Predicting the Oil Price Movement in Commodity Markets in Global Economic Meltdowns

Abstract

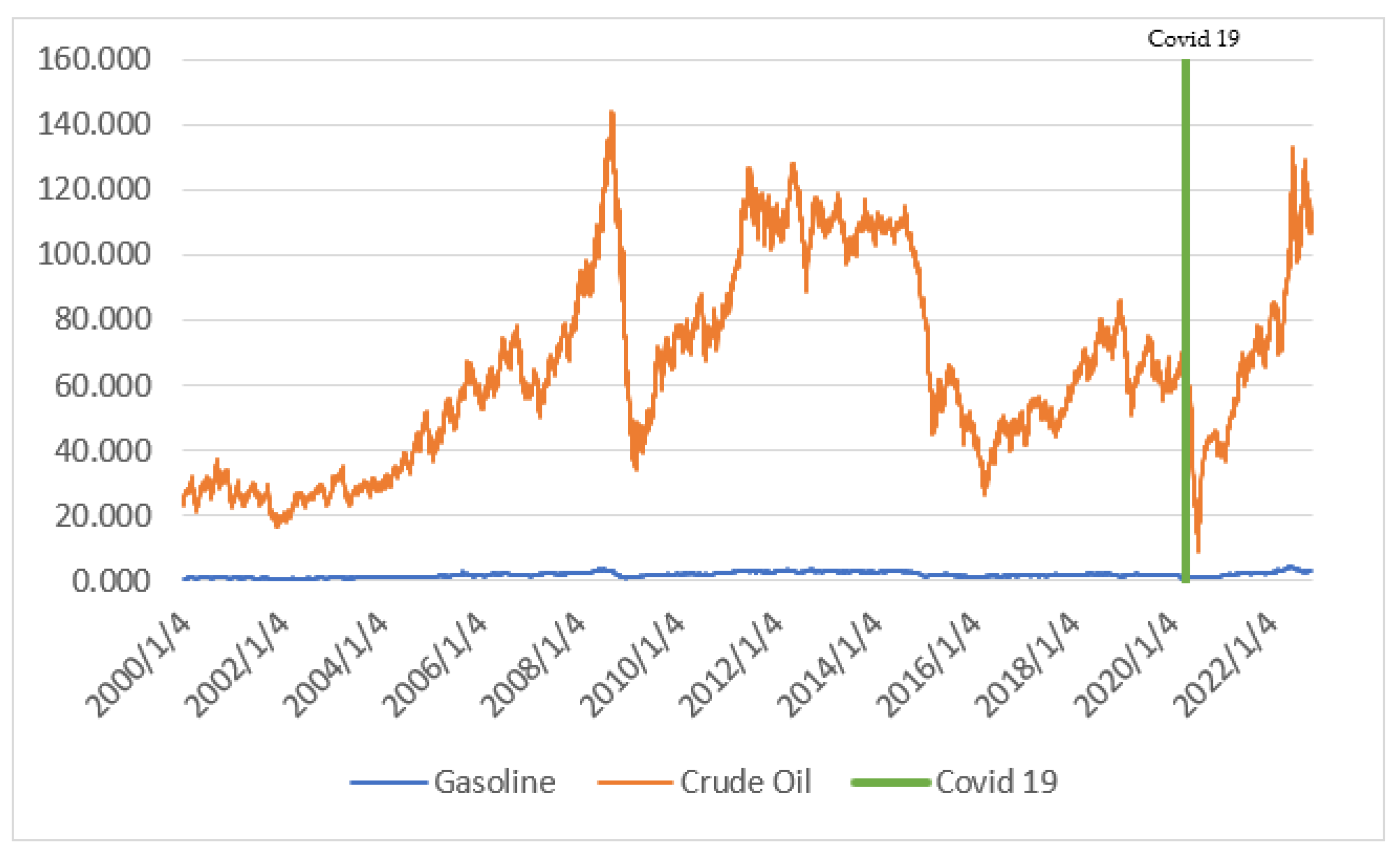

1. Introduction

2. Literature Research

3. Materials and Methods

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhao, L.T.; Wang, Z.J.; Wang, S.P.; He, L.Y. Predicting Oil Prices: An Analysis of Oil Price Volatility Cycle and Financial Markets. Emerg. Mark. Financ. Trade 2021, 57, 1068–1087. [Google Scholar] [CrossRef]

- Liu, J.; Huang, X. Forecasting Crude Oil Price Using Event Extraction. IEEE Access 2021, 9, 149067–149076. [Google Scholar] [CrossRef]

- Vochozka, M.; Horak, J.; Krulicky, T.; Pardal, P. Predicting future Brent oil price on global markets. Acta Montan. Slovaca 2020, 25, 375–392. [Google Scholar]

- Drebee, H.A.; Razak, N.A.A. Impact of Oil Price Fluctuations on Economic Growth, Financial Development, and Exchange Rate in Iraq: Econometric Approach. Ind. Eng. Manag. Syst. 2022, 21, 110–118. [Google Scholar] [CrossRef]

- Khan, M.I.; Teng, Z.; Khan, M.K.; Khan, M.F. The impact of oil prices on stock market development in Pakistan: Evidence with a novel dynamic simulated ARDL approach. Resour. Policy 2021, 70, 101899. [Google Scholar] [CrossRef]

- Dai, W.; Pan, W.; Shi, Y.; Hu, C.; Pan, W.; Huang, G.E. Crude Oil Price Fluctuation Analysis Under Considering Emergency and Network Search Data. Global Chall. 2020, 4, 2000051. [Google Scholar] [CrossRef]

- Singhal, S.; Choudhary, S.; Biswal, P. Return and volatility linkages among international crude oil price, gold price, exchange rate, and stock markets: Evidence from Mexico. Resour. Policy 2019, 60, 255–261. [Google Scholar] [CrossRef]

- Vochozka, M.; Suler, P.; Marousek, J. The influence of the international price of oil on the value of the EUR/USD exchange rate. J. Compet. 2020, 12, 167–190. [Google Scholar] [CrossRef]

- Demirbas, A.; Al-Sasi, B.O.; Nizami, A.S. Recent volatility in the price of crude oil. Energy Sources Part B Econ. Plan. Policy 2017, 12, 408–414. [Google Scholar]

- Zheng, Y.H.; Du, Z. A systematic review in crude oil markets: Embarking on the oil price. Green Financ. 2019, 1, 328–345. [Google Scholar] [CrossRef]

- Glaserova, D. Ceny Benzinu Stále Rostou, Klesají Naopak u Nafty. Nejdramatičtější je Vývoj u Alternativních Paliv [The Prices of Gasoline Are Still Rising, Diesel Prices Are Declining. The Development of Alternative Fuels Is the Most Dramatic]; Czech Television: Prague, Czech Republic, 2022. [Google Scholar]

- Byrne, D.P. Gasoline Pricing in the Country and the City. Rev. Ind. Organ. 2019, 552, 209–235. [Google Scholar]

- Chen, H.; Sun, Z. International crude oil price, regulation and asymmetric response of China’s gasoline price. Energy Econ. 2021, 94, 105049. [Google Scholar] [CrossRef]

- Lv, X.; Dong, X.; Dong, W. Oil Prices and Stock Prices of Clean Energy: New Evidence from Chinese Sub-sectoral Data. Emerg. Mark. Financ. Trade 2019, 57, 1088–1102. [Google Scholar]

- Xu, L.; Chen, F.; Qu, F.; Wang, J.; Lu, Y. Queuing to refuel before price rise in China: How do gasoline price changes affect consumer responses and behaviours? Energy 2022, 253, 124166. [Google Scholar] [CrossRef]

- Valadkhani, A.; Smyth, R. Asymmetric responses in the timing, and magnitude, of changes in Australian monthly petrol prices to daily oil price changes. Energy Econ. 2018, 69, 89–100. [Google Scholar]

- The Czech Association of Petroleum Industry and Trade. Ropa Jako Nenahraditelná Surovina [Oil as an Irreplaceable Raw Material]. 2021. Available online: https://www.cappo.cz/pohonne-hmoty-a-energie-pro-mobilitu/ropa-jako-nenahraditelna-surovina (accessed on 11 November 2022).

- Fahmy, H. The rise in investors’ awareness of climate risks after the Paris Agreement and the clean energy-oil-technology prices nexus. Energy Econ. 2022, 106, 105738. [Google Scholar] [CrossRef]

- Liden, T.; Santos, I.C.; Hildenbrand, Z.L.; Schug, K.A. Treatment modalities for the reuse of produced waste from oil and gas development. Sci. Total Environ. 2018, 643, 107–118. [Google Scholar] [CrossRef]

- Wang, J.; Li, X.; Hong, T.; Wang, S. A semi-heterogeneous approach to combining crude oil price forecasts. Inf. Sci. 2018, 460, 279–292. [Google Scholar] [CrossRef]

- Mohamued, E.A.; Ahmed, M.; Pyplacz, P.; Liczmanska-Kopcewicz, K.; Khan, M.A. Global Oil Price and Innovation for Sustainability: The Impact of R&D Spending, Oil Price and Oil Price Volatility on GHG Emissions. Energies 2021, 14, 1757. [Google Scholar]

- Song, X.; Qu, D.; Zou, C. Low-cost development strategy for oilfields in China under low oil prices. Pet. Explor. Dev. 2021, 48, 1007–1018. [Google Scholar] [CrossRef]

- Wang, C.; Lü, Y.; Song, C.; Zhang, D.; Rong, F.; He, L. Separation of emulsified crude oil from produced water by gas flotation: A review. Sci. Total Environ. 2022, 845, 157304. [Google Scholar] [PubMed]

- Li, X.; Ventura, J.A.; Ayala, L.F. Carbon dioxide source selection and supply planning for fracking operations in shale gas and oil wells. J. Nat. Gas Sci. Eng. 2018, 55, 74–88. [Google Scholar] [CrossRef]

- Ge, Y.; Wu, H. Environmental Assessment of Asymmetric Hysteresis of China’s Crude Oil Price to Gasoline Price. Ekoloji 2018, 27, 1563–1574. [Google Scholar]

- Shahid, I.; Siddique, A.; Nawas, T.; Tahir, M.B.; Fatima, J.; Hussain, A.; Alrobei, H. Heterogeneous nanocatalyst for biodiesel fuel production: Bench scale from waste oil sources. Z. Fur Phys. Chem. Int. J. Res. Phys. Chem. Chem. Phys. 2022, 236, 1377–1410. [Google Scholar] [CrossRef]

- Qazi, U.Y. Future of Hydrogen as an Alternative Fuel for Next-Generation Industrial Applications; Challenges and Expected Opportunities. Energies 2022, 15, 4741. [Google Scholar]

- Vochozka, M.; Horak, J.; Krulicky, T. Innovations in management forecast: Time development of stock prices with neural networks. Mark. Manag. Innov. 2020, 2, 324–339. [Google Scholar]

- Vrbka, J.; Horak, J.; Krulicky, T. The Influence of World Oil Prices on the Chinese Yuan Exchange Rate. Entrep. Sustain. Issues 2022, 9, 439–462. [Google Scholar]

- Herrera, G.P.; Herrera, G.P.; Constantino, M.; Tabak, B.M.; Pistori, H.; Su, J.J.; Naranpanawa, A. Long-term Forecast of Energy Commodities Price Using Machine Learning. Energy 2019, 179, 214–221. [Google Scholar]

- Zhao, Y.; Zhang, Y.; Wei, W. Quantifying International Oil Price Shocks on Renewable Energy Development in China. Appl. Econ. 2020, 53, 329–344. [Google Scholar]

- Dabrowski, M.A.; Papiez, M.; Rubaszek, M.; Smiech, S. The Role of Economic Development for the Effect of Oil Market Shocks on Oil-Exporting Countries: Evidence from the Interacted Panel VAR Model. Energy Econ. 2022, 110, 106017. [Google Scholar] [CrossRef]

- Dehghani, H.; Zangeneh, M. Crude Oil Price Forecasting: A Biogeography-Based Optimization Approach. Energy Sources Part B Econ. Plan. Policy 2018, 13, 328–339. [Google Scholar]

- Kumeka, T.T.; Uzoma-Nwosu, D.C.; David-Wayas, M.O. The Effects of COVID-19 on the Interrelationship Among Oil Prices, Stock Prices and Exchange Rates in Selected Oil Exporting Economies. Resour. Policy 2022, 77, 102744. [Google Scholar] [CrossRef] [PubMed]

- Zafeiriou, E.; Arabatzis, G.; Karanikola, P.; Tampakis, S.; Tsiantikoudis, S. Agricultural Commodities and Crude Oil Prices: An Empirical Investigation. Sustainability 2018, 10, 1199. [Google Scholar] [CrossRef]

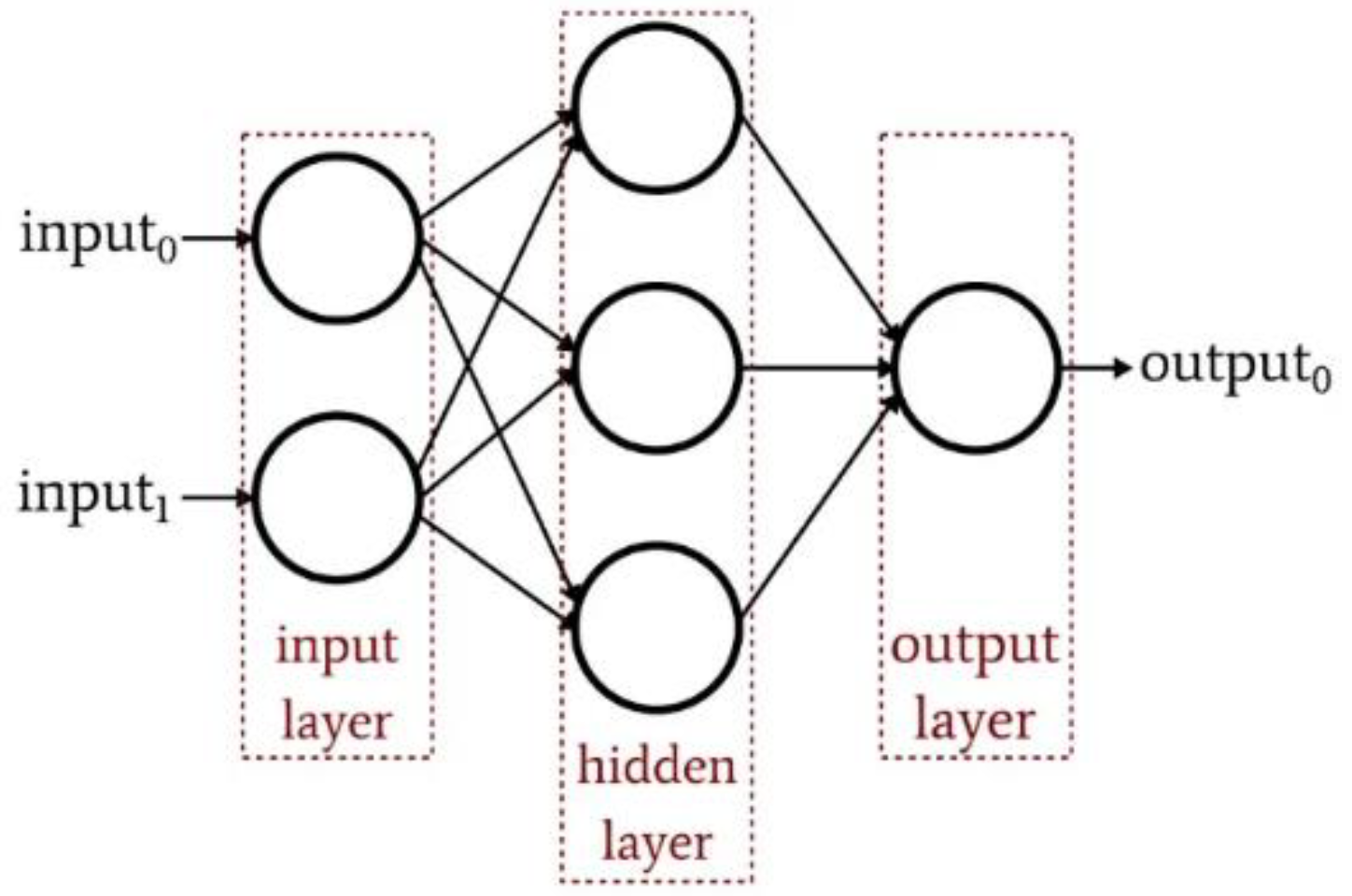

- Keim, R. How to Train a Multilayer Perceptron Neural Network. All About Circuits 2019. Available online: https://www.allaboutcircuits.com/technical-articles/how-to-train-a-multilayer-perceptron-neural-network/ (accessed on 11 November 2022).

- He, H.; Yan, Y.; Chen, T.; Cheng, P. Tree Height Estimation of Forest Plantation in Mountainous Terrain from Bare-Earth Points Using a DoG-Coupled Radial Basis Function Neural Network. Remote Sens. 2019, 11, 1271. [Google Scholar]

- Kudova, P. Neuronové Sítě Typu RBF pro Analýzu dat [BF Type Neural Networks for Data Analysis]. Master’s thesis, Charles University, Prague, Czech Republic, 2001. [Google Scholar]

- Suler, P.; Machova, V. Better Results of Artificial Neural Networks in Predicting ČEZ Share Prices. J. Int. Stud. 2020, 13, 259–278. [Google Scholar] [CrossRef]

- Naderi, M.; Khamehchi, E.; Karimi, B. Novel statistical forecasting models for crude oil price, gas price, and interest rate based on meta-heuristic bat algorithm. J. Pet. Sci. Eng. 2019, 172, 13–22. [Google Scholar]

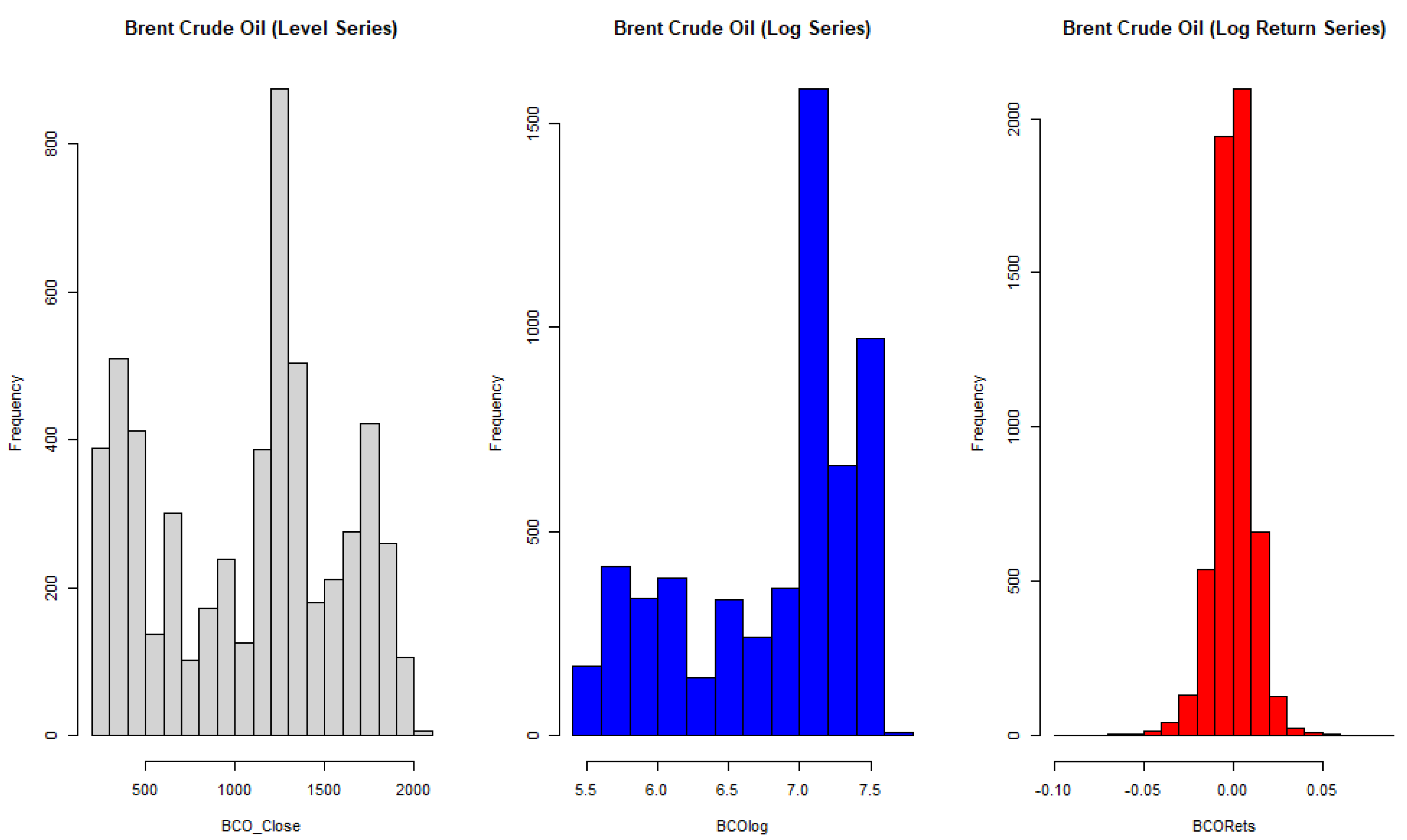

| Type | n | Mean | Median | Std | Skew | Kurtosis | Min | Max | JB |

|---|---|---|---|---|---|---|---|---|---|

| BCO (Level) | 5607 | 1070.8 | 1204.3 | 511.37 | −0.15 | −1.21 | 255.1 | 2051 | 0.000 |

| BCO (Log) | 5607 | 6.82 | 7.09 | 0.61 | −0.74 | −0.84 | 5.54 | 7.63 | 0.000 |

| BCO (Log Return) | 5607 | 0.00 | 0.00 | 0.01 | 0.29 | 5.42 | −0.1 | 0.09 | 0.000 |

| Function | Definition | Range |

|---|---|---|

| Identity | a | |

| Logistic sigmoid | (0, 1) | |

| Hyperbolic tangent | (−1, +1) | |

| Exponential | ||

| Sine |

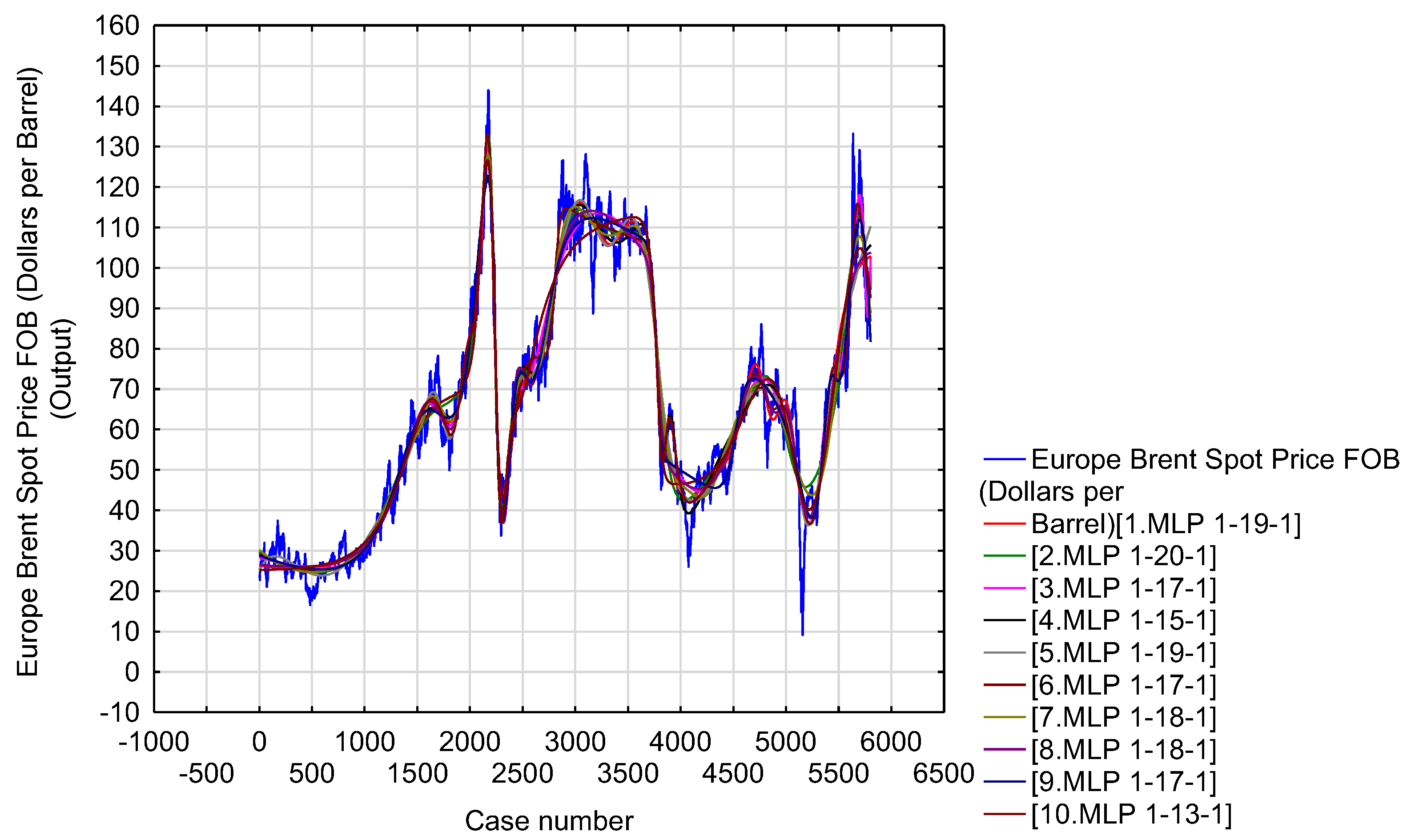

| Index | Net. Name | Training Error | Test Error | Validation Error | Training Algorithm | Error Function | Hidden Activation | Output Activation |

|---|---|---|---|---|---|---|---|---|

| 1 | MLP 1-13-1 | 20.03877 | 18.92097 | 21.70152 | BFGS 735 | SOS | Tanh | Sine |

| 2 | MLP 1-14-1 | 18.08013 | 18.38972 | 20.96396 | BFGS 596 | SOS | Logistic | Identity |

| 3 | MLP 1-18-1 | 19.48483 | 19.02263 | 21.81718 | BFGS 918 | SOS | Logistic | Sine |

| 4 | MLP 1-17-1 | 19.51369 | 19.09565 | 22.28044 | BFGS 1312 | SOS | Logistic | Sine |

| 5 | MLP 1-18-1 | 19.07577 | 17.72344 | 20.75263 | BFGS 8505 | SOS | Logistic | Exponential |

| 6 | MLP 1-14-1 | 18.86865 | 18.02551 | 20.75844 | BFGS 5198 | SOS | Logistic | Tanh |

| 7 | MLP 1-17-1 | 19.27102 | 18.25229 | 20.93904 | BFGS 9999 | SOS | Logistic | Exponential |

| 8 | MLP 1-14-1 | 20.25959 | 18.84478 | 21.82503 | BFGS 9999 | SOS | Tanh | Logistic |

| 9 | MLP 1-13-1 | 19.40942 | 21.08859 | 23.08233 | BFGS 283 | SOS | Tanh | Exponential |

| 10 | MLP 1-18-1 | 16.82161 | 16.05422 | 19.36678 | BFGS 904 | SOS | Logistic | Logistic |

| Network | Train | Test | Validation |

|---|---|---|---|

| 1 MLP 1-13-1 | 0.977013 | 0.978338 | 0.974803 |

| 2 MLP 1-14-1 | 0.979275 | 0.978936 | 0.975573 |

| 3 MLP 1-18-1 | 0.977647 | 0.978204 | 0.974569 |

| 4 MLP 1-17-1 | 0.977613 | 0.978108 | 0.974041 |

| 5 MLP 1-18-1 | 0.978121 | 0.979737 | 0.975867 |

| 6 MLP 1-14-1 | 0.978361 | 0.979375 | 0.975863 |

| 7 MLP 1-17-1 | 0.977895 | 0.979126 | 0.975575 |

| 8 MLP 1-14-1 | 0.976747 | 0.978452 | 0.974627 |

| 9 MLP 1-13-1 | 0.977746 | 0.975819 | 0.973097 |

| 10 MLP 1-18-1 | 0.980733 | 0.981667 | 0.977439 |

| Statistics | 1 MLP 1-13-1 | 2 MLP 1-14-1 | 3 MLP 1-18-1 | 4 MLP 1-17-1 | 5 MLP 1-18-1 | 6 MLP 1-14-1 | 7 MLP 1-17-1 | 8 MLP 1-14-1 | 9 MLP 1-13-1 | 10 MLP 1-18-1 |

|---|---|---|---|---|---|---|---|---|---|---|

| Minimum prediction (Train) | 26.3905 | 26.1152 | 25.5647 | 20.2299 | 24.4610 | 27.0507 | 26.5083 | 25.9120 | 24.8399 | 25.8734 |

| Maximum prediction (Train) | 130.0736 | 133.2628 | 129.0131 | 127.8012 | 137.3579 | 124.6570 | 132.8783 | 127.9347 | 134.1820 | 131.0164 |

| Minimum prediction (Test) | 26.3905 | 26.1234 | 25.5649 | 22.3235 | 24.4615 | 27.0507 | 26.5083 | 25.9160 | 24.8402 | 25.8734 |

| Maximum prediction (Test) | 129.9874 | 133.0829 | 128.9972 | 127.7984 | 135.9908 | 124.6420 | 132.7024 | 127.8371 | 134.0083 | 130.9436 |

| Minimum prediction (Validation) | 26.3905 | 26.1193 | 25.5647 | 21.5489 | 24.4613 | 27.0507 | 26.5084 | 25.9140 | 24.8400 | 25.8745 |

| Maximum prediction (Validation) | 130.0663 | 133.2565 | 128.3634 | 126.9342 | 137.1561 | 123.8298 | 132.8783 | 127.9357 | 134.1763 | 131.0035 |

| Date | 1 MLP 1-13-1 | 2 MLP 1-14-1 | 3 MLP 1-18-1 | 4 MLP 1-17-1 | 5 MLP 1-18-1 | 6 MLP 1-14-1 | 7 MLP 1-17-1 | 8 MLP 1-14-1 | 9 MLP 1-13-1 | 10 MLP 1-18-1 |

|---|---|---|---|---|---|---|---|---|---|---|

| 8 November 2022 | 91.81 | 95.15 | 109.08 | 100.23 | 94.81 | 101.25 | 72.60 | 96.94 | 87.82 | 90.65 |

| 9 November 2022 | 91.77 | 94.74 | 109.20 | 100.07 | 95.62 | 103.68 | 70.91 | 99.16 | 87.11 | 90.86 |

| 10 November 2022 | 91.76 | 94.60 | 109.24 | 100.02 | 95.92 | 104.52 | 70.34 | 99.97 | 86.87 | 90.95 |

| 11 November 2022 | 91.76 | 94.48 | 109.29 | 99.97 | 96.22 | 105.38 | 69.79 | 100.81 | 86.63 | 91.04 |

| 14 November 2022 | 91.75 | 94.32 | 109.32 | 99.92 | 96.53 | 106.25 | 69.21 | 101.69 | 86.38 | 91.14 |

| 15 November 2022 | 91.75 | 94.17 | 109.37 | 99.87 | 96.86 | 107.13 | 68.65 | 102.60 | 86.14 | 91.24 |

| 16 November 2022 | 91.77 | 93.74 | 109.49 | 99.71 | 97.90 | 109.82 | 66.95 | 105.53 | 85.41 | 91.60 |

| 17 November 2022 | 91.78 | 93.60 | 109.52 | 99.65 | 98.27 | 110.73 | 66.38 | 106.57 | 85.16 | 91.74 |

| 18 November 2022 | 91.76 | 93.44 | 109.57 | 99.60 | 98.65 | 111.65 | 65.81 | 107.64 | 84.92 | 91.89 |

| 21 November 2022 | 91.81 | 93.30 | 109.61 | 99.54 | 99.04 | 112.57 | 65.25 | 108.73 | 84.67 | 92.03 |

| 22 November 2022 | 91.83 | 93.15 | 109.65 | 99.49 | 99.44 | 113.49 | 64.68 | 109.85 | 84.43 | 92.19 |

| 23 November 2022 | 91.90 | 92.70 | 109.77 | 99.32 | 100.72 | 116.25 | 62.99 | 113.34 | 83.69 | 92.70 |

| 24 November 2022 | 91.93 | 92.54 | 109.81 | 99.26 | 101.17 | 117.16 | 62.42 | 114.54 | 83.43 | 92.89 |

| 25 November 2022 | 91.97 | 92.39 | 109.85 | 99.20 | 101.64 | 118.07 | 61.86 | 115.75 | 83.18 | 93.08 |

| 28 November 2022 | 92.00 | 92.23 | 109.89 | 99.14 | 102.11 | 118.98 | 61.30 | 116.98 | 82.93 | 93.28 |

| 29 November 2022 | 92.04 | 92.08 | 109.93 | 99.08 | 102.60 | 119.88 | 60.74 | 118.20 | 82.68 | 93.50 |

| 30 November 2022 | 92.17 | 91.60 | 110.05 | 98.90 | 104.14 | 122.50 | 59.06 | 121.88 | 81.93 | 94.16 |

| 1 December 2022 | 92.22 | 91.44 | 110.09 | 98.85 | 104.68 | 123.35 | 58.50 | 123.10 | 81.68 | 94.4 |

| 2 December 2022 | 92.28 | 9129 | 110.13 | 98.78 | 105.23 | 124.19 | 57.95 | 124.30 | 81.42 | 94.64 |

| 5 December 2022 | 92.33 | 91.12 | 110.17 | 98.72 | 105.79 | 125.01 | 57.39 | 125.48 | 81.17 | 94.89 |

| Date | Real Price of Oil |

|---|---|

| 8 November 2022 | 96.85 |

| 9 November 2022 | 93.05 |

| 10 November 2022 | 94.25 |

| 11 November 2022 | 96.37 |

| 14 November 2022 | 93.59 |

| 15 November 2022 | 94.30 |

| 16 November 2022 | 92.61 |

| 17 November 2022 | 91.00 |

| 18 November 2022 | 88.93 |

| 21 November 2022 | 88.44 |

| 22 November 2022 | 88.65 |

| 23 November 2022 | 85.90 |

| 24 November 2022 | 85.59 |

| 25 November 2022 | 83.40 |

| 28 November 2022 | 83.50 |

| 29 November 2022 | 83.22 |

| 30 November 2022 | 85.61 |

| 1 December 2022 | 86.28 |

| 2 December 2022 | 86.54 |

| 5 December 2022 | 83.36 |

| Date | Residuals 1 MLP 1-13-1 | Residuals 2 MLP 1-14-1 | Residuals 3 MLP 1-18-1 | Residuals 4 MLP 1-17-1 | Residuals 5 MLP 1-18-1 | Residuals 6 MLP 1-14-1 | Residuals 7 MLP 1-17-1 | Residuals 8 MLP 1-14-1 | Residuals 9 MLP 1-13-1 | Residuals 10 MLP 1-18-1 |

|---|---|---|---|---|---|---|---|---|---|---|

| 8 November 2022 | 5.04 | 1.70 | −12.23 | −3.38 | 2.04 | −4.40 | 24.25 | −0.09 | 9.03 | 6.20 |

| 9 November 2022 | 1.28 | −1.69 | −16.15 | −7.02 | −2.57 | −10.63 | 22.14 | −6.11 | 5.94 | 2.19 |

| 10 November 2022 | 2.49 | −0.35 | −14.99 | −5.77 | −1.67 | −10.27 | 23.91 | −5.72 | 7.38 | 3.30 |

| 11 November 2022 | 4.61 | 1.89 | −12.92 | −3.60 | 0.15 | −9.01 | 26.58 | −4.44 | 9.74 | 5.33 |

| 14 November 2022 | 1.84 | −0.73 | −15.73 | −6.33 | −2.94 | −12.66 | 24.38 | −8.10 | 7.21 | 2.45 |

| 15 November 2022 | 2.55 | 0.13 | −15.07 | −5.57 | −2.56 | −12.83 | 25.65 | −8.30 | 8.16 | 3.06 |

| 16 November 2022 | 0.84 | −1.13 | −16.88 | −7.10 | −5.29 | −17.21 | 25.66 | −12.92 | 7.20 | 1.01 |

| 17 November 2022 | −0.78 | −2.60 | −18.52 | −8.65 | −7.27 | −19.73 | 24.62 | −15.57 | 5.84 | −0.74 |

| 18 November 2022 | −2.83 | −4.51 | −20.64 | −10.67 | −9.72 | −22.72 | 23.12 | −18.71 | 4.01 | −2.96 |

| 21 November 2022 | −3.37 | −4.86 | −21.17 | −11.10 | −10.60 | −24.13 | 23.19 | −20.29 | 3.77 | −3.59 |

| 22 November 2022 | −3.18 | −4.50 | −21.00 | −10.84 | −10.79 | −24.84 | 23.97 | −21.20 | 4.22 | −3.54 |

| 23 November 2022 | −6.00 | −6.80 | −23.87 | −13.42 | −14.82 | −30.35 | 22.91 | −27.44 | 2.21 | −6.80 |

| 24 November 2022 | −6.34 | −6.95 | −24.22 | −13.67 | −15.58 | −31.57 | 23.17 | −28.95 | 2.16 | −7.30 |

| 25 November 2022 | −8.57 | −8.99 | −26.45 | −15.80 | −18.24 | −34.67 | 21.54 | −32.35 | 0.22 | −9.68 |

| 28 November 2022 | −8.50 | −8.73 | −26.39 | −15.64 | −18.61 | −35.48 | 22.20 | −33.48 | 0.57 | −9.78 |

| 29 November 2022 | −8.82 | −8.86 | −26.71 | −15.86 | −19.38 | −36.66 | 22.48 | −34.98 | 0.54 | −10.28 |

| 30 November 2022 | −6.56 | −5.99 | −24.44 | −13.29 | −18.53 | −36.89 | 26.55 | −36.27 | 3.68 | −8.55 |

| 1 December 2022 | −5.94 | −5.16 | −23.81 | −12.57 | −18.40 | −37.07 | 27.78 | −36.82 | 4.60 | −8.12 |

| 2 December 2022 | −5.74 | −4.75 | −23.59 | −12.24 | −18.69 | −37.65 | 28.59 | −37.76 | 5.12 | −8.10 |

| 5 December 2022 | −8.97 | −7.76 | −26.81 | −15.36 | −22.43 | −41.65 | 25.97 | −42.12 | 2.19 | −11.53 |

| Total | −56.96 | −80.64 | −411.59 | −207.88 | −215.90 | −490.42 | 488.66 | −431.62 | 93.79 | −67.43 |

| Mean | −2.85 | −4.03 | −20.58 | −10.39 | −10.8 | −24.52 | 24.43 | −21.58 | 4.69 | −3.37 |

| Median | −3.28 | −4.63 | −21.09 | −10.97 | −10.7 | −24.49 | 24.11 | −20.75 | 4.41 | −3.57 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Horák, J.; Jannová, M. Predicting the Oil Price Movement in Commodity Markets in Global Economic Meltdowns. Forecasting 2023, 5, 374-389. https://doi.org/10.3390/forecast5020020

Horák J, Jannová M. Predicting the Oil Price Movement in Commodity Markets in Global Economic Meltdowns. Forecasting. 2023; 5(2):374-389. https://doi.org/10.3390/forecast5020020

Chicago/Turabian StyleHorák, Jakub, and Michaela Jannová. 2023. "Predicting the Oil Price Movement in Commodity Markets in Global Economic Meltdowns" Forecasting 5, no. 2: 374-389. https://doi.org/10.3390/forecast5020020

APA StyleHorák, J., & Jannová, M. (2023). Predicting the Oil Price Movement in Commodity Markets in Global Economic Meltdowns. Forecasting, 5(2), 374-389. https://doi.org/10.3390/forecast5020020