Green Hydrogen as a Decarbonization Pathway for Steel Industry in Pakistan †

Abstract

1. Introduction

1.1. Significance of Green Hydrogen (GH2) for Decarbonization of Steel Industry

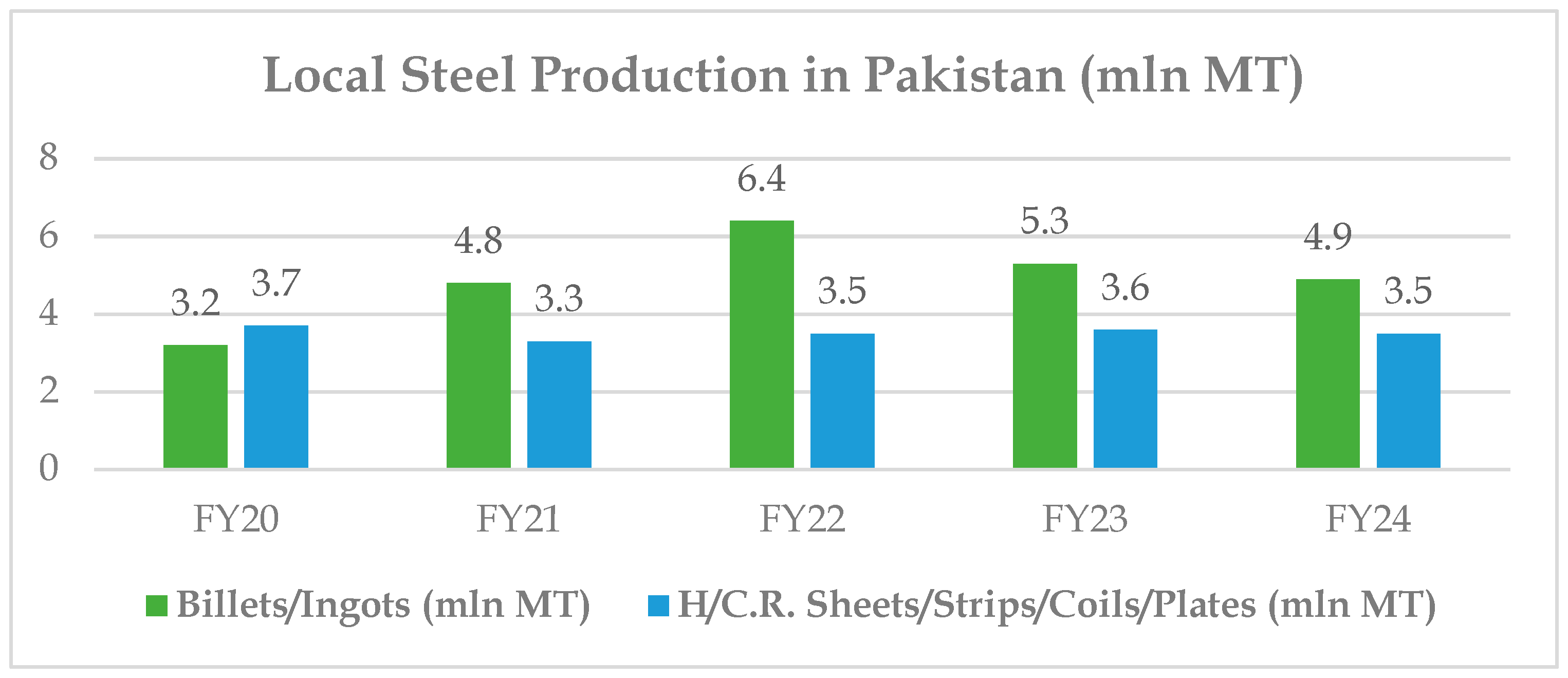

1.2. Status Quo of Decarbonization in Steel Industry of Pakistan

2. Methodology

3. Results and Discussion

3.1. Phenomenon of Wind Curtailment in Pakistan

3.2. Proposed Avenues/Models for GH2 Production from Curtailed RE

3.3. Opportunities

3.4. Challenges

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- BusinessWire. Steel Global Industry Business Report 2025: Trade Policies, Geopolitical Factors, and Cost of Raw Materials Significantly Impacting Prices—Global Forecast to 2030. BusWire 2025. Available online: https://www.businesswire.com/news/home/20250212852496/en/Steel-Global-Industry-Business-Report-2025-Trade-Policies-Geopolitical-Factors-and-Cost-of-Raw-Materials-Significantly-Impacting-Prices---Global-Forecast-to-2030---ResearchAndMarkets.com (accessed on 23 June 2025).

- Precedence Research. Iron and Steel Market Size, Share, and Trends 2025 to 2034. Precedence Research 2025. Available online: https://www.precedenceresearch.com/iron-and-steel-market#:~:text=The%20Asia%20Pacific%20market%20size,2024%20as%20the%20base%20year (accessed on 15 May 2025).

- World Steel Association. Sustainability Indicators Report. World Steel Association 2024. Available online: https://worldsteel.org/wider-sustainability/sustainability-indicators/ (accessed on 20 June 2025).

- Qureshi, S.; Younas, M.H. Pakistan’s Potential for Low Carbon Development of Steel Industry. SDPI 2024. Available online: https://sdpi.org/pakistans-potential-for-low-carbon-development-of-steel-industry/publication_detail (accessed on 21 June 2025).

- IEA; IRENA; U.C.C.H.-L. Champions. Breakthrough Agenda Report 2023. IEA 2023. in press. Available online: https://iea.blob.core.windows.net/assets/d7e6b848-6e96-4c27-846e-07bd3aef5654/THEBREAKTHROUGHAGENDAREPORT2023.pdf (accessed on 24 June 2025).

- EU Commission. Carbon Border Adjustment Mechanism. EU Commission 2025. Available online: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (accessed on 22 June 2025).

- EU Commission. The Green Deal Industrial Plan: Putting Europe’s Net-Zero Industry in the Lead. EU Commission 2025. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/green-deal-industrial-plan_en (accessed on 22 June 2025).

- World Bank Group. Industrial Energy Efficiency and Decarbonization (EE&D) in Pakistan. World Bank Group 2025–26, in press.

- PACRA. Steel Sector Study. PACRA Res. 2024. Available online: https://www.pacra.com/view/storage/app/Steel%20-%20PACRA%20Research%20-%20Sep%2724_1725624982.pdf (accessed on 10 May 2025).

- Climate Transparency. Climate Transparency Report: Pakistan’s Climate Action and Responses to the COVID-19 Crisis. Climate Transparency 2020. Available online: https://www.climate-transparency.org/wp-content/uploads/2021/11/Pakistan-CP-2020.pdf (accessed on 10 June 2025).

- Pakistan Bureau of Statistics (PBS). Advance Release on External Trade Statistics for the Month of January, 2025. PBS 2025. Available online: https://www.pbs.gov.pk/sites/default/files/external_trade/monthly_external_trade/2025/Release_Statement_January_2025.pdf (accessed on 11 June 2025).

- Siddiqui, H.A. Are Better Days in Store for PSM? Dawn 2025. Available online: https://www.dawn.com/news/1918354 (accessed on 9 July 2025).

- SDPI. Annual State of Renewable Energy Report Pakistan 2023–2024. SDPI 2024. Available online: https://sdpi.org/annual-state-of-renewable-energy-report-pakistan-2023-2024/publication_detail (accessed on 14 June 2025).

- SDPI. Exploring the Potential of Green Hydrogen in Hard-to-Abate Sectors of Pakistan. SDTV 2024. Available online: https://www.youtube.com/watch?v=oUXxDh_OlFo&ab_channel=SDTV (accessed on 1 July 2025).

- SDPI. Special Lecture with Amreli Steels Limited on Charting the Course of the Decarbonization Drive in Pakistan’s Steel Industry. SDTV 2024. Available online: https://www.youtube.com/watch?v=lHUhWU9IYLM&ab_channel=SDTV (accessed on 1 July 2025).

- SDPI. Pakistan’s Industrial Decarbonization—Ep. 1: Steel Sector Pathways and Global Insights. SDTV 2025. Available online: https://www.youtube.com/watch?v=T_GWo2a-Leo&ab_channel=SDTV (accessed on 2 July 2025).

- SDPI. Pakistan’s Industrial Decarbonization—Ep. 2: Green Hydrogen Pathways for a Clean Industrial Future. SDTV 2025. Available online: https://www.youtube.com/watch?v=8gDSqYfGTGQ&ab_channel=SDTV (accessed on 4 July 2025).

- SDPI. Good Power, Good Steel! SDTV 2023. Available online: https://www.youtube.com/watch?v=Pe-Dgh5saic&ab_channel=SDTV (accessed on 1 July 2025).

- The Express Tribune. Businessmen Slam Wind Power Curtailment. Express Tribune 2025. Available online: https://tribune.com.pk/story/2533942/businessmen-slam-wind-power-curtailment (accessed on 15 May 2025).

- Babar, R.; Naveed, H.; Amjad, M.M. Pakistan Electricity Review. Renewables First 2024. Available online: https://uploads.renewablesfirst.org/Pakistan_Electricity_Review_2024_2_cda6c4cedd.pdf#:~:text=Wind%20energy%20experienced%20no%20growth%2C%20remaining%20flat,energy%20saw%20a%20minor%20increase%20of%200.04 (accessed on 18 June 2025).

- Khidirova, M. Green Hydrogen and Chemical Production in Pakistan: A Pathway to Decarbonization and Export Potential by 2050. SSRN 2025. Available online: https://ssrn.com/abstract=5243698 (accessed on 11 July 2025).

- Tahir, M.M.; Abbas, A.; Dickson, R. Green Hydrogen and Chemical Production from Solar Energy in Pakistan: A Geospatial, Techno-Economic, and Environmental Assessment. Int. J. Hydrogen Energy 2025, 116, 613–626. [Google Scholar] [CrossRef]

- Renewables First. Integrating Sustainability in Green Hydrogen Advancements in Pakistan. Renewables First 2024. Available online: https://uploads.renewablesfirst.org/Integrating_Susutainability_in_Green_Hydrogen_for_Pakistan_e0aff8fce7.pdf (accessed on 11 July 2025).

- Government of Pakistan (GoP). Updated Nationally Determined Contributions. UNFCCC 2021. Available online: https://unfccc.int/sites/default/files/NDC/2022-06/Pakistan%20Updated%20NDC%202021.pdf (accessed on 1 July 2025).

- Deloitte. Green Hydrogen: Energizing the Path to Net Zero. Deloitte 2023. Available online: https://www.deloitte.com/global/en/issues/climate/green-hydrogen.html (accessed on 1 July 2025).

- Laila, J.; Anwar, M.; Hassan, M.; Kazmi, S.A.A.; Ali, R.; SA, M.A.; Rafique, M.Z. Techno-Economic Analysis of Green Hydrogen Production from Wind and Solar along CPEC Special Economic Zones in Pakistan. Int. J. Hydrogen Energy. 2024, 96, 811–828. [Google Scholar] [CrossRef]

- Yale University. Environmental Performance Index. EPI 2024. Available online: https://epi.yale.edu/country/2024/PAK (accessed on 12 July 2025).

- Business Recorder. Green Energy: NEECA Prepares ‘Concept Note’ to Seek Assistance. Business Recorder 2024. Available online: https://www.brecorder.com/news/40294022/green-energy-neeca-prepares-concept-note-to-seek-assistance (accessed on 12 July 2025).

| Location | Installed Capacity |

|---|---|

| Jhimpir | 1543 MW |

| Gharo | 249 MW |

| Jamshoro | 50 MW |

| Total Installed Capacity | 1842 MW |

| Total Evacuation | 1100 MW |

| Capacity under Curtailment | 742 MW |

| Month | Hours of Curtailment (at Different Levels of Generation) |

|---|---|

| January | 330 |

| February | 380 |

| March | 117 |

| April | 53 |

| May | 30 |

| June | 115 |

| July | 164 |

| August | 384 |

| Total | 1573 h |

Pillar | Short-Term (1–3 Years) | Medium-Term (3–7 Years) | Long-Term (7–15 Years) |

|---|---|---|---|

| 1. Policy & Regulation | Enable power wheeling for renewable-H2 projects under CTBCM rules. | Establish hydrogen certification and traceability system (aligned with CBAM) | Enforce industrial decarbonization targets for hard-to-abate sectors |

| Establish a regulatory sandbox to enable steel manufacturers to pilot digital twin technologies in real-world environments, supported by dedicated R&D funding. | Integrate GH2 in IGCEP and ARE Policy updates | Mandate renewable hydrogen share in large-scale industry | |

| Issue guidelines for pilot H2 use in steel and mobility sectors. | Mandate % use of GH2 in steel sector | Embed hydrogen into national climate compliance regulation | |

| 2. Finance & Investment | Secure concessional climate financing for pilot projects. | Issue green bonds for hydrogen infrastructure | Integrate hydrogen into carbon pricing mechanisms |

| Provide tax credits for industrial off-takers using certified H2 | |||

| Offer blended finance packages for electrolyzer-linked RE projects | Secure FDI via bilateral energy MOUs | Channel carbon revenues into innovation and grid modernization | |

| Offer incentives for green steel and hydrogen exports | |||

| Leverage existing green sukuks for pilot projects | Offer incentives for green steel and hydrogen exports | ||

| 3. Technology & Innovation | Deploy 2–3 pilot H2 electrolysis units (10–20 MW) in Jhimpir/Thatta | Scale up to 100–200 MW green H2 plants co-located with solar/wind IPPs | Facilitate the transition to hydrogen-based direct reduced iron (DRI), enabling low-carbon steel production through the use of green hydrogen (GH2) instead of coal-based reduction |

| Use AI/SCADA for renewable-to-hydrogen integration | Retrofit 1–2 EAF/DRI units for H2 in steel hubs | ||

| Initiate DRI steel trial using blended H2 at Karachi plants | Develop local R&D fund for electrolysis and H2 compression/storage | Enable multi-sector use: refining, fertilizers, mobility | |

| Localize basic electrolyzer assembly via industrial partnerships | Deploy GW-scale H2 production clusters for domestic use and export readiness | ||

| 4. Infrastructure | Commission Thar-Gharo and Matiari-Moro-RYK HVDC lines | Develop hydrogen-ready industrial zones (e.g., Port Qasim hub) | Develop on-site or proximate renewable energy sources, strengthen grid connectivity for reliable power supply, and deploy energy storage solutions (such as BESS or pumped hydro) to address fluctuations in renewable generation. |

| Conduct bankable feasibility studies for H2 pipelines and storage | Build port and transport infrastructure for hydrogen carriers (ammonia, liquid organic hydrogen carrier (LOHC)) | Expand to inter-provincial H2 corridors. | |

| Install pilot BESS units to stabilize RE for H2 production | Integrate smart grid/SCADA for real-time energy-to-H2 operations | Develop export terminals (ammonia or LOHC-based) with maritime infrastructure | |

| 5. Capacity & Skills | Develop Hydrogen Skills Accelerator with TVETs in Sindh/Karachi, training technicians for electrolyzer & storage operations | Include hydrogen engineering curriculum in universities | Enable regional partnerships (China, UAE, Germany) for workforce exchange, innovation, and joint training programs |

| Offer financial incentives for the adoption of IoT and smart automation technologies in material handling, alongside tailored training programs for workers | Create public–private partnerships for facilitating R&D grants and incubators |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ijaz, A.; Qureshi, S.; Zia, U.U.R.; Zia, S.; Malik, S.A.A.; Zulfiqar, M. Green Hydrogen as a Decarbonization Pathway for Steel Industry in Pakistan. Eng. Proc. 2025, 111, 39. https://doi.org/10.3390/engproc2025111039

Ijaz A, Qureshi S, Zia UUR, Zia S, Malik SAA, Zulfiqar M. Green Hydrogen as a Decarbonization Pathway for Steel Industry in Pakistan. Engineering Proceedings. 2025; 111(1):39. https://doi.org/10.3390/engproc2025111039

Chicago/Turabian StyleIjaz, Arfa, Saleha Qureshi, Ubaid Ur Rehman Zia, Sarim Zia, Saad Ali Ahmed Malik, and Muhammad Zulfiqar. 2025. "Green Hydrogen as a Decarbonization Pathway for Steel Industry in Pakistan" Engineering Proceedings 111, no. 1: 39. https://doi.org/10.3390/engproc2025111039

APA StyleIjaz, A., Qureshi, S., Zia, U. U. R., Zia, S., Malik, S. A. A., & Zulfiqar, M. (2025). Green Hydrogen as a Decarbonization Pathway for Steel Industry in Pakistan. Engineering Proceedings, 111(1), 39. https://doi.org/10.3390/engproc2025111039