Forecasting Agricultural Area Using Nerlovian Model in Côte d’Ivoire †

Abstract

:1. Introduction

2. Materials and Methods

2.1. Specification of the Nerlove Model of the Cultivated Area

2.2. Estimation of the Cultivated Area Model

- (a)

- Estimation of the β parameter

- (b)

- Ordinary least squares method (OLS)

- (c)

- Maximum likelihood method

2.3. Data

3. Results and Discussions

3.1. Estimation of the Elasticity Coefficient

- For the cashew nuts: we remark that the elasticities , and of the minimum, third quartile and maximum prices, respectively, were moderately sensitive to the prices actually practiced. On the other hand, the elasticities and , respectively, of the first quartile and median prices were highly sensitive to the price practiced.

- In the case of cacao, we also noted a low sensitivity of the stock market price in relation to the field price of cocoa.

3.2. Estimation of the Nerlove Model Parameters of the Cultivated Area

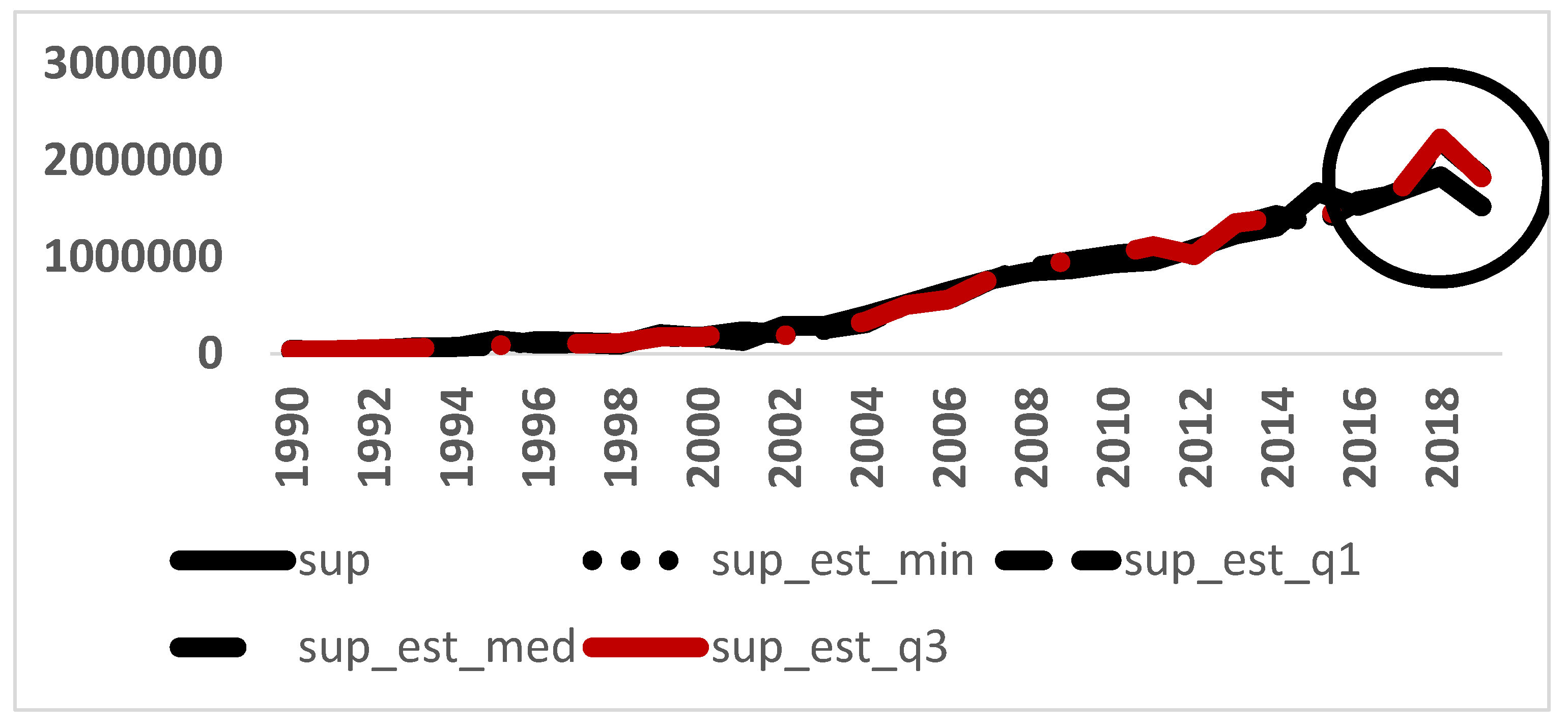

3.3. Forecast of Cashew Area

3.4. Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- ICCO. Quarterly Bulletin of Cocoa Statistics; Cocoa Year 2013/2014; ICCO: London, UK, 2014. [Google Scholar]

- ICCO. Quarterly Bulletin of Cocoa Statistics; Cocoa Year 2017/18; ICCO: London, UK, 2008. [Google Scholar]

- PND 2016–2020, Groupe Consultatif, Plan National De Developpement, Côte d’Ivoire. Available online: http://www.caidp.ci/uploads/506b0bce6be504b64d5359c6407cd7df.pdf (accessed on 1 January 2016).

- Nerlove, M. Estimates of the Elasticities of Supply of Selected of Agricultural Commodities. J. Farm Econ. 1956, 38, 496–509. [Google Scholar]

- Nerlove, M. The Dynamics of Supply: Estimation of Farmers Response to Price; John Hopkins University Press: Baltimore, MD, USA, 1958. [Google Scholar]

- Cagan, P. The Monetary Dynamics of Hyperinflation. In Studies in the Quantity Theory of Money; Friedman, M., Ed.; University of Chicago Press: Chicago, IL, USA, 1956; pp. 25–117. [Google Scholar]

- Koyck, L.M. Distributed Lags and Investment Analysis; North-Holland Publishing Company: Amsterdam, The Netherlands, 1954. [Google Scholar]

- Gujarati, D.N. Basic Econometrics, 4th ed.; McGraw-Hill Companies: Singapore, 2004. [Google Scholar]

- Askari, H.; John, T. Cumming, Agricultural Supply Response: A Survey of the Econometric Evidence; Praeger Publishers: Westport, CT, USA, 1977. [Google Scholar]

| Variables | Anticipation Elasticity | Estimated Values |

|---|---|---|

| Cacao | 0.012 | |

| Cashew nuts | 0.37 | |

| 0.71 | ||

| 0.65 | ||

| 0.31 | ||

| 0.23 |

| Models | Anticipation Elasticity | p Value DW | ||||||

|---|---|---|---|---|---|---|---|---|

| 1 | 1.716 ** | 0.694 *** | −0.00114 * | 0.268 ** | −0.0027 | 0.9665 | 0.8602 | |

| 2 | 2.092 ** | 0.514 *** | −0.00112 | 0.459 ** | −0.0016 | 0.9647 | 0.8018 | |

| 3 | 1.992 ** | 0.545 *** | −0.00113. | 0.427 ** | −0.00173 | 0.9649 | 0.8143 | |

| 4 | 1.696 ** | 0.7469 *** | −0.00112 * | 0.209 ** | −0.0031 | 0.9668 | 0.8543 | |

| 5 | −1.752 × 106 ** | 1.708 × 105 *** | 4.546 × 10 | 2.046 × 100 *** | −1.381 × 103 | 0.9221 | 0.01856 |

| Model | Elasticity | ||||

|---|---|---|---|---|---|

| 6 | 0.375 | 0.010 | 0.002 | −0.001 |

| Model | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| 0.02841696 | 0.02842018 | 0.02841973 | 0.02841385 |

| Model | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| 0.0109437 | 0.01070902 | 0.01072822 | 0.01119934 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Okou, G.C.; Keita, K.; N’Dri, Y.A.; Kouakou, A.K. Forecasting Agricultural Area Using Nerlovian Model in Côte d’Ivoire. Eng. Proc. 2023, 39, 35. https://doi.org/10.3390/engproc2023039035

Okou GC, Keita K, N’Dri YA, Kouakou AK. Forecasting Agricultural Area Using Nerlovian Model in Côte d’Ivoire. Engineering Proceedings. 2023; 39(1):35. https://doi.org/10.3390/engproc2023039035

Chicago/Turabian StyleOkou, Gueï Cyrille, Kolé Keita, Yao Aubin N’Dri, and Auguste K. Kouakou. 2023. "Forecasting Agricultural Area Using Nerlovian Model in Côte d’Ivoire" Engineering Proceedings 39, no. 1: 35. https://doi.org/10.3390/engproc2023039035

APA StyleOkou, G. C., Keita, K., N’Dri, Y. A., & Kouakou, A. K. (2023). Forecasting Agricultural Area Using Nerlovian Model in Côte d’Ivoire. Engineering Proceedings, 39(1), 35. https://doi.org/10.3390/engproc2023039035