Here, we address the concept selection for subsequent tasks, namely concept prototyping and testing. The task of selecting the more promising concepts is crucial but complex, as it requires decisions under scenarios of large complexity and uncertainty. Typically, the DT is required to set criteria for comparison and then compare abstract entities—the concepts—to establish a relative order. Very often, the elements of the DT have different perceptions at the beginning, and the procedure firstly serves to articulate differences in understanding and to achieve a consensus [

30]. We followed the approach proposed by Ulrich and Eppinger [

1] and Otto and Wood [

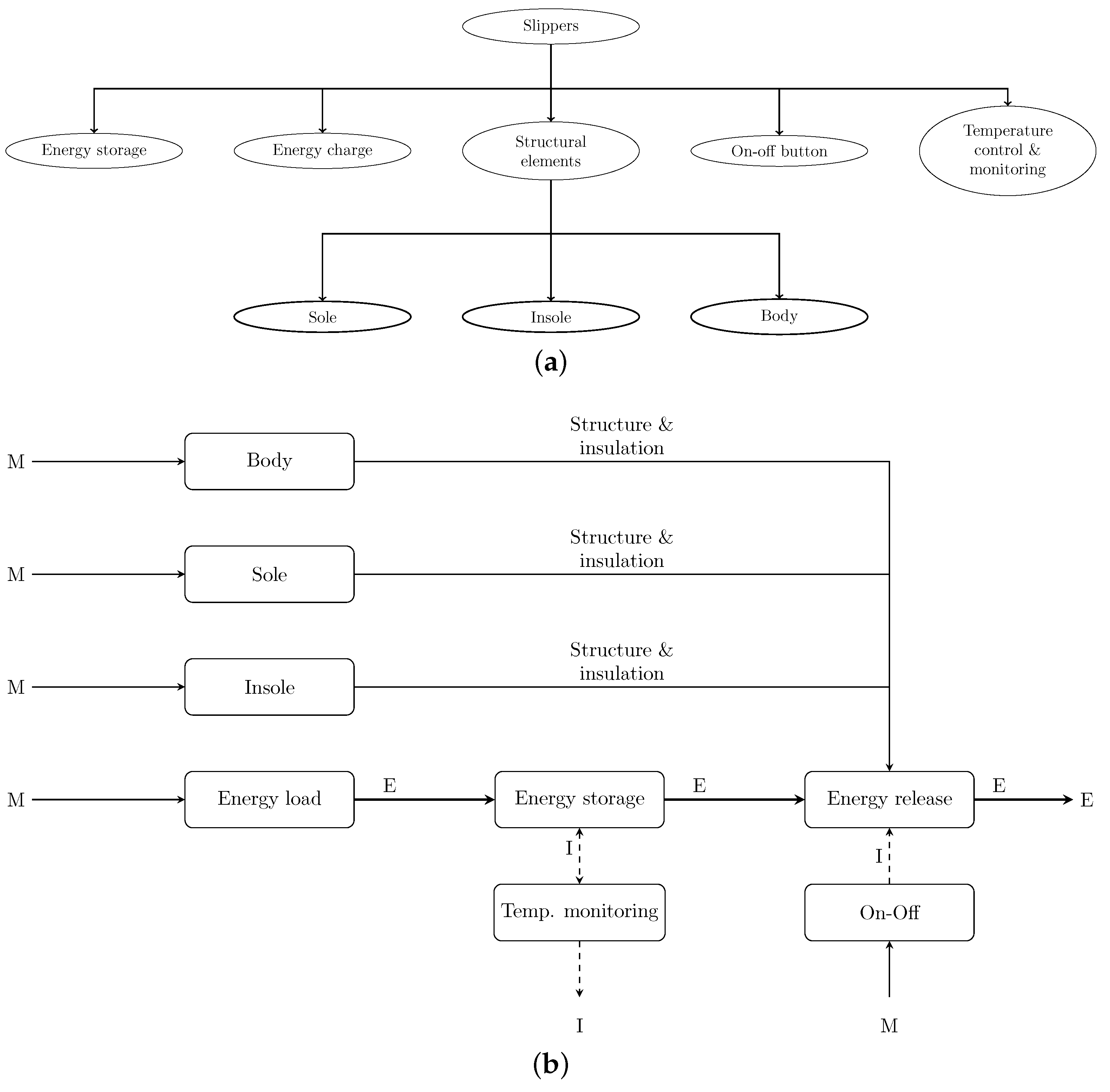

7] and decomposed the procedure into four sequential steps: i. concept screening, where concepts are compared to find a set of feasible (promising) alternatives (see

Section 5.1); ii. improvement of concepts with negative solutions (see

Section 5.2); iii. concept rating, where concepts are compared using the relative importance elicited for customers’ needs, in order to find the alternatives to develop (see

Section 5.3); and iv. robustness analysis of the previous choice via Monte Carlo sampling methods (see

Section 5.4).

5.1. Concept Screening

This Section addresses the comparison of concepts to reach a set of physically feasible alternatives. The approach followed is a four-step process [

7]. First, the DT agreed on the criteria used for comparison. The adopted criteria (first column of

Table 15) are aligned with the needs elicited from the customers and corresponding product performance specifications (see

Table 7 in

Section 2). To stimulate the creative aspects of concepts, the criterion

Price was not considered in this phase, as it may hinder creative aspects of the concepts under evaluation, but, naturally, it must be incorporated in the decision in subsequent development phases. The objectives considered are in column 1 of

Table 15. To simplify the subsequent mathematical treatment, let CR

be the representation of the

lth criterion.

The second step required the DT to compare concepts. To simplify the process, one reference product existing in the market was considered (see the column 2 of

Table 15), and the concepts emerging from

Section 4.3 were compared to the reference for each of the criteria. Using a physically existing reference product is a common solution adopted for reducing the comparison bias [

31,

32]. The product chosen for reference was one of those previously considered in benchmarking analysis; here, it is denoted by R. In the discussion motivated by the comparison, the elements of the DT increased the understanding of the concepts and respective functional elements, which allowed reaching consensual positions.

The method used for concept screening was the decision-matrix based method proposed by Pugh [

33]. Concepts are compared to the reference using a scale with three levels:

. The sign “

” corresponds to “better than”, “0” stands for “the same as”, and “

” for “worse than”. The results of the comparison of the concepts to the reference product are in columns 3-7 of

Table 15.

For a clear systematization of the method, let ”

” be the logical proposition stating that concept C

is better than the reference regarding the

lth criterion. Similarly, ”

” states that C

is worse than the reference and ”

” that C

performs similarly to the reference. Let

be the score received by concept

regarding a criterion

, with possible values

, 0 and

.

is then given by:

The overall performance of concept

is now measured by:

where

L is the number of criteria.

In the third step, the DT ranked the performance of the concepts using the metric

. The alternatives that rate poorly are removed from the analysis, and the promising alternatives should be re-examined.

Table 15 shows the results of concept screening. The concepts

Teddy Slipper and

Tough Slipper are preferred over the reference in some criteria but perform worse in some others, which results in an overall score

. The concepts

Techno Slipper,

Star Slipper, and

Diamond Slipper appear as promising alternatives but should be re-analyzed, and if possible improved, since they are in some cases dominated by the reference, in particular in the

Biodegradability criterion (see the seventh line of

Table 15).

The fourth step of the procedure—improving promising concepts—is addressed next. Practically, it may generate improved and/or additional concepts, and if this happens, a second round of concept screening will be needed.

5.2. Attacking the Negatives and Improving Concepts

This Section deals with the improvement of negative-ranked criteria of the set of promising concepts. This task is more a reformulation of some concepts and, consequently, the generation of new ones than it is a selection step.

First, the DT analyzed the negative-ranked criteria of all concepts in

Table 15. Then, we focused on the most promising alternatives, i.e.,

Star Slipper and

Diamond Slipper concepts, and used the basis of solutions (

Table 11) to prescribe physically compatible alternative solutions for criteria that compare negatively with R.

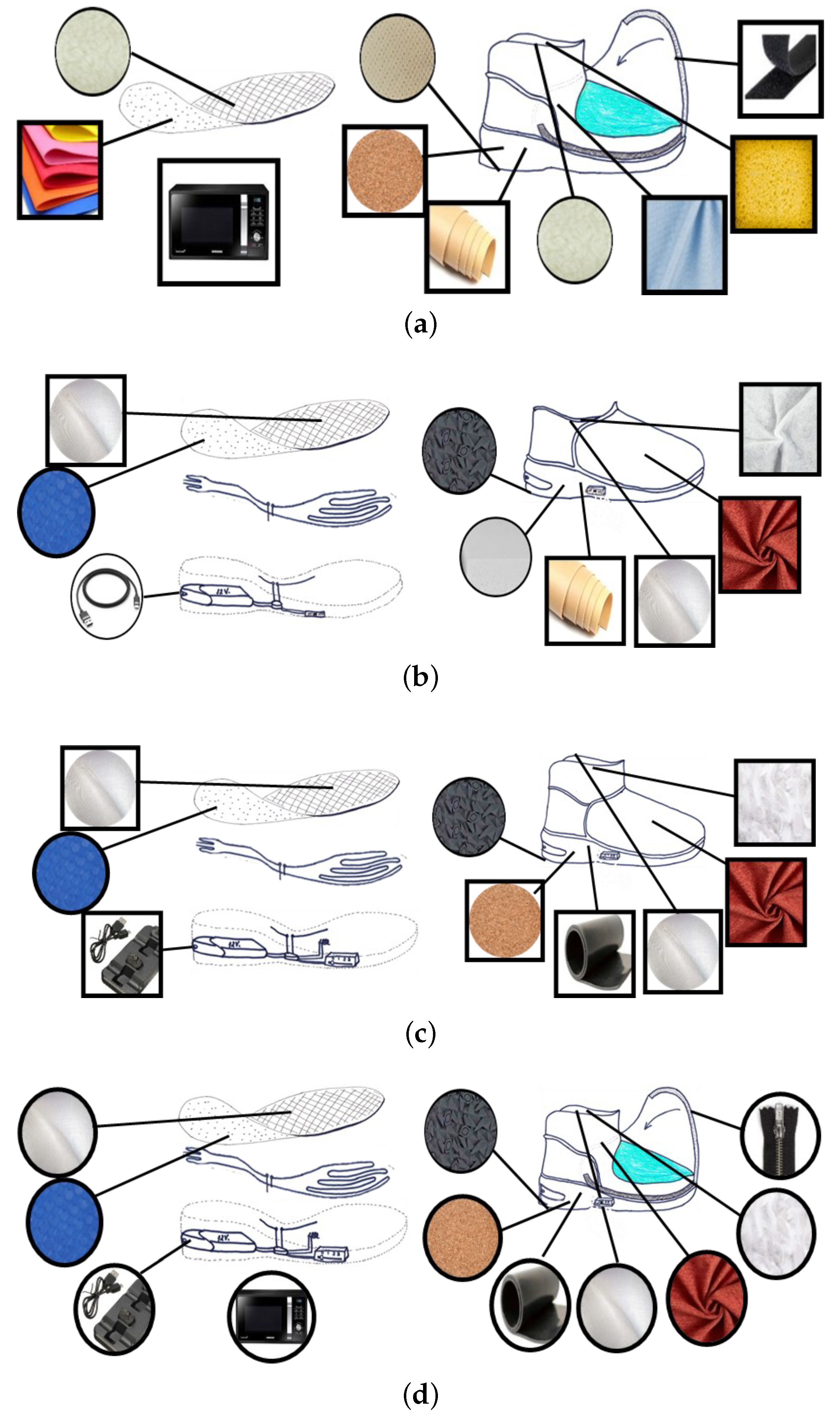

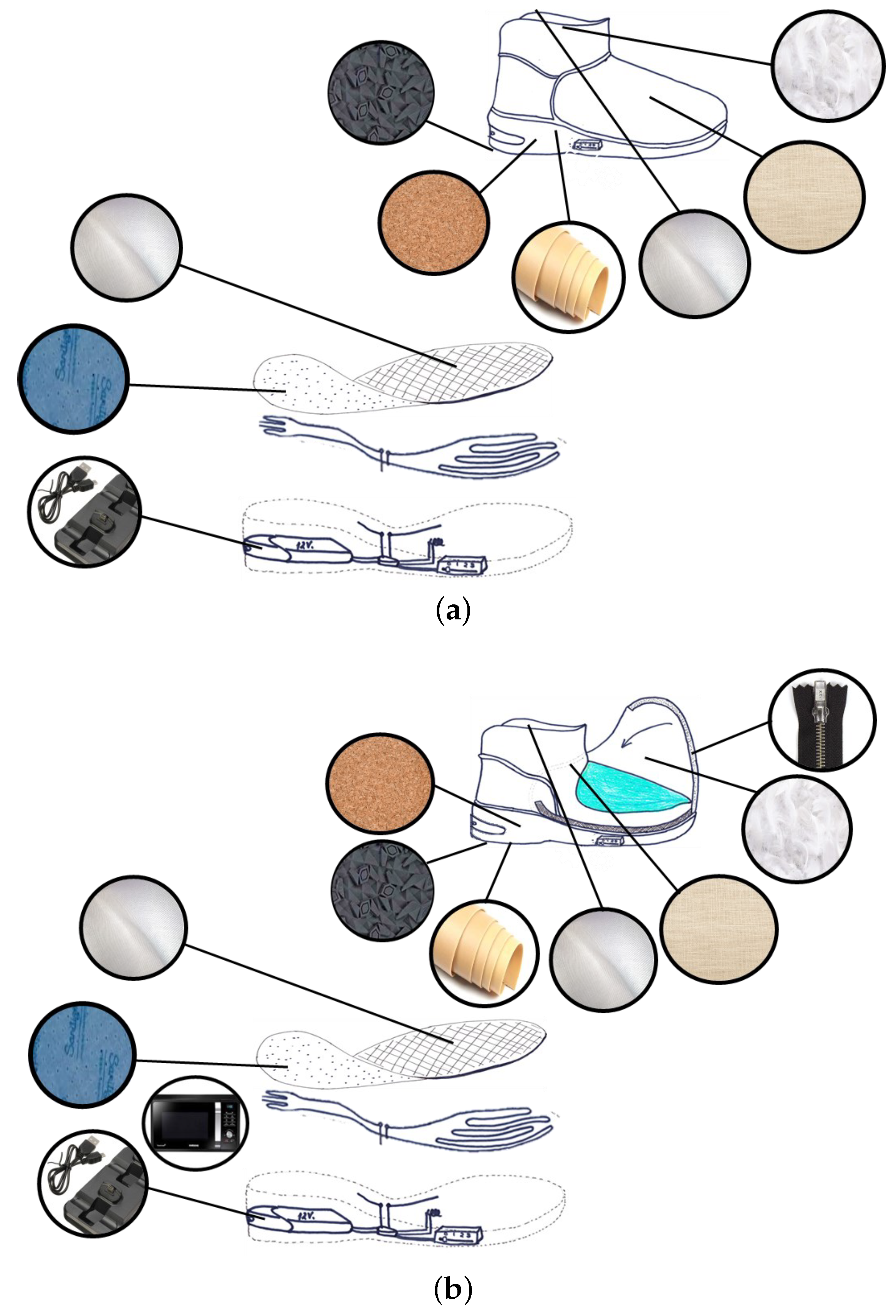

This reanalysis resulted in improved concepts named

Star Slipper+ and

Diamond Sleeper+, characterized in

Table 16 and sketched in

Figure 4. The concept

Diamond Sleeper+ has the characteristics of a high-range product incorporating two distinct solutions for subproblems SP

and SP

. The concept can be used to extend the product mix. On the contrary, the concept

Star Slipper+ has the potential for being an entry range product in the firm’s mix.

The new set of alternatives was ranked using the approach introduced in

Section 5.1. The results are shown in

Table 17. The concepts

Techno Slipper,

Star Slipper+, and

Diamond Slipper+ should be further analyzed and rated using a finer comparison scale. This task is addressed next, in the concept-rating phase.

5.3. Concept Rating

Here, we rank the remaining concepts using an increased resolution scale able to better differentiate among competing concepts. The approach followed also relies on the method of Pugh [

33], introduced in

Section 5.1.

The scale used herein is also ordinal with five levels. The scale levels are the elements of

where “5” means “much better than the reference”, “4” means“better than the reference”, “3” means “same as the reference”, “2” means “worse than the reference ” and “1” means “much worse than the reference”. The criteria used for comparison are the same as those used in

Section 5.1. The result of the comparison of concept

to the reference is stored in the score variables

.

To incorporate the relative importance of the customer’s needs in the decision, the criteria are weighted. The weights, designated by

(for

lth criterion), were set based on the relative importance of needs elicited in

Section 2.3 (see

Table 4) whose satisfaction they intend to measure. They were set by the DT after consensus and sum to 1.0 (see the second column of

Table 18). The overall performance of the concepts is now measured by

The results of concept rating are shown in

Table 18. Alternatives

Star Slipper+ and

Diamond Slipper+ have the potential to progress to testing phase, the former as an entry-range product and the latest as an high-range product.

5.4. Robustness of the Choice

This Section analyzes the robustness of the rating of concepts and selection made in the previous subsection and can be seen as a validation step.

The decision for the two concepts (

Star Slipper+ and

Diamond Slipper+) involves various sources of uncertainty and inaccuracy, namely the weights

and the scores

in Equation (

4). To overcome this problem, we use Monte Carlo sampling to generate a large set of scenarios, varying the values of these parameters, and then determine the dominantconcept for each scenario, i.e., the concept with the maximum score for

. Monte Carlo sampling is a computational technique based on constructing a random process for carrying out a numerical experiment by

n-fold sampling from a random sequence of numbers with a prescribed probability distribution [

34].

Here, we assume a normal distribution to generate random numbers, simulating uncertainty in criteria weights. Specifically, we consider independent normal distributions

for each weight, where

is the re-scaled standard deviation of weight

, estimated from the relative importance of customer needs (see

Table 4 in

Section 2.3). The reference values of weights,

, are in the second column of

Table 18. The re-scaled standard deviation of weights is given by

where

and

are the standard deviation and the average of the importance of

need in original BARS, respectively. To ensure that the weights sum to 1 in each scenario, we first generate

L random numbers, and then re-scale them to unity. This procedure is repeated for each scenario; the number of scenarios,

N, used in this study was set to 1e6.

Regarding scores , we consider an uncertainty of for scores 2, 3, and 4; for score 5; and for score 1. This is simulated using independent integer uniform distributions for each . More precisely, , where is a subset of ; when , ; when , 3, or 4, ; and when , . This approach is also repeated for N scenarios.

For each scenario

, we determine the concept

with the best performance, i.e.,

. Then, we compute the frequency of dominance of each of the concepts, i.e., the number of times the concept

is the best over the total number of scenarios:

where

is an indicator variable that is 1 when

and 0 otherwise.

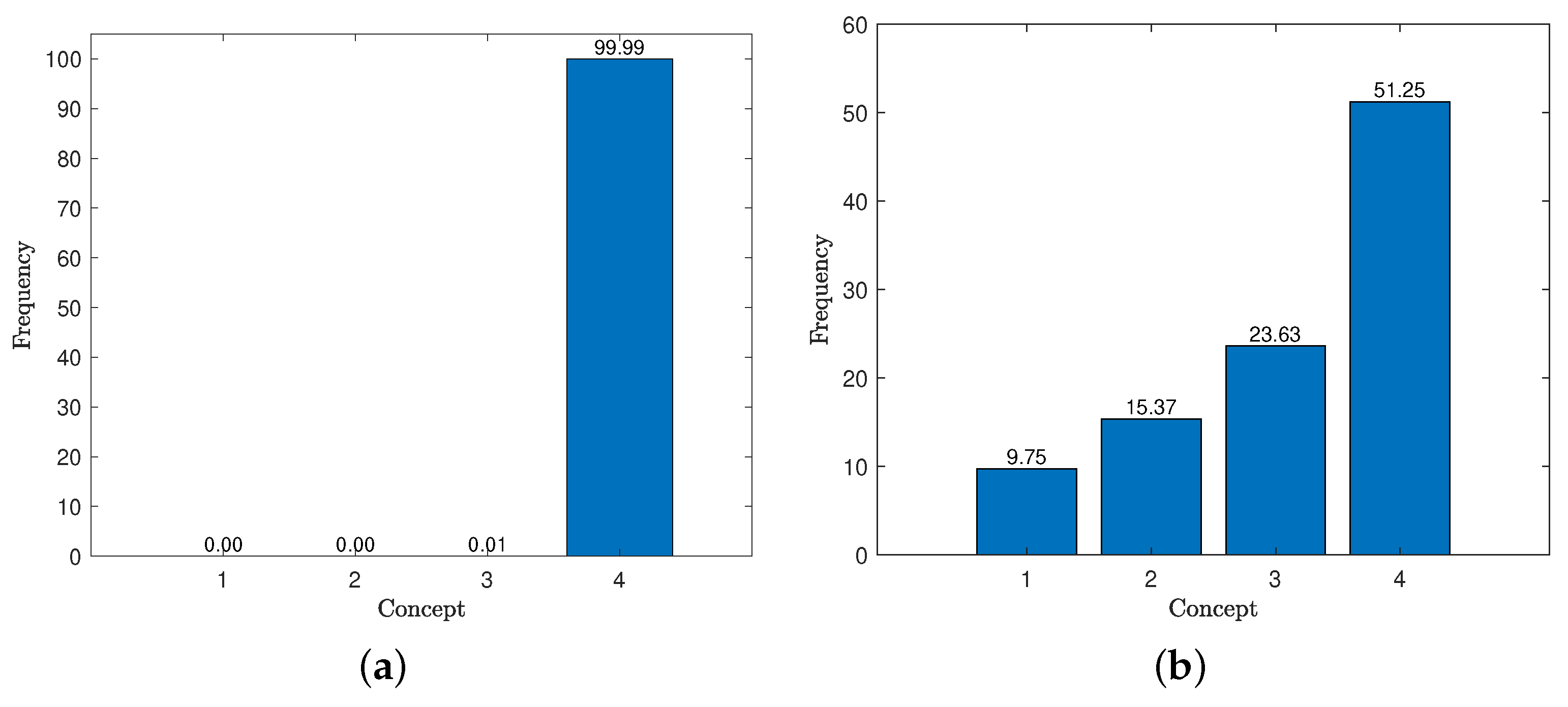

The results of Monte Carlo sampling analysis are displayed in

Figure 5 and they show that:

- i.

concept

Diamond Slipper+ is extensively dominant when the weights

are varied (keeping scores

at their nominal values—see

Figure 5a)—and

- ii.

concept

Diamond Slipper+ is also dominant when scores

vary (with weights

fixed at their nominal values; see

Figure 5b). In the second case, the dominance is weaker, with the concept

Star Slipper+ also being well ranked.

A similar analysis incorporating the

Price as an additional criterion may reduce (or extinguish) the gap between both concepts. The findings obtained in

Section 5.3 are thus corroborated with this sensitivity analysis, and we can now conclude with more certainty that concepts

Star Slipper+ and

Diamond Slipper+ are good candidates to progress to prototyping and testing stages.

Table 19 summarizes the tasks included in the concept selection phase and the methods adopted herein.