4.1. Combustion Analysis

4.1.1. Analysis of the Stoichiometry of Combustion

According to

Table 6, R varies significantly among the four fuels, reflecting the differences that exist in their chemical compositions and the amount of oxygen required for complete combustion. Likewise, we fixed the mass of fuel injected as standard to evaluate the behavior of each fuel according to the need for injected air, and we observed the variations for each fuel.

Methane has an intermediate air/fuel ratio, with 17.20 kg of air per kilogram of fuel, and for methanol and ammonia, both have lower and quite similar air/fuel ratios of 6.46 kg and 6.07 kg, respectively. Of the four, hydrogen has the highest ratio, with a value of 34.22 kg of air per kilogram of fuel, mainly due to its low molar mass and the fact that it does not have oxygen in its molecular structure, making it necessary to provide large amounts of oxygen for the formation of water, because water can be generated even if the H2 is not completely burned, with air being a limitation to be taken into account.

These considerations have important implications for the design and operation of combustion systems, including engines, burners and turbines. Hydrogen requires larger intake systems or fans to supply sufficient air, while methanol and ammonia offer more efficient combustion with lower air demand, although they also need air support systems.

As for methane, it is the most balanced of the fuels under study. Its air/fuel ratio is lower than that of hydrogen but much higher than that of methanol and ammonia, making it an intermediate choice in terms of air requirements.

4.1.2. Analysis of Emissions

As discussed in

Section 4.1, air is made up of a set of gases. However, under conditions of temperature and pressure during combustion, as well as the possibility that fuel combustion may not be complete, gases may appear in the products that cause the greenhouse effect, such as NO

x or CO

x, among others, although the most important problem with incomplete combustion is the loss of efficiency.

Although it is true that the previous section dealt with the complete combustion of fuels, it is necessary to deal with cases in which incomplete combustion takes place, favoring the appearance of polluting elements in all the fuels under study. The combustion of methane and methanol is quite similar.

Ammonia combustion produces mainly nitrogen and water under conditions of complete combustion, since nitrogen is inert and does not oxidize. However, when oxygen is insufficient, nitrogen monoxide and other oxides can form pollutants and contribute to smog and acid rain, as NOx.

NH3 generates nitrogen oxides that are an environmental concern, especially at high temperatures, so its use in engines or combustion systems must be well controlled to minimize NOx emissions. In addition, its combustion has the advantage of not generating carbon dioxide, which makes it a potential candidate for low-climate-impact fuels, although NOx formation remains a challenge.

The incomplete combustion of hydrogen is uncommon due to its strong ability to burn under poor conditions, although in extreme cases of oxygen deficiency, trace amounts of hydrogen monoxide (HO) may be formed. Furthermore, although hydrogen does not contain nitrogen, when burned in the presence of air, which contains nitrogen, nitrogen oxides can be formed if combustion occurs at temperatures above 1200 °C.

In terms of emissions, the cleanest fuels are hydrogen and methane when burned completely, since their main products are water and carbon dioxide in the case of methane, but with minimal emissions of pollutants compared to methanol.

However, it should be mentioned that hydrogen emissions have an influence on terrestrial methane. Recent studies have shown that hydrogen’s potential as a clean fuel could be compromised due to its ability to react with the hydroxyl radical (OH) in the atmosphere, which is responsible for breaking down methane. If hydrogen emissions exceed a certain point, this reaction could increase the accumulation of atmospheric methane, aggravating the problem of global warming [

29].

4.1.3. Analysis of the Fuel Injected

This section will be approached from two points of view: as a function of the mass injected and the volume of the combustion chamber. If a calculation is made at the same injected mass of the four types of fuel of 0.0129 kg/cycle, a combustion duration of 38 degrees of crankshaft rotation is established [

30].

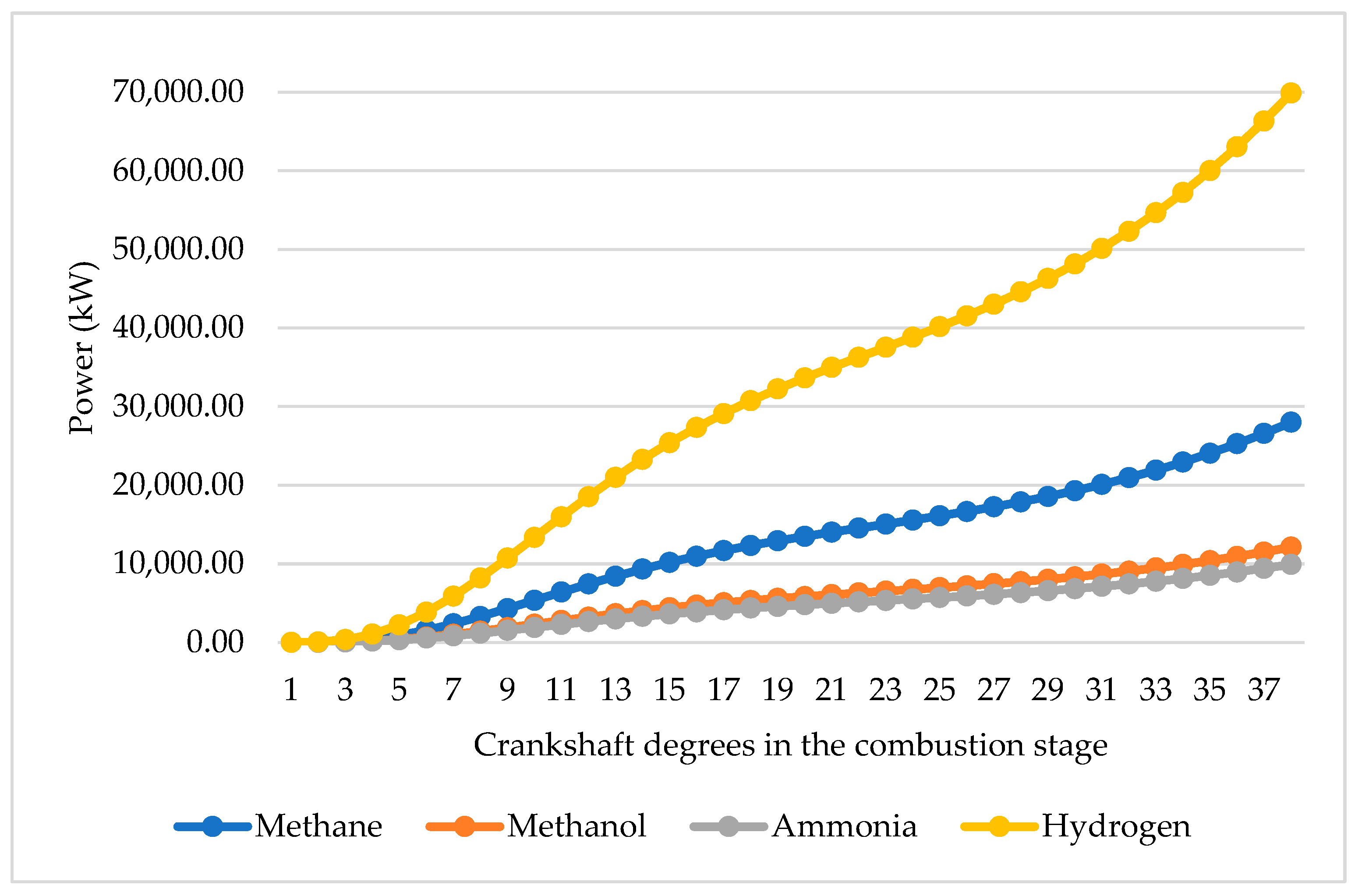

At the same mass injected, the high calorific value of hydrogen allows this fuel to generate more power than the others, followed by methane, ammonia and methanol, in that order.

All other things being equal and in an ideal environment, hydrogen would produce around 70,000 kW of power compared to the 12,100 kW generated by methanol, the 9920 kW by ammonia or the 28,000 kW by methane. This confirms that the fuel with the highest LHV, hydrogen, requires less mass to deliver the same amount of energy.

If calculations are made for use in internal combustion engines, the mass injected will be limited by the capacity of the combustion chamber, with the physical geometry of the cylinders coming into play and, thus, conditioning the final size that the engine may have.

According to Equations (1), (4) and (18) and the data in

Table 5, the overall volume of the combustion chamber was calculated independently of the fuel used. For this purpose, it was averaged according to the ranges of the usual compression ratios (rC) depending on the fuel [

31,

32,

33,

34,

35,

36,

37,

38,

39,

40,

41,

42]:

Methane: 12-18:1;

Methanol: 10-16:1;

Ammonia: 12-18:1;

Hydrogen: 12-20:1.

Next, the lower and upper ranges were averaged, these being 11.5 and 18, respectively. If the arithmetic average of these two values is taken, the average compression ratio of the four fuels is 14.75. The common compression ratio is taken as 15:1 by rounding up.

Evaluating this compression ratio for each fuel,

Table 5 shows the number of cylinders that would be necessary to obtain the same power depending on the fuel used.

Analyzing the data presented in

Table 5, it is important to highlight that the number of cylinders obtained is different for all the fuels analyzed, so that, with an equal number of cylinders, the fuel injection systems will have to be different according to the fuel in order to increase the volume of fuel injected and reduce the number of cylinders required.

In the more specific case of hydrogen, its low density means that a high number of cylinders is required to provide the same power output.

The type of fuel has a direct impact on the number of cylinders required for each engine and, therefore, on the final geometry and volumes that an engine can occupy depending on the type of fuel used, as well as its weight.

By varying the compression ratio from 12 to 16, but keeping the rest of the parameters, as can be seen in

Figure 4, methane is the fuel that best withstands the variations, followed by methanol. Ammonia and hydrogen, with a variation of five points in the compression ratio, need five more cylinders for the same power; although the number of cylinders for ammonia is lower, they do have similar behavior.

4.1.4. Analysis of Mean Effective Pressure

The MEP depends on the fuel as it is linked to its density, its calorific value and the volumetric flow rate injected into the cylinder. According to

Table 5, since the same power is set for all fuels, the MEP varies around 160 bar. Precisely, hydrogen, having a higher fuel volume, requires a lower MEP, while methane requires a higher MEP. However, the differences in pressure are negligible, so this indicator could be negligible when comparing the different fuels.

4.1.5. Analysis of Flammability Range

The flammability range describes the concentration of fuel in air within which combustion can be maintained and is a key parameter for the design of injection systems and combustion chambers. The flammability characteristics of each fuel are listed in

Table 6:

Table 6.

Flammability characteristics by fuels [

32,

33,

34,

35].

Table 6.

Flammability characteristics by fuels [

32,

33,

34,

35].

| Fuel | Lower Flammability Limit (LFL) (% vol.) | Upper Flammability Limit (UFL) (% vol.) | Flammability Range (% vol.) | Reactivity |

|---|

| Methane | 5.00 | 15.00 | 10.00 | Moderate |

| Methanol | 6.00 | 36.00 | 30.00 | High |

| Ammonia | 15.00 | 28.00 | 13.00 | Low |

| Hydrogen | 4.00 | 75.00 | 71.00 | Very high |

According to the flammability range, methane has a more restricted flammability range (5% to 15%), which results in greater stability when used as a fuel, since its moderate range ensures combustion control, reducing the risk of pre-ignition.

Methanol has an intermediate flammability range of thirty points, from 6% to 36%. Its high proportion of intrinsic oxygen due to the alcohol composition facilitates its complete combustion and reduces the formation of contaminating particles, but it requires careful control of the mixture and operating conditions to avoid problems related to the accumulation of flammable vapors and the risks associated with this.

Ammonia, with a range of 15% to 28%, presents its main challenge in maintaining combustion due to low reactivity. This results in the need for very advanced injection systems or the use of auxiliary mixtures to favor its reaction.

As for hydrogen, it has a very wide flammability range of more than 70 points and a high reactivity, which allows it to burn even in very poor mixtures. These wide ranges give rise to dangerous characteristics in terms of its handling and use as a fuel, since a small leak can very easily create flammable atmospheres.

4.1.6. Analysis of Injection Pressure (IP)

The relationship between the LHV of the fuel and the pressure required in the engine is derived from the basic principles of thermodynamics and injection system design contained in Equations (2), (17) and (19).

If the required power output is fixed, the LHV directly affects the amount of fuel to be injected and, therefore, the pressure required to ensure efficient combustion inside the cylinder.

The design of the injection system must ensure that the fuel enters the combustion chamber with sufficient pressure to atomize and mix with the air. It follows that the injection pressure depends on the mass flow and the characteristics of the system, such as the diameter of the injectors and the injection speed.

A higher mass flow due to a fuel with a lower LHV implies that the injection pressure needs to be increased to ensure efficient fuel delivery.

Several readings can be extracted from

Table 6 about this. For sizing an injection system based on the LHV of the fuel, those with a higher LHV, such as methane or hydrogen, require lower mass flow, which allows relatively low injection pressures or smaller injector sizes. Conversely, fuels with lower LHV, such as methanol and ammonia, require higher mass flow for the same power output, resulting in increased pressure required to atomize the fuel and maintain injection timing.

Fuel choice directly affects injection system design and engine efficiency. Fuels with a high LHV such as methane and hydrogen are more suitable for systems that prioritize efficiency and simplicity in their design, while methanol and ammonia may require significant adjustments to the injection system to handle their higher flow and injection pressure needs.

4.2. Feasibility Analysis

Methane, methanol, ammonia and hydrogen have emerged as viable options due to their physicochemical properties as alternative fuels in the maritime sector; however, their implementation, regardless of their characteristics, will depend on the infrastructure that guarantees their supply and competitive prices in the fuel market. Therefore, the economic and availability study of these fuels worldwide is fundamental to understanding their practical feasibility in the maritime context.

Each of these fuels presents unique characteristics in terms of their production, distribution, storage and use, as well as the associated costs.

This analysis focuses on assessing both the economic and global availability of these fuels, considering factors such as production trends, infrastructure development and demand projections in the industry.

For this purpose, use was made of the Alternative Fuels Insight (AFI) database of the classification society Det Norske Veritas (DNV) and the Argus database.

4.2.1. Availability and Production Analysis

According to

Figure 5, presenting the sector’s projections, methane continues to consolidate its position as the most widely used alternative fuel. Its infrastructure, with 115 terminals in operation and 82 in the pipeline, reflects a fuel that has solid projects and prospects for its use as a marine fuel. This fuel offers a cleaner alternative to traditional fossil fuels, thanks to its ability to significantly reduce CO

2 emissions and other pollutants.

Methanol, on the other hand, is emerging as an increasingly relevant option for the decarbonization of maritime transport. With 120 terminals in operation and 10 more under development, this fuel has gained popularity due to its lower emissions and its compatibility with existing engines, which reduces propulsion system conversion costs. Although its growth is more moderate compared to methane, the gradual expansion of its bunkering infrastructure supports its potential as a viable long-term alternative.

In contrast, ammonia and hydrogen face more compromised situations in terms of their infrastructure development. Ammonia, with 8 active terminals, including supply to other sectors, but with 263 under development or in evaluation, has considerable potential due to its ability to completely eliminate CO2 emissions during combustion. However, its implementation as a fuel is mainly hampered by the technologies required for its safe use. Hydrogen, although the cleanest fuel, is at an early stage of development with only two terminals in operation and none in the pipeline, reflecting the difficulties associated with its production, storage and distribution, similar to ammonia. Despite this, both fuels have promising prospects as technologies advance and the necessary infrastructure materializes.

An analysis of the projects underway and planned for the maritime sector, as shown in

Figure 6, reveals a transformation in the energy landscape, with very marked differences between fuels in terms of their role and future potential. Methane, although growing steadily, remains a transitional option due to its lower environmental impact compared to traditional fossil fuels. However, its sustained growth compared to the exponential increase in other alternatives reflects a loss of prominence as the industry seeks more sustainable solutions.

Methanol shows accelerated growth, driven by its ability to reduce emissions and by investments in infrastructure and technology that are positioning it as a viable solution in the medium and long term. On the other hand, ammonia, with a much more pronounced increase, is emerging as a strategic fuel in the energy transition, particularly for its ability to not generate CO2 during its use. However, its adoption is going to depend on overcoming the barriers already discussed above, as well as ensuring that it is produced sustainably, especially by using green hydrogen in its manufacture.

Although hydrogen does not appear to be positioned as a direct fuel for the maritime sector due to the difficulties associated with its storage and transportation, it plays a key role as a building block in the production of cleaner fuels such as ammonia and methanol. Its use in the form of green hydrogen is key to ensuring that these fuels are truly sustainable, which reinforces its importance within the energy transition. Taken together, these dynamics reflect a shift towards alternative fuels that integrate hydrogen as an essential component, with methane playing a transitional role and methanol emerging as the most viable solution to meet the decarbonization goals of the power and maritime sectors.

4.2.2. Economic Analysis and Forecasts

Looking at the data in

Table 7, methane continues to be the dominant fuel among the fuels under study, although there is a slight decrease in its percentage share of the total number of ships. In 2025, 86.69% of ships using alternative fuels will be powered by methane. Although the number of vessels operating with it continues to increase from 814 in 2025 to 996 in 2028, its share of total alternative fuels gradually decreases, reaching 76.79% in 2028. This trend reflects an increase in the adoption of other alternative fuels, such as methanol, but methane remains the most widely used option due to its accessibility, existing bunkering infrastructures and its environmental advantage compared to other fossil fuels.

As for methanol, considerable growth is shown during this period. In 2025, only 10.65% of ships will operate with methanol, but this percentage increases in the following years. In 2026, the share of methanol will increase to 18.28%, and in 2027, the forecast is for a 23.78% increase, underlining the growing interest in this fuel. Although in 2028 there is a slight drop in its share, reaching 21.36%, the total number of ships using methanol will continue to grow, driven by the increasing investment in bunkering infrastructures and the development of engines capable of using methanol efficiently.

Ammonia is experiencing more modest growth compared to methane and methanol, but its market share is estimated to increase gradually. In 2025, 0.43% of ships consuming new fuels will use ammonia, with four ships operating on this fuel. However, in 2026, its share increases to 1.72%, and in 2027, it rises to 1.94%, reflecting an increase in the research and development of technologies adapted to the use of ammonia. The total number of ships operating with ammonia remains very small, mainly because the lack of bunkering infrastructures and the technical difficulties in adapting marine engines to the use of ammonia, and the toxicity of ammonia as a fuel, slow down its adoption. In 2028, its share drops to 1.00%, which may indicate a certain slowdown due to the challenges it still faces to become a viable option in the fleet.

Finally, hydrogen shows a somewhat irregular evolution. In 2025, 2.24% of alternative fuel ships will use hydrogen, reflecting an initial interest in this clean fuel. However, its adoption does not follow an upward line, but experiences a steep drop in the following years. The decline in hydrogen adoption is largely due to high production costs, the lack of adequate bunkering infrastructure and the technical challenges associated with its storage and use in marine engines.

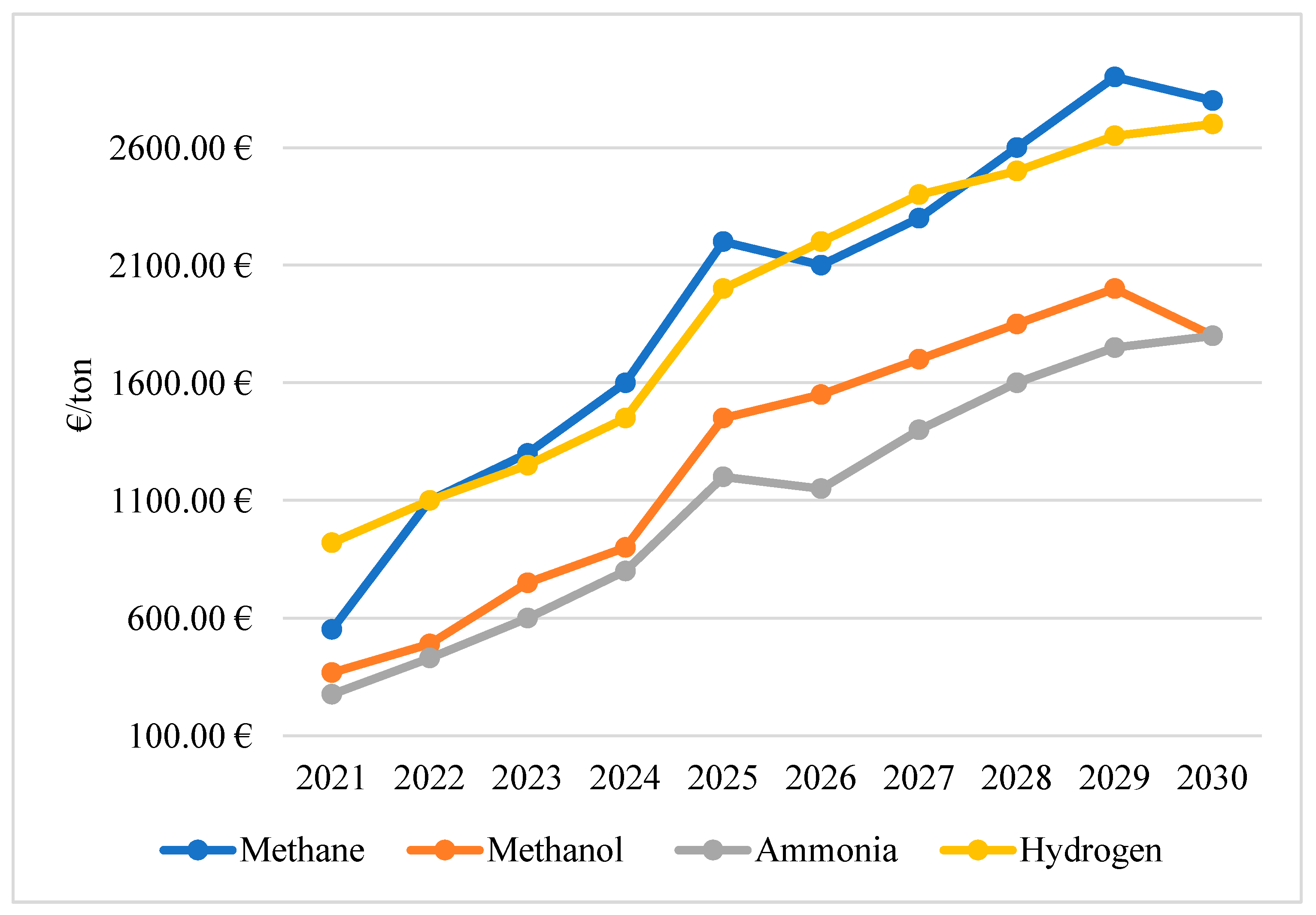

As for price developments, addressed in

Figure 7, between 2021 and 2024, the overall trend for methane was for a gradual increase in prices driven by several factors. The post-pandemic economic recovery, Brexit, and the Russia–Ukraine conflict, in addition to the increase in global gas demand, are key factors influencing this growth. In addition, the expansion of bunkering infrastructures and the improvement of methane engine technologies have contributed to the stabilization of its price, albeit with slight fluctuations due to variations in global natural gas markets.

Between 2025 and 2030, the trend towards a higher price is evident. This is due to the growing investment in technology associated with natural gas, coupled with an increase in demand for more sustainable solutions in the maritime sector. However, methane’s price will also be influenced by fluctuations in international energy markets, especially variations in gas production and energy policies that encourage the use of cleaner sources.

Methanol is becoming an increasingly viable alternative fuel for marine propulsion, largely due to its low environmental impact in terms of sulfur and nitrogen oxide emissions. Between 2021 and 2024, there was an increasing trend in prices, driven mainly by fluctuations in the cost of the raw materials used for its production, such as natural gas. For the 2025–2030 period, demand for methanol as a greener alternative to diesel will continue to rise. This will lead to an increase in prices, supported by greater investment in methanol production from renewable sources and an increase in the adoption of systems using this fuel. However, despite the upward trend, forecasts indicate that prices will remain volatile due to feedstock availability and costs, as well as challenges related to the expansion of the global methanol bunkering infrastructure.

On the other hand, ammonia is still in the development stages for use as a marine fuel, expectations are high due to its potential as a clean energy source. Between 2021 and 2024, ammonia prices increased moderately, mainly due to the growing interest in its adoption, driven by the need to reduce the emissions of polluting gases. However, the lack of infrastructure and the need to develop specific equipment and services for its use in engines limit its insertion in the fuel market, which may generate price fluctuations. From 2025 to 2030, ammonia is expected to become an increasingly attractive option, but price fluctuations will be related to advances in the production of sustainable ammonia and its viability on board.

Finally, as for hydrogen, if it is used as a fuel, it faces problems related to its storage and distribution, resulting in the high prices observed between 2021 and 2024. During this period, prices follow a moderate upward trend, driven by the growing demand for sustainable solutions and the lack of infrastructure for large-scale production and distribution.

As we move into the 2025–2030 period, hydrogen will likely play a key role in the decarbonization of the maritime sector. Prices are expected to continue to rise, albeit with more pronounced fluctuations, driven by the expansion of hydrogen production and storage infrastructure, and the rise in methane, by comparison, will also be driven by taxes on carbon-polluting emissions, which will drive up demand for hydrogen.

4.3. Discussion

In accordance with the methodology described in

Section 3.2, in order to establish a homogeneous evaluation of the results,

Section 4.1 and

Section 4.2 were evaluated numerically from 1 to 4, with 1 being the most unfavorable option and 4 the most favorable. On this basis,

Table 8,

Table 9 and

Table 10 were obtained.

Table 8 reflects the six analyses that were carried out within

Section 4.1 and that evaluate the combustion of each fuel using the scoring system described above.

Table 9 shows the scoring of the analysis related to fuel production and fuel price.

Table 10 is a summary table of the scores obtained in

Table 8 and

Table 9, summing them up:

Overall, although methane’s characteristics are not the best in terms of combustion, its availability and viability as a fuel within the maritime sector make it the highest-scoring fuel in the overall assessment. With good flammability, moderate pollutant emissions and being a widely available and economical fuel, with well-developed infrastructure for its production and distribution, it is a viable and economical option. However, its problems with fugitive emissions suggest that it still requires technological improvements to reduce its environmental impact.

As for methanol, it has the best characteristics in terms of combustion analysis. In terms of emissions, it is less polluting than fossil fuels, although it still produces CO2, which limits its attractiveness as a completely clean alternative within the sector, and, although it is an accessible option as a fuel, it does not have the supply infrastructure of methane. Yes, it is relatively inexpensive and available, but its large-scale production, especially from biomass or natural gas, is not competitive. It is presented as an environmentally friendly alternative to fossil fuels, but its viability does not make it the industry’s first choice. Its cost and infrastructure limit its use, although with improvements in this aspect, it could become a much more attractive solution.

Ammonia has a complex combustion performance. Its need for air is not excessive, but it requires high temperatures and tends to generate NOx, which has a negative impact on its emissions, even though it is capable of not generating COx. In terms of feasibility, ammonia faces difficulties in both availability and cost. Although it is produced at the industrial level, its infrastructure for use as a fuel is very limited and its economic competitiveness is low, due to the high costs of production, storage and distribution. All this is without even considering that, of the four fuels, its high toxicity is what poses the greatest challenges for its implementation as a fuel in the sector.

Ammonia has great potential in terms of CO2 emission reduction, but its complex combustion and low viability make it less attractive in the short term.

Lastly, there is hydrogen, which, although standing out for its clean combustion, presents many more limitations than the other fuels in terms of its management as a fuel, despite its high calorific value. Its low energy density is a handicap that other fuels do not have. In terms of infrastructure, hydrogen is the least developed of them all; its availability is very low and its costs are extremely high due to the lack of production, especially when obtained from renewable sources, whose market value is skyrocketing.

Hydrogen has excellent environmental potential due to its zero emissions, but its economic and technological difficulties make it unfeasible.

Only 2% of ships can currently run on low- or carbon-neutral fuels, an insufficient percentage to have a direct impact on the reduction in polluting emissions, although the maritime sector is only responsible for 3% of GHG emissions in the world. All this without taking into account the problem of the availability of new fuels and the competition that will arise with other sectors for this.

Moreover, if one takes into account the high costs of obtaining green hydrogen, and that it is absolutely essential to obtain green ammonia, green methanol or other by-products, this will lead to a rise in the price of green hydrogen derivatives.

As for fuels such as methane, ammonia or methanol, they stand as a transition bridge between the most polluting fossil fuels and those that do not generate harmful emissions for the environment, with hydrogen being positioned as an energy vector that allows obtaining non-biological fuels that are neutral in polluting emissions, as shown both by its situation in the order book and in the fuels market.

There is currently no demand for green hydrogen. Global hydrogen production rose by 3% compared to 2021, and only 0.7% of all the hydrogen generated in the world was considered “low emissions”, including the 0.1% produced by electrolysis.

In terms of combustion analysis, methane is reasonably efficient, but, under incomplete combustion conditions, it can generate pollutants such as carbon monoxide, formaldehyde and fugitive emissions, making it a problem for engines seeking to comply with the strictest environmental regulations. On a safety level, methane has a more limited flammability range than hydrogen, between 5% and 15%, making it less dangerous from a reactivity standpoint. In addition, methane behaves more stably in the face of compression ratio variations, which makes it suitable for engines with greater operating flexibility.

As for methanol, it has a lower air/fuel ratio than hydrogen and methane (6.46 kg of air per kilogram of fuel). This means that it requires less air for combustion, which allows for smaller intake systems. Its ICP is 19,700 kJ/kg, so it generates less power than hydrogen and methane. In terms of efficiency, methanol tends to generate excess air during combustion, which lowers the combustion temperature and reduces its thermal efficiency. A major disadvantage of methanol is its tendency to generate pollutants such as formaldehyde and carbon monoxide when it does not burn completely. In addition, methanol has a flammability range between 6% and 36%, which makes it relatively safe.

A particular characteristic of ammonia is its tendency to form nitrogen oxides in the event of incomplete combustion. This NOx contributes to the formation of smog and acid rain, which is a problem from an environmental point of view. In terms of safety, ammonia has a flammability range of 15% to 28%, which makes it safer than hydrogen but less stable than methane. Ammonia requires a specific injection system design because, like methanol, it needs a higher injection pressure to ensure combustion. In addition, its low LHV means that, despite its lower air requirement, engines must be adapted to adjust their efficiency.

Hydrogen stands out for having the highest air/fuel ratio due to its low molar mass and the lack of oxygen in its molecular structure. This characteristic means that engines using hydrogen must have much larger air intake systems. In terms of emissions, hydrogen has the advantage of being almost clean when burned completely, producing mainly water vapor. However, at high temperatures, it can form nitrogen oxides, contributing to air pollution. Although incomplete combustion is rare in the case of hydrogen, the risks associated with its wide flammability range are a concern in terms of safety.

Economic and availability analysis of fuels, carried out based on industry estimates, defines that from the period 2021 to 2030, clear and significant trends are being observed in terms of the price evolution and adoption of the new generation of fuels.

As global energy transition policies intensify, the maritime industry is undergoing a gradual transformation towards more sustainable and environmentally friendly sources, but it still faces severe problems in terms of supply infrastructure, technology and the production of these fuels, which still underpins the procurement of new ships with fuels that generate polluting emissions such as those derived from fuel oil, or that use methane as fuel.

In terms of prices, a clear upward trend is anticipated, especially for the more environmentally friendly fuels such as methanol, ammonia and hydrogen. These fuels show a price evolution influenced by investments in new technologies and the construction of bunkering infrastructures, which increases costs in the short and medium term.

In the case of methane, although it is expected to remain a predominant fuel in the maritime industry, prices will be increasingly affected by global energy transition policies.

As restrictions on fossil fuels increase and demand for cleaner options grows, the price of methane could experience variations that, while not completely displacing it, will affect its competitiveness against other cleaner options, this being dependent on the regulations and standards that define what is a clean fuel and what is not.

Nevertheless, of all of the alternative fuels, methane remains the most widely used in the maritime sector. Although, in absolute terms, the number of ships using methane as fuel continues to grow, its percentage share within the alternative fuel market has started to gradually decline.

The maritime sector is in the midst of a transition to alternative fuels, with methane as the main option. However, its dominance is expected to decline progressively as other alternative fuels emerge, although it remains the majority choice due to its established infrastructure ensuring its availability and its relatively low cost compared to other fuels.

Methanol is emerging as the main competitor to methane and is set to grow in the coming years. Its attractiveness lies in its lower environmental impact, the feasibility to comply with regulations via its use, and the development of bunkering infrastructure. These advantages are increasing its adoption, positioning it as a key alternative for the decarbonization of the sector.

Ammonia, on the other hand, is advancing more moderately. Its potential lies in its ability to reduce CO2 emissions, but it faces problems such as toxicity and lack of infrastructure. Despite its slow growth, it is still considered a long-term option.

Hydrogen, although promising as a clean fuel, faces barriers that are currently insurmountable in the maritime sector. Lack of infrastructure, high production costs and technological difficulties prevent its expansion in the market, resulting in a reduced market share in the coming years on its own, but it will be a vital part of green fuels.