Abstract

This work analyzes the electric vehicle (EV) sales trends of plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs) and trends in the growth of Alternating Current (AC) and Direct Current (DC) charging infrastructure station scenarios in Europe and Italy. It offers a comprehensive view of market trends, technical developments, infrastructure development, and worldwide standardization initiatives for policymakers, researchers, and industry. A detailed classification of the charging technologies of EVs, i.e., conductive, wireless power transfer (WPT), battery swapping (BS), and different EV types, is presented. Finally, this work provides a comparative overview of charging standards and protocols, including the ones established by the Society of Automotive Engineers (SAE), International Electrotechnical Commission (IEC), and Standardization Administration of China (SAC), emphasizing interoperability and cross-border integration to accelerate the transition to clean transportation.

1. Introduction

According to new reviews and investigations, internal combustion engine (ICE)-based transportation continues to overwhelm the global vehicle industry [1,2]. Fueled by population and economic expansion, this dominance strongly contributes to energy consumption growth. This industry discharges many greenhouse gases (GHGs) because it relies on fossil fuels, particularly carbon dioxide (CO2), as they play a significant role in driving global warming and influencing climate patterns [3,4,5]. Moreover, this dependence raises substantial issues, such as severe climate contamination, energy deficiencies, and a rapid decrease in global oil supplies [6].

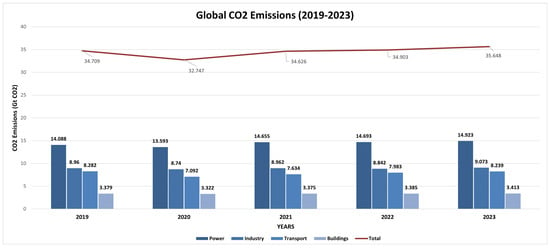

Figure 1 shows the CO2 spread from different areas (2019–2023) [7], characterized by the International Energy Agency (IEA) and the Emissions Database for Global Atmospheric Research (EDGAR) [8]. The areas covered include power, transport, industrial, and residential. Based on data, the power production sector was the most significant contributor, emitting 14.9 billion metric tons of CO2 (Gt), accounting for 41.9% of total emissions. In 2023, the transportation sector was the second largest contributor, accounting for 8.44 Gt (23.7%) of total CO2 emissions.

Figure 1.

Global CO2 emissions (2019–2023).

The most crucial move to reduce CO2 emissions from the transportation industry is the switch to EVs from ICE vehicles [9]. EVs may operate with almost zero CO2 emissions when recharged using renewable or low-carbon energy, which makes them great for reducing emissions associated with mobility [10]. According to the European Environment Agency (EEA), EVs can reduce 50–60% CO2 emissions throughout their lifetime when implemented in combination with the typical European power system mix. Similarly, the U.S. Environmental Protection Agency (EPA) emphasizes that EVs do not emit tailpipe emissions and decrease the adverse environmental impact when renewable energy is recharged on the grid [11]. Under similar circumstances, according to the International Council on Clean Transportation (ICCT) future EVs can release 50 to 70% less CO2 than ICE vehicles over their lifetime. This reduction assumes the continued decarbonization of the electricity grid, with increasing shares of renewable energy that minimize fossil fuel use for power generation [12]. Achieving these reductions is necessary to meet global climate targets, such as the European Green Deal target of net zero emissions by 2050 [13,14].

Creating an extensive charging infrastructure, advances in battery technology for greater endurance and range, and reasonably priced vehicles are necessary to effectively adopt EV transportation [15,16]. It requires robust government support through policies, subsidies, incentives, and public awareness to address misconceptions and encourage adoption [17]. Integrating renewable energy with smart grids ensures sustainability, while collaboration among automakers, tech companies, governments, and communities drives innovation and infrastructure development [18,19]. Holistically addressing these key factors will accelerate the transition to electric vehicles and ensure economic and environmental sustainability [20].

Developing a charging infrastructure is crucial to advancing EVs, particularly in countries with well-established land and marine transportation systems [21,22,23]. However, battery technology, battery thermal stability, and, most importantly, the lack of an available charging infrastructure are significant obstacles to the widespread adoption of EVs. The growing demand for EV charging cannot be met by the current number of charging outlets and high-speed charging stations [24,25]. Due to the scarcity of charging stations, prospective EV users are deterred, which impedes the growth and uptake of EVs.

To encourage the broad adoption of EVs, national development plans must include an expanded infrastructure network for charging. The move from conventional ICE Vehicles to EVs is prompted by several reasons, including the depletion of fossil fuels, the lack of CO2 emissions, and advancements in auxiliary technologies. In addition, infrastructure advances such as Vehicle-to-Grid (V2G) and Grid-to-Vehicle (G2V) technologies enhance the system’s stability and allow for more intelligent energy management. In addition, a sustainable method of recharging EVs is made possible by the increasing usage of renewable energy sources [26]. The popularity of EVs can also be attributed to the rapid development of electronic control systems and EV charging technologies, which have made the procedure more practical and efficient.

This paper contributes to the review of electric vehicles, including market sales, charging infrastructure, standards, and technologies.

The main objectives of this paper are as follows:

- (1)

- Analyzing the EV market, such as sales performance and charging infrastructure, in major European countries, and focusing mainly on Italy.

- (2)

- Overview of international and European EV charging standards and charging levels.

- (3)

- Brief discussion of the novel technology of EV charging and its implications for future mobility.

2. Research Methodology

The research methodology employed in this work follows a structured and systematic approach to reviewing the existing literature, analyzing data, and synthesizing key insights into EV technology, charging standards, and market trends. This study is conducted through a comprehensive literature review utilizing qualitative and quantitative data sources.

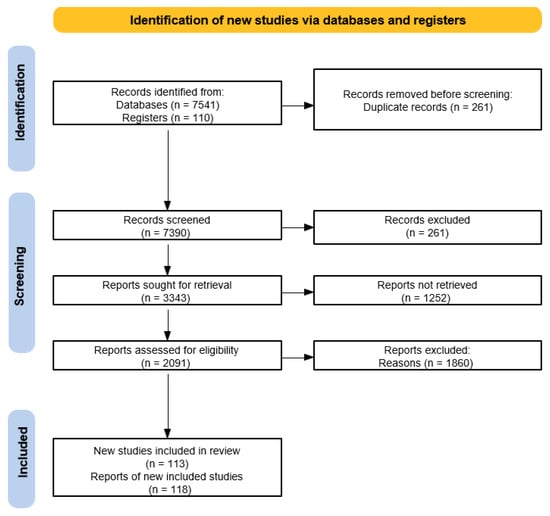

This study follows the PRISMA methodology [27]. Initially, a selection of research papers was compiled from Scopus, Web of Science, and Google Scholar. The search query included keywords such as EV Charging Standards, EV Charging Systems, EV Charging techniques, and European EV Sales. The search was limited to publications from 2018 to 2025 to ensure relevance to the latest advances. After multiple screening stages, 113 research papers and 100 reports were included in this review, ensuring comprehensive and diverse subject matter coverage. The PRISMA diagram for the systematic literature review is shown in Figure 2.

Figure 2.

PRISMA diagram of systematic literature review.

Organization of the Paper

The manuscript is structured as follows:

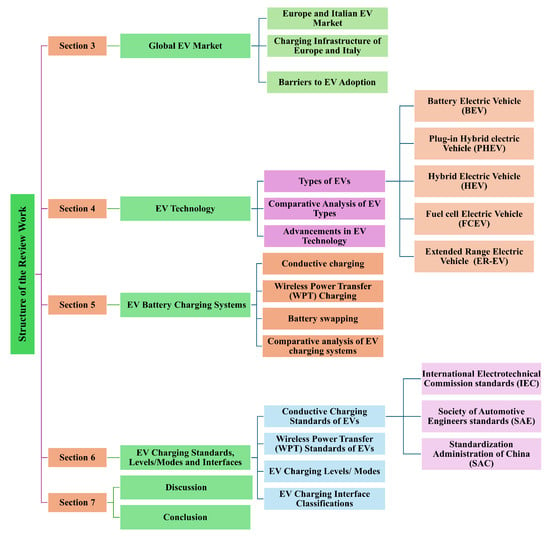

Section 3 analyzes the global and regional EV market, covering adoption trends, market growth in Europe and Italy, sales comparisons of BEVs and PHEVs, and charging infrastructure distribution. Section 4 classifies the EV types (BEV, PHEV, HEV, FCEV, and REX EV) and compares them based on efficiency, range, cost, and technology. Section 5 examines EV charging systems, including a comparison of conductive, WPT, and BS charging systems. Section 6 reviews global EV charging standards (IEC, SAE, and GB/T), charging levels, interface types, and interoperability challenges. Section 7 presents the Discussion and Section 8 presents the conclusion. Figure 3 shows the structure of the review work.

Figure 3.

Schematic diagram of the electric vehicle.

3. Global EV Market

The global EV market has experienced unprecedented growth in recent years, driven by technological advances, consumer interest, and supportive government policies [28]. China, Europe, and the United States (USA) are the three areas that dominate the global EV market. With more than half of all EVs sold annually, China is the largest EV market and has continuously dominated worldwide sales. Currently, it leads the market, accounting for nearly 45% of global EV sales in 2024, supported by robust domestic manufacturing, extensive government support, and a vast consumer base [29]. PHEVs are more prevalent in regions like the UK, the Netherlands, and Sweden, and BEVs are favored in markets such as France and China, with Norway and Japan maintaining a balanced mix [30].

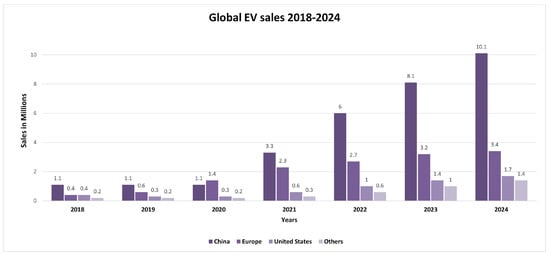

In 2020, 3 million EVs were sold worldwide and this figure increased to more than 10 million by 2022. According to the IEA Global EV Outlook 2024, new electric car registrations in Europe reached nearly 3.2 million in 2023, marking a 20% increase from 2022. Of these, around 1.1 million were PHEVs, and 2.2 million were BEVs [15]. Countries such as Norway, Sweden, and Germany dominate Europe due to strong incentives, tax benefits, and a well-developed charging infrastructure. Norway is currently leading in Europe in the adoption of EVs, with a market share of 95.8% (8954 out of 9343 fully EVs in January 2025, up from 29% in 2016, 74.7% in 2020, and 89.3% in 2024. In 2020, it became the first country where the sales of electric cars surpassed those of ICE vehicles. It got closer to its goal of EV-only sales by the end of the year [31,32,33,34].

In 2024, worldwide sales of electric vehicles (EVs) totaled around 17.1 million units, representing a 25% rise compared to the previous year. This surge was largely fueled by substantial market growth in China, Europe, and North America. Looking ahead, forecasts suggest that annual sales of EVs could exceed 50 million units by 2030, underscoring the rapid global transition to sustainable transportation [35,36]. Technological innovations such as improved battery efficiency, faster charging, V2G integration, autonomous driving capabilities, and stricter emission regulations are expected to sustain this momentum. With Europe expected to hold a 25% market share and the US over 11% by 2024, the EV market is poised for transformative growth in the coming decade [15]. Although it has a smaller market share than China and Europe, the United States is gradually expanding due to more expenditures on infrastructure and the production of EVs. Although they make up a small portion of worldwide sales, other regions, such as South Korea and Japan, are essential to advancing EV technology. Figure 4 shows how EV sales increased significantly worldwide between 2018 and 2024.

Figure 4.

Global electric vehicles (EVs) sales (2018–2024).

3.1. Europe and Italian EV Market

3.1.1. EV Market of Europe

With notable increases in BEV and PHEV sales between 2020 and 2024, the European EV industry has emerged as a major global player in the shift to sustainable transportation. As seen in Figure 4, Europe is growing rapidly and closing the gap with China in terms of EV market volume, despite the disruptions caused by the COVID-19 pandemic [30]. This growth reflects the success of Europe’s strong regulations promoting low-emission vehicles and indicates a broader societal shift toward greener modes of transportation.

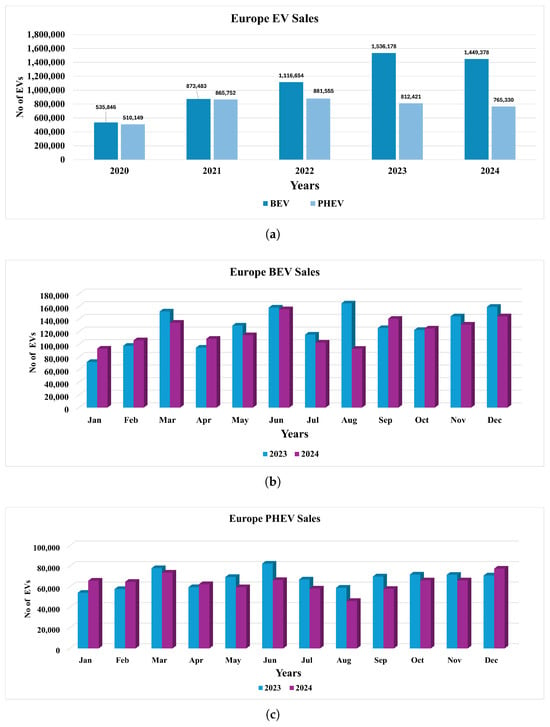

Figure 5a shows that the number of EVs sold has increased dramatically from about 1 million in 2020 to 2.5 million in 2024. In particular, as customers choose completely electric solutions over transitional technologies, BEVs have seen a faster growth trajectory, surpassing PHEVs. This pattern shows that consumers are becoming more confident in EV technology due to improved driving ranges, declining battery prices, and the growth of fast charging networks. Despite growing more slowly than BEVs, PHEVs remain popular among drivers who want familiarity and flexibility as they move away from ICE vehicles. When taken as a whole, these patterns demonstrate how Europe is setting the stage for a future with decarbonized transportation [37].

Figure 5.

Europe EV market: (a) Total EV sales (2020–2024). (b) Monthly BEV sales (2023–2024). (c) Monthly PHEV sales (2023–2024).

When closely examining annual sales, the decline from 2023 to 2024 in Europe is primarily due to changes in incentives and policies in several major countries, which significantly impacted overall EV sales. This decline is explained in more detail in Section 3.1.2.

In addition to demonstrating the growing popularity of electric cars, Figure 5b, the monthly breakdown of BEV sales in Europe for 2023 and 2024 also identifies the dynamic variables influencing these trends. Sales peaks in March, June, and December most likely coincide with automotive production cycles, government budgetary deadlines for incentives, or the arrival of new models, demonstrating how outside factors influence customer behavior. Compared to 2023, BEV sales in Europe decreased in several months of 2024, mainly due to reduced government incentives, economic challenges, and increased competition from hybrid vehicles [38]. This slowdown indicates that while EVs remain a crucial part of the transition to sustainable mobility, market dynamics, and policy changes have impacted their growth [39]. The graph reflects these changes, showing that external factors have influenced consumer purchasing decisions despite continued interest in BEVs.

As seen in the monthly sales statistics for PHEVs for 2023 and 2024 in Figure 5c, PHEVs continue to play a significant role in the electrification journey of Europe, even as BEVs are at the forefront. The constant demand for PHEVs highlights their function as a bridge technology, attracting those who embrace electric mobility while desiring the security of hybrid systems. According to statistics, PHEV sales have steadily increased over time, reaching their peak in the same months as BEV sales. This concurrent expansion shows a common effect of governmental policies and promotional incentives. However, data suggest that the industry may gradually shift to electric alternatives if BEV sales increase faster. The development of the PHEV industry is consistent with the bigger picture of electrification: as the infrastructure expands, more people choose EVs, and customers become more used to electric powertrains. However, the continued interest in PHEVs underlines their importance in particular areas where the development of the charging infrastructure is still lagging behind [37].

The European Green Deal, which is attempting to achieve carbon neutrality by 2050, is also responsible for developing the European EV industry. Automakers have been encouraged to accelerate their EV offers and switch to sustainable automobile manufacturing due to this campaign [13,14]. However, this remains a highly delicate subject under intense discussion within the European Commission as policymakers debate the balance between ambitious environmental goals and economic feasibility. Key concerns include the affordability of EVs, the pace of expansion of the charging infrastructure, and the competitiveness of the European automotive industry in a rapidly evolving global market [40].

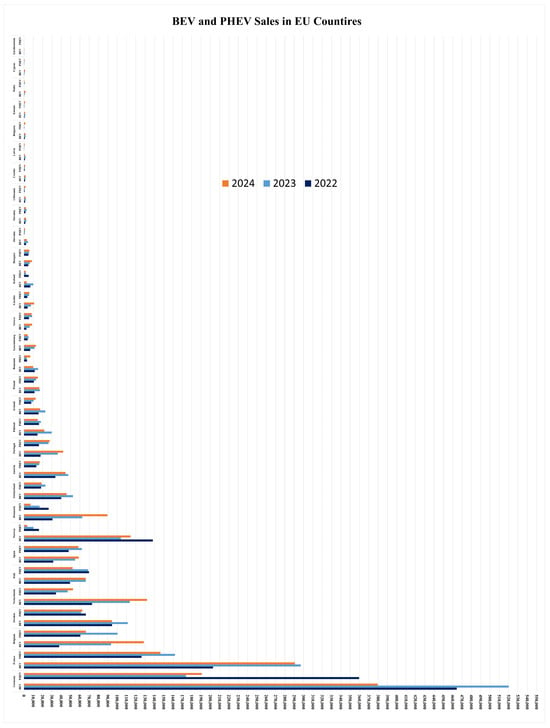

3.1.2. Ev Sales Decline in Europe (2023–2024): A Policy-Driven Trend

Between 2023 and 2024, Europe witnessed a notable decline in EV sales, specifically in BEVs and PHEVs. The combined sales dropped from 2,348,599 units in 2023 to 2,214,708 units in 2024, marking a 5.7% decrease. This trend is significant, given that EV adoption has shown consistent growth in previous years. As illustrated in Figure 6, which displays the total sales (BEV + PHEV) per country (2022–2024) data, this decline in 2024 sales is not uniform across all European markets. Instead, it is primarily driven by sharp sales contractions in a few key countries: Germany, France, Italy, Sweden, Finland, and Switzerland. These countries, traditionally among the top contributors to the European EV market, collectively account for the bulk of the decrease. The policies and incentives of the major countries that influenced 2024 EV sales in Europe are listed in Table A1.

Figure 6.

Total (BEV + PHEV) sales of European countries 2022–2024.

Germany had the highest number of EV sales in 2022, then dropped in 2023 and 2024; see Figure 6a. This decline followed the gradual removal of government support, especially EV purchase incentives for private buyers at the end of 2023 Table A1. Until then, subsidies had significantly boosted consumer interest in EVs. Once removed, it sharply reduced affordability and consumer interest. Market uncertainty and concerns about energy costs compounded the effect [41].

France has been a leader in the adoption of EVs, with sales growing by 40% from 2022 to 2023, then dropping slightly in 2024, due to tighter rules and changes in who qualifies for support. Although incentives remained in place, they were tightened to exclude higher income earners and more expensive vehicle models Table A1. Furthermore, administrative hurdles and delays in EV bonus payouts discouraged buyers [42].

Between 2020 and 2025, Italy introduced some of the most generous incentives in Europe for EVs, offering purchase bonuses, 5-year tax exemptions, and 80% subsidies for charging infrastructure, but EV sales showed little progress, increasing slightly from 119,213 in 2022 to 135,108 in 2023 before falling to 118,486 in 2024, This slowdown occurred despite public awareness of EVs, and sales slowed due to the very short period availability of purchase incentives in 2024 and underwhelming incentive programs. The policy supports lagged demand Table A1 [43].

Sweden experiences a small increase in sales from 2022 to 2023, but sales decreased in 2024 Figure 6. This drop followed the end of key purchase incentives, such as the climate bonus, which had offered up to SEK 70,000 for BEVs Table A1, and its full impact was felt in 2023–2024 as buyer interest decreased. Although lower road taxes and company car tax breaks are still in place, the loss of upfront support has probably made EVs less attractive to buyers. Meanwhile, the charging infrastructure grew rapidly. The government also continued to support home charger installations through tax deductions and the “Ladda Bilen” grant [44].

Finland’s EV market also showed strong growth between 2022 and 2023, supported by strong purchase incentives and tax benefits. However, in 2024, sales dropped despite the continued expansion of the infrastructure Figure 6. This drop reflects the end of direct purchase incentives, showing that, while tax benefits and infrastructure are essential, upfront subsidies are often a decisive factor for private buyers. The case of Finland highlights the need to maintain a balance between long-term fiscal policies and short-term consumer incentives to maintain the momentum of the EV market Table A1 [45].

The 2023–2024 decline in EV sales reveals the market’s high sensitivity to policy changes. A stable and predictable policy framework is crucial to maintaining consumer trust and industry growth. Instead of abrupt incentive cuts, governments should pursue gradual phase-outs based on clear milestones such as EV cost parity or infrastructure readiness. Although targeting low-income groups ensures equity, broad middle-class participation is vital for scaling adoption and meeting climate goals. Looking ahead, a coordinated pan-European EV strategy is needed to reduce policy fragmentation. Long-term success depends on aligning incentives with parallel investment in charging networks, battery production, and supply chains. Without such an approach, the EV market may face repeated cycles of instability, slowing Europe’s transition to clean mobility.

3.1.3. Analysis of Europe EV Models

Based on the EV database [46], more than 400 EV models are available on the European market. These models represent various vehicle types, manufacturers, and technological advances. There are two critical performance aspects of these EV models to analyze: (1) Energy consumption watt-hour/kilometers (Wh/km) is a metric that provides a measure of the energy efficiency of EVs, which is essential to evaluate their operational costs, environmental impact, and alignment with sustainability goals. (2) On-board charger (OBC) power ratings play a crucial role in determining the charging speed and convenience of an EV, directly impacting user satisfaction and overall adoption rates. One of the primary advantages of an OBC is its ability to recharge EVs using Alternating Current (AC) charging stations, which are the most widely available and cost-effective charging solution. EV drivers commonly adopt AC charging due to its affordability and accessibility, making it a preferred method to charge at night and at home. By supporting efficient AC charging, OBCs contribute significantly to the convenience and feasibility of EV ownership.

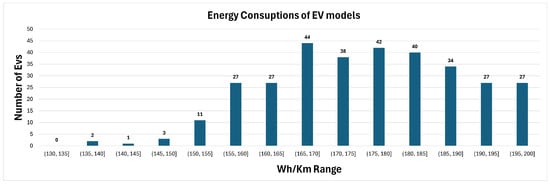

The analysis of 435 EV models in Europe highlights trends in energy consumption measured in Wh/km as shown in Figure 7. Most models cluster between the 155 and 185 range, with the 165–170 range being the most common in 44 models, followed by the 175–180 range in 42 models and the 180–185 range in almost 40 models. Lower consumption ranges of 130–150 are rare, while higher ranges of 185–200 gradually decline in prevalence [46]. These patterns reflect the manufacturers’ focus on balancing efficiency and performance to meet consumer demands and regulatory standards. The European EV market is a global benchmark for achieving optimal energy efficiency in advanced EV technology.

Figure 7.

Energy consumption (Wh/km) of European EV models.

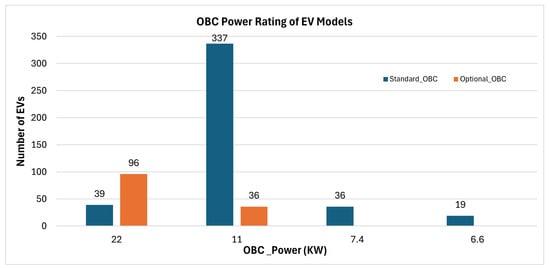

Figure 8 shows the OBC power ratings. Among the four primary OBC power levels, the 11 kW standard power is the most popular, adopted by almost 337 models in Europe, and 22 kW, 7.4 kW, and 6.6 kW are used in 39, 36, and 19 models, respectively. For optional powers, higher power ratings dominate; the 22 kW power appears in 96 models, while the 11 kW power is in 32 models. The OBC power rating determines the charging speed and efficiency of an EV, influencing affordability and convenience. Lower-power OBCs (6.6 kW, 7.4 kW) are cost-effective solutions for small EVs, suitable for home and public AC charging. Midrange OBCs (11 kW) balance speed and affordability, ideal for midsize EVs with three-phase charging access. High-power OBCs (22 kW) are found in premium EVs, enabling faster AC charging, but require specialized infrastructure [40].

Figure 8.

On-board charger (OBC) power ratings of European EV models.

3.1.4. EV Market of Italy

Between 2020 and 2024, Italy’s EV industry grew steadily, mainly due to government subsidies, increased consumer awareness, and the development of charging stations. However, compared to other key European markets, Italy has faced particular obstacles, such as delayed charging station installations and different regional acceptance rates [43].

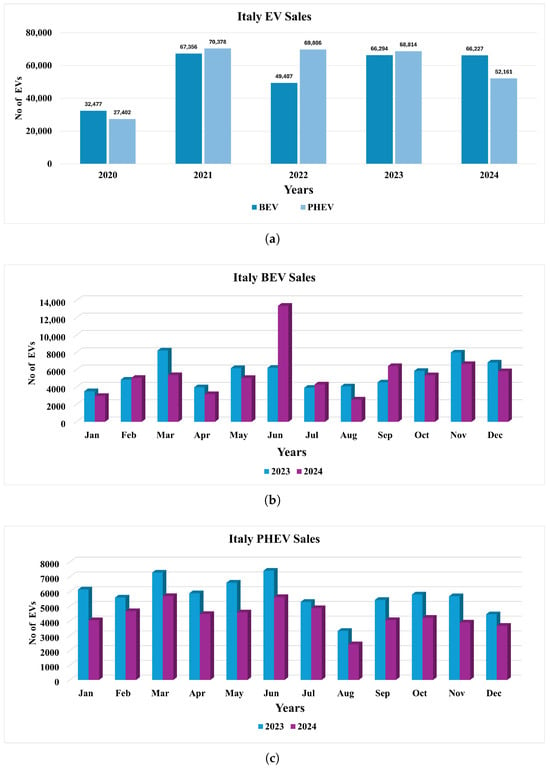

As shown in Figure 9a, EV sales in Italy jumped from around 60,000 units in 2020 to more than 140,000 units in 2024. PHEVs and BEVs have contributed to this. Between 2020 and 2024, BEV sales in Italy tripled due to rising consumer confidence in fully EVs. This rise was made possible by government initiatives such as the Eco-bonus program, which offered financial assistance to purchase EVs and an exemption from vehicle registration payments. Given their sizable market share, PHEVs can be a transition option for customers who are not yet ready to switch to BEVs. This is particularly true in places with inadequate charging infrastructure, where dual flexibility is still favored. The rise in EV sales demonstrates Italy’s determination to reach the broader European decarbonization goals, although at a slower pace due to regional obstacles.

Figure 9.

Italy EV market: (a) Total EV sales (2020–2024). (b) Monthly BEV sales (2023–2024). (c) Monthly PHEV sales (2023–2024).

Figure 9b shows that the monthly breakdown of BEV sales for 2023 and 2024 exhibits notable fluctuations, and several months in 2024 recorded lower sales compared to 2023. In particular, March to August 2024 experienced significant declines, possibly due to reduced government incentives, economic uncertainties, and slower infrastructure development Table A1. However, June 2024 showed a high increase, suggesting a potential recovery or a seasonal demand shift. This pattern reflects a complex interaction of policy changes, consumer preferences, and market conditions, underscoring the need for sustained support and investment in the Italian EV sector to ensure long-term growth [47,48].

Figure 9c shows that, like BEVs, PHEV sales in Italy follow a seasonal trend, peaking in March, June, and December. PHEV sales are still smaller than those of BEVs despite this, suggesting that consumer preferences have changed. Consumers who value hybrid technology’s adaptability keep gravitating to PHEVs, particularly in suburban or rural areas with few charging outlets. As customers adjust to better infrastructure and less range anxiety, the slower increase in PHEVs in 2024 compared to BEVs points to a gradual shift toward complete EVs. Although PHEVs are still a crucial first step in the Italian EV industry, their importance is expected to decline as BEVs become more widely available and helpful.

3.2. Charging Infrastructure of Europe and Italy

3.2.1. Charging Infrastructure of Europe

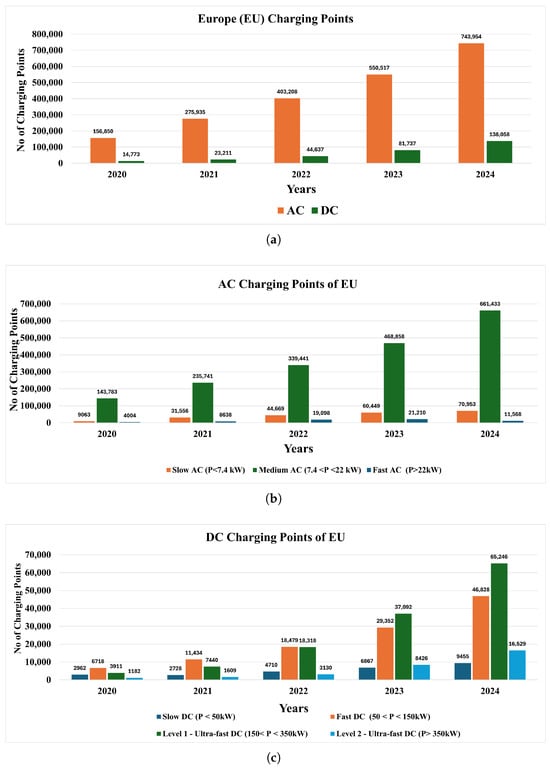

The development of charging infrastructure has primarily facilitated the rapid increase in the adoption of EVs in Europe. Thanks to the concerted efforts of governments, automakers, and private firms, the area saw significant advances in AC and DC charging networks between 2020 and 2024 [49].

Between 2020 and 2024, Europe’s total number of charging stations increased dramatically as seen in Figure 10a. The extensive use of slower charging options for home and office environments was reflected in the deployment of AC charging stations, which outnumbered DC charging stations. However, the consistent expansion of DC charging stations emphasizes the growing need for quicker recharging options in cities and on the highways. Most of the installed charging stations were AC chargers, satisfying the demand of regular EV users to charge at home and at work. To fulfill the need for high-speed charging options for long-distance trips and business EV fleets, the number of DC charging stations increased gradually, although more slowly.

Figure 10.

Charging infrastructure of Europe (2020–2024): (a) Total AC and DC charging points, (b) AC charging points, (c) DC charging points.

Figure 10b, which divides AC chargers into three categories, provides more information about the expansion of AC charging stations in Europe. Slow AC: single-phase (<7.4 kW). Due to consumers’ growing preference for fast charging options, the percentage of sluggish AC chargers stayed constant but was still relatively low. Medium-speed and fast-speed AC chargers, which accounted for a large amount of the expansion at this time, dominated the market (7.4–22 kW) and (>22 kW), respectively. These chargers are frequently seen in public areas, including parking lots, malls, and offices. The market’s desire for mid-range charging speeds that balance installation costs and charge efficiency is demonstrated by this classification.

Although they comprise a minor part of the overall infrastructure, DC charges are essential to reduce range anxiety and facilitate long-distance travel Figure 10c. There are four types of DC chargers: slow DC (<50 kW), fast DC (between 50 and 150 kW), Level 1 ultrafast DC (150–350 kW), and Level 2 Ultra-fast DC (>350 kW). Ultra-fast DC chargers have been given priority in Europe, especially for busy metropolitan areas and highway corridors. Despite the general increase, many countries have different DC charging point distribution strategies, with Germany, the Netherlands, and Norway setting the standard.

3.2.2. Charging Infrastructure of Italy

Despite regional variations in the rate of development, Italy has made notable progress in developing its EV charging infrastructure between 2020 and 2024. Private-sector investments, government-led programs, and EU-wide decarbonization objectives have primarily fueled the expansion. However, issues continue to exist, including unequal regional distribution, a lack of ultra-fast charging networks, and a slower adoption rate than nations in northern Europe. Despite these obstacles, Italy’s infrastructure for charging EVs is improving, meeting the country’s increasing demand [50].

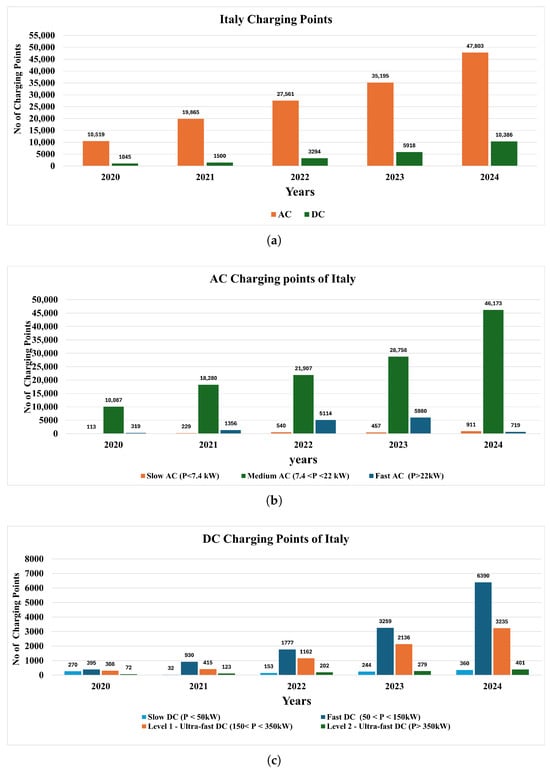

Figure 11a illustrates how the number of charging stations in Italy gradually increased from around 20,000 in 2020 to more than 60,000 in 2024. The growth shows the nation’s commitment to creating an efficient system that can handle the growing EVs on the road. However, there is still a noticeable disparity between AC and DC chargers, and most installations are AC chargers. Due to their lower installation costs and versatility for home and office use, AC chargers are the most common in the Italian charging network. These chargers meet the demands of light car users and regular commuters who can handle extended charging durations. During this time, the number of DC chargers has increased consistently, although it makes up a lower percentage of the entire network. Long-distance travel is made possible by DC charges, which are essential to reduce range anxiety, particularly on highways and in crowded metropolitan areas. The difference between AC and DC chargers emphasizes how crucial it is to invest in high-speed charging options to satisfy the demands of business and long-distance EV customers [50].

Figure 11.

Charging infrastructure of Italy (2020–2024): (a) Total AC and DC charging points, (b) AC charging points, (c) DC charging points.

AC charging stations are broken down by type in Figure 11b: slow AC charging points (up to 7.4 kW), medium AC charging points (7.4 –22 kW), and fast AC (P > 22 kW). This segmentation reveals interesting patterns in the development of AC infrastructure in Italy. Most of the expansion in AC infrastructure was driven by medium-speed AC chargers, which increased from 10,000 in 2020 to more than 40,000 in 2024. These chargers are perfect for installation in public areas like shopping malls, office buildings, and parking lots since they compromise price and charging speed. Slow AC chargers are helpful for home charging, where customers can leave their cars plugged in overnight, even if they constitute a smaller percentage of the overall AC infrastructure. Due to their versatility and cost, AC chargers are becoming increasingly popular for residential and business applications. As EV usage increases, medium-speed chargers are expected to continue to serve as the foundation of Italy’s charging infrastructure, facilitating a steady shift to faster charging options [50].

DC charges have grown significantly between 2020 and 2024 as Figure 11c illustrates. DC chargers are further divided into four groups: ultra-fast DC solutions (UF DC Level 1: 150–350 kW and UF DC Level 2: >350 kW), fast DC (50–150 kW), and slow DC (<50 kW). A significant percentage of DC installations are fast DC chargers, which serve EV users who need rapid recharges for business or interstate trips. Although they still have uses, slow DC chargers are losing ground to quicker options. Italy’s emphasis on facilitating long-distance EV travel and satisfying the demands of high-mileage consumers is reflected in the notable growth of ultra-fast DC chargers. UF DC Level 2 chargers have started to appear in premium areas to prepare the network for future EV technologies with higher battery capacity. In contrast, UF Level 1 chargers have been steadily adopted along essential roads and EV hubs. Rural areas are neglected by DC charger deployment, which is disproportionately concentrated in urban and industrial locations. The need for focused infrastructure initiatives to provide fair access to high-speed charging throughout the country is highlighted by this unequal distribution [50].

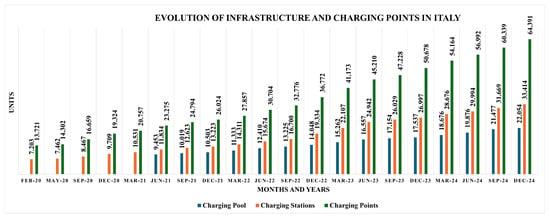

A thorough overview of Italy’s charging infrastructure development between September 2019 and September 2024 may be seen in the timeline in Figure 12. Three essential indicators are monitored: charging points (A fixed or mobile interface, having one or more connectors, charging only one EV at a time), charging stations (physically installed, charging more than one EV at a time), and charging pools (site, a unique address, location, where one or more charging stations are installed). From over 20,000 charging stations in 2019 to over 60,000 in 2024, the number of charging stations almost quadrupled. The efficiency of government subsidies and European Union (EU) financing initiatives meant to hasten the adoption of EVs is demonstrated by this quick rise. Peaks in the infrastructure deployment match important policy turning points, including the start of the EU’s Green Deal, which highlighted electrification as a crucial decarbonization plan of action, and the Ecobonus program, which offered incentives for establishing charging stations. The data show consistent monthly increases in charging pools, stations, and points, demonstrating the continued momentum in Italy’s EV ecosystem. Despite these developments, the relatively slow dissemination of EVs in rural and southern regions remains a significant barrier to their wider adoption [51].

Figure 12.

Monthly distribution of Italy charging points.

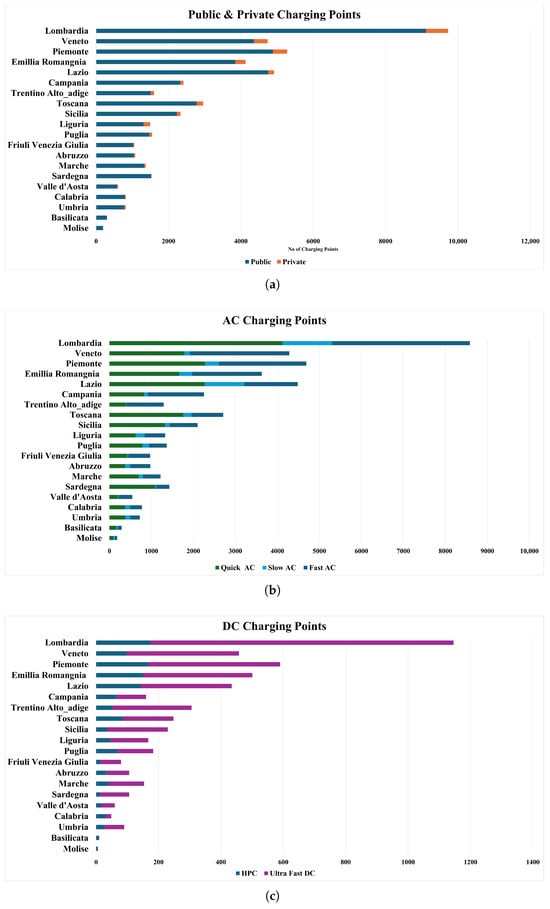

3.2.3. Regional Distribution of Charging Infrastructure in Italy

The location of the charging infrastructure in Italy varies notably by region, with the northern and urban areas having a far larger number of charging stations than the rural and southern areas. This discrepancy highlights the need for targeted investments to ensure equal access to EV charging stations worldwide [52].

As seen in Figure 13a, there are notable locations. Differences in the number of public and private charging stations in Italy. Lombardia is the region with the most charging stations in the country, followed by Piemonte, Lazio, and Veneto. These regions benefit from proactive regional policies that support the infrastructure of EVs, higher urbanization rates, and improved economic conditions. Due to private investments and commercial installations in commercial buildings and residential complexes, urban areas in these regions also have higher percentages of private charging stations. There are far fewer charging stations in southern areas like Molise, Basilicata, and Valle d’Aosta, which indicates slower EV adoption rates and less infrastructure spending. The disparity between private and public stations highlights the need for concerted efforts to improve public infrastructure in areas neglected [52].

Figure 13.

Charging infrastructure of Italy by Regions: (a) public and private charging points, (b) AC charging points, (c) DC charging points.

Figure 13b displays the distribution of AC charging stations by region, separating Slow, Quick, and Fast AC chargers. With the largest network of quick and fast AC chargers, Lombardia has the best infrastructure for AC charging compared to other areas. With many medium-speed chargers ideal for commuters in cities and suburbs, Piemonte, Lazio, and Veneto are the next largest donors to the AC network. Slow AC chargers are still widely used in rural areas, where overnight charging is most convenient, although their usage is largely restricted in metropolitan areas. Due to their affordability and versatility for use in public, commercial, and domestic settings, AC chargers are widely used in all locations [52].

Figure 13c displays the distribution of DC charging stations divided into Ultra-Fast and High Power Charging. Most UF DC chargers are found in areas like Lombardia, Piemonte, and Veneto, especially near major highways and metropolitan centers. These chargers ease range anxiety for the adoption of EVs by catering to long-distance and high-mileage drivers. Very few UF chargers are deployed in rural and southern areas like Molise, Basilicata, and Calabria, which have little infrastructure for DC charging. This discrepancy emphasizes the urgent need for these locations to invest in high-speed charging infrastructure. In almost every location, Ultrafast DC chargers (50–150 kW) make up a sizable amount of the DC network, serving ordinary EV consumers and business fleets [52].

In addition to demonstrating a forward-thinking strategy, the deliberate positioning of ultra-fast chargers in economic centers also identifies geographical shortages that must be filled to expand EVs nationwide. The wider socioeconomic and geographic variations throughout Italy are reflected in regional discrepancies in public and private AC and DC charging infrastructure. Important findings include the following. Due to higher EV adoption rates, improved financing sources, and more robust regional regulations, urban areas such as Lombardia, Lazio, and Piemonte have the best charging infrastructure. The lack of adequate public charging networks in rural and southern regions restricts the adoption of EVs. Public–private partnerships and particular government subsidies are required to accelerate infrastructure building. Given the increasing popularity of HPC (>150kW) in demand locations, there is an opportunity to replicate this strategy in underserved areas, especially along significant transit routes [52].

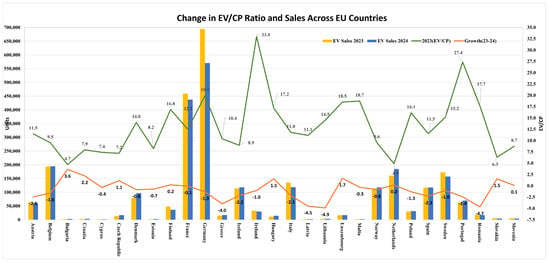

3.3. Linking EV Adoption to Charging Point Availability Across Europe

As the usage of electric vehicles increases across Europe, a suitable charging infrastructure is critical for long-term growth. Sales data illustrate market trends but may not fully reflect a country’s infrastructural readiness. The EV-to-charging-point (EV/CP) ratio provides a more precise assessment, with lower values indicating improved accessibility and less network strain. This section compares 2023–2024 EV sales to EV/CP ratio changes in European countries. As demonstrated in Figure 14, where the green line shows the 2023 EV/CP ratio and the blue one shows the improvement from 2023 to 2024, several countries strengthened their infrastructure despite dropping sales [37], emphasizing continuous investment and policy-driven expansion, regardless of short-term demand swings.

Figure 14.

Comparative analysis of EV infrastructure adequacy and sales trends in Europe (2023–2024).

For example, in Romania, the EV/CP ratio improved from 17.7 in 2023 to 13.0 in 2024, despite a 8% decline in EV sales. Similarly, Latvia recorded a 4.5-point improvement with a drop in sales 5%. In Austria, the ratio decreased from 11.5 to 9.0, while sales decreased by 4%. Spain also demonstrated an improvement ratio of 11.5 to 9, while sales were almost the same as in 2023 [53,54,55,56].

In Italy, the ratio dropped from 11.8 to 9.7, although sales decreased almost 12%. Similarly, Germany saw an improvement in its 1.3-point ratio, but sales decreased almost drastically by 18%. France and Sweden also improved their EV/CP ratio to 1.0 point, but sales declined 5% and 9%, respectively [41,42,43,44].

However, Belgium, Iceland, Norway, and Poland also show clear improvements in infrastructure, reflected in a decreasing EV/CP ratio at 1.6, 2.2, 0.8, and 1.3, respectively, with only a minor improvement in sales at 1%, 3%, 3%, and 4%, respectively [57,58,59,60].

These findings indicate that the charging infrastructure in Europe is steadily improving, even as EV sales have declined in some countries. This suggests that the decline in sales from 2023 to 2024 is not primarily due to infrastructure limitations but is more likely driven by other factors, most notably changes in national incentive policies. As detailed in Section 3.1.2 and in Table A1, reductions in subsidies, tax benefits, or purchase incentives have significantly influenced consumer demand. Thus, while infrastructure expansion reflects ongoing policy and investment commitments, EV adoption remains highly responsive to changes in financial support mechanisms.

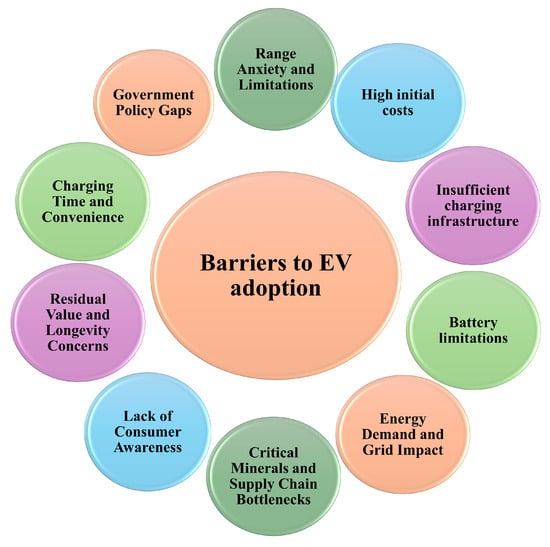

3.4. Barriers to EV Adoption

The adoption of EVs has been accelerating globally, but several key barriers continue to hinder their widespread use. These multifaceted challenges involve technical, economic, infrastructural, and behavioral factors [61,62]. Figure 15 illustrates the factors that affect the adoption of EVs.

Figure 15.

Barriers to EV adoption.

Range anxiety and limitations: Range anxiety is one of the most significant psychological barriers to the adoption of EVs, stemming from the fear of depleting battery power before reaching a charging station or destination. Unlike ICE vehicles, which typically offer ranges greater than 500 km with quick refueling, many EVs provide shorter ranges, necessitating more frequent stops [63]. This challenge is further exacerbated by energy-intensive features (e.g., heating, cooling, and infotainment), aggressive driving habits, and extreme weather conditions that can significantly reduce battery performance. Although emerging technologies such as solid-state batteries and advances in lithium-ion chemistry hold promise for extending EV ranges, these solutions are not yet widely accessible [64].

High initial cost: Batteries, which constitute 30–50% of the EV manufacturing cost, contribute significantly to the higher initial price of EVs compared to ICE vehicles despite declining Li-ion battery prices [65]. This cost disparity mainly affects lower- and middle-income consumers, restricting market penetration and making EVs less accessible. In addition, the expense of battery repair or replacement, especially in older models, reinforces the perception of high ownership costs. In regions lacking substantial subsidies or tax incentives, the price gap between EVs and ICE vehicles becomes even more pronounced, further impeded by widespread adoption.

Insufficient charging infrastructure: Urban areas tend to have a higher concentration of charging stations, while rural and remote regions often lack sufficient infrastructure, leading to inequitable access and discouraging the adoption of EV in less populated areas [66]. The slow expansion of charging networks is further hindered by the significant investment required, and private companies are reluctant to deploy chargers in low-demand areas due to limited profitability. Furthermore, the lack of standardization between EV brands and charging networks creates interoperability issues, complicating the charging experience for drivers. Public charging reliability is another concern, as frequent malfunctions or unavailability of chargers erode consumer confidence in the system [67].

Battery limitations: EV batteries lag behind the energy density of liquid fuels, limiting their competitiveness with ICE vehicles for long-distance travel. Recharging times, even with fast chargers, range from 30 min to an hour, much longer than the few minutes needed to refuel an ICE vehicle [68]. Over time, battery degradation reduces performance, necessitating costly replacements, while battery recycling remains a complex and expensive process with potential environmental impacts. Furthermore, the increasing demand for critical materials such as lithium and cobalt places immense pressure on global supply chains, further complicating battery production and sustainability [69].

Energy demand and grid impact: The rapid growth of EV adoption risks overloading the capacity of existing power grids, particularly during peak times, creating a mismatch. Investing in grid infrastructure will help address this problem of instability. Another challenge is balancing EV charging demand with intermittent renewable energy production. In the absence of efficient load balancing and grid management, the environmental advantages of EVs can be offset by a greater dependence on fossil fuels during peak hours, undermining their sustainability goals [70].

Critical minerals and supply chain bottlenecks: Critical EV battery manufacture suffers because of the shortage of essential elements such as nickel, cobalt, and lithium, which are needed to make these batteries. Because many of these resources are available in regions with unstable governments, geopolitical risks worsen the problem by introducing liabilities within supply chains [71].

Lack of consumer awareness: Many EV consumers lack information and are unaware of reduced maintenance costs and environmental benefits. Persistent rumors further hamper adoption, such as EVs being unsuitable for cold locations or containing dangerous batteries [72].

Residual value and longevity concerns: Due to deterioration of battery life, the resale value of EVs is frequently unpredictable, discouraging interested buyers. In addition, the rapid pace with which EV technology is developing could make older models less appealing, reducing their market value, and raising consumer concerns about long-term investment.

Charging time and convenience: Even with fast chargers, charging an EV takes much longer than recharging an ICE vehicle, which might be an essential concern for specific customers. Long wait times caused by the scarcity of public charging stations during peak hours worsen this problem and further reduce the convenience and attraction of EVs for many prospective users [73].

Government policy gaps: In certain regions, inconsistent government subsidies for EVs confuse suppliers and consumers, making decision-making more difficult. In addition, the growth of the availability of EVs and the necessary charging infrastructure is slowed by the absence of clear and solid long-term EV policies, which deter automakers and infrastructure developers from making significant investments in new markets [74].

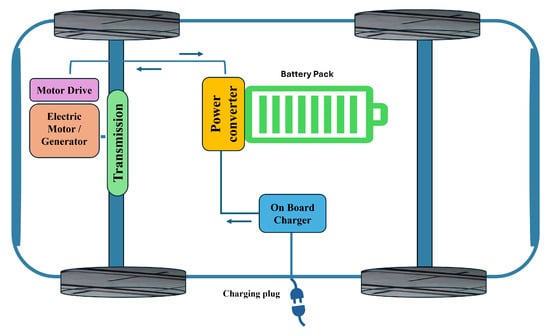

4. Electric Vehicle Technology

The transportation sector is about to undergo a revolution thanks to EVs. Advanced technologies from various engineering specialties, such as mechanical, electrical, electronics, automotive, and chemical engineering, are being integrated to drive this change. Combining these technologies increases the overall efficiency of EVs, reducing emissions and energy consumption. The electric motor (EM), power converter, and energy source are some of the essential parts of EVs that are shown in Figure 16. Each of these parts is essential for improving the sustainability and performance of the vehicle. Greener and more efficient transportation is unavoidable, given the explosive rise in the adoption of EVs, driven by ongoing advances in these interrelated technologies [75].

Figure 16.

Main parts of the electric vehicle.

Numerous studies have examined the technological development of EVs from various angles, including standards, converter layouts, battery management, charging topologies, and motor types as stated in Table 1.

Table 1.

Review of studies conducted on electric vehicle (EV) technology.

4.1. Types of Electric Vehicles

EVs come in a variety of forms and operate using a range of technologies. EVs can be classified into five groups according to technology. An overview of these types is explained below.

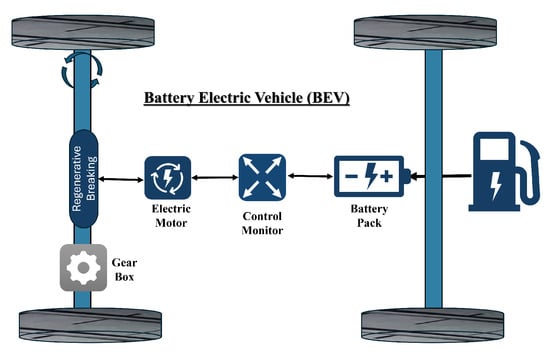

4.1.1. Battery Electric Vehicle (BEV)

With the continued advancement of battery technology and declining costs, BEVs are predicted to dominate the EV industry. BEVs are powered solely by EM and driven by a battery without ICE. The battery capacity of a vehicle directly affects its electric driving range [85]. BEVs have many advantages, including zero emissions, which makes them especially useful in cities where air quality is a big issue [78]. Although many alternative BEV layouts depend on different manufacturers’ designs, the fundamental arrangement and key parts are usually the same, illustrated in Figure 17. Although there are various EV charger options, the battery obtains power from the distribution network. When braking and decelerating, an EM turns the kinetic energy into electrical energy, known as regenerative braking, to charge the battery [86]. This technique, which is also utilized in other electrified public transportation systems, including metros and trams, is made possible by a bidirectional DC/AC converter [87]. Electricity may be transferred using this converter from the battery to the AC motor while operating and back to the battery when it stops.

Figure 17.

Battery electric vehicle (BEV).

Two of the main issues with BEVs are their long charging times and the lack of a public charging infrastructure [88]. However, future developments in battery technology are anticipated to alleviate this problem by increasing the range of BEVs between charges [89]. Furthermore, the extensive installation of fast charging stations in public spaces will help reduce range anxiety among EV users [90]. In the future, BS charging, a technique that quickly swaps out an empty battery for a fully charged one at designated stations, may be introduced by some BEV manufacturers. This would significantly reduce recharge downtime. Modern BEVs offer a driving range between 100 km and 700 km on a single charge [91]. You may find further information on BS technology in Section 5.3.

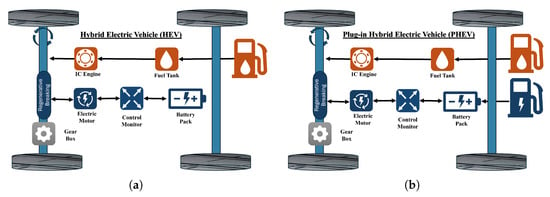

4.1.2. Hybrid Electric Vehicle (HEV)

HEVs use an ICE and an EM to improve fuel efficiency and reduce emissions. When the load is light, the ICE and regenerative braking recharges the battery. HEVs are powered by the EM and the battery at lower speeds, whereas the ICE takes control at faster speeds. In addition, EM improves performance and efficiency by helping under heavy loads. Compared to ICE cars, HEVs use less fuel and emit less GHG emissions [92,93]. HEVs do not require external charging, so they do not strain the power grid. They are more expensive than traditional gas-powered vehicles but cheaper than PHEVs. For example, in 2024, the gas-powered Toyota RAV4 started at EUR 26.829 [94], and the HEV model at EUR 29.236 [95,96]. As fuel costs increase, long-term savings can offset the higher initial price of HEVs. Figure 18a illustrates the structure of HEVs.

Figure 18.

(a) Hybrid electric vehicle (HEV), (b) plug-in hybrid electric vehicle (PHEV).

4.1.3. Plug-In Hybrid Electric Vehicle (PHEV)

PHEVs can charge their batteries by plugging into the power grid, using the ICE, or using regenerative braking. Unlike HEVs, they can be plugged in and drive longer distances on electric power alone [97]. They combine an EM with an ICE, allowing them to switch between or combine both power sources for better efficiency, and do not produce GHG emissions when running on electricity, making them more environmentally friendly for short trips. Once the battery is depleted, ICE takes over, providing extended range and flexibility for longer trips [98]. For example, the Toyota Prius PHEV has an 8.8 kWh battery, offering approximately 40 km of electric driving. It can cover up to 1030 km in total while using power and fuel [99]. PHEVs are a great option for drivers who want the benefits of electric driving without the risk of running out of batteries on longer trips. It is essential to remember that it may consume more gasoline than planned, depending on how they are driven [100]. They come in various types and combinations to meet individual needs and tastes. Figure 18b illustrates the structure of PHEVs.

4.1.4. Fuel Cell Electric Vehicle (FCEV)

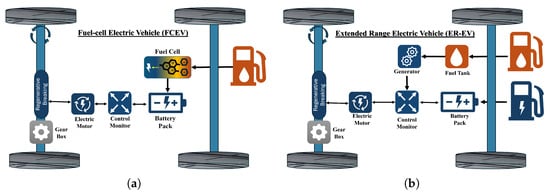

FCEVs run on electricity from a chemical reaction between hydrogen (H2) and oxygen (O2) in a fuel cell. Unlike BEVs, FCEVs do not need to be plugged in to charge. Instead, they are refueled with hydrogen gas, similar to how gasoline cars are refueled, and the process takes only a few minutes [101]. The fuel cell transforms the chemical energy of hydrogen gas into electrical energy, which drives the motor. There are several ways to produce hydrogen for FCEVs, including using electrolysis of water or fossil fuels like natural gas. Although these vehicles are thought to be emission free, the only byproduct is water vapor, so it is important to be aware that although green hydrogen exists, most of the hydrogen used in cars is made from natural gas. Figure 19a illustrates the structure of FCEV. Since these EVs do not need to be charged by the grid, they do not affect the power supply if no battery is used [102]. They offer a long driving range and are ideal for drivers who want fast fuel and clean energy. However, hydrogen refueling stations are still limited in many areas, which can affect convenience and availability. The only FCEV on the market is the Toyota Mirai, the most recent model, which was unveiled in 2021 and has a range of 650 km between fill-ups. Its only pollutant is pure water [103].

Figure 19.

(a) Fuel Cell Electric Vehicle (FCEV). (b) Extended Range Electric Vehicle (ER-EV).

4.1.5. Extended Range Electric Vehicle (ER-EV)

The driving range of ER-EV can be increased by an additional power source known as a range extender. Most range extenders have an electric generator that drives the motor and uses small ICEs to replenish the battery [104]. When the range extender is active, the ER-EV produces CO2 emissions, but it operates emissions-free when it is running on electric power alone. An ER-EV emits significantly less CO2 during its lifetime than a traditional ICE vehicle. The BMW i3 is a notable example of an ER-EV, with a Li-ion battery and an optional range-extending gasoline engine [105]. The essential components and assembly of an ER-EV are illustrated in Figure 19b.

4.2. Comparative Analysis of Electric Vehicle Types

EV technology has experienced significant advancements since its inception in the late nineteenth century, evolving into a diverse range of options that meet various transportation needs. Today, the market includes traditional ICE vehicles alongside more advanced systems such as BEV, HEV, PHEV, FCEV, and ER-EV [90]. Each of these types of vehicles presents unique characteristics, with different advantages and limitations, as summarized in Table 2. The selection of a suitable EV technology depends on several factors, including budget, driving patterns, lifestyle preferences, and the availability of supporting infrastructure. For example, BEVs are particularly well suited for urban commuters with shorter travel distances and access to charging networks. At the same time, PHEVs and FCEVs can better accommodate people who frequently travel long distances or require greater flexibility [106]. Regional variations in energy prices, policies, and the development of electric and hydrogen fuel stations further influence the practicality of each type. In conclusion, EV technology is not universally ideal. The optimal choice varies according to individual requirements and circumstances. As EV technologies progress and the infrastructure grows internationally, electric cars will play an increasingly important role in reducing GHG emissions and achieving sustainable transportation goals.

Table 2.

Overview of various electric vehicle (EV) types and their characteristics.

4.3. Advancements in Electric Vehicle Technology

Advancements in EV technology have played a significant role in making electric mobility more practical, efficient, and accessible to the public. One of the most important developments in battery technology is at the forefront of this transformation [107]. Modern lithium-ion batteries now offer a higher energy density, which means EVs can travel longer distances on a single charge, with some models reaching over 700 km. Research is also progressing on solid-state batteries, which promise faster charging, improved safety, and even longer life spans [108]. Beyond new battery designs, sustainable battery life cycle management has gained traction, with recycling technologies recovering valuable materials like lithium, cobalt, and nickel. Repurposing used EV batteries for second-life applications, such as energy storage at home and the grid, extends their utility and reduces their environmental impact [109].

In addition to battery improvements, autonomous and connected EVs are reshaping transportation. Integrating AI-driven autonomous technologies enhances safety and energy efficiency by enabling advanced driver assistance systems, optimized route planning, and predictive maintenance. These features improve the user experience and reduce energy consumption during operation [110]. Vehicle to Everything (V2X) communication further revolutionizes connectivity by allowing EVs to interact with their surroundings, including other vehicles, infrastructure, and the electric grid [111,112].

The growth of the charging infrastructure has been rapid. Fast chargers can charge an EV battery to 80% in as little as 20–30 min, and ultra-fast chargers are being developed for even quicker recharges. Furthermore, intelligent wireless charging systems integrate EVs with the grid that is the V2G technology grid, enabling dynamic load balancing to prevent grid overload during peak demand and optimizing charging schedules to take advantage of lower-cost electricity and renewable energy availability, allowing EVs to charge without cables and even supply power back to the grid [113]. EMs have become smaller, lighter, and more powerful, increasing vehicle acceleration and performance. Innovative regenerative braking technologies assist in collecting energy while slowing down, enhancing overall efficiency. Thermal management technologies have also been upgraded to ensure battery health and performance in various weather conditions [114]. On the software side, EVs now include innovative systems for scheduling routes, energy consumption monitoring, and virtual diagnostics. Many are equipped with advanced driver assistance systems (ADASs) and combined with autonomous vehicle technology, making them safer and more efficient [115]. Manufacturers are also looking for sustainable materials and environmentally friendly manufacturing procedures to reduce the overall carbon footprint of EV production.

Furthermore, the expansion of EV battery recycling programs lowers waste and enables the reuse of precious components like lithium, cobalt, and nickel [109]. These advances collectively address key challenges in the adoption of EVs, including range anxiety, charging infrastructure limitations, and sustainability concerns. Using cutting-edge technology, the EV industry is poised to play a critical role in reducing GHG emissions, promoting energy efficiency, and transforming global transportation systems into cleaner, more innovative, and more sustainable networks. Table 3 provides an overview of these key advancements, summarizing their contributions to the EV industry.

Table 3.

Emerging research and development areas in EVs.

5. Electric Vehicle Battery Charging Systems

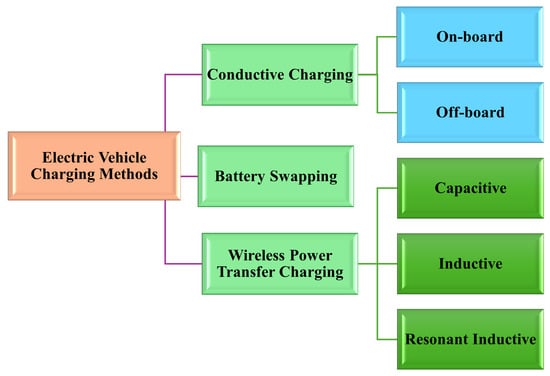

There are three main ways to charge an EV: conductive charging, WPT charging, and battery swapping station (BSS). Conductive charging is the EV industry’s most well-established and often utilized method. In contrast, inductive charging is still in the early stages of research and has not yet gained widespread use. Although they exist, battery switch stations are rarely used compared to the other two techniques. Figure 20 shows the classification of various EV charging technologies available today.

Figure 20.

Classification of electric vehicle battery charging technology.

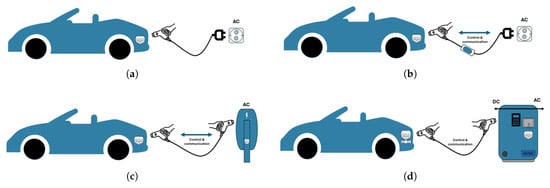

5.1. Conductive Charging System

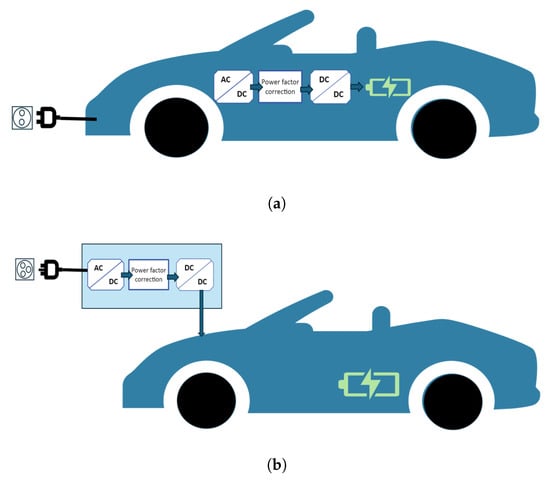

Since the convenient availability of charging stations is a prerequisite for EV adoption and public acceptance, EV battery chargers are essential to the growth of EVs [116]. The three primary components of an EV charger are an AC/DC converter, a DC/DC converter, and a power factor correction device [79,117]. There are two primary types of chargers: on-board (placed within the vehicle for slow charging) and off-board (external, utilized for quick charging) as shown in Figure 21a and Figure 21b, respectively.

Figure 21.

(a) On-board charging. (b) Off-board charging.

OBCs are compact, lightweight, and cost effective, allowing EV owners to charge wherever a power source is available but have limited power capacity, leading to longer charging times. Off-board chargers, less restricted by size and weight, support slow and fast charging but are more expensive to install due to their complexity [118]. Table 4 compares the on-board and off-board chargers. This chart helps you choose the best EV charger by comparing the two types of chargers.

Table 4.

Key differences between on-board and off-board electric vehicle charging systems.

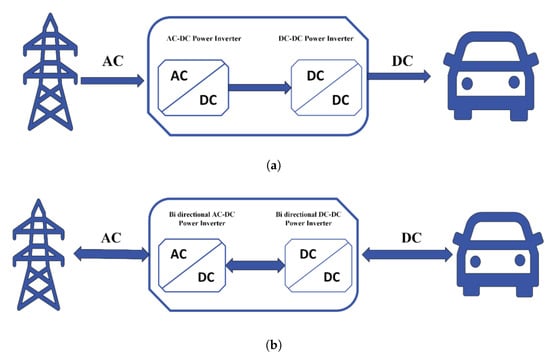

Depending on the direction, the chargers are classified as unidirectional or bidirectional. A unidirectional EV charger uses a diode rectifier and a unidirectional DC/DC converter, making it more straightforward to control with fewer interconnection issues and reduced battery degradation. However, it cannot provide ancillary services to the grid [119]. In contrast, a bidirectional charger employs bidirectional DC/DC and AC/DC converters to enable it to function in both the charging and discharging modes. Because of this, EVs can provide grid services. Nevertheless, frequent discharging can reduce battery life; Figure 22 shows the basic setup of Unidirectional and Bidirectional chargers. Table 5 presents a comparison of unidirectional and bidirectional chargers. This comparative analysis briefly examines the distinctions between unidirectional and bidirectional chargers. Table 6 presents a wide range of novel methods and findings on the subject of inductive or wired charging. Every research contributes to the changing field of EV plug-in charging by tackling various issues, from grid stability and renewable energy integration to dynamic pricing and consumer satisfaction. Table 1 highlights the main points in the literature on plug-in EV charging.

Figure 22.

(a) Uni-directional power flow. (b) Bi-directional power flow.

Table 5.

Key differences between unidirectional and bidirectional electric vehicle charging systems.

Table 6.

Summary of studies concluded on conductive charging systems.

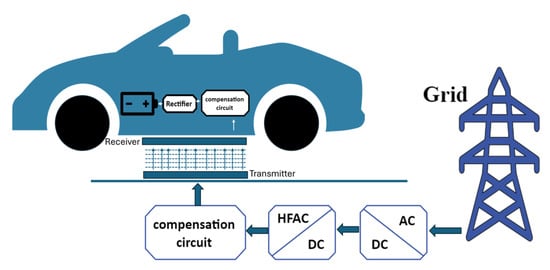

5.2. Wireless Power Transfer (WPT) Charging System

WPT charging systems are an innovation that allows batteries to be recharged without physical wires. Instead of connecting a device to a power source with a cable, electromagnetic fields transport energy wirelessly. This approach is also known as inductive charging [125]. WPT functions employ various methods, including capacitive coupling, resonant inductive coupling, and inductive coupling. It first operates using the AC/DC converter built within the WPT to convert AC power from the power grid to DC power. This DC electricity is converted back into high-frequency AC power and sent to a transmitting coil buried beneath the road. Electromagnetic induction is used by the receiving coil, which is housed within the EV, to collect power from the transmitting coil via an air gap. The battery is charged once the energy is transformed back into DC power by the internal AC/DC converter of the EV [126].

WPT is divided into two categories: inductive and resonant charging. Inductive charging is the most common and requires close contact between the charger and the device. Resonant charging, however, can work over slightly greater distances and is often used in EVs and medical devices. Other emerging technologies like radio frequency (RF) and laser charging are still in the experimental stages and aim to provide wireless power over longer ranges using waves or focused light beams [127]. Current WPT systems are designed for one-way power transfer as illustrated in Figure 23, where energy flows from the grid to an EV. However, future developments in WPT technology are expected to enable bidirectional energy flow, allowing vehicles to wirelessly return energy to the grid, supporting V2G capabilities [128].

Figure 23.

Wireless power transfer (WPT) charging system.

The key benefits of WPT include user convenience and the option of seamless cable-free charging. Enhanced electrical safety, eliminating the risk of accidents from exposed wires or physical connections [125]. Despite these advantages, WPT has notable limitations. Lower power transfer efficiency leads to higher energy losses than conductive charging methods. High infrastructure costs, such as WPT, require more expensive technology and installation than traditional plug-in charging systems. In addition, most systems require precise alignment between the transmitter and receiver, and the effective charging range is usually limited [125]. Numerous cutting-edge strategies have been investigated to improve wireless charging’s practicality, system integration, and charging efficiency. Table 7 highlights the key findings and main points from the literature on WPT systems.

Table 7.

Summary of studies concluded on wireless power transfer (WPT) charging systems.

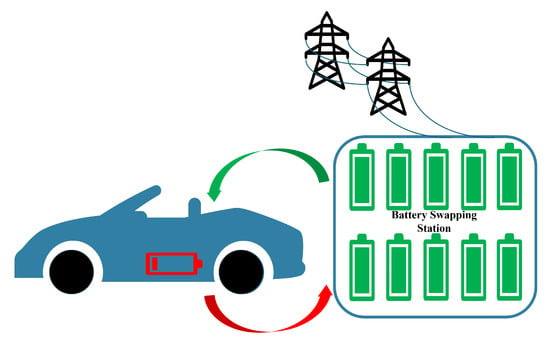

5.3. Battery Swapping (BS) Charging System

The rapid swapping of fully charged EV batteries for depleted batteries is possible using the BSS. This method allows for quick turnaround times by replacing the exhausted battery of the EVs with a fully charged one. The BSS or a third party must have a substantial stock of batteries, which the EV user may rent or purchase, for this technology to function. A BSS infrastructure typically consists of distribution transformers, batteries, battery-switching devices, and AC/DC converters for battery charging [136].

According to some research, BSS technology might support bidirectional charging, allowing energy to flow back into the grid and providing grid services [137]. Some authors’ works are highlighted in Table 8. However, BSSs face several challenges, including battery uniformity, infrastructure costs, and a large physical footprint. Despite these challenges, advances in BS technology continue. In 2013, Tesla introduced a BS system that can replace a battery in 90 s. In 2024, several advances in BS charging were made. Oak Ridge National Laboratory in the United States achieved a significant milestone with 100 kW wireless charging technology, reaching efficiency 96% [138], and companies such as the Chinese multinational electric vehicle manufacturer (NIO) have introduced faster and more automated stations, with their 4.0 model supporting even larger and faster swaps. BS charging is especially expanding in Asia, where companies like Vmoto and Sun Mobility are developing networks to facilitate this solution [139]. By addressing technological, financial, operational and user-centric issues, the BSS study aimed to establish BSS as a feasible, effective, and essential component of the EV ecosystem. Figure 24 shows the BSS.

Table 8.

Summary of studies concluded on battery swapping (BS) charging systems.

Figure 24.

Battery swapping (BS) charging.

5.4. Comparative Analysis of EV Charging Systems

As EVs continue to gain popularity, various charging systems have emerged to meet the various needs of users and the infrastructure. The three primary EV charging systems—conductive charging, wireless charging, and BS charging stations—each provide unique solutions with specific advantages and limitations. These systems are critical in shaping the future of EV adoption by addressing challenges related to convenience, efficiency, and scalability. A detailed comparative analysis of these systems is presented in Table 9, highlighting their key characteristics. Another Table 10 outlines the impact of each system and offers a holistic view of their feasibility and implementation challenges.

Table 9.

Characteristics of different EV charging systems.

Table 10.

Comparison of conductive, wireless power transfer (WPT) and battery swapping (BS) charging technologies.

6. Electric Vehicle Charging Standards, Levels and Interfaces

The charging procedure, which requires the transfer of electricity from the grid to the EV battery at the appropriate levels, is one of the main obstacles to the widespread adoption of EVs. The charging times depend on the size of the battery and the power output of the charger [146]. Two significant hurdles are the long charging duration and the limited battery lifespan. Several EV charging sets are discussed, including both on-board and off-board chargers. The infrastructure of charging stations is also covered in this section, along with safety recommendations established by organizations such as the SAE and IEC. It also highlights the various connections and charging stations used in different countries.

6.1. Conductive Charging Standards of Electric Vehicles

The transportation and electric power industries now have new dimensions due to the development of EVs. Standardizing every component of this new technology is crucial to operating it globally in a uniform way. Table 11 lists the regulatory bodies and guidelines related to the conductive charging of EVs.

Table 11.

Standard list of regulatory bodies related to conductive charging.

6.1.1. International Electrotechnical Commission Standards (IEC)

An international standardization organization called the IEC develops standards for technologies related to electrical, electronic, and other domains.

IEC 61851: This standard regulates how conductive charging systems for EVs operate [165]. It applies to charging equipment for both on-board and off-board applications and supports rated supply voltages up to 1500 V DC and 1000 V AC [147,166]. IEC 61851 series comprises different aspects highlighted in Table 12.

IEC 62196: This standard is for outlets, plugs, vehicle connections, and inlets used in the conductive charging of EVs. The IEC 62196 series comprises different aspects highlighted in Table 13.

IEC 63110: This standard defines communication protocols to operate and manage EVs charging and discharging systems. It enables smart charging, remote control, energy management, and interoperability between charging stations and back-end systems [151].

IEC 63119: This standard provides protocols for EV consumers to access charging services across several networks (roaming), allowing seamless authentication, authorization, and billing between service providers. This is critical to creating a consistent and user-friendly charging environment, particularly when drivers move between regions or nations and use multiple charging networks [148].

IEC 61980: This standard defines WPT systems and allows supply voltages of up to 1500 V DC and 1000 V AC. WPT systems with on-site energy storage options are also included [167,168].

Table 12.

Series of IEC 61851 standard for conductive EV charging systems [169,170,171,172,173].

Table 12.

Series of IEC 61851 standard for conductive EV charging systems [169,170,171,172,173].

| Series | Explanation |

|---|---|

| 61851-1 | Guidelines for various EV plug and charging wire layouts. |

| 61851-21-1 | Guidelines of electromagnetic compatibility (EMC) requirements for on-board chargers used in EVs with conductive charging. |

| 61851-21-2 | Guidelines for EMC standards for off-board chargers used in CCSs. |

| 61851-22 | Guidelines for AC charging station requirements. |

| 61851-23 | Guideline Covers the technical requirements for DC fast charging stations, ensuring safe and effective high-power charging. |

| 61851-24 | Guidelines for digital communication between the electric vehicle supply equipment (EVSE) and the EV charging controller during DC charging. |

Table 13.

Series of IEC 62196 standards for EV charging connectors and interfaces [174,175,176].

Table 13.

Series of IEC 62196 standards for EV charging connectors and interfaces [174,175,176].

| Series | Explanation |

|---|---|

| 62196-1 | Guidelines for plugs, automotive connectors, vehicle inlets, and socket outlets required for EV conductive charging. Safety, electrical characteristics, and mechanical strength are all included. |

| 62196-2 | Guidelines covers several AC charging connection types. Types 1 through 3 correspond to single- and 3 AC charging, respectively. |

| 62196-3 | Guidelines of Connectors for DC fast charging, including CHAdeMO, CCS1, CCS2, and GB/T standards. |

6.1.2. Society of Automotive Engineers Standards (SAE)

An American professional organization, the SAE, creates standards for engineering firms in various sectors.

SAE J1772: This standard defines the physical connector and communication protocol for EV charging in Level 1 and Level 2 AC charging applications. This standard is North America’s most widely adopted charging interface for AC charging [154,177].

SAE J2293: This standard defines the architecture and requirements for energy transfer systems between an EV and the electric utility, covering both AC and DC charging modes while ensuring safe, efficient, and controlled power delivery, making it a foundational standard for the overall EV charging ecosystem [178,179,180].

SAE J2847: This standard series defines a set of communication protocols between EVs and charging equipment, enabling smart charging, load management, and V2G integration services, ensuring that EVs can interact effectively with charging infrastructure and utility systems to support advanced energy management. The SAE J2847 series is listed in Table 14.

SAE J2836: This standard series defines communication between EVs and the electric grid, focusing on enabling V2G functionality and other interactive services of the grid. These standards provide the functional framework for the participation of EVs in a modern and innovative grid ecosystem [155]. Each document in series J2836 outlines specific interaction scenarios between EVs and EVSE, utilities, and grid operators listed in Table 15.

SAE J2931: This standard series enables secure and standardized communication between EVs and the power grid. Defining robust network protocols and cyber security frameworks ensures the safety, privacy, and trustworthiness of V2G interactions, a vital component of the future of the smart grid [181]. The SAE J2931 series is listed in Table 16.

SAE J2954 and SAE J2954 recommended practice (RP): This standard defines WPT for EVs, which only supports the wireless charging of level 2. However, a newly released version of the RP claims to enable level 3. In addition, the upgraded version offers a standardized testbed for validating and measuring the performance of new products from infrastructure and EV manufacturers. In addition to payment processing, autonomous charging, and driver assistance for easy parking of EVs, this standard [182,183].

SAE J1773: This standard defines the requirements for WPT charging systems of EVs. Transfer energy from a charging station to a vehicle without physical connectors by magnetic field, offering a vision of hands-free, user-friendly charging [184,185,186].

SAE J3400: This standard formalizes the NACS, originally developed by Tesla. 3400 NACS connector is compact and lightweight and supports both AC (Level 1 and Level 2) and DC fast charging, depending on vehicle and charger compatibility, through the same port, unlike the SAE J1772 (AC) and CCS1 (DC) used previously. By unifying AC and DC charging into a single connector, the J3400 reduces complexity and improves user convenience [159].

Table 14.

Series of SAE J2847 standards for communication protocols [187,188,189].

Table 14.

Series of SAE J2847 standards for communication protocols [187,188,189].

| Series | Explanation |

|---|---|

| J2847-1 | Communication in Smart Charging of Plug-in EVs using Smart Energy Profile. |

| J2847-2 | Interaction Between Off-Board DC Chargers and Plug-in Vehicles. |

| J2847-3 | Plug-in Vehicle Communication as a Distributed Energy Source. |

| J2847-6 | Communication related to plug-in hybrid charging behavior. |

Table 15.

Series of SAE J2836 standard communication between plug-in vehicles and the utility grid [188,190,191,192,193,194].

Table 15.

Series of SAE J2836 standard communication between plug-in vehicles and the utility grid [188,190,191,192,193,194].

| Series | Explanation |

|---|---|

| J2836-1 | Communication for energy services between plug-in cars and the grid. |

| J2836-2 | Communication between Off-Board DC Chargers and Plug-in Vehicles. |

| J2836-3 | WPT charging communication between infrastructure and automobiles. |

| J2836-4 | Applications of Plug-in EV Diagnostic Communication. |

| J2836-5 | Use Cases for Plug-in EV Customer Communication. |

| J2836-6 | Applications for Plug-in EV Wireless Charging Communication. |

Table 16.

Series of SAE J2931 standard [195,196].

Table 16.

Series of SAE J2931 standard [195,196].

| Series | Explanation |

|---|---|

| J2931-1 | Requirements for wired and wireless communication between EVs and the electric grid for energy management and charging. |

| J2931-3 | Diagnostic and maintenance communication requirements for PEV charging systems. |

| J2931-4 | Addresses security-related requirements and encryption for communications between EVs, charging stations, and the grid. |

| J2931-5 | Interaction between the EV and utility systems for grid stabilization, demand response, and energy storage. |

6.1.3. Standardization Administration of China (SAC)

The SAC is the government authority responsible for developing and managing standards for EV charging infrastructure, assuring compatibility, safety, and interoperability across all EVs, chargers, and related systems in China.

GB/T 20234: It provides the interface requirements for EVs and charging stations (AC or DC), such as plugs, sockets, connections, and vehicle inlets. It is the main standard for the China EV charging connection system [197,198,199]. The GB/T 20234 series comprises different aspects highlighted in Table 17.

Table 17.

Series of GB/T 20234 standard for EV charging interfaces in China (AC/DC plugs, sockets, connectors, and vehicle inlets) [197,198,199].

GB/T 18487: The standard addresses the complete conductive charging system, including safety, performance, and compatibility. It outlines how charging systems interact with the grid and automobiles and the infrastructure required for the significant adoption of EVs in China [200,201,202]. The GB/T 18487 series comprises different aspects highlighted in Table 18.

Table 18.

Series of GB/T 18487 standard for general specifications and safety requirements of EV CCSs in China [200,201,202].