Climate Risk in Intermediate Goods Trade: Impacts on China’s Fisheries Production

Abstract

1. Introduction

2. Method and Data

2.1. Data

2.2. Theoretical Model

2.3. Input-Driven Climate Risk Indicator of Intermediate Goods Supply Chain

2.4. Mechanism Verification

3. Results

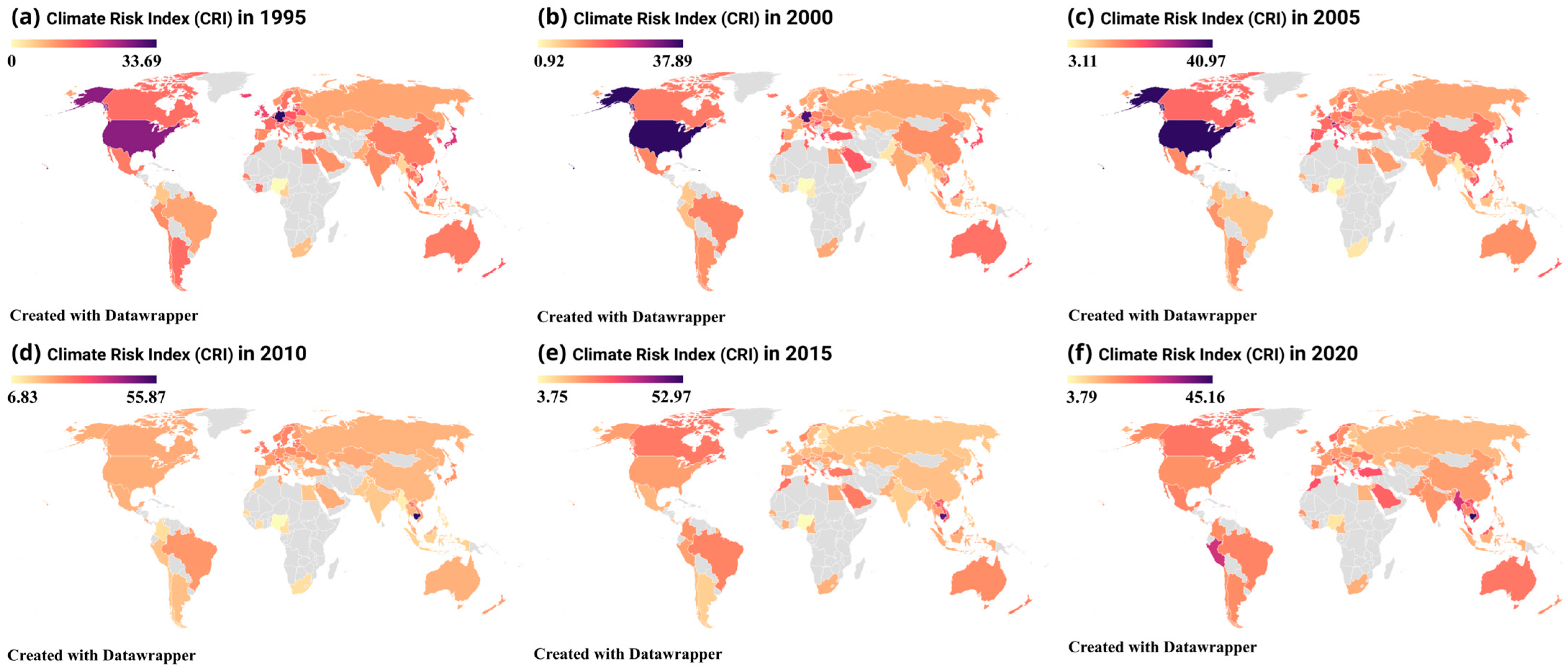

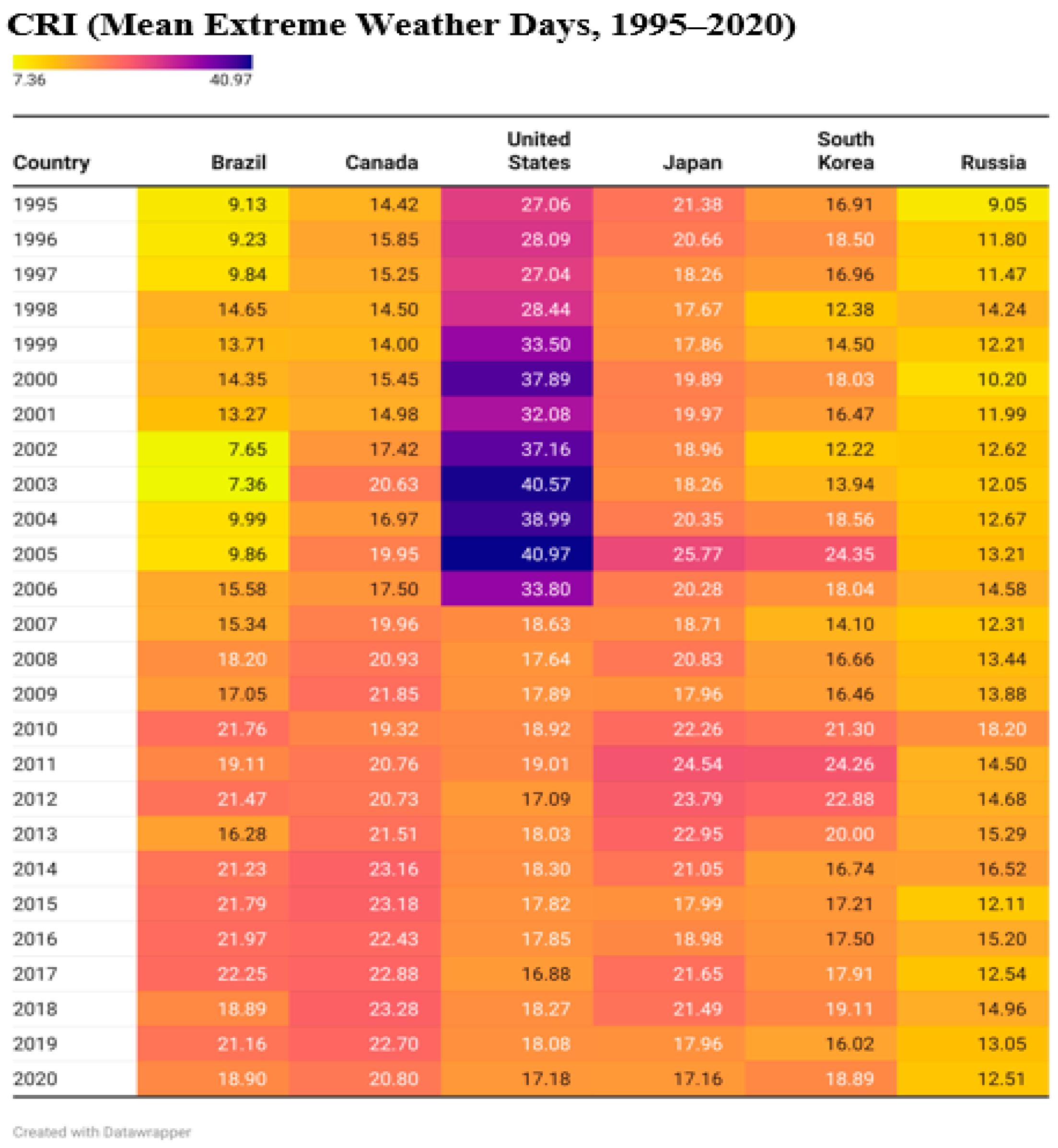

3.1. Intermediate Goods Supply Chain Input-Driven Climate Risk Indicator

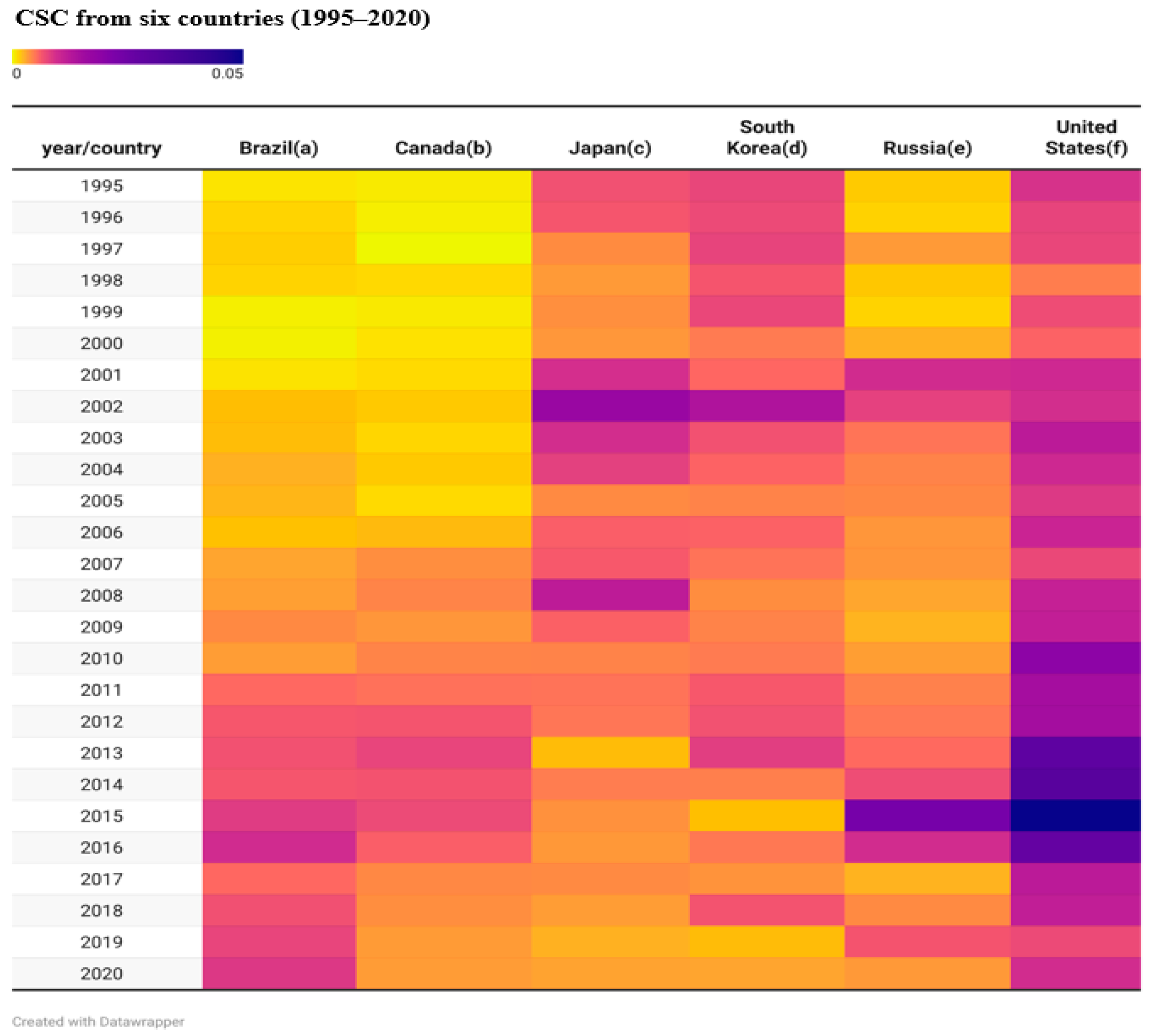

3.2. Decomposition of Contribution in the CSC

3.3. Mechanism Verification Results

3.3.1. Mechanism Verification Results for Brazil and Canada

3.3.2. Mechanism Verification Results for Japan and the United States

3.3.3. Mechanism Verification Results for South Korea and Russia

4. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Definitions of Variables for Mechanism Verification

| Variables | Meaning | Unit | Mean | Min | Max |

| Y | Yield of fishery sector | 104 tons | 5931.154 | 3387 | 8393 |

| K | Number of motorized fishing vessels | 104 ships | 57.01538 | 43.22 | 69.62 |

| L | Labor of fishery sector | 104 People | 1323.69 | 1142.87 | 1458.5 |

| mj | Aquaculture area | 104 hectares | 697.9038 | 538.5 | 846.5 |

| tech | Technological progress of fishery sector | -- | 1.050158 | 0.671 | 1.744 |

| chncri | CRI of China | -- | −15.00768 | −19.41347 | −10.36588 |

| brcri | CRI of Brazil | -- | −15.77005 | −22.24976 | −7.359041 |

| candcri | CRI of Canada | -- | −19.24685 | −23.2785 | −14.00453 |

| japcri | CRI of Japan | -- | −20.25526 | −25.77114 | −17.1599 |

| krcri | CRI of South Korea | -- | −17.68847 | −24.35056 | −12.22282 |

| uscri | CRI of United States | -- | −25.27672 | −40.97225 | −16.879 |

| ruscri | CRI of Russia | -- | −18.02085 | −26.78888 | −9.051196 |

| brdh | Index of supply chain of Brazil | -- | 158.9846 | 0.2211305 | 972.817 |

| cadh | Index of supply chain of Canada | -- | 21.67196 | 0.4242613 | 79.6852 |

| japdh | Index of supply chain of Japan | -- | 265.8424 | 58.86237 | 734.3646 |

| krdh | Index of supply chain of South Korea | -- | 180.2936 | 16.85807 | 490.6147 |

| usdh | Index of supply chain of United States | -- | 1665.902 | 26.2002 | 11960.74 |

| rusdh | Index of supply chain of Russia | -- | 42.44457 | 1.513084 | 220.6419 |

References

- Ghadge, A.; Wurtmann, H.; Seuring, S. Managing climate change risks in global supply chains: A review and research agenda. Int. J. Prod. Res. 2019, 58, 44–64. [Google Scholar] [CrossRef]

- Sussman, F.G.; Freed, J.R. Adapting to Climate Change: A Business Approach; Pew Center on Global Climate Change: Arlington, VA, USA, 2008; Volume 41, Available online: https://www.c2es.org/wp-content/uploads/2008/04/adapting-climate-change-business-approach.pdf (accessed on 1 April 2008).

- Dasaklis, T.; Pappis, C. Supply chain management in view of climate change: An overview of possible impacts and the road ahead. J. Ind. Eng. Manag. 2013, 6, 1139–1161. [Google Scholar] [CrossRef]

- Dawson, J.; Holloway, J.; Debortoli, N.; Gilmore, E. Treatment of International Economic Trade in Intergovernmental Panel on Climate Change (IPCC) Reports. Curr. Clim. Change Rep. 2020, 6, 155–165. [Google Scholar] [CrossRef]

- Kara, M.; Ghadge, A.; Bititci, U. Modelling the impact of climate change risk on supply chain performance. Int. J. Prod. Res. 2020, 59, 7317–7335. [Google Scholar] [CrossRef]

- Brander, K. Global fish production and climate change. Proc. Natl. Acad. Sci. USA 2007, 104, 19709–19714. [Google Scholar] [CrossRef]

- Free, C.M.; Thorson, J.T.; Pinsky, M.L.; Oken, K.L.; Wiedenmann, J.; Jensen, O.P. Impacts of historical warming on marine fisheries production. Science 2019, 363, 979–983. [Google Scholar] [CrossRef] [PubMed]

- Chang, Y.; Lee, M.; Lee, K.; Shao, K. Adaptation of fisheries and mariculture management to extreme oceanic environmental changes and climate variability in Taiwan. Mar. Policy 2013, 38, 476–482. [Google Scholar] [CrossRef]

- Caputi, N.; Kangas, M.; Denham, A.; Feng, M.; Pearce, A.; Hetzel, Y.; Chandrapavan, A. Management adaptation of invertebrate fisheries to an extreme marine heat wave event at a global warming hot spot. Ecol. Evol. 2016, 6, 3583–3593. [Google Scholar] [CrossRef]

- Do, V.; Phung, M.; Truong, D.; Pham, T.; Dang, V.; Nguyen, T. The impact of extreme events and climate change on agricultural and fishery enterprises in Central Vietnam. Sustainability 2021, 13, 7121. [Google Scholar] [CrossRef]

- PwC. International Threats and Opportunities of Climate Change to the UK: Report Prepared for the UK Department for Environment, Food and Rural Affairs (Defra); Price Water House Coopers LLP: London, UK, 2013; pp. 149–203. [Google Scholar]

- Merino, G.; Barangé, M.; Mullon, C. Climate variability and change scenarios for a marine commodity: Modelling small pelagic fish, fisheries and fishmeal in a globalized market. J. Mar. Syst. 2010, 81, 196–205. [Google Scholar] [CrossRef]

- Yasmin, R.; Islam, M. Sustainability of fisheries and aquaculture in context of emerging climate change issues. Int. J. Fish. Aquat. Stud. 2017, 5, 176–187. [Google Scholar]

- Hall, G. Impact of climate change on aquaculture: The need for alternative feed components. Turk. J. Fish. Aquat. Sci. 2015, 15, 569–574. [Google Scholar] [CrossRef] [PubMed]

- Teng, P.; Lassa, J.; Caballero-Anthony, M. Climate change and fish availability. COSMOS 2016, 12, 29–42. [Google Scholar] [CrossRef]

- Fleming, A.; Hobday, A.; Farmery, A.; van Putten, E.; Pecl, G.; Green, B.; Lim-Camacho, L. Climate change risks and adaptation options across Australian seafood supply chains—A preliminary assessment. Clim. Risk Manag. 2014, 1, 39–50. [Google Scholar] [CrossRef]

- Allison, E.; Perry, A.; Badjeck, M.; Adger, W.; Brown, K.; Conway, D.; Halls, A.; Pilling, G.; Reynolds, J.; Andrew, N.; et al. Vulnerability of national economies to the impacts of climate change on fisheries. Fish Fish. 2009, 10, 173–196. [Google Scholar] [CrossRef]

- Sumaila, U.; Cheung, W.; Lam, V.; Pauly, D.; Herrick, S. Climate change impacts on the biophysics and economics of world fisheries. Nat. Clim. Change 2011, 1, 449–456. [Google Scholar] [CrossRef]

- Marshak, A.; Link, J. Primary production ultimately limits fisheries economic performance. Sci. Rep. 2021, 11, 12154. [Google Scholar] [CrossRef]

- Gurgel, C.; Camacho, O.; Minne, A.; Wernberg, T.; Coleman, M. Marine heatwave drives cryptic loss of genetic diversity in underwater forests. Curr. Biol. 2020, 30, 1199–1206.e2. [Google Scholar] [CrossRef]

- Pujolar, J.; Vincenzi, S.; Zane, L.; Jeseňsek, D.; Leo, G.; Crivelli, A. The effect of recurrent floods on genetic composition of marble trout populations. PLoS ONE 2011, 6, e23822. [Google Scholar] [CrossRef]

- Gray, S.; Dermody, O.; Klein, S.; Locke, A.; McGrath, J.; Paul, R.; Rosenthal, D.; Ruiz-Vera, U.; Siebers, M.; Strellner, R.; et al. Intensifying drought eliminates the expected benefits of elevated carbon dioxide for soybean. Nat. Plants 2016, 2, 16132. [Google Scholar] [CrossRef]

- Stokeld, E.; Croft, S.; dos Reis, T.N.; Stringer, L.C.; West, C. Stakeholder perspectives on cross-border climate risks in the Brazil-Europe soy supply chain. J. Clean. Prod. 2023, 428, 139292. [Google Scholar] [CrossRef]

- Rezaee, S.; Pelot, R.; Ghasemi, A. The effect of extreme weather conditions on commercial fishing activities and vessel incidents in Atlantic Canada. Ocean Coast. Manag. 2016, 130, 115–127. [Google Scholar] [CrossRef]

- Bednar, F.B.; Knittel, N.; Raich, J.; Adams, K.M. Adaptation to transboundary climate risks in trade: Investigating actors and strategies for an emerging challenge. WIREs Clim. Change 2022, 13, e758. [Google Scholar] [CrossRef]

- Carter, T.; Benzie, M.; Campiglio, E.; Carlsen, H.; Fronzek, S.; Hildén, M.; Reyer, C.P.; West, C. A conceptual framework for cross-border impacts of climate change. Glob. Environ. Change 2021, 69, 102307. [Google Scholar] [CrossRef]

- Tang, Y.; Zou, W.H.; Hu, Z.M. An analysis of utilization status and management of marine fisheries resources in china based on statistics data. Resour. Sci. 2009, 31, 1061–1068. (In Chinese) [Google Scholar]

- Yang, Z.J. Evaluation of the contribution of technological progress in China’s fishery industry based on TFP measurement. In Proceedings of the 2011 China Fisheries Economics Expert Forum, Beijing, China, 21–22 June 2011; Chinese Academy of Fishery Sciences: Beijing, China, 2011; p. 10. (In Chinese). [Google Scholar]

- Zhang, T. Research on the Changes in Total Factor Productivity and Regional Convergence of China’s Fishery Industry. Doctoral Dissertation, Zhejiang Ocean University, Zhoushan, China, 2021; pp. 1–43. (In Chinese). [Google Scholar]

- Guo, K.; Ji, Q.; Zhang, D. A dataset to measure global climate physical risk. Data Brief 2024, 54, 110502. [Google Scholar] [CrossRef] [PubMed]

- Jones, M.; Dye, S.; Pinnegar, J.; Warren, R.; Cheung, W. Using scenarios to project the changing profitability of fisheries under climate change. Fish Fish. 2015, 16, 603–622. [Google Scholar] [CrossRef]

- Suh, D.; Pomeroy, R. Projected economic impact of climate change on marine capture fisheries in the Philippines. Front. Mar. Sci. 2020, 7, 232. [Google Scholar] [CrossRef]

- Nguyen, T. Welfare impact of climate change on capture fisheries in Vietnam. PLoS ONE 2022, 17, e0264997. [Google Scholar] [CrossRef]

- Cripps, M.W.; Myles, G.D. General equilibrium and imperfect competition: Profit feedback and price normalization. Res. Agric. Appl. Econ. Work. Pap. 1988, 295. [Google Scholar] [CrossRef]

- Wagner, S.M.; Bode, C. An empirical investigation into supply chain vulnerability. J. Purch. Supply Manag. 2006, 12, 301–312. [Google Scholar] [CrossRef]

- Su, Q. Analysis of the relationship between security and efficiency in global supply chains. Int. Political Sci. 2021, 6, 1–32. (In Chinese) [Google Scholar]

- Zhu, J.L.; Fang, Y. Multilateral Trade Cooperation and the “Stabilization Chain” of Chinese Manufacturing under the Dynamic Global Trade Pattern—Based on the Estimation of Production Risk Sources in China’s Manufacturing Supply Chain. Quant. Econ. Tech. Econ. Res. 2024, 41, 89–111. (In Chinese) [Google Scholar]

- Rubinstein, A. Modeling Bounded Rationality; Zeuthen Lecture Book Series; MIT Press: Cambridge, MA, USA, 1988; Volume 220, pp. 1–208. [Google Scholar] [CrossRef]

- Sun, Y.; Zou, X.; Shi, X.; Zhang, P. The economic impact of climate risks in China: Evidence from 47-sector panel data, 2000–2014. Nat. Hazards 2024, 95, 289–308. [Google Scholar] [CrossRef]

- Li, S.; Yang, Z.; Nadolnyak, D.; Zhang, Y.; Luo, Y. Economic impacts of climate change: Profitability of freshwater aquaculture in China. Aquac. Res. 2016, 47, 1537–1548. [Google Scholar] [CrossRef]

- Chand, A. China’s marine fisheries and climate risks. Nat. Food 2024, 5, 4. [Google Scholar] [CrossRef]

- Holst, R.; Yu, X. Climate Change and Production Risk in Chinese Aquaculture. Courant Research Centre Discussion Papers 2011, No. 64. Available online: https://hdl.handle.net/10419/90469 (accessed on 20 April 2025).

- Yao, Z.; Chen, Y.; Deng, S.; Zhang, Y.; Wei, Y. Carbon emission allowance, global climate risk, and agricultural futures: An extreme spillover analysis in China. Financ. Res. Lett. 2025, 71, 106391. [Google Scholar] [CrossRef]

- Calderón, R.G.; Brunella, B.; Llatas, H.; Delicia, F. Perú fishmeal exports, 2018–2022. In Proceedings of the Latin American and Caribbean Conference for Engineering and Technology, San José, Costa Rica, 17–19 July 2024; pp. 1–11. [Google Scholar] [CrossRef]

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| Variables | lny | lnbrdh | lny | Variables | lny | lncadh | lny |

| lnbrcri | −0.383 * (0.118) | −2.936 (1.299) | −0.173 * (0.0844) | lncandcri | −1.135 * (0.283) | −4.791 * (1.600) | −0.367 (0.149) |

| lnbrdh | 0.0716 * | lncadh | 0.160 * | ||||

| (0.0132) | (0.0176) | ||||||

| lnchncri | −0.378 * | −5.171 | −0.00744 | lnchncri | −0.135 | −2.748 | 0.306 * |

| (0.203) | (2.234) | (0.146) | (0.201) | (1.139) | (0.100) | ||

| lntp | 0.0279 | 0.260 | 0.00928 | lntp | −0.152 | −0.304 | −0.103 |

| (0.161) | (1.773) | (0.102) | (0.152) | (0.858) | (0.0662) | ||

| lnl | −1.611 * | −21.14 | −0.0967 | lnl | −0.965 | −5.705 | −0.0508 |

| (0.899) | (9.885) | (0.635) | (0.868) | (4.904) | (0.390) | ||

| lnk | 0.255 | 5.669 | −0.152 | lnk | 0.236 | 2.330 | −0.138 |

| (0.409) | (4.490) | (0.269) | (0.362) | (2.044) | (0.162) | ||

| lnmj | 1.024 | 8.207 * | 0.436 | lnmj | 0.510 | 3.150 | 0.00498 |

| (0.359) | (3.942) | (0.252) | (0.351) | (1.982) | (0.162) | ||

| Constant | 10.45 | 56.52 | 6.405 * | Constant | 7.607 | −8.405 | 8.954 * |

| (4.748) | (52.18) | (3.100) | (4.503) | (25.46) | (1.963) | ||

| Mediation Effect | 54% | Mediation Effect | 67.53% | ||||

| Observations | 26 | 26 | 26 | Observations | 26 | 26 | 26 |

| R-squared | 0.823 | 0.786 | 0.933 | R-squared | 0.851 | 0.879 | 0.973 |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| Variables | lny | lnjapdh | lny | Variables | lny | lnusdh | lny |

| lnjapcri | 1.195 * | 5.174 * | 0.934 | lnuscri | 0.321 | 1.726 * | 0.0243 |

| (0.273) | (1.348) | (0.362) | (0.128) | (0.588) | (0.0979) | ||

| lnjapdh | 0.0506 | lnusdh | 0.172 * | ||||

| (0.0463) | (0.0317) | ||||||

| lnchncri | −0.986 * | −5.202 * | −0.723 | lnchncri | −0.394 * | −0.685 | −0.276 * |

| (0.216) | (1.063) | (0.322) | (0.220) | (1.007) | (0.141) | ||

| lntp | −0.0289 | −0.311 | −0.0132 | lntp | −0.0264 | −0.450 | 0.0509 |

| (0.142) | (0.698) | (0.142) | (0.174) | (0.798) | (0.111) | ||

| lnl | −2.102 | 1.871 | −2.197 | lnl | −1.588 | −7.139 | −0.362 |

| (0.771) | (3.799) | (0.772) | (0.986) | (4.523) | (0.664) | ||

| lnk | 0.899 * | −1.014 | 0.951 * | lnk | 0.372 | 4.497 | −0.400 |

| (0.288) | (1.420) | (0.290) | (0.445) | (2.043) | (0.316) | ||

| lnmj | 0.997 * | −0.858 | 1.041 * | lnmj | 1.086 | 6.918 * | −0.101 |

| (0.316) | (1.556) | (0.316) | (0.389) | (1.785) | (0.330) | ||

| Constant | 14.54 * | 3.080 | 14.39 * | Constant | 11.42 | −2.193 | 11.79 * |

| (4.127) | (20.35) | (4.109) | (5.100) | (23.39) | (3.231) | ||

| Mediation Effect | 22% | Mediation Effect | 100% | ||||

| Observations | 26 | 26 | 26 | Observations | 26 | 26 | 26 |

| R-squared | 0.863 | 0.615 | 0.871 | R-squared | 0.793 | 0.895 | 0.921 |

| (1) | (2) | (3) | (4) | (5) | (6) | ||

|---|---|---|---|---|---|---|---|

| Variables | lny | lnkrdh | lny | Variables | lny | lnrusdh | lny |

| lnkrcri | 0.516 | 1.495 | 0.227 | lnruscri | 0.0704 | 0.945 | −0.0623 |

| (0.243) | (0.940) | (0.177) | (0.219) | (1.269) | (0.134) | ||

| lnkrdh | 0.193 * | lnrusdh | 0.140 * | ||||

| (0.0405) | (0.0238) | ||||||

| lnchncri | −0.848 * | −3.046 | −0.259 | lnchncri | −0.476 * | −3.582 | 0.0263 |

| (0.293) | (1.133) | (0.235) | (0.262) | (1.513) | (0.179) | ||

| lntp | −0.0199 | −0.158 | 0.0106 | lntp | −0.0140 | −0.308 | 0.0292 |

| (0.180) | (0.697) | (0.123) | (0.201) | (1.160) | (0.121) | ||

| lnl | −2.656 | −7.332 * | −1.239 | lnl | −2.184 * | 0.442 | −2.246 * |

| (0.995) | (3.845) | (0.742) | (1.138) | (6.580) | (0.684) | ||

| lnk | 1.009 | 3.031 | 0.423 | lnk | 1.063 | 2.112 | 0.767 * |

| (0.365) | (1.409) | (0.278) | (0.404) | (2.335) | (0.248) | ||

| lnmj | 1.177 * | 3.419 | 0.516 | lnmj | 0.980 | 2.730 | 0.596 |

| (0.411) | (1.587) | (0.313) | (0.449) | (2.598) | (0.278) | ||

| Constant | 15.17 | 19.01 | 11.50 * | Constant | 12.58 * | −33.41 | 17.27 * |

| (5.330) | (20.60) | (3.721) | (6.049) | (34.97) | (3.720) | ||

| Mediation Effect | 0% | Mediation Effect | 0% | ||||

| Observations | 26 | 26 | 26 | Observations | 26 | 26 | 26 |

| R-squared | 0.777 | 0.725 | 0.901 | R-squared | 0.726 | 0.641 | 0.906 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.; Liao, Z.; Zhang, Y.; Ren, Y.; Qu, H. Climate Risk in Intermediate Goods Trade: Impacts on China’s Fisheries Production. Fishes 2025, 10, 210. https://doi.org/10.3390/fishes10050210

Yang S, Liao Z, Zhang Y, Ren Y, Qu H. Climate Risk in Intermediate Goods Trade: Impacts on China’s Fisheries Production. Fishes. 2025; 10(5):210. https://doi.org/10.3390/fishes10050210

Chicago/Turabian StyleYang, Shunxiang, Zefang Liao, Yingli Zhang, Yuqing Ren, and Hang Qu. 2025. "Climate Risk in Intermediate Goods Trade: Impacts on China’s Fisheries Production" Fishes 10, no. 5: 210. https://doi.org/10.3390/fishes10050210

APA StyleYang, S., Liao, Z., Zhang, Y., Ren, Y., & Qu, H. (2025). Climate Risk in Intermediate Goods Trade: Impacts on China’s Fisheries Production. Fishes, 10(5), 210. https://doi.org/10.3390/fishes10050210