A Fractional Heston-Type Model as a Singular Stochastic Equation Driven by Fractional Brownian Motion

Abstract

1. Introduction

2. Approximating Sequences in fHt Model

- (i)

- The function defined by is continuous and admits a continuous partial derivative with respect to x on .

- (ii)

- for any , there exists such that

2.1. Approximating Sequences of

- Case 2. For , the dominated convergence theorem shall be applied. Firstly, we need to show the pointwise convergence of the approximated stochastic process towards , that is . For this, let be the first time the process hits . Since the sample paths of the stochastic process are positive everywhere almost surely as in Theorem 1, then and consequently, almost surely.Next, denote the stochastic process up to stopping time . Then, for all and using the definition of given by (16), almost surely when since the drift function is monotonic.Again, the positiveness of means that We may conclude that almost surely and for all .On the other hand, the result from Hu et al. [29] (Theorem 3.1) shows that for a fixed and for all ,where is a non-random constant taking the formwhere , , and are nonrandom constants depending on parameters , andThis result also implies thatIt follows that which yields the desired convergence.

- Case 3. For , we consider a sequence of an increasing drift function and define the stochastic process as follows:where is defined by (15) and is the first time that the stochastic process hits zero. If we now define be the first time the process hits , then from Theorem 2, for any fixed , as . This implies that a.s. This is because the process remains positive up to time which is not necessary equal to infinity unlike the previous case.After using similar arguments for Case 2, one may conclude that for all . Next, we need to show that . To achieve this, we borrow some ideas from Mishura and Yurchenko-Tytarenko [30].Firstly, let be a small positive value less than the initial value such that and let be the last time the stochastic process hits (or before hits) , that is,Technically, there exists a constant such that . Now we can consider two cases: and .Case 3.1: . By triangle inequality, we haveBy applying the Callebaut’s inequality theorem, it will be easy to show that for all ,Since the drift function satisfies the linear growth condition, this means there exists a positive constant k such that . It follows thatFrom the Grönwall–Bellman inequality theorem, we obtainwhich can be shortly written as where is a non-random constant in parameters , and H taking the following formwhere and are non-random constants defined byandCase 3.2: with DefineThen we have:As previously stated, the integral in the last inequality of (24) can be expressed as followsOn the other hand, we may observe thatIt follows that,

2.2. Approximating Sequences of Stock Price Process

- 1.

- The stochastic process is a unique solution of a geometric Brownion motion of the formthat can be found using the standard Itô formula, yielding:

- 2.

- The approximated stochastic volatility and stock price processes will be compulsory for and optional for . However, for the sake of consistency, we shall use the approximated sequences (14) with for and with for .

3. Malliavin Differentiability

3.1. Preliminaries on Malliavin Calculus for fBm

- (1)

- Integration by parts, in the sense that for all ,

- (2)

- Chain rule, that is, for , then the smooth functionand

- (3)

- The future Malliavin derivative of an adapted process is zero, that is, for all ,

3.2. Differentiability of Stochastic Processes and

4. Expected Payoff Function

4.1. Differentiability of Expected Payoff Function

4.2. Some Simulations

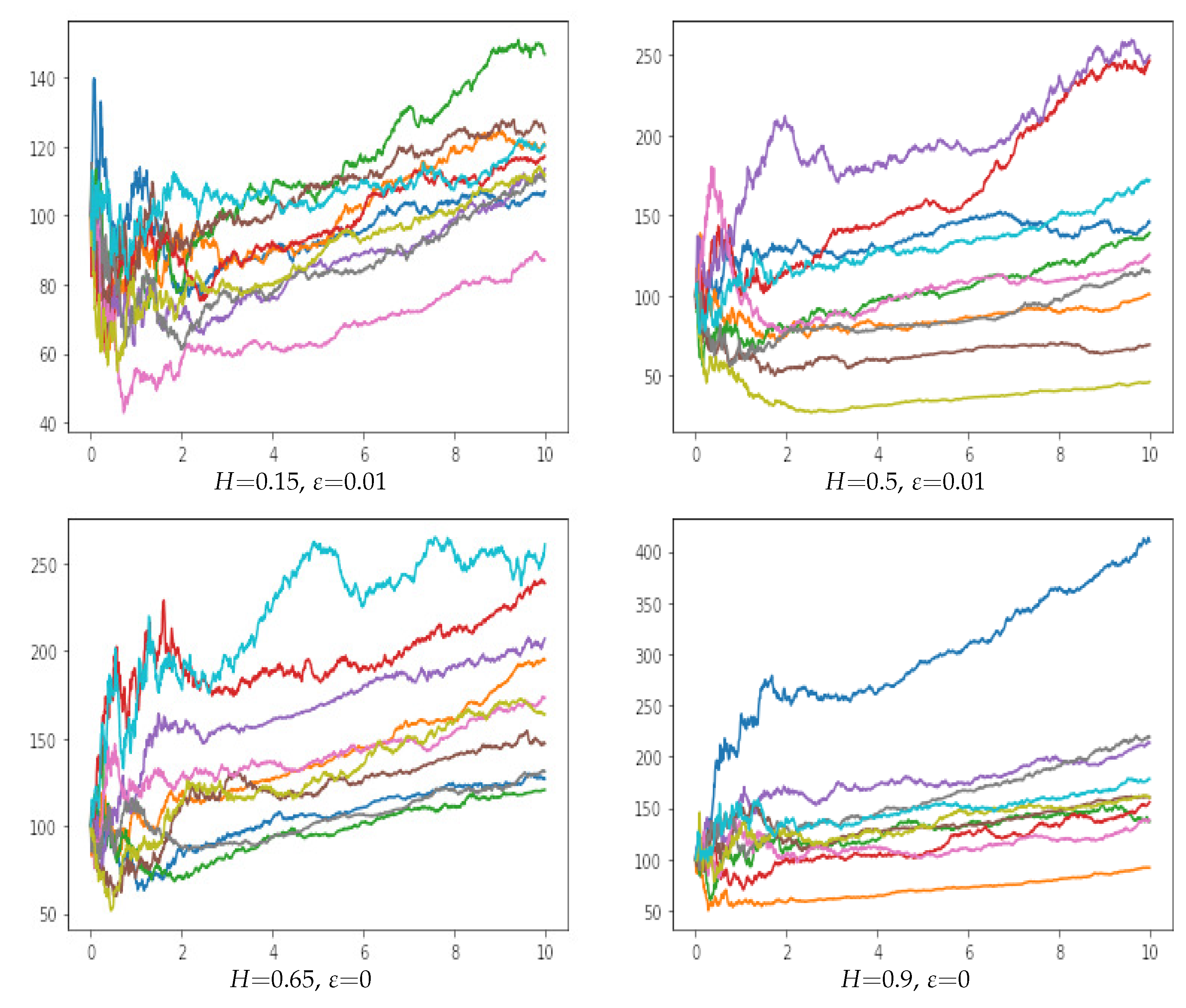

4.2.1. Simulations of Stock Price Process

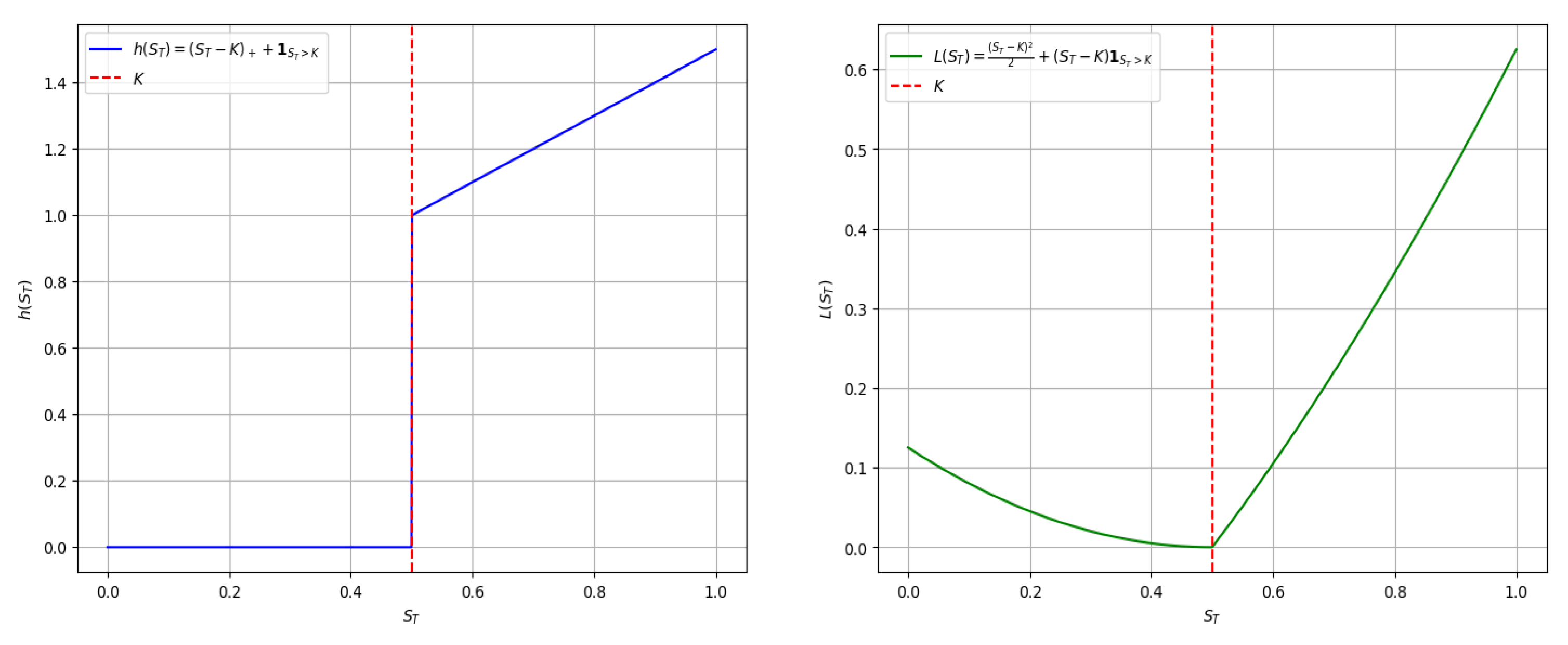

4.2.2. Payoff Function with Volatility Taking the Form of Ornstein–Uhlenbeck and Standard fCIR Processes

- 1.

- The direct expectation , for a fixed strike price .

- 2.

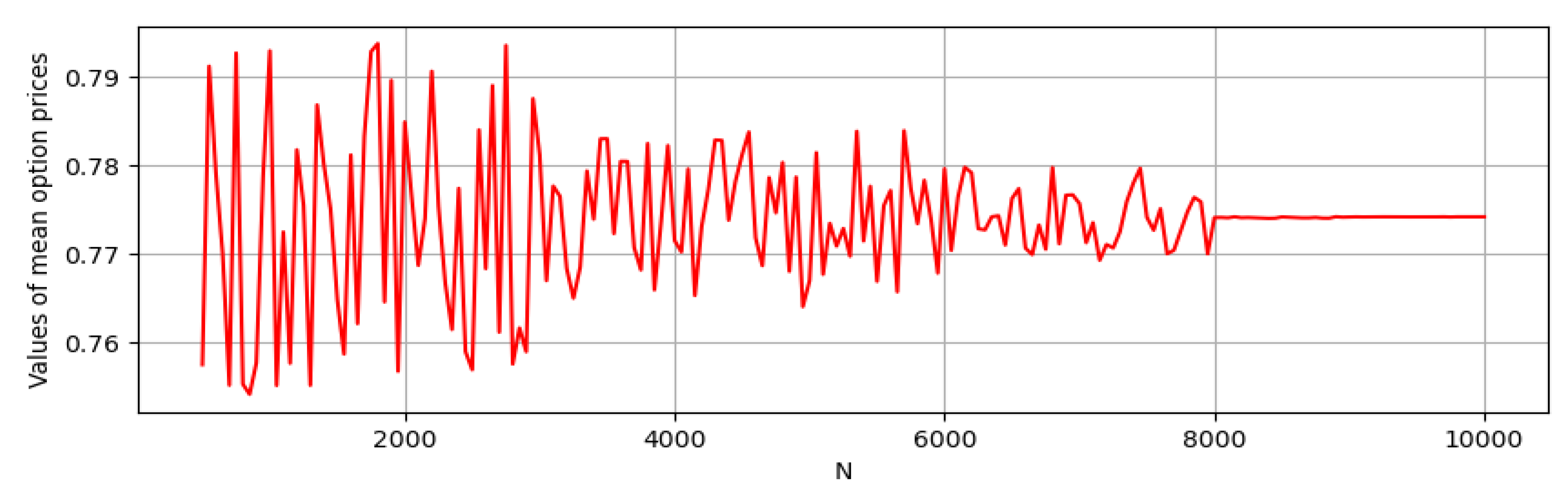

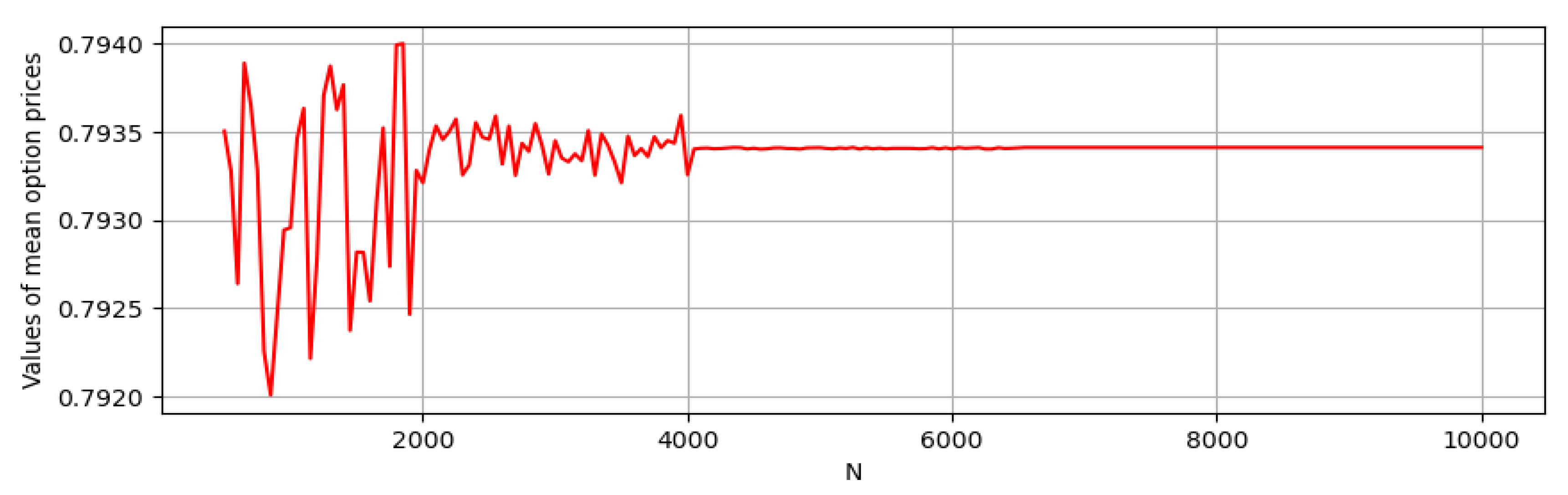

4.2.3. Expected Payoff Function with Volatility Taking the Form of fCIR Process with Time-Varying Parameters

5. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Heston, S.L. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 1993, 6, 327–343. [Google Scholar] [CrossRef]

- Alòs, E.; Mancino, M.E.; Wang, T.H. Volatility and volatility-linked derivatives: Estimation, modeling, and pricing. Decis. Econ. Financ. 2019, 42, 321–349. [Google Scholar] [CrossRef]

- Alos, E.; León, J.A.; Vives, J. On the short-time behavior of the implied volatility for jump-diffusion models with stochastic volatility. Financ. Stochastics 2007, 11, 571–589. [Google Scholar] [CrossRef]

- Fukasawa, M. Asymptotic analysis for stochastic volatility: Martingale expansion. Financ. Stochastics 2011, 15, 635–654. [Google Scholar] [CrossRef]

- Gatheral, J.; Jaisson, T.; Rosenbaum, M. Volatility is rough. Quant. Financ. 2018, 18, 933–949. [Google Scholar] [CrossRef]

- Livieri, G.; Mouti, S.; Pallavicini, A.; Rosenbaum, M. Rough volatility: Evidence from option prices. Iise Trans. 2018, 50, 767–776. [Google Scholar] [CrossRef]

- Takaishi, T. Rough volatility of Bitcoin. Financ. Res. Lett. 2020, 32, 101379. [Google Scholar] [CrossRef]

- Fukasawa, M. Volatility has to be rough. Quant. Financ. 2021, 21, 1–8. [Google Scholar] [CrossRef]

- Brandi, G.; Di Matteo, T. Multiscaling and rough volatility: An empirical investigation. Int. Rev. Financ. Anal. 2022, 84, 102324. [Google Scholar] [CrossRef]

- Comte, F.; Renault, E. Long memory in continuous-time stochastic volatility models. Math. Financ. 1998, 8, 291–323. [Google Scholar] [CrossRef]

- Chronopoulou, A.; Viens, F.G. Hurst index estimation for self-similar processes with long-memory. In Recent Development in Stochastic Dynamics and Stochastic Analysis; World Scientific: Singapore, 2010; pp. 91–117. [Google Scholar]

- Chronopoulou, A.; Viens, F.G. Estimation and pricing under long-memory stochastic volatility. Ann. Financ. 2012, 8, 379–403. [Google Scholar] [CrossRef]

- Tripathy, N. Long memory and volatility persistence across BRICS stock markets. Res. Int. Bus. Financ. 2022, 63, 101782. [Google Scholar] [CrossRef]

- Alòs, E.; Lorite, D.G. Malliavin Calculus in Finance: Theory and Practice; Chapman and Hall/CRC: Boca Raton, FL, USA, 2021. [Google Scholar]

- Funahashi, H.; Kijima, M. A solution to the time-scale fractional puzzle in the implied volatility. Fractal Fract. 2017, 1, 14. [Google Scholar] [CrossRef]

- Alòs, E.; Yang, Y. A fractional Heston model with H>1/2. Stochastics 2017, 89, 384–399. [Google Scholar] [CrossRef]

- Mishura, Y.; Yurchenko-Tytarenko, A. Approximating Expected Value of an Option with Non-Lipschitz Payoff in Fractional Heston-Type Model. Int. J. Theor. Appl. Financ. 2020, 23, 2050031. [Google Scholar] [CrossRef]

- Mehrdoust, F.; Fallah, S. On the calibration of fractional two-factor stochastic volatility model with non-Lipschitz diffusions. Commun. -Stat.-Simul. Comput. 2022, 51, 6332–6351. [Google Scholar] [CrossRef]

- Tong, K.Z.; Liu, A. The valuation of barrier options under a threshold rough Heston model. J. Manag. Sci. Eng. 2023, 8, 15–31. [Google Scholar] [CrossRef]

- Richard, A.; Tan, X.; Yang, F. On the discrete-time simulation of the rough Heston model. Siam J. Financ. Math. 2023, 14, 223–249. [Google Scholar] [CrossRef]

- Mishura, Y.; Piterbarg, V.; Ralchenko, K.; Yurchenko-Tytarenko, A. Stochastic representation and path properties of a fractional Cox–Ingersoll–Ross process. Theory Probab. Math. Stat. 2018, 97, 167–182. [Google Scholar] [CrossRef]

- Mishura, Y.; Yurchenko-Tytarenko, A. Fractional Cox–Ingersoll–Ross process with non-zero “mean”. Mod. Stochastics Theory Appl. 2018, 5, 99–111. [Google Scholar] [CrossRef]

- Mpanda, M.M.; Mukeru, S.; Mulaudzi, M. Generalisation of fractional Cox–Ingersoll–Ross process. Results Appl. Math. 2022, 15, 100322. [Google Scholar] [CrossRef]

- Nourdin, I. Selected Aspects of Fractional Brownian Motion; Springer: Berlin/Heidelberg, Germany, 2012; Volume 4. [Google Scholar]

- Decreusefond, L.; Üstünel, A.S. Stochastic analysis of the fractional Brownian motion. Potential Anal. 1999, 10, 177–214. [Google Scholar] [CrossRef]

- Nualart, D.; Ouknine, Y. Regularization of differential equations by fractional noise. Stoch. Processes Their Appl. 2002, 102, 103–116. [Google Scholar] [CrossRef]

- Bezborodov, V.; Di Persio, L.; Mishura, Y. Option pricing with fractional stochastic volatility and discontinuous payoff function of polynomial growth. Methodol. Comput. Appl. Probab. 2019, 21, 331–366. [Google Scholar] [CrossRef]

- Alos, E.; Ewald, C.O. Malliavin differentiability of the Heston volatility and applications to option pricing. Adv. Appl. Probab. 2008, 40, 144–162. [Google Scholar] [CrossRef]

- Hu, Y.; Nualart, D.; Song, X. A singular stochastic differential equation driven by fractional Brownian motion. Stat. Probab. Lett. 2008, 78, 2075–2085. [Google Scholar] [CrossRef]

- Mishura, Y.; Yurchenko-Tytarenko, A. Fractional Cox–Ingersoll–Ross process with small Hurst indices. Mod. Stochastics Theory Appl. 2019, 6, 13–39. [Google Scholar] [CrossRef]

- Nualart, D. The Malliavin Calculus and Related Topics; Springer: Berlin/Heidelberg, Germany, 2006; Volume 1995. [Google Scholar]

- Da Prato, G. Introduction to Stochastic Analysis and Malliavin Calculus; Springer: Berlin/Heidelberg, Germany, 2014; Volume 13. [Google Scholar]

- Nunno, G.D.; Øksendal, B.; Proske, F. Malliavin Calculus for Lévy Processes with Applications to Finance; Springer: Berlin/Heidelberg, Germany, 2008. [Google Scholar]

- Bouleau, N.; Hirsch, F. Dirichlet Forms and Analysis on Wiener Space; Walter de Gruyter: Berlin, Germany, 2010; Volume 14. [Google Scholar]

- Detemple, J.; Garcia, R.; Rindisbacher, M. Representation formulas for Malliavin derivatives of diffusion processes. Financ. Stochastics 2005, 9, 349–367. [Google Scholar] [CrossRef]

- Mukeru, S. The zero set of fractional Brownian motion is a Salem set. J. Fourier Anal. Appl. 2018, 24, 957–999. [Google Scholar] [CrossRef]

- Altmayer, M.; Neuenkirch, A. Multilevel Monte Carlo quadrature of discontinuous payoffs in the generalized Heston model using Malliavin integration by parts. Siam J. Financ. Math. 2015, 6, 22–52. [Google Scholar] [CrossRef]

| H | 0.1 | 0.3 | 0.5 | 0.7 | 0.9 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean/CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV |

| 0.774185342 | 0.062159457 | 0.782211975 | 0.015363114 | 0.775305642 | 0.053605636 | 0.765667823 | 0.022561751 | 0.776062568 | 0.061121985 | |

| 0.932824188 | 0.023154477 | 0.959352477 | 0.019764205 | 0.946670803 | 0.008803027 | 0.952432308 | 0.016014640 | 0.948353316 | 0.008871172 | |

| 0.707885444 | 0.093317545 | 0.715438258 | 0.077237936 | 0.695277007 | 0.053520175 | 0.720631067 | 0.041407711 | 0.729078909 | 0.085659766 | |

| H | 0.1 | 0.3 | 0.5 | 0.7 | 0.9 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean/CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV |

| 0.79340973 | 0.07560649 | 0.81121348 | 0.04028921 | 0.78827183 | 0.11421244 | 0.76642501 | 0.08935762 | 0.7704734 | 0.13411309 | |

| 0.99910672 | 0.09628926 | 0.95410606 | 0.16524115 | 0.97622451 | 0.06896021 | 0.97074148 | 0.10076119 | 1.013755924 | 0.10492516 | |

| 0.67871381 | 0.08759139 | 0.69286223 | 0.09071164 | 0.66834204 | 0.10850252 | 0.69416225 | 0.09554705 | 0.707316469 | 0.07008638 | |

| H | 0.1 | 0.3 | 0.5 | 0.7 | 0.9 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean/CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV |

| 0.757738549 | 0.048177774 | 0.769114549 | 0.057692257 | 0.756162793 | 0.045562288 | 0.756665572 | 0.051234111 | 0.763148888 | 0.043265712 | |

| 0.932035897 | 0.012595508 | 0.934337494 | 0.022642941 | 0.933212125 | 0.024487 | 0.928706032 | 0.014969569 | 0.929103212 | 0.01457107 | |

| 0.770104152 | 0.088196662 | 0.782432528 | 0.062946479 | 0.75433847 | 0.069371091 | 0.746931996 | 0.072156192 | 0.75975843 | 0.084981952 | |

| H | 0.1 | 0.3 | 0.5 | 0.7 | 0.9 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean/CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV | Mean | CV |

| 0.769174923 | 0.159481951 | 0.79459017 | 0.136648616 | 0.781942914 | 0.157116756 | 0.747618003 | 0.12525256 | 0.755713234 | 0.06592363 | |

| 0.94650013 | 0.102404072 | 1.02769617 | 0.128530355 | 0.919334248 | 0.111971197 | 0.983793301 | 0.095406694 | 0.88152163 | 0.101523439 | |

| 0.803170587 | 0.273211512 | 0.793796973 | 0.205160841 | 0.756164588 | 0.210899491 | 0.742696383 | 0.203031148 | 0.759959966 | 0.198280955 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mpanda, M.M. A Fractional Heston-Type Model as a Singular Stochastic Equation Driven by Fractional Brownian Motion. Fractal Fract. 2024, 8, 330. https://doi.org/10.3390/fractalfract8060330

Mpanda MM. A Fractional Heston-Type Model as a Singular Stochastic Equation Driven by Fractional Brownian Motion. Fractal and Fractional. 2024; 8(6):330. https://doi.org/10.3390/fractalfract8060330

Chicago/Turabian StyleMpanda, Marc Mukendi. 2024. "A Fractional Heston-Type Model as a Singular Stochastic Equation Driven by Fractional Brownian Motion" Fractal and Fractional 8, no. 6: 330. https://doi.org/10.3390/fractalfract8060330

APA StyleMpanda, M. M. (2024). A Fractional Heston-Type Model as a Singular Stochastic Equation Driven by Fractional Brownian Motion. Fractal and Fractional, 8(6), 330. https://doi.org/10.3390/fractalfract8060330