1. Introduction

Korea’s early distribution channels have conventionally been normal offline stores. However, in this digital transformation era, these stores have transformed into Internet-based e-commerce sites. As Korea’s information technology (IT) powerhouse converges with distribution channels, digital platforms establish a market-leading environment. They have evolved into a “mobile commerce” form, combining technologies based on the fourth industrial revolution with the spread of smartphones. Presently, the Korean distribution market is struggling owing to the coronavirus disease 2019 (COVID-19). By enabling market evolution through “digital transformation” that combines various distribution channels, e-commerce and m-commerce are rapidly growing in preparation for the prolonged COVID-19 pandemic [

1,

2,

3,

4,

5]. This growth links the emergence of digital platform-based distribution channels to digital market transformation. Among them, “livestreaming commerce” is a leading platform for e-commerce. Live commerce first appeared in the Chinese market in 2016, with an initial market value of about 30 billion USD and gained popularity [

6,

7,

8]. The market size of livestreaming commerce expanded rapidly as it combined with Korea’s distribution channels, surpassing the existing commerce market within 2–3 years of its introduction; it is estimated to grow to 8 billion USD by 2023 [

9].

The market for livestreaming commerce has shown more growth than its counterparts during the pandemic. Companies in countries with global-scale economies have launched livestreaming services; it is predicted that more companies will participate in this trend. Globally, companies such as Kakao and Naver in Korea, Taobao and TikTok in China, and Amazon in the U.S. are leading streaming commerce. As livestreaming is linked to mobile phones, many mobile live streaming platforms and apps have emerged [

10]. These platforms constitute a streaming channel where consumers can engage in entertainment and purchase products using the Internet and mobile devices. On these platforms, consumers’ favorite influencers and creators appear as information providers and participate in two-way, real-time communication via video or chat. Therefore, existing e-commerce companies are conducting livestreaming services for various product groups by hiring information providers to discover new content and attract consumers, in line with the digital transformation era.

Therefore, it is essential to accurately understand the characteristics of the overall live commerce and streaming platform, the market environment, and consumer perception through social big data analysis. Furthermore, as the online commerce environment is changing due to the growth of live commerce and the expansion of the market size before and during COVID-19, it is necessary to provide the market analysis data comparing consumer perceptions by consumption class. In other words, a study should be conducted to collect data from fashion and beauty channels, which are subcategories of live commerce, and to compare and analyze consumers’ perception structures according to consumption classes. In addition, it is time to conduct research to examine how consumer perceptions of live commerce channels are formed before and during the COVID-19 outbreak, and when and whether the current live commerce channels are being popularized by consumers. Therefore, based on the classified items by clustering fashion and beauty attributes, which are subcategories of live commerce, we intend to analyze the commonalities and differences between fashion and beauty to provide information to the market and conduct research that can contribute to the development of the industry.

Livestreaming commerce differs from traditional e-commerce in several ways. First, in traditional online shopping, customers can only obtain information about products or services through pictures and texts. Conversely, in livestreaming commerce, they can obtain real-time information about products or services and directly experience results from information providers through streaming platforms [

11,

12]. Second, livestreaming commerce allows information providers to broadcast on the platforms in real-time and bilaterally communicate with customers, thereby influencing customers’ purchasing behavior by providing customized services and mutual question-and-answer (Q and A) sessions [

13,

14]. Consequently, many companies have been attempting to engage with and energize potential customers by offering livestreaming. Additionally, companies can produce various streaming platforms for livestreaming commerce to actively promote their products and services, thereby enabling extensive commercial exploitation. These companies can also simultaneously collect information from consumers who access the streaming services, maintain existing customers through databases, and build marketing strategies to attract new customers. From the commercial marketing perspective, livestreaming commerce is being used because it is an optimal marketing tool that can generate economic benefits for companies.

After the COVID-19 pandemic, consumers show a preference for untact (or no-contact) services to minimize unnecessary contact with others. Consequently, fashion and beauty distribution channels that focus on online and mobile shopping have strengthened the online market by drawing attention to livestreaming commerce, thereby overcoming the limitations of traditional e-commerce sites and mobile devices. Moreover, broadcasting is conducted in connection with general fashion, beauty, traditional markets, and automobile industries, some of which were previously difficult to access. As the demand increased for fun content and play options, through which consumers profit by solving quizzes while watching live broadcasting, entertainment was identified as an essential factor. Therefore, the live market is expected to continue to grow as it adapts to “digitalization” according to consumers’ tastes in various industries, even after the COVID-19 pandemic.

Currently, livestreaming commerce is recognized as an important marketing tool, especially in the context of the current pandemic, and research on this topic is underway. However, most studies relating to live commerce have focused on system developments, case studies, and psychological variables. The Korean livestreaming commerce market is an emerging powerhouse in the e-commerce ecosystem, and is an existing powerhouse of information and communications technology. Therefore, research should be conducted on the psychological variables of Korean consumers and overall consumer perception using social big data. To date, most research has focused on the Chinese commerce market, which is leading livestreaming commerce [

15,

16,

17,

18]. Hence, from the perspective of live commerce consumers in a new market, this study aimed to investigate the changes in consumer interest since the COVID-19 pandemic. To identify and analyze Korean consumers’ overall perception of live commerce, we used text mining and social big data analytics, which involved collecting posts and articles from Korean portal sites. Moreover, we intend to present a new marketing strategy for live commerce companies by deriving meaningful clusters of keywords with the CONCOR analysis program using UCINET, and identifying important issues of the live commerce industry through the analysis results.

More specifically, we aimed to analyze and compare Korean consumer perception structure on fashion and beauty channels, which are subcategories of live commerce.

1.1. Theoretical Background: An Overview of Livestreaming Commerce

Live streaming commerce is a new concept that combines video streaming and e-commerce; it enables transactions between producers and consumers via livestreaming platforms for products or services sold in offline stores [

19]. Further, it is a service that enables real-time bilateral communication through videos, audio, and chatting by combining real-time video content and chatting channels. Live streaming commerce is also defined as a marketing tool for commercial activities to communicate about and share products or service-related information with streaming platforms [

20]. With the spread of the Internet and smartphones, shopping and distribution channels for consumers have diversified, and live streaming commerce platforms have emerged. These platforms facilitate sales by encouraging real-time communication between producers and consumers in a virtual space; they also facilitate the immediate sharing of product information and addressing customers’ questions [

21]. Livestreaming commerce is a platform service that has evolved from the existing e-commerce format. While the latter only provides photos or basic information related to products, the former is a more sophisticated interface that provides professional information or videos to consumers, enabling transactions in a mutually beneficial relationship [

22].

Specifically, livestreaming commerce is a new paradigm in the commerce market that can address problems, such as a lack of communication with customers, as well as the physical limitations of existing e-commerce types, such as T-commerce (television), M-commerce (mobile), and S-commerce (social) [

23]. Further, livestreaming commerce fosters interaction that can actively induce consumers’ participation via Q and A in real-time. It also provides easily accessible information that can be shared freely across space and time, building consumer motivation [

24,

25].

When selling, information providers use products in their videos. They also respond to consumers’ questions in real-time, resolving the uncertainty that exists on shopping platforms, resulting in high consumer satisfaction [

26]. Therefore, livestreaming commerce is becoming more influential as a core shopping platform in the e-commerce market. With diverse distribution and shopping channels entering livestreaming commerce, its market size continues to grow [

18]. Currently, Korea’s livestreaming commerce uses not only global social media platforms (e.g., YouTube and Instagram) but also Korean ones (e.g., Naver, Kakao and Timon). That is, livestreaming commerce is a bilateral communication platform by which companies or sellers deliver information and entertainment to consumers in real-time via online and mobile devices. It is recognized as an optimal marketing vehicle for the untact era.

1.2. Changes in the Untact Digital Environment before and after COVID-19

The outbreak of COVID-19 in late 2019 led to a profound negative impact on the world’s economy, forcing most industries into a recession [

27,

28]. This phenomenon has fundamentally changed consumption patterns, and the altered consumer behavior and attitudes are reflected in the market [

29]. This has also rendered the recent economic crisis quite different from the one in 2008 and the International Monetary Fund crisis in South Korea. The pandemic has forced people to spend an extended amount of time away from others in a confined space, especially their own homes. Therefore, consumer behavior has become more self-centered and focused on the COVID-19 prevention measures. The new “untact society” that has emerged from the drastically altered daily lives of people has formed a new “untact market” that is now supporting the global economy [

30]. As the “untact environment” is taking hold, companies are striving to meet new consumer needs by providing digital transformation-oriented platforms to industry sectors based on untact technology [

31,

32,

33]. These changes in consumer trends are affecting various industries, including the fashion and beauty industries, which are experiencing challenges because of the newly established untact environment in Korea [

34]. Essentially, the untact environment has restricted people’s daily lives, directly impacting the fashion and beauty industries. For instance, because of the mandate of wearing masks in public in our daily lives, the demand for eye makeup products has increased tremendously, as the eyes are the only exposed part of the face [

35]. For the fashion industry, the periodic fashion shows have now been replaced with digital fashion weeks through contact-free, livestreaming platforms, which has led to a decreased interest in the shows [

36]. Moreover, the prolonged COVID-19 crisis has activated a compensation mentality for restricted daily life and impulse buying. This has increased the level of interest in luxury items while decreasing the overall fashion-related consumption, resulting in a “consumption polarization” phenomenon [

37].

1.3. Influence of Fashion and Beauty Products

Product information is shared among consumers via the Internet. Therefore, consumers’ perceptions about products and services in the fashion and beauty industries are being investigated and utilized, using social big data. Existing research temporally compares consumer perceptions over a period to examine changing consumer interests and perceptions. Under the COVID-19 pandemic, consumers’ perceptions of fashion and shopping trends are changing according to the situation, using a network connection [

38,

39]. Choi and Lee [

34] found a change in consumers’ perceptions of fashion and beauty products before and after the outbreak of COVID-19. The authors found that keywords related to health and prevention ranked high in consumer perceptions of fashion and beauty products, because of the spread of COVID-19 [

40,

41]. In addition, as the number of confirmed cases continued to increase, consumer interest was focused on items such as homeware, masks, eye makeup, skincare, body products, and self-care [

42].

As fashion product evaluations are based on form, material, and color, and beauty is derived from item-specific attributes, such as function, material, and form, consumer perceptions change accordingly. Therefore, before COVID-19, fashion and beauty-related products were selected as product groups that consumers could consume continuously both offline and online.

1.4. Objectives

This study explored how livestream e-commerce affects consumers in the Korean market and how it has spread during the COVID-19 pandemic. The study limited its investigation to the fashion and beauty subcategories of livestreaming commerce platforms, comparing and analyzing consumer awareness structures and the characteristics of each industry. Specifically, this study’s objectives were as follows:

Objective 1. To analyze the changes in consumer awareness of livestreaming commerce before and after COVID-19.

Objective 2. To analyze consumers’ awareness structure of livestreaming commerce for fashion and beauty-related products, which are two subcategories of livestreaming commerce.

Objective 2-1. To identify consumers’ awareness and structure regarding livestreaming commerce of fashion-related products.

Objective 2-2. To identify consumers’ awareness and structure regarding livestreaming commerce of beauty-related products.

2. Data Collection and Analysis

Three major online portals in Korea, Naver, Google and Daum, were used as analysis platforms to determine the overall consumer awareness criteria for livestreaming commerce. The search trend for “livestreaming commerce” was analyzed using Naver Data Lab by Naver (South Korea, Pangyo), which accounted for about 60% of the market share, as of 2021.

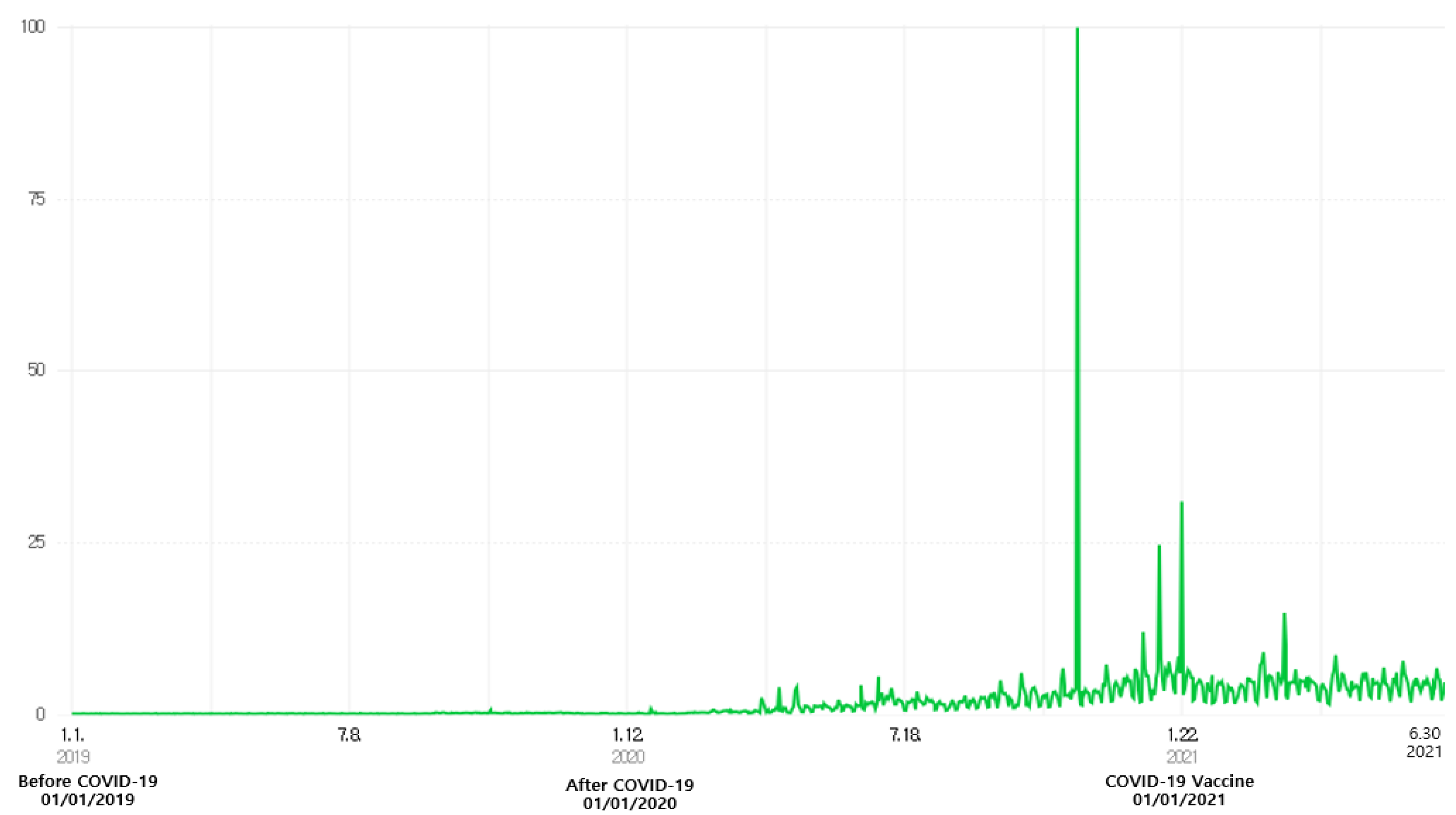

Figure 1 illustrates the results. The analysis period was from 1 January 2019, before the COVID-19 outbreak, to 30 June 2021, when the virus had spread globally, causing a pandemic. The analysis showed that livestreaming commerce searches began in January 2020 after the COVID-19 pandemic. After the first and second waves of the pandemic (i.e., from August 2020), consumer interest in livestreaming commerce surged.

In this study, the big data-based text mining technique and semantic network analysis were examined. First, text mining was used to find the similarity and generality of ranking or recognition by refining collected words using natural language processing and morpheme analysis technology, extracting words and suggesting frequency [

43]. In this study, keywords related to live shopping were extracted from the live commerce platform, and words irrelevant to shopping were deleted. In addition, words with the same meaning were integrated, and incomplete words were refined. Second, semantic network analysis applies social network analysis to communication messages and thus, it is mainly used in social science [

44]. In other words, it is used as an analysis method to derive the content of the message contained in the form of the relationship by analyzing the structural relationship according to the use and arrangement of words forming the message in the text, and by analyzing the pattern and meaning of the structure [

45]. The channels for collecting consumer awareness data were limited to the three portals mentioned previously. Data were collected from news, blogs, and bulletin board services. Centrality measurements were made for the top 50 keywords based on frequency. The words were refined through text mining pre-processing using the TEXTOM program to understand consumer awareness and interest. Additionally, the collected data were analyzed by conducting duplicate test processing and error correction. Further, a measured centrality analysis was performed using the UCINET 5 package. Therefore, in order to see the network between words related to live shopping, the network was analyzed and visualized using the NetDraw function of the UCINET program, and the influence relationship between keywords was identified by conducting a CONCOR analysis. As shown in

Table 1, 17,502 data on fashion and beauty by live shopping, a key medium for livestreaming commerce, were collected in 2019. Furthermore, a total of 33,972 data points were collected in 2020—nearly doubling the data collection frequency compared to before the pandemic. This result shows that interest in livestreaming commerce as well as the size of the e-commerce market, both of which are suitable for the contactless era, have been increasing rapidly since the onset of COVID-19.

3. Research Results

For the analysis method of this study, pre-processing and morphological analysis were performed on text data using Natural Language Processing (NLP) with TEXTOM, an automated text analysis program [

46]. First, in the pre-processing stage, unnecessary words and phrases for analysis were deleted from the collected text data, and in the morphological analysis, only the nouns related to this study were derived from the related sentences by breaking sentences down into morphemes, the smallest unit of meaning. Second, among text mining techniques, term frequency-inverse document frequency (TF-IDF) analysis and connection centrality analysis were performed using TEXTOM. The TF-IDF analysis is a method of extracting frequently mentioned keywords within a specific document group, and analyzing their importance according to the frequency of mentions. Third, to analyze the characteristics of keywords and groups derived in relation to live commerce, a CONCOR analysis was performed using UCINET’s NetDraw program to derive network clusters.

3.1. Consumer Awareness of Livestreaming Commerce

The top 20 criteria for keyword frequency related to livestreaming commerce were used for centrality analysis and clustering. Separate analyses of the pre-pandemic data for 2019 and post-pandemic data for 2020 showed that keyword frequency, term frequency-inverse document frequency (TF-IDF), and connection centrality rankings were similar. As presented in

Table 2, keywords “mobile” in 2019 (2530) and “Naver” in 2020 (15,342), which had the highest frequency, showed the highest levels of TF-IDF and connection centrality. Keywords such as “travel” (1311), “hotel” (798), “performance” (740) and “concert” (367), which are hobbies or leisure activities, were among the largest features in consumer awareness of livestreaming commerce in 2019 before the COVID-19 outbreak. In contrast, consumer awareness of livestreaming commerce in 2020 after the outbreak of COVID-19 revealed keywords related to the pandemic, such as “real-time” (6057), “untact” (4522) and “coronavirus” (2048). These findings confirm that COVID-19 was an important factor in consumer awareness of livestreaming commerce, indicating that the two may be mutually connected.

Naver, which has the largest market share among Korean portal sites, is at the top of the keyword list, with values of 1024 in 2019 and 15,342 in 2020, for appearance frequency. This is because Korean consumers use it frequently because of its ease of accessibility. The platform of Naver livestreaming commerce has recorded 100 million searches and views since the outbreak of COVID-19 and is continuing to increase its market share. Furthermore, “communication” (2526), “TF-IDF” (7531.01), “show host” (1113) and “TF-IDF” (4236.49) emerged as major keywords since COVID-19 and are at the top of the list in terms of appearance frequency. This is because an environment enabling easy communication with consumers can be achieved under livestreaming commerce. Further, professional information on products and services is seamlessly provided to consumers, creating a reciprocal relationship between information providers and consumers. Additionally, as the distribution channels that have symbiotic relationships with livestreaming commerce are growing, various distribution channels linked to livestreaming commerce are expanding, increasing the interest in the associated services and benefits offered to consumers, as indicated in the occurrence of the word “benefits” (1889).

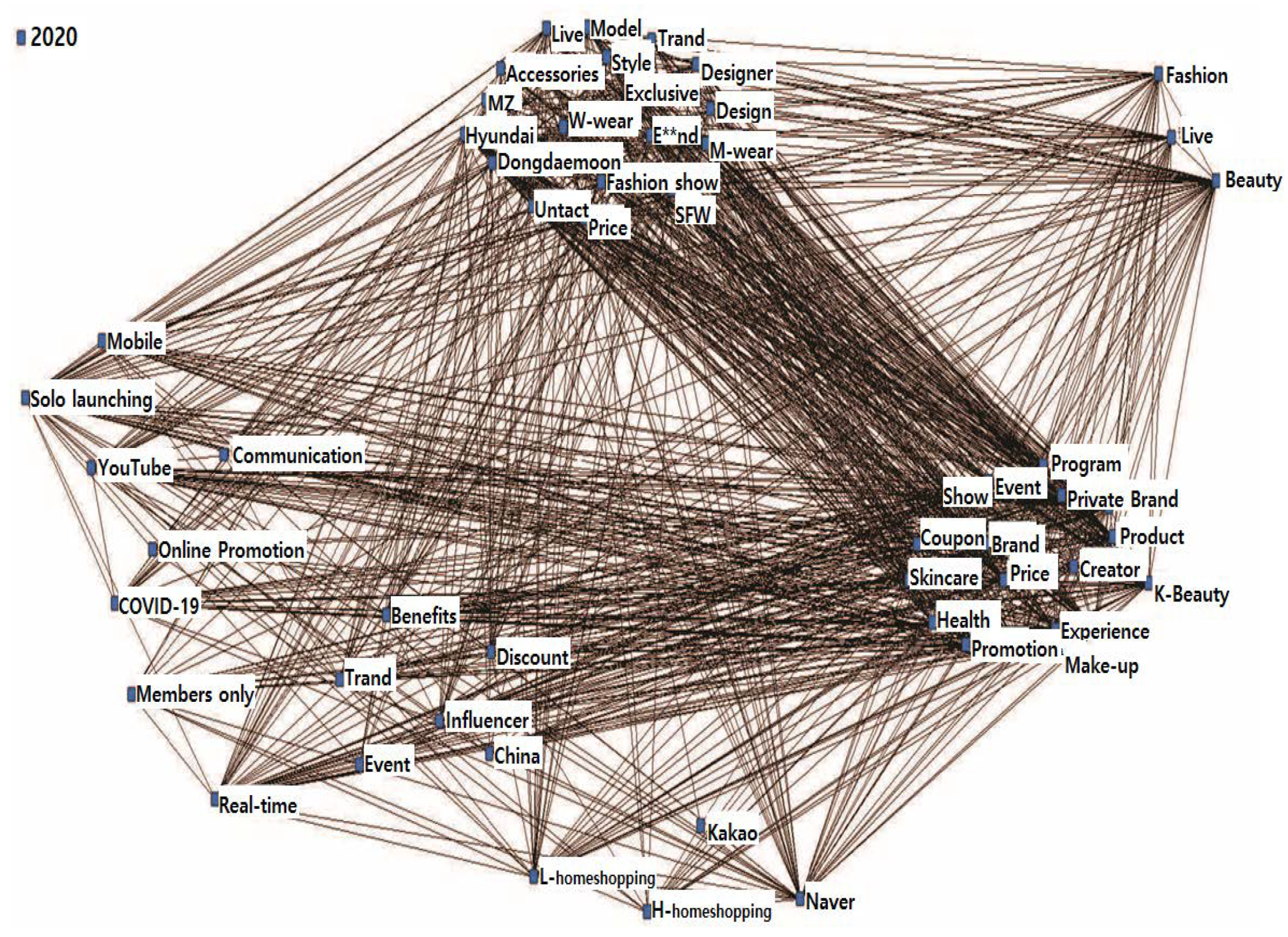

In 2020, the keywords “fashion” and “beauty” had an appearance frequency of 773 and 1028, a TF-IDF of 2813.64 and 4578.88, and connection centrality rankings of 0.80 and 0.82, respectively. Furthermore, as a result of CONCOR analysis, the words related to fashion and beauty were derived as high cluster groups in 2020 as shown in

Figure 2. They are shown as clusters with high relevance because of their high density, and Group 1 was composed of Designer, Design, Seoul Fashion Week, MZ Generation, Model, and Women’s Wear, while Group 2 consisted of Private Brand, Health, Coupon, Makeup, K-Beauty, Experience, etc.

Having a higher connection centrality than the appearance frequency of portal sites shows that the keywords “fashion” and “beauty” are interconnected with others on livestreaming commerce. That is, fashion and beauty are perceived by consumers as subcategories of livestreaming commerce because the two industries are used as key intermediaries of the service platform. This indicates that they are the top keywords in consumer awareness and important categories of livestreaming commerce.

3.2. Commonalities and Differences in Livestreaming Commerce Awareness before and after COVID-19

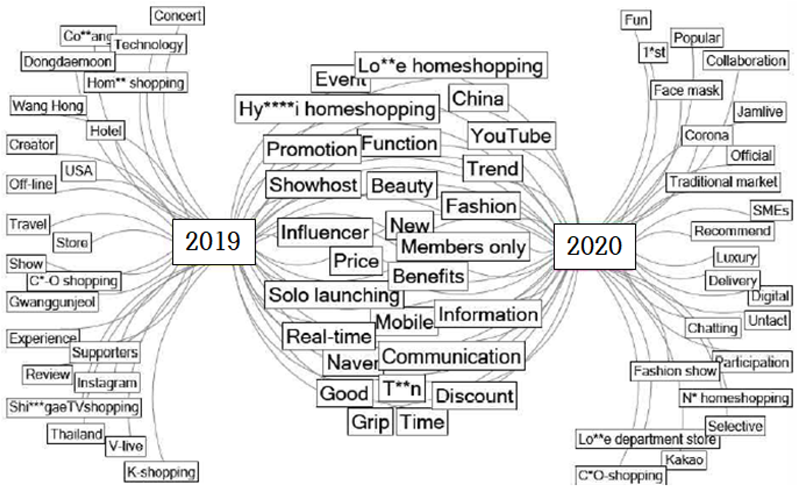

The livestreaming commerce awareness survey analyzed data for 2019 (i.e., before COVID-19) and 2020 (i.e., after COVID-19). A total of 30 keywords were extracted based on their frequency of appearance, and common factors and characteristics of each factor on the network were derived, as shown in

Figure 3. The commonalities between 2019 and 2020 were the streaming platform and shopping channels used in live commerce related markets. The two major categories of information providers included influencers and show hosts. Given that live commerce is a platform characterized by two-way communication, the roles of these categories were critical as they exert a significant influence online. Keywords appearing most frequently on the service platform included “event,” “price,” “information,” “communication,” “discount” and “trend.” This implies that consumers use live commerce with the expectation of acquiring information, communication, and economic benefits.

There were differences in the top keywords used in 2019 and 2020. In 2019 (i.e., before COVID-19), keywords such as “concert,” “travel,” “hotel,” “performance” and “store” appeared the most frequently; these keywords were indicative of leisure or hobby activities and had offline properties. Further, keywords such as “promotion,” “fan” and “live,” which were directly connected to livestreaming commerce, also appeared. Therefore, consumers may have been exposed to keywords for livestreaming commerce before COVID-19 as the platform service is an evolved form of e-business. The keywords were probably found by analyzing and providing increased interest offline as consumers changed their lifestyles.

In contrast, in 2020, keywords closely related to contactless activities resulting from the emergence of COVID-19 appeared frequently, namely “coronavirus,” “contactless,” “launching” and “digital.” Keywords such as “livestreaming commerce platforms,” “online shopping” and “TV shopping” became common as channels related to non-contact activities. In addition, livestreaming commerce expanded extensively during this period. Consumers recognized the advantages of livestreaming commerce because of changes in the social environment and market and through collaboration with various related industries and fields.

3.3. Structuring Consumer Awareness of Fashion and Beauty Livestreaming Commerce

A total of 13,205 data points were collected on fashion-related livestreaming commerce. We found no significant difference in connection centrality and proximity centrality rankings. As shown in

Table 3, keywords including “Naver” (3623), “event” (1955) and “contactless” (1389), which appeared the most frequently, accounted for the most important aspects of consumer awareness. Fashion-related keywords used on shopping channels accounted for the largest share of the top 20 keywords appearing most frequently, as consumers considered them the most important in their perception of livestreaming commerce related to fashion. Keywords such as “Naver” (0.83), “event” (0.82), “real-time” (0.81), “communication” (0.82), “designer” (0.79), “model” (0.80) and “collaboration” (0.77) were important factors in consumers’ purchasing considerations in livestreaming commerce. Among them, keywords that were directly related to fashion, such as “designer,” “model” and “collaboration,” enabled consumers to obtain information from information providers and gain economic benefits from livestreaming commerce. In addition, keywords such as “contactless” (0.83) and “coronavirus” (0.82) emerged on the platform service after COVID-19 and influenced consumer awareness of fashion livestreaming commerce, with their high frequency of appearance and connection centrality. While “fashion show” is offline oriented, it has opened up a new consumer market by offering consumers online products/services, as it has been converted to a non-contact market. This is indicated by its values for frequency of appearance (859) and connection centrality (0.77). Furthermore, factors such as “designer” (0.79), “model” (0.80) and “influencer” (0.81) have become important factors in connecting with consumers as reliable information providers in livestreaming commerce.

A total of 12,189 data were collected on beauty-related livestreaming commerce. The results showed no significant difference in connection centrality and proximity centrality rankings. As presented in

Table 3, keywords such as “Naver” (2524), “China” (1808) and “event” (1356), which appeared the most frequently, accounted for the most important aspects of consumer awareness. Beauty-related keywords, such as “China,” “Wang Hong” and “shopping,” accounted for the largest share of the top 20 keywords appearing the most frequently, as China started using livestreaming commerce to promote brands and products and build strategies as marketing tools. Livestreaming commerce in China had been growing and evolving even before COVID-19, with livestreaming commerce in Korea benchmarking it as a reference. Moreover, Korean beauty products are gaining popularity as “K-beauty,” mainly in the Chinese market. Therefore, keywords such as “China” and “Wang Hong” were found. The keywords presented in

Table 3 are the top keywords and reflect the fact that beauty products are a category with a high degree of consumer brand loyalty. In beauty, much as in fashion, factors such as “contactless” (0.83), “real-time” (0.81) and “coronavirus” (0.82) had a great influence on livestreaming commerce. Keywords such as “influencer” (0.80), “Wang Hong” (0.78) and “show host” (0.72) were factors that enabled consumers to obtain information and affected consumer purchase intention positively. Additionally, keywords such as “K-beauty” (0.80) and “makeup” (0.79) were factors that helped the Korean beauty market gain prominence.

3.4. Commonalities and Differences in Livestreaming Commerce by Fashion and Beauty Products

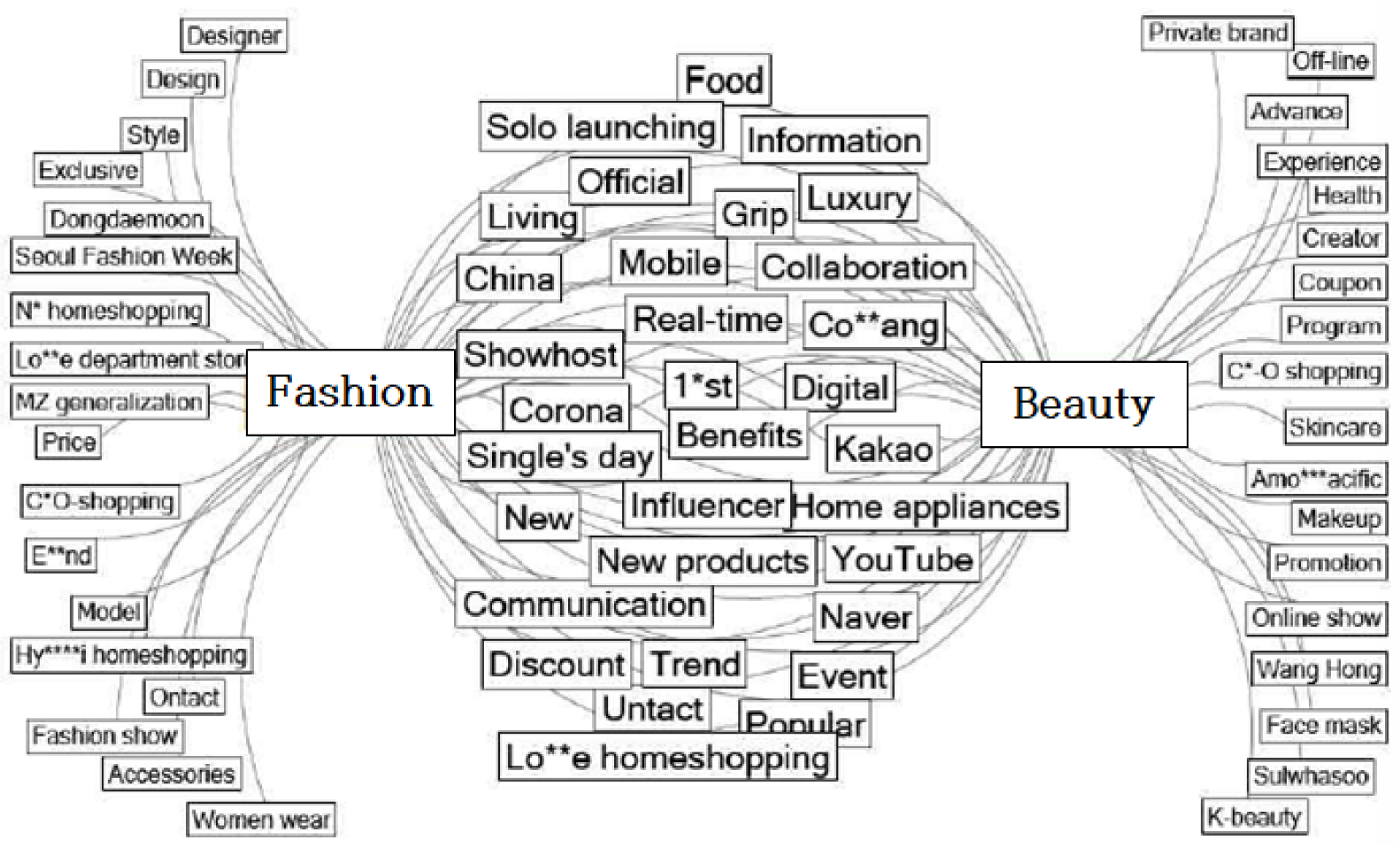

A total of 30 keywords were extracted based on their frequency of appearance to compare fashion and beauty characteristics since 2020. The common factors and characteristics of each factor on the network were derived, as shown in

Figure 4. A commonality in livestreaming commerce between fashion and beauty product groups was the occurrence of keywords such as “contactless,” “coronavirus” and “real-time” because of COVID-19. Moreover, “influencer” and “show host,” both of whom are active in live commerce, were information providers. Factors derived as attributes of livestreaming commerce, such as “launching,” “information,” “collaboration,” “event,” “communication” and “real-time,” appeared as common keywords in both fashion and beauty, implying that the two may form complementary relationships with one another. These common fashion and beauty attributes were observed to be important factors affecting consumers in livestreaming commerce. Furthermore, the market environment has shifted from offline to online because of the impact of COVID-19 on both the fashion and beauty industries. Therefore, livestreaming commerce is making great progress, with a variety of service delivery-based platforms being built.

A few differences were also observed in livestreaming commerce between fashion and beauty product groups. Before COVID-19, the fashion industry was characterized by its offline communication with consumers. However, fashion shows, which used to be an important communication channel for the fashion industry, became difficult to host because of COVID-19; consequently, the entire industry struggled. The fashion industry eventually began relying on livestreaming commerce as a new shopping channel to promote sales, find creative ways to hold fashion industry events and induce communication between consumers and information providers. Thus, live commerce is to a considerable degree replacing the existing online shopping function for consumers, as fashion companies are continuing to launch livestreaming commerce platform channels. Meanwhile, the beauty industry was characterized by keywords related to beauty brands and information providers, such as “influencer,” “creator” and “Wang Hong.” Additionally, the product groups affected by COVID-19, such as health, beauty, makeup, and masks, are the most popular factors in livestreaming commerce. As COVID-19 continues, interest in beauty is increasing. Moreover, product groups focusing on health, as a sub-market of beauty products, are being launched in line with increased consumer interest in health. Regarding the change in fashion in livestreaming commerce, the “K-beauty” term is gaining popularity in Korea and the world market, centered around China. Additionally, the active interaction online between information providers and consumers is resulting in synergistic effects.

4. Discussion and Conclusions

In this study, we analyzed Korean consumer perception of livestreaming commerce amid the ongoing development of the platform’s market, based on industry 4.0 technologies and digital transformation, particularly during the COVID-19 pandemic, when livestreaming commerce has grown rapidly and increased in importance. In this consumer perception survey on Korea’s livestreaming commerce between 2019 and 2020, which included the time period before the COVID-19 outbreak, the word “mobile” appeared frequently and had a high degree of centrality. This is because livestreaming commerce is a mobile-based service, and Korean consumers perceive mobile streaming as playing a major role as a platform. “Fashion” and “beauty,” classified as subcategories of livestreaming commerce in Korea, were the top keywords, as they frequently appeared regardless of the COVID-19 outbreak. Korean consumers classify fashion and beauty products as important product groups in their daily lives and consume them with great interest on livestreaming commerce platforms. Despite the shrinking consumption market in the wake of COVID-19, fashion and beauty products continue to be consumed both offline and online and are leading the e-commerce market.

Before COVID-19, livestreaming commerce was merely a tool for publicity or marketing products and services that could lead to offline leisure activities or hobbies. It was perceived as a means of entertainment rather than consumption. However, after the onset of the pandemic, the market environment shifted to being contactless. Consequently, the real-time, informational and interactive characteristics of social media services were fused with livestreaming commerce to allow two-way communication with consumers. As various livestreaming commerce platforms emerged, different interests and keywords appeared, as compared to before the pandemic.

The results of the consumer perception survey on fashion revealed the following clusters: (1) determinants of the purchase decision and e-commerce attributes related to COVID-19, (2) attributes related to livestreaming commerce channels, and (3) determinants of purchase decision related to fashion shows and social phenomena. The characteristics of each cluster included the determinant of purchase decision attributes. However, the livestreaming commerce channel attribute did not include the determinant of purchase decision. Additionally, regarding the fashion-related attribute, various shopping channels linked to livestreaming commerce were distributed at the top and provided platforms for consumers to choose from, which is an important factor in livestreaming commerce. An increasing number of brands are managing online shopping channels, which establish incentive policies that selectively provide benefits according to the consumers’ consumption levels and grades. Fashion-related keywords such as “launching,” “collaboration,” “trend” and “designer” appeared most frequently and affected purchase intention positively in livestreaming commerce. They are important factors to be considered when livestreaming platforms and fashion-related products are linked together. Furthermore, “fashion show,” a keyword with a low degree centrality but high frequency, is now hosted on livestreaming commerce platforms. It solicits consumer interest by providing elements of entertainment in content suited to the contactless era; therefore, it is recognized as an innovative livestreaming service.

The results of the consumer perception survey on beauty revealed the following clusters: (1) YouTube market and shopping channel attributes, determinants of purchase decision, and livestreaming commerce category attributes; (2) beauty brands, determinants of purchase decision, and K-Beauty attributes; and (3) purchase factors, beauty products, distribution channels, and livestreaming commerce attributes. In the beauty subcategory, keywords such as “shopping channels” and “brands” appeared with high frequency, suggesting that they are important factors for consumers even with the impact of COVID-19. This is because beauty products characteristically have high customer loyalty and a direct impact on consumers. In the present contactless era, where consumers cannot directly experience beauty products, livestreaming platforms enable the building of trust and intimacy with consumers. In addition, these platforms render real-time two-way communication between information providers or influencers and consumers possible. Such sharing of product information and indirect product experiences are important factors in promoting consumption.

The similarities and differences in the major keywords in the subcategories of fashion and beauty were analyzed. One similarity was that, for Korean consumers, “trend,” “information,” “communication” and “discount” appeared as important keywords, with the expectation that factors such as information acquisition, mutual communication, and economic benefits will be gained. In addition, keywords such as “online shopping,” “contactless” and “real-time” in the livestreaming commerce categories revealed that both the fashion and beauty industries are increasing the proportion of their online markets. Consumers are also recognizing this market change and are being introduced to livestreaming commerce. They perceive livestreaming commerce as a platform for purchasing products and recognize that it has optimized content in the contactless era, incorporating the elements of entertainment for enjoyment.

In contrast, one difference between the keywords derived for fashion and beauty is that, in fashion, keywords such as “fashion show,” “designer” and “trend,” which are important mediums in the fashion industry, appear most frequently. The reason is that specific groups, such as Korea’s Generation MZ (the pairing of Millennials and Generation Z), are shifting their interest to online markets and livestreaming platforms, thereby expanding the industry’s market size. In particular, Generation MZ has witnessed that livestreaming commerce can resolve the shrinking consumer market caused by the cancellation or downscaling of the previous fashion industry and offline fashion-related events because of COVID-19.

It is true that fashion and beauty-related content dominate the market among live commerce channels. This is because, as a non-face-to-face market environment is established due to the pandemic, live streaming-based live broadcasting is opened to transfer the characteristics of offline stores to online channels, allowing consumers to wear and demonstrate fashion and beauty products and provide information to consumers. In addition, it is possible to communicate in real-time between the show host and the consumer during live broadcasting, so that each person’s reaction can be immediately identified and responded to. Existing commerce channels check and respond to consumer reactions through Q and A or reviews, which are one-way communication methods, and analysis to enable flexible marketing strategies. In fact, as shown in the research analysis and results, fashion and beauty-related contents are being broadcasted in collaboration with influencers and celebrities in live commerce, providing contents that can actively communicate with consumers and establishing communication marketing strategies.

According to the survey results, more diverse factors are considered in beauty than in fashion. In the case of beauty, consumption patterns in the Korean market have changed because of COVID-19, and core beauty brands and products have evolved to fit the pandemic environment. In fact, because of COVID-19, Korean consumers have become increasingly interested in health-related beauty products and eye makeup, as wearing masks outdoors has become commonplace. However, as consumers cannot directly experience beauty products in offline stores, they utilize livestreaming commerce to acquire product-related information from information providers in real-time through communication and feedback and consume the beauty products only after sufficient browsing. Therefore, considering the social environment and the characteristics of livestreaming commerce, providing services that enable consumers to participate more actively on the streaming platform is necessary. In addition, related companies that utilize livestreaming commerce in their sales promotion activities should provide services in which specialized knowledge providers can serve customers according to the product category.

Live commerce is content that allows product sellers to create regular customers and effectively advertises their new products. Therefore, sellers should use live commerce as a tool to communicate with customers visiting the store and explain products through the video screen. In other words, the strategy that live commerce should build on is to focus on the interaction between the seller and the user rather than the form of supporting mass sales through existing outlets such as home shopping or online commerce. Live commerce is the best platform for both online and offline companies to meet with customers frequently in a non-contact environment because of COVID-19. Accordingly, to produce and provide live commerce, the key focus must be on building customer trust by focusing on customer interactions, creating content to enhance customer experience, and securing professional sellers. Furthermore, recent fashion and beauty-related live commerce is providing content with a focus on customer appeal by hiring attractive-looking hosts and salespeople for streaming. However, the major consumer group of live commerce is the MZ generation, who value playful factors, and thus when developing and providing streaming content, the playfulness that can make them feel more fun and interested should be included rather than attractiveness. Therefore, for live commerce to grow further, it is necessary to provide content that highlights playfulness through customer interactions at the core so that it can continue to grow in the in-person environment as well as the contactless space.

This study was a consumer perception survey on livestreaming commerce, which has been growing in the “new normal” after COVID-19. The study findings are expected to serve as preliminary data for suggesting a method for the Korean fashion and beauty industries to expand and lead using livestreaming commerce. The study proposes livestreaming commerce as the best alternative to overcome the current economic recession caused by the shrinking global market consumption because of COVID-19, and it provides practical data, enhancing insight into consumers’ consumption patterns during livestreaming commerce. However, despite attempts to effectively analyze unstructured data in the study, a methodological limitation of the results exists because of the subjective interpretation of the researcher during the analysis process. Therefore, in future research, it is suggested that cross-validation be conducted by adding a quantitative method to the consumer perception survey based on the derived results, previous literature, and references.