Enabling Solar PV Localization in Pakistan Through Strategic Pathways Under China–Pakistan Industrial Cooperation †

Abstract

1. Introduction

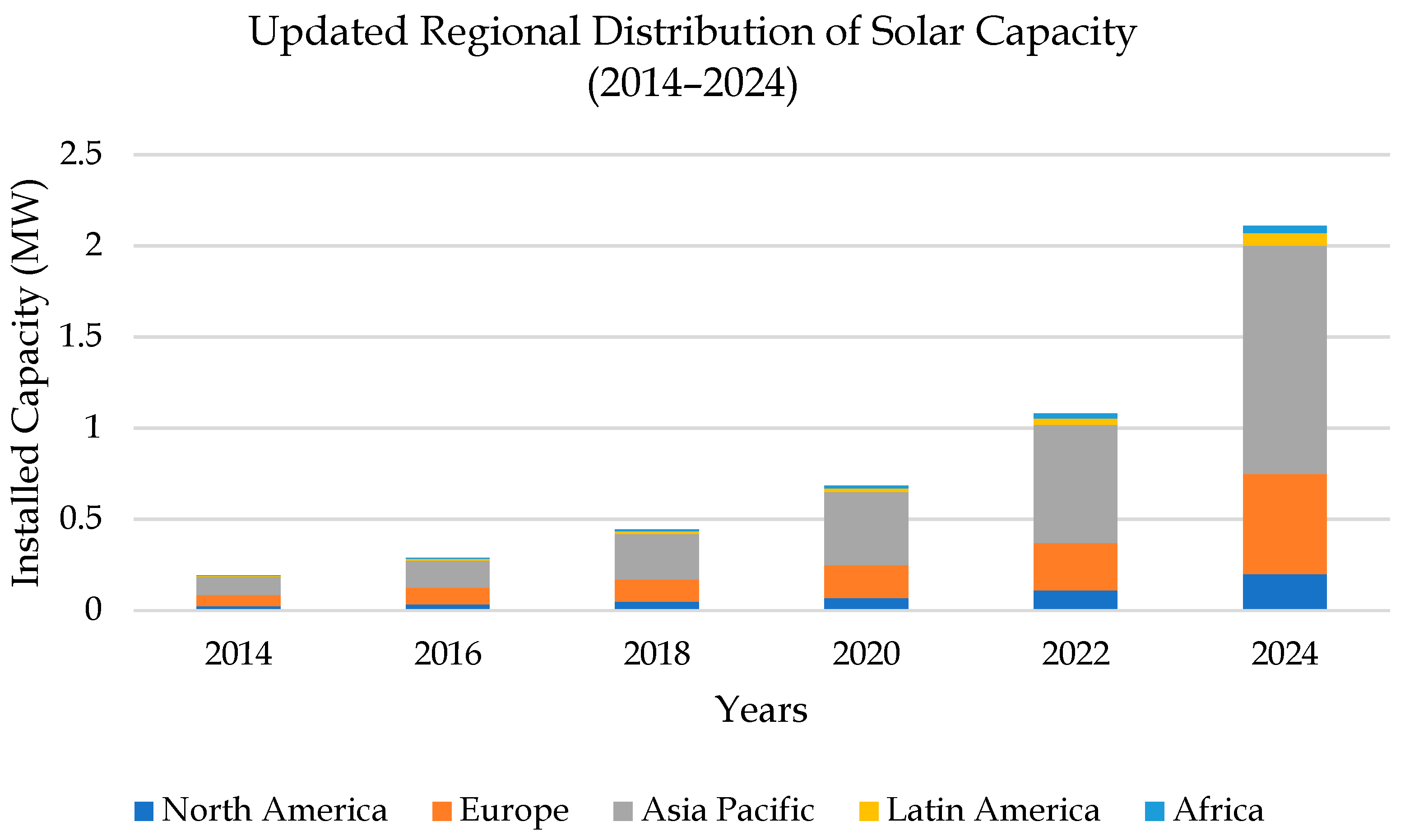

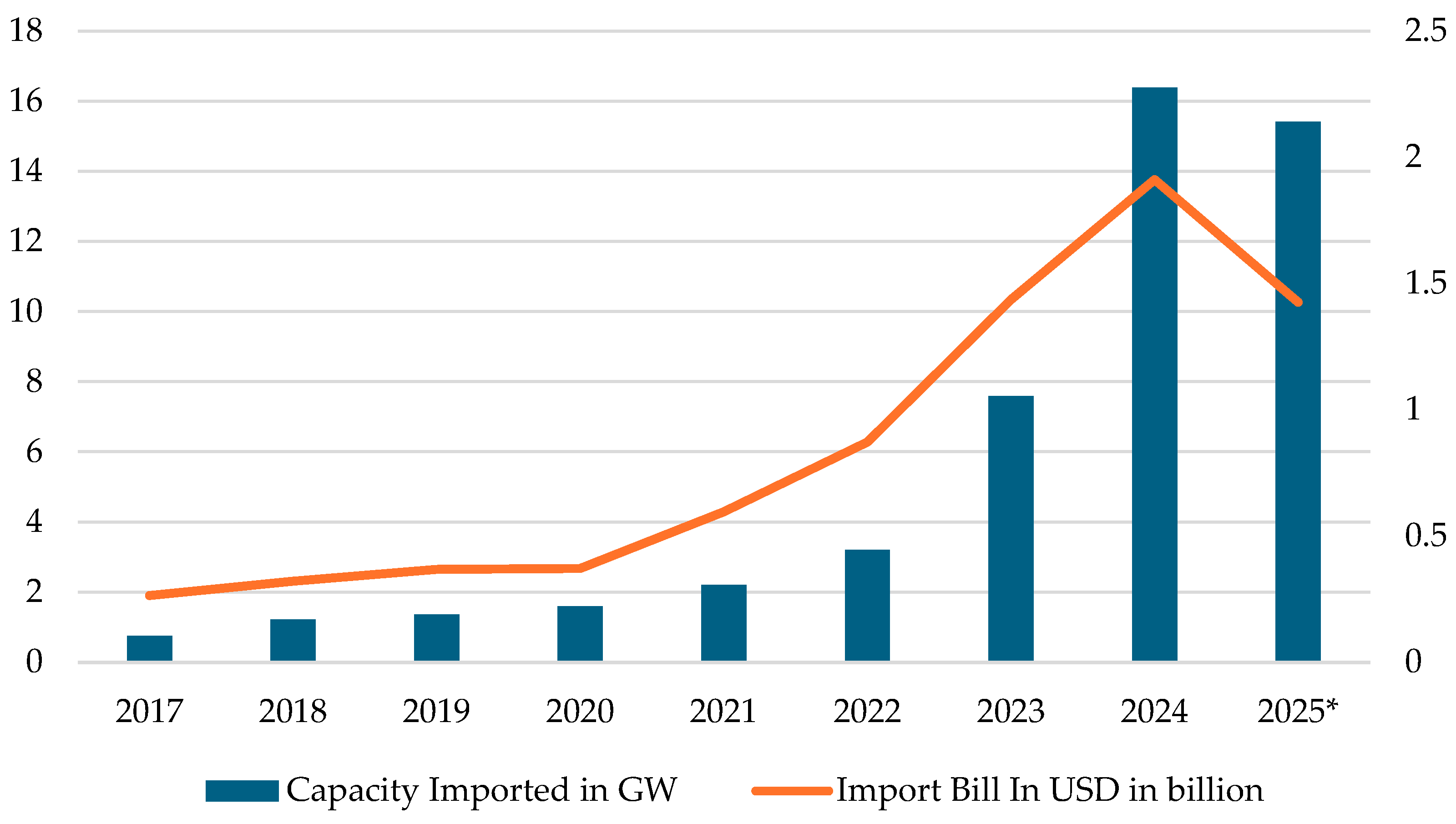

China’s Role in Energy and the Emerging Opportunity for Localization

2. Methodology

3. Key Findings & Discussion

3.1. China’s Green Governance and Localization Strategy

3.2. Solar PV Localization and Implications for Pakistan

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ritchie, H. Solar Panel Prices Have Fallen by Around 20% Every Time Global Capacity Doubled. 2024. Available online: https://ourworldindata.org/data-insights/solar-panel-prices-have-fallen-by-around-20-every-time-global-capacity-doubled (accessed on 1 July 2025).

- SolarInsure. How Much Solar Energy Does the World Generate? 2024. Available online: https://www.solarinsure.com/how-much-solar-energy-does-the-world-generate (accessed on 25 June 2025).

- APP. Pakistan’s Solar Revolution Rewriting Energy Landscape; 22 GW of Solar Panels Imported in 18 Months. 2025. Available online: https://www.app.com.pk/national/pakistans-solar-revolution-rewriting-energy-landscape-22-gw-of-solar-panels-imported-in-18-months/#:~:text=Balochi/Brahvi-,Pakistan’s%20solar%20revolution%20rewriting%20energy%20landscape;%2022%20GW%20of%20solar,because%20economics%20make%20perfect%20sense.%E2%80%9D (accessed on 29 June 2025).

- CPECInfo. Pakistan Becomes Second-Largest Market for Chinese Solar Exports in 2024. 2024. Available online: https://cpecinfo.com/pakistan-becomes-second-largest-market-for-chinese-solar-exports-in-2024/#:~:text=Pakistan%20has%20become%20a%20key,%2C%20households%2C%20hospitals%20and%20mosques (accessed on 25 June 2025).

- GoP. Updated Nationally Determined Contributions. 2021. Available online: https://unfccc.int/sites/default/files/NDC/2022-06/Pakistan%20Updated%20NDC%202021.pdf (accessed on 1 July 2025).

- Amjad, M.M.; Malik, S.; Ahmad, A.; Ahmed, A.; Ali, H.; Naveed, H.; Ghauri, M.B.; Babar, R.; Ashfaq, Z. The Great Solar Rush in Pakistan. 2024. Available online: https://uploads.renewablesfirst.org/The_Great_Solar_Rush_in_Pakistan_38157451a3.pdf#:~:text=BloombergNEF%20reports%20that%20Pakistan%20imported%20solar%20panels,of%20panels%20from%20China%20in%20just%20the (accessed on 28 June 2025).

- Isaad, H.; Sayed, M.H. Pakistan Must Rebuild Chinese Investor Confidence in Its Energy Transition. 2025. Available online: https://dialogue.earth/en/energy/pakistan-must-rebuild-chinese-investor-confidence-in-its-energy-transition/#:~:text=What%20will%20CPEC%202.0%20look%20like?%20CPEC’s,industrialisation%2C%20agriculture%2C%20and%20technology%20transfer%20through%20SEZs (accessed on 2 July 2025).

- CPECInfo. Experts Say Pakistan Needs Stable Policies to Fully Utilize China’s Expertise in Clean Energy and Industrial Development. 2025. Available online: https://cpecinfo.com/experts-say-pakistan-needs-stable-policies-to-fully-utilize-chinas-expertise-in-clean-energy-and-industrial-development/ (accessed on 29 June 2025).

- Sindh, I.D. A Delegation of 12 Major Chinese Companies Visited Dhabeji Special Economic Zone Along with Special Assistant to the Chief Minister of Sindh Syed Qasim Naveed Qamar. 2024. Available online: https://sindhinvestment.gos.pk/node/475#:~:text=Karachi%2C%20December%2011%2C%202024,friendship%20between%20China%20and%20Pakistan (accessed on 2 July 2025).

- Fetters, M.D.; Curry, L.A.; Creswell, J.W. Achieving integration in mixed methods designs-principles and practices. Health Serv. Res. 2013, 48, 2134–2156. [Google Scholar] [CrossRef] [PubMed]

- Shaw, V. China Hits 1 TW Solar Milestone. 2025. Available online: https://www.pv-magazine.com/2025/06/23/china-hits-1-tw-solar-milestone/ (accessed on 3 July 2025).

- Fleck, A. China Pulls Far Ahead in Green Energy Investment. 2025. Available online: https://www.statista.com/chart/34682/global-investment-in-renewable-power-and-fuels/#:~:text=China%20is%20the%20world%20leader,REN21%20Global%20Status%20Report%202025 (accessed on 30 June 2025).

- Chowdhury, M.S.; Rahman, K.S.; Chowdhury, T.; Nuthammachot, N.; Techato, K.; Akhtaruzzaman, M.; Tiong, S.K.; Sopian, K.; Amin, N. An overview of solar photovoltaic panels’ end-of-life material recycling. Energy Strategy Rev. 2020, 27, 100431. [Google Scholar] [CrossRef]

- Midfa, N.A. The U.S.-China Trade War: China’s Challenge in Navigating U.S. Tariffs and Global Trade Tensions. 2025. Available online: https://trendsresearch.org/insight/the-u-s-china-trade-war-chinas-challenge-in-navigating-u-s-tariffs-and-global-trade-tensions/#:~:text=Furthermore%2C%20China%20is%20focusing%20on,economic%20growth%20and%20export%20capabilities (accessed on 4 July 2025).

- Maguire, G. Pakistan’s Solar Surge Lifts It into Rarefied 25% Club. 2025. Available online: https://www.reuters.com/markets/commodities/pakistans-solar-surge-lifts-it-into-rarefied-25-club-2025-06-17/ (accessed on 15 June 2025).

- PVknowhow. Solar Energy in Pakistan Backed by Government: No Taxes. 2024. Available online: https://www.pvknowhow.com/news/solar-energy-in-pakistan-no-taxes/#:~:text=Economic%20Benefits%20of%20Solar%20Energy,costs%20and%20increased%20energy%20independence (accessed on 11 July 2025).

- Hussain, F.; Maeng, S.-J.; Cheema, M.J.M.; Anjum, M.N.; Afzal, A.; Azam, M.; Wu, R.-S.; Noor, R.S.; Umair, M.; Iqbal, T. Solar Irrigation Potential, Key Issues and Challenges in Pakistan. Water 2023, 15, 1727. [Google Scholar] [CrossRef]

- Reuters. Global Energy Transition Investment Exceeded $2 Trillion Last Year, Report Shows. 2025. Available online: https://www.reuters.com/business/energy/global-energy-transition-investment-exceeded-2-trln-last-year-report-shows-2025-01-30/ (accessed on 26 June 2025).

- Reuters. Pakistan’s Solar Revolution Leaves Its Middle Class Behind. 2025. Available online: https://www.reuters.com/business/energy/pakistans-solar-revolution-leaves-its-middle-class-behind-2025-04-29/ (accessed on 13 July 2025).

- News, A. Chinese Company Asks Govt to End Duties on Solar Panel Components. 2024. Available online: https://english.aaj.tv/news/330376268/chinese-company-asks-govt-to-end-duties-on-solar-panel-components (accessed on 9 July 2025).

| Category | Challenge | Description |

|---|---|---|

| Policy & Regulation | Fragmented Industrial Policy Framework | Lack of a unified industrial policy aligned with renewable energy goals hampers coherent development and investor confidence. |

| Institutional Capacity | Weak Institutional Coordination | Overlapping mandates and limited coordination among federal and provincial bodies delay implementation and dilute policy effectiveness. |

| Infrastructure | Inadequate Industrial Infrastructure | Many SEZs face delays in the provision of basic utilities (electricity, water, roads), impeding industrial activity and investor readiness. |

| Finance & Investment | Limited Access to Green Finance | Absence of structured financing options and incentives discourages private investment in renewable manufacturing and clean technologies. |

| Technology & Skills | Low Domestic Manufacturing Capability | Pakistan lacks local production capacity for critical solar PV components (e.g., wafers, cells), relying heavily on imports. |

| Workforce Development | Skills Mismatch in Renewable Energy Sector | Insufficient technical training and education programs limit the availability of a skilled workforce in green manufacturing. |

| Market Structure | Informal Assembly & Unregulated Markets | Existing solar PV assembly occurs in informal setups, lacking quality control, scalability, and integration with formal industrial zones. |

| Governance | Unpredictable Policy Environment | Inconsistencies and abrupt changes in policies (e.g., tax breaks, tariffs) create uncertainty for long-term investors. |

| Energy Supply | Dependence on Fossil Fuels for Industrial Power | Most SEZs are still powered by conventional energy sources, undermining the green goals of CPEC 2.0. |

| Investment Risk | High Perceived Risk from Political and Economic Instability | Investor hesitancy stems from macroeconomic volatility and concerns over contract enforcement and bureaucratic delays. |

| Policy Domain | Key Actions | Relevant Authorities | Timeline | Strategic Implications |

|---|---|---|---|---|

| Industrial Incentives | Approve and implement the 10-year “Solar Panel and Allied Equipment Manufacturing Policy” | Ministry of Industries & Production, EDB, FBR | 0–3 years | Encourages private investment, reduces import reliance, and establishes a foundation for domestic solar manufacturing. |

| Provide streamlined sales tax and duty structure for both panels and components, with reduced duties on key components while gradually increasing duties on fully assembled imported panels | Ministry of Finance (MoF), FBR, Ministry of Commerce | |||

| Establish a blended finance vehicle to de-risk early-stage solar investments, while enabling long-term scale-up by mobilizing private capital through contract enforcement, reduced input costs, and streamlined land, tax, and permitting regulations. | MoF, SBP, BoI | |||

| Market Structuring | Redirect localization efforts to Balance-of-System (BoS) components such as inverters, mounting structures, and wiring, which constitute 60–70% of project costs, offering near-term feasibility and competitive advantage over full panel manufacturing. | MoIP, SMEDA, EDB, Private sector, PSMA | 0–2 years | Enables faster and more feasible localization, supports SMEs, and increases domestic value addition in the solar supply chain. |

| Introduce SME-focused incentives | SMEDA, MoF | |||

| Technology Transfer & FDI | Facilitate relocation of Chinese solar firms through SEZs | BOI, SIFC, CPEC Authority | 1–3 years | Accelerates industrial upgrading, promotes technology transfer, and integrates Pakistan into global renewable energy value chains. |

| Promote joint ventures, licensing, and vertically integrated clusters with export incentives | Ministry of Commerce, Pakistan Engineering Council (PEC), SECP | |||

| Workforce Development | Update engineering curricula to include PV and semiconductor technologies | HEC, NAVTTC, PEC | 0–2 years | Develops a skilled domestic workforce, addresses technical skill gaps, and reduces dependence on foreign expertise. |

| Launch vocational training and international exchange programs | NAVTTC, TEVTAs, Ministry of Federal Education and Professional Training | |||

| Grid & Storage Integration | Implement smart grid systems, microgrids, and integrated solar-storage projects | NEPRA, NTDC, DISCOs | 1–5 years | Improves grid flexibility and reliability, supports renewable energy integration, and enhances national energy security. |

| Circular Economy | Establish regulatory framework for solar panel and battery recycling | EDB, MoCC&EC, EPA | 1–3 years | Ensures sustainable lifecycle management of solar infrastructure, reduces environmental impact, and opens new green industry segments. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Naeem, A.; Ijaz, A.; Zia, U.U.R.; Zia, S. Enabling Solar PV Localization in Pakistan Through Strategic Pathways Under China–Pakistan Industrial Cooperation. Eng. Proc. 2025, 111, 36. https://doi.org/10.3390/engproc2025111036

Naeem A, Ijaz A, Zia UUR, Zia S. Enabling Solar PV Localization in Pakistan Through Strategic Pathways Under China–Pakistan Industrial Cooperation. Engineering Proceedings. 2025; 111(1):36. https://doi.org/10.3390/engproc2025111036

Chicago/Turabian StyleNaeem, Ayesha, Arfa Ijaz, Ubaid Ur Rehman Zia, and Sarim Zia. 2025. "Enabling Solar PV Localization in Pakistan Through Strategic Pathways Under China–Pakistan Industrial Cooperation" Engineering Proceedings 111, no. 1: 36. https://doi.org/10.3390/engproc2025111036

APA StyleNaeem, A., Ijaz, A., Zia, U. U. R., & Zia, S. (2025). Enabling Solar PV Localization in Pakistan Through Strategic Pathways Under China–Pakistan Industrial Cooperation. Engineering Proceedings, 111(1), 36. https://doi.org/10.3390/engproc2025111036