The Impact of ESG Certifications on Class A Office Buildings in Madrid: A Multi-Criteria Decision Analysis

Abstract

1. Introduction

1.1. Background on ESG and Real Estate

1.2. Research Objectives

2. Literature Review

2.1. ESG Factors, KPIs and Climate Risk in Real Estate

2.2. European Central Bank Directives and Climate Risk

2.3. Multi-Criteria Decision-Making in Real Estate

3. Madrid Office Market Dynamics

4. Multi-Criteria Decision Making in Real Estate

5. Materials and Methods

Research Design

6. MCDM Framework

6.1. Criteria. Scoring and Weighting Process

6.2. Appraisal

6.3. Empirical Results

7. Results

7.1. Statistical Analysis of ESG Impact

- ESG-Certified Buildings (n = 15): Mean = 7.52, SD = 0.68, Median = 7.55, Range = 6.57–8.32

- Non-Certified Buildings (n = 6): Mean = 6.21, SD = 0.74, Median = 6.19, Range = 5.05–7.05

- Rental Rates: Overall (n = 21): Mean = €38.57/sqm/month, SD = €6.23, Median = €39.00, Range = €30–€50

- Asset Values: Overall (n = 21): Mean = €3245/sqm, SD = €823, Median = €3150/sqm, Range = €2100–€4500/sqm.

7.2. ESG Certifications

7.3. Location and Accessibility

7.4. Developer and Owner Influence

7.5. Tenant Appeal and Quality

7.6. Sustainability Features

7.7. Rental Performance

7.8. Brand and Architecture

7.9. Top Performers

7.10. Distribution of Scores

8. Discussion

8.1. Interpretation of Key Findings

8.2. Implications for Stakeholders

8.3. Comparison with Previous Studies

8.4. Applicability to Other Markets

8.5. Limitations of the Study

8.6. Theoretical and Policy Implications

8.7. Acknowledgment of Limitations and Suggestions for Future Research

8.8. Recommendations for Climate Risk Mitigation

9. Conclusions

Supplementary Materials

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Campiglio, E.; Dafermos, Y.; Monnin, P.; Ryan-Collins, J.; Schotten, G.; Tanaka, M. Climate change challenges for central banks and financial regulators. Nat. Clim. Change 2018, 8, 462–468. [Google Scholar] [CrossRef]

- Hardy, C.; Schultz, S.; Gilligan, B.; Mcclung, A.; Tersch, W. Triple bottom line, environmental, social and governance and net zero in commercial real estate. Corp. Real Estate J. 2025, 13, 225–241. [Google Scholar] [CrossRef]

- Ionașcu, E.; Mironiuc, M.; Anghel, I.; Huian, M.C. The Involvement of Real Estate Companies in Sustainable Development—An Analysis from the SDGs Reporting Perspective. Sustainability 2020, 12, 798. [Google Scholar] [CrossRef]

- Morri, G.; Dipierri, A.; Colantoni, F. ESG dynamics in real estate: Temporal patterns and financial implications for REITs returns. J. Eur. Real Estate Res. 2024, 17, 263–285. [Google Scholar] [CrossRef]

- Cordero, A.S.; Melgar, S.G.; Márquez, J.M.A. Green Building Rating Systems and the New Framework Level(s): A Critical Review of Sustainability Certification within Europe. Energies 2019, 13, 66. [Google Scholar] [CrossRef]

- Hristov, I.; Searcy, C. Integrating sustainability with corporate governance: A framework to implement the corporate sustainability reporting directive through a balanced scorecard. Manag. Decis. 2024, 63, 443–467. [Google Scholar] [CrossRef]

- Nugroho, D.; Hsu, Y.; Hartauer, C.; Hartauer, A.I. Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior. Sustainability 2024, 16, 614. [Google Scholar] [CrossRef]

- Yébenes, M.O. Climate change, ESG criteria and recent regulation: Challenges and opportunities. Eurasian Econ. Rev. 2024, 14, 87–120. [Google Scholar] [CrossRef]

- Ziolo, M.; Filipiak, B.Z.; Bąk, I.; Cheba, K. How to design More Sustainable Financial Systems: The roles of environmental, social, and governance factors in the Decision-Making Process. Sustainability 2019, 11, 5604. [Google Scholar] [CrossRef]

- Manioudis, M.; Meramveliotakis, G. Broad strokes towards a grand theory in the analysis of sustainable development: A return to the classical political economy. New Political Econ. 2022, 27, 866–878. [Google Scholar] [CrossRef]

- Huang, Y.; Bai, F.; Shang, M.; Ahmad, M. On the fast track: The benefits of ESG performance on the commercial credit financing. Environ. Sci. Pollut. Res. 2023, 30, 83961–83974. [Google Scholar] [CrossRef] [PubMed]

- Abrudan, L.; Matei, M.; Abrudan, M. Towards Sustainable finance: Conceptualizing future generations as stakeholders. Sustainability 2021, 13, 13717. [Google Scholar] [CrossRef]

- Van Overbeek, R.; Ishaak, F.; Geurts, E.; Remøy, H. The added value of environmental certification in the Dutch office market. J. Eur. Real Estate Res. 2024, 17, 70–86. [Google Scholar] [CrossRef]

- Mangialardo, A.; Micelli, E.; Saccani, F. Does Sustainability Affect Real Estate Market Values? Empirical Evidence from the Office Buildings Market in Milan (Italy). Sustainability 2018, 11, 12. [Google Scholar] [CrossRef]

- Liang, R.; Zheng, X.; Wang, P.-H.; Liang, J.; Hu, L. Research Progress of Carbon-Neutral Design for Buildings. Energies 2023, 16, 5929. [Google Scholar] [CrossRef]

- De Castro, A.V.; Pacheco, G.R.; González, F.J.N. Holistic approach to the sustainable commercial property business: Analysis of the main existing sustainability certifications. Int. J. Strateg. Prop. Manag. 2020, 24, 251–268. [Google Scholar] [CrossRef]

- Karsak, E.E.; Ahiska, S.S. Practical common weight multi-criteria decision-making approach with an improved discriminating power for technology selection. Int. J. Prod. Res. 2025, 43, 1537–1554. [Google Scholar] [CrossRef]

- Erdogan, S.; Naumčik, A. Evaluation of investing in real estate in EU and non-EU countries based on MCDM. In Proceedings of the 13th International Scientific Conference “Modern Building Materials, Structures and Techniques”, Vilnius, Lithuania, 16–17 May 2019; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Le, A.; Rodrigo, N.; Domingo, N.; Senaratne, S. Policy Mapping for Net-Zero-Carbon Buildings: Insights from Leading Countries. Buildings 2023, 13, 2766. [Google Scholar] [CrossRef]

- Bytebier, K.; De Troyer, J. The ECB’s Decarbonization Plan for Corporate Bonds. Eur. Bus. Law Rev. 2024, 35, 81–94. [Google Scholar]

- Brinkman, D.M. Climate-related risks and banking supervision: From climate change risk mitigation to double materiality. Maastricht J. Eur. Comp. Law 2023, 30, 396–413. [Google Scholar] [CrossRef]

- Wilkinson, S.J.; Sayce, S. Decarbonising real estate. J. Eur. Real Estate Res. 2020, 13, 387–408. [Google Scholar] [CrossRef]

- Ahmad, H.; Yaqub, M.; Lee, S. Environmental-, social-, and governance-related factors for business investment and sustainability: A scientometric review of global trends. Environ. Dev. Sustain. 2023, 22, 2965–2987. [Google Scholar] [CrossRef] [PubMed]

- Abubakar, I.; Dano, U. Sustainable urban planning strategies for mitigating climate change in Saudi Arabia. Environ. Dev. Sustain. 2020, 22, 2. [Google Scholar] [CrossRef]

- Kerscher, A.; Schäfers, W. Corporate social responsibility and the market valuation of listed real estate investment companies. Ger. J. Real Estate Res. 2015, 1, 117–143. [Google Scholar] [CrossRef]

- Locurcio, M.; Tajani, F.; Anelli, P.M.Y.D. A multi-criteria decision analysis for the assessment of the real estate credit risks, de Appraisal and Valuation. In Green Energy and Technology; Springer: Cham, Switzerland, 2020; pp. 327–337. [Google Scholar]

- Contat, J.; Hopkins, C.; Mejia, L.; Suandi, M. When climate meets real estate: A survey of the literature. Real Estate Econ. 2024, 52, 618–659. [Google Scholar] [CrossRef]

- Vanhuyse, F.; Piseddu, T.; Moberg, Å. What evidence exists on the impact of climate change on real estate valuation? A systematic map protocol. Environ. Evid. 2023, 12, 1. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Sheedy, E. Climate Risk Management; Taylor & Francis: Oxford, UK, 2021. [Google Scholar]

- Zhang, L.; Bai, E. The regime complexes for global climate governance. Sustainability 2023, 15, 9077. [Google Scholar] [CrossRef]

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

- Ozkan, A.; Temiz, H.; Yildiz, Y. Climate risk, corporate social responsibility, and firm performance. Br. J. Manag. 2022, 34, 1791–1810. [Google Scholar] [CrossRef]

- Hultman, N.E.; Hassenzahl, D.M.; Rayner, S. Climate risk. Annu. Rev. Environ. Resour. 2010, 35, 283–303. [Google Scholar] [CrossRef]

- Karerat, S.; Houghton, A.; Dickinson, G. Leveraging healthy buildings as a tool to apply a people-centric approach to ESG. Corp. Real Estate J. 2023, 13, 32–43. [Google Scholar] [CrossRef]

- Deyris, J. Too green to be true? Forging a climate consensus at the European Central Bank. New Political Econ. 2023, 28, 713–730. [Google Scholar] [CrossRef]

- Redondo, H.; Aracil, E. Climate-related credit risk: Rethinking the credit risk framework. Glob. Policy 2024, 15, 21–33. [Google Scholar] [CrossRef]

- Aloui, D.; Benkraiem, R.; Guesmi, K.; Vigne, S. The European Central Bank and green finance: How would the green quantitative easing affect the investors’ behavior during times of crisis? Int. Rev. Financ. Anal. 2023, 85, 102464. [Google Scholar] [CrossRef]

- Chabot, M.; Bertrand, J. Climate risks and financial stability: Evidence from the European financial system. J. Financ. Stab. 2023, 69, 101190. [Google Scholar] [CrossRef]

- Feng, Z.; Lu-Andrews, R.; Wu, Z. Commercial Real Estate in the Face of Climate Risk: Insights from REITs. J. Real Estate Res. 2024, 1, 29. [Google Scholar] [CrossRef]

- Pérez-Gladish, B.; Ferreira, F.; Zopounidis, C. MCDM/A studies for economic development, social cohesion and environmental sustainability: Introduction. Int. J. Sustain. Dev. World Ecol. 2021, 28, 1–3. [Google Scholar] [CrossRef]

- Clayton, J.; Devaney, S.; Sayce, S. Climate risk and real estate prices: What do we know? Portf. Manag. Res. 2021, 47, 75–90. [Google Scholar] [CrossRef]

- Hakimian, R. Newcivilengineer.com. Available online: https://www.newcivilengineer.com/latest/leading-industry-organisations-launch-new-uk-standard-for-zero-carbon-buildings-24-09-2024/ (accessed on 14 December 2024).

- Hamrouni, A.; Boussaada, R.; Toumi, N.B.F. Corporate social responsibility disclosure and debt financing. J. Appl. Account. Res. 2019, 20, 394–415. [Google Scholar] [CrossRef]

- Ling, D.C.; Robinson, S.; Sanderford, A.R.; Wang, C. Climate change and commercial property markets. J. Reg. Sci. 2024, 64, 2. [Google Scholar] [CrossRef]

- Li, J.; Zhai, Z.; Li, H.; Ding, Y.; Chen, S. Climate change’s effects on the amount of energy used for cooling in hot, humid office buildings and the solutions. J. Clean. Prod. 2024, 442, 2. [Google Scholar] [CrossRef]

- Fernandes, M.S.; Coutinho, B.; Rodrigues, E. The impact of climate change on an office building in Portugal: Measures for a higher energy performance. J. Clean. Prod. 2024, 445, 141255. [Google Scholar] [CrossRef]

- Cellura, M.; Guarino, F.; Longo, S.; Tumminia, G. Climate change and the building sector: Modelling and energy implications to an office building in southern Europe. Energy Sustain. Dev. Energy Sustain. Dev. 2018, 45, 2. [Google Scholar] [CrossRef]

- Amaripadath, D.; Rahif, R.; Zuo, W.; Velickovic, M.; Voglaire, C.; Attia, S. Climate change sensitive sizing and design for nearly zero-energy office building systems in Brussels. Energy Build. 2023, 286, 2. [Google Scholar] [CrossRef]

- Hooyberghs, H.; Verbeke, S.; Lauwaet, D.; Costa, H.; Floater, G.; De Ridder, K. Influence of climate change on summer cooling costs and heat stress in urban office buildings. Clim. Change 2017, 144, 721–735. [Google Scholar] [CrossRef]

- Bagh, T.; Fuwei, J.; Khan, M.A. From risk to resilience: Climate change risk, ESG investments engagement and Firm’s value. Heliyon 2024, 10, 5. [Google Scholar] [CrossRef]

- Naseer, M.M.; Khan, M.A.; Bagh, T.; Guo, Y.; Zhu, X. Firm climate change risk and financial flexibility: Drivers of ESG performance and firm value. Borsa Istanb. Rev. 2023, 24, 106–117. [Google Scholar] [CrossRef]

- Li, M.; Shi, J.; Cao, J.; Fang, X.; Wang, M.; Wang, X. Climate change impacts on extreme energy consumption of office buildings in different climate zones of China. Theor. Appl. Climatol. 2020, 140, 4. [Google Scholar] [CrossRef]

- Bliūdžius, R.; Banionis, K.; Monstvilas, E.; Norvaišienė, R.; Adilova, D.; Prozuments, A.; Borodinecs, A. Analysis of Improvement in the Energy Efficiency of Office Buildings Based on Energy Performance Certificates. Buildings 2024, 14, 2791. [Google Scholar] [CrossRef]

- Olanrewaju, O.I.; Enegbuma, W.I.; Donn, M. Operational, embodied and whole life cycle assessment credits in green building certification systems: Desktop analysis and natural language processing approach. Build. Environ. 2024, 258, 2. [Google Scholar] [CrossRef]

- Dobrovolskienė, N.; Tamošiūnienė, R.; Banaitis, A.; Ferreira, F.A.F.; Banaitienė, N.; Taujanskaitė, K.; Meidutė-Kavaliauskienė, I. Developing a composite sustainability index for real estate projects using multiple criteria decision making. Oper. Res. 2017, 19, 2. [Google Scholar] [CrossRef]

- Zopounidis, C.; Garefalakis, A.; Lemonakis, C.; Passas, I. Environmental, social and corporate governance framework for corporate disclosure: A multicriteria dimension analysis approach. Manag. Decis. 2020, 58, 2473–2496. [Google Scholar] [CrossRef]

- Parvaneh, F.; Hammad, A. Application of Multi-Criteria Decision-Making (MCDM) to select the most sustainable Power-Generating technology. Sustainability 2024, 16, 3287. [Google Scholar] [CrossRef]

- Taherdoost, H.; Madanchian, M. Multi-Criteria Decision Making (MCDM) methods and Concepts. Encyclopedia 2023, 3, 77–87. [Google Scholar] [CrossRef]

- Ghosh, C.; Petrova, M.T. Building Sustainability, Certification, and Price Premiums: Evidence from Europe. J. Real Estate Res. 2023, 42, 516–537. [Google Scholar] [CrossRef]

- Ciambra, A.; Stamos, I.; Siragusa, A. Localizing and Monitoring Climate Neutrality through the Sustainable Development Goals (SDGs) Framework: The Case of Madrid. Sustainability 2023, 15, 4819. [Google Scholar] [CrossRef]

- Metaxas, T.; Juarez, L.; Gavriilidis, G. Planning and Marketing the City for Sustainability: The Madrid Nuevo Norte Project. Res. Pap. Econ. 2021, 13, 2094. [Google Scholar] [CrossRef]

- Camacho, M.; Ramallo, S.; Ruiz, M. Price and Spatial Distribution of Office Rental in Madrid: A Decision Tree Analysis. Economia 2021, 44, 20–40. [Google Scholar] [CrossRef]

- Suárez, M.; Rieiro-Díaz, A.M.; Alba, D.; Langemeyer, J.; Gómez-Baggethun, E.; Ametzaga-Arregi, I. Urban resilience through green infrastructure: A framework for policy analysis applied to Madrid, Spain. Landsc. Urban Plan. 2024, 241, 104923. [Google Scholar] [CrossRef]

- Keisler, J.M.; Wells, E.M.; Linkov, I. A multicriteria decision analytic approach to systems resilience. Int. J. Disaster Risk Sci. 2014, 15, 657–672. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. The price of innovation: An analysis of the marginal cost of green buildings. J. Environ. Econ. Manag. 2019, 98, 2. [Google Scholar] [CrossRef]

- Purcarea, L.; Radulescu, C.; Manescu, A.M. Benefits of Integrating Sustainability into Insurance Companies. Rev. De Stud. Financ. 2024, 9, 17. [Google Scholar] [CrossRef]

- Saarikoski, H. Multi-Criteria Decision Analysis and Cost-Benefit Analysis: Comparing alternative frameworks for integrated valuation of ecosystem services. Ecosyst. Serv. 2016, 22, 238–249. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z. Multiple criteria decision making (MCDM) methods in economics: An overview. Technol. Econ. Dev. Econ. 2011, 17, 397–427. [Google Scholar] [CrossRef]

- Doukas, H.; Nikas, A. Decision support models in climate policy. Eur. J. Oper. Res. 2019, 280, 1–24. [Google Scholar] [CrossRef]

- Nasr, A.; Johansson, J.; Ivanov, O.L.; Björnsson, I.; Honfi, D. Risk-based multi-criteria decision analysis method for considering the effects of climate change on bridges. Struct. Infrastruct. Eng. 2022, 19, 1445–1458. [Google Scholar] [CrossRef]

- Mercereau, B.; Melin, L.; Lugo, M.A. Creating shareholder value through ESG engagement. J. Asset Manag. 2022, 23, 550–566. [Google Scholar] [CrossRef]

- Porumb, V.; Maier, G.; Anghel, I. The impact of building location on green certification price premiums: Evidence from three European countries. J. Clean. Prod. 2020, 272, 122080. [Google Scholar] [CrossRef]

- Eichholtz, P.; Holtermans, R.; Kok, N. Environmental Performance of Commercial Real Estate:New Insights into Energy Efficiency Improvements. J. Portf. Manag. 2019, 45, 113–129. [Google Scholar] [CrossRef]

- Leskinen, N.; Vimpari, J.; Junnila, S. A review of the impact of green building certification on the cash flows and values of commercial properties. Sustainability 2020, 12, 2729. [Google Scholar] [CrossRef]

- Cho, K.; Kim, J.; Kim, T. Critical Review on Economic Effect of renovation works for sustainable office building based on Opinions of Real-Estate Appraisers. Sustainability 2022, 14, 6124. [Google Scholar] [CrossRef]

- Wong, W.C.; Batten, J.A.; Ahmad, A.H.; Mohamed-Arshad, S.B.; Nordin, S.; Adzis, A.A. Does ESG certification add firm value? Financ. Res. Lett. 2020, 39, 101593. [Google Scholar] [CrossRef]

- De Jong, M.; Rocco, S. ESG and impact investing. J. Asset Manag. 2022, 23, 547–549. [Google Scholar] [CrossRef]

- Vaisi, S.; Varmazyari, P.; Esfandiari, M.; Sharbaf, S.A. Developing a multi-level energy benchmarking and certification system for office buildings in a cold climate region. Appl. Energy 2023, 336, 2. [Google Scholar] [CrossRef]

- Lemma, T.T.; Muttakin, M.; Mihret, D. Environmental, social, and governance performance, national cultural values and corporate financing strategy. J. Clean. Prod. 2022, 373, 133821. [Google Scholar] [CrossRef]

- Yu, E.P.; Guo, C.Q.; Van, B. Luu Environmental, social and governance transparency and firm value. Bus. Strategy Environ. 2018, 27, 987–1004. [Google Scholar] [CrossRef]

- Ke, Q.; White, M. Does Energy Performance Rating Affect Office Rents? A Study of the UK Office Market. J. Sustain. Real Estate 2024, 16, 2356715. [Google Scholar] [CrossRef]

- Aroul, R.; Sabherwal, S.; Villupuram, S. ESG, operational efficiency and operational performance: Evidence from Real Estate Investment Trusts. Manag. Financ. 2022, 48, 1206–1220. [Google Scholar] [CrossRef]

- Dobrovolskienė, N.; Pozniak, Y.M.; Tvaronavičienė, A. Assessment of the sustainability of a real estate project using Multi-Criteria decision making. Sustainability 2021, 13, 4352. [Google Scholar] [CrossRef]

- Hsu, L.-C. A hybrid multiple criteria decision-making model for investment decision making. J. Bus. Econ. Manag. 2014, 15, 509–529. [Google Scholar] [CrossRef]

- Bhole, G. Multi Criteria Decision Making (MCDM) Methods and its applications. Int. J. Res. Appl. Sci. Eng. Technol. 2018, 6, 5. [Google Scholar] [CrossRef]

- Colapinto, C.; Jayaraman, R.; Abdelaziz, F.; Torre, D. Environmental sustainability and multifaceted development: Multi-criteria decision models with applications. Ann. Oper. Res. 2019, 293, 405–432. [Google Scholar] [CrossRef]

- Kettani, O.; Oral, Y.; Siskos, Y. A Multiple Criteria Analysis Model For Real Estate Evaluation. J. Glob. Optim. 1998, 12, 197–214. [Google Scholar] [CrossRef]

- Kim, J. Green building strategies for LEED-certified laboratory buildings: Comparison between gold and platinum levels. Int. J. Sustain. Build. Technol. Urban Dev. 2020, 11, 153–173. [Google Scholar]

- Kopczewska, K.; Lewandowska, A. The price for subway access: Spatial econometric modelling of office rental rates in London. Urban Geogr. 2018, 39, 1528–1554. [Google Scholar] [CrossRef]

- Kim, S.; Choi, M. A study on the Effect of Property management service Quality on renewal intent of Commercial real estate: Focusing on Office Building Property Management (PM). J. Korean Soc. Hous. Environ. 2022, 20, 121–140. [Google Scholar]

- Cheshire, P.C.; Dericks, G.H. “Trophy Architects” and Design as Rent-seeking: Quantifying Deadweight Losses in a Tightly Regulated Office Market. Economica 2020, 87, 1078–1104. [Google Scholar] [CrossRef]

- Liu, Q.; Zhu, M.; Xiao, Z. Workplace Parking Provision and built environments: Improving Context-Specific Parking Standards towards Sustainable transport. Sustainability 2019, 11, 1142. [Google Scholar] [CrossRef]

- Liu, C.; Zheng, C.; Zhu, B. The Agglomerative Effects of Neighborhood and Building Specialization on Office Values. In Proceedings of the 28th Annual European Real Estate Society Conference (ERES), Milan, Italy, 22–25 June 2022. [Google Scholar]

- Rezaee, Z.; Homayoun, S.; Poursoleyman, E.; Rezaee, N.J. Comparative analysis of environmental, social, and governance disclosures. Glob. Financ. J. 2023, 55, 100804. [Google Scholar] [CrossRef]

- Matsuo, K.; Tsutsumi, M.; Toyokazu, I.; Takeshi, K. The Impact of the Flight to Quality on Office Rents and Vacancy Rates in Tokyo. Real Estate Manag. Valuat. 2024, 32, 3. [Google Scholar] [CrossRef]

- Tsolacos, S.; Lee, S.; Tse, H. ‘Space-as-a-service’: A premium to office rents? J. Eur. Real Estate Res. 2023, 16, 64–77. [Google Scholar] [CrossRef]

- Jayakody, T.A.C.H.; Vaz, A. Impact of green building certification on the rent of commercial properties: A review. J. Inform. Web Eng. 2023, 2, 8–28. [Google Scholar] [CrossRef]

- Hossain, S.M.; Van De Wetering, J.; Devaney, S.; Sayce, S. UK commercial real estate valuation practice: Does it now build in sustainability considerations? J. Prop. Invest. Financ. 2023, 41, 406–428. [Google Scholar] [CrossRef]

- Sonnenschein, T.; Scheider, S.; Zheng, S. The rebirth of urban subcenters: How subway expansion impacts the spatial structure and mix of amenities in European cities. Environ. Plan. B Urban Anal. City Sci. 2021, 49, 1266–1282. [Google Scholar] [CrossRef]

- Saygın, M. Competitiveness of the cities: Branding and positioning. Int. J. Prof. Bus. Rev. 2023, 8, e02210. [Google Scholar] [CrossRef]

- Chiang, K.C.; Wachtel, G.J.; Zhou, X. Corporate Social Responsibility and Growth Opportunity: The Case of Real Estate Investment Trusts. J. Bus. Ethics 2017, 155, 463–478. [Google Scholar] [CrossRef]

- Vonlanthen, J. ESG Ratings and Real Estate Key Metrics: A Case Study. Real Estate 2024, 1, 267–292. [Google Scholar] [CrossRef]

- Morri, G.; Yang, F.; Colantoni, F. Green investments, green returns: Exploring the link between ESG factors and financial performance in real estate. J. Prop. Invest. Financ. 2024, 42, 435–452. [Google Scholar] [CrossRef]

- Grove, H.; Clouse, M.; Xu, T. Risk governance for environmental, social, and governance investing and activities. Risk Gov. Control. Financ. Mark. Inst. 2024, 14, 50–58. [Google Scholar] [CrossRef]

- Jaspers, E.; Ankerstjerne, P. The ESG challenge for real estate. Corp. Real Estate J. 2023, 12, 206–215. [Google Scholar] [CrossRef]

- Klarin, T. The Concept of Sustainable Development: From its Beginning to the Contemporary Issues. Zagreb Int. Rev. Econ. Bus. 2018, 21, 67–94. [Google Scholar] [CrossRef]

- Soyombo, N.D.A. The role of policy and regulation in promoting green buildings. World J. Adv. Res. Rev. 2024, 22, 139–150. [Google Scholar] [CrossRef]

- Raji, D. Sustainable Finance in Action: Exploring Green Loans in Promoting Environmental Responsibility. Kristu Jayanti J. Manag. Sci. (KJMS) 2024, 2, 14–25. [Google Scholar] [CrossRef]

- Lützkendorf, T.; Lorenz, D. Sustainable property investment: Valuing sustainable buildings through property performance assessment. Build. Res. Inf. 2025, 33, 212–234. [Google Scholar] [CrossRef]

- Theilig, K.; Lourenço, B.; Reitberger, R. Life cycle assessment and multi-criteria decision-making for sustainable building parts: Criteria, methods, and application. Int. J. Life Cycle Assess. 2024, 29, 1965–1991. [Google Scholar] [CrossRef]

- Marques, A.; Januário, J.F.; Cruz, C.O. Sustainability Certifications in Real Estate: Value and Perception. Buildings 2024, 14, 3823. [Google Scholar] [CrossRef]

- Ta-Chung, C.; Dizon, J.D.Y.C. Evaluating real estate using a fuzzy MCDM approach. Int. J. Bus. Syst. Res. 2012, 6, 395–412. [Google Scholar]

- Nieuwenhuijsen, M. Urban and Transport Planning Pathways to Carbon Neutral, Liveable and Healthy Cities. Environ. Int. 2020, 140, 105661. [Google Scholar] [CrossRef]

- Brotman, B.A. The impact of corporate tax policy on sustainable retrofits. J. Corp. Real Estate 2017, 19, 53–63. [Google Scholar] [CrossRef]

- Cheng, M.-C.; Tzeng, Z.-C. Effect of Leverage on Firm Market Value and How Contextual Variables Influence this Relationship. Rev. Pac. Basin Financ. Mark. Policies 2017, 17, 1450004. [Google Scholar] [CrossRef]

- Glascock, J.L.; Lu, C.; So, R.W. Further Evidence on the Integration of REIT, Bond, and Stock Returns. J. Real Estate Financ. Econ. 2000, 20, 177–194. [Google Scholar] [CrossRef]

- Bell, J.; Battisti, G.; Guin, B. The greening of lending: Evidence from banks’ pricing of energy efficiency before climate-related regulation. Econ. Lett. 2023, 230, 111212. [Google Scholar] [CrossRef]

- Bingler, J.A.; Senni, C.C.; Monnin, P. Climate Transition Risk Metrics: Understanding Convergence and Divergence across Firms and Providers. RePEc Res. Pap. Econ. 2021, 21, 363. [Google Scholar] [CrossRef]

- Yazo-Cabuya, E.; Herrera-Cuartas, J.; Ibeas, A. Organizational Risk Prioritization Using DEMATEL and AHP towards Sustainability. Sustainability 2024, 16, 1080. [Google Scholar] [CrossRef]

- Rincón, L.; Gangolells, M.; Medrano, M.; Casals, M. Climate change mitigation and adaptation in Spanish office stock through cool roofs. Energy Build. 2024, 323, 2. [Google Scholar] [CrossRef]

- Naseer, M.M.; Guo, Y.; Bagh, T.; Zhu, X. Sustainable investments in volatile times: Nexus of climate change risk, ESG practices, and market volatility. Int. Rev. Financ. Anal. 2024, 95, 2. [Google Scholar] [CrossRef]

- Sayce, S.L.; Clayton, J.; Devaney, S. Climate risks and their implications for commercial property valuations. J. Prop. Invest. Financ. 2022, 40, 430–443. [Google Scholar] [CrossRef]

- Li, C.; Tang, W.; Liang, F.; Wang, Z. The impact of climate change on corporate ESG performance: The role of resource misallocation in enterprises. J. Clean. Prod. 2024, 445, 141263. [Google Scholar] [CrossRef]

- Feng, S. Leveraging artificial intelligence to enhance ESG models: Transformative impacts and implementation challenges. Appl. Comput. Eng. 2024, 69, 37–42. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, L. Research on sustainable green building space design model integrating IoT technology. PLoS ONE 2024, 19, e0298982. [Google Scholar] [CrossRef]

- Al-Obaidi, K.M.; Hossain, M.; Alduais, N.A.M.; Al-Duais, H.S.; Omrany, H.; Ghaffarianhoseini, A. A review of Using IoT for Energy Efficient Buildings and Cities: A Built Environment Perspective. Energies 2022, 1516, 5991. [Google Scholar] [CrossRef]

- Poyyamozhi, M.; Murugesan, B.; Rajamanickam, N.; Shorfuzzaman, M.; Aboelmag, Y.D. IOT—A Promising solution to energy management in smart Buildings: A Systematic Review, applications, barriers, and future scope. Buildings 2024, 14, 3446. [Google Scholar] [CrossRef]

- Newell, G. Real Estate Insights The increasing importance of the “S” dimension in ESG. J. Prop. Invest. Financ. 2023, 41, 453–459. [Google Scholar] [CrossRef]

- Matisoff, D.C.; Noonan, D.S.; Flowers, M.E. Policy Monitor—Green Buildings: Economics and Policies. Rev. Environ. Econ. Policy 2016, 10, 329–346. [Google Scholar] [CrossRef]

- Riandari, F.; Albert, M.Z.; Rogoff, S.S. MCDM methods to address sustainability challenges, such as climate change, resource management, and social justice. Idea Future Res. 2023, 1, 25–38. [Google Scholar] [CrossRef]

- Coën, A.; Lefebvre, B.; Simon, A. Monetary Policies and European Office markets dynamics. J. Real Estate Res. 2022, 44, 553–573. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

| KPI | Relevance | Justification |

|---|---|---|

| CO2 emissions (kgCO2/m2/year) | Highest | Directly measures climate impact; crucial for climate change assessment; aligns with EU carbon reduction goals |

| Energy consumption (kWh/m2/year) | Highest | Strongly linked to CO2 emissions and building efficiency; fundamental component of EPCs [55] |

| Renewable energy production (onsite) | Very High | A building with very high energy performance, as determined in accordance with Annex I, Article 11 of the EPBD. |

| Green building certifications (e.g., BREEAM, LEED) | Very High | Comprehensive measure of overall building sustainability; BREEAM dominant in UK/Europe, LEED gaining ground |

| Physical climate risk analysis | High | Important for assessing long-term climate change impacts on the property; crucial for long-term valuation and risk management |

| Energy rating (EPC) | High | Indicates energy efficiency; mandatory in EU for property transactions |

| Water usage efficiency | Moderate | Key component of occupant health and wellbeing; emphasized in certifications like WELL |

| Waste management and recycling rate | Moderate | Important for energy management and occupant comfort; increasingly relevant in EMEA |

| CREM or other pathway analysis | Lower | Measures carbon footprint of construction materials/processes, gaining importance in lifecycle assessments [56] |

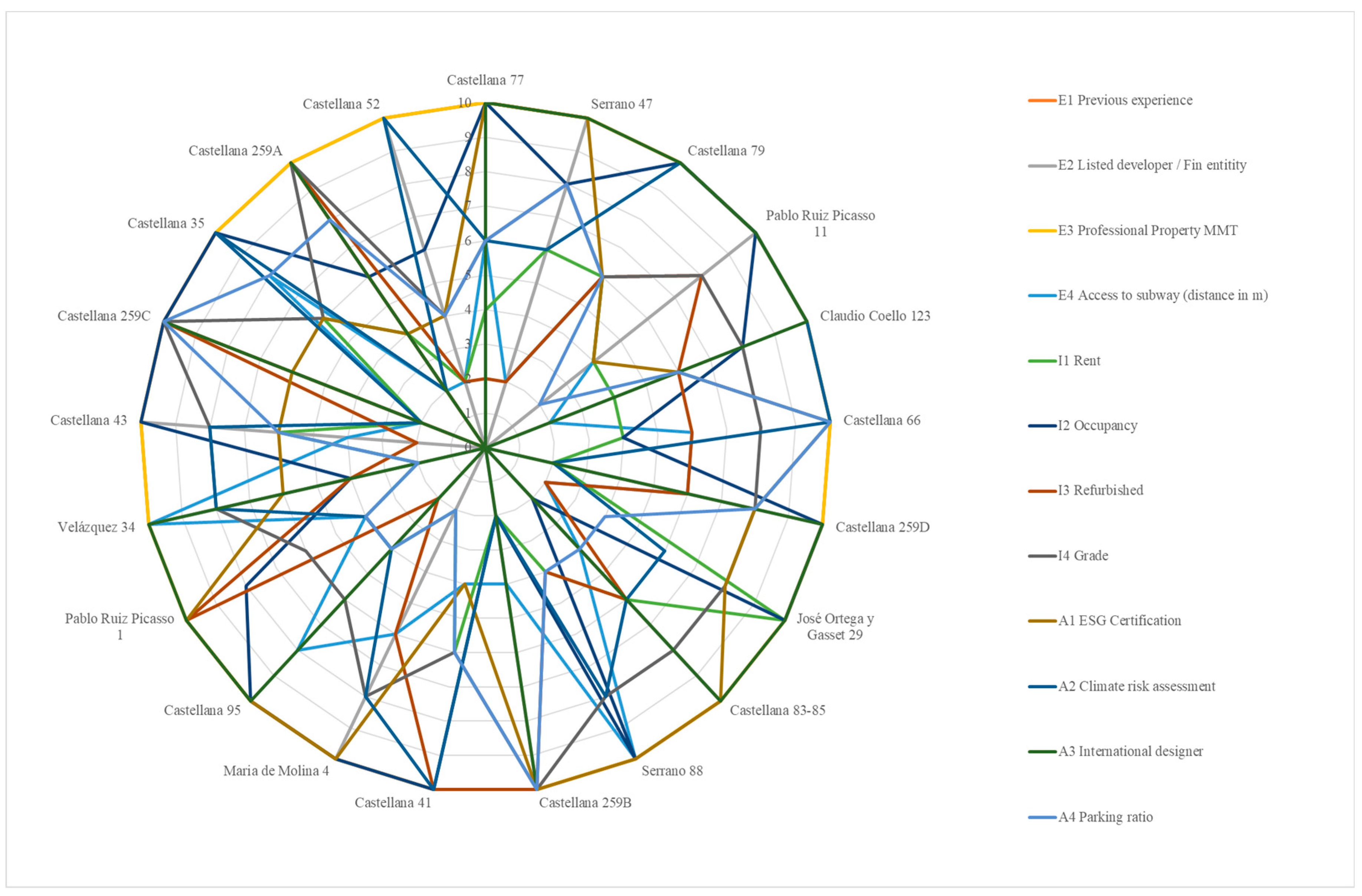

| E | I | A1 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| E1 | E2 | E3 | E4 | I1 | I2 | I3 | I4 | A1 | A2 | A3 | A4 | |

| Previous experience | Listed developer/Fin entity | Professional Property MMT | Access to subway (distance in m) | Rent | Occupancy | Refurbished | Grade | ESG Certification | Climate risk assessment | International designer | Parking ratio | |

| Criteria (1–5) | 4 | 2 | 2 | 4 | 5 | 4 | 3 | 4 | 5 | 4 | 3 | 2 |

| Project\Indicator | E1 | E2 | E3 | E4 | I1 | I2 | I3 | I4 | A1 | A2 | A3 | A4 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Castellana 77 | 10 | 10 | 10 | 6 | 4 | 10 | 2 | 6 | 10 | 6 | 10 | 6 |

| Project\Indicator | CJ | E1 | E2 | E3 | E4 | I1 | I2 | I3 | I4 | A1 | A2 | A3 | A4 | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Castellana 77 | 7.38 | 10 | 10 | 10 | 6 | 4 | 10 | 2 | 6 | 10 | 6 | 10 | 6 | 90 |

| Serrano 47 | 7.33 | 10 | 10 | 10 | 2 | 6 | 8 | 2 | 8 | 10 | 6 | 10 | 8 | 90 |

| Castellana 79 | 7.33 | 10 | 0 | 10 | 6 | 6 | 10 | 6 | 6 | 6 | 10 | 10 | 6 | 86 |

| Pablo Ruiz Picasso 11 | 7.29 | 10 | 10 | 10 | 4 | 4 | 10 | 8 | 8 | 4 | 10 | 10 | 2 | 90 |

| Claudio Coello 123 | 7.19 | 10 | 10 | 10 | 2 | 4 | 8 | 6 | 8 | 6 | 10 | 10 | 6 | 90 |

| Castellana 66 | 7.14 | 10 | 10 | 10 | 6 | 4 | 4 | 6 | 8 | 10 | 10 | 0 | 10 | 88 |

| Castellana 259D | 7.10 | 10 | 10 | 10 | 6 | 2 | 10 | 6 | 8 | 8 | 2 | 10 | 8 | 90 |

| José Ortega y Gasset 29 | 7.10 | 10 | 0 | 10 | 2 | 10 | 10 | 2 | 8 | 8 | 6 | 10 | 4 | 80 |

| Castellana 83–85 | 7.05 | 10 | 10 | 10 | 4 | 6 | 2 | 6 | 8 | 10 | 6 | 10 | 4 | 86 |

| Serrano 88 | 7.00 | 10 | 0 | 10 | 10 | 4 | 10 | 4 | 8 | 10 | 8 | 0 | 4 | 78 |

| Castellana 259B | 6.95 | 10 | 10 | 10 | 4 | 2 | 2 | 10 | 10 | 10 | 2 | 10 | 10 | 90 |

| Castellana 41 | 6.95 | 10 | 10 | 10 | 4 | 6 | 10 | 10 | 6 | 4 | 10 | 0 | 6 | 86 |

| Maria de Molina 4 | 6.90 | 10 | 10 | 10 | 6 | 2 | 10 | 6 | 8 | 10 | 8 | 0 | 2 | 82 |

| Castellana 95 | 6.81 | 10 | 0 | 10 | 8 | 4 | 10 | 2 | 6 | 10 | 4 | 10 | 4 | 78 |

| Pablo Ruiz Picasso 1 | 6.81 | 10 | 0 | 10 | 4 | 4 | 8 | 10 | 6 | 10 | 4 | 10 | 4 | 80 |

| Velázquez 34 | 6.81 | 10 | 10 | 10 | 10 | 2 | 4 | 4 | 8 | 6 | 8 | 10 | 2 | 84 |

| Castellana 43 | 6.62 | 10 | 10 | 10 | 4 | 6 | 10 | 2 | 8 | 6 | 8 | 0 | 6 | 80 |

| Castellana 259C | 6.57 | 10 | 0 | 10 | 2 | 2 | 10 | 10 | 10 | 6 | 2 | 10 | 10 | 82 |

| Castellana 35 | 6.48 | 10 | 0 | 10 | 8 | 6 | 10 | 0 | 6 | 6 | 10 | 0 | 8 | 74 |

| Castellana 259A | 6.10 | 10 | 0 | 10 | 2 | 4 | 6 | 10 | 10 | 4 | 2 | 10 | 8 | 76 |

| Castellana 52 | 5.05 | 10 | 10 | 10 | 2 | 2 | 6 | 2 | 4 | 4 | 10 | 0 | 4 | 64 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Valero, A. The Impact of ESG Certifications on Class A Office Buildings in Madrid: A Multi-Criteria Decision Analysis. Standards 2025, 5, 14. https://doi.org/10.3390/standards5020014

Valero A. The Impact of ESG Certifications on Class A Office Buildings in Madrid: A Multi-Criteria Decision Analysis. Standards. 2025; 5(2):14. https://doi.org/10.3390/standards5020014

Chicago/Turabian StyleValero, Alfonso. 2025. "The Impact of ESG Certifications on Class A Office Buildings in Madrid: A Multi-Criteria Decision Analysis" Standards 5, no. 2: 14. https://doi.org/10.3390/standards5020014

APA StyleValero, A. (2025). The Impact of ESG Certifications on Class A Office Buildings in Madrid: A Multi-Criteria Decision Analysis. Standards, 5(2), 14. https://doi.org/10.3390/standards5020014