1. Introduction

The birth of Industrie 4.0 has incurred a lot of thoughts and discussions in both Germany as well as in China. From the western point of view, trying to grasp the grand old Chinese culture alone will take some effort. Since “openness” and “integration” are the major philosophies of Industrie 4.0, how does one integrate these with China, which is one of the most important manufacturing bodies in the world? From the Chinese point of view, the concepts and philosophies of Industrie 4.0 have inspired them in their search for better living, but the question of how to deploy these concepts to suit their mentality and environment remains a field that requires further investigations from academics and the market.

This paper reviews the development of Industrie 4.0 in China. We look at Industrie 4.0 in China from a macroeconomic point of view, as well as looking into concrete digitalization projects to discuss the problems that enterprises encounter. We also look at the history up to the present situation and discuss the possible future development of Industrie 4.0 in China. Through a better understanding of the market and how it would further develop, each enterprise or individual could have a better judgement of its/their strategy of engagement with China.

We make our observations and conclusions on the Chinese market based on engagements with large state-owned-enterprises (SOEs) and small-and-medium enterprises (SMEs) predominantly in automotive discrete manufacturing (OEM and supplier). We dive into deeper insights to the SMEs as they define to a higher degree the phenomenon of the Chinese economy. We feel that more attention should be directed to the SMEs than the huge conglomerates.

The authors intentionally used the term “Industrie 4.0” in its original German spelling throughout the paper. The intention was to stress the affinity of the Chinese to the German technologies and philosophies in its authentic form. As Prof. Henning Kagermann, co-Father of Industrie 4.0, once remarked after his visit to China, “The Chinese spell Industrie 4.0 with ‘ie’.”

Methodology

This paper presents research results from a market perspective, the paper therefore does not represent research in a narrow sense. This practice-oriented paper provides important and helpful insights for applied research on smart manufacturing.

The results come from real-life customer projects, customer surveys and personal experiences of the authors as experienced IT/OT managers and entrepreneurs with long years of industry experiences in both Germany and China. The insights to the market need for digitalization in China are concluded from over 150 cases of customer engagements at the pre-sale phases between 2018 and 2022.

We have carried out dozens of digitalization projects in the manufacturing industry in China. We conducted surveys, collected feedbacks and carried out discussions with the customers during and after every project. The observations, conclusions and recommendations are also made from this specific industry (industrial software) point of view but most of them are generally applicable to any other industries.

For a topic like Industrie 4.0, the problems and feedback from the market and politics very much build the foundation to shape its development. Therefore, the case studies presented in this paper can be valuable to both researchers and practitioners of the field. The conclusions derived from these projects can also be generally applicable to many other similar fields of studies and regional applied research.

2. Overview of Industrie 4.0 in China

Industrie 4.0 represents the interconnection of people, intelligent objects and machines, the use of service-oriented architectures and the composition of services and data from different sources into new business processes. Industrie 4.0 is the basis for the future of industrial value creation. The focus is on data-based value creation, digitally enhanced business models and forms of organization, but also new solutions in areas such as energy, finance, health, and mobility. Economically, it initially involved a shift from traditional automation with predetermined outcomes to learning and self-adapting machines and environments that react in real time to changes in customer demand as well as to unexpected disruptions. This is accompanied by a move from mass production to customization, i.e., the competitively priced production of individual, tailor-made products [

1,

2].

In 2013, with the publication of the revolutionary white paper “

Recommendations for implementing the strategic initiative INDUSTRIE 4.0. Securing the future of German manufacturing industry. Final Report of the Industrie 4.0 Working Group” [

3], Prof. Henning Kagermann and Prof. Wolfgang Wahlster introduced the concept of “Industrie 4.0“to the world. The beauty of Industrie 4.0 to the Chinese was that it initiated them to begin pondering the question “What is the future of manufacturing?” and gave the answer “Digitalization and new business models create values” at the same time [

3,

4]. Since then, Industrie 4.0 has become a hype word in China. There has been a rush to learn, implement and practice Industrie 4.0 technologies and methodologies in the industry.

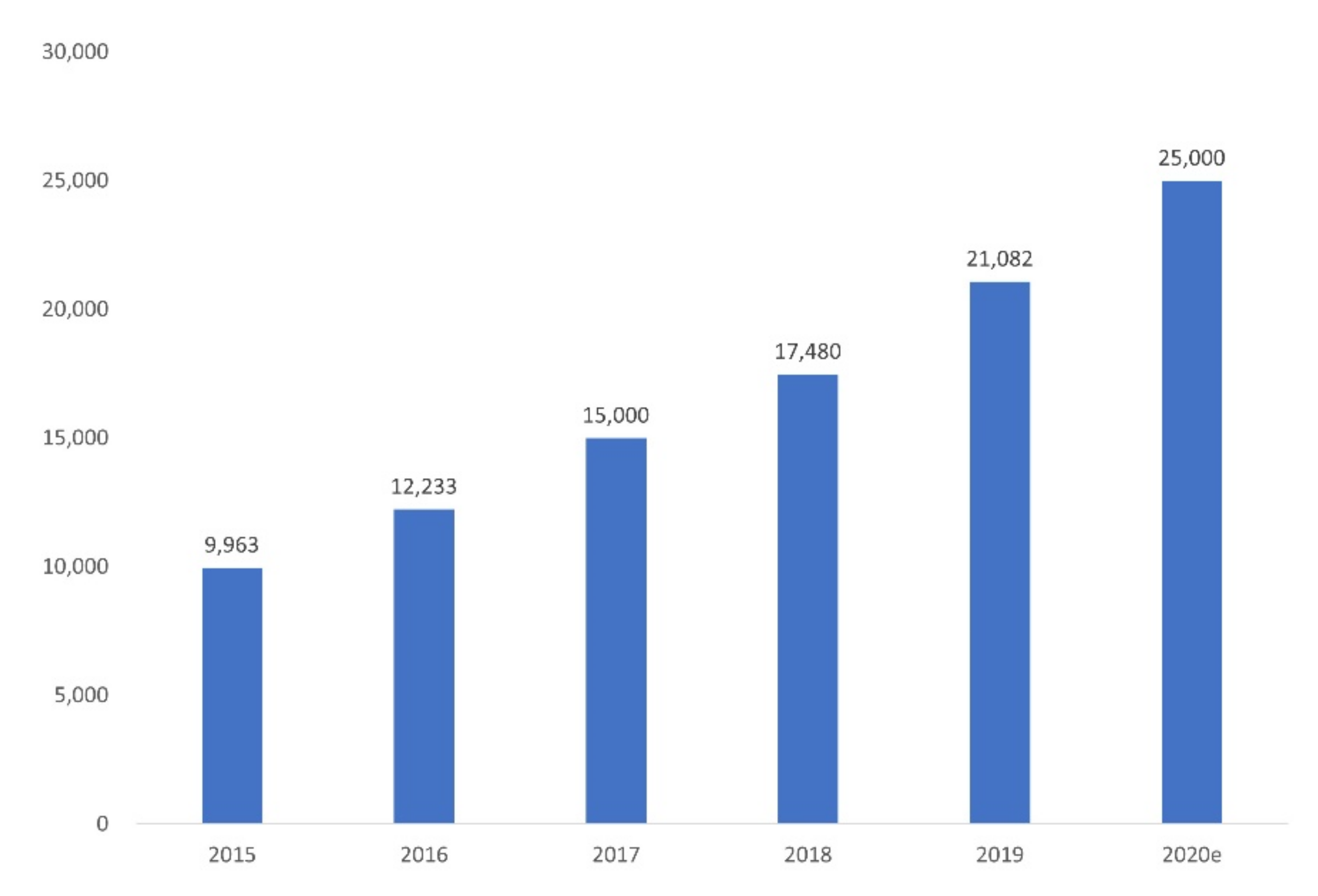

Figure 1 shows the growth of the market for intelligent manufacturing in the past few years.

Lately, compared with the rush and the attempts for a radical change in manufacturing a few years back, the major players of Industrie 4.0 in China are becoming calm and thoughtful about their endeavor. After numerous explorations from different angles, it has become obvious that this road would not be an easy one. Patience, experience, accumulation of technology foundations and knowledges, as well as sufficient monetary investments are critical factors for the success.

2.1. Variants of Chinese Versions of Industrie 4.0

A paradigm like Industrie 4.0 is bound to be influenced by the practical deployment of relevant projects in the market. Problems and issues encountered in the market provide feedbacks to help reshape the development of Industrie 4.0. In China, where the economy, technological progress and cultural environment are very much different than in Germany, implementing Industrie 4.0 in the Chinese market demands constant modification to the model and adapting the local needs, what is commonly called “localization”. Parallel to deploying Industrie 4.0 in the Chinese industrial environment, several variants of Industrie 4.0 have emerged to suit different market demands at different stages.

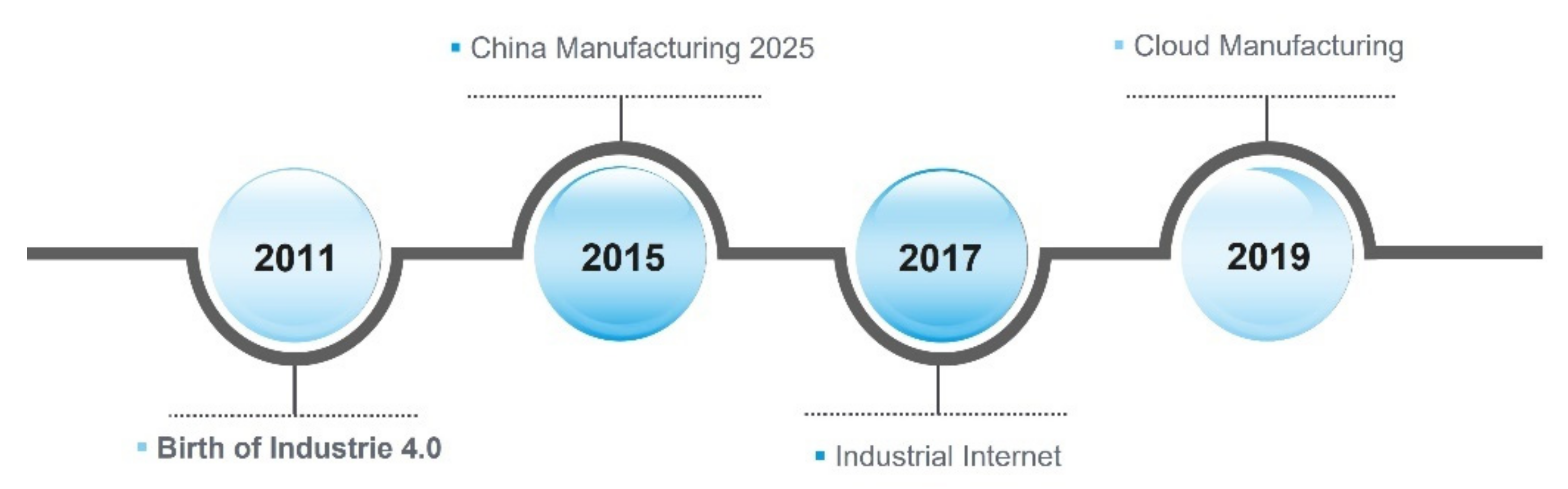

Figure 2 shows the timeline of the emergence of the variants of Industrie 4.0 in China. These variants of Industrie 4.0 dominated the major philosophy of smart manufacturing in the Chinese market at the different stages.

2.1.1. China Manufacturing 2025

“China Manufacturing 2025” was a strategic initiative brought out by Prime Minister Li Keqiang. An official document was issued by the State Council in May 2015 meant to strengthen the manufacturing capability of the Chinese economy.

The China Manufacturing 2025 Plan is also known as the “China Version of The Industrie 4.0 Plan”. The concept of “China Manufacturing 2025” was first proposed by the Chinese Academy of Engineering. Under the overall planning of the State Council, the Ministry of Industry and Information Technology (MIIT) took the lead in working with more than 20 ministries and commissions such as the National Development and Reform Commission, the Ministry of Science and Technology and more than 50 academicians to formally compile the “China Manufacturing 2025 Plan” [

5].

The core goal of “China Manufacturing 2025” was to transform China from a manufacturing supplier to a manufacturing driver. The year 2025 was chosen after careful analysis of China’s status of manufacturing capabilities and the overall market environment at that time (2015). It was set as a goal to transform, in 10 years, its capability from simply providing low-cost labor for manufacturing outsourcing, to the form where demands of the new era will challenge the supply end and thus bring added value to the industry by driving innovations in the supplier technologies.

2.1.2. Industrial Internet

The concept of “Industrial Internet” actually originated in America. It was first proposed by General Electric (GE) in 2012 through the release of the white paper “

Industrial Internet: Pushing the boundaries of minds and machines” [

6], which elaborated on the connotation and future vision of the Industrial Internet from the aspects of technical architecture, development opportunities, potential benefits, application conditions, etc. In essence, industrial interconnectivity is the integration and innovation of industrial and IT capabilities. Subsequently, five industry giants in the United States joined forces to form the Industrial Internet Consortium (IIC), which vigorously promoted the concept of Industrial Internet and set off a wave of Industrial Internet movement in the world.

In 2015, MIIT issued the documents “

Implementation of the State Council on actively promoting the Internet + Guidance action plans (year 2015–2018)” [

7], clearly stating the guidelines for the internet to be widely integrated into the entire process of production and manufacturing, the entire value chain and the whole life cycle of products, cultivating and developing an open innovative R&D model, and accelerating the development and application of industrial big data.

In February 2016, China established the Alliance of Industrial Internet (AII). Jointly initiated by the China Academy of Information and Communications Technology and related enterprises such as manufacturing, communications industry, and the Internet, the alliance actively carries out work in the research of major issues of the Industrial Internet, the development of standards, technical test verification, and industry promotion. In the same year, AII released version 1.0 of the Industrial Internet Architecture.

Since then, hundreds of industrial internet platforms have been founded and have entered the market, providing solutions and services to the manufacturing industry.

2.1.3. Cloud Manufacturing

In 2009, the research team led by Prof. Li Bohu, an academician of the Chinese Academy of Engineering and Professor Zhang Lin, then deputy dean of the School of Automation Science and Electrical Engineering of Beihang University, realized that the deep integration of advanced information technologies such as cloud computing and the Internet of Things with the manufacturing industry will bring profound changes to the manufacturing industry and they took the lead in proposing the concept of “Cloud Manufacturing” [

8]. They pointed out that “cloud manufacturing was a kind of network and service platform, organizing online manufacturing resources according to user needs”, to provide users with a variety of on-demand manufacturing services.

Cloud manufacturing provides a new model and means for China to move from a manufacturing outsourcer to a manufacturing driver. The initiative was jointly supported by more than 300 researchers and developers from 28 organizations of universities, research institutes and enterprises across the country, and achieved a number of pioneering research results [

9,

10].

Prof. Li Bohu, Prof. Zhang Lin and their team members have publicized and introduced the concept and research results of cloud manufacturing by organizing international conferences or forums, publishing academic papers, carrying out academic exchanges and other forms, which have made important contributions to the recognition and attention of international counterparts for cloud manufacturing research, and gradually forming a new research direction in the world. Cloud manufacturing is one of the very few academic directions initiated by China that attracted the attentions of international academies.

3. The Need of Digitalization

In the eyes of most people, a factory has the means to receive orders, manufacture and ship produced goods. In this process, the business owners and the employees made a certain profit out of it. A need for digitalization was not very straight forward.

However, in the past few years, especially after the 2008 financial crisis, a higher level of perception to the means of a factory became more and more widespread. In the entire industrial chain, the raw materials were processed and turned into finished products to complete the value-adding. A factory was beginning to be perceived as the means of value discovery, value creation and value transmission.

In the past over 30 years, the economic environment in China has favored the growth of a manufacturing market [

11]. Most manufacturing businesses founded have encountered relatively low founding hurdles and most of them lacked core competitive technologies. Thus, they would compete in the market with product cost performance (mainly price). Businesses with better management gradually outperform their competitors and those with poor management faced the threat of being discarded by the market competition. With the continuous rise in labor, rent and raw material prices, as well as intensive homogeneous competition, the pressure of efficiency in factory operation was increasing. The COVID pandemic has also made many traditional manufacturing practitioners understand the importance of digital operation. At the same time, international trade war, the financial crisis, fluctuations in exchange rates or other unpredictable factors threatened the future of manufacturing businesses.

Huge conglomerates have the expertise and capabilities to take measures to mitigate the risks of uncertainties. However, a large majority of the Chinese businesses came in existence simply because the market has been generous. These companies grew in an environment without much risk, and they have not been able to build up the necessary risk mitigation capabilities [

12]. They are facing challenges today that were never encountered in the past 30 years. This is an obvious driving factor for a growing need to seek for solutions to ensure their survival in the market.

3.1. China’s SMEs in Urgent Need of Digitalization

Digital transformation of SMEs in China is a very important aspect of the overall digital transformation in China’s economy. The big enterprises alone will not be able to bring forward the entire economy to a digitalized one. Therefore, it is crucial to look into and understand the problems and difficulties of the SMEs in their digitalization transformation endeavor.

One point to note is the difference in perception of the different cultures and markets. This very often leads to differences in usage of vocabularies and semantics for mutual understanding. For example, when we mention “Small and Medium Enterprises” in Germany, we envision companies which the ownership, management and liability are traditionally in one hand. The German SMEs can be strong partners for large companies worldwide, and they bear responsibility for the skilled workers of tomorrow and stand for innovative strength, sustainable growth and job creation [

13]. In an associated recommendation of the Commission of the European Communities from 6 May 2003, SMEs have up to 249 employees and make a yearly turnover of less than 50 million Euros [

14]. Many German SMEs are even world leading in the technologies of their field, the so-called “hidden champions”. However, the perception of SMEs in China is a completely different concept. Very often, a company with several thousand employees will still be regarded as an SME. The majority of SMEs in China have not overcome the phase of struggling for survival. Such conceptional differences increase the difficulties for communication and critical messages are very often misinterpreted.

According to the “

Analysis Report on the Digital Transformation of Small and Medium-sized Enterprises (2020)” [

15] published by the Chinese Electronics Standardization Institute, 89% of China’s SMEs are exploring digital transformation, but only 3% of SMEs are in the stage of more extensive applications of digital transformation. This number, according to the research done by ZEW (Leibniz-Zentrum für Europäische Wirtschaftsforschung) and Infas (Institut für angewandte Sozialwissenschaft), sits at 21% in Germany [

16]. These figures highlight the expectations and dilemmas of current SMEs in China regarding digital transformation.

Through the digital transformation of manufacturing enterprises, the Chinese manufacturing industry aims to achieve cost reduction and an increase in efficiency, energy saving, improve product quality, improve product added value, shorten the time for products to go to market, address the customization needs of customers, and seeking profitability from providing services, etc., and ultimately enhance the core competitiveness and profitability of enterprises. The demands fall mainly in the following three aspects.

3.1.1. Adapting to Rapidly Changing Market Conditions

China’s manufacturing industry has roughly gone through three periods. In the 1980s, there was generally a shortage of goods, and thus the manufacturing industry only focused on “producing” to meet market demand; from 1990 to 2010, commodities became abundant, customers began to have a higher demand of goods, and enterprises began to pay attention to marketing, branding, quality and service. To achieve this, it needed the support of information technology. Since 2010, with a general surplus in production, there began the need for upgrading in consumptions. Customers began to be more focused on customization, user experience, and posed high demand on the supplier’s rapid response to products and services. Thus, enterprises needed to constantly innovate to meet the needs of consumers, and they had to quickly adapt to market changes, improve work efficiency as well as improve the customer experience.

3.1.2. Improve Product Quality and Production Management Efficiency

Although China’s manufacturing industry is large in scale and complete in offerings, it has been relatively weak in terms of innovativeness for a certain period of time, and there are still great inefficiencies in the management of the production processes. With the drastic changes in today’s manufacturing environment where the costs of labor and raw materials are rising rapidly, the Chinese manufacturing industry must focus on improving product quality and production management efficiency in order to regain a competitive advantage in the global market.

In addition, with the increasing popularity of the Internet, the rapid development of computing and storage capabilities, the wide application of the Internet of Things and sensor technology, and the continuous evolution of industrial software, the technical foundation has been laid for the acquisition, storage, transmission, display, analysis and optimization of data. At this point, digital transformation supported by technologies such as mobile internet, cloud computing, big data, and artificial intelligence is an important way to increase the competitiveness of the manufacturing industry.

3.1.3. Reduce Cost of Labor and Shortage of Skilled Workers

In the past years when there was a surplus of workforce in the labor market, it was a common practice for enterprises to rely on adding human workforce for scaling up their businesses. Therefore, many enterprises, especially in the manufacturing industries, developed on the foundation of labor-intensive business models.

However, the “one child policy” that was implemented in the 1980s has taken effect and made a drastic impact on the overall population and thus on the supply of the labor workforce. The Chinese economy turned from a market with a labor surplus to a market with a labor shortage within a decade. The business models that were working very well just a few years ago suddenly broke down, and the enterprises are facing challenges that they had never experienced before.

On the one hand, the problems of blue-collar recruitment difficulties and the shortage of high-skilled workers in the production workshop are frequent; on the other hand, there is a high demand for skilled talent to accomplish challenging tasks like digital transformation of enterprises. In many locations it becomes harder and harder to hire qualified workers.

Software developers in China with a relatively demanding skill level are already very expensive. Many of the SMEs cannot afford this cost. Even if they are determined to cultivate their own talents, it will take a long time until their problems are solved.

3.2. The Difficulties for SMEs in Digital Transformation

Industrie 4.0 has clearly shown the path for the development of the manufacturing industry. The core and basic part are the digitalization that brings changes to the way enterprises do business, as well as the intelligence that came along with it, built on the foundation of digitalization.

However, there are many concepts surrounding the idea of digitalization. For example, big data, cloud manufacturing, internet, AI. There are even more complicated concepts like “Integration of IT & OT”, “Smart Manufacturing Total Solution”, “Internet + Manufacturing”, “Industrial Big Data”, “Industrial APP” etc. The multitude of hype words enveloping the digitalization paradigm has been very confusing, and the industries have not been able to standardize their vocabulary. This creates even more obstacles for SMEs, who are trying to find ways into the digitalization world.

Unlike big enterprises, which have extensive resources of professionals for production, IT, for internet platform and for services, the SMEs generally face the problems of lack of financing and expertise. When the SMEs turn to look for assistance from third parties, for example, by outsourcing or engaging external consultants, they find that the market has not developed such experience and expertise sufficiently.

For most of the SMEs in manufacturing industries in China, there are many semi-mechanized, outdated technologies, processes and equipment, and traditional management methodologies and mentalities that are still dominating a large proportion of the businesses. Due to the shortage of funds and talents, many of their immediate pain-points are about the survival, so much of the efforts invested in digital transformation have to be short-termed and produce immediate results. There is little tolerance for ambiguity of the returns they can expect.

On top of that, due to the nature of the manufacturing industry itself, where standardization in the business processes has been difficult, a lack of standardized methodology in digital transformation poses a dilemma to the SMEs. On the one hand, they are educated by the big companies through pilot and lighthouse projects which demand huge investments that they can never afford; on the other hand, the success stories they see from the market are difficult to duplicate, and learning of countless failures they hear in the market make them hesitant to go forward in their attempts at digital transformation.

3.2.1. Sales—The Major Stumbling Block of the Chinese SMEs

For many of the vendors, their Industrie 4.0 solutions originate from the manufacturing end. Many solution providers believe that the owner of the businesses would need efficiency in the production processes. This is of course true. However, it is also important to understand that in reality, the boss is not the only deciding factor for the success of a digitalization program.

Making changes in an enterprise is normally painful, because there are always existing mechanisms or interested parties that are affected by the change. Thus, very often, we came across projects where the boss was very enthusiastic, but the employees would not have the matching passion to support the projects. In fact, they felt that the introduction of the solutions brought more troubles to their work.

Therefore, some Industrie 4.0 solution providers in China came into the market with very innovative offerings. They bundled shop floor digitalization solutions together with B2B sales platform solutions. The logic was to address the greatest pain of the business owner. The business owner could have access to the sales channels if they deployed the shop floor solutions as well, which were fully integrated into the sales platform.

3.2.2. Lack of Expertise in IT Strategy

Unlike in the mature western countries, China has a short history of cultivating experts well trained in IT strategy. This leads to the phenomenon that most of the CIOs (regardless of company size) tend to look for vendors who can provide total solutions to their digitalization needs. In other words, the capabilities in integration are demanded, and there is a tendency to shift the responsibility of integration to the vendor.

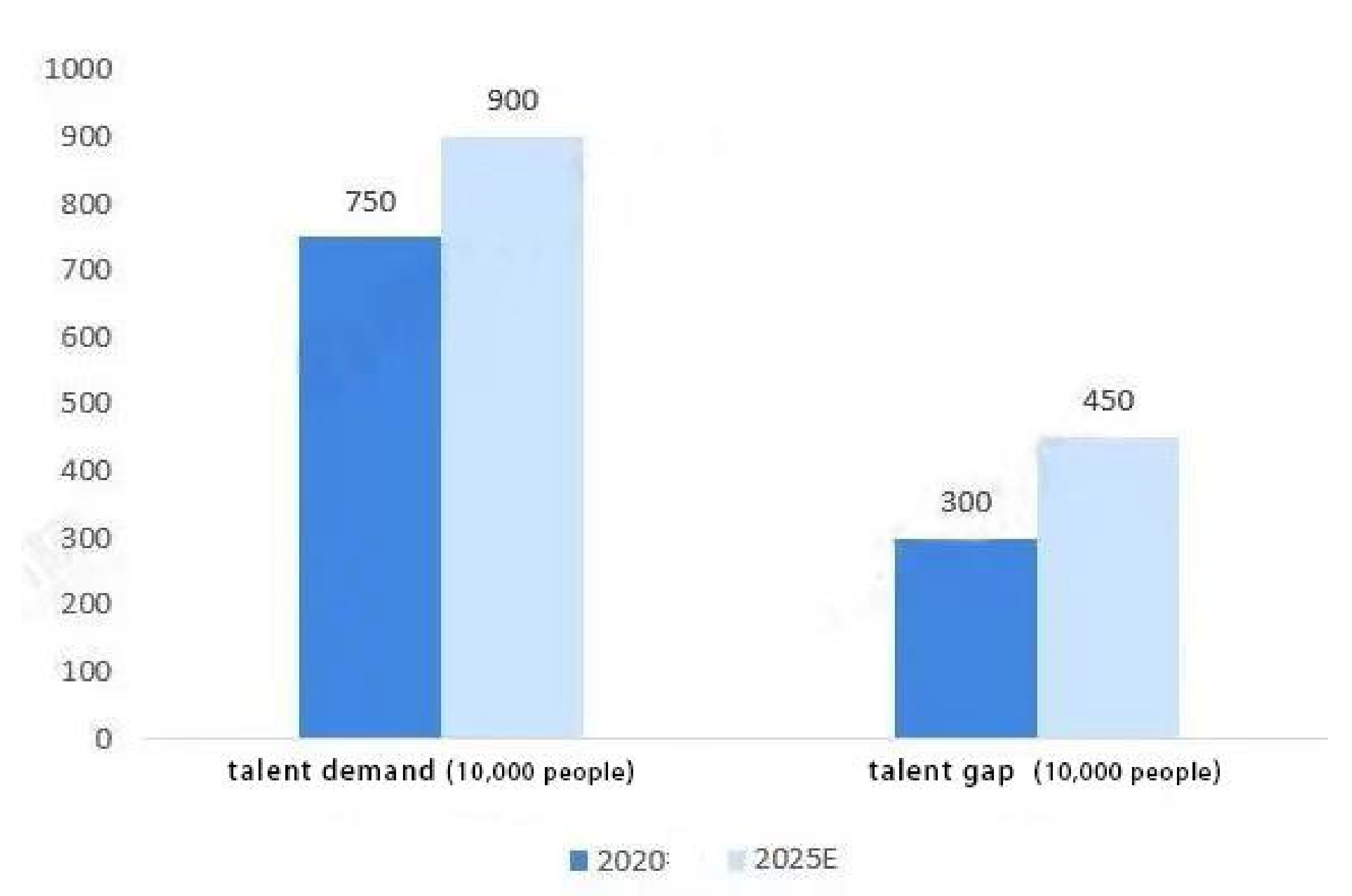

Figure 3 shows the talent gap for intelligent manufacturing in China. The gap will persist through 2025. Because of the lack of expertise in IT strategy, it is very common that the enterprises, especially the SMEs, carry out digitalization projects without proper consideration for long and short-term goals. Therefore, they very often run into difficulties in the middle of the projects.

3.3. Pursuing for New Business Models—Small Lot Manufacturing and Mass Customization

The introduction of Industrie 4.0 gives the Chinese economy the hope of reformation in its economy. With digital transformation, many new business models become possible. The emergence of new business models gives key players (especially the investors) hope, and thus patience for the future.

One of the biggest dreams of manufacturing enterprises is to connect directly to the end consumer market. If one can connect directly to the end consumer, one can maximize the efficiency of customized production, thus increasing value and profitability. In terms of a business model, the biggest wish of manufacturing companies is to use factories to directly connect to end-consumers as this is the only way to maximize the efficiency of customized production.

The Chinese adopted the first experience with C2B (Customer to Business) from the USA in 2006. As the concept that was very successfully driven by Groupon in USA spread to China, Groupon-duplicate companies like Meituan emerged and flourished in the Chinese market as well. At that time, the C2B model was more or less restricted to the consumer market. Most players did not have the confidence to migrate the business model to the manufacturing end.

The concept of C2M went a step further than C2B, bringing the end consumer directly to the manufacturer. Here, there was a huge emphasis in “dis-intermediary”, i.e., bypassing the need of agents, distributors, resellers, thus reducing the cost of the value chain.

Many manufacturing enterprises were ambitious to achieve a breakthrough with the C2M model. They firmly believed that future consumers would pay less attention to product branding. Instead, the trend was that consumers would look for “uniqueness” of customized products and were willing to sacrifice the branding values. Therefore, their weaknesses in marketing and attracting sales traffic would no longer be an obstacle to their success in business.

So, for many years, there was a rush to establish their own portals for end consumers, wechat shops, webshops etc. There was a movement where the manufacturers insisted on building their own sales channels and setting up their own banners.

However, realities are often crueler than dreams.

Except for big brands like Haier, Midea, Huawei or such, who had a huge manufacturing capacity and had established their own sales channels, the majority of the manufacturing enterprises had no or very limited influence at the sales end. They had no access to the end consumers, and the effort in trying to do so became too much of a burden. The ideal C2M did not arrive as promised.

The lessons learned were painful. The field of attracting traffic and sales was a totally different business than that of manufacturing. Even big brands like Haier with killer platforms like COSMOPlat would still rely on third party sales channels for their sales processes. Professional businesses should be handled by professional people. Bypassing the sales value chain was fated to fail from the very beginning.

In contrast, the internet giants that owned a large wave of consumer traffic began to penetrate the manufacturing end at a very high speed.

In the years between 2016–2018, internet giants like Netease, Alibaba, and JD.com launched their own C2M platforms. These platforms introduced to the consumer market the concept of ODM (Original Design Manufacturer). These internet giants took advantage of their consumer-end traffic to get into a preliminary exploration of the C2M business model.

The returns were not very promising. After engaging in uncountable price competitions among the internet giants, they finally returned to the more profitable platform model. The internet platforms began to probe the OBM (Original Brand Manufacturing) model, where the manufacturers were allowed to promote their own brands on these platforms. Alibaba went further to deploy simple technologies like bar codes, RFID, cameras etc. in the factories, attempting to integrate the factories’ production data with the sales orders in order to realize the model of “Manufacture to Order”.

These were courageous attempts to probe the new business models with the SMEs. Values were created for both the customers as well as the platforms. The SMEs who were thirsty for sales traffic welcomed such platforms as they brought additional values targeted at their immediate pain points—sales. And furthermore, these internet companies were eager to learn and reacted very fast to the market. Starting from the SMEs, successful test pilots could be iteratively developed into more mature solutions and finally penetrate the bigger enterprises. This could be a different path to achieve a country-wide penetration of Industrie 4.0 solutions and practices.

A more detailed description of this part of C2M history can be found in [

17].

4. Case Study: Experimenting Industrie 4.0 of a Chinese Manufacturing Enterprise

The following is an overview of a typical Chinese SME in its journey throughout a digital transformation. The example given here comes from a very typical medium Chinese manufacturing enterprise, with a kind of “mass customization” production model.

4.1. Background of GuoMao Reducer

Founded in 1993, GuoMao has grown into a mid-size company with 2200 employees, making a revenue of almost RMB 3 billion (about Euro 450 million) in 2021. Since its public listing on the stock market in 2019, GuoMao has achieved strong growth, even amidst the COVID pandemic. It is now a market leader in the China’s market of general reducer machine industry.

GuoMao is headquartered in Changzhou City in the Jiangsu Province. Its main products are industrial reducers with many product models. GuoMao produces more than a dozen series of varieties of transmission machineries, tens of thousands of varieties such as standard, customized, large and medium-sized non-standard, new products, high-precision transmission, etc. At the same time, GuoMao is developing its business overseas such as Southeast Asia, Europe and the United States.

4.2. Challenges and Motivation for Digital Transformation

GuoMao has the ambition to become a “world class transmission producer”. After careful analysis and considerations, it is decided that digitalization would be the means to achieve this goal. GuoMao believes that the long-term goal of digital transformation is to capture growth and drive value, and the adoption and implementation of all digital technologies should also revolve around this goal.

The immediate pain point that GuoMao wanted to address was the bottleneck to achieve large scale personalized customization of the customer orders. Due to the nature of the business, GuoMao intended to seek solutions to customize on demand plus a certain degree of flexible manufacturing. The ultimate goal would be to be able to deliver on a large scale, while ensuring that the quality and cost of each product unit were well controlled.

For GuoMao, gaining a competitive advantage in the market required improvement in the following capabilities: individual customization, agile planning, precise logistics, production transparency, flexible manufacturing, full traceability and energy savings.

The targets that GuoMao set for the digitalization programs were as follows:

Making a change in the existing production management model.

Achieve transparent and traceable production processes.

Improve productivity and operational efficiency in the production process.

Achieve reliability and efficiency in warehouse logistics, in combination with lean logistics.

4.3. The Struggle for Digital Transformation

The road through the digitalization transformation was not without challenges. First of all, there were few or no success stories similar to the GuoMao case which the task force could learn from. CIO Kong Donghua saw the greatest challenges coming from the lack of expertise and experience in the IT team to realize the desired targets, whereas the operations departments mentioned that it was generally difficult to understand the large number of professional jargons that appeared in the context of digitalization.

4.3.1. Designing the Overall Roadmap and Looking for Solutions

After defining the overall targets with the management, the task force set out to define the overall roadmap for the digitalization program. There were 3 possible lines of thoughts to meet a variety of “smart manufacturing” system architecture requirements:

The traditional architecture: ERP on the top floor + MES on the shop floor;

Advance architecture: middleware + professional system architecture with “connectivity” as the focus;

Ultimate architecture: business applications running on an IOT enabled scenario.

Unable to determine what was the most suitable way for itself, the digitalization task force decided to probe each possibility and learn on its way. GuoMao started seeking for solutions in the market. From his personal previous experience, CIO Kong Donghua knew that interfacing and integration among systems would be the most challenging part of the technology implementation. Therefore, special attention was given to the completeness and feasibilities of integration of the solutions.

4.3.2. Top Floor—Implementation of a Pricing System

The digitalization task force defined the implementation program into two phases and defined the tactical targets for each phase.

The pain points to be addressed in the first phase of implementation were:

Huge amount of manual work for the calculation of product pricing; GuoMao had a total of 1.3 billion individually customized products. Considering freight, insurances and such, there were billions of pricing calculations that it was no longer possible to build price lists in the traditional way and manage them in the traditional way of a database.

Historical product pricing and the management of current pricing policies were not conformed. Multiple versions of the pricing were left unmanaged in the field.

Lack of product pricing life cycle management, this resulted in difficulties to analyze the pricing fluctuation.

In the second phase of the projects, the pain points to be addressed were split into business and IT scenarios.

Pain points in the business scenario:

The overall production plan and cycle time were not fast enough to respond to the market demand.

Lack of end-to-end tracking of the materials (from procurement to warehousing and production and then to shipping).

Material allocation and logistics were managed manually, error prone and high cost.

Pain points in the IT landscape:

Efficiency and cost in operation of the data center.

The capabilities of designing architectures for both cloud native and non-cloud native systems.

Ensuring the end-to-end definition for cloud native systems, as well as the delivery and operational capabilities.

Leading the partners to reduce cost while ensuring quality during collaborative delivery.

The digitalization task force started to get in contact and learned from the different cloud infrastructure vendors in 2019. In the beginning, it was not easy for them to clearly differentiate which of the providers would be the best choice to solve their problems. However, during the long engagement of communication and market research, they were convinced by the consultants of the Amazon Cloud Technology team. Other than technical expertise and the positive and responsible attitude which were also visible with other vendors, the ultimate deciding factor was the feeling of the willingness of the Amazon consultants to understand and learn from GuoMao’s business. Furthermore, the Amazon consultants were also willing to impart their expertise to enable a traditional machining production enterprise like GuoMao. This was very important as the task force was aware that the road ahead would not be smooth, and a vendor who positioned itself as a partner could help to overcome unforeseen difficulties and ensure the smooth implementation of the project. After careful analysis, the digitalization task force decided on AWS to be their cloud backbone architecture. AWS provided the foundation platform to enable cloud-native applications and infrastructures from scratch.

With the help of the implementation partner, GuoMao deployed the flexible and extensible architecture for multiple quotation. They implemented the cloud-native price management solutions with the corresponding APIs. For the infrastructure, the project team used the Amazon VPC, EKS, DynamoDB, S3 and cloud-native safety and security measures, among other technologies. They integrated the CI/CD lines and deployed the monitoring and logging functionalities of the infrastructure. For the people empowerment, the project team introduced the trainings of the management tools and coached the workers in the usage of the applications. In addition, further trainings had been given to employees for agile product design, architecture, development, testing, process documentations, as well as trainings for cloud-native applications, infrastructure, coding, testing and system security.

The project team sought for an application with the minimal delivery value (so called MVP) as the entry point for the digital transformation. The project was divided into phases, each phase gradually carried out, making full use of the advantages of microservices and cloud services. At the same time, the consultants worked with GuoMao employees hand-in-hand to implement the project, meanwhile empowering the GuoMao employees in the implementation capabilities. The IT staff were trained in several fields, such as basic operations of cloud technology, business driven methodologies, project implementation methods and tools usage. During this time, communications to the management was crucial, this was the way to close the gaps with between the management and the employees for such traditional, large-scale manufacturers.

The project team encountered various problems of technical difficulties. For example, the problems of integration among the systems, the synchronization of the master data, and so on. The capabilities of the consultants were very crucial, not only must they be able to resolve the technical problems, they must also have the capabilities to empower the customer to resolve the problems on their own in the long run.

4.3.3. Shop Floor—Implementation of a MES System

The pain points on the shop floor were very much different than those on the top floor. In the shop floor, GuoMao was confronted with an outdated existing production management model. There was generally a lack of transparency in the production process and the production efficiencies could not be properly measured. At the same time, it took a lot of manpower to collect the data necessary for financial accounting. The managers of the shop floor could not perceive and understand the problems and actual situation of the production line in time, this resulted in poor management performances and a huge loss to the company’s resources. For a traditional discrete manufacturing enterprise like GuoMao, where there is high labor intensiveness and low level of automation, data acquisition and reporting on the production front were done mostly manually, the accuracy and integrity of the data in the reports were very much questionable.

Searching for a solution for the shop floor was a lot more challenging than that for the top floor. The countless number of solutions offered in the market made it difficult to distinguish what the best solution could be. The road to digitalization on the shop floor was not as smooth as that on the top floor, GuoMao had to suffer setbacks and learned from its mistakes before it could find the most suitable solution for itself.

Stage 1: Realizing MES Functionalities with ERP

In the first stage, the digitalization task force chose to extend the shop floor digitalization from the existing ERP system. The task force established a team internally and assessed the shop floor situation, defining the necessary MES functionalities. Then a project was defined, budget allocated, and the MES project implementation started.

The project implementation took several months, and finally failed. There were fundamentally two reasons for the failure.

Firstly, because of the nature of the business (mass customization of the products), the system had to process a huge amount of data on the shop floor. Attempts were made to extend the shop floor functionalities from the ERP but it ended up with the performance of the entire ERP system deteriorating. The application extended from the ERP systems were generally not meant to process data of such volumes. The team could not resolve the performance issue with any ERP technology which was very frustrating for them.

Secondly, the fundamental conflict of the ERP logic to the production logic was more or less the showstopper. This was a general issue that occurred in many cases and so far, it was not obvious that such conflicts could be reconciled. GuoMao had to terminate the project and look for other solutions.

Stage 2: Implement MES Functionality Using Customized Development from Scratch

Since realizing MES functionalities through ERP extensions did not work, the digitalization task force turned to the idea of developing the functionalities by customized development. As the requirements had already been determined in the first stage, they just needed to convert the requirements into detailed functional specifications and engage programmers to realize the functionalities.

The attempt failed again after one year.

The task force analyzed the reasons for the failure and drew the following conclusions:

For a project in the field of MES, a platform was indispensable. The MES solution would not be scalable without a development platform. A simple issue like program version control could easily grow into a nightmare caused by the diversification of the business processes.

Functionalities were developed from scratch. The long development cycle resulted in the sponsors losing faith in its success.

Lack of professional bug handling mechanisms posed too many risks, especially when the MES systems were to be deployed at the production sites.

Lack of transparency in the production processes resulted in difficulties to track the products.

Overall, instability in the system that was developed, poor scalability, long development cycle time, high development costs resulted in the failure, and a loss to all stakeholders involved.

Stage 3: Engaging Professional Shop Floor Solutions

Summarizing the lessons learned from the previous failures, the digitalization team realized that a professional MES solution would be needed to solve their problems on the shop floor. Thus, they began looking in the market for such a solution.

After communicating with several MES vendors in the market, GuoMao decided to select FORCAM as their partner for the shop floor digitalization. The product FORCAM FORCE® IIoT (FORCAM GmbH, Ravensburg, Germany) was deployed in different phases of several projects.

The major reasons for a decision in favor of the FORCAM solution were:

Clear and simple user interface. User friendliness of the solution was an important factor as it had direct impact on the willingness of the workers to use the system in their daily work.

Productized solution with modular design. This made it convenient for users with various needs for individual selection.

The system parameters were configurable and flexible enough to address varying customers’ needs, furthermore, quick implementation was desired.

Powerful reporting functions, the team was looking for best practices that were verified by other customers. GuoMao could learn from the various dimensions of reporting how other users used the data to manage their production processes.

Customizable reporting functions to cater for diversified management reporting needs.

B/S architecture for the solution. This largely reduced the operational and maintenance costs of the IT team.

The overall architecture of the IIoT platform was suitable for the expansion of enterprise needs, and it was convenient to hook up new application software and realize information exchange between application software through API.

GuoMao began implementing FORCAM FORCE® IIoT in March 2019. A total of 5 production lines (gear and tooth axis lines of the pre-heating workshop, grinding lines of the post heating workshop) were chosen for the pilot project. The pilot was completed and went live after three months of project implementation.

4.3.4. Results and Achievements

The first phase of the project was the implementation of a pricing system. Traditionally, the quotation was done manually, the workload was huge, the result was error-prone and difficult to scale. Without proper product pricing life cycle management, it was not possible to analyze the pricing strategies. The new system enabled the automation of price calculation processes, ensured the consistency of the product prices globally, and saved an estimated 16 h/person/month of the workload. GuoMao was able to increase the frequency of product releases and upgrades from quarterly to at least once a week. GuoMao planned to further integrate the quotation system with other systems such as WMS, APS and the MES.

After the completion of the second phase of the project, the following problems were solved:

The cycle time of production planning and capacity was shortened from T+7 to T+3.

The number of order-taking personnel in one of the final assembly lines was reduced from 5 to 0.

The flow of materials was fully traceable from end to end.

After the pricing system went live, GuoMao has even constructed a new service offering to the market, providing a price management service to its suppliers and end customers. This new business model became GuoMao’s target for the next phase of digital transformation. This is a very strong supporting argument for the original decision for the digital transformation.

The implementation of the MES solution on the shop floor achieved the following benefits:

This subverted the conventional production management model. Deploying a MES system that meets the characteristics of GuoMao’s business and products, plus an open IOT architecture platform that meets the ultimate needs of “smart manufacturing”, helped to achieve real-time transparency and availability on the shop floor.

- 2.

Realize transparencies in equipment availability and visualization in production processes.

The actual operation status and product order information of each machine became clear at a glance; the production data was collected in a real-time manner and was accurate. The managers on the shop floor could keep abreast of the actual situation on the production lines, which greatly improved the efficiency of management and provided a reliable basis for accurate and correct decision-making. The cycle time for the transmission of production instructions, on-site confirmation and production preview was reduced from originally 4–8 h to the current 10 min.

- 3.

Various production KPIs were refined and optimized.

Based on the “true availability” data collected, managers could better calculate downtime and maintenance costs. Control and calculation of production indicators such as OEE, availability, performance, quality, production cycle time) on the shop floor were optimized. Not only was the production efficiency increased by over 30%, the digitalization of the shop floor production process also generated an impetus to the surrounding systems. These indirect gains in efficiency were invaluable to GuoMao because they allowed GuoMao to gain an overall competitive advantage when producing similar products.

- 4.

Continuous CIP reduced the manufacturing costs for GuoMao

Using digital monitoring of the machines in production, the digitalization task force continuously deployed lean management to make improvements in a timely manner when abnormalities were discovered. At the same time, the introduction of continuous improvement mechanisms, improvement of bottlenecks in production management, shortening of time to delivery, ultimately reduced the total manufacturing costs.

4.4. Lessons Learned

The GuoMao case study shows an example of a fast-growing Chinese manufacturing enterprise that has a very dynamic culture. Though GuoMao is a very typical mid-size manufacturing enterprise in China, the digitalization journey it went through was extraordinary. Even without a clear roadmap ahead, it took the courage to take the first steps to test out different possibilities. It was not afraid to fail and kept readjusting its strategy by learning from the mistakes. These were characteristics that were seldom found in manufacturing enterprises of its size.

The digitalization transformation was just at the beginning. There were still many plans ahead. Nevertheless, it was already worth the effort to summarize the lessons learned so far.

4.4.1. Short-Term ROIs Are Very Important

It is important to focus on the problems one wants to solve with digitalization, and also to analyze in advance one’s own capabilities. SMEs normally have relatively low tolerance for making mistakes, so short-term ROIs are very important. It is crucial for the sponsors to see what the returns are in a timely manner. Though there has been a rush for “Dark Factories” where full automation throughout the production processes was anticipated, GuoMao chose the path to move forward in phases, weighing the pros and cons of each phase, and analyzing the investment-benefits ratio. Thus, even after the first phases of digitalization, one can still see a lot of manual processes in GuoMao where workers still enter some data onto dashboards manually. This is the result of careful consideration of the benefits and investment needed to turn it digitalized.

4.4.2. Digitalization Does Not Equal Informatization

There are many IT providers who are vigorously promoting the concept of “digitalization”. However, some of them are simply driven by selling IT solutions that turn offline business processes into online processes.

GuoMao learned during the exploration that informatization is just one of the means used in the digitalization process. It mainly uses software systems to achieve process optimization and efficiency improvement within the organization, which is still one of the technical paths of management improvement. For example, GuoMao implemented ERP, but only used it to solve the problem of financial accounting, invoicing and inventory; it went to the MES to solve the problem of on-site production management.

In the past, management in the factories were done with huge amount of manual workload, it was error-prone, and the processes were not clear. It was difficult to analyze the KPIs from the results as the processes were not transparent. Furthermore, the inhouse IT team was comparatively weak in digitalization know-how, but all these underwent a great change after the projects.

4.4.3. Digitalization Does Not Equal Data

A common misconception in the Chinese SMEs was that through deployment of IOT technologies, enterprise hard- and software systems, digitalization can be achieved by means of various large-screen dashboards and explicit BI visualizations.

GuoMao learned from the digitalization process that such visualizations are just a different way that business data is presented. Analogous to the manufacturing processes, the data collected from the business processes is like the “raw materials”. If GuoMao could not change the way the company’s business are operated, then this change of data presentation will remain at the “raw material” stage. What GuoMao as an enterprise needed was to process these “raw material” into finished products which it can then consume. Only then was value created, and only then transformation occurred.

Digitalization is the “digitization of business”, and the starting point of transformation is the integration of business and IT, which cannot be separated from business application scenarios. GuoMao learned that digital transformation only occurred when new business opportunities are created under the support of new technologies, leading to access to incremental markets. There should be significant changes in corporate strategies, business processes, organizational capabilities and profit models.

4.4.4. People Are the Most Important Success Factor

Generally, in the Chinese market there exists IT solutions that are still built on outdated architectures from decades ago. When GuoMao began looking for solutions in the market, they were worried about this and paid special attention to the technological background of the vendors. During the projects, they realized that it makes a big difference to the final result whether one learns from the projects, so a good teacher taking them alongside and teaching them hand-in-hand became a very critical requirement. All project development is also the process of developing the people, and the cultivation of digital talents will yield very high benefits, even if a project might not have fully achieved its targets in the short run.

Furthermore, the digitalization processes introduced a lot of flexibilities in the business operations [

18]. For example, the prices of each product were encapsulated in the product definitions in the past. After the digitalization, GuoMao is now able to change and amend the prices anytime. This gives them a lot of freedom and they even introduced agile methodologies to manage the processes. The people are thus empowered, and their capabilities grow together with the business.

The purpose of intelligent manufacturing has to be people-centric, i.e., to solve the problems for people. Whether for managers or for front-line workers, it is a person’s common desire to pursue a better life, and intelligent manufacturing is a means to assist people to achieve this goal.

4.4.5. Management Methodology of Software Products and Integration Projects Is Generally Applicable to Enterprise Management

By introducing the agile development methodology and actively learning from the professional software providers how to build good products, GuoMao found that the management philosophy of software products and integration projects could be applied to any area of the enterprise management. This was a windfall benefit for GuoMao in this digitalization transformation journey.

4.4.6. Creation of New Business Model as a Highlight for Industrie 4.0

A major highlight of digitalization was the creation of a pricing management system which GuoMao is currently incubating into a new business model. This pricing management is very useful in dealing with very complex quotation scenarios.

Guomao has always invested efforts in the product quality and cost control, but the quotation process has always been done manually, relying on spreadsheets and staff experience. When GuoMao developed more and more new products, the customers began to doubt the inconsistencies of the price quotations. An example was the criticism that two reducers with very different functionalities had the same price simply because they looked similar, or because they had the same cost of production.

With digitalization, GuoMao was able to integrate the rules, conditions and logic of the pricing mechanism into a rule engine. Adding visualization with a web interface to the rule engine, GuoMao was able to offer its customers and suppliers a pricing management system. This not only created a new profit center, but also strengthened the image and thus market leadership of GuoMao.

5. Discussions on Future Development of Industrie 4.0 in China

Being one of the largest manufacturing economies in the world, China will inevitably move forward into the smart manufacturing world. We have seen from the above examples that enterprises on both end of the industrial chain are striving towards the next level of Industrie 4.0. We summarize here some of our observations of the Chinese smart manufacturing movements, especially in the discrete manufacturing market.

Observation 1. China local customized solutions necessary to address the market requirements.

An interesting observation with the industrial software market is that the market is split in two directions. In the market where specific professional technologies are dominant, this market is dominated by technologies from the western countries where the few global leaders take up the absolute majority of the market. This we see in the field of ERP and in specialized industrial software like Product Lifecycle Management (PLM), Computer-aided Design/Engineering (CAD/CAE), etc. On the other hand, the market for general-purpose industrial software like Warehouse Management System (WMS), Manufacturing Execution System (MES), etc. is full of local competitions. The foreign software and platform providers face very often the challenge of the requirement of “China only” solutions.

The market challenges are two-fold. In the specialized industrial software field, the market leaders will have to expect to face intensive competitions from big major players in China. It is necessary on the national strategic consideration to have a certain level of local providers on the specific industry. For the general-purpose software industry, the main challenge will only come from market competitions.

In both cases, to remain competitive, local solutions to a certain degree is indispensable. When there is a surplus of product offerings in the market, the tolerance of the end-user to adapt to systems not localized for Chinese usage is becoming less and less.

Almost all the digitalization projects we encountered demanded localized solutions to the standard products. In the GuoMao case study, additional customized development was necessary in both top floor and shop floor digitalization projects so that the requirement gaps could be covered up. Therefore, flexibility to support localization is an indispensable requirement for all Industrie 4.0 solutions aiming to penetrate the Chinese market.

Observation 2. Machine Connectivity/Digital Twin not yet the top priority. Machine Connectivity is perceived as non-issue in the SMEs.

The concept of Digital Twin and the related “Factory of the Future” seemed not to be on the top of the mind of most discrete manufacturing leaders. The lack of standardization at the machine connectivity level posed a lot of difficulties in the digitalization of the shop floor. Most of the digitalization projects started with very ambitious top-level designs, and finally ended up in only partial realization of the digital processes. This resulted in the majority of the manufacturing industries positioning the shop floor digitalization with a “try and see” attitude. More strategic focuses were positioned at resolving the bottlenecks at the sales order front. So far, the machine data to be collected was mostly focused on operations. The scope for that was limited and the machine connectivity were mostly implemented by local suppliers in a customized manner. No doubt, this will definitely change in the near future. We believe that the key driver for a change would be a successful standardization process in the machine connectivity issue.

Observation 3. The market development is technology driven instead of management methodology driven. Lean Management is not yet in focus.

Unlike most of the western developed countries where the experience of management in conjunction with software technologies to improve efficiencies have been very much developed, China is still generally undergoing the transition phase when upgrading in hardware technologies which alone will make a great change in the production efficiencies. This resulted in the phenomenon that Lean methodology and OEE KPI-driven improvements are not a top priority in the majority of the market. In the GuoMao case study, the original intention was to deploy digitalization technologies and expecting obvious value from the deployment. Throughout the projects, GuoMao learnt that the technologies were simply tools which have to be supplemented by management methodologies. GuoMao set off to learn and figured out Lean methodologies with inhouse managers after realizing that data acquisition alone could not bring the value they were expecting. As is generally the case in the Chinese market, the values of management methodologies are palpable only after technologies are successfully deployed. We can also see that when the market leaders in Lean Management barely generated revenue worth mentioning. As the market matures over time, we believe that the tipping point for that will sooner or later arrive. As from past experience from other industries, once it does, it probably will take no time to burst into a huge market demand.

Observation 4. The demand for small-lot manufacturing technologies is very high in China SMEs.

The Chinese history of economic reform mentioned above resulted in a huge market of Chinese SME manufacturing industry offering comparatively lower value of production goods. Instead of production in mass quantity, these manufacturers normally produce a larger variety of goods in much smaller quantity. The inefficiency is the major reason for low profit margins. With the advancement in internet and IOT technologies, and with the introduction of Industrie 4.0, the concepts like “make-to-order” or “flexible manufacturing” became more and more feasible to the SMEs. This has released a huge market demand for technologies that would help SMEs with digitalization catered to small-lot manufacturing.

6. Conclusions

The 3rd Industrial Revolution was the biggest beneficiary of globalization. The first ten years of Industrie 4.0 also benefitted from globalization as its influence got widespread throughout the world [

19]. Globalization originated from the need to optimize the allocation of global resources and the formation of industrial value chains under the impetus of the international division of labor [

20]. Currently, globalization is facing more and more challenges in the international economic development. Geopolitical tensions increase supply chain and technological decoupling risks. Foreign companies face more and more strategic challenges in China.

Despite these challenges, we believe that China will continue to open up and integrate to the international community. The Chinese have painstakingly learned of the consequences that followed when the country shut its door to the world. Rejecting communication and integration to the international community 300 years ago did hinder industry competition, protected its market and brought tentative stability and prosperity to its country, but it also became a curse to the country in which the damage persisted until even today [

21]. Furthermore, the opening up of its market has brought more benefits than ever before. Therefore, integration with the international community is the only logical and feasible path for its future development.

To reach its ultimate goal, Industrie 4.0 has still a long way to go, and it is not a disruptive transformation that can be completed overnight. China, with its 1.4 billion population, sound infrastructure and a rich market of industrial application scenarios, offers a very good opportunity to test, validate, and stimulate further development of Industrie 4.0. New technologies, new products, new methodologies, and new business models are emerging endlessly in a very dynamic way, and it is monetarily rewarding. The talents for design, R&D, manufacturing, sales and other fields are sufficient and the cost is comparatively low.

China will continue with a high speed of change in the market demand, the thirst for innovation is never ending. China has passed the time when they were simply learning from their counterparts in the west. They are now offering a lot of learning opportunities for how the development could proceed, like in the area of artificial intelligence, autonomous driving, circular economy etc.

The Chinese market has similar demands in Industrie 4.0 like Germany on the strategic level. However, at the execution and operation levels, the problems encountered are very different. Filling up these gaps is on one hand challenging to the technology providers, but on the other hand also strengthens their capabilities. We can expect that Industrie 4.0 technologies that successfully survive the challenges in the Chinese market will provide better and more robust solution offerings to the world.

The technology innovations of Chinese companies are very much driven by monetary powers. The impatience of capital for returns result in the flow of investments into businesses which are innovative in business models instead of technologies. We see the internet businesses in China has developed in a light-speed manner, with all unimaginable ways of doing businesses. But there is generally a lack of market leaders who are leading in technologies, with very few exceptions.

The opportunities for collaborations between Germany and China thus arise here. Germans are the leaders for building engines and foundational technologies. Combining this capability with Chinese user applications would result in a kind of best breed solutions—applications with fancy user interfaces and yet powerful and stable engines. From the point of R&D, it is very appropriate to adopt non-competitive R&D in the initial stage of scientific exchanges and co-operation between the western countries and China. It is only when the two countries conduct joint R&D based on their respective strengths that they will find the possibility of entering into specialized R&D together [

22].

From the projects and experience we encounter in the field, we conclude that the China market offers a lot of value for the development of Industrie 4.0 and China will continue to be relevant to the development of Industrie 4.0 for the next ten years.

7. Future Directions

We see from the market that localization of Industrie 4.0 solutions is in strong demand in China. The existence of the variants of Industrie 4.0 indicates that even the development model of Industrie 4.0 itself requires localization. This is due to the fact that after decades of development, China has so far acquired the capabilities in almost every aspect of technology development. According to the United Nations, China is the only country in the world which possesses all industrial categories listed in the United Nations, i.e., one can produce anything imaginable in China. This resulted in vendors of a specific technology having to deliver more efficiently and at much lower price. Those who managed to innovate to meet such demands are rewarded with tremendous success from the huge market. Therefore, in the 21st century, any foreign companies which wish to be successful in China need a new strategy suitable in the new environment. Those companies who failed to adopt a localized strategy inevitably are unsuccessful in the Chinese market.

It would be beneficial to have an understanding of the major parameters (for example, pricing models, industry know-how availability, user interfaces, ability to scale etc.) that have to be localized in order for an Industrie 4.0 technology developed in Germany to be successful in the China market.

On the other hand, research of Industrie 4.0 requires the collaboration between theorists and practitioners, where the fundamentals of the theories are verified in the field by the projects. Countless numbers of digitalization projects are being carried out every day in China. Many innovations occur every day as new knowledge is gained in the execution of the projects. Some of the projects are successful, but the majority of them suffered setbacks and ended in failures. Failed digitalization projects are valuable in the sense that they provide market feedback to pitfalls and difficulties that can occur in the field. An interesting research direction could be derived from generalizing the projects and identify the parameters that lead to the success and failures of the projects under different scenarios. In addition, it would be also interesting to determine how to generalize these findings into structured knowledge so that future Industrie 4.0 projects could learn from the failures.

To make the vision of Industrie 4.0 visible it is recommendable to establish a standard “Factory of the Future” model to explain and demonstrate very clearly the different aspects of the Industrie 4.0 initiative. From a Chinese market point of view, it is important to stress the fact that Industrie 4.0 was initiated in Germany to make sure that manufacturing in Germany (Europe) stays competitive to other markets (and especially Asia).

Since a shortage of skilled labor and the increasing cost of labor is a fact in China it appears that China has also to adopt Industrie 4.0, though probably in a different variant. For that, the “Digital Twin” and AAS (Asset Administration Shell) should gain more visibility and importance in China. On top, material provisioning must be automated, inventory be managed end to end, the supply chain tightly integrated.