Exploring the Ingredient Choices and Maximum Budget for Fresh Food Boxes in Taiwan

Abstract

1. Introduction

2. Materials and Methods

2.1. Data Collecting

2.2. Methodologies

2.2.1. One-Way ANOVA F-TEST

2.2.2. Interval Regression Model

3. Theory and Calculation

3.1. Random Utility Approach

3.2. The Estimation of Maximum Budget

4. Results and Discussions

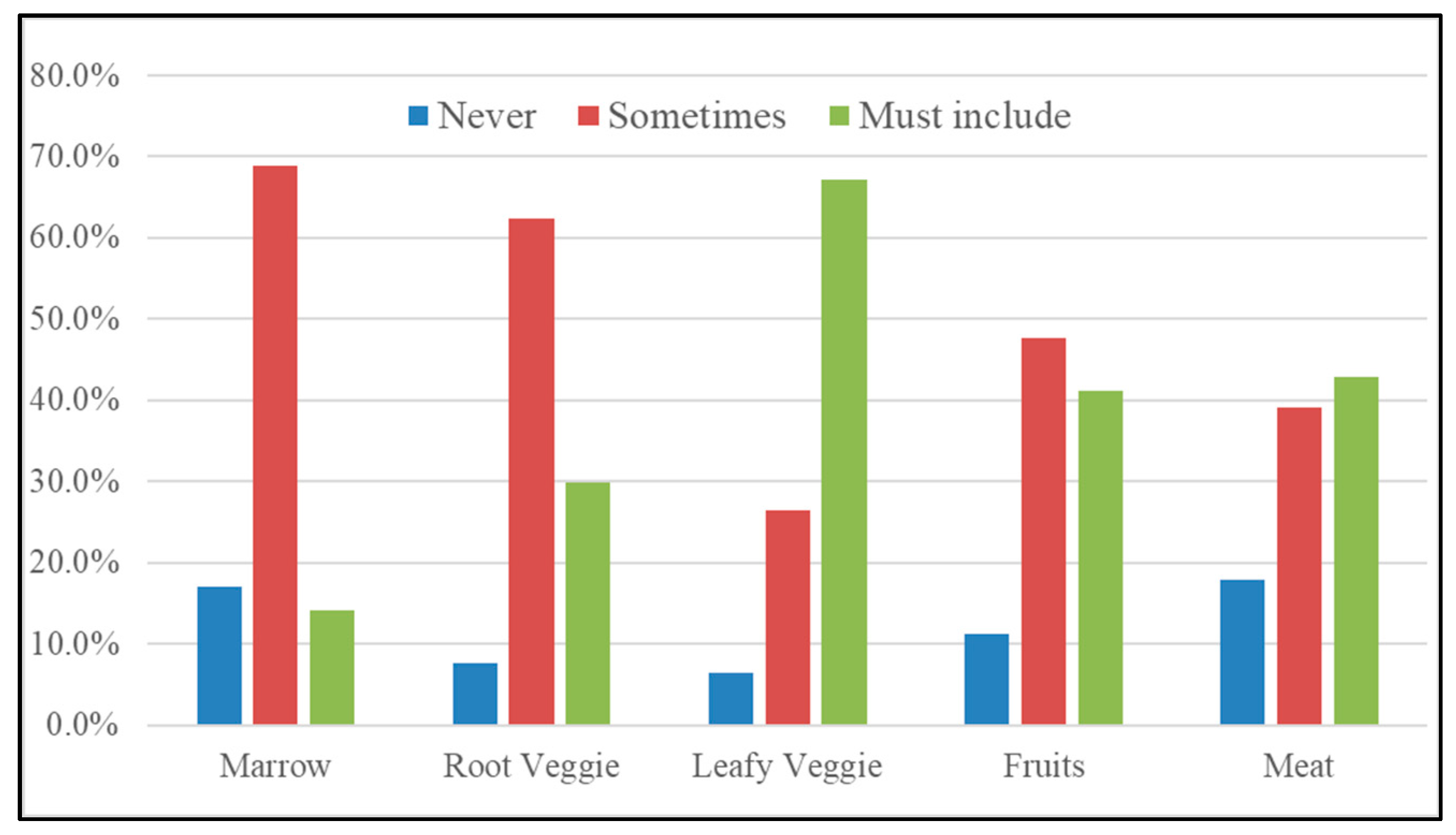

4.1. Descriptive Analysis

4.2. The ANOVA F-TEST

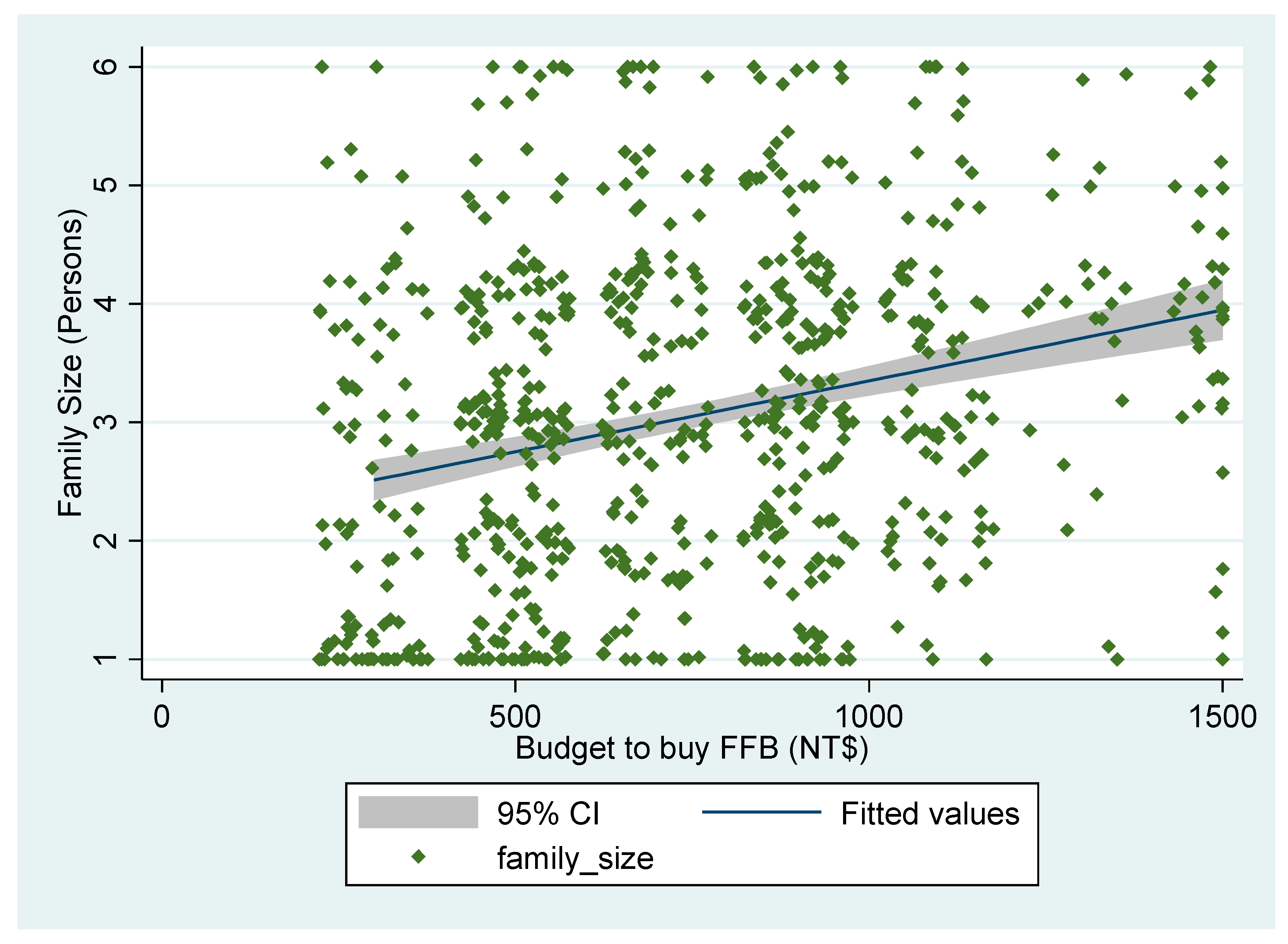

4.2.1. Relationship between Family Size and Fresh Food Box Budget

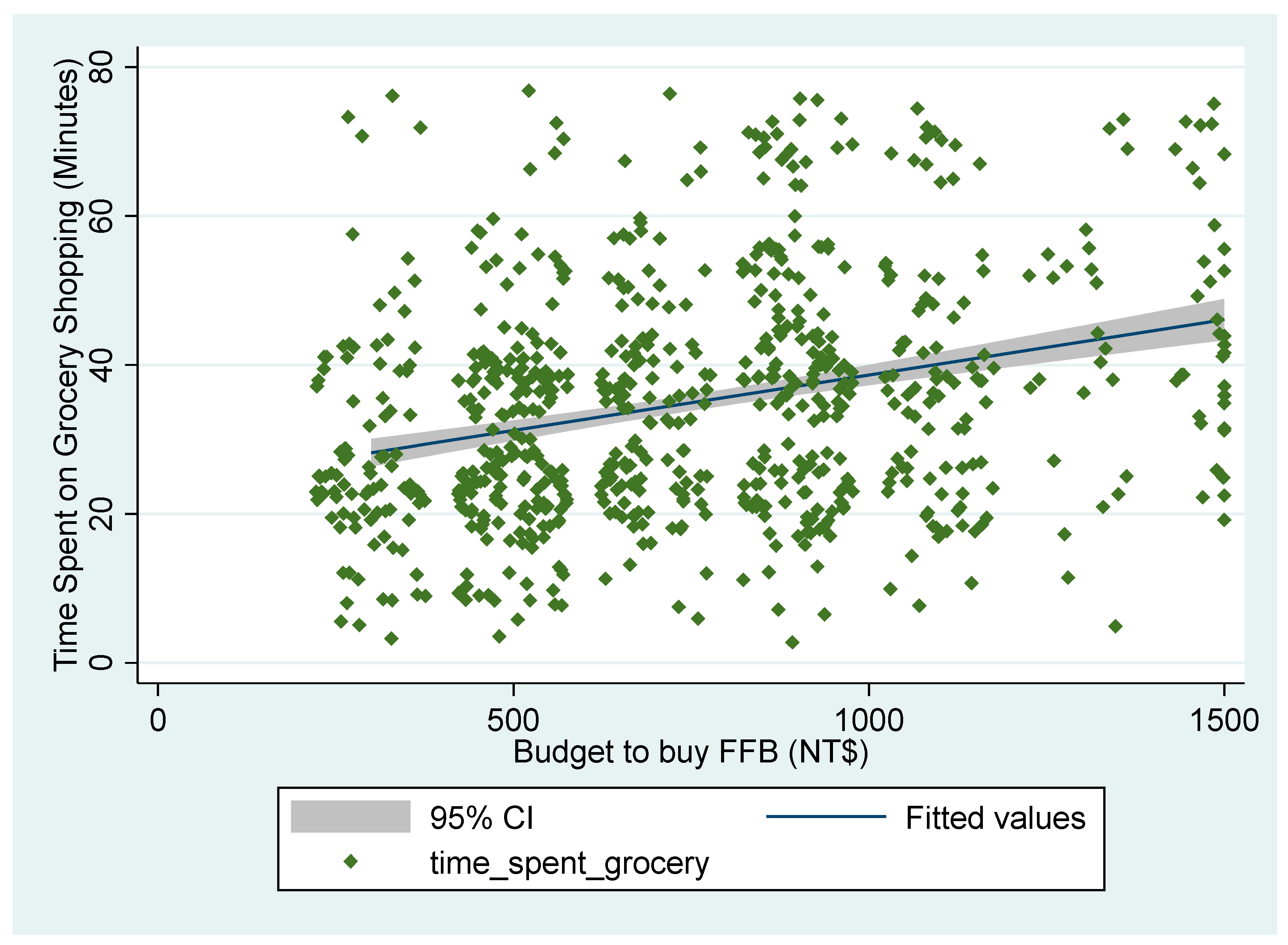

4.2.2. Relationship between Time Spent on Grocery Shopping and Fresh Food Box Budget

4.3. The Interval Regression Models

4.4. The Elicitation of Maximum Budget

4.5. Discussions

5. Conclusions

6. Limitation

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Brown, E.; Dury, S.; Holdsworth, M. Motivations of Consumers That Use Local, Organic Fruit and Vegetable Box Schemes in Central England and Southern France. Appetite 2009, 53, 183–188. [Google Scholar] [CrossRef] [PubMed]

- Thom, A.; Conradie, B. Urban Agriculture’s Enterprise Potential: Exploring Vegetable Box Schemes in Cape Town. Agrekon 2013, 52, 64–86. [Google Scholar] [CrossRef]

- Haldy, H.M. Organic Food Subscription Schemes in Germany, Denmark, the Netherlands and the United Kingdom. Definitions and Patterns of Development in an International Context. Master’s Thesis, Aston Business School, Birmingham, UK, 2004. [Google Scholar]

- Soil Association. Organic Market Report 2014. Soil Association Scotland. Available online: https://www.palomaquaculture.com/support-files/palom-aquaculture-soil-association-report-2014_opt.pdf (accessed on 10 March 2021).

- Schermer, M. From “Food from Nowhere” to “Food from Here”: Changing Producer–Consumer Relations in Austria. Agric. Hum. Values 2014, 32, 121–132. [Google Scholar] [CrossRef]

- Jones, P.; Comfort, D.; Hillier, D. A case study of local food and its routes to market in the UK. Br. Food J. 2004, 106, 328–335. [Google Scholar] [CrossRef]

- Economic Development R.O.C (Taiwan). Available online: https://ws.ndc.gov.tw/Download.ashx?u=LzAwMS9hZG1pbmlzdHJhdG9yLzEwL3JlbGZpbGUvNTYwNy83MzEvMDAxOTgyMy5wZGY%3D&n=RWNvbm9taWMgRGV2ZWxvcG1lbnQgUi5PLkMgKFRhaXdhbikoMjAxMykucGRm&icon=..pdf. (accessed on 10 March 2021).

- Chen, M.F. Consumer’s trust-in-food-safety typology in Taiwan: Food-related lifestyle matters. Health Risk Soc. 2011, 13, 503–526. [Google Scholar] [CrossRef]

- Convenience Store Numbers Rose 5% Last Year: Survey. Taipei Times. 2020. Available online: https://www.taipeitimes.com/News/biz/archives/2020/08/08/2003741290 (accessed on 10 March 2021).

- Ho, P.S. The top-10 food retailers in Taiwan: Industry needs a leader. Business Next. 2018. Available online: https://www.bnext.com.tw/article/49319/offline-retail-much-bigger-than-online-in-tw (accessed on 7 October 2021).

- Central Region Office, Ministry of Economic Affairs. National Public and Private Traditional Markets Statistics. 2019. Available online: https://www.cto.moea.gov.tw/upload/statistics_upload/%E5%85%A8%E5%9C%8B%E5%85%AC%E6%B0%91%E7%87%9F%E5%82%B3%E7%B5%B1%E9%9B%B6%E5%94%AE%E5%B8%82%E5%A0%B4%E5%8F%8A%E6%94%A4%E8%B2%A9%E9%9B%86%E4%B8%AD%E5%A0%B4%E7%B5%B1%E8%A8%88%E8%A1%A8.pdf. (accessed on 7 October 2021).

- Varelala, M.O.; Huang, W.C.; Sanyang, S. Consumer Behavior and Preference in the Fruit Markets of Taiwan. Agric. Econ. Market. J. 2009, 2, 19–28. [Google Scholar]

- Statista. Annual Expenditure on Food, Beverage, and Tobacco Per Household in Taiwan from 2009 to 2019. Available online: https://www.statista.com/statistics/922694/taiwan-expenditure-on-food-beverage-tobacco-per-household/ (accessed on 3 August 2021).

- Taiwan—Fresh Fruits. Available online: https://www.export.gov/apex/article2?id=Taiwan-Fresh-Fruit (accessed on 10 March 2021).

- Yang, E.C.L.; Lattimore, C.K. Food and the Perception of Eating: The Case of Young Taiwanese Consumers. Asia Pac. J. Tour. Res. 2015, 20, 1545–1564. [Google Scholar] [CrossRef]

- Boutelle, K.; Fulkerson, J.; Neumark-Sztainer, D.; Story, M.; French, S. Fast food for family meals: Relationships with parent and adolescent food intake, home food availability and weight status. Public Health Nutr. 2007, 10, 16–23. [Google Scholar] [CrossRef]

- Pan, W.H.; Wu, H.J.; Yeh, C.J.; Chuang, S.Y.; Chang, H.Y.; Yeh, N.H.; Hsieh, Y.T. Diet and health trends in Taiwan: Comparison of two nutrition and health surveys from 1993–1996 and 2005–2008. Asia Pac. J. Clin. Nutr. 2011, 20, 238–250. [Google Scholar]

- Simmons, D.; Chapman, G.E. The significance of home cooking within families. Br. Food J 2012, 114, 1184–1195. [Google Scholar] [CrossRef]

- Tiwari, A.; Aggarwal, A.; Tang, W.; Drewnowski, A. Cooking at home: A strategy to comply with US dietary guidelines at no extra cost. Am. J. Prev. Med. 2017, 52, 616–624. [Google Scholar] [CrossRef]

- Daniels, S.; Glorieux, I.; Minnen, J.; van Tienoven, T.P. More than preparing a meal? Concerning the meanings of home cooking. Appetite 2012, 58, 1050–1056. [Google Scholar] [CrossRef]

- Wolfson, J.A.; Bleich, S.N.; Smith, K.C.; Frattaroli, S. What does cooking mean to you? Perceptions of cooking and factors related to cooking behavior. Appetite 2016, 97, 146–154. [Google Scholar] [CrossRef] [PubMed]

- Guthrie, J.F.; Lin, B.H.; Frazao, E. Role of food prepared away from home in the American diet, 1977–1978 versus 1994–1996: Changes and consequences. J. Nutr. Educ. Behav. 2002, 34, 140–150. [Google Scholar] [CrossRef]

- Orfanos, P.; Naska, A.; Trichopoulos, D.; Slimani, N.; Ferrari, P.; van Bakel, M.; Deharveng, G.; Overvad, K.; Tjønneland, A.; Halkjaer, J.; et al. Eating out of home and its correlates in 10 European countries. The European Prospective Investigation into Cancer and Nutrition (EPIC) study. Public Health Nutr. 2007, 10, 1515–1525. [Google Scholar] [CrossRef] [PubMed]

- Hearst, M.; Pasch, K.; Laska, M. Urban v. suburban perceptions of the neighbourhood food environment as correlates of adolescent food purchasing. Public Health Nutr. 2012, 15, 299–306. [Google Scholar] [CrossRef][Green Version]

- Smith, L.; Ng, S.; Popkin, B. Trends in US home food preparation and consumption: Analysis of national nutrition surveys and time use studies from 1965–1966 to 2007–2008. Nutr. J. 2013, 12, 45. [Google Scholar] [CrossRef] [PubMed]

- Wolfson, J.; Leung, C.; Richardson, C. More frequent cooking at home is associated with higher Healthy Eating Index-2015 score. Public Health Nutr. 2020, 23, 2384–2394. [Google Scholar] [CrossRef]

- Flesher, M.; Woo, P.; Chiu, A.; Charlebois, A.; Warburton, D.E.; Leslie, B. Self-management and biomedical outcomes of a cooking, and exercise program for patients with chronic kidney disease. J. Renal Nutr. 2011, 21, 188–195. [Google Scholar] [CrossRef]

- Chen, R.; Lee, M.; Chang, Y.; Wahlqvist, M. Cooking frequency may enhance survival in Taiwanese elderly. Public Health Nutr. 2012, 15, 1142–1149. [Google Scholar] [CrossRef]

- Maguire, E.R.; Burgoine, T.; Monsivais, P. Area deprivation and the food environment over time: A repeated cross-sectional study on takeaway outlet density and supermarket presence in Norfolk, UK, 1990–2008. Health Place 2015, 33, 142–147. [Google Scholar] [CrossRef]

- Result of the 2002 Farmer Survey. Available online: https://core.ac.uk/download/pdf/10925154.pdf (accessed on 10 March 2021).

- Hashem, S.; Migliore, G.; Schifani, G.; Schimmenti, E.; Padel, S. Motives for buying local, organic food through English box schemes. Br. Food J. 2018, 120, 1600–1614. [Google Scholar] [CrossRef]

- Blankenhorn, B.; Demkina, T.; Franzmayr, S.; Funk, A.; Iwanov, G.; Jelović, D.; Lechthaler, S.; Paris, P.; Perrin, A.; Anna, S.; et al. Organic Box Schemes. In Student Report within Lecture “Organic Farming and Regional Development” (Lecture Nr. 933.316), Summer Term 2016; Kummer, S., Ed.; University of Natural Resources and Life Sciences Vienna: Vienna, Austria, 2016; 109p, Available online: https://short.boku.ac.at/643epz (accessed on 10 March 2021).

- Milestad, R.; Kummer, S.; Hirner, P. Does Scale Matter? Investigating the Growth of a Local Organic Box Scheme in Austria. J. Rural Stud. 2017, 54, 304–313. [Google Scholar] [CrossRef]

- Kummer, S.; Milestad, R. The Diversity of Organic Box Schemes in Europe—An Exploratory Study in Four Countries. Sustainability 2020, 12, 2734. [Google Scholar] [CrossRef]

- Wang, X.; Cheng, Z. Cross-sectional studies: Strengths, weaknesses, and recommendations. Chest 2020, 158, S65–S71. [Google Scholar] [CrossRef]

- Gill, J.; Johnson, P. Research Methods for Managers, 4th ed.; Sage Publication Ltd.: Thousand Oaks, CA, USA, 2010. [Google Scholar]

- Taherdoost, H. Determining sample size; how to calculate survey sample size. Int. J. Econ. Manag. Syst. 2017, 2, 237–239. [Google Scholar]

- Hu, M.C.; Chen, Y.H.; Huang, L.C. A sustainable vegetable supply chain using plant factories in Taiwanese markets: A nashcournot model. Int. J. Prod. Econ. 2014, 152, 49–56. [Google Scholar] [CrossRef]

- Hsieh, S.C. Organic Farming for Sustainable Agriculture in Asia with Special Reference to Taiwan Experience; Food and Fertilizer Technology Center (FFTC) for the Asian and Pacific Region: Taipei, Taiwan, 2005; Available online: https://www.fftc.org.tw/en/publications/main/1287 (accessed on 10 March 2021).

- Barten, A.P.; Böhm, V. Chapter 9 consumer theory. Handbook Math. Econ. 1982, 2, 381–429. [Google Scholar]

- McFadden, D. Economic choices. Am. Econ. Rev. 2001, 91, 351–378. [Google Scholar] [CrossRef]

- Bruin, J. Interval Regression Stata Data Analysis Examples; UCLA, Statistical Consulting Group: Shenzhen, China, 2006; Available online: https://stats.idre.ucla.edu/stata/dae/interval-regression/ (accessed on 10 March 2021).

- Wooldridge, J.M. Econometric Analysis of Cross Section and Panel Data; MIT Press: Cambridge, MA, USA, 2002; pp. 508–509. [Google Scholar]

- National Development Council Population Projections for the R.O.C (Taiwan). Available online: https://pop-proj.ndc.gov.tw/main_en/dataSearch.aspx?uid=78&pid=78 (accessed on 10 March 2021).

- Shiu, E.C.; Dawson, J.A. Demographic segmentation of shoppers at traditional markets and supermarkets in Taiwan. J. Segm. Mark. 2001, 4, 69–85. [Google Scholar] [CrossRef]

- Li, H.; Houston, J.E. Factors affecting consumer preferences for major food markets in Taiwan. J. Food Distrib. Res. 2001, 32, 97–109. [Google Scholar]

- Pisarn, P.; Kim, M.K.; Yang, S.-H. A Potential Sustainable Pathway for Community-Supported Agriculture in Taiwan: The Consumer Perspective in a Farmers’ Market. Sustainability 2020, 12, 8917. [Google Scholar] [CrossRef]

- Investment Opportunities in the Food Industry in Taiwan. Available online: https://www.roc-taiwan.org/uploads/sites/20/2015/08/48181647971.pdf (accessed on 10 March 2021).

- Overview of Statistical Survey Results over the Years. Available online: https://eng.stat.gov.tw/public/Data/4815173411ECWGCXEJ.pdf (accessed on 10 March 2021).

- Nugraha, W.S.; Yang, S.-H.; Ujiie, K. The Heterogeneity of Consumer Preferences for Meat Safety Attributes in Traditional Markets. Foods 2021, 10, 624. [Google Scholar] [CrossRef]

- Chang, C. Taiwan Retail Foods Report. USDA 2019, TW19022. Available online: https://apps.fas.usda.gov/newgainapi/api/report/downloadreportbyfilename?filename=Taiwan%20Retail%20Foods%20Report_Taipei%20ATO_Taiwan_7-29-2019.pdf (accessed on 10 March 2021).

- Fromm, J. Marketing Convenience to the Modern Consumer. Forbes. 2019. Available online: https://www.forbes.com/sites/jefffromm/2019/01/04/marketing-convenience-to-the-modern-consumer/?sh=62e86e1d127f (accessed on 20 September 2021).

- Katawetawaraks, C.; Wang, C.L. Online Shopper Behavior: Influences of Online Shopping Decision. Asian J. Bus. Res. 2011, 1, 66–74. [Google Scholar] [CrossRef]

- Seyfang, G. New Initiatives for Sustainable Food: A Case Study of an Organic Producerco-Operative (Working Paper EDM 04-11). Centre for Social and Economic Researchon the Global Environment. 2004. Available online: http://hdl.handle.net/10419/80233 (accessed on 28 September 2021).

- Nielsen Taiwan. Taiwanese Consumers’ Purchasing Behaviours and Divers of Horticulture Products: Based on Consumer Testing and Focus Group Discussions, as well as In-depth Interviews with Supermarket Managers. Nielsen Holdings N.V.; 2017. Available online: https://www.publications.qld.gov.au/dataset/d1da5ddc-acc1-4801-992d-7dd7f066ef3f/resource/5dbfd0fc-6bda-4aa8-93d7-842f30fba5d1/download/taiwan-purchasing-behaviours-and-drivers-report.pdf (accessed on 9 September 2021).

- Broekhuizen, T.; Huizingh, E. Online purchase determinants: Is their effect moderated by direct experience? Manag. Res. News 2009, 32, 440–457. [Google Scholar] [CrossRef]

- Thilakarathne, N.; Jayasinghe-Mudalige, U.; Udagama, J.; Edirisinghe, J.; Herath, H. Role of information on women consumer decision making on food quality: An analysis based on visual presentation of dairy quality attributes. J. Agric. Sci. 2015, 10, 109. [Google Scholar] [CrossRef]

- Heath, C.; Soll, J.B. Mental budgeting and consumer decisions. J. Consum. Res. 1996, 23, 40–52. [Google Scholar] [CrossRef]

- Wu, W. New Vegetable Boxes Available for Delivery in Taiwan. Taiwan News. 2021. Available online: https://www.taiwannews.com.tw/en/news/4207175 (accessed on 9 September 2021).

- Chang, H.H.; Meyerhoefer, C.D. COVID-19 and the demand for online food shopping services: Empirical Evidence from Taiwan. Am. J. Agric. Econ. 2020, 103, 448–465. [Google Scholar] [CrossRef]

- Evans, C. Coronavirus: Fruit and Veg Box Demand Increases. BBC News. 2020. Available online: https://www.bbc.com/news/uk-wales-52328344 (accessed on 9 September 2021).

- Gangloff, C. COVID-19 Pandemic Has Mixed Impact on Fresh Produce Corrugated Box Market. CISION PR Newswire. 2021. Available online: https://www.prnewswire.com/news-releases/covid-19-pandemic-has-mixed-impact-on-fresh-produce-corrugated-box-market-301334796.html (accessed on 9 September 2021).

| Dependent Variables | Variable Type | Mean |

|---|---|---|

| MaxBudgetHigher | CV, if FFB max-budget is higher than grocery budget | 855.16 |

| MaxBudgetSame | CV, if FFB max-budget is same with grocery budget | 656.62 |

| MaxBudgetLower | CV, if FFB max-budget is lower than grocery budget | 608.61 |

| MaxBudgetAll Sample | CV, max-budget for all sample | 749.20 |

| Independent Variables | ||

| Socio-economic background | ||

| Gender | DV = 1 if one is female | 0.69 |

| Age | CV, years of age | 32.35 |

| Monthly income | CV, monthly income (unit: NTD 1000) | 61.86 |

| Junior school graduated | DV = 1 if one graduated from junior school | 0.01 |

| High school graduated | DV = 1 if one graduated from high school | 0.07 |

| Family size | CV, number of family members (persons) | 3.05 |

| Number of children | CV, number of children at home (persons) | 1.28 |

| North | DV = 1 if one lives in the Northern region | 0.30 |

| Central | DV = 1 if one lives in the Central region | 0.50 |

| Urban | DV = 1 if one lives in the urban area | 0.71 |

| Suburb | DV = 1 if one lives in the suburb area | 0.14 |

| Grocery shopping behaviors | ||

| Frequency of eating out | CV, frequency of eating out per week | 8.15 |

| Frequency of cooking | CV, frequency of cooking at home per week | 5.84 |

| Time spent on grocery | CV, time spent on grocery shopping (minutes) | 34.91 |

| Frequently visiting traditional market | DV = 1 if one visits traditional market often frequently | 0.26 |

| Frequently visiting supermarket | DV = 1 if one visits supermarket often frequently | 0.55 |

| Frequently visiting hypermarket | DV = 1 if one visits hypermarket often frequently | 0.27 |

| Frequently visiting farmer market | DV = 1 if one visits farmer market often frequently | 0.02 |

| Frequently visiting online market | DV = 1 if one visits online market often frequently | 0.03 |

| Reason to buy FFB | ||

| Because of holidays | DV = 1 if one buys FFB because of holidays | 0.16 |

| Because of group shopping | DV = 1 if one buys FFB because of group shopping | 0.49 |

| Ingredient-choice preferences of FFB | ||

| Must include marrow vegetables | DV = 1 if one must include marrow vegetables in FFB | 0.14 |

| Must include root vegetables | DV = 1 if one must include root vegetables in FFB | 0.31 |

| Must include leafy vegetables | DV = 1 if one must include leafy vegetables in FFB | 0.68 |

| Must include fruits | DV = 1 if one must include fruits in FFB | 0.42 |

| Must include meats | DV = 1 if one must include meat in FFB | 0.44 |

| Variables | MaxBudget Higher | MaxBudget Same | MaxBudget Lower | MaxBudget All Sample |

|---|---|---|---|---|

| Coefficient | Coefficient | Coefficient | Coefficient | |

| Socio-economic background | ||||

| Gender | −52.39 | −25.45 | −7.17 | −49.94 ** |

| Age | 6.74 *** | 8.28 *** | 4.84 *** | 5.94 *** |

| Monthly income | 0.63 | 2.94 *** | 1.07 | 1.36 *** |

| Junior school graduated | 115.60 | −25.33 | 85.68 | 165.30 |

| High school graduated | −35.60 | 38.30 | −63.93 | 2.92 |

| Family size | 23.27 ** | 55.43 *** | −4.75 | 41.98 *** |

| Number of children | 3.54 | 8.08 | 25.77 | −9.84 |

| North | 29.30 | 65.86 | 55.57 | 46.70 |

| Central | −3.23 | 82.75 | 110.95 ** | 65.11 ** |

| Urban | −6.17 | −37.21 | −39.64 | −1.50 |

| Suburb | −39.09 | −22.48 | −0.22 | −10.90 |

| Grocery shopping behaviors | ||||

| Frequency of eating out | −6.69 | −7.82 | 3.19 | −4.39 |

| Frequency of cooking | −7.94 | −2.95 | 5.28 | −1.67 |

| Time spent on grocery | 3.95 *** | 8.93 *** | 4.97 *** | 4.54 *** |

| Frequently visiting traditional market | −27.39 | −12.56 | −41.26 | −22.26 |

| Frequently visiting supermarket | 37.30 | −18.23 | −22.43 | 19.09 |

| Frequently visiting hypermarket | 22.60 | −55.61 | −16.90 | −25.23 |

| Frequently visiting farmer market | −28.35 | 169.76 | 55.53 | 41.47 |

| Frequently visiting online market | 178.34 *** | −11.93 | 92.21 | 89.51 |

| Reason to buy FFB | ||||

| Because of holidays | −8.72 | −3.46 | 33.45 | 40.84 |

| Because of group shopping | 12.46 | 8.13 | 13.85 | 29.01 |

| Ingredient-choice preferences of FFB | ||||

| Must include marrow vegetables | 104.36 ** | −7.77 | 29.71 | 73.63 |

| Must include root vegetables | 9.49 | 77.80 | 53.86 | 29.56 |

| Must include leafy vegetables | −19.28 | −40.31 | −39.05 | −37.11 |

| Must include fruits | 5.76 | 96.10 | 109.79 ** | 70.40 *** |

| Must include meats | 24.90 | 43.24 | 22.63 | 53.11 ** |

| Constant | 492.43 *** | −266.04 | 77.49 | 155.09 |

| Wald χ2 | 145.36 *** | 6570.44 *** | 2563.48 *** | 234.11 *** |

| Number of observations | 339 | 272 | 137 | 748 |

| Log-Likelihood | −539.27 | −406.16 | −192.47 | −1249.43 |

| AIC | 1134.54 | 866.32 | 438.95 | 2554.86 |

| Variables | Assumed Variable Value | MaxBudget Higher (NTD) | MaxBudget Same (NTD) | MaxBudget Lower (NTD) | MaxBudget All Sample (NTD) |

|---|---|---|---|---|---|

| Socio-economic background | |||||

| Gender | 1 | −49.94 | |||

| Age | 32.35 | 217.90 | 267.76 | 157.60 | 192.21 |

| Monthly income | 61.86 | 181.85 | 84.31 | ||

| Family size | 3.05 | 70.98 | 169.07 | 128.05 | |

| Central | 1 | 110.95 | 65.11 | ||

| Grocery shopping behaviors | |||||

| Time spending on grocery | 34.91 | 138.02 | 311.85 | 173.40 | 158.63 |

| Frequently visiting online market | 1 | 178.34 | |||

| Ingredient-choice preferences of FFB | |||||

| Must include marrow vegetables | 1 | 104.36 | |||

| Must include fruits | 1 | 109.79 | 70.40 | ||

| Must include meats | 1 | 53.11 | |||

| Constant | 1 | 492.43 | |||

| Total of MaxBudget (column sum) | 1202 | 930 | 551 | 702 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vo Nguyen, M.-T.; Kim, M.-K.; Yang, S.-H. Exploring the Ingredient Choices and Maximum Budget for Fresh Food Boxes in Taiwan. Horticulturae 2021, 7, 408. https://doi.org/10.3390/horticulturae7100408

Vo Nguyen M-T, Kim M-K, Yang S-H. Exploring the Ingredient Choices and Maximum Budget for Fresh Food Boxes in Taiwan. Horticulturae. 2021; 7(10):408. https://doi.org/10.3390/horticulturae7100408

Chicago/Turabian StyleVo Nguyen, Minh-Trang, Man-Keun Kim, and Shang-Ho Yang. 2021. "Exploring the Ingredient Choices and Maximum Budget for Fresh Food Boxes in Taiwan" Horticulturae 7, no. 10: 408. https://doi.org/10.3390/horticulturae7100408

APA StyleVo Nguyen, M.-T., Kim, M.-K., & Yang, S.-H. (2021). Exploring the Ingredient Choices and Maximum Budget for Fresh Food Boxes in Taiwan. Horticulturae, 7(10), 408. https://doi.org/10.3390/horticulturae7100408