Improved Output Gap Estimates and Forecasts Using a Local Linear Regression †

Abstract

1. Introduction

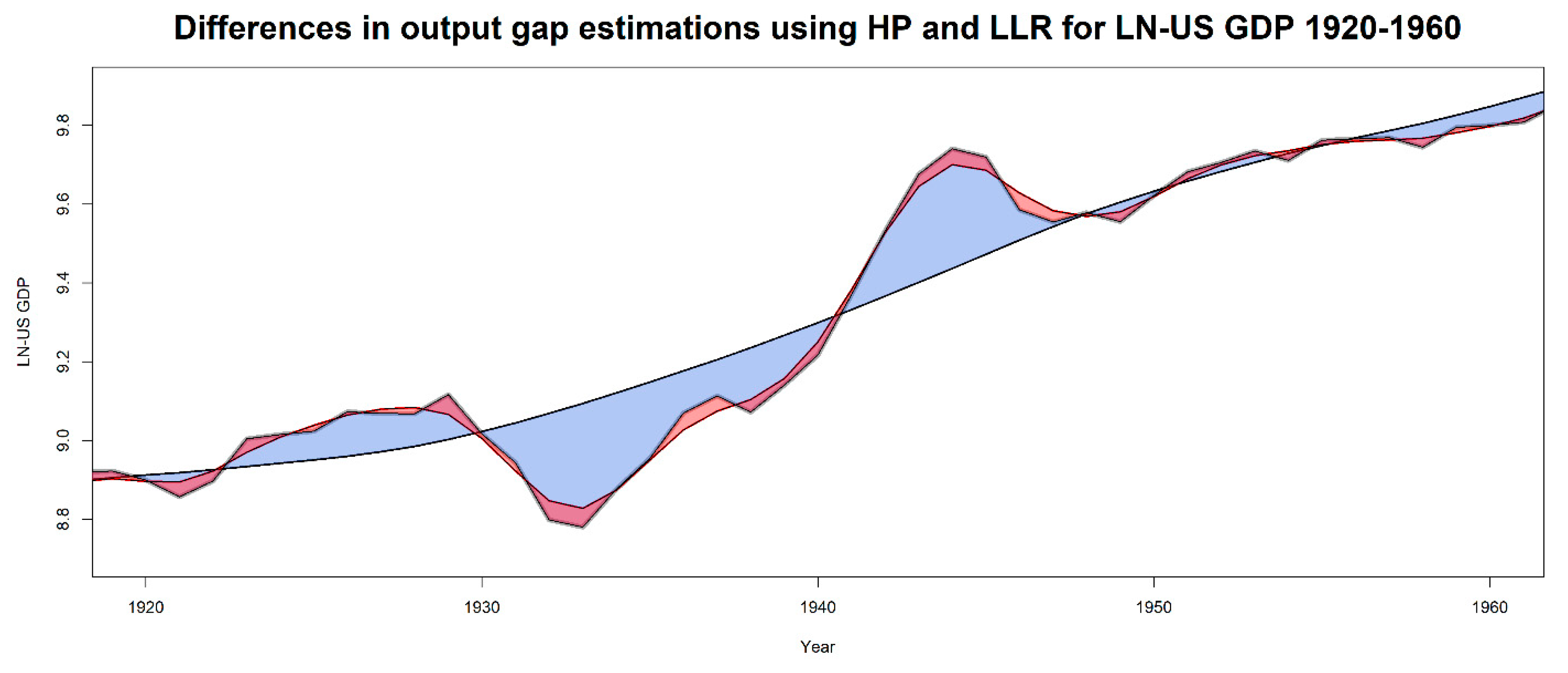

2. Local Linear Regression

3. Output Gap Estimation Using the LLR

4. Models for the Output Gap Component

4.1. Semi-SETAR Model

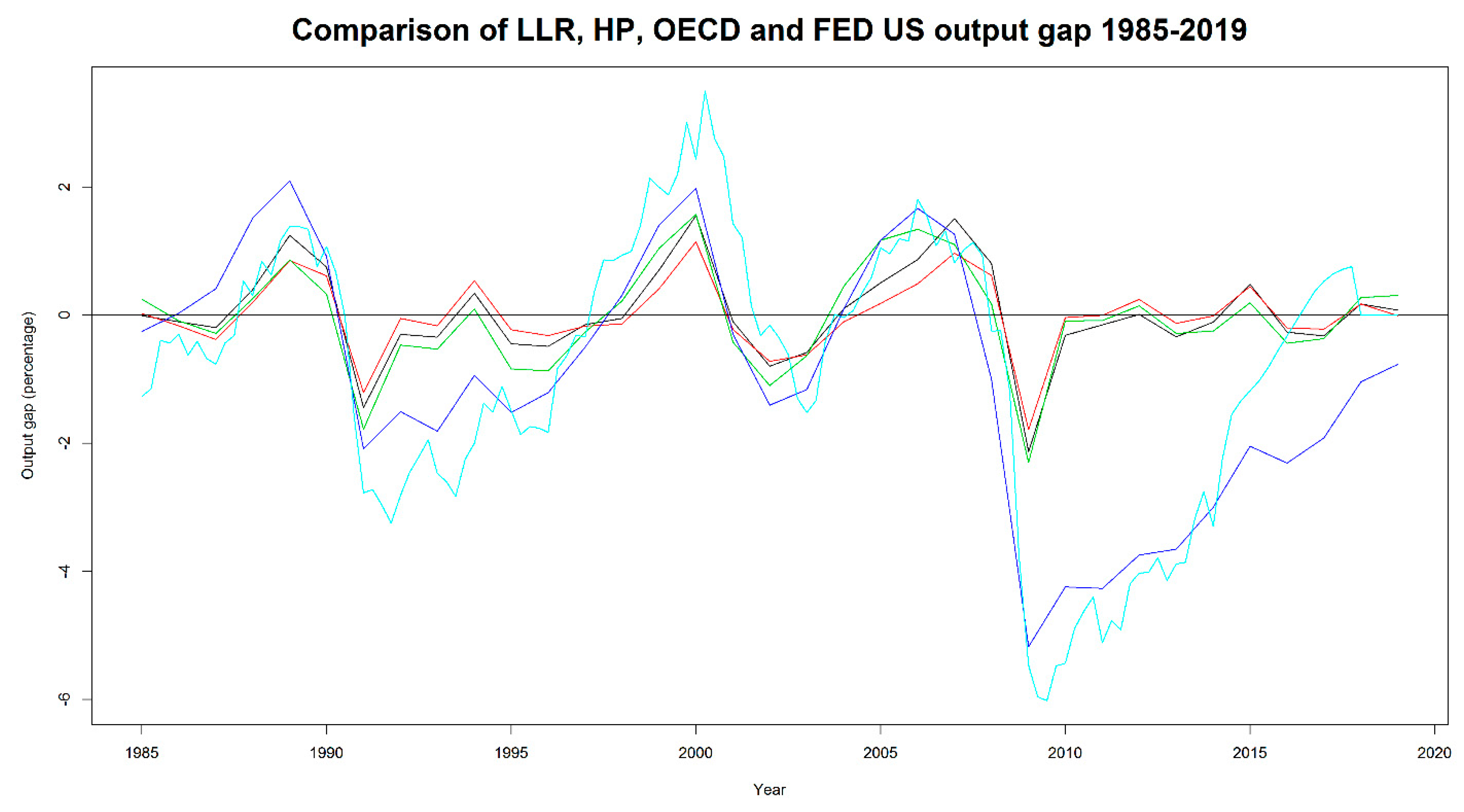

4.2. The OECD Approach and the Multivariate LLR

4.3. Comparison of Univariate EC and Multivariate OECD Approach

5. Forecasting and Evaluating Output Gaps

5.1. Output Gap Forecasting Using the Semi-SETAR Model

5.2. Predictive Power of the LLR Output Gap for Output Growth

6. Policy Implications and Conclusions

Supplementary Materials

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

- Federal Reserve Bank of Philadelphia. Quarterly Real GDP Vintages; Historical Data Files for the Real-Time Data Set by D. Croushore and T. Stark. 2019Available online: https://www.philadelphiafed.org/research-and-data/real-time-center/real-time-data/data-files/routput (accessed on 29 May 2019).

- Federal Reserve Bank of Philadelphia. Greenbook Output Gap DH Web FED. 2021. Available online: https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/gap-and-financial-data-set (accessed on 20 January 2021).

- US Bureau of Economic Analysis. Real Gross Domestic Product; 2019. Accessed from FRED, Federal Reserve Bank of St. Louis. Available online: https://research.stlouisfed.org/fred2/series/GDPC1 (accessed on 24 April 2019).

- Johnston, L.; Williamson, S.H. “What Was the U.S. GDP Then?”. Measuring Worth 2019. Available online: http://www.measuringworth.org/usgdp/ (accessed on 15 June 2019).

Acknowledgments

Conflicts of Interest

References

- Orphanides, A.; van Norden, S. The Unreliability of Output-Gap Estimates in Real Time. Rev. Econ. Stat. 2002, 84, 569–583. [Google Scholar] [CrossRef]

- Marcellino, M.; Musso, A. The Reliability of Real Time Estimates of the Euro Area Output Gap. Econ. Model. 2010, 28, 1842–1856. [Google Scholar] [CrossRef]

- Coibion, O.; Gorodnichenko, Y.; Ulate, M. The Cyclical Sensitivity in Estimates of Potential Output; National Bureau of Economic Research Working Paper No. w23580; National Bureau of Economic: Cambridge, MA, USA, 2017. [Google Scholar]

- Nelson, E.; Nikolov, K. UK Inflation in the 1970s and 1980s: The Role of Output Gap Mismeasurement. J. Econ. Bus. 2003, 55, 353–370. [Google Scholar] [CrossRef]

- Grigoli, F.; Herman, A.; Swiston, A.; Di Bella, G. Output Gap Uncertainty and Real-Time Monetary Policy. Russ. J. Econ. 2015, 1, 329–358. [Google Scholar] [CrossRef]

- Álvarez, L.J.; Gómez-Loscos, A. A Menu on Output Gap Estimation Methods. J. Policy Model. 2018, 40, 827–850. [Google Scholar] [CrossRef]

- Baxter, M.; King, R.G. Measuring Business Cycles: Approximate Band-Pass Filters for Economic Time Series. Rev. Econ. Stat. 1999, 81, 573–593. [Google Scholar] [CrossRef]

- Beveridge, S.; Nelson, C.R. A New Approach to Decomposition of Economic Time Series into Permanent and Transitory Components with Particular Attention to Measurement of the Business Cycle. J. Monet. Econ. 1981, 7, 151–174. [Google Scholar] [CrossRef]

- Kamber, G.; Morley, M.; Wong, B. Intuitive and Reliable Estimates of the Output Gap from a Beveridge-Nelson Filter. Rev. Econ. Stat. 2018, 100, 550–566. [Google Scholar] [CrossRef]

- Hodrick, R.J.; Prescott, E.C. Postwar U.S. Business Cycles: An Empirical Investigation. J. Money Credit Bank. 1997, 29, 1–16. [Google Scholar] [CrossRef]

- De Brouwer, G. Estimating Output Gaps; Research Discussion Paper 9809; Reserve Bank of Australia: Sydney, Australia, 1998. [Google Scholar]

- Hamilton, J.D. Why You Should Never Use the Hodrick-Prescott Filter. Rev. Econ. Stat. 2018, 100, 831–843. [Google Scholar] [CrossRef]

- Edge, R.M.; Rudd, J.B. Real-Time Properties of the Federal Reserve’s Output Gap. Rev. Econ. Stat. 2016, 98, 785–791. [Google Scholar] [CrossRef]

- Fritz, M.; Gries, T.; Feng, Y. Growth Trends and Systematic Patterns of Booms and Busts—Testing 200 Years of Business Cycle Dynamics. Oxf. Bull. Econ. Stat. 2019, 81, 62–78. [Google Scholar] [CrossRef]

- Feng, Y.; Gries, T.; Fritz, M. Data-driven local polynomial for the trend and its derivatives in economic time series. J. Nonparametric Stat. 2020, 32, 1–24. [Google Scholar] [CrossRef]

- Watson, M.W. How Accurate Are Real-Time Estimates of Output Trends and Gaps? Econ. Q. 2007, 93, 143–161. [Google Scholar]

- Fritz, M.; Gries, T.; Feng, Y. Secular Stagnation? Is there Statistical Evidence of an Unprecedented, Systematic Decline in Growth? Econ. Lett. 2019, 181, 47–50. [Google Scholar] [CrossRef]

- Johnston, L.; Williamson, S.H. “What Was the U.S. GDP Then?”. Measuring Worth. 2019. Available online: http://www.measuringworth.org/usgdp/ (accessed on 15 June 2019).

- Quast, J.; Wolters, M.H. Reliable Real-Time Output Gap Estimates Based on a Modified Hamilton Filter. J. Bus. Econ. Stat. 2020, 1–17. [Google Scholar] [CrossRef]

- McCallum, B.T. Alternative Monetary Policy Rules: A Comparison with Historical Settings for the United States, the United Kingdom, and Japan; National Bureau of Economic Research Working Paper No. w7725; National Bureau of Economic: Cambridge, MA, USA, 2000. [Google Scholar]

- Pollock, D.S.G. Trend Estimation and De-Trending via Rational Square-Wave Filters. J. Econom. 2000, 99, 317–334. [Google Scholar] [CrossRef]

- Tong, H. Threshold Models in Nonlinear Time Series Analysisl; Time Series Analysis; Springer: Berlin, Germany, 1983. [Google Scholar]

- Grabowski, D.; Staszewska-Bystrova, A.; Winker, P. Generating Prediction Bands for Path Forecasts from SETAR Models. Stud. Nonlinear Dyn. Econom. 2017, 21, 1–18. [Google Scholar] [CrossRef]

- Chalaux, T.; Guillemette, Y. The OECD Potential Output Estimation Methodology; OECD Economics Department Working Papers No. 1563; OECD Publishing: Paris, France, 2019. [Google Scholar] [CrossRef]

- Blanchard, O.; Lorenzoni, G.; L’Huillier, J.P. Short-Run Effects of Lower Productivity Growth. A Twist on the Secular Stagnation Hypothesis. J. Policy Model. 2017, 39, 639–649. [Google Scholar] [CrossRef][Green Version]

- Nelson, C.R. The Beveridge-Nelson Decomposition in Retrospect and Prospect. J. Econom. 2008, 146, 202–206. [Google Scholar] [CrossRef]

| Output Gap | FED | OECD |

|---|---|---|

| LLR | 0.6488 | 0.7071 |

| HP | 0.5071 | 0.5678 |

| Horizon | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|

| LLR/HP | 0.9999 | 1.0031 | 1.0074 | 1.0058 | 0.9958 | 0.9842 | 0.9717 | 0.9612 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fritz, M. Improved Output Gap Estimates and Forecasts Using a Local Linear Regression. Eng. Proc. 2021, 5, 32. https://doi.org/10.3390/engproc2021005032

Fritz M. Improved Output Gap Estimates and Forecasts Using a Local Linear Regression. Engineering Proceedings. 2021; 5(1):32. https://doi.org/10.3390/engproc2021005032

Chicago/Turabian StyleFritz, Marlon. 2021. "Improved Output Gap Estimates and Forecasts Using a Local Linear Regression" Engineering Proceedings 5, no. 1: 32. https://doi.org/10.3390/engproc2021005032

APA StyleFritz, M. (2021). Improved Output Gap Estimates and Forecasts Using a Local Linear Regression. Engineering Proceedings, 5(1), 32. https://doi.org/10.3390/engproc2021005032