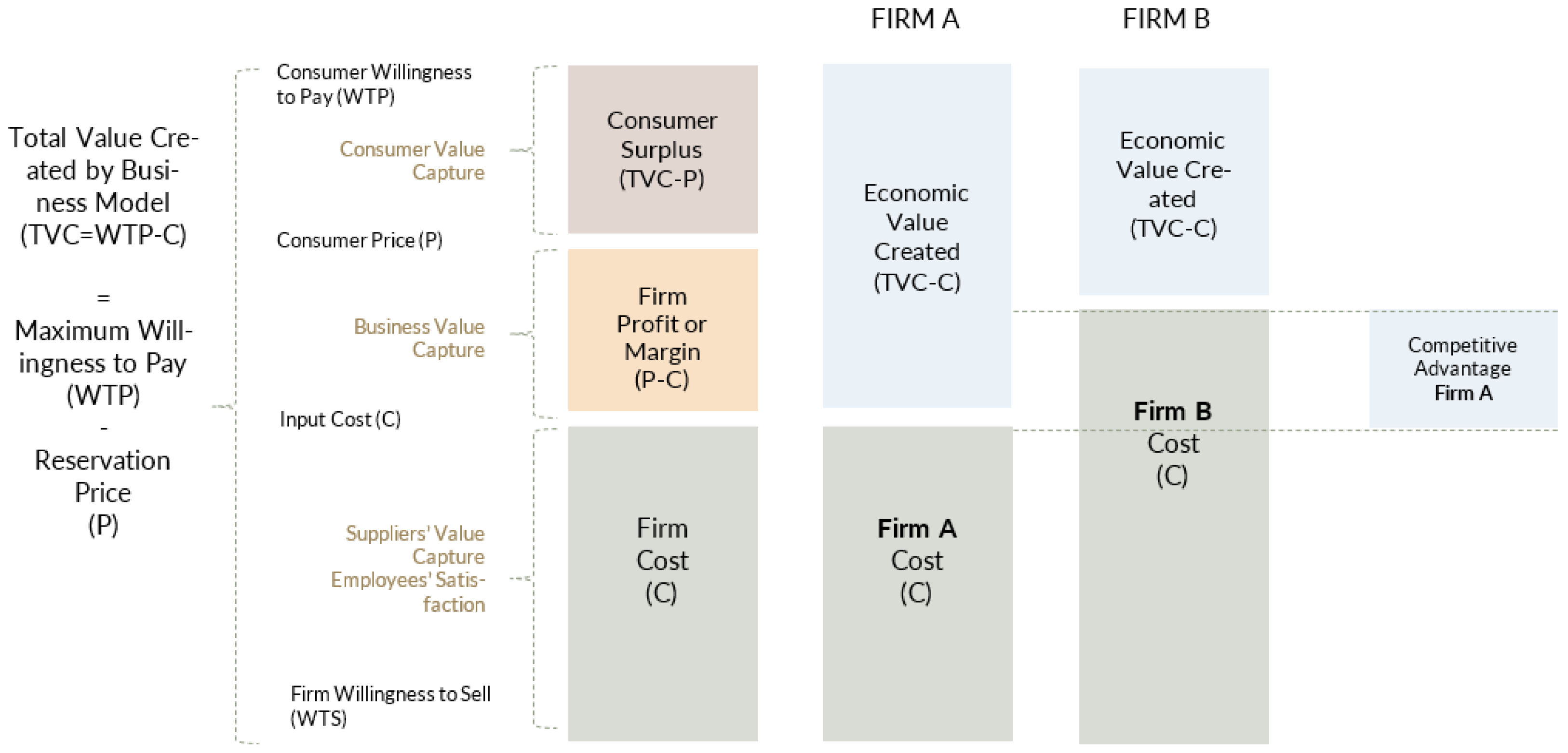

2.2. Value Creation Ontology

- Business Value: Generating returns for shareholders and ensuring the financial sustainability of the organization.

- Stakeholders Value: Enhancing value within the supply chain through cooperation and shared benefits among stakeholders. Walters and Lancaster (2000) introduce this concept that is also called Corporate Value, which suggests that the objectives of all stakeholders must be met or optimized through negotiation alongside the goals of the customer.

- Societal Value: Promoting value creation that benefits society, including managing negative externalities through corporate social responsibility (CSR) and compliance with regulations. The concept, also known as Shared Value, was proposed by Porter and Kramer (2011). This approach emphasizes that businesses can achieve economic success while actively improving social and environmental conditions in the communities they serve.

- WACC—Weighted Average Cost of Capital, and

- K—capital employed.

- Internal Value Chain Analysis: Assess costs and value added at each stage of the organization to identify internal efficiencies.

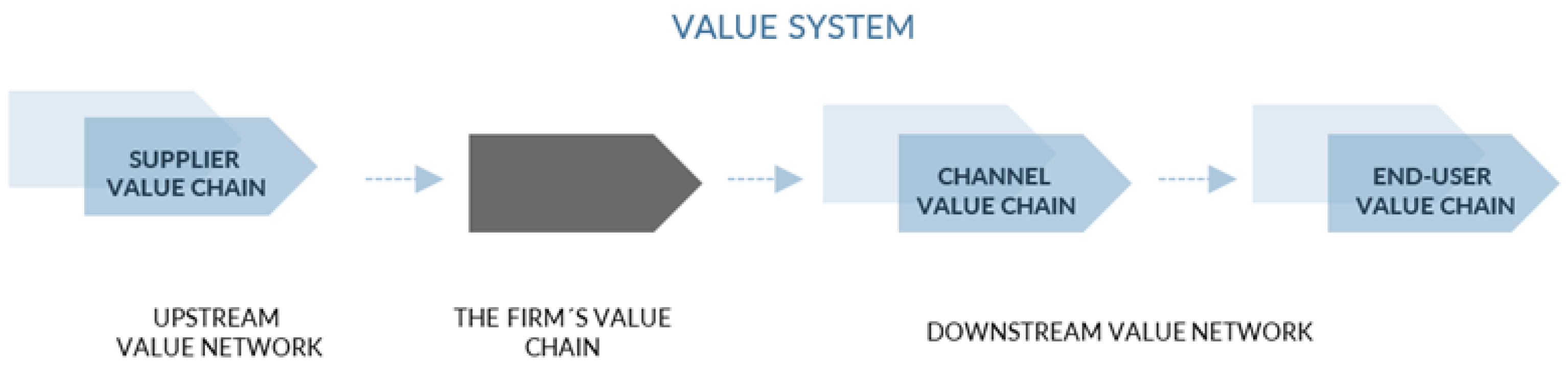

- Flow of Goods and Total Value Analysis: Quantify the value created by both upstream and downstream industries that interact with the product. This step can be further evaluated using metrics such as Economic Value Added (EVA) or Earnings Before Interest and Taxes (EBIT).

- Identify Value Creation Opportunities: Enhance value by improving product quality or reducing costs at every stage of the extended value chain.

- Network Configuration: Establish strategic partnerships with other companies to optimize the delivery of potential value to customers.

- Capture Created Value: Utilize strategic alliances, joint ventures, or acquisitions to secure and maximize the value generated.

- Cross-Industry Value Chain Management: Effectively coordinate activities across industries to optimize value creation and capture for sustainable growth.

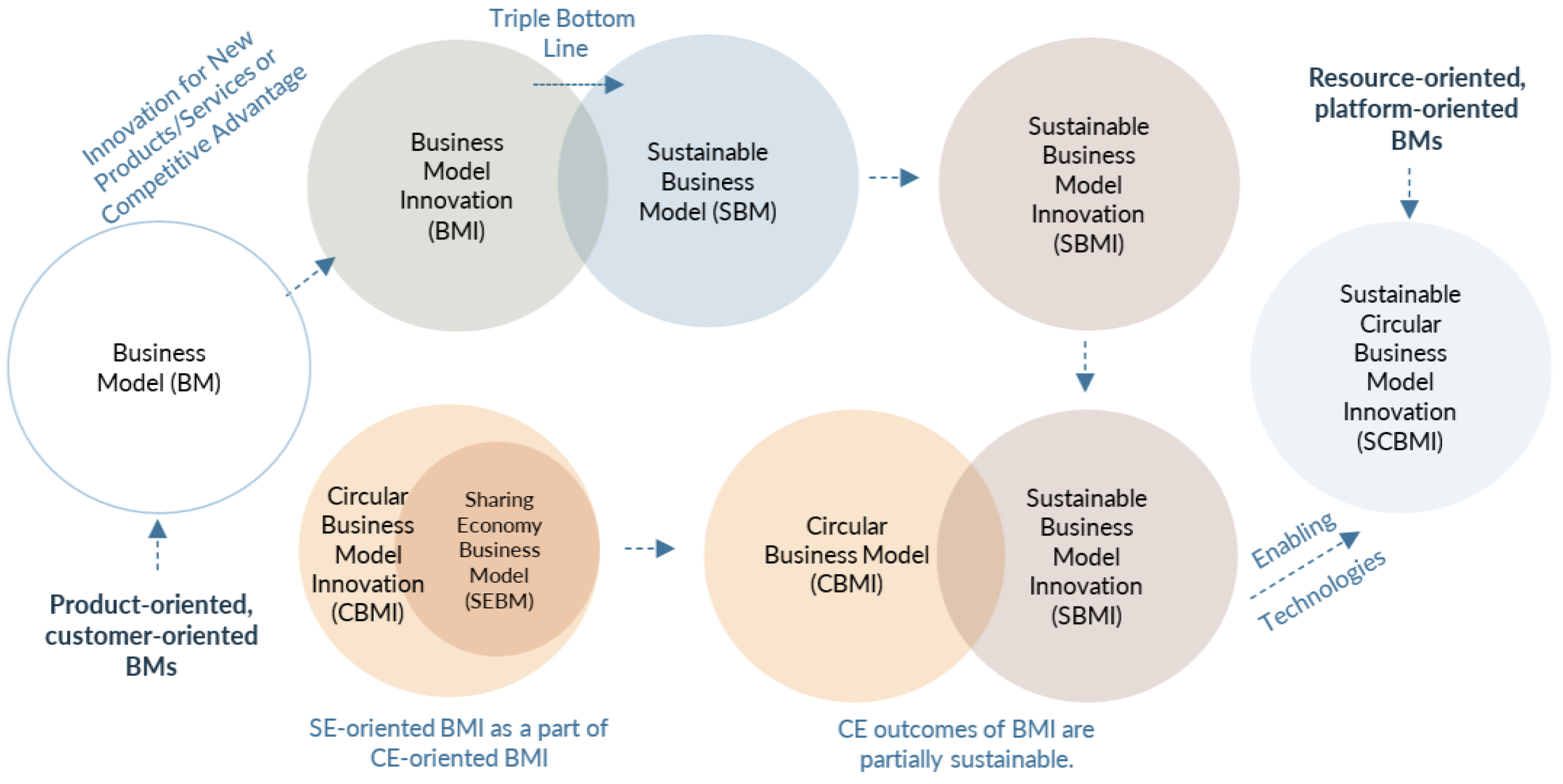

3. From Linear to Sustainable Circular Business Model Innovation

3.1. Business Models Evolution

- Value Propositions: The benefits and value offered to customers.

- Target Customers: The specific customer segments the business aims to serve.

- Distribution Channels: The means used to deliver value to customers.

- Market Relationships: The interactions and relationships established with customers.

- Value Configuration: How resources and activities are organized to create value.

- Core Competency: The unique strengths and capabilities of the business.

- Partner Network: The external partners that support the business model.

- Cost Structures: The expenses incurred to operate the business model.

- Revenue Model: The way the business generates income.

- -

- Value Capture (revenue model): Why do we use this business model?

- -

- Value Delivery (operating model): How do we deliver the value?

- -

- Value Creation (market model): Who is at the centre of each business model?

- -

- Value Proposition (value model): What is offered to the client to meet their needs?

3.1.1. Business Model Innovation (BMI)

3.1.2. Sustainable Business Model Innovation (SBMI)

- Economic Value Proposition: Traditionally centres on customers acquiring ownership of the product, with the company’s revenue relying on the sale price and a standard two-year warranty (Barquet et al., 2011). However, transitioning from selling products to offering servitized products requires a broader perspective on the economic value proposition, incorporating lifecycle thinking. This shift involves considering the product’s use phase, and tools like Total Cost of Ownership (TCO) can provide a more accurate picture of actual costs by accounting for expenses related to acquisition, use, and disposal (Ellram, 1995).

- Social Value Proposition: This aspect has often been linked to the principle of “doing less harm” and adhering to compliance standards, which are traditional elements of corporate social responsibility (CSR).

- Environmental Value Proposition: Traditionally, the environmental aspect of a business model focuses on using Lifecycle Assessment (LCA) to evaluate the environmental impacts of a product or service and improving environmental performance (e.g., Joyce & Paquin, 2016).

3.1.3. Circular Business Model Innovation (CBMI)

3.1.4. Sustainable Circular Business Model Innovation (SCBMI)

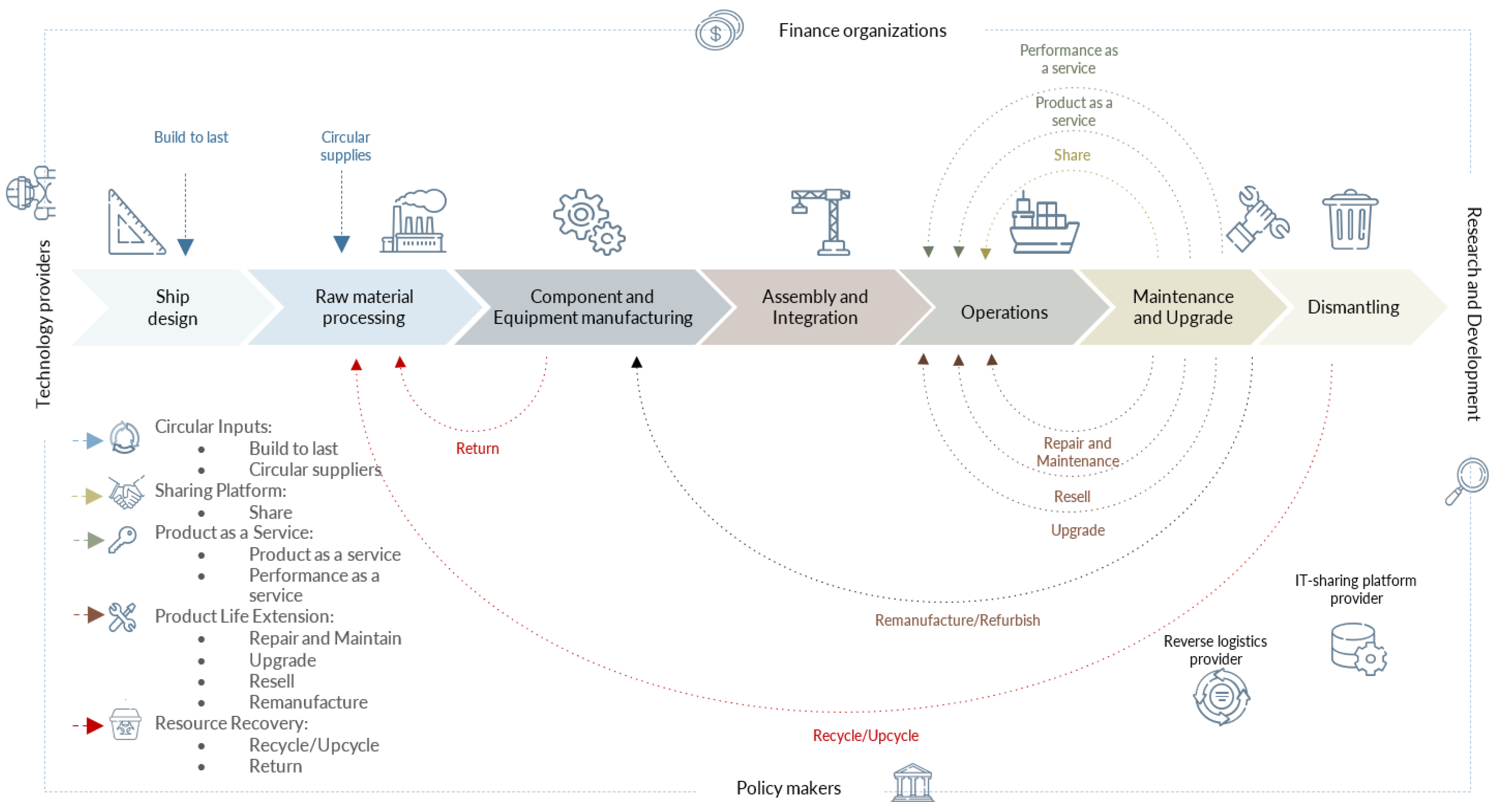

4. Framework for a Sustainable Circular Business Model: Maritime Industry Case

4.1. Sustainable Circular Business Model Foundations

- -

- R0: Refuse: Avoiding the use of hazardous materials, substituting some materials with a radically different product.

- -

- R1: Rethink: Maximizing the efficiency of product usage through shared consumption models or multifunctional products.

- -

- R2: Reduce: Minimizing resource and material usage and prolonging the lifetime.

- -

- R3: Reuse: Reusing parts during maintenance and recycling.

- -

- R4: Repair: Restoring the functionality of broken or faulty products to their original state.

- -

- R5: Refurbish: Enhancing or updating parts during operation, maintenance, and recycling.

- -

- R6: Remanufacture: Taking components from used parts and utilizing them to produce a new product with similar functionality.

- -

- R7: Repurpose: Reimagining discarded parts or their components to serve a new function.

- -

- R8: Recycling: Converting materials to regain original quality/into materials for alternative uses.

- -

- R9: Recover: Recovering energy from used materials.

- Circular Inputs: Replaces conventional inputs with bio-based, renewable, or recovered materials to minimize resource consumption.

- Sharing Models: Maximizes the utilization of underused consumer assets by facilitating shared access. Well-known examples include platforms like Airbnb and Uber, where private individuals share assets such as homes and cars for payment.

- Product as a Service (PaaS) or Product–Service Systems (PSSs): Combines a physical product with a service component, where ownership remains with the supplier. Customers pay for the use or function of the product rather than purchasing it outright.

- Product Life Extension: Focuses on extending the lifespan of products by incorporating circular principles at the design stage. This includes enabling direct reuse, maintenance, repair, refurbishment, remanufacturing, and recyclability, as well as using secondary resources in production.

- Resource Recovery: Involves extracting secondary raw materials from waste streams and closing material loops through recycling and recovery processes.

- -

- Product-oriented: Focused on providing products along with additional services such as advice and consultancy.

- -

- Use-oriented: Emphasizes product usage through leasing, renting/sharing, or pooling models.

- -

- Result-oriented: Centres on delivering results through activity management, pay-per-service-unit, or functional result models.

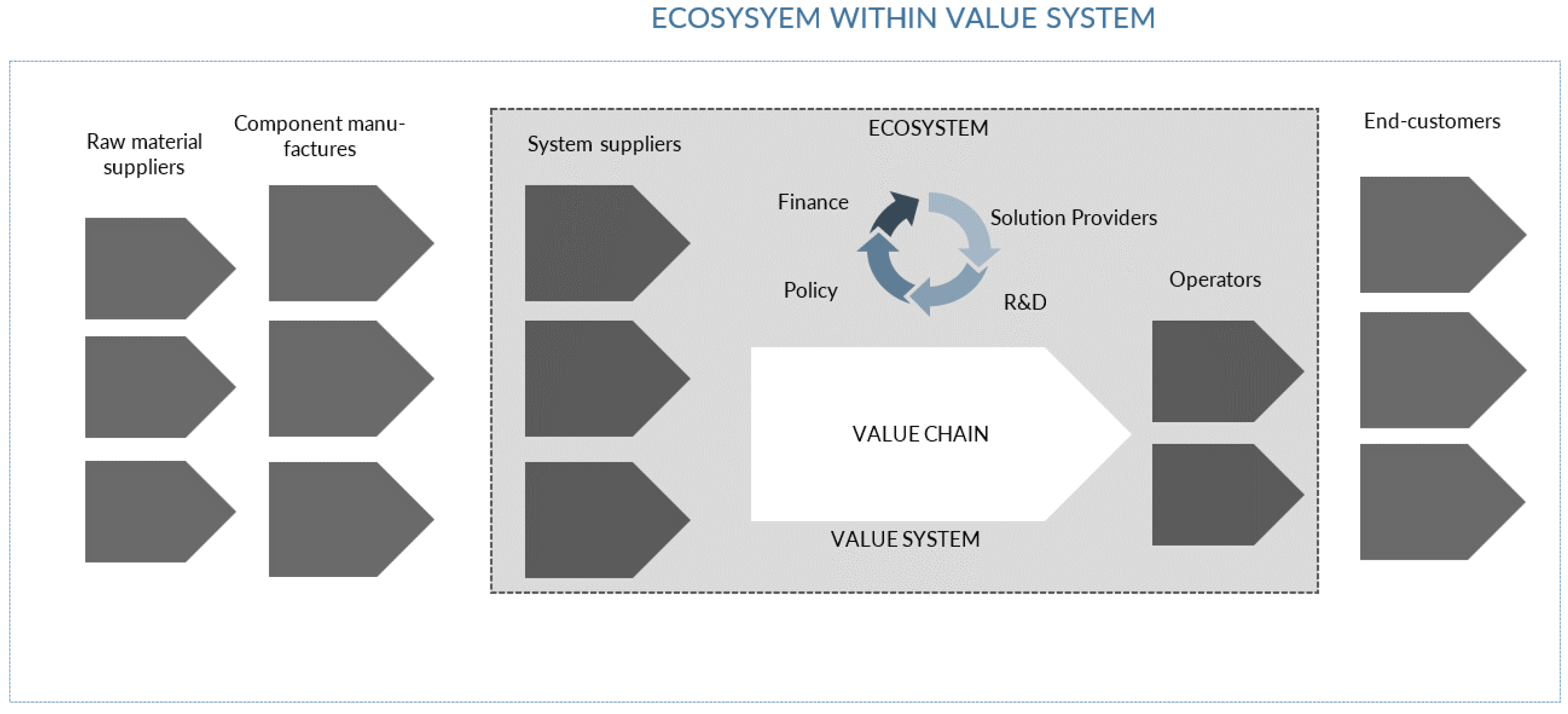

4.2. Ecosystem Transformation

- Circular Designer: Responsible for designing vessels and equipment for circular use, with a focus on upgrades, disassembly, and recycling.

- Circular Material Supplier: Supplies recycled materials to manufacturers.

- Upgrader: Enhances the efficiency and performance of existing equipment.

- Recycler: Sorts and processes various elements for recycling or reuse.

- Reverse Logistics Provider: Returns used equipment or components to manufacturers for recycling.

- IT Platform Provider: Offers data-sharing platforms to support the ecosystem.

- Researcher and Developer: Drives knowledge sharing and innovation related to circular solutions.

- Technology Provider: Provides advanced tools and technologies to optimize resource use and reduce emissions.

- -

- Sustainable Ship Recycling: Sea2Cradle supports shipowners in ensuring safe and environmentally responsible vessel decommissioning. Their services include hazardous material assessments, brokerage, facility audits, and recycling planning. By overseeing the entire recycling process, Sea2Cradle maximizes material recovery and aims for near-total recyclability while upholding high safety standards (Sea2Cradle, n.d.).

- -

- Retrofit and Refurbishment: Evac offers retrofit and refurbishment solutions to upgrade vessel systems, enabling older ships to integrate modern technologies. These upgrades enhance efficiency, reduce resource consumption, and support CE by extending fleet performance while decreasing the need for new ship construction (Evac, n.d.).

- -

- Component Remanufacturing: Wärtsilä specializes in remanufacturing worn-out engine components to restore them to full functionality. Remanufactured components maintain the same quality as new ones but come at a lower cost. This process significantly reduces maintenance expenses while minimizing environmental impact by reusing materials rather than producing new ones (Wärtsilä, n.d.).

- -

- Product-Centricity and Customer-Centricity (as-a-product value delivery models). Traditional “as-a-product value” delivery models have served as the backbone of industries over decades, setting the stage for the conventional approach to value creation. In particular, product-centric model prioritizes the product’s development, quality, and delivery as the primary value proposition. Conversely, the customer-centric model shifts the focus to the customer, aiming to create personalized experiences and tailor offerings that cater to individual needs and preferences.

- -

- Resource-Centricity and Platform-Centricity (as-a-service value delivery models). However, it became clear that current frameworks were insufficient to comprehensively address both traditional and emerging business models. With the rise of contemporary trends such as the sharing economy, the Resource Economy, servitization, Uberization, and the Network Economy, the necessity to revisit and expand these paradigms became apparent. Resource-centric models embrace a “regenerative philosophy”, focusing on maximizing utilization rather than ownership. Although resource sharing is not new, digital technologies such as the internet and mobile platforms have revolutionized this model. What sets today’s platform-centric models apart is the digital revolution, which has dismantled the traditional barriers of geography and time. Now, digital platforms enable exchanges to occur at an unprecedented scale and speed, transforming isolated markets into interconnected ecosystems that operate with immediacy and ubiquity. As acquiring new customers becomes more challenging and expensive, organizations are shifting their focus towards customer retention. However, this transformation is proving difficult due to limited resources, varying readiness levels across departments, and competing corporate objectives that do not always align with this strategic shift (Le & Tyni, 2020). Hence, further research on as-a-service value models, such as SCBMI, is needed.

5. Conclusions

- -

- Policy and Regulation Alignment: Governments and maritime authorities should incentivize circular practices (e.g., tax benefits for sustainable ship recycling) and create global CE regulations to ensure industry-wide adoption.

- -

- Adoption of Circular Business Models: Shipping companies should transition from asset-heavy ownership models to servitization models (e.g., ship leasing and maintenance-as-a-service) to optimize lifecycle utilization.

- -

- Investment in Digital Technologies: Digitalization—through AI for predictive maintenance, blockchain for material tracking, and digital twins for optimizing ship design—should be prioritized to facilitate CE implementation.

- -

- Industry Collaboration and Circular Supply Chains: Ports, shipyards, and logistics companies should work together to create closed-loop resource flows, ensuring ship materials, fuels, and waste are reused, recycled, or repurposed.

- -

- Capacity Building and Awareness: Shipping stakeholders, from operators to policymakers, should receive training on CE principles and best practices, ensuring industry-wide adoption beyond isolated initiatives.

- -

- High Initial Costs: CE technologies and practices require upfront investment. Solution: Governments and industry bodies can provide subsidies or tax incentives.

- -

- Regulatory Inconsistencies: Different countries have varying environmental and recycling policies. Solution: Establishing international CE shipping regulations via IMO or EU frameworks can help standardize practices.

- -

- Lack of Awareness and Resistance to Change: Many stakeholders remain focused on traditional linear business models. Solution: Conducting industry-wide training and showcasing successful CE implementations can encourage wider adoption.

- -

- Technology Gaps and Digitalization Challenges: Many CE innovations rely on advanced technologies that are not yet universally accessible. Solution: Investing in collaborative research and piloting digital tools in key maritime hubs can accelerate adoption.

Funding

Conflicts of Interest

References

- Abecassis-Moedas, C. (2006). Integrating design and retail in the clothing value chain: An empirical study of the organization of design. International Journal of Operations and Production Management, 26(3/4), 412–428. [Google Scholar] [CrossRef]

- Adner, R. (2017). Ecosystem as structure: An actionable construct for strategy. Journal of Management, 43(1), 39–58. [Google Scholar] [CrossRef]

- Agarwala, N. (2023). Promoting circular economy in the shipping industry. Journal of International Maritime Safety, Environmental Affairs, and Shipping, 7(4), 2276984. [Google Scholar] [CrossRef]

- Allee, V. (2000). Reconfiguring the value network. Journal of Business Strategy, 21, 36–39. [Google Scholar] [CrossRef]

- Antikainen, M., & Valkokari, K. (2016). A framework for sustainable circular business model innovation. Technology Innovation Management Review (TIM Review), 6(7), 5–12. [Google Scholar] [CrossRef]

- Antikainen, M., Valkokari, K., Korhonen, H., & Wallenius, M. (2013, June 16–19). Exploring networked innovation in order to shape sustainable markets [Paper presentation]. XXIV ISPIM Conference, Helsinki, Finland. [Google Scholar]

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. [Google Scholar] [CrossRef]

- Barquet, A. P. B., Cunha, V. P., Oliveira, M. G., & Rozenfeld, H. (2011). Business model elements for product-service system. In J. Hesselbach, & C. Herrmann (Eds.), Functional thinking for value creation. Springer. [Google Scholar] [CrossRef]

- Biloshapka, V., & Osiyevskyy, O. (2018). Value creation mechanisms of business models: Proposition, targeting, appropriation, and delivery. The International Journal of Entrepreneurship and Innovation, 19(3), 166–176. [Google Scholar] [CrossRef]

- Bocken, N. M. P., de Pauw, I., Bakker, C., & van der Grinten, B. (2016a). Product design and business model strategies for a circular economy. Journal of Industrial and Production Engineering, 1015, 308–320. [Google Scholar] [CrossRef]

- Bocken, N. M. P., Fil, A., & Prabhu, J. (2016b). Scaling up social businesses in developing markets. Journal of Cleaner Production, 139, 295–308. [Google Scholar] [CrossRef]

- Bocken, N. M. P., Short, S., Rana, P., & Evans, S. (2013). A value mapping tool for sustainable business modelling. Corporate Governance: International Journal of Business in Society, 13, 482–497. [Google Scholar] [CrossRef]

- Bocken, N. M. P., Short, S. W., Rana, P., & Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production, 65, 42–56. [Google Scholar] [CrossRef]

- Boons, F., & Lüdeke-Freund, F. (2013). Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. Journal of Cleaner Production, 45, 9–19. [Google Scholar] [CrossRef]

- Borch, O. J., & Roaldsen, I. H. E. (2007, March 8–10). Competitive positioning and value chain configuration in international markets for traditional food specialties [Paper presentation]. 105th EAAE Seminar “International Marketing and International Trade of Quality Food”, Bologna, Italy. Available online: https://agriregionieuropa.univpm.it/sites/are.econ.univpm.it/files/materiale/2007/EAAE105_Proceedings.pdf (accessed on 25 November 2024).

- Bovel, D., & Martha, J. (2000). From supply chain to value net. Journal of Business Strategy, 21, 24–28. [Google Scholar] [CrossRef]

- Brandenburger, A. M., & Stuart, H. W. (1996). Value-based business strategy. Journal of Economics and Management Strategy, 5(1), 5–24. [Google Scholar] [CrossRef]

- Brenner, B., & Drdla, D. (2023). Business model innovation toward sustainability and circularity—A systematic review of innovation types. Sustainability, 15(15), 11625. [Google Scholar] [CrossRef]

- Brown, L. (1997). Competitive marketing strategy. Nelson. [Google Scholar]

- Carlborg, P., Snyder, H., & Witell, L. (2024). How sustainable is the sharing business model? Toward a conceptual framework. R&D Management, 54(5), 1131–1144. [Google Scholar] [CrossRef]

- Chabowski, B. R., Gabrielsson, P., Hult, G. T. M., & Morgeson, F. V., III. (2023). Sustainable international business model innovations for a globalizing circular economy: A review and synthesis, integrative framework, and opportunities for future research. Journal of International Business Studies. [Google Scholar] [CrossRef]

- Chauhan, C., Parida, V., & Dhir, A. (2022). Linking circular economy and digitalisation technologies: A systematic literature review of past achievements and future promises. Technological Forecasting and Social Change, 177, 121508. [Google Scholar] [CrossRef]

- Chesbrough, H., & Rosenbloom, R. (2002). The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spin-off companies. Industrial and Corporate Change, 11(3), 529–555. [Google Scholar] [CrossRef]

- Chiappetta Jabbour, C. J., De Camargo Fiorini, P., Wong, C. W. Y., Jugend, D., Lopes De Sousa Jabbour, A. B., Roman Pais Seles, B. M., Paula Pinheiro, M. A., & Ribeiro da Silva, H. M. (2020). First-mover firms in the transition towards the sharing economy in metallic natural resource-intensive industries: Implications for the circular economy and emerging industry 4.0 technologies. Resources Policy, 66, 101596. [Google Scholar] [CrossRef]

- Clinton, L., & Whisnant, R. (2019). Business model innovations for sustainability. In G. G. Lenssen, & N. C. Smith (Eds.), Managing sustainable business. Springer. [Google Scholar] [CrossRef]

- Dabić, M., Kraus, S., Clauss, T., Brem, A., & Ritala, P. (2024). Business models for the sharing economy: Charting the multidisciplinary research field. R&D Management, 54(5), 1089–1103. [Google Scholar] [CrossRef]

- De Chernatony, L., Harris, F., & Riley, F. D. (2000). Added value: Its nature, roles and sustainability. European Journal of Marketing, 34(1/2), 39–56. [Google Scholar] [CrossRef]

- Ellram, L. M. (1995). Total cost of ownership: An analysis approach for purchasing. International Journal of Physical Distribution & Logistic, 25, 4e23. [Google Scholar] [CrossRef]

- Er, M., & MacCarthy, B. (2002, September 19–20). Configuration of international supply networks and their operational implications: Evidences from manufacturing companies in Indonesia [Paper presentation]. 7th Cambridge International Manufacturing Symposium, Cambridge, UK. [Google Scholar]

- European Commission. (2019). The european green deal. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal_en (accessed on 15 December 2024).

- European Commission. (2020a). Circular economy action plan. Available online: https://environment.ec.europa.eu/strategy/circular-economy-action-plan_en (accessed on 25 November 2024).

- European Commission. (2020b). EU taxonomy for sustainable activities. Available online: https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en (accessed on 30 November 2024).

- European Commission. (2022). Ecodesign for sustainable products. Available online: https://commission.europa.eu/energy-climate-change-environment/standards-tools-and-labels/products-labelling-rules-and-requirements/ecodesign-sustainable-products-regulation_en (accessed on 15 December 2024).

- Evac. (n.d.). Retrofit and modernization. Available online: https://evac.com/lifecycle-services/retrofit-and-modernization/ (accessed on 15 November 2024).

- Evans, S., Fernando, L., & Yang, M. (2017). Sustainable value creation—From concept towards implementation. In R. Stark, G. Seliger, & J. Bonvoisin (Eds.), Sustainable manufacturing (pp. 203–220). Springer. [Google Scholar] [CrossRef]

- Faut, L., Soyeur, F., Haezendonck, E., Dooms, M., & de Langen, P. W. (2023). Ensuring circular strategy implementation: The development of circular economy indicators for ports. Maritime Transport Research, 4, 100087. [Google Scholar] [CrossRef]

- Fet, A. M., Knudson, H., & Keitsch, M. (2023). Sustainable development goals and the capsem model. In A. M. Fet (Ed.), Business transitions: A path to sustainability. Springer. [Google Scholar] [CrossRef]

- Fjeldstad, Ø. D., & Haanaes, K. (2001). Strategy tradeoffs in the knowledge and network economy. Business Strategy Review, 12, 1–10. [Google Scholar] [CrossRef]

- Foss, N. J., & Saebi, T. (2018). Business models and business model innovation: Between wicked and paradigmatic problems. Long Range Planning, 51(1), 9–21. [Google Scholar] [CrossRef]

- Freeman, R. E. (1984). Strategic management: A stakeholder approach. Pitman. [Google Scholar]

- Fuerst, S., Sanchez-Dominguez, O., & Rodriguez-Montes, M. A. (2023). The role of digital technology within the business model of sustainable entrepreneurship. Sustainability, 15(14), 10923. [Google Scholar] [CrossRef]

- Geissdoerfer, M., Morioka, S. N., de Carvalho, M. M., & Evans, S. (2018). Business models and supply chains for the circular economy. Journal of Cleaner Production, 190, 712–721. [Google Scholar] [CrossRef]

- Geissdoerfer, M., Pieroni, M. P. P., Pigosso, D. C. A., & Soufani, K. (2020). Circular business models: A review. Journal of Cleaner Production, 277, 123741. [Google Scholar] [CrossRef]

- Gilbert, P., Wilson, P., Walsh, C., & Hodgson, P. (2017). The role of material efficiency to reduce CO2 emissions during ship manufacture: A life cycle approach. Marine Policy, 75, 227–237. [Google Scholar] [CrossRef]

- Goedkoop, M. J., van Halen, C. J. G., te Riele, H. R. M., & Rommens, P. J. M. (1999). Product service system, ecological and economic basic (Vol. 36). The Report No. 1999/36 Submitted to Ministerje van Volkshuisvesting. Ruimtelijke Ordening en Milieubeheer. ISBN 3170342622. [Google Scholar]

- Green Yard. (2021). Major contract with solstad offshore ASA for ship recycling. Available online: https://en.greenyard.no/news-articles/major-contract-with-solstad-offshore-asa-for-ship-recycling (accessed on 15 November 2024).

- Green Yard Kleven. (n.d.). Recycling. Available online: https://greenyard.no/resirkulering (accessed on 27 November 2024).

- Hariyani, D., Hariyani, P., Mishra, S., & Sharma, M. K. (2024). Leveraging digital technologies for advancing circular economy practices and enhancing life cycle analysis: A systematic literature review. Waste Management Bulletin, 2(3), 69–83. [Google Scholar] [CrossRef]

- Harland, C. M. (1996). Supply chain management, purchasing and supply management, logistics, vertical integration, materials management and supply chain dynamics. Encyclopedic Blackwell Dictionary of Operations Management (Blackwell). [Google Scholar]

- Hellin, J., & Meijer, M. (2006). Guidelines for value chain analysis. Food and Agriculture Organization (FAO); UN Agricultural Development Economics Division. [Google Scholar]

- Hinterhuber, A. (2002). Value chain orchestration in action and the case of the global agrochemical industry. Long Range Planning, 35, 615–635. [Google Scholar] [CrossRef]

- Hoang, K. M., & Böckel, A. (2024). Cradle-to-cradle business model tool: Innovating circular business models for startups. Journal of Cleaner Production, 467, 142949. [Google Scholar] [CrossRef]

- IIRC. (2018). Business model representation in integrated reporting: Best practices and guidelines. International Integrated Reporting Council. Available online: https://integratedreporting.ifrs.org/wp-content/uploads/2018/03/NIBR_GUIDA-BM_16feb2018_ENG.pdf (accessed on 15 October 2024).

- IISD. (n.d.). Sustainable development. International Institute for Sustainable Development. Available online: https://www.iisd.org/mission-and-goals/sustainable-development (accessed on 15 October 2024).

- Johnson, G., & Scholes, K. (1999). Exploring corporate strategy (5th ed.). Prentice Hall. [Google Scholar]

- Joyce, A., & Paquin, R. L. (2016). The triple layered business model canvas: A tool to design more sustainable business models. Journal of Cleaner Production, 135, 1474–1486. [Google Scholar] [CrossRef]

- Kay, J. (1993). Foundations of corporate success. OUP. [Google Scholar]

- Kohtamäki, M., Parida, V., Oghazi, P., Gebauer, H., & Baines, T. (2019). Digital servitization business models in ecosystems: A theory of the firm. Journal of Business Research, 104, 380–392. [Google Scholar] [CrossRef]

- Koilo, V. (2024). Unlocking the sustainable value with digitalization: Views of maritime stakeholders on business opportunities. Problems and Perspectives in Management, 22(1), 401–417. [Google Scholar] [CrossRef]

- Kongsberg. (n.d.). Level-up operations and maintenance by doubling-down on digital. Available online: https://www.kongsbergdigital.com/solution/operations-and-maintenance-solutions (accessed on 15 November 2024).

- Korver, E. (2019). Business model matrix: A blueprint for equitable and sustainable success. Available online: https://roundmap.com/business-model-matrix/ (accessed on 17 December 2024).

- Kotler, P. (2003). Marketing management (11th ed.). Prentice-Hall. [Google Scholar]

- Kristensen, H. S., & Remmen, A. (2019). A framework for sustainable value propositions in product-service systems. Journal of Cleaner Production, 223, 25–35. [Google Scholar] [CrossRef]

- Lam, C. Y., Chan, S. L., & Lau, C. W. (2008). Collaborative supply chain network using embedded genetic algorithms. Industrial Management & Data Systems, 108(8), 1101–1110. [Google Scholar] [CrossRef]

- Le, G., & Tyni, V. (2020). Market leadership in the digital and customer centric age. Available online: https://www.reddal.com/insights/pdf/maintain-focus-and-market-leadership-in-the-digital-and-customer-centric-age/ (accessed on 15 November 2024).

- Lepak, D. P., Smith, K. G., & Taylor, M. S. (2007). Value creation and value capture: A multilevel perspective. Academy of Management Review, 32(1), 180–194. [Google Scholar] [CrossRef]

- Long, T. B., & Young, C. W. (2022). Supply chain climate change mitigation strategies and business models. In P. Gianiodis, M. Espina, & W. R. Meek (Eds.), World scientific encyclopedia of business sustainability, ethics and entrepreneurship (pp. 49–87). World Scientific. [Google Scholar] [CrossRef]

- Lugnet, J., Ericson, Å., & Larsson, T. (2020). Design of product–service systems: Toward an updated discourse. Systems, 8(4), 45. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F., Rauter, R., Pedersen, E., & Nielsen, C. (2020). Sustainable value creation through business models: The what, the who and the how. Journal of Business Models, 8, 62–90. [Google Scholar]

- MacArthur, E. (2013). Towards the circular economy. Journal of Industrial Ecology, 2(1), 23–24. [Google Scholar]

- Moore, J. F. (1993). Predators and prey: A new ecology of competition. Harvard Business Review, 71(3), 75–83. [Google Scholar]

- Normann, R., & Ramirez, R. (1993). From value chain to value constellation: Designing interactive strategy. Harvard Business Review, 71, 65–77. [Google Scholar] [PubMed]

- Norris, S., Hagenbeck, J., & Schaltegger, S. (2021). Linking sustainable business models and supply chains—Toward an integrated value creation framework. Business Strategy and the Environment, 30(8), 3960–3974. [Google Scholar] [CrossRef]

- Notteboom, T., Pallis, A., & Rodrigues, J.-P. (2022). Port economics, management and policy (690p). Routledge. [Google Scholar] [CrossRef]

- Nußholz, J. (2017). Circular business models: Defining a concept and framing an emerging research field. Sustainability, 9, 1810. [Google Scholar] [CrossRef]

- Nußholz, J. L. K. (2018). A circular business model mapping tool for creating value from prolonged product lifetime and closed material loops. Journal of Cleaner Production, 197(1), 185–194. [Google Scholar] [CrossRef]

- OECD. (2019). Business models for the circular economy—Opportunities and challenges for policy. OECD Publishing. [Google Scholar]

- Okumus, D., Gunbeyaz, S. A., Kurt, R. E., & Turan, O. (2023). Towards a circular maritime industry: Identifying strategy and technology solutions. Journal of Cleaner Production, 382, 134935. [Google Scholar] [CrossRef]

- Okumus, D., Gunbeyaz, S. A., Kurt, R. E., & Turan, O. (2024). An approach to advance circular practices in the maritime industry through a database as a bridging solution. Sustainability, 16(1), 453. [Google Scholar] [CrossRef]

- Osterwalder, A., Pigneur, Y., & Tucci, C. (2005). Clarifying business models: Origins, present, and future of the concept. Communications of the Association for Information Systems, 16. [Google Scholar] [CrossRef]

- PEMSEA. (2022). Managing port and shipping waste. challenges and best practices. Partnerships in Environmental Management for the Seas of East Asia. Available online: https://www.pemsea.org/sites/default/files/2023-12/IPA%20Managing%20Port%20and%20Shipping%20Waste%2020221021.pdf (accessed on 15 November 2024).

- Peppard, J., & Rylander, A. (2006). From value chain to value network: Insight from mobile operators. European Management Journal, 24, 128–141. [Google Scholar] [CrossRef]

- Pieroni, M. P., McAloone, T., & Pigosso, D. A. C. (2019). Business model innovation for circular economy and sustainability: A review of approaches. Journal of Cleaner Production, 215, 198–216. [Google Scholar] [CrossRef]

- Port of Naantali. (n.d.). Safety through co-operation. Turku Repair Yard Ltd. Available online: https://portofnaantali.fi/en/reference/turun-korjaustelakka-oy/?utm_source=chatgpt.com (accessed on 15 October 2024).

- Porter, M. E. (1980). Competitive strategy: Techniques for analyzing industries and competition. Free Press. [Google Scholar]

- Porter, M. E. (1985). Competitive advantage: Creating and sustaining superior performance. The Free Press. [Google Scholar]

- Porter, M. E., & Kramer, M. R. (2011). The big idea: Creating shared value. Harvard Business Review, 89, 2–17. [Google Scholar]

- Rashid, A., Asif, F. M., Krajnik, P., & Nicolescu, C. M. (2013). Resource conservative manufacturing: An essential change in business and technology paradigm for sustainable manufacturing. Journal of Cleaner Production, 57, 166–177. [Google Scholar] [CrossRef]

- Razmjooei, D., Alimohammadlou, M., Ranaei Kordshouli, H. A., & Askarifar, K. (2023). A bibliometric analysis of the literature on circular economy and sustainability in maritime studies. Environment Development and Sustainability, 26(3), 5509–5536. [Google Scholar] [CrossRef] [PubMed]

- Rong, K., Lin, Y., Li, B., Burström, T., Butel, L., & Yu, J. (2018). Business ecosystem research agenda: More dynamic, more embedded, and more internationalized. Asian Business Management, 17, 167–182. [Google Scholar] [CrossRef]

- Rosa, P., Sassanelli, C., Urbinati, A., Chiaroni, D., & Terzi, S. (2020). Assessing relations between circular economy and industry 4.0: A systematic literature review. International Journal of Production Research, 58(6), 1662–1687. [Google Scholar] [CrossRef]

- Sea2Cradle. (n.d.). Ship recycling. Available online: https://www.sea2cradle.com/services/ship-recycling/ (accessed on 17 November 2024).

- Shakeel, J., Mardani, A., Chofreh, A. G., Goni, F. A., & Klemeš, J. J. (2020). Anatomy of sustainable business model innovation. Journal of Cleaner Production, 261, 121201. [Google Scholar] [CrossRef]

- SINTEF. (2020). Studie av potensialet for verdiskaping og sysselsetting av sirkulærøkonomiske tiltak utvalgte tiltak og case. Available online: https://www.sintef.no/globalassets/sintef-industri/rapporter/sluttrapport_verdiskaping_sysselsetting_sirkularokonomi_mars2021_versjon3.pdf (accessed on 30 November 2024).

- Sposato, P., Preka, R., Cappellaro, F., & Cutaia, L. (2017). Sharing economy and circular economy. how technology and collaborative consumption innovations boost closing the loop strategies. Environmental Engineering and Management Journal, 16, 1797–1806. [Google Scholar] [CrossRef]

- SSI. (2021). Exploring shipping’s transition to a circular industry. Sustainable Shipping Initiative. Available online: https://www.sustainableshipping.org/wp-content/uploads/2021/06/Ship-lifecycle-report-final.pdf (accessed on 17 November 2024).

- Stabell, C. B., & Fjeldstad, Ø. D. (1998). Configuring value for competitive advantage: On chains, shops and networks. Strategic Management Journal, 19, 413–437. [Google Scholar] [CrossRef]

- Stern, J. (1985). Acquisition, pricing, and incentive compensation. Corporate Accounting, 3(2), 26–31. [Google Scholar]

- Stern, J. M., Stewart, G. B., III, & Chew, D. H. (1995). The eva financial management system. Journal of Applied Corporate Finance, 8, 32–46. [Google Scholar] [CrossRef]

- Stewart, G. B. (1991). The quest for value. Harper and Collins. [Google Scholar]

- Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533. [Google Scholar] [CrossRef]

- Teece, D. T. (2010). Business models, business strategy and innovation. Long Range Planning, 43(2–3), 172–194. [Google Scholar] [CrossRef]

- The UN Global Compact. (2016). The UN global compact-accenture strategy CEO study 2016. Available online: https://unglobalcompact.org/library/4331 (accessed on 15 November 2024).

- Treacy, M., & Wiersema, F. (1995). The discpline of market leaders: Choose your customers, narrow your focus, dominate your market. Perseus Books Group. [Google Scholar]

- Tukker, A. (2004). Eight types of product–service system: Eight ways to sustainability? Experiences from SusProNet. Business Strategy and the Environment, 13, 246–260. [Google Scholar] [CrossRef]

- Tukker, A. (2015). Product services for a resource-efficient and circular economy—A review. Journal of Cleaner Production, 97, 76–91. [Google Scholar] [CrossRef]

- UN. (n.d.). Sustainable development goals: 17 goals to transform our world. United Nations. Available online: https://www.un.org/en/exhibits/page/sdgs-17-goals-transform-world (accessed on 15 December 2024).

- Verbeke, A., Osiyevskyy, O., & Backman, C. A. (2017). Strategic responses to imposed innovation projects: The case of carbon capture and storage in the Alberta oil sands industry. Long-Range Planning, 50(5), 684–698. [Google Scholar] [CrossRef]

- Wallenius Wilhelmsen. (2023). Sustainability. Available online: https://www.walleniuswilhelmsen.com/who-we-are/sustainability?utm_source=chatgpt.com (accessed on 15 October 2024).

- Walters, D., & Lancaster, G. (2000). Implementing value strategy through the value chain. Management Decision, 38(3), 160–178. [Google Scholar] [CrossRef]

- Walters, D., & Rainbird, M. (2004). The demand chain as an integral component of the value chain. Journal of Consumer Marketing, 21(7), 465–475. [Google Scholar] [CrossRef]

- Wärtsilä. (n.d.). Lifecycle upgrades. Available online: https://www.wartsila.com/marine/services/lifecycle-upgrades (accessed on 15 November 2024).

- Weidner, K., Nakata, C., & Zhu, Z. (2021). Sustainable innovation and the triple bottom-line: A market-based capabilities and stakeholder perspective. Journal of Marketing Theory and Practice, 29(2), 141–161. [Google Scholar] [CrossRef]

- Wells, P., & Seitz, M. (2005). Business models and closed-loop supply chains: A typology. Supply Chain Management, 10(4), 249–251. [Google Scholar] [CrossRef]

- Wessels, D., Koller, T., & Goedhart, M. (2020). Valuation: Measuring and managing the value of companies (7th ed.). John Wiley & Sons, Inc. [Google Scholar]

- Widmer, T. (2016). Assessing the strengths and limitations of business model frameworks for product service systems in the circular economy: Why canvas and co. are not enough [Master’s thesis, Kungliga Tekniska högskolan]. Available online: https://kth.diva-portal.org/smash/get/diva2:942100/FULLTEXT01.pdf (accessed on 15 November 2024).

- Wirtz, B. W., Pistoia, A., Ullrich, S., & Gottel, V. (2016). Business models: Origin, development and future research perspectives. Long Range Planning, 49, 36–54. [Google Scholar] [CrossRef]

- Zott, C., & Amit, R. (2010). Business model design: An activity system perspective. Long Range Planning, 43, 216–226. [Google Scholar] [CrossRef]

| Strategy | Phase | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Design | Raw Material Processing | Component and Equipment Manufacturing | Assembly and Integration | Operations | Maintenance and Upgrade | Dismantling | |||

| Short loops | Smarter creation and use of products | R0 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| R1 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| R2 | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Medium loops | Extending the lifespan of products and parts | R3 | ✓ | ✓ | |||||

| R4 | ✓ | ✓ | |||||||

| R5 | ✓ | ✓ | |||||||

| R6 | ✓ | ✓ | |||||||

| R7 | ✓ | ✓ | |||||||

| Long loops | Useful application of materials | R8 | ✓ | ||||||

| R9 | ✓ | ||||||||

| Business Model | Sub-Model | Relevant SDGs | |

|---|---|---|---|

| Circular Inputs | Build to last: Design products to have a longer lifecycle by using durable materials. | SDG 9, SDG 12, SDG 13 |

| Circular suppliers: Source materials and components that are either recycled, renewable, or easily repurposed. | SDG 7, SDG 9, SDG 12 | ||

| Sharing Platform | Share: Create platforms that allow users to share products, increasing their utility and lifespan. | SDG 8, SDG 9, SDG 11, SDG 12 |

| Product as a Service | Shift from product ownership to a service model where customers pay for use, not ownership. | SDG 9, SDG 12, SDG 13 |

| Performance as a service: Deliver service guaranteeing the product’s functionality or performance. | SDG 9, SDG 12, SDG 17 | ||

| Product Life Extension | Repair and Maintain: Offer repair services, extending the product lifecycle. | SDG 8, SDG 9, SDG 12 |

| Upgrade: Provide updates or upgrades without requiring complete replacement. | SDG 9, SDG 12 | ||

| Resell: Facilitate the resale of used products, keeping them in circulation longer. | SDG 8, SDG 12 | ||

| Remanufacture: Refurbish and remanufacture used products to like-new condition. | SDG 9, SDG 12 | ||

| Resource Recovery | Recycle/Upcycle: Reprocess materials to create new products. | SDG 12, SDG 13, SDG 14, SDG 15 |

| Return: Establish systems for consumers to return used products for recovery or recycling. | SDG 12, SDG 13, SDG 17 | ||

| Value Chain Stage | Example Actors | Key Products and Services | Circular Economy (CE) Initiatives | |

|---|---|---|---|---|

| Ship Design | NSK Ship Design, SSPA, Foreship, ENG’d | Delivers comprehensive ship design, offshore engineering, and construction support services. | Build to Last—Modular design principles |

| Raw Material Processing | SSAB, Hydro, Outokumpu | Supplies essential raw materials, including aluminum, stainless steel, composites, syntactic foam, and concrete. | Circular Supplies—High recyclability of materials |

| Component and Equipment Manufacturing | Wärtsilä, Kongsberg, ABB, Promeco | Develops key maritime equipment and integrated solutions, such as power engines, propulsion systems, and advanced navigation technologies. | Modular Design, Return Waste Materials, Product-as-a-Service |

| Assembly and Integration | Helsinki Shipyard, Kleven, Ulstein | Builds ship hulls, assembles critical components, and completes vessels with painting, coating, and the installation of necessary equipment. | Modular Design, Product Use Extension, Repair and Remanufacture Services |

| Operation | Wallenius Wilhelmsen, Finnlines | Equips vessels for the transportation of goods and passengers, ensuring readiness for maritime operations. | Rental Agreements, Chartering |

| Maintenance and Upgrade | Turku Repair Yard, Ulstein | Offers services in ship repair, refurbishment, and conversion projects, which include replacing equipment and repainting vessels. | Lifecycle Services—Repair, refurbishment, and repainting |

| Dismantling | Delete, Hans Langh | Provides decommissioning services for end-of-life vessels, including dismantling, material sorting, and efficient processing for recycling or disposal. | Recycle/Upcycle, Return Services |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Koilo, V. Driving the Circular Economy Through Digital Servitization: Sustainable Business Models in the Maritime Sector. Businesses 2025, 5, 12. https://doi.org/10.3390/businesses5010012

Koilo V. Driving the Circular Economy Through Digital Servitization: Sustainable Business Models in the Maritime Sector. Businesses. 2025; 5(1):12. https://doi.org/10.3390/businesses5010012

Chicago/Turabian StyleKoilo, Viktoriia. 2025. "Driving the Circular Economy Through Digital Servitization: Sustainable Business Models in the Maritime Sector" Businesses 5, no. 1: 12. https://doi.org/10.3390/businesses5010012

APA StyleKoilo, V. (2025). Driving the Circular Economy Through Digital Servitization: Sustainable Business Models in the Maritime Sector. Businesses, 5(1), 12. https://doi.org/10.3390/businesses5010012