Abstract

Background: Industry 4.0 is a burgeoning research area that has been addressed by many research entities. However, the literature shows that the industrial sector lacks the awareness and knowledge needed to comply with Industry 4.0 implications, particularly in developing countries. Methods: This study evaluates the status of small and medium enterprises (SMEs) in Jordan concerning Industry 4.0. Four criteria are assessed, including Industry 4.0 readiness, maturity, drivers, and barriers. Samples of SME respondents and Industry 4.0 experts are surveyed using an online questionnaire. Results: The results show that SMEs in Jordan are not mature enough nor ready to apply Industry 4.0. For the readiness dimension, SME respondents and experts agreed that the Jordanian SMEs’ status is between having initiatives in the pilot phase or implementing concepts to low degrees, except for autonomous workpiece and smart product aspects, in which Jordanian SMEs are behind due to financial and technological reasons. It was found that none of the Industry 4.0 investigated technologies have reached maturity levels. Customer requirements, cost reduction, competitors’ practice, productivity improvement, and quality improvement are found to be the major influencing drivers for Industry 4.0, while a lack of awareness and knowledge is found to be the crucial barrier hampering Industry 4.0 implementation. Conclusions: Jordan needs country-scale initiatives for the implementation of groundbreaking Industry 4.0 development, incorporating government agencies, industrial parties, and experts, relying on Industry 4.0’s readiness and practice status as a starting point, and considering the influential drivers and barriers to steer the development process.

1. Introduction

Since the 1800s, humanity has experienced three industrial revolutions, each powered by new technology: the use of steam power and mechanization of production (Industry 1.0), the discovery of electricity and assembly line production (Industry 2.0), and partial automation using memory-programmable controls and computers (Industry 3.0). Recently, the concept of digital transformation of the industry (known as the fourth industrial revolution or Industry 4.0) has begun to change the world of manufacturing in parallel with its economic environment.

The term Industry 4.0 was invented in 2011 in Germany as an initiative of the German federal government to strengthen the competitiveness of the German manufacturing industry [1,2]. There are many definitions for Industry 4.0. For example, Kagermann et al. [3] defined it as the involvement of the technical integration of cyber–physical systems in manufacturing and logistics and the use of the internet of things and services in industrial processes. Trappey et al. [4] defined it as a general concept of manufacturing, enabling the elements of tactical intelligence using techniques and technologies such as the internet of things, cloud computing, and big data. Industry 4.0 technologies are applied to enable companies to have flexibility in manufacturing processes with real-time data analysis. This implies developing embedded systems and enhancing strategic and operational decision-making processes [5]. Nine technologies have been considered as Industry 4.0 application pillars: big data and analytics, autonomous robots, simulation, horizontal and vertical integration, the industrial internet of things (IIoT), cybersecurity, the cloud, additive manufacturing, and augmented reality [6]. Such technologies could improve information transmission throughout the system, which enables more control over operations and adaptability to stochastic environments [7].

Small and medium enterprises (SMEs) are engines of sustainable economic growth worldwide. Industry 4.0 application to SMEs is not only a new research field, but also it has a limited implementation even in developed countries due to a lack of awareness and knowledge [7,8,9,10,11]. This study aims to investigate the status of SMEs in Jordan concerning their Industry 4.0 readiness, maturity, drivers, and barriers. It aims to diagnose how ready the Jordanian industry is to absorb and apply Industry 4.0 concepts and technologies. Additionally, it aims to point out the weaknesses and improvement points that should be taken into consideration regarding applying Industry 4.0 technologies in Jordan.

The rest of this paper is organized as follows: Section 2 describes the industrial sector in Jordan. The literature review is presented in Section 3. The methodology is explained in Section 4. The key findings are demonstrated and discussed in Section 5. Finally, the conclusions, study implications, and suggestions for future research are outlined in Section 6.

2. Industrial Sector in Jordan

This section describes two aspects of the industrial sector in Jordan: the technological development process and the SMEs’ status.

2.1. Technological Development

It is well known that the adoption of advanced technologies is more challenging in developing countries due to several reasons such as culture, level of education, limited resources, and political instability. Consequently, companies in developing countries are behind their counterparts in developed countries concerning technology adoption [5]. This technological gap is quantified by a measure called the “growth competitiveness index”, which accounts for the competitiveness in several aspects such as institutional framework and infrastructure, health and education, the size of the market, the environment at the macroeconomic level, development of capital markets, availability of technology, and business development and creativity [12]. The first appearance of Jordan in this index, which is tabulated by the World Economic Forum, occurred in 1996 [13]. The annual survey of the World Economic Forum, in 2014, revealed that Jordan progressed forward by four degrees in indicators of competitiveness to be ranked 64th globally and eighth among Arab countries. The report also showed the relative improvement in the economic indicators of Jordan in terms of reducing the budget deficit and the development of the financial market and education sectors [13]. In general, it can be seen that Jordan is achieving progress according to several growth competitiveness index indicators, which makes it a promising environment for Industry 4.0 development. Jordan is also a good candidate for this study due to its vital geographical position and political stability. Moreover, the Jordanian government, in spite of its limited resources, is making tremendous efforts to support and facilitate SMEs’ economic growth.

Several developed countries have formulated national strategies and programs for incentivizing Industry 4.0 technologies such as the “High-Tech Strategy 2020” program in Germany, the “Advanced Manufacturing Partnership” program in the USA, and the “Made in China 2025” program in China [3,14,15]. Jordan, as a developing economy, still does not have a roadmap for Industry 4.0 adoption and implementation; however, the government of Jordan has made a lot of effort to start up country-based initiatives to facilitate digitalization and technological development, including:

- The Higher Counsel of Science and Technology (HCST). This institute is responsible for coordinating and promoting science and technology in Jordan. It also sponsors projects championed by academics to support local industries [16];

- The Jordan Enterprise Development Corporation (JEDCO). This institute provides startups and SMEs with funds, technical assistance, and support to start their business in the local market [17];

- Several detached initiatives from different nonprofit organizations, universities, and private sectors have been launched to promote the implementation of Industry 4.0 technologies. Good examples of this category are the Deanship of Innovation, Technology Transfer and Entrepreneurship (DI-TECH) in the German Jordanian University and the Jordan Industry 4.0 Innovation Center (InJo4.0) [18].

2.2. SMEs’ Status

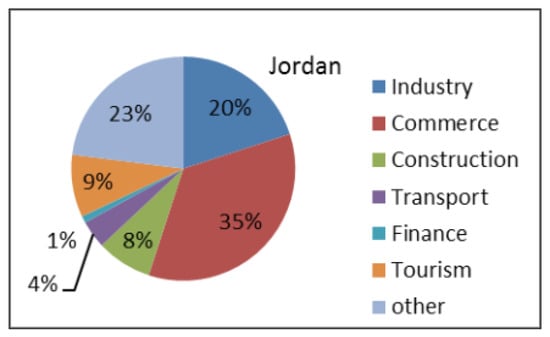

Jordan is an upper-middle income country that depends almost completely on SMEs as the economy driver. For instance, in 2021, SMEs accounted for 95% of the business market in Jordan [19]. Moreover, SMEs represent roughly 95% of all registered companies, contribute 50 percent or more to GDP, and provide employment to an estimated 60 percent of the Jordanian workforce [20]. These are significant indicators of the importance of SMEs to the Jordanian economy and how crucial their involvement in any economic development plan is. In Europe, an SME is defined as a firm that has fewer than 250 employees with a total turnover that does not exceed EUR 50 million [21], while in Jordan the numbers are much smaller, where SMEs are defined as firms employing fewer than 100 employees with a total turnover that does not exceed JOD 3 million (JOD 1 JD equals USD 1.41) [17]. According to the Ministry of Industry (Trade and Supply Act No. 10 of 2005), a small enterprise in Jordan is defined as any individual company or enterprise with the primary purpose of industry, where its capital is less than JOD 30,000, and it has fewer than 10 employees registered in the Social Security Administration. Micro businesses comprise 89% of the total enterprises in Jordan, while 9% are small enterprises and the remaining 2% are medium and large enterprises [22]. Figure 1 depicts the sectoral distribution of SMEs in Jordan. It can be seen in Figure 1 that the largest share of SMEs in Jordan is in the commercial establishment category (35%), followed by the service provider category (23%), whereas a significant share is in industrial production (20%), and the rest is dedicated to tourism, construction, transport, and the finance sectors (9%, 8%, 4%, and 1%, respectively) [22].

Figure 1.

Sectoral distribution of SMEs in Jordan [22].

Jordan began promoting SMEs in the early 1970s through a five-year economic development plan (1976–1980), which enabled SMEs to provide alternatives for imported goods and products. After that, several corporations, societies, and socio-economic production programs were created, focusing on the development of SMEs [23]. SMEs have different characteristics to large enterprises that should be taken into consideration when investigating Industry 4.0 application; firstly, they have fewer resources and less experience in managing new technologies [24,25]. Secondly, they strongly involve top management in all the company’s decisions. Thirdly, they are more operation-focused on the expense of strategic activities [26,27]. SMEs in Jordan are facing many challenges that could hinder their technological development, including financial, exports, fees and procedures, and decentralization challenges. Regarding the financial constraints, a lack of different forms of financial funding is a traditional constraint preventing SMEs from growth and expansion [28]. For instance, the share of credit allocated to SMEs in Jordan is small and shrinking too, declining from 11% to only 8.5% of total credit available to the private sector in 2016 [29]. Concerning exports, most SMEs are not export-oriented because they focus on the production of traditional, low-value-added products or services with modest quality [30]. Regarding fees and procedure limitations, the cost of conducting business is considered high for several SMEs in Jordan. The tax system in Jordan and the newly produced law, which forces companies with a capital of JOD 20,000 to appoint legal counsel, have both led to additional costs. Moreover, SMEs that create patents may not be able to protect their intellectual property due to the high cost of intellectual property registration in Jordan [31]. Decentralization is an obstacle facing SMEs in many countries, including Jordan. The companies and their commercial activities are agglomerated in the capital city, where a high-income population resides. Meanwhile, outside Amman, many cities suffer from underdevelopment, which implies high unemployment rates and poverty. SME establishment outside the capital needs encouragement via tax incentives and the facilitating of policies [31].

3. Literature Review

There is a scarcity of published research regarding the application of Industry 4.0 to SMEs [7]. One of the reasons could be the lack of awareness of how important it is to apply Industry 4.0 technologies, and how they could be harmonized with the companies’ business processes [8]. According to several surveys, leaders of many enterprises have not heard about Industry 4.0. On the other hand, a large portion of them is aware of the Industry 4.0 basic concept, but they lack the knowledge related to introducing this new concept and how to be compliant with it [8]. It has also been found that many academic Industry 4.0 readiness models are not even known for the industrial sector [9]. For instance, a survey, conducted among 1000 medium-sized companies in Germany, revealed that in 25% of the surveyed companies, the topic of digitalization is not yet relevant [10]. In another recent survey, conducted by the consulting firm Deloitte in 19 countries, the results revealed that only 14% of chief executive officers were sure that their organizations are ready and capable to incorporate the changes accompanied by Industry 4.0 [11].

It is important to realize that the digital transformation process is an overall business strategy, with multi-components, which involves the management’s commitment to adopt technological and organizational changes. Such a major strategic decision requires a prerequisite of enterprises’ assessment of their status and readiness to apply Industry 4.0 technologies before investing resources [8,32]. Maturity models are one of the most used tools to evaluate the status of the company, concerning industrial revolutions, and assess its ability to apply Industry 4.0 technologies [32]. In the last few years, there has been a rapid increase in the number of Industry 4.0 readiness models [33]. However, a recent literature review revealed that there is a lack of empirical research on the application of Industry 4.0 technologies in SMEs [7]. Another study showed that larger companies are more ready to apply Industry 4.0 technologies than SMEs, which means that SMEs could face more barriers while trying to adopt and implement Industry 4.0 concepts, but this cannot be proved since little is currently known about implementing Industry 4.0 in this category [2,34,35].

Regarding maturity models, Mittal et al. [36] reviewed the commonly available models for Industry 4.0. Fifteen maturity models were presented and compared in terms of their methodology, focus, dimensions, and gaps. In terms of dimensions, the most used are strategy and organization, technology, IT, smart factory, smart products, data utilization, and employees. Other models included extra dimensions such as security policies [37] and customers [32].

IMPULS—Industrie 4.0 Readiness is one of the most well-known Industry 4.0 readiness models, which was developed by IW Consult (a subsidiary of the Cologne Institute for Economic Research) and the Institute for Industrial Management (FIR) at RWTH Aachen University [36]. The assessment process in this model relies on six pillars including strategy and organization, smart factory, smart operations, smart products, data-driven services, and employees. According to IMPULS, companies are classified into three categories, with six levels, based on their level of readiness to apply Industry 4.0. The first category is the newcomers, which includes two levels: the outsider and beginner levels. The learners’ category is the second, which comprises the intermediate level. The third category is the leaders, which encompasses experienced, experts, and top performers [38]. Another well-known model is the connected enterprise maturity model in which Industry 4.0 is implemented in five stage processes; assessment, secure and upgraded networks and control, defined and organized working data capital, analytics, and collaboration [37]. A third important model for manufacturing enterprises’ maturity is the one developed by Schumacher et al. [32]. In this model, nine dimensions are defined, and sixty-two items assigned to them. The dimensions are products, customers, operations, technology, strategy, leadership, governance, culture, and people.

Stentoft et al. [35] investigated the relationship between Industry 4.0 drivers and barriers to Industry 4.0 readiness and actual practice. They analyzed 308 Danish SMEs, from different manufacturing sectors, to examine how managers’ perception of Industry 4.0 drivers and barriers could affect their companies’ readiness and practice of Industry 4.0 technologies. They measured a relatively low degree of Industry 4.0 readiness and practice among the studied SMEs. They also found, through testing different hypotheses, that Industry 4.0 drivers have a positive impact on Industry 4.0 readiness and practice. Raj et al. [11] focused their study on the barriers to Industry 4.0 implementation, in the manufacturing sector, for both developed and developing economies. Among the 15 barriers they investigated, they found that the lack of a digital strategy alongside resource scarcity is the prominent barrier in both economies. They also found that improving standards and government regulation could enhance the adoption of Industry 4.0 technologies in developing countries, while in developed countries, technological infrastructure would be essential to promote Industry 4.0 adoption and implementation.

Several initiatives, in different countries, have tried to assess the readiness for Industry 4.0 technologies’ application. One experience is from Hungarian industry where a hybrid model was used, relying on three different resources; the IMPULS—Industrie 4.0 Readiness model, the Hungarian Industry 4.0 National Technology Platform suggestions, and the authors’ contribution based on in-depth expert interviews [39]. A study based on the Czech experience was simpler; it focused on four main aspects including Industry 4.0 awareness, barriers, drivers, and strategy [40]. Another country-based attempt to assess Industry 4.0 readiness was conducted in Malaysia and relied on seven key areas: market pressure, risk taking, knowledge, management support, competencies, motivation, and freedom [41]. A specific study for manufacturing companies was conducted in Serbia to evaluate the role of advanced digital technologies (e.g., ERP as a backbone of vertical integration) in the context of Industry 4.0 [42]. To the best of the researchers’ knowledge, this study is the first to investigate the status of SMEs in Jordan concerning Industry 4.0.

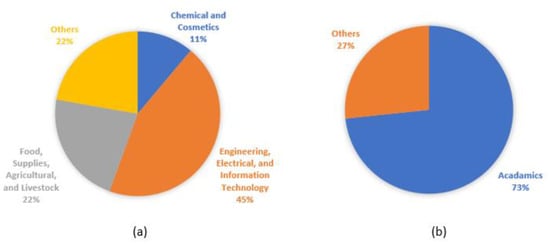

4. Methodology

The current research surveys the awareness and application of Industry 4.0 concepts and technologies in Jordanian SMEs. The main research question in this survey is: What is the situation of Jordanian SMEs concerning Industry 4.0 readiness, maturity, drivers, and barriers? To answer this question, an online questionnaire was created. Questionnaires are the typical quantitative technique to adopt in such exploration studies [32,39,41,43]. The study explores the views of two different categories; the first one is the SME respondents, while the other category represents local experts in Industry 4.0, including industry consultants, legislation bodies, and academics. SMEs’ responses reflect the real situation of Industry 4.0 on the ground, which is, in general, profit-oriented and focused on short-term deliverables. Conversely, the long-term vision, theoretical background, and enlightenments, revealed in experts’ opinions, could be utilized in strategizing and planning schema for Industry 4.0 implementation at a country scale. Data collection was carried out by completing the online questionnaire. Overall, 90 companies and 35 Industry 4.0 experts were addressed and 24 of them fully answered the entire questionnaire, which made for a 19.2% response rate. These modest values are justified for such kinds of surveys due to the following practical and theoretical reasons; practically, purpose sampling technique was used as a pilot study to obtain representative responses. The questionnaire was only sent to respondents for whom Industry 4.0 concepts are relevant. Otherwise, the responses would have underestimated the status of Industry 4.0 due to misunderstanding and lack of knowledge. This technique is also used in other country-based initiatives to evaluate Industry 4.0 status [40,41]. Theoretically, the sample size was within the acceptable range for pilot studies mentioned in the literature. For instance, Saunders and Tosey [44] recommend a minimum of 10 respondents, Aaker and Keppel [45] recommend 15 to 25 respondents, Taylor et al. [46] recommend 15 to 30 respondents, Johanson and Brooks [47] recommend that 30 respondents’ sample is a reasonable count for a pilot study. Respondents who answered the questions consisted mainly of practitioners from industry (37.5%) and experts (62.5%). According to Amman Chamber of Industry (ACI), the industrial companies in Jordan are categorized under one of the following ten categories: chemical and cosmetics; engineering, electrical, and IT; leather and garments; mining; printing, packaging, paper, cartoon, and stationeries; therapeutic and pharmaceutical; construction; food, supplies, agricultural, and livestock; wooden and furniture; and plastic and rubber [48]. In this study, the ACI classification is considered to group SMEs. Figure 2 depicts the breakdown of respondents by categories. As can be seen in Figure 2, most of the SME respondents (45%) were from engineering, electrical, and IT industries. The second largest category was from food, supplies, agricultural, and livestock industries (22%), followed by chemicals and cosmetics (11%). The category “others” included areas such as transport, tourism, and finance sectors. Industry 4.0 experts’ sample consisted mainly of academics (73%). The “other” category includes Industry 4.0 consultants, legislation bodies, etc.

Figure 2.

Responses’ breakdown by categories: (a) SME respondents; (b) Industry 4.0 experts.

Table 1 depicts the four criteria surveyed in this study along with brief descriptions, number of related survey questions, questions’ type, and associated literature. Those criteria are mainly based on the IMPULS model and partially on Stentoft et al.’s [35] study, with some modifications to make them compatible and applicable in a developing country such as Jordan. The first criterion is about how the SMEs in Jordan are able to exploit Industry 4.0 principles (Industry 4.0 readiness). It includes six items: strategy, plans, smart equipment, digital data collection, autonomous workpiece, and smart product. The second criterion is related to the degree the Jordanian SMEs apply the nine technologies of Industry 4.0. The third criterion measures the motivations behind Industry 4.0 application. Seven different drivers are investigated which are: customer requirements, competitors’ practice of Industry 4.0, cost reduction, legal requirements, productivity improvement, quality improvement, and flexibility improvement. The last criterion measures the obstacles preventing the application of Industry 4.0 technologies. Seven different barriers are also investigated which are: lack of knowledge (know-how), lack of standards, lack of data protection, lack of qualified workforce, lack of awareness of the importance of Industry 4.0, lack of financial resources, and lack of governmental support. The first two criteria are measured using a 5-point rating scale to capture the intensity of respondents’ opinions about the questionnaire items. The five scales used are: 1—Don’t have, 2—Have only in the test and pilot phase, 3—Have to a low degree, 4—Have to a moderate degree, 5—Have to a high degree. The third and fourth criteria are measured using multi-response questions that allow the respondents to choose from none to all the drivers and barriers given in the designed questions.

Table 1.

The four surveyed criteria in this study.

The questionnaire used in this study was developed in a multi-stage process. Firstly, a more detailed and technical questionnaire was developed based on the IMPULS maturity model. Next, the developed questionnaire was evaluated by two Industry 4.0 experts to check if it would be applicable in the Jordanian market. The feedback received from the experts indicated that the first version of the questionnaire was too technical and advanced to be suitable for the modest initiatives of Industry 4.0 in Jordan. Finally, a simplified and generalized version of the questionnaire was constructed and used incorporating suggestions given by the two experts.

Regarding the theoretical contribution of this study, the new dimension, which is not addressed in the literature, is the alignment between the theoretical aspect, represented in the experts’ opinions, and the practical aspect, which reflects the situation on the ground. Accordingly, the findings of this study add to the literature of Industry 4.0. As revealed in this study, Industry 4.0 experts in Jordan have a bird’s eye view with accurate judgment for the status of Industry 4.0. This holistic view and experience should be exploited by the Jordanian government to steer the SMEs toward smart products and operations’ transition, using the available resources and technologies. The other theoretical outcome of this study is the hybrid model, which was specifically built for the Jordanian case. In this modified model, Industry 4.0 major dimensions (readiness, maturity, drivers, and barriers) have been addressed but in a simplified schema to be compatible with the modest initiatives in Jordan. However, this model can be exported and applied in similar developing countries, especially in the Middle East region.

5. Results and Discussion

This section presents the findings of the Industry 4.0 criteria measures for SMEs in Jordan. Table 2 shows the mean of each measure for both respondents’ categories (SME respondents and Industry 4.0 experts). The general trend in the results of both categories is that the Jordanian SMEs are not mature enough nor ready for Industry 4.0 implementation, with most mean values between two and three (mostly between a pilot level and a low level). This result is expected in a developing country with limited resources such as Jordan. In the absence of thorough governmental efforts to spread a digitalization culture among the industrial society, Industry 4.0 initiatives are launched by individuals who are not fully aware of the organizational and structural changes needed to embrace Industry 4.0 philosophy. Instead, they partially employ some Industry 4.0 technologies that are compatible with their business, need low investment, and acquire a naive technological infrastructure.

Table 2.

Summary of Industry 4.0 readiness and maturity measures’ means.

Going through the readiness six dimensions, the results, summarized in Table 2, show that the Industry 4.0 strategy is not clearly defined nor spread out among employees (SME respondents’ mean: 2.56, experts’ mean: 2.00), in the absence of indicators to orient the development process. The same is true for Industry 4.0 implementation plans over a five-year period (SME respondents’ mean: 2.67, experts’ mean: 2.80), with modest investments in this aspect. This proves the fact that SMEs are more operation-focused on the expense of strategic activities [26,27]. The smart equipment dimension is not found to be widely applied on the ground (SME respondents’ mean: 2.56, experts’ mean: 2.33). This could be simply due to financial and technological drawbacks incorporated in the smart equipment’s utilization, which is not expected to witness a revolution under the current economic status of Jordan. As a prerequisite to smart factories, digital data collection systems should exist, including smart collection, storage, and processing of data to assure the efficient utilization of resources. The findings have revealed a shortage in real-time, enterprise-wide, and cross-enterprise collaboration between different entities (SME respondents’ mean: 2.78, experts’ mean: 2.40). This could be attributed to the point that the information technology culture in Jordan is not mature enough to support cyber–physical systems, interoperability, and IIoT, which are essential parts of the infrastructure for efficient digital data systems. The dimensions that show the lowest readiness levels are the autonomous workpiece (SME respondents’ mean: 1.78, experts’ mean: 1.60) and the smart product (SME respondents’ mean: 1.44, experts’ mean: 2.40). It is expected to have close findings for these dimensions because they are logically related. The smart product dimension implies equipping items with Information and Communications Technology (ICT) components (e.g., RFID, sensors, communications interface) to collect data related to their status and environment. Without having these features, the workpiece is not be able to interact with its environment and lead itself through the production process autonomously. Since these technologies require high investments in parallel with advanced technological levels, the Jordanian SMEs are behind in comparison to other Industry 4.0 readiness measures. It is worth mentioning that for the six readiness dimensions, there is no statistical difference (p-values are more than 0.05) between SME respondents’ and experts’ opinions, which reflects the experts’ awareness of Industry 4.0’s status in Jordan. This concurrence could lead to a consolidated onset of collaboration between theory and practice in order to set a schema for Industry 4.0 implementation at the country level.

Regarding Industry 4.0 technologies’ implementation in Jordan, it is noticed in Table 2 that none of the surveyed technologies reached acceptable maturity levels (with almost all mean values below three). This is not a surprising outcome based on the modest readiness levels obtained in the previously investigated dimension. However, an interesting observation is that in three out of the nine surveyed technologies, experts overestimated the practice level (experts’ mean values were higher than those for SME respondents. They statistically differed with p-values less than or equal to 0.05). The two respondents’ categories differed in autonomous robots, additive manufacturing, and augmented reality aspects. Most experts who overestimated autonomous robots and augmented reality levels are academics, whose opinion, in these aspects, could be a bit biased toward technology, so we do think that the industries’ findings are closer to reality for these items. Additive manufacturing is currently applied in different sectors in Jordan, especially the rubber and plastic industry. For instance, 3D printing, is currently used to produce prototypes and individual components. This feature could provide innovative solutions for supply chain implications, associated with manufacturing processes [49,50]. Experts’ opinions reflected this fact. However, due to the SME samples’ demography, taken from different sectors, a lower estimate for the status of this technology was obtained. To obtain more insight into each surveyed item within the four studied criteria, the responses of SME participants and experts are illustrated in Figure 3, Figure 4, Figure 5, Figure 6, Figure 7, Figure 8, Figure 9, Figure 10, Figure 11, Figure 12, Figure 13, Figure 14, Figure 15, Figure 16, Figure 17, Figure 18 and Figure 19.

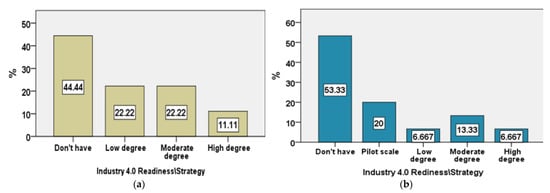

Figure 3.

Response to Industry 4.0 Readiness\Strategy question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

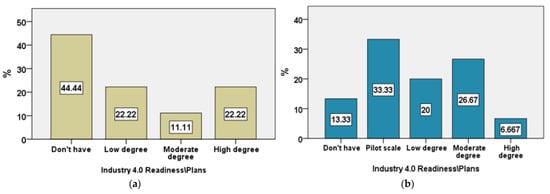

Figure 4.

Response to Industry 4.0 Readiness\Plans question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

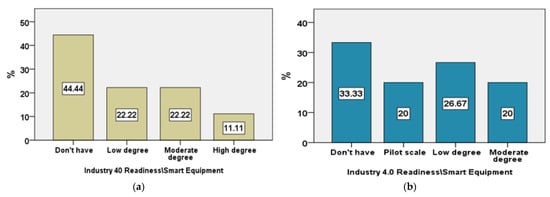

Figure 5.

Response to Industry 4.0 Readiness\Smart Equipment question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

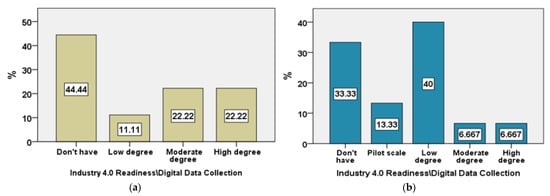

Figure 6.

Response to Industry 4.0 Readiness\Digital Data Collection question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

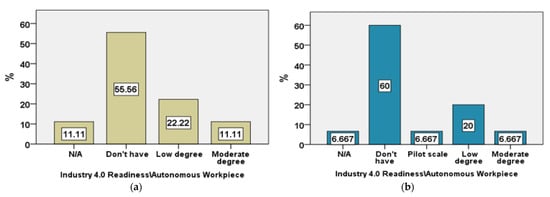

Figure 7.

Response to Industry 4.0 Readiness\Autonomous Workpiece question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

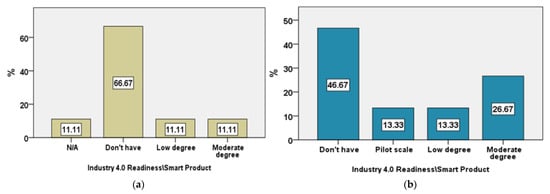

Figure 8.

Response to Industry 4.0 Readiness\Smart Product question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

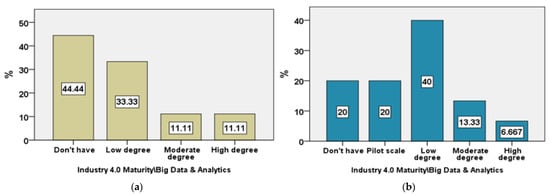

Figure 9.

Response to Industry 4.0 Maturity\Big Data and Analytics question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

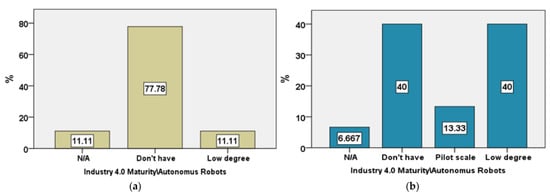

Figure 10.

Response to Industry 4.0 Maturity\Autonomous Robots question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

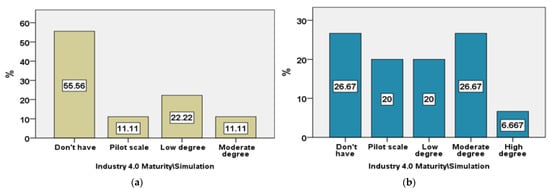

Figure 11.

Response to Industry 4.0 Maturity\Simulation question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

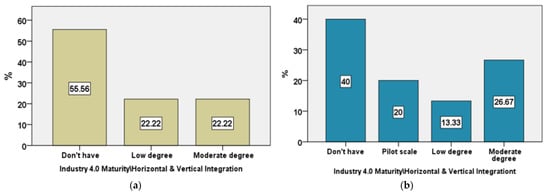

Figure 12.

Response to Industry 4.0 Maturity\Horizontal and Vertical Integration question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

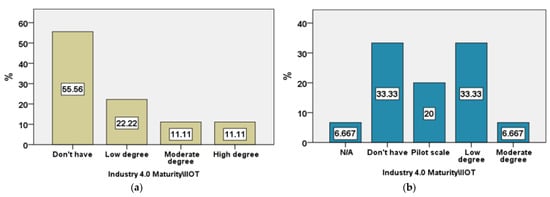

Figure 13.

Response to Industry 4.0 Maturity\IIoT question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

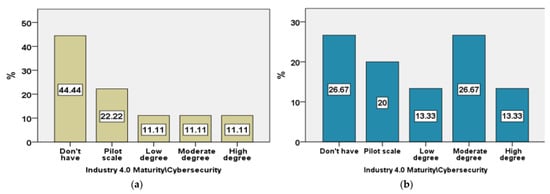

Figure 14.

Response to Industry 4.0 Maturity\Cybersecurity question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

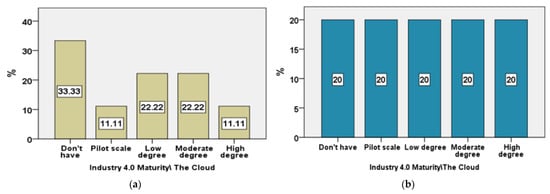

Figure 15.

Response to Industry 4.0 Maturity\The Cloud question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

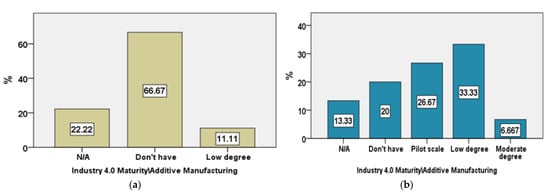

Figure 16.

Response to Industry 4.0 Maturity\Additive Manufacturing question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

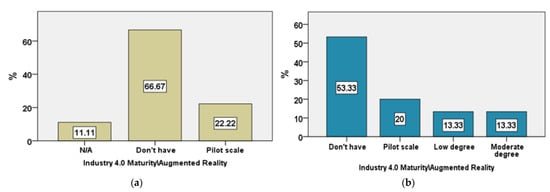

Figure 17.

Response to Industry 4.0\Augmented Reality question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

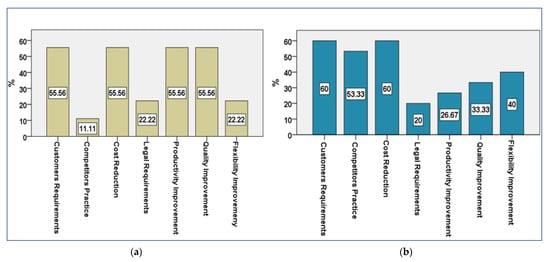

Figure 18.

Response to Industry 4.0 Drivers multi-response question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

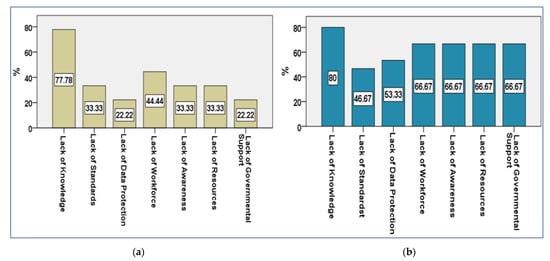

Figure 19.

Response to Industry 4.0 Barriers multi-response question from two categories: (a) SME respondents; (b) Industry 4.0 experts.

To make it easier for the reader to analyze the data in the following figures, Figure 3 is described in detail, while in the other figures, only the major findings are summarized. As depicted in Figure 3, around 44% of the surveyed SMEs do not have a specific strategy for Industry 4.0 implementation, while around 22% of them have a strategy at low or medium levels. Only around 11% of the investigated companies have an Industry 4.0 strategy with a high level. Industry 4.0 experts have a slightly different opinion regarding this item; around 53% of Industry 4.0 experts, in the surveyed sample, see that SMEs in Jordan do not have a specific strategy for Industry 4.0, while 20% see that the SME sector has Industry 4.0 strategy initiatives in the pilot phase. The same percentage of the experts (around 6.7%) see that the companies have a strategy to apply Industry 4.0 to low or high levels. The rest of the investigated sample (around 13.3%) see that Industry 4.0 strategy is applied to a moderate level. As mentioned earlier in this section, the results obtained for this aspect coincide with the literature, stating that SMEs do not focus on long-term strategies and they are operations-oriented [8,27]. These findings highlight the exigency for country-scale initiatives to strategize Industry 4.0, incorporating government agencies, industry chambers, and experts.

In Figure 4, the major finding is that the highest percentage (around 44%) of the SMEs in the surveyed sample do not have plans to implement Industry 4.0 in the next five years. However, the experts’ highest percentage (around 33%) shows that the companies have initiated plans in the pilot phase. Regarding having smart equipment infrastructure (e.g., machines and systems controlled through IT, machine-to-machine communication), the highest percentage of the companies in the sample (around 44%) do not have such infrastructure. The same trend is obvious in the experts’ sample; around 33% agree that SMEs in Jordan do not have smart equipment infrastructure (Figure 5). SMEs’ preference for the human workforce, at the expense of smart equipment, could be due to financial considerations. In developing countries such as Jordan, labor cost is relatively low and customer quality requirements are not excessive; hence, investing in smart equipment is not feasible. As can be seen in Figure 6, the highest percentage of the surveyed companies (around 44%) lack the availability of digital systems to collect machines and process data during production. Conversely, the experts’ highest percentage (40%) supported the idea that SMEs in Jordan have digital data collection systems, which are used at low levels. This could be attributed to the nature of SMEs. The organizational structure of SMEs is simpler than large enterprises, with a lower number of organizational levels. This would decrease the need for traditional or digital data collection systems. Regarding the autonomous workpiece dimension, most of the investigated companies (around 56%) do not have this feature, which is compatible with most of the experts’ opinions (60%) (Figure 7). The same is true for smart products, equipped with smart add-on functionalities (e.g., product memory, automatic identification, self-reporting). Most SMEs in the sample stated that they do not have these functionalities. This also complies with the judgment given by around 47% of Industry 4.0 experts (Figure 8). The outcomes obtained in the last two aspects are expected to dominate in Jordan. Autonomous workpieces and smart products are considered advanced Industry 4.0 technologies and having them within SMEs in developing countries is unlikely.

The first aspect of Industry 4.0 practice and maturity is big data and analytics. As can be seen in Figure 9, the highest percentage of the SMEs (around 44%) do not use big data and analytics, while 40% of Industry 4.0 experts think that this technology is applied in Jordan to a low degree. The reason for this difference could be the holistic view of Industry 4.0 experts, which is missing within narrow industrial horizons. Experts’ opinion is based on their solid academic background in addition to their broad experience in Industry 4.0 implications. An interesting finding about the use of autonomous robots in production processes can be noticed in Figure 10. In total, 80% of the experts are divided into two equal groups, the first group (40% of the sample) think that SMEs in Jordan are not using autonomous robots, while the other group supports the idea that this technology is used in Jordan with low levels. Practically, most of the industry sample (around 78%) stated that they do not utilize autonomous robots. As stated earlier in this section, industry responses, in this aspect, are more realistic and objective than experts’ opinions, which could be biased toward technology due to their academic background. The same pattern is noticed for the Industry 4.0 maturity\simulation aspect. Around 27% of the experts believe that this technology is not used in the Jordanian industry. The same percentage thinks that simulation is employed to a moderate level, while most SMEs (around 56%) depicted that they do not employ simulation in their industrial processes (Figure 11). For the horizontal and vertical integration measure, around 56% of the sample admitted that they are not users of this technology. At the same time, 40% of the experts expected this result (Figure 12). These results agree with the results of a study regarding the use of supply chain management information systems within the Jordanian manufacturing sector [44]. As can be seen in Figure 13, Figure 14, Figure 15 and Figure 17, the pattern is the same for IIoT, cybersecurity, the cloud, and augmented reality technologies; the highest percentage of SMEs stated that they do not have this technology (around 56%, 44%, 33%, and 67%, respectively) which coincides with the statements given by the highest percentage of Industry 4.0 experts (around 33%, 27%, 20%, and 54%, respectively). For additive manufacturing technology, although 57% of SMEs stated that they do not use this aspect, the highest percentage of the experts (around 33%) agreed that additive manufacturing is utilized to a low degree in Jordan (Figure 16). This is because additive manufacturing does not require high investments and could be feasibly implemented in Jordanian SMEs, particularly in sectors such as engineering and plastic and rubber.

The third and fourth criteria investigated in this study are Industry 4.0 drivers and barriers (Figure 18 and Figure 19, respectively). As mentioned earlier in this study, these criteria were measured using multi-response questions in which the respondent chose from none to all of the given drivers and barriers. For comparison purposes, any driver or barrier that is chosen by more than 50% of the samples, is considered an influential factor in Industry 4.0 adoption and implementation. As can be seen in Figure 18, there are many commonalities in the Industry 4.0 drivers chosen by industry respondents and Industry 4.0 experts. For the SME sample, the respondents chose four influential drivers which were: customer requirements, cost reduction, productivity improvement, and quality improvement. However, the experts selected customer requirements, cost reduction, and competitors’ practice as influential drivers. As satisfying the customer requirements is crucial for all companies and is a key quality principle, it was expected to be the most important driver. Similarly, cost reduction is crucial in driving the adoption of any new technological revolution. For Industry 4.0 barriers, the two samples had different attitudes in selecting influential barriers. For SME respondents, only one barrier, which was lack of knowledge, was chosen by more than 50% of the sample, while for the Industry 4.0 experts, six out of the seven barriers were selected by more than 50% of the sample; these influential barriers were lack of knowledge, lack of data protection, lack of qualified workforce, lack of awareness of the importance of Industry 4.0, lack of financial resources, and lack of governmental support. This can be explained by the fact that the Industry 4.0 experts have a bird eye view toward not only the short-term barriers but also the long-term barriers that companies could face during all stages of Industry 4.0 application. This holistic view, in general, will not be clear for industry practitioners who do not have previous experience in implementing Industry 4.0 technologies in their companies.

Some of the findings in this paper are aligned with other research findings. For instance, it was found that many SMEs in Jordan do not have a specific strategy for Industry 4.0, and they do not assign employees to handle Industry 4.0 implications. The same result is true for the Czech case [40]. It was found that a lack of knowledge and lack of resources are major influencing factors that hamper Industry 4.0 penetration for both the SME respondents and Industry 4.0 experts in Jordan. The same barriers were also found in the Czech companies [40]; however, Raj et al. [11] stated that the most important influencing factor in the developed economy is the lack of maturity in technology. Regarding the other measures investigated in this research, the authors did not find in the literature a previous experience of evaluating Industry 4.0 status in a developing country such as Jordan to compare with.

6. Conclusions, Implications, and Future Work

This paper surveys the status of the Jordanian SMEs concerning Industry 4.0 readiness, maturity, drivers, and barriers. Two samples are selected from different parties: SME respondents and Industry 4.0 experts. The general outcome of both the respondents’ samples is that SMEs in Jordan are not mature enough or ready to initiate the implementation of Industry 4.0 technologies.

For the six investigated aspects in Industry 4.0 readiness, SME respondents and experts agreed that, on average, the Jordanian SMEs’ status is between having initiatives in the pilot phase or implementing concepts to low degrees. It is also noticed that the autonomous workpiece and smart product aspects are the least applicable in Jordan due to their considerable financial and technological requirements. Regarding Industry 4.0’s maturity level, it is concluded that none of the Industry 4.0 investigated technologies have reached appropriate maturity levels. However, experts coincide with industry respondents in six out of the nine investigated technologies. The overestimation from the experts’ side for the remaining three technologies (autonomous robots, additive manufacturing, and augmented reality) could be attributed to experts’ possible bias toward technology.

It is concluded, from the empirical findings of this study, that customer requirements, cost reduction, competitors practice, productivity improvement, and quality improvement are essential motives to be considered when designing milestones of Industry 4.0 involvement. It is also found that the major obstacle preventing Industry 4.0 from advancing in SMEs in Jordan is the lack of awareness of the benefits and importance of applying Industry 4.0 technologies, in parallel with a deficiency in technical knowledge crucial to applying Industry 4.0 concepts.

The findings obtained in this study could be significant for current and future SME leaders to draw a roadmap for assessing their companies’ status concerning Industry 4.0, measuring the gap between what exists and what is required based on their drivers for Industry 4.0 implementation, and then deploying an Industry 4.0 philosophy within their work environments. The results can also be used pragmatically by managers to identify strengths and weaknesses in the rollout of their Industry 4.0 projects. Helping SMEs to create strategies for Industry 4.0 adoption can lead to positive social changes by improving economies and creating jobs.

The government of Jordan might also use the findings of this study to diagnose how ready the Jordanian market is for Industry 4.0 implementation, providing improvement spaces for policy making on Industry 4.0. For instance, if such studies are performed on a regular time basis, they would be a reference for the government to measure the progress the companies achieve regarding technological advancement. Accordingly, they can target the government’s financial and technical support for specific aspects that are promising and influential in the Industry 4.0 transition process. The outcomes of such studies could also help the government to formulate its key performance indicators that are tailored to the Jordanian experiment. The findings can be employed in country-scale initiatives for groundbreaking Industry 4.0 development, incorporating government agencies, industrial parties, and experts, relying on Industry 4.0’s readiness and practice status as a starting point, and considering the influential drivers and barriers in steering the development process.

One of the major limitations of this study is the low size of the questionnaire responses. In the absence of Industry 4.0 philosophy in Jordan, it is challenging to find a representative sample from SMEs for which Industry 4.0 concepts are relevant. One recommendation is to increase the sample size and to have a variety of sectors involved. It is expected for a developing country with limited resources such as Jordan to have many struggles while trying to adopt the major changes needed to implement Industry 4.0 technologies. Some of the hampering factors found in this study that should be further investigated are the lack of data protection, lack of a qualified workforce, lack of financial resources, and lack of governmental support. There is a scarcity of country-based studies that investigate the status of Industry 4.0 in general and in developing countries specifically. For future research, these findings from Jordan can be compared with other counties, especially in the Middle East. Another recommendation is to have similar studies, in Jordan, for large enterprises to find out how sensitive the process of Industry 4.0 application is to business size. A good point is to have customized surveys for specific industrial or service sectors and compare the results of the same sector in different countries, investigating how geography and demography can affect Industry 4.0 implementation. Finally, there will be added value if more studies are conducted on specific industrial sectors in Jordan that are more advanced and more able to absorb Industry 4.0 concepts such as the pharmaceutical and mining industries.

Author Contributions

Conceptualization, S.A.A.; methodology, M.I.S. and S.A.A.; software, M.I.S.; formal analysis, M.I.S. and S.A.A.; data curation, M.I.S.; writing—original draft preparation, M.I.S.; writing—review and editing, S.A.A.; supervision, S.A.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the Deanship of Scientific Research of German Jordanian University on September 27th, 2022 (In reference to the Regulations for Scientific Research at the German Jordanian University of 2008).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Herrman, M.; Pentic, T.; Otto, B. Design principles for Industrie 4.0 scenarios. In Proceedings of the 49th Hawaii International Conference on System Sciences, Koloa, HI, USA, 5–8 January 2016. [Google Scholar]

- Issa, A.; Hatiboglu, B.; Bildstein, A.; Bauernhansl, T. Industrie 4.0 roadmap: Framework for digital transformation based on the concepts of capability maturity and alignment. Procedia CIRP 2018, 72, 973–978. [Google Scholar] [CrossRef]

- Kagermann, H.; Wahlster, W.; Helbig, J. Securing the Future of German Manufacturing Industry: Recommendations for Implementing the Strategic Initiative Industrie 4.0; Final Report of the Industrie 4.0 Working Group; Acatech—National Academy of Science and Engineering: Berlin, Germany, 2013. [Google Scholar]

- Trappey, A.J.C.; Trappey, C.V.; Govindarajan, U.H.; Chuang, A.C.; Sun, J.J. A Review of Essential Standards and Patent Landscapes for the Internet of Things: A Key Enabler for Industry 4.0. In Advanced Engineering Informatics; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Dalenogare, L.S.; Benitez, G.B.; Ayala, N.F.; Frank, A.G. The expected contribution of Industry 4.0 technologies for industrial performance. Int. J. Prod. Econ. 2018, 204, 383–394. [Google Scholar] [CrossRef]

- Ruessmann, M.; Lorenz, M.; Gerbert, P.; Waldner, M.; Justus, J.; Engel, P.; Harnisch, M. Industry 4.0: The Future of Productivity and Growth in Manufacturing Industries; Boston Consulting Group: Boston, MA, USA, 2015. [Google Scholar]

- Moeuf, A.; Pellerin, R.; Lamouri, S.; Tamayo-Giraldo, S.; Barbaray, R. The industrial management of SMEs in the era of Industry 4.0. Inter. J. Prod. Res. 2018, 56, 1118–1136. [Google Scholar] [CrossRef]

- Rajnai, Z.; Kocsis, I. Assessing industry 4.0 readiness of enterprises. In Proceedings of the IEEE 16th World Symposium on Applied Machine Intelligence and Informatics (SAMI), Kosice/Herlany, Slovakia, 7–10 February 2018. [Google Scholar]

- Haddara, M.; Elragal, A. The Readiness of ERP Systems for the Factory of the Future. Proceedia Comput. 2015, 64, 721–728. [Google Scholar] [CrossRef]

- Enigma, G. Umfrage in Mittelständischen Unternehmen Zum Thema Digitalisierung Bedeutung Für den Mittelstand (Study Ordered by DZ Bank 2014). Available online: https://www.deutschland-made-bymittelstand.de/mittelstandskampagne2014 (accessed on 7 January 2022).

- Raj, A.; Dwivedi, G.; Sharma, A.; Jabbour, A.; Rejak, S. Barriers to the adoption of industry 4.0 technologies in the manufacturing sector: An inter-country comparative perspective. Int. J. Prod. Econ. 2020, 224, 107546. [Google Scholar] [CrossRef]

- Al-Refai, M.F.; Abdelhadi, S.; Al-Qaraein, A.A. The impact of technological development on Jordanian industrial sector. Int. J. Bus. Manag. 2016, 11, 291–298. [Google Scholar] [CrossRef]

- World Economic Forum. (n.d.). World Economic Forum, Annual Survey of the World Economic Forum. Available online: http://www.weforum.org/reports (accessed on 12 August 2022).

- Rafael, R.; Shirley, A.J.; Liveris, A. Report to the President Accelerating, U.S. Advanced Manufacturing; The President’s Council of Advisors on Science and Technology: Washington, DC, USA, 2014. [Google Scholar]

- Zhou, J. Intelligent manufacturing-main direction of “made in China 2025”. China Mech. Eng. 2015, 26, 2273. [Google Scholar]

- Higher Counsel of Science and Technology. Available online: http://www.hcst.gov.jo (accessed on 12 August 2022).

- Jordan Enterprise Development Corporation. Available online: http://www.JEDCO.gov.jo (accessed on 12 August 2022).

- Jordan Industry 4.0 Digitalization Innovation Centre. Available online: http://www.Injo4.0.org (accessed on 12 August 2022).

- Abu-Mater, W.; Afifa, M.A.; Alghazzawi, M.M.A. The impact of COVID-19 pandemic on small and medium enterprises in Jordan. JAFMS 2021, 16, 129–149. [Google Scholar]

- USAID U.S. for International Development. Fact Sheets. Available online: https://www.usaid.gov/jordan/fact-sheets/jordan-loan-guarantee-facility (accessed on 19 January 2022).

- European Commission. Un Small Business Act pour l ’Europe [A Small Business Act for Europe]. Available online: http://www.eurosfaire.prd.fr/7pc/bibliotheque/consulter.php?id=2321 (accessed on 7 January 2022).

- Jordan Department of Statistics. Jordan Statistical Yearbook 2014. Available online: http://dosweb.dos.gov.jo/publications/ (accessed on 12 August 2022).

- Abu Shihab, R.N.; Abdul Khaliq, S.Y. The impact of Corona pandemic on SMEs: Experience from Jordan. JIMIDS 2021, 24, 1–11. [Google Scholar]

- Chang, S.I.; Hung, S.Y. Critical factors of ERP adoption for small- and medium-sized enterprises: An empirical study. J. Glob. Inf. Manag. 2010, 18, 82–106. [Google Scholar] [CrossRef]

- Zach, O.; Munkvold, B.E.; Olsen, D.H. ERP system implementation in SMEs: Exploring the influences of the SME context. EIS 2014, 8, 309–335. [Google Scholar] [CrossRef]

- Buonanno, G.; Faverio, P.; Pigni, F.; Ravarini, A.; Sciuto, D.; Tagliavini, M. Factors affecting ERP system adoption: A comparative analysis between SMEs and large companies. J. Enertp. 2005, 18, 384–426. [Google Scholar]

- Forsman, H. Business development success in SMEs: A case study approach. J. Small Bus. 2008, 15, 606–622. [Google Scholar] [CrossRef]

- Durmus, C.; Ozlem, T.; Ayfer, G. Financial Problems of Small and Medium-Sized Enterprises in Turkey. Int. J. Acad. Res. Bus. Soc. Sci. 2015, 5, 27–37. [Google Scholar]

- Central Bank of Jordan. Annual Report 2017. Available online: https://www.bankofjordan.com/page/annualreports (accessed on 12 August 2022).

- El-Said, H.; Ahmed, R. Micro, small and medium sized enterprises development in Egypt, Jordan, Morocco & Tunisia: Structure, obstacles and policies. EMNES 2017, 4, 24–35. [Google Scholar]

- Abou Elseoud, M.S.; Kreishan, F.M.; Ali, M.A. The Reality of SMEs in Arab Nations: Experience of Egypt, Jordan and Bahrain. J. Islam. Fin. Stud. 2019, 5, 110–126. [Google Scholar] [CrossRef]

- Schumacher, A.; Erol, S.; Sihn, W. A maturity model for assessing industry 4.0 readiness and maturity of manufacturing enterprises. Procedia CIRP 2016, 52, 161–166. [Google Scholar] [CrossRef]

- Sony, M.; Naik, S. Key ingredients for evaluating Industry 4.0 readiness for organizations: A literature review. ISO4 2020, 27, 2213–2232. [Google Scholar] [CrossRef]

- Stentoft, J.; Rajkumar, C.; Madsen, E.S. Industry 4.0 in Danish Industry; Department of Entrepreneurship and Relationship Management, University of Southern Denmark: Odense, Denmark, 2017. [Google Scholar]

- Stentoft, J.; Jensen, K.W.; Philipsen, K.; Haug, A. Drivers and Barriers for Industry 4.0 Readiness and Practice: A SME Perspective with Empirical Evidence. In Proceedings of the 52nd Hawaii International Conference on System Sciences, Maui, HI, USA, 8–11 January 2019. [Google Scholar]

- Mittal, S.; Ahmad Kahn, M.; Romero, D.; Wuest, T. A critical review of smart manufacturing & Industry 4.0 maturity models: Implications for small and medium-sized enterprises. J. Manuf. Syst. 2018, 49, 194–214. [Google Scholar]

- Rockwell Automation. The Connected Enterprise Maturity Model. Available online: https://literature.rockwellautomation.com/idc/groups/literature/documents/wp/cie-wp002_-en-p.pdf (accessed on 25 January 2022).

- Lichtblau, K.; Stich, V.; Bertenrath, R.; Blum, M.; Bleider, M.; Millack, A.; Schmitt, K.; Schmitz, E.; Schröter, M. Industrie 4.0-Readiness; IMPULS-Stiftung: Cologne, Germany, 2015. [Google Scholar]

- Nick, G.; Szaller, A.; Bergmann, J.; Vargedo, T. Industry 4.0 readiness in Hungary: Model, and the first results in connection to data application. IFAC 2019, 52, 289–294. [Google Scholar] [CrossRef]

- Basl, J. Pilot study of readiness of Czech companies to implement the principles of Industry 4.0. Manag. Prod. Eng. Rev. 2017, 8, 3–8. [Google Scholar] [CrossRef]

- Soomro, M.; Hanafiah, M.; Abdullah, N.; Ali, M.; Jusoh, M. Industry 4.0 readiness of technology companies: A pilot study from Malaysia. Adm. Sci. Q 2021, 11, 56. [Google Scholar] [CrossRef]

- Medić, N.; Anišić, Z.; Lalić, B.; Marjanović, U.; Brezocnik, M. Hybrid fuzzy multi-attribute decision making model for evaluation of advanced digital technologies in manufacturing, Industry 4.0 perspective. Adv. Prod. Eng. Manag. 2019, 14, 483–493. [Google Scholar]

- Al-Odeh, M.; Altarazi, S. Supply chain management information systems survey for Jordanian companies. Int. J. Math. Eng. Manag. Sci. 2019, 4, 567–579. [Google Scholar] [CrossRef]

- Saunders, B.M.; Tosey, P. The Layers of Research Design. Rapport NLP Prof. 2012, 4, 58–59. [Google Scholar]

- Aaker, D.A.; Keppel, G. Design and Analysis: A Researcher’s Handbook. J. Mark. Res. 2006, 13, 318. [Google Scholar] [CrossRef]

- Taylor, K.; Nettleton, S.; Harding, G. Social Research Methods. In Sociology for Pharmacists; Taylor & Francis Group: London, UK, 2010. [Google Scholar]

- Johanson, G.A.; Brooks, G.P. Initial Scale Development: Sample Size for Pilot Studies. Educ. Psychol. Meas. 2010, 70, 394–400. [Google Scholar] [CrossRef]

- ACI, Amman Chamber of Industry. Available online: https://www.aci.org.jo/ (accessed on 29 January 2022).

- Özceylan, E.; Çetinkaya, C.; Demirel, N.; Sabırlıoğlu, O. Impacts of additive manufacturing on supply chain flow: A simulation approach in healthcare industry. Logistics 2017, 2, 1. [Google Scholar] [CrossRef]

- Verboeket, V.; Krikke, H. Additive manufacturing: A game changer in supply chain design. Logistics 2019, 3, 13. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).