Fractional-Order Financial System and Fixed-Time Synchronization

Abstract

:1. Introduction

- A financial model with a Caputo operator is constructed, which reflects the memory property of the financial system. The dynamic behaviors of the fractional-order financial system with variations of fractional orders and parameters are studied;

- The fixed-time synchronization and identification of the unknown parameters are realized. The resulting setting time of the fractional-order control system depends only on the parameters of the controller and the order of the fractional-order derivative;

- The proposed fixed-time synchronization method is applied to fractional-order chaotic financial systems, which has theoretical and practical significance.

2. Preliminaries, Algorithms and Modeling

2.1. Preliminaries

2.2. Algorithms

2.3. Modeling

2.4. Equilibrium Points Analysis

3. Dynamics Analysis

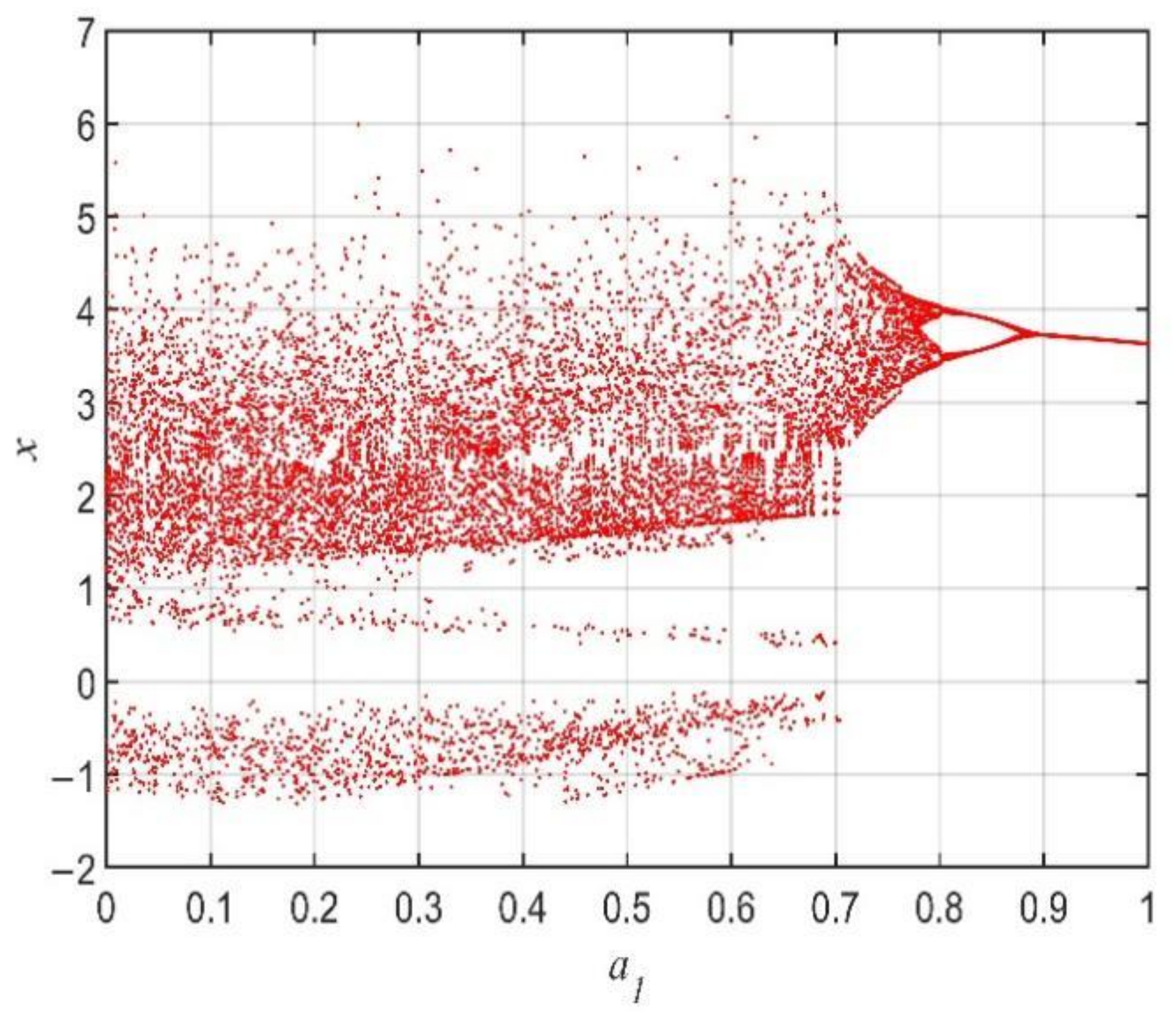

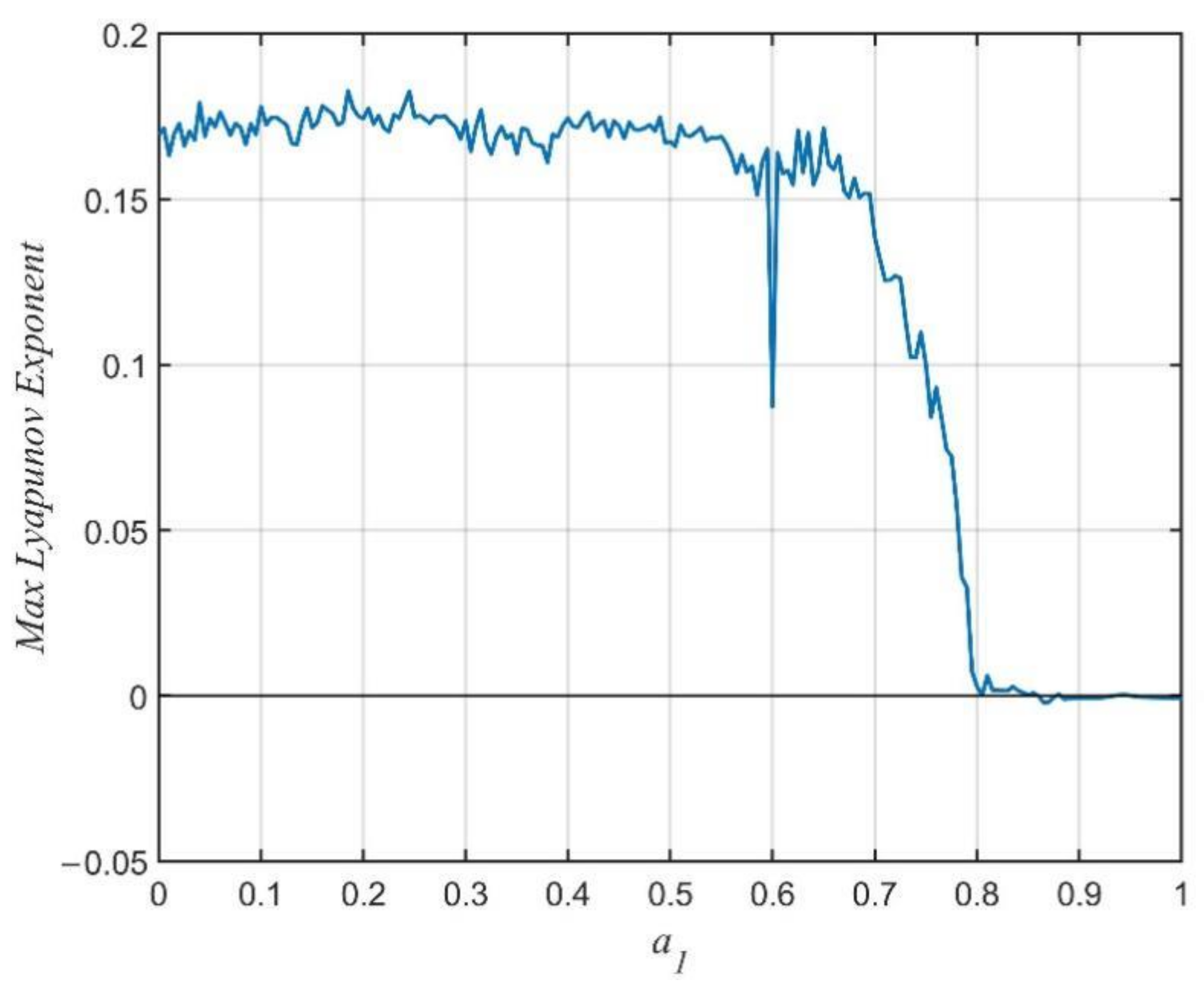

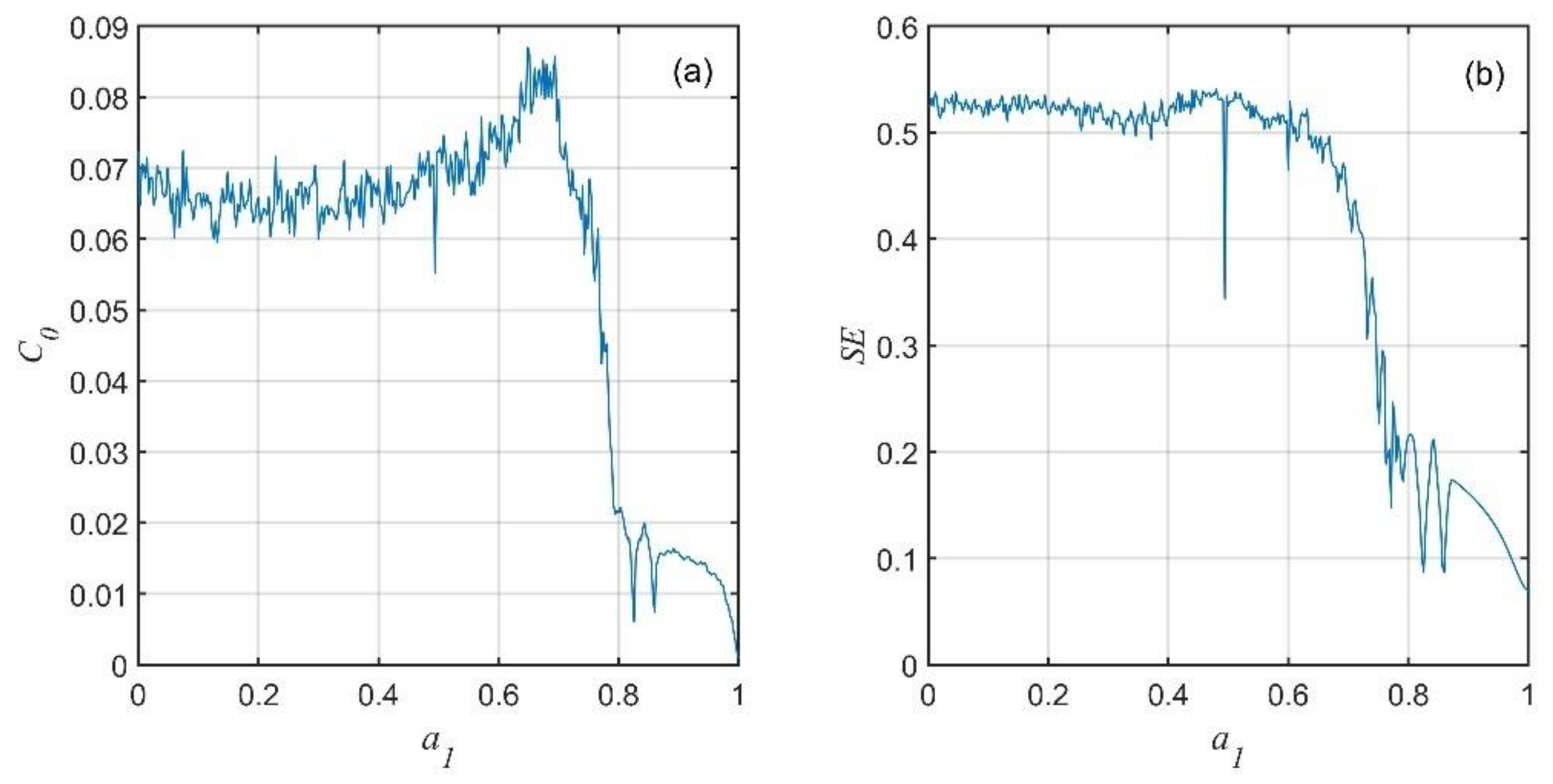

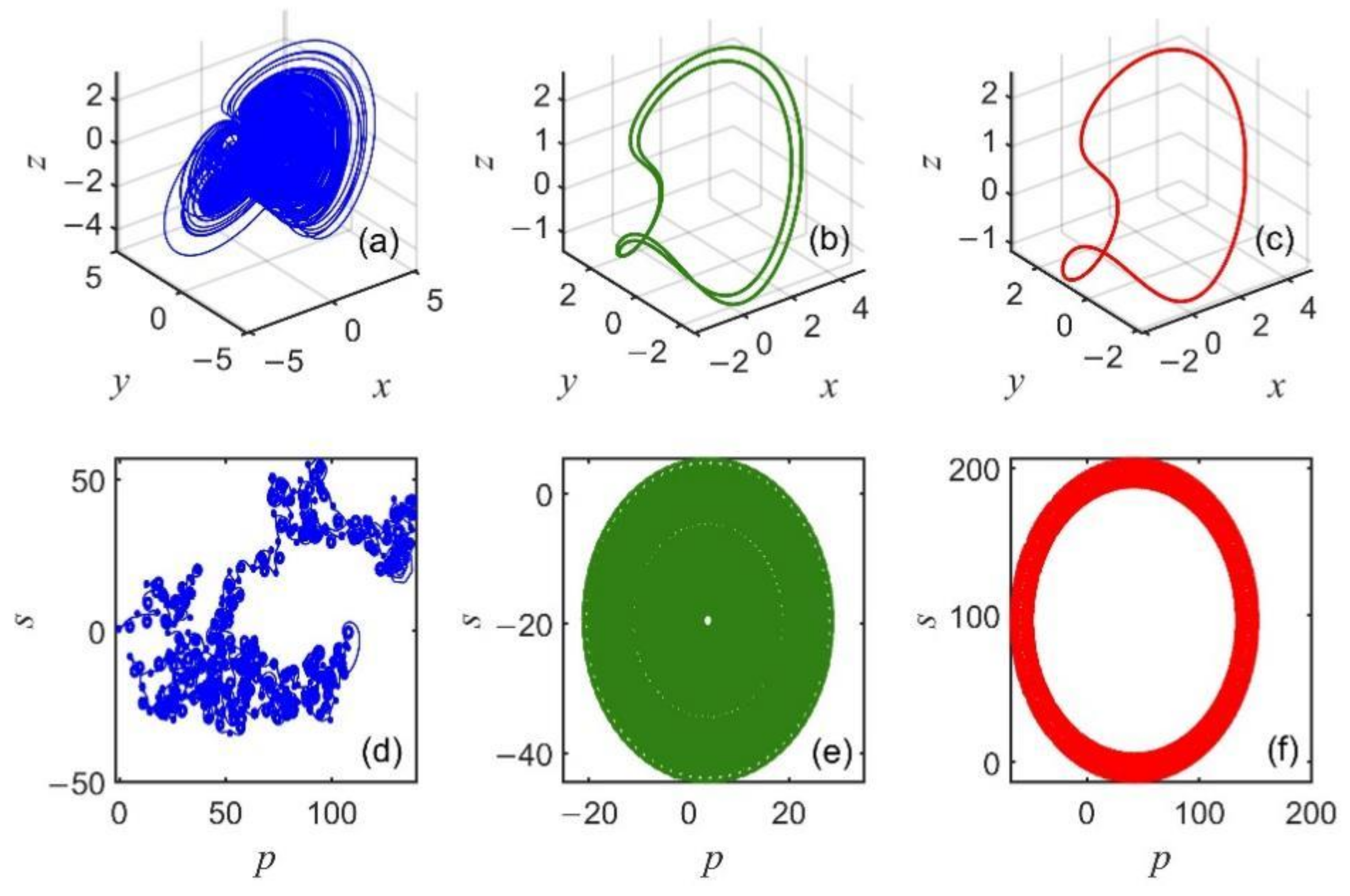

3.1. Dynamics of the Financial System with the Variation in the Parameter

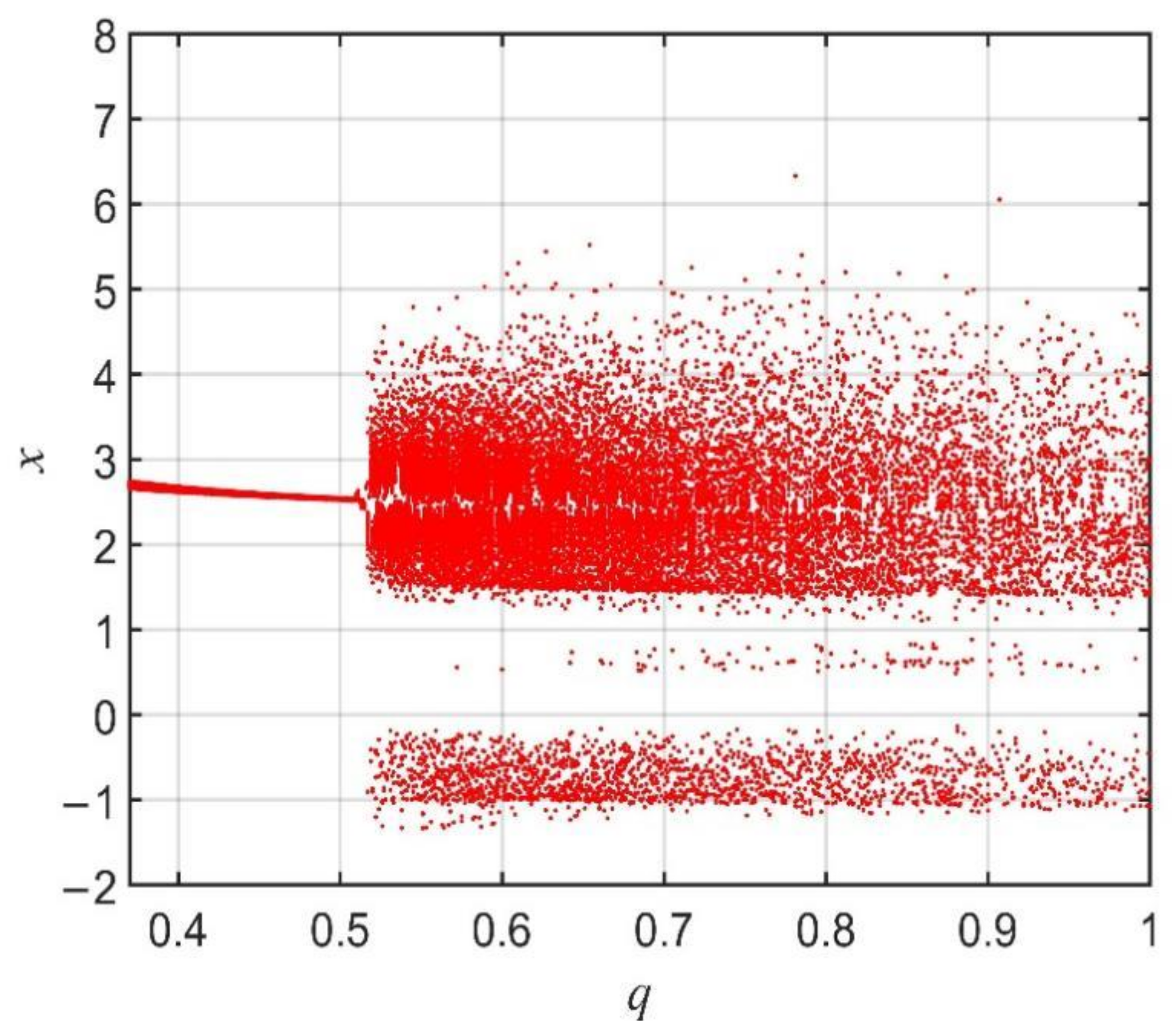

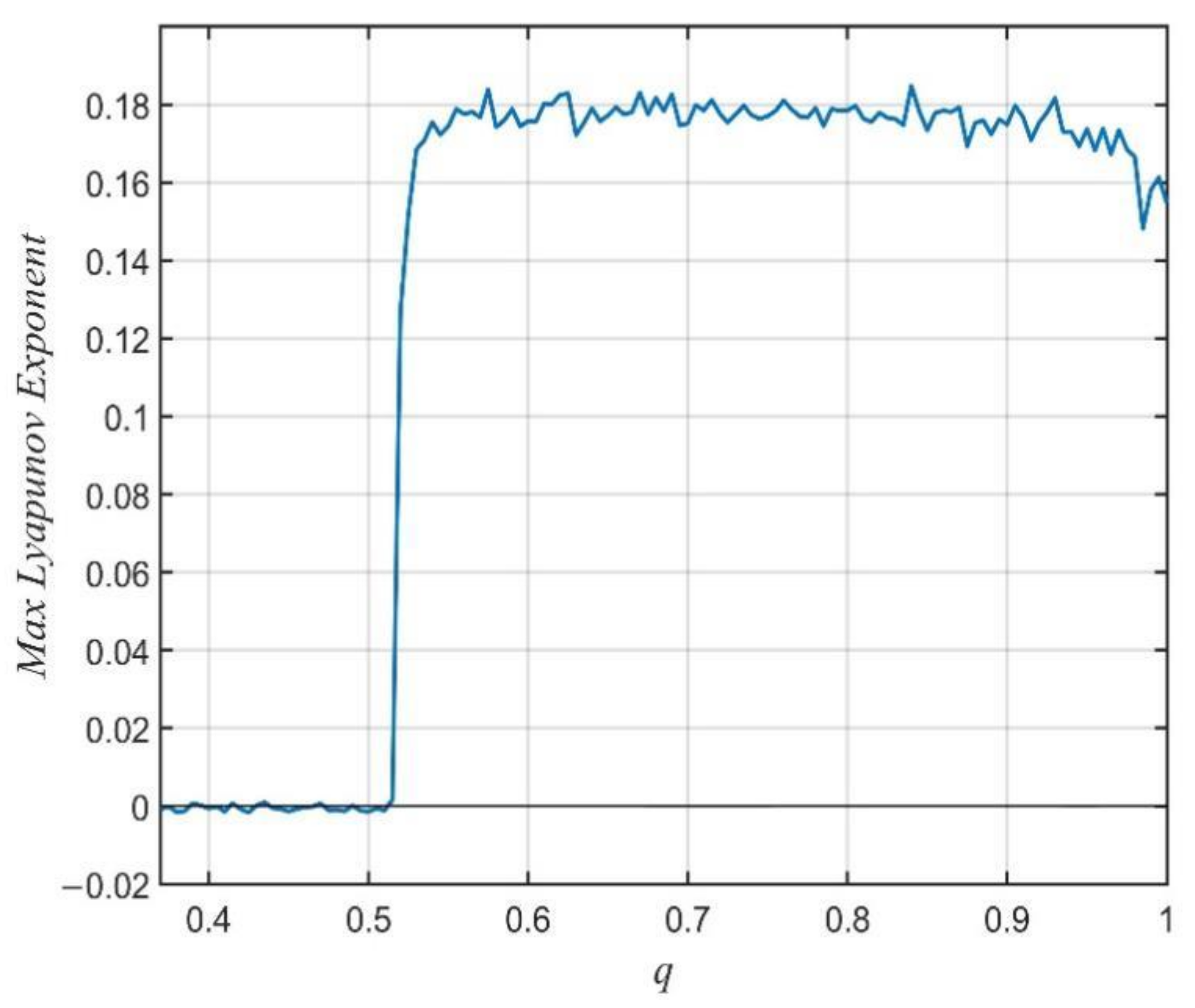

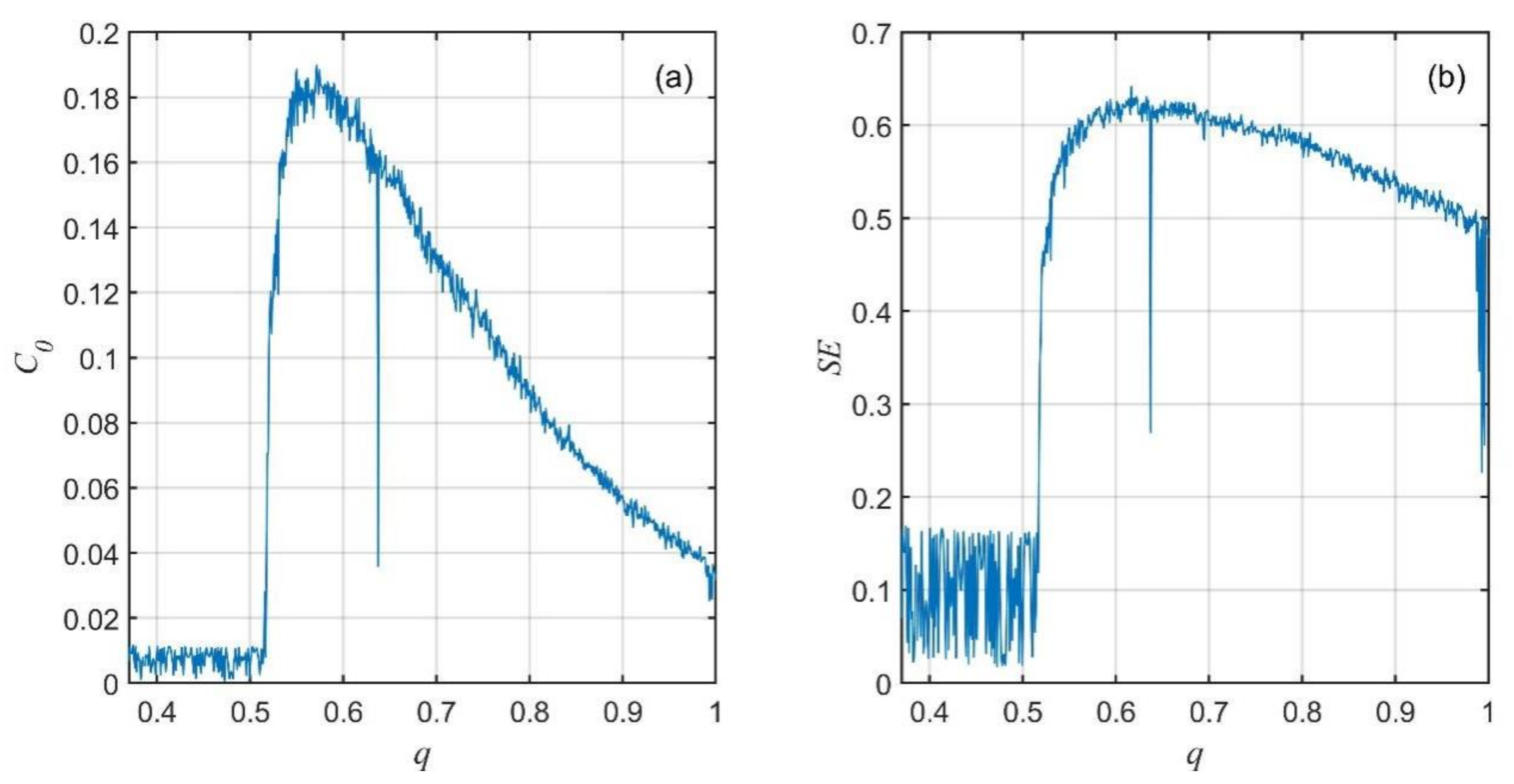

3.2. Dynamics of the Financial System with the Variation in the Fractional Order

4. Fixed-Time Synchronization of Fractional-Order Chaotic Financial Systems

4.1. Fixed-Time Synchronization Implementation

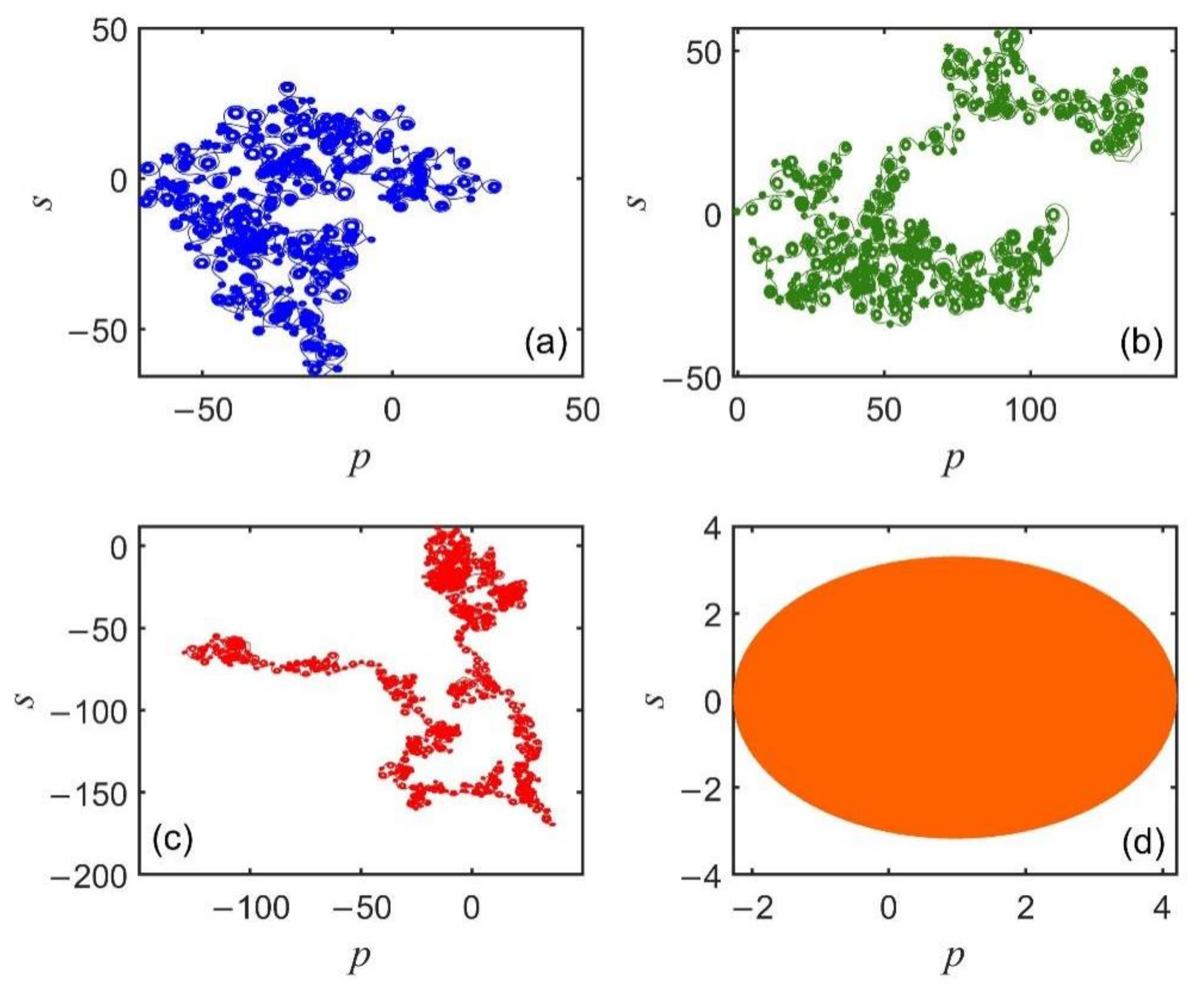

4.2. Numerical Simulation

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Yuan, L.; Yang, Q. Parameter identification and synchronization of fractional-order chaotic systems. Commun. Nonlinear Sci. Numer. Simul. 2012, 17, 305–316. [Google Scholar] [CrossRef]

- Yuan, L.; Zheng, S.; Alam, Z. Dynamics analysis and cryptographic application of fractional logistic map. Nonlinear Dyn. 2019, 96, 615–636. [Google Scholar] [CrossRef]

- Chen, L.; Yin, H.; Huang, T.; Yuan, L.; Zheng, S.; Yin, L. Chaos in fractional-order discrete neural networks with application to image encryption. Neural Netw. 2020, 125, 174–184. [Google Scholar] [CrossRef] [PubMed]

- He, Y.; Zheng, S.; Yuan, L. Dynamics of fractional-order digital manufacturing supply chain system and its control and synchronization. Fractal Fract. 2021, 5, 128. [Google Scholar] [CrossRef]

- Cafagna, D.; Grassi, G. Bifurcation and chaos in the fraction-order Chen system via time-domain approach. Int. J. Bifurc. Chaos 2008, 18, 1845–1863. [Google Scholar] [CrossRef]

- Tavazoei, M.; Asemani, M. On Robust stability of incommensurate fractional-order systems. Commun. Nonlinear Sci. Numer. Simul. 2020, 90, 105344. [Google Scholar] [CrossRef]

- Wang, J.; Mou, J.; Xiong, L.; Zhang, Y.; Cao, Y. Fractional-order design of a novel non-autonomous laser chaotic system with compound nonlinearity and its circuit realization. Chaos Solitons Fractals 2021, 152, 111324. [Google Scholar] [CrossRef]

- Mahmoud, E.E.; Trikha, P.; Jahanzaib, L.S.; Almaghrabi, O.A. Dynamic analysis and chaos control of the fractional chaotic ecological model. Chaos Solitons Fractals 2020, 141, 110348. [Google Scholar] [CrossRef]

- Debbouche, N.; Almatroud, A.O.; Ouannas, A.; Batiha, I.M. Chaos and coexisting attractors in glucose-insulin regulatory system with incommensurate fractional-order derivatives. Chaos Solitons Fractals 2021, 143, 110575. [Google Scholar] [CrossRef]

- Ma, J.; Chen, Y. Study for the bifurcation topological structure and the global complicated character of a kind of nonlinear finance system (I). Appl. Math. Mech. 2001, 22, 1240–1251. [Google Scholar] [CrossRef]

- Ma, J.; Chen, Y. Study for the bifurcation topological structure and the global complicated character of a kind of nonlinear finance system (II). Appl. Math. Mech. 2001, 22, 1375–1382. [Google Scholar] [CrossRef]

- Yu, H.; Cai, G.; Li, Y. Dynamic analysis and control of a new hyperchaotic finance system. Nonlinear Dyn. 2012, 67, 2171–2182. [Google Scholar] [CrossRef]

- Cai, G.; Yao, L.; Hu, P.; Fang, X. Adaptive full state hybrid function projective synchronization of financial hyperchaotic systems with uncertain parameters. Discret. Contin. Dyn. Syst.-Ser. B 2017, 18, 2019–2028. [Google Scholar] [CrossRef]

- Jin, S.; Zhao, L. Complexity analysis of a four-dimensional energy-Economy-environment dynamic system. Complexity 2020, 2020, 7626792. [Google Scholar] [CrossRef]

- Gholamin, P.; Sheikhani, A. Dynamic analysis of a new three-dimensional fractional chaotic system. Pramana 2019, 92, 91. [Google Scholar] [CrossRef]

- Zhang, X.; Zhu, H.; Sahoo, A. Hopf bifurcation and chaos of a delayed finance System. Complexity 2019, 2019, 6715036. [Google Scholar] [CrossRef]

- Peters, E.E. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics; Wiley: New York, NY, USA, 1994; pp. 39–64. [Google Scholar]

- Granger, C.W.J.; Joyeux, R. An introduction to long memory time series models and fractional differencing. Time Ser. 1980, 1, 15–39. [Google Scholar] [CrossRef]

- Baillie, R.N. Long memory processes and fractional integration in econometrics. J. Econom. 1996, 73, 5–59. [Google Scholar] [CrossRef]

- Xin, B.; Li, Y. 0-1 test for chaos in a fractional order financial system with investment incentive. Abstr. Appl. Anal. 2013, 2013, 876298. [Google Scholar] [CrossRef]

- Xu, S.; Lv, H.; Liu, H.; Liu, A. Robust control of disturbed fractional-order economical chaotic systems with uncertain parameters. Complexity 2019, 2019, 7567695. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Z.; Zhang, J.; Cheng, F.; Xu, Y. Bifurcation analysis and stability criterion for the nonlinear fractional-order three-dimensional financial system with delay. Asian J. Control 2019, 21, 1–11. [Google Scholar] [CrossRef]

- Wang, S.; He, S.; Yousefpour, A.; Jahanshahi, H.; Repnik, R.; Perc, M. Chaos and complexity in a fractional-order financial system with time delays. Chaos Solitons Fractals 2020, 131, 109521. [Google Scholar] [CrossRef]

- Chu, Y.M.; Bekiros, S.; Zambrano-Serrano, E.; Orozco-López, O.; Lahmiri, S.; Jahanshahi, H.; Aly, A.A. Artificial macro-economics: A chaotic discrete-time fractional-order laboratory model. Chaos Solitons Fractals 2021, 145, 110776. [Google Scholar] [CrossRef]

- Lin, Z.; Wang, H. Modeling and application of fractional-order economic growth model with time delay. Fractal Fract. 2021, 5, 74. [Google Scholar] [CrossRef]

- Jahanshahi, H.; Sajjadi, S.S.; Bekiros, S.; Aly, A.A. On the development of variable-order fractional hyperchaotic economic system with a nonlinear model predictive controller. Chaos Solitons Fractals 2021, 144, 110698. [Google Scholar] [CrossRef]

- Zhang, Y.; Du, Y. Synchronization Problem of a novel fractal-fractional orders’ hyperchaotic finance system. Math. Probl. Eng. 2021, 2021, 4152160. [Google Scholar] [CrossRef]

- Hajipour, A.; Hajipour, M.; Baleanu, D. On the adaptive sliding mode controller for a hyperchaotic fractional-order financial system. Phys. A Stat. Mech. Its Appl. 2018, 497, 139–153. [Google Scholar] [CrossRef]

- Liping, C.; Khan, M.A.; Atangana, A.; Kumar, S. A new financial chaotic model in Atangana-Baleanu stochastic fractional differential equations. AEJ-Alex. Eng. J. 2021, 60, 5193–5204. [Google Scholar] [CrossRef]

- Shi, J.; He, K.; Fang, H. Chaos, Hopf bifurcation and control of a fractional-order delay financial system. Math. Comput. Simul. 2022, 194, 348–364. [Google Scholar] [CrossRef]

- Jahanshahi, H.; Shahriari-Kahkeshi, M.; Alcaraz, R.; Wang, X.; Singh, V.P.; Pham, V.T. Entropy analysis and neural network-based adaptive control of a non-equilibrium four-dimensional chaotic system with hidden attractors. Entropy 2019, 21, 156. [Google Scholar] [CrossRef] [Green Version]

- Zheng, S. Parameter identification and adaptive impulsive synchronization of uncertain complex-variable chaotic systems. Nonlinear Dyn. 2013, 74, 957–967. [Google Scholar] [CrossRef]

- Zheng, S. Stability of uncertain impulsive complex-variable chaotic systems with time varying delays. ISA Trans. 2015, 58, 20–26. [Google Scholar] [CrossRef] [PubMed]

- Zheng, S. Synchronization analysis of time delay complex-variable chaotic systems with discontinuous coupling. J. Frankl. Inst. 2016, 353, 1460–1477. [Google Scholar] [CrossRef]

- Chen, H.; Yu, L.; Wang, Y.; Guo, M. Synchronization of a hyperchaotic finance System. Complexity 2021, 2021, 6618435. [Google Scholar] [CrossRef]

- Tacha, O.I.; Volos, C.K.; Kyprianidis, I.M.; Stouboulos, I.N.; Vaidyanathan, S.; Pham, V.T. Analysis, adaptive control and circuit simulation of a novel nonlinear finance system. Appl. Math. Comput. 2016, 276, 200–217. [Google Scholar] [CrossRef]

- Rao, R.; Zhu, Q. Exponential synchronization and stabilization of delayed feedback hyperchaotic financial system. Adv. Differ. Equ. 2021, 2021, 216. [Google Scholar] [CrossRef]

- Zheng, S. Further Results on the impulsive synchronization of uncertain complex-variable chaotic delayed systems. Complexity 2016, 21, 131–142. [Google Scholar] [CrossRef]

- Zheng, S.; Yuan, L. Nonperiodically intermittent pinning synchronization of complex-valued complex networks with non-derivative and derivative coupling. Phys. A Stat. Mech. Its Appl. 2019, 525, 587–605. [Google Scholar] [CrossRef]

- Bhat, S.P.; Bernstein, D.S. Finite-time stability of continuous autonomous systems. SIAM J Control Optim 2000, 38, 751–766. [Google Scholar] [CrossRef]

- Li, H.L.; Cao, J.; Jiang, H.; Alsaedi, A. Finite-time synchronization and parameter identification of uncertain fractional-order complex networks. Phys. A: Stat. Mech. Its Appl. 2019, 533, 122027. [Google Scholar] [CrossRef]

- Luo, R.; Su, H. Finite-time control and synchronization of a class of systems via the twisting controller. Chin. J. Phys. 2017, 55, 2199–2207. [Google Scholar] [CrossRef]

- Yang, J.; Xiong, J.; Cen, J.; He, W. Finite-time generalized synchronization of non-identical fractional order chaotic systems and its application in speech secure communication. PLoS ONE 2022, 17, e0263007. [Google Scholar] [CrossRef] [PubMed]

- Polyakov, A. Nonlinear feedback design for fixed-time stabilization of linear control systems. IEEE Trans. Automat. Contr. 2012, 57, 2106–2110. [Google Scholar] [CrossRef]

- Su, H.; Luo, R.; Fu, J.; Huang, M. Fixed time stability of a class of chaotic systems with disturbances by using sliding mode control. ISA Trans. 2021, 118, 75–82. [Google Scholar] [CrossRef] [PubMed]

- Fu, J.; Luo, R.; Huang, M.; Su, H. Fixed time synchronization of a class of chaotic systems based via the saturation control. Rev. Mex. De Fis. 2021, 67, 041401. [Google Scholar] [CrossRef]

- Ding, Y.; Liu, H. A new fixed-time stability criterion for fractional-order systems. AIMS Math. 2022, 7, 6173–6181. [Google Scholar] [CrossRef]

- Shirkavand, M.; Pourgholi, M.; Yazdizadeh, A. Robust global fixed-time synchronization of different dimensions fractional-order chaotic systems. Chaos Solitons Fractals 2022, 154, 111616. [Google Scholar] [CrossRef]

- Kandasamy, U.; Rihan, F.A.; Rajan, R.; El-Khouly, M.M. New fixed-time stability theorems for delayed fractional-order systems and applications. IEEE Access 2022, 10, 63230–63244. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, Y. Fixed-time Synchronization of delayed fractional-order memristor-based fuzzy cellular neural networks. IEEE Access 2020, 8, 165951–165962. [Google Scholar] [CrossRef]

- Podlubny, I. Fractional Differential Equations, Mathematics in Science and Engineering; Academic Press: Cambridge, MA, USA, 1999. [Google Scholar]

- Petráš, I. Fractional-Order Nonlinear Systems: Modeling, Analysis and Simulation; DBLP: Trier, Germany, 2011. [Google Scholar]

- Yu, Y.; Li, H.X.; Wang, S.; Yu, J. Dynamic analysis of a fractional-order Lorenz chaotic system. Chaos Solitons Fractals 2009, 42, 1181–1189. [Google Scholar] [CrossRef]

- Staniczenko, P.; Lee, C.; Jones, N. Rapidly detecting disorder in rhythmic biological signals: A spectral entropy measure to identify cardiac arrhythmias. Phys. Rev. E 2009, 79, 011915. [Google Scholar] [CrossRef] [PubMed]

- Shen, E.; Cai, Z.; Gu, F. Mathematical foundation of a new complexity measure. Appl. Math. Mech. 2005, 26, 1188–1196. [Google Scholar]

- Gottwald, G.; Melbourne, I. A new test for chaos in deterministic systems. Proc. R. Soc. A Math. Phys. Eng. Sci. 2004, 460, 603–611. [Google Scholar] [CrossRef]

- Zhang, S.; Yu, Y.; Wang, H. Mittag-Leffler stability of fractional-order hopfield neural networks. Nonlinear Anal. Hybrid Syst. 2015, 16, 104–121. [Google Scholar] [CrossRef]

- Hardy, G.H.; Littlewood, J.E.; Polya, G. Inequalities; Cambridge University Press: Cambridge, UK, 1952. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, Y.; Peng, J.; Zheng, S. Fractional-Order Financial System and Fixed-Time Synchronization. Fractal Fract. 2022, 6, 507. https://doi.org/10.3390/fractalfract6090507

He Y, Peng J, Zheng S. Fractional-Order Financial System and Fixed-Time Synchronization. Fractal and Fractional. 2022; 6(9):507. https://doi.org/10.3390/fractalfract6090507

Chicago/Turabian StyleHe, Yingjin, Jun Peng, and Song Zheng. 2022. "Fractional-Order Financial System and Fixed-Time Synchronization" Fractal and Fractional 6, no. 9: 507. https://doi.org/10.3390/fractalfract6090507

APA StyleHe, Y., Peng, J., & Zheng, S. (2022). Fractional-Order Financial System and Fixed-Time Synchronization. Fractal and Fractional, 6(9), 507. https://doi.org/10.3390/fractalfract6090507