Determination of the Expected Value of Losses Caused by the Cargo Transportation Insurance Risks by Water Transport

Abstract

:1. Introduction

1.1. Study Topicality

1.2. Justification of the Need to Develop New Methodological Approaches

2. Materials and Methods

2.1. Methodology

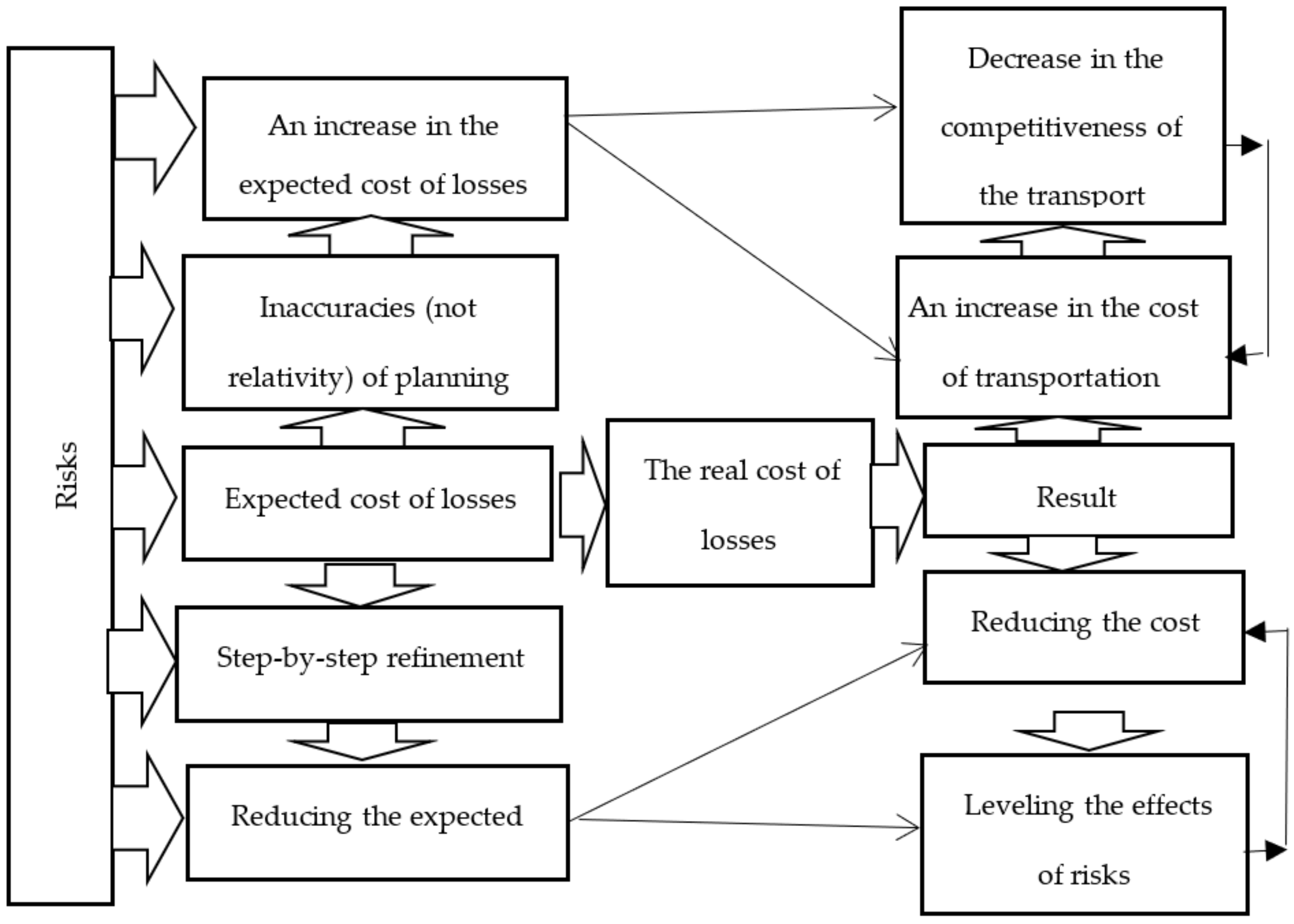

2.2. Algorithm for the Systematic Assessment of the Dependence of the Expected and Real Cost of Losses on Risks

- Estimates of losses directly in the monetary equivalent. Some methods suggest identifying losses from risks as a function of the probability of the occurrence of an undesirable event multiplied by the result of its impact, which is measured in monetary terms.

- Estimated loss assessment consists in reducing the assessment to take into account the physical dimension (for example, the number of cases of injury or death, the number of wild animals that died as a result of an accident, etc.). In particular, MAMC [24] offers a quantitative model for the implementation of this option IWRAP MKII [24].

- Index assessment. By combining the frequency and consequences of risks, an index for shipping zones is formed, which represents a relative category of losses. According to MCDA, this technique is called “Analysis of conclusions by many criteria” and is used to evaluate alternative options for actions, routes, etc.

- Mathematical modeling according to many criteria. An approach that is able to reduce different scales of measurement of losses—quantitative, monetary, qualitative, and proposals for the selection and equipment of waterways to a single scale.

- Expert opinion. In the absence of reliable data, practitioners sometimes recommend forming a loss estimate based on expert experience or opinion.

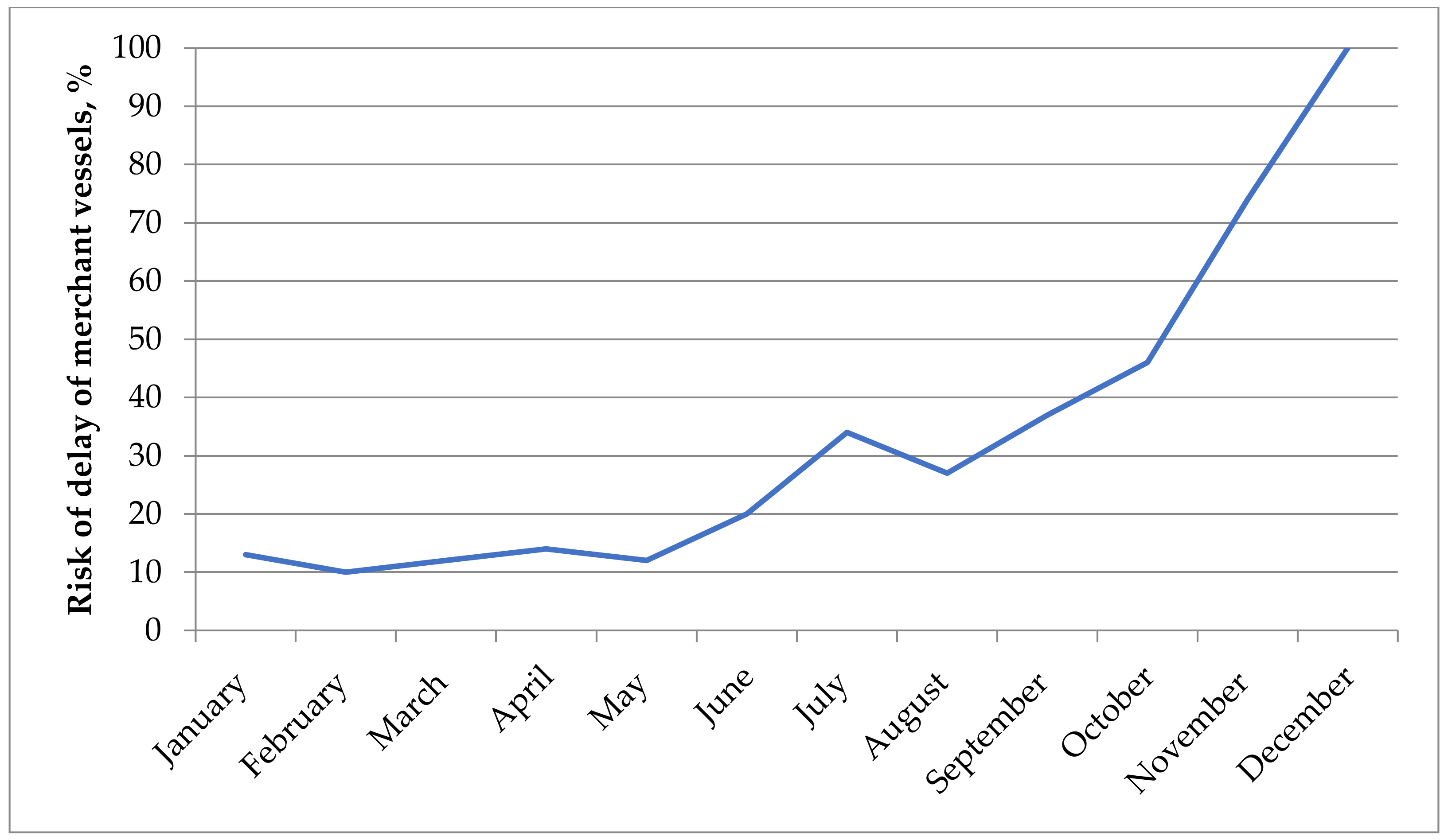

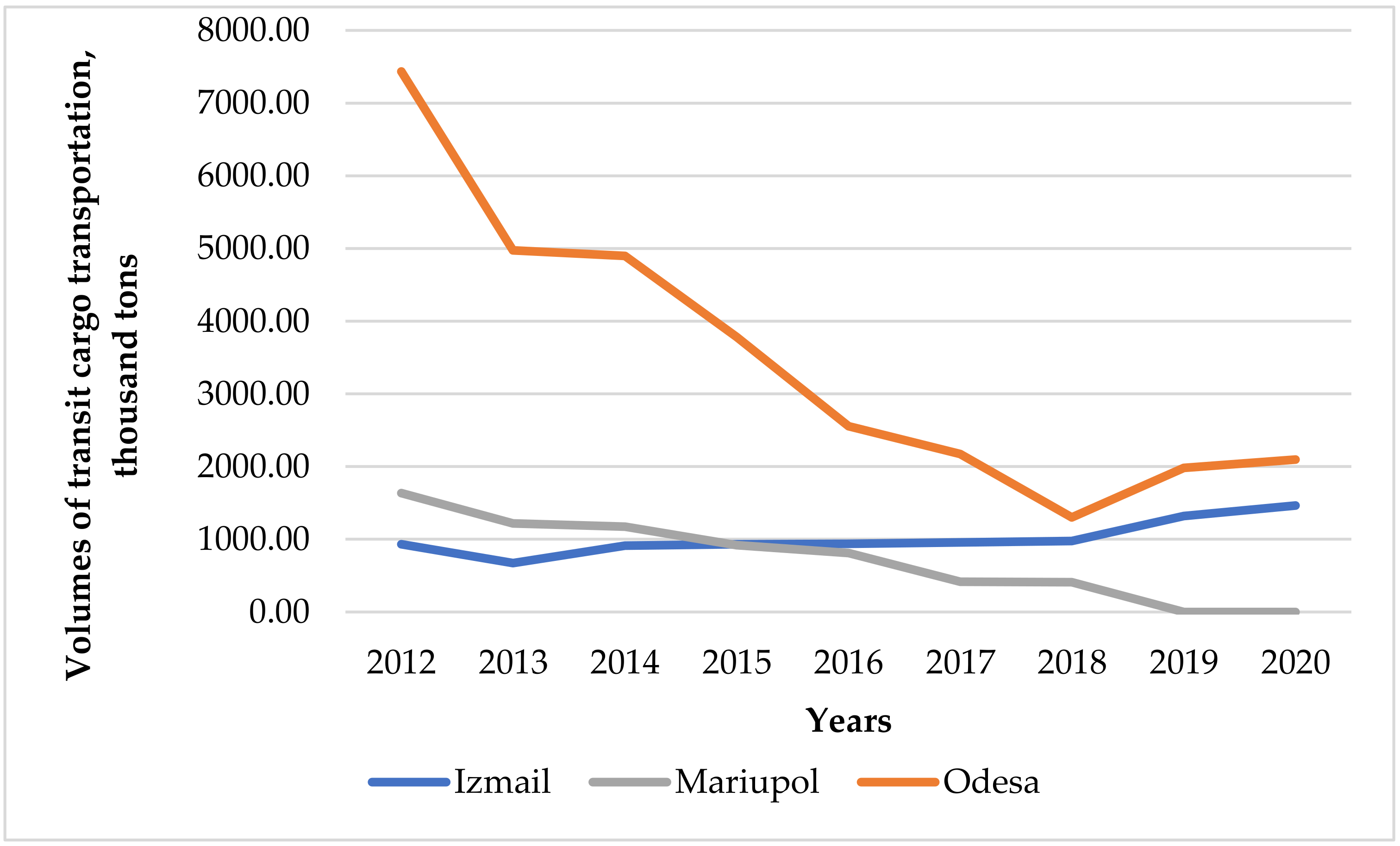

3. Results and Discussion

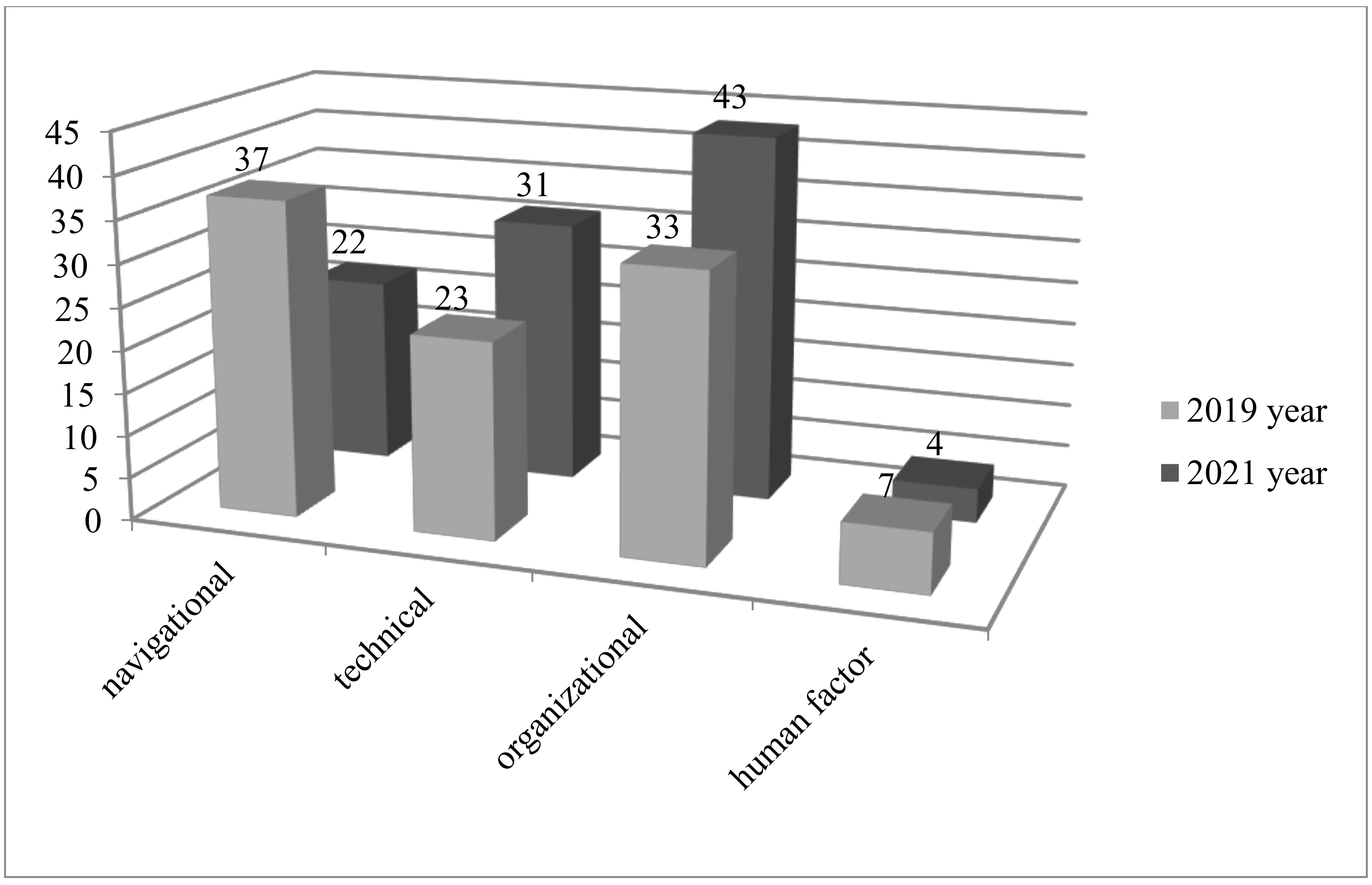

- Ignoring the recommendations of international and national transport organizations by the command staff and crews of vessels.

- Inadequate discipline of the crews in the performance of watch duty and unpreparedness for actions in the approach of emergency situations and during them.

- Lack of training of crews for actions during accidents.

- Inadequate technical preparation of the vessel before sailing, including technical preparation for sailing in limited conditions of the port water area and during sailing on river inland waterways.

- Aging of vessels and their equipment.

- A decrease in the qualification level of personnel due to changes in the personnel composition by age and significant trends towards the outflow of specialists to foreign transport companies.

4. Conclusions and Recommendation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hellwege, P.; Rossi, G. (Eds.) Maritime Risk Management: Marine Insurance, General Average, Sea Loan. In Maritime Risk Management; Duncker & Humblot GmbH: Berlin, Germany, 2021; Volume 11, pp. 9–16. [Google Scholar]

- Piccinno, L.; Iodice, A. Managing Shipping Risk: General Average and Marine Insurancein Early Modern Genoa. In Maritime Risk Management; Hellwege, P., Rossi, G., Eds.; Duncker & Humblot GmbH: Berlin, Germany, 2021; Volume 11, pp. 83–110. [Google Scholar]

- Clemente, C.C.; Macuri, Y.R.; Zúniga, L.M.B. Impact by acquisition of cargo insurance policy in international maritime transport. In Proceedings of the 5th International Conference on Computers in Management and Business (ICCMB), Singapore, 28 March 2022. [Google Scholar] [CrossRef]

- Balobanov, O.; Andriiaschenko, O. Insurance of Sea Cargo Transportation: Some Organizational and Legal Aspects. Lex Portus 2018, 12, 80–88. [Google Scholar] [CrossRef]

- Mitkov, M.; Radukanov, S.; Petrova, M. Risk management in maritime transport of goods through insurance. MATEC Web Conf. 2021, 339, 01003. [Google Scholar] [CrossRef]

- Koh, A.; Nightingale, A. The Cost of Insuring Black Sea Shipping Is Out of Control. Bloomberg. Europe Edition. 2022. Available online: https://www.bloomberg.com/news/articles/2022-04-08/ships-entering-the-black-sea-are-becoming-almost-uninsurable (accessed on 16 May 2022).

- Nitsenko, V.; Kotenko, S.; Hanzhurenko, I.; Mardani, A.; Stashkevych, I.; Karakai, M. Mathematical Modeling of Multimodal Transportation Risks. Recent Adv. Soft Comput. Data Min. 2020, 978, 439–447. [Google Scholar] [CrossRef]

- Lim, G.J.; Cho, J.; Bora, S.; Biobaku, T.; Parsaei, H. Models and computational algorithms for maritime risk analysis: A review. Ann. Oper. Res. 2018, 271, 765–786. [Google Scholar] [CrossRef]

- Ouedraogo, C.A.; Montarnal, A.; Gourc, D. Multimodal Container Ttransportation Ttraceability and Supply Chain Risk Management: A Review of Methods and Solutions. Int. J. Supply Oper. Manag. 2022, 9, 212–234. [Google Scholar] [CrossRef]

- Esmer, S. The factors affecting the sea transportation in the new globalization era. J. Manag. Mark. Logist. 2018, 5, 166–171. [Google Scholar] [CrossRef]

- Kretschmann, L. Leading indicators and maritime safety: Predicting future risk with a machine learning approach. J. Shipp. Trade 2020, 5, 19. [Google Scholar] [CrossRef]

- Nguyen, S. A risk assessment model with systematical uncertainty treatment for container shipping operations. Marit. Policy Manag. 2020, 47, 778–796. [Google Scholar] [CrossRef]

- Likun, W.; Zaili, Y. Bayesian network modelling and analysis of accident severity in waterborne transportation: A case study in China. Reliab. Eng. Syst. Saf. 2018, 180, 277–289. [Google Scholar]

- Wang, S.; Yin, J.; Khan, R.U. The Multi-State Maritime Transportation System Risk Assessment and Safety Analysis. Sustainability 2020, 12, 5728. [Google Scholar] [CrossRef]

- Zhang, Y. Public Policy Risk Assessment and Response of International Maritime Transport. J. Coast. Res. 2020, 112, 443–446. [Google Scholar] [CrossRef]

- Chang, C.-H.; Xu, J.; Dong, J.; Yang, Z. Selection of effective risk mitigation strategies in container shipping operations. Marit. Bus. Rev. 2019, 4, 413–431. [Google Scholar] [CrossRef]

- Wan, C.; Yan, X.; Zhang, D.; Yang, Z. Analysis of risk factors influencing the safety of maritime container supply chains. Int. J. Shipp. Transp. Logist. 2019, 11, 476–507. [Google Scholar] [CrossRef]

- He, J.; Hao, Y.; Wang, X. An Interpretable Aid Decision-Making Model for Flag State Control Ship Detention Based on SMOTE and XGBoost. J. Mar. Sci. Eng. 2021, 9, 156. [Google Scholar] [CrossRef]

- Baksh, A.; Abbassi, R.; Garaniya, V.; Khan, F. Marine transportation risk assessment using Bayesian Network: Application to Arctic waters. Ocean Eng. 2018, 159, 422–436. [Google Scholar] [CrossRef]

- Adland, R.; Jia, H.; Lode, T.; Skontorp, J. The value of meteorological data in marine risk assessment. Reliab. Eng. Syst. Saf. 2021, 209, 107480. [Google Scholar] [CrossRef]

- Kotenko, S.; Nitsenko, V.; Hanzhurenko, I.; Havrysh, V. The Mathematical Modeling Stages of Combining the Carriage of Goods for Indefinite, Fuzzy and Stochastic Parameters. Int. J. Integr. Eng. 2020, 12, 173–180. [Google Scholar] [CrossRef]

- Bazaluk, O.; Kotenko, S.; Nitsenko, V. Entropy as an Objective Function of Optimization Multimodal Transportations. Entropy 2021, 23, 946. [Google Scholar] [CrossRef] [PubMed]

- Posner, C.N.; Armaş, I. Conceptual approaches concerning risk, vulnerability and adaptation. Riscuri Catastr. 2014, 15, 7–24. [Google Scholar]

- Manual of MAMS No. 1018 from Risk Management. Available online: https://hydro.gov.ua/dl/iala/ua/03_1018_MAMS_vol_1.pdf (accessed on 23 May 2022).

- Administration of Sea Ports of Ukraine. Available online: https://www.uspa.gov.ua/ (accessed on 21 February 2022).

- Maritime Facts and Figures: Casualties. International Maritime Organization. Available online: https://imo.libguides.com/c.php?g=659460&p=4655524 (accessed on 19 May 2022).

- Zablotskyi, V. Maritime Disasters. A Non-Historical Context. 2019. Available online: https://tyzhden.ua/World/229599 (accessed on 21 May 2022).

| №/№ | Risk Factors | Effects | |||||

|---|---|---|---|---|---|---|---|

| Parameters of Ships and Their Movement | Characteristics of Ships | Shipping Conditions | Waterway Configuration | Short-Term | Long-Term | ||

| 1 | Species | Quality of vessels | Big drop | Day/night | Depth | Injuring people | Impact on health and safety |

| 2 | Competence of the crew | Small sediment | Excitement of the sea | Channel width | Oil spills | Violation of lifestyle | |

| 3 | Types of vessels | Commercial fishing vessels | Wind mode | Obstacles to proper visibility | Emissions of harmful substances | Impact on fisheries | |

| 4 | Traffic density | Pleasure boats | Currents (river, tides, ocean) | The complexity of the waterway | Property damage | Impact on endangered species | |

| 5 | The nature of the cargo | High-speed ships | Limitation of visibility | Bottom type | Refusal to use the waterway | Coastline destruction | |

| 6 | Ice conditions | Stability (silting) | Destruction of reefs | ||||

| 7 | Background lighting | Economical | |||||

| 8 | Debris | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kotenko, S.; Ilchenko, S.; Kasianova, V.; Diakov, V.; Mashkantseva, S.; Nitsenko, V. Determination of the Expected Value of Losses Caused by the Cargo Transportation Insurance Risks by Water Transport. Inventions 2022, 7, 81. https://doi.org/10.3390/inventions7030081

Kotenko S, Ilchenko S, Kasianova V, Diakov V, Mashkantseva S, Nitsenko V. Determination of the Expected Value of Losses Caused by the Cargo Transportation Insurance Risks by Water Transport. Inventions. 2022; 7(3):81. https://doi.org/10.3390/inventions7030081

Chicago/Turabian StyleKotenko, Sergiy, Svitlana Ilchenko, Valeriia Kasianova, Vitalii Diakov, Svitlana Mashkantseva, and Vitalii Nitsenko. 2022. "Determination of the Expected Value of Losses Caused by the Cargo Transportation Insurance Risks by Water Transport" Inventions 7, no. 3: 81. https://doi.org/10.3390/inventions7030081

APA StyleKotenko, S., Ilchenko, S., Kasianova, V., Diakov, V., Mashkantseva, S., & Nitsenko, V. (2022). Determination of the Expected Value of Losses Caused by the Cargo Transportation Insurance Risks by Water Transport. Inventions, 7(3), 81. https://doi.org/10.3390/inventions7030081