1. Introduction

The transport, forwarding, and logistics (TFL) sector plays an increasingly important role in modern supply chains, being responsible for the physical movement of goods and the coordination of multiple stakeholders. Trade globalization, the dynamic growth of e-commerce, and the volatility of the macroeconomic and geopolitical environment have forced logistics enterprises to operate under growing uncertainty. In this context, effective information management and the ability to make rapid operational decisions based on reliable, up-to-date, and integrated data become critical success factors.

Despite the wide availability of digital solutions, the logistics sector continues to face substantial obstacles in achieving full digital maturity. This is particularly evident in intermodal transport, where the complexity of operations, the fragmentation of responsibilities, and the need for seamless data exchange across modes pose significant implementation challenges. Recent studies have shown that digital transformation in logistics is often hindered by organizational inertia, limited interoperability, and insufficient alignment between technology providers and the operational needs of logistics enterprises [

1,

2]. Moreover, while many digital planning tools offer theoretical benefits, their practical application is constrained by gaps in functionality, scalability, and integration [

3].

What is notably missing in current practice is a system-wide approach that would coordinate digitalization across stakeholders, especially in intermodal supply chains. Many logistics operators implement isolated solutions with little support for cross-enterprise integration. This siloed approach leads to the duplication of efforts, increased uncertainty, and the underutilization of available technology.

In light of these shortcomings, there is a growing demand for empirical studies that investigate how digital planning tools are actually being used, what prevents their broader adoption, and how these dynamics differ between large logistics firms and SMEs. This article responds to that gap by examining the barriers to digital adoption in Polish intermodal transport operations, using primary data collected from a representative group of logistics enterprises.

In practice, many enterprises in the TFL sector still face challenges related to the lack of smooth and automated information exchange between internal systems and those of their business partners. The dominant standard remains fragmented, locally developed solutions—often based on spreadsheets or custom-built applications—which do not support interoperability or process scalability. Unified data formats are lacking, and the implementation of systems such as TMS (Transport Management System)-, WMS (Warehouse Management System)-, CRM (Customer Relationship Management)-, or SaaS-based platforms faces numerous barriers.

In light of these challenges, digital planning tools—particularly those supporting transport planning—can play a critical role in improving operational efficiency, reducing risk, and building competitive advantage. This is especially relevant in the context of intermodal transport, where coordination across multiple transport modes (road, rail, maritime) is required, along with adaptation to shifting schedules, load space availability, and environmental requirements (e.g., carbon footprint calculation).

In order to frame the adoption dynamics of digital solutions in the logistics sector, this study refers to the Technology Acceptance Model (TAM), a widely used framework in information systems research. According to TAM, two primary factors influence a user’s decision to adopt new technology: perceived usefulness and perceived ease of use. In logistics, these dimensions have been shown to significantly shape attitudes toward digital platforms and planning systems, particularly among operational staff and decision-makers [

4,

5]. Prior studies suggest that additional variables—such as organizational trust, previous digital experience, or perceived reliability—can moderate the model’s core components, especially in business-to-business contexts involving logistics service providers [

6,

7]. By incorporating TAM as an interpretive lens, this study aims to better understand the behavioral foundations of digital tool adoption, especially in the context of intermodal transport planning.

The aim of this article is to identify the barriers to the adoption of digital planning tools in the TFL sector, with particular emphasis on intermodal transport. The article presents a review of existing technological solutions and the results of a survey conducted among Polish logistics enterprises. Based on the analysis of the collected data, the study discusses key obstacles, motivations, and user satisfaction levels related to digital planning tools, while also indicating future directions for technological development in the TFL sector.

The paper is divided into 6 chapters that jointly provide a literature review, an overview of the methodology used, results, and the conclusion of research on digital planning tool implementation in intermodal transport in Poland.

Section 2 provides a structured literature review, focusing on digital planning tools in logistics, barriers to adoption, and intermodal transport planning.

Section 3 outlines the research methodology and describes the survey design and respondent characteristics.

Section 4 presents empirical findings, including tool usage, satisfaction levels, implementation barriers, and sustainability practices.

Section 5 discusses the results in the context of existing research and offers practical implications, while finally

Section 6 concludes the study and proposes directions for future research.

2. Literature Review

The aim of this chapter is to contextualize the research problem within the broader discourse on logistics digitalization, with a focus on intermodal transport and the challenges faced by small and medium-sized enterprises (SMEs). The review covers five thematic areas:

Section 2.1 outlines the general landscape of digital transformation in the transportation, forwarding, and logistics (TFL) sector.

Section 2.2 focuses on the adoption of Transport Management Systems (TMS) and related tools.

Section 2.3 identifies barriers to digital adoption at the organizational and system levels.

Section 2.4 discusses the specific challenges of intermodal transport planning and the role of digital platforms in supporting this process.

Section 2.5 highlights the research gap, particularly the limited understanding of digital tool adoption in SMEs and the underexplored relationship between platform functionalities, user satisfaction, and environmental performance.

By structuring the review thematically, we aim to provide a coherent foundation for the empirical research presented in the following chapters.

In this article, the term digital planning tools refers to digital systems, platforms, or software solutions that support the planning, coordination, and execution of transport processes. This includes tools such as Transport Management Systems (TMS), route optimization software, cloud-based platforms (SaaS), and integrated decision-support systems used in logistics and intermodal operations. The terms “digital tools,” “planning systems,” and “platforms” are used interchangeably in industry practice; however, for clarity, the term digital planning tools will be used consistently throughout this paper.

2.1. Digital Transformation in the TFL Sector

The digital transformation of the transportation, forwarding, and logistics (TFL) sector is reshaping operational models and decision-making processes. Digital planning tools allow real-time data exchange, improved process transparency, and the automation of routine tasks. Studies emphasize that digital maturity is associated with higher logistics performance, improved customer service, and increased supply chain resilience [

8,

9].

Despite these advantages, the adoption of digital technologies remains inconsistent. According to a DHL report, only 23% of logistics service providers globally have digitalized more than 75% of their processes [

10]. In Central and Eastern Europe, many TFL enterprises still rely on non-integrated legacy systems or spreadsheet-based tools, which limit process scalability and hinder interoperability [

11].

The contrast between large enterprises and small and medium-sized enterprises (SMEs) is particularly striking. Large enterprises are more likely to invest in modern ICT infrastructure and integrated systems, while SMEs often face barriers such as limited access to funding, insufficient digital competencies, and a lack of strategic focus on transformation [

12,

13].

It has also been demonstrated that digitalization is not purely a technological challenge, but an organizational one. Leadership commitment, employee awareness, and cultural readiness play an essential role in enabling successful transformation [

14]. Therefore, improving digital maturity in the logistics sector requires not only investment in technology but also structural and behavioral adaptation.

International studies confirm that SMEs face both threats and opportunities—and must actively manage both as part of their digital transformation. A study conducted in the Czech Republic identified five key dimensions—digital maturity, security, customer orientation, Industry 4.0 readiness, and sustainability—as determinants of SMEs’ ability to navigate digital ecosystems effectively [

15,

16].

This aligns with findings in Poland, where enterprises display limited awareness of available digital planning tools, while expecting strategic payoff in the form of competitiveness and emissions reduction.

The Nederland initiatives on Logistics Data Spaces (LDS) demonstrate that beyond individual firm adoption, digital interoperability requires coordination across technical, semantic, organizational, and legal layers [

17]

Lessons from the Nederland case suggest that fragmented tool uptake—such as limited use of standalone route planners—will not suffice to build end-to-end intermodal visibility.

A recent MDPI

Sustainability article further emphasizes that digital technologies are essential for sustainability goals, and that SMEs need to engage stakeholders early in digital transformation journeys [

18,

19]. Hence, enhancing awareness, stakeholder engagement, and interoperable systems are critical for building scalable and integrated digital planning platforms in logistics.

2.2. Adoption of Transport Management Systems in the TFL Sector

Transport Management Systems (TMS) and related digital platforms play a central role in the automation and optimization of logistics processes. They enable enterprises to manage transport planning, monitor shipments, optimize routes, and reduce administrative overhead. Alongside TMS, logistics operators often implement Warehouse Management Systems (WMS), Enterprise Resource Planning (ERP), and Customer Relationship Management (CRM) tools, which support warehouse control, resource integration, and client interaction [

20].

Recent years have also seen the rise of the cloud-based Software-as-a-Service (SaaS) models, which offer modularity, lower implementation costs, and easier integration with existing systems—particularly beneficial for small and medium-sized enterprises [

21]. SaaS solutions are becoming increasingly popular due to their scalability and limited infrastructure requirements.

Beyond classical management systems, logistics enterprises are experimenting with advanced technologies such as artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA). AI-based systems support predictive analytics, automated shipment pricing, and demand forecasting, while RPA can automate repetitive tasks such as invoice processing and document circulation [

22,

23].

However, the degree of adoption varies significantly across enterprise sizes and regions. While global logistics enterprises have implemented integrated digital ecosystems, smaller enterprises often continue to rely on partial solutions or spreadsheets. A recent survey by PwC showed that less than half of European freight forwarders had implemented dedicated TMS or WMS platforms [

24].

Slow adoption is not only a result of budgetary limitations but often reflects strategic misalignment and insufficient understanding of system capabilities. Moreover, many off-the-shelf systems lack adaptation to local market realities, including language support, transport regulations, and modal diversity, particularly in intermodal operations [

25].

2.3. Barriers to Digital Adoption in the TFL Sector

Although the benefits of digital technologies in logistics are well documented, their adoption is often hindered by a range of structural, organizational, and perceptual barriers. These limitations vary by enterprise size, market maturity, and internal readiness for transformation.

In small and medium-sized enterprises (SMEs), the most frequently cited challenges include limited financial resources, lack of qualified personnel with IT competencies, and insufficient awareness of available technological solutions [

15,

26]. SMEs are more likely to rely on spreadsheets or fragmented tools and tend to prioritize day-to-day operations over long-term innovation [

27]. Furthermore, the absence of dedicated digital strategies often results in uncoordinated or delayed implementation efforts [

28].

Organizational resistance also plays a significant role. Employees may perceive automation as a threat to job security or struggle to adapt to new interfaces and workflows. These psychological and cultural barriers can slow down or even derail digital transformation projects [

29]. In some cases, management underestimates the complexity of implementation, resulting in insufficient planning or unrealistic expectations regarding return on investment.

Larger logistics enterprises, while generally more technologically advanced, face their own constraints. These include the complexity of integrating new tools with legacy IT systems and the growing demand for internal IT specialists [

30]. Many organizations report that their internal digital teams are overloaded or lack expertise in emerging technologies such as AI or blockchain.

A broader, systemic limitation is the fragmentation of the digital solutions market. Logistics enterprises frequently struggle with the lack of standardized interfaces, making it difficult to integrate systems with partners across the supply chain [

31]. This lack of interoperability leads to duplicated data entry, inconsistent formats, and increased operational risk.

Ultimately, successful digital adoption requires not only technical infrastructure, but also strategic alignment, leadership support, and change management capabilities. Without these elements, even well-designed tools may fail to deliver their intended value.

2.4. Intermodal Transport and Planning Challenges

Intermodal transport plays a key role in creating sustainable, resilient, and efficient freight systems. By combining multiple modes—typically rail, road, and maritime—intermodal solutions enable cost-effective and low-emission cargo movement over long distances. However, effective planning in this context poses unique operational and technical challenges due to the complexity of synchronizing schedules, handling transshipments, and coordinating with multiple stakeholders [

32].

One of the principal difficulties is the rigidity of rail and maritime timetables, which limit operational flexibility and require precise alignment of transshipment windows and resource availability. Additionally, the involvement of multiple actors using heterogeneous IT systems hinders seamless data exchange and reduces shipment visibility across the full supply chain [

33]. Fragmented data flows often result in redundant communication, delays, or errors—particularly in environments lacking standardized formats or integration protocols.

Digital platforms dedicated to intermodal planning, such as RouteScanner, Freightos, and SeaRates, offer users tools for route selection, transit time and cost comparison, and—more recently—CO

2 emission estimation [

34]. These features can support both operational decisions and regulatory or corporate reporting needs. However, the adoption of such tools remains limited, especially among small and medium-sized logistics enterprises in Central and Eastern Europe, which often face barriers in integrating external platforms with internal systems.

Another pressing issue is data availability for less frequently served or multimodal routes. Incomplete or outdated datasets compromise the reliability of system outputs and discourage automation. As a result, many enterprises continue to rely on manual quoting processes, particularly when managing international or non-standard shipments [

35].

Finally, the growing demand for carbon transparency is transforming the role of intermodal digital planning tools. Enterprises increasingly expect tools to provide emissions metrics aligned with recognized standards (e.g., EN 16258, [

36]), not only for internal analysis but also for compliance with customer, investor, or regulatory expectations [

37].

These platforms typically operate as cloud-based SaaS solutions, offering users access via web interfaces and API integrations with transport management or ERP systems. Tools like Routescanner and SeaRates rely on global carrier databases and geospatial algorithms for routing and pricing calculations. However, they often lack seamless integration with local terminal operators and national rail carriers, which limits real-time data exchange and reduces their usefulness for smaller enterprises or those operating in less digitized regions.

2.5. Research Gap

While the literature on logistics digitalization has grown significantly in recent years, several important gaps remain—particularly concerning the practical adoption of digital planning tools in intermodal transport by small and medium-sized enterprises (SMEs).

Most existing studies focus on the advantages of implementing systems such as TMS, WMS, or ERP, with particular attention to large global enterprises [

8,

38]. The perspectives of SMEs—despite their dominant role in the logistics sector, especially in Central and Eastern Europe—remain underrepresented. Few empirical studies explore how resource constraints, strategic priorities, or organizational capabilities affect digital tool adoption in smaller logistics enterprises [

12].

Moreover, the majority of available analyses focus on general digital maturity or system architecture, rather than the specific functionalities and limitations of tools supporting intermodal operations. There is a lack of research investigating the real-world experiences of users interacting with digital platforms, including the reasons behind low satisfaction rates or abandonment of existing tools [

39].

Another limitation in the literature is the insufficient integration of environmental concerns—such as CO

2 emission estimation—into the evaluation of digital systems. While many platforms now offer basic carbon footprint features, few studies examine whether these capabilities are used, trusted, or meet the expectations of logistics providers or clients [

40].

Finally, only a limited number of works rely on primary data obtained directly from logistics professionals. Most conclusions are derived from theoretical frameworks or aggregated industry reports, which may overlook local market dynamics and implementation realities [

15]. Addressing these gaps requires context-specific, data-driven research that connects operational challenges with strategic decisions at the firm level.

3. Methodology

3.1. Research Design and Objectives

The study was conducted in accordance with the principles outlined in the Declaration of Helsinki. Participation in the survey was entirely voluntary, and no personal or sensitive data were collected. Respondents were informed about the purpose of the study prior to participation. In accordance with national and institutional guidelines, this type of anonymous, non-invasive research does not require approval from an ethics committee.

This study employs a quantitative, survey-based research design to explore the adoption of digital planning tools in the Polish transportation, forwarding, and logistics (TFL) sector, with a particular focus on intermodal digital planning tools. The study aims to identify the current level of digitalization, the perceived usefulness of available tools, and the main organizational and technological barriers limiting their implementation.

Given the exploratory nature of the research, the primary goal was to gather practical insights from industry professionals responsible for operational decision-making or IT system deployment. The research contributes to closing the gap between theoretical frameworks of digital logistics and their practical application in small and medium-sized enterprises (SMEs).

Three research questions guided the study:

RQ1: What types of digital planning tools are currently used in the TFL sector for transportation planning, particularly in intermodal contexts?

RQ2: What are the key organizational, financial, and technical barriers that limit the implementation of such tools?

RQ3: How do logistics professionals perceive the performance and added value of digital planning tools, especially regarding automation, system integration, and CO2 emissions tracking?

3.2. Data Collection and Sample Characteristics

Data was collected through an online survey conducted between 20 April and 27 May 2025. The questionnaire was distributed via Google Forms and addressed to representatives of Polish transportation, forwarding, and logistics (TFL) enterprises engaged in intercontinental intermodal transport. The sampling method was purposive, targeting individuals responsible for operational or implementation-related decisions regarding digital systems—such as logistics managers, operations directors, or IT specialists.

A total of 80 valid responses were obtained. More than half of the respondents (54%) represented enterprises employing over 251 people, and one-third worked in enterprises with 51–250 employees. This indicates that medium and large enterprises accounted for nearly 90% of the sample.

With respect to the scale of operations, 70% of enterprises reported importing or exporting over 1000 transport units annually (containers, trailers, or swap bodies). The dominant mode of transport is maritime (67%), followed by road (25%) and rail (8%). Furthermore, most respondents declared that their enterprises operated beyond national borders, with over 60% involved in European and intercontinental shipments, often requiring multimodal coordination across ports and inland terminals.

Table 1 provides an overview of the key characteristics of the surveyed enterprises, including size, volume, dominant transport modes, and operational geography.

3.3. Survey Instrument and Data Analysis

The empirical data were collected using a proprietary online questionnaire developed in Google Forms. The survey consisted of approximately 30 questions, including 17 core questions and several conditional follow-ups depending on respondent pathways. The total number of individual response elements, including Likert-scale assessments, exceeded 30. A blank version of the questionnaire is available as

Supplementary Material.

The questionnaire was structured around four thematic blocks:

Block I: Intermodal activity and transport organization—including questions about the scale of import/export operations, transport modes used, and forms of transport organization (in-house, freight forwarders, etc.).

Block II: The use of planning tools and user satisfaction—assessing the use of digital platforms such as RouteScanner, Freightos, or VIA TMS, and collecting responses on user satisfaction, strengths, and limitations.

Block III: Functional requirements and expectations—using a 3-point Likert scale, respondents evaluated features such as travel time estimation, CO2 emission tracking, real-time visibility, and integration with TMS systems.

Block IV: Barriers to adoption—respondents were asked to indicate up to three main reasons limiting the use of digital planning tools in their organization. The most frequently selected items included low awareness of available tools, internal resistance to change, reliance on internal solutions (e.g., Excel-based templates), a lack of interoperability with partners, and insufficient integration with other systems (see

Table 2). These barriers highlight that strategic and organizational factors may outweigh financial constraints.

The survey was conducted between 20 April and 27 May 2025 using a purposive sampling approach. Invitations were distributed through professional associations, LinkedIn, and email networks. The questionnaire was aimed at decision-makers responsible for operational logistics or IT implementation, including logistics managers, transport directors, and system integrators. A total of 80 responses were collected. Approximately 30% of respondents reported the active use of intermodal transport in their operations.

Although the study relied solely on quantitative survey data, it should be noted that the absence of qualitative methods limits the ability to explore deeper contextual or organizational dynamics. Furthermore, despite strong environmental declarations—75% of firms indicated CO2 reduction targets—only a minority used systems capable of calculating emissions. This suggests that either such features are lacking in commercial tools, or that enterprises lack the competencies or trust to use them effectively.

The results were processed in Microsoft Excel 2019 (Microsoft Corporation, Redmond, WA, USA) and IBM SPSS Statistics 29 (IBM Corp., Armonk, NY, USA). Analyses included descriptive statistics and selected cross-tabulations (e.g., system usage by company size). No inferential statistics were applied due to the exploratory nature of the study.

4. Results

4.1. Digital Tool Usage and Automation Level

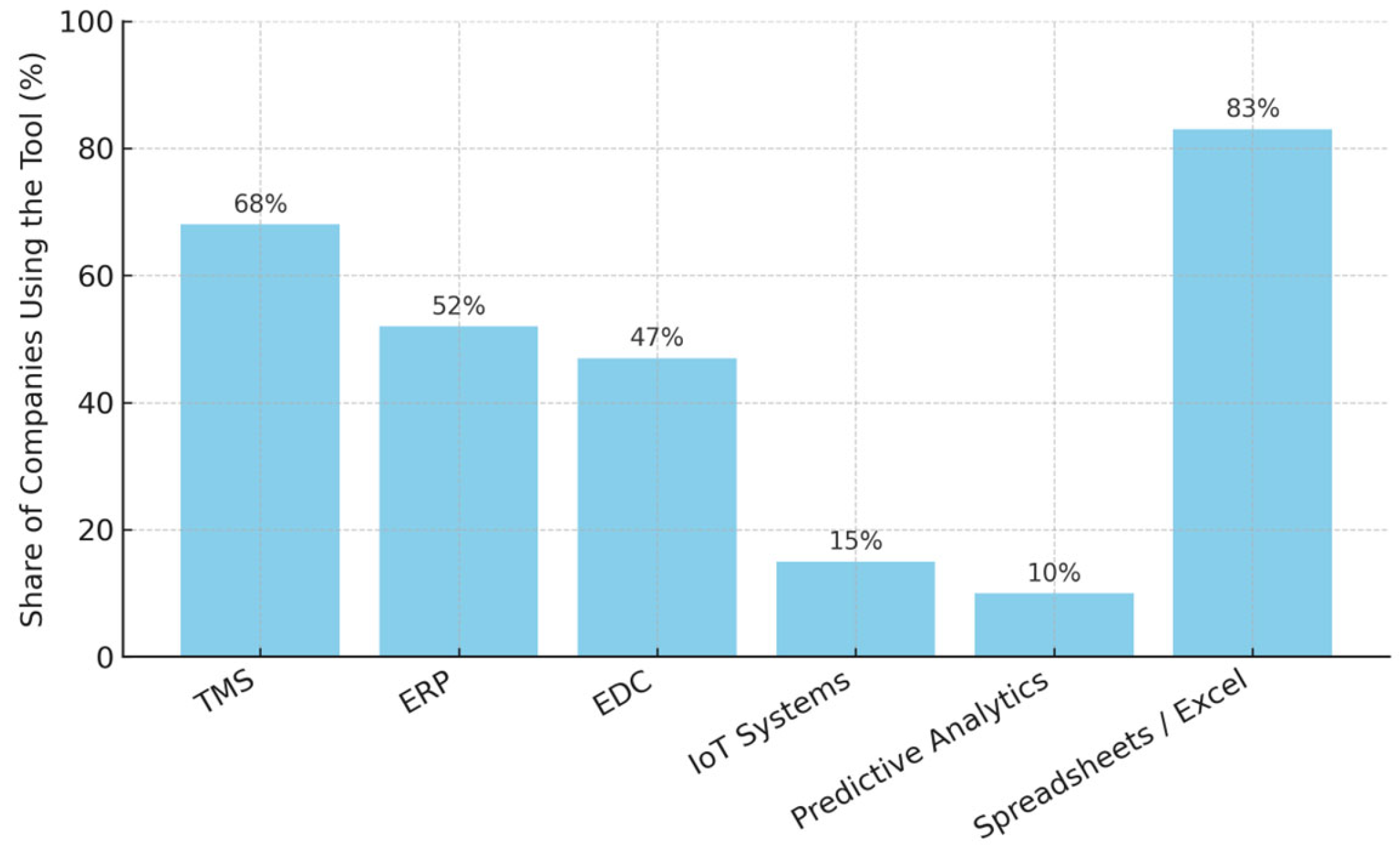

The survey results reveal a relatively high level of adoption of basic logistics systems among the enterprises surveyed, but limited deployment of advanced digital solutions. Transport Management Systems (TMS) were the most widely used, with 68% of enterprises reporting implementation. Enterprise Resource Planning (ERP) systems followed at 52%, while Electronic Document Circulation (EDC) platforms were used by 47% of respondents.

In contrast, only a minority of enterprises reported using predictive analytics, Internet of Things (IoT) devices, or integration platforms. These technologies were more commonly found in large enterprises, whereas micro and small enterprises rely on basic office tools such as spreadsheets, email, and telephone communication.

This discrepancy reflects a common pattern noted in the literature: enterprises tend to implement systems that are easy to integrate into existing workflows without requiring major organizational change. More complex, multi-source and adaptive systems are adopted at a much slower pace due to their technical complexity and the financial or competency-related resources they demand.

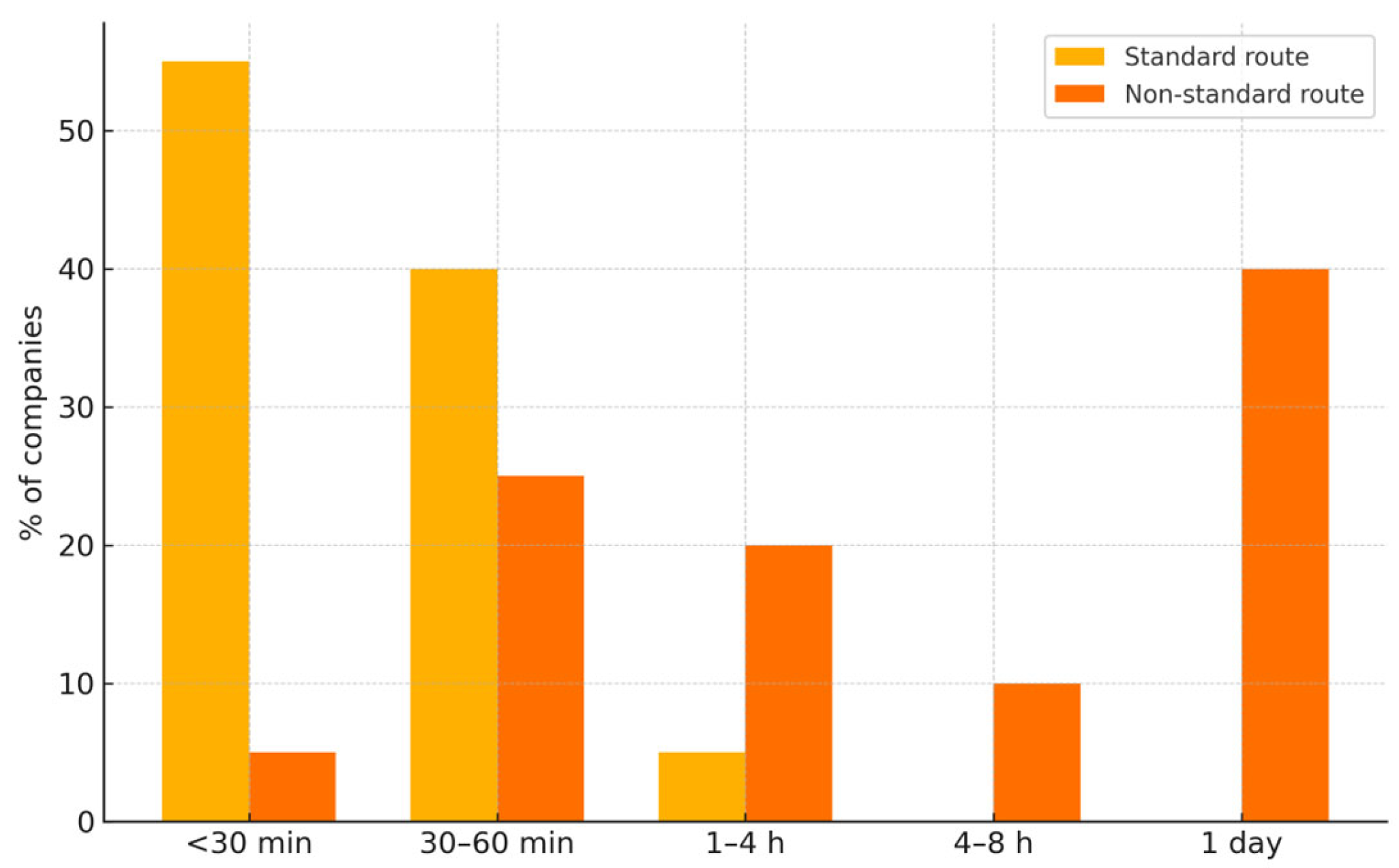

One operational area where this asymmetry is evident is the preparation of transport quotations. For standardized routes, the process was efficient: over 50% of surveyed enterprises could generate an official quote within 30 min, and another 40% within one hour. This suggests the use of templates, predefined pricing structures, or automated support.

For standard and repetitive routes, the quotation process is relatively fast: over half of the enterprises reported preparing a quote in under 30 min, and another 4 out of 10 did so within an hour. As shown in

Figure 1, nearly all enterprises can prepare quotations for standard routes within an hour. This suggests a high degree of process standardization and the possible use of templates or support systems. However, for non-standard or intercontinental routes, more than half of the respondents indicated that quotation preparation took a full workday or longer, highlighting the lack of automation and reliance on manual procedures. This limits responsiveness and may negatively affect competitiveness in fast-moving logistics markets.

The data suggests that while routine operations are moderately digitalized, exceptional or irregular processes still depend on human intervention and case-by-case estimation. This reinforces the importance of flexible planning tools capable of integrating multiple data sources and supporting automated decision-making.

Figure 2 illustrates the variation in digital tool adoption across company sizes. While TMS and ERP systems are relatively widespread among large enterprises, the uptake of advanced tools such as IoT or integration platforms remains low across the board, particularly among small and medium-sized enterprises. This reinforces the observation that SMEs tend to rely on simpler, less integrated solutions, often driven by resource limitations and operational pressures.

4.2. Use of Route Planning Tools and User Satisfaction

The survey found that only 20% of respondents reported using dedicated tools for route or intermodal planning. Among these users, just 60% declared being satisfied with the functionality and outcomes of such tools, indicating a narrow segment of effective digital tool adoption in the sector.

Among the enterprises that do not currently use such tools, the most frequently cited reason was a focus on other strategic priorities. Additionally, nearly one-third of enterprises stated they relied on in-house solutions, often developed internally or based on spreadsheets. A notable barrier was limited awareness of the existence of commercial planning tools, which suggests an ongoing need for market education and communication from solution providers.

Among satisfied users, the most appreciated features were as follows:

Ease of integration with internal systems;

Time savings in operational planning;

Interface intuitiveness;

The high accuracy of estimated transit times and costs compared to actual conditions.

On the other hand, enterprises that reported dissatisfaction most often mentioned the need to go through too many steps to obtain results, as well as functional shortcomings or discrepancies between system-generated data and market realities. One respondent explicitly noted that “the tool doesn’t always work”, pointing to reliability issues.

In summary, route planning tools are used by a small minority of TFL enterprises, and even among users, perceptions remain mixed. Functional limitations, integration challenges, and market fragmentation continue to act as barriers to broader adoption, especially among small and medium-sized enterprises.

4.3. Carbon Footprint Tracking and Sustainability Practices

As part of the survey, respondents were asked whether their enterprises engage in activities aimed at reducing greenhouse gas emissions and whether digital planning tools are used to estimate the carbon footprint of transport operations. The findings are encouraging: 75% of enterprises declared they are taking steps toward emission reduction, reflecting growing environmental awareness across the logistics sector.

However, only a minority of firms reported using planning tools with built-in CO2 emission estimation features. Among these, many indicated that such functionalities are used primarily for internal reporting or as part of sustainability initiatives linked to client expectations or financing requirements. The availability of emissions-related data is also viewed as increasingly important in commercial tenders and ESG reporting processes.

Enterprises that do not use such features most commonly emphasized

A lack of trust in estimation algorithms;

Insufficient precision for use in formal documentation;

Irrelevance to their operational model (e.g., subcontracted transport with limited control over emission sources).

The growing relevance of carbon metrics, both in terms of regulatory compliance (e.g., Fit for 55, CSRD) and customer-driven sustainability, suggests that CO2 tracking capabilities may soon become a standard requirement for digital planning tools used in intermodal logistics.

4.4. Summary of Key Findings

The survey results reveal several critical insights into the current state of digitalization in the Polish transportation, forwarding, and logistics (TFL) sector, particularly with respect to intermodal operations.

First, although basic systems such as TMS and ERP are widely used, the adoption of advanced or integrated digital planning tools—especially those supporting intermodal planning—is limited. Only 20% of enterprises use such tools, and satisfaction levels remain modest.

Second, significant barriers to adoption persist. These include limited awareness of available tools, organizational resistance, and a tendency to rely on internally developed solutions. Interestingly, financial concerns were less frequently cited, suggesting that strategic alignment and communication may be more decisive factors.

Third, while many enterprises demonstrate strong environmental awareness—75% report efforts to reduce CO2 emissions—few currently use digital planning tools for carbon footprint tracking. The gap between sustainability goals and digital support systems suggests an opportunity for platform developers to better align their offerings with user expectations.

Finally, the data point to an uneven level of digital maturity. Larger enterprises are generally more advanced in terms of tool adoption, automation, and process integration, while SMEs remain constrained by operational pressures and limited implementation capacity.

5. Discussion

The results confirm a pattern observed in prior research: digitalization in the logistics sector is progressing selectively, with advanced tools such as intermodal digital planning tools adopted by only a minority of enterprises. While basic platforms like TMS and ERP are relatively widespread, only 20% of surveyed enterprises use route planning tools, and just 10% report satisfaction with their performance. These figures are consistent with earlier findings on the functionality limitations and poor integration of commercial logistics platforms [

18,

39].

A distinctive contribution of this study is the identification of non-financial barriers as more significant than cost. Enterprises most often emphasized focus on other strategic priorities, reliance on internal tools, and lack of awareness—rather than insufficient budget—as reasons for non-adoption. This aligns with growing evidence that organizational readiness, digital leadership, and internal strategy play a greater role in tool implementation than funding alone [

14,

28,

29].

The findings also highlight a gap between environmental aspirations and digital practice. Although 75% of enterprises declared carbon reduction goals, few use systems that track CO

2 emissions. This suggests either limited trust in estimation tools or a perception that such functions are non-essential. Yet, as regulatory pressures (e.g., CSRD, Fit for 55) and client expectations grow, carbon tracking may soon shift from a nice-to-have to a standard requirement in digital platforms [

41].

Furthermore, the strong reliance on manual processes for non-standard quotations—often taking a full workday or more—shows that many firms still lack the agility required for complex, international forwarding. Here, digital innovation could focus on quotation engines based on real-time data, historical rates, and carrier integration, particularly relevant for intermodal shipments where decision complexity is high.

From a practical standpoint, the study offers several implications:

Platform developers should enhance usability, simplify multi-step processes, and improve data reliability—especially for CO2 estimation.

Policymakers and sector associations should focus on awareness-building and implementation support for SMEs, including access to tailored tools and training.

Logistics managers need to align digitalization efforts with long-term strategy, treating automation not only as a cost-saver but as a capability-building process.

This study is not without limitations. The non-random sampling and predominance of larger enterprises may restrict generalizability. The data were collected in one country, and results may differ in other regulatory or market contexts. Nonetheless, the insights provide a solid basis for future research on tool performance, SME-specific implementation models, and the role of sustainability features in digital adoption.

Future studies should explore longitudinal adoption patterns, the evolution of satisfaction over time, and comparative research between national markets. They should also examine how CO2 reporting tools are used in practice—and whether they influence transport planning decisions or serve purely reporting purposes.

The differentiation of user needs between large enterprises and SMEs is well-documented in the literature provided. Large enterprises typically expect high levels of integration with internal ERP and CRM systems, real-time shipment visibility, and functionalities supporting environmental reporting and cost optimization. These enterprises are more likely to have the IT infrastructure and human resources required for advanced digital implementation and data-driven decision-making processes [

42,

43].

In contrast, small and medium-sized enterprises often face significant barriers in adopting such complex systems, including limited budgets, lack of IT personnel, and lower digital maturity. For SMEs, the most valuable features are simplicity, low onboarding effort, clear licensing models, and access to ready-to-use templates and interfaces for cooperation with ports or carriers [

44]. Cloud-based SaaS platforms, modular solutions, and drag-and-drop interfaces have been shown to support higher adoption rates in this segment [

45,

46].

Therefore, platform developers should offer differentiated product strategies, including scalable architectures that enable SMEs to start small and expand over time, while simultaneously meeting the complex requirements of large logistics players.

6. Conclusions

This study examined the current use of digital planning tools in the Polish transportation, forwarding, and logistics (TFL) sector, with a particular focus on intermodal transport planning. Despite increasing awareness of the benefits of digitalization, the actual adoption of advanced tools remains limited. Only a small share of enterprises uses route digital planning tools, and satisfaction with existing solutions is modest.

In order to accelerate digital transformation in the intermodal transport sector—particularly among small and medium-sized enterprises—public policy interventions should go beyond financial incentives and include targeted support measures. We recommend the implementation of national or regional digital advisory programs coordinated by institutions such as the Polish Agency for Enterprise Development (PARP). These programs should provide sector-specific guidance, promote interoperability standards for planning tools, and offer technical assistance for SMEs during system implementation. Additionally, awareness-raising campaigns that showcase successful digitalization cases and clarify the return on investment of planning systems could help address resistance and uncertainty among managers. Such measures could bridge the knowledge gap and support the more inclusive and scalable adoption of digital solutions in the logistics sector.

The findings indicate that barriers such as a lack of awareness, organizational inertia, and strategic misalignment outweigh financial concerns. The study also reveals the discrepancy between environmental goals and the use of CO2 tracking tools, suggesting that further development and trust-building are needed in this area.

Digital platforms must evolve to better address user expectations—particularly in SMEs—by offering simplified integration, reliable emissions estimation, and support for non-standard operations. Policymakers and logistics leaders alike should prioritize not only funding but also education, capacity building, and access to practical solutions.

While the study has limitations related to sample composition and national scope, it offers valuable insights into the challenges and opportunities of digital transformation in intermodal logistics. Future research should explore longitudinal trends, performance outcomes, and international comparisons to deepen the understanding of adoption dynamics in this evolving field.