Membrane-Based Hydrogen Production: A Techno-Economic Evaluation of Cost and Feasibility

Abstract

1. Introduction

2. Methods

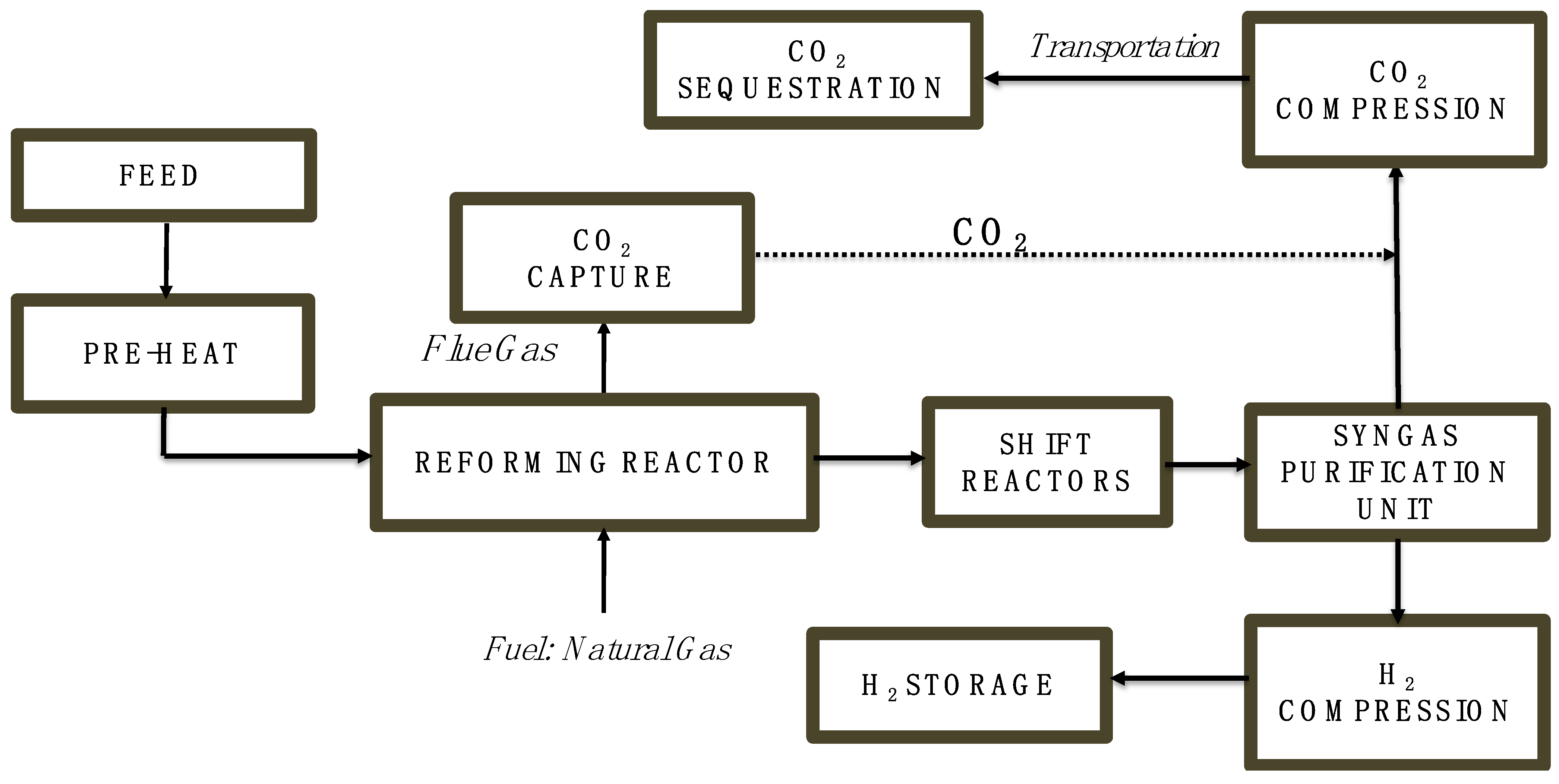

2.1. Overview of Steam Methane Reforming with Pressure Swing Adsorption

2.2. Overview of Steam Methane Reforming with Palladium Membrane and Ceramic–Carbonate Membrane Coupled with Carbon Capture System

2.3. Techno-Economic Analysis

2.3.1. Capital Cost

2.3.2. Operating Cost

2.3.3. Maintenance Cost

2.3.4. Selling Price Credit

2.3.5. By-Product Credit

2.4. Sensitivity Analysis

3. Results

3.1. Data Requirement

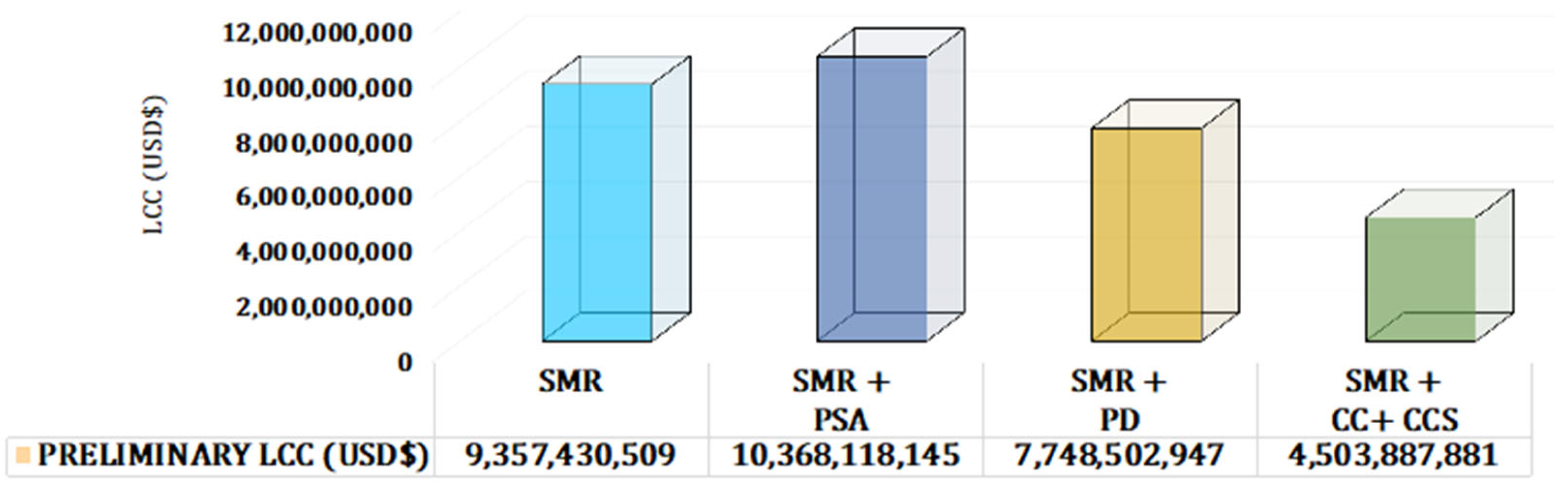

3.2. Cost Breakdown of Each Configurations

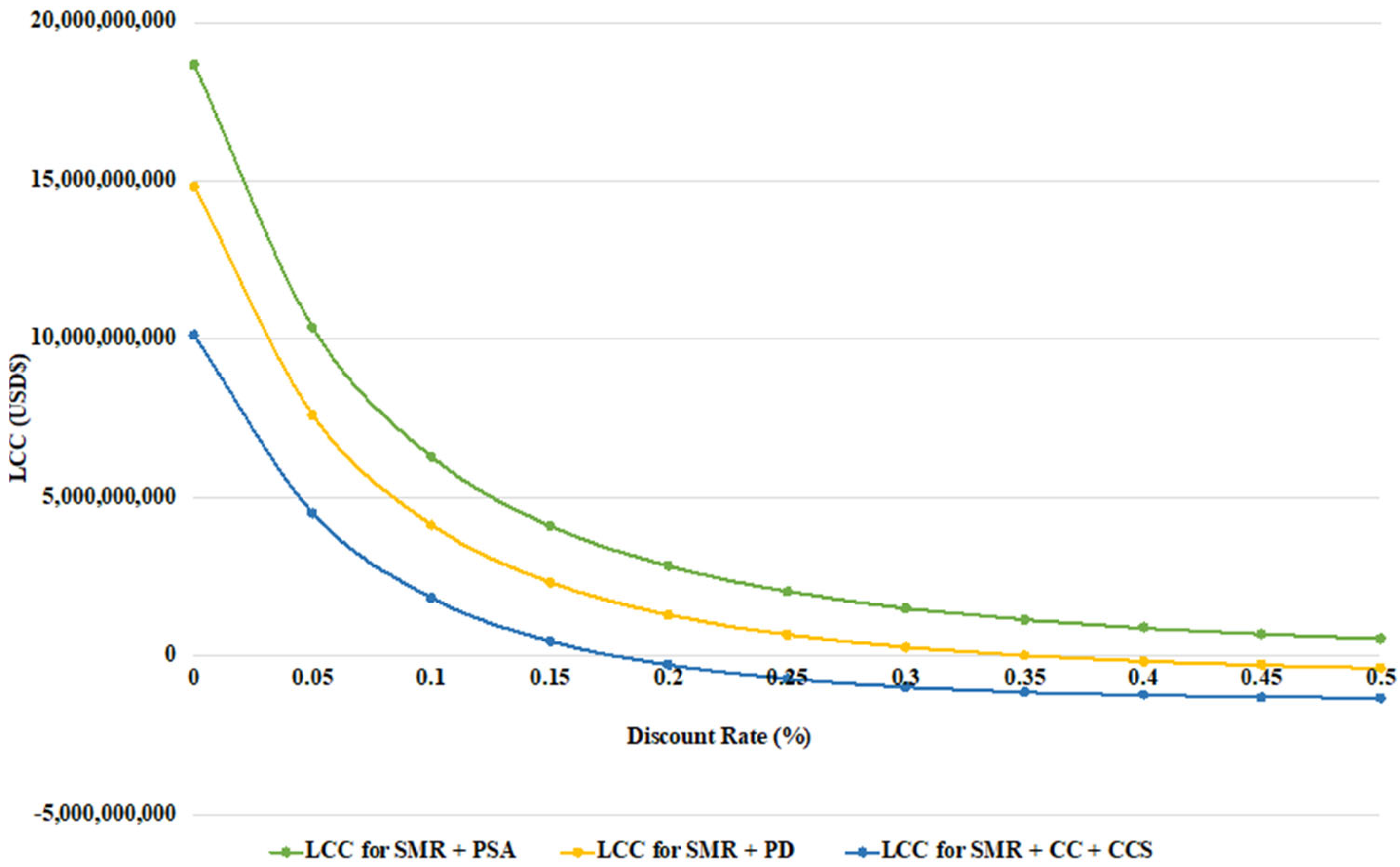

3.3. Life Cycle Cost Distribution

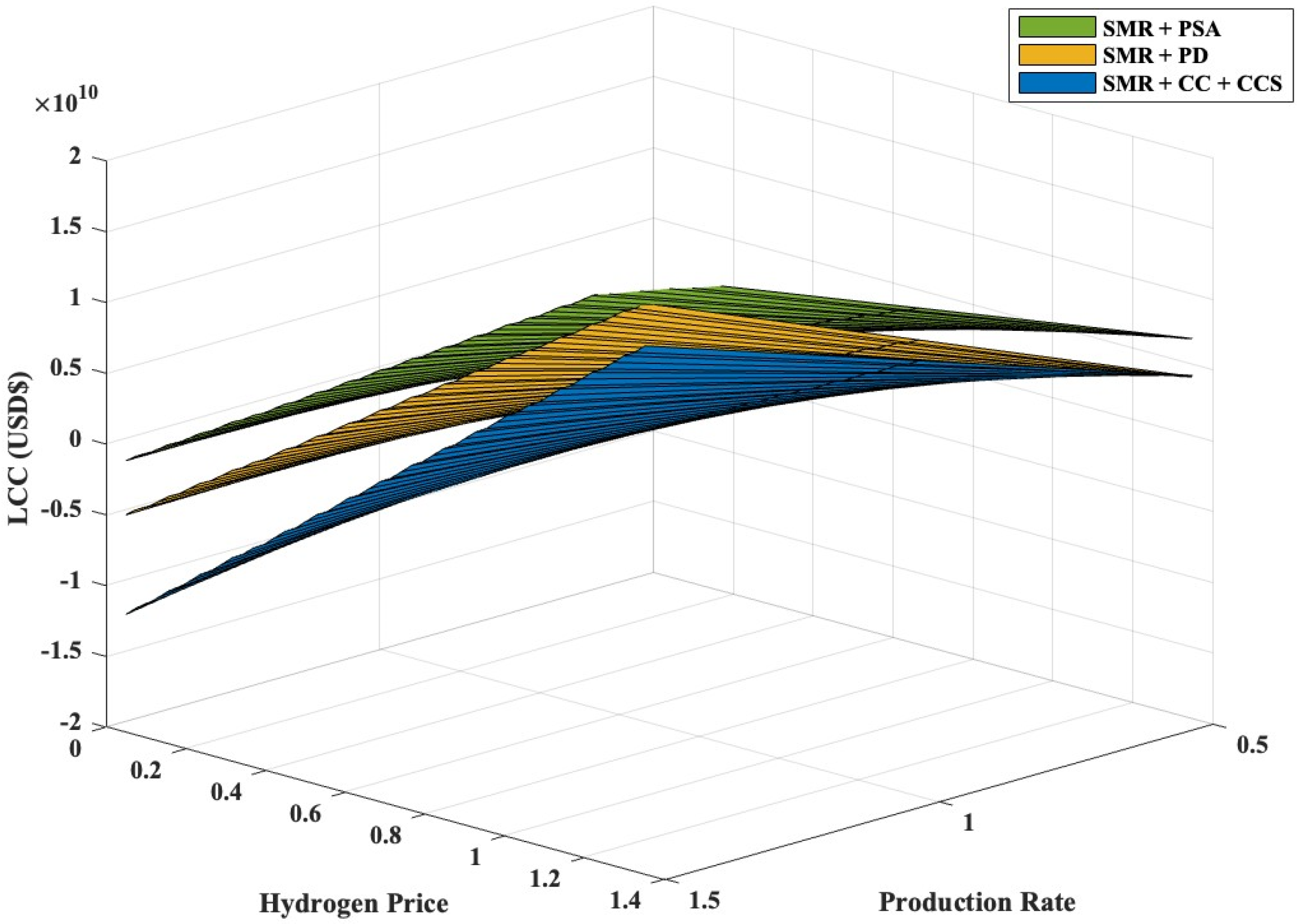

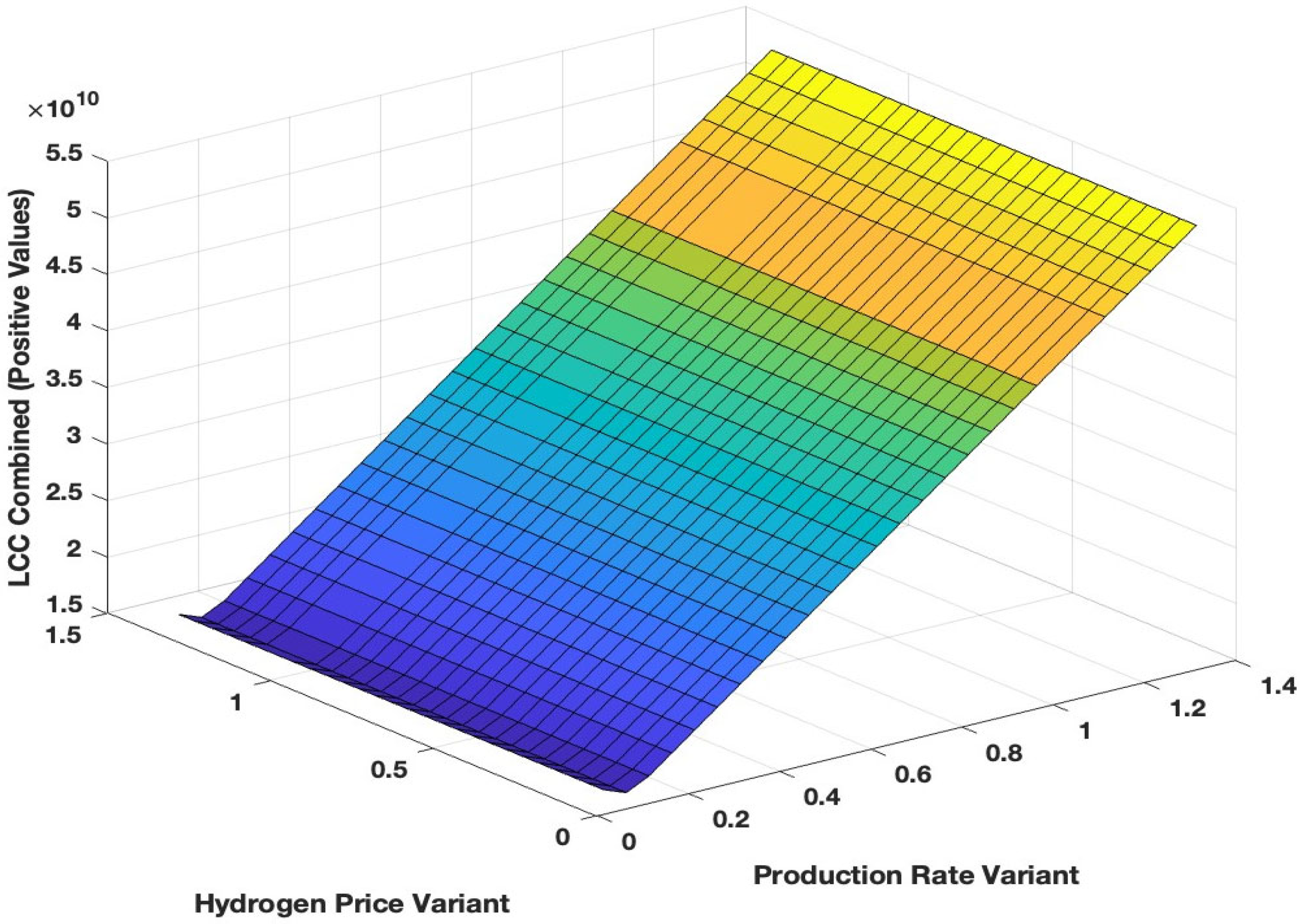

3.4. Sensitivity Analysis on Different Key Parameters

4. Discussion

4.1. Economic Comparison

4.2. Feasibility Comparison

4.3. Environmental Impact

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Danial, M.; Azis, F.A.; Abas, P.E. Techno-Economic Analysis and Feasibility Studies of Electric Vehicle Charging Station. World Electr. Veh. J. 2021, 12, 264. [Google Scholar] [CrossRef]

- Mahlia, T.M.I.; Lim, J.Y.; Aditya, L.; Riayatsyah, T.M.I.; Abas, A.E.P.; Nasruddin. Methodology for implementing power plant efficiency standards for power generation: Potential emission reduction. Clean Technol. Environ. Policy 2018, 20, 309–327. [Google Scholar] [CrossRef]

- Sheta, W.; Abdeltawab, N.M.; Shash, A.Y. Economical study for hydrogen production from seawater using renewable energy in Egypt. Mater. Werkst. 2023, 54, 371–384. [Google Scholar] [CrossRef]

- Kamaroddin, M.F.A.; Sabli, N.; Abdullah, T.A.T.; Siajam, S.I.; Abdullah, L.C.; Jalil, A.A.; Ahmad, A. Membrane-Based Electrolysis for Hydrogen Production: A Review. Membranes 2021, 11, 810. [Google Scholar] [CrossRef]

- Bauer, C.; Treyer, K.; Antonini, C.; Bergerson, J.; Gazzani, M.; Gencer, E.; Gibbins, J.; Mazzotti, M.; McCoy, S.T.; McKenna, R.; et al. On the climate impacts of blue hydrogen production. chemRxiv 2021. [Google Scholar] [CrossRef]

- Zhang, K.; Lau, H.C.; Chen, Z. Using Blue Hydrogen to Decarbonize Heavy Oil and Oil Sands Operations in Canada. ACS Sustain. Chem. Eng. 2022, 10, 10003–10013. [Google Scholar] [CrossRef]

- Accelerating SDGs, Diversity, Equity, and Inclusion in Hydrogen. Hydrogen Council. Available online: https://hydrogencouncil.com/en/accelerating-sdgs-diversity-equity-and-inclusion-in-hydrogen/ (accessed on 9 November 2024).

- The 17 Goals. Sustainable Development. Available online: https://sdgs.un.org/goals (accessed on 9 November 2024).

- Katebah, M.; Al-Rawashdeh, M.; Linke, P. Analysis of hydrogen production costs in Steam-Methane Reforming considering integration with electrolysis and CO2 capture. Clean. Eng. Technol. 2022, 10, 100552. [Google Scholar] [CrossRef]

- Oni, A.O.; Anaya, K.; Giwa, T.; Di Lullo, G.; Kumar, A. Comparative assessment of blue hydrogen from steam methane reforming, autothermal reforming, and natural gas decomposition technologies for natural gas-producing regions. Energy Convers. Manag. 2022, 254, 115245. [Google Scholar] [CrossRef]

- Liguori, S.; Kian, K.; Buggy, N.; Anzelmo, B.H.; Wilcox, J. Opportunities and challenges of low-carbon hydrogen via metallic membranes. Prog. Energy Combust. Sci. 2020, 80, 100851. [Google Scholar] [CrossRef]

- Appari, S.; Janardhanan, V.M.; Bauri, R.; Jayanti, S. Deactivation and regeneration of Ni catalyst during steam reforming of model biogas: An experimental investigation. Int. J. Hydrogen Energy 2014, 39, 297–304. [Google Scholar] [CrossRef]

- Tan, R.; Zhuge, K.; Ma, X.; Mou, X.; Ren, M.; Chang, R.; Zhou, Q.; Yan, L.; Lin, R.; Ding, Y. Interfacial effects of Cu/Fe3O4 in water-gas shift reaction: Role of Fe3O4 crystallite sizes. Int. J. Hydrogen Energy 2024, 78, 741–752. [Google Scholar] [CrossRef]

- Al Hameli, F.; Belhaj, H.; Al Dhuhoori, M. CO2 Sequestration Overview in Geological Formations: Trapping Mechanisms Matrix Assessment. Energies 2022, 15, 7805. [Google Scholar] [CrossRef]

- Chen, F.; Chen, B.; Ma, Z.; Mehana, M. Economic assessment of clean hydrogen production from fossil fuels in the intermountain-west region, USA. Renew. Sustain. Energy Transit. 2024, 5, 100077. [Google Scholar] [CrossRef]

- Zang, P.; Tang, J.; Zhang, X.; Cui, L.; Chen, J.; Zhao, P.; Dong, Y. Strategies to improve CaO absorption cycle stability and progress of catalysts in Ca-based DFMs for integrated CO2 capture-conversion: A critical review. J. Environ. Chem. Eng. 2023, 11, 111047. [Google Scholar] [CrossRef]

- Burgers, I.; Dehdari, L.; Xiao, P.; Li, K.G.; Goetheer, E.; Webley, P. Techno-economic analysis of PSA separation for hydrogen/natural gas mixtures at hydrogen refuelling stations. Int. J. Hydrogen Energy 2022, 47, 36163–36174. [Google Scholar] [CrossRef]

- Soo, X.Y.D.; Lee, J.J.C.; Wu, W.-Y.; Tao, L.; Wang, C.; Zhu, Q.; Bu, J. Advancements in CO2 capture by absorption and adsorption: A comprehensive review. J. CO2 Util. 2024, 81, 102727. [Google Scholar] [CrossRef]

- Delgado, J.A.; Águeda, V.I.; Uguina, M.A.; Sotelo, J.L.; Brea, P.; Grande, C.A. Adsorption and diffusion of H2, CO, CH4, and CO2 in BPL activated carbon and 13X zeolite: Evaluation of performance in pressure swing adsorption hydrogen purification by simulation. Ind. Eng. Chem. Res. 2014, 53, 15414–15426. [Google Scholar] [CrossRef]

- Song, H.; Liu, Y.; Bian, H.; Shen, M.; Lin, X. Energy, environment, and economic analyses on a novel hydrogen production method by electrified steam methane reforming with renewable energy accommodation. Energy Convers. Manag. 2022, 258, 115513. [Google Scholar] [CrossRef]

- Kolor, E.; Usman, M.; Boonyubol, S.; Mikami, K.; Cross, J.S. Advances in Palladium-Based Membrane Research: High-Throughput Techniques and Machine Learning Perspectives. Processes 2024, 12, 2855. [Google Scholar] [CrossRef]

- Al-Mufachi, N.A.; Rees, N.V.; Steinberger-Wilkens, R. Hydrogen selective membranes: A review of palladium-based dense metal membranes. Renew. Sustain. Energy Rev. 2015, 47, 540–551. [Google Scholar] [CrossRef]

- Bhalani, D.V.; Lim, B. Hydrogen Separation Membranes: A Material Perspective. Molecules 2024, 29, 4676. [Google Scholar] [CrossRef]

- Chen, T.; Xu, Y.; Zhang, Y.; Gong, Y.; Zhang, Y.; Lin, J.Y.S. Double-layer ceramic-carbonate hollow fiber membrane with superior mechanical strength for CO2 separation. J. Memb. Sci. 2022, 658, 120701. [Google Scholar] [CrossRef]

- Ishimoto, Y.; Wulf, C.; Schonhoff, A.; Kuckshinrichs, W. Life cycle costing approaches of fuel cell and hydrogen systems: A literature review. Int. J. Hydrogen Energy 2024, 54, 361–374. [Google Scholar] [CrossRef]

- Khzouz, M.; Gkanas, E.I.; Shao, J.; Sher, F.; Beherskyi, D.; El-Kharouf, A.; Al Qubeissi, M. Life Cycle Costing Analysis: Tools and Applications for Determining Hydrogen Production Cost for Fuel Cell Vehicle Technology. Energies 2020, 13, 3783. [Google Scholar] [CrossRef]

- Riayatsyah, T.M.I.; Ong, H.C.; Chong, W.T.; Aditya, L.; Hermansyah, H.; Mahlia, T.M.I. Life Cycle Cost and Sensitivity Analysis of Reutealis trisperma as Non-Edible Feedstock for Future Biodiesel Production. Energies 2017, 10, 877. [Google Scholar] [CrossRef]

- Manpower Planning and Employment Council (MPEC) Secretariat Prime Minister’s Office. Majlis Perancangan Ekonomi dan Kewangan (MPEC), Salary Guideline—2023 Edition, Brunei Darussalam: MPEC. 2023. Available online: https://www.mpec.gov.bn/Lists/EmployeePoliciesAndGuidelines/Attachments/8/Salary%20Guideline%20-%202023%20Edition.pdf (accessed on 13 January 2025).

- Manufacturing Insurance Costs Explained: A Comprehensive Guide for Manufacturers. Available online: https://allenthomasgroup.com/manufacturing-insurance-costs/ (accessed on 13 January 2025).

- Insurance—Chemical Engineering Projects. Available online: https://chemicalprojects.wordpress.com/tag/insurance/ (accessed on 13 January 2025).

- Hamilton, S. Must Chemical Companies Outsource Logistics to Save Money; ChemLogix LLC: Blue Bell, PA, USA, 2003. [Google Scholar]

- Towler, G.; Sinnott, R. Chemical Engineering Design: Principles, Practice and Economics of Plant and Process Design; Elsevier: Amsterdam, The Netherlands, 2021. [Google Scholar] [CrossRef]

- Economics—SGH2 Energy. Available online: https://www.sgh2energy.com/economics (accessed on 9 November 2024).

- Synapse Carbon Dioxide Price Forecast. Synapse Energy. Available online: https://www.synapse-energy.com/synapse-carbon-dioxide-price-forecast (accessed on 10 November 2024).

- Qiao, Y.; Liu, W.; Guo, R.; Sun, S.; Zhang, S.; Bailey, J.J.; Fang, M.; Wu, C. Techno-economic analysis of integrated carbon capture and utilisation compared with carbon capture and utilisation with syngas production. Fuel 2023, 332, 125972. [Google Scholar] [CrossRef]

- Arfan, M.; Eriksson, O.; Wang, Z.; Soam, S. Life cycle assessment and life cycle costing of hydrogen production from biowaste and biomass in Sweden. Energy Convers. Manag. 2023, 291, 117262. [Google Scholar] [CrossRef]

- Operating Hours for Plant Capacity—Chemical Plant Design & Operations. Eng-Tips. Available online: https://www.eng-tips.com/threads/operating-hours-for-plant-capacity.389883/ (accessed on 10 November 2024).

- Chen, W.H.; Hsu, P.C.; Lin, B.J. Hydrogen permeation dynamics across a palladium membrane in a varying pressure environment. Int. J. Hydrogen Energy 2010, 35, 5410–5418. [Google Scholar] [CrossRef]

- Fernandes, F.A.N.; Soares, A.B. Methane steam reforming modeling in a palladium membrane reactor. Fuel 2006, 85, 569–573. [Google Scholar] [CrossRef]

- Lee, H.; Lee, B.; Byun, M.; Lim, H. Comparative techno-economic analysis for steam methane reforming in a sorption-enhanced membrane reactor: Simultaneous H2 production and CO2 capture. Chem. Eng. Res. Des. 2021, 171, 383–394. [Google Scholar] [CrossRef]

- Xu, G.; Qian, H.; Zhang, Q.; Alsenani, T.R.; Bouzgarrou, S.; Alturise, F. Integration of biomass gasification and O2/H2 separation membranes for H2 production/separation with inherent CO2 capture: Techno-economic evaluation and artificial neural network based multi-objective optimization. Renew. Energy 2024, 224, 120150. [Google Scholar] [CrossRef]

- Golmakani, A.; Fatemi, S.; Tamnanloo, J. Investigating PSA, VSA, and TSA methods in SMR unit of refineries for hydrogen production with fuel cell specification. Sep. Purif. Technol. 2017, 176, 73–91. [Google Scholar] [CrossRef]

- Shi, W.; Yang, H.; Shen, Y.; Fu, Q.; Zhang, D.; Fu, B. Two-stage PSA/VSA to produce H2 with CO2 capture via steam methane reforming (SMR). Int. J. Hydrogen Energy 2018, 43, 19057–19074. [Google Scholar] [CrossRef]

- Al-Rowaili, F.N.; Khaled, M.; Jamal, A.; Zahid, U. Mixed matrix membranes for H2/CO2 gas separation—A critical review. Fuel 2023, 333, 126285. [Google Scholar] [CrossRef]

- Palma, V.; Barba, D.; Meloni, E.; Ruocco, C.; Martino, M. Membrane reactors for H2 and energy production. In Current Trends and Future Developments on (Bio-) Membranes: Membrane Systems for Hydrogen Production; Elsevier: Amsterdam, The Netherlands, 2020; pp. 33–56. [Google Scholar] [CrossRef]

- Lin, J.Y.S.; Huang, K. High Temperature Ceramic-Carbonate Dual-Phase Membrane Reactor for Pre-Combustion Carbon Dioxide Capture; U.S. Department of Energy, Office of Scientific and Technical Information: Tempe, AZ, USA, 2022.

- Wu, H.C.; Rui, Z.; Lin, J.Y.S. Hydrogen production with carbon dioxide capture by dual-phase ceramic-carbonate membrane reactor via steam reforming of methane. J. Memb. Sci. 2020, 598, 117780. [Google Scholar] [CrossRef]

- Norton, T.T.; Lin, Y.S. Ceramic–carbonate dual-phase membrane with improved chemical stability for carbon dioxide separation at high temperature. Solid State Ion. 2014, 263, 172–179. [Google Scholar] [CrossRef]

| Parameter | Value | Unit | Reference |

|---|---|---|---|

| Gray Hydrogen Price | 6 | USD/kg | [33] |

| Green Hydrogen Price | 8 | USD/kg | [33] |

| Blue Hydrogen Price | 8 | USD/kg | [33] |

| Carbon Dioxide Price | 25 | USD/tonne | [34] |

| Carbon Monoxide Price | 720.25 | USD/tonne | [35] |

| Parameter | Value | Unit | Reference |

|---|---|---|---|

| Plant Size/System Capacity (Large Scale) | 182,500 | ton/year | [9] |

| Plant Lifetime | 20 | year | [36] |

| Plant Operational Hour | 8103 | h/year | [37] |

| Hydrogen Production Rate | 20,830 or 500 | kg H2/h ton/day | [9] |

| Hydrogen Production Rate | 182,500 | ton/year | [9] |

| Carbon Dioxide Production Rate | 902,375 | ton/year | [33] |

| Carbon Monoxide Production Rate | 42,269 | ton/year | [33] |

| SMR | SMR with PSA | SMR with Palladium Membrane | SMR with Ceramic–Carbonate Membrane Coupled with CCS | |

|---|---|---|---|---|

| Preliminary LCC (USD) | 9,357,430,509 | 10,368,118,145 | 7,748,502,947 | 4,503,887,881 |

| LCC (USD$) | |||

|---|---|---|---|

| Parameter | Low | Base | High |

| Production Rate (+/−30%) | 6.29 × 109 | 9.36 × 109 | 1.24 × 1010 |

| Hydrogen Price (+/−15%) | 7.60 × 109 | 9.36 × 109 | 1.11 × 1010 |

| Feedstock Price (+/−40%) | 8.52 × 109 | 9.36 × 109 | 1.41 × 1010 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pg Haji Omar Ali, D.N.H.A.; Suhaimi, H.; Abas, P.E. Membrane-Based Hydrogen Production: A Techno-Economic Evaluation of Cost and Feasibility. Hydrogen 2025, 6, 9. https://doi.org/10.3390/hydrogen6010009

Pg Haji Omar Ali DNHA, Suhaimi H, Abas PE. Membrane-Based Hydrogen Production: A Techno-Economic Evaluation of Cost and Feasibility. Hydrogen. 2025; 6(1):9. https://doi.org/10.3390/hydrogen6010009

Chicago/Turabian StylePg Haji Omar Ali, Dk Nur Hayati Amali, Hazwani Suhaimi, and Pg Emeroylariffion Abas. 2025. "Membrane-Based Hydrogen Production: A Techno-Economic Evaluation of Cost and Feasibility" Hydrogen 6, no. 1: 9. https://doi.org/10.3390/hydrogen6010009

APA StylePg Haji Omar Ali, D. N. H. A., Suhaimi, H., & Abas, P. E. (2025). Membrane-Based Hydrogen Production: A Techno-Economic Evaluation of Cost and Feasibility. Hydrogen, 6(1), 9. https://doi.org/10.3390/hydrogen6010009