Analyzing SME Digitalization Requirements Through a Technology Radar Framework in Southeast Lower Saxony

Abstract

1. Introduction

1.1. Motivation

1.2. Aims and Scope

- (1)

- What are the key digitalization needs and barriers faced by SMEs in the Southeast Lower Saxony region?

- (2)

- Which current technologies are most relevant to these SMEs, and how can they be categorized within a Technology Radar framework?

- (3)

- How can the Technology Radar be used by SMEs and regional stakeholders to effectively allocate technologies to organizational domains?

2. State of the Art

2.1. Digitalization

2.1.1. Definitions and Characteristics

2.1.2. Impact on the Automotive Industry

2.1.3. Digitalization Process

2.2. Key Technologies

- (1)

- broad applicability across industries,

- (2)

- strong, non-substitutable complementarity with other technologies, and

- (3)

- high performance enhancement potential, both for the technology itself and its applications.

2.3. Needs Assessment

2.4. Trend- and Technology-Radars

3. Methods I—Analysis of the Needs of SMEs

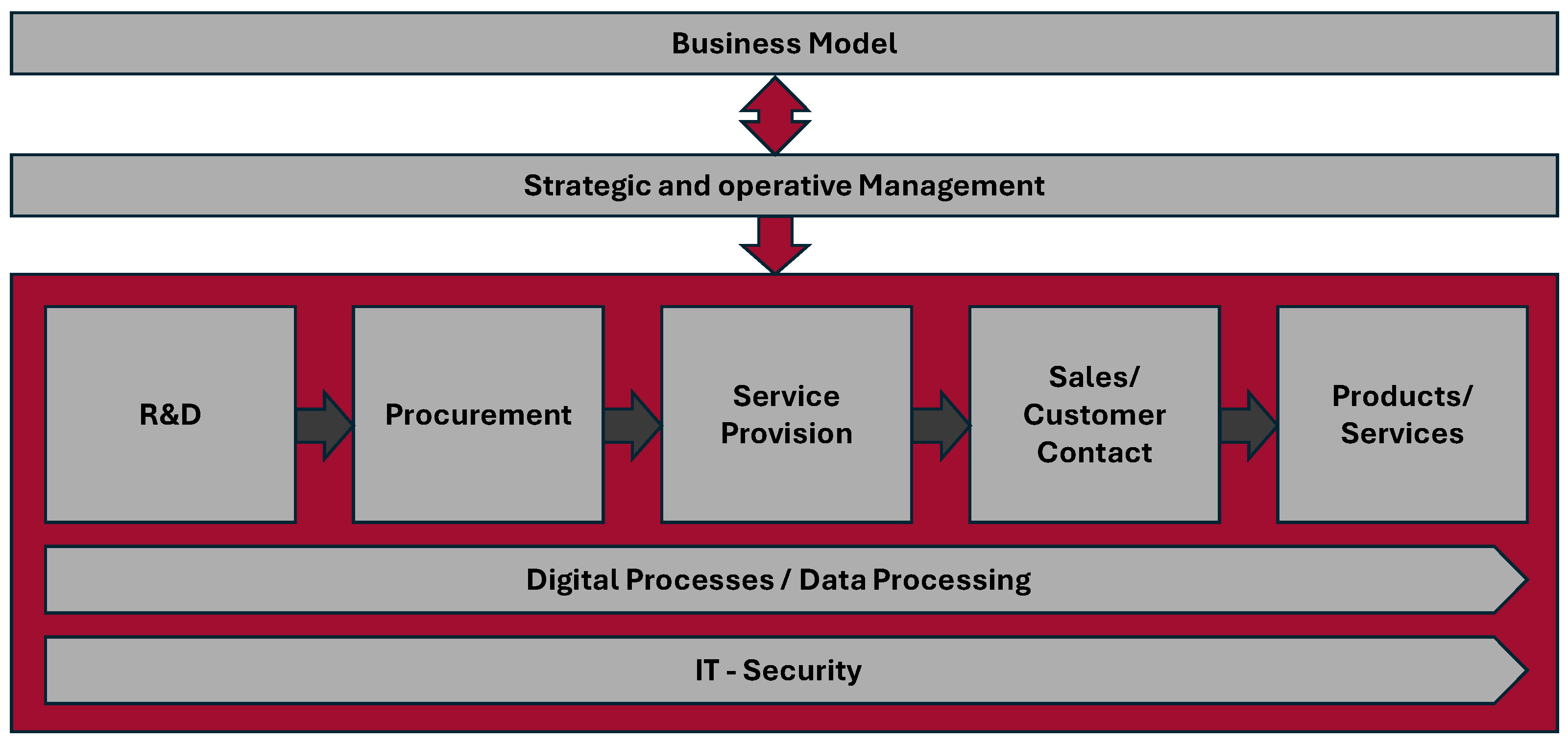

3.1. Categorization of the Central Needs of Digitalization

3.1.1. Business Model

- (1)

- Adding services to physical products using sensors and connectivity;

- (2)

- Enhancing machinery with digital monitoring for predictive maintenance;

- (3)

- Shifting from product sales to usage-based service models;

- (4)

- Implementing digital customer interfaces for sales and configuration; and

- (5)

- Enabling mass customization via smart manufacturing.

3.1.2. Strategic and Operative Management

3.1.3. Research and Development

3.1.4. Procurement and Service Provision

3.1.5. Sales and Customer Interaction

3.1.6. Products and Services

3.1.7. Digital Processes, Data Analysis, and IT-Security

3.2. Barriers and Challenges of Digitalization

3.2.1. Financial Challenges

3.2.2. Resource Limitations

3.2.3. Uncertainty and Internal Resistance

3.2.4. Technical Challenges

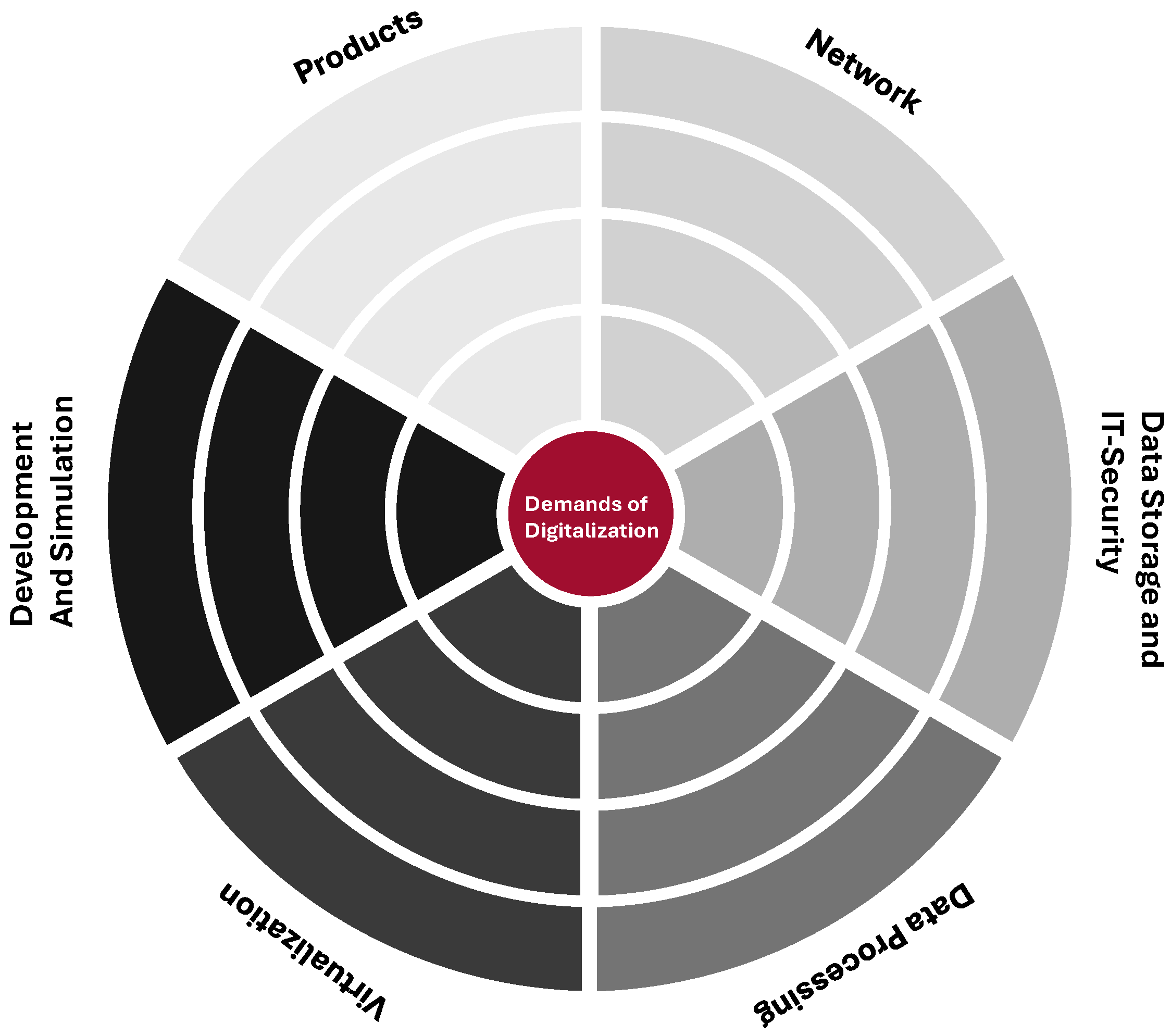

4. Methods II—Analysis of Technology Offerings

4.1. Networks

4.2. Data Storage and IT-Security

4.3. Data Processing

4.4. Virtualization

4.5. Development and Simulation

4.6. Products

5. Results—Technology Radar Concept Development

5.1. Structure and Applications

5.1.1. Setup and Functions of the “Needs–Technology Matrix”

5.1.2. Setup of the Technology Radar

5.1.3. Application Example

5.2. Recommendations for Companies and Institutions

6. Summary

7. Discussion

8. Conclusions

9. Outlook

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AR | Augmented Reality |

| DLT | Distributed Ledger Technology |

| HR | Human Resources |

| ICT | Information and Communication Technology |

| IoB | Internet of Behaviors |

| IoT | Internet of Things |

| IPFS | InterPlanetary File System |

| AI | Artificial Intelligence |

| SMEs | Small and Medium-Sized Enterprises |

| NLP | Natural Language Processing |

| OEM | Original Equipment Manufacturer (Automotive) |

| ReTraSON | Regional Transformation Network South-East Lower Saxony |

| RFID | Radio-Frequency Identification |

| SON | Southeast Lower Saxony |

| VR | Virtual Reality |

| IT | Information Technology |

| B2B | Business-to-Business |

| B2C | Business-to-Customer |

References

- Allianz für Die Region. Situations- und Chancen-Risiko-Analyse zur Regionalen Mobilitätswirtschaft im Rahmen Von ReTraSON. Available online: https://retrason.de/analyse/ (accessed on 22 April 2025).

- Marbler, M.; Ernst & Young GmbH. Digitalisierung im Deutschen Mittelstand: Befragungsergebnisse; EY: Stuttgart, Germany, 2022; Available online: https://www.slideshare.net/slideshow/ey-mittelstandsbarometer-deutschland-2018-digitalisierung/91184880#7 (accessed on 22 April 2025).

- Commerzbank. Management im Wandel. Digitaler, Effizienter, Flexibler! Available online: https://www.commerzbank.com/corporateclients/unternehmerperspektiven/initiative/?utm_source=chatgpt.com#overview-of-our-previous-surveys (accessed on 23 April 2025).

- DIHK. Mittelstand Fällt Zurück. Available online: https://www.munich-startup.de/6653/mittelstand-faellt-zurueck-der-dihk-innovationsreport/ (accessed on 23 April 2025).

- Schawel, C.; Billing, F. Top 100 Management Tools; Springer: Wiesbaden, Germany, 2018; ISBN 978-3-658-18916-7. [Google Scholar]

- Saleh, S.; Saleh, M. Internationales Management für Dienstleistungsbetriebe; Springer: Wiesbaden, Germany, 2020; ISBN 978-3-658-30813-1. [Google Scholar]

- Leidinger, B. Wertorientierte Instandhaltung; Springer: Wiesbaden, Germany, 2017; ISBN 978-3-658-17854-3. [Google Scholar]

- Becker, W.; Ulrich, P. BWL im Mittelstand; W. Kohlhammer GmbH: Stuttgart, Germany, 2015; ISBN 9783170286467. [Google Scholar]

- North, K.; Maier, R.; Haas, O. Knowledge Management in Digital Change; Springer International Publishing: Cham, Switzerland, 2018; ISBN 978-3-319-73545-0. [Google Scholar]

- Bertagnolli, F. Lean Management; Springer: Wiesbaden, Germany, 2022; ISBN 978-3-658-36086-3. [Google Scholar]

- Kallmuenzer, A.; Mikhaylov, A.; Chelaru, M.; Czakon, W. Adoption and performance outcome of digitalization in small and medium-sized enterprises. Rev. Manag. Sci. 2025, 19, 2011–2038. [Google Scholar] [CrossRef]

- Hafeez, S.; Shahzad, K.; Helo, P.; Mubarak, M.F. Knowledge management and SMEs’ digital transformation: A systematic literature review and future research agenda. J. Innov. Knowl. 2025, 10, 100728. [Google Scholar] [CrossRef]

- European Commission. Commission Recommendation of 6 May 2003: Concerning the Definition of Micro, Small and Medium-Sized Enterprises (2003/361/EC). Off. J. Eur. Union 2003, 46, 36–41. [Google Scholar]

- Strelow, M.; Wussmann, M. Digitalisierung in der Automobilindustrie. Available online: https://i-b-partner.com/wp-content/uploads/2016-09-06-Iskander-RZ-Whitepaper-Digitalisierung-in-der-Automobilindustrie-DIGITAL.pdf (accessed on 22 April 2025).

- Winkelhake, U. Die Digitale Transformation der Automobilindustrie; Springer: Berlin/Heidelberg, Germany, 2024; ISBN 978-3-662-68793-2. [Google Scholar]

- Schuh, G.; Graf, L.; Zeller, P.; Scholz, P.; Studerus, B. Eine Branche im Umbruch—Den Technologischen Wandel in der Automobilindustrie Gestalten; Deutsche Nationalbibliothek: Leipzig, Germany, 2019. [Google Scholar]

- Stehnken, T.; Aminova, E.; Klement, B.; Dornbusch, F.; Mittenzwei, M. Schlüsseltechnologien und Technologische Zukunftsfelder in Ostdeutschland. Available online: https://publica.fraunhofer.de/entities/publication/052d6b2a-ea56-4dee-875f-6da3caf1b7df (accessed on 22 April 2025).

- Expertenkommission Forschung und Innovation. Gutachten zu Forschung, Innovation und Technologischer Leistungsfähigkeit Deutschlands. 2022. Available online: https://www.e-fi.de/fileadmin/Assets/Gutachten/2022/EFI_Gutachten_2022.pdf (accessed on 23 April 2025).

- Stich, V.; Stroh, M.-F.; Abbas, M.; Frings, K.; Kremer, S. Digitalisierung der Wirtschaft in Deutschland. 2023. Available online: https://www.bmwk.de/Redaktion/DE/Publikationen/Digitalisierungsindex/publikation-download-Langfassung-digitalisierungsindex-2021.pdf?__blob=publicationFile&v=2 (accessed on 21 April 2025).

- Toepfer, G. Historisches Wörterbuch der Biologie; J.B. Metzler: Stuttgart, Germany, 2011; ISBN 978-3-476-02318-6. [Google Scholar]

- Krismajayanti, N.P.A.; Darma, G.S.; Mahyuni, L.P.; Martini, I.A.O. Drivers, Barriers and Key Success of Digital Transformation on SMEs: A Systematic Literature Review. J. Account. Strateg. Financ. 2024, 7, 158–180. [Google Scholar] [CrossRef]

- Alter, S. Work System Theory: Overview of Core Concepts, Extensions, and Challenges for the Future. J. Assoc. Inf. Syst. 2013, 14, 72–121. [Google Scholar] [CrossRef]

- Blechschmidt, J. Quick Guide Trendmanagement; Springer: Berlin/Heidelberg, Germany, 2024; ISBN 978-3-662-69194-6. [Google Scholar]

- Brecher, C.; Kozielski, S.; Schapp, L. Integrative Produktionstechnik für Hochlohnländer. In Wertschöpfung und Beschäftigung in Deutschland; Gausemeier, J., Wiendahl, H.-P., Eds.; Springer: Berlin/Heidelberg, Germany, 2011; pp. 47–70. ISBN 978-3-642-20203-2. [Google Scholar]

- Smolinski, R.; Gerdes, M.; Siejka, M.; Bodek, M.C. Innovationen und Innovationsmanagement in der Finanzbranche; Springer: Wiesbaden, Germany, 2017; ISBN 978-3-658-15647-3. [Google Scholar]

- Botzkowski, T. Digitale Transformation Von Geschäftsmodellen im Mittelstand; Springer: Wiesbaden, Germany, 2018; ISBN 978-3-658-20332-0. [Google Scholar]

- Appelfeller, W.; Feldmann, C. Die Digitale Transformation des Unternehmens; Springer: Berlin/Heidelberg, Germany, 2023; ISBN 978-3-662-65412-5. [Google Scholar]

- Fortmann, H.R. Digitalisierung im Mittelstand; Springer: Wiesbaden, Germany, 2020; ISBN 978-3-658-29290-4. [Google Scholar]

- Fend, L.; Hofmann, J. Digitalisierung in Industrie-, Handels- und Dienstleistungsunternehmen; Springer: Wiesbaden, Germany, 2024; ISBN 978-3-658-43440-3. [Google Scholar]

- Langmann, C. Digitalisierung im Controlling; Springer: Wiesbaden, Germany, 2019; ISBN 978-3-658-25016-4. [Google Scholar]

- Najderek, A. Auswirkungen der Digitalisierung im Rechnungswesen—Ein Überblick. In Innovationen für Eine Digitale Wirtschaft; Müller, A., Graumann, M., Weiß, H.-J., Eds.; Springer: Wiesbaden, Germany, 2020; pp. 127–145. ISBN 978-3-658-29026-9. [Google Scholar]

- Kitsios, V. Ihre Produktentwicklung Digitalisieren; Springer: Wiesbaden, Germany, 2021; ISBN 978-3-658-33861-9. [Google Scholar]

- Küstner, C. Assistenzsystem zur Unterstützung der Datengetriebenen Produktentwicklung; FAU University Press: Boca Raton, FL, USA, 2020. [Google Scholar]

- Müller, E.; Horler, S.; Götze, A. Digitalisierung Von Geschäftsprozessen: Umsetzungsstand und Aktuelle Bedarfe im Mittelstand. Ergebnisse der Bedarfsanalyse der Mittelstand 4.0-Agentur Prozesse; Technische Universität Chemnitz: Chemnitz, Germany, 2016. [Google Scholar]

- Bruhn, M.; Hadwich, K. Automatisierung und Personalisierung Von Dienstleistungen; Springer: Wiesbaden, Germany, 2020; ISBN 978-3-658-30165-1. [Google Scholar]

- Ternès, A.; Schieke, S. Mittelstand 4.0; Springer: Wiesbaden, Germany, 2018; ISBN 978-3-658-20916-2. [Google Scholar]

- Demary, V.; Engels, B.; Röhl, K.-H.; Rusche, C. Digitalisierung und Mittelstand: Eine Metastudie. Available online: https://www.econbiz.de/Record/digitalisierung-und-mittelstand-eine-metastudie-demary-vera/10011626453 (accessed on 23 April 2025).

- Koch, V.; Geissbauer, R.; Kuge, S.; Schrauf, S. Industrie 4.0: Chancen und Herausforderungen der Vierten Industriellen Revolution. Available online: https://www.pwc.ch/de/publications/2016/pwc_studie_industrie_d.pdf (accessed on 23 April 2025).

- Noerr LLP. Industrie 4.0—Rechtliche Herausforderungen der Digitaliserung. Available online: https://bdi.eu/media/presse/publikationen/information-und-telekommunikation/201511_Industrie-40_Rechtliche-Herausforderungen-der-Digitalisierung.pdf (accessed on 23 April 2025).

- Balas, V.E.; Solanki, V.K.; Kumar, R.; Khari, M. Internet of Things and Big Data Analytics for Smart Generation; Springer International Publishing: Cham, Switzerland, 2019; ISBN 978-3-030-04202-8. [Google Scholar]

- Pistorius, J. Industrie 4.0—Schlüsseltechnologien für Die Produktion; Springer: Berlin/Heidelberg, Germany, 2020; ISBN 978-3-662-61579-9. [Google Scholar]

- Zhou, L.; Zhang, L.; Fang, Y. Logistics service scheduling with manufacturing provider selection in cloud manufacturing. Robot. Comput.-Integr. Manuf. 2020, 65, 101914. [Google Scholar] [CrossRef]

- Luber, S. Was Ist Web 3.0? Available online: https://www.cloudcomputing-insider.de/was-ist-web-30-a-2cdee050bfe3f06da78acdf3ec082e7d/ (accessed on 11 June 2025).

- Schulz, P.; Wolf, A.; Fettweis, G.P.; Waswa, A.M.; Mohammad Soleymani, D.; Mitschele-Thiel, A.; Dudda, T.; Dod, M.; Rehme, M.; Voigt, J.; et al. Network Architectures for Demanding 5G Performance Requirements: Tailored Toward Specific Needs of Efficiency and Flexibility. IEEE Veh. Technol. Mag. 2019, 14, 33–43. [Google Scholar] [CrossRef]

- Goldacker, G. Digitale Souveränität; Kompetenzzentrum Öffentliche IT (ÖFIT): Berlin, Germany, 2017. [Google Scholar]

- Frauenhofer IEM. Technologie- und Trendradar: Entwicklungen für Ihr Unternehmen der Zukunft. Available online: https://mittelstand-digital-ruhr-owl.de/wp-content/uploads/Technologie-und-Trendradar_Nachhaltigkeit.pdf (accessed on 11 June 2025).

- Patsakis, C.; Casino, F. Hydras and IPFS: A Decentralised Playground for Malware. Int. J. Inf. Secur. 2019, 18, 787–799. [Google Scholar] [CrossRef]

- Dachs, B. Schlüsseltechnologien der Digitalisierung und Ihre Effekte Auf Die Außenwirtschaft. Available online: https://hdl.handle.net/10419/185695 (accessed on 11 June 2025).

- David Groombridge. Gartner Top 10 Strategic Technology Trends for 2023. Available online: https://www.gartner.com/en/articles/gartner-top-10-strategic-technology-trends-for-2023 (accessed on 11 June 2025).

- Brynjolfsson, E.; McAfee, A.; Henzler, H.A. The Second Machine Age: Wie Die Nächste Digitale Revolution Unser Aller Leben Verändern Wird; Plassen Verlag: Kulmbach, Germany, 2018; ISBN 3864705940. [Google Scholar]

- LucidChart. Das Potenzial der Echtzeit-Datenvisualisierung. Available online: https://www.lucidchart.com/blog/de/echtzeit-datenvisualisierung (accessed on 11 June 2025).

- Stefan Luber. Was Ist das Metaverse?: Definition Metaverse. Available online: https://www.security-insider.de/was-ist-das-metaverse-a-daf78495d1b3e9ffb7590fccfb2fb697/ (accessed on 11 June 2025).

- RedHat. Was Ist Virtualisierung? Available online: https://www.redhat.com/de/topics/virtualization/what-is-virtualization (accessed on 11 June 2025).

- Schneider, D. Methodik zur Entwicklung und Initiierung Von Digitalisierungsstrategien im Mittelstand. Ph.D. Thesis, Technische Universität Braunschweig, Braunschweig, Germany, 2023. [Google Scholar]

- Reisinger, G.; Komenda, T.; Hold, P.; Sihn, W. A Concept towards Automated Data-Driven Reconfiguration of Digital Assistance Systems. Procedia Manuf. 2018, 23, 99–104. [Google Scholar] [CrossRef]

- Kroll, H. Schlüsseltechnologien. Available online: https://www.econstor.eu/handle/10419/251361 (accessed on 11 June 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Krüger, B.; Stein, A.; Gründker, L.; Vietor, T. Analyzing SME Digitalization Requirements Through a Technology Radar Framework in Southeast Lower Saxony. Digital 2025, 5, 60. https://doi.org/10.3390/digital5040060

Krüger B, Stein A, Gründker L, Vietor T. Analyzing SME Digitalization Requirements Through a Technology Radar Framework in Southeast Lower Saxony. Digital. 2025; 5(4):60. https://doi.org/10.3390/digital5040060

Chicago/Turabian StyleKrüger, Björn, Armin Stein, Luis Gründker, and Thomas Vietor. 2025. "Analyzing SME Digitalization Requirements Through a Technology Radar Framework in Southeast Lower Saxony" Digital 5, no. 4: 60. https://doi.org/10.3390/digital5040060

APA StyleKrüger, B., Stein, A., Gründker, L., & Vietor, T. (2025). Analyzing SME Digitalization Requirements Through a Technology Radar Framework in Southeast Lower Saxony. Digital, 5(4), 60. https://doi.org/10.3390/digital5040060