Abstract

This study investigates the role of the China–Pakistan Economic Corridor (CPEC) in expediting energy transition in Pakistan, specifically during its second phase of development, i.e., CPEC 2.0. The study provides an overview of energy projects under CPEC, detailing the diverse sources contributing to the energy mix, highlighting China’s significant investments in green energy and its pivotal role in global renewable energy transition. A mixed-method approach is applied; the research integrates secondary data analysis with consultative discussions and key informant interviews. Findings underscore China’s pivot towards green investment, exemplified by significant commitments to clean energy infrastructure. The paper further analyzes challenges and opportunities for Pakistan under CPEC 2.0, emphasizing the imperative nature of regulatory consistency, debt restructuring, and the cultivation of public–private partnerships. Recommendations encompass policy coherence, debt management strategies, and collaboration among pertinent ministries to ensure sustainable and inclusive growth facilitated by CPEC.

1. Introduction

In the first phase of the China–Pakistan Economic Corridor (CPEC), approximately USD 34 billion was invested in the energy sector which incorporates projects such as coal, liquefied natural gas, hydropower, nuclear power, solar, and wind farms [1]. With an estimated USD 15 billion investment (8020 MW, One HVDC Transmission Line), 14 energy projects have been completed and 2 projects are under construction with an estimated USD 2.5 billion investment (1184 MW), and the remaining are in the planning stages [2]. In 2023, China’s green energy investments reached USD 7.9 billion, accounting for 28% of its energy engagement, with an additional USD 1.6 billion (6%) invested in hydropower. This marks the greenest year since the Belt and Road Initiative (BRI)’s 2013 inception [3]. Pakistan, with significant wind and solar potential, aims to boost its renewable energy share from under 5% to 30% by 2030, using Chinese expertise as outlined in its 2019 Alternative Renewable Energy Policy.

Energy Projects under CPEC

The projects under the CPEC aim to add a significant amount of electricity to the national grid, with a total capacity of 17,000 megawatts through various sources including coal, wind, solar, and hydropower. The CPEC coal-fired power plants have a total capacity of approximately 4320 MW with an estimated cost of USD 5.8 billion across different provinces in Pakistan, including Punjab, Sindh, and Baluchistan [2]. In 2024, Chinese companies developed a new 380 MW coal-fired power plant unit, and the previous government of Pakistan approved 300 MW of coal-fired power in Gwadar, to be constructed by China [2]. Also, some other projects are under consideration such as 1124 MW Kohala Hydropower Project, 700.7 MW Azad Pattan Hydropower Project, 50 MW Cacho Wind Power Project, and 50 MW Western Energy (Pvt.) Ltd. Wind Power Project [2].

However, as Pakistan transition towards the second phase, a larger focus has been made from a government-to-government (G2G) to business-to-business (B2B) model. The second phase is to bring more industrialization with a comparatively higher participation of the Chinese private sector. However, tapping that potential would require scoping of key areas and financing mechanisms that not only provide potential avenues for financing, but also address the ongoing challenges with Chinese investments in Pakistan.

2. Methodology and Data Collection

The study used a mixed-method approach to analyze the pathways for green energy transition under the CPEC in Pakistan. For secondary data analysis, an extensive desk review is conducted to understand the energy landscape in Pakistan, including baseline levels, sources of energy, ongoing projects, and the policy framework targeting energy transition. The desk review sources data from government reports, industry publications, and academic research.

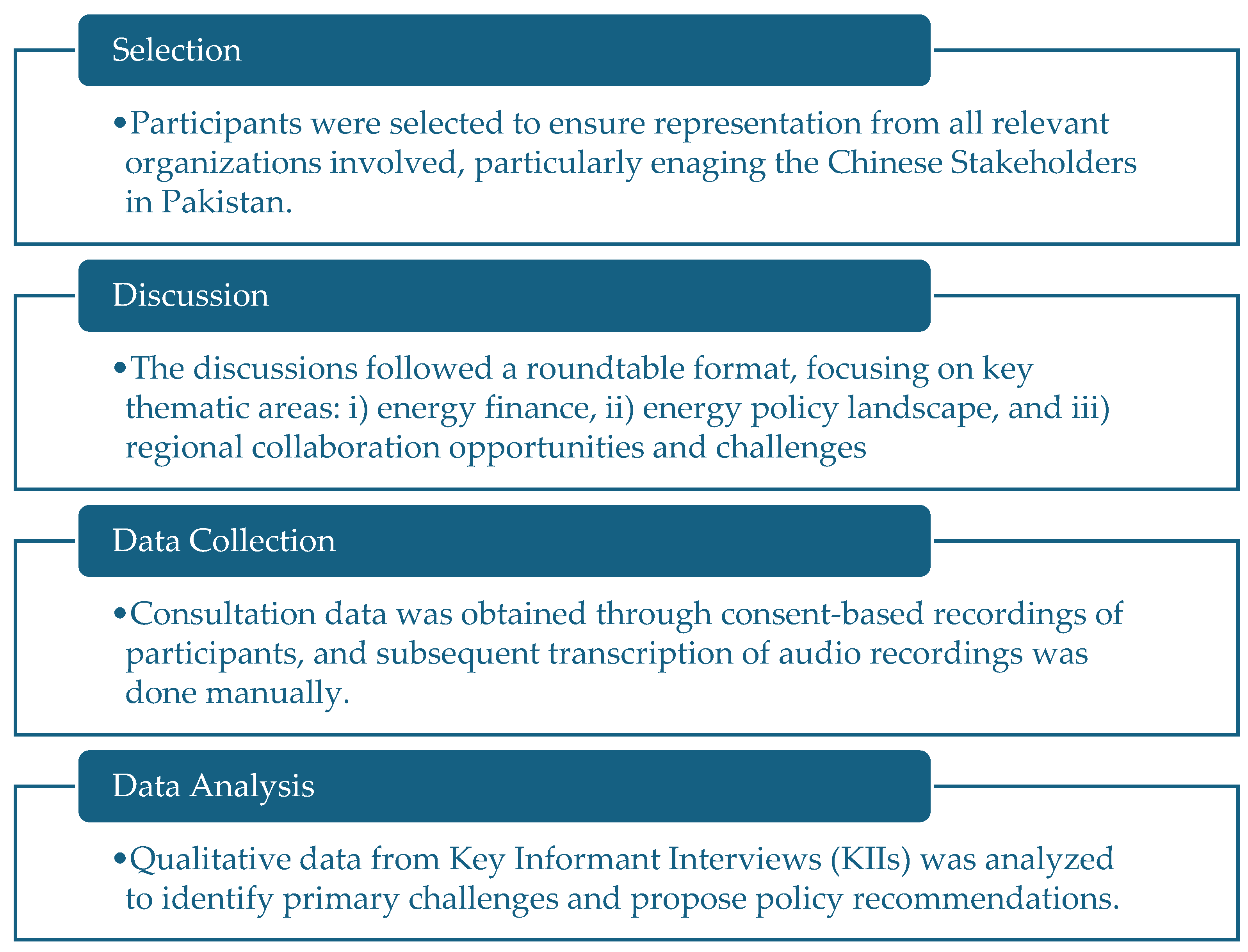

Additionally, the study incorporates insights and recommendations from consultative discussions and key informant interviews facilitated by the Sustainable Development Policy Institute (SDPI). The framework followed at these consultative discussions is explained (Figure 1). These discussions include public–private dialogues and expert consultations. All participants provided informed consent, and data confidentiality was ensured through anonymization. To mitigate potential biases, including selection bias and subjectivity in data interpretation, findings were cross-checked across multiple sources. The study included key informant interviews and pivotal public–private dialogues.

Figure 1.

Framework of the consultative discussions.

- Summit on “Green Financing Summit: Driving Energy Transition through alternate and Green Financing Mechanisms”

- Policy Dialogue on “Ten Years of BRI: Lessons Learnt & Charting a Way Forward for Green Development”

- Policy Dialogue on “Gwadar as an Energy Hub of Pakistan: Pathways for Sustainable Development”

- Policy Dialogue on “Transforming the Power Sector: Exploring the Prospects of China-Pakistan JETPs”

Based on an extensive consultative discussion with the relevant stakeholders—Chinese and Pakistani governments—and desk review, the following [Table 1] shows challenges and opportunities for expanding the renewable energy landscape in Pakistan. This analysis highlights critical investment needs, regulatory hurdles, and potential avenues for collaboration, particularly in the context of China’s green financing initiatives and Pakistan’s energy strategy under CPEC 2.0. The framework for these consultative discussions is explained in [Figure 1].

Table 1.

Overview of key challenges and opportunities in the transition to green energy in Pakistan based on key informant interviews (KIIs).

3. Key Findings and Discussion

3.1. China’s Shift to Green Investment

3.1.1. China’s Emergence as a Renewable Energy Leader

A successful global energy transition requires an estimated investment of USD 1 trillion in renewable energy infrastructure by 2020, to achieve net zero carbon emissions. An additional USD 3–6 trillion is needed to mitigate and reduce the impact of greenhouse gas emission across all sectors by 2050 [4]. A key enabler in this transition is China, leading the way in global energy transition and the development of low-carbon technology. It accounted for one-third of the global clean energy investment. USD 890 billion was contributed by China in developing the renewable energy infrastructure. This was the biggest driver of its economy in 2023, leading to 40% overall growth [5].

According to the International Energy Agency, China is set to invest approximately USD 675 billion in clean energy in 2024 [6]. An investment approaching the combined levels of the United States and Europe. These investments are in line with China’s objective of achieving carbon neutrality before 2026, as stated by Chinese President Xi Jinping at United Nations General Assembly in September 2020, and remarkable progress has been shown in developing additional renewable capacity. In 2023, China installed as many solar PV panels as the entire world did in 2022, and its wind power projects also increased by 66% compared to the previous year. Moreover, over the last five years, China has expanded its nuclear power capacity by 11 GW, surpassing any other country in the world [7].

In 2023, the “new three-(xin-sanyang)” industries, comprising solar cells, lithium batteries, and electric vehicles (EVs), experienced significant growth, with exports surging by 30% compared to the previous year. Forecasts suggest that in 2024, a significant portion of China’s investments will continue to focus on low-emission power technologies [7]. Moreover, China invested over USD 130 billion into the solar industry in the previous year and is estimated to dominate more than 80 percent of the world’s solar manufacturing capacity between 2023 and 2026 [8].

3.1.2. China’s Green Financing Market

This transition to a low-carbon economy is crucial for China’s sustainable development and economic growth. To accelerate this transition, the Chinese government, in its 14th Five-Year Plan, aims to augment renewable energy generation by approximately 50% by 2025, compared to 2020 figures [9]. This commitment is already evident: In 2022, renewable sources accounted for 32% of China’s total power output, marking a significant increase from 17% in 2008 [10].

During this transition, China’s green finance market will play a pivotal role in channeling and managing investments to support the green sectors. Anticipated economic progress in China is poised to involve an expansion of the green finance industry.

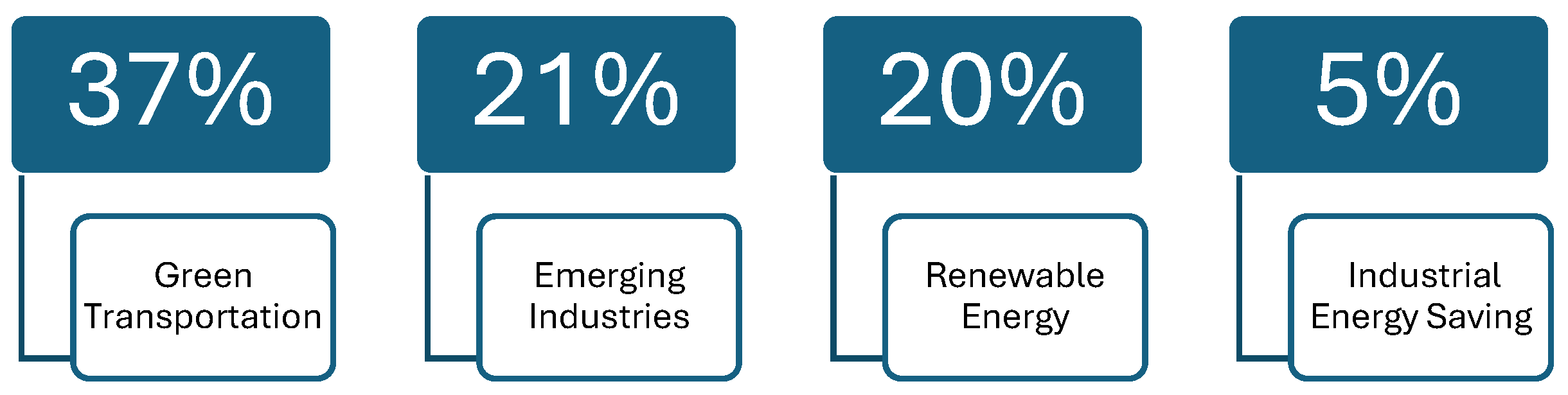

Figure 2 illustrates the major sectors that received the green financing as per the China Banking and Insurance Regulatory Commission (CBIRC). Since 2016, 59% of the green bonds issued have supported various sectors, including transportation, energy production, and energy efficiency. In contrast, 13% were allocated specifically for clean energy projects, while 11% focused on clean transportation initiatives [11]. As of now, China holds the position of the second largest green bond market in the world, trailing the United States. By 31 December 2021, China had 1643 green bonds, collectively valued at CNY 1727 billion [12].

Figure 2.

Top sectors for green credits according to CBIRC.

3.1.3. Capitalizing on China’s Green Financing: Opportunities and Challenges for Pakistan under CPEC 2.0

As CPEC 2.0 unfolds, it provides an opportune avenue for Pakistan to capitalize on the green financing available from China to support its energy transition. While CPEC projects have played a pivotal role in addressing Pakistan’s energy crisis, coal currently constitutes 80.3% of the electricity generation capacity under CPEC; this reliance has been deemed necessary for achieving energy security. Simultaneously, there is a concerted effort to diversify energy sources, with more than 50% of new projects focusing on renewable and hydropower. This aligns with China’s Green Investment and Finance Partnership (GIFP), announced at the 3rd Belt and Road Forum. President Xi pledged USD 100 billion annually for financing clean energy transition amongst the BRI-participating countries [13].

Pakistan’s energy transition requires USD 115.7 billion, out of which USD 15.12 and USD 20.5 billion are required for solar and wind projects, respectively [14]. This financing gap can be fulfilled by investment from the Chinese private sector, under the ambit of CPEC 2.0. The first phase was more focused towards government-to-government (G2G) collaborations, while the second phase of CPEC is based on the business-to-business (B2B) framework.

However, due to some factors, Chinese investment in Pakistan’s renewable sector has been hampered. The accumulating debt to Chinese IPPs, which has soared to PKR 493 billion in 2024, obstructs the progress and development of renewable energy projects [15]. Sinosure, the Chinese credit insurer, requires prior payments for existing plants before new projects commence. Uncertainty in foreign exchange availability disrupts financial planning and budgeting in the power sector. Port Qasim Electric Power (Pvt.) Co faced shutdown threats due to government defaults and coal shipment halts, impacting investor attractiveness. Curtailment issues in Pakistan’s wind power sector disrupt investor stability. Moreover, challenges like insufficient transmission networks, policy gaps, and technical issues impede wind power’s growth.

Furthermore, mobilizing finance for Chinese investors in Pakistan presents various challenges, including limited local investment opportunities, hindering collaboration and diversification of investment portfolios. Scarce viable local partners restrict long-term investment initiatives, increasing reliance on external resources. Difficulties in managing foreign exchange transactions in Pakistan pose hurdles, with regulatory restrictions and bureaucratic procedures impeding efficient capital movement. Stringent taxation policies, characterized by complex regulations and high tax rates, add financial burdens and operational uncertainties, undermining investor confidence.

Frequent changes in power policies from federal and provincial governments diminish investor confidence by creating uncertainty in the regulatory environment. Government policy lacks clarity, particularly in identifying key decision-makers, leading to confusion and project approval delays. The complex process for renewable energy project approval, coupled with unclear laws and policies, adds uncertainty to investments. Lack of investigation and understanding of Chinese investors’ backgrounds and expertise hinders Pakistan’s ability to attract mutually beneficial investment partnerships.

3.1.4. The Way Forward

Pakistan needs to adopt several steps to accelerate the investment in RE and to instill confidence among Chinese investors. The most paramount step is to ensure regulatory and policy consistency. The Ministry of Energy (Power Division) should lead the development of a comprehensive plan for RE development. This should encompass regulatory frameworks and fiscal measures, with active involvement from provincial authorities. Consistency in renewable energy targets across policies such as the Alternate and Renewable Energy Policy 2019, Indicative Generation Capacity Expansion Plan (IGCEP), and Nationally Determined Contributions (NDCs) is crucial, ensuring alignment with a unified regulatory framework.

Additionally, restructuring CPEC debt into investments in Special Economic Zones (SEZs) and facilitating debt swaps for green energy are supported by the Ministry of Planning Development & Special Initiatives (MoPD&SI), Ministry of Commerce, People’s Republic of China, and National Development and Reform Commission China (NDRC). This would address the rising debt issues. Open communication channels between government bodies and project developers must be established to ensure consensus on critical topics such as financial situations of distribution companies (DISCOs), renewable energy project priorities, payment guarantees, and penalties for delays.

Moreover, a clear and concise long-term policy framework is essential to provide stability and certainty for investors. This would minimize uncertainties and enhance market confidence. Establishing public–private partnerships for renewable energy parks, promoting trade policies supporting RE technology imports, and ensuring communication channels for clarity and consistency are vital steps. Collaborative efforts between relevant ministries, including the Ministry of Energy, Ministry of Planning Development & Special Initiatives, and NDRC, are necessary to ensure sustainable and inclusive growth driven by CPEC.

Author Contributions

Conceptualization, Z.U. and S.S.; methodology, Z.U.; formal analysis, Z.U.; data curation, M.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created.

Acknowledgments

The authors would like to acknowledge the support received from the Pakistan–China Institute (PCI), China Chambers of Commerce in Pakistan (CCCPK), China Study Centers (CSC) in Pakistan, Yixian Sun from the University of Bath and Christoph NEDOPIL WANG from Fudan University in Shanghai, China. Also, we really appreciate the valuable input from Khalid Waleed, Ubaid Ur Rehman Zia, and Zainab Babar.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Lakhani, S. The China-Pakistan Economic Corridor: Regional effects and Recommendations for Sustainable Development and Trade. Digital Commons @ DU. Available online: https://digitalcommons.du.edu/djilp/vol45/iss4/3/ (accessed on 27 September 2024).

- Ministry of Planning, Development & Special Initiatives. Energy Projects under CPEC|China-Pakistan Economic Corridor (CPEC) Secretariat Official Website. Available online: https://cpec.gov.pk/energy (accessed on 27 September 2024).

- Wang, C.N. China Belt and Road Initiative (BRI) Investment Report 2023—Green Finance & Development Center. 5 February 2024. Available online: https://greenfdc.org/china-belt-and-road-initiative-bri-investment-report-2023/ (accessed on 27 September 2024).

- The Green Technology Innovation Pipeline: Lessons from China. World Economic Forum, 10 May 2024. Available online: https://www.weforum.org/agenda/2024/05/china-financing-green-transition/#:~:text=By%202050%2C%20China%20needs%20roughly,related%20and%20digital%20economy%20support (accessed on 27 September 2024).

- Saxena, V. China’s Clean Energy Spending Set to Match US-Europe Combined. Asia Financial, 6 June 2024. Available online: https://www.asiafinancial.com/chinas-clean-energy-spending-set-to-match-us-europe-combined (accessed on 27 September 2024).

- Investment in Clean Energy This Year Is Set to be Twice the Amount Going to Fossil Fuels—News—IEA. IEA, 6 June 2024. Available online: https://www.iea.org/news/investment-in-clean-energy-this-year-is-set-to-be-twice-the-amount-going-to-fossil-fuels (accessed on 27 September 2024).

- China—World Energy Investment 2024—Analysis—IEA. IEA. Available online: https://www.iea.org/reports/world-energy-investment-2024/china (accessed on 27 September 2024).

- Mackenzie, W. China to Hold over 80% of Global Solar Manufacturing Capacity from 2023-26. Wood Mackenzie, 7 November 2023. Available online: https://www.woodmac.com/press-releases/china-dominance-on-global-solar-supply-chain/ (accessed on 27 September 2024).

- Feng, Z. China’s 14th Five-Year Plans on Renewable Energy Development and Modern Energy System. Available online: https://www.efchina.org/Blog-en/blog-20220905-en#:~:text=The%20plan%20targets%20a%2050,China’s%20incremental%20electricity%20and%20energy (accessed on 27 September 2024).

- Stephan. 2022 Energy Statistics Show Rapid Development of Renewable Energy in China—Sino-German Cooperation on. Sino-German Cooperation on Climate Change, Environment, and Natural Resources, 13 April 2023. Available online: https://climatecooperation.cn/climate/2022-energy-data-released/ (accessed on 27 September 2024).

- Briefing, C. China’s Green Finance Market: Policy Support & Investment Opportunities. China Briefing News, 20 October 2022. Available online: https://www.china-briefing.com/news/chinas-green-finance-market-policies-incentives-investment-opportunities/ (accessed on 27 September 2024).

- China’s Green-Bond Market: Growing Issuance and Historical Outperformance. MSCI. Available online: https://www.msci.com/www/blog-posts/china-s-green-bond-market/03029315810 (accessed on 27 September 2024).

- Jamal, N. Seeking Fresh Growth under BRI. DAWN.COM, 23 October 2023. Available online: https://www.dawn.com/news/1782976 (accessed on 27 September 2024).

- Abid, Z.; Rehman Zia, U.U. Unlocking Private Finance to Achieve Nationally Determined Contributions (NDCs) in Pakistan; Sustainable Development Policy Institute: Islamabad, Pakistan, 2024. [Google Scholar]

- Rana, S. Dues to Chinese IPPs Hit Record 1 8b. The Express Tribune, 24 February 2024. Available online: https://tribune.com.pk/story/2457399/dues-to-chinese-ipps-hit-record-18b (accessed on 27 September 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).