The Efficacy of Allocating Housing Growth in the Los Angeles Region (2006–2014)

Abstract

1. Introduction

2. Housing Allocations and California Housing Law

2.1. The Origins of Allocating Housing Needs

2.2. California’s Housing Element Law

2.3. A Note on the Great Recession and Homeownership

3. Materials and Methods

Map Design and Software

4. Results

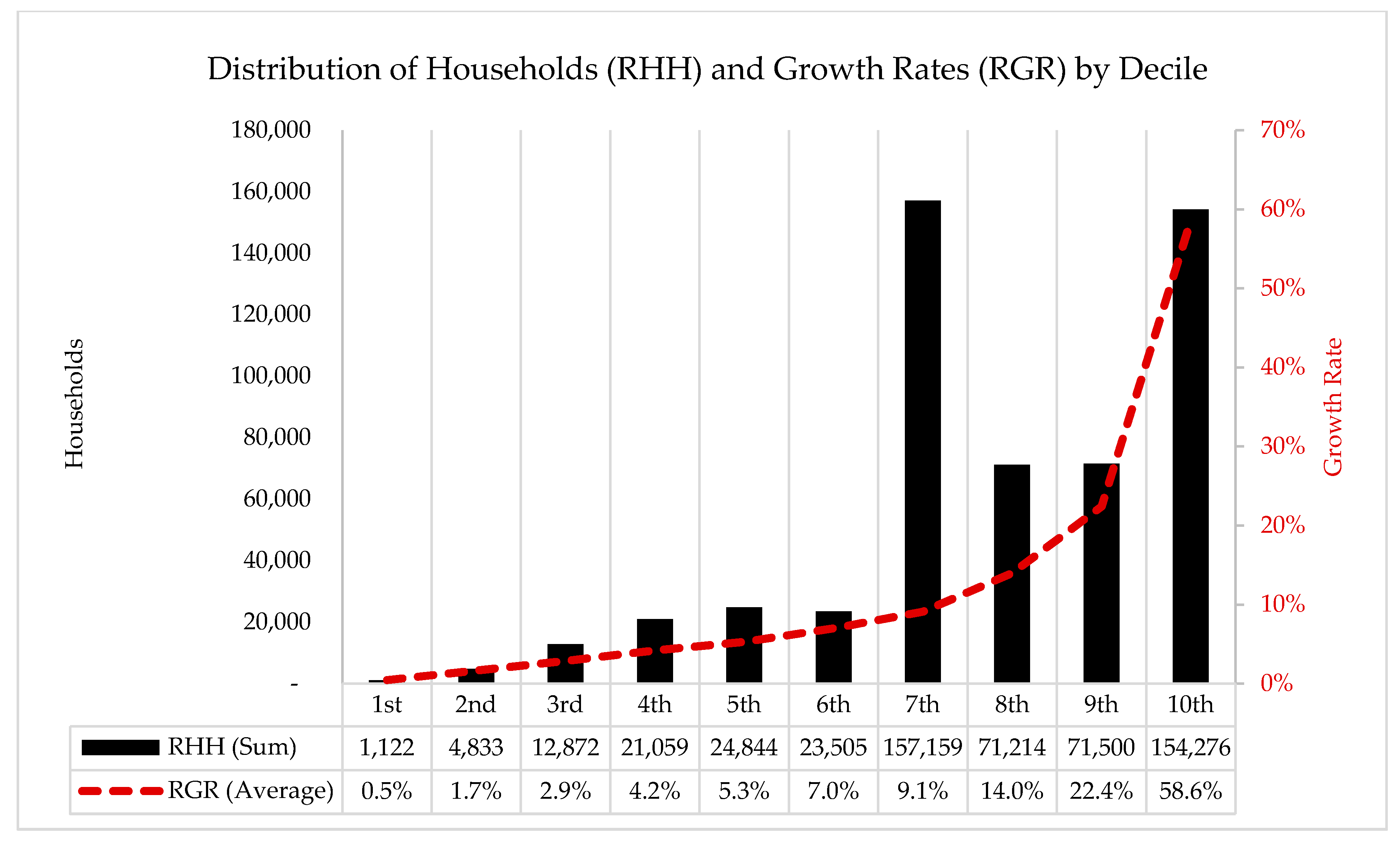

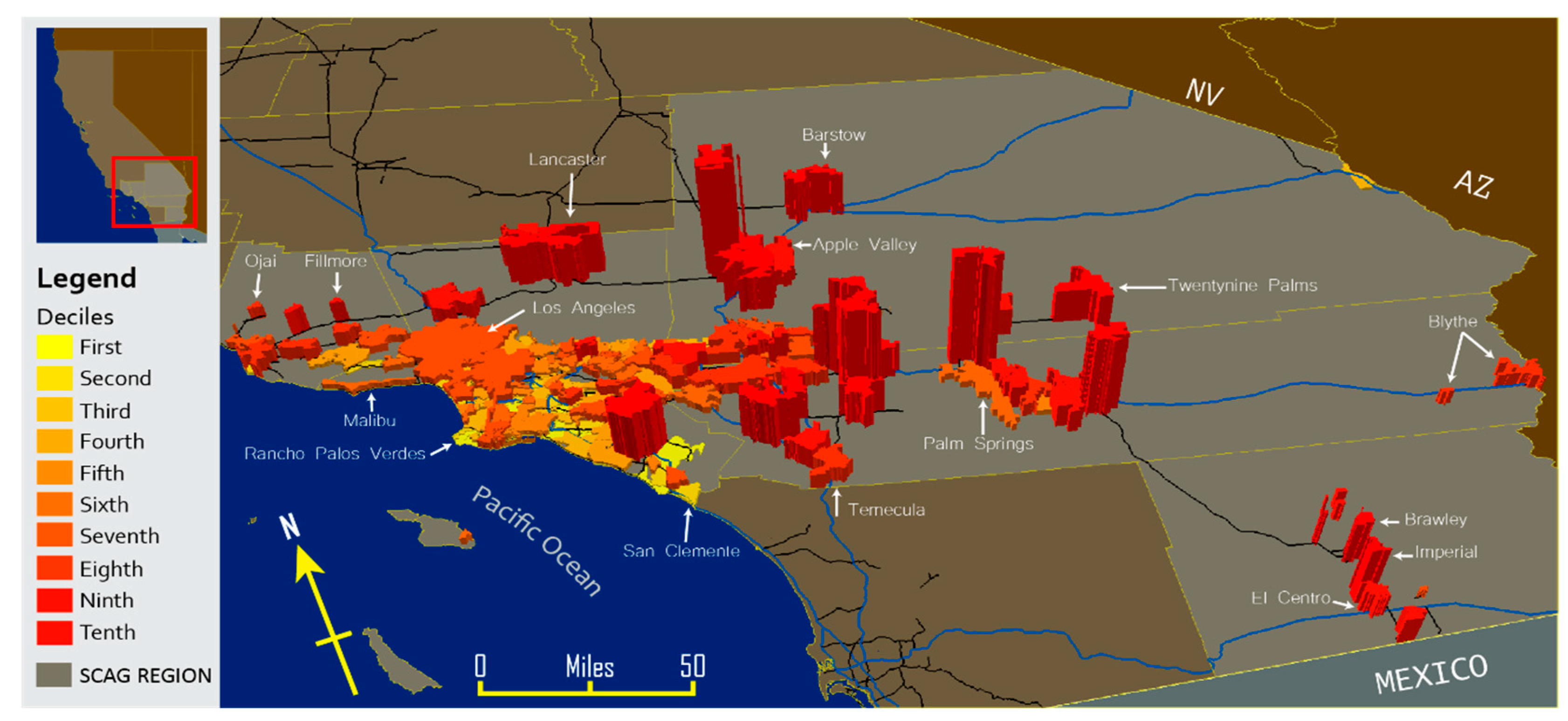

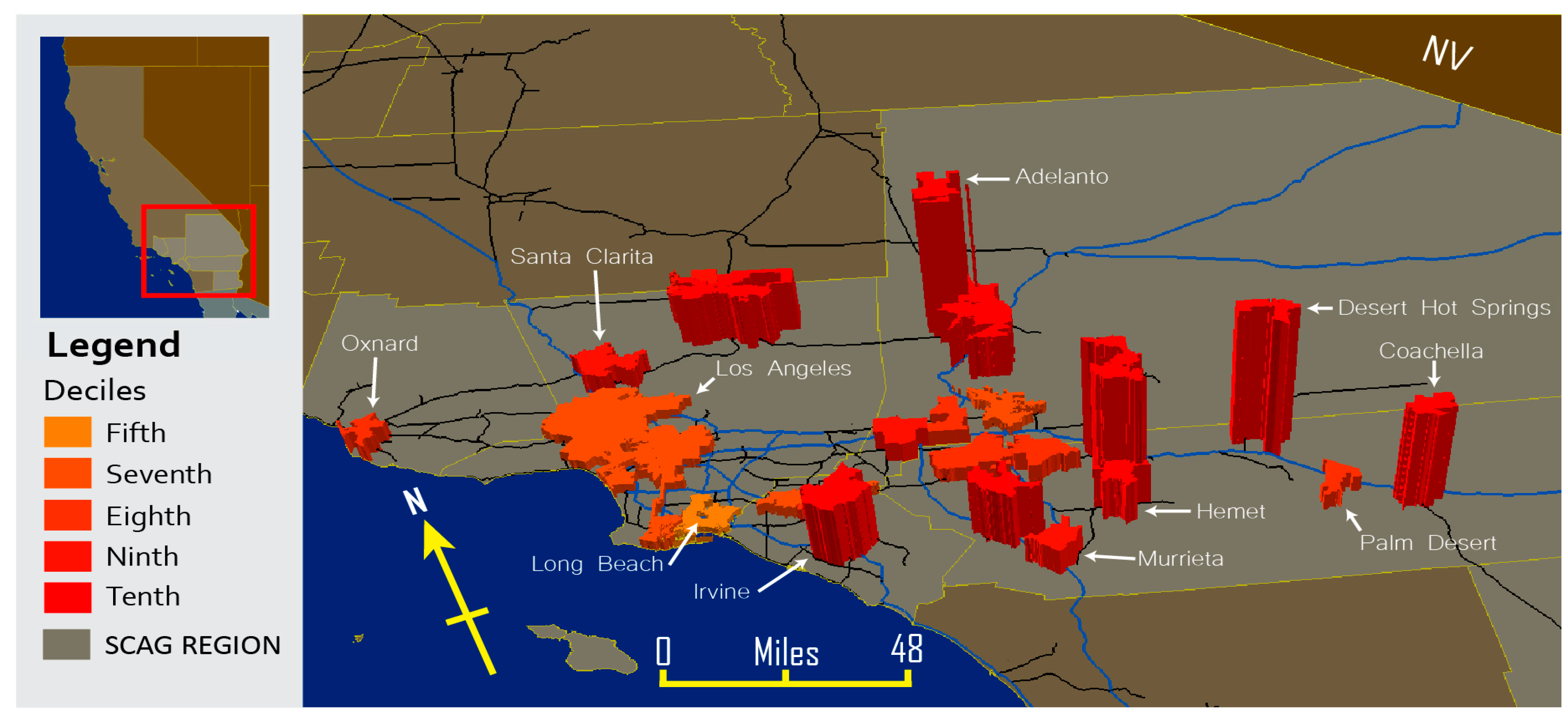

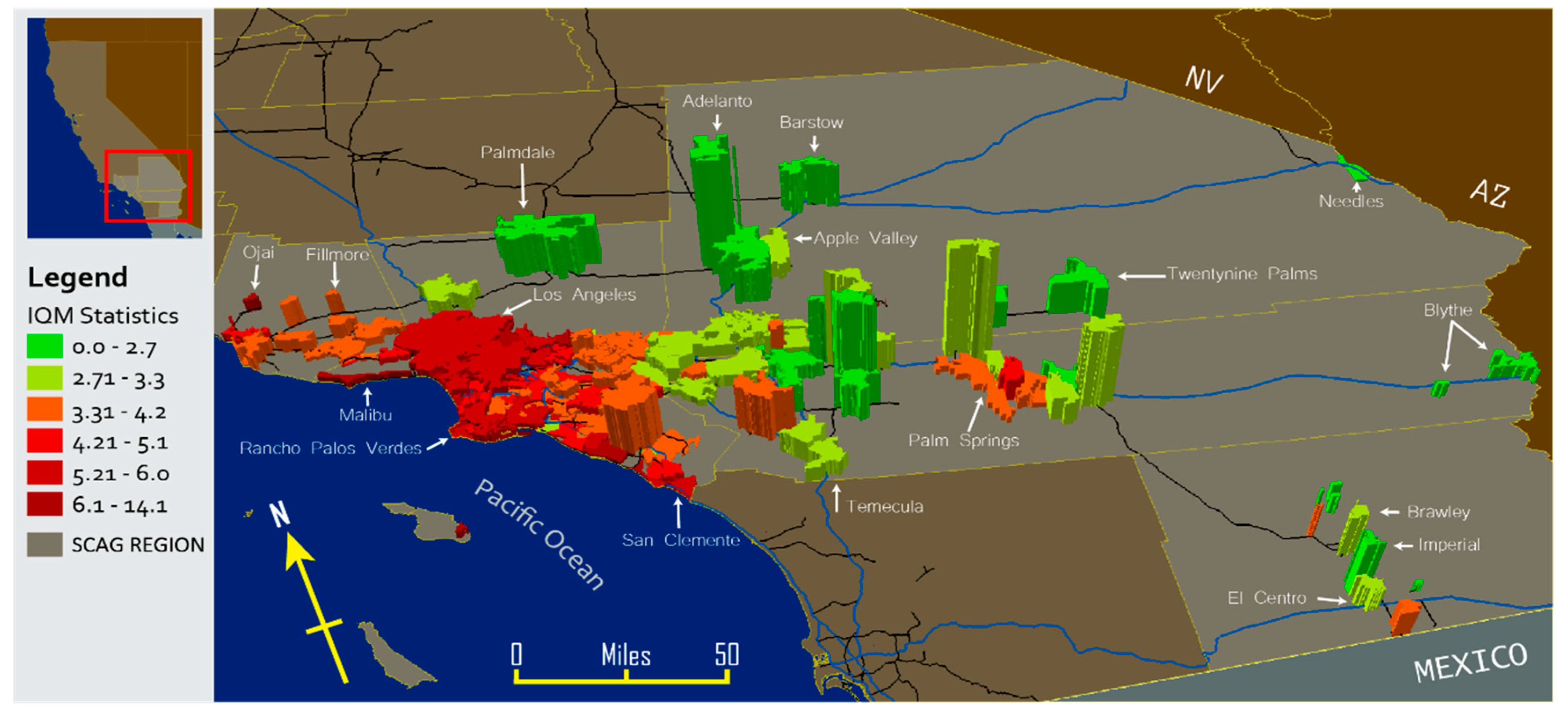

4.1. Where Did RHNA Direct Housing Growth?

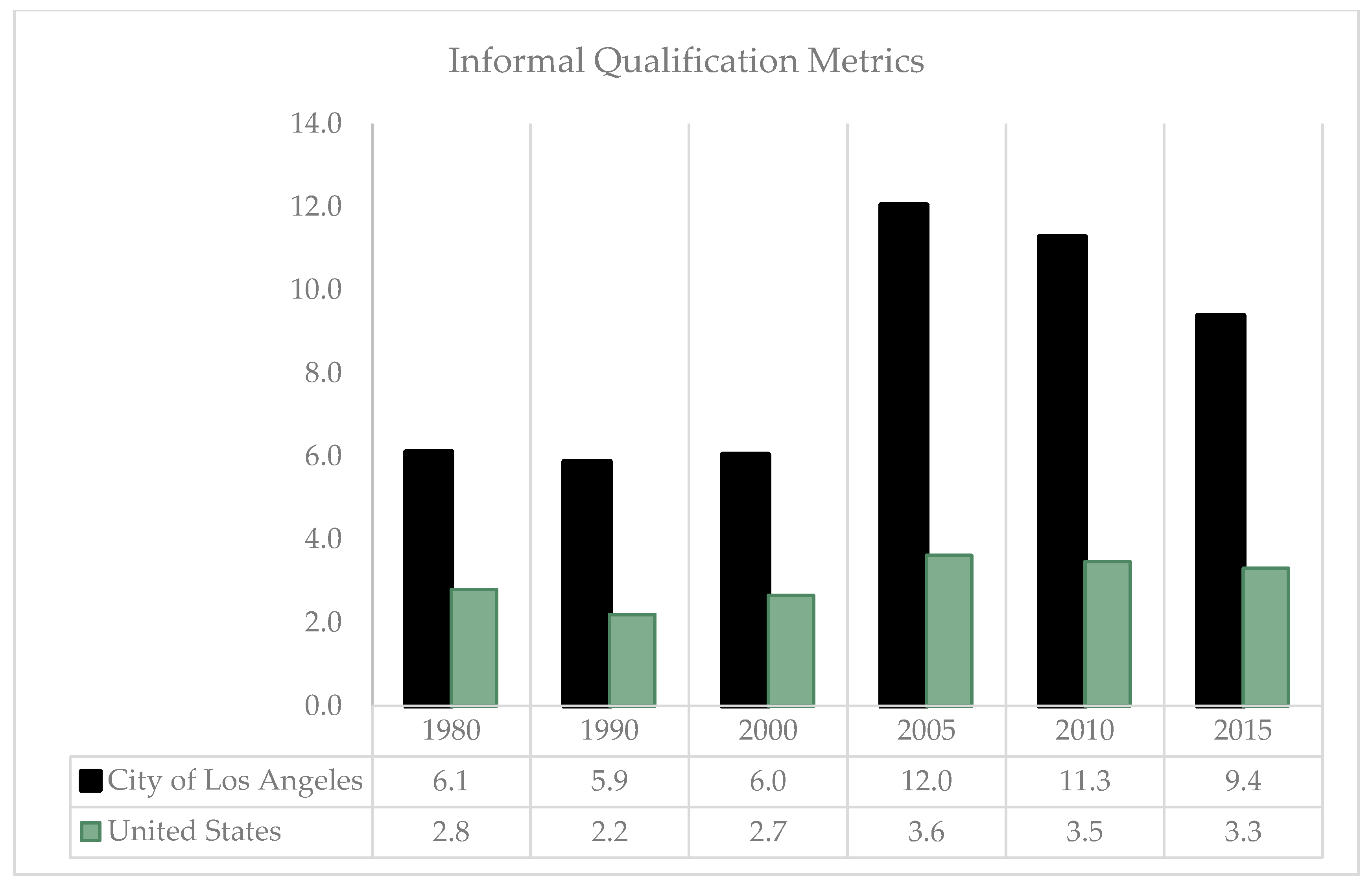

4.2. Did RHNA Direct Housing Growth Towards the Region’s Unaffordable Cities?

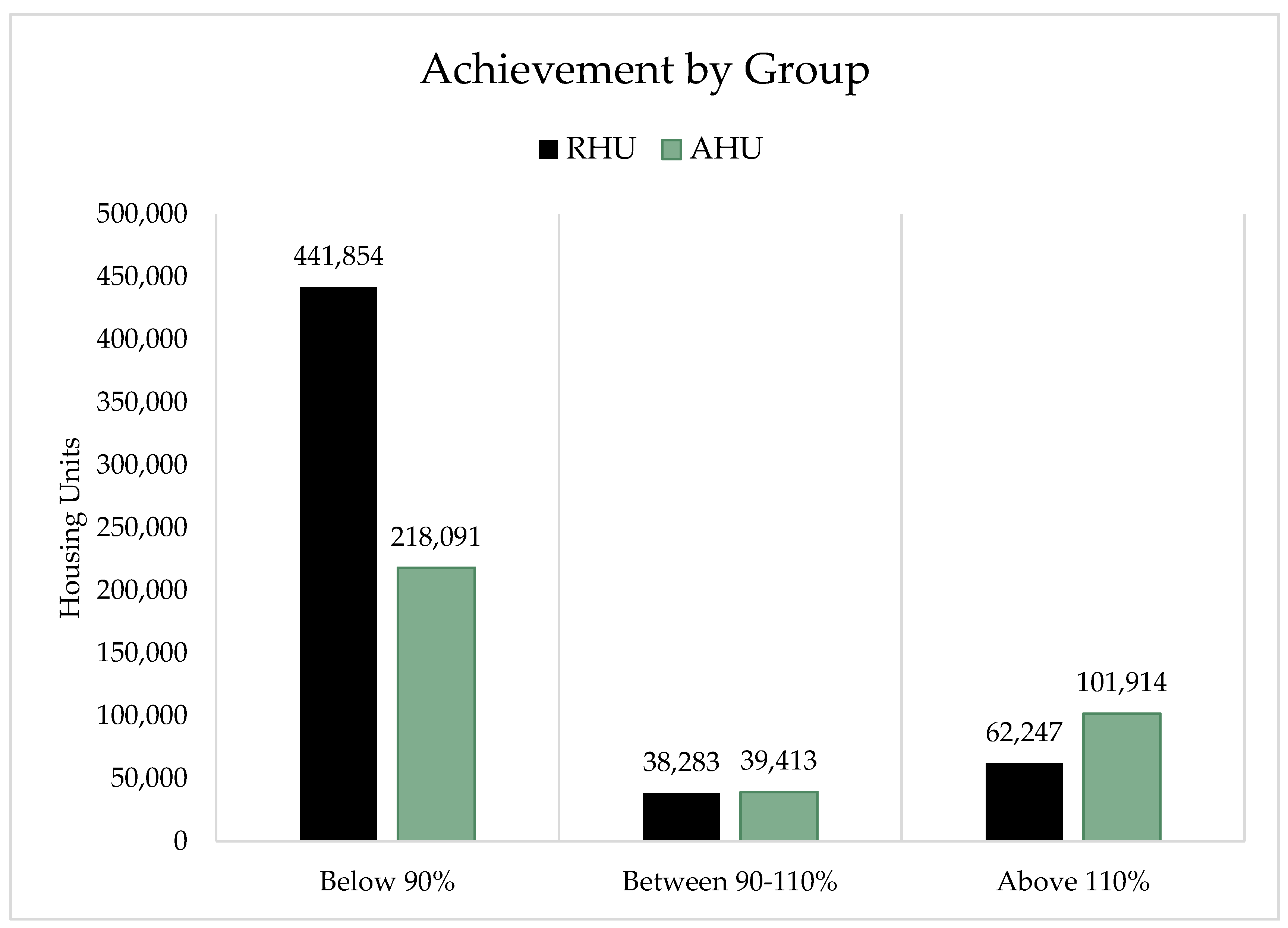

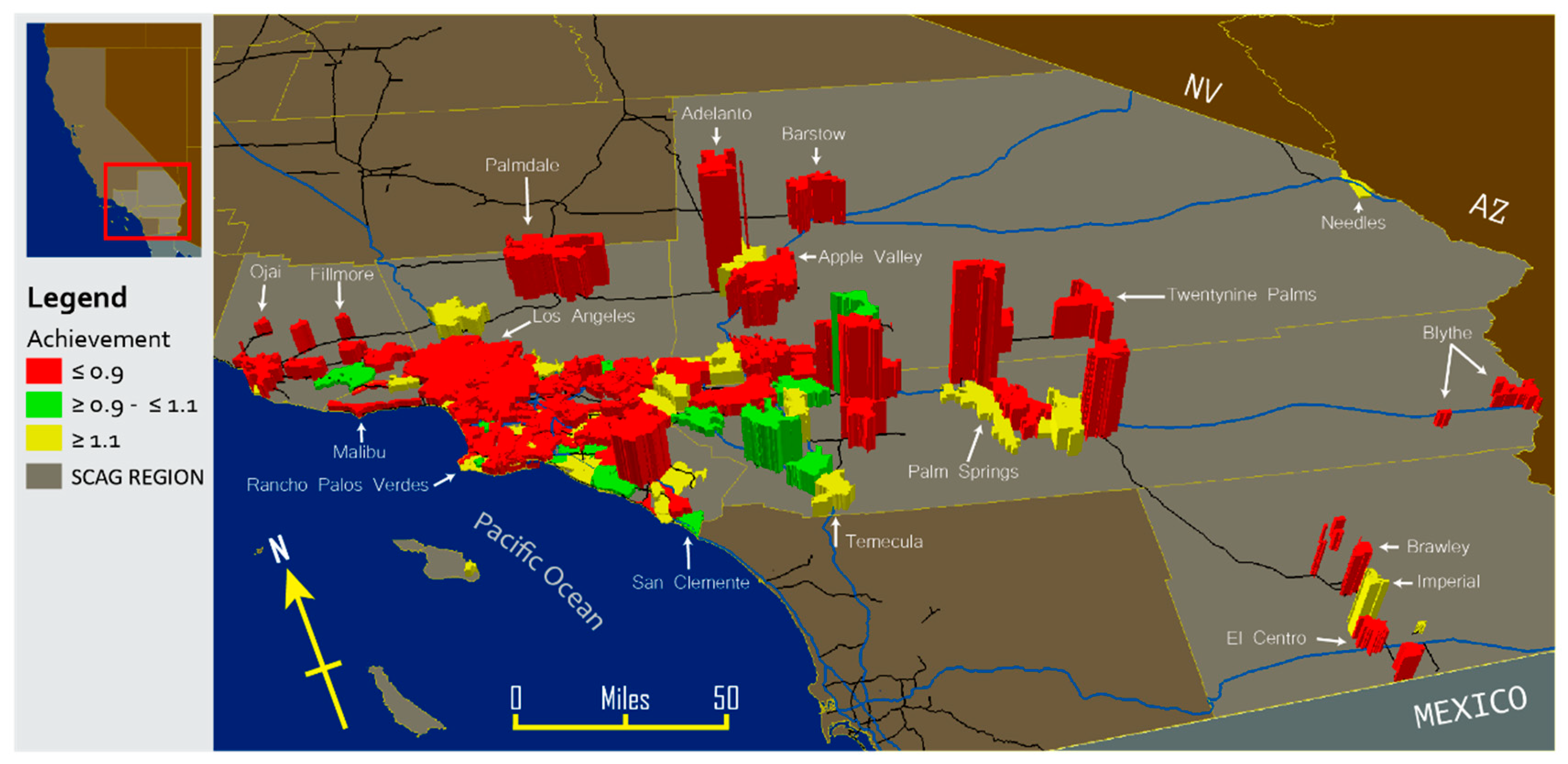

4.3. Did Any City Achieve Its Housing Growth?

4.4. Did RHNA Influence Regional Housing Inventory?

5. Discussion

5.1. Considering the Role of Metropolitan Agencies

5.2. California’s Approach to Housing Affordability

5.3. Ensuring Equitable Municipal Effort

Supplementary Materials

Funding

Acknowledgments

Conflicts of Interest

References

- Weinfeld, E. Can America Be Adequately Housed? Am. J. Econ. Sociol. 1949, 9, 77–84. [Google Scholar] [CrossRef]

- Hauser, P.M.; Jaffe, A.J. The Extent of the Housing Shortage. Law Contemp. Probl. 1947, 12, 3–15. [Google Scholar] [CrossRef]

- Robinson, H.; Weinstein, L.H. The Federal Government and Housing. Wis. Law Rev. 1952, 581–616. [Google Scholar]

- The United States Congress. Housing Act of 1949, Pub. L. No. Pub. L. No. 171 § Chapter 228; The United States Congress: Washington, DC, USA, 1949. [Google Scholar]

- Florida, R. Where the House-Price-To-Income Ratio Is Most out of Whack. 2018. Available online: https://www.citylab.com/equity/2018/05/where-the-house-price-to-income-ratio-is-most-out-of-whack/561404/ (accessed on 15 January 2020).

- Schwartz, A. Housing Policy in the United States; Routledge: New York, NY, USA, 2010. [Google Scholar]

- Bratt, R.G. Overcoming Restrictive Zoning for Affordable Housing in Five States: Observations for Massachusetts; Citizens’ Housing and Planning Association: Boston, MA, USA, 2012; Available online: https://www.chapa.org/sites/default/files/Bratt-OvercomingRestrictiveZoningExecutiveSummary.pdf (accessed on 8 September 2020).

- Goetz, E.G.; Chapple, K.; Lukermann, B. Enabling Exclusion: The Retreat from Regional Fair Share Housing in the Implementation of the Minnesota Land Use Planning Act. J. Plan. Educ. Res. 2003, 22, 213–225. [Google Scholar] [CrossRef]

- Choi, S.; Wen, F.; Carreras, J. Regional Housing Needs Alocation: The Southern California Approach. In Proceedings of the 2008 Joint ACSP-AESOP Conference, Chicago, IL, USA, 6–11 July 2008. [Google Scholar]

- Ajise, K. SCAG’s Objection to HCD’s Regional Housing Need Determination; Southern California Association of Governments: Los Angeles, CA, USA, 2019. Available online: http://www.scag.ca.gov/programs/Documents/RHNA/SCAG-Objection-Letter-RHNA-Regional-Determination.pdf (accessed on 8 September 2020).

- McCauley, D.R. Final Regional Housing Need Allocation; California Department of Housing and Community Development: Sacramento, CA, USA, 2019. Available online: http://www.scag.ca.gov/programs/Documents/RHNA/HCD-SCAG-RHNA-Final-Determination-101519.pdf (accessed on 8 September 2020).

- Kirkeby, M. Regional Housing Need Determination; California Department of Housing and Community Development: Sacramento, CA, USA, 2019. Available online: http://www.scag.ca.gov/Documents/6thCycleRHNA_SCAGDetermination_08222019.pdf (accessed on 8 September 2020).

- Baer, W.C. California’s Housing Element—A Backdoor Approach to Metropolitan Governance and Regional Planning. Town Plan. Rev. 1988, 59, 263–276. [Google Scholar] [CrossRef]

- Von Hoffman, A. The End of the Dream: The Political Struggle of America’s Public Housers. J. Plan. Hist. 2005, 4, 222. [Google Scholar] [CrossRef]

- Rothstein, R. The Color of Law: A Forgotten History of How Our Government Segregated America; Liveright Publishing: New York, NY, USA, 2017. [Google Scholar]

- Hillier, A.E. Spatial analysis of historical redlining: A methodological explanation. J. Hous. Res. 2003, 14, 137–169. [Google Scholar]

- Woods, L.L. The Federal Home Loan Bank Board, Redlining, and the National Proliferation of Racial Lending Discrimination, 1921–1950. J. Urban Hist. 2012, 38, 1036–1059. [Google Scholar] [CrossRef]

- Nelson, R.K.; Winling, L.; Marciano, R. (nd). Mapping Inequality, Redlining in New Deal America. Available online: https://dsl.richmond.edu/panorama/redlining/#loc=5/36.721/-96.943&text=intro (accessed on 15 January 2019).

- Zelizer, J. The Kerner Report: The National Advisory Commission on Civil Disorders; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

- U.S. Congress Senate. Hearings before the Subcommittee on Housing and Urban Affairs of the Committee on Banking and Currency. In Proceedings of the 90th Congress Sess., Washington, DC, USA, 15 January–14 October 1968. [Google Scholar]

- Ramsey-Musolf, D. State Mandates, Housing Elements, and Low-income Housing Production. J. Plan. Lit. 2017, 32, 117–140. [Google Scholar] [CrossRef]

- The United States Congress. Housing Act of 1954, Pub. L. No. Pub. L. No. 560 § Chapter 649; The United States Congress: Washington, DC, USA, 1954. [Google Scholar]

- US District Court for the District of Connecticut. City of Hartford v. Carla Hills, No. 408F, Supp. 809; US District Court for the District of Connecticut: New Haven, CT, USA, 1976.

- Wheaton, W.L.C. Metro-Allocation Planning. J. Am. Inst Plan. 1967, 33, 103–107. [Google Scholar] [CrossRef]

- McGee, H. llusion and Contradiction in the Quest for a Desegregated Metropolis. U. Ill. LF 1976, 948. Available online: https://digitalcommons.law.seattleu.edu/faculty/707 (accessed on 8 September 2020).

- Listokin, D. Fair Share Housing Allocation; Center for Urban Policy Research, Rutgers University: New Brunswick, NJ, USA, 1976. [Google Scholar]

- Marando, V.L. A Metropolitan Lower Income Housing Allocation Policy. Am. Behav. Sci. 1975, 19, 75–103. [Google Scholar] [CrossRef]

- Feiss, C. The Foundations of Federal Planning Assistance: A Personal Account of the 701 Program. J. Am. Plan. Assoc. 1985, 51, 175–184. [Google Scholar] [CrossRef]

- Graham, C.B. State Consultation Processes after Federal A-95 Overhaul. State Local Gov. Rev. 1985, 17, 207–212. [Google Scholar]

- California Legislature. Assembly Bill 2853 Chapter 1443, California Statutes; California Legislature: Sacramento, CA, USA, 1980.

- Bollens, S.A. Fragments of regionalism: The limits of Southern California governance. J. Urban Aff. 1997, 19, 105–122. [Google Scholar] [CrossRef]

- Ramsey-Musolf, D. Evaluating California’s Housing Element Law, Housing Equity, and Housing Production (1990–2007). Hous. Policy Debate 2016, 26, 488–516. [Google Scholar] [CrossRef]

- The California Legislature. Housing Element Law, California Government Code; The California Legislature: Sacramento, CA, USA, 1967.

- Department of Housing and Urban Development. (n.d.); Income Limits. Available online: https://www.huduser.gov/portal/datasets/il.html#2018_faq (accessed on 5 August 2020).

- Veronica Tam & Associates & City of Glendora. Department of Community Development. 2008–2014 Housing Element; Department of Community Development: Glendora, CA, USA, 2009. Available online: http://www.ci.glendora.ca.us/ (accessed on 15 April 2010).

- Department of Regional Planning. Income Limits. In Los Angeles County Affordable Housing Program; Department of Regional Planning: Los Angeles, CA, USA, 2009. Available online: http://planning.lacounty.gov/assets/upl/project/housing_2009-income-limits-costs.pdf (accessed on 5 August 2020).

- White, J.B. Passion for affordable housing drives California Assembly speaker. The Sacrarmento Bee. 13 March 2015. Available online: https://www.sacbee.com/news/politics-government/capitol-alert/article14080046.html (accessed on 8 September 2020).

- Fulton, W.; Stephens, J. Redevelopment Will Be Back—But At What Price? California Planning & Development Report. 29 December 2011. Available online: http://www.cp-dr.com/node/3081 (accessed on 8 September 2020).

- Chapman, J.I. Proposition 13: Some Unintended Consequences; Public Policy Institute of California: San Francisco, CA, USA, 1998. [Google Scholar]

- Development Services Department. General Plan Housing Element 2013–2020; Development Services Department: San Diego, CA, USA, 2013.

- Campora, G.A. City of San Diego’s 5th Cycle (2013–2021) Adopted Housing Element; Department of Housing and Community Development: Sacramento, CA, USA, 2013. Available online: https://www.sandiego.gov/planning/genplan/housingelement (accessed on 18 December 2019).

- Coghlan, E.; McCorkell, L.; Hinkley, S. What Really Caused the Great Recession? UC Berkeley, Institute for Research on Labor and Employment: Berkeley, CA, USA, 2018; Available online: https://escholarship.org/uc/item/74x0786t (accessed on 8 September 2020).

- Adelino, M.; Schoar, A.; Severino, F. Dynamics of Housing Debt in the Recent Boom and Great Recession. NBER Macroecon. Annu. 2018, 32, 265–311. [Google Scholar] [CrossRef]

- Bardhan, A.; Walker, R. California shrugged: Fountainhead of the Great Recession. Camb. J. Reg. Econ. Soc. 2011, 4, 303–322. [Google Scholar] [CrossRef]

- California Association of Realtors. Housing Affordability Index—Traditional; California Association of Realtors: Los Angeles, CA, USA, (n.d.); Available online: https://car.sharefile.com/d-s9aad8a3f14e49db9 (accessed on 28 August 2020).

- Kroll, C.A. The Great Recession and Housing Affordability; UC Berkeley: Fisher Center for Real Estate and Urban Economics: Berkeley, CA, USA, 2013; Available online: https://escholarship.org/uc/item/7q95j497 (accessed on 8 September 2020).

- Ellen, I.G.; Dastrup, S. Housing and the Great Recession. In A Great Recession Brief; Furman Center for Real Estate and Urban Policy, New York University: New York, NY, USA, 2012; Available online: https://furmancenter.org/files/publications/HousingandtheGreatRecession.pdf (accessed on 8 September 2020).

- Elul, R. Collateral Damage: House Prices and Consumption During the Great Recession; Federal Reserve Bank of Philadelphia: Philadelphia, PA, USA, 2019; Available online: https://www.philadelphiafed.org/-/media/research-and-data/publications/economic-insights/2019/q3/eiq319-collateral-damage.pdf?la=en (accessed on 28 August 2020).

- Myers, D.; Park, J. The Great Housing Collapse in California; Fannie Mae Foundation: Washington, DC, USA, 2002; Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.458.3983&rep=rep1&type=pdf (accessed on 8 September 2020).

- Department of Housing and Community Development. (n.d.-b); Housing Element Status Reports. Available online: http://www.hcd.ca.gov/community-development/housing-element/index.shtml (accessed on 15 October 2015).

- Southern California Association of Governments. (n.d.); About SCAG. Available online: http://www.scag.ca.gov/about/Pages/Home.aspx (accessed on 18 December 2019).

- Norris; U.S. Department of Housing and Urban Development. HUD News, Press Release 76-308. In Final Grant Reports, 1951–1981, #616313; National Archives: Washington, DC, USA, 1976. [Google Scholar]

- Ramsey-Musolf, D. California’s Housing Element Law: Evaluating and Predicting Municipal Effort, 1990–2007. Ph.D. Thesis, University of Wisconsin, Madison, WI, USA, 2013. Unpublished work. [Google Scholar]

- Ling, S. How Fair is Fair-Share? A Longitudinal Assessment of California’s Housing Element Law. Master’s Thesis, University of California, Los Angeles, CA, USA, 2018. Available online: https://escholarship.org/uc/item/45g2k3fp (accessed on 8 September 2020).

- Ransom, F.V. Hundreds Oppose Proposal for Low-Income Housing: Planning: The city could lose federal funds if it doesn’t provide affordable housing. Residents say they fear overcrowding and crime. Los Angeles Times. 28 November 1991. Available online: http://articles.latimes.com/1991-11-28/news/ga-98_1_low-income-housing (accessed on 8 September 2020).

- Petix, M. From here to Barstow—Imagine a region packed with houses, stores and offices stretching into the desert. Now, think about it happening in a dozen years. The Press-Enterprise. 16 August 1998. Available online: https://infoweb-newsbank-com.silk.library.umass.edu/apps/news/document-view?p=AWNB&docref=news/0EB04355217DF2DD (accessed on 8 September 2020).

- Hamilton, W. Housing Policy in Question—Agoura Hills Urged to Rewrite Guidelines. In Los Angeles Daily News; MediaNews Group: Los Angeles, CA, USA, 1992. [Google Scholar]

- Nicolosi, M. Five North Tustin citizens appointed to advisory group. In The Orange County Register; MediaNews Group: Los Angeles, CA, USA, 1990. [Google Scholar]

- Tanenbaum, M. Unrealistic housing numbers worry city. Required new housing nearly triples, to 3716 units by 2014. Palo Alto Online. 26 January 2007. Available online: http://www.paloaltoonline.com/weekly/story.php?story_id=4129 (accessed on 8 September 2020).

- Trout, B. ABAG housing projections split Palo Alto City Council, Would 2860 new units help Earth or ruin Palo Alto? Palo Alto Weekly. 16 October 2007. Available online: http://www.planetizen.com/node/27743 (accessed on 8 September 2020).

- Hsieh, C.; Maisonneuve, P.; Boyle, P.; Macfarlane, G.J.; Robertson, C. Analysis of Quantitative Data by Quantiles in Epidemiologic Studies: Classification According to Cases, Noncases, or All Subjects? Epidemiology 1991, 2, 137–140. [Google Scholar] [CrossRef]

- Robin, A.; Mills, C.; Tuck, R.; Lennon, D. The epidemiology of acute rheumatic fever in Northland, 2002–2011. N. Z. Med. J. 2013, 126, 46–52. [Google Scholar]

- Pendall, R.; Hedman, C. Worlds Apart: Inequality between America’s Most and Least Affluent Neighborhoods; Urban Institute: Washington, DC, USA, 2015; Available online: https://www.urban.org/research/publication/worlds-apart-inequality-between-americas-most-and-least-affluent-neighborhoods (accessed on 8 September 2020).

- Hulse, K.; Yates, J. A private rental sector paradox: Unpacking the effects of urban restructuring on housing market dynamics. Hous. Stud. 2017, 32, 253–270. [Google Scholar] [CrossRef]

- Quigley, J.M.; Raphael, S. Is Housing Unaffordable? Why Isn’t It More Affordable? J. Econ. Perspect. 2004, 18, 191–214. [Google Scholar] [CrossRef]

- Baker, E.; Mason, K.; Bentley, R. Measuring Housing Affordability: A Longitudinal Approach. Urban Policy Res. 2015, 33, 275–290. [Google Scholar] [CrossRef]

- Pinto, E.; Peter, T. AEI Center on Housing Markets and Finance Announces the 10 Best and Worst Metropolitan Areas for First-Time Homebuyers; American Enterprise Institute: Washington, DC, USA, 2018; Available online: https://www.aei.org/press/release-aei-center-on-housing-markets-and-finance-announces-the-10-best-and-worst-metropolitan-areas-for-first-time-homebuyers/ (accessed on 8 September 2020).

- Southern California Association of Governments. City Boundaries. [GIS Shapefiles]. Dataset(s); 2020. Available online: http://gisdata-scag.opendata.arcgis.com/datasets/27b134459761486991f0b72f8a9a67c5_0 (accessed on 15 January 2020).

- Southern California Association of Governments. County Boundaries. [GIS Shapefiles]. Dataset(s); 2020. Available online: http://gisdata-scag.opendata.arcgis.com/datasets/4342378398be43e091da8dd85b02ab1d_1 (accessed on 15 January 2020).

- National Historical Geographic Information System, & Minnesota Population Center. US States 2010. [GIS Shapefiles]. Dataset(s). 2011. Available online: https://www.nhgis.org/ (accessed on 15 January 2020).

- National Historical Geographic Information System, & Minnesota Population Center. (nd). California Counties. [GIS Shapefiles]. Dataset(s). Available online: https://www.nhgis.org/ (accessed on 15 January 2020).

- National Geographic Center, & ESRI. Mexican State Boundaries. [GIS Shapefiles]. Dataset(s). 2012. Available online: https://www.arcgis.com/home/item.html?id=ac9041c51b5c49c683fbfec61dc03ba8 (accessed on 15 January 2020).

- Ramsey-Musolf, D. Data for “The Efficacy of Allocating Housing Growth in the Los Angeles Region (2006–2014)”. [CSV Files]. Dataset(s). 2020. Available online: https://scholarworks.umass.edu/data/110/ (accessed on 20 May 2020).

- State of California, & Department of Finance. E-8 Historical Population and Housing Estimates for Cities, Counties, and the State, 2000–2010. [Online Tables]. Dataset(s); 2012. Available online: http://www.dof.ca.gov/Forecasting/Demographics/Estimates/E-8/2000-10/ (accessed on 15 September 2019).

- State of California, & Department of Finance. E-5 Population and Housing Estimates for Cities, Counties, and the State, January 1, 2011–2018, with 2010 Benchmark. [Online Tables]. Dataset(s); 2018. Available online: http://www.dof.ca.gov/Forecasting/Demographics/Estimates/E-5/ (accessed on 15 September 2019).

- U.S. Census Bureau. American Factfinder. Dataset(s); 2000 SF3 Median Home Value, 2000 SF3—Median Household Income, 2015 ACS 5YR B25007—Median Home Value, 2015 ACS 5YR S1903—Median Household Income. 2020. Available online: http://factfinder.census.gov/faces/nav/jsf/pages/index.xhtml (accessed on 15 January 2020).

- Community Development Department. 2008–2014 Housing Element; Community Development Department: Irvine, CA, USA, 2012.

- California Court of Appeal. City of Irvine v. Southern California Association of Governments, No. No. G040513, 175 506; California Court of Appeal, 4th Appellate Dist., 3rd Div.: Santa Ana, CA, USA, 2009.

- Myers, D.; Pitkin, J.R.; Park, J. Estimation of housing needs amid population growth and change. Hous. Policy Debate 2002, 13, 567–596. [Google Scholar] [CrossRef]

- Peppin, J.C. Municipal Home Rule in California: I. Calif. Law Rev. 1941, 30, 1–45. [Google Scholar] [CrossRef][Green Version]

- Community Development Department. Laguna HIlls 2013–2021 Housing Element; Community Development Department: Laguna HIlls, CA, USA, 2013.

- Community Development Department. Lake Forest 2013–2021 Housing Element; Community Development Department: Lake Forest, CA, USA, 2014.

- Community Development Department. Santa Clarita 2013–2021 Housing Element; Community Development Department: Santa Clarita, CA, USA, 2013.

- Lanzerotti, L. Homeownership at High Cost: Foreclosure Risk and High Cost Loans in California; Federal Reserve Bank of San Francisco: San Francisco, CA, USA, 2006; Available online: https://www.frbsf.org/community-development/publications/working-papers/2006/july/homeownership-foreclosure-risk-loans-california/ (accessed on 8 September 2020).

- Molina, E.T. Reversed gains? African-Americans and foreclosures in the Los Angeles metropolitan area, 2008–2009. In Black California Dreamin’: The Crises of California’s African-American Communities; Banks, I., Johnson, G., Lipsitz, G., Taylor, U., Widener, C.W.C., Eds.; Center for Black Studies Research, UC Santa Barbara: Santa Barbara, CA, USA, 2012; pp. 127–142. [Google Scholar]

- Creswell, C.E. Amendment of State Housing Element Law—AB 2348; California Department of Housing and Community Development: Sacramento, CA, USA, 2005. Available online: https://www.hcd.ca.gov/grants-funding/active-funding/iigp/docs/ab2348stat04ch724.pdf (accessed on 8 September 2020).

- Uhler, B. A Look at Recent Progress Toward Statewide Housing Goals. In California Economy and Taxes; 2016. Available online: https://lao.ca.gov/LAOEconTax/Article/Detail/226 (accessed on 20 May 2020).

- Baer, W.C. California’s Fair-Share Housing 1967–2004: The Planning Approach. J. Plan. Hist. 2008, 7, 48–71. [Google Scholar] [CrossRef]

- Calavita, N.; Grimes, K. Inclusionary housing in California—The experience of two decades. J. Am. Plan. Assoc. 1998, 64, 150–169. [Google Scholar] [CrossRef]

- Meck, S.; Retzlaff, R.C.; Schwab, J. Regional Approaches to Affordable Housing; American Planning Association: Chicago, IL, USA, 2003. [Google Scholar]

- Lewis, P.G. Can state review of local planning increase housing production? Hous. Policy Debate 2005, 16, 173–200. [Google Scholar] [CrossRef]

- Lewis, P.G. California’s Housing Element Law: The Issue of Local Noncompliance; Public Policy Institute of CA: San Francisco, CA, USA, 2003; Available online: http://www.ppic.org/main/publication.asp?i=350 (accessed on 8 September 2020).

- Southern California Association of Governments. Estimate of SCAG RHNA Allocation Based on Regional Council. FINAL RHNA Allocation Methodology (Adopted by Regional Council 3/5/20). 2020. Available online: http://www.scag.ca.gov/programs/Documents/RHNA/Staff-Recommended-RHNA-Estimated-Allocations-030520.pdf (accessed on 15 May 2020).

- Rosenfeld, D.; Littlejohn, D. Draft regional housing plan requires dramatic increase in units for beach cities. The Beach Reporter. 12 November 2019. Available online: http://tbrnews.com/news/draft-regional-housing-plan-requires-dramatic-increase-in-units-for/article_6df2f58c-04b4-11ea-b8d6-93be32c3d992.html (accessed on 8 September 2020).

- Southern California Association of Governments. RHNA Appeals Procedures; Southern California Association of Governments: Los Angeles, CA, USA, 2020. Available online: http://www.scag.ca.gov/programs/Documents/RHNA/RHNA-Adopted-Appeals-Procedures.pdf (accessed on 15 May 2020).

- Lewis, P.G. Regionalism and representation—Measuring and assessing representation in metropolitan planning organizations. Urban Aff. Rev. 1998, 33, 839–853. [Google Scholar] [CrossRef]

- Baldassare, M.; Hassol, J.; Hoffman, W.; Kanarek, A. Possible planning roles for regional government—A survey of city planning directors in California. J. Am. Plan. Assoc. 1996, 62, 17–29. [Google Scholar] [CrossRef]

- Wassmer, R.W.; Lascher, E.L. Who supports local growth and regional planning to deal with its consequences? Urban Aff. Rev. 2006, 41, 621–645. [Google Scholar] [CrossRef]

- U.S. Department of Transportation. Program History. (nd). Available online: https://www.transportation.gov/utc/program-history (accessed on 7 August 2020).

- Wheeler, M. Regional Consensus on Affordable Housing: Yes in My Backyard? J. Plan. Educ. Res. 1993, 12, 139. [Google Scholar] [CrossRef]

- Babcock, R.F. The Zoning Game: Municipal Practices and Policies; University of Wisconsin Press: Madison, WI, USA, 1966. [Google Scholar]

- Landis, J.D.; Smith-Heimer, M.; Larice, M.; Reilly, M.; Corley, M.; Jerchow, O. Raising the Roof: California Housing Development Projections and Constraints, 1997–2020; UC Berkeley: Sacramento, CA, USA, 2000. Available online: https://www.hcd.ca.gov/policy-research/plans-reports/docs/Raising-the-Roof.pdf (accessed on 8 September 2020).

- Olshansky, R.B. The California Environmental Quality Act and local planning. J. Am. Plan. Assoc. 1996, 62, 313–330. [Google Scholar] [CrossRef]

- Landis, J.D.; Pendall, R.; Olshansky, R.B.; Huang, W. FIXING CEQA: Options and Opportunities for Reforming the California Environmental Quality Act; UC Berkeley: Berkeley, CA, USA, 1995. [Google Scholar]

- Dillon, L. An aggressive Proposal that touched a lot of nerves: Why Gov. Brown’s plan to stem the housing crisis failed. Los Angeles Times. 12 September 2016. Available online: http://www.latimes.com/politics/la-pol-sac-governor-housing-failure-20160912-snap-story.html# (accessed on 8 September 2020).

- Dillon, L. Why cities have an incentive to cheat under the governor’s new housing plan. Los Angeles Times. 29 May 2016. Available online: http://www.latimes.com/politics/la-pol-sac-city-cheating-housing-20160529-snap-story.html (accessed on 8 September 2020).

- Pendall, R. Local land use regulation and the chain of exclusion. J. Am. Plan. Assoc. 2000, 66, 125–142. [Google Scholar] [CrossRef]

- Pendall, R. Opposition to housing—NIMBY and beyond. Urban Aff. Rev. 1999, 35, 112–136. [Google Scholar] [CrossRef]

- Schill, M.H. Regulations and Housing Development: What We know. Cityscape 2005, 8, 5–19. [Google Scholar]

- Taylor, M. Considering Changes to Streamline Local Housing Approvals; Legislative Analyst’s Office: Sacramento, CA, USA, 2016. Available online: http://www.lao.ca.gov/reports/2016/3470/Streamline-Local-Housing-Approvals.pdf (accessed on 8 September 2020).

- Taylor, M. California’s High Housing Costs: Causes and Consequences; Legislative Analyst’s Office: Sacramento, CA, USA, 2015. Available online: http://www.lao.ca.gov/reports/2015/finance/housing-costs/housing-costs.aspx (accessed on 8 September 2020).

- Monkkonen, P.; Manville, M. Opposition to development or opposition to developers? Experimental evidence on attitudes toward new housing. J. Urban Aff. 2019, 41, 1123–1141. [Google Scholar] [CrossRef]

- Nguyen, M.T.; Basolo, V.; Tiwari, A. Opposition to Affordable Housing in the USA: Debate Framing and the Responses of Local Actors. Hous. Theory Soc. 2013, 30, 107–130. [Google Scholar] [CrossRef]

- Vogel, R.K.; Nezelkewicz, N. Metropolitan planning organizations and the new regionalism: The case of Louisville. Publius J. Fed. 2002, 32, 107–129. [Google Scholar] [CrossRef]

- Dillon, L. More than 130 bills take aim at California’s housing crisis. Los Angeles Times. 20 May 2017. Available online: http://www.latimes.com/politics/essential/la-pol-ca-essential-politics-updates-more-than-130-bills-take-aim-at-1490028641-htmlstory.html (accessed on 8 September 2020).

- Department of Housing and Community Development. California’s 2017 Housing Package; Department of Housing and Community Development: Sacramento, CA, USA, 2018. Available online: https://www.hcd.ca.gov/policy-research/docs/HousingBillMatrix.pdf (accessed on 8 September 2020).

- Kirkeby, M. Review of Draft Regional Housing Need Allocation (RHNA) Methodology; California Department of Housing and Community Development: Sacramento, CA, USA, 2020. Available online: http://www.scag.ca.gov/programs/Documents/RHNA/HCD-Review-RC-Approved-Draft-RHNA-Methodology.pdf (accessed on 8 September 2020).

- Department of Housing and Community Development. (n.d.-a); Accountability and Enforcement. Available online: https://www.hcd.ca.gov/community-development/accountability-enforcement.shtml (accessed on 15 July 2020).

- California Governor’s Office of Planning and Research. General Plan Guidelines; California Governor’s Office of Planning and Research: Sacramento, CA, USA, 2017. Available online: https://opr.ca.gov/docs/OPR_COMPLETE_7.31.17.pdf (accessed on 10 August 2020).

- Naungayan, K.C. Six Cities Receive State Approval for Their Housing Plans; California Department of Housing and Community Development: Sacramento, CA, USA, 2020.

- Ramsey-Musolf, D. According to the Plan: Testing Housing Plan Quality on Low-income Housing Production. Urban Sci. 2018, 2, 1. [Google Scholar] [CrossRef]

- Stephens, J. Loss of Redevelopment Set-Aside Could Decimate Affordable Housing. Calif. Plan. Dev. Rep. 2011, 26. Available online: http://www.cp-dr.com/node/2864 (accessed on 8 September 2020).

- Community Development Department City of La Puente 2008–2014 Housing Element; Community Development Department: La Puente, CA, USA, 2008.

- Community Development Department. City of Alhambra, 2008–2014 Housing Element; Community Development Department: Alhambra, CA, USA, 2009.

- Community Development Department. City of Los Angeles 2006–2014 Housing Element; Community Development Department: Los Angeles, CA, USA, 2009.

- The City Council. City of Arcadia 2008–2014 Housing Element Technical Background Report; The City Council: Arcadia, CA, USA, 2010.

- Community Development Department. City of Covina Housing Element Update, Draft; Community Development Department: Covina, CA, USA, 2010.

- Community Development Department. City of La Verne 2008–2014 Housing Element; Community Development Department: La Verne, CA, USA, 2010.

- Community Development Department. City of Pomona Housing Element of the General Plan, 2008–2014; Community Development Department: Pomona, CA, USA, 2011.

- Community Development Department. Expanded Housing Element; Community Development Department: La Palma, CA, USA, 2010.

- Marantz, N.J. Drift and conversion in metropolitan governance: The rise of California’s redevelopment agencies. J. Urban Aff. 2018, 40, 901–922. [Google Scholar] [CrossRef]

- Blount, C.; Ip, W.; Nakano, I.; Ng, E. Redevelopment Agencies in California: History, Benefits, Excesses, and Closure; U.S. Department of Housing and Urban Development: Washington, DC, USA, 2014. Available online: http://www.huduser.gov/portal/publications/redevelopment_whitepaper.pdf (accessed on 8 September 2020).

- Veronica Tam & Associates & City of Glendora. Department of Community Development. 2013–2021 Housing Element; Department of Community Development: Glendora, CA, USA, 2013. Available online: https://www.cityofglendora.org/departments-services/planning/current-projects/housing-element-update (accessed on 24 August 2020).

- Knight, H. There no stopping it: Bay Area cities reluctantly approve housing in face of state laws. San Francisco Chronicle. 5 August 2020. Available online: https://www.sfchronicle.com/bayarea/article/There-s-no-stopping-it-Bay-Area-cities-15462259.php (accessed on 8 September 2020).

- Mitchell, J.L. Will Empowering Developers to Challenge Exclusionary Zoning Increase Suburban Housing Choice? J. Policy Anal. Manag. 2004, 23, 119–134. [Google Scholar] [CrossRef]

- Payne, J.M. The Paradox of Progress: Three Decades of the Mount Laurel Doctrine. J. Plan. Hist. 2006, 5, 126. [Google Scholar] [CrossRef]

- DeSantis, S. Myths and Facts about Affordable and High Density Housing; California Planner’s Roundtable & California Department of Housing and Community Development: Sacramento, CA, USA, 2002. Available online: https://cproundtable.org/publications/myths-facts-about-affordable-and-high-density-housing/ (accessed on 8 September 2020).

- Goetz, E.G. Words Matter: The Importance of Issue Framing and the Case of Affordable Housing. J. Am. Plan. Assoc. 2008, 74, 222–229. [Google Scholar] [CrossRef]

- Galster, G. William Grigsby and the Analysis of Housing Sub-markets and Filtering. Urban Stud. 1996, 33, 1797–1805. [Google Scholar] [CrossRef]

| Income Group | RHNA Allocation | Los Angeles County Household Income Limits (FY 2008) Household of 4 Persons |

|---|---|---|

| Very Low (<50% AMI) | 192 | Up to $37,900 per year |

| Low (51–80% AMI) | 119 | Up to $60,650 per year |

| Moderate (81–120% AMI) | 127 | Up to $71,800 per year |

| Above Moderate (121% + AMI) | 307 | Above $71,800 per year |

| Total | 745 |

| RHNA Growth Rate | RHNA Households | IQM 2000 | Housing Inventory 2015 | Actual Growth Rate | Achievement | IQM 2015 | |

|---|---|---|---|---|---|---|---|

| Mean | 12.7% | 2931.8 | 4.2 | 30,684.08 | 7.4% | 92.6% | 6.6 |

| Median | 5.9% | 985.0 | 3.9 | 16,233.00 | 3.3% | 59.0% | 6.3 |

| SD | 19.4% | 8975.6 | 1.5 | 106,652.28 | 12.5% | 236.3% | 2.5 |

| Min | 0.1% | 8.0 | 2.0 | 397 | −5.8% | −1150.0% | 2.3 |

| Max | 119.5% | 112,876.0 | 14.0 | 1,440,779 | 105.9% | 2534.0% | 17.8 |

| Pearson Correlation | |||||

|---|---|---|---|---|---|

| Housing Inventory (2015) | IQM (2015) | ACH | AGR | ||

| RHNA Growth Rate (RGR) | −0.026 | −0.457 ** | −0.096 | 0.718 ** | |

| BCa CI 95% | Upper | −0.516 | 0.606 | ||

| Lower | −0.417 | 0.831 | |||

| RHNA Households (RHH) | 0.934 ** | −0.052 | −0.037 | 0.182 * | |

| BCa CI 95% | Lower | 0.495 | 0.062 | ||

| Upper | 0.983 | 0.616 | |||

| N | 185 | 185 | 185 | 185 | |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ramsey-Musolf, D. The Efficacy of Allocating Housing Growth in the Los Angeles Region (2006–2014). Urban Sci. 2020, 4, 43. https://doi.org/10.3390/urbansci4030043

Ramsey-Musolf D. The Efficacy of Allocating Housing Growth in the Los Angeles Region (2006–2014). Urban Science. 2020; 4(3):43. https://doi.org/10.3390/urbansci4030043

Chicago/Turabian StyleRamsey-Musolf, Darrel. 2020. "The Efficacy of Allocating Housing Growth in the Los Angeles Region (2006–2014)" Urban Science 4, no. 3: 43. https://doi.org/10.3390/urbansci4030043

APA StyleRamsey-Musolf, D. (2020). The Efficacy of Allocating Housing Growth in the Los Angeles Region (2006–2014). Urban Science, 4(3), 43. https://doi.org/10.3390/urbansci4030043