4.1. Results from Models

Table 4 displays the descriptive statistics for 132 samples collected from 12 different cities over 11 years.

Table 5 shows the pairwise correlations among the Smart City Index, its Supporting Index, the Digital Technology Index, GPP per capita, Annual GINI, and Government R&D. The Smart City Index strongly correlated with the Supporting Index (

), confirming their conceptual alignment. Its correlation with the Digital Technology Index is also substantial (

), indicating that smarter cities tend to have more advanced digital infrastructures. The Digital Technology Index and GPP per capita exhibit an exceptionally high correlation (

), suggesting that economic growth and digital capacity advance in correlation. In contrast, Annual GINI and Government R&D show only weak associations with the Smart City Index (

and

, respectively), implying that neither income inequality nor public research spending bears a strong direct relationship to overall smart city performance.

A more detailed sub-index correlation matrix (

Table 6) reveals that the seven domain sub-indices are themselves highly intercorrelated (pairwise

). The Digital Technology Index maintains moderate correlations with each domain, ranging from 0.610 (Living) to 0.751 (Energy), showing that while digital capacity is integral to every smart city dimension, it does not fully subsume them. GPP per capita again correlates strongly with both digital capacity and each sub-index. Annual GINI and Government R&D remain only marginally related to the sub-indices (

), reinforcing the view that these factors play a limited cross-sectional role in shaping individual smart city domains.

The GLS estimation in

Table 7 reveals a positive and statistically significant relationship between the Digital Technology Index and the Smart City Index, supporting prior research that highlights digital infrastructure as crucial to urban innovation and effectiveness [

8,

13]. In practical terms, cities with higher levels of digital infrastructure implementation tend to score better on the smart city scale. The coefficient on the Digital Technology Index is positive and significant (

), confirming that digital infrastructure is a key driver of smart city performance. Substantively, the magnitude of this effect is considerable: a one-standard-deviation increase in the Digital Technology Index is associated with roughly a 0.7 standard deviation increase in the Smart City Index. This finding aligns with prior research suggesting that digital advancement propels smart urban development. It also corresponds to the strong bivariate correlation (

) observed between the two indices in

Table 5, indicating that nearly half of the variance in smart city outcomes can be explained by variation in digital infrastructure alone. Results of sub-index can be found in

Table A1,

Table A2,

Table A3 and

Table A4, and the interpretation can also be found in

Appendix A.

The GLS model’s constant term is positive, implying that even at very low levels of digitalization there is a baseline smart-city capacity, likely reflecting foundational urban factors or other dimensions of smartness not entirely captured by digital infrastructure. Crucially, even after controlling other factors, the Digital Technology Index remains a robust predictor. Neither the inequality measure (Gini) nor government R&D spending shows a significant effect on the Smart City Index in this specification. Their coefficients are small and not statistically distinguishable from zero. This suggests that, within our sample, socio-economic inequality and public R&D investment do not directly translate into measurable differences in overall smart city performance (at least not in the short-run or in the presence of high multicollinearity among development indicators). The dominance of digitalization variables in explaining smart city rankings underscores the central role of technological implementation in urban innovation outcomes, consistent with the notion that smarter cities are fundamentally enabled by ICT infrastructure and digital services [

11].

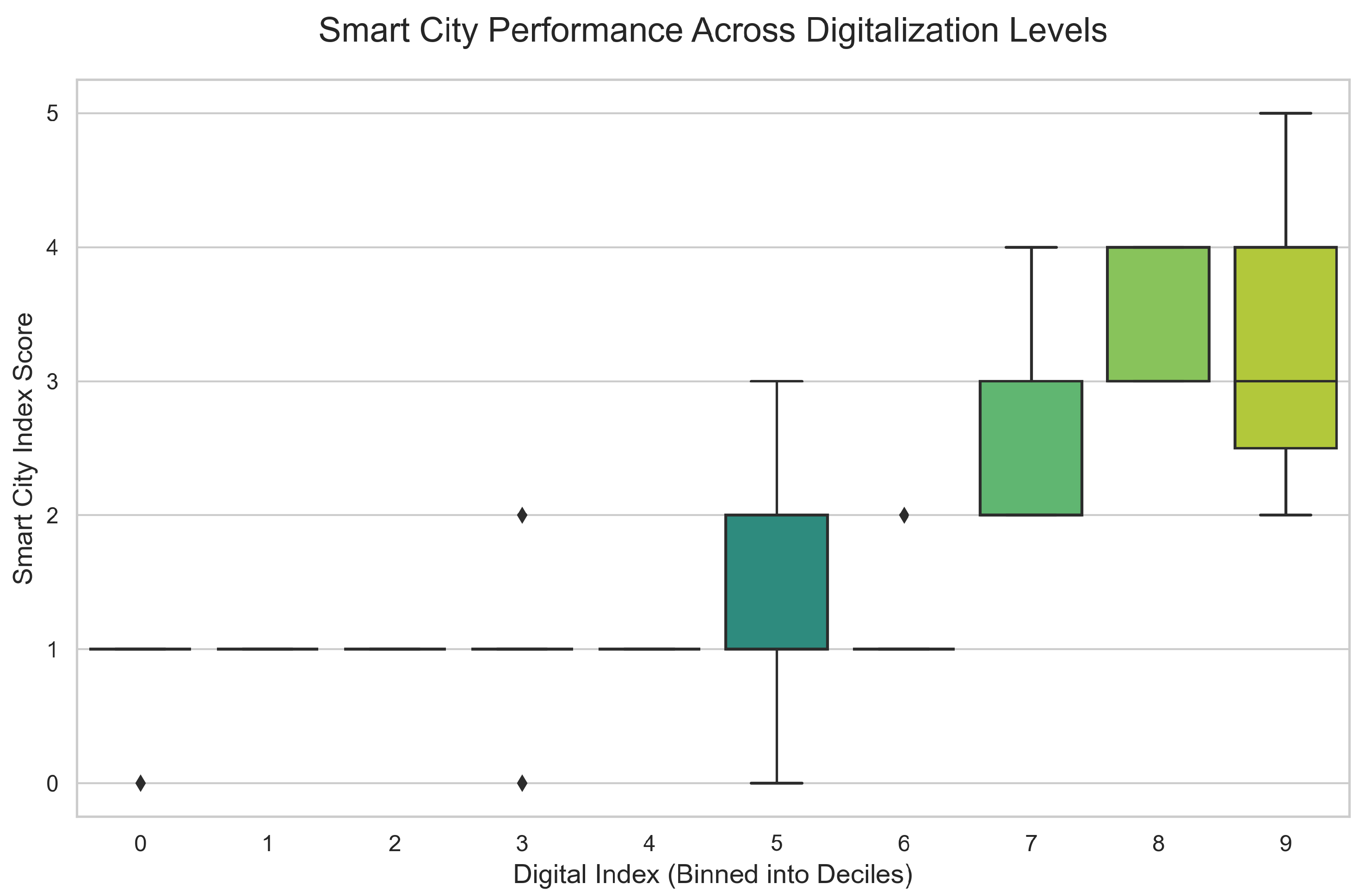

Figure 1 shows box plot of the Smart City Index across binned levels of the Digital Index. The Digital Index has been segmented into ten deciles (0–9) to show the distribution of smart city performance at each level of digital maturity. The y-axis represents the Smart City Index, a composite score ranging from 0 to 5. The plot illustrates a clear positive trend, where provinces in higher deciles of digitalization also exhibit higher median smart city scores and greater overall performance.

Figure 2 shows heatmap of the conditional probability of Smart City Index levels. Each column represents a decile of the Digital Index, and each row represents a discrete level of the Smart City Index (0–5). The color and number in each cell indicate the probability of a province falling into a specific Smart City Index level, given its Digital Index bin. The concentration of higher probabilities in the top-right portion of the map reinforces the strong positive relationship between the two indices.

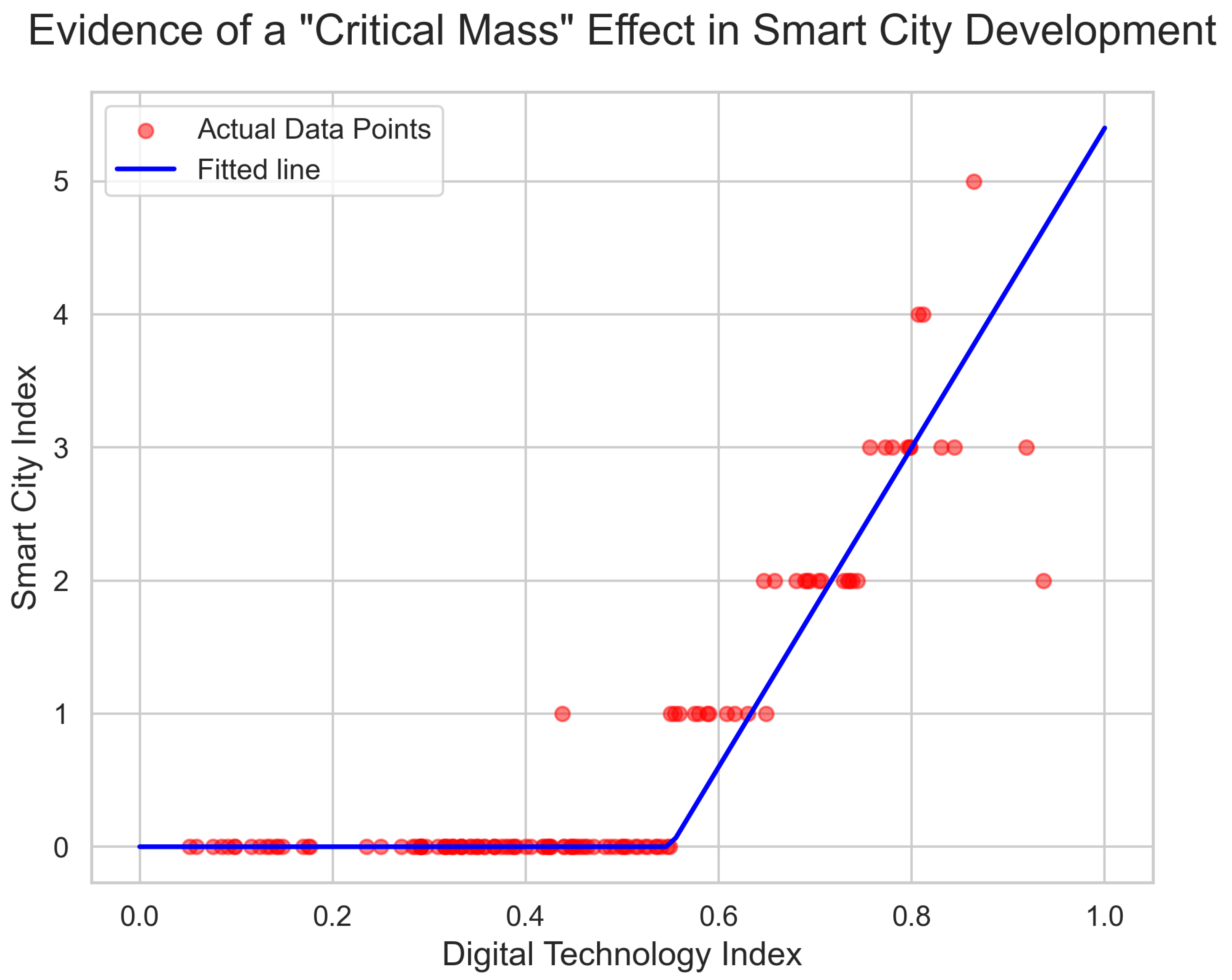

Figure 3 shows the relationship between the Digital Index and Smart City Index with a segmented regression line. The red points represent the actual observations for each province-year. The solid blue line represents the fitted relationship from the segmented regression model, with the “kink” occurring at the median value of the Digital Technology Index (0.42). The flat initial slope followed by a steep increase provides strong visual evidence of a critical mass or tipping point effect, where the benefits of digitalization only accelerate after a foundational threshold has been crossed.

While the linear GLS model confirms a positive linkage, the overall goodness-of-fit is only modest, and diagnostic plots shown in

Figure 1 and

Figure 2 suggest that the relationship may not be strictly linear. The model’s R-squared is moderate, indicating that a substantial portion of variability in the Smart City Index remains unexplained by our linear specification. More revealingly, a visual examination of the data points in

Figure 3 show a piecewise pattern. The slope of the relationship appears steeper at lower to mid-range values of the Digital Technology Index and then rises at higher values.

The preceding analysis establishes a strong, piecewise-linear relationship between digital infrastructure and smart city performance, with evidence of accelerating returns after a critical mass threshold is reached. However, these models do not explain the underlying governance and institutional factors that enable cities to cross this threshold. To explore these mechanisms, we now turn to our explanatory case study of Wang Chan Valley, a site where these dynamics can be observed in detail.

4.2. Non-Linearity Analysis: Evidence of Accelerating Returns

To formally test the hypothesis of a piecewise-linear relationship between digitalization and smart city performance, a segmented panel regression was estimated. This approach addresses the potential for a non-linear impact more robustly than a simple quadratic model [

29]. The sample was split into low and high digitalization groups based on the median value of the digital index (0.4259). An interaction term was then introduced to test if the effect of the digital index was statistically different for the high-digitalization group.

The results, presented in

Table 8, reveal a significant non-linear relationship consistent with an acceleration effect. The coefficient on the interaction term is positive and highly significant (

,

), indicating that the benefits of digital infrastructure are substantially greater in provinces that have already achieved a critical mass of digitalization.

For the low-digitalization group, the effect of the digital index is modest and only marginally significant (, ). However, for the high-digitalization group, the effect is nearly four times larger and highly significant (). This finding provides strong evidence that smart city policies may have the greatest impact when they can push developing regions across a key digital maturity threshold, unlocking accelerating returns.

4.3. Stakeholder Interview Insights

To complement the quantitative analysis, we conducted semi-structured interviews with key stakeholders involved in Thailand’s smart city initiatives between October and December 2024. Two interviews were particularly informative: one with a senior digital innovation official from the Eastern Economic Corridor Office (Respondent A), and another with a municipal smart city coordinator from the broader EEC region (Respondent B).

The interview data provides a compelling narrative for the critical mass effect observed in the quantitative results. Respondent A confirmed our quantitative findings regarding non-linear returns to digital investment, noting that while initial digital deployments produced rapid improvements in management and energy efficiency within 18 months, subsequent technology additions yielded progressively smaller gains. This aligns with the initial, flatter part of the curve in

Figure 3. Critically, both respondents emphasized that the transition to the steeper, accelerating part of the curve required fundamental shifts toward collaborative governance. They described moving from “top-down technology deployment” to “collaborative innovation” involving universities, businesses, and residents. This institutional evolution supports our theoretical framework linking digital infrastructure effectiveness to Quadruple Helix governance arrangements and provides a tangible explanation for the acceleration of returns: the threshold is not merely technological, but institutional.

Respondent B provided evidence of positive externalities from Wang Chan Valley’s Quadruple Helix approach. They described how neighboring municipalities adapted WCV’s digital systems and, more importantly, its stakeholder engagement methods. Spillover mechanisms included knowledge transfer workshops, regional supply chain development, and workforce training programs confirming our hypothesis about innovation hubs generating broader urban benefits. This demonstrates that the QH model does not just optimize performance within a single entity but can create a learning ecosystem that diffuses innovation across a region.

Both respondents highlighted challenges in replicating WCV’s success across smaller municipalities, particularly regarding institutional capacity for multi-stakeholder collaboration. Respondent B noted that while technology costs are declining, the human capital and coordination requirements for effective implementation may increase as cities move beyond basic digitalization. These interviews validate key aspects of our theoretical framework while revealing important contextual factors specific to emerging economic contexts. The stakeholder perspectives confirm that digital infrastructure effectiveness is mediated by governance quality and that innovation hubs can generate positive spillovers through deliberate knowledge transfer mechanisms. However, they also suggest that the S-curve dynamic we observed quantitatively may be more pronounced in developing urban systems due to uneven institutional capacity, potentially creating new forms of digital divide based on governance capability rather than technological access alone.