A Two-Storage Inventory Model with Trade Credit Policy and Time-Varying Holding Cost under Quantity Discounts

Abstract

:1. Introduction

- The selling price and advertisement frequency are two significant demand-impacting variables. Also, a hike in demand may favor profit enhancement. What will be the overall impacts of on-average profit enhancement?

- A demand hike may cause a need for a big purchasing order size. However, carrying the warehouse may lead to additional costs for the retailer. What is the optimal scenario that can ensure the best profit?

- There may be two different warehousing scenarios available. The warehouse may be rented or owned. Rented warehouses are taken to ensure inventory for uninterrupted supply and deterioration-related issues, but this adds costs. What will be the best scenario for choosing the tenure of owned and rented warehouses?

2. Literature Review

2.1. Inventory Model with Various Kinds of Demand Function

2.2. Inventory Model with Quantity Discount

2.3. Inventory Model with Time-Varying Holding Cost

2.4. Two-Warehouse Inventory Model

2.5. Inventory Model Based on Trade Credit Policy

2.6. Research Gaps and Our Contribution

3. Notations and Assumptions

3.1. Notations

3.2. Assumptions

- Both warehouses have constant rates of deterioration. Due to the better infrastructure, the deterioration rate in an R.W. is, however, lower than that in an O.W., i.e., (see Tiwari et al. [48]).

- The demand function of a product is considered as a multiplicative of the selling price and advertisement frequency in the following way: (see Khan et al. [69]).

- The supplier allows for some time for the consumer to pay the purchasing amount, but the retailer must pay the amount in full before making the subsequent order.

- The planning horizon for inventories is infinite.

- The complete lot size is provided in a single batch.

4. Mathematical Model

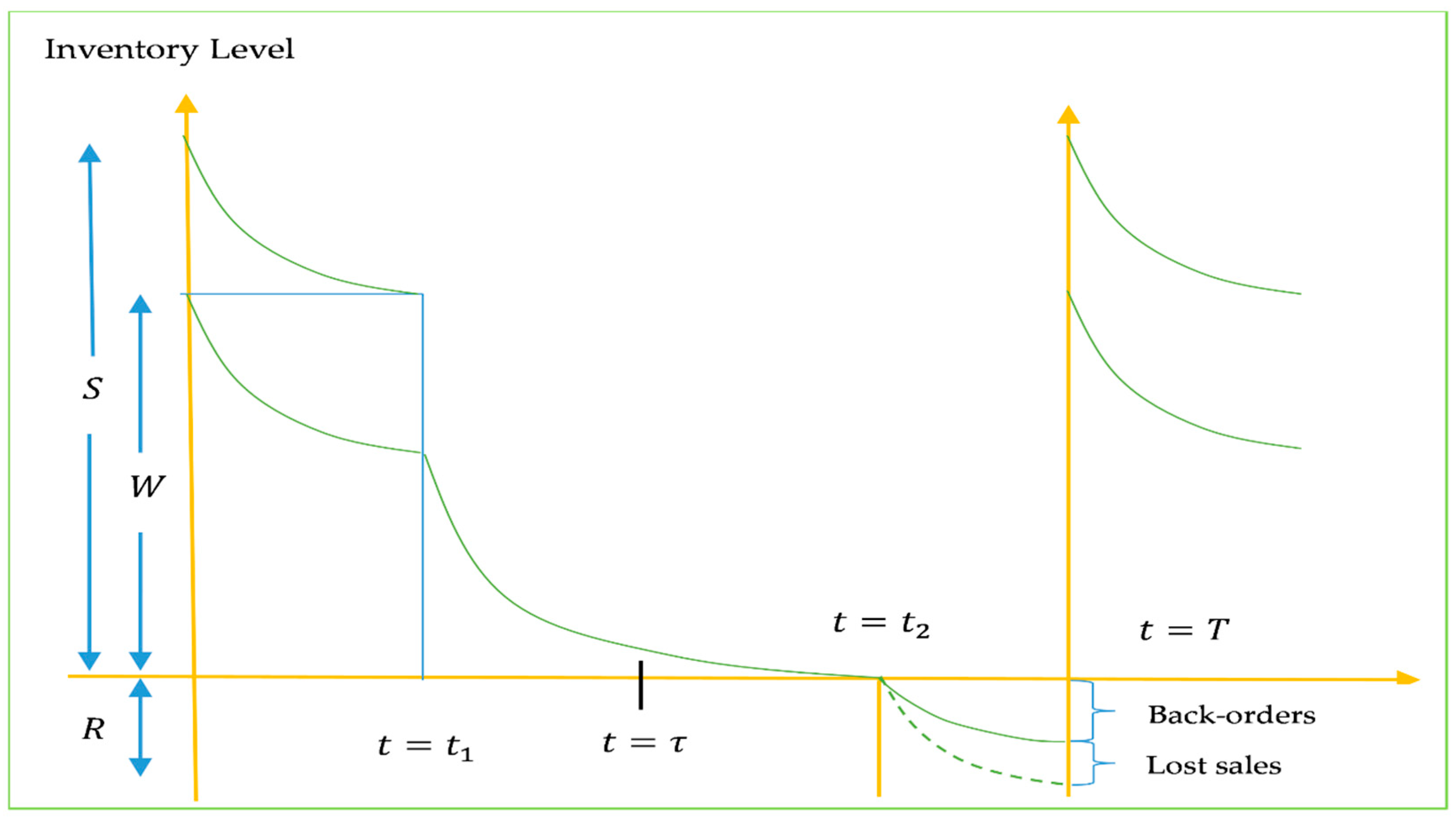

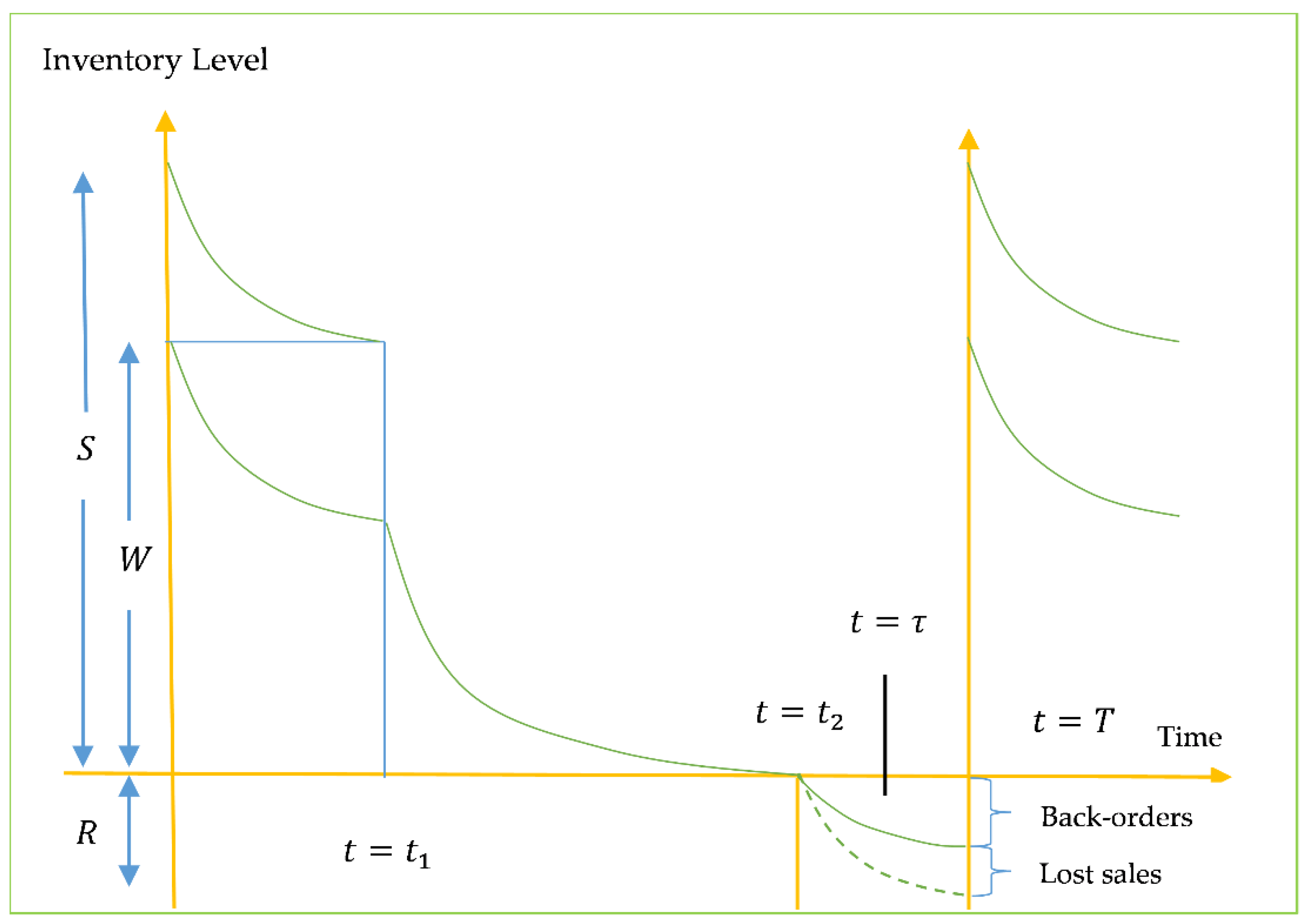

4.1. Inventory Model for Rented Warehouse (R.W.)

4.2. Inventory Model for Owned Warehouse (O.W.)

4.3. Computation of Different Costs

- (i)

- Cost of ordering (O.C.): .

- (ii)

- Cost of advertisement (A.C.): .

- (iii)

- Holding cost : The total cost of holding (H.C.) over a complete cycle is given by

- (iv)

- Shortage cost (S.C.):

- (v)

- Deterioration cost (D.C.):

- (vi)

- Lost sale cost (LSC):

5. Analysis of Trade Credit Policy

5.1. When Trade Credit Time Is in Stock-In Period, i.e., ()

5.1.1. When the Total Earning Amount Is Greater than the Total Purchasing Cost, i.e.,

5.1.2. When the Total Earning Amount Is Less than the Total Purchasing Cost, i.e.,

When a Partial Payment Is Allowed at

When a Partial Payment Is Not Allowed at

5.2. When Trade Credit Time Is in a Stock-Out Period, i.e., ()

6. Computational Algorithms

6.1. Conditions for the Existence of Optimal Solution of

6.2. Conditions for the Existence of Optimal Solution of

6.3. Conditions for the Existence of Optimal Solution of

6.4. Conditions for the Existence of Optimal Solution of

7. Numerical Simulation

7.1. Solution Procedure

| Algorithm 1: Numerical computation procedure for getting best profit |

. , this solution is infeasible, so go to step 7. Otherwise, go to step 5. , the solution is . Go to step 6. . If this condition holds, go to step 8. Otherwise, go to step 7. , go to step 8. with the optimal values . Step 9: End. |

7.2. Numerical Illustration

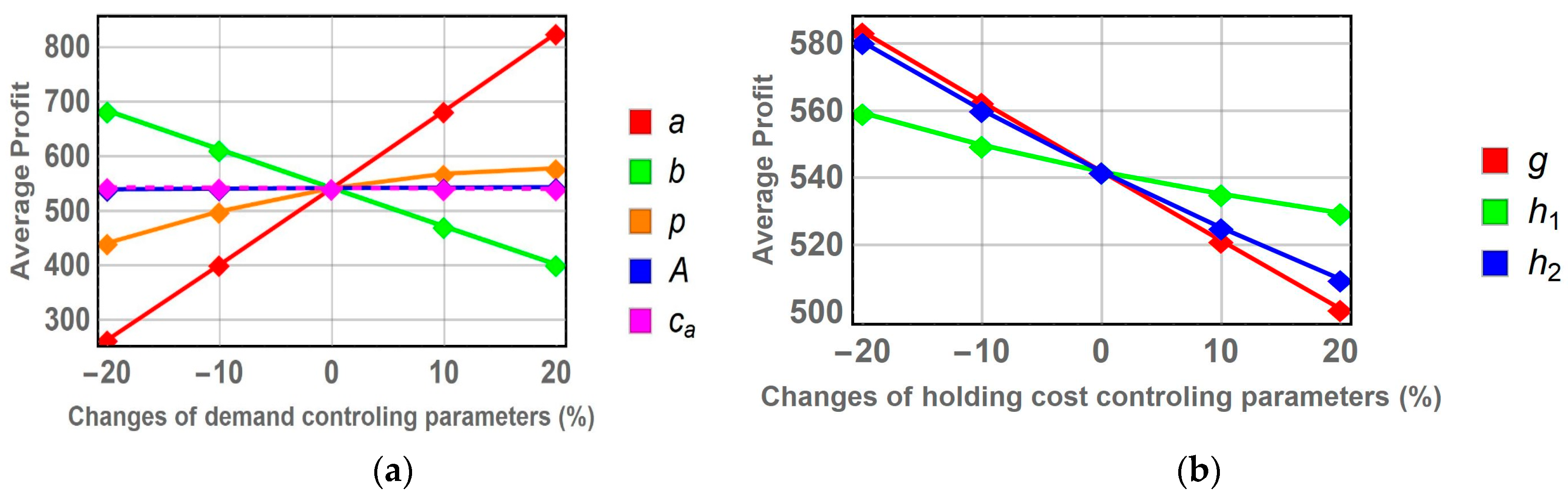

8. Sensitivity Analysis and Managerial Insights

8.1. Sensitivity of the Optimal Solution

8.2. Management Insights

9. Conclusions and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Harris, F.W. How many parts to make at once. J. Manuf. Syst. 1913, 10, 135–136. [Google Scholar] [CrossRef]

- Silver, E.A. A heuristic for selecting lot size quantities for the case of a deterministic time-varying demand rate and discrete opportunities for replenishment. Prod. Inventory Manag. J. 1973, 2, 64–74. [Google Scholar]

- Kim, J.; Hwang, H.; Shinn, S. An optimal credit policy to increase supplier’s profits with price-dependent demand functions. Prod. Plan. Control 1995, 6, 45–50. [Google Scholar] [CrossRef]

- Giri, B.C.; Pal, S.; Goswami, A.; Chaudhuri, K.S. An inventory model for deteriorating items with stock-dependent demand rate. Eur. J. Oper. Res. 1996, 95, 604–610. [Google Scholar] [CrossRef]

- Goyal, S.K.; Gunasekaran, A. An integrated production-inventory-marketing model for deteriorating items. Comput. Ind. Eng. 1995, 28, 755–762. [Google Scholar] [CrossRef]

- Nouira, I.; Frein, Y.; Hadj-Alouane, A.B. Optimization of manufacturing systems under environmental considerations for a greenness-dependent demand. Int. J. Prod. Econ. 2014, 150, 188–198. [Google Scholar] [CrossRef]

- Yang, Y.; Chi, H.; Zhou, W.; Fan, T.; Piramuthu, S. Deterioration control decision support for perishable inventory management. Decis. Support Syst. 2020, 134, 113308. [Google Scholar] [CrossRef]

- Rahman, M.S.; Manna, A.K.; Shaikh, A.A.; Konstantaras, I.; Bhunia, A.K. Optimal decision making, using interval uncertainty techniques, of a production-inventory model under warranty-linked demand and carbon tax regulations. Soft Comput. 2023, 27, 2903–2920. [Google Scholar] [CrossRef]

- Mondal, B.; Bhunia, A.K.; Maiti, M. Inventory models for defective items incorporating marketing decisions with variable production cost. Appl. Math. Model. 2009, 33, 2845–2852. [Google Scholar] [CrossRef]

- Muhlemann, A.P.; Valtis-Spanopoulos, N.P. A variable holding cost rate EOQ model. Eur. J. Oper. Res. 1980, 4, 132–135. [Google Scholar] [CrossRef]

- Sarker, B.R.; Jamal, A.M.M.; Wang, S. Optimal payment time under permissible delay in payment for products with deterioration. Prod. Plan. Control. 2000, 11, 380–390. [Google Scholar] [CrossRef]

- Aggarwal, S.P.; Jaggi, C.K. Ordering policies of deteriorating items under permissible delay in payments. J. Oper. Res. Soc. 1995, 46, 658–662. [Google Scholar] [CrossRef]

- Ho, C.H. The optimal integrated inventory policy with price-and-credit-linked demand under two-level trade credit. Comput. Ind. Eng. 2011, 60, 117–126. [Google Scholar] [CrossRef]

- Chen, L.H.; Kang, F.S. Integrated inventory models considering the two-level trade credit policy and a price-negotiation scheme. Eur. J. Oper. Res. 2010, 205, 47–58. [Google Scholar] [CrossRef]

- Shah, N.H.; Soni, H.N.; Patel, K.A. Optimizing inventory and marketing policy for non-instantaneous deteriorating items with generalized type deterioration and holding cost rates. Omega 2013, 41, 421–430. [Google Scholar] [CrossRef]

- Bhunia, A.K.; Shaikh, A.A.; Sharma, G.; Pareek, S. A two-storage inventory model for deteriorating items with variable demand and partial backlogging. J. Ind. Prod. Eng. 2015, 32, 263–272. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Gautam, P.; Khanna, A. Inventory decisions for imperfect quality deteriorating items with exponential declining demand under trade credit and partially backlogged shortages. Qual. IT Bus. Oper. 2018, 18, 213–229. [Google Scholar]

- Tripathi, R.P. Innovation of economic order quantity (EOQ) model for deteriorating items with time-linked quadratic demand under non-decreasing shortages. Int. J. Appl. Comput. 2019, 5, 123. [Google Scholar] [CrossRef]

- Namdeo, A.; Khedlekar, U.K.; Singh, P. Discount pricing policy for deteriorating items under preservation technology cost and shortages. J. Manag. Anal. 2020, 7, 649–671. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Panda, G.C.; Khan, M.A.A.; Mashud, A.H.M.; Biswas, A. An inventory model for deteriorating items with preservation facility of ramp type demand and trade credit. Int. J. Math. Oper. 2020, 17, 514–551. [Google Scholar] [CrossRef]

- Handa, N.; Singh, S.R.; Punetha, N. Impact of inflation on production inventory model with variable demand and shortages. Decis. Mak. Invent. Manag. 2021, 3, 37–48. [Google Scholar]

- Mishra, U. A waiting time deterministic inventory model for perishable items in stock and time dependent demand. Int. J. Syst. Assur. Eng. Manag. 2015, 7, 294–304. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Shaikh, A.A.; Cárdenas-Barrón, L.E.; Mashud, A.H.M.; Treviño-Garza, G.; Céspedes-Mota, A. An inventory model for non-instantaneously deteriorating items with nonlinear stock-dependent demand, hybrid payment scheme and partially backlogged shortages. Mathematics 2022, 10, 434. [Google Scholar] [CrossRef]

- Shah, B.J.; Shroff, A. Inventory model for sustainable operations of fixed-life products: Role of trapezoidal demand and two-level trade credit financing. J. Clean. Prod. 2022, 380, 135093. [Google Scholar] [CrossRef]

- Hadley, G.; Whitin, T.M. Analysis of Inventory Systems; Prentice Hall: Englewood Cliffs, NJ, USA, 1963; pp. 658–787. [Google Scholar]

- Shi, J.; Zhang, G.; Lai, K.K. Optimal ordering and pricing policy with supplier quantity discounts and price-dependent stochastic demand. Optimization 2012, 61, 151–162. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Pentico, D.W. An economic order quantity model with partial backordering and all-units discount. Int. J. Prod. Econ. 2014, 155, 172–184. [Google Scholar] [CrossRef]

- Alfares, H.K. Maximum-profit inventory model with stock-dependent demand, time dependent holding cost, and all-units quantity discounts. Math. Model. Anal. 2015, 20, 715–736. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Khan, M.A.A.; Panda, G.C.; Konstantaras, I. Price discount facility in an EOQ model for deteriorating items with stock-dependent demand and partial backlogging. Int. Trans. Oper. Res. 2019, 26, 1365–1395. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Ahmed, S.; Babu, M.S.; Sultana, N. Optimal lot-size decision for deteriorating items with price-sensitive demand, linearly time-dependent holding cost under all-units discount environment. Int. J. Syst. Sci. Oper. Logist. 2020, 9, 61–74. [Google Scholar] [CrossRef]

- Rahman, M.S.; Duary, A.; Khan, M.A.A.; Shaikh, A.A.; Bhunia, A.K. Interval valued demand related inventory model under all units discount facility and deterioration via parametric approach. Artif. Intell. Rev. 2022, 55, 2455–2494. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Cárdenas-Barrón, L.E.; Treviño-Garza, G.; Céspedes-Mota, A. A prepayment installment decision support framework in an inventory system with all-units discount against link-to-order prepayment under power demand pattern. Expert Syst. Appl. 2022, 213, 119247. [Google Scholar] [CrossRef]

- Momena, A.F.; Rahaman, M.; Haque, R.; Alam, S.; Mondal, S.P. A Learning-Based Optimal Decision Scenario for an Inventory Problem under a Price Discount Policy. Systems 2023, 11, 235. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Cárdenas-Barrón, L.E.; Smith, N.R.; Bourguet-Díaz, R.E.; Loera-Hernández, I.D.J.; Peimbert-García, R.E.; Treviño-Garza, G.; Céspedes-Mota, A. Effects of all-units discount on pricing and replenishment policies of an inventory model under power demand pattern. Int. J. Syst. Sci. Oper. Logist. 2023, 10, 2161712. [Google Scholar] [CrossRef]

- Ferguson, M.; Jayaraman, V.; Souza, G.C. Note: An application of the EOQ model with nonlinear holding cost to inventory management of perishables. Eur. J. Oper. Res. 2007, 180, 485–490. [Google Scholar] [CrossRef]

- Mishra, V.K. An inventory model of instantaneous deteriorating items with controllable deterioration rate for time dependent demand and holding cost. J. Ind. Eng. Manag. 2013, 6, 495–506. [Google Scholar] [CrossRef]

- Dutta, D.; Kumar, P. A partial backlogging inventory model for deteriorating items with time-varying demand and holding cost. Int. J. Math. Oper. 2015, 7, 281–296. [Google Scholar] [CrossRef]

- Pervin, M.; Roy, S.K.; Weber, G.W. An integrated inventory model with variable holding cost under two levels of trade-credit policy. Numer. Algebra Control Optim. 2018, 8, 169–191. [Google Scholar] [CrossRef]

- Garai, T.; Chakraborty, D.; Roy, T.K. Fully fuzzy inventory model with price-dependent demand and time varying holding cost under fuzzy decision variables. J. Intell. Fuzzy Syst. 2019, 36, 3725–3738. [Google Scholar] [CrossRef]

- Pando, V.; San-José, L.A.; García-Laguna, J.; Sicilia, J. Optimal lot-size policy for deteriorating items with stock-dependent demand considering profit maximization. Comput. Ind. Eng. 2018, 117, 81–93. [Google Scholar] [CrossRef]

- Swain, P.; Mallick, C.; Singh, T.; Mishra, P.J.; Pattanayak, H. Formulation of an optimal ordering policy with generalised time-dependent demand, quadratic holding cost and partial backlogging. J. Inf. Optim. Sci. 2021, 42, 1163–1179. [Google Scholar] [CrossRef]

- Paul, A.; Pervin, M.; Roy, S.K.; Maculan, N.; Weber, G.W. A green inventory model with the effect of carbon taxation. Ann. Oper. Res. 2022, 309, 233–248. [Google Scholar] [CrossRef]

- Kumar, S.; Singh, S.R.; Agarwal, S.; Yadav, D. Joint effect of selling price and promotional efforts on retailer’s inventory control policy with trade credit, time-dependent holding cost, and partial backlogging under inflation. RAIRO Oper. Res. 2023, 57, 1491–1522. [Google Scholar] [CrossRef]

- Hartley, R.V. Operations Research: A Managerial Emphasis; Goodyears Pub. Comp: Pacific Palisades, CA, USA, 1976; pp. 315–317. [Google Scholar]

- Yang, H.L.; Chang, C.T. A two-warehouse partial backlogging inventory model for deteriorating items with permissible delay in payment under inflation. Appl. Math. Model. 2013, 37, 2717–2726. [Google Scholar] [CrossRef]

- Bhunia, A.K.; Jaggi, C.K.; Sharma, A.; Sharma, R. A two-warehouse inventory model for deteriorating items under permissible delay in payment with partial backlogging. Appl. Math. Comput. 2014, 232, 1125–1137. [Google Scholar] [CrossRef]

- Xu, X.; Bai, Q.; Chen, M. A comparison of different dispatching policies in two-warehouse inventory systems for deteriorating items over a finite time horizon. Appl. Math. Model. 2017, 41, 359–374. [Google Scholar] [CrossRef]

- Tiwari, S.; Jaggi, C.K.; Bhunia, A.K.; Shaikh, A.A.; Goh, M. Two-warehouse inventory model for non-instantaneous deteriorating items with stock-dependent demand and inflation using particle swarm optimization. Ann. Oper. Res. 2017, 254, 401–423. [Google Scholar] [CrossRef]

- Chakraborty, D.; Jana, D.K.; Roy, T.K. Two-warehouse partial backlogging inventory model with ramp type demand rate, three-parameter Weibull distribution deterioration under inflation and permissible delay in payments. Comput. Ind. Eng. 2018, 123, 157–179. [Google Scholar] [CrossRef]

- Jonas, C.P. Optimizing a two-warehouse system under shortage backordering, trade credit, and decreasing rental conditions. Int. J. Prod. Econ. 2019, 209, 147–155. [Google Scholar]

- Ghiami, Y.; Beullens, P. The continuous resupply policy for deteriorating items with stock-dependent observable demand in a two-warehouse and two-echelon supply chain. Appl. Math. Model. 2020, 82, 271–292. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Shaikh, A.A.; Panda, G.C.; Bhunia, A.K.; Konstantaras, I. Non-instantaneous deterioration effect in ordering decisions for a two-warehouse inventory system under advance payment and backlogging. Ann. Oper. Res. 2020, 289, 243–275. [Google Scholar] [CrossRef]

- Xu, C.; Zhao, D.; Min, J.; Hao, J. An inventory model for nonperishable items with warehouse mode selection and partial backlogging under trapezoidal-type demand. J. Oper. Res. Soc. 2021, 72, 744–763. [Google Scholar] [CrossRef]

- Thilagavathi, R.; Viswanath, J.; Cepova, L.; Schindlerova, V. Effect of Inflation and Permitted Three-Slot Payment on Two-Warehouse Inventory System with Stock-Dependent Demand and Partial Backlogging. Mathematics 2022, 10, 3943. [Google Scholar] [CrossRef]

- Padiyar, S.S.; Bhagat, N.; Singh, S.R.; Punetha, N.; Dem, H. Production policy for an integrated inventory system under cloudy fuzzy environment. Int. J. Appl. Decis. Sci. 2023, 16, 255–299. [Google Scholar]

- Goyal, S.K. Economic order quantity under conditions of permissible delay in payments. J. Oper. Res. Soc. 1985, 36, 335–338. [Google Scholar] [CrossRef]

- Taleizadeh, A.A. An EOQ model with partial backordering and advance payments for an evaporating item. Int. J. Prod. Econ. 2014, 155, 185–193. [Google Scholar] [CrossRef]

- Wu, J.; Ouyang, L.Y.; Cárdenas-Barrón, L.E.; Goyal, S.K. Optimal credit period and lot size for deteriorating items with expiration dates under two-level trade credit financing. Eur. J. Oper. Res. 2014, 237, 898–908. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S.; Cárdenas-Barron, L.E. An inventory model with trade-credit policy and variable deterioration for fixed lifetime products. Ann. Oper. Res. 2015, 229, 677–702. [Google Scholar] [CrossRef]

- Tiwari, S.; Ahmed, W.; Sarkar, B. Multi-item sustainable green production system under trade-credit and partial backordering. J. Clean. Prod. 2018, 204, 82–95. [Google Scholar] [CrossRef]

- Rapolu, C.N.; Kandpal, D.H. Joint pricing, advertisement, preservation technology investment and inventory policies for non-instantaneous deteriorating items under trade credit. Opsearch 2020, 57, 274–300. [Google Scholar] [CrossRef]

- Duary, A.; Das, S.; Arif, M.G.; Abualnaja, K.M.; Khan, M.A.A.; Zakarya, M.; Shaikh, A.A. Advance and delay in payments with the price-discount inventory model for deteriorating items under capacity constraint and partially backlogged shortages. Alex. Eng. J. 2022, 61, 1735–1745. [Google Scholar] [CrossRef]

- Jani, M.Y.; Patel, H.A.; Bhadoriya, A.; Chaudhari, U.; Abbas, M.; Alqahtani, M.S. Deterioration Control Decision Support System for the Retailer during Availability of Trade Credit and Shortages. Mathematics 2023, 11, 580. [Google Scholar] [CrossRef]

- Tiwari, S.; Cárdenas-Barrón, L.E.; Shaikh, A.A.; Goh, M. Retailer’s optimal ordering policy for deteriorating items under order-size dependent trade credit and complete backlogging. Comput. Ind. Eng. 2020, 139, 105559. [Google Scholar] [CrossRef]

- Yang, C.T.; Dye, C.Y.; Ding, J.F. Optimal dynamic trade credit and preservation technology allocation for a deteriorating inventory model. Comput. Ind. Eng. 2015, 87, 356–369. [Google Scholar] [CrossRef]

- Cheng, M.C.; Lo, H.C.; Yang, C.T. Optimizing Pricing, Pre-Sale Incentive, and Inventory Decisions with Advance Sales and Trade Credit under Carbon Tax Policy. Mathematics 2023, 11, 2534. [Google Scholar] [CrossRef]

- Mahata, P.; Mahata, G.C.; De, S.K. An economic order quantity model under two-level partial trade credit for time varying deteriorating items. Int. J. Syst. Sci. Oper. Logist. 2020, 7, 1–17. [Google Scholar] [CrossRef]

- Vandana; Singh, S.R.; Yadav, D.; Sarkar, B.; Sarkar, M. Impact of energy and carbon emission of a supply chain management with two-level trade-credit policy. Energies 2021, 14, 1569. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Shaikh, A.A.; Konstantaras, I.; Bhunia, A.K.; Cárdenas-Barrón, L.E. Inventory models for perishable items with advanced payment, linearly time-dependent holding cost and demand dependent on advertisement and selling price. Int. J. Prod. Econ. 2020, 230, 107804. [Google Scholar] [CrossRef]

- Alfares, H.K.; Ghaithan, A.M. Inventory and pricing model with price-dependent demand, time-varying holding cost, and quantity discounts. Comput. Ind. Eng. 2016, 94, 170–177. [Google Scholar] [CrossRef]

| Authors | Year | Model Type | TW | Dete. | Demand | PBS | TCP | TDHC | AUDP | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PD | A.D. | TD | SD | |||||||||

| Taleizadeh and Pentico [27] | 2014 | EOQ | √ | √ | ||||||||

| Alfares [28] | 2015 | EPQ | √ | √ | √ | |||||||

| Dutta and Kumar [37] | 2015 | EOQ | √ | √ | √ | √ | ||||||

| Mishra [22] | 2015 | EOQ | √ | √ | √ | √ | ||||||

| Tiwari et al. [48] | 2017 | EOQ | √ | √ | √ | √ | ||||||

| Tiwari et al. [60] | 2018 | EPQ | √ | √ | ||||||||

| Chakraborty et al. [49] | 2018 | EOQ | √ | √ | √ | √ | √ | √ | ||||

| Jonas [50] | 2019 | EOQ | √ | √ | √ | |||||||

| Garai et al. [39] | 2019 | EOQ | √ | √ | √ | |||||||

| Khan et al. [30] | 2020 | EOQ | √ | √ | √ | √ | ||||||

| Khan et al. [52] | 2020 | EOQ | √ | √ | √ | √ | ||||||

| Khan et al. [69] | 2020 | EOQ | √ | √ | √ | √ | √ | √ | ||||

| Shaikh et al. [20] | 2020 | EOQ | √ | √ | √ | √ | ||||||

| Khan et al. [23] | 2022 | EOQ | √ | √ | √ | √ | ||||||

| Thilagavathi et al. [54] | 2022 | EOQ | √ | √ | √ | √ | ||||||

| Rahman et al. [31] | 2022 | EOQ | √ | √ | √ | √ | √ | √ | ||||

| Duary et al. [62] | 2022 | EOQ | √ | √ | √ | √ | √ | √ | √ | |||

| Momena et al. [33] | 2023 | EOQ | √ | √ | √ | |||||||

| Jani et al. [63] | 2023 | EOQ | √ | √ | √ | |||||||

| Kumar et al. [43] | 2023 | EOQ | √ | √ | √ | √ | √ | |||||

| This paper | EOQ | √ | √ | √ | √ | √ | √ | √ | √ | |||

| Notations | Units | Description |

|---|---|---|

| USD/order | Ordering cost | |

| Constant | ||

| Constant | ||

| Constant | Advertisement frequency | |

| USD/ad. | Cost of advertisement | |

| USD/unit | Purchasing cost | |

| USD/unit | Selling price | |

| USD/unit | Shortage cost | |

| USD/unit | Cost of deterioration | |

| USD/unit | Opportunity cost | |

| USD/unit | Fixed part of holding cost | |

| USD/unit | Coefficient of time in holding cost function at R.W. | |

| USD/unit | Coefficient of time in holding cost function at O.W. | |

| Constant | Deterioration at R.W. | |

| Constant | Deterioration at O.W. | |

| Units | O.W. storage capacity | |

| Units | Shortage unit | |

| Units | Total storing capacity | |

| Units | Stock level in R.W. | |

| Units | Stock level in O.W. | |

| Years | Credit time of the retailer | |

| USD/year | Rate of interest earned by the retailer | |

| USD/year | Rate of interest mandated by the supplier | |

| USD/cycle | ||

| Years | Stock level finishing time in R.W. | |

| Years | Stock level finishing time in O.W. | |

| Years | Total inventory cycle length |

| Quantity | |||

|---|---|---|---|

| Parameters | Original Value | New Value | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 250 | 300 | 3.5601 | 7.69842 | 8.34401 | 504.469 | 33.2368 | 537.706 | 535.789 | |

| 275 | 3.53477 | 7.65995 | 8.27831 | 502.882 | 31.8601 | 534.742 | 538.797 | ||

| 225 | 3.48275 | 7.58112 | 8.14430 | 499.629 | 29.0635 | 528.692 | 544.886 | ||

| 200 | 3.45602 | 7.54069 | 8.07589 | 497.961 | 27.6423 | 525.603 | 547.969 | ||

| 100 | 120 | 3.35163 | 7.24035 | 7.51293 | 568.053 | 19.8628 | 587.916 | 826.483 | |

| 110 | 3.41962 | 7.40554 | 7.81309 | 534.831 | 25.3538 | 560.185 | 683.651 | ||

| 90 | 3.63344 | 7.9164 | 8.77289 | 467.26 | 35.0608 | 502.321 | 401.519 | ||

| 80 | 3.82386 | 8.35627 | 9.63835 | 432.669 | 38.888 | 471.557 | 263.677 | ||

| 2.5 | 3 | 3.63344 | 7.91640 | 8.77289 | 467.26 | 35.0608 | 502.321 | 401.519 | |

| 2.75 | 3.56553 | 7.75581 | 8.46596 | 484.329 | 32.8427 | 517.171 | 471.441 | ||

| 2.25 | 3.461 | 7.50551 | 7.99713 | 518.098 | 27.9662 | 546.064 | 612.589 | ||

| 2 | 3.41962 | 7.40554 | 7.81309 | 534.831 | 25.3538 | 560.185 | 683.651 | ||

| 20 | 24 | 4.41983 | 9.09599 | 10.4615 | 507.638 | 55.0937 | 562.731 | 578.229 | |

| 22 | 3.90457 | 8.26704 | 9.14527 | 503.628 | 40.4193 | 544.047 | 568.183 | ||

| 18 | 3.17973 | 7.07736 | 7.49365 | 498.931 | 23.7331 | 522.664 | 499.338 | ||

| 16 | 2.88802 | 6.59343 | 6.90665 | 495.638 | 19.5393 | 515.177 | 441.288 | ||

| 4 | 4.8 | 3.51907 | 7.63412 | 8.23337 | 502.801 | 31.0303 | 533.831 | 543.519 | |

| 4.4 | 3.51401 | 7.62742 | 8.22242 | 502.049 | 30.7481 | 532.797 | 542.73 | ||

| 3.6 | 3.50402 | 7.61448 | 8.20145 | 500.456 | 30.1944 | 530.651 | 540.797 | ||

| 3.2 | 3.49912 | 7.60832 | 8.19156 | 499.605 | 29.9244 | 529.53 | 539.609 | ||

| 15 | 18 | 3.52142 | 7.63971 | 8.24381 | 502.047 | 31.1387 | 533.185 | 540.371 | |

| 16.5 | 3.51522 | 7.6303 | 8.22781 | 501.658 | 30.8044 | 532.463 | 541.099 | ||

| 13.5 | 3.50274 | 7.61138 | 8.19565 | 500.878 | 30.1332 | 531.011 | 542.56 | ||

| 12 | 3.49645 | 7.60187 | 8.17949 | 500.485 | 29.7964 | 530.282 | 543.293 | ||

| 0.03 | 0.036 | 3.504 | 7.60889 | 8.18937 | 502.907 | 30.2317 | 533.138 | 548.68 | |

| 0.033 | 3.50649 | 7.61487 | 8.20054 | 502.086 | 30.3509 | 532.437 | 545.246 | ||

| 0.027 | 3.5115 | 7.62687 | 8.22301 | 500.456 | 30.5867 | 531.042 | 538.43 | ||

| 0.024 | 3.51402 | 7.6329 | 8.2343 | 499.646 | 30.7033 | 530.349 | 535.047 | ||

| 0.20 | 0.24 | 3.44955 | 7.54065 | 8.22332 | 497.557 | 35.1077 | 532.665 | 500.932 | |

| 0.22 | 3.47974 | 7.58132 | 8.2185 | 499.441 | 32.8119 | 532.253 | 521.289 | ||

| 0.18 | 3.53731 | 7.65929 | 8.20311 | 503.041 | 28.0801 | 531.121 | 562.553 | ||

| 0.16 | 3.56471 | 7.69662 | 8.19258 | 504.758 | 25.6447 | 530.403 | 583.461 | ||

| 0.30 | 0.36 | 3.09919 | 7.27241 | 7.74452 | 475.902 | 24.4284 | 500.33 | 529.531 | |

| 0.33 | 3.28794 | 7.43141 | 7.95696 | 487.521 | 27.1518 | 514.673 | 535.19 | ||

| 0.27 | 3.77255 | 7.85118 | 8.52399 | 517.86 | 34.6107 | 552.471 | 549.737 | ||

| 0.24 | 4.0941 | 8.13843 | 8.91736 | 538.4 | 39.947 | 578.347 | 559.335 | ||

| 0.10 | 0.12 | 3.47943 | 7.25155 | 7.7755 | 499.422 | 27.0703 | 526.492 | 509.788 | |

| 0.11 | 3.48944 | 7.42161 | 7.97402 | 500.047 | 28.5173 | 528.564 | 525.134 | ||

| 0.09 | 3.54147 | 7.8579 | 8.50109 | 503.301 | 33.1153 | 536.417 | 560.129 | ||

| 0.08 | 3.59181 | 8.14518 | 8.86033 | 506.459 | 36.7436 | 543.202 | 580.375 | ||

| 0.05 | 0.060 | 3.45384 | 7.57271 | 8.14638 | 501.381 | 29.5956 | 530.976 | 540.298 | |

| 0.055 | 3.4812 | 7.59656 | 8.17875 | 501.329 | 30.0275 | 531.357 | 541.059 | ||

| 0.045 | 3.53724 | 7.64562 | 8.24543 | 501.199 | 30.9211 | 532.121 | 542.61 | ||

| 0.40 | 3.56596 | 7.67085 | 8.2798 | 501.121 | 31.3834 | 532.504 | 543.40 | ||

| 0.20 | 0.24 | 3.59207 | 7.44607 | 7.98219 | 506.475 | 27.6891 | 534.164 | 533.915 | |

| 0.22 | 3.55265 | 7.53029 | 8.09269 | 504.002 | 29.0243 | 533.027 | 537.716 | ||

| 0.18 | 3.46069 | 7.719 | 8.34108 | 498.252 | 32.0484 | 530.301 | 546.295 | ||

| 0.16 | 3.40735 | 7.8263 | 8.48296 | 494.929 | 33.796 | 528.725 | 551.162 | ||

| 6.5 | 7.80 | 3.43785 | 7.51324 | 7.96554 | 496.828 | 23.4175 | 520.245 | 540.725 | |

| 7.15 | 3.4688 | 7.56002 | 8.07233 | 498.758 | 26.4778 | 525.236 | 541.209 | ||

| 5.85 | 3.56338 | 7.70339 | 8.40182 | 504.675 | 35.9021 | 540.577 | 542.655 | ||

| 5.20 | 3.6414 | 7.82214 | 8.67721 | 509.577 | 43.7555 | 553.332 | 543.812 | ||

| 0.5 | 0.60 | 3.50857 | 7.62022 | 8.21027 | 501.242 | 30.4268 | 531.669 | 541.823 | |

| 0.55 | 3.50878 | 7.62054 | 8.21101 | 501.256 | 30.448 | 531.704 | 541.826 | ||

| 0.45 | 3.50921 | 7.62119 | 8.2125 | 501.282 | 30.4905 | 531.773 | 541.832 | ||

| 0.40 | 3.50942 | 7.62151 | 8.21324 | 501.296 | 30.5118 | 531.807 | 541.836 | ||

| 0.9 | 1.08 | 3.51678 | 7.6667 | 8.28554 | 501.756 | 31.884 | 533.64 | 539.638 | |

| 0.99 | 3.51299 | 7.64399 | 8.24895 | 501.519 | 31.182 | 532.701 | 540.726 | ||

| 0.81 | 3.50477 | 7.59731 | 8.17393 | 501.005 | 29.7454 | 530.75 | 542.948 | ||

| 0.72 | 3.50032 | 7.57332 | 8.13545 | 500.727 | 29.0102 | 529.737 | 544.083 | ||

| 0.06 | 0.072 | 3.51192 | 7.6253 | 8.22182 | 501.452 | 30.648 | 532.1 | 541.855 | |

| 0.066 | 3.51045 | 7.62307 | 8.21676 | 501.360 | 30.5581 | 531.918 | 541.842 | ||

| 0.054 | 3.50756 | 7.61869 | 8.20682 | 501.179 | 30.3816 | 531.561 | 541.816 | ||

| 0.048 | 3.50614 | 7.61654 | 8.20195 | 501.091 | 30.295 | 531.386 | 541.803 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Momena, A.F.; Haque, R.; Rahaman, M.; Mondal, S.P. A Two-Storage Inventory Model with Trade Credit Policy and Time-Varying Holding Cost under Quantity Discounts. Logistics 2023, 7, 77. https://doi.org/10.3390/logistics7040077

Momena AF, Haque R, Rahaman M, Mondal SP. A Two-Storage Inventory Model with Trade Credit Policy and Time-Varying Holding Cost under Quantity Discounts. Logistics. 2023; 7(4):77. https://doi.org/10.3390/logistics7040077

Chicago/Turabian StyleMomena, Alaa Fouad, Rakibul Haque, Mostafijur Rahaman, and Sankar Prasad Mondal. 2023. "A Two-Storage Inventory Model with Trade Credit Policy and Time-Varying Holding Cost under Quantity Discounts" Logistics 7, no. 4: 77. https://doi.org/10.3390/logistics7040077

APA StyleMomena, A. F., Haque, R., Rahaman, M., & Mondal, S. P. (2023). A Two-Storage Inventory Model with Trade Credit Policy and Time-Varying Holding Cost under Quantity Discounts. Logistics, 7(4), 77. https://doi.org/10.3390/logistics7040077