Unveiling Potential Industry Analytics Provided by Unmanned Aircraft System Remote Identification: A Case Study Using Aeroscope

Abstract

1. Introduction

1.1. Problem

1.2. Current Estimates of UAS Utilization and Longevity

1.3. Limitations of Existing Datasets and Analysis Methods

- UAS Registration Database: In 2015, the Federal Aviation Administration released a rule requiring small-unmanned-aircraft operators to register sUAS weighing more than 0.55 lbs [2]. UAS registration data rely on individual operators to comply with registering their UAS to ensure database accuracy. FAA analysts acknowledge that the total size of the UAS fleet likely exceeds total registrations by 15% [1], with the excess likely caused by operator registration non-compliance.

- UAS Sighting Reports: In 2023, the FAA recorded 1685 sighting reports—reports submitted by pilots, law enforcement, aviation stakeholders, and others—that indicated potentially dangerous activity involving unmanned aircraft. While these reports may highlight potential hazard areas for drone encounters, their utility is limited. Previous research has shown that the accuracy of UAS sighting reports is subject to significant human error [3,4,5] and likely does not accurately reflect the reality of encounters within the National Airspace System [6].

- Remote Pilot Database: The Remote Pilot Database provides records of newly certified, renewed, and expired UAS pilots certified under 14 CFR 107 rules. While these records do provide a reasonable measure of one segment of the population of operators, the dataset does not accurately measure the extent of operations conducted by each operator. This approach fails to account for the operation of multiple UAS.

- Recreational UAS Safety Test: In 2021, the FAA mandated that UAS operators flying for recreational purposes complete a short educational course designed to reinforce aeronautical knowledge and safety concepts [7]. Similar to the Remote Pilot Database, Recreational UAS Safety Test statistics merely measure the potential population of UAS hobbyists operating under model aircraft rules. This dataset also fails to account for non-compliant operators who fail to achieve required certification.

- Low-Altitude Authorization and Notification Capability (LAANC) Requests/Approvals: In 2017, LAANC was created as a collaborative initiative between the FAA and UAS industry to establish a capability to disseminate airspace data and approve airspace usage requests, facilitated by a series of UAS Service Suppliers (USSs) [1,8]. LAANC provides near-real-time airspace access to remote pilots within controlled airspace areas by providing an automated process for managing and approving airspace requests within low-risk areas and altitudes defined by a grid system of UAS Facility Maps (UASFMs) [8]. Currently, 11 USS companies support the LAANC infrastructure, enabling access from PCs and a myriad of mobile devices [8]. As of 2023, LAANC covered 726 airports and provided 341,496 approvals for airspace access for non-recreational UAS operations and 155,418 approvals for recreational flights, and sent 43,760 requests for further FAA approval coordination [1]. LAANC approval data are perhaps the most accurate and informative dataset of the true state of UAS operations available to the FAA, without the use of supplemental sensor equipment.

- UAS Waivers/Airspace Authorizations: Like LAANC requests and approvals, UAS waivers/airspace authorizations only reveal a partial story about the state of UAS operations in the NAS. They reflect data for only those operators desiring to deviate from permanently established regulation or restrictions. While they may serve as a reasonable gauge to assess the adequacy of permanent regulations in meeting UAS operator demand, this dataset is a relatively poor means of assessing operational trends.

- Remote Identification Registration: In 2019, the FAA issued a notice of proposed rulemaking requiring that most unmanned aircraft systems incorporate Remote Identification Systems onboard to provide electronic conspicuity of UAS for safety and security purposes. Although the new rule generally addresses the inclusion of Remote ID systems on newly manufactured UAS, obtaining relevant data from this source requires UAS operators to properly register their drones to link their operator registration with the Remote ID serial number [9,10].

- Drone Industry Economic Data: A market report by Drone Industry Insights [11] indicates that Da Jiang Industries (DJI) continues to dominate the drone industry, with an estimated 70% global market share. Since DJI is a privately held company, financial details such as product sales are not publicly reported [12]. Other generalized economic data may also play a role in estimating drone populations and operational activity. Unfortunately, these data can only provide estimates of questionable accuracy and generalizability.

- Operator Survey Data: The FAA leverages survey data collected from UAS operators to inform upon UAS activities and trends, based on a stratified, random sampling of recreational and commercial UAS operators, and varied geographical locations around the U.S. [1]. As with many surveys, a low response rate creates challenges in achieving generalizability. For the most recent 2023 survey, the FAA received a 26.2% response rate from all sampled participants [1]. Another potential limitation of using survey data to assess operational factors is that survey results can be skewed by the operator’s perception of their activity. An operator might believe that they only fly 20 min per day, but operational activity might be significantly more or less. Without the benefit of implementing higher fidelity tracking means (such as operator activity logging), this measurement instrument also has limitations.

- Additional Considerations: While regulatory data are well covered, it is essential to also consider the limitations in academic sources that used samples to predict similar sorts of information. Survey data, such as discussed by Huang et al. [13], often suffer from low response rates and potential biases in respondent self-reporting, which can affect the accuracy and generalizability of the findings. For example, the logistic regression analysis used in their study is robust but limited by the normality assumption and requires a careful consideration of socio-demographic factors [13].

- Limitations of RID as a Source of Information: It is important to acknowledge the limitations of RID technology as source data. RID systems are vulnerable to spoofing, where fake identities can be transmitted by malicious drones, and they can be disabled or circumvented by operators [14]. Additionally, RID systems can experience technical failures or inaccuracies due to interference or errors in onboard modules [14].

1.4. Purpose

1.5. Research Questions

- What is the lifespan of sUAS systems?

- How often are sUAS flown?

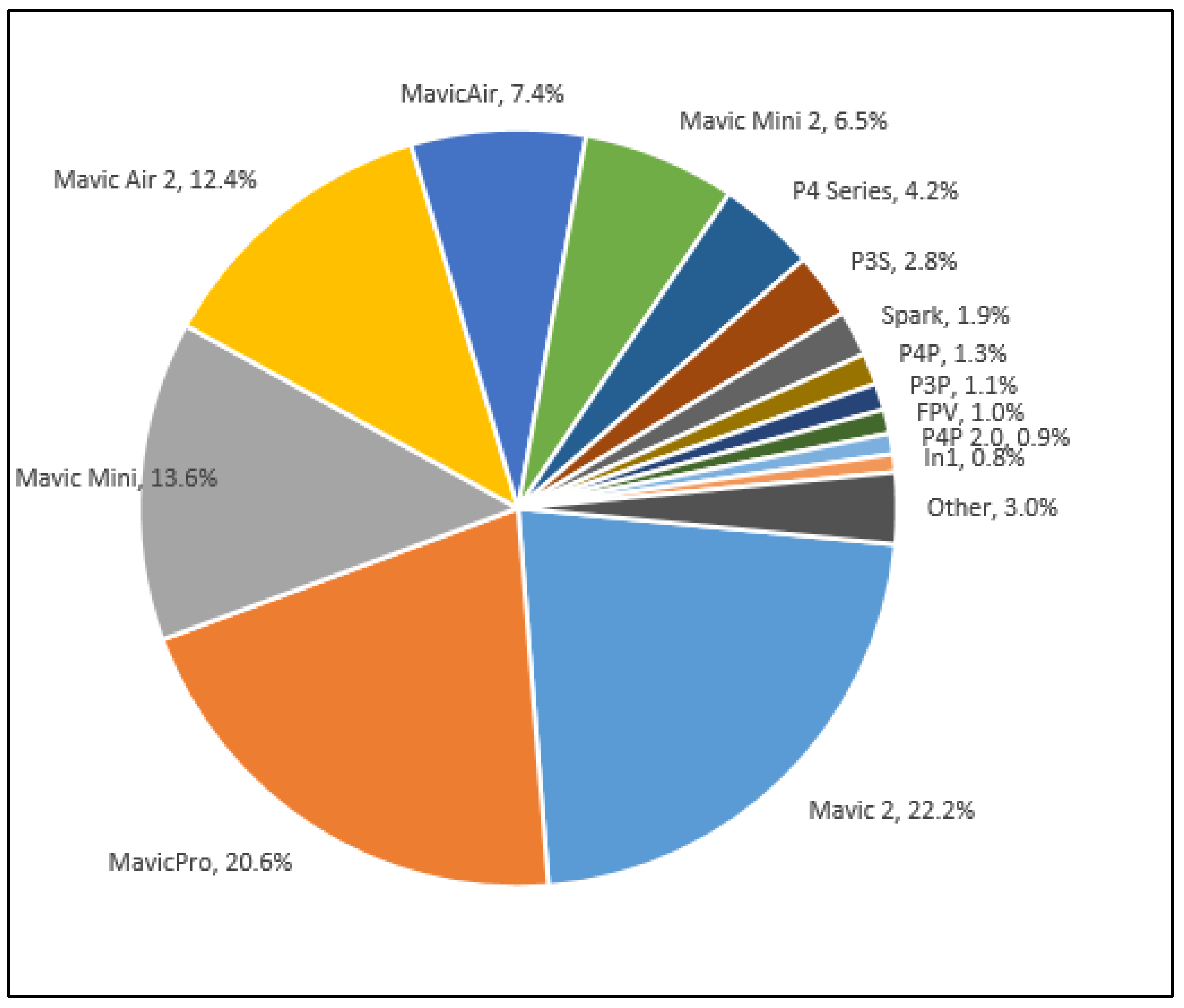

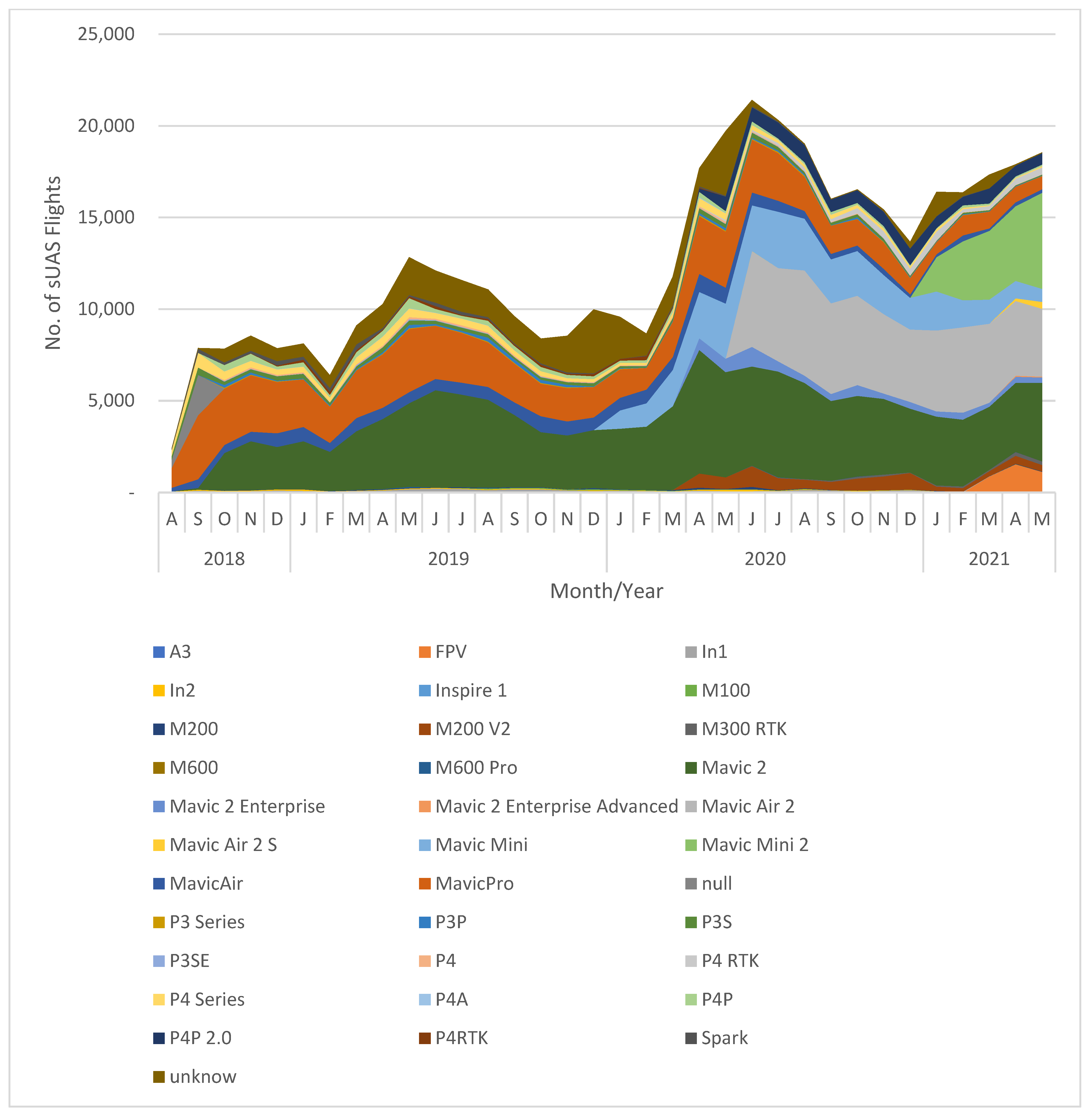

- What can sUAS platform use inform us about market trends?

2. Background

2.1. Aeroscope

2.2. Remote Identification

2.3. Similarities between Aeroscope and Remote Identification

2.4. Advantages of Using UAS Tracking Data

2.5. Improved Data Granularity and Precision/Case Studies

2.6. Operational Purpose Identification

2.7. Real-Time Monitoring and Data Collection

2.8. Comprehensive Data Coverage and Operator Inclusion

2.9. Longitudinal Data Collection

2.10. Integration with Other Data Sources

3. Methodology

3.1. Instrument

3.2. Sample

3.3. Data Collection and Analysis

3.4. Assumptions and Limitations

- The Aeroscope was limited to detecting only DJI platforms. As of March 2020 (one month prior to this study), DJI commanded a 77% market share, with no other individual company exceeding a 4% market share [25]. In a recent study by Drone Industry Insights [11], DJI’s market share reportedly slipped to 70%.

- The number of detected aircraft does not necessarily equate to the number of UAS operators. It is not uncommon for UAS operators to own several UAS platforms.

- The flight identifier number is assigned by the Aeroscope cycles when the detection of a UAS serial number is interrupted. This can normally be attributed to landing the UAS, but can also occur if the line of sight between the UAS signal is broken or interrupted by an obstruction. The research team assumed that flight count was relatively accurate and did not assess or adjust flight counts for potential duplicate counting.

- A UAS was considered active if the respective serial number was detected during any portion of a calendar month, regardless of flight frequency. Moreover, a detection occurs once the Aeroscope sensor detects the presence of the command and control datalink. This means that a flight will be counted once the UAS is activated, even if the aerial vehicle is not airborne. A UAS was considered inactive if the serial number was not detected during a calendar month.

- Calculations related to lifespan excluded newly identified UAS serial numbers detected within the past six months of this study. This decision was intended to avoid inappropriately left-skewing lifespan values for UAS that potentially remained active after this study ended.

4. Findings and Discussion

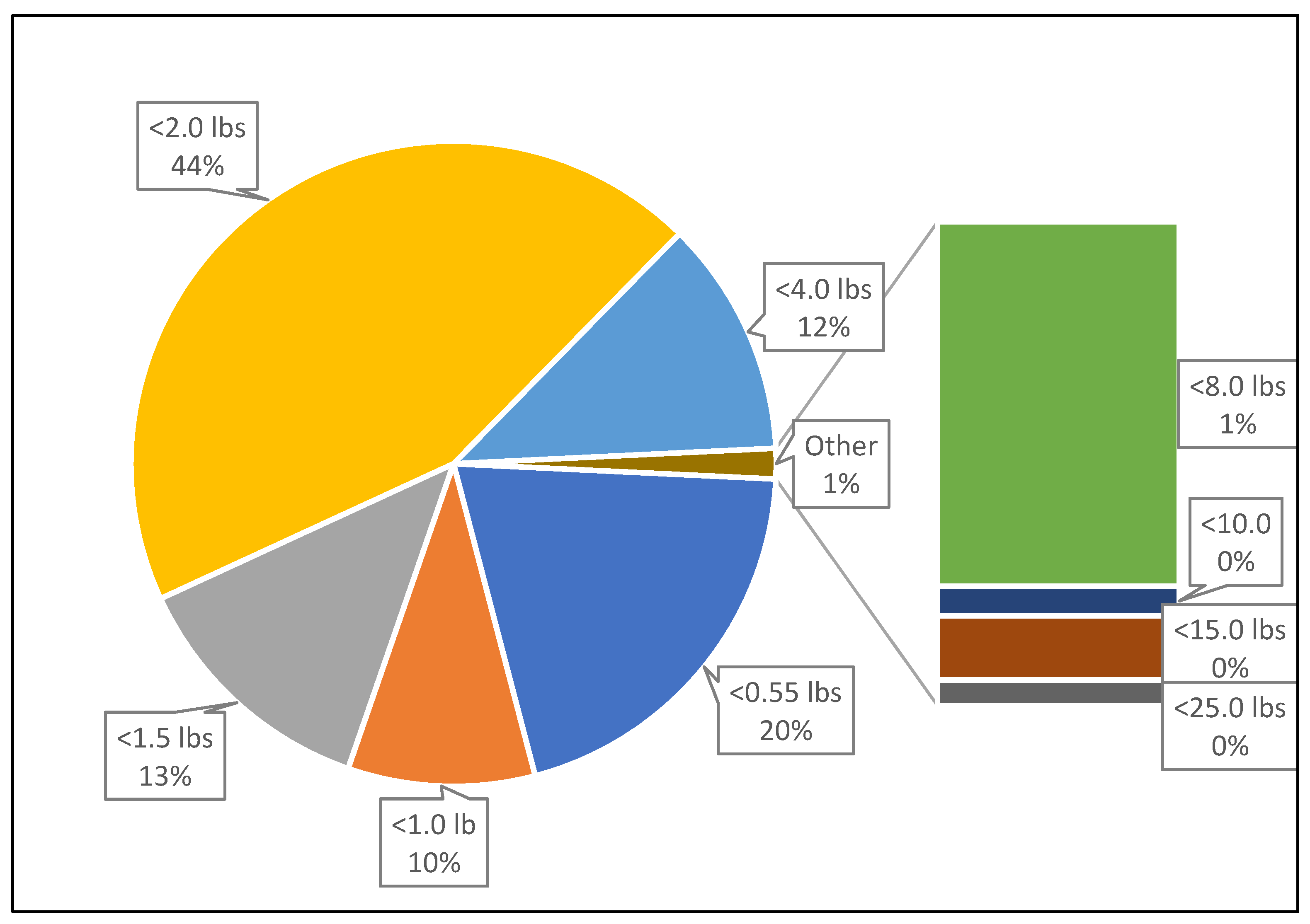

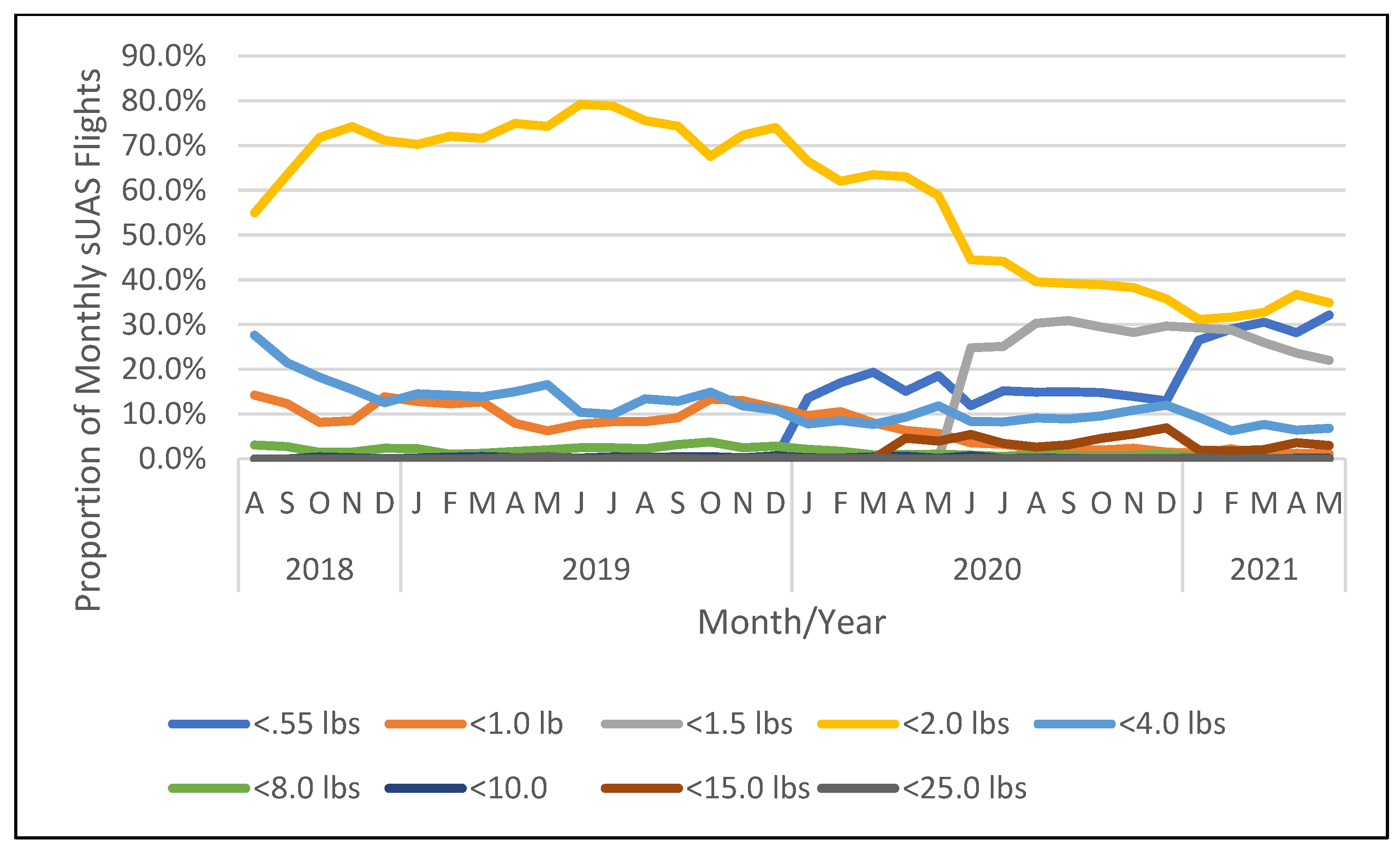

4.1. sUAS Operations’ Census

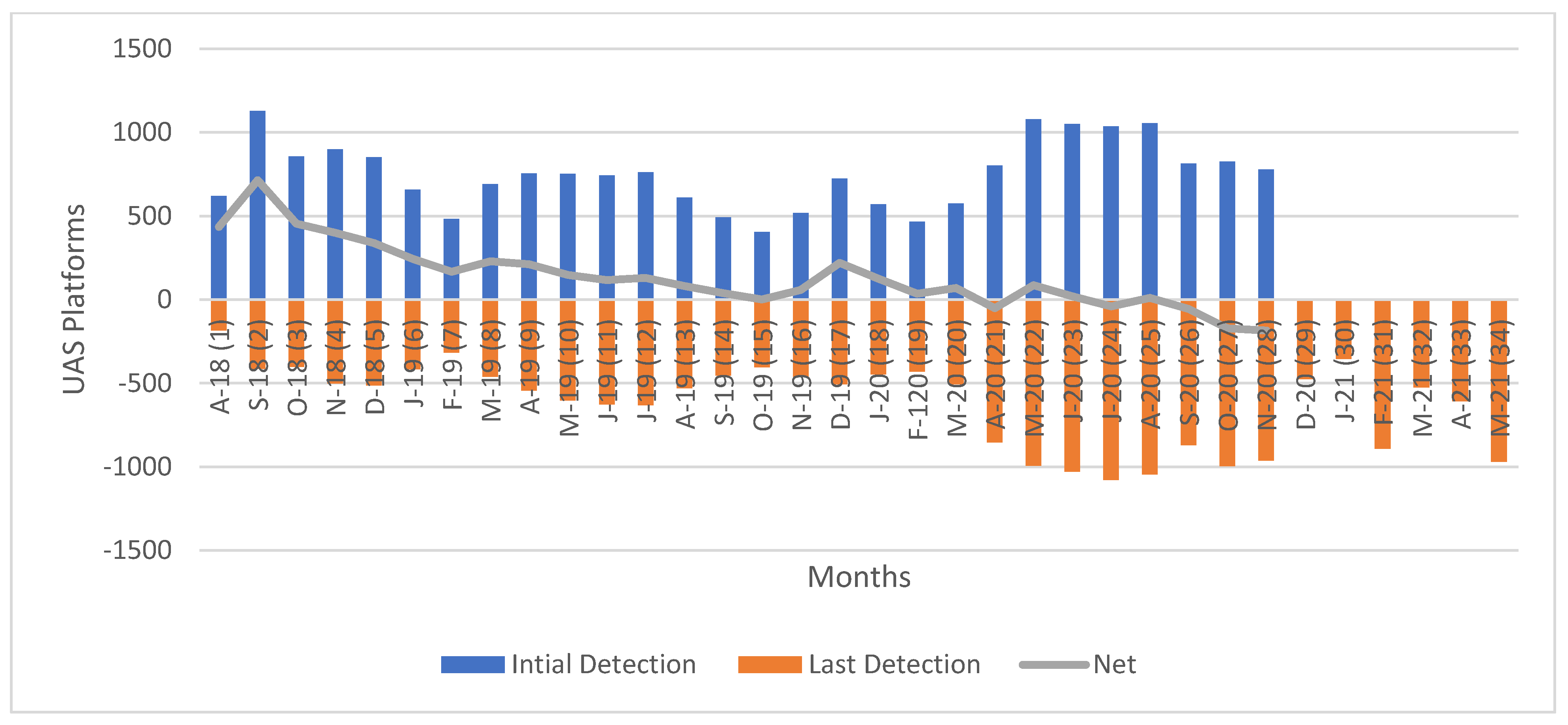

4.2. sUAS Population Trend Analysis

4.3. sUAS Activity Trend Analysis

4.4. UAS Population by Weight Class

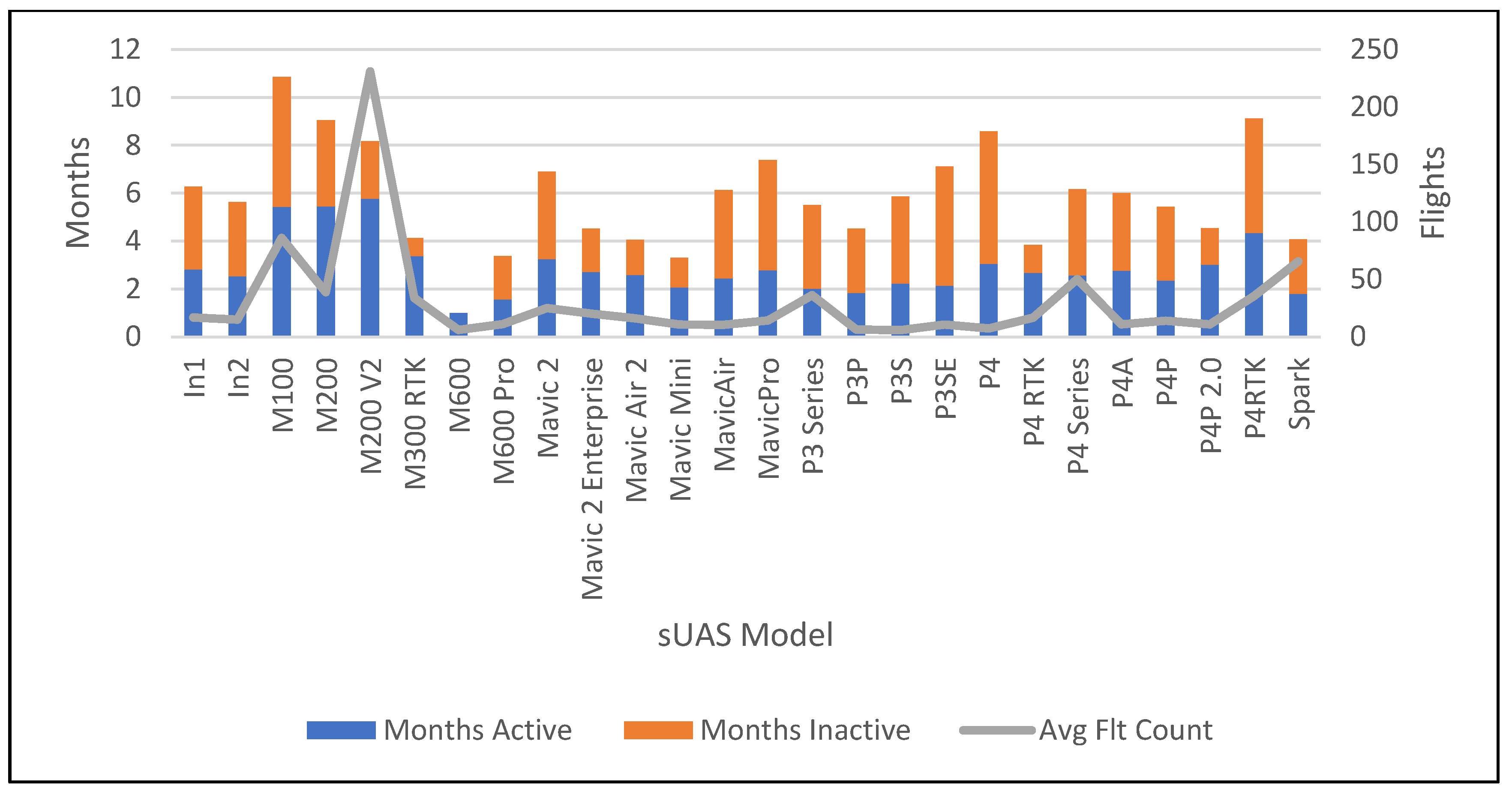

4.5. Active sUAS Population and Lifespan

5. Conclusions

- What is the lifespan of sUAS systems?

- How often are sUAS flown?

- What can sUAS platform use inform us about market trends?

5.1. sUAS Lifespan

5.2. How Often Are sUAS Flown?

5.3. Market Trends

5.4. Implications

5.5. Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Federal Aviation Administration [FAA]. FAA Aerospace Forecast FY 2024–2044: UAS Compendium. 2024. Available online: https://www.faa.gov/data_research/aviation/aerospace_forecasts/unmanned_aircraft_systems.pdf (accessed on 13 August 2024).

- Registration and Marking Requirements for Small Unmanned Aircraft, 80 FR § 78594-78598. 2015. Available online: https://www.federalregister.gov/documents/2015/12/16/2015-31750/registration-and-marking-requirements-for-small-unmanned-aircraft (accessed on 13 August 2024).

- Loffi, J.M.; Wallace, R.J.; Jacob, J.D.; Dunlap, J.C. Seeing the Threat: Pilot Visual Detection of Small Unmanned Aircraft in Visual Meteorological Conditions. Int. J. Aviat. Aeronaut. Aerosp. 2016, 3, 13. [Google Scholar] [CrossRef]

- Wallace, R.J.; Vance, S.M.; Loffi, J.M.; Jacob, J.; Dunlap, J.C. Cleared to Land: Pilot Visual Detection of Small Unmanned Aircraft During Final Approach. Int. J. Aviat. Aeronaut. Aerosp. 2019, 6, 12. [Google Scholar] [CrossRef]

- Loffi, J.M.; Wallace, R.J.; Vance, S.M.; Jacob, J.; Dunlap, J.; Mitchell, T.A.; Johnson, D.C. Pilot Visual Detection of Small Unmanned Aircraft on Final Approach during Nighttime Conditions. Int. J. Aviat. Aeronaut. Aerosp. 2021, 8, 11. [Google Scholar] [CrossRef]

- Wallace, R.J.; Winter, S.R.; Rice, S.; Kovar, D.C.; Lee, S. Three Case Studies on Small Uncrewed Aerial Systems Near Midair Collisions with Aircraft: An Evidence-Based Approach for Using Objective Uncrewed Aerial Systems Detection Technology. SAW Int. J. Aerosp. 2023, 16, 2023. [Google Scholar] [CrossRef]

- Federal Aviation Association. Recreational UAS Safety Test (TRUST). 2024. Available online: https://www.faa.gov/uas/recreational_flyers/knowledge_test_updates (accessed on 13 August 2024).

- Federal Aviation Administration. UAS Data Exchange (LAANC). 2024. Available online: https://www.faa.gov/uas/getting_started/laanc (accessed on 13 August 2024).

- Remote Identification of Unmanned Aircraft Systems [RIDUAS], 84 FR § 72438-72524. 2019. Available online: https://www.federalregister.gov/documents/2019/12/31/2019-28100/remote-identification-of-unmanned-aircraft-systems (accessed on 13 August 2024).

- Federal Aviation Administration. Remote Identification of Drones. 2024. Available online: https://www.faa.gov/uas/getting_started/remote_id (accessed on 13 August 2024).

- Drone Industry Insights. Global Drone Market Report 2023–2030. 2023. Available online: https://droneii.com/product/drone-market-report (accessed on 13 August 2024).

- Forge. DJI IPO. 2024. Available online: https://forgeglobal.com/dji_ipo/ (accessed on 13 August 2024).

- Huang, C.; Chen, Y.C.; Harris, J. Regulatory compliance and socio-demographic analyses of civil unmanned aircraft systems users. Technol. Soc. 2021, 65, 101578. [Google Scholar] [CrossRef]

- Belwafi, K.; Alkadi, R.; Alameri, S.A.; Al Hamadi, H.; Shoufan, A. Unmanned aerial vehicles’ remote identification: A tutorial and survey. IEEE Access 2022, 10, 87577–87601. [Google Scholar] [CrossRef]

- DJI. DJI Aeroscope. 2021. Available online: https://www.dji.com/aeroscope (accessed on 13 August 2024).

- 911 Security. DJI Aeroscope has Robust Capabilities to Track DJI Brand Drones. 2021. Available online: https://www.911security.com/request-aeroscope-product-details?gclid=EAIaIQobChMIoNiS__Kt8QIVF-XICh0vGgDgEAAYASAAEgIlZvD_BwE (accessed on 13 August 2024).

- 911 Security. DJI Aeroscope Review: Features, Specs, and How It’s Used to Layered Drone Detection. 2020. Available online: https://www.911security.com/blog/dji-aeroscope-review-features-specs-and-how-its-used-in-layered-drone-detection (accessed on 13 August 2024).

- DJI. DJI Developer. 2018. Available online: https://developer.dji.com/mobile-sdk/documentation/introduction/product_introduction.html#remote-controller (accessed on 13 August 2024).

- Roth, E.; DJI Quietly Discontinues Its Drone Detecting Aeroscope System. The Verge. 2023. Available online: https://www.theverge.com/2023/3/5/23626057/dji-discontinues-aeroscope-drone-detecting-system (accessed on 13 August 2024).

- ASTM International. Standard Specification for Remote ID and Tracking. 2022. Available online: https://www.astm.org/f3411-22a.html (accessed on 13 August 2024).

- Military Aerospace Electronics. What Are the ISM Bands, and What Are They Used For? 2019. Available online: https://www.militaryaerospace.com/directory/blog/14059677/what-are-the-ism-bands-and-what-are-they-used-for (accessed on 13 August 2024).

- Federal Aviation Administration. Advisory on the Application of Federal Laws to the Acquisition and Use of Technology to Detect and Mitigate Unmanned Aircraft Systems. 2020. Available online: https://www.faa.gov/sites/faa.gov/files/uas/resources/c_uas/Interagency_Legal_Advisory_on_UAS_Detection_and_Mitigation_Technologies.pdf (accessed on 13 August 2024).

- Federal Aviation Administration. Geographic Listing of Hobbyist & Non-Hobbyist Small Unmanned Aircraft Systems (sUAS) Registry Enrollments & Registrants. 2023. Available online: https://www.faa.gov/foia/electronic_reading_room/uas#registrants (accessed on 13 August 2024).

- Federal Aviation Administration. How to Register Your Drone. 2024. Available online: https://www.faa.gov/uas/getting_started/register_drone (accessed on 13 August 2024).

- Schmidt, B.; Vance, A.; DJI Won the Drone Wars, and Now It’s Paying the Price. Bloomberg. 2020. Available online: https://www.bloomberg.com/news/features/2020-03-26/dji-s-drone-supremacy-comes-at-a-price (accessed on 13 August 2024).

- Wallace, R.J.; Winter, S.R.; Rice, S.; Loffi, J.M.; Misra, S.; Lee, S.; Park, J.; Neff, A.; McNall, C. An Examination of sUAS Operations in Proximity to a Major U.S. Airport. Technol. Soc. 2024, 76, 102433. [Google Scholar] [CrossRef]

- Olivares, G.; Divo, E.; Shah, H.; Gomez, L.; Khalili, F.; Sathyanarayanna, N. Volume V: UAS Airborne Collision Severity Evaluation—Assessment of sUAS deflections Due to Aerodynamic Interaction with a 14 CFR Part 25 Commercial Aircraft. 2021. Available online: https://assureuas.com/wp-content/uploads/2021/06/VLQN0XH.pdf (accessed on 13 August 2024).

- Olivares, G.; Gomez, L.; Marco, R. Volume VII: UAS Airborne Collision Severity Evaluation—14 CFR Part 23 General Aviation. 2022. Available online: https://assureuas.com/wp-content/uploads/2021/06/Volume-VII-Airborne-Collision-Severity-Evaluation-14-CFR-Part-23-General-Aviation.pdf (accessed on 13 August 2024).

- Olivares, G.; Gomez, L.; Marco, R.; Ly, H.; Calderon del Rey, J.; Duling, C.; Zwiener, M.; Perrin, Z. Volume VI: UAS Airborne Collision Severity Evaluation—14 CFR Part 29 Rotorcraft. 2022. Available online: https://assureuas.com/wp-content/uploads/2021/06/Volume-VI-Airborne-Collision-Severity-Evaluation-14-CFR-Part-29-Rotorcraft.pdf (accessed on 13 August 2024).

- Campolettano, E.T.; Bland, M.L.; Gellner, R.A.; Sproule, D.W.; Rowson, B.; Tyson, A.M.; Duma, S.M.; Rowson, S. Ranges of Injury Risk Associated with Impact from Unmanned Aircraft Systems. Ann. Biomed. Eng. 2017, 45, 2733–2741. [Google Scholar] [CrossRef] [PubMed]

- Henderson, I.L.; Shelley, A. Examining unmanned aircraft user compliance with Civil Aviation Rules: The case of New Zealand. Transp. Policy 2023, 133, 176–185. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wallace, R.J.; Rice, S.; Lee, S.-A.; Winter, S.R. Unveiling Potential Industry Analytics Provided by Unmanned Aircraft System Remote Identification: A Case Study Using Aeroscope. Drones 2024, 8, 402. https://doi.org/10.3390/drones8080402

Wallace RJ, Rice S, Lee S-A, Winter SR. Unveiling Potential Industry Analytics Provided by Unmanned Aircraft System Remote Identification: A Case Study Using Aeroscope. Drones. 2024; 8(8):402. https://doi.org/10.3390/drones8080402

Chicago/Turabian StyleWallace, Ryan J., Stephen Rice, Sang-A Lee, and Scott R. Winter. 2024. "Unveiling Potential Industry Analytics Provided by Unmanned Aircraft System Remote Identification: A Case Study Using Aeroscope" Drones 8, no. 8: 402. https://doi.org/10.3390/drones8080402

APA StyleWallace, R. J., Rice, S., Lee, S.-A., & Winter, S. R. (2024). Unveiling Potential Industry Analytics Provided by Unmanned Aircraft System Remote Identification: A Case Study Using Aeroscope. Drones, 8(8), 402. https://doi.org/10.3390/drones8080402