Proposal for Customer Identification Service Model Based on Distributed Ledger Technology to Transfer Virtual Assets

Abstract

:1. Introduction

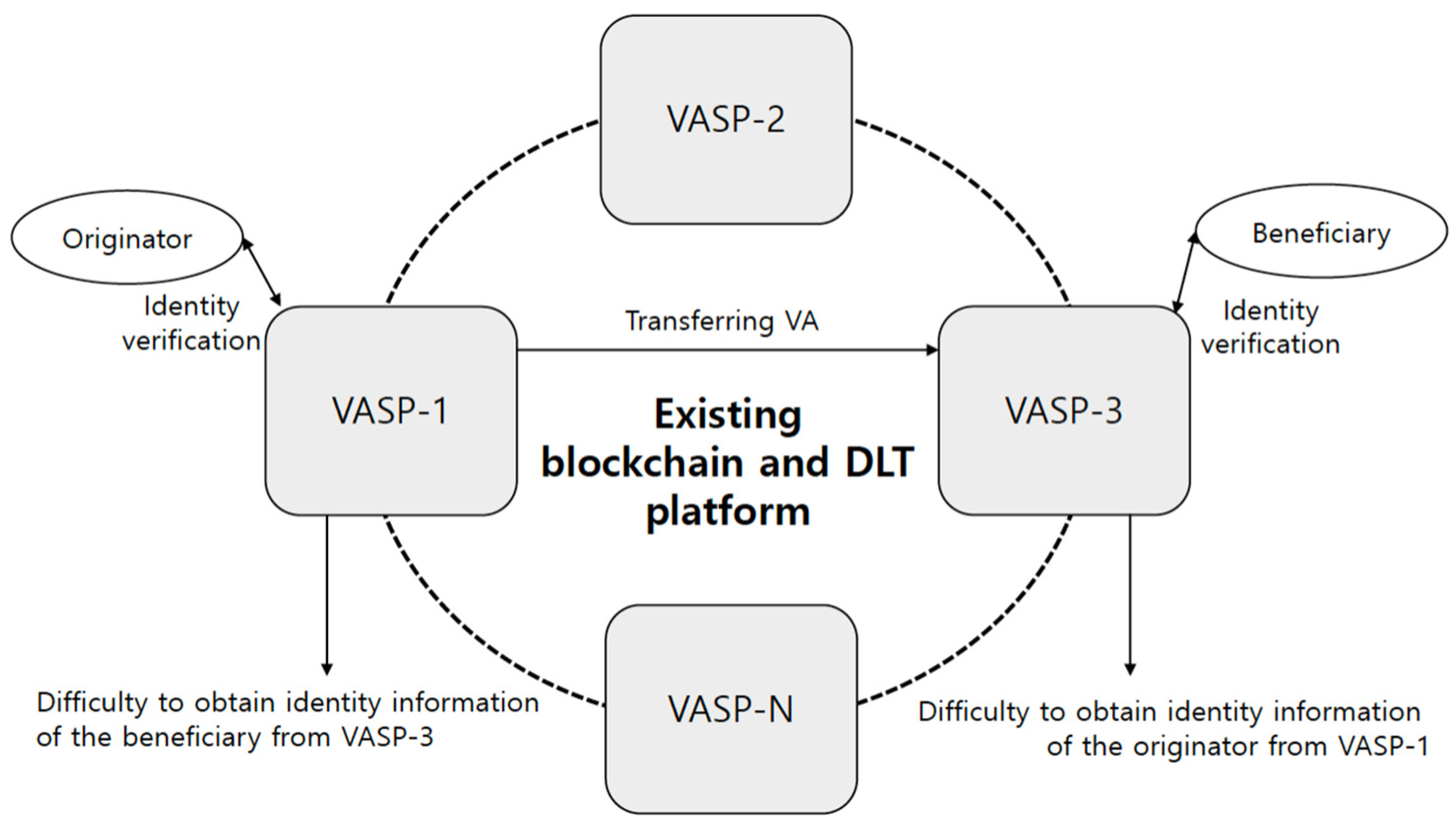

2. Background

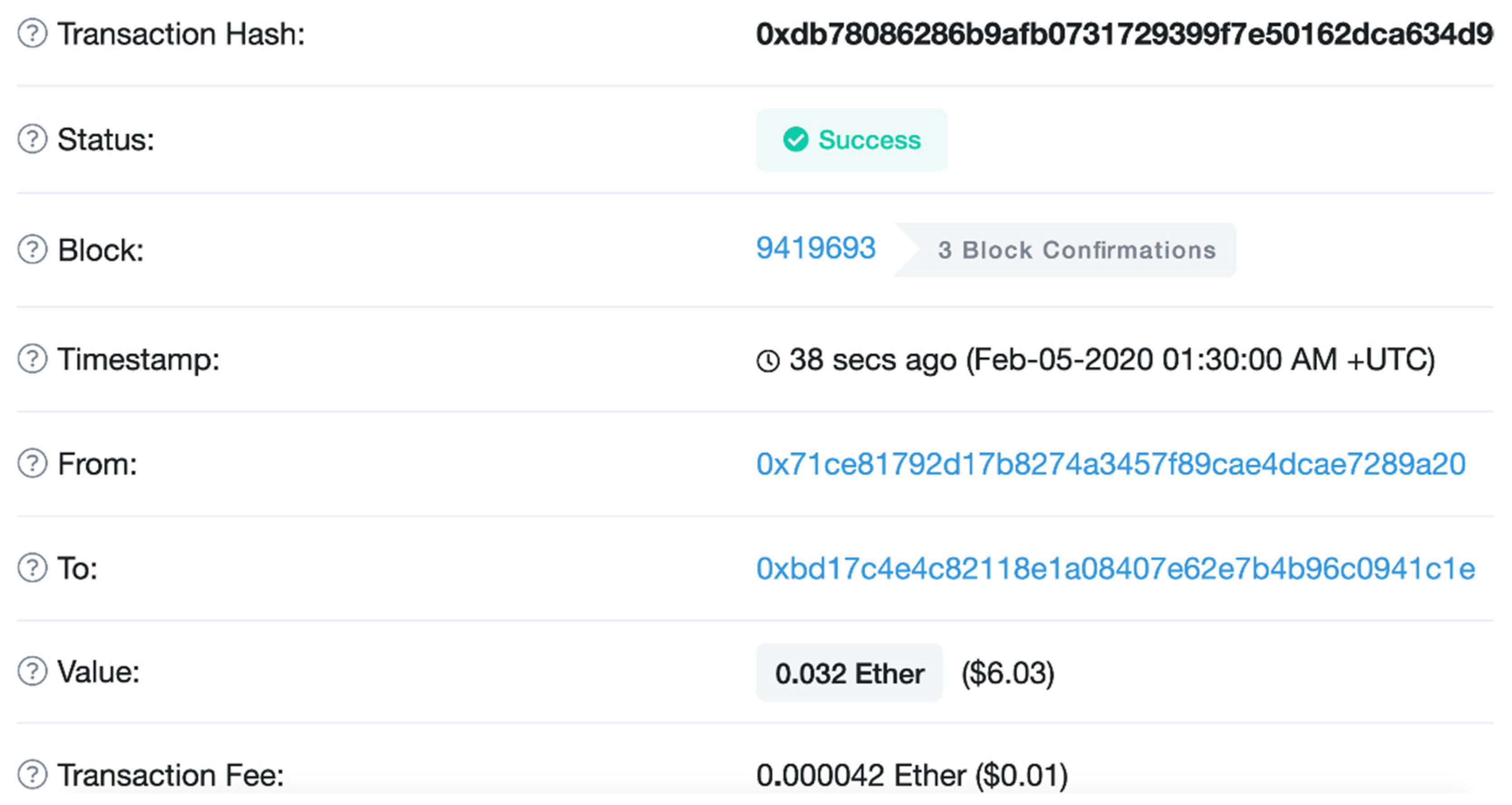

2.1. Virtual Asset Transfer

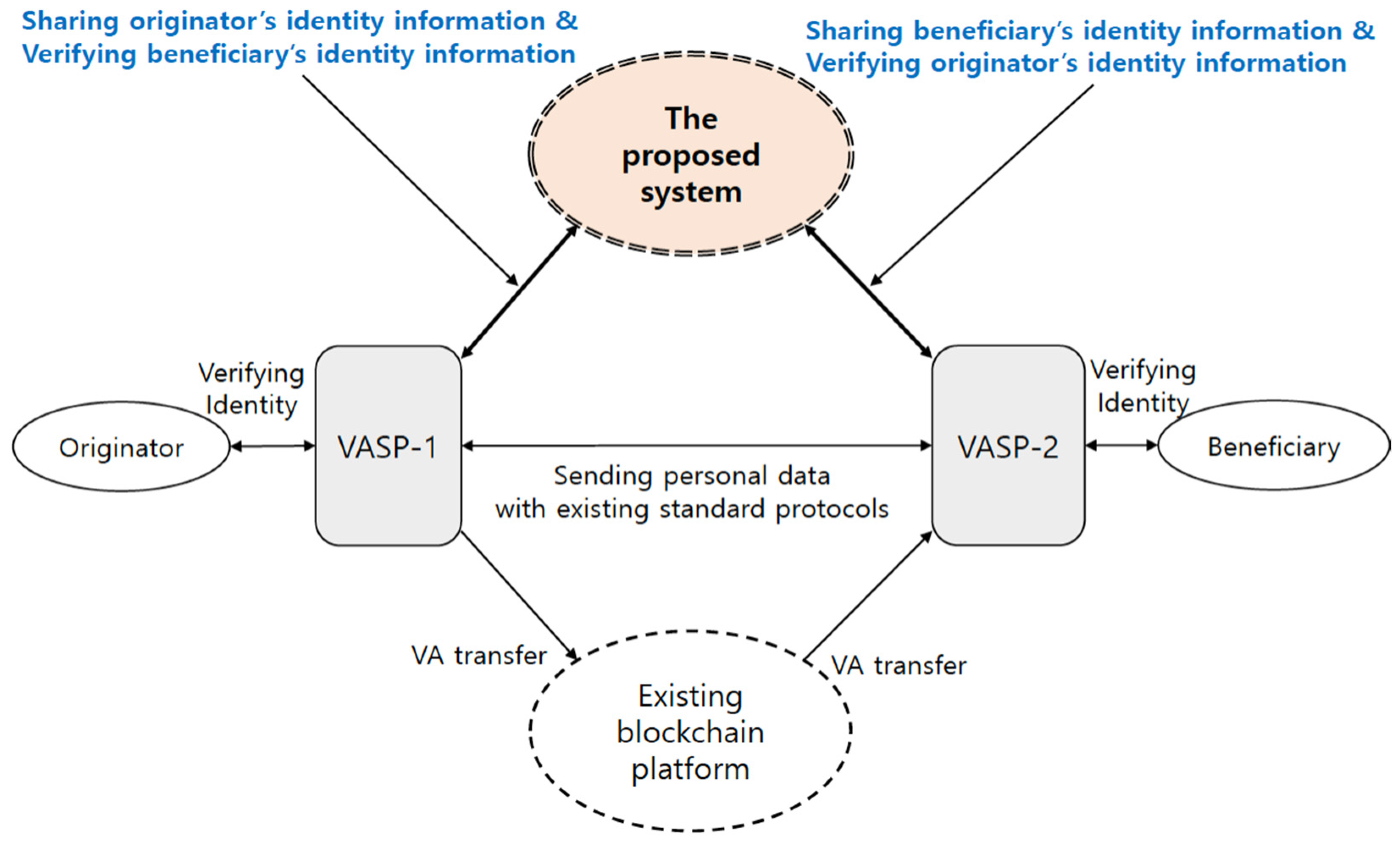

2.2. Solution to Customer Identification

3. Related Studies

3.1. Terms and Definition

- A virtual asset (VA) is a digital representation of value that can be digitally traded, or transferred, and can be used for payment or investment purposes [9];

- Virtual asset service provider (VASP) means any natural or legal person that, as a business, conducts one or more of the activities or operations (e.g., exchange, transfer, safekeeping, etc.) for or on behalf of another natural or legal person [9];

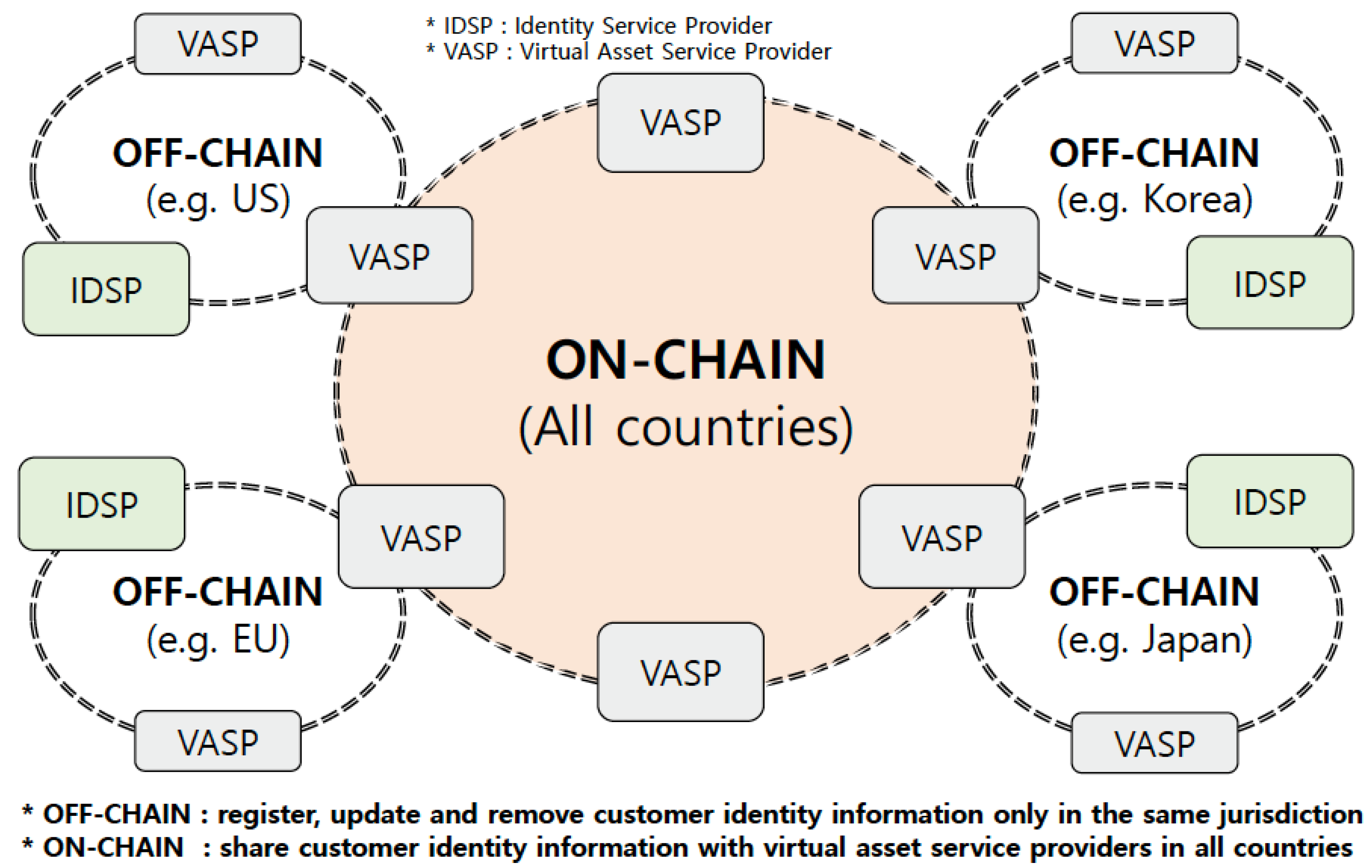

- Off-chain: related to a blockchain system, but located, performed, or run outside that blockchain system [10];

- On-chain: located, performed, or run inside a blockchain system [10];

- Identity service provider (IDSP): a generic umbrella term that refers to all of the various types of entities involved in providing and operating the processes and components of a digital ID system or solution. IDSPs provide digital ID solutions to users and relying parties [11];

- Permissioned distributed ledger system: distributed ledger system in which permissions are required to maintain and operate a node [10];

- Private distributed ledger system: distributed ledger system that is accessible for use only to a limited group of DLT users [10];

- Know your customer (KYC): process to verify the identity of a customer in order to prevent financial crime, money laundering, and terrorism financing;

- Customer due diligence (CDD): a process where relevant information about the customer is collected and evaluated for any potential risk for the organization or money laundering/terrorist financing activities.

3.2. Regulation Issues of CDD for AML

7. (a) R.10—The occasional transactions designated threshold above which VASPs are required to conduct CDD is USD/EUR 1000;

7. (b) R.16—Countries should ensure that originating VASPs obtain and hold required and accurate originator information and required beneficiary information on virtual asset transfers. Countries should ensure that beneficiary VASPs obtain and hold required originator information and required and accurate beneficiary information on virtual asset transfers. The same obligations apply to financial institutions when sending or receiving virtual asset transfers on behalf of a customer.

Article 79 Recommendation 10 is technology-neutral. Recommendation 10 (a) permits financial institutions to use “documents” as well as “information or data”, when conducting customer identification and verification. Recommendation 10 (a) does not impose any restrictions on the form (documentary/physical or digital) that identity evidence—“source documents, information or data”—can take.[11]

3.3. Regulation Issues of Privacy

- Article 2: Definitions (1–2): “A pseudonymization” means the removal of a part of personal data, or the replacement of part or all, such that a particular individual is not identifiable without additional information;

- Article 21: Destruction of personal data (1): The personal data processor shall destroy the personal data without delay when the data becomes unnecessary, such as the expired retention period or the achievement of the purpose of processing the data;

- Article 28-2: Processing pseudonym information (1): The personal data processor may process the pseudonym information without the consent of the data subject for statistical preparation, scientific research, and public record preservation [17].

3.4. Problem with Customer Identification

3.5. Other Approaches for Customer Identification

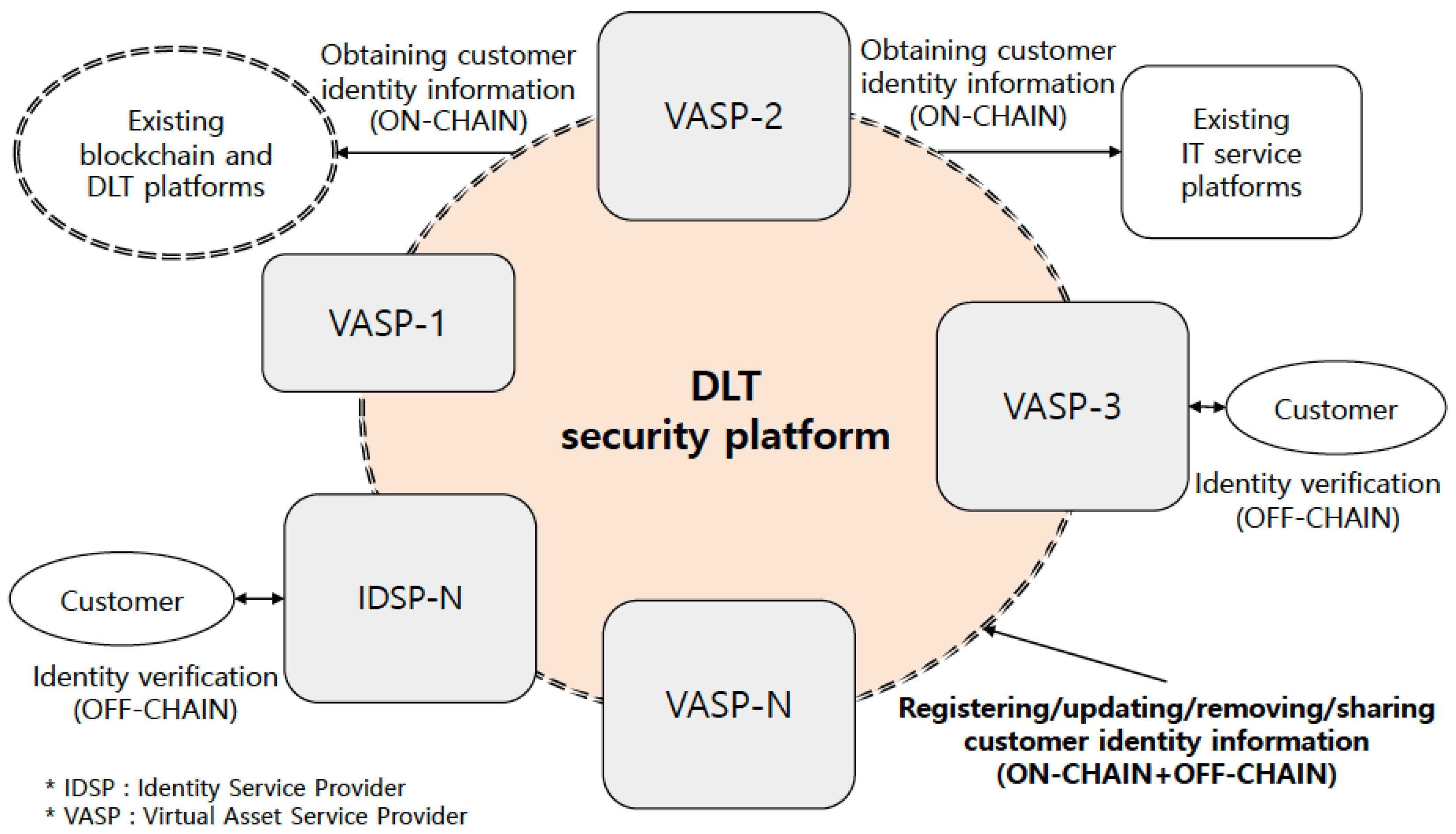

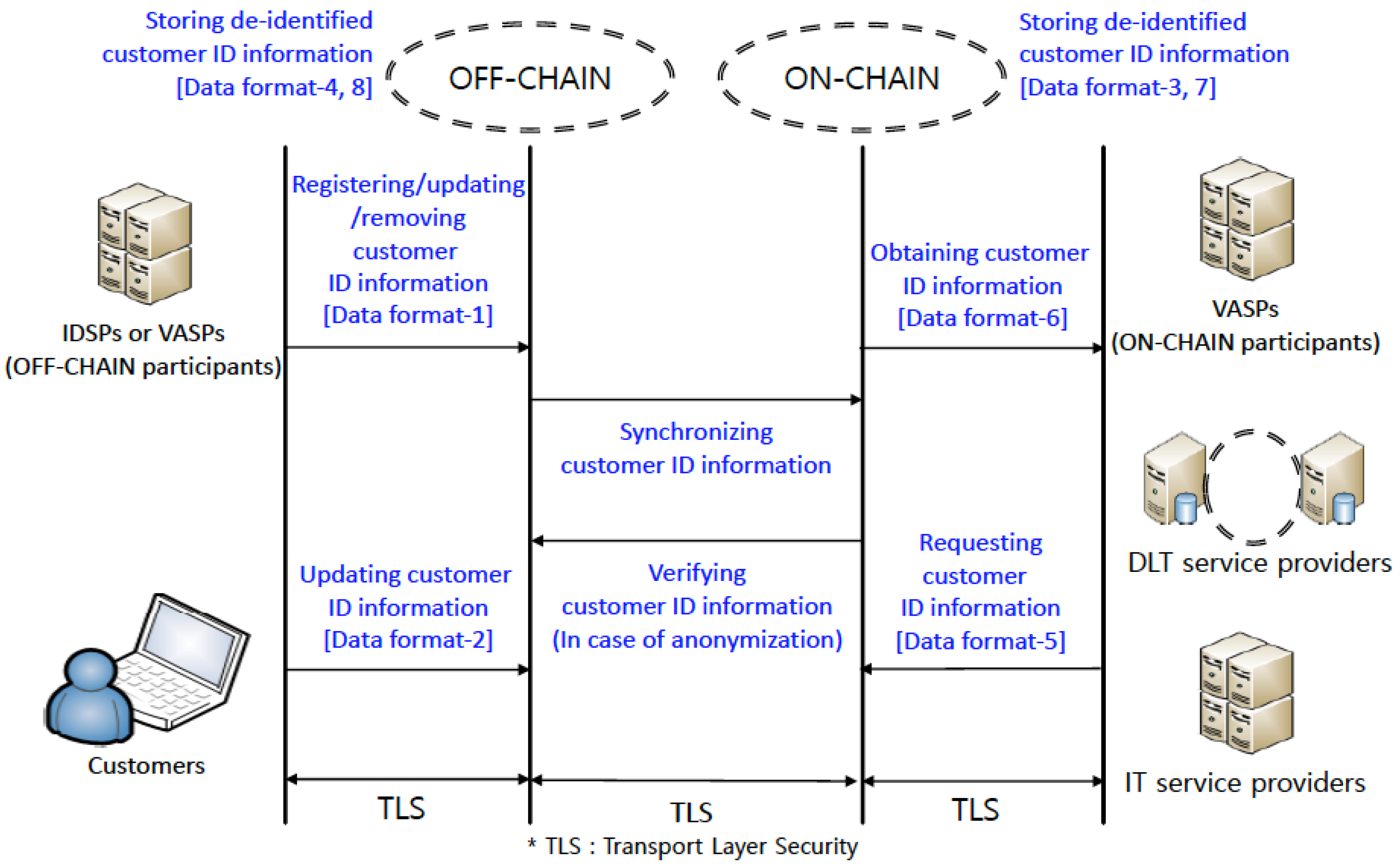

4. Proposal for Customer Identification Service Model

4.1. Overview

- “Identification and Authentication” provides a means of identifying and authenticating users or applications in accordance with identity verification procedures [21]. The solution should meet the following security functional components: FIA_AFL.1 (Authentication failure handling), FIA_ATD.1 (User attribute definition), FIA_SOS.1 (Verification of secrets), FIA_SOS.2 (TSF Generation of secrets), FIA_UAU.2 (User authentication before any action), FIA_UAU.5 (Multiple authentication mechanisms), FIA_UAU.6 (Re-authenticating), FIA_UAU.7 (Protected authentication feedback), FIA_UID.2 (User identification before any action), FTA_MCS.1 (Basic limitation on multiple concurrent sessions), FTA_SSL.3 (TSF-initiated termination), and FTA_SSL.4 (User-initiated termination) in Common Criteria (CC) [35];

- “Security Audit” provides a means to track the accountability for security incidents by recording the user’s behavior logs and keeping it safe [21]. The solution should meet the following security functional components: FAU_ARP.1 (Security alarms), FAU_GEN.1 (Audit data generation), FAU_GEN.2 (User identity association), FAU_SAR.1 (Audit review), FAU_SAR.2 (Restricted audit review), FAU_SAR.3 (Selectable audit review), FAU_SEL.1 (Selective audit), FAU_STG.1 (Protected audit trail storage), FAU_STG.2 (Guarantees of audit data availability), FAU_STG.3 (Action in case of possible audit data loss), FAU_STG.4 (Prevention of audit data loss), and FPT_STM.1 (Reliable time stamps) in Common Criteria (CC) [35];

- “Communication Protection” provides a safe communication means for transmitting critical information between nodes participating in distributed ledger network and provides a safe communication means for transmitting critical information between DLT system and external system [21]. The solution should meet the following security functional components: FCO_NRO.2 (Enforced proof of origin), FCO_NRR.2 (Enforced proof of receipt), FPT_ITC.1 (Inter-TSF confidentiality during transmission), FPT_ITI.1 (Inter-TSF detection of modification), and FTP_ITC.1 (Inter-TSF trusted channel) in Common Criteria (CC) [35];

- “Cryptography Control” provides a means to securely process cryptographic keys for either digital signatures during transaction between users or encryption while transmitting and storing critical data [21]. The solution should meet the following security functional components: FCS_CKM.1 (Cryptographic key generation), FCS_CKM.2 (Cryptographic key distribution), FCS_CKM.3 (Cryptographic key access), FCS_CKM.4 (Cryptographic key destruction), and FCS_COP.1 (Cryptographic operation) in Common Criteria (CC) [35];

- “Privacy Protection” provides a means to securely handle the user’s personal data to prevent leakage and exposure [21]. The solution should meet the following security functional components: FPR_PSE.2 (Reversible pseudonymity) and FDP_RIP.2 (Full residual information protection) in Common Criteria (CC) [35];

- “Data Protection” provides a means to securely transmit or store critical information such as user’s transaction data and distributed ledger data (including personal data) to prevent leakage or tampering [21]. The solution should meet the following security functional components: FDP_DAU.2 (Data Authentication with Identity of Guarantor), FDP_ETC.1 (Export of user data without security attributes), FDP_ETC.2 (Export of user data with security attributes), FDP_ITC.1 (Import of user data without security attributes), FDP_ITC.2 (Import of user data with security attributes), FDP_RIP.2 (Full residual information protection), FDP_SDI.1 (Stored data integrity monitoring), FDP_SDI.2 (Stored data integrity monitoring and action), FDP_UCT.1 (Basic data exchange confidentiality), and FDP_UIT.1 (Data exchange integrity) in Common Criteria (CC) [35];

- “Resource Availability” provides a means to maximize system availability in response to lack of system resources (e.g., CPU, memory, network, and storage) of nodes participating in distributed ledger network, and software error in operating DLT system [21]. The solution should meet the following security functional components: FRU_FLT.1 (Degraded fault tolerance), FRU_PRS.1 (Limited priority of service), and FRU_RSA.1 (Maximum quotas) in Common Criteria (CC) [35].

4.2. Service Scenario and Data Flow

- (Step 1): the originator submits VA transfer information (e.g., originator’s name, originator’s digital wallet address, beneficiary’s name, beneficiary’s digital wallet address, and VA amount) to originator-VASP;

- (Step 2): the originator-VASP verifies both the originator’s identity information and beneficiary’s identity information including validity of their digital wallets by comparing the VA transfer information with customer identity information as Data format-6 (see Table 7) from the ON-CHAIN in the proposed service model;

- (Step 3): the originator-VASP identifies and authenticates the beneficiary-VASP by comparing the VA transfer information with customer identity information as Data format-6 (see Table 7) from the ON-CHAIN in the proposed service model;

- (Step 5): if step 2, step 3, and step 4 are successful, the originator-VASP transfers VAs to the beneficiary-VASP using existing blockchain;

- (step 6): if step 5 is successful, the originator-VASP directly sends the originator’s personal data (e.g., address, national identity number, and date and place of birth) required by the FATF guidance to the beneficiary-VASP using standard protocols (e.g., SAML [5], OpenID Connect [6], TLS [7,8], etc.);

- (Step 7): if step 5 is successful, the beneficiary-VASP identifies and authenticates the originator-VASP by comparing the VA transfer information with customer identity information such as Data format-6 (see Table 7) from the ON-CHAIN in the proposed service model;

- (Step 8): if step 7 is successful, the beneficiary-VASP directly sends the beneficiary’s personal data (e.g., address, national identity number, and date and place of birth) required by the FATF guidance to the originator-VASP using standard protocols (e.g., SAML [5], OpenID Connect [6], and TLS [7,8]).

5. Security Threats and Requirements

5.1. Security Threats

- (ST-1): Malicious customers can register stolen identity information in the OFF-CHAIN. (ST-1) can be misused for money laundering;

- (ST-2): Malicious customers can update their own identity information on the OFF-CHAIN. (ST-2) can be misused for money laundering;

- (ST-3): Malicious IDSPs (or VASPs acting as IDSPs) can register stolen identity information in the OFF-CHAIN. (ST-3) can be misused for money laundering;

- (ST-4): Unsafe cryptographic algorithms can be used for de-identification of customer’s personal data stored in the ON-CHAIN and OFF-CHAIN. The (ST-4) can be misused for re-identification of customer’s personal data;

- (ST-5): Unsafe cryptographic algorithms can be used for de-identification of customer’s personal data during transmission from an entity (i.e., VASP, IDSP, customer) to the OFF-CHAIN. (ST-5) can be misused for re-identification of customer’s personal data;

- (ST-6): Unsafe cryptographic algorithms can be used for de-identification of customer’s personal data during transmission from the OFF-CHAIN to ON-CHAIN. The (ST-6): Can be misused for re-identification of customer’s personal data;

- (ST-7): Unsafe cryptographic algorithms can be used for de-identification of customer’s personal data during transmission from the ON-CHAIN to an entity (i.e., IDSP, DLT service provider, IT service provider). (ST-7) can be misused for re-identification of customer’s personal data;

- (ST-8): Malicious customers can repudiate an update of their own identity information on the OFF-CHAIN. (ST-8) can be misused for money laundering;

- (ST-9): Malicious IDSPs (or VASPs acting as IDSPs) can repudiate registration of customer’s identity information on the OFF-CHAIN. (ST-9) can be misused for money laundering.

5.2. Security Requirements

- (SR-1): The proposed service model should enable the IDSP (or VASP acting as IDSP) to register customer’s identity information in the OFF-CHAIN and not let the customer register their own identity information in the OFF-CHAIN;

- (SR-2): The proposed service model should enable the customer to update minimal of their own identity information on the OFF-CHAIN and then let VASP confirm the updated identity information on the OFF-CHAIN;

- (SR-3): The proposed service model should confirm if VASP holds an official license issued by government authorities [9] (see Section 3.2) before the VASP participates in the OFF-CHAIN;

- (SR-6): the proposed service model should verify PKI (public key infrastructure) based digital signature [39] of a customer when the customer updates own identity information on the OFF-CHAIN;

- (SR-7): The proposed service model should verify PKI based digital signature of IDSP (or VASP acting as IDSP) when the IDSP (or VASP acting as IDSP) registers customer’s identity information in the OFF-CHAIN.

6. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Maekyung Media Group. Samsung Pay Global Advances. US Money Transfer Service. Available online: https://www.mk.co.kr/news/economy/view/2019/10/798414/ (accessed on 7 May 2021).

- Edaily. [Toktok! Financial] 15 Trillion Overseas Remittance Hot Festival. Available online: https://www.edaily.co.kr/news/read?newsId=01266086625635752&mediaCodeNo=257 (accessed on 7 May 2021).

- Global Economy Times. World Bank Transfer Fee Report (2014)-Survey by Country and Remittance Method. Available online: http://m.getnews.co.kr/view.php?ud=201409031754000002074_16 (accessed on 7 May 2021).

- Etherscan. Transactions. Available online: https://etherscan.io/txs (accessed on 7 May 2021).

- Nick, R.; John, H.; Rob, P.; Eve, M.; Paul, M.; Tom, S. Security Assertion Markup Language (SAML) V2.0 Technical Overview. Available online: http://docs.oasis-open.org/security/saml/Post2.0/sstc-saml-tech-overview-2.0.html (accessed on 7 May 2021).

- Sakimura, N.; Bradley, J.; Jones, M.; de Medeiros, B.; Mortimore, C. OpenID Connect Core 1.0 Incorporating Errata Set 1. Available online: https://openid.net/specs/openid-connect-core-1_0.html (accessed on 7 May 2021).

- OpenSSL Software Foundation. Vulnerabilities. Available online: https://www.openssl.org/news/vulnerabilities.html (accessed on 7 May 2021).

- Internet Engineering Task Force (IETF). The Transport Layer Security (TLS) Protocol Version 1.3. Available online: https://tools.ietf.org/html/rfc8446 (accessed on 7 May 2021).

- FATF. Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers; FATF: Paris, France, 2019. [Google Scholar]

- Youm, H.Y.; Kim, M.; Hurwitz, S. Technical Specification FG DLT D1.1 Distributed Ledger Technology Terms and Definitions; ITU-T Focus Group on Application of Distributed Ledger Technology (FG DLT): Geneva, Switzerland, 2019. [Google Scholar]

- FATF. Guidance on Digital Identity; FATF: Paris, France, 2020. [Google Scholar]

- FATF-GAFI. FATF Members and Observers. Available online: http://www.fatf-gafi.org/about/membersandobservers/ (accessed on 7 May 2021).

- FATF. Public Statement on Virtual Assets and Related Providers; FATF: Paris, France, 2019. [Google Scholar]

- Kim, B.; You, D.; Do, J.; Ko, Y.; Youn, J.; Jung, J.; Lee, J.; Lee, Y.; Choi, W.; Lee, H. Partial Amendment Act on the Reporting and Use of Specific Financial Transaction Information; The National Assembly of Republic of Korea: Seoul, Korea, 2019. [Google Scholar]

- FATF. 2012–2019 International Standards on Combating Money Laundering and the Financing of Terrorism & Proliferation; FATF: Paris, France, 2019. [Google Scholar]

- Council of the European Union. General Data Protection Regulation (GDPR); Council of the European Union: Brussels, Belgium, 2016. [Google Scholar]

- Chairman of Administrative Safety. Partial Amendment of the Personal Data Protection Act; The National Assembly of Republic of Korea: Seoul, Korea, 2019. [Google Scholar]

- Hyperledger. A Blockchain Platform for the Enterprise Hyperledger Fabric. Available online: https://hyperledger-fabric.readthedocs.io/en/latest/ (accessed on 7 May 2021).

- Ethereum Community. Ethereum Homestead Documentation. Available online: https://ethereum-homestead.readthedocs.io/en/latest/ (accessed on 7 May 2021).

- COINREADERS. FBI “Cryptocurrency, Threat to National Security” Warning of Possible Abuse against Terrorism One After Another. Available online: http://coinreaders.com/5913 (accessed on 7 May 2021).

- Park, K.; Kim, D.K.; Youm, H.Y. Security Enhancements for Distributed Ledger Technology Systems Based on Open Source. J. Korea Inst. Inf. Secur. Cryptol. 2019, 29, 919–943. [Google Scholar]

- VASPnet. Open interVASP Messaging Standards. Available online: https://www.vaspnet.org (accessed on 7 May 2021).

- Riegelnig, D.; Suisse, B. OpenVASP: An Open Protocol to Implement FATF Travel Rule for Virtual Assets; OpenVASP Association: Zug, Switzerland, 2019. [Google Scholar]

- CipherTrace. Travel Rule Information Sharing Architecture for Virtual Asset Service Providers (TRISA Version 4); CipherTrace: Los Gatos, CA, USA, 2019. [Google Scholar]

- Shyft Network. Shyft Network Whitepaper V. 4.1. Available online: https://shyft.network/assets/pdfs/shyft-network-inc-whitepaper_v4.1.pdf (accessed on 7 May 2021).

- Sygna. Sygna Bridge. Available online: https://www.sygna.io/bridge/ (accessed on 7 May 2021).

- Moyano, J.P.; Ross, O. KYC Optimization Using Distributed Ledger Technology. Bus. Inf. Syst. Eng. 2017, 59, 411–423. [Google Scholar] [CrossRef] [Green Version]

- Biryukov, A.; Khovratovich, D.; Tikhomirov, S. Privacy-preserving KYC on Ethereum. In Proceedings of the 1st ERCIM Blockchain Workshop, Amsterdam, The Netherlands, 8–9 May 2018. [Google Scholar]

- Hardjono, T.; Lipton, A.; Pentland, A. Privacy-Preserving Claims Exchange Networks for Virtual Asset Service Providers. arXiv Prepr. 2020, arXiv:1912.06871v2. [Google Scholar]

- Hardjono, T.; Lipton, A.; Pentland, A. Towards a Public Key Management Framework for Virtual Assets and Virtual Asset Service Providers. arXiv Prepr. 2019, arXiv:1909.08607. [Google Scholar]

- Hughes, S.J.; Middlebrook, S.T. Advancing a Framework for Regulating Cryptocurrency Payments Intermediaries. Yale J. Regul. 2015, 32, 495. [Google Scholar]

- Poskriakov, F.; Chiriaeva, M.; Cavin, C. Cryptocurrency Compliance and Risks: A European KYC/AML Perspective. In Blockchain & Cryptocurrency Regulation; Global Legal Group Ltd.: London, UK, 2019. [Google Scholar]

- Reed, D.; Sporny, M.; Longley, D.; Allen, C.; Grant, R.; Sabadello, M. Decentralized Identifiers (DIDs) V1.0. Available online: https://www.w3.org/TR/did-core/ (accessed on 7 May 2021).

- Karl, W.; Gervais, A. “Do You Need a Blockchain?” IACR Cryptology ePrint Archive. 2017. Available online: https://eprint.iacr.org/2017/375.pdf (accessed on 19 June 2021).

- The Common Criteria (CC). Common Criteria for Information Technology Security Evaluation—Part 2: Security Functional Components Version 3.1 Revision 5 (CCMB-2017-04-002). Available online: https://commoncriteriaportal.org/files/ccfiles/CCPART2V3.1R5.pdf (accessed on 7 May 2021).

- Barker, E. Recommendation for Key Management: Part 1—General (NIST Special Publication 800-57 Part 1 Revision 5); National Institute of Standards and Technology (NIST): Gaithersburg, MD, USA, 2020. [Google Scholar]

- Korea Internet; Security Agency (KISA). Guidance for Cryptographic Algorithm and Key Length Usage (KISA-GD-2018-0034); KISA: Seoul, Korea, 2018. [Google Scholar]

- Telecommunication Standardization Sector of ITU (ITU-T). ITU-T Recommendation, X.509 (Information Technology—Open Systems Interconnection—The Directory: Public-Key and Attribute Certificate Frameworks); ITU-T: Geneva, Switzerland, 2019. [Google Scholar]

- National Institute of Standards and Technology (NIST). Digital Signature Standard (DSS) (FIPS 186-4); NIST: Gaithersburg, MD, USA, 2013. [Google Scholar]

| Item | Encryption | Value | Description |

|---|---|---|---|

| D-0 | - | Customer number | - Unique number given to a customer - Hash Value for D-1 to D-3 |

| D-1 | Encryption | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Encryption | Name | - Full name of the customer who is natural person or legal person |

| D-3 | Encryption | Certificate | - Certificate of the customer (e.g., X.509) |

| D-4 | Encryption | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | - | VASP | - Identifier of the virtual asset service provider that manages the customer digital wallet - e.g., Coinbase |

| D-6 | - | IDSP | - Identifier of the service provider who verified the customer identity - It can be same as VASP |

| D-7 | - | Validity | - Validity of the customer identity - e.g., Valid (possible to transact), Invalid (impossible to transact), N/A (impossible to verify) |

| D-8 | - | RESERVED | RESERVED |

| D-9 | - | RESERVED | RESERVED |

| Item | Necessary/ Optional | Value | Description |

|---|---|---|---|

| D-0 | - | RESERVED | RESERVED |

| D-1 | Necessary | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Necessary | Name | - Full name of the customer who is natural person or legal person |

| D-3 | Necessary | Certificate | - Certificate of the customer (e.g., X.509) |

| D-4 | Necessary | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | Necessary | VASP | - Identifier of the virtual asset service provider that manages customer digital wallet - e.g., Coinbase |

| D-6 | Necessary | IDSP | - Identifier of the service provider who verified the customer identity - It can be same as VASP |

| D-7 | Necessary | Validity | - Validity of the customer identity - e.g., Valid (possible to transact), Invalid (impossible to transact), N/A (impossible to verify) |

| Item | Necessary/ Optional | Value | Description |

|---|---|---|---|

| D-0 | - | RESERVED | RESERVED |

| D-1 | Necessary | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Necessary | Name | - Full name of the customer who is natural person or legal person |

| D-3 | Necessary | Certificate | - Certificate of the customer (e.g., X.509) |

| D-4 | Necessary | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | - | RESERVED | RESERVED |

| D-6 | - | RESERVED | RESERVED |

| D-7 | - | RESERVED | RESERVED |

| Item | Encryption | Value | Description |

|---|---|---|---|

| D-0 | - | Customer number | - Unique number given to a customer |

| D-1 | Uni-direction | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Uni-direction | Name | - Full name of the customer who is a natural person or legal person |

| D-3 | - | RESERVED | RESERVED |

| D-4 | Uni-direction | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | - | VASP | - Identifier of the virtual asset service provider that manages the customer digital wallet - e.g., Coinbase |

| D-6 | - | RESERVED | RESERVED |

| D-7 | - | Validity | - Validity of the customer identity - e.g., Valid (possible to transact), Invalid (impossible to transact), N/A (impossible to verify) |

| Item | Encryption | Value | Description |

|---|---|---|---|

| D-0 | - | Customer number | - Unique number given to a customer |

| D-1 | Bi-direction | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Bi-direction | Name | - Full name of the customer who is natural person or legal person |

| D-3 | Bi-direction | Certificate | - Certificate of the customer (e.g., X.509) |

| D-4 | Bi-direction | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | - | VASP | - Identifier of the virtual asset service provider that manages the customer digital wallet - e.g., Coinbase |

| D-6 | - | IDSP | - Identifier of the service provider who verified the customer identity - It can be same as VASP |

| D-7 | - | Validity | - Validity of the customer identity - e.g., Valid (possible to transact), Invalid (impossible to transact), N/A (impossible to verify) |

| Item | Necessary/ Optional | Value | Description |

|---|---|---|---|

| D-0 | Optional | Customer number | - Unique number given to a customer |

| D-1 | Necessary | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Necessary | Name | - Full name of the customer who is natural person or legal person |

| D-3 | - | RESERVED | RESERVED |

| D-4 | Necessary | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | Optional | VASP | - Identifier of the virtual asset service provider that manages the customer digital wallet - e.g., Coinbase |

| D-6 | - | RESERVED | RESERVED |

| D-7 | - | RESERVED | RESERVED |

| Item | Necessary/ Optional | Value | Description |

|---|---|---|---|

| D-0 | Optional | Customer number | - Unique number given to a customer |

| D-1 | Necessary | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Necessary | Name | - Full name of the customer who is natural person or legal person |

| D-3 | - | RESERVED | RESERVED |

| D-4 | Necessary | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | Optional | VASP | - Identifier of the virtual asset service provider that manages the customer digital wallet - e.g., Coinbase |

| D-6 | - | RESERVED | RESERVED |

| D-7 | Necessary | Validity | - Validity of the customer identity - e.g., Valid (possible to transact), Invalid (impossible to transact), N/A (impossible to verify) |

| Item | Encryption | Value | Description |

|---|---|---|---|

| D-0 | - | Customer number | - Unique number given to a customer |

| D-1 | Uni-direction | Country code | - Nationality of the customer - e.g., KR (Korea), US (United States), etc. |

| D-2 | Uni-direction | Name | - Full name of the customer who is natural person or legal person |

| D-3 | - | RESERVED | RESERVED |

| D-4 | Uni-direction | Digital wallet address | - Digital wallet address for transferring virtual assets |

| D-5 | - | VASP | - Identifier of the virtual asset service provider that manages the customer digital wallet - e.g., Coinbase |

| D-6 | - | RESERVED | RESERVED |

| D-7 | - | Validity | - Validity of the customer identity - Set up N/A (impossible to verify) |

| Item | Encryption | Value | Description |

|---|---|---|---|

| D-0 | - | Customer number | - Unique number given to a customer |

| D-1 | Bi-direction | RESERVED | RESERVED |

| D-2 | Bi-direction | RESERVED | RESERVED |

| D-3 | Bi-direction | RESERVED | RESERVED |

| D-4 | Bi-direction | RESERVED | RESERVED |

| D-5 | - | VASP | - Identifier of the virtual asset service provider that manages the customer digital wallet - e.g., Coinbase |

| D-6 | - | IDSP | - Identifier of the service provider who authenticated the customer - It can be the same as VASP |

| D-7 | - | Validity | - Validity of the customer identity - Set up N/A (impossible to verify) |

| SR-1 | SR-2 | SR-3 | SR-4 | SR-5 | SR-6 | SR-7 | |

|---|---|---|---|---|---|---|---|

| ST-1 | O | ||||||

| ST-2 | O | ||||||

| ST-3 | O | ||||||

| ST-4 | O | ||||||

| ST-5 | O | ||||||

| ST-6 | O | ||||||

| ST-7 | O | ||||||

| ST-8 | O | ||||||

| ST-9 | O |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, K.; Youm, H.-Y. Proposal for Customer Identification Service Model Based on Distributed Ledger Technology to Transfer Virtual Assets. Big Data Cogn. Comput. 2021, 5, 31. https://doi.org/10.3390/bdcc5030031

Park K, Youm H-Y. Proposal for Customer Identification Service Model Based on Distributed Ledger Technology to Transfer Virtual Assets. Big Data and Cognitive Computing. 2021; 5(3):31. https://doi.org/10.3390/bdcc5030031

Chicago/Turabian StylePark, Keundug, and Heung-Youl Youm. 2021. "Proposal for Customer Identification Service Model Based on Distributed Ledger Technology to Transfer Virtual Assets" Big Data and Cognitive Computing 5, no. 3: 31. https://doi.org/10.3390/bdcc5030031

APA StylePark, K., & Youm, H.-Y. (2021). Proposal for Customer Identification Service Model Based on Distributed Ledger Technology to Transfer Virtual Assets. Big Data and Cognitive Computing, 5(3), 31. https://doi.org/10.3390/bdcc5030031