Abstract

The Russian invasion of Ukraine on 24 February 2022 accelerated agricultural commodity prices and raised food insecurities worldwide. Ukraine and Russia are the leading global suppliers of wheat, corn, barley and sunflower oil. For this purpose, we investigated the relationship among these four agricultural commodities and, at the same time, predicted their future performance. The series covers the period from 1 January 1990 to 1 August 2022, based on monthly frequencies. The VAR impulse response function, variance decomposition, Granger Causality Test and vector error correction model were used to analyze relationships between variables. The results indicate that corn prices are an integral part of price changes in wheat, barley and sunflower oil. Wheat prices are also essential but with a weaker influence than that of corn. The additional purpose of this study was to forecast their price changes ten months ahead. The Vector Autoregressive (VAR) and Vector Error Correction (VECM) fanchart estimates an average price decline in corn, wheat, barley and sunflower oil in the range of 10%. From a policy perspective, the findings provide reliable signals for countries exposed to food insecurities and inflationary risk. Recognizing the limitations that predictions maintain, the results provide modest signals for relevant agencies, international regulatory authorities, retailers and low-income countries. Moreover, stakeholders can become informed about their price behavior and the causal relationship they hold with each other.

JEL Classifications:

F17; F51

1. Introduction

Prices are essential signals for market participants, as they enable the efficient allocation of physical, human and financial resources. Agricultural commodities are no exception, for which supply and demand mechanisms are essential for adjusting excesses. Compared to equity stocks, for which speculation is integral to their price movements, agricultural commodities before the 2000s were partially immune to this phenomenon; afterward, they have been characterized by progressive financialization [1,2,3]. Economic history has shown that, during crisis periods, agricultural commodities can be prone to speculative elements. Despite this fact, the global supply of agricultural commodities is concentrated in a few countries where Russia and Ukraine hold dominant positions. The International Grains Council declared that the exports of these two countries account for almost 32% of the world’s supplies of barley and wheat [4]. However, on 24 February 2022, Russia launched a full-scale invasion of Ukraine with devastating consequences for human life, the economy and infrastructure. This is considered the most prominent military conflict since the end of the Second World War. The United Nations High Commissioner for Human Rights confirmed that, due to this war, until 22 August 2022, 5587 people were killed, with 38 children among them [5]. In response, Western countries imposed sanctions on the Russian Federation, blocking access to capital markets and limiting their export capacities [6,7]. These sanctions, together with the inability of Ukraine to export through its main ports, further accelerated agricultural prices. In this context, Ihle et al. [8] documented the Russian invasion of Ukraine through a concordance index that includes 15 key global commodities. The results indicate that, due to this conflict, international trade commodities prices have shown stronger synchronization. On the other hand, Svanidze et al. [9] investigated the price effects of the 2010 Russian wheat export ban. They concluded that wheat world prices skyrocketed due to export restrictions, and price transmission was evident for other agricultural commodities as well. Considering the period from 1990 to 2022, we can conclude that corn is an integral element of wheat, barley and sunflower oil prices. On the other hand, corn prices tend to move independently of the effects of wheat, barley and sunflower oil prices.

Presently, both countries are the leading suppliers of food commodities and are considered the ‘global breadbasket. The World Food and Agriculture Organization has recorded an unprecedented rise in the Food Price Index (FPI) during this period of over 17.1% [10]. Insufficient food, poverty and malnutrition are still unresolved issues for many low-income countries. Due to the Ukraine conflict, an additional 10 million people worldwide are expected to fall into poverty, including 4 million children [11]. This conflict came at tough times for the world economy, when nation-states were still coping with the consequences of the COVID-19 pandemic [12,13,14]. The world economic outlook seems gloomy, and many countries simultaneously face high inflation and negative growth. The contraction of economic activity diminishes the government’s budgetary capacity while enforcing constraints on safety nets [15]. The countries of the Middle East and North Africa, due to their heavy dependence on agricultural imports from Russia and Ukraine, are widely exposed to this conflict. Russia and Ukraine are key players in the global supply of corn, wheat, barley and sunflower oil [16]. These agricultural commodities were chosen because their market prices have experienced unprecedented developments recently. For this purpose, this work investigates the relationship between these commodities and predicts their future price changes. The results reveal that wheat and corn influence barley and sunflower oil market prices. Regarding the forecasts, estimations highlight a possible decline in the market prices of these four agricultural commodities. The supply and demand mechanism moves prices toward equilibrium and adjusts market excesses. The outbreak of the COVID-19 pandemic gave a boost to the prices of agricultural products, and the Russia–Ukraine war took them to another level. For this purpose, we chose four agricultural products that derive precisely from this conflict. Therefore, this work is part of the theoretical contributions emphasizing the significance of unexpected shocks and their influence on price changes. Moreover, the results document from a historical perspective how these four critical agricultural products for Ukraine and Russia have influenced each other.

The price instability of crops is vital for starvation, poverty and global malnutrition. Low-income families allocate a significant part of their budget to food consumption, for whom high prices constrain their spending capacity. An additional concern for policymakers is that unstable agricultural commodity prices are directly transmitted into inflation. Extensive literature supports the claim that high agricultural prices are quickly integrated into the consumer price index [17,18,19]. The outbreak of COVID-19, in addition to disrupting supply chains, limited the movement of workers in the agriculture sector. Adding stringency measures imposed by nation-states [20], the global food prospect deteriorates. Peersman’s [21] work highlights that almost 30% of inflationary pressures in the Euro area can be explained by harvest shocks during COVID-19. The inflation shown in the eurozone after the financial meltdown of 2008/09 might also be attributed to harvest shocks and weather conditions [22,23]. Additional spikes in global agricultural commodity prices characterized the Greek debt crisis of 2011/12. During this period, agricultural prices jumped by 30%, mainly due to substantial contraction in global supply [24]. Minor price changes in agricultural commodities in low-income countries send millions into poverty. To this end, uninterrupted supply chains and their unrestricted movements remain critical issues for food security. Due to the occupation of Black Sea ports by Russian military forces, Ukraine could lose half of its agricultural exports [25]. This problem was exacerbated when countries such as Argentina, Serbia, China and India placed quotas on their agricultural exports. A recent study by Just and Echaust [26] investigated spillover effects carried by the primary agricultural commodities exported by Ukraine and Russia. The authors considered wheat, maize and barley the primary transmitters of high spikes in the FPI. Ultimately, agricultural exports are limited in a few countries, and the rest of the world depends on their disposition.

Based on the circumstances created by the Russia-Ukraine war, our work analyzes the influence that wheat, corn, barley and sunflower oil maintain on each other. Based on a monthly series, we also predict their price changes over the next ten months. To obtain the intended results, an unrestricted VAR, Granger Causality Test and VECM were employed. The relevance of this study arises when Russia and Ukraine are considered the primary worldwide suppliers of these commodities. While this article is being written, the war in Ukraine is ongoing, and food prices are constantly accelerating. These two countries are chosen because one is partially under occupation, and the second is subject to international sanctions. This fact could make the global supply of wheat, corn, barley and sunflower oil carry enormous uncertainties. Nevertheless, the results provide a reasonable indication for nation-states and their government authorities that are heavily reliant on Russian and Ukrainian imports. From a practical perspective, retail brokers are informed about these agricultural products’ effects on one another. The importance grows with the fact that corn, wheat, barley and sunflower oil are treated as the primary source of food production and food prices. The practical implications of this research are twofold. First, countries facing food security issues must address the problem of agricultural commodities in the context of the events. Second, state authorities should not separate forecasts from agricultural products’ influences on each other. To our best knowledge, this is the first study that has investigated this issue considering the circumstances generated by the war in Ukraine. Considering the complexity of this conflict and its importance for the European economy and beyond, we raise the following questions.

RQ1: What is the causal effect among wheat, corn, barley and sunflower oil from January 1990 to July 2022?

RQ2: What will be the performance of these four agricultural commodities in the ten months ahead?

2. Literature Review

Researchers, media and regulatory bodies have widely commented on the factors influencing the price formation of agricultural products. Most of the literature in this field addresses the influence of oil prices, financial market volatility and artificial fertilizers on crops. The work by Mišečka et al. [27] considered that agricultural prices are profoundly affected by the online activities of traders. An additional explanation stands on the fact that they are easily substitutable products and share identical production costs [28]. The Russian invasion of Ukraine created numerous uncertainties in global trade and deteriorated international supply. Presently, Russia and Ukraine are significant players in international trade, affecting food supply chains and global nutrition [29]. According to Prohorovs [30], this conflict will heavily influence the European continent while reshaping the global economy. As a result of export restrictions and sanctions imposed on Russia, commodity prices spiked high. As part of China’s Belt Road Initiative, Russia represented a trade “gateway” with EU member states. However, this “gate” is now partly closed, resulting in the disruption of free trade and increasing food and energy insecurity for the entire continent [31]. Since the outbreak of this conflict, agricultural commodities have been characterized by permanent uncertainties due to supply shocks. In the meantime, it is vital to emphasize that agricultural commodity prices are prone to seasonal patterns. Their market prices tend to increase during the winter period while falling during summer and autumn. The work by Dodd et al. [32] pointed out that export-oriented countries and their geopolitical influence fundamentally drive the market prices of agricultural commodities. According to Siqueira et al. [33], agricultural commodities are less volatile than stocks and other financial securities. Despite this, the authors declared that there is a strong association between the commodities market and stock exchanges. The market prices of agricultural commodities rely on the production capacities and cultivation of agricultural crops [34]. This ultimately also occurs during economic crises and armed conflicts. This situation will increase corn’s market prices by 4.6% and those of wheat by 7.2% [35]. Moreover, many countries today are facing a lack of food storage and budget cuts, which might accelerate further food prices. For global agricultural commodity markets, the outbreak of the Russian–Ukrainian conflict meant a further price rise. This was due to the limitation of Ukraine’s export capacity, labor shortage, limited access to critical agricultural fertilizers and uncertainty regarding spring planting and the winter harvest [16]. These causes were the essential drivers for buying pressure in the agricultural market at the country and individual level, which pushed up commodity prices; food prices rose in line with them. In the Euro area, in the ten months from 12/2021 to 09/2022, the increase in food prices amounted to 12% [36].

Ukraine and Russia are among the leading exporters of agricultural commodities worldwide. At the same time, both are leading worldwide exports of wheat, barley, corn and sunflower oil [10]. The Russian invasion of Ukraine generated an imbalance in international trade, in which Latin American countries were the most prominent beneficiaries [37]. As a result of the conflict, agricultural commodities became the central element of inflationary pressures and market instabilities in the rest of the world [26]. The advantages of Ukraine in cultivating food commodities are favorable climate conditions and cheap labor. Russia, on the other hand, has constantly faced unfavorable climatic conditions but has managed to achieve excessive yields. According to Gordeev et al. [38], the diversity of artificial fertilizers has positively affected Russian agricultural production. Farm productivity in Ukraine and Russia significantly declined between 1991 and 1999, causing global commodity prices to rise [39]. These countries and the entire Eastern Bloc were experiencing structural reforms, one of which was in the agricultural sector. Embracing the free market principles in the early 1990s made these countries face global competition. The agricultural industry was not seen with interest due to low prices and outdated technology. The parcelization of land and the problems of ownership transfers were additional obstacles that hindered the development of this sector. Recently, Svanidze and Duric [40] stated that Russian and Ukrainian food exports to Europe, Asia and North Africa are causing food insecurity and inflationary pressures. Wheat, on the other hand, is the most important crop, as it tends to derive the prices of other agricultural commodities. The Russian Federation is the largest global wheat exporter, with 35 million tons annually [41]. The main exports of Russian wheat are to Egypt (3.23 billion USD), Turkey (1.66 billion USD), Nigeria (556 million USD), Bangladesh (409 million USD) and Pakistan (394 million USD) [42]. These countries endanger food security not only from the accelerated prices but also from a lack of food storage. In the past, grain exports from Russia have been exposed to enormous price uncertainties and volume restrictions. In 2010, due to droughts and a lack of rainfall, Russia limited agricultural exports, causing a global disaster [43]. At that time, food commodity prices experienced double-digit growth, and supply chains were blocked. To address this issue, Zyukin et al. [44] suggested increasing the capacities of Russian ports through the Azov Sea and the Black Sea. On the other hand, Vasylieva [45] considered that, to increase export volume, Ukraine should improve logistics routes and initiate structural reforms in the agricultural sector. The production potential of Ukrainian farmland has been dangerously exhausted mainly due to excessive usage and humus content [46]. Russia, as the second largest producer of barley, tends to export primarily to Saudi Arabia (514 million USD), Jordan (75.6 million USD), Turkey (70.7 million USD), Tunisia (49.5 million USD) and Libya (37.3 million USD). On the other side, Ukraine was the fourth global supplier of barley in 2020, with exports in the range of 883 million USD worldwide [42]. Ukraine’s barley exports are generally oriented to China (470 million USD) and Israel (27.3 million USD). Ajanovic’s [47] work focused on the boom in agricultural commodity prices after 2006. He explained how biofuels have linked the fuel and agricultural markets, sparking a new era in commodity prices. Biofuel policy and corn markets were vital drivers of the sharp increase in food commodity prices. Furthermore, Kapustová et al. [48] showed a strong dependence between biofuel prices and corn, wheat and soybean oil prices. The consequence is an increase in the price level of food depending on the rise in biofuel prices. The aforementioned functional connection between prices in the biofuel market and the prices of agricultural commodities, or, respectively, food, has been confirmed by several authors. Persson [49] presented an overview of 121 studies using different methods to analyze the relationship between biofuel demand and agricultural commodity prices. He described the so-called wave effects that the increased demand for corn as a source for ethanol production has on the prices of other farm commodities. Less definitive conclusions were reached by Khanna et al. [50], who showed that the expansion of biofuels contributed to an initial increase in agricultural commodity prices; however, these effects dissipated over time. The reason was the increase in the productivity of crops and a change in their cultivation methods.

The demand shock initiated by the COVID-19 pandemic caused a deep recession, with the agricultural market less affected than other markets due to the relatively low demand elasticity [51]. The work by Vercammen [52] during COVID-19 indicates that wheat futures options prices are followed by an enormous increase in price volatility. The threat of the escalation of export restrictions could significantly multiply the demand shock and increase the world prices of agricultural commodities or foods in the order of units to tens of percent [53]. In the case of rising food prices, this was partially fulfilled—mainly, integrated markets were hit, and segmented markets were affected to a significantly lesser extent. The food price response is mediated by reduced mobility and is moderated by markets’ reliance on trade before the outbreak of COVID-19 [54]. In Asian countries, corn is mainly considered a primary agricultural commodity due to the local climate. These countries often cannot cover their consumption with domestic production, so they rely on imports. Russia is the 12th largest corn exporter worldwide, and its largest importers are Turkey (116 million USD), Vietnam (89.9 million USD), South Korea (47.4 million USD), China (26.1 million USD) and Libya (17.1 million USD) [42]. According to Nechaev et al. [55], it should focus on hybrid production to increase its corn exports. Conversely, Ukraine is the world’s fourth largest supplier of corn. Moreover, Ukraine concentrates a significant part of its export to the Netherlands (with 513 million USD) and Spain (with 460 million USD). Ukraine does not use corn as an alternative energy source but only for consumption and export. Global corn exports influence development and uncertainties generated on the oil market [56]. The frequent world price uncertainties of corn significantly affect the prices of wheat, barley and sunflower oil. For this purpose, Grabovskyi et al. [57] recommended using corn as an alternative source of biofuel. This action is environmentally friendly and can possibly lower the correlation between corn and oil prices. The effective production of sunflower oil can also be used as a biofuel, dampening the interconnectedness with oil prices [58]. In the meantime, Russia and Ukraine are considered the world’s critical exporters of sunflower oil. The main Russian exports of sunflower oil are to China (540 million USD), Turkey (462 million USD), India (334 million USD), Egypt (143 million USD) and Sudan (58.3 million USD). Due to the embargo imposed on Russia, all these countries are at inflationary risk due to the lack of international supply. The importance of this article for literature and policymakers is twofold. First, it derives from the context of the war in Ukraine and its effects on global food security. Second, corn, wheat, barley and sunflower oil are considered the main components of food processing. From a practical point of view, it is also essential to understand how these four agricultural products are priced based on one another. Additionally, the series of our variables turn back 30 years, which captures their dynamic movements from a long-run historical perspective. Recognizing the importance of these four agricultural commodities for global food security, this is the first empirical work to analyze this concern in the context of the Russia–Ukraine war. However, to generate a more comprehensive approach, other scholars may include shocks such as COVID-19, climate change, exchange rates, transportation costs and wars. This study is mainly motivated by two shocks that accelerated the prices of agricultural commodities. First, the period of the COVID-19 pandemic, which limited people’s movements, slowed down world trade and the migration of workers. Second, the Russian invasion of Ukraine further raised food insecurity issues and impeded global inflation. Changes in oil prices and the exchange rates of hard currencies (such as the US dollar and the euro) directly affect the prices of agricultural commodities. This is because oil prices are an integral part of agricultural sector costs. In this context, shocks (positive or negative) affect production costs and, therefore, market prices. On the other hand, exchange rate stability is vital for international trade and inflationary issues. To this end, other scholars could achieve more comprehensive results if these variables are part of their analysis. However, the reason why the present study has yet to include these two variables is mainly due to the fact that VAR and VECM models tend to perform better when no more than four variables are in the system, and we intended explicitly to focus on the interplay between agricultural commodities.

3. Methodology

This section is divided into two parts: Section 3.1 describes data collection and processing, and Section 3.2 describes the methods used.

3.1. Data

This article tends to predict price changes in the World Corn Price (WPC), World Price of Barley (WPB), World Wheat Price (WPW) and World Sunflower Oil Prices (WPSF) for the ten months ahead. The techniques used to generate the estimated forecasts were the VAR (1) fanchart and VECM fanchart. The identical models were applied to measure the causal relationships among variables from 1 January 1990 to 1 July 2022. The data were collected from the St. Louis FED database [59] based on monthly series. Moreover, each is presented in the same measurement unit, such as US dollars per metric ton. The individual prices indicate a representative global benchmark of the four selected agricultural commodities. The market prices are determined using worldwide exporters regularly traded on exchanges. Further, the frequencies are based on average monthly prices denominated in nominal US dollars. Moreover, each variable contains 391 observations and is analyzed in the identical currency. The food commodities that were selected for analysis are WPC, WPB, WPW and WPSF. WPC stands for the world price of corn, WPB stands for the world price of barley, WPW stands for the world price of wheat, and WPSF stands for the world price of sunflower oil. The Russian invasion of Ukraine on 24 February 2022, accelerated the prices of major food commodities. From 24 February 2022 to 1 May 2022, sunflower oil prices increased by 36.5%, wheat prices increased by 27%, corn prices increased by 17.8%, and barley prices increased by only 3.2%. Moreover, Ukraine and Russia are two of the primary world producers of wheat, corn, barley and sunflower oil.

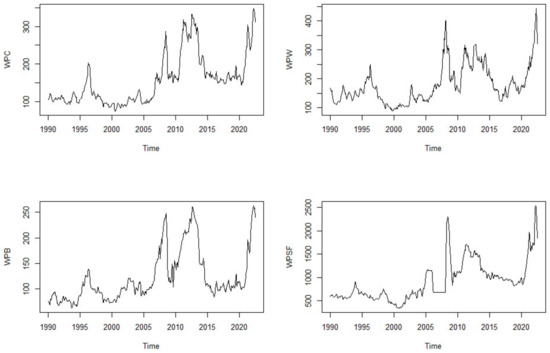

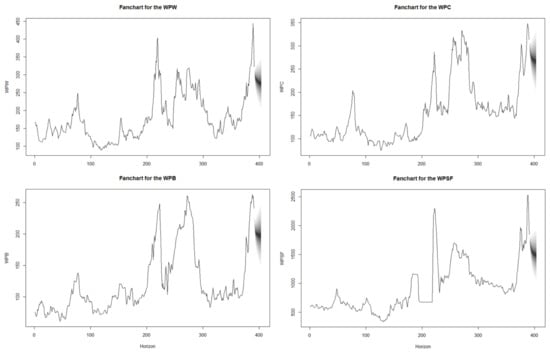

Figure 1 presents the market prices of wheat, corn, barley and sunflower oil from 1 January 1990 to 1 July 2022, covering monthly frequencies. The series tend to have an upward trend, and their prices move in an almost identical pattern. Because our series date from the early 1990s, they carry two significant shocks necessary for worldwide food security. From 1 January 1995 to 1 January 1996, corn prices increased by 47%, wheat prices increased by 27%, barley prices increased by 45%, and sunflower oil prices dropped by 13%. The inflation in food commodities during this period was mainly linked to weather conditions and labor shortages in the agricultural sector [60]. From 1990 to 1995, former communist countries, considered the major world suppliers of agricultural commodities, were conducting structural reforms in the economy. Among those reforms was the farm sector, where productivity dropped dramatically due to free market initiatives in the early 1990s. Other spikes were related to the global financial crisis of 2008/09, when the prices of these four commodities almost tripled. The financial meltdown in this period and the devastating effects on the financial system were quickly transferred to the real economy. The recession of that time spilled over to the global economy mainly due to globalization and the interconnected world financial system. Agricultural products generally contain inelastic demand, as their prices do not vary with business cycles. Global demand surged in 2008 while production declined, causing prices to spike. Three years later, in 2011, wheat, corn, barley and sunflower oil prices experienced an additional shock. This period corresponds to the Greek debt crisis of 2011/12, which placed the European financial system in cardiac arrest. Recently, the prices of these four crops began to accelerate again with the outbreak of the COVID-19 pandemic. Since then, prices have constantly been rising, and the war in Ukraine has given them an additional boost. To examine the shocks more accurately, isolating the frequencies into two diverse time periods might allow for an in-depth investigation. Analyzing the series from the beginning of the 1990s to the end of 2000 would provide more realistic results. This period corresponds with structural reforms in Eastern European countries.

Figure 1.

Market prices of WPC, WPW, WPB and WPSF from 1 January 1990 to 1 July 2022.

- Note: plots are constructed based on 391 observations and stand on monthly observations. The R studio program was used for data processing and visualization. The monthly series were obtained from St. Louis FED [59], indicating raw data. The figures were constructed using R studio’s “tidyverse” and “ggplot2” packages. WPW stands for the World Price of Wheat, WPB stands for the World Price of Barley, WPC stands for the World Price of Corn, and the World Price of Sunflower Oil holds the acronym WPSF.

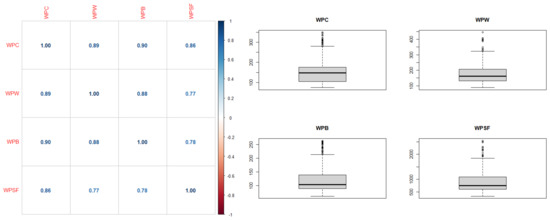

Table 1 contains descriptive statistics of WPC, WPB, WPW and WPSF based on raw data from 1 January 1990 to 1 July 2022. This table presents the number of observations (n), mean, median, standard deviation (Std), skewness (skew), kurtosis, minimum (Min) and maximum (Max). The variables in the system possess a total of 391 observations covering the entire period. These agricultural products reach their maximum price only three months after the outbreak of the war in Ukraine. The minimum one relates to the 1990s period when the disintegration of the former Soviet Union started. Sunflower oil prices are, on average, 6.1 times higher than those of corn, 5.8 times higher than those of wheat and 7.6 times higher than those of barley. Moreover, the volatility (Std) is almost 6.4 times higher than those of corn and wheat and 8.5 times higher than that of barley. The standard deviation is directly linked to its high prices, for which small unit changes produce significant uncertainties. Regarding the series distribution, the data are positively skewed or leptokurtic. The kurtosis of our dataset is below three, which indicates lighter tails. Figure A1 in the Appendix A suggests the correlation matrix and data distribution via boxplots. Based on the correlation matrix, the series has a strong positive correlation above 0.73. The strongest positive correlation appears between wheat and barley (0.90), followed by that between wheat and corn (0.89) and that between wheat and sunflower oil (0.77).

Table 1.

Summary statistics of WPW, WPB, WPC and WPSF based on raw data.

3.2. Methods Used

The VAR is a multivariate time series model in which variables are affected by their lags and lags of other variables in the system. The VAR model is widely used in analyzing monetary shocks, fiscal policies and crisis periods [61]. The VAR stands for a system of equations in which series are a function of their past lags and lags of other series in the model. The unrestricted VAR treats all variables as endogenous and does not place any restrictions on their relations [62]. Moreover, the VAR model requires following several statistical steps, which allow for completing an accurate process. To test the series for unit roots are used the Augmented Dickey–Fuller Test (ADF), Phillip–Peron Test (PP), and Kwiatkowski–Phillips–Schmidt–Shin (KPSS) Test. Second, the series are tested for their normality, serial correlation and structural breaks. In R studio, these tests are performed using the functions adf. test(), pp. test() and kpss. test(). The adf. test() and pp. test() require that the data maintain a p-value lower than a 5% significance level, and the kpss.test() requires it to be higher than 5%. The argument that usually arises in implementing VAR is whether level or differentiated data should be used. This largely depends on the nature of the series, for which agricultural commodities at the level frequently do not pass the unit root tests. Likewise, our series, after the first differentiation, passed the unit root tests, including the ADF [63], PP [64] and KPSS [65] tests. In the case of the ADF and PP tests, they use a 1% significance level, and the KPSS test uses a 10% significance level. The VAR model is usually determined using the system’s optimal number of lags (p). The following equation represents VAR with four variables and one autoregressive lag.

, , and indicate the shocks (impulses) in which each equation in the system is estimated through Ordinary Least Squares (OLS). , , and represent the orders of the variables, which, in this case, are four. stands for WPW, WPB is represented by , WPC indicates , and WPSF by The autoregressive lags (p) are denoted by , , and . Moreover, all variables are endogenous, and no exogenous variables exist in the system. The same formula can also take the matrix form, as shown below.

In the VAR model, each equation performs independently based on the optimal number of lags. After the first differencing, the series emerge from having applied VAR (I). Therefore, determining the number of lags during VAR construction is very important. The number of lags can be performed through the following information criteria: the Akaike Information Criterion (AIC), the Hannan-Quin (HQ) criterion, the Schwarz (SC) criterion and the Akaike Final Prediction Error (FPE). In R studio, information criteria are executed with the “vars” package and the function “optimal_lag$selection”. The VAR results are more clearly visualized through the impulse response function (IRF) and variance decomposition (FEVD). The outcome from IRF and FEVD depends mainly on the number of lags and the order of variables. The model is widely used by international financial institutions such as the International Monetary Fund (IMF), the World Bank, and national central banks for forecasting. In R studio, estimated forecasts are generally conducted with the “vars” package and the “VAR fanchart” function.

An important statistical technique that identifies long-run relationships is the Johansen cointegration test. The cointegration is formed when two or more variables in the model maintain a long-run association [66]. The mathematical representation of the Johansen cointegration model is as follows.

where:

The vectors within each independent equation are denominated with and , and stands for the eigenvalue and trace decomposition matrix. If four variables in the system exist, we can have a maximum of four independent vectors. The ranking of sequential tests can take the form 0, 1, 2, 3, 4, …, n, considering the number of inputs in the system. A zero ranking reports no cointegration, one vector indicates one cointegration in the system, etc. The Johansen cointegration test is regularly executed through trace statistics and the maximal eigenvalue. The tests in R studio were employed through the “urca” package and the “ca. jo” functions. As in the VAR model, in the Johansen test, determining the optimal number of lags is important as well. Cointegration among variables is very important in implementing the VECM. Therefore, the essential criterion is that the variables must maintain a long-term association to perform the VECM.

The VECM is suitable when there is at least one cointegration exists in the system. As with unrestricted VAR, in the Johansen test, defining the number of lags for the VECM is vital. In R studio, the VECM is implemented through the “vars” package and the “vecm” function. Additionally, we used VECM to forecast the performance of the four agricultural commodities in the next ten months. The forecast function in R studio is named “predict”, and the estimations are generated via the “VECM fanchart”.

4. Results

This section reports the results, in which 4.1 indicates unrestricted VAR, 4.2 indicates the Granger Causality tests, 4.3 indicates the VECM together with the Johansen tests, and 4.4 indicates the estimated forecasts.

4.1. VAR Estimated Results

In this part, we analyze the relationships among the four agricultural commodities and predict their performance ten months ahead. This section presents the results of the unrestricted VAR (1) model with one autoregressive lag. Figure A1 in the Appendix A shows the stability of the VAR (1) model through structural breaks. The results in the figure confirm that residuals stand within the 95% confidence band, which indicates a stable model. Moreover, three other additional diagnostic tests were performed, such as serial correlation (arch effect), heteroscedasticity, and normality tests. The series pass the serial correlation and arch effect but not the normality test. The optimal number of lags is determined through information criteria such as AIC = 1, HQ = 1, SC = 1 and FPE = 2. We chose one autoregressive lag (L1) because this is the number that is most repeated in four types of information criteria (AIC, HQ, SC and FPE). On the other hand, the unit root tests are important for identifying the stationary issue of the time series. For this purpose, three types of tests were used to identify this problem: ADF, PP and KPSS. The four series do not pass stationarity tests at a signficant level but only after the first differentiation. After the first differentiation, ADF and PP tests indicate p-values lower than the 5% significance level and higher than 5% for the KPSS test.

Table 2 contains the results of the unrestricted VAR (1) with differenced series and one autoregressive lag. The data hold 390 observations because one observation is lost due to using one lag in the system. Model (1) shows the impacts on the WPC from its lag and the lags of other commodities in the system. The WPC is influenced by its lag (L1) at a 1% significance level and by those of WPW (L1) and WPSF (L1) at a 5%. In Model (2), we see that the WPW is influenced only by its lag (L1) without effects from other variables. Model (3), which also contains the highest R2, shows that the WPB is influenced mainly by the WPC (L1), followed by its lag and the lag of WPW (L1). Finally, Model (4) represents that the WPSF is influenced by its own lag at 1% and that of the WPW (L1) at the 5% significance level. Based on the unrestricted VAR (1) results, we can conclude that past wheat prices, WPW (L1), maintain an effect on the three other commodities and on itself. On the contrary, corn prices, WPC (L1), appear to significantly influence themselves and barley prices. Global barley prices are influenced by the lags of corn, wheat and themselves. Finally, sunflower oil prices are impacted by its lags and the lags of wheat.

Table 2.

Estimation results of the VAR (1) model with one lag in the system.

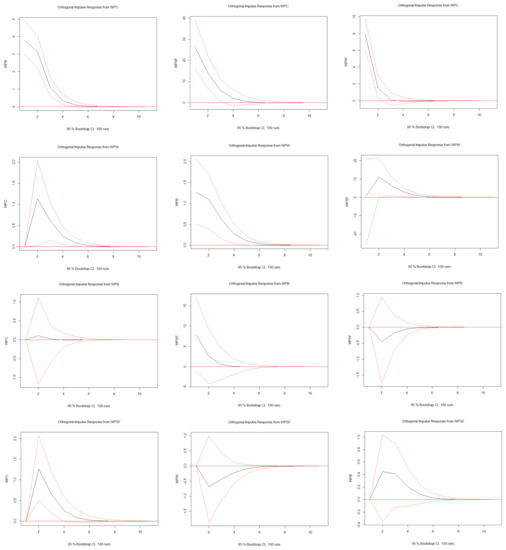

The results of VAR (1) can only be explained with IRF and FEVD. Figure 2 shows the VAR (1) impulse response function with 12 combinations of variables in the system. The first combination indicates the impact of WPC on three other commodities with a 95% confidence band and 100 trials. In the short term, a positive shock on the WPC increases the WPB, WPSF and WPW. In the case of WPB and WPSF, the impact vanishes after the fifth month, and in the case of WPW, it vanishes after the third month. The WPW holds an almost identical influence on other commodities, but the effect disappears in six months. The WPB does not imply any impact on other commodities due to a high error term. The positive shock on WPSF holds a positive influence on WPC, and this effect is sustainable for up to six months. Moreover, the impact of the WPSF on the WPW and the WPB is insignificant due to a high error term. In other words, the IRS results align with those generated from unrestricted VAR (1) in Table 2.

Figure 2.

VAR (1) IRF with twelve combinations of variables in the system.

- Note: Plots indicate the VAR (1) impulse response function with twelve combinations of WPC, WPB, WPW and WPSF. IRF results stand within a 95% confidence interval (CI) and are constrained to ten periods ahead. Red lines represent error margins, and simulations were performed with 100 trials. Because our differenced series are monthly, the IRF effects were measured for the next ten months. The variables display the period from 1 January 1990 to 1 August 2022. The figure was generated in R studio using the package “vars” and the function “irf”.

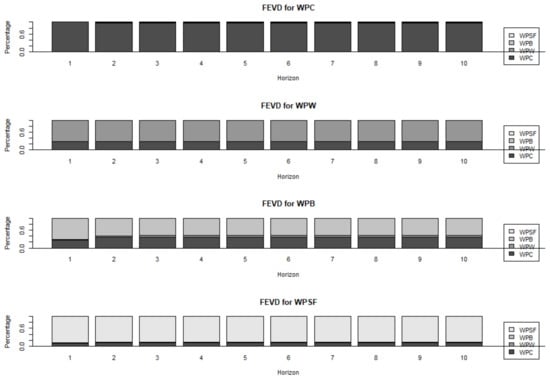

Figure 3 presents VAR variance decomposition (FEVD) with four variables in the system for the next ten months. The FEVD shows how much each variable affects the other within the auto-regression model. Therefore, it determines how much forecast variance error of each variable can be analyzed from shocks generated by other variables in the system. The WPC changes in the ten months ahead generally move due to its autoregressive lags. In the case of the WPW, the precise impact of the WPC can be observed from 31% in the first months, reaching 34.5% in the last month. The effect of the WPC on the WPB is even more pronounced, whereas in the previous months (9th and 10th), it reaches a level of 40%. Finally, the influence of WPC in WPSF increases from 13% in the first months to 21% in the last months. The results of FEVD indicate that changes in the WPC influence all other variables in the system.

Figure 3.

FEVD results for 10 periods ahead.

- Note: This figure highlights FEVD results based on four variables in the system for 10 months ahead. The series were differenced indicating the full period from 1 January 1990 to 1 August 2022. Plots were generated in R studio through the “vars” package and implemented with the “fevd” function. Results in a numerical format are available upon request.

4.2. Granger Causality Tests

The Granger causality test is an important technique that identifies whether one variable helps forecast the movements of the other variables. The hypotheses in our case indicate group testing, in which each variable is tested concerning all others. This is one of this work’s limitations; the variables were tested in groups. The results would differ if the variables were tested against each other and not in a group. However, this issue is constrained by the unrestricted VAR (1), in which the variables are grouped as a common system.

Table 3 presents the Granger tests generated by the VAR (1) model, where the H0 hypotheses of the four variables are tested. Constantly aware of group testing, we can conclude that all variables Granger-cause each other, except the WPB. Moreover, the null hypothesis can be rejected in the case of the WPC, WPW and WPSF because the p-value is lower than 5%. In short, movements in the WPC, WPW and WPSF affect future price changes in each other and also in the WPSF.

Table 3.

Granger causality results based on differenced series.

Changes in exchange rates and oil prices can be additional elements in the prices of agricultural products. Therefore, future studies should seriously consider these two inputs (oil and exchange rates), as they directly affect the performance of the agricultural sector.

4.3. Estimated VECM Results

The VECM measures the short-term and long-term causality between variables in a system. In R studio, the results of the VECM were implemented through the “tsDyn” package and implemented through the “vecm” function. However, before performing the VECM, the condition was that the variables must be cointegrated. For this purpose, the Johansen test with trace statistics and the maximal eigenvalue was performed using the maximum likelihood vector. Concerning the optimal number of lags, the information criteria for the Johansen test suggested using four lags. However, because the variables had been differentiated once, it was preferable to use only three lags in the system (n-1). It was evident that, after the series passed unit root tests and maintained cointegration, the VECM results are more reliable. However, the VAR estimation results were set only to be compared with those of the VECM.

Table 4 presents the results of the Johansen test through trace statistics and the maximal eigenvalue with three optimal lags. According to the trace method, the test statistics (Test) are always higher than the critical value with 1%, 5% and 10% significance levels. From this, we can conclude that, in the case of trace statistics, we have at least three cointegration relations. Although in the social sciences, the comparison is generally performed with a 5% significance level, in our case, validity also stands for the 1% and 10% significance levels. The maximal eigenvalue displays similar results, in which the test statistic is always higher than the critical values with 1%, 5% and 10% significance levels. Based on these tests, we could identify at least three cointegration relations that allowed us to continue implementing the VECM.

Table 4.

Johansen cointegration test with trace statistics and maximal eigenvalue.

Table 5 highlights the results of the VECM with four differenced series covering the period from 1 January 1990 to 1 August 2022. Because we had three cointegrations, we present three error correction terms (ECT1, ECT2 and ECT3). The WPC is significant at 5% only in ECT1, in which 73% of the disequilibrium is corrected within a month (because our data are monthly). The WPB is also significant in ECT1 at 5%, but the disequilibrium is corrected by only 3.9% within a month. In ECT2, the WPW and WPSF are significant at the 1% and 5% levels, respectively. Therefore, the corrections of disequilibrium in ECT2 report that, for WPW, these corrections stand at 9.1%, and for WPSF, they stand at 1%. However, in ECT3, indicating corrections in three months, only the WPC is presented as a significant variable. To this end, almost 11% of the disequilibrium in the case of the WPC is corrected within 3 months.

Table 5.

VECM estimation results.

In the short term, the VECM results differ slightly from those of the unrestricted VAR (1). The WPW in its first lag (L1) significantly influences the WPC, WPB and itself. The second lag (L2) of the WPW does not influence the three other variables or itself. On the other hand, the first group of the WPB and WPSF affect themselves but have no impact on others. The second lag (L2) of the WPB has no short-term effect on others or on itself. The situation changes in the second lag of WPSF, which appears to have a significant influence on the WPC, WPW, and WPB. The first lag of WPC influences itself, while the second lag only WPSF. The results of VECM and those of VAR (1) confirm the influence of the WPC and WPW on itself and other variables. The novelty in the VECM results compared to those of VAR is the second lag of the WPSF, which maintains an impact on all other variables.

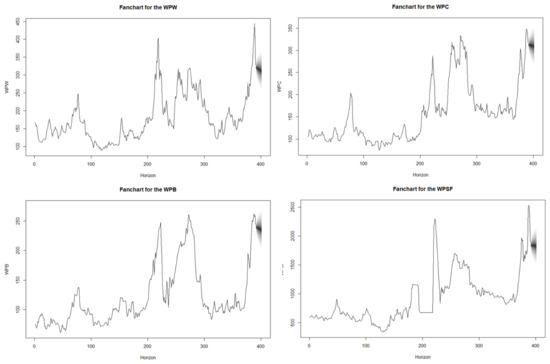

4.4. Estimated Forecasts with VAR and VECM Fanchart

The VAR fanchart and VECM fanchart are widely used techniques by international financial institutions for short-term forecasting. These models include the influence of their autoregressive lags and the lags of other variables. Therefore, they consider past prices and the former movements of other series in the system. The estimated forecasts for both the VECM and VAR fancharts were performed for ten periods ahead. The forecasts are presented in a graphic form in Figure 4 and Figure 5 and in a numerical format in Table A1 and Table A2 in the Appendix A.

Figure 4.

Estimated forecasts with the VAR fanchart for ten periods ahead.

- Note: Plots indicate predictions with raw data through the VAR fanchart package. The estimated forecasts were conducted individually for each variable with a 95% confidence band for ten months ahead. The results cover the entire period from 1 January 1990 to 1 June 2022, based on 391 observations. The estimated forecasts start on 1 July 2022, and end on 1 April 2023. The black line represents the predictions, and the gray-shaded area indicates the error margin.

Figure 4 presents the forecasts with the VAR fanchart for ten months ahead based on level data. Based on these estimations, the prices of these four agricultural commodities tend to fall in the next ten months. The forecast starts on 1 July 2022 and ends on 1 April 2023, and the speed of the decline is diverse among the four variables. The world price of corn (WPC) is expected to fall from 297.1 USD per metric ton in July 2022 to 266.68 USD per metric ton in April 2023, a decrease of 10.4%. The wheat (WPW) price for the same period is expected to fall by 8.27%, i.e., from 302.31 USD to 277.82 USD per metric ton. In the next ten months, barley (WPB) prices are expected to fall by 12.8% from 223.73 USD to 194.98 USD per metric ton. Finally, sunflower oil (WPSF) prices might drop from 1666.86 USD to 1530.28 USD in early April 2023, a decrease of 8.16%. On average, the prices of these four commodities, in the ten months ahead will fall by 9.92%. Sunflower oil might have the most profound drop in absolute value by 136.8 USD per metric ton. In the end, barley prices are expected to fall by 12.8% for the same period.

Figure 5.

Estimated forecasts of the WPW, WPC, WPB and WPSF based on the VECM fanchart.

- Note: This figure presents the forecasts for the next ten months based on 391 observations of each variable in the model. The forecast starts on 1 July 2022 and ends on 1 April 2023 using raw data. Estimations were conducted through the VECM fanchart on a 95% confidence band. The black line represents estimated forecasts, and the shaded part in gray is the error margin. The figure was generated in R studio using the “forecast” package and the “fanchart” function.

Figure 5 presents the estimated forecasts based on level data for the next 10 months using the VECM fanchart. Identical results are presented in a numerical form in Table A2 in the Appendix A. Based on the VECM fanchart, corn prices (WPC) in the next 10 months will fall by 9.33%, those of wheat (WPW) will fall by 6.77%, those of barley (WPB) will fall by 9.65%, and those of sunflower oil (WPSF) will fall by 11.53%. On average, the global prices of these four agricultural commodities, based on the VECM fanchart, are estimated to fall by 9.32%. Compared to the VAR fanchart, the VECM fanchart predicts a more gradual decline in prices by 0.6 percentage points on average. However, the series start from the early 1990s and include only a few months of the war in Ukraine. In this context, we could not divide the series before and during the conflict in Ukraine due to a lack of data for this period. To measure the accuracy of these predictions, other studies can verify them through more complex models, such as neural networks.

5. Discussion: Price Forecasts—Presumption and Limits

Within the analyzed period of 1 January 1990 to 1 July 2022, two stages of above-standard jump growth in the prices of the examined commodities appeared, i.e., in 2006 and 2020. From the point of view of external factors, 2006 was mainly associated with the development of the biofuel market, and the year 2020 was mainly associated with the COVID-19 pandemic, which was followed by the Russian-Ukrainian conflict. These and other uncontrollable exogenous factors, such as persistent inflation pressure, imported petrol prices, etc., have caused agricultural commodity prices to fluctuate significantly [67]. This fluctuation can reflect relatively large statistical errors in the forecasting models used herein. These methods are based on analyzing the historical price series of agricultural commodities while ignoring other factors. In other words, the turbulent period precludes making credible estimates regarding the rate of price changes in a period longer than a few months.

Thus, a short-term ten-month price development prediction was made using the VAR and VECM fanchart methods, which indicate a price drop of up to 10%. This is a statistical estimate based on the past situation of commodity prices. It needs more information on fundamental factors, such as expected overall and core inflation, data on war conflict forecasts, potential natural disasters’ influence, transportation, storage, etc. These factors are prone to have an inflationary impact in the form of price shocks of agricultural commodities across countries with different structural characteristics and political frameworks. As the analysis of Gelos and Ustyug [68] suggests, economies with a higher share of food in CPI baskets, fuel intensity and pre-existing higher inflation levels are more susceptible to the persistent inflationary effects of commodity price shocks. On the other hand, evidence exists that suggests that financial development, trade openness and labor market flexibility minorly affect how domestic inflation responds to international agricultural commodity price shocks [69]. Contextualizing the conflict in Ukraine, Svanidze et al. [9] used the 2010 wheat export ban to Russia as a trigger for the prices of other agricultural commodities. In contrast, our study covers a more extended period (January 1990 to August 2023) and focuses only on corn, wheat, barley, and sunflower oil. However, both studies use the VECM as a model for disequilibrium correction: one for weekly series and the other for monthly series.

From a short term point of view of the current state of affairs and current knowledge, it can be judged that the most downward pressures on agricultural commodity prices and related low pressures on food prices will appear in countries where imports comprise a small share of total domestic consumption and in countries with the regimes of inflation-targeting and with stably anchored inflation expectations. Compared to Ihle et al. [8], who analyzed a wider group of agricultural commodities, our study focuses only on the main four commodities of Russia’s and Ukraine’s agricultural industries. Moroever, their study investigated price synchronization, and ours investigates shocks through VAR and VECM methods. Regarding the development of the prices of agricultural commodities in the long term, the authors inferred that, just as the expansion of biofuel production in 2006 had a significant initial but transitory effect on agricultural commodity prices [70], the external factors of the COVID-19 pandemic and the Russian–Ukrainian conflict will also have a temporary effect on price disturbances. This view is supported by the analysis by Jacks et al. [71], who refuted the widely accepted argument that, due to price peaks and troughs, the volatility of commodity prices has increased over time [72]. On the contrary, price volatility in the most recent period does not appear to differ significantly from earlier periods over the past 50 years.

6. Conclusions

Agricultural commodities are an essential element of food security for low-income countries. This issue again received international attention due to the Russia–Ukraine war outbreak. Moreover, Russia and Ukraine are the world’s leading producers of wheat, corn, barley and sunflower oil. The results are addressed with particular emphasis on African countries, where food security problems are more pronounced. Recognizing this fact, we investigated the relationship among these four commodities and forecasted their performance for the ten months ahead. The VAR and VECM results indicate the impact of corn prices on wheat, barley and sunflower oil. The VAR impulse response function and variance decomposition confirm the same results. Clearly, corn, from a statistical point of view, is an essential contributor to price changes in wheat, barley and sunflower oil prices. The findings from the variance decomposition show that corn prices significantly determine future price changes in three other agricultural commodities. World wheat prices also impact barley and sunflower oil prices, but with a minor influence. The additional purpose of this study was to predict the future price movements of these four agricultural commodities in the next ten months. The estimation forecasts with VAR and VECM fanchart indicate a price decline, which is a relaxing signal for developing countries. The VAR fanchart predicts an average reduction of 9.92%, and the VECM fanchart predicts a drop of 9.65%. Based on VECM estimates, sunflower oil will have the most profound price drop during this period of 11.53%. Alternatively, the VAR predicts something else, by which corn will be the product with the most pronounced decline of 10.52%. This study contains several limitations, and one of them is related to the frequency of time series. Series with daily frequencies would enhance prediction accuracy. However, the future is entirely uncertain, as it depends on government decisions, wars, natural disasters, geopolitical contexts, etc. The performance of these agricultural commodities will depend on many factors, but the most important is the conflict in Ukraine. Future studies might investigate the scope that these commodities contribute to inflation issues in the European continent. To give a comprehensive description of the findings, future researchers might analyze energy commodities but also agricultural fertilizers. This could show a broader picture of the impact that energy commodities and artificial fertilizers hold on agricultural commodities.

Author Contributions

Conceptualization, F.A. and J.K.; methodology, F.A.; validation, F.A., J.K. and S.H.; formal analysis, F.A.; investigation, F.A. and J.K.; resources, F.A.; data curation, F.A.; writing—original draft preparation, F.A.; writing—review and editing, J.K. and S.H.; visualization, J.K.; supervision, F.A. and S.H.; project administration, F.A. and J.K.; funding acquisition, S.H. All authors have read and agreed to the published version of the manuscript.

Funding

This work is supported by Grant No. IDUZO22041, School of Expertness and Valuation, Institute of Technology and Business in České Budějovice.

Data Availability Statement

The research was conducted using public data.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

Correlation matrix and boxplots of the four agricultural commodities used in our work.

- Note: The figure indicates the correlation matrix based on the raw data of individual variables. The series represents the full-time period from 1 January 1990 to 1 August 2022. However, the boxplots were also based on raw data, and the plots were generated using the package “tidyverse” in R studio.

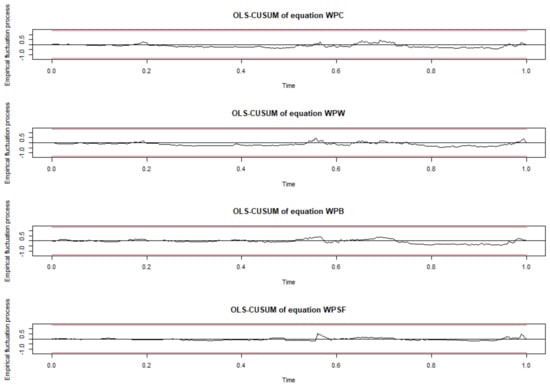

Figure A2.

Structural breaks of four variables within the system.

- Note: The plot was completed in R studio using the “vars” package and was generated through the “stability” function. The monthly series cover the entire period from 1 January 1990 to 1 August 2022. The red lines show each variable’s 95% confidence band within the system. The series is within the 95% confidence band, indicating a stable system.

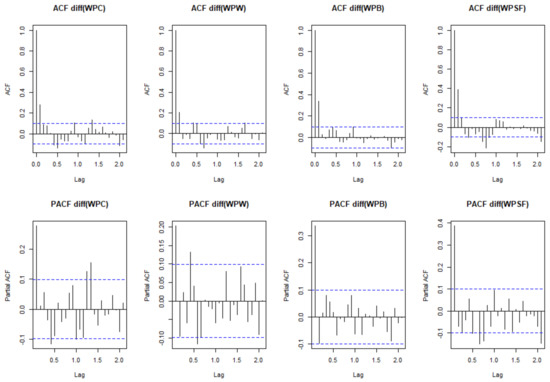

Figure A3.

Autocorrelation Function (ACF) and Partial Autocorrelation Function (PACF) with differenced data.

- Note: Plots were built in R studio using the functions “acf” and “pacf” through the “vars” package. The series represents the full time period from 1 January 1990 to 1 August 2022, using the first difference. The first differencing was used because the data did not pass the stationarity tests in their raw form. The blue line stands for the 95% confidence band, and the black bars highlight the number of autoregressive lags in the system.

Table A1.

Estimated predictions of the four variables used in our work, based on VAR (1) fanchart.

Table A1.

Estimated predictions of the four variables used in our work, based on VAR (1) fanchart.

| Time | fcst (WPC) | fcst (WPW) | fcst (WPB) | fcst (WPSF) |

|---|---|---|---|---|

| 1 July 2022 | 297.32 | 302.31 | 223.73 | 1666.86 |

| 1 August 2022 | 288.83 | 297.71 | 214.47 | 1587.24 |

| 1 September 2022 | 283.95 | 295.76 | 209.53 | 1555.62 |

| 1 October 2022 | 280.65 | 293.64 | 206.52 | 1545.06 |

| 1 November 2022 | 278.01 | 291.11 | 204.26 | 1542.13 |

| 1 December 2022 | 275.60 | 288.38 | 202.27 | 1540.85 |

| 1 January 2023 | 273.31 | 285.62 | 200.39 | 1538.83 |

| 1 February 2023 | 271.07 | 282.93 | 198.56 | 1535.34 |

| 1 March 2023 | 268.87 | 280.33 | 196.76 | 1530.28 |

| 1 April 2023 | 266.68 | 277.82 | 194.98 | 1523.82 |

Note: This table contains the forecasts of the WPC, WPW, WPB and WPSF for the next 10 months. The monthly forecast estimations start on 1 July 2022 and end on 1 April 2023 with a 95% confidence band. The inputs used for forecasting are based on raw data and cover the period from 1 January 1990 to 1 June 2022. Predictions were made individually for each series through VAR (1) fanchart, performed in R studio through the “forecast” package.

Table A2.

Estimated predictions through the VECM fanchart for the four variables in our system.

Table A2.

Estimated predictions through the VECM fanchart for the four variables in our system.

| Horizon | fcst (WPC) | fcst (WPW) | fcst (WPB) | fcst (WPSF) |

|---|---|---|---|---|

| 1 July 2022 | 295.36 | 297.31 | 218.98 | 1693.19 |

| 1 August 2022 | 285.69 | 290.54 | 206.28 | 1637.49 |

| 1 September 2022 | 279.14 | 287.66 | 202.09 | 1600.58 |

| 1 October 2022 | 275.18 | 285.65 | 200.88 | 1569.88 |

| 1 November 2022 | 272.97 | 283.52 | 200.08 | 1546.78 |

| 1 December 2022 | 271.46 | 281.53 | 199.32 | 1530.63 |

| 1 January 2023 | 270.25 | 279.98 | 198.69 | 1519.40 |

| 1 February 2023 | 269.27 | 278.81 | 198.25 | 1510.98 |

| 1 March 2023 | 268.47 | 277.91 | 197.99 | 1504.00 |

| 1 April 2023 | 267.78 | 277.16 | 197.84 | 1497.89 |

Note: This table shows the estimated forecasts for the next 10 months of WPC, WPB, WPW and WPSF variables in the system. The series used are raw data, and the plots were generated in R studio through the “forecast” library. The estimated forecasts are within the 95% confidence band and are limited by the VECM.

References

- Algieri, B.; Kalkuhl, M.; Koch, N. A tale of two tails: Explaining extreme events in financialized agricultural markets. Food Policy 2017, 69, 256–269. [Google Scholar] [CrossRef]

- Cheng, I.H.; Xiong, W. Financialization of commodity markets. Ann. Rev. Financ. Econ. 2014, 6, 419–441. [Google Scholar] [CrossRef]

- Algieri, B.; Leccadito, A. Price volatility and speculative activities in futures commodity markets: A combination of combinations of p-values test. J. Commod. Mark. 2019, 13, 40–54. [Google Scholar] [CrossRef]

- International Grains Council IGC. Grain Market Report 2022/23. Available online: https://www.igc.int/en/default.aspx (accessed on 11 May 2022).

- United Nations Human Rights Office of the High Commissioner–UNHCR. Ukraine: Civilian Causality Updates August 2022. Available online: https://www.ohchr.org/en/news/2022/08/ukraine-civilian-casualty-update-22-august-2022 (accessed on 11 May 2022).

- Aliu, F.; Hašková, S.; Bajra, U.Q. Consequences of Russian invasion on Ukraine: Evidence from foreign exchange rates. J. Risk Financ. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Sun, M.; Zhang, C. Comprehensive analysis of global stock market reactions to the Russia-Ukraine war. Appl. Econ. Lett. 2022, 1–8. [Google Scholar] [CrossRef]

- Ihle, R.; Bar-Nahum, Z.; Nivievskyi, O.; Rubin, O.D. Russia’s invasion of Ukraine increased the synchronisation of global commodity prices. Aust. J. Agric. Resour. Econ. 2022, 66, 775–796. [Google Scholar] [CrossRef]

- Svanidze, M.; Götz, L.; Serebrennikov, D. The influence of Russia’s 2010/2011 wheat export ban on spatial market integration and transaction costs of grain markets. Appl. Econ. Perspect. Policy 2022, 44, 1083–1099. [Google Scholar] [CrossRef]

- FAO. Impact of the Ukraine-Russia Conflict on Global Food Security and Related Matters under the Mandate of the Food and Agriculture Organization of the United Nations (FAO). Available online: https://www.fao.org/3/ni734en/ni734en.pdf (accessed on 11 May 2022).

- United Nations Children’s Fund–UNICEF. The Impact of the War in Ukraine and Subsequent Economic Downturn on Child Poverty in Eastern Europe and Central Asia. Available online: https://reliefweb.int/report/ukraine/impact-war-ukraine-and-subsequent-economic-downturn-child-poverty-eastern-europe-and-central-asia (accessed on 30 October 2022).

- Hassan, M.K.; Muneeza, A.; Sarea, A.M. The impact of the COVID-19 pandemic on Islamic finance: The lessons learned and the way forward. In Towards a Post-Covid Global Financial System; Emerald Publishing Limited: Bingley, UK, 2022. [Google Scholar]

- Batten, J.A.; Choudhury, T.; Kinateder, H.; Wagner, N.F. Volatility impacts on the European banking sector: GFC and COVID-19. Ann. Oper. Res. 2022, 1–26. [Google Scholar]

- Kinateder, H.; Campbell, R.; Choudhury, T. Safe haven in GFC versus COVID-19: 100 turbulent days in the financial markets. Financ. Res. Lett. 2021, 43, 101951. [Google Scholar] [CrossRef]

- International Monetary Fund. World Economic Outlook, July 2022: Gloomy and Uncertain. Available online: https://www.imf.org/en/Publications/WEO#:~:text=Global%20growth%20is%20projected%20to,percent%20over%20the%20medium%20term (accessed on 30 October 2022).

- Ben Hassen, T.; El Bilali, H. Impacts of the Russia-Ukraine war on global food security: Towards more sustainable and resilient food systems? Foods 2022, 11, 2301. [Google Scholar] [CrossRef]

- Furceri, D.; Loungani, P.; Simon, J.; Wachter, S.M. Global food prices and domestic inflation: Some cross-country evidence. Oxf. Econ. Pap. 2016, 68, 665–687. [Google Scholar] [CrossRef]

- Ferrucci, G.; Jiménez-Rodríguez, R.; Onorantea, L. Food price pass-through in the euro area: Non-linearities and the role of the common agricultural policy. Int. J. Cent. Bank. 2018, 8, 179–217. [Google Scholar]

- Pedersen, M. Propagation of Shocks to Food and Energy Prices: An International Comparison; Central Bank of Chile: Santiago, Chile, 2011. [Google Scholar]

- Bajra, U.Q.; Aliu, F.; Aver, B.; Čadež, S. COVID-19 pandemic–related policy stringency and economic decline: Was it really inevitable? Econ. Res.—Ekon. Istraž. 2022, 36, 1–17. [Google Scholar] [CrossRef]

- Peersman, G. International food commodity prices and missing (dis) inflation in the euro area. Rev. Econ. Stat. 2022, 104, 85–100. [Google Scholar] [CrossRef]

- Mester, L.J. The Role of Inflation Expectations in Monetary Policymaking: A Practitioner’s Perspective. Available online: https://www.ecb.europa.eu/pub/conferences/ecbforum/shared/pdf/2022/Mester_speech.pdf (accessed on 30 October 2022).

- Coibion, O.; Gorodnichenko, Y. Is the Phillips curve alive and well after all? Inflation expectations and the missing disinflation. Am. Econ. J. Macroecon. 2015, 7, 197–232. [Google Scholar] [CrossRef]

- De Winne, J.; Peersman, G. Macroeconomic Effects of Disruptions in Global Food Commodity Markets: Evidence for the United States. Brookings Papers on Economic Activity; Brookings Institution Press: Washington, DC, USA, 2016; pp. 183–286. [Google Scholar]

- Astrov, V.; Ghodsi, M.; Grieveson, R.; Holzner, M.; Kochnev, A.; Landesmann, M.; Bykova, A. Russia’s invasion of Ukraine: Assessment of the humanitarian, economic, and financial impact in the short and medium term. Int. Econ. Econ. Policy 2022, 19, 331–381. [Google Scholar] [CrossRef]

- Just, M.; Echaust, K. Dynamic spillover transmission in agricultural commodity markets: What has changed after the COVID-19 threat? Econ. Lett. 2022, 217, 110671. [Google Scholar] [CrossRef]

- Mišečka, T.; Ciaian, P.; Rajčániová, M.; Pokrivčák, J. In search of attention in agricultural commodity markets. Econ. Lett. 2019, 184, 108668. [Google Scholar] [CrossRef]

- Gardebroek, C.; Hernandez, M.A.; Robles, M. Market interdependence and volatility transmission among major crops. Agric. Econ. 2016, 47, 141–155. [Google Scholar] [CrossRef]

- Jagtap, S.; Trollman, H.; Trollman, F.; Garcia-Garcia, G.; Parra-López, C.; Duong, L.; Martindale, W.; Munekata, P.E.S.; Lorenzo, J.M.; Hdaifeh, A.; et al. The Russia-Ukraine conflict: Its implications for the global food supply chains. Foods 2022, 11, 2098. [Google Scholar] [CrossRef]

- Prohorovs, A. Russia’s war in Ukraine: Consequences for European countries’ businesses and economies. J. Risk Financ. Manag. 2022, 15, 295. [Google Scholar] [CrossRef]

- Mendez, A.; Forcadell, F.J.; Horiachko, K. Russia–Ukraine crisis: China’s Belt Road Initiative at the crossroads. Asian Bus. Manag. 2022, 21, 488–496. [Google Scholar] [CrossRef]

- Dodd, O.; Fernandez-Perez, A.; Sosvilla-Rivero, S. Currency and commodity return relationship under extreme geopolitical risks: Evidence from the invasion of Ukraine. Appl. Econ. Lett. 2022. Early Access. [Google Scholar] [CrossRef]

- Siqueira, E.L., Jr.; Stošić, T.; Bejan, L.; Stošić, B. Correlations and cross-correlations in the Brazilian agrarian commodities and stocks. Phys. A Stat. Mech. Appl. 2010, 389, 2739–2743. [Google Scholar] [CrossRef]

- Lundberg, C.; Abman, R. Maize price volatility and deforestation. Am. J. Agric. Econ. 2022, 104, 693–716. [Google Scholar] [CrossRef]

- Carriquiry, M.; Dumortier, J.; Elobeid, A. Trade scenarios compensating for halted wheat and maize exports from Russia and Ukraine increase carbon emissions without easing food insecurity. Nat. Food 2022, 3, 847–850. [Google Scholar] [CrossRef]

- Eurostat. The Food Price Monitoring Tool. 2022. Available online: https://ec.europa.eu/eurostat/cache/metadata/en/prc_fsc_idx_esms.htm (accessed on 30 October 2022).

- Ahn, S.; Kim, D.; Steinbach, S. The impact of the Russian invasion of Ukraine on grain and oilseed trade. Agribusiness 2023, 39, 291–299. [Google Scholar] [CrossRef]

- Gordeev, R.V.; Pyzhev, A.I.; Zander, E.V. Does Climate Change Influence Russian Agriculture? Evidence from Panel Data Analysis. Sustainability 2022, 14, 718. [Google Scholar] [CrossRef]

- World Data Center. Ukraine: Agricultural Overview. 2022. Available online: http://wdc.org.ua/en/node/29 (accessed on 15 October 2022).

- Svanidze, M.; Đurić, I. Global wheat market dynamics: What is the role of the EU and the Black Sea wheat exporters? Agriculture 2021, 11, 799. [Google Scholar] [CrossRef]

- Zyukin, D.A.; Zhilyakov, D.I.; Bolokhontseva, Y.I.; Petrushina, O.V. Export of Russian grain: Prospects and the role of the state in its development. Amazon. Investig. 2020, 9, 320–329. [Google Scholar] [CrossRef]

- Observatory of Economic Complexity OEC. Export of Corn of Russia. Available online: https://oec.world/en/profile/bilateral-product/corn/reporter/rus (accessed on 15 October 2022).

- Hunt, E.; Femia, F.; Werrell, C.; Christian, J.I.; Otkin, J.A.; Basara, J.; McGaughey, K. Agricultural and food security impacts from the 2010 Russia flash drought. Weather Clim. Extremes 2021, 34, 100383. [Google Scholar] [CrossRef]

- Zyukin, D.A.; Pronskaya, O.N.; Golovin, A.A.; Belova, T.V. Prospects for increasing exports of Russian wheat to the world market. Amazon. Investig. 2020, 9, 346–355. [Google Scholar] [CrossRef]

- Vasylieva, N. Ukrainian Cereals in Global Food Security: Production and Export Components. Montenegrin J. Econ. 2020, 16, 143–153. [Google Scholar] [CrossRef]

- Chuprina, Y.Y.; Klymenko, I.V.; Belay, Y.M.; Golovan, L.V.; Buzina, I.M.; Nazarenko, V.V.; Laslo, O.O. The adaptability of soft spring wheat (Triticum aestivum L.) varieties. Ukr. J. Ecol. 2021, 11, 267–272. [Google Scholar]

- Ajanovic, A. Biofuels versus food production: Does biofuels production increase food prices? Energy 2011, 36, 2070–2076. [Google Scholar] [CrossRef]

- Kapustová, Z.; Kapusta, J.; Bielik, P. Food-biofuels interactions: The case of the US biofuels market. AGRIS Pap. Econ. Inform. 2018, 10, 27–38. [Google Scholar] [CrossRef]

- Persson, U.M. The impact of biofuel demand on agricultural commodity prices: A systematic review. Adv. Bioenergy Sustain. Chall. 2016, 4, 410–428. [Google Scholar]

- Khanna, M.; Rajagopal, D.; Zilberman, D. Lessons learned from US experience with biofuels: Comparing the hype with the evidence. Rev. Environ. Econ. Policy 2021, 15, 67–86. [Google Scholar] [CrossRef]

- Barichello, R. The COVID-19 pandemic: Anticipating its effects on Canada’s agricultural trade. Can. J. Agric. Econ./Rev. Can. D’agroecon. 2020, 68, 219–224. [Google Scholar] [CrossRef]

- Vercammen, J. Information-rich wheat markets in the early days of COVID-19. Can. J. Agric. Econ./Rev. Can. D’agroecon. 2020, 68, 177–184. [Google Scholar] [CrossRef]

- Espitia, A.; Rocha, N.; Ruta, M. COVID-19 and Food Protectionism: The Impact of the Pandemic and Export Restrictions on World Food Markets. World Bank Policy Research Working Paper; World Bank Group: Washington, DC, USA, 2020; p. 9253. [Google Scholar]

- Dietrich, S.; Giuffrida, V.; Martorano, B.; Schmerzeck, G. COVID-19 policy responses, mobility, and food prices. Am. J. Agric. Econ. 2022, 104, 569–588. [Google Scholar] [CrossRef]

- Nechaev, V.; Mikhailushkin, P.; Davydova, Y. Complex of economic measures for the production of corn hybrids in the Russia. IOP Conf. Ser. Earth Environ. Sci. 2020, 604, 012004. [Google Scholar] [CrossRef]

- Hamulczuk, M.; Makarchuk, O. Time-varying relationship between Ukrainian corn and world crude oil prices. Econ. Ann. XXI 2020, 184, 49–57. [Google Scholar] [CrossRef]

- Grabovskyi, M.; Lozinskyi, M.; Grabovska, T.; Roubík, H. Green mass to biogas in Ukraine—Bioenergy potential of corn and sweet sorghum. Biomass Convers. Biorefinery 2021, 13, 3309–3317. [Google Scholar] [CrossRef]

- Shyurova, N.A.; Dubrovin, V.V.; Narushev, V.B.; Kozhevnikov, A.A.; Milovanov, I.V. Biofuel as an Alternative Energy Source for the Automobile Industry: The Experience of the Lower Volga Region (Russia). J. Ecol. Eng. 2020, 21, 29–35. [Google Scholar] [CrossRef]

- St. Louis FRED (2022). Economic Data on Global Commodity Prices. Available online: https://fred.stlouisfed.org/series/PBARLUSDM (accessed on 15 October 2022).

- Light, J.; Shevlin, T. The 1996 grain price shock: How did it affect food inflation. Mon. Lab. Rev. 1998, 121, 3. [Google Scholar]

- Stock, J.H.; Watson, M.W. Vector Autoregressions. J. Econ. Perspect. 2001, 15, 101–115. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and reality. Econ. J. Econ. Soc. 1980, 48, 1–48. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.C.; Perron, P. Testing for a unit root in time series regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Kwiatkowski, D.; Phillips, P.C.; Schmidt, P.; Shin, Y. Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J. Econ. 1992, 54, 159–178. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W. Cointegration and error correction: Representation, estimation, and testing. Econ. J. Econ. Soc. 1987, 55, 251–276. [Google Scholar]

- Wu, H.; Wu, H.; Zhu, M.; Chen, W.; Chen, W. A new method of large-scale short-term forecasting of agricultural commodity prices: Illustrated by the case of agricultural markets in Beijing. J. Big Data 2017, 4, 1–22. [Google Scholar] [CrossRef]

- Gelos, G.; Ustyugova, Y. Inflation responses to commodity price shocks–How and why do countries differ? J. Int. Money Financ. 2017, 72, 28–47. [Google Scholar] [CrossRef]

- De Gregorio, J. Commodity prices, monetary policy, and inflation. IMF Econ. Rev. 2012, 60, 600–633. [Google Scholar] [CrossRef]

- Myers, R.J.; Johnson, S.R.; Helmar, M.; Baumes, H. Long-run and Short-run Co-movements in Energy Prices and the Prices of Agricultural Feedstocks for Biofuel. Am. J. Agric. Econ. 2014, 96, 991–1008. [Google Scholar] [CrossRef]

- Jacks, D.S.; O’rourke, K.H.; Williamson, J.G. Commodity price volatility and world market integration since 1700. Rev. Econ. Stat. 2011, 93, 800–813. [Google Scholar] [CrossRef]

- Vochozka, M.; Janek, S.; Rowland, Z. Coffee as an Identifier of Inflation in Selected US Agglomerations. Forecasting 2023, 5, 153–169. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).