Abstract

Tourism plays an important economic role for many economies and after the COVID-19 pandemic, accurate tourism forecasting become critical for policymakers in tourism-dependent economies. This paper extends the growing literature on the use of internet search data in tourism forecasting through evaluating the predictive ability of Destination Insight with Google, a new Google product designed to monitor tourism recovery after the COVID-19 pandemic. This paper is the first attempt to explore the forecasting ability of the new Google data. The study focuses on the case of Dubai, given its status as a world-leading tourism destination. The study uses time series models that account for seasonality, trending variables, and structural breaks. The study uses monthly data for the period of January 2019 to April 2022. We explore whether the internet travel search queries can improve the forecasting of tourist arrivals to Dubai from the UK. We evaluate the accuracy of forecasts after incorporating the Google variable in our model. Our findings suggest that the new Google data can significantly improve tourism forecasting and serves as a leading indicator of tourism demand.

1. Introduction

Economists are increasingly using nontraditional data and new technologies to help in monitoring economic activity. Recent examples include tracking merchandise trade from space, using satellite-based vessel tracking data or relying on nighttime light intensity as a proxy for GDP growth [1,2]. With the growing use of the Internet across the world, internet search data such as Google Trends have emerged as new sources of valuable economic information. Web search data can capture users’ interests and the intentions of consumers, investors, and travelers [3,4]. The existing literature indicates that internet search data have opened up new opportunities for analysis in a wide range of areas and enabled researchers to revisit existing topics innovatively. For example, Raubenheimer, et al. [5] used web search data to predict the outcome of the 2020 cannabis referendum in New Zealand. Berniell and Facchini [6] used the web search data to study the effect of lockdown on domestic violence and to make a cross-country comparison. Choi and Varian [7] demonstrate the helpfulness of search volume data in making short-term economic predictions. They showed that the Google queries’ data can significantly improve the near-term forecast for automobile sales, unemployment claims, and consumer sentiment. Askitas and Zimmermann [8] used Google data to forecast unemployment rates in Germany and found a strong correlation between unemployment rates and keyword searches such as unemployment office and unemployment rate. Vosen and Schmidt [9] have utilized Google Trends to forecast private consumption in the US. Interestingly, they showed that Google Trends outperform the conventional survey-based indicators in forecasting consumer spending.

The importance of internet search data has even increased after the Russian war and the COVID-19 pandemic. A growing number of studies are relying on internet search data for their analysis. For example, Juric [10] used migration-related search queries on estimating the refugee flows from Ukraine to the EU. Tseng, et al. [11] used Google search data in assessing the public awareness and attitude toward the COVID-19 pandemic in Taiwan. Deb [12] used web search data on analyzing airlines’ stock price volatility during the COVID-19 outbreak. Ciofani, et al. [13] found a strong association between internet search volume for chest pain and COVID-19 case numbers in the United States.

Given the significant impact of tourism on several economies, a large emerging literature is looking at the predictive power of the web search volume in improving the forecasting of tourism inflows [14,15,16,17,18,19,20,21,22,23,24,25,26,27,28]. The premise is that online travel queries can be a leading indicator for subsequent hotel or flight booking, as travelers plan the trips of their actual booking. Thus, the web search data might be helpful in reflecting travelers’ holiday intentions.

Tourism demand forecasting has received more attention after the COVID-19 pandemic, as the crisis and the suspension of traveling increased the volatility of public revenues and disrupted economic activity. In fact, the literature on tourism forecasting after COVID-19 is expanding rapidly. Several recent papers have been attempting to use innovative tools to forecast tourist arrivals and analyze the effect of the COVID-19 shock on tourism demand [25,29,30,31,32]. For example, Ouassou and Taya [29] attempted to forecast the regional tourism demand in Morocco using classical econometric methods (ARIMA, AR, etc.) as well as artificial intelligence techniques, and their findings suggest that combing classical and AI models produce the best results and overcome the limitations of the two methods. Similarly, Nguyen, Fernandes and Teixeira [31] examine the predictive ability of an artificial intelligence technique known as an artificial neural network to forecast tourism demand in Vietnam. Godovykh, Ridderstaat, Baker and Fyall [32] used time-series analysis to examine the effect of COVID-19 news on travel sentiment and their findings show that the COVID-19 statistics such as the number of cases, deaths, and vaccination rate have a significant impact on the attitudes toward traveling. Chan and Trupp [25] focused on the role of search data in predicting the recovery of the tourism sector in Singapore and Malaysia after COVID-19. The study finds that search volume data remain useful in predicting holiday intention after COVID-19.

Dubai is one of the world’s leading tourism destinations. It has witnessed a continual rise in the number of international visitors that has grown from 6.9 million in 2007 to about 17 million visitors in 2019. The rapid growth in the tourism sector has translated into more employment opportunities, faster economic growth, more public revenue, and the development of tourism infrastructure. The World Bank estimated that the travel and tourism sector represents about 20% of Dubai’s GDP [33]. The number of employees in hotels and restaurants accounts for about 8% (218,887 workers) of the total employment in Dubai [34]. The sector also plays an essential role in economic diversification efforts.

Tourism in Dubai has been affected by the unprecedented fall in international tourism driven by the COVID-19 outbreak. The number of international visitors fell by 67% in 2020 from 16.7 million visitors to 5.5 million visitors [34]. With the growing importance of the tourism sector’s contribution to economies and with the COVID-19 pandemic that has resulted in unprecedented travel shock, the process of forecasting tourists’ arrivals and its accuracy becomes vital for tourism-dependent economies.

In 2021, Google launched Destination Insight with Google to track tourism recovery after COVID-19. The objective of the new Google product is to provide a powerful insight into travel demand based on global Google search. Destination Insight with Google allows for the tracking of how tourism demand is changing for travel destinations based on users’ search queries. Before Destination Insight with Google, researchers were experimenting with different travel keywords that might be associated with tourist arrivals and chose the keyword most related to tourist arrivals as a variable in forecasting tourism demand. The new Google platform saves this trial-and-error process of choosing the right travel keyword. The purpose of this study is to build on the past literature and is particularly interested in assessing the predictive capacity of Destination Insight with Google in forecasting tourism demand after the COVID-19 pandemic. To the best of our knowledge, this study represents the first attempt to assess the predictive capability of the new Google product in forecasting tourism flows with an application to Dubai’s case as a top tourist destination. Therefore, this study offers two contributions to the literature: First, this study adds to the literature through our findings in assessing the predictive power of Destination Insight with Google in tourism forecasting. Second, the study is one of the few that reviews the predictive capability of travel-related web search after the COVID-19 pandemic and accounts for the structural break in the data that took place during the global lockdown.

Our findings suggest the online travel search for accommodation and flights can improve the performance of tourism forecasting. The time series model that incorporates travel search data as an explanatory variable along with macroeconomic variables outperforms models that did not incorporate internet travel data. The next section describes the data and method, followed by the results section, and Section 4 concludes the study.

2. Materials and Methods

This study uses monthly data on the number of overnight UK visitors sourced from the Dubai Department of Economy and Tourism, which are available at (https://www.dubaitourism.gov.ae/en/research-and-insights, accessed on 15 May 2022). The study focused on UK tourism for two reasons. First, it is historically considered to be one of the most important source-countries for tourism in Dubai and the number of visitors has been constantly growing. Second, data on explanatory variables such as UK GDP are published regularly and on a monthly basis. Travel search for accommodation and flights on the internet could be a proxy for tourism demand. Google is the most important search engine on the internet around the world and accounts for 90% of all searches on the internet [15]. Google launched a new platform called Destination Insight with Google. It provides data on what Google called travel demand, which allows one to determine whether there is a growing or declining trend in travel interest for a particular location compared with previous years. The travel demand reflects users’ interests in visiting a particular destination based on google.com queries where Google searches are used to express the intent to travel. For example, keywords searched on google.com such as a cheap flight from London to Dubai or Armani hotel Dubai are used to monitor the travel demand in Dubai. The travel demand index reflects the number of times users search for destination-based accommodation keywords and queries that reflect travelers’ interest over time. All data are indexed. The index ranges from 0 to 100, where 100 is the maximum search interest for the time and location selected. Users can access the data via the following website (https://destinationinsights.withgoogle.com/, accessed on 15 May 2022). Interestingly, the travel demand can be broken down according to the country of origin of the travel searchers. The data are high-frequency data and are refreshed weekly. The data are available from January 2019.

The previous literature in forecasting tourism demand with Google Trends examines whether models that include web search variables have a better forecasting performance than the baseline models (usually autoregressive ones) [27]. Better forecasting performance is assessed based on out-of-sample forecast evaluation. We follow the same methodology here.

As economic growth and economic conditions in the UK are major determinants of UK outbound tourism, we added UK GDP to our model as an explanatory variable. Data on the monthly UK GDP were obtained from the Office for National Statistics (ONS). We expected a positive association between tourist arrivals and UK GDP. The past literature pointed out that the real effective exchange rate (REER) is one of the most important determinants of tourism demand [35]. An increase in REER of the tourist destination implies that the destination has become more expensive and less competitive and vice versa. Data on the REER for the UAE dirham are obtained from the Bank for International Settlements (BIS). We expected a negative association between REER and tourist arrivals. Testing the stationarity of the UK’s GDP as well as the REER variables is necessary. The stationarity tests suggest that the two variables are both nonstationary and will be used in the first difference format.

Our multivariate time series model that forecasts the UK tourist arrivals to Dubai incorporates UK GDP, the real effective exchange rate, and the past realization of the dependent variable (AR (1) term). The advantage of incorporating the AR (1) term in the model is that it can control for behavioral patterns such as habits and persistence in the data. Our dependent variable, UK visitors, exhibits seasonality, as it is strongly influenced by the seasonal holiday factor. To account for the seasonality in the data, we included a set of monthly dummy variables in the model. The dependent variable is stationary. However, it was exposed to structural change due to the COVID-19 shock. Therefore, a dummy variable that accounts for the COVID-19 period was added:

where Yt stands for the number of UK visitors to Dubai at time t, ∆GDP refers to the UK GDP in first difference, and ∆REER refers to REER in first difference. The Covid variable refers to the dummy variable that equals one during the period from 1 March 2020 to 1 August 2021. The variable MonDu corresponds to the monthly dummies to account for the seasonality.

Then, we added our variable of interest, Google travel search, to the above model to determine whether its inclusion can improve the predictive accuracy of the model. However, we considered that the COVID-19 structural break because it changed the relationship between the number of visitors and Google travel search. We generated a new Google search variable for each break regime [36,37]. The forecasting model can be presented as:

where G1t−1 refers to the lagged Google search index in the pre-COVID-19 period and equals zero otherwise, while G2 corresponds to the lagged Google search index in the period from February 2020 to July 2021 and zero otherwise. Lastly, G3 refers to the lagged Google search index in the period from August 2021 onwards. The lagged form is adopted as travelers expected to begin their web search about Dubai before their travel data. Our monthly data cover the period from January 2019 to April 2022. The two regression models run over the period from January 2019 up through December 2021. We saved the remaining four data points for forecasting assessment purposes.

3. Results

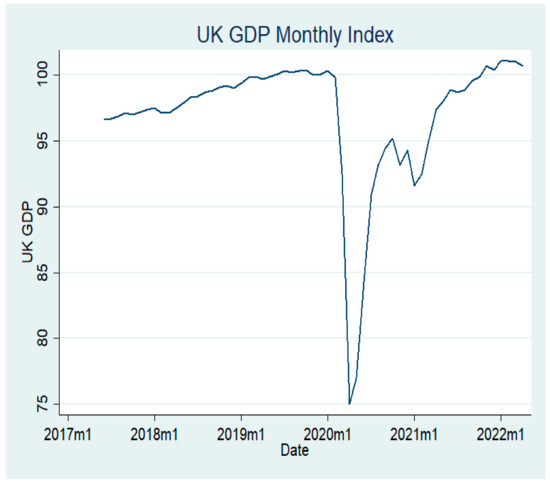

We begin this section by discussing the key changes in the explanatory variables. Figure 1 shows the UK monthly GDP, which measures the value of goods and services produced in the UK. The figure shows that GDP was constantly growing until the pandemic hit in 2020. With the ease of COVID-19 restrictions and the development of the COVID-19 vaccine, the UK started its recovery journey. In November 2021, the UK economy grew above its prepandemic level for the first time.

Figure 1.

UK GDP, 2019 = 100.

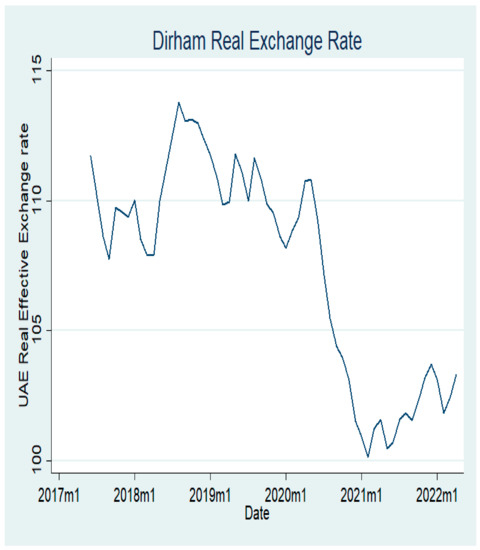

The UAE currency has been pegged to the US dollar since November 1997, at AED 3.67 to the dollar, which has shaped the UAE monetary policy by aligning the CB’s interest rate with the US Federal Funds’ target rate. While the peg to the dollar, which is the main currency used in international reserves and transactions, reduces foreign exchange-related risks and uncertainty, its impact on international competitiveness is not avoided, as changes in exchange rates between the dollar and other currencies result in variations in the UAE real effective exchange rates, which is the value of a currency against a weighted average of several foreign currencies divided by a price deflator or index of costs. In line with the US dollar and as a result of the quantitative easing after the COVID-19 pandemic, the UAE dirham has depreciated in 2020 and 2021, boosting the competitiveness of the tourism sector (see Figure 2).

Figure 2.

Dirham real exchange rate.

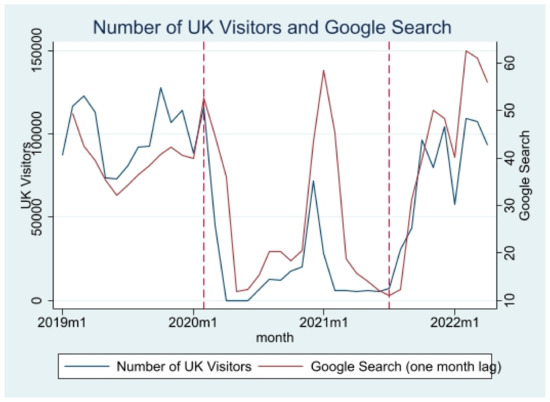

Figure 3 reflects the close association between the Google travel search to Dubai inside the UK and the number of overnight visitors from the UK. The simple correlation coefficient between the number of UK visitors and the Google searches (lagged one month) suggests a strong correlation between the two variables with a value correlation coefficient of about 0.74. The figure demonstrates the major disruption that occurred to the number of UK visitors due to the COVID-19 shock, as reflected by the unprecedented hit in the number of visitors. Thus, a dummy variable for the COVID-19 period is necessary. The figure also demonstrates that the number of UK visitors to Dubai rose again to reach the prepandemic levels around the last quarter of 2021.

Figure 3.

UK visitors and Google searches for accommodation and flights.

Table 1 presents the regression results for Equations (1) and (2). Equation (1) controls for the AR (1) term, the COVID-19-period dummy, the UK GDP in the first difference, the REER in the first difference, and the monthly dummies. On the other hand, Equation (2) combines all the previous variables along with Google travel search data (although we lost one observation due to the use of lag). To choose which forecasting equation was most suitable, we used both in-sample criteria as well as out-of-sample criteria. For the in-sample criteria, we looked at the adjusted R-squared. Adding Google search data to the model improved the value of adjusted R2 significantly, as it increases from 0.90 to 0.97, reflecting that the Google-augmented model fits better than the model with traditional macrovariables. The Google search variables (G1, G2, G3) are all significant at a 10% level of significance. G1 and G3 are significant at a 1% level of significance. Equation (2) suggests that the relation between tourist arrivals and web search has not been stable throughout the study period, as the value of Google coefficients changes at different break dates. Interestingly, all the control variables become insignificant after the inclusion of Google searches in the model. The UK GDP, as well as the REER coefficients, both have the expected sign. However, they were insignificant due to the large standard errors.

Table 1.

Regression results.

The measures of out-of-sample forecast accuracy, root mean squared error (RMSE), mean absolute error (MAE), mean absolute percentage error (MAPE), and Theil’s U are defined by the following equations (Wooldridge [38] and materialized in Stata software via Baum [39].

where is the forecasted values and is the actual values. The model with smaller RMSE, MAE, MAPE, and Theil’s U will be the preferred model, as it has a smaller forecast error. Equations (1) and (2) use data up to December 2021, and this leaves four out-of-sample observations to use in estimating RMSE, MAE, MAPE, and Theil’s U. The two models forecast the number of UK visitors to Dubai in the first four months of the year 2022, and Table 2 presents the estimated RMSE, MAE, MAPE, and Theil’s U. According to the Table 2 results, there is no ambiguity in deciding which model has better forecasting performance. The model that incorporates the Google variable with the traditional variables produces a much better out-of-sample forecast for the period from January 2022 to April 2022, and this is reflected by smaller RMSE, MAE, MAPE, and Theil’s U.

Table 2.

Forecast accuracy comparison.

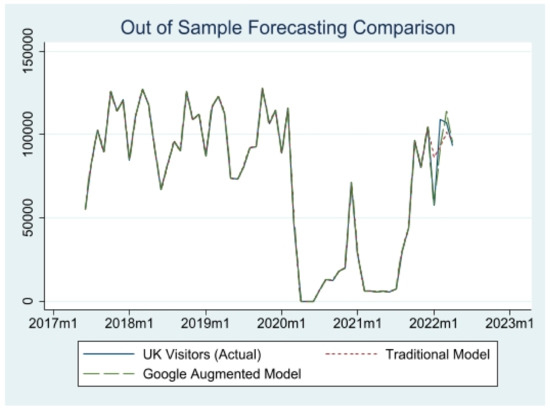

Figure 4 provides a visual description of the forecasting performance, as it compares the actual values of visitors to the out-of-sample forecasted values using Equations (1) and (2). The Figure confirms that the Google-augmented model performs better, as it follows the actual values more closely than the traditional model.

Figure 4.

Forecasting comparison.

4. Discussion and Conclusions

Tourism plays an important economic role, and several economies are highly tourism dependent. Before the COVID-19 pandemic, tourism accounted for more than 10% of global GDP and more than 320 million jobs worldwide. After the COVID-19 pandemic and the unprecedented decline in the number of tourists, tourism demand forecasting becomes an essential exercise for tourism-dependent economies. Real-time indicators can help to track travel activity. The purpose of this study is to extend the existing literature on the use of internet search data in tourism forecasting. Previous research investigates whether the Google Trends data, data on the volume of queries that users enter into Google, can improve tourism demand forecasting. This study adds to the previous research through evaluating the predictive ability of Destination Insight with Google, Google’s newest product for tracking tourism recovery that launched after the COVID-19 pandemic. While the previous literature focuses on the usefulness of Google Trends data in forecasting tourist arrivals, this study is the first attempt to evaluate the use of Destination Insight with Google in tourism forecasting. The advantage of the use of Destination Insight with Google is that Destination Insight with Google consolidates different travel-related searches on one index covering both the accommodation search and the flight search. On the other hand, the previous research has been attempting to experiment with different search terms on Google Trends that potentially might be correlated with tourist arrivals and use them as explanatory variables. For example, Cevik (2020) tried to identify the most relevant search term and compared the following travel-related search terms: the Bahamas, the Bahamas Travel, the Bahamas Beach, the Bahamas hotels, the Bahamas resorts, and the Bahamas flights, and chose “the Bahamas travel” as the most appropriate online search term for tourism forecasting in the Bahamas. However, after the launch of Destination Insight with Google, this step might be skipped, and tourism forecasters can move directly to the next step in their forecasting exercise. Thus, Destination Insight with Google might represent an upgrade for forecasters compared to Google Trends; thus, it is vital to evaluate its predictive ability, and this is the purpose of this study. What also adds to the importance of this paper is that it is one of the first attempts to forecast the tourism demand after the COVID-19 pandemic and provides guidance on dealing with the structural break that was caused by the global lockdown.

Dubai is one of the world’s leading tourism destinations, and the tourism sector plays a vital economic role in its economy. This study investigates the predictive ability of the new Google product to forecast tourist arrivals to Dubai from the UK during the period of January 2019 to April 2022, as it is one of the top-five source markets for visitors to Dubai. The study collected monthly data on UK visitors to Dubai.

In line with previous research, this paper compares the forecast accuracy of the traditional model (see Equation (1)), which relies on traditional economic variables such as UK GDP, and REER with the Google-augmented model (see Equation (2)), which combines the same traditional variables along with Google search variable. The study used MAE, MAPE, RMSE, and U-Theil to evaluate the forecast accuracy. The models account for seasonality, nonstationarity, and the structural break resulting from the global lockdown and the suspension of travel activity.

This study’s findings suggest that the model that incorporates the Google destination insight data fits the data better and outperforms the model with the classical variables. The out-of-sample comparison of tourist arrivals forecasts implies that the model that includes the Google search data produces better out-of-sample forecasts. The study’s findings have obvious implications. First, on a theoretical level, the paper points to the potential role that the new Google data can play in forecasting tourist arrivals and monitoring the recovery of the tourism sector after the COVID-19 pandemic. A theoretical implication is that using the new data in forecast studies saves researchers the step of searching for the right search term and the possibility of missing the search term that accurately reflects the tourism demand. A policy implication is that policymakers and hotel managers may benefit from the new Google data in estimating the state of tourism demand and in better planning and investment.

The current study is not free from limitations. One limitation of this study is that the significant association between web search and tourist arrivals to Dubai should not be interpreted as a causal relationship. Rather, it is a leading indicator of tourism demand.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used in this study is publicly available. The Google search data has is available at Destination Insight with Google (https://destinationinsights.withgoogle.com/, accessed on 15 May 2022). The tourist numbers is available at Dubai Tourism website (https://www.dubaitourism.gov.ae/en/research-and-insights, accessed on 15 May 2022). The GDP data is available at (https://www.ons.gov.uk/, accessed on 20 May 2022). The exchange rate data is available at the Bank of International Settlements (https://www.bis.org/statistics/eer.htm, accessed on 20 May 2022).

Conflicts of Interest

The author declares no conflict of interest.

References

- Arslanalp, S.; Koepke, R.; Verschuur, J. Tracking Trade from Space: An Application to Pacific Island Countries; International Monetary Fund: Washington, DC, USA, 2021. [Google Scholar]

- Hu, Y.; Yao, J. Illuminating economic growth. J. Econom. 2022, 228, 359–378. [Google Scholar] [CrossRef]

- Hand, C.; Judge, G. Searching for the picture: Forecasting UK cinema admissions using Google Trends data. Appl. Econ. Lett. 2012, 19, 1051–1055. [Google Scholar] [CrossRef] [Green Version]

- Da, Z.; Engelberg, J.; Gao, P. In search of attention. J. Financ. 2011, 66, 1461–1499. [Google Scholar] [CrossRef]

- Raubenheimer, J.E.; Riordan, B.C.; Merrill, J.E.; Winter, T.; Ward, R.M.; Scarf, D.; Buckley, N.A. Hey Google! will New Zealand vote to legalise cannabis? Using Google Trends data to predict the outcome of the 2020 New Zealand cannabis referendum. Int. J. Drug Policy 2021, 90, 103083. [Google Scholar] [CrossRef]

- Berniell, I.; Facchini, G. COVID-19 lockdown and domestic violence: Evidence from internet-search behavior in 11 countries. Eur. Econ. Rev. 2021, 136, 103775. [Google Scholar] [CrossRef] [PubMed]

- Choi, H.; Varian, H. Predicting the present with Google Trends. Econ. Rec. 2012, 88, 2–9. [Google Scholar] [CrossRef]

- Askitas, N.; Zimmermann, K.F. Google Econometrics and Unemployment Forecasting. Appl. Econ. Q. 2009, 55, 107. [Google Scholar] [CrossRef] [Green Version]

- Vosen, S.; Schmidt, T. Forecasting private consumption: Survey-based indicators vs. Google trends. J. Forecast. 2011, 30, 565–578. [Google Scholar] [CrossRef] [Green Version]

- Juric, T. Predicting refugee flows from Ukraine with an approach to Big (Crisis) Data: A new opportunity for refugee and humanitarian studies. medRxiv 2022. [Google Scholar] [CrossRef]

- Tseng, P.; Tsai, F.-J.; Hsu, J.C.; Chang, Y.-C.; Wang, K.-H.; Wu, M.-K.; Chen, M.; Su, C.-H.; Shia, B.-C.; Miser, J.S. Public Awareness as a Line of Defense Against COVID-19 in Taiwan. Asia Pac. J. Public Health 2021, 33, 981–982. [Google Scholar] [CrossRef]

- Deb, S. Analyzing airlines stock price volatility during COVID-19 pandemic through internet search data. Int. J. Financ. Econ. 2021. [Google Scholar] [CrossRef]

- Ciofani, J.L.; Han, D.; Allahwala, U.K.; Asrress, K.N.; Bhindi, R. Internet search volume for chest pain during the COVID-19 pandemic. Am. Heart J. 2021, 231, 157–159. [Google Scholar] [CrossRef] [PubMed]

- Bangwayo-Skeete, P.F.; Skeete, R.W. Can Google data improve the forecasting performance of tourist arrivals? Mixed-data sampling approach. Tour. Manag. 2015, 46, 454–464. [Google Scholar] [CrossRef]

- Cevik, S. Where should we go? Internet searches and tourist arrivals. Int. J. Financ. Econ. 2020. [Google Scholar] [CrossRef]

- Yang, X.; Pan, B.; Evans, J.A.; Lv, B. Forecasting Chinese tourist volume with search engine data. Tour. Manag. 2015, 46, 386–397. [Google Scholar] [CrossRef]

- Rivera, R. A dynamic linear model to forecast hotel registrations in Puerto Rico using Google Trends data. Tour. Manag. 2016, 57, 12–20. [Google Scholar] [CrossRef] [Green Version]

- Pan, B.; Wu, D.C.; Song, H. Forecasting hotel room demand using search engine data. J. Hosp. Tour. Technol. 2012, 3, 196–210. [Google Scholar] [CrossRef] [Green Version]

- Siliverstovs, B.; Wochner, D.S. Google Trends and reality: Do the proportions match?: Appraising the informational value of online search behavior: Evidence from Swiss tourism regions. J. Econ. Behav. Organ. 2018, 145, 1–23. [Google Scholar] [CrossRef]

- Camacho, M.; Pacce, M.J. Forecasting travellers in Spain with Google’s search volume indices. Tour. Econ. 2018, 24, 434–448. [Google Scholar] [CrossRef]

- Saidi, N.; Scacciavillani, F.; Ali, F. Forecasting tourism in Dubai; Economic Note(8); Dubai International Finance Centre: Dubai, United Arab Emirates, 2010. [Google Scholar]

- Havranek, T.; Zeynalov, A. Forecasting tourist arrivals: Google Trends meets mixed-frequency data. Tour. Econ. 2021, 27, 129–148. [Google Scholar] [CrossRef] [Green Version]

- Antolini, F.; Grassini, L. Foreign arrivals nowcasting in Italy with Google Trends data. Qual. Quant. 2019, 53, 2385–2401. [Google Scholar] [CrossRef]

- Bokelmann, B.; Lessmann, S. Spurious patterns in Google Trends data-An analysis of the effects on tourism demand forecasting in Germany. Tour. Manag. 2019, 75, 1–12. [Google Scholar] [CrossRef]

- Chan, L.F.; Trupp, A. Holiday intention after COVID-19 pandemic in Malaysia and Singapore. In Proceedings of the Main Conference Proceedings of the the 20th Asia-Pacific CHRIE 2022, Subang Jaya, Malaysia, 3–25 May 2022; p. 533. [Google Scholar]

- Park, S.; Lee, J.; Song, W. Short-term forecasting of Japanese tourist inflow to South Korea using Google trends data. J. Travel Tour. Mark. 2017, 34, 357–368. [Google Scholar] [CrossRef]

- Önder, I. Forecasting tourism demand with Google trends: Accuracy comparison of countries versus cities. Int. J. Tour. Res. 2017, 19, 648–660. [Google Scholar] [CrossRef]

- Dinis, G.; Costa, C.; Pacheco, O. The use of Google Trends data as proxy of foreign tourist inflows to Portugal. Int. J. Cult. Digit. Tour. 2016, 3, 66–75. [Google Scholar]

- Ouassou, E.h.; Taya, H. Forecasting Regional Tourism Demand in Morocco from Traditional and AI-Based Methods to Ensemble Modeling. Forecasting 2022, 4, 420–437. [Google Scholar] [CrossRef]

- Gunter, U. Improving Hotel Room Demand Forecasts for Vienna across Hotel Classes and Forecast Horizons: Single Models and Combination Techniques Based on Encompassing Tests. Forecasting 2021, 3, 884–919. [Google Scholar] [CrossRef]

- Nguyen, L.Q.; Fernandes, P.O.; Teixeira, J.P. Analyzing and Forecasting Tourism Demand in Vietnam with Artificial Neural Networks. Forecasting 2022, 4, 36–50. [Google Scholar] [CrossRef]

- Godovykh, M.; Ridderstaat, J.; Baker, C.; Fyall, A. COVID-19 and Tourism: Analyzing the Effects of COVID-19 Statistics and Media Coverage on Attitudes toward Tourism. Forecasting 2021, 3, 870–883. [Google Scholar] [CrossRef]

- World Bank. Macro Poverty Outlook: United Arab Emirates; World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Dubai Statistics Center. Statistical Year Book; Dubai Statistics Center: Dubai, United Arab Emirates, 2021. [Google Scholar]

- Ongan, S.; Işik, C.; Özdemir, D. The effects of real exchange rates and income on international tourism demand for the USA from some European Union countries. Economies 2017, 5, 51. [Google Scholar] [CrossRef] [Green Version]

- Ditzen, J.; Karavias, Y.; Westerlund, J. Testing and estimating structural breaks in time series and panel data in stata. arXiv 2021, arXiv:2110.14550. [Google Scholar]

- Bai, J.; Perron, P. Estimating and testing linear models with multiple structural changes. Econometrica 1998, 66, 47–78. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Introductory Econometrics: A modern Approach; Cengage Learning: Boston, MA, USA, 2015. [Google Scholar]

- Baum, C. FCSTATS: Stata Module to Compute Time Series Forecast Accuracy Statistics. 2018. Available online: https://econpapers.repec.org/software/bocbocode/s458358.htm#:~:text=FCSTATS%3A%20Stata%20module%20to%20compute%20time%20series%20forecast%20accuracy%20statistics,-Christopher%20Baum%20(baum&text=Abstract%3A%20fcstats%20calculates%20several%20measures,(MAPE)%20and%20Theils%20U (accessed on 4 May 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).