Green Hydrogen in Europe: Where Are We Now?

Abstract

1. Introduction

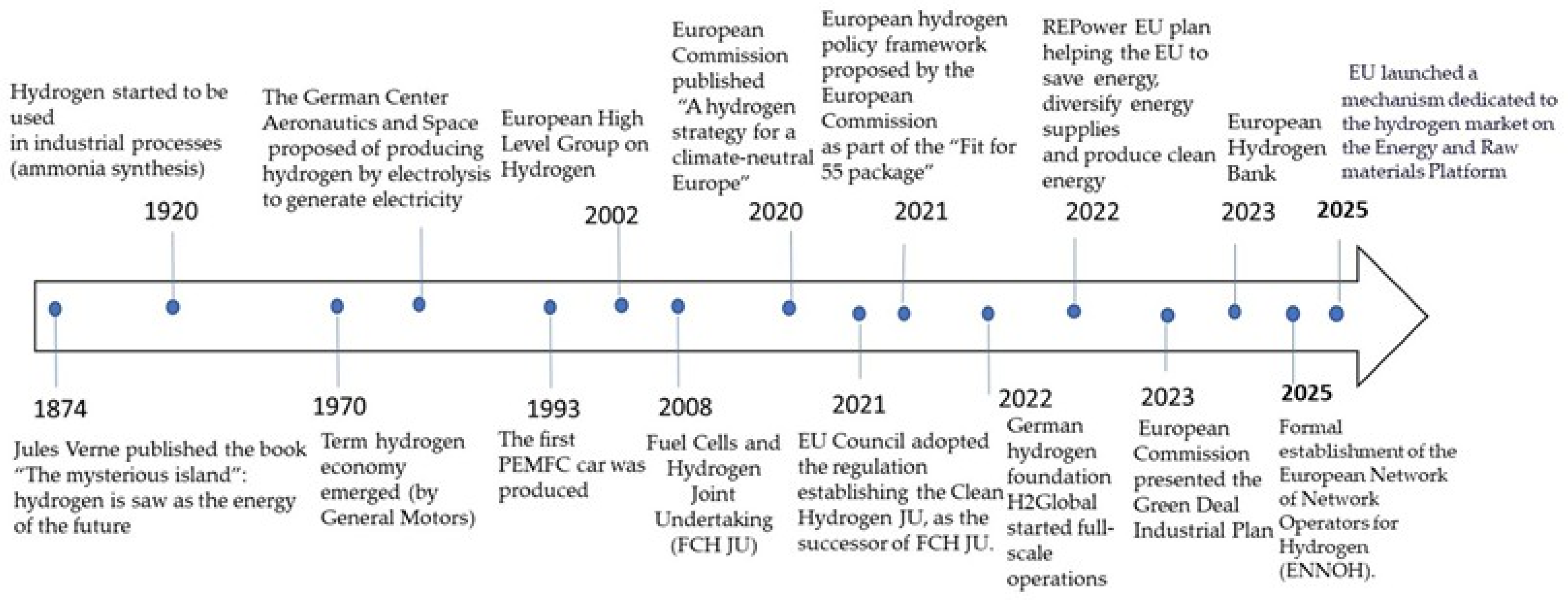

2. The Steps Toward a Green Hydrogen Economy in Europe

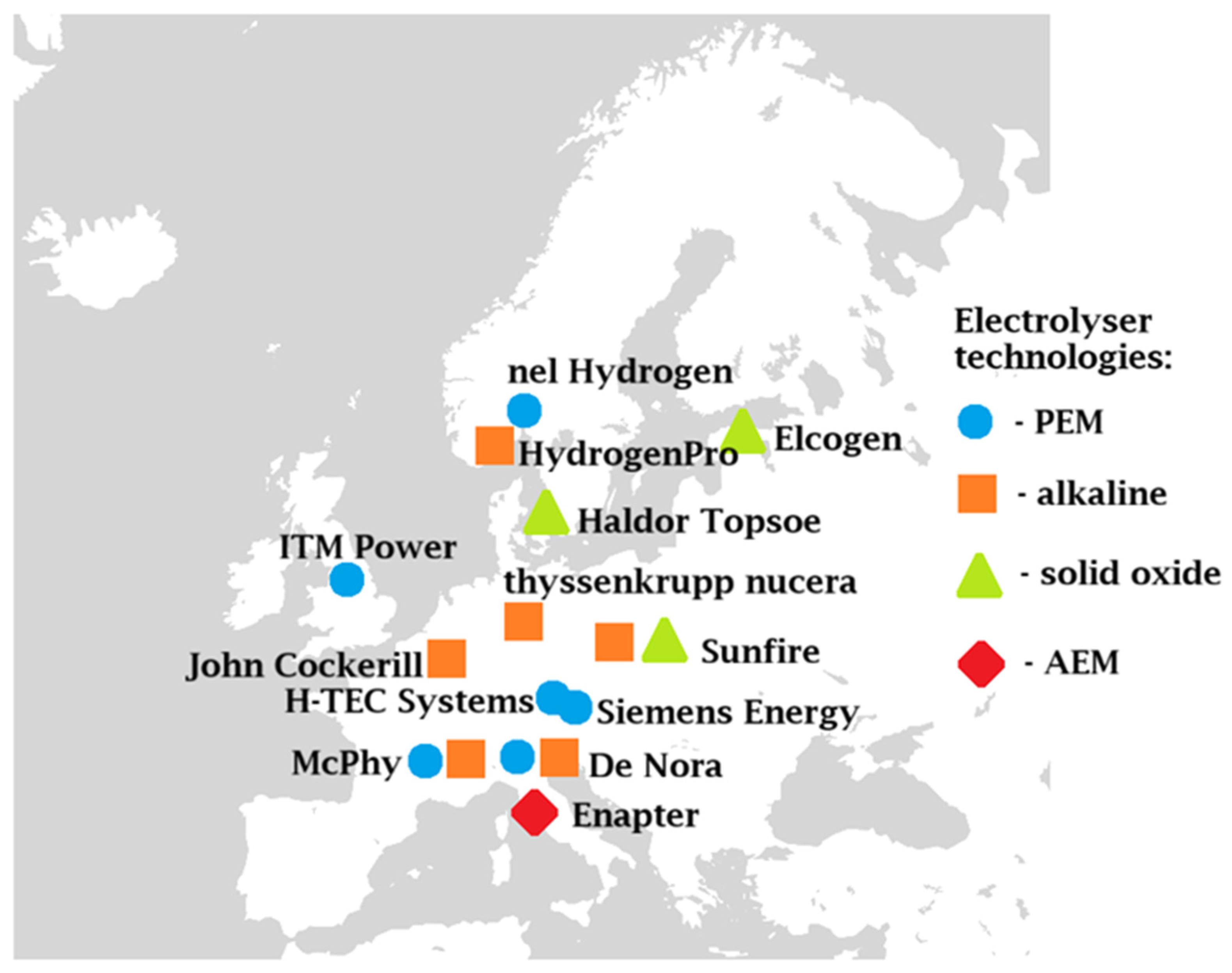

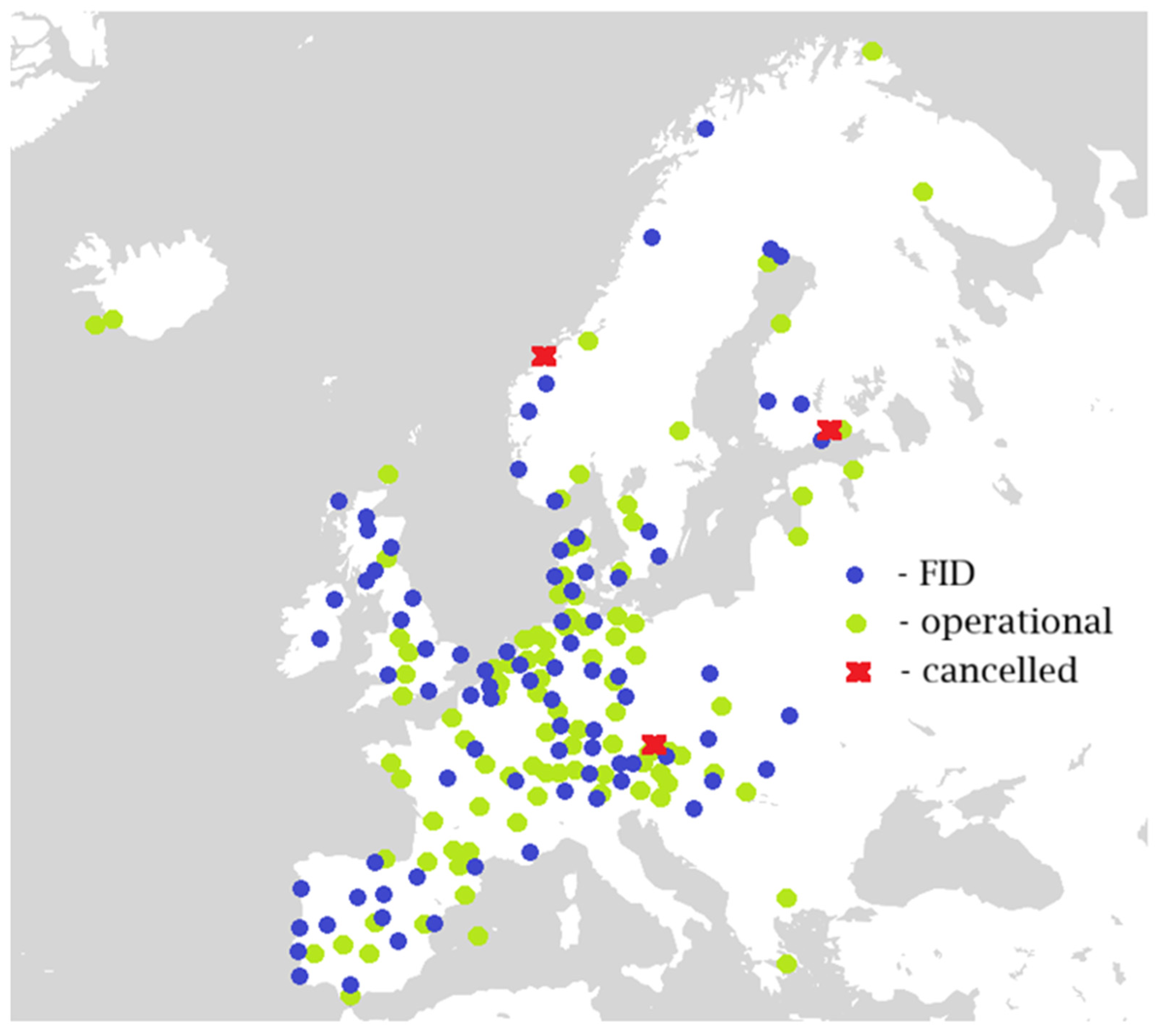

3. Types of Electrolyzers: Theoretical Background and Relevant Projects

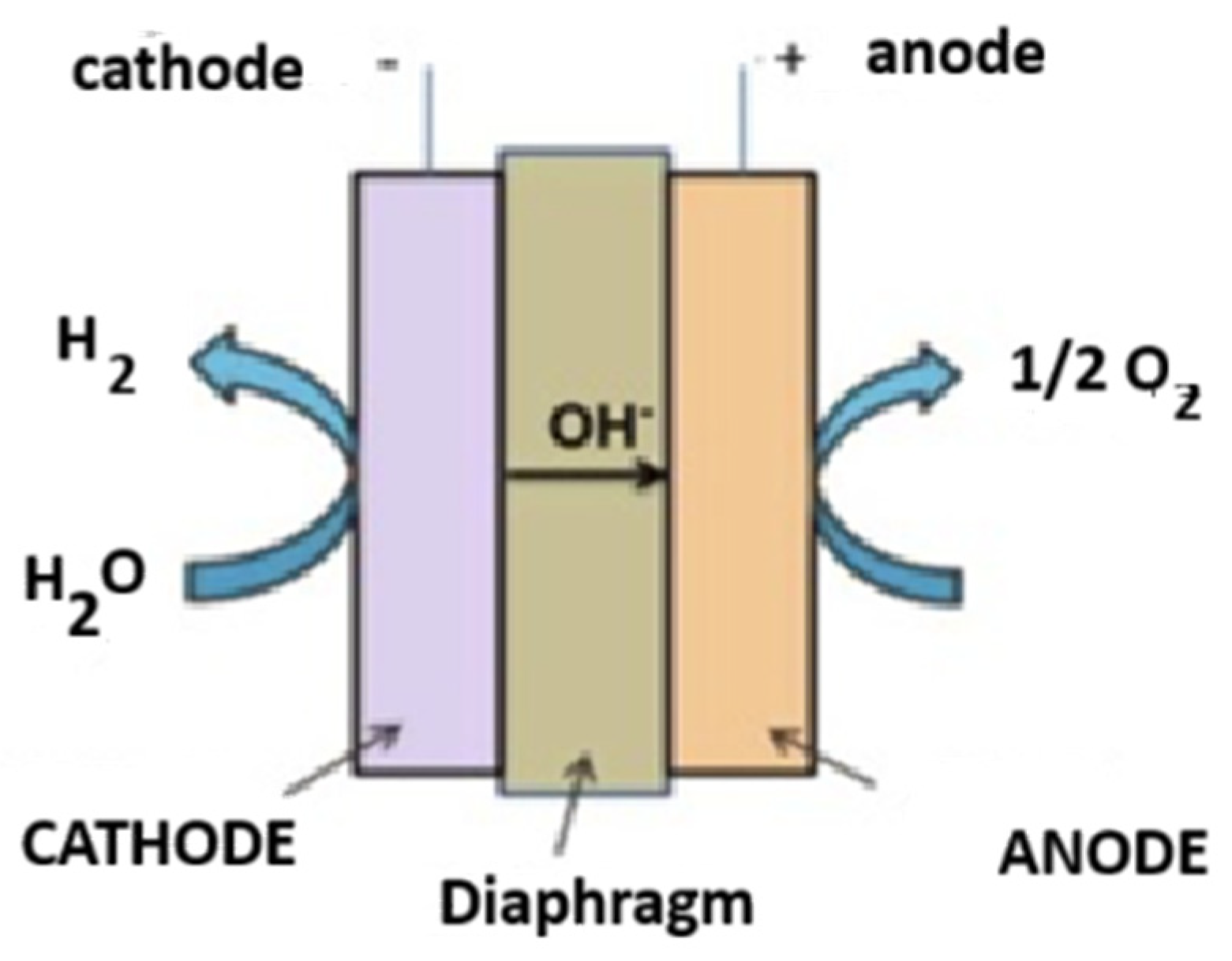

3.1. Alkaline Electrolysis (ALK)

3.2. Proton Exchange Membrane (PEM)

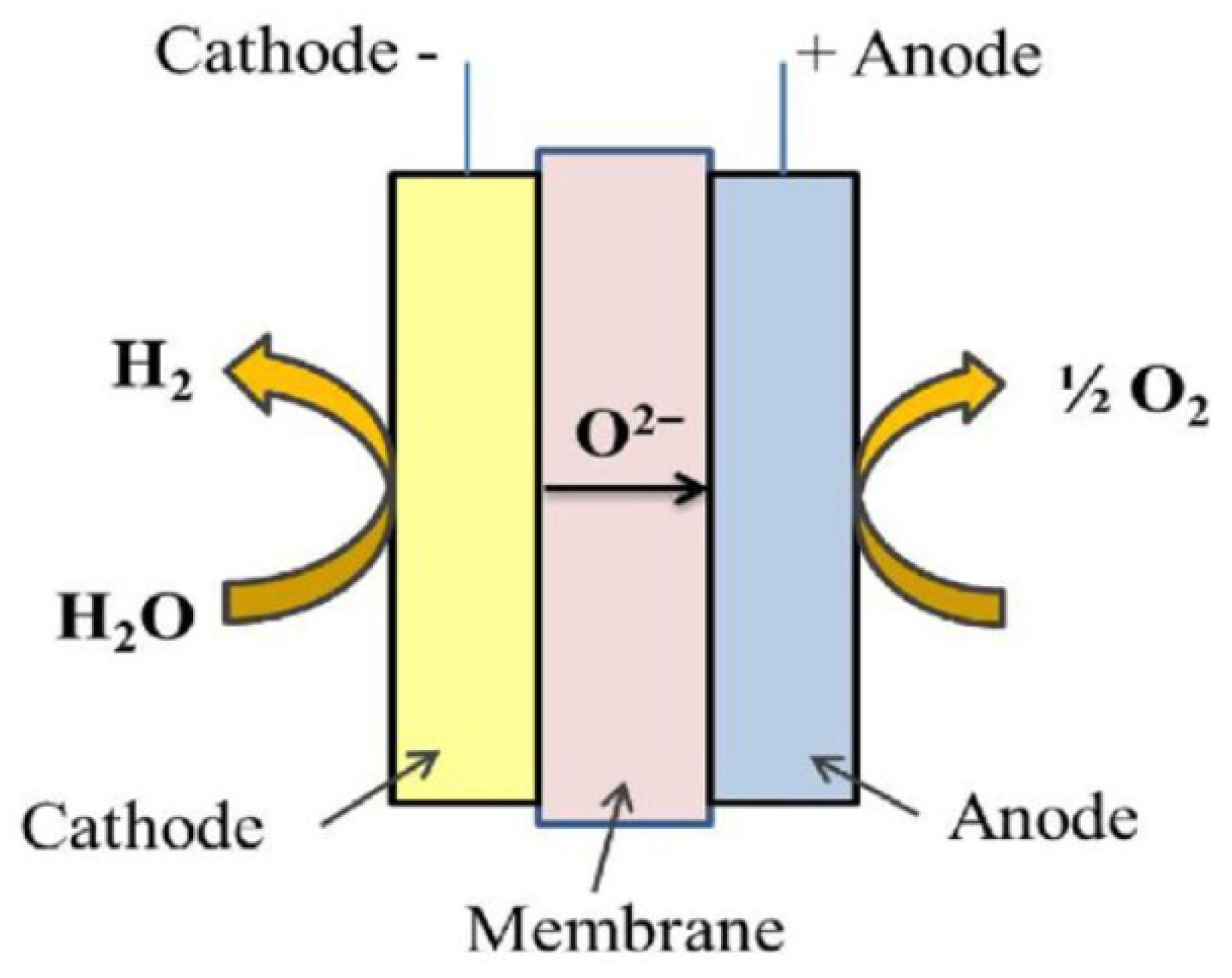

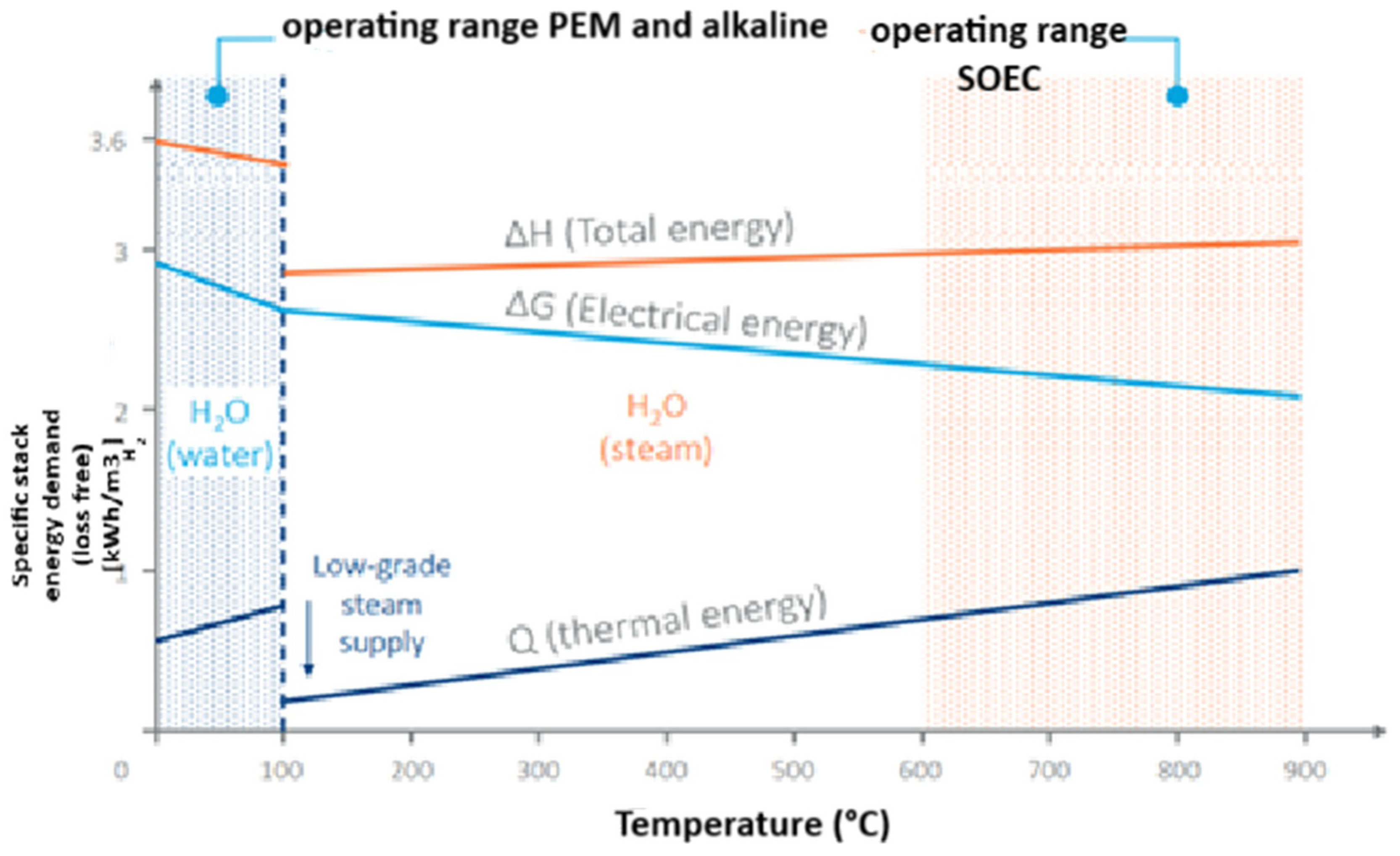

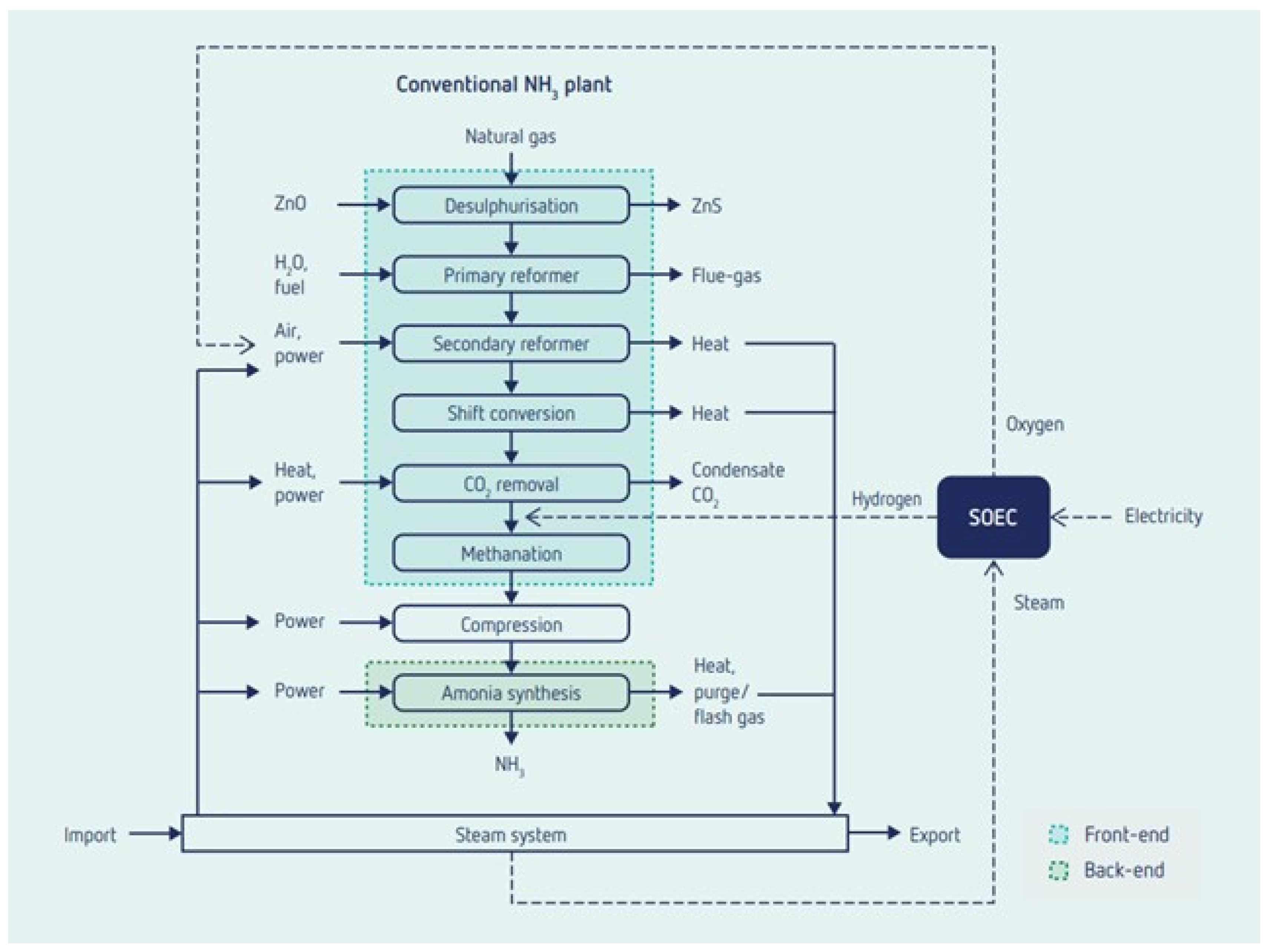

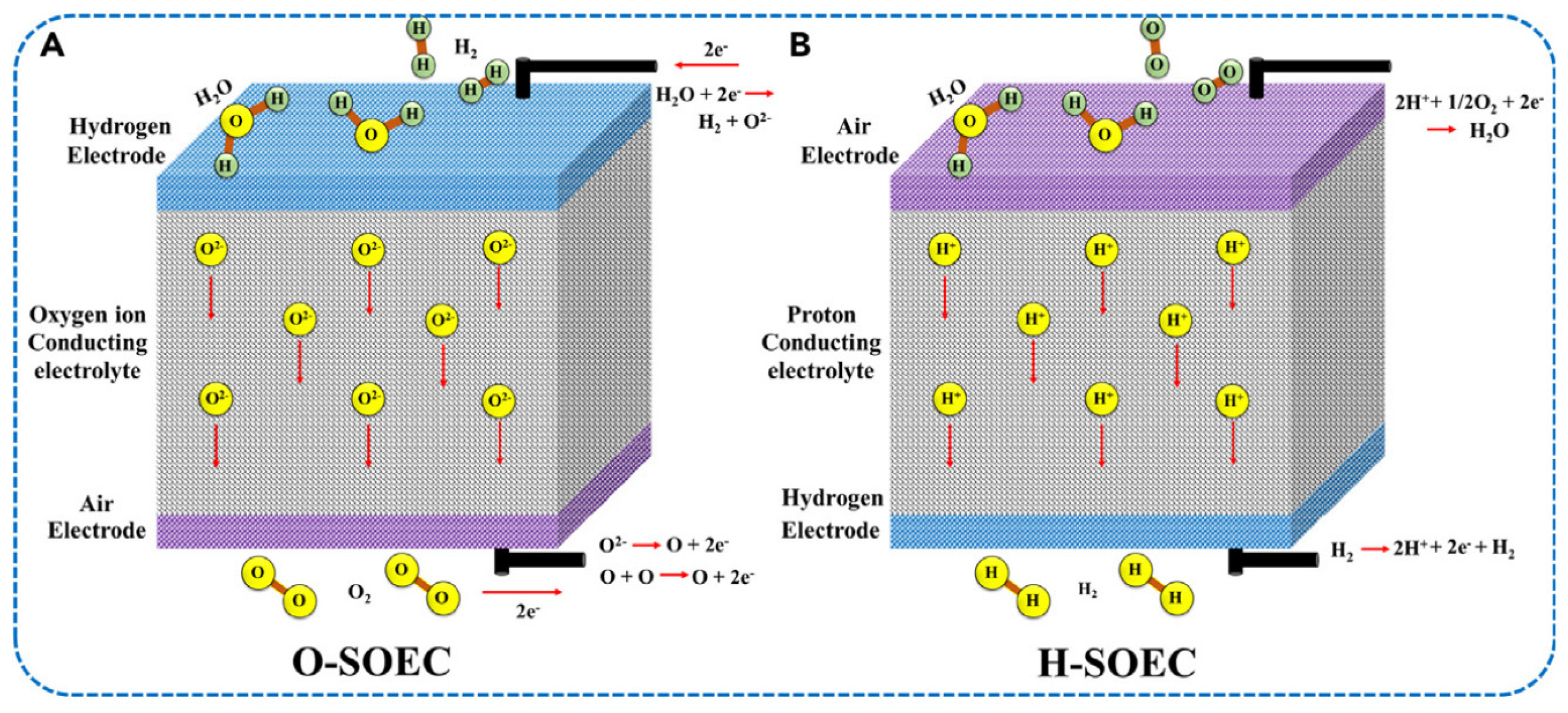

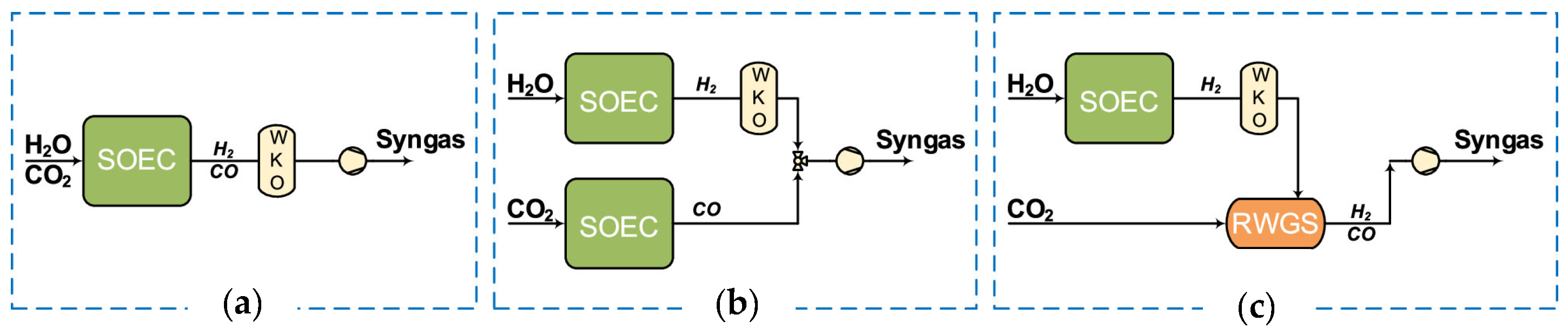

3.3. Solid Oxide Electrolyser (SOEC)

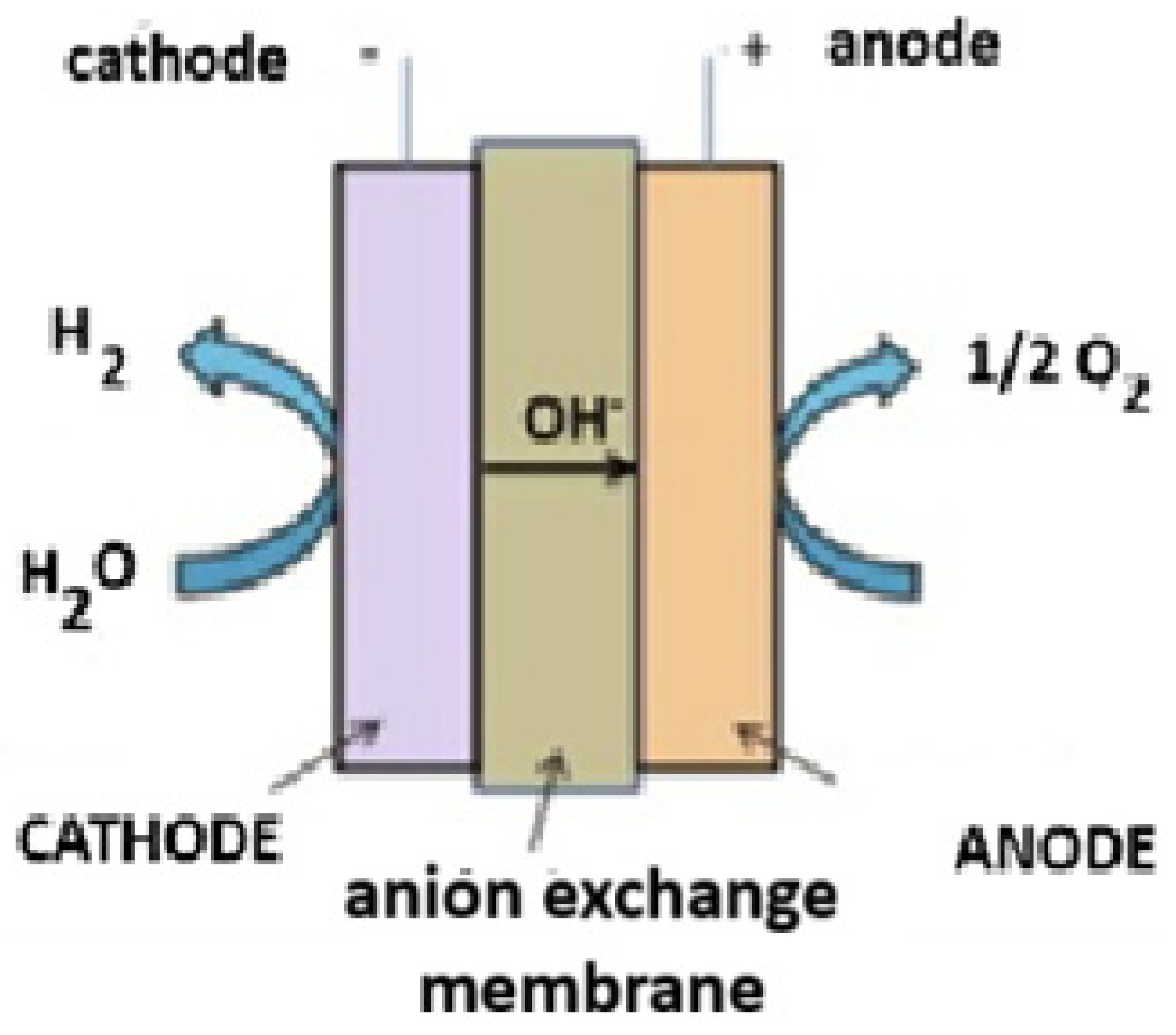

3.4. Anion Exchange Membrane (AEM)

4. Socio-Political Challenges

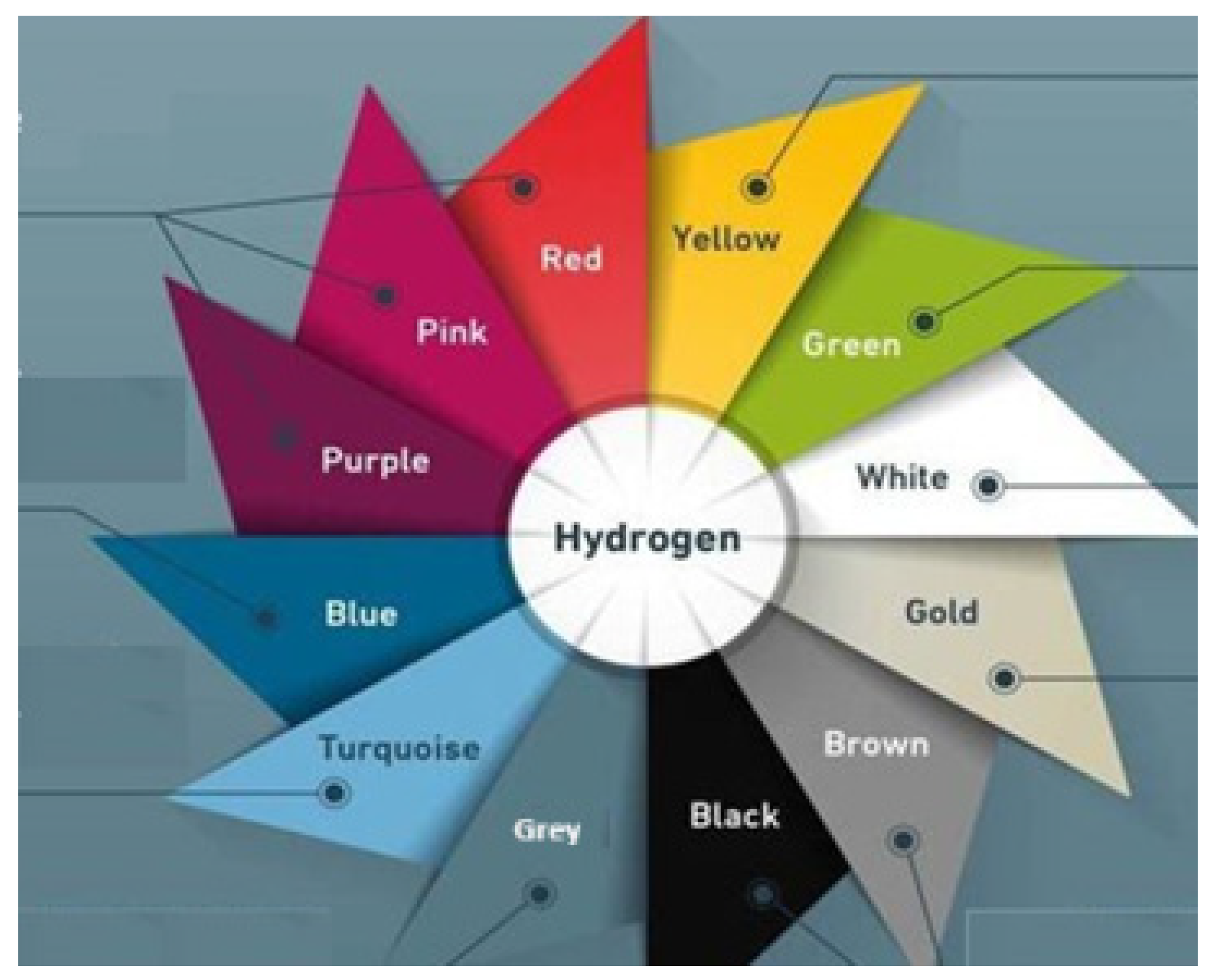

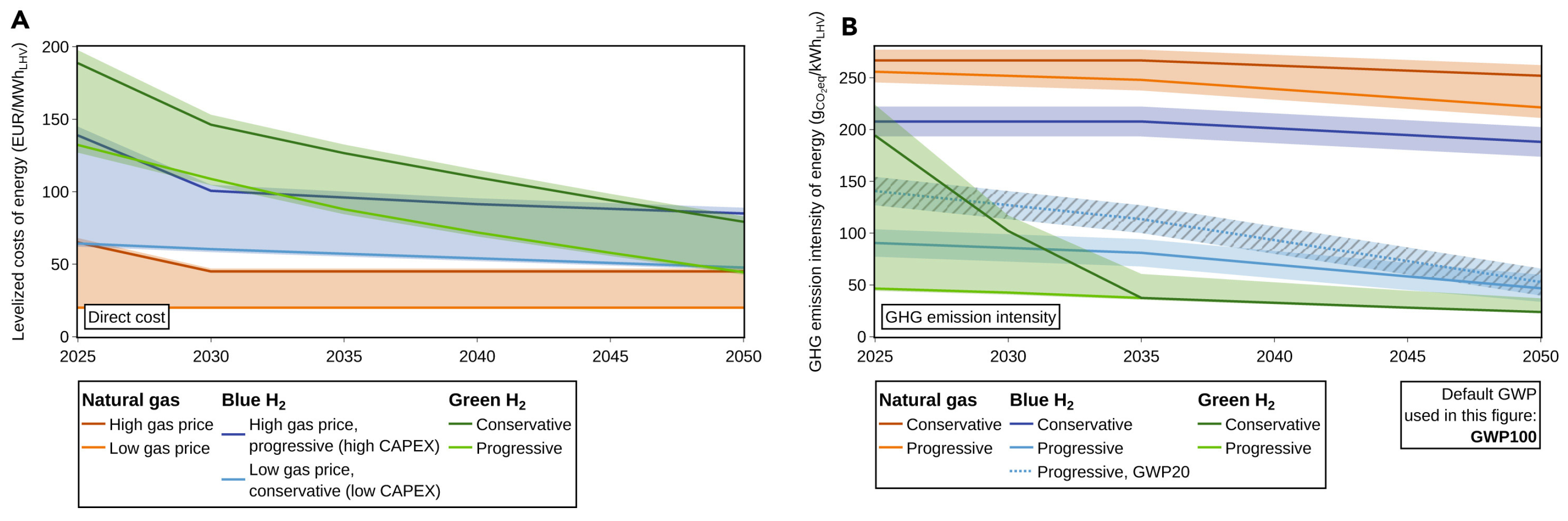

5. To What Extent Can Low-Carbon Hydrogen Complement Green Hydrogen?

6. Conclusions and Outlook

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ballentine, C.J.; Karolytė, R.; Cheng, A.; Lollar, B.S.; Gluyas, G.; Daly, M.C. Natural hydrogen resource accumulation in the continental crust. Nat. Rev. Earth Environ. 2025, 6, 342–356. [Google Scholar] [CrossRef]

- Klein, F.; Tarnas, J.D.; Bach, W. Abiotic sources of molecular hydrogen on Earth. Elements 2020, 16, 19–24. [Google Scholar] [CrossRef]

- Natural (Geologic) Hydrogen and Its Potential Role in a Net-Zero Carbon Future: Is All That Glitters Gold? Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2024/09/ET38-Natural-geologic-hydrogen-and-its-potential-role-in-a-net-zero-carbon-future.pdf (accessed on 13 September 2025).

- Gold Hydrogen is an Untapped Resource in Depleted Oil Wells. Available online: https://www.wired.com/story/gold-hydrogen/ (accessed on 13 September 2025).

- How Clean is Green Hydrogen? Available online: https://climate.mit.edu/ask-mit/how-clean-green-hydrogen (accessed on 8 September 2025).

- Alabbadi, A.A.; AlZahrani, A.A. Nuclear hydrogen production using PEM electrolysis integrated with APR1400 power plant. Int. J. Hydrogen Energy 2024, 60, 241–260. [Google Scholar] [CrossRef]

- Global Hydrogen Review. 2024. Available online: www.iea.org (accessed on 13 September 2025).

- The Clean Industrial Deal: A Joint Roadmap for Competitiveness and Decarbonization. Available online: https://commission.europa.eu/document/download/9db1c5c8-9e82-467b-ab6a-905feeb4b6b0_en (accessed on 3 March 2025).

- A Clean Industrial Deal for Competitiveness and Decarbonisation in the EU. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_25_550 (accessed on 3 March 2025).

- Bettenhausen, C. Green Hydrogen is Still Making Gains. Chemical & Engineering News. Available online: https://cen.acs.org/energy/hydrogen-power/Green-hydrogen-still-making-gains/103/web/2025/05 (accessed on 8 May 2025).

- Buonomenna, M.G.; Patonia, A. Green hydrogen: Where are we are? Preprints 2025. [Google Scholar] [CrossRef]

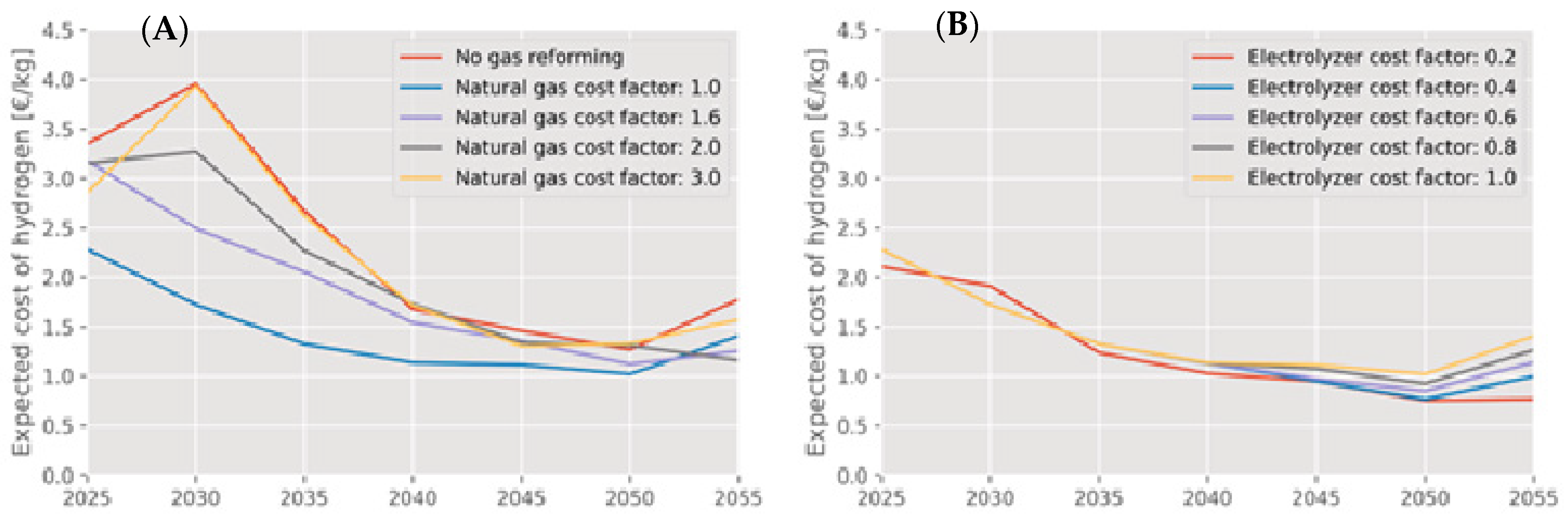

- Ajanovic, A.; Sayer, M.; Haas, R. On the future relevance of green hydrogen in Europe. Appl. Energy 2024, 358, 122586. [Google Scholar] [CrossRef]

- Groll, M. Can climate change be avoided? Vision of a hydrogen-electricity energy economy. Energy 2023, 264, 126029. [Google Scholar] [CrossRef]

- Clean Hydrogen Partneship_Our Story. Available online: https://www.clean-hydrogen.europa.eu/about-us/our-story_en#:~:text=2002%20%2D%202004,on%20the%20clean%20energy%20map (accessed on 9 September 2025).

- A Hydrogen Strategy for a Climate-Neutral Europe. Available online: https://energy.ec.europa.eu/system/files/2020-07/hydrogen_strategy_0.pdf (accessed on 9 September 2025).

- Hydrogen. Available online: https://energy.ec.europa.eu/topics/eus-energy-system/hydrogen_en (accessed on 9 September 2025).

- REPowerEU. Available online: https://commission.europa.eu/topics/energy/repowereu_en (accessed on 9 September 2025).

- On the European Hydrogen Bank. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52023DC0156&qid=1682349760946 (accessed on 9 September 2025).

- Mechanism to Support the Market Development of Hydrogen. Available online: https://energy.ec.europa.eu/topics/eus-energy-system/hydrogen/european-hydrogen-bank/mechanism-support-market-development-hydrogen_en (accessed on 1 November 2025).

- Buonomenna, M.G. Inorganic thin-film solar cells: Challenges at the terawatt-scale. Symmetry 2023, 159, 1718. [Google Scholar] [CrossRef]

- Ivanova, M.E.; Peters, R.; Müller, M.; Haas, S.; Seidler, M.F.; Mutschke, G.; Eckert, K.; Röse, P.; Calnan, S.; Bagacki, R.; et al. Technological Pathways to Produce Compressed and Highly Pure Hydrogen from Solar Power. Angew. Chem. Int. Ed. 2023, 62, e202218850. [Google Scholar] [CrossRef] [PubMed]

- Lange, H.; Klose, A.; Lippmann, W.; Urbas, L. Technical evaluation of the flexibility of water electrolysis systems to increase energy flexibility: A review. Int. J. Hydrogen Energy 2023, 48, 15771–15783. [Google Scholar] [CrossRef]

- Danish Energy Agency, Energinet. Technology data for Renewable Fuels. Tech. Rep. 2023. Available online: http://www.ens.dk/teknologikatalog (accessed on 9 September 2025).

- Proost, J. State-of-the art CAPEX data for water electrolysers, and their impact on renewable hydrogen price settings. Int. J. Hydrogen Energy 2019, 44, 4406–4413. [Google Scholar] [CrossRef]

- Guillet, N.; Millet, P. Alkaline Water Electrolysis. In Hydrogen Production; Wiley-VCH: Hoboken, NJ, USA, 2015; pp. 117–166. ISBN 9783527333424. [Google Scholar]

- Tüysüz, H. Alkaline Water Electrolysis for Green Hydrogen Production. Acc. Chem. Res. 2024, 57, 558–567. [Google Scholar]

- Santoro, C.; Lavacchi, A.; Mustarelli, P.; Di Noto, V.; Elbaz, L.; Dekel, D.R.; Jaouen, F. What is Next in Anion-Exchange Membrane Water Electrolyzers? Bottlenecks, Benefits, and Future. ChemSusChem 2022, 15, e202200027. [Google Scholar] [CrossRef]

- Hassan, A.; Abdel-Rahim, O.; Bajaj, M.; Zaitsev, I. Power electronics for green hydrogen generation with focus on methods, topologies, and comparative analysis. Sci. Rep. 2024, 14, 24767. [Google Scholar] [CrossRef]

- World’s ‘Largest’ Green Hydrogen Plant Construction Reaches 80% Completion. Available online: https://www.offshore-energy.biz/worlds-largest-green-hydrogen-plant-construction-reaches-80-completion/ (accessed on 9 September 2025).

- Green Hydrogen Picks Up Pace in Portugal. Available online: https://www.energiser.pt/en/forward/2023-10-04-Green-hydrogen-picks-up-pace-in-Portugal-28614f9a#:~:text=Galp%20has%20been%20increasingly%20involved,to%20commence%20operations%20in%202025 (accessed on 9 September 2025).

- Lusa—Business News—Portugal: Galp Sees Green Hydrogen, Biofuels Units Starting Production in 2026. Available online: https://www.aman-alliance.org/Home/ContentDetail/87785 (accessed on 9 September 2025).

- Portuguese Green Energy Corridor Projects Have a European Seal of Common Interest. Available online: https://www.portugal.gov.pt/en/gc23/communication/news-item?i=portuguese-green-energy-corridor-projects-have-a-european-seal-of-common-interest (accessed on 9 September 2025).

- Denmark’s First Large-Scale Electrolyser Module Delivered. Available online: https://greenhyscale.eu/wp-content/uploads/2023/04/UK_Denmarks-first-large-scale-electrolyser-module-delivered.pdf (accessed on 9 September 2025).

- Biswas, S.; Kulkarni, A.P.; Giddey, S.; Bhattacharya, S. A Review on Synthesis of Methane as a Pathway for Renewable Energy Storage With a Focus on Solid Oxide Electrolytic Cell-Based Processes. Front. Energy Res. 2020, 8, 570112. [Google Scholar] [CrossRef]

- Freija Unveils Plan for One of Europe’s Largest Major Green Hydrogen-Based E-Methane Facility in Nokia, Norway. Available online: https://fuelcellsworks.com/2025/01/23/fuel-cells/freija-unveils-plan-for-one-of-europe-s-largest-major-green-hydrogen-based-e-methane-facility-in-nokia-norway (accessed on 9 September 2025).

- MOL Group Opens 10 MW Green Hydrogen Plant in Hungary. Available online: https://www.offshore-energy.biz/mol-group-opens-10-mw-green-hydrogen-plant-in-hungary/ (accessed on 9 September 2025).

- Arcadia eFuels’ Danish SAF Plant to Use 280MW Plug Power Electrolyser. Available online: https://www.h2-view.com/story/arcadia-efuels-danish-saf-plant-to-use-280mw-plug-power-electrolyser/2100389.article/ (accessed on 9 September 2025).

- Galp Announces Launch of a Major 100 MW Electrolysis Plant in Portugal. Available online: https://fuelcellsworks.com/news/galp-announces-launch-of-a-major-100-mw-electrolysis-plant-in-portugal (accessed on 9 September 2025).

- Yara Starts up Europe’s Largest Green Hydrogen Plant in Norway. Available online: https://www.spglobal.com/commodity-insights/en/news-research/latest-news/energy-transition/061024-yara-starts-up-europes-largest-green-hydrogen-plant-in-norway (accessed on 9 September 2025).

- Yara Opens Renewable Hydrogen Plant: “A Major Milestone”. Available online: https://www.yara.com/corporate-releases/yara-opens-renewable-hydrogen-plant-a-major-milestone/ (accessed on 9 September 2025).

- Shell to Build 100-Megawatt Renewable Hydrogen Electrolyser in Germany. Available online: https://www.shell.com/what-we-do/hydrogen/latest-news-from-shell-hydrogen/shell-to-build-100-megawatt-renewable-hydrogen-electrolyser-in-germany.html (accessed on 9 September 2025).

- BASF Commissions 54-Megawatt Water Electrolyzer. Available online: https://www.basf.com/global/en/media/news-releases/2025/03/p-25-046 (accessed on 9 September 2025).

- Nel ASA: Receives Purchase Order for One MC500 Containerized PEM Electrolyser. Available online: https://bebeez.eu/2025/03/20/nel-asa-receives-purchase-order-for-one-mc500-containerized-pem-electrolyser/ (accessed on 9 September 2025).

- Renewable Hydrogen, Made Cost Competitive. Available online: https://nelhydrogen.com/wp-content/uploads/2020/03/Renewable-hydrogen-made-cost-competitive.pdf (accessed on 9 September 2025).

- Hydrasun Selects 2.5MW Nel Electrolyser for Aberdeen Hydrogen Hub. Available online: https://www.h2-view.com/story/hydrasun-selects-2-5mw-nel-electrolyser-for-aberdeen-hydrogen-hub/2123272.article/ (accessed on 9 September 2025).

- Buonomenna, M.G. Proton-Conducting Ceramic Membranes for the Production of Hydrogen via Decarbonized Heat: Overview and Prospects. Hydrogen 2023, 4, 807–830. [Google Scholar] [CrossRef]

- Production of Renewable Hydrogen and Syngas Via High Temperature Electrolysis. Available online: https://multiplhy-project.eu/Documents/Workshop%20on%20Advanced%20PtG%20and%20PtL%20Technologies%20High-Temperature%20Electrolysis_Posdziech.pdf (accessed on 14 September 2025).

- The Concept for a Sustainable Future. Available online: https://salcos.salzgitter-ag.com/en/salcos.html (accessed on 9 September 2025).

- Syrius Project. Available online: https://syrius-project.eu/project/ (accessed on 9 September 2025).

- Next level Solid Oxide Electrolysis by Institute for Sustainable Process Technology. Available online: https://ispt.eu/media/20230508-FINAL-SOE-public-report-ISPT.pdf (accessed on 9 September 2025).

- Topsoe and First Ammonia Launch Zero Emission Ammonia Production with the World’s Largest Reservation of Electrolyzer Capacity. Available online: https://www.topsoe.com/press-releases/topsoe-and-first-ammonia (accessed on 9 September 2025).

- Hanif, M.B.; Rauf, S.; Abadeen, Z.; Khan, K.; Tayyab, Z.; Qayyum, S.; Mosiałek, M.; Shao, Z.; Li, C.X.; Motola, M. Proton-conducting solid oxide electrolysis cells: Relationship of composition-structure-property, their challenges, and prospects. Matter 2023, 6, 1782–1830. [Google Scholar] [CrossRef]

- Choi, W.; Choi, Y.; Choi, E.; Yun, H.; Jung, W.; Lee, W.H.; Oh, H.-S.; Won, D.H.; Na, J.; Hwang, Y.J. Microenvironments of Cu catalysts in zero-gap membrane electrode assembly for efficient CO2 electrolysis to C2+ products. J. Mater. Chem. A 2022, 10, 10363–10372. [Google Scholar] [CrossRef]

- Cheon, H.; Kim, J.H.; Kim, J.S.; Park, J.-B. Valorization of single-carbon chemicals by using carboligases as key enzymes. Curr. Opin. Biotechnol. 2024, 85, 103047. [Google Scholar] [CrossRef]

- Berberich, M.E.; Beaulieu, J.J.; Hamilton, T.L.; Waldo, S.; Buffam, I. Spatial variability of sediment methane production and methanogen communities within a eutrophic reservoir: Importance of organic matter source and quantity. Limnol. Oceanogr. 2023, 65, 1336–1358. [Google Scholar] [CrossRef] [PubMed]

- Bube, S.; Sens, L.; Drawer, C.; Kaltschmitt, M. Power and biogas to methanol—A techno-economic analysis of carbon-maximized green methanol production via two reforming approaches. Energy Convers. Manag. 2024, 304, 118220. [Google Scholar] [CrossRef]

- Rapp, D.; Inglezakis, V.J. Mars In Situ Resource Utilization (ISRU) with Focus on Atmospheric Processing for Near-Term Application—A Historical Review and Appraisal. Appl. Sci. 2024, 14, 653. [Google Scholar] [CrossRef]

- Gupta, S.; Riegraf, M.; Costa, R.; Heddrich, M.P.; Friedrich, K.A. Solid Oxide Electrolysis Cell-Based Syngas Production and Tailoring: A Comparative Assessment of Coelectrolysis, Separate Steam, CO2 Electrolysis, and Steam Electrolysis. Ind. Eng. Chem. Res. 2024, 63, 8705–8712. [Google Scholar] [CrossRef]

- Strategic Research And Innovation Agenda 2021−2027, Clean Hydrogen Joint Undertaking. 2022. Available online: https://www.clean-hydrogen.europa.eu/system/files/2022-02/Clean%20Hydrogen%20JU%20SRIA%20-%20approved%20by%20GB%20-%20clean%20for%20publication%20%28ID%2013246486%29.pdf (accessed on 9 September 2025).

- Thyssenkrupp Nucera and Fraunhofer IKTS Open First SOEC Pilot Production Plant for Stacks for the Production of Green Hydrogen. Available online: https://www.thyssenkrupp-nucera.com/thyssenkrupp-nucera-and-fraunhofer-ikts-open-first-soec-pilot-production-plant-for-stacks-for-the-production-of-green-hydrogen/ (accessed on 9 September 2025).

- Serov, A.; Kovnir, K.; Shatruk, M.; Kolen’ko, Y.V. Critical Review of Platinum Group Metal-Free Materials for Water Electrolysis: Transition from the Laboratory to the Market. Johns. Matthey Technol. Rev. 2021, 65, 207–226. [Google Scholar] [CrossRef]

- Jin, H.; Ruqia, B.; Park, Y.; Kim, H.J.; Oh, H.-S.; Choi, S.-I.; Lee, K. Nanocatalyst Design for Long-Term Operation of Proton/Anion Exchange Membrane Water Electrolysis. Adv. Energy Mater. 2021, 11, 2003188. [Google Scholar] [CrossRef]

- Ďurovič, M.; Hnat, J.; Bouzek, K. Electrocatalysts for the hydrogen evolution reaction in alkaline and neutral media. J. Power Sources 2021, 493, 229708. [Google Scholar] [CrossRef]

- Mahmood, N.; Yao, Y.; Zhang, J.-W.; Pan, L.; Zhang, X.; Zou, J.-J. Electrocatalysts for Hydrogen Evolution in Alkaline Electrolytes: Mechanisms, Challenges, and Prospective Solutions. Adv. Sci. 2018, 5, 1700464. [Google Scholar] [CrossRef]

- Baek, D.S.; Lee, J.; Lim, J.S.; Joo, S.H. Nanoscale electrocatalyst design for alkaline hydrogen evolution reaction through activity descriptor identification. Mater. Chem. Front. 2021, 5, 4042–4058. [Google Scholar] [CrossRef]

- Yang, L.; Dong, S.; Yang, T.; Liu, J.; Liu, S.; Wang, K.; Wang, E.; Wang, H.; Chou, K.C.; Hou, X. Membrane Electrode Assembly Design for High-Efficiency Anion Exchange Membrane Water Electrolysis. Research 2025, 8, 0907. [Google Scholar] [CrossRef]

- How to Say Goodbay to PFAS. Available online: https://cen.acs.org/environment/persistent-pollutants/say-goodbye-PFAS/97/i46 (accessed on 14 September 2025).

- Cousins, I.T.; Goldenman, G.; Herzke, D.; Lohmann, R.; Miller, M.; Ng, C.A.; Patton, S.; Scheringer, M.; Trier, X.; Vierke, L.; et al. The concept of essential use for determining when uses of PFASs can be phased out. Environ. Sci. Process. Impacts 2019, 21, 1803–1815. [Google Scholar] [CrossRef] [PubMed]

- HYscale. Economic Green Hydrogen Production at Scale Via a Novel, Critical Raw Material Free, Highly Efficient and Low Capex Advanced Alkaline Membrane Water Electrolysis Technology. Available online: https://cordis.europa.eu/project/id/101112055/reporting#:~:text=The%20HYScale%20project%20is%20a,hydrogen%20technology%20innovation%20and%20deployment (accessed on 14 September 2025).

- AEM-HUB. Available online: https://www.sintef.no/projectweb/channel-fch/aem-hub/#:~:text=The%20AEM%2DHUB%20is%20a%20cluster%20of%20three,water%20electrolysers%20(AEMEL)%20for%20green%20hydrogen%20production (accessed on 14 September 2025).

- AEM Nexus. Available online: https://enapter.com/en/product/aem-nexus/ (accessed on 14 September 2025).

- Fallback Thursday: Enapter to Supply AEM Nexus Electrolysers for Falconara Hydrogen Project in Italy. Available online: https://fuelcellsworks.com/2025/03/13/electrolyzer/fallback-thursday-enapter-to-supply-aem-nexus-electrolysers-for-falconara-hydrogen-project-in-italy (accessed on 14 September 2025).

- Italy Grants €317m to State-Owned Company to Build AEM Hydrogen Electrolysers. Available online: https://www.hydrogeninsight.com/innovation/italy-grants-317m-to-state-owned-company-to-build-aem-hydrogen-electrolysers/2-1-1784205 (accessed on 14 September 2025).

- European Investment Bank. A Pipeline to Better Lives. Available online: https://www.eib.org/en/stories/morocco-water-scarcity (accessed on 14 September 2025).

- Voice of America. Morocco Expands Freshwater Efforts, but Needs More Energy. Available online: https://learningenglish.voanews.com/a/morocco-expands-freshwater-efforts-but-needs-more-energy/6844012.html (accessed on 14 September 2025).

- Jenkins, K.; McCauley, D.; Heffron, R.; Stephan, H.; Rehner, R. Energy justice: A conceptual framework. Energy Res. Soc. Sci. 2021, 75, 101–112. [Google Scholar]

- A Conceptual Framework for Assessing and Monitoring Social Risks and Impacts Related to Hydrogen Technologies and Their Value Chains. Available online: https://publications.jrc.ec.europa.eu/repository/handle/JRC138850 (accessed on 7 September 2025).

- Corporate Europe Observatory. Hydrogen from North Africa—A Neo-Colonial Resource Grab. Available online: https://corporateeurope.org/en/2022/05/hydrogen-north-africa-neocolonial-resource-grab (accessed on 14 September 2025).

- Skládalová, D. Unmasking Green Colonialism in EU-Namibia Hydrogen Deal. Available online: https://www.ejiltalk.org/unmasking-green-colonialism-in-eu-namibia-hydrogen-deal/ (accessed on 14 September 2025).

- CIC energiGUNE. Electrolyzers: A Manufacturing Industry That Everyone Wants to Lead. Available online: https://cicenergigune.com/en/blog/electrolyzers-manufacturing-industry-everyone-lead (accessed on 14 September 2025).

- Blackridge Research and Consulting. Global Top 20 Hydrogen Electrolyzer Manufacturers. Available online: https://www.blackridgeresearch.com/blog/list-of-global-top-hydrogen-electrolyzer-manufacturers-companies-makers-suppliers-in-the-world (accessed on 14 September 2025).

- Dillman, K.J.; Heinonen, J. A ‘just’ hydrogen economy: A normative energy justice assessment of the hydrogen economy. Renew. Sustain. Energy Rev. 2022, 167, 112648. [Google Scholar] [CrossRef]

- Dembi, V. Ensuring Energy Justice in Transition to Green Hydrogen. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4015169 (accessed on 14 September 2025).

- Europe Hydrogen. Hydrogen Production & Water Consumption. Available online: https://hydrogeneurope.eu/wp-content/uploads/2022/02/Hydrogen-production-water-consumption_fin.pdf (accessed on 14 September 2025).

- International PtX Hub. A First Look at Water Demand for Green Hydrogen and Concerns and Opportunities with Desalination. Available online: https://ptx-hub.org/a-first-look-at-water-demand-for-green-hydrogen-and-concerns-and-opportunities-with-desalination/ (accessed on 14 September 2025).

- Ourya, I.; Nabil, N.; Abderafi, S.; Boutammachte, N.; Rachidi, S. Assessment of green hydrogen production in Morocco, using hybrid renewable sources (PV and wind). Int. J. Hydrogen Energy 2023, 48, 37428–37442. [Google Scholar] [CrossRef]

- EU’s Clean Hydrogen Plan Raises Dirty Doubts. Available online: https://www.politico.eu/article/eu-clean-hydrogen-plan-doubts/ (accessed on 14 September 2025).

- Walker, G. Beyond distribution and proximity: Exploring the multiple spatialities of environmental justice. Antipode 2009, 41, 614–634. [Google Scholar] [CrossRef]

- Schlosberg, D. The justice of environmental justice: Reconciling equity, recognition, and participation in a political movement. In Moral and Political Reasoning in Environmental Practice; Light, A., De-Shalit, A., Eds.; MIT Press: London, UK, 2003; pp. 125–156. [Google Scholar]

- BBC. Hydrogen Heating Trial Treats Us Like Guinea Pigs—Residents. Available online: https://www.bbc.com/news/science-environment-64028510 (accessed on 14 September 2025).

- ‘We’ve Got No Choice’: Locals Fear Life as Lab Rats in UK Hydrogen Heating Pilot. Available online: https://www.theguardian.com/environment/2022/nov/21/no-choice-hydrogen-heating-pilot-whitby-ellesmere-port-lab-rats (accessed on 14 September 2025).

- Energy Institute. UK Government Rejects Whitby Hydrogen Village Trial. Available online: https://knowledge.energyinst.org/new-energy-world/article?id=138075 (accessed on 14 September 2025).

- Voice of America. Namibia’s Nama Community Rejects Green-Hydrogen Port Expansion. Available online: https://www.voanews.com/a/namibia-s-nama-community-rejects-green-hydrogen-port-expansion-/7574111.html (accessed on 14 September 2025).

- Future Power Technology. La Guajira: The Renewable Centre Tearing Itself Apart Over Wind. Available online: https://power.nridigital.com/future_power_technology_aug23/guajira-colombia-development-wayuu-enel-wind (accessed on 14 September 2025).

- Latina Pensa. Colombian Government to Solve Vulnerabilities in La Guajira. Available online: https://www.plenglish.com/news/2023/06/24/colombian-government-to-solve-vulnerabilities-in-la-guajira/ (accessed on 14 September 2025).

- Wind Energy and Wayuu Indigenous Communities: Challenges in La Guajira. Available online: https://www.sei.org/features/wind-energu-wayuu-la-guajira/ (accessed on 14 September 2025).

- ReCharge. ‘This Hurts Us’. Enel Suspends Colombia Wind Farm Build as Years of Protests Take Toll. Available online: https://www.rechargenews.com/wind/this-hurts-us-enel-suspends-colombia-wind-farm-build-as-years-of-protests-take-toll/2-1-1456238 (accessed on 14 September 2025).

- Bullard, R.D. Environmental justice in the 221st century. In Debating the Earth; Dryzek, J., Schlosburg, D., Eds.; Oxford University Press: Oxford, UK, 2005; pp. 322–356. [Google Scholar]

- Davies, A. Environmental justice as subtext or omission: Examining discourses of anti-incineration campaigning in Ireland. Geoforum 2006, 37, 708–724. [Google Scholar] [CrossRef]

- McSheffrey, E. Northwest First Nations Join Forces to Pursue Renewable Energy in B.C. Available online: https://globalnews.ca/news/10076258/first-nations-renewable-energy-bc/ (accessed on 9 September 2025).

- WSRW. Greenwashing Occupation. Available online: https://vest-sahara.s3.amazonaws.com/wsrw/feature-images/File/405/616014d0c1f1d_Greenwashing-occupation_web.pdf (accessed on 9 September 2025).

- Expensive ‘Green’ Hydrogen Jeopardises German Industrial Energy Transition. Available online: https://www.ft.com/content/bc4e49d6-ac89-4835-80dd-87663de0cfd1 (accessed on 9 September 2025).

- Hydrogen and Decarbonised Gas Market. Available online: https://energy.ec.europa.eu/topics/markets-and-consumers/hydrogen-and-decarbonised-gas-market_en (accessed on 9 September 2025).

- Clarity to Hydrogen Sector with New EU Methodology for Low-Carbon Hydrogen and Fuels. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_25_1743 (accessed on 9 September 2025).

- George, J.F.; Muller, V.P.; Winkler, J.; Ragwitz, M. Is blue hydrogen a bridging technology?—The limits of a CO2 price and the role of state-induced price components for green hydrogen production in Germany. Energy Policy 2022, 167, 113072. [Google Scholar] [CrossRef]

- Ueckerdt, F.; Verpoort, P.C.; Anantharaman, R.; Bauer, C.; Beck, F.; Longden, T.; Roussanaly, S. On the cost competitiveness of blue and green hydrogen. Joule 2024, 8, 104–128. [Google Scholar] [CrossRef]

- Bauer, C.; Treyer, K.; Antonini, C.; Bergerson, J.; Gazzani, M.; Gencer, E.; Gibbins, J.; Mazzotti, M.; McCoy, S.T.; McKenna, R.; et al. On the climate impacts of blue hydrogen production. Sustain. Energy Fuels 2021, 6, 66–75. [Google Scholar] [CrossRef]

- Oni, A.O.; Anaya, K.; Giwa, T.; Di Lullo, G.; Kumar, A. Comparative assessment of blue hydrogen from steam methane reforming, autothermal reforming, and natural gas decomposition technologies for natural gasproducing regions. Energy Convers. Manag. 2022, 254, 115245. [Google Scholar] [CrossRef]

- Antonini, C.; Treyer, K.; Streb, A.; van der Spek, M.; Bauer, C.; Mazzotti, M. Hydrogen production from natural gas and biomethane with carbon capture and storage—A techno-environmental analysis. Sustain. Energy Fuels 2020, 4, 2967–2986. [Google Scholar] [CrossRef]

- Global Hydrogen Review 2022. Available online: https://www.iea.org/reports/global-hydrogen-review-2022 (accessed on 9 September 2025).

- Durakovic, G.; Crespo del Granado, P.; Tomasgard, A. Are green and blue hydrogen competitive or complementary? Insights from a decarbonized European power system analysis. Energy 2023, 282, 128282. [Google Scholar] [CrossRef]

- Important Step Towards Establishing the European Network of Network Operators for Hydrogen. Available online: https://energy.ec.europa.eu/news/important-step-towards-establishing-european-network-network-operators-hydrogen-2025-05-16_en (accessed on 14 September 2025).

| Entry | Hydrogen Designation | Carbon Footprint (Kg CO2 Kg−1 H2) | Production Cost (USD Kg−1 H2) |

|---|---|---|---|

| 1 | Black/Grey | 10–25 | 1.0–2.7 |

| 2 | Blue | 1–10 | 1.0–4.0 |

| 3 | White | ≥0.4 | ≥1.0 |

| 4 | Green | 0.3 | 2.5–6.5 (by 2050 1.0–3.5) |

| Technology | ALK | PEM | SOEC | AEM |

|---|---|---|---|---|

| Oxygen Evolution Reaction (OER) | 2OH−→1/2O2+ H2O+2e− | H2O→1/2O2+ 2H++ 2e− | O2−→1/2O2 + 2e− | 2OH−→1/2O2+ H2O+2e− |

| Hydrogen Evolution Reaction (HER) | 2H2O+2e−→H2+2OH− | 2H++2e−→H2 | H2O+2e−→H2+O2− | 2H2O+2e−→H2+2OH− |

| Carrier | OH− | H+ | O2− | OH− |

| Operating range temperature (°C) | 70–90 | 50–80 | 700–850 | 40–60 |

| Cell pressure (bar) | <30 | <80 | ≤1 | <35 |

| Voltage efficiency (LHV) (%) [21] | 50–68 | 50–68 | 75–85 | 52–67 |

| Lifetime (stack) (kh) [21] | 60 | 50–80 | <20 | <5 |

| Specific energy consumption stack (kWh/m3 H2) [22] | 4.2–4.8 | 4.4–5.0 | 3.7 | 4.8–6.9 |

| Cell area (m2) [22] | 3–3.6 | <0.13 | <0.06 | - |

| Capital cost (stack) minimum 1 MW [USDkW−1] [21] | 270 | 400 | >2000 | - |

| Capital cost (system) minimum 1 MW [USDkW−1] [21] | 500–1000 | 700–1400 | - | - |

| Technology readiness level (TRL) | Commercialized (9) | Commercialized (9) | Approaching commercialization (7/8) | Approaching commercialization (7/8) |

| Applicable scenarios | Large-scale installations | Smaller-scale applications | Industrial scale uses | From small- to large-scale decentralized installations |

| Parameter | State of the Art | FCH JU | |||

|---|---|---|---|---|---|

| 2012 | 2017 | 2020 | 2024 | 2030 | |

| ALK single cell | |||||

| electricity consumption at nominal capacity [kWh kg−1] | 57 | 51 | 50 | 49 | 48 |

| capital cost | |||||

| [EUR (kg d−1)−1] | 8000 | 1600 | 1250 | 1000 | 800 |

| ([EUR kW−1]) | (~3000) | −750 | −600 | −480 | −400 |

| operation and maintenance cost [EUR (kg d−1)−1 yr−1] | 160 | 32 | 26 | 20 | 16 |

| ALK stack | |||||

| degradation [% (1000 h)−1] | - | 0.13 | 0.12 | 0.11 | 0.1 |

| current density [A cm−2] | 0.3 | 0.5 | 0.7 | 0.7 | 0.8 |

| use of CRMs as catalysts [mg W−1] | 8.9 | 7.3 | 3.4 | 2.1 | 0.7 |

| Manufacturer | Country | Model | Flow Rate (Nm3/h) | Stack Power Consumption (kWh/Nm3) | Delivery Pressure (bar) | Capacity Factor (%) |

|---|---|---|---|---|---|---|

| Green Hydrogen Systems | Denmark | A-series 90&180 | 90/180 | 75.73 | 30 | 0–100 |

| X-1200 | 1200 | 74.16 | 35 | 0–100 | ||

| McPhy | France/Italy/ Germany | McLyzer 200 | 200 | 4.65 | 27–30 | 20–100 |

| McLyzer 200 | 400 | 4.65 | 27–30 | 20–100 | ||

| McLyzer 200 | 800 | 4.65 | 27–30 | 20–100 | ||

| McLyzer 200 | 3200 | 4.65 | 27–30 | 10–100 | ||

| Sagim-NEL A-series | France/US | A150 | 50–150 | 3.8–4.4 | 1–200 | 15–100 |

| A300 | 150–300 | 3.8–4.4 | 1–200 | 15–100 | ||

| A485 | 300–485 | 3.8–4.4 | 1–200 | 15–100 | ||

| A1000 | 600–970 | 3.8–4.4 | 1–200 | 15–100 | ||

| A3880 | 2400–3880 | 3.8–4.4 | 1–200 | 15–100 | ||

| Sagim S.A. | France | M 1500 to 5000 | 1.5–5 | 5 | 7 | NR |

| AccaGen | Switzerland | Res2H2 | 5 | 4.5 | 10–20 | 15–100 |

| Sunfire | Germany | Alkaline | - | - | 30 | - |

| Parameter | State of the Art | FCH JU | |||

|---|---|---|---|---|---|

| 2012 | 2017 | 2020 | 2024 | 2030 | |

| PEM single cell | |||||

| electricity consumption at nominal capacity [kWh kg−1] | 60 | 58 | 55 | 52 | 50 |

| capital cost | |||||

| [EUR (kg d−1)−1] | 8000 | 2900 | 2000 | 1500 | 1000 |

| ([EUR kW−1]) | (~3000) | −1200 | −900 | −700 | −500 |

| operation and maintenance cost [EUR (kg d−1)−1 yr−1] | 160 | 58 | 41 | 30 | 21 |

| PEM stack | |||||

| degradation [% (1000 h)−1] | 0.375 | 0.25 | 0.19 | 0.125 | 0.12 |

| current density [A cm−2] | 1.7 | 2 | 2.2 | 2.4 | 2.5 |

| use of CRMs as PGM electro catalysts [mg W−1] | - | 5 | 2.7 | 1.25 | 0.4 |

| use of CRMs as catalysts [mg W−1] | - | 1 | 0.7 | 0.4 | 0.1 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Buonomenna, M.G.; Patonia, A. Green Hydrogen in Europe: Where Are We Now? Hydrogen 2025, 6, 105. https://doi.org/10.3390/hydrogen6040105

Buonomenna MG, Patonia A. Green Hydrogen in Europe: Where Are We Now? Hydrogen. 2025; 6(4):105. https://doi.org/10.3390/hydrogen6040105

Chicago/Turabian StyleBuonomenna, Maria Giovanna, and Aliaksei Patonia. 2025. "Green Hydrogen in Europe: Where Are We Now?" Hydrogen 6, no. 4: 105. https://doi.org/10.3390/hydrogen6040105

APA StyleBuonomenna, M. G., & Patonia, A. (2025). Green Hydrogen in Europe: Where Are We Now? Hydrogen, 6(4), 105. https://doi.org/10.3390/hydrogen6040105