Techno-Economic Assessment of Hydrogen Integration for Decarbonizing the Steel Industry: A Case Study

Abstract

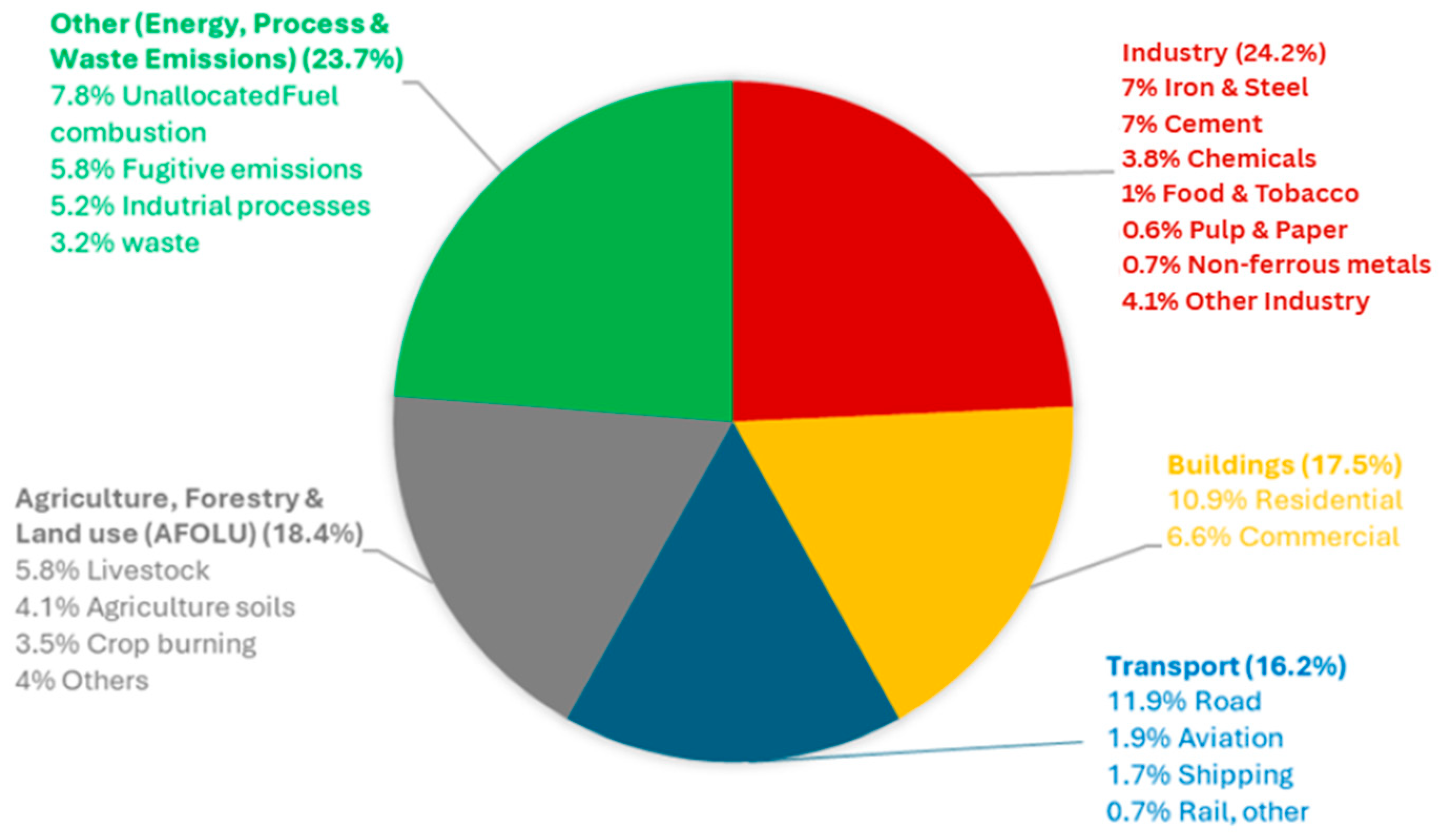

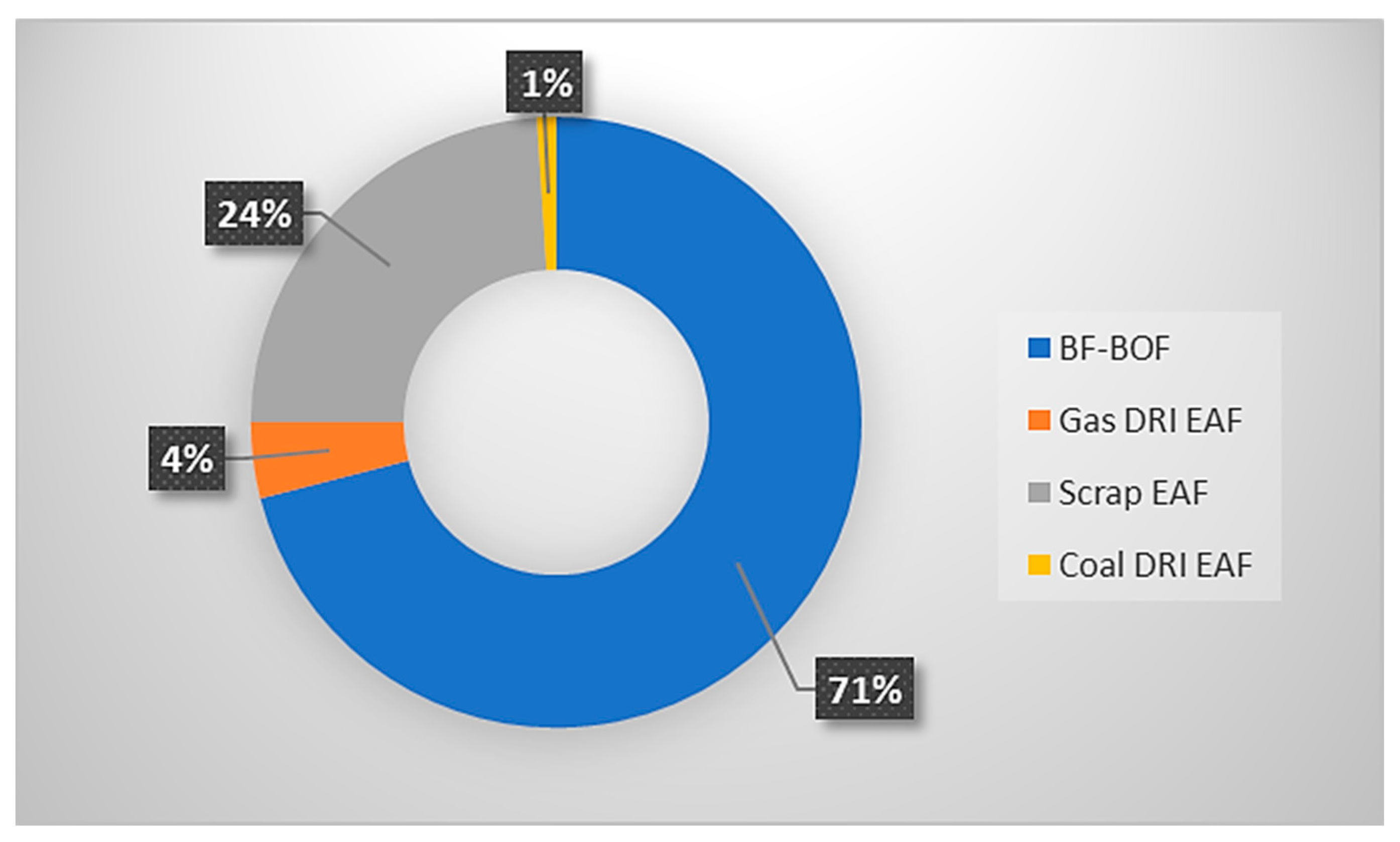

1. Introduction

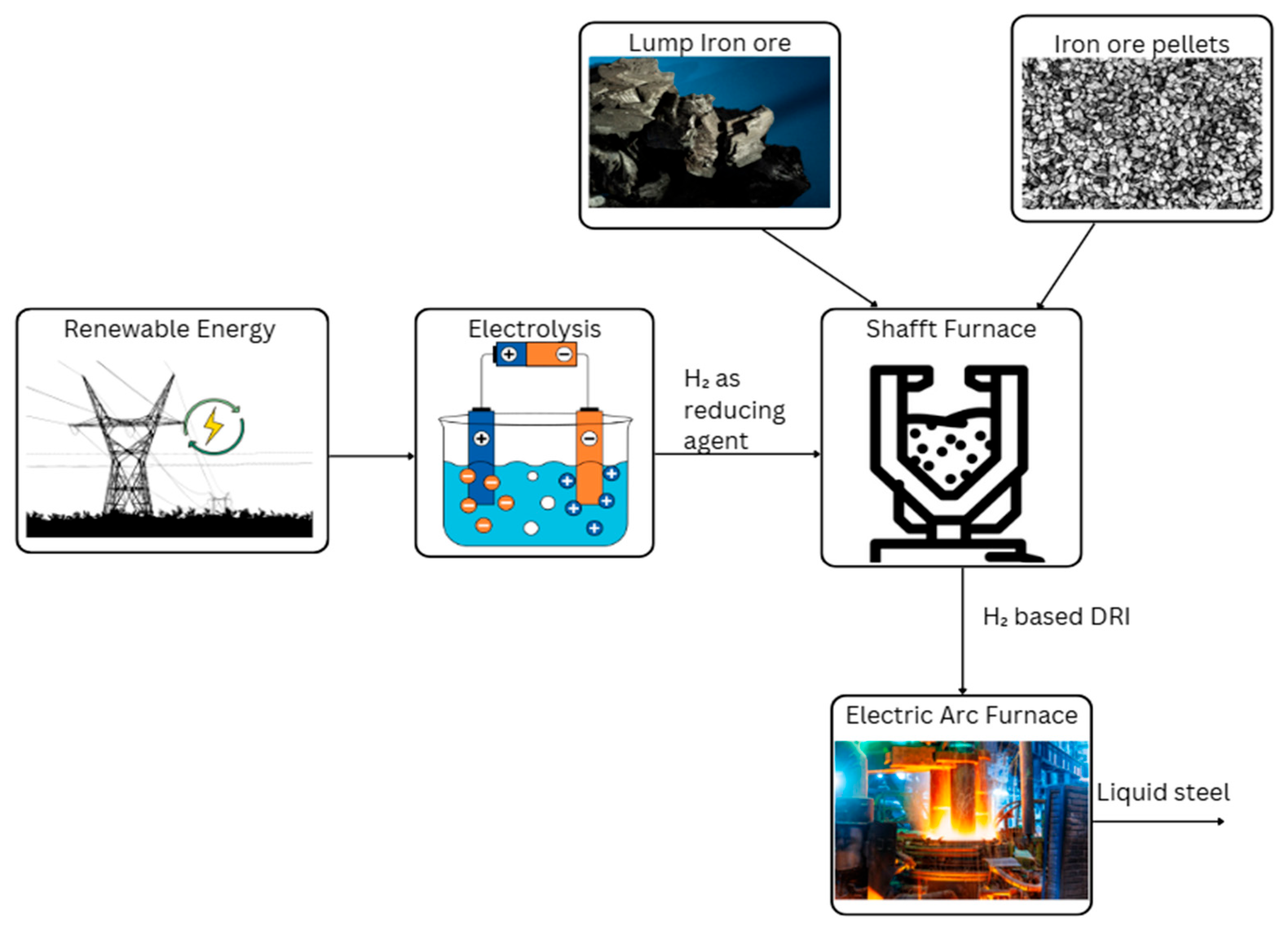

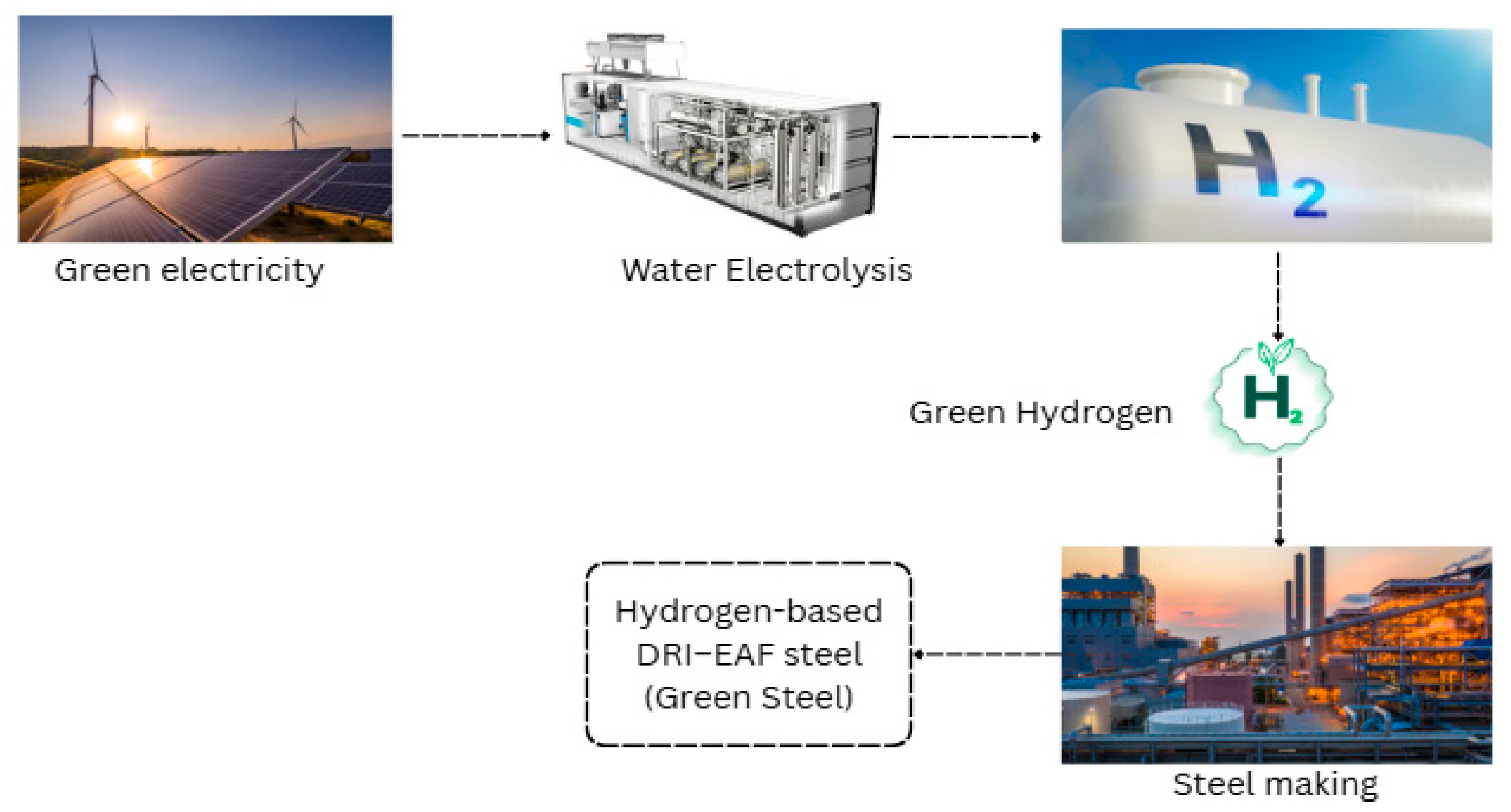

1.1. Hydrogen as a Decarbonization Pathway for Steel

1.2. Taranto Steel Plant Case Study Context

1.3. Research Gap and Objectives

2. Literature Review

3. Methodology

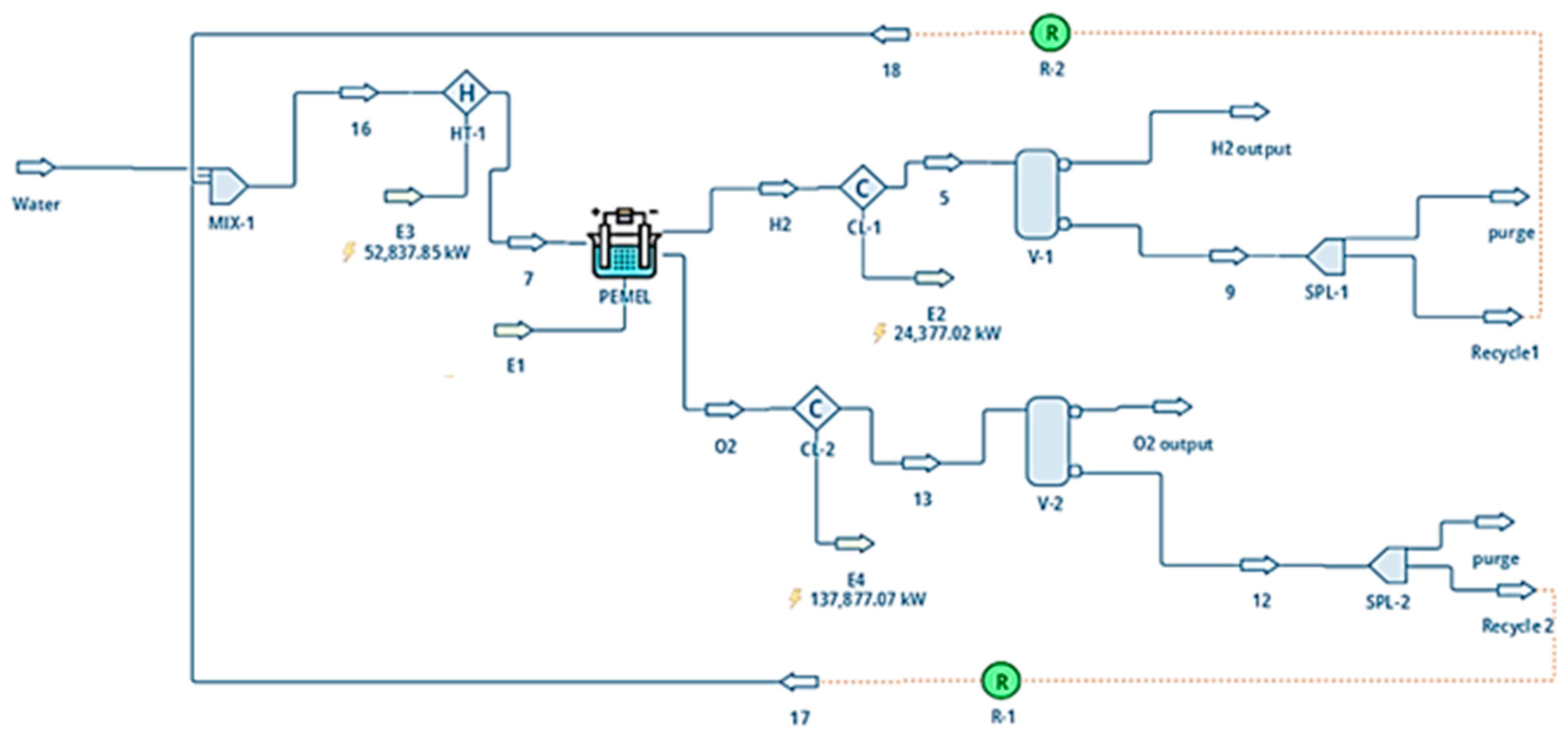

3.1. Process Simulation Model (DWSIM)

Renewable Energy and Storage

3.2. Economic Parameters and Scenario

3.2.1. Base Case Scenario

3.2.2. Low Electricity Price Scenario

3.2.3. Low Electrolyzer CAPEX Scenario

3.2.4. Combined Optimistic Scenario

3.3. Water Consumption

3.4. Carbon Price

3.5. CO2 Emissions Estimation

3.5.1. Baseline BF-BOF Emissions

3.5.2. Hydrogen DRI-EAF Emissions

3.6. Emission Compliance Cost Calculation

3.7. By-Product Oxygen and Water

4. Results and Discussion

4.1. Hydrogen Production Simulation for H2-DRI Steelmaking

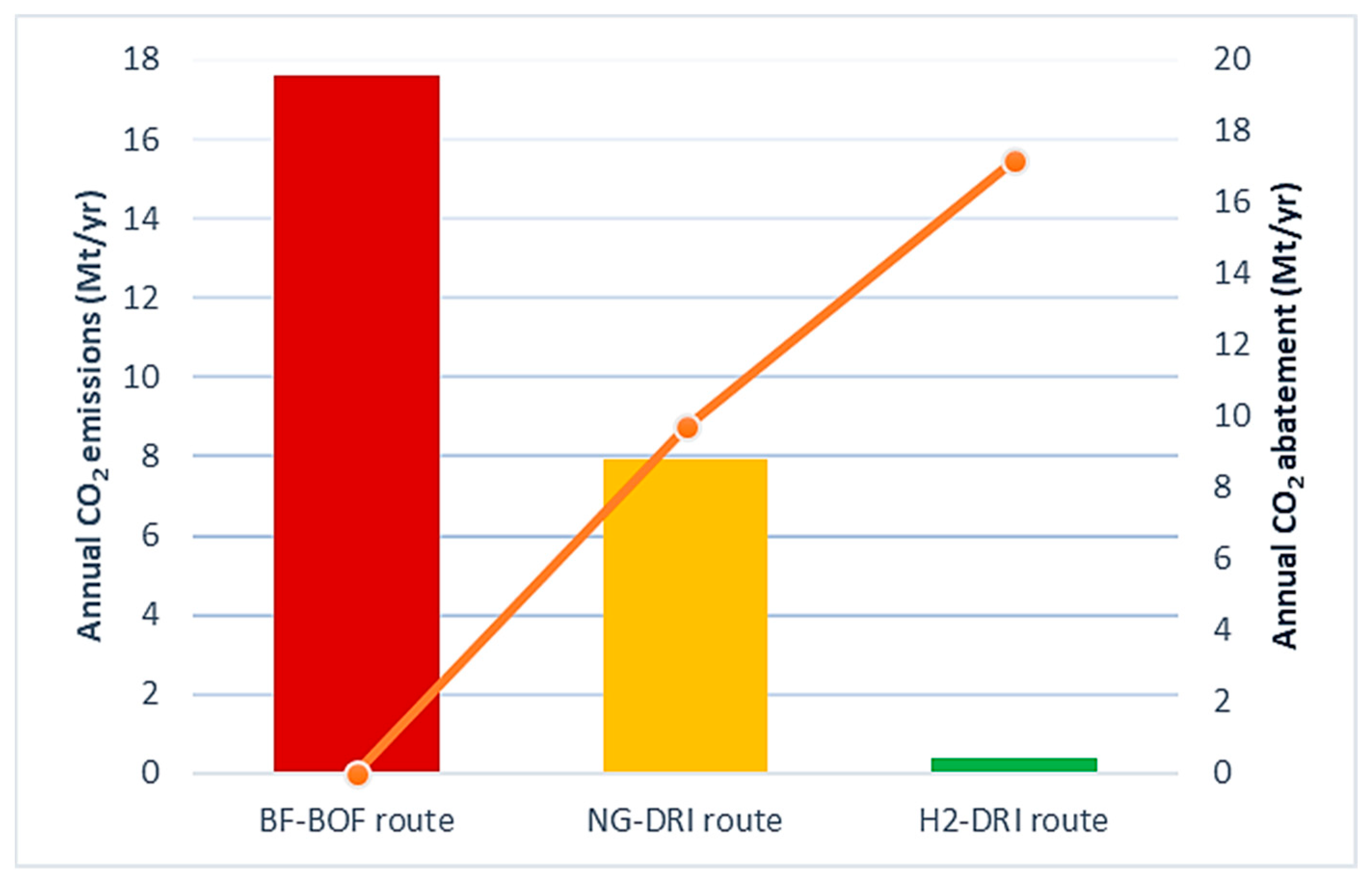

4.2. Full-Scale Hydrogen Supply and Emissions Mitigation

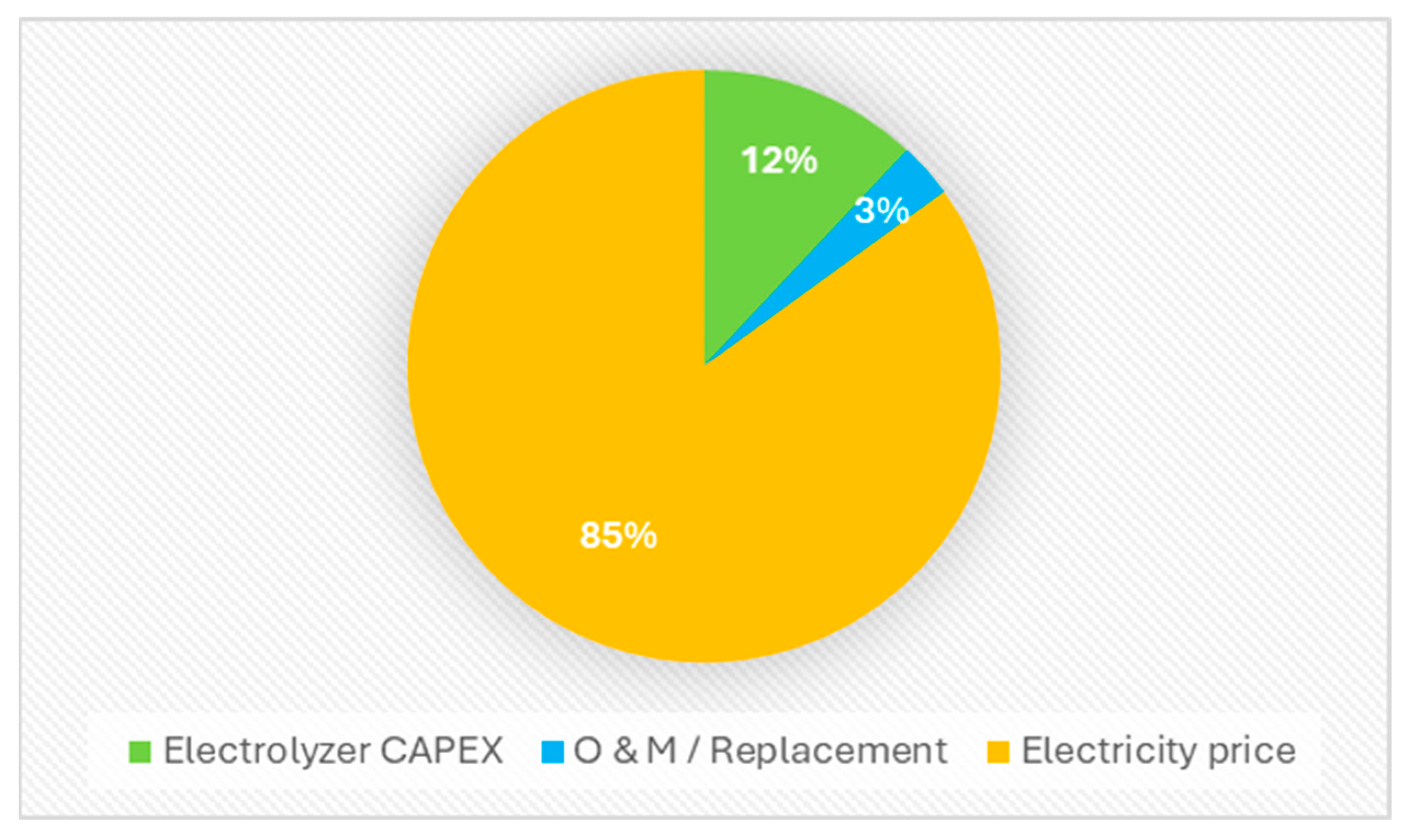

4.3. Hydrogen Production Cost (LCOH) and Green Steel Cost

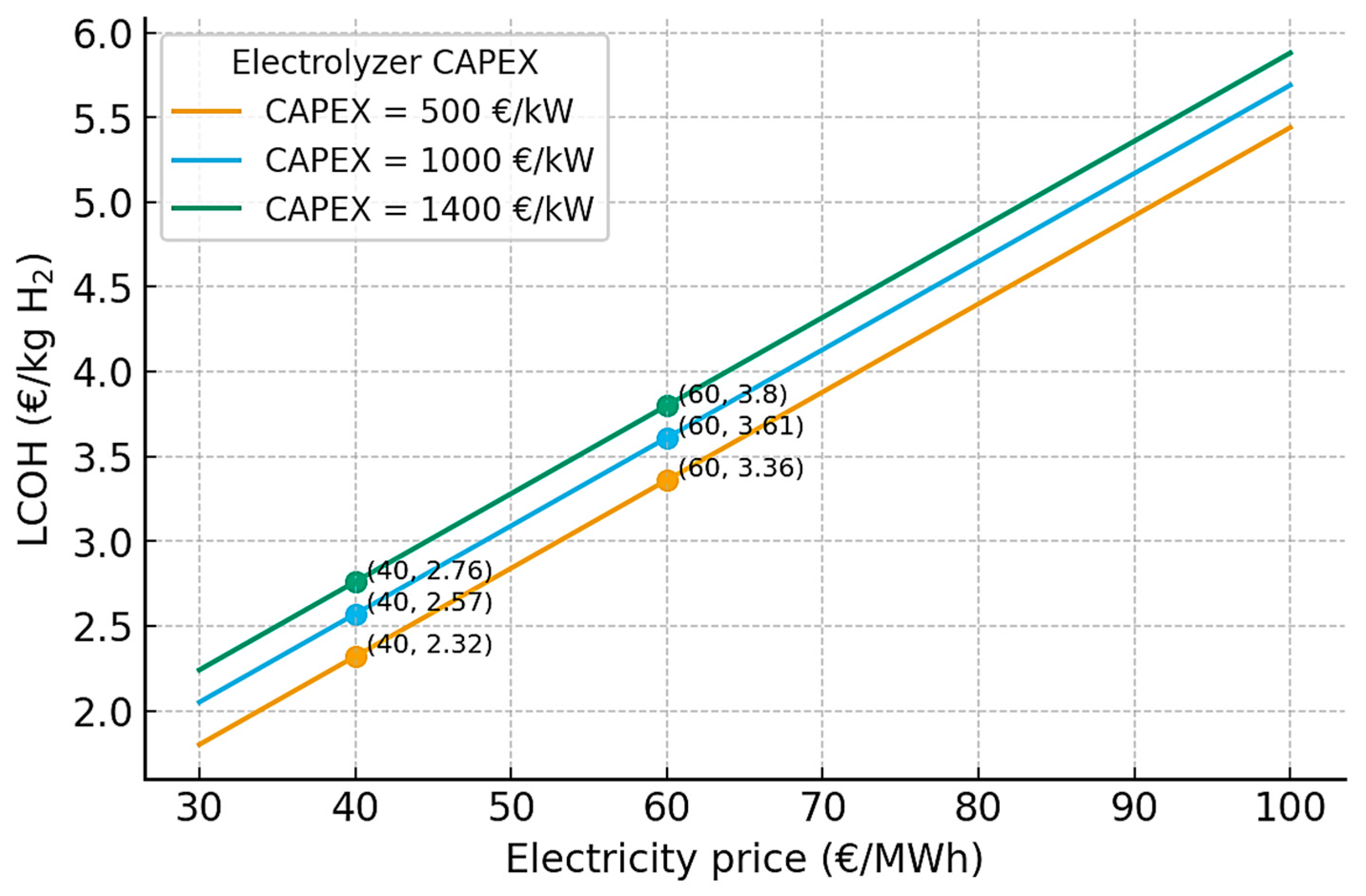

4.4. Scenario and Sensitivity Analysis of Hydrogen Cost

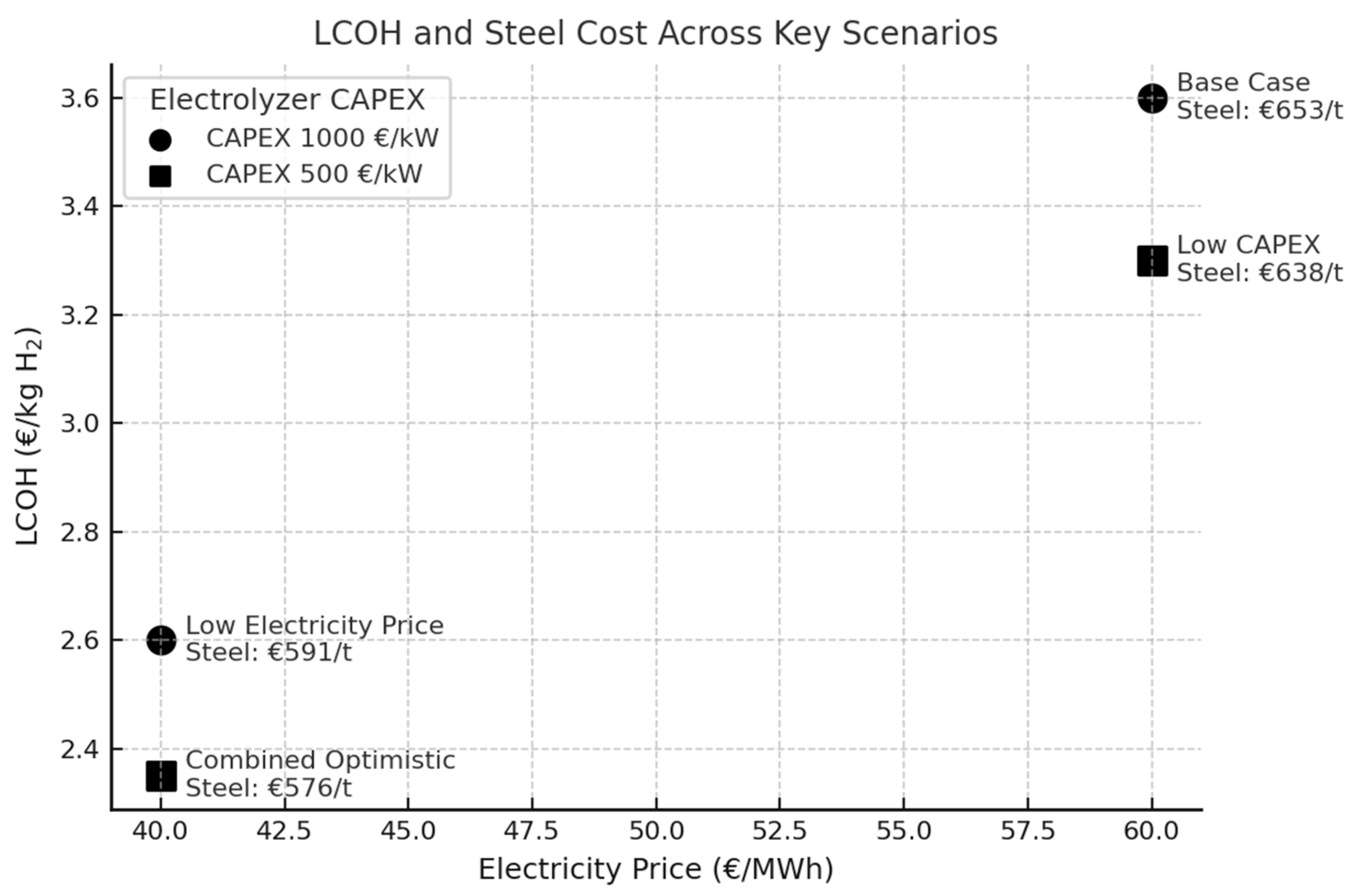

- Base Case: Electricity price 60 EUR/MWh, electrolyzer CAPEX 1000 EUR/kW. This resulted in an LCOH of 3.6 EUR/kg H2, as described above.

- Low Electricity Cost: Electricity price reduced to 40 EUR/MWh (reflecting long-term renewable PPA rates). This results in LCOH dropping to 2.6 EUR/kg, a 28% reduction, significantly improving economics. In fact, at 2.6 EUR/kg H2, the hydrogen-based steel cost would be very competitive with BF-BOF costs, even without carbon pricing.

- Low Electrolyzer CAPEX: Capital costs reduced to 500 EUR/kW (consistent with optimistic 2030 projections). This results in an LCOH lowered by roughly 0.3 EUR/kg to around 3.3 EUR/kg. This reflects the smaller but non-negligible influence of CAPEX on hydrogen costs.

- Combined Optimistic Scenario: Both low electricity (40 EUR/MWh) and low CAPEX (500 EUR/kW) together. The resulting LCOH falls to approximately 2.3 EUR/kg (nearly 36% below the base case). This scenario represents a plausible future case (early 2030s) where continued renewable energy cost declines and technology learning curves make green hydrogen far more affordable. At ≤2.5 EUR/kg H2, the production cost of hydrogen-based steel would drop well below current BF-BOF costs (even without carbon costs), indicating full cost competitiveness of fossil-free steel. Table 2 summarizes the scenario results.

- Comparison with HYBRIT and ArcelorMittal

- Capital Investment vs. Savings

- By-product Oxygen Utilization

- Water Supply Considerations

- Site-Specific Advantages

- Future Outlook

5. Conclusions

Limitations and Future Work

- Dynamic modeling of hydrogen storage and electrolyzer operation under renewable intermittency is recommended (to optimize electrolyzer sizing and storage needs for a variable supply).

- Detailed integration studies including grid reinforcement, hybrid renewable portfolios, and energy storage sizing for continuous supply.

- Life-cycle assessment (LCA) covering upstream pellet production, transportation, and EAF slag handling to confirm cradle-to-gate CO2 savings.

- Socio-economic impact analysis examining job creation, supply chain opportunities, and policy instruments (e.g., CfDs, green steel standards) needed to accelerate deployment.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| Abbreviation | Full Form |

| BF-BOF | Blast Furnace–Basic Oxygen Furnace |

| CBAM | Carbon Border Adjustment Mechanism |

| CCS | Carbon Capture and Storage |

| CCfD | Carbon Contracts for Difference |

| DRI | Direct Reduced Iron |

| DWSIM | Open-Source Chemical Process Simulation Software |

| EAF | Electric Arc Furnace |

| ETS (EU ETS) | European Union Emissions Trading System |

| H2-DRI | Hydrogen-Based Direct Reduced Iron |

| HHV | Higher Heating Value |

| ILVA | Former name of the Taranto Steel Plant (Acciaierie d’Italia) |

| IPCC | Intergovernmental Panel on Climate Change |

| LCOH | Levelized Cost of Hydrogen |

| PCI | Pulverized Coal Injection |

| PEM | Proton Exchange Membrane (Electrolyzer) |

| PPA | Power Purchase Agreement |

| SEC | Specific Energy Consumption |

References

- Kim, J.; Sovacool, B.K.; Bazilian, M.; Griffiths, S.; Lee, J.; Yang, M.; Lee, J. Decarbonizing the iron and steel industry: A systematic review of sociotechnical systems, technological innovations, and policy options. Energy Res. Soc. Sci. 2022, 89, 102565. [Google Scholar] [CrossRef]

- Worldsteel. Climate Change and the Production of Iron and Steel. Available online: https://worldsteel.org/climate-action/climate-change-and-the-production-of-iron-and-steel/ (accessed on 15 September 2025).

- IPCC. The Evidence is Clear: The Time for Action is Now. We Can Halve Emissions by 2030. Available online: https://www.ipcc.ch/2022/04/04/ipcc-ar6-wgiii-pressrelease/ (accessed on 6 August 2024).

- Fan, Z.; Friedmann, S.J. Low-carbon production of iron and steel: Technology options, economic assessment, and policy. Joule 2021, 5, 829–862. [Google Scholar] [CrossRef]

- Institute for Energy and Transport (Joint Research Centre). Prospective Scenarios on Energy Efficiency and CO2 Emissions in the EU Iron & Steel Industry. Available online: https://op.europa.eu/en/publication-detail/-/publication/69893c31-b50a-11e5-8d3c-01aa75ed71a1/language-en (accessed on 10 September 2025).

- IEA. Iron and Steel Technology Roadmap—Analysis. Available online: https://www.iea.org/reports/iron-and-steel-technology-roadmap? (accessed on 15 September 2025).

- Peppas, A.; Politi, C.; Taxiarchou, M. The Extractive Industry’s Decarbonization Potential Using Electrification and Hydrogen Technologies. Hydrogen 2025, 6, 19. [Google Scholar] [CrossRef]

- Ritchie, H. Sector by Sector: Where do Global Greenhouse Gas Emissions Come from? Our World Data, September 2020. Available online: https://ourworldindata.org/ghg-emissions-by-sector (accessed on 17 September 2025).

- Franco, A.; Giovannini, C. Recent and Future Advances in Water Electrolysis for Green Hydrogen Generation: Critical Analysis and Perspectives. Sustainability 2023, 15, 16917. [Google Scholar] [CrossRef]

- Mirshokraee, S.A.; Bedogni, S.; Bindi, M.; Santoro, C. Substituting Natural Gas with Hydrogen for Thermal Application in a Hard-to-Abate Industry: A Real Case Study. Hydrogen 2025, 6, 37. [Google Scholar] [CrossRef]

- Iron Bear. Pellets. Available online: https://www.cyclonemetals.au/iron-bear/pellets/ (accessed on 17 September 2025).

- Ji, Y.; Chi, Z.; Yuan, S.; Chen, Y.; Li, Y.; Jiang, T.; Liu, X.; Zhang, W. Development and Application of Hydrogen-Based Direct Reduction Iron Process. Processes 2024, 12, 1829. [Google Scholar] [CrossRef]

- CGEP. Low-Carbon Production of Iron & Steel: Technology Options, Economic Assessment, and Policy. Center on Global Energy Policy at Columbia University SIPA. Available online: https://www.energypolicy.columbia.edu/publications/low-carbon-production-iron-steel-technology-options-economic-assessment-and-policy/ (accessed on 15 September 2025).

- Devlin, A.; Kossen, J.; Goldie-Jones, H.; Yang, A. Global green hydrogen-based steel opportunities surrounding high quality renewable energy and iron ore deposits. Nat. Commun. 2023, 14, 2578. [Google Scholar] [CrossRef] [PubMed]

- CDP Italy. The Italian Steel Industry Across National and European Challenges: What Prospects for Development? Available online: https://www.cdp.it/resources/cms/documents/CDP-Brief-Italian-Steel-Industry-ENG.pdf (accessed on 10 September 2025).

- Steel Radar. Electric Arc Furnace Usage in Global Steel Production Hits 28.6%. Available online: https://www.steelradar.com/en/usage-of-electric-arc-furnace-in-global-steel-production-reaches-286 (accessed on 18 September 2025).

- Mapelli, C.; Dall’Osto, G.; Mombelli, D.; Barella, S.; Gruttadauria, A. Future Scenarios for Reducing Emissions and Consumption in the Italian Steelmaking Industry. Steel Res. Int. 2022, 93, 2100631. [Google Scholar] [CrossRef]

- Dall’Osto, G.; Mombelli, D.; Mapelli, C. Consequences of the Direct Reduction and Electric Steelmaking Grid Creation on the Italian Steel Sector. Metals 2024, 14, 311. [Google Scholar] [CrossRef]

- About Acciaierie d’Italia|EN. Available online: https://www.acciaierieditalia.com/en/company/about-us/? (accessed on 15 September 2025).

- GMK. Acciaierie d’Italia Produced About 3 Million Tons of Steel in 2023—News—GMK Center. Available online: https://gmk.center/en/news/acciaierie-ditalia-produced-about-3-million-tons-of-steel-in-2023/ (accessed on 15 September 2025).

- Carbon Market Watch. The Emissions Aristocracy. Available online: https://carbonmarketwatch.org/wp-content/uploads/2024/03/cmw_report-3.pdf? (accessed on 10 September 2025).

- Leogrande, S.; Alessandrini, E.R.; Stafoggia, M.; Morabito, A.; Nocioni, A.; Ancona, C.; Bisceglia, L.; Mataloni, F.; Giua, R.; Mincuzzi, A.; et al. Industrial air pollution and mortality in the Taranto area, Southern Italy: A difference-in-differences approach. Environ. Int. 2019, 132, 105030. [Google Scholar] [CrossRef]

- EFFACE (European Union Action to Fight Environmental Crime). Environmental Crime and Corporate Miscompliance: Case Study on the ILVA Steel Plant in Italy. Available online: https://www.ecologic.eu/sites/default/files/news/2015/efface_environmental_and_corporate_mis-compliance.pdf? (accessed on 5 September 2025).

- ECCO Climate. Taranto, Primary Steel Production in The Challenge of Decarbonisation. Available online: https://eccoclimate.org/wp-content/uploads/2021/11/Taranto-eng-1.pdf (accessed on 7 September 2025).

- European Commission. 2030 Climate Targets. Available online: https://climate.ec.europa.eu/eu-action/climate-strategies-targets/2030-climate-targets_en (accessed on 15 September 2025).

- INVITALIA. Invitalia—Prospectus 2025. Available online: https://www.invitalia.it/sites/invitalia.it/files/2025-07/Invitalia%20Prospectus%202025.pdf (accessed on 16 September 2025).

- Acciaierie d’Italia in Amministrazione Straordinaria: Blast Furnace 1 at Taranto Plant Reignited Decarbonization Plan Confirmed|EN. Available online: https://www.acciaierieditalia.com/en/press-releases/Acciaierie-d-Italia-under-extraordinary-administration-Blast-furnace-1-in-Taranto-restarted/ (accessed on 15 September 2025).

- Reuters. EU Awards Italian Energy Groups $402 mln for Green Hydrogen, 26 February 2024. Available online: https://www.reuters.com/sustainability/climate-energy/eu-awards-italian-energy-groups-402-mln-green-hydrogen-2024-02-26/ (accessed on 15 September 2025).

- Zou, B.; Zhang, Y.; Chen, Q.; Hu, Q.; Hu, X.; Shi, J.; Li, Z.; Wang, Q. Low-carbon economic schedule of the H2 DRI-EAF steel plant integrated with a power-to-hydrogen system driven by blue hydrogen and green hydrogen. IET Renew. Power Gener. 2024, 18, 3839–3854. [Google Scholar] [CrossRef]

- Elegbeleye, I.; Oguntona, O.; Elegbeleye, F. Green Hydrogen: Pathway to Net Zero Green House Gas Emission and Global Climate Change Mitigation. Hydrogen 2025, 6, 29. [Google Scholar] [CrossRef]

- SSAB. HYBRIT®. A New Revolutionary Steelmaking Technology. Available online: https://www.ssab.com/en-us/fossil-free-steel/insights/hybrit-a-new-revolutionary-steelmaking-technology (accessed on 15 September 2025).

- Vattenfall. HYBRIT: SSAB, LKAB and Vattenfall First in the World with Hydrogen-Reduced Sponge Iron. Available online: https://group.vattenfall.com/press-and-media/pressreleases/2021/hybrit-ssab-lkab-and-vattenfall-first-in-the-world-with-hydrogen-reduced-sponge-iron (accessed on 15 September 2025).

- Volvo Launches World’s First Vehicle Using Fossil-Free Steel. Available online: https://www.volvoce.com/global/en/news-and-events/news-and-stories/2021/volvo-launches-worlds-first-vehicle-using-fossil-free-steel/ (accessed on 15 September 2025).

- ArcelorMittal. Hamburg H2: Working Towards the Production of Zero-Carbon Emissions Steel with Hydrogen. Available online: https://corporate.arcelormittal.com (accessed on 15 September 2025).

- How Hydrogen will Give Us Low-Carbon Steel. Available online: https://www.siemens-energy.com/us/en/home/stories/h2future-voestalpine-linz.html (accessed on 16 September 2025).

- Rosner, F.; Papadias, D.; Brooks, K.; Yoro, K.; Ahluwalia, R.; Autrey, T.; Breunig, H. Green steel: Design and cost analysis of hydrogen-based direct iron reduction. Energy Environ. Sci. 2023, 16, 4121–4134. [Google Scholar] [CrossRef]

- Thyssenkrupp. Injection of Hydrogen into Blast Furnace: Thyssenkrupp Steel Concludes First Test Phase Successfully. Available online: https://www.thyssenkrupp-steel.com/en/newsroom/press-releases/thyssenkrupp-steel-concludes-first-test-phase-successfully.html (accessed on 18 September 2025).

- Barrett, N.; Mitra, S.; Doostmohammadi, H.; O’dea, D.; Zulli, P.; Chew, S.; Honeyands, T. Assessment of Blast Furnace Operational Constraints in the Presence of Hydrogen Injection. ISIJ Int. 2022, 62, 1168–1177. [Google Scholar] [CrossRef]

- Shen, J.; Zhang, Q.; Tian, S.; Li, X.; Liu, J.; Tian, J. The role of hydrogen in iron and steel production: Development trends, decarbonization potentials, and economic impacts. Int. J. Hydrog. Energy 2024, 92, 1409–1422. [Google Scholar] [CrossRef]

- Bataille, C.; Waisman, H.; Briand, Y.; Svensson, J.; Vogt-Schilb, A.; Jaramillo, M.; Delgado, R.; Arguello, R.; Clarke, L.; Wild, T.; et al. Net-zero deep decarbonization pathways in Latin America: Challenges and opportunities. Energy Strategy Rev. 2020, 30, 100510. [Google Scholar] [CrossRef]

- Xue, B.; Wei, G.; Hou, Y.; Hu, H.; Zhang, H.; Zhu, R.; Dong, K.; Feng, C.; Yang, L.; Wang, H. Comparative analysis of process selection and carbon emissions assessment of innovative steelmaking routes. J. Clean. Prod. 2024, 451, 142102. [Google Scholar] [CrossRef]

- Konovalov, D.; Tolstorebrov, I.; Iwamoto, Y.; Lamb, J.J. Hydrogen and Japan’s Energy Transition: A Blueprint for Carbon Neutrality. Hydrogen 2025, 6, 61. [Google Scholar] [CrossRef]

- Mio, A.; Danielis, R.; Carrosio, G.; Pricl, S. Decarbonization Pathways for the Italian Steel Sector: Environmental, Economic and Social Implications. Chem. Eng. Trans. 2025, 117, 325–330. [Google Scholar] [CrossRef]

- Li, L.; Aravind, P.V.; Boldrini, A.; van den Broek, M. Techno-economic assessment of off-grid hydrogen supply from distant solar or wind sources to steelmaking. Appl. Energy 2025, 391, 125947. [Google Scholar] [CrossRef]

- Reznicek, E.P.; Koleva, M.N.; King, J.; Kotarbinski, M.; Grant, E.; Vijayshankar, S.; Brunik, K.; Thomas, J.; Gupta, A.; Hammond, S.; et al. Techno-economic analysis of low-carbon hydrogen production pathways for decarbonizing steel and ammonia production. Cell Rep. Sustain. 2025, 2, 100338. [Google Scholar] [CrossRef]

- Jordan, K.H.; Jaramillo, P.; Karplus, V.J.; Adams, P.J.; Muller, N.Z. The Role of Hydrogen in Decarbonizing U.S. Iron and Steel Production. Environ. Sci. Technol. 2025, 59, 4915–4925. [Google Scholar] [CrossRef]

- International Carbon Action Partnership. EU Emissions Trading System (EU ETS). Available online: https://icapcarbonaction.com/system/files/ets_pdfs/icap-etsmap-factsheet-43.pdf (accessed on 15 September 2025).

- Richstein, J.C.; Neuhoff, K. Carbon contracts-for-difference: How to de-risk innovative investments for a low-carbon industry? iScience 2022, 25, 104700. [Google Scholar] [CrossRef]

- Center for Study of Science, Technology and Policy (CSTEP). Advanced Process Simulation Modelling for Hydrogen Application in Steel and Cement—A Technical and Economic Assessment. Available online: https://cstep.in/drupal/sites/default/files/2024-12/Advanced%20process%20simulation%20modelling%20for%20hydrogen%20application%20in%20steel%20and%20cement%20%E2%80%93%20A%20technical%20and%20economic%20assessment.pdf#:~:text=Thermodynamic%20process%20simulation%20software%2C%20such,studies%2C%20sensitivity%20testing%2C%20and%20process (accessed on 17 September 2025).

- Scheepers, F.; Stähler, M.; Stähler, A.; Rauls, E.; Müller, M.; Carmo, M.; Lehnert, W. Temperature optimization for improving polymer electrolyte membrane-water electrolysis system efficiency. Appl. Energy 2021, 283, 116270. [Google Scholar] [CrossRef]

- DWSIM—Open Source Chemical Process Simulator. Features by Platform. Available online: https://dwsim.org/wiki/index.php?title=Features_by_Platform (accessed on 18 September 2025).

- Bhaskar, A.; Abhishek, R.; Assadi, M.; Somehesaraei, H.N. Decarbonizing primary steel production: Techno-economic assessment of a hydrogen based green steel production plant in Norway. J. Clean. Prod. 2022, 350, 131339. [Google Scholar] [CrossRef]

- Strategic Energy Europe. Italy Boosts Industry with “Energy Release”: Renewable Energy at €65/MWh and Up to 5.5 GW of New Capacity. Available online: https://strategicenergy.eu/energy-release-gse-industry/ (accessed on 16 September 2025).

- Energy System. IEA. Electrolysers. Available online: https://www.iea.org/energy-system/low-emission-fuels/electrolysers (accessed on 16 September 2025).

- Vogl, V.; Åhman, M.; Nilsson, L.J. Assessment of hydrogen direct reduction for fossil-free steelmaking. J. Clean. Prod. 2018, 203, 736–745. [Google Scholar] [CrossRef]

- Renewable Power Generation Costs in 2023. Available online: https://www.irena.org/Publications/2024/Sep/Renewable-Power-Generation-Costs-in-2023 (accessed on 17 October 2025).

- Reksten, A.H.; Thomassen, M.S.; Møller-Holst, S.; Sundseth, K. Projecting the future cost of PEM and alkaline water electrolysers; a CAPEX model including electrolyser plant size and technology development. Int. J. Hydrog. Energy 2022, 47, 38106–38113. [Google Scholar] [CrossRef]

- Slanger, D. Hydrogen Reality Check: Distilling Green Hydrogen’s Water Consumption. RMI. Available online: https://rmi.org/hydrogen-reality-check-distilling-green-hydrogens-water-consumption/ (accessed on 17 September 2025).

- Enerdata. Carbon Price Forecast Under the EU ETS. Available online: https://www.enerdata.net/publications/executive-briefing/carbon-price-forecast-under-eu-ets.pdf (accessed on 15 September 2025).

- Institute of Energy Economics and Financial Analysis. Fact Sheet: The Facts About Steelmaking, Steelmakers Seeking Green Steel. Available online: https://ieefa.org/sites/default/files/2022-06/steel-fact-sheet.pdf (accessed on 16 September 2025).

- Bailera, M.; Lisbona, P.; Peña, B.; Romeo, L.M. A review on CO2 mitigation in the Iron and Steel industry through Power to X processes. J. CO2 Util. 2021, 46, 101456. [Google Scholar] [CrossRef]

- Rübbelke, D.; Vögele, S.; Grajewski, M.; Zobel, L. Hydrogen-based steel production and global climate protection: An empirical analysis of the potential role of a European cross border adjustment mechanism. J. Clean. Prod. 2022, 380, 135040. [Google Scholar] [CrossRef]

- European Commission. Carbon Border Adjustment Mechanism. Available online: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (accessed on 18 September 2025).

- Büsch, L.; Jakschik, M.; Syniawa, D.; Masuhr, C.; Christ, L.; Schachtsiek, J.; Haalck, K.; Nerlich, L.; Frömsdorf, E.; Schirmack, N.; et al. HyPLANT100: Industrialization from Assembly to the Construction Site for Gigawatt Electrolysis. Hydrogen 2024, 5, 185–208. [Google Scholar] [CrossRef]

- Haas, L. European Steel HRC Prices Largely Flat in Europe Amid Seasonal Trading Slowdown—EUROMETAL. Available online: https://eurometal.net/european-steel-hrc-prices-largely-flat-in-europe-amid-seasonal-trading-slowdown/ (accessed on 18 September 2025).

| Parameter | Value |

|---|---|

| Hydrogen production rate | 55 t/h |

| Annual hydrogen production | 0.48 Mt/y |

| Electrolyzer power duty | 2.68 GW |

| Auxiliary power duty | 0.215 GW |

| Specific energy consumption | 54 kWh/kg H2 |

| Overall efficiency (HHV) | 74% |

| Water consumption | 10 million m3/y |

| Scenario | Electricity Price (EUR/MWh) | Electrolyzer CAPEX (EUR/kW) | LCOH (EUR/kg H2) | Steel Cost (EUR/t) | CO2 Avoided (Mt/y) | Avoided Carbon Cost (EUR/y) | Steel Cost vs. Base Case |

|---|---|---|---|---|---|---|---|

| Base Case | 60 | 1000 | 3.6 | 653 | 17.6 | 1.06 bn EUR | -- |

| Low Electricity Price | 40 | 1000 | 2.6 | 591 | 17.6 | 1.06 bn EUR | −9.5% |

| Low CAPEX | 60 | 500 | 3.3 | 638 | 17.6 | 1.06 bn EUR | −2.3% |

| Combined Optimistic | 40 | 500 | 2.3 | 576 | 17.6 | 1.06 bn EUR | −11.8% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Joyo, F.H.; Groppi, D.; Villani, L.; Irfan; Astiaso Garcia, D. Techno-Economic Assessment of Hydrogen Integration for Decarbonizing the Steel Industry: A Case Study. Hydrogen 2025, 6, 104. https://doi.org/10.3390/hydrogen6040104

Joyo FH, Groppi D, Villani L, Irfan, Astiaso Garcia D. Techno-Economic Assessment of Hydrogen Integration for Decarbonizing the Steel Industry: A Case Study. Hydrogen. 2025; 6(4):104. https://doi.org/10.3390/hydrogen6040104

Chicago/Turabian StyleJoyo, Farhan Haider, Daniele Groppi, Lorenzo Villani, Irfan, and Davide Astiaso Garcia. 2025. "Techno-Economic Assessment of Hydrogen Integration for Decarbonizing the Steel Industry: A Case Study" Hydrogen 6, no. 4: 104. https://doi.org/10.3390/hydrogen6040104

APA StyleJoyo, F. H., Groppi, D., Villani, L., Irfan, & Astiaso Garcia, D. (2025). Techno-Economic Assessment of Hydrogen Integration for Decarbonizing the Steel Industry: A Case Study. Hydrogen, 6(4), 104. https://doi.org/10.3390/hydrogen6040104