1. Introduction

The healthcare industry, encompassing the production, distribution, and provision of goods and services vital for disease treatment, health maintenance, and overall well-being, is on a trajectory of consistent and significant expansion. This growth is propelled by a confluence of factors, including the demographic shift towards aging populations globally, a discernible increase in the prevalence of chronic diseases requiring long-term management, rising disposable income levels enabling greater healthcare expenditure, and a heightened societal consciousness regarding health and wellness [

1]. Within this expanding landscape, the logistics component of the healthcare sector, particularly for pharmaceuticals and biotechnology products, is projected to command a substantial share, estimated at approximately 3.5% of the total global freight volume by 2025. This demand is further intensified by the escalating need for vaccines, a continuous pipeline of new pharmaceuticals, and evolving distribution paradigms, such as the shift towards non-face-to-face channels accelerated by recent global events [

2]. Consequently, the imperative for highly efficient, responsive, and resilient healthcare logistics operations has never been more pronounced.

Healthcare products, fundamentally distinct from general consumer commodities due to their direct and critical impact on human life and therapeutic outcomes, necessitate sophisticated distribution systems. These systems must be adept at managing frequent, often small-quantity orders across an extensive and diverse variety of items, each with specific handling and storage requirements. In response to these complexities, there is a burgeoning impetus to integrate advanced automation and information technologies throughout the healthcare supply chain. The objectives are multifaceted: to curtail escalating inventory costs, enhance the speed and traceability of deliveries, elevate the quality of patient services, and cultivate a lean, agile supply chain ecosystem [

3]. A prerequisite for the successful implementation of such automation is a thorough understanding of the prevailing logistics service formats within the industry, as the scope, nature, and financial implications of automation investments vary significantly based on these existing structures.

In parallel with these developments, healthcare organizations increasingly face decisions regarding the adoption of various logistics automation models [

4,

5], each presenting distinct strengths and implementation challenges. Traditional manual approaches remain common among smaller clinics and pharmacies due to their straightforward operation and relatively low initial cost; however, these systems are often limited by labor intensity, reduced scalability, and increased risk of human error. Conversely, high-density automation solutions—such as Automated Storage and Retrieval Systems (AS/RSs), Mini-Load shuttles, and AutoStore technology—are being adopted by larger manufacturers and wholesalers, offering substantial improvements in storage efficiency, order accuracy, and regulatory compliance. Nevertheless, such systems require significant capital investment and may encounter considerable integration and maintenance hurdles, especially in environments reliant on legacy infrastructure. Emerging technologies for internal transport, including Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), allow hospitals and distribution centers to streamline operations and reduce manual handling [

6]. Their implementation, however, calls for robust IT support, upfront investment, and thorough staff training. Additionally, “smart warehousing” approaches that integrate RFID, IoT sensors, and AI-powered analytics enable real-time inventory visibility and predictive management [

7], yet introduce new complexities related to data integration, information security, and operational governance. Ultimately, organizations must carefully balance operational needs, resource availability, and their capacity to manage technological complexities when considering the degree and form of automation most appropriate to their context.

In the context of South Korea, for instance, a predominant portion of pharmaceutical distribution, approximately 89.5%, is channeled through wholesalers, representing a third-party logistics (3PL) operational model. In contrast, direct transactions from manufacturers or importers to healthcare institutions (indicative of first-party logistics [1PL] or second-party logistics [2PL]) account for a smaller share of 10.5% (Health Insurance Review & Assessment Service, 2023) [

8]. This pronounced reliance on wholesalers, who are tasked with managing a wide array of functions spanning the continuum from production to final consumption, can inadvertently impede the cultivation of specialized distribution expertise and may contribute to increased transactional costs and complexities within the supply chain.

For manufacturers or importers who opt to manage their logistics operations internally (1PL), the strategic introduction of logistics automation presents a direct pathway to enhanced operational efficiency and control. However, within the dominant 3PL structure, characterized by a high degree of dependency on wholesalers, the substantial investment costs typically associated with sophisticated logistics automation technologies pose a formidable challenge. Innovative mobile robotic solutions, such as Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), are emerging as potentially more viable alternatives, offering greater investment flexibility and adaptability compared to traditional fixed automation systems, particularly within the context of contract logistics agreements [

9].

Despite the growing need, empirical evidence indicates that logistics automation in the healthcare sector remains limited—only 14.9% of healthcare organizations report automation investment, compared to an 18% industrial average (2022 Survey on the Current State of Corporate Logistics Costs). While the literature has addressed general warehouse automation or specific high-tech hospital cases, few studies explore how automation adoption varies across stakeholder types or operational models in healthcare. Most notably, logistics practices in small- to medium-sized clinics, pharmacies, and 3PL wholesalers remain largely undocumented. Moreover, few studies provide actionable, contingency-based frameworks to guide healthcare stakeholders in making automation decisions that align with their scale and operational realities.

This study addresses these gaps by conducting an exploratory qualitative investigation of logistics automation in the healthcare sector, drawing on in-depth interviews with 20 organizations across five stakeholder categories: manufacturers/importers, wholesalers, hospitals, clinics, and pharmacies. By capturing diverse operational contexts, this study examines the current state of automation, perceived barriers, adoption drivers, and system needs across different organizational types.

The central research objective is to develop an empirically grounded framework that identifies how logistics automation can be strategically adopted based on two key contingency factors: order volume and inventory complexity. This study offers a directional map that helps healthcare organizations assess their automation readiness and select appropriate technologies and strategies tailored to their operational scale and product characteristics. In doing so, it contributes both theoretical insight and practical guidance to a sector that remains underserved by automation research despite its high logistics demands.

3. Methodology

This research adopted an exploratory-descriptive qualitative (EDQ) research methodology, as defined by Hunter et al. [

36]. This approach is particularly well-suited for investigating phenomena where the existing literature or understanding is limited, as it allows researchers to delve deeply into the perspectives and experiences of participants, thereby fostering the development of new knowledge and insights directly from the field [

37]. The primary mode of data collection was through semi-structured interviews. This technique combines a pre-determined set of guiding questions with the flexibility to probe deeper into emergent themes and allow participants to elaborate on areas they deem significant [

38,

39].

A total of 20 healthcare organizations operating in the Republic of Korea participated in the study, as shown in

Table 1. This sampling approach ensures high ecological validity, as participants represent actual decision-makers currently facing real automation choices in their operational contexts, rather than theoretical or hypothetical scenarios. The sample was purposefully selected to ensure representation across the healthcare supply chain and diversity in operational scale.

The selection criteria for participating companies and interviewees were multi-faceted:

Industry Category: A deliberate effort was made to include stakeholders from each key segment of the healthcare supply chain (manufacturing, wholesale distribution, and healthcare provision at hospital, clinic, and pharmacy levels) to capture a holistic view of logistics automation application and perception.

Company Size: Given the generally low levels of automation observed in healthcare logistics, the sample included a mix of large companies (potentially capable of adopting or having already adopted comprehensive automation) and medium- to small-sized companies (more likely to consider partial or specific automation solutions, or to face significant barriers). This allowed for an exploration of how scale influences automation decisions.

Interviewee Role and Experience: Participants were selected from mid-level management positions and above, or individuals with direct responsibility for and in-depth knowledge of their organization’s logistics processes and any existing or considered automation initiatives (e.g., logistics managers, pharmacy chiefs, operations directors).

A preliminary interview guide with open-ended questions was developed based on the research objectives and a review of the relevant literature. This guide underwent pilot testing with representatives from two companies that were part of the target sample. Feedback from these pilot interviews was instrumental in refining the questionnaire. Key revisions included the following:

The discussion was structured around a simplified flowchart of general logistics processes relevant to the specific business type (e.g., manufacturer, hospital). This provided a common framework and helped interviewees articulate their processes more systematically.

Questions were modified to allow respondents to freely discuss the factors they considered most important in logistics management and their unprompted perceptions of automation, rather than being constrained by pre-defined categories or priorities.

For companies that had not yet adopted any significant logistics automation, supplementary materials providing examples of common automation technologies and their applications in the broader healthcare industry were shared prior to the interview. This was intended to provide a basic level of background knowledge and facilitate a more informed discussion.

Interviews were conducted through various modalities based on participant preference and geographical location: face-to-face at the company’s site, via email (where the questionnaire was sent in advance, followed by a detailed phone interview), or directly via phone call. Each interview lasted approximately 30 min on average, though some were longer depending on the depth of the discussion. All interviews were conducted with the explicit informed consent of the participants, who were assured of the confidentiality and anonymity of their responses and organizational data. Interviews were primarily audio-recorded (with permission) and supplemented with detailed handwritten notes.

The analysis of the interview data commenced with the full transcription of all audio recordings. This step was crucial for capturing the nuances of the conversation and ensuring that no potentially relevant information was overlooked [

40]. Following transcription, a systematic thematic analysis was performed, adhering to the six-phase process outlined by Braun and Clarke [

41]:

Familiarization with the data: Repeated reading of transcripts and notes to gain an overall understanding.

Generating initial codes: Identifying interesting features of the data and systematically coding them across the entire dataset.

Searching for themes: Collating codes into potential themes and gathering all data relevant to each potential theme.

Reviewing themes: Checking if the themes work in relation to the coded extracts and the entire dataset, and generating a thematic ‘map’ of the analysis.

Defining and naming themes: Conducting ongoing analysis to refine the specifics of each theme and the overall story the analysis tells, generating clear definitions and names for each theme.

Producing the report: Conducting the final analysis, involving selecting compelling extract examples, relating the analysis back to the research question and the literature, and producing a scholarly report of the analysis.

Specifically in this study, this process involved organizing all interview data (transcripts, notes); consolidating interviewee and company profiles; identifying the key variables mentioned (such as order volume and inventory levels) as influencing factors; grouping data by business type to compare and contrast logistics processes, management priorities, and automation perceptions; mapping commonalities and differences; and finally, summarizing the adoption status, rationales, perceived benefits or drawbacks, and future outlook regarding logistics automation for each stakeholder category. This structured analytical approach enabled the identification of patterns, key insights, and overarching themes related to the application of logistics automation in the Korean healthcare industry.

To strengthen the trustworthiness of this exploratory qualitative study, multiple strategies were employed in line with qualitative research best practices. First, an audit trail was systematically maintained, documenting methodological decisions across all stages—from interview guide development to coding schema revisions and theme construction. This included version-controlled documents such as interview protocols, memos, codebooks, and cross-case comparison matrices, ensuring transparency and dependability.

In addition, triangulation techniques were used to validate the credibility of the findings. According to Creswell and Miller [

42], triangulation enhances accuracy by using multiple validation sources. Two key techniques were employed:

Member checking, wherein preliminary interpretations and the directional automation framework were shared with selected participants to verify whether the findings resonated with their lived experience and operational context. Participants confirmed that the themes and framework accurately reflected their perspectives, supporting credibility [

43,

44].

Peer debriefing, which involved presenting intermediate findings to logistics experts in academic and industry roles for critical feedback. Their insights were used to refine the thematic categorization and validate the strategic directionality of the automation adoption model [

42,

45].

These combined strategies—documented procedural rigor and triangulated validation—enhanced the study’s confirmability, credibility, and transferability.

4. Results and Discussion

This section presents the empirical findings derived from this exploratory qualitative study, detailing the logistics management practices and the status and perception of logistics automation implementation across the different segments of the healthcare industry interviewed.

4.1. Manufacturer Insights

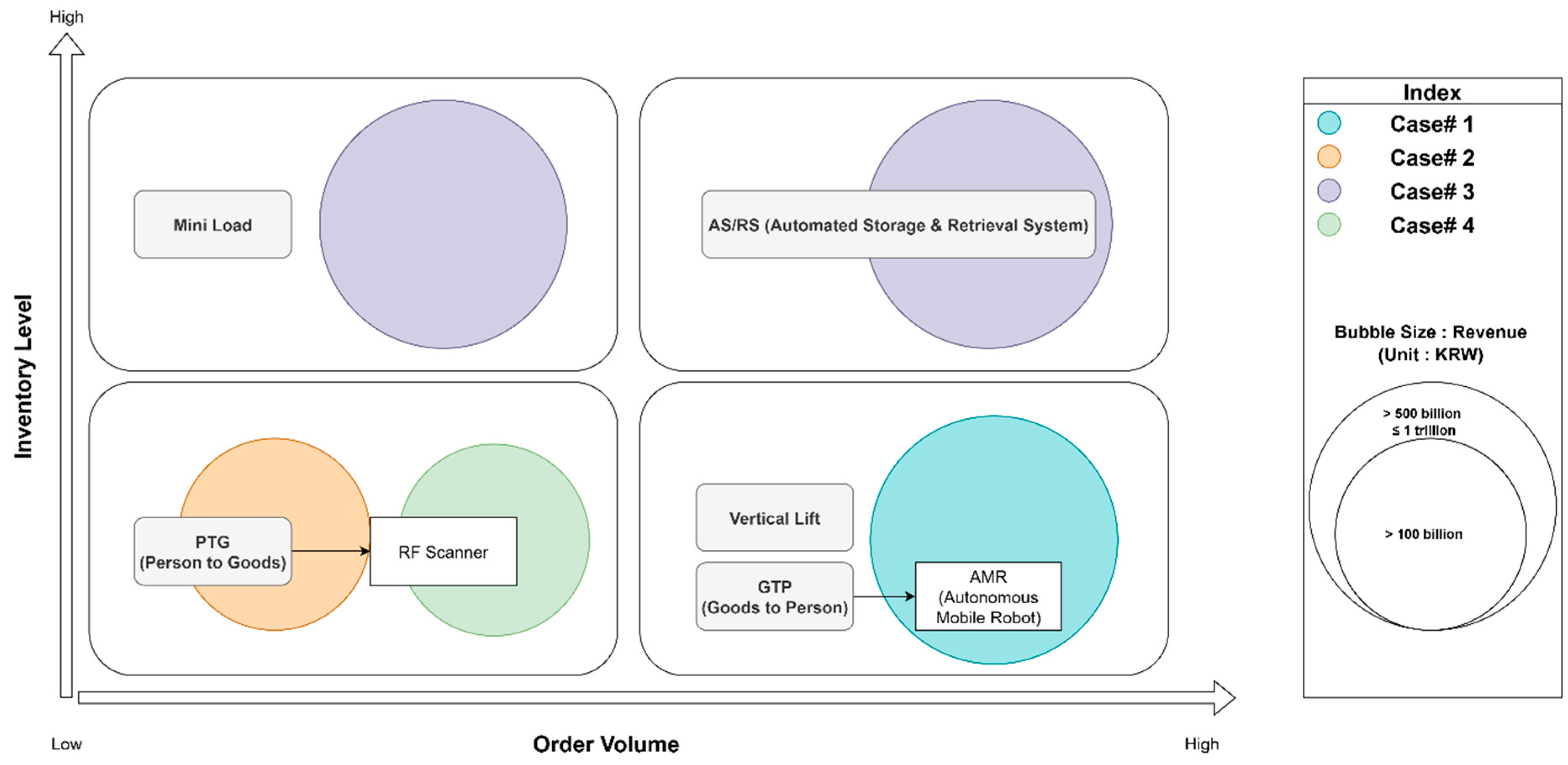

Interviews were conducted with representatives from four companies in the Producer category (Cases 1, 2, 3, and 4). The surveyed results are mapped in

Figure 4.

Cases 1 and 2, acting as Korean branches and importers for American life science product manufacturers, operate their own warehouses (1PL model). A primary focus for them is enhancing productivity and, critically, reducing human error in their logistics operations. They identify domestic supply reliability as a key factor influencing their market share, making operational accuracy paramount.

Case 3 represents a German life science product manufacturer currently in the process of establishing a new manufacturing subsidiary in Korea, intended to serve the broader Asia–Pacific region. Their emphasis is on holistically improving the supply chain management (SCM) process, from raw material receipt through production to final product logistics, by embedding lean management principles from the outset.

Case 4 is a U.S.-based diagnostic device manufacturer that outsources its logistics operations to an external third-party logistics (3PL) provider through a five-year contract. They focused on productivity improvement, inventory accuracy, and cost reduction in third-party logistics (3PL) as core objectives of their logistics operations.

All four companies described comprehensive logistics processes, encompassing receiving, storing, picking, packing, and shipping. For Cases 1 and 3, where logistics automation has either been implemented or is integral to new facility plans, partial automation solutions were noted in areas such as internal transportation, storage systems, and order picking processes.

Regarding data management, all three have established largely automated interface systems. Beyond standard Enterprise Resource Planning (ERP) systems, Cases 1, 3, and 4 reported leveraging specialized management systems like Warehouse Management Systems (WMSs), Fleet Management Systems (FMSs) for transportation, Quality Management Systems (QMSs) for product integrity, and Transportation Management Systems (TMSs) to enhance operational efficiency and visibility at various stages of their logistics chain.

Case 1 (Partial Logistics Automation Implemented): This company’s move to a significantly larger warehouse (three times the previous size) without a corresponding increase in staffing created an urgent need to maintain and improve productivity. This coincided with a broader digital transformation initiative from their American parent company, which provided investment for digital facilities. “To address the challenge of maintaining productivity with the same number of personnel in a larger space, we introduced automation to replace simple, repetitive tasks”, stated the Inventory Manager. They implemented Autonomous Mobile Robots (AMRs) for internal transport and vertical lift modules (VLMs) in the pick-front zone to optimize workflow and reduce travel distances. A Warehouse Management System (WMS) was also implemented, providing enhanced visibility and real-time data for work management. Expected benefits include improved On-Time In-Full (OTIF) metrics, labor cost savings from not requiring additional staff, enhanced customer satisfaction due to more precise operations, and increased operational visibility. However, the manager also noted limitations: “Due to the timing of automation system implementation, it was only possible to introduce automation in some of the ambient storage areas…. for more than 50% of our inventory, which consists of refrigerated and frozen products, we were unable to implement automation. As the facility operates at lower temperatures, it inevitably affects the productivity of our staff. Therefore, we are keen on introducing the AutoStore system…. It encompasses storage, transportation, and sorting functionalities, and is compatible with our reagent products”.

Case 2 (No Logistics Automation Implemented): The Logistics Supervisor explained their rationale: “Due to the nature of our products, most of which are large equipment such as mass spectrometers, they are directly delivered to customers or wholesalers near airports or ports through third-party logistics (3PL) external warehouses after customs clearance. As a result, we do not hold a significant amount of inventory in our own operating warehouses. Therefore, it is more efficient to contract with 3PL companies to utilize their space and logistics services rather than investing in automation facilities independently”. A key inconvenience, however, is the difficulty in real-time inventory tracking for equipment managed by 3PL, necessitating cumbersome physical audits. Future considerations, should their 1PL warehousing needs grow, include vertical lift modules for storing and handling smaller items like equipment spare parts, and a desire for better WMS integration with their 3PL providers.

Case 3 (Partial Logistics Automation Implementation Scheduled): This company is constructing new production facilities and associated logistics infrastructure. The Logistics Director emphasized that a primary driver for implementing automation was “to bring about a change from the reliance on manual labor in the existing factory and logistics environment”. The new logistics facility is planned to be equipped with Automated Storage and Retrieval Systems (AS/RSs) for manufacturing raw materials and Mini-Load systems (capable of storing, picking, and sorting) for finished goods, aiming for efficient personnel management and increased productivity. Regarding future aspirations, the Director stated: “We wanted to have a fully automated factory logistics facility, but due to budget constraints. There is some desirable equipment we couldn’t afford. For the sorting system, we have plans for an X-belt sorter, Automated Mobile Robots (AMR) for raw material movement, and a robot arm for depalletizing. As the logistics department head, the system I wanted to introduce the most is the robot arm for depalletizing. Despite being a simple task, dismantling and moving items from pallets is physically taxing and labor-intensive”.

Case 4 (Partial Logistics Automation Implementation Scheduled): In the case of this company, the diagnostic equipment product portfolio is diverse, and due to the large number of component supplies required for the equipment, there is a significant need to improve logistics accuracy and productivity for these products. Additionally, when a large volume of diagnostic devices and components are received through imports, a considerable amount of manpower is required for depalletizing and storage. When considering future investments in the currently used dedicated warehouse, the company’s SCM manager stated the following: “Since logistics operations are currently outsourced through 3PL services, any increase in manpower or process complexity leads to higher costs. Therefore, investing in automation is considered a meaningful long-term strategy, as it can help reduce monthly logistics expenses over time”.

In summary, manufacturers and importers with direct warehousing responsibilities show a clear focus on productivity improvement and error reduction, often driven by global parent company strategies or the establishment of new, efficient facilities. Storage automation (AS/RSs, Mini-Load, VLMs) and transport automation (AMRs) are key considerations, supported by robust IT infrastructure. For those relying heavily on 3PL for large items, the focus shifts to managing these external relationships and improving inventory visibility.

4.2. Wholesaler Insights

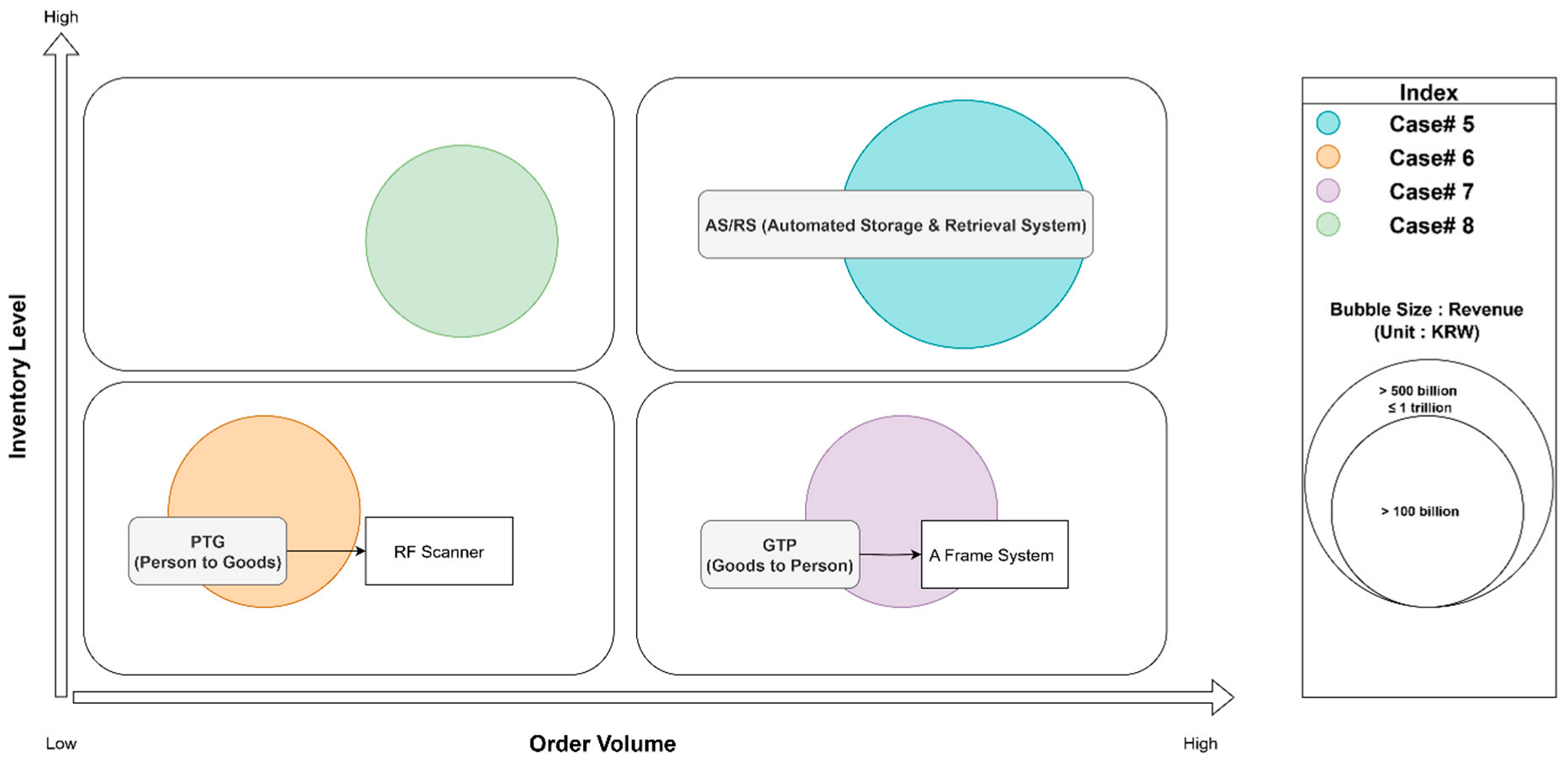

Interviews were conducted with representatives from two pharmaceutical wholesale companies (Cases 5, 6, 7, and 8). The surveyed results are mapped in

Figure 5.

Both companies operate as Logistics Service Providers (LSPs), performing 3PL services for pharmaceutical manufacturers. Consequently, their core logistics management priorities are storage optimization (maximizing the use of often temperature-controlled warehouse space) and stringent quality control to comply with pharmaceutical handling regulations, such as KGSP. Wholesalers in the healthcare industry often handle the full spectrum of logistics functions, as obtaining a wholesale permit typically requires meeting specific facility, storage capacity, and distribution process standards. Compared to manufacturers/importers, their processes are often more storage-centric and can be highly labor-intensive, especially in picking and packing diverse orders for numerous downstream customers (hospitals, pharmacies). Since wholesale logistics involves direct delivery to end customers, it is important to optimize delivery routing by analyzing existing delivery data to configure the most efficient routes.

Case 5 (Partial Logistics Automation Implemented): This company, the Korean branch of a Swiss pharmaceutical logistics firm, has had a basic crane-type AS/RS installed in its main company-owned warehouse for nearly two decades. The Senior Manager of Operation Transformation explained, “As a Swiss pharmaceutical logistics company, we adopted AS/RS gradually as part of the group’s policy. It was introduced almost simultaneously with the establishment of our Korean branch…. in our own building…. Although it’s been in use for a long time, it’s still operating well, and especially during inbound and inventory replenishment, it’s considered the most productive equipment”. He noted that due to the uncertainty of customer contract longevity in other leased warehouses (they operate 14 in total), major facility investments like AS/RSs are typically confined to their owned properties. As a 3PL, maximizing space utilization and enhancing labor productivity are crucial. The company had plans to build a new mega-hub and considered introducing 4-way shuttles and AMRs to further boost productivity. However, these plans were regrettably halted. “During the vendor selection process for logistics automation equipment in the Asia-Pacific branch, we extensively contacted Chinese manufacturers to achieve cost savings. This resulted in significant language barriers and communication issues with the vendors, leading to the discontinuation of the automation equipment introduction”.

Case 6 (Partial Logistics Automation Implementation Scheduled): This company specializes in clinical trial logistics, a niche within pharmaceutical wholesale that demands extremely high service levels. They are in the process of relocating to a new warehouse due to lease expiration and are actively considering the introduction of a logistics automation system as part of this transition. The Clinical Reach Distribution Center Manager stated, “We are currently in the midst of an RFP process with logistics automation equipment vendors and are considering AutoStore as an option”. He highlighted the unique demands of their sector: “The expected effects of introducing automation systems in clinical logistics differ from those in general pharmaceutical logistics. Clinical logistics involve the distribution of pharmaceuticals for regulatory approval, making it a high-cost logistics service. From receipt and distribution to disposal after clinical trials, temperature control is crucial. Additionally, dedicated, segregated spaces for each customer conducting clinical trials are necessary, emphasizing the importance of storage optimization tailored to individual customer needs”. The primary drivers for automation are therefore maintaining impeccable temperature integrity and optimizing storage for high-value, often irreplaceable, clinical trial materials.

Case 7 (Partial Logistics Automation Implemented): This company has been actively advancing its logistics operations through automation technologies to enhance efficiency, accuracy, and scalability. The company operates one of the largest logistics terminal networks in South Korea, and its automation initiatives include the following: An Automated Sorting System called ‘a frame system’ that high-speed sorting machines use to classify parcels based on destination, size, and priority, significantly reducing manual labor and processing time. They integrate intelligent WMSs to track inventory, optimize storage, and streamline inbound and outbound logistics. By leveraging IoT and data analytics, the company monitors delivery performance and predicts optimal routes for faster and more reliable service. The logistics director of this company emphasizes “Customized Logistics Solutions”. They can offer tailored logistics services for various industries, supported by automated infrastructure to meet specific customer needs.

Case 8 (Partial Logistics Automation Implementation Scheduled): This company primarily handles logistics and wholesale distribution for medical device manufacturers. Due to the nature of the products, they store not only bulky medical equipment but also consumables that require frequent replacement, as well as small, irregularly shaped items such as catheters. Because there is no master data available for the specifications of the stored products, it has been difficult to implement automation. One of their dedicated-space clients is currently considering investing in automation for frequently used products. As part of this initiative, they are reviewing the introduction of a vertical lift system. The logistics manager of the company stated: “Given the nature of medical devices, it is essential to strictly manage regulatory approvals and procedures. I believe that digitizing product specifications is a top priority and a fundamental step toward automation”.

Wholesalers, particularly those in specialized pharmaceutical logistics, prioritize storage optimization, quality management, and adherence to stringent regulatory standards. Automation adoption is often driven by parent company policies, the establishment of new flagship facilities, or the specific demands of their niche market (e.g., clinical trials). Systems that enhance storage density (AS/RSs, AutoStore) and ensure product integrity are of particular interest. Challenges include justifying ROI in leased facilities and navigating complex vendor selection processes for advanced automation.

4.3. Hospital Insights

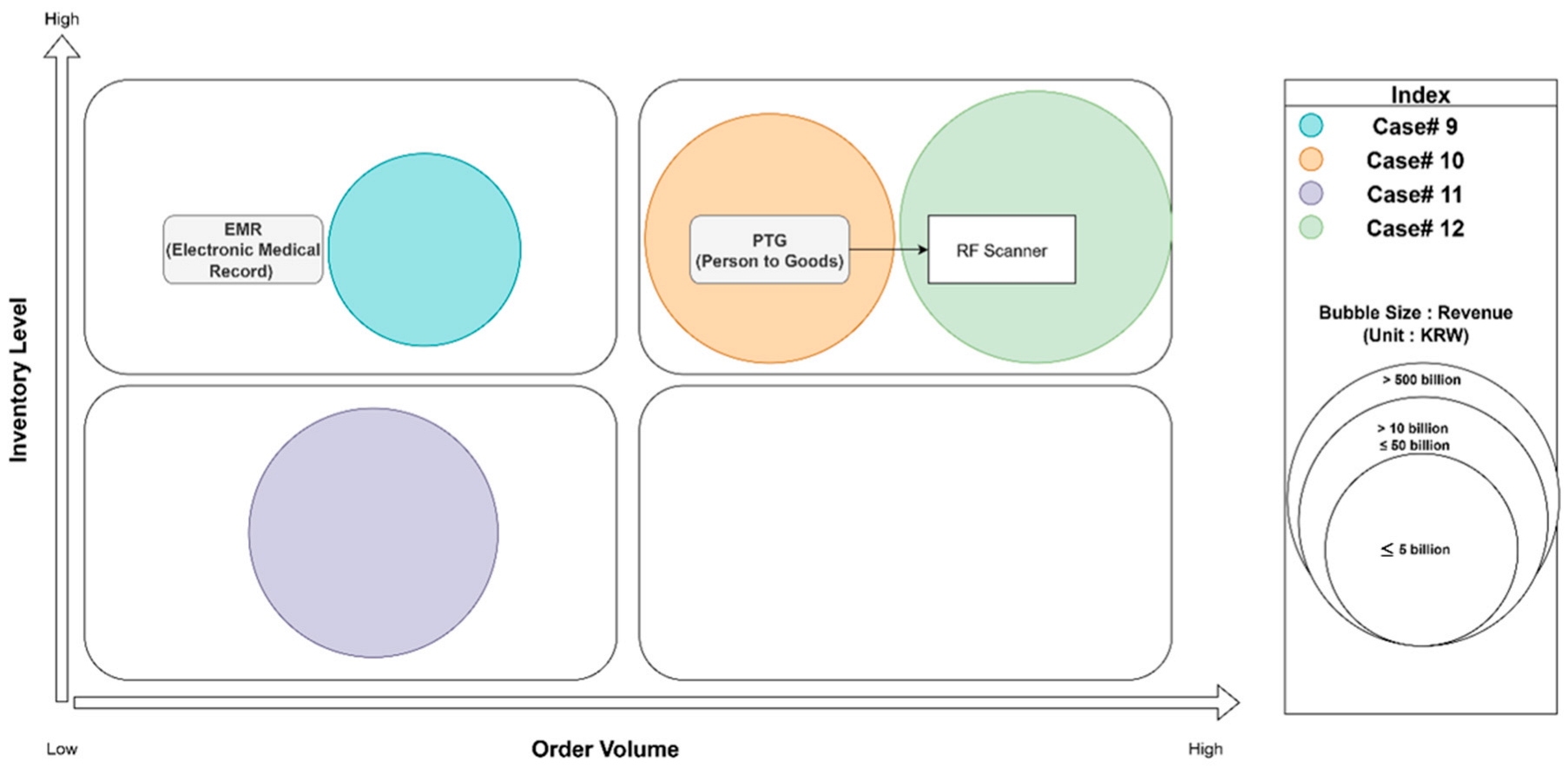

Interviews were conducted with personnel from three hospitals (Cases 9, 10, 11, and 12), representing different scales and service focuses. The surveyed results are mapped in

Figure 6.

For the larger hospitals interviewed (Case 9, a semi-general hospital; Case 10, a specialized semi-general hospital; and Case 12 University hospital), a common emphasis was on effective inventory management for their in-house pharmacies and for the wide range of medical tools and consumables required for patient treatment and surgical procedures. Compared to commercial enterprises, hospital logistics processes are generally simpler in scope, primarily focused on supporting internal operations related to patient care, diagnostics, and surgeries, rather than external sales. The degree of system automation and the presence of dedicated logistics personnel varied with hospital size and complexity.

Case 9 (No Logistics Automation Implemented): This was a relatively small convalescent hospital, with fewer acute surgeries and complex treatments compared to general hospitals. The interviewee stated that there were no physical logistics automation systems in place. “The only system used is an Electronic Medical Record (EMR) system for transmitting prescription data to the in-house pharmacy”. Reasons cited for not implementing logistics automation included the hospital’s small scale (based on annual revenue), the perceived difficulty in managing initial investment costs, and the fact that their annual volume of outbound shipments (internal transfers) and inventory holdings were not significant enough to cause major inconveniences in manual logistics management. Consequently, there was little perceived likelihood of adopting such systems in the future.

Case 10 (Partial Logistics Automation Implementation Scheduled): This semi-general hospital was the largest among the three interviewed and had a dedicated logistics management department. The logistics manager reported that current logistics management involved data capture through RF scanners, and the hospital had automated its data storage and tracking with an ERP system. Regarding physical logistics automation, he mentioned, “Higher-tier university hospitals are also interested in internal logistics automation, and we are currently evaluating the investment costs for logistics automation in line with these trends”. The primary expected benefit of automation was “reducing cost losses due to the disposal of various in-house inventories” (e.g., expired medications or supplies). When asked about specific equipment under consideration, the manager stated: “We believe that the logistics automation equipment we can introduce internally is AMR (Automated Mobile Robots). We can use AMRs to deliver medications from the in-house pharmacy to patients, and for surgical materials needed in the operating room. Previously, these materials were transported manually using carts…. By using AMRs for transportation, we expect that staff can focus more on other tasks”.

Case 11 (No Logistics Automation Implemented): This interview was with the chief pharmacist of a semi-general hospital specializing in spine and joint treatment, as there was no dedicated logistics manager. In-house pharmacy logistics were managed manually using Excel spreadsheets. The chief pharmacist explained that “it is challenging to consider facility investments for in-house logistics since the hospital is still investing in facilities for wards and operating rooms”. A significant operational inconvenience highlighted was the “lack of a system for First-In–First-Out (FIFO) management, which is crucial for managing the expiration dates of medications”. For future automation systems, the preference was clearly for “a computerized system to accurately track inventory levels across departments and facilitate FIFO management”, rather than physical automation systems.

Case 12 (Partial Logistics Automation Implementation Scheduled): This hospital manages its pharmaceutical logistics with a strong focus on safety, regulatory compliance, and operational efficiency. The logistics system encompasses the entire lifecycle of medical supplies and pharmaceuticals. Medications and medical supplies are sourced through approved vendors, with inventory levels maintained based on average usage and safety stock thresholds. This ensures timely availability while minimizing waste. Pharmaceuticals are stored under strict environmental controls to maintain efficacy. Distribution within the hospital is managed through automated systems and barcode tracking to ensure accuracy and traceability. Given the sensitive nature of pharmaceuticals, they enforce rigorous documentation and approval procedures. This includes managing licenses, expiration dates, and batch tracking to comply with national health regulations. For rare or high-cost medications, they use a “zero inventory” approach, securing stock only upon prescription to avoid unnecessary holding costs. To optimize procurement costs and streamline supply chain operations, they collaborate with a Group Purchasing Organization (GPO), leveraging collective buying power for better pricing and vendor management. The interviewee mentioned “This comprehensive logistics system supports our hospital’s commitment to high-quality patient care, ensuring that medications are delivered safely, efficiently, and in full compliance with healthcare standards”.

Hospital logistics automation focuses primarily on internal inventory management and the timely delivery of medications and supplies to patient care areas. Larger hospitals with dedicated logistics departments are beginning to explore AMRs for internal transport to improve efficiency and reduce manual labor. However, for many, especially smaller or specialized hospitals, the high initial investment costs for physical automation are a significant barrier, and the priority often lies in improving system-level capabilities for inventory tracking, expiration date management (FIFO), and data integration (e.g., through enhanced EMRs or dedicated inventory management software).

4.4. Clinic Insights

Interviews were conducted with representatives from three clinics (Cases 13, 14, 15, and 16), including an internal medicine clinic, a dental clinic, a radiology clinic, and Korean medicine clinic. The surveyed results are mapped in

Figure 7.

A common theme among the clinics was the importance of maintaining appropriate inventory levels for essential medications and consumables, and ensuring accurate and timely delivery of these items from their pharmaceutical and medical suppliers (typically wholesalers). Logistics management in clinics is almost exclusively handled by existing clinic staff (nurses, assistants, or the practitioners themselves) and primarily involves basic inventory control, such as managing items in treatment rooms, storing IV fluids, and ensuring vaccines are correctly refrigerated. The scale of these operations is significantly smaller than in hospitals or commercial entities.

Case 13 (System Only—EMRs for Prescriptions): The representative from this internal medicine clinic, which had fewer than five staff members, stated that “manual processes are more cost-effective for small clinics”. They reported no significant inconveniences in their current practice as long as the necessary medications and supplies were delivered accurately by wholesalers upon request. There were no plans or perceived needs to adopt additional automation in the future.

Cases 14, 15, and 16 (No Logistics Automation Implemented): Representatives from the dental clinic (Case 14), the radiology clinic (Case 15), and even the Korean medicine clinic (Case 16) provided similar responses. They indicated that there was no dedicated computerized system for logistics beyond basic EMR functionalities, and logistics management was limited to manual inventory control, typically involving placing phone orders for necessary medications and supplies as needed. A significant portion of the interview time for these clinics was spent explaining the concept of logistics and the purpose of the research, indicating a general lack of awareness or dedicated focus on logistics management as a distinct operational area. While they could see a potential, albeit limited, need for some level of computerized system automation for better tracking, they expressed strong skepticism about the cost investment and depreciation benefits of any physical logistics systems. The prevailing sentiment was that “investing in the latest dental or radiology equipment would better serve their primary goal of providing patient care” than investing in logistics automation. Especially in the case of traditional Korean medicine, treatments are primarily performed directly by physicians, such as pulse diagnosis, acupuncture, and Chuna therapy, rather than using specific medical equipment. As a result, the types of consumables used are relatively consistent and predictable, leading to the view that a separate logistics system is not necessary. Regarding prescriptions, many are customized for individual patients. Therefore, instead of stocking medications in advance, prescriptions are prepared on the spot according to the patient’s condition and immediately delivered to them. For this reason, the concept of inventory does not apply in this context.

Clinics, particularly smaller, specialized practices, exhibit very limited engagement with or perceived need for logistics automation. Their internal logistics requirements are minimal, primarily focused on ensuring the availability of essential supplies through reliable external suppliers. Manual processes are deemed sufficient and more cost-effective. There is a notable lack of awareness regarding broader logistics management principles and automation technologies, with investment priorities heavily skewed towards primary medical equipment and direct patient care facilities.

4.5. Pharmacy Insights

Interviews were conducted with pharmacists/managers from four pharmacies (Cases 17, 18, 19, and 20). The surveyed results are mapped in

Figure 8.

All pharmacies fulfill a dual role: accurately preparing and dispensing prescriptions based on physician orders, and acting as retailers of over-the-counter (OTC) medications and other health-related products. Consequently, effective inventory management is a universally critical aspect of their operations. This includes managing a wide range of pharmaceutical products, ensuring appropriate storage conditions, tracking expiration dates, and minimizing stockouts of frequently prescribed or requested items. Both pharmacies reported using standard pharmacy management software systems (e.g., Hupos, VALCRETEC, Seoul, Republic of Korea, Pharm IT 3000, Health Resources Development Institute, Cheongju-si, Republic of Korea) for prescription processing, patient records, and basic inventory tracking. Their logistics processes for acquiring medications are largely dependent on deliveries from pharmaceutical wholesalers.

Case 17 (System Only—Pharmacy Management Software): This pharmacy was approximately five times the size of Case 18 and located on the first floor of a medical building, catering to prescription demands from various clinics within the building as well as selling OTC medications to local residents. The pharmacy owner stated that the current staffing level—one salaried pharmacist and one sales assistant in addition to the owner—was sufficient to handle all demands manually; hence there was no perceived need for physical automation. A notable point was the “low trust in physical automation systems for medications that are administered directly to people”, reflecting a concern for accuracy and safety. Regarding operational inconveniences, the pharmacy owner highlighted the following: “Since medications are administered directly to people, managing expiration dates is crucial. Currently, we handle the return process for medications nearing expiration through the wholesaler from whom we purchased them. If we could manage expiration dates better, the return rate would decrease, and we would have more space to store necessary medications”. Consequently, the owner expressed a future desire to implement “a medication management system that optimizes storage and manages both first-in–first-out (FIFO) and expiration dates” more effectively.

Case 18 (System Only—Pharmacy Management Software): This represented a small-scale local pharmacy situated within an apartment complex, primarily serving demand from a family medicine clinic in the same building and the surrounding residents. The pharmacy was solely managed by the owner. Regarding the adoption of logistics automation, the owner mentioned that “there is no need for additional manpower, and therefore, there is no requirement for automation to replace human resources”, given the small scale of operations. However, similar to the previous case, a recognized need was “a first-in–first-out (FIFO) system for managing medication expiration dates”. Human involvement was considered more cost-effective for all other tasks.

Case 19 (System Only—Pharmacy Management Software): This pharmacy is located in a region with a high concentration of office buildings. Within the building, there are typically three to four clinics, which results in a high demand for prescription-based pharmaceutical products. However, due to the large number of office workers, there is also significant demand for general over-the-counter (OTC) medicines. The pharmacy operates only during weekdays, from early morning before office hours until the end of the workday, and is closed on weekends. Because of this limited operating schedule, the pharmacist emphasizes the importance of maintaining appropriate inventory levels. “The inventory is managed with a 50:50 ratio between prescription medicines and general OTC products. Despite being located in a central business district, the pharmacy’s limited operating hours reduce the flexibility for product returns. Therefore, the pharmacist is seeking to implement a logistics system that can support efficient return handling and reverse logistics processes”.

Case 20 (System Only—Pharmacy Management Software): This pharmacy is located within a subway station and operates from the early morning, starting with the beginning of subway services. Due to the high foot traffic in the station, the peak sales periods are during morning and evening rush hours. The majority of sales consist of general over-the-counter (OTC) medicines and consumables such as masks and bandages, rather than prescription medications. Because the products sold are mostly low-cost items, the pharmacy does not maintain a large inventory. Instead, it places orders as needed. Additionally, the physical space within the subway station is limited, making it difficult to store large quantities of stock. Given these constraints, the pharmacist expressed “the need for a logistics system that can support appropriate inventory levels while enabling efficient storage and replenishment of high-demand products. “

Pharmacies, regardless of size, place a strong emphasis on inventory management, with a particular focus on accurate dispensing and meticulous control of medication expiration dates. Physical automation is generally not a priority due to concerns about cost, the perceived adequacy of manual processes for their scale of operation, and, in some cases, a preference for human oversight in dispensing medications. The primary area where automation or system enhancement is desired lies in more sophisticated software solutions for inventory tracking, FIFO management, and optimizing the handling of expiring stock to reduce waste and improve space utilization. Since most pharmacies operate in a retail format, they often face limitations in storage space for pharmaceutical products. To address this issue, there is a growing demand for storage systems that can improve space efficiency and support better inventory management. A system that meets these needs could be proposed to help pharmacies maintain appropriate stock levels while optimizing their limited storage capacity.

4.6. Contingency Factors and Development Directions for Healthcare Logistics Automation

The analysis of interview data reveals that the adoption and application of logistics automation in the interviewed healthcare companies is often partial and is highly contingent upon several interacting factors. Key among these are the order volumes handled by the organization and the level and complexity of inventory they manage. These factors, in turn, are influenced by the specific industry type (e.g., manufacturer vs. hospital), the overall scale of operations, and the prevailing business model (e.g., 1PL vs. 3PL).

Companies classified as large enterprises within their respective sectors (e.g., multinational manufacturers/importers, major pharmaceutical wholesalers) and those handling high order volumes were significantly more likely to have already established some level of logistics automation or to be actively implementing or planning such initiatives. Moreover, these larger entities often expressed a strong desire and strategic intent to further enhance their automation capabilities. The nature of their logistics operation processes tended to be more detailed and complex, necessitating different types of automation systems based on their core functions. For instance, manufacturing/importing companies operating their own large warehouses focused on automation solutions for high-bay storage, efficient material flow, and high-speed picking and sorting. Conversely, wholesalers, while also dealing with high volumes, often prioritized automation that maximized storage density for bulk goods and facilitated efficient break-bulk and order assembly operations.

In the healthcare provision sector, however, mid-sized and larger institutions (e.g., general hospitals), despite their scale and significant internal movement of goods, often lacked extensive physical automation for internal transportation or overall logistics management. Their preference, and often their initial steps towards “automation”, leaned more towards establishing robust IT systems for data tracking, inventory visibility, and management (e.g., advanced EMR modules, dedicated inventory management software, or barcode/RF scanning systems).

The level and characteristics of the inventory held also significantly shaped automation decisions. Manufacturing/importing companies typically managed a higher number of Stock-Keeping Units (SKUs) representing their proprietary product lines, but their overall storage volume for any single item might have been lower compared to wholesalers who store products in bulk. Their automation needs might therefore have focused on systems that can handle a wide variety of item dimensions and facilitate efficient each-picking or case-picking for diverse orders.

Wholesalers, on the other hand, often stored large quantities of a more limited range of high-turnover items on behalf of multiple customers. This often resulted in fewer SKUs per customer but significantly higher overall storage volume and throughput requirements for those items. Consequently, their automation strategies frequently centered on maximizing cubic space utilization in warehouses (e.g., through high-density AS/RSs or pallet shuttle systems) and ensuring rapid replenishment and dispatch of bulk orders.

For healthcare institutions, inventory complexity was a key driver. Pharmacies, acting as retailers and dispensers, maintained a diverse inventory of medications requiring careful management of expiration dates and lot numbers, often using specialized pharmacy management systems. While larger hospitals also managed substantial and diverse inventories, their focus was on ensuring timely availability for patient care. Clinics, due to limited internal storage space and typically lower patient throughput compared to hospitals, often managed inventory by ordering supplies (e.g., medications, consumables) on an as-needed or just-in-time basis, storing only enough for short-term use (e.g., a month’s supply). This minimized their perceived need for sophisticated inventory storage or handling automation.

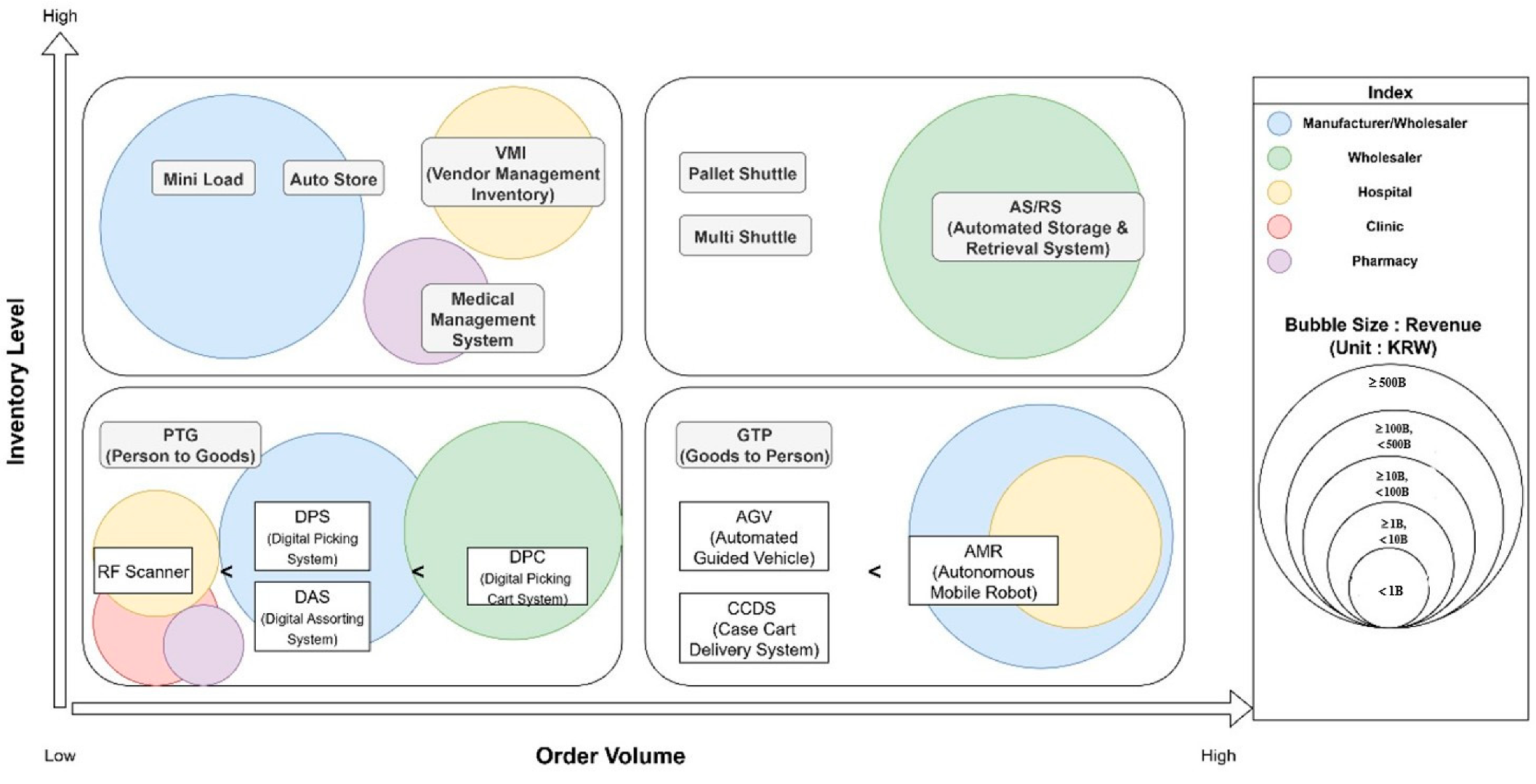

The proposed directional map presented in

Figure 9 directly responds to three critical real-world challenges identified through our interviews: (1) the need for investment guidance tailored to organizational scale, (2) the requirement for phased implementation approaches given capital constraints, and (3) the necessity of contingency-based decision frameworks that account for operational heterogeneity across healthcare sectors.

This framework is theoretically grounded in

Contingency Theory, which emphasizes the importance of alignment between organizational structure and environmental conditions [

46], and the

Resource-Based View (RBV), which explains how firm-specific assets influence strategic decisions such as technology adoption [

47]. By linking order volume and inventory complexity—two core operational contingencies—to automation strategies, the model reflects how internal capabilities and external demands jointly shape logistics innovation in healthcare settings.

Following Corley and Gioia’s [

48] typology of theoretical contributions, our study offers both a clarification and extension of existing theories as well as a contextualized explanation. First, we apply and adapt the principles of

Contingency Theory and the

Resource-Based View (RBV) in the underexplored domain of healthcare logistics automation. While these theories are well established in the organizational design and operations literature, their intersection with automation strategy in healthcare contexts has received limited empirical attention. Our quadrant-based framework extends the theoretical application of these perspectives by demonstrating how specific operational contingencies—namely, order volume and inventory complexity—shape technology adoption decisions in real-world settings. Second, this study provides a contextualized explanation through the development of a directional map grounded in stakeholder interviews. This framework embeds decision logic within the practical constraints and organizational dynamics of various healthcare actors, offering insight into why automation is unevenly adopted and how strategic alignment can be guided across differing operational profiles. Together, these contributions deepen theoretical understanding while offering actionable guidance to practitioners navigating automation decisions in complex healthcare supply chains.

Figure 9 maps organizations into one of four quadrants based on their order volume and inventory level. Each quadrant reflects a distinct operational profile and suggests tailored automation strategies aligned with firm capability and task environment:

Quadrant I (Low Order Volume, Low Inventory Level): Clinics and small pharmacies typically fall here. For these entities, full-scale automation is not cost-effective; basic digital tools (e.g., EMR-integrated inventory software, FIFO tracking) offer cost-effective ways to improve operational visibility and reduce risk.

Quadrant II (High Order Volume, Low Inventory Level): High-throughput pharmacies and similar operations benefit from task-specific automation in high-frequency, repetitive processes. Solutions such as AMRs, pick-to-light systems, or digital sorting carts reduce labor input and improve fulfillment speed, representing low-complexity, high-volume use cases.

Quadrant III (Low Order Volume, High Inventory Level): Specialized wholesalers or importers with large SKU portfolios and low transaction frequencies should focus on storage optimization using systems like AS/RSs or vertical lift modules, paired with WMS integration. These firms face high inventory complexity despite limited daily throughput.

Quadrant IV (High Order Volume, High Inventory Level): Large hospitals, life science manufacturers, and 3PL fall into this zone. These organizations are suited for full-scale, integrated automation—including AS/RSs, AMRs, Warehouse Management Systems (WMSs), and robotic sorting arms—to optimize both speed and complexity management. Their scale and resource capacity allow for multi-phase automation strategies aligned with complex operational demands.

Overall, the framework provides a scalable, theory-informed roadmap that guides logistics automation investment decisions in healthcare, reflecting both the pragmatic needs of diverse stakeholders and contributing to the theoretical understanding of how organizations align automation strategies with operational contingencies and resource configurations.

This map is intended to serve as a guiding framework for healthcare companies. It suggests that even within the same industry segment, the appropriate degree and type of automation will vary significantly depending on the specific operational scale (reflected in order volume) and the nature of the inventory being managed. Rather than prescribing a one-size-fits-all solution, it encourages a tailored approach to automation adoption, considering these critical contingency factors. The findings strongly suggest that for many in the healthcare sector, particularly those currently operating with predominantly manual, labor-intensive processes, a phased or incremental approach to automation—starting with partial automation in areas with the highest potential for ROI or operational improvement and gradually expanding—is likely to be more practical and successful than attempting an immediate, large-scale, full automation transformation.

A case study from 30 Spanish hospitals implementing automated dispensing cabinets (ADCs), carousels, or robotic dispensing systems reported a net gain of EUR 3 in revenue for every EUR 1 invested, with full ROI achieved within one year, based on an approximately EUR 1.3 million initial investment and EUR 4 million annual drug consumption [

49]. Operationally, robotic dispensing systems in tertiary hospital pharmacies significantly reduced error rates and enhanced workflow accuracy in a comparative before-and-after evaluation [

50]. Other documented systems demonstrated staff efficiency improvements of up to 25–30% and picking-time reductions of ~50% compared to manual workflows in healthcare logistics settings [

51]. These metrics support our quadrant-based interpretation in

Figure 9: organizations in Quadrant IV, with high order volume and inventory complexity, stand to gain the greatest operational and quality benefits from comprehensive automation systems—while selective or minimal automation may offer limited ROI for those in Quadrants I or II.

The proposed directional map is grounded in empirical insights derived from in-depth interviews with 20 healthcare organizations, evenly distributed across five stakeholder groups: manufacturers/importers, wholesalers, hospitals, clinics, and pharmacies. This expanded sample improves the representativeness and analytical saturation of the findings, enhancing the reliability of the quadrant-based framework. The model links automation strategies to key operational contingencies—namely, order volume and inventory complexity—offering a practical tool for evaluating automation readiness.

While the framework is inductively derived from qualitative data, we acknowledge that it remains exploratory in nature. To support its scientific utility, we outline the following boundary conditions under which it is most appropriately applied: (1) organizations operating within healthcare logistics environments where multi-stakeholder distribution and regulatory constraints are present; (2) firms managing moderate to high SKU diversity and variable order volumes, as these dimensions define the framework’s structure; and (3) decision contexts involving physical automation systems, rather than purely digital or administrative process optimization. These conditions reflect the scope of our empirical dataset and provide guidance for both practitioners and future researchers aiming to apply or test the model in similar settings.

5. Conclusions

This study has provided a detailed qualitative exploration of the application and perception of logistics automation across the diverse landscape of the South Korean healthcare industry. By systematically categorizing stakeholders—manufacturers/importers, wholesalers, hospitals, clinics, and pharmacies—and examining their unique logistics processes, current automation adoption status, and perceived challenges, the research offers timely insights into a sector where automation is increasingly critical yet unevenly adopted. Through 20 in-depth interviews, the study surfaced both the practical demand for automation and the barriers impeding its implementation, particularly among smaller entities with limited resources or awareness.

A central contribution of this research is the development of a contingency-based framework—visualized as a directional map—that guides healthcare organizations in identifying appropriate levels and types of logistics automation. This framework is grounded in two key operational factors: annual order volume and inventory complexity. Notably, organizations managing over 100,000 order lines and more than 1000 SKUs were significantly more likely to adopt systems such as AS/RSs, AMRs, and AutoStore, while those below this threshold often relied on manual processes or basic system-level tools.

Given the healthcare sector’s continued dependence on labor-intensive logistics practices, this study advocates a pragmatic, stepwise approach to automation. Rather than immediate full-scale implementation, it recommends initiating partial automation in high-impact areas and scaling gradually as benefits emerge and operational maturity increases. By translating stakeholder-specific insights into a scalable decision-support framework, this study contributes both theoretical and practical value to the underexplored field of healthcare logistics automation and provides a foundation for future research aimed at the broader validation and quantification of automation impacts.

Several limitations of this study and the proposed framework must be acknowledged. First, the framework’s foundation is based on qualitative findings from a relatively small, context-specific sample of 20 South Korean healthcare organizations. While the insights are grounded in diverse stakeholder interviews, the generalizability of the proposed directional map across broader healthcare contexts or international markets remains limited. This constraint calls for further empirical validation through quantitative research and comparative studies in other geographic regions. Second, the framework’s primary contingency dimensions—order volume and inventory complexity—were inductively derived and not empirically tested for predictive validity. Their practical utility, while supported by interview narratives, may vary depending on specific organizational strategies, external logistics partners, or national regulatory environments. Future studies should rigorously test these factors and explore the integration of other potential variables such as workforce structure, IT capability, or financial resilience. Third, the study reveals substantial financial, organizational, and perceptual barriers to the adoption of automation. The proposed framework, while offering a tailored direction, does not fully resolve the challenge of overcoming these systemic constraints—particularly for smaller entities with limited capital or strategic logistics focus. In this respect, the model’s current prescriptive power is limited and should be treated as a conceptual starting point rather than a definitive guide. Lastly, a critical limitation lies in the lack of rich, peer-reviewed case studies across varied healthcare institution types. This paucity restricts the depth and contextual richness with which the framework can be further refined. Future research should prioritize the documentation and analysis of successful logistics automation cases—especially those from underrepresented stakeholders, such as clinics and small pharmacies—to broaden the empirical foundation and practical relevance of the framework.

Looking ahead, future research should aim to enhance this framework by incorporating mixed-method approaches, cross-sectoral validation, and the development of implementation roadmaps tailored to the financial and operational constraints of smaller healthcare organizations. Efforts to systematically quantify ROI, document transitional adoption paths, and address stakeholder-specific barriers will be crucial to advancing both theory and practice in healthcare logistics automation.