A Multi-Country Comparison of Consumers’ Preferences for Imported Fruits and Vegetables

Abstract

1. Introduction

2. Literature Reviews

2.1. Imported Fruits and Vegetables in Taiwan, Japan, and Indonesia

2.2. Food Values

- Product origin label refers to a label showing the origin of imported fruits or vegetables.

- Food safety certified refers to the safety certification of imported fruits or vegetables and confirms that the products were safe.

- High quality appearance indicates the imported fruits or vegetables have good appearance.

- Domestic rarity refers to the unavailability of the imported fruits and vegetables, which are not easy to find or not common in the country.

- Price refers to the amount of money that was spent to buy the imported fruits or vegetables.

- Plantations indicates how the imported fruit or vegetable products were grown.

- Freshness refers to the condition of the imported fruits and vegetables that were still fresh when consumers purchased them. Due to the long distance or long-distance distribution, freshness is challenging for the trading agents. The level of freshness is considered as a significant factor among consumers when purchasing the products. These seven food values are considered as the potential hypotheses to be examined.

3. Data and Methodology

3.1. Questionnaire Design and Data Collection

3.2. Best–Worst Scaling Method

3.3. Latent Class Multinomial Logit Model

4. Results

4.1. Socio-Demographic Information

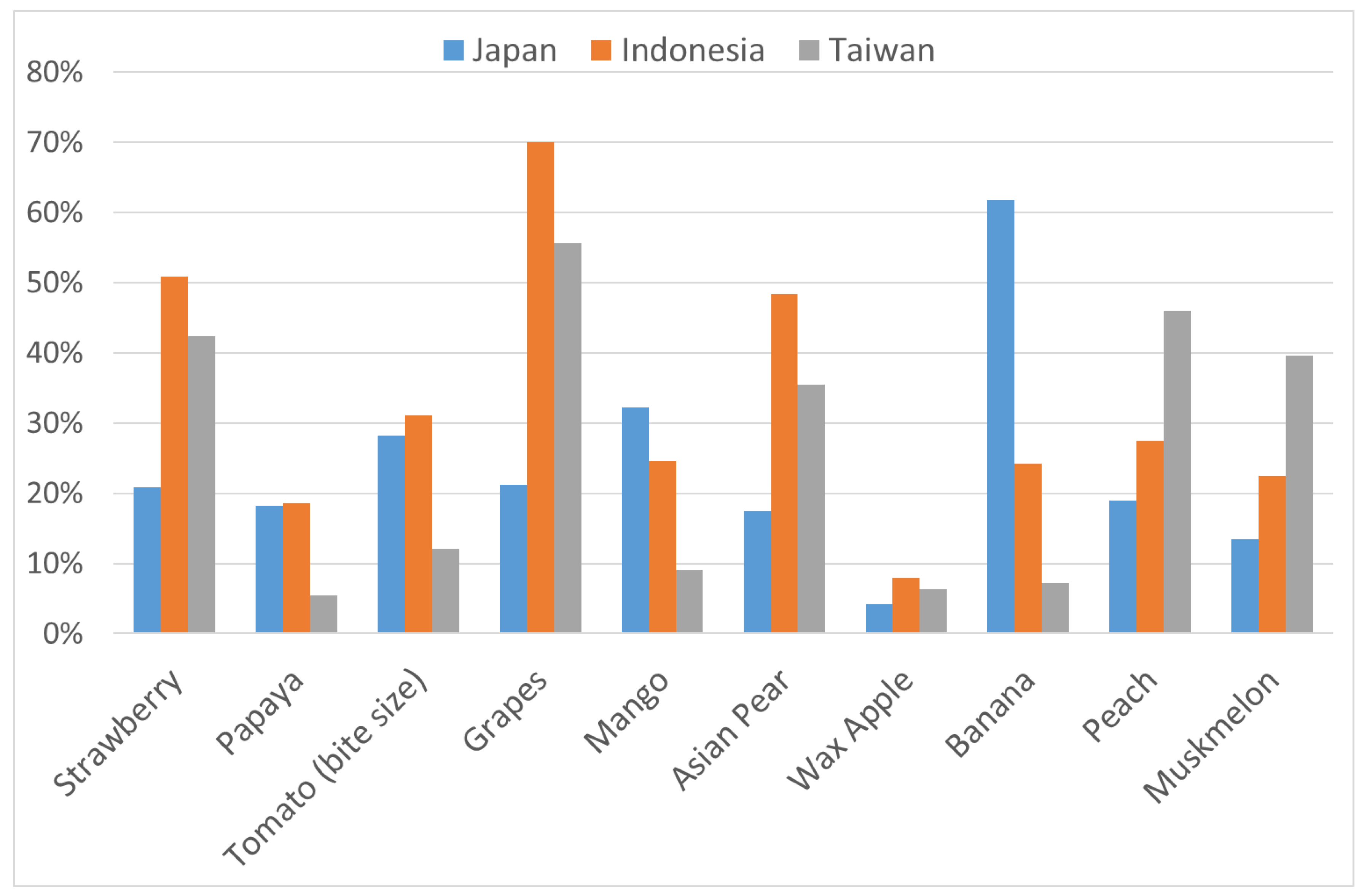

4.2. The Preference of Imported Fruit Products for These Three Countries

4.3. Latent Class Multinomial Logit Model including Socio-Demographic Variables

4.4. Probability and Share of Preferences of Socio-Demographic Characteristics

5. Discussion

Policy Implications

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Cummins, A.M.; Olynk Widmar, N.J.; Croney, C.C.; Fulton, J.R. Understanding Consumer Pork Attribute Preferences. Theor. Econ. Lett. 2016, 6, 166–177. [Google Scholar] [CrossRef]

- Huang, S. Global Trade Patterns in Fruit and Vegetables; U.S. Department of Agriculture: Washington, DC, USA, 2004; 83p. [Google Scholar]

- Gracia, A.; de-Magistris, T. Consumer Preferences for Food Labeling: What Ranks First? Food Control 2016, 61, 39–46. [Google Scholar] [CrossRef]

- Yeh, C.H.; Chen, C.I.; Sher, P.J. Investigation on Perceived Country Image of Imported Food. Food Qual. Prefer. 2010, 21, 849–856. [Google Scholar] [CrossRef]

- Lusk, J.L.; Briggeman, B.C. Food Values. Am. J. Agric. Econ. 2009, 91, 184–196. [Google Scholar] [CrossRef]

- Lusk, J.L.; Norwood, F.B. Animal Welfare Economics. Appl. Econ. Perspect. Policy 2011, 33, 463–483. [Google Scholar] [CrossRef]

- Auger, P.; Devinney, T.M.; Louviere, J.J. Using Best-Worst Scaling Methodology to Investigate Consumer Ethical Beliefs across Countries. J. Bus. Ethics 2007, 70, 299–326. [Google Scholar] [CrossRef]

- Bech-Larsen, T.; Grunert, K.G. The Perceived Healthiness of Functional Foods: A Conjoint Study of Danish, Finnish and American Consumers’ Perception of Functional Foods. Appetite 2003, 40, 9–14. [Google Scholar] [CrossRef]

- Loureiro, M.L.; Umberger, W.J. A Choice Experiment Model for Beef: What US Consumer Responses Tell Us about Relative Preferences for Food Safety, Country-of-Origin Labeling and Traceability. Food Policy 2007, 32, 496–514. [Google Scholar] [CrossRef]

- Bazzani, C.; Gustavsen, G.W.; Nayga, R.M.J.; Rickertsen, K. Are Consumers’ Preferences for Food Values in the U. S. and Norway Similar? A Best-Worst Scaling Approach. In Proceedings of the Agricultural & Applied Economics Association Annual Meeting, Boston, MA, USA, 31 July–2 August 2016; pp. 1–34. [Google Scholar]

- Chern, W.S.; Rickertsen, K.; Tsuboi, N.; Fu, T.-T. Nervous Disorders of Swallowing. AgBioForum 2002, 5, 105–112. [Google Scholar] [CrossRef]

- Chang, J.B.; Lusk, J.L.; Norwood, F.B. How closely do hypothetical surveys and laboratory experiments predict field behavior? Am. J. Agr. Econ. 2009, 91, 518–534. [Google Scholar] [CrossRef]

- Prescott, J. Comparisons of Taste Perceptions and Preferences of Japanese and Australian Consumers: Overview and Implications for Cross-Cultural Sensory Research. Food Qual. Prefer. 1998, 9, 393–402. [Google Scholar] [CrossRef]

- Feldmann, C.; Hamm, U. Consumers’ Perceptions and Preferences for Local Food: A Review. Food Qual. Prefer. 2015, 40, 152–164. [Google Scholar] [CrossRef]

- Ndraha, N.; Hsiao, H.I.; Chih Wang, W.C. Comparative Study of Imported Food Control Systems of Taiwan, Japan, the United States, and the European Union. Food Control 2017, 78, 331–341. [Google Scholar] [CrossRef]

- USDA. Trade opportunities in Southeast Asia: Indonesia, Malaysia, and the Philippines. Available online: https://www.fas.usda.gov/sites/default/files/2018-07/2018-07_iatr_se_asia_0.pdf (accessed on 15 March 2021).

- Dekhili, S.; Sirieix, L.; Cohen, E. How Consumers Choose Olive Oil: The Importance of Origin Cues. Food Qual. Prefer. 2011, 22, 757–762. [Google Scholar] [CrossRef]

- Nelson, R.; Kashiwagi, A. Gain Report—Global Agricultural Information Network: The Japanese Processed Vegetable Market—Changes and Opportunities. Available online: https://gain.fas.usda.gov/ (accessed on 15 March 2021).

- USDA. Japanese Fresh Fruit Market Overview 2018 (JA8706). Available online: https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Japanese%20Fresh%20Fruit%20Market%20Overview%202018_Osaka%20ATO_Japan_10-30-2018.pdf (accessed on 15 March 2021).

- Council of Agriculture Executive Yuan, R.O.C. (2017). Import by Food Groups. Available online: https://eng.coa.gov.tw/upload/files/eng_web_structure/2505521/BB_B04-2-01-B04-2-11_106.pdf (accessed on 15 March 2021).

- USDA. Taiwan Exporter Guide 2018 (TW18016). Available online: https://gain.fas.usda.gov/Recent%20GAIN%20Publications/Exporter%20Guide%20_Taipei%20ATO_Taiwan_12-5-2017.pdf (accessed on 15 March 2021).

- Sinaga, A.M.; Yusnita, E.; Arifatus, A.; Hariantoko, H. Preferences and Willingness to Pay for Local and Imported Citrus. In Proceedings of the ICSAFS Conference Proceedings, 2nd International Conference on Sustainable Agriculture and Food Security: A Comprehensive Approach, Jatinangor, Sumedang, West Java, Indonesia, 12–13 October 2015; Muhaemin, M., Hidayat, Y., Lengkey, H.A.W., Eds.; KnE Publishing: Dubai, United Arab Emirates, 2021. [Google Scholar]

- Global Business Guide Indonesia. Overview of Indonesia’s Horticulture Sector-Fruit & Vegetables. Available online: http://www.gbgindonesia.com/en/agriculture/article/2012/overview_of_indonesia_s_horticulture_sector_fruit_vegetables.php (accessed on 6 December 2021).

- Ariyanti, F. Daftar Negara Pemasok Buah Dan Sayur Terbesar Ke RI [in Indonesian]. Available online: https://www.liputan6.com/bisnis/read/3168268/daftar-negara-pemasok-buah-dan-sayur-terbesar-ke-ri (accessed on 6 December 2021).

- Feng, N.; Zhang, A.; van Klinken, R.D.; Cui, L. An Integrative Model to Understand Consumers’ Trust and Willingness to Buy Imported Fresh Fruit in Urban China. Br. Food J. 2021, 123, 2216–2234. [Google Scholar] [CrossRef]

- Bardi, A.; Schwartz, S.H. Values and Behavior: Strength and Structure of Relations. Personal. Soc. Psychol. Bull. 2003, 29, 1207–1220. [Google Scholar] [CrossRef]

- Rokeach, M. The Nature of Human Values; American Psychological Association: Washington, DC, USA, 1978. [Google Scholar]

- Manyiwa, S. Determining Linkages between Consumer Choices in a Social Context and the Consumer’s Values: A Means–End Approach. J. Consum. Behav. 2001, 2, 54–70. [Google Scholar] [CrossRef]

- Blandford, D.; Fulponi, L. Emerging Public Concerns in Agriculture: Domestic Policies and International Trade Commitments. Eur. Rev. Agric. Econ. 1999, 26, 409–424. [Google Scholar] [CrossRef]

- Connors, M.; Bisogni, C.A.; Sobal, J.; Devine, C.M. Managing Values in Personal Food Systems. Appetite 2001, 36, 189–200. [Google Scholar] [CrossRef]

- Dagevos, H.; vanOphem, J. Food Consumption Value: Developing a Consumer-Centred Concept of Value in the Field of Food. Br. Food J. 2013, 115, 1473–1486. [Google Scholar] [CrossRef]

- Lusk, J.L. External Validity of the Food Values Scale. Food Qual. Prefer. 2011, 22, 452–462. [Google Scholar] [CrossRef]

- Trading Economics. Taiwan GDP. Retrieved from Trading Economics. 2021. Available online: https://tradingeconomics.com/taiwan/gdp (accessed on 15 March 2021).

- Trading Economics. Japan GDP. Retrieved from Trading Economics. 2021. Available online: https://tradingeconomics.com/japan/gdp (accessed on 15 March 2021).

- Trading Economics. Indonesia GDP. Retrieved from Trading Economics. 2021. Available online: https://tradingeconomics.com/indonesia/gdp (accessed on 15 March 2021).

- Cohen, S.H. Maximum Difference Scaling: And Preference for Segmentation. Sawtooth Softw. Res. Pap. Ser. 2003, 98382, 1–17. [Google Scholar]

- Lee, J.A.; Soutar, G.; Louviere, J. The Best-Worst Scaling Approach: An Alternative to Schwartz’s Values Survey. J. Pers. Assess. 2008, 90, 335–347. [Google Scholar] [CrossRef] [PubMed]

- Casini, L.; Corsi, A.M.; Goodman, S. Consumer Preferences of Wine in Italy Applying Best-Worst Scaling. Int. J. Wine Bus. Res. 2009, 21, 64–78. [Google Scholar] [CrossRef]

- Finn, A.; Louviere, J.J. Determining the Appropriate Response to Evidence of Public Concern: The Case of Food Safety. J. Public Policy Mark. 1992, 11, 12–25. [Google Scholar] [CrossRef]

- Cohen, E. Applying Best-Worst Scaling to Wine Marketing. Int. J. Wine Bus. Res. 2009, 21, 8–23. [Google Scholar] [CrossRef]

- de-Magistris, T.; Gracia, A.; Albisu, L.M. Wine Consumers’ Preferences in Spain: An Analysis Using the Best-Worst Scaling Approach. Span. J. Agric. Res. 2014, 12, 529–541. [Google Scholar] [CrossRef]

- Lockshin, L.; Cohen, E. Using Product and Retail Choice Attributes for Cross-National Segmentation. Eletronic Libr. 2011, 45, 1236–1252. [Google Scholar] [CrossRef]

- Lusk, J.L.; Parker, N. Consumer Preferences for Amount and Type of Fat in Ground Beef. J. Agric. Appl. Econ. 2009, 41, 75–90. [Google Scholar] [CrossRef]

- Jaeger, S.R.; Jørgensen, A.S.; Aaslyng, M.D.; Bredie, W.L.P. Best-Worst Scaling: An Introduction and Initial Comparison with Monadic Rating for Preference Elicitation with Food Products. Food Qual. Prefer. 2008, 19, 579–588. [Google Scholar] [CrossRef]

- Jaeger, S.R.; Cardello, A.V. Direct and Indirect Hedonic Scaling Methods: A Comparison of the Labeled Affective Magnitude (LAM) Scale and Best-Worst Scaling. Food Qual. Prefer. 2009, 20, 249–258. [Google Scholar] [CrossRef]

- Menictas, C.; Wang, P.Z.; Louviere, J.J. Assessing the Validity of Brand Equity Constructs. Australas. Mark. J. 2012, 20, 3–8. [Google Scholar] [CrossRef]

- Aoki, K.; Akai, K.; Ujiie, K. A Choice Experiment to Compare Preferences for Rice in Thailand and Japan: The Impact of Origin, Sustainability, and Taste. Food Qual. Prefer. 2017, 56, 274–284. [Google Scholar] [CrossRef]

- Lagerkvist, C.J. Consumer Preferences for Food Labelling Attributes: Comparing Direct Ranking and Best-Worst Scaling for Measurement of Attribute Importance, Preference Intensity and Attribute Dominance. Food Qual. Prefer. 2013, 29, 77–88. [Google Scholar] [CrossRef]

- Aizaki, H.; Nakatani, T.; Sato, K. Stated Preference Methods Using R; CRC Press: Boca Raton, FL, USA, 2014. [Google Scholar] [CrossRef]

- Nassani, M.Z.; Locker, D.; Elmesallati, A.A.; Devlin, H.; Mohammadi, T.M.; Hajizamani, A.; Kay, E.J. Dental Health State Utility Values Associated with Tooth Loss in Two Contrasting Cultures. J. Oral Rehabil. 2009, 36, 601–609. [Google Scholar] [CrossRef]

- Sarrias, M.; Daziano, R.A. Multinomial Logit Models with Continuous and Discrete Individual Heterogeneity in R: The Gmnl Package. J. Stat. Softw. 2017, 79, 1–46. [Google Scholar] [CrossRef]

- Miller-Graff, L.E.; Howell, K.H.; Martinez-Torteya, C.; Hunter, E.C. Typologies of Childhood Exposure to Violence: Associations with College Student Mental Health. J. Am. Coll. Health 2015, 63, 539–549. [Google Scholar] [CrossRef]

- CIA. The World Factbook. Available online: https://www.cia.gov/the-world-factbook/ (accessed on 15 March 2021).

- Lusk, J.L.; Roosen, J.; Fox, J.A. Demand for Beef from Cattle Administered Growth Hormones or Fed Genetically Modified Corn: A Comparison of Consumers in France, Germany, the United Kingdom, and the United States. Am. J. Agric. Econ. 2003, 85, 16–29. [Google Scholar] [CrossRef]

- Thaiyotin, P.; Ujiie, K.; Shuto, H. An Evaluation of Consumers’ Preference on Food Safety Certificate and Product Origins: A Choice Experiment Approach for Fresh Oranges in Metropolitan Bangkok, Thailand. Agric. Inf. Res. 2015, 24, 74–80. [Google Scholar] [CrossRef][Green Version]

- Wange, E.P.; Gao, Z.; Heng, Y. Improve Access to the EU Market by Identifying French Consumer Preference for Fresh Fruit from China. J. Integr. Agric. 2018, 17, 1463–1474. [Google Scholar] [CrossRef]

- Insch, A.; Jackson, E. Consumer Understanding and Use of Country-of-Origin in Food Choice. Br. Food J. 2014, 116, 62–79. [Google Scholar] [CrossRef]

- Xie, J.; Gao, Z.; Swisher, M.; Zhao, X. Consumers’ Preferences for Fresh Broccolis: Interactive Effects between Country of Origin and Organic Labels. Agric. Econ. 2016, 47, 181–191. [Google Scholar] [CrossRef]

- Slamet, A.S.; Nakayasu, A. Consumer Preferences for Traceable Fruit and Vegetables and Their Influencing Factor in Indonesia. Int. J. Sustain. Futur. Hum. Secur. 2017, 5, 47–58. [Google Scholar] [CrossRef]

- Holmes, T.P.; Adamowicz, W.L.; Carlsson, F. Choice experiments. In A Primer on Nonmarket Valuation; Springer: Dordrecht, The Netherlands, 2017; pp. 133–186. [Google Scholar] [CrossRef]

| Variable | Taiwan (n = 333) | Japan (n = 500) | Indonesia (n = 517) |

|---|---|---|---|

| Mean | Mean | Mean | |

| Female | 0.750 | 0.850 | 0.970 |

| 40 years old or younger | 0.675 | 0.200 | 0.964 |

| Full-time employee | 0.778 | 0.488 | 0.402 |

| High level of education (16 years or above) | 0.757 | 0.592 | 0.141 |

| Urban area | 0.830 | 0.892 | 0.760 |

| Number of people in household (1–2 people) | 0.160 | 0.480 | 0.200 |

| Has children at home | 0.475 | 0.300 | 0.580 |

| High Income -Taiwan: NTD 75,001 or above -Japan: JPY 7,000,001 or above -Indonesia: Rp 4,500,001 or above | 0.289 | 0.384 | 0.490 |

| Food Values | Minority Group (Class 1) | Middle Group (Class 2) | Majority Group (Class 3) |

|---|---|---|---|

| Product origin label | −2.301 *** (0.193) | 0.260 (0.176) | 1.836 *** (0.099) |

| Food safety certified | −0.741 *** (0.143) | 1.407 *** (0.188) | 2.667 *** (0.102) |

| High quality appearance | −0.834 *** (0.147) | 0.827 *** (0.191) | 0.419 *** (0.088) |

| Domestic rarity | −3.845 *** (0.212) | 1.329 *** (0.171) | −1.099 *** (0.085) |

| Plantations | −3.255 *** (0.194) | −0.374 * (0.178) | 0.686 *** (0.085) |

| Freshness | 0.286 * (0.137) | 1.188 *** (0.200) | 1.868 *** (0.097) |

| Class assignment | |||

| Intercept | 0.345 (0.323) | 1.301 *** (0.248) | |

| Gender | −0.468 ** (0.180) | 0.222 (0.127) | |

| (1 = female, 0 = male) | |||

| Age | 0.303 (0.210) | −0.812 *** (0.125) | |

| (1 = 40 years old or younger, 0 = 41 years old or older) | |||

| Occupation | −0.592 ** (0.185) | −0.235 (0.127) | |

| (1 = full-time employee, 0 = not full-time employee) | |||

| Education | −0.263 (0.223) | 0.111 (0.141) | |

| (1 = high level of education, 0 = low level of education) | |||

| Living place | −0.511 * (0.236) | −0.047 (0.178) | |

| (1 = urban area, 0 = rural area) | |||

| Having children in household (1 = yes, 0 = no) | −0.190 (0.177) | 0.201 (0.116) | |

| Number of people in household (1 = 1–2 people, 0 = more than 2 people) | 0.190 (0.270) | 0.790 *** (0.179) | |

| Income | 0.604 *** (0.180) | −0.340 ** (0.129) | |

| (1 = high income, 0 = low income) | |||

| Model statistics | |||

| Class shares | 0.164 | 0.232 | 0.604 |

| Number of observations | 2331 | ||

| Log likelihood | −4146.500 | ||

| Food Values | Middle Group (Class 2) | Majority Group (Class 3) | Minority Group (Class 1) |

|---|---|---|---|

| Product origin label | −3.009 *** (0.182) | 1.353 *** (0.089) | 0.064 (0.114) |

| Food safety certified | −2.465 *** (0.160) | 2.432 *** (0.100) | 0.138 (0.115) |

| High quality appearance | −5.375 *** (0.198) | −2.260 *** (0.103) | −0.329 ** (0.123) |

| Domestic rarity | −5.300 *** (0.204) | −1.685 *** (0.095) | −0.013 (0.120) |

| Plantations | −3.906 *** (0.196) | 0.452 *** (0.086) | −0.358 ** (0.126) |

| Freshness | −1.075 *** (0.125) | 1.623 *** (0.095) | 0.385 *** (0.113) |

| Class assignment | |||

| Intercept | 0.116 (0.199) | −1.241 *** (0.304) | |

| Gender | 0.463 *** (0.121) | −0.259 (0.169) | |

| (1 = female, 0 = male) | |||

| Age | −0.298 ** (0.113) | 0.854 *** (0.133) | |

| (1 = 40 years old or younger, 0 = 41 years old or older) | |||

| Occupation | −0.668 *** (0.094) | −0.331 * (0.145) | |

| (1 = full-time employee, 0 = not full-time employee) | |||

| Education | 0.120 (0.090) | −0.073 (0.131) | |

| (1 = high level of education, 0 = low level of education) | |||

| Living place | 0.539 *** (0.128) | 0.237 (0.211) | |

| (1 = urban area, 0 = rural area) | |||

| Having children in household (1 = yes, 0 = no) | −0.430 *** (0.122) | 0.525 * (0.233) | |

| Number of people in household (1 = 1–2 people, 0 = more than 2 people) | −0.022 (0.110) | 0.744 ** (0.228) | |

| Income | 0.617 *** (0.094) | −0.089 (0.147) | |

| (1 = high income, 0 = low income) | |||

| Model statistics | |||

| Class shares | 0.415 | 0.466 | 0.120 |

| Number of observations | 3500 | ||

| Log likelihood | −5662.700 | ||

| Food Values | Middle Group (Class 2) | Majority Group (Class 3) | Minority Group (Class 1) |

|---|---|---|---|

| Product origin label | −2.449 *** (0.105) | −0.076 (0.077) | −0.598 *** (0.127) |

| Food safety certified | −0.731 *** (0.092) | 2.666 *** (0.110) | 2.349 *** (0.150) |

| High quality appearance | −0.561 *** (0.095) | 0.446 *** (0.090) | 0.854 *** (0.130) |

| Domestic rarity | −2.066 *** (0.100) | −0.792 *** (0.079) | 2.618 *** (0.155) |

| Plantations | −2.278 *** (0.109) | 0.426 *** (0.088) | −0.020 (0.127) |

| Freshness | 0.510 *** (0.091) | 2.071 *** (0.104) | 2.158 *** (0.161) |

| Class assignment | |||

| Intercept | 1.051 ** (0.377) | −2.228 *** (0.523) | |

| Gender (1 = female, 0 = male) | −0.197 (0.220) | 0.875 (0.977) | |

| Age | −0.113 (0.207) | −0.081 (0.250) | |

| (1 = 40 years old or younger, 0 = 41 years old or older) | |||

| Occupation | −0.101 (0.089) | −0.285 * (0.120) | |

| (1 = full-time employee, 0 = not full-time employee) | |||

| Education | −0.041 (0.114) | −0.346 * (0.136) | |

| (1 = high level of education, 0 = low level of education) | |||

| Living place | −0.410 (0.234) | 0.846 (0.978) | |

| (1 = urban area, 0 = rural area) | |||

| Having children in household (1 = yes, 0 = no) | −0.165 (0.101) | 0.409 ** (0.151) | |

| Number of people in household (1 = 1–2 people, 0 = more than 2 people) | 0.067 (0.121) | 0.423 * (0.165) | |

| Income | −0.080 (0.085) | 0.067 (0.108) | |

| (1 = high income, 0 = low income) | |||

| Model statistics | |||

| Class shares | 0.252 | 0.721 | 0.027 |

| Number of observations | 3619 | ||

| Log likelihood | −6664.000 | ||

| Variables | Percentage | |||

|---|---|---|---|---|

| All Samples | Minority Group | Middle Group | Majority Group | |

| Gender | ||||

| Female | 74.78 | 15.46 | 13.67 | 70.86 |

| Age | ||||

| 40 years old or younger | 67.27 | 22.01 | 42.11 | 35.89 |

| Occupation | ||||

| Full-time employee | 66.67 | 21.35 | 16.68 | 61.97 |

| Education | ||||

| High level of education | 75.68 | 16.16 | 17.55 | 66.30 |

| Living Place | ||||

| Urban area | 89.19 | 18.69 | 15.83 | 65.48 |

| Having children in household | ||||

| Yes | 47.45 | 15.02 | 17.56 | 67.42 |

| Number of people in household | ||||

| 1–2 people | 16.52 | 9.26 | 15.82 | 74.92 |

| Income | ||||

| High income | 28.83 | 16.14 | 41.69 | 42.17 |

| Class Share | 16.43 | 23.21 | 60.35 | |

| Variable | Percentage | |||

|---|---|---|---|---|

| All Samples | Minority Group | Middle Group | Majority Group | |

| Gender | ||||

| Female | 85.00 | 7.41 | 33.25 | 59.34 |

| Age | ||||

| 40 years old or younger | 20.40 | 27.02 | 39.80 | 33.18 |

| Occupation | ||||

| Full-time employee | 54.20 | 11.64 | 56.06 | 32.30 |

| Education | ||||

| High level of education | 59.00 | 10.59 | 39.45 | 49.96 |

| Living Place | ||||

| Urban area | 90.00 | 11.12 | 30.38 | 58.49 |

| Having children in household | ||||

| Yes | 30.20 | 22.01 | 45.07 | 32.93 |

| Number of people in household | ||||

| 1–2 people | 48.00 | 22.47 | 36.95 | 40.59 |

| Income | ||||

| High income | 38.40 | 7.91 | 29.90 | 62.20 |

| Class Share | 11.98 | 41.46 | 46.56 | |

| Variable | Percentage | |||

|---|---|---|---|---|

| All Samples | Minority Group | Middle Group | Majority Group | |

| Gender | ||||

| Female | 96.71 | 7.16 | 27.71 | 65.13 |

| Age | ||||

| 40 years old or younger | 95.94 | 2.72 | 27.35 | 69.93 |

| Occupation | ||||

| Full-time employee | 42.17 | 2.21 | 27.26 | 70.53 |

| Education | ||||

| High level of education | 81.05 | 1.99 | 26.16 | 71.85 |

| Living Place | ||||

| Urban area | 96.90 | 7.97 | 31.75 | 60.29 |

| Having children in household | ||||

| Yes | 58.80 | 4.52 | 27.88 | 67.60 |

| Number of people in household | ||||

| 1–2 people | 20.70 | 3.89 | 23.68 | 72.43 |

| Income | ||||

| High income | 49.70 | 3.07 | 26.61 | 70.32 |

| Class Share | 2.71 | 25.19 | 72.09 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.-H.; Panjaitan, B.P. A Multi-Country Comparison of Consumers’ Preferences for Imported Fruits and Vegetables. Horticulturae 2021, 7, 578. https://doi.org/10.3390/horticulturae7120578

Yang S-H, Panjaitan BP. A Multi-Country Comparison of Consumers’ Preferences for Imported Fruits and Vegetables. Horticulturae. 2021; 7(12):578. https://doi.org/10.3390/horticulturae7120578

Chicago/Turabian StyleYang, Shang-Ho, and Bella Pebriyani Panjaitan. 2021. "A Multi-Country Comparison of Consumers’ Preferences for Imported Fruits and Vegetables" Horticulturae 7, no. 12: 578. https://doi.org/10.3390/horticulturae7120578

APA StyleYang, S.-H., & Panjaitan, B. P. (2021). A Multi-Country Comparison of Consumers’ Preferences for Imported Fruits and Vegetables. Horticulturae, 7(12), 578. https://doi.org/10.3390/horticulturae7120578