Tracking Flows of End-of-Life Battery Materials and Manufacturing Scrap

Abstract

:1. Introduction

| Element | kg/Car (100 kWh) | U.S. Reserves (kT) | World Reserves (kT) | Number for U.S. (Million) | Number for World (Billion) |

|---|---|---|---|---|---|

| Cobalt | 15.4 | 69 | 8300 | 4.5 | 0.54 |

| Nickel | 46.3 | 370 | >100,000 | 8.0 | 2.2 |

| Lithium | 9.4 | 1000 | 26,000 | 107 | 2.8 |

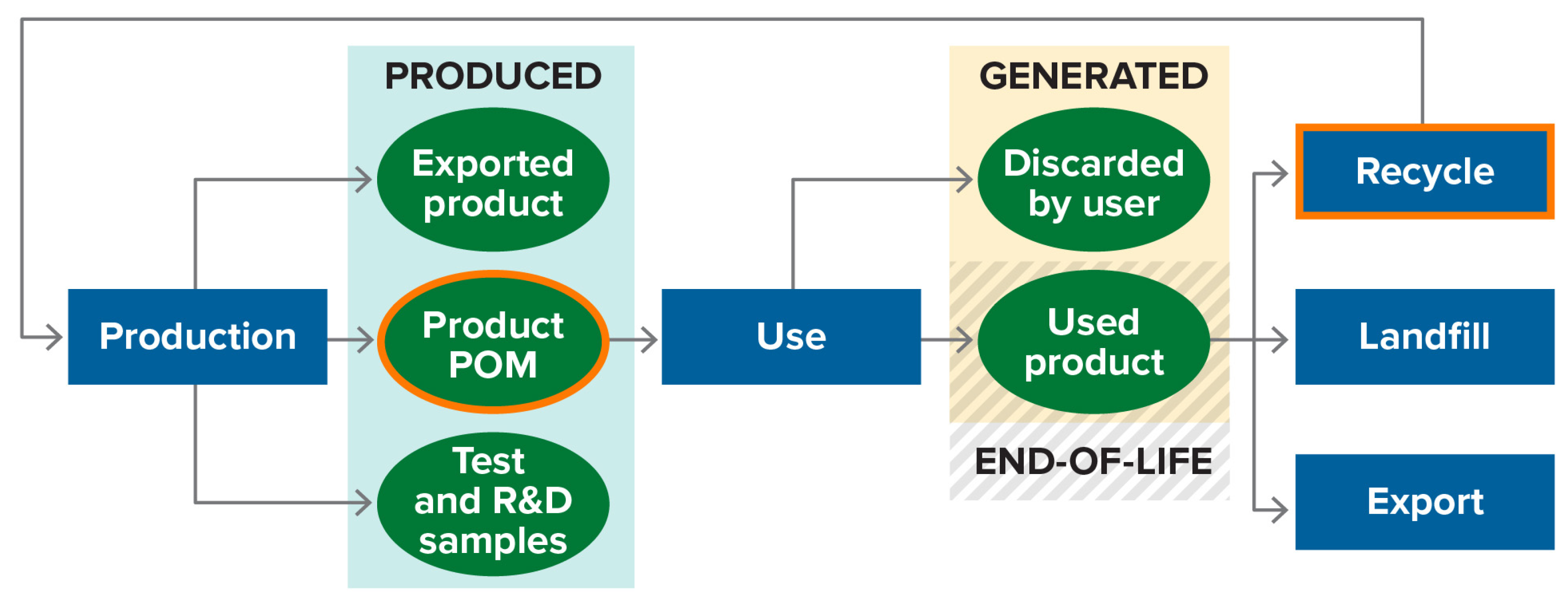

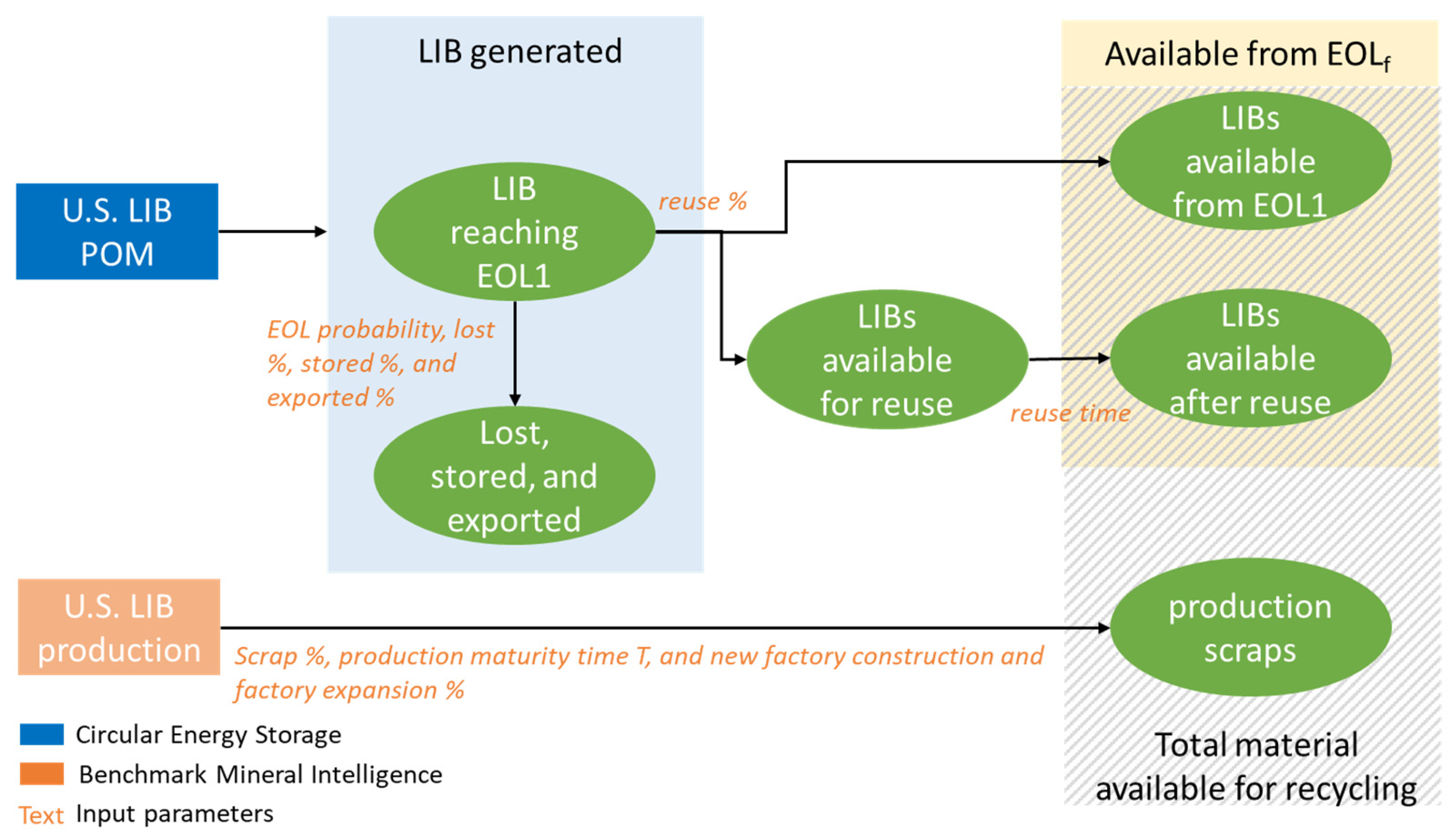

2. Framework and Definitions

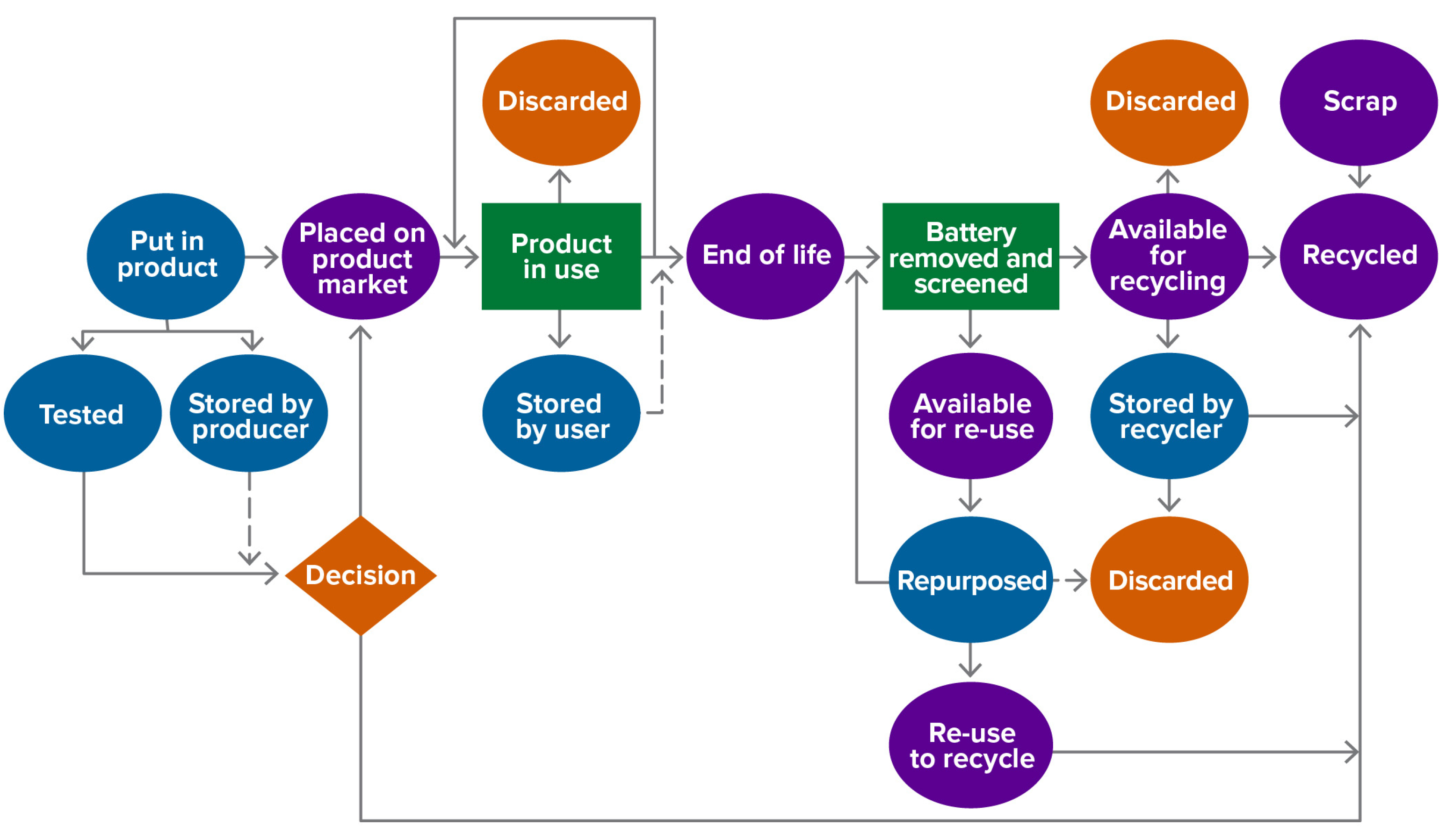

2.1. End-of-Life Material

2.1.1. Simple Product Case

2.1.2. Complex Product Case (Batteries)

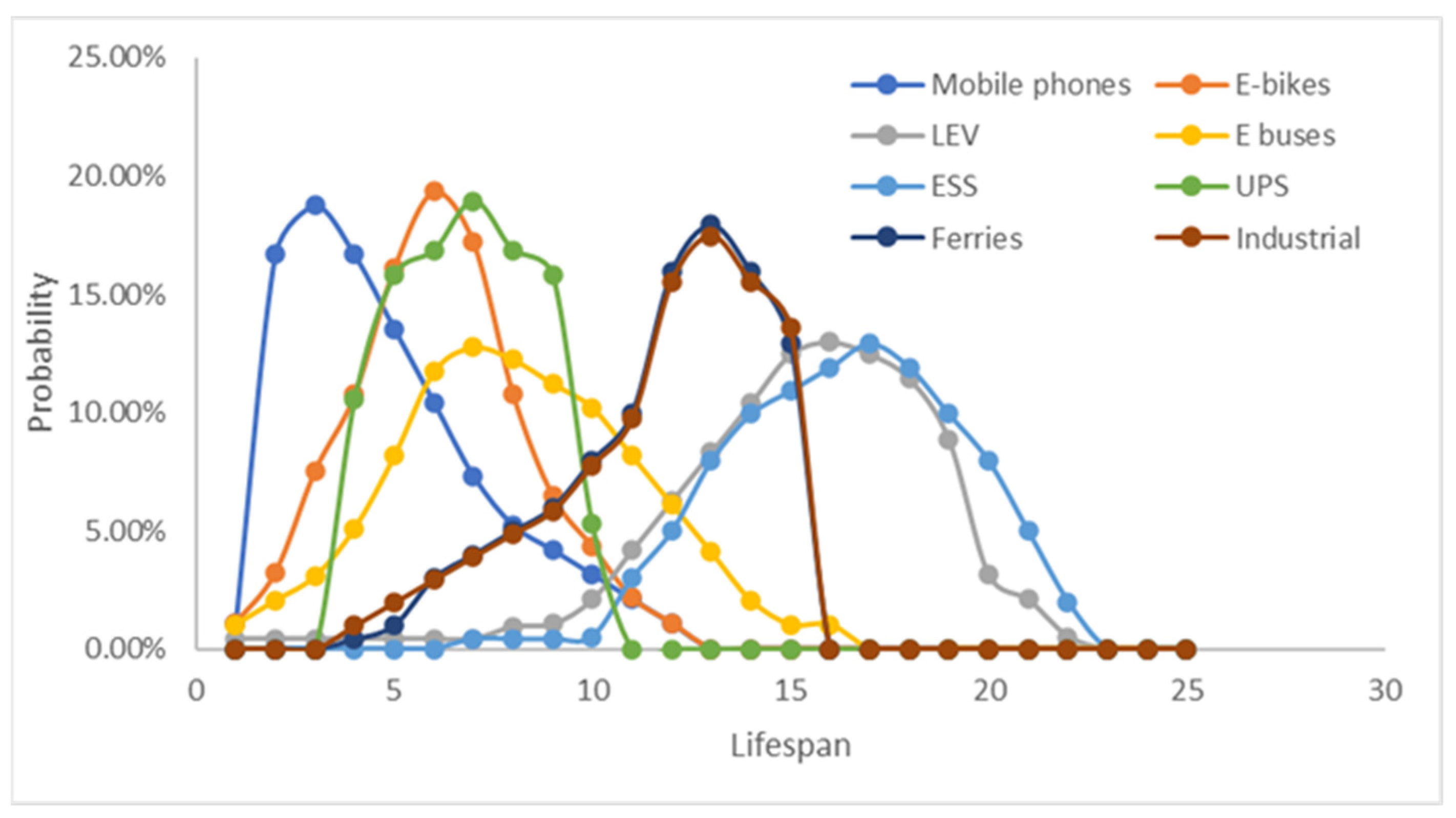

- Long product life: A battery has a long lifetime, and those in any one use will become unusable over a lengthy period (Figure 3), with some expiring much sooner than others. That is, batteries becoming unusable today were produced over an extended past interval.

- Chemistry is evolving: The chemical composition of cells is changing, so the recovered material is likely to differ from that used at the time of recovery.

- Product complexity: A battery is a complex product comprising many components, each in a highly processed state. Component parts may have different lifetimes and may be more or less recyclable, by different processes, with varied products.

- Not a stand-alone product: A battery is generally not used alone but as part of a host product (e.g., cell phone or EV) for which it provides power. It may outlive the host product and then be transferred to another host, or it may fail during the host’s lifetime, complicating collection.

- May be exported: Both host products and separate batteries may be traded internationally, at any point during the lifecycle, complicating tracking of materials flows.

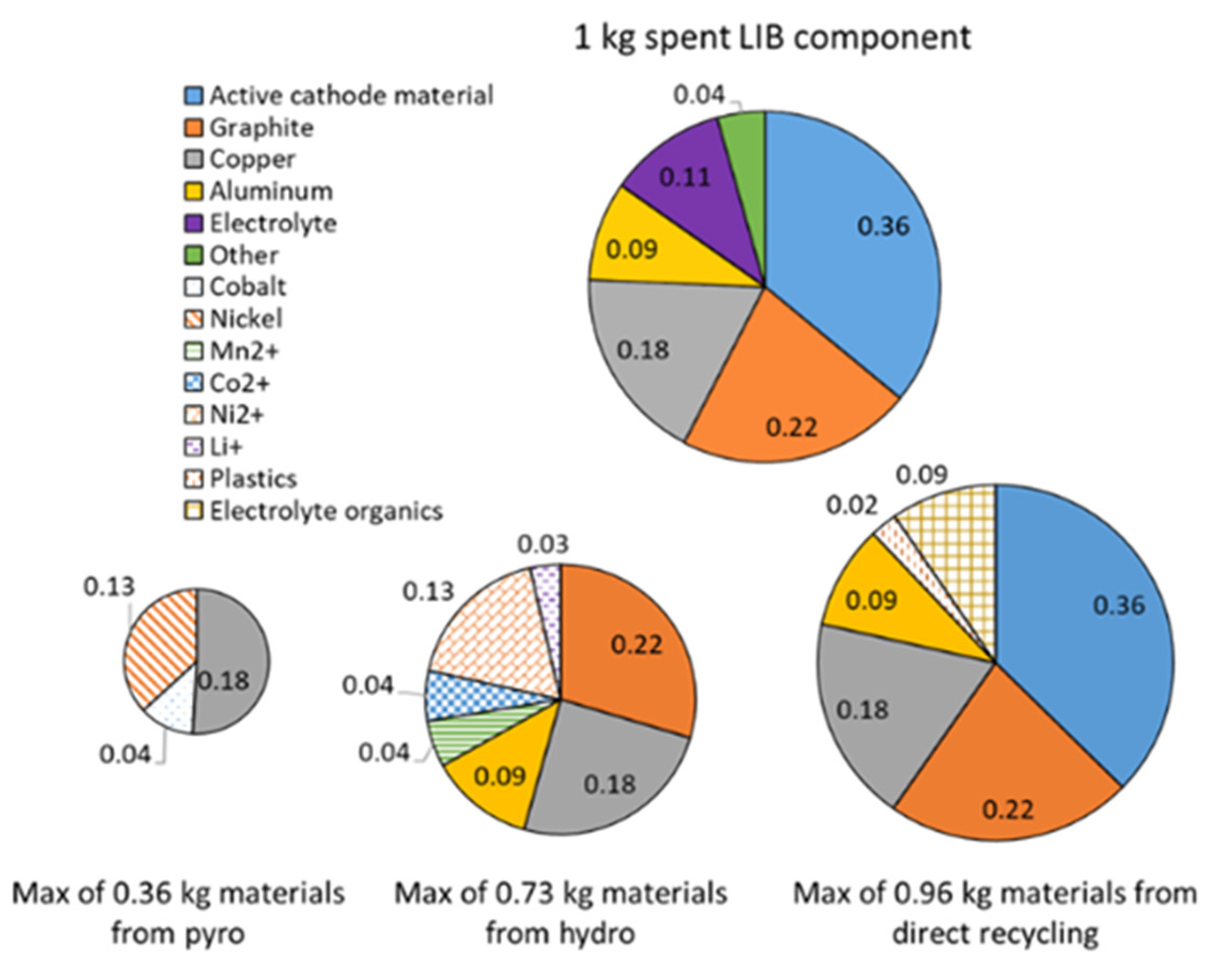

2.1.3. Battery Recycling Metrics

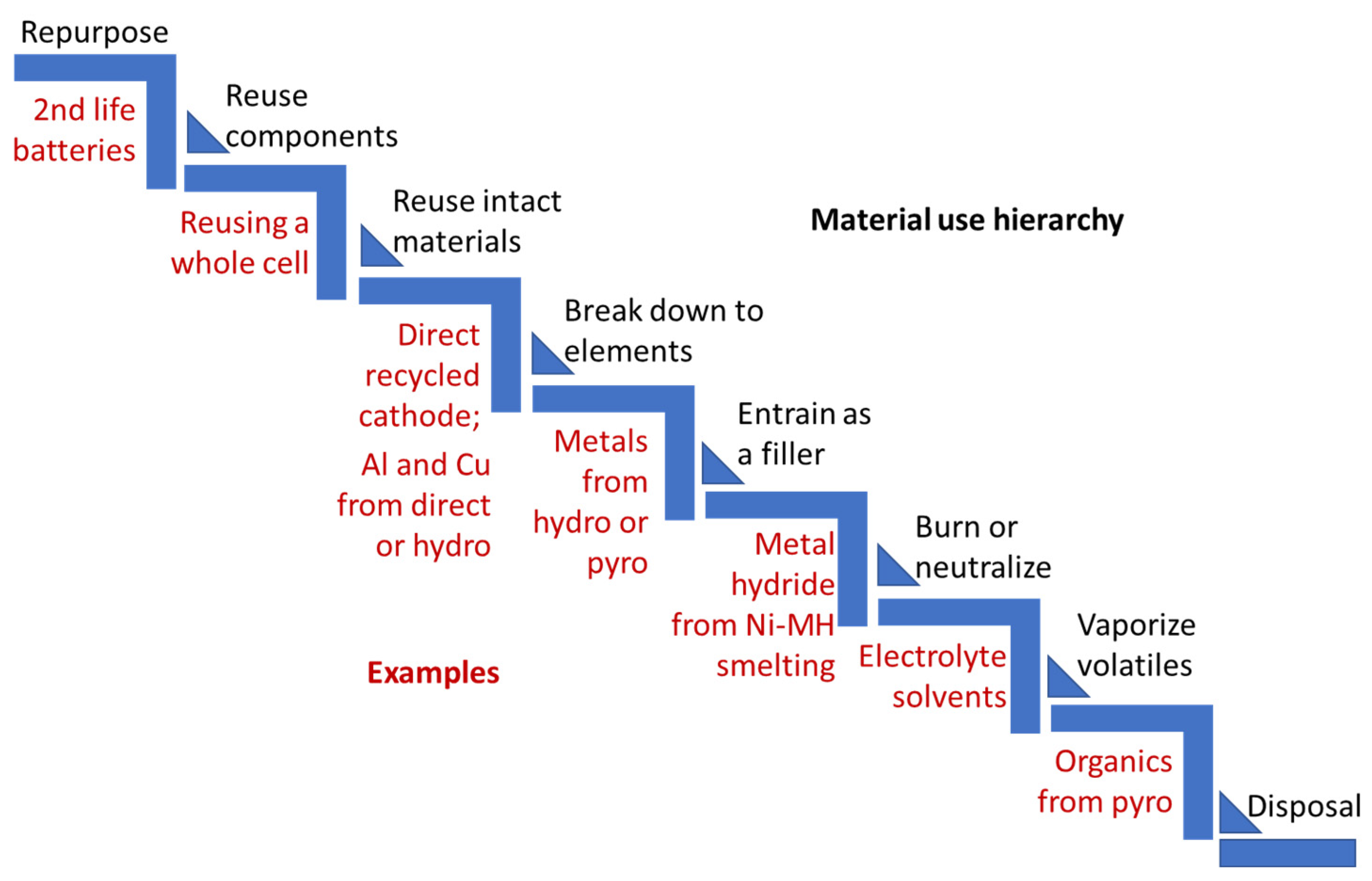

2.1.4. Recycling Quality Characterization

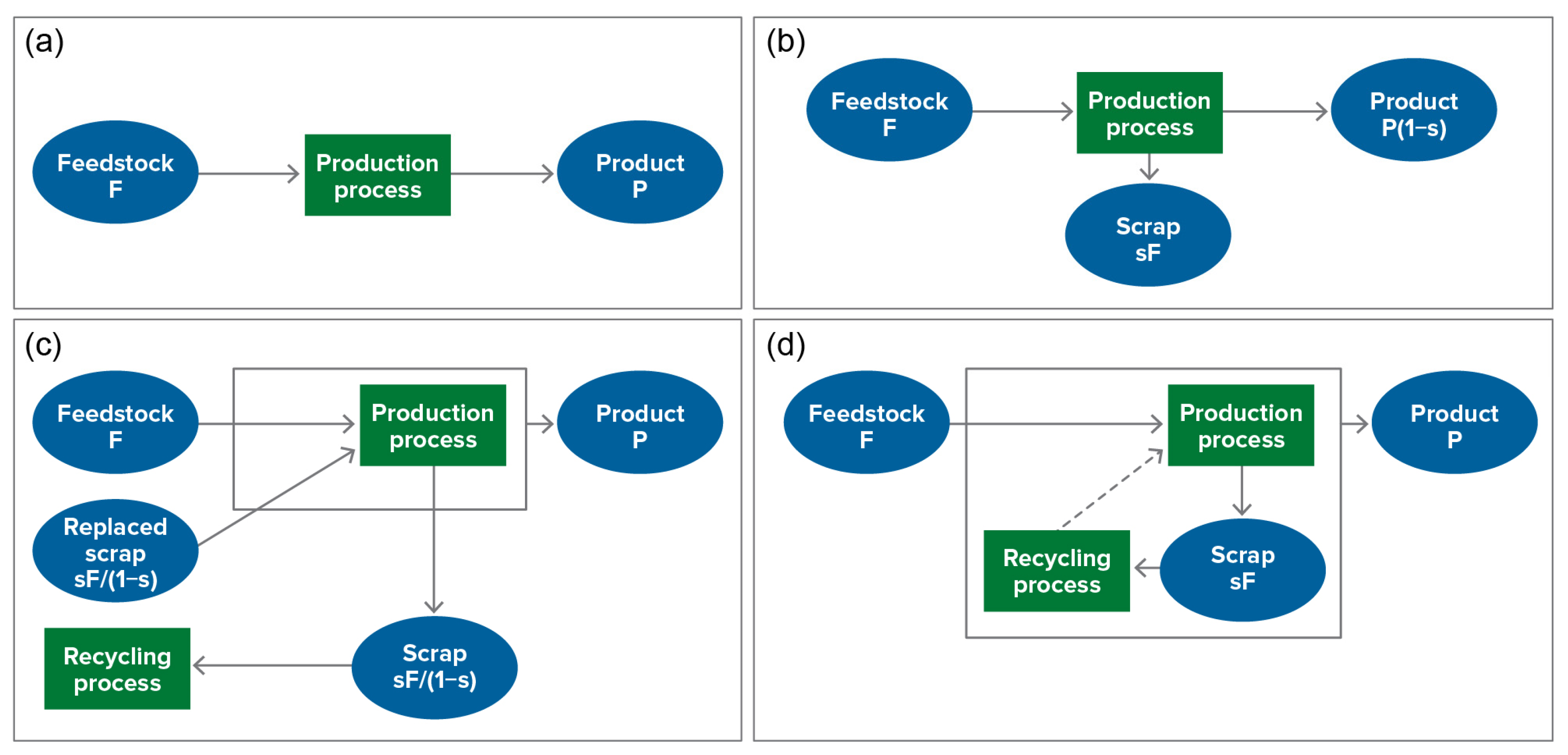

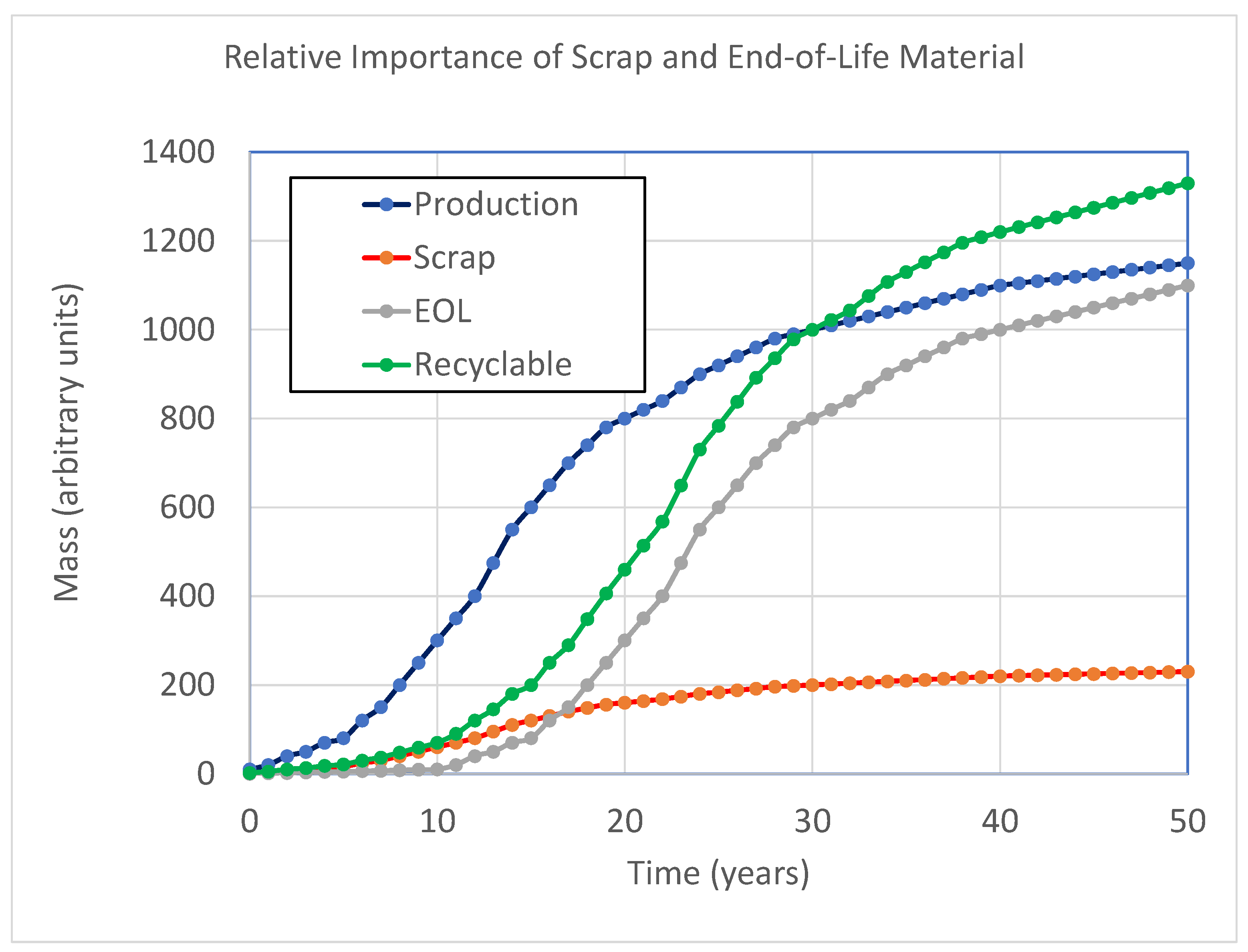

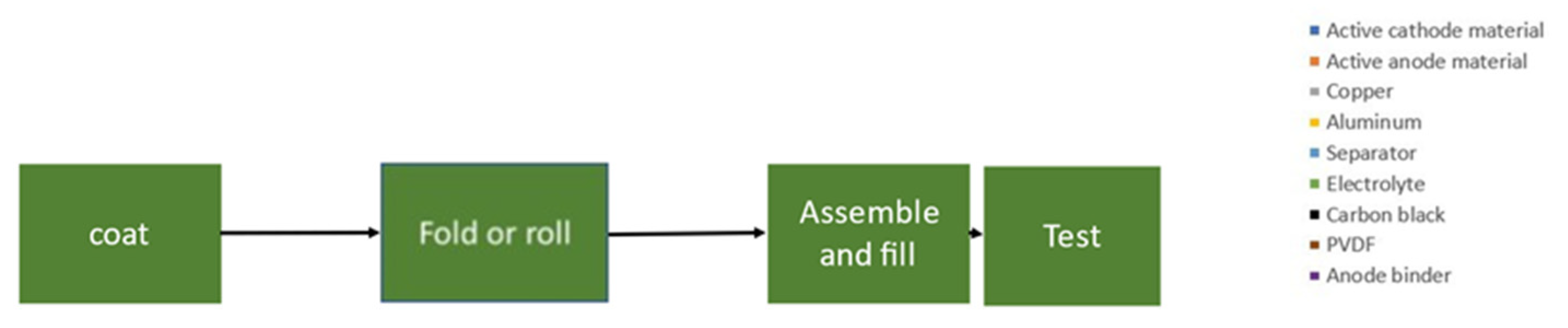

2.2. Manufacturing Scrap

3. Methodology and Results

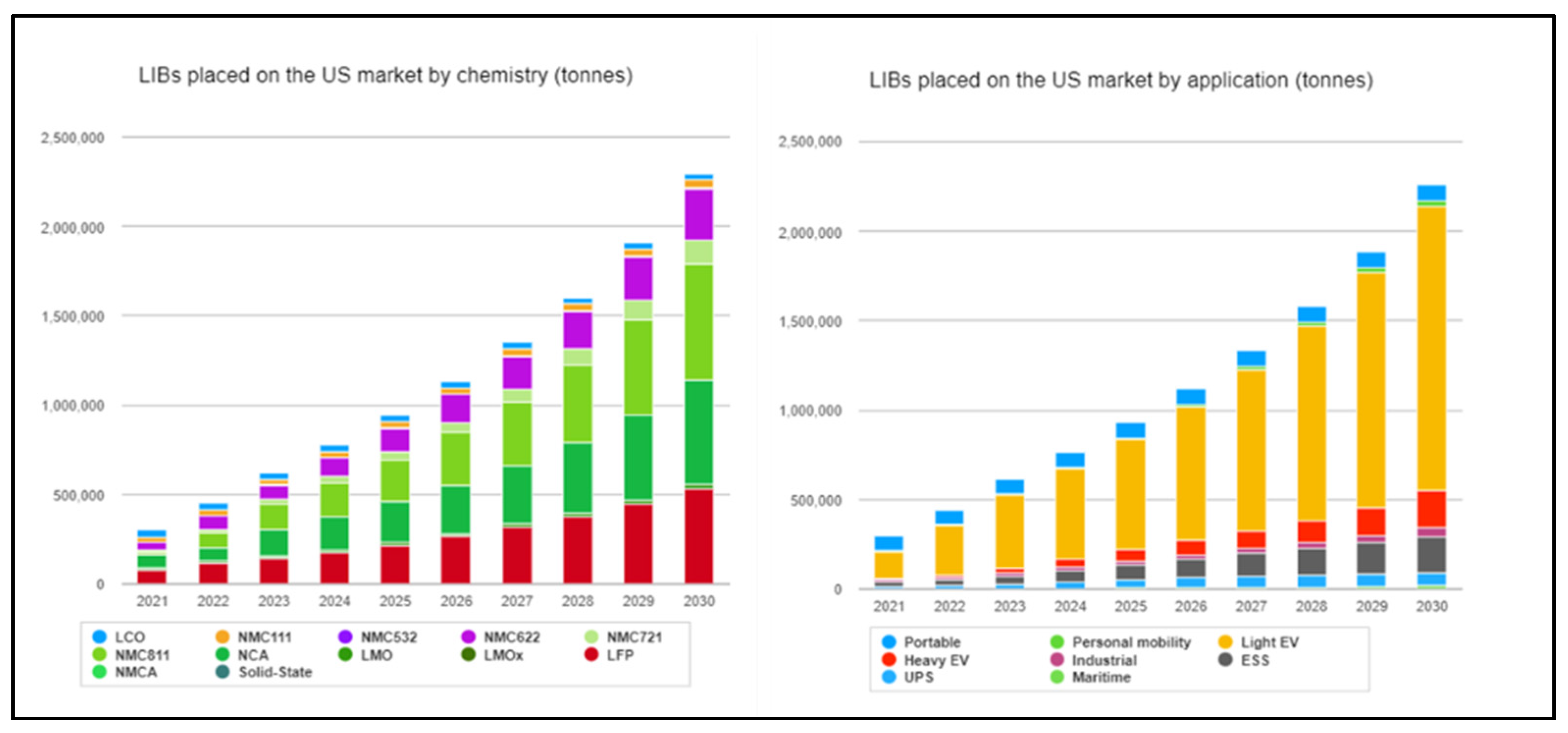

3.1. Data and Method

3.1.1. Data Sources

3.1.2. Data Reliability

3.1.3. Data Availability

3.1.4. Modifications to CES’s Data

3.1.5. Methodology

3.1.6. Sensitivity and Scenario Analyses

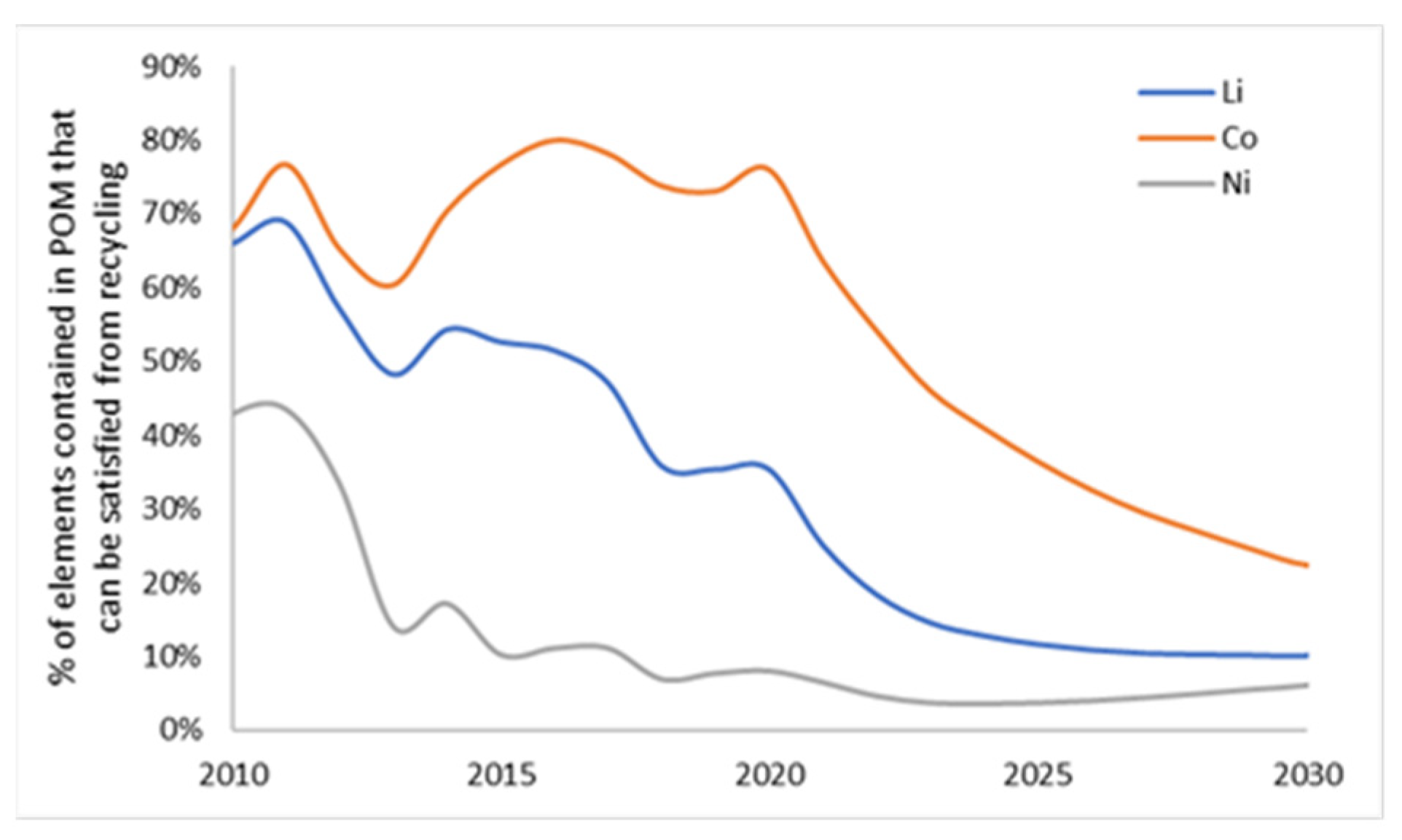

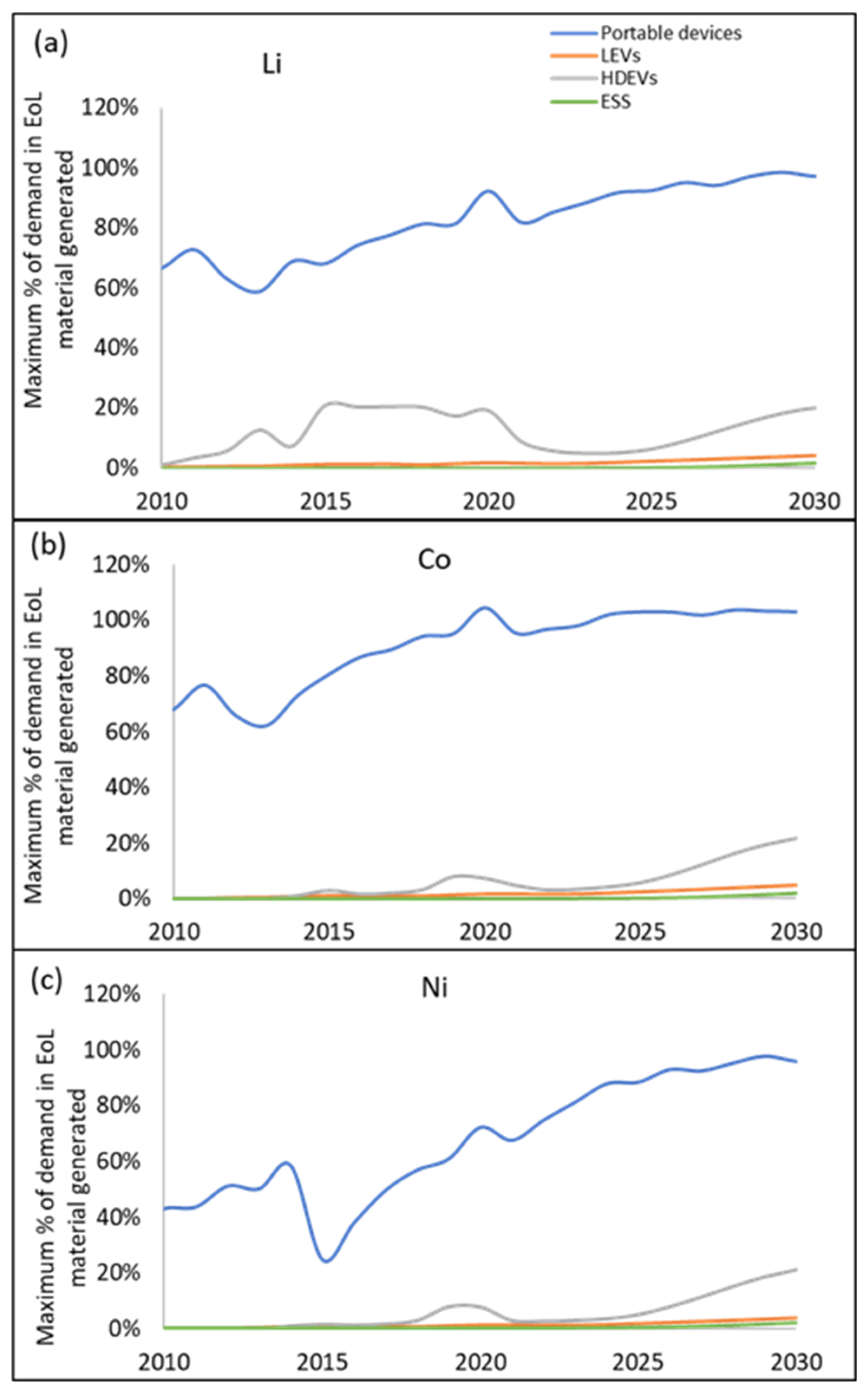

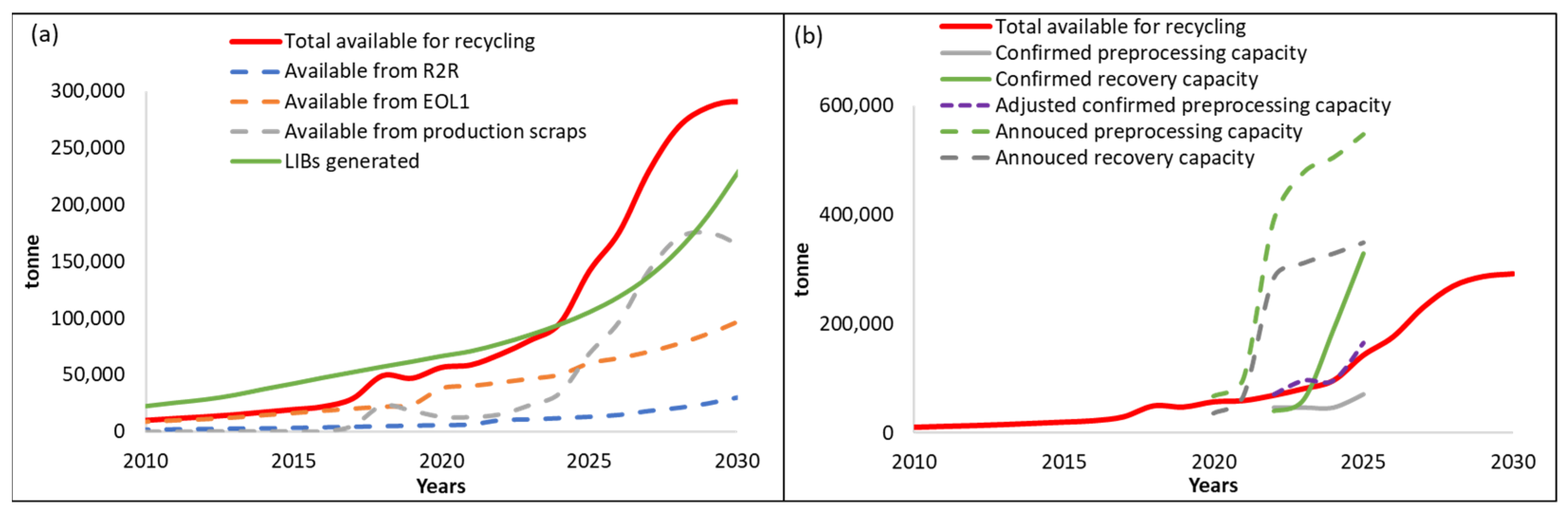

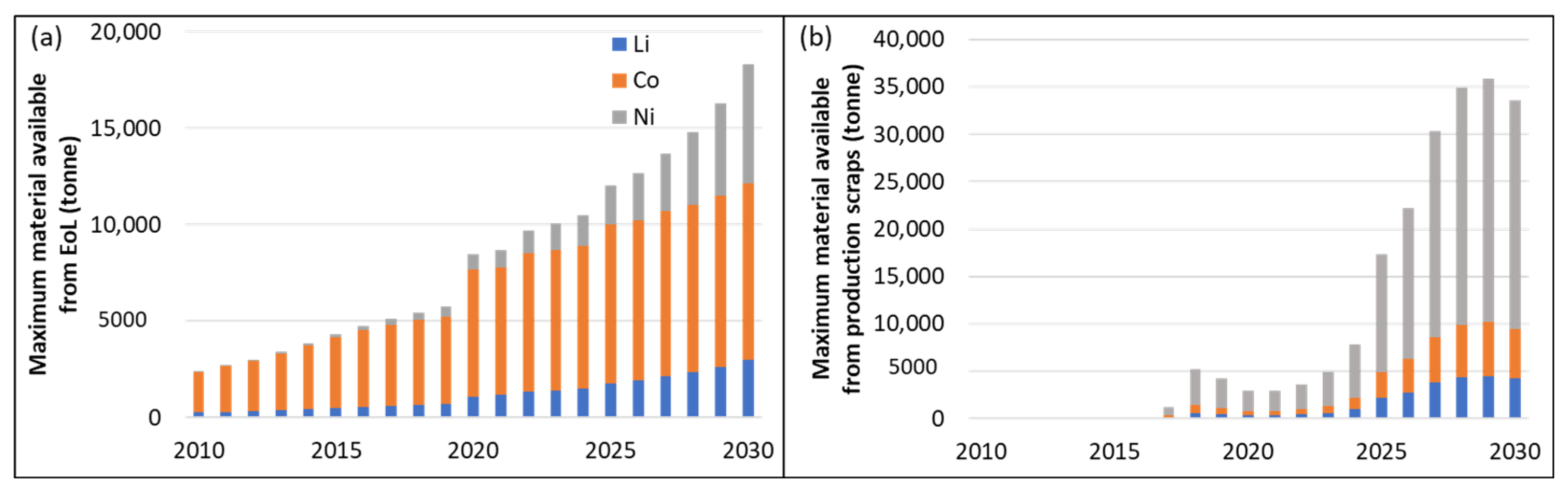

3.2. Demand Compared to Maximum Material Potentially Available from Recycling

3.3. U.S. Material Availability and Processing Capacity

3.3.1. Material Availability

3.3.2. North American Recycling Capacity

- Collection/consolidation;

- Sorting;

- Size reduction/dismantling;

- Black mass recovery (but note some recovery processes might not go via black mass);

- Precursor production;

- Production of cathode and other products.

4. Summary and Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Glossary

- Cathode-to-Cathode Recycling: Recovery of cathode material for reuse in a battery (see direct recycling).

- Gross Available for Recycling: Total material that is ready to be recycled in a given year; equal to the sum of the material available for recycling at EOL, reaching the end of its utility in reuse, and production scrap.

- Closed-Loop Recycling: Recycling of material into the same product from which it was recovered.

- Collected: The quantity of material gathered and kept out of the waste stream.

- Direct (Cathode) Recycling: Recovery, regeneration, and reuse of battery components (cathode material) directly without breaking down the chemical structure.

- Disposal: Final non-productive disposition of a material for which no use is economical, often in a landfill.

- Element-Specific Recycling Process Efficiency: 100× the usable quantity of the element exiting the process divided by that entering. It may differ by element for any given process.

- Element-Specific Recycling Rate: The mass of an element actually recycled, divided by the its mass contained in the used material generated that year (expressed as a percent).

- End-of-(First)-Life (EOL1): Standard designation of a product that has reached the end of its useful life for its primary application (typically falling below 80% of original discharge capacity for EV batteries). It is when a battery is removed from its first host product. It may still be usable for one or more subsequent lives.

- End of Final Life (EOLf): Designates a battery that has been repurposed until no longer serviceable and is sent for recycling. The additional material is accounted for as “R2R” (reuse to recycling) and gets added to material available for recycling after its first life.

- Export %: Percentage of used LIBs (in or out of vehicles) that are sold overseas.

- Generated: All the material that reaches the end of its usefulness, wherever it is.

- Hydrometallurgy: Process or technique of extracting material at ordinary temperatures by leaching ores (or recovered material) with liquid solvents.

- Lost %: Mass percentage of LIBs that would have been expected to go out of service at this time but are instead lost or discarded. EOL material is reduced by this material. Expected to be negligible for EV and ESS uses.

- New Scrap: Scrap generated in manufacturing processes from out-of-specification products or general manufacturing reject material (also known as home scrap or pre-consumer).

- Old Scrap: Material from end-of-life products that can be recovered (also known as post-consumer scrap).

- Open-Loop Recycling: Recycling a material into a different product than the one from which it was recovered.

- Production Maturity Time: Years required for a factory to decrease production scrap (from 30%) to 5%.

- Percent Recycled: 100× the quantity of EOL material processed (at least to shred stage) in a given year divided by the quantity of material generated in that year. It will differ by type of product, location, and time. Scrap, test, and unsold material are not included.

- Placed on Market: Made available for sale; equivalent to product demand.

- Preprocessing: Recycling process steps up to/including black mass recovery.

- Pyrometallurgy: Process or technique of refining ores (or recovered material) using heat to melt the metallic and burn the non-metallic content.

- Recovery: Recycling processes that accomplish chemical or physical upgrading of the material to a market commodity such as cathodes or cathode precursors.

- Recycle: Convert materials that are no longer functional into usable materials or products.

- RE: The “RE” terms below are widely used with varying connotations. Terms are not mutually exclusive.

- Recycled Content: The percent of mass post-consumer material contained in a recycled product (this may also differ by element).

- Recycling Process Efficiency: can be defined as 100× (a) the mass of recycled materials exiting the recycling process and returned to the economy, divided by (b) the mass of materials entering the recycling process. (Recycled product/Recycling process input).

- Recycling Rate: the mass of used material actually recycled, divided by the mass of used material generated that year (expressed as a percent).

- Refurbish: Repair or freshen a product to meet original specifications, typically done by the original manufacturer. Generally, does not entail major modification.

- Rejuvenate: Restore materials or devices to performance similar to their pristine state. Similar to refurbish, but not necessarily done by the original manufacturer.

- Remanufacture: Return previously sold, worn, or non-functional products to same-as-new condition and performance for original use. Automotive parts are disassembled and re-machined during remanufacture.

- Repair: Restore to operational condition.

- Repurpose: Reuse a battery pack or components for a new and often less demanding application. Generally, requires reconfiguration and new BMS.

- Reuse: Using a product again with or without major modifications. (Generic term).

- Reuse %: Percentage of EOL LIBs judged available for reuse.

- Reuse time: Length of service in 2nd and subsequent lives.

- Scrap: Material that enters production process but does not make it out as usable product. Could define percent as 100 minus yield for a simple process.

- Second Life: Use of an end-of-life battery for a new purpose. Possibly then suitable for another, even less-demanding use, or unusable, i.e., spent (see below).

- Secondary Material: Material that has been previously used and is to be used again.

- Spent Battery: Battery or cell that can no longer supply sufficient storage capacity for use. Suitable for recycling to recover useful components.

- Stored %: Mass percentage of (portable device) LIBs that would have been expected to go out of service at this time but are instead stored by the user, so still counted as in use.

- Upcycle: Recycle to a higher-value use. DOE’s ReCell Center is trying to upcycle NMC111 to NMC622.

References

- Xu, C.; Dai, Q.; Gaines, L.; Hu, M.; Tukker, A.; Steubing, B. Future material demand for automotive lithium-based batteries. Commun. Mater. 2020, 1, 99. [Google Scholar] [CrossRef]

- Neidhardt, M.; Mas-Peiro, J.; Schulz-Moenninghoff, M.; Pou, J.O.; Gonzalez-Olmos, R.; Kwade, A.; Schmuelling, B. Forecasting the global battery material flow: Analyzing the break-even points at which secondary battery raw materials can substitute primary materials in the battery production. Appl. Sci. 2022, 12, 4790. [Google Scholar] [CrossRef]

- Abdelbaky, M.; Peeters, J.R.; Dewulf, W. On the influence of second use, future battery technologies, and battery lifetime on the maximum recycled content of future electric vehicle batteries in Europe. Waste Manag. 2021, 125, 1–9. [Google Scholar] [CrossRef] [PubMed]

- Shafique, M.; Rafiq, M.; Azam, A.; Luo, X. Material flow analysis for end-of-life lithium-ion batteries from battery electric vehicles in the USA and China. Resour. Conserv. Recycl. 2022, 178, 106061. [Google Scholar] [CrossRef]

- Richa, K.; Babbitt, C.W.; Gaustad, G.; Wang, X. A future perspective on lithium-ion battery waste flows from electric vehicles. Resour. Conserv. Recycl. 2014, 83, 63–76. [Google Scholar] [CrossRef]

- Dunn, J.; Slattery, M.; Kendall, A.; Ambrose, H.; Shen, S. Circularity of lithium-ion battery materials in electric vehicles. Environ. Sci. Technol. 2021, 55, 5189–5198. [Google Scholar] [CrossRef] [PubMed]

- U.S. Geological Survey. Mineral Commodity Summaries 2023; U.S. Geological Survey: Reston, VA, USA, 2023. [CrossRef]

- Knehr, K.W.; Kubal, J.J.; Nelson, P.A.; Ahmed, S. Battery Performance and Cost Modeling for Electric-Drive Vehicles: A Manual for BatPaC V5.0; ANL/CSE-22/1; Argonne National Laboratory: Lemont, IL, USA, 2022. [Google Scholar] [CrossRef]

- CES Online. Batteries Placed on the Market. Available online: https://www.circularenergystorage-online.com/placed-on-the-market (accessed on 1 October 2022).

- European Parliament; Council of the European Union. Battery Directive 2006: Directive 2006/66/EC of the European Parliament and of the Council of 6 September 2006 on Batteries and Accumulators and Waste Batteries and Accumulators and Repealing Directive 91/157/EEC. 2006. Available online: https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A32006L0066 (accessed on 10 May 2023).

- Kendall, A.; Slattery, M.; Dunn, J. Lithium-ion Car Battery Recycling Advisory Group Final Report; California Environmental Protection Agency: Sacramento, CA, USA, 2022. Available online: https://calepa.ca.gov/wp-content/uploads/sites/6/2022/05/2022_AB-2832_Lithium-Ion-Car-Battery-Recycling-Advisory-Goup-Final-Report.pdf (accessed on 1 June 2023).

- CES Online. Batteries Reaching End of Life. Available online: https://www.circularenergystorage-online.com/end-of-life (accessed on 1 October 2022).

- CES. The Lithium-Ion Battery Life Cycle Report 2021; Circular Energy Storage Research and Consulting: London, UK, 2021; Available online: https://static1.squarespace.com/static/587657ddbe659497fb46664c/t/5fdaa991dc2ddb6396c30fa6/1608165783527/The+lithium-ion+battery+life+cycle+report+sample.pdf (accessed on 10 September 2022).

- Melin, H.E. Update on Used EV Battery Prices–New Indicators, Drivers and Data; Circular Energy Storage Research and Consulting: London, UK, 2022; Available online: https://www.circularenergystorage-online.com/_files/ugd/0cdb21_9e5c976aa70742458f1b2763cefdc351.pdf (accessed on 10 September 2022).

- Gaines, L.; Dai, Q.; Vaughey, J.; Gillard, J. Direct Recycling R&D at the ReCell Center. Recycling 2021, 6, 31. [Google Scholar] [CrossRef]

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature, 2019; 75, 75–86. [Google Scholar] [CrossRef] [Green Version]

- Gaines, L. The future of automotive lithium-ion battery recycling: Charting a sustainable course. Sustain. Mater. Technol. 2014, 1–2, 2–7. [Google Scholar] [CrossRef] [Green Version]

- Argonne National Laboratory. GREET® Model: The Greenhouse Gases, Regulated Emissions, and Energy Use in Transportation Model. Available online: https://greet.es.anl.gov/ (accessed on 12 June 2023).

- Argonne National Laboratory. EverBatt. Available online: https://www.anl.gov/amd/everbatt (accessed on 22 October 2022).

- Sphera. Search Life Cycle Assessment Datasets (fka GaBi). Available online: https://sphera.com/product-sustainability-gabi-data-search/ (accessed on 3 June 2023).

- SimaPro. LCA Software for Informed Change-Makers. Available online: https://simapro.com/ (accessed on 3 June 2023).

- U.S. Environmental Protection Agency. ReCiPe2016v1.1 for FEDEFLv1. Available online: https://edg.epa.gov/metadata/catalog/search/resource/details.page?uuid=%7B2EB191F8-43DB-4CF1-8DFD-E4F1652133AC%7D (accessed on 3 June 2023).

- Ellen Macarthur Foundation. The Butterfly Diagram: Visualizing the Circular Economy. Available online: https://ellenmacarthurfoundation.org/circular-economy-diagram (accessed on 3 June 2023).

- Bai, Y.; Hawley, W.B.; Jafta, C.J.; Muralidharan, N.; Polzin, P.J.; Belharouak, I. Sustainable recycling of cathode scraps via Cyrene-based separation. Sustain. Mater. Technol. 2020, 25, e00202. [Google Scholar] [CrossRef]

- European Parliament. Batteries: Deal on New EU Rules for Design, Production and Waste Treatment. Available online: https://www.europarl.europa.eu/news/en/press-room/20221205IPR60614/batteries-deal-on-new-eu-rules-for-design-production-and-waste-treatment (accessed on 26 May 2023).

- Czarnota, M.; Recharge Recycling LLC, Flint, MI, USA; Gaines, L.; Argonne National Laboratory, Lemont, IL, USA. Personal communication. 2023. [Google Scholar]

- Randall, T. A Tesla Co-Founder Aims to Build an Entire US Battery Industry. Available online: https://www.bloomberg.com/news/articles/2021-09-14/a-tesla-co-founder-aims-to-build-an-entire-u-s-battery-industry?srnd=hyperdrive&leadSource=uverify%20wall (accessed on 1 June 2023).

- Ascend Elements. Ascend Elements Begins Construction of Apex 1 in Southwestern Kentucky. Available online: https://ascendelements.com/ascend-elements-begins-construction-of-apex-1-in-southwestern-kentucky/ (accessed on 1 March 2022).

- Spiers, D. Roundtable: Who Will the Winners and Losers in the Battery Business Be Five Years From Now? In Proceedings of the 14th Annual NAATBaat Annual Meeting, Litchfield Park, AZ, USA, 20–23 February 2023. [Google Scholar]

- CRS. Infrastructure Investment and Jobs Act. In Proceedings of the 117th U.S. Congress, Washington, DC, USA, 3 January 2021; Available online: https://www.congress.gov/117/bills/hr3684/BILLS-117hr3684enr.pdf (accessed on 1 June 2023).

- CRS. Inflation Reduction Act of 2022. In Proceedings of the 117th U.S. Congress, Washington, DC, USA, 3 January 2021; Available online: https://www.congress.gov/bill/117th-congress/house-bill/5376/text (accessed on 1 June 2023).

- Circular Energy Storage Online. n.d. Available online: https://www.circularenergystorage-online.com/ (accessed on 1 March 2023).

- Benchmark Mineral Intelligence. Price Reporting Agency & Market Intelligence for Lithium Ion Battery, Electric Vehicle & Energy Storage Supply Chains. 2022. Available online: https://www.benchmarkminerals.com (accessed on 1 March 2023).

- dataweb.usitc.gov (USITC). 2023. Available online: https://dataweb.usitc.gov/ (accessed on 1 March 2023).

- Experian. Auto Registration Database. 2023. Available online: https://www.experian.com/automotive/auto-vehicle-data (accessed on 1 March 2023).

- Proceedings of the 14th Annual NAATBatt Meeting, Litchfield Park, AZ, USA, 20–23 February 2023.

- Melin, H.E. State-of-the-Art in Reuse and Recycling of Lithium-Ion Batteries–A Research Review. 2019. Available online: https://www.energimyndigheten.se/globalassets/forskning--innovation/overgripande/state-of-the-art-in-reuse-and-recycling-of-lithium-ion-batteries-2019.pdf (accessed on 1 March 2023).

- Zlatev, D. Tesla Battery Factory Took Panasonic 6 Years to Master since US Workers Lost Their Manufacturing Skills. Notebookcheck, 27 February 2023. Available online: https://www.notebookcheck.net/Tesla-battery-factory-took-Panasonic-6-years-to-master-since-US-workers-lost-their-manufacturing-skills.697571.0.html (accessed on 1 March 2023).

- Green Giant; Ace Green Team Up for Texas Recycling Plant. Energy Storage Journal (ESJ). 2003. Available online: https://www.energystoragejournal.com/green-giant-ace-green-team-up-for-texas-recycling-plant/?utm_campaign=BESB+No.+178%3A+EU+risks+%27losing+all%27+in+gigafactory+stakes%2C+says+new+study&utm_content=batteriesinternational-magazine.com&utm_medium=email&utm_source=Batteries+International&wp-linkindex=16 (accessed on 1 March 2023).

- Nickle; Doug; (American Battery Technology, Reno, NV, USA). Personal Communication to Linda Gaines. 13 March 2023. [Google Scholar]

- Ascend Elements. “Ascend Elements to Recycle Lithium-ion Battery Manufacturing Scrap for SK Battery America.” News release, 9 March 2022. Available online: https://ascendelements.com/sk-battery-america/ (accessed on 1 March 2023).

- Cirba Solutions. “World-Class EV Battery Materials Facility in South Carolina.” News Release, 22 March 2023. Available online: https://www.cirbasolutions.com/world-class-ev-battery-materials-facility-in-south-carolina/ (accessed on 1 March 2023).

- Electra. “Electra Achieves first Plant-Scale Recycling of Black mass In NORTH America.” News release, 14 February 2023. Available online: https://electrabmc.com/electra-achieves-first-plant-scale-recycling-of-black-mass-in-north-america-marks-important-milestone-for-north-americas-ev-battery-supply-chain/ (accessed on 1 March 2023).

- Kochar; Ajay; (Li-Cycle, Mississauga, ON, Canada). Personal Communication to Linda Gaines. 12 March 2023. [Google Scholar]

- Sloop; Steve. Personal Communication to Linda Gaines, 12 March 2023.

- NAATBatt Recap. 2023. Available online: https://nac.naatbatt.org/naatbatt-annual-conference-2023/presentations/ (accessed on 1 March 2023).

- Benchmark Mineral Intelligence. Battery Recyclers Database Q4-2022. 2022. Available online: https://www.benchmarkminerals.com/forecasts/#battery-database (accessed on 1 March 2023).

- Turner; Shawn. Personal Communication to Linda Gaines. 14 March 2023. [Google Scholar]

- Recycling Product News Staff. “Redwood Materials Makes Policy Suggestions for EV Battery Recycling following Successful Recycling Program.” Recycling Product News, 7 March 2023. Available online: https://www.recyclingproductnews.com/article/39953/redwood-materials-makes-policy-suggestions-for-ev-battery-recycling-following-successful-recycling-program (accessed on 1 March 2023).

- ReElement Technologies LLC. “ReElement Technologies Takes Possession of Initial Battery Element Purification Equipment.” News Release, 6 October 2022. Available online: https://www.einpresswire.com/article/594572674/reelement-technologies-takes-possession-of-initial-battery-element-purification-equipment (accessed on 1 March 2023).

- ReCell Advanced Battery Recycling. Lithium-ion Battery and Recycling Terminology. Available online: https://recellcenter.org/lithium-ion-battery-and-recycling-terminology/ (accessed on 1 March 2023).

| Process | Cathode | Li | Co, Ni, Mn | CU | Al | Anode | Electrolyte | Separator |

|---|---|---|---|---|---|---|---|---|

| Pyro | ||||||||

| Hydro | ||||||||

| Direct | N/A |

| Material | Default | Mixing | Coating | Electrode Slitting | Cell Stacking | Electrolyte Filling |

|---|---|---|---|---|---|---|

| Active cathode material | 92.2% | 99% | 95% | 99% | 99% | |

| Active anode material | 92.2% | 99% | 95% | 99% | 99% | |

| Aluminum foil | 90.2% | 99% | 92% | 99% | ||

| Copper foil | 90.2% | 99% | 92% | 99% | ||

| Separator | 98.0% | 98% | ||||

| Electrolyte | 99.0% | 99% |

| Portable Devices | LEVs | HDEVs | |

|---|---|---|---|

| Stored % | 5% | -- | -- |

| Lost % | 0% for first 2 years and 1–10% from year 3 to year 10 | -- | -- |

| Export % | 45% (2000–2019); 20% (2020–2024); 10% (2025–2030) | 5% | 5% |

| Reuse % | 20% | LFP (2000–2019): 85%; LFP (2019–): 90%; Other chemistries (2000–2019): 60%; Other chemistries (2019–): 70% | LFP (2000–2019): 70%; (2019–): 75%; Other chemistries: 80% |

| Reuse time (years) | 2 | 6 | 6 |

| Scrap % | Decreases from 30% to 5% in 4 years | ||

| Production maturity time (years) | 4 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gaines, L.; Zhang, J.; He, X.; Bouchard, J.; Melin, H.E. Tracking Flows of End-of-Life Battery Materials and Manufacturing Scrap. Batteries 2023, 9, 360. https://doi.org/10.3390/batteries9070360

Gaines L, Zhang J, He X, Bouchard J, Melin HE. Tracking Flows of End-of-Life Battery Materials and Manufacturing Scrap. Batteries. 2023; 9(7):360. https://doi.org/10.3390/batteries9070360

Chicago/Turabian StyleGaines, Linda, Jingyi Zhang, Xin He, Jessey Bouchard, and Hans Eric Melin. 2023. "Tracking Flows of End-of-Life Battery Materials and Manufacturing Scrap" Batteries 9, no. 7: 360. https://doi.org/10.3390/batteries9070360

APA StyleGaines, L., Zhang, J., He, X., Bouchard, J., & Melin, H. E. (2023). Tracking Flows of End-of-Life Battery Materials and Manufacturing Scrap. Batteries, 9(7), 360. https://doi.org/10.3390/batteries9070360