Abstract

Courier, express, and parcel (CEP) services represent one of the most challenging and dynamic sectors of the logistics industry. Companies of this sector must solve several challenges to keep up with the rapid changes in the market. In this context, the introduction of autonomous delivery using self-driving trucks might be an appropriate solution to overcome the problems that the industry is facing today. This paper investigates if the introduction of autonomous trucks would be feasible for deliveries in urban areas from the experts’ point of view. Furthermore, the potential advantages of such autonomous vehicles were highlighted and compared to traditional delivery methods. At the same time, barriers that could slow down or hinder such an implementation were also discovered by conducting semi-structured interviews with experts from the field. The results show that CEP companies are interested in innovative logistics solutions such as autonomous vans, especially when it comes to business-to-consumer (B2C) activities. Most of the experts acknowledge the benefits that self-driving vans could bring once on the market. Despite that, there are still some difficulties that need to be solved before actual implementation. If this type of vehicle will become the sector’s disruptor is yet to be seen.

1. Introduction

Due to the complexity of urban areas, planning and execution of transport and logistics are among the most challenging tasks faced by private organizations and public authorities. Nowadays, the last-mile problem generates significant issues for delivery service providers, and to remain competitive, these companies must deal with several challenges [1]. This research presents a comprehensive overview of autonomous trucks or lorries (T&L), as upcoming developments that could alter the customer experience and the logistics behind urban deliveries. While a decade ago, driverless vehicles seemed unimaginable; they are getting closer to become a reality. According to the “DHL Logistics Trend Radar,” self-driving vehicles have a high probability of fundamentally transforming the way businesses are executed today, creating new possibilities in different sectors [2]. Moreover, driverless cars could reshape our society and have such an enormous impact on humanity as the first automobiles. The expression “driverless car” will maybe sound similar to the anachronism “horseless carriage” in the future [3].

The importance of autonomous vehicles (AVs) for future urban logistics development has been stated by a handful of journal articles or institutions. Researchers have highlighted that these advancements in the automobile sector have the potential to significantly reduce the transport and logistics-related challenges in complicated urban settings [1,4]. However, most of the articles in the field either hold a general description of autonomous trucks without distinguishing an industry, or they present various logistical innovations in the field of courier, express, and parcel (CEP) companies, such as drones, light electric freight vehicles, self-driving parcels or droids [5,6]. Few of the papers have already suggested examining the potential of using autonomous trucks in urban areas for last-mile deliveries, stating that “specific areas such as last-mile logistics would be of interest” [7]. It is still not known how to “assess the benefits of self-driving vehicles for city logistics”, so more research is needed in this area [1].

Finding the possible use cases, advantages, and barriers is crucial to establish a better understanding of the topic as the “challenges of urban logistics change continually” [1]. Thus, a single paper cannot bring the overall solution to this problem, but it could be a good starting point when it comes to autonomous trucks and their implications. The significance of the innovation in the mobility sector with autonomous vehicles is undeniable. Therefore, this paper aims to examine what autonomous T&L could offer in comparison to traditional delivery methods and to what extent these vehicles could be used in the future. This will be answered by presenting the current perception and opinion of the experts working in CEP companies. It leads to the primary research question of this paper:

- How is the introduction and implementation of self-driving trucks currently viewed by the experts of the CEP segment?

In order to answer this question as precisely as possible, the article has two other sub-questions which should enable to examine the main question stated above from two different angles:

- 1a.

- How could autonomous T&L be more advantageous than traditional delivery methods when it comes to urban areas?

- 1b.

- What are the possible barriers that could hinder or slow down the implementation of autonomous T&L in urban settings?

Without formulating research objectives, the “same level of precision” cannot be achieved, as they help to specify and detail the research questions even more [8]. Therefore, this study presents a three-fold research objective:

- To sketch use-case scenarios for driverless T&L in urban settings;

- To investigate the feasibility of a potential autonomous delivery implementation from different viewpoints;

- To review the possible logistical changes this implementation could bring for the CEP sector.

2. Literature Review

The purpose of this section is to create an excellent theoretical understanding of the topic and present the state of the art. To achieve this, the chapter will be divided into four different subtopics. The first part will define urban delivery and CEP companies as significant players on the market while elaborating on the challenges related to last-mile delivery. After that, autonomous trucks will be presented as potential solutions for this problem. Lastly, the paper will examine the implications on logistics.

Most of the information presented derives from secondary literature, for example, scholarly journal articles. The topic of autonomous trucks is relatively new in the academic field, so a considerable part of the literature review is also based on trend reports or blog posts of consulting firms, companies involved in transportation, logistics or supply chain management, and experts in the field. Besides, the paper has made beneficial use of primary sources found, such as patents. These types of sources were essential to show real-life examples of autonomous vehicles.

Last but not least, two events organized by the Institute for Transport and Logistics Management of WU (Vienna University of Economics and Business) were also attended. The first event was a roundtable discussion entitled “KEP-Dienstleister im Schatten der Online-Giganten.” At the same time, the second was an online lecture held by Mr. Jakob Puchinger called “Urban Deliveries with Autonomous Vehicles.” Both events helped to gather more information, dig deeper, and gain additional knowledge about the topic.

Thus, investigating different kinds of source has ensured a robust and reliable background for a topic which is still open for discussions.

2.1. Urban Delivery

2.1.1. Domains of Urban Logistics

The concept of city logistics has gained popularity in the last few years but is not by any means a new phenomenon. One way to describe city logistics could be as “finding efficient and effective ways to transport goods” [1]. Cardenas et al. [9] state that there is a lack of consensus when it comes to the terminology used for different areas of urban logistics. In order to achieve a certain level of transparency, the authors have created a framework with three urban logistics domains and present two different scopes: first, the geographical scope describes the boundaries of each domain while specifying their space of activity and second, the functional scope explains what the focus of the domain is [9].

Urban goods distribution (macro-level) and last-mile delivery (micro-level) will represent the dominant fields in the case of this article, as it will analyze how would autonomous trucks alter the design of distribution networks and how they would affect logistics services [9]. Furthermore, it will also give a detailed overview of the final product delivery under those new circumstances. However, AVs can also be recognized as innovation examples in a “smart city” context. These initiatives try to enhance the performance of urban environments with the help of information technologies in order to “provide more efficient services to citizens” and “to encourage innovative business models” [10].

2.1.2. Courier, Express and Parcel (CEP) Companies

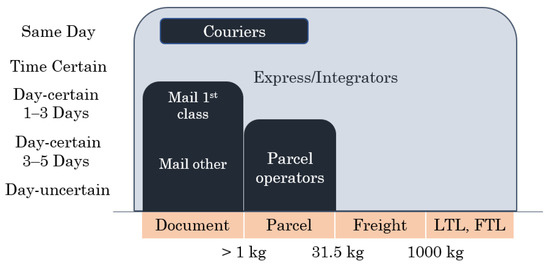

Since this paper will investigate the topic of autonomous trucks and vans from the perspective of CEP companies, it is crucial to present these vital market players. The CEP service providers have a particular significance in urban logistics. This sector can be examined based on two dimensions: time-certainty or speed and weight [11]. The maximum weight of parcels is around 31.5 kg [12]. Couriers deliver lightweight shipments usually on the same day, while express delivery is defined by a fixed time window (within one or two days). Finally, parcel providers consolidate lightweight parcels [11,12,13]. Express is also called integrator because it covers almost every market segment [11]. Figure 1 presents this classification. Some parts of these services are overlapping; hence most of the CEP players offer all of them [12].

Figure 1.

Courier, express, and parcel (CEP) company definition based on TNT [11] and Ducret [12].

2.1.3. Challenges of Urban Deliveries and the CEP Sector

As mentioned in the introduction, there is a vast number of drivers that shape the process of urban distribution. The difficulty of performing urban deliveries derives from a series of challenges that CEP companies must face. Accessing certain areas of a city, the distance and space are just a few problems mentioned by Cardenas et al. [9]. Because of the complexity of urban areas, delivering on time is a crucial challenge as well [9]. Furthermore, policy regulations like parking or truck size restrictions, time-windows, or a ban on night deliveries can also represent an immense hurdle to delivery companies [14].

On top of that, current trends also have a massive impact on urban logistics. Population growth and urbanization are continuously increasing the demand for goods and services [1]. Savelsbergh and Van Woensel [1] highlight that by 2050 two-thirds of the world’s population will live in cities. The expansion of emerging markets and globalization are other megatrends that give rise to urban delivery challenges [11]. Another crucial driver is e-commerce, which has given a substantial boost to the business-to-consumer (B2C) sector in recent years [1,11]. Consequently, CEP companies also started to offer same-day delivery options or, in some extreme cases, even instant deliveries in order to “compete with brick-and-mortar retailers” [1]. The desire for speed, instant gratification, and the loss of patience is not a new phenomenon, and companies are trying to build their services around those needs [15]. As a result, consumers are accustomed to real-time services and favor those over regular delivery times [15].

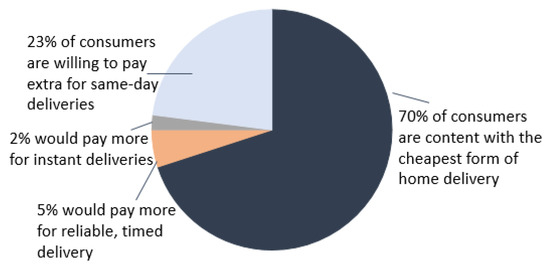

Interestingly, the majority of customers would not pay additional fees when it comes to extra services [1]. McKinsey and Company [6] have found that only about a quarter of customers are willing to pay for a same-day delivery, which shows how cost-sensitive are the end-customers. Figure 2 illustrates the percentage of people that would pay a premium to benefit from a select delivery option.

Figure 2.

Share of consumers choosing different delivery options based on McKinsey and Company [6].

We can conclude that the CEP company plays a crucial role in urban areas and will get even more attention in the future. To tackle the market challenges, CEP players must find suitable solutions and design innovative strategies in order to remain competitive and execute high-quality services.

2.2. Autonomous Trucks

2.2.1. A Promising Solution

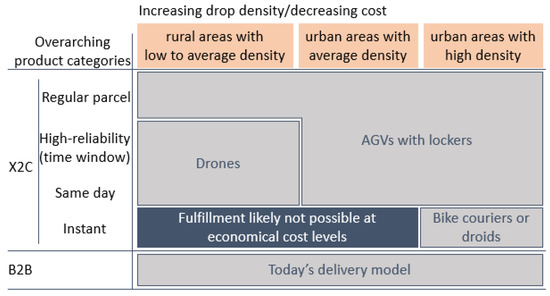

When it comes to urban deliveries, several future models are envisioned. However, automotive technology is mentioned by several different papers. Savelsbergh and Van Woensel [1] underline that the actual introduction of self-driving cars might be close in the next few years. Based on three distinct aspects (financial value, social value, and feasibility), McKinsey and Company [16] have found six promising approaches, which have the most significant potential to mitigate the urban delivery problems. It turns out that one of the best transportation solutions could be autonomous ground vehicles with parcel lockers [16].

McKinsey and Company [6] also published a matrix with two essential dimensions, one being general customer preferences (regular parcel, high reliability of timing, same-day, and instant delivery) and the second dimension being drop density. The result shows that autonomous ground vehicles (AGVs) with parcel lockers will dominate urban areas with average to high densities (excluding instant deliveries) in the anything-to-customer (X2C) sector [6]. Based on this report, the use of drones is only cost-efficient in rural areas, while droids might be applicable just in case of instant deliveries in dense cities [6]. Figure 3 depicts those findings.

Figure 3.

Future delivery models (author’s rendition: adopted form McKinsey and Company [6]).

2.2.2. Autonomous Driving

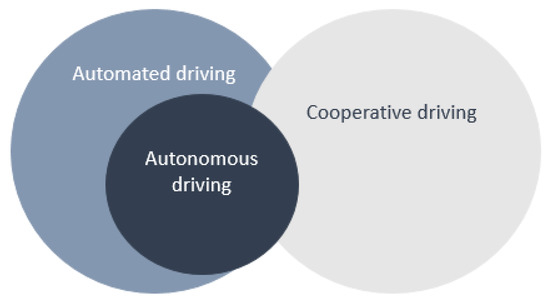

To understand what impact AGVs could have on the CEP industry, we first have to define what is autonomous driving. “Automated driving,” “autonomous driving,” and “cooperative driving” are terminologies often used in a general sense, even though these have different meanings [17]. Based on the definition of smart [17], automated driving means that a specific autonomous (sub)system runs and supports the driver, who is in control of driving. The highest degree version of automated driving is autonomous driving, in which case no human intervention is necessary. Meanwhile, cooperative driving focuses on different technologies, which are important to gain information and communicate in road traffic systems. There are two types of communication: “vehicle-to-vehicle” and between “vehicle and road infrastructure” [17]. Figure 4 shows how the three types of driving overlap.

Figure 4.

Areas and overlap for three types of driving based on SMART [17].

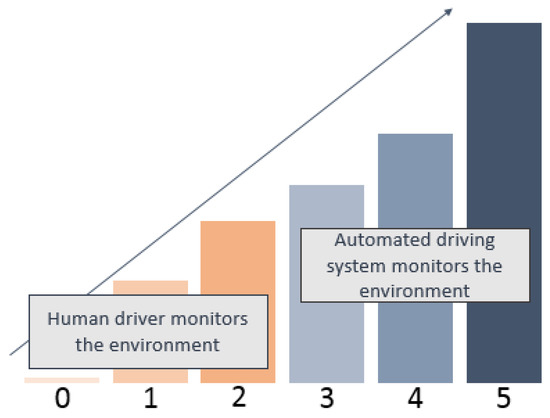

Furthermore, Society of Automotive Engineering (SAE) International [18] offers a taxonomy that describes the various levels of automation, presenting five various stages. We can see this distinction in Figure 5. Level 0 or “no automation” serves as a starting point or “point of reference.” According to SAE International [18], the first 3 levels need a human driver to monitor the environment. In contrast, in the case of levels 3, 4, and 5, this is the task of the automated driving system, as stated in Figure 5. The classification of the Federal Highway Research Institute (BASt) and the National Highway Traffic Safety Administration may slightly differ but approximately correspond to each other [18]. This study will mainly focus on automation levels 4 and 5 because the principal advantages of the implementation could only unfold under the circumstances created by fully autonomous trucks (i.e., no human driver behind the wheel).

Figure 5.

SAE automation levels based on SAE International [18].

2.2.3. Autonomous Truck Patents and Examples

As we can conclude from the previous explanations, AGVs are basically “land-based robots,” which do not need the presence of a human in order to operate [19]. Thus, this category involves autonomous trucks, lorries, and vans as well. There is a lengthy list of companies that are involved in manufacturing the best concepts for urban deliveries. These innovative vehicles all have different futuristic features and attributes, which could immensely improve parcel deliveries. Table 1 contains a wide range of these plans.

Table 1.

Company investments into self-driving vehicles.

2.2.4. Future Use Cases of Autonomous Trucks

Autonomous trucks with parcel lockers could be used in two different ways. In the first version, the vehicle could drive itself to the address of the customer. If a truck is scheduled to deliver packages, a compartment could be reserved, and a package could be placed in it [20]. The truck would drive autonomously to the address, and the addressee could open the compartment using a personal identification number (PIN) code [20]. That is the so-called “direct” or “door-to-door” delivery [16]. In the second, cheaper version, AGVs could function similarly like regular parcel lockers and serve as pick-up points. The autonomous truck would inform the customers in the area, and for a prolonged time, they could collect their packets. The most significant advantage in contrast with today’s parcel lockers would be the opportunity to move the whole truck to another area. Thus, a truck could always park in the proximity of customers or “easy-to-access locations” [16]. Besides, the examples mentioned above show that autonomous trucks could be united with other methods of deliveries, like drones, droids, or robots, that could significantly improve the last-mile delivery.

2.3. Implications for Logistics

Implementing autonomous T&L will drastically restructure the logistics network, in terms of processes, stages of delivery, or distribution network. It is the case when it comes to same-day deliveries, as these need to be fulfilled within a short amount of time. Urban consolidation centers (UCCs), which are “large facilities usually located within the suburban area of big cities,” might not be enough in the future to perform these services [26]. It will be more reasonable to locate the logistics center closer to the recipient [6].

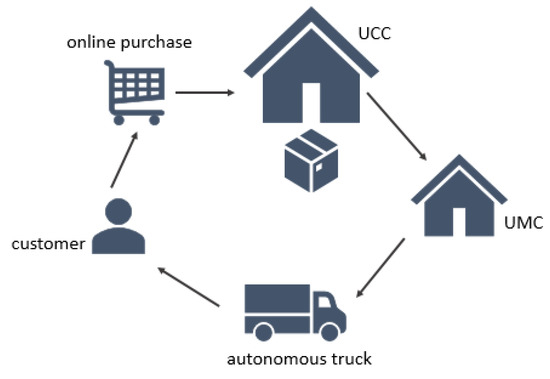

Furthermore, McKinsey and Company [6] accentuates the fact that autonomous trucks will be smaller than regular trucks and thus will need to be reloaded more times. This is one of the reasons why CEP companies could decide to use so-called “city hubs” or “micro-distribution centers” to deliver parcels [12]. Based on Ducret [12], this solution sees widespread usage amongst innovative new players on the market (e.g., last-mile deliveries done with tricycles or mini-vans). It could also be implemented in the case of (electric) AGVs. An urban micro-consolidation center (UMC) or micro distribution center (MDC) would primarily focus on the package sorting (barcodes), loading/unloading of cargo, short-term or overnight storage, delivery scheduling and vehicle maintenance [27]. Figure 6 shows how could UMCs be integrated into the delivery circle of CEP companies.

Figure 6.

The integration of urban micro-consolidation center (UMCs) into the delivery circle.

3. Methodology

Investigating the secondary literature about the main topic has not only helped to draw up the research questions and to construct the literature review, but it was also the starting point for the research approach and design. Once the research questions and objectives were clear and defined, the “research onion” of Saunders et al. [8] has helped immensely to point out the right direction for this paper. This chapter will present the decision-making process regarding the methodological approach and data analysis.

3.1. Research Philosophy and Research Approach

Saunders et al. [8] state that a research question usually cannot be categorized that easily into a particular research philosophy. Undeniably, the subject of AGVs required a high degree of flexibility. As the research strategy and design can influence the understanding and the results of the research, choosing an appropriate research philosophy at the very start of the research was crucial. The topic of autonomous vehicles is future-oriented, and at this stage, generalizations are nearly impossible. Furthermore, the outcome of this trend is shaped in the present by different social actors through their decisions, actions, and belief. This is particularly true when it comes to the business world and management. Thus, interpretivism, as research philosophy, was chosen to answer the research questions in as detailed a way as possible [8].

The paper aimed to capture data about the perception of AGVs in the field of CEP or postal companies and to report these in a way that gives a rich and systematic insight. Because of the missing theoretical framework, this was done with an inductive approach—rather than testing a hypothesis, and the end goal was to develop a theory [8]. Based on the opinion of several researchers, qualitative data are more suitable for induction [8,28]. It must be stated that due to the qualitative character of the research building, a theory in this context purely means “internal generalizability” instead of a statistical one. However, this can still provide valuable insights, for example, by posing “a general but articulated question” [28]. Generally speaking, in the case of qualitative research, it is harder to guarantee the validity and reliability of the data which is why the checklist containing different criteria (such as ethics, worthy topic, credibility, meaningful coherence, contribution, etc.) of Easterby-Smith et al. [28] was used as a guideline to ensure the quality of this paper.

3.2. Data Collection Method

As mentioned above, the paper should explore many different aspects of the topic (within the boundaries of the research questions) and detail these in depth. Because of the investigative nature of the research and since induction uses mostly qualitative data and small samples, a single qualitative data collection technique was chosen to collect primary data, namely semi-structured interviews. In the case of semi-structured interviews, the researcher will try to cover a list of predetermined themes, but questions can be omitted/added or asked in a different order [8]. It gives more flexibility than highly structured interviews and, at the same time, offers some sort of system in contrast to unstructured interviews [28].

Keeping in mind the research questions, the most appropriate form of information collection was to conduct expert interviews. Bogner et al. [29] define experts as individuals who acquired specialized knowledge through their specific functions, e.g., their professional role. This type of interview is exceptionally efficient in the case of projects which are in the exploratory phase—such as the implementation of autonomous trucks—because they can serve as “crystallization points” [29].

3.3. Selecting Samples and Creating Access

The limitation of the topic and the research questions to a particular type of company explain the use of non-probability and purposive sampling, as these will enable selecting experts who can answer the research questions specifically related to these firms [8].

Choosing specific experts in the CEP industry, who have an adequate insight and necessary experience or knowledge to form a solid opinion about this topic, was of high importance, as the results were deducted from the current viewpoints of these persons. This approach has also ensured the comparability of the different interviews. As a result, experts with a secure connection to the field, either by being an employee at a CEP company or working closely with these types of company, were chosen as interview partners. Moreover, they needed to be up to date with innovative logistics solutions and trends.

The process of finding the right people for this research was a multi-stage process. First, it was cardinal to limit the geographical location of the experts to Austria in order to locate and contact them at the authors’ convenience. Second, reading newspapers (e.g., “Verkehr”), transportation magazines (e.g., “Delivered.”), and research papers have helped to identify professionals with enough expertise. In some cases, the contact details of these persons could be found online. In other cases, it was necessary to network on different professional platforms or websites such as LinkedIn. At this point, the goal was to reach out to them and explain the aim of the research. Some researchers suggest sending an introductory letter which “should outline in brief (...) how the person contacted might be able to help and what is likely to be involved in participating” [8]. Additionally, potential interview candidates were sent a sample interview questionnaire to familiarize themselves with possible questions. Many authors also suggest the use of topic guides in the case of semi-structured interviews, which “can be used as a loose structure for the questions” [28]. The topic guide created for the interviews can be found in the Appendix A.

3.4. The Interview Process

After searching for potential candidates, the next step was to conduct the interviews. In total, 17 international CEP organizations that were involved in international logistical activities and had a significant share in B2C services were selected for this study. Out of 17, 4 companies agreed to the interview. However, one company prohibited us from using the information provided by them due to some internal issues; therefore, the authors could only account for three interviews with four interviewees. The interviews were conducted in the English language with experts in the CEP sector in Vienna, Austria. All of the CEP companies are big players on the market, offering parcel transport and a wide range of B2C services (express delivery, postal services, etc.). One of the interviews was conducted face to face at the headquarters of the company, and two were the telephonic interviews. According to Saunders et al. [8], this type of interview can be used effectively where the distance or the accessibility of interview partners raises issues. Moreover, Easterby-Smith et al. [28] highlight that managers can even prefer remote interviewing to face-to-face interviews because it is more flexible. Specifics and information about the interviews conducted are presented in Table 2, which details the duration, date, type of interviews, and gives a piece of overall information about the organizations and interviewees.

Table 2.

Information about respondents and organizations (Adopted from [4]—Author’s rendition).

In the research where comments and opinions of the professionals and experts are assessed, several different ethical issues can arise, such as the privacy and anonymity of the participants or the problem of maintaining confidentiality [8]. Therefore, for the sake of impartiality and to avoid any biased opinions, the identity of the CEP organizations and interviewees is kept anonymous. At the start of the interviews, it was always explained that the interviewee could withdraw from the process, and it was ensured that they agreed to the conditions. For example, the participants were asked to give verbal consent to record the interview and to produce a transcript. It was later used to quote some of the answers directly.

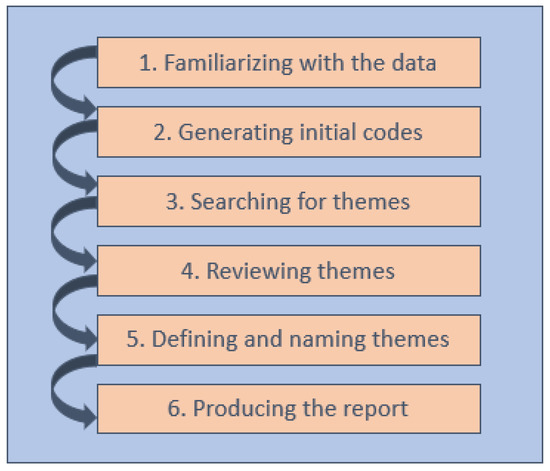

3.5. Data Analysis

Considering the small sample size and the richness of the data, thematic analysis was chosen as a data analysis method. Based on the definition of Braun and Clarke [30], thematic analysis is “a method for identifying, analyzing, and reporting patterns (themes) within data.” Nowell et al. [31] present in great detail the six phases of the thematic analysis, which is depicted in Figure 7. In this paper, the purpose of the data analysis was to recognize emerging themes and detail these in-depth. This means that particular data gain attention (by being labeled as a code) not because of the number or frequency they appear, but because they capture the information relevant to the overall research question [30]. Of course, the findings were compared to each other, so similarities and differences across the interviews were elaborated to find critical themes and depict different opinions even better. However, this was not done to quantify the initial data, like in the case of content analysis [30].

Figure 7.

Phases of thematic analysis based on Nowell et al. [31].

The codes were selected inductively, without a “pre-existing coding frame,” so any topics that might have been identified during previous research done by others did not get more attention than an entirely new piece of information [30].

3.6. Reporting the Findings

Producing a transparent and rich extract of the findings is the essence of the whole research. That is why one of the most critical parts of this research was to write the following chapter to be as intriguing as possible. First of all, the goal was not a simple description of the answers gathered, but rather to present the information as part of a whole, complex system. Otherwise, the results will not serve its purpose correctly and “will only offer a flat descriptive account with very little depth” [31].

In order to achieve this complexity and to create an “overall story,” several methods presented by Nowell et al. [31] were used. Firstly, the report contains short quotes and lengthier passages as well. This way, the more succinct answers can ground the “understanding of specific points”, while the more extensive quotations can “give readers a flavor of the original texts” [31]. Secondly, the report refers to the literature to confirm the research findings or to challenge them, which can expand the knowledge by adding new interpretations. Thirdly, all of the relevant information, even unexpected ones, are discussed to ensure credibility [31].

4. Results and Analysis

The following chapter will summarize the findings of the interviews held with the experts and will answer the research questions defined in the introductory part of the article. This chapter will also compare the answers of the participants to the current literature findings.

4.1. How Is the Introduction and Implementation of Self-Driving Trucks Currently Viewed by the Experts of the CEP Segment? (RQ 1.)

During the interviews, the experts were shown to have a profound understanding of the topic and a positive attitude toward logistical innovations. In general, CEP companies are aware of the sector’s changes, and some of them have started to invest in pilot projects and research as a response to the market’s push. However, based on their answers, using a fully automated vehicle for B2C processes is still not anticipated for the next several years due to the risks associated with this new form of delivery. To investigate the attitude of the experts toward innovative trends and to answer the research question precisely and accurately, the interviewees were asked to state their opinion on some of the actual megatrends. Thus, subtopics like autonomous vehicles, logistical innovations in the CEP industry, potential use cases of self-driving trucks, and changes in the delivery process were brought to the discussion.

4.1.1. Autonomous Driving and Autonomous Vehicles

The experts had a good basic understanding of the term autonomous vehicle, and they were describing it similarly. E1 mentioned different steps of the autonomous driving stating that “[in case of] semi-autonomous driving, you still have a driver, but there is some sort of technique which enables the autonomous driving” and “fully autonomous driving is when you have a truck or a van completely driving on its own.” E2 gave the following definition: “a vehicle which is capable of moving around completely on its own without the need of somebody to use any kind of remote control or even any kind of route planning because this is something the vehicle is ideally capable of doing on its own.” Last but not least, E3 stated that “there is no need for somebody who holds the wheel and physically controls the vehicle.” Obviously, these answers are not as precise as the SMART definition, but this had no adverse effects on the results because every expert understood the meaning of a fully autonomous vehicle.

4.1.2. Logistical Innovations (in the CEP Industry)

E1 highlighted the importance of logistical innovations for the CEP industry: “in the B2C sector, you have to constantly offer new things because that is what enables the company to gain additional business”. E1 also mentioned that “because of e-commerce, the prices are always under pressure.” Thus, innovation in different areas like “customer service, online tools, communication with customers, and consignees” is of great importance. E2 claimed that autonomous delivery is something the company is looking at “just to figure out if it is usable or not,” but right now, the firm does not have any specific business model for that. E3 highlighted the importance of logistical innovations in the following way: “[in our company] we always try to approach problems by using digitalization (...) we do not call this innovation but rather we ask how could we digitalize the whole system, how can we integrate artificial intelligence into our procedures either by using specific robots or technologies”.

4.1.3. Potential Use-Cases

When asking to describe potential use-cases for autonomous vans in the B2C sector in urban areas, the ideas mentioned were mostly similar to the box truck concept mentioned in the second chapter of the paper. An autonomous van having multiple lockers that could drive to a specific place, and once arrived, the recipient could pick up the parcel. E1 brought up the fact that the company already had this idea: “we thought about this without autonomous driving, we call it a mobile parcel shop (...) but we could also do that with a van that drives around autonomously”. E2 also spoke briefly about this type of delivery, stating that “it could work, it is something that maybe we are implementing, I am not sure.” E3 also tried to describe this as “post boxes where you can pick up your parcel or return a parcel”, stating that “it does make sense to try to automate it and it could be executed”.

Another mentioned use-case of E2 was a “kind of semi-automated assistance for the employee,” in which case “the autonomous van might be driving around the street, and the employee has the time to look for the parcel” or “maybe the employee has to go from one door to the next door, and the vehicle would be waiting already there.”

As the paper examines fully autonomous vehicles, alternative solutions where a driver is still part of the delivery will not be detailed further. So, the next sections of the results will only refer to the box truck scenario.

4.1.4. Alteration of Logistical Processes

Everyone agreed that a fully autonomous delivery would change at least some of the logistical processes. E1 pointed out that “there will be areas where you would need to alter processes.” According to E2, “if a company would plan to fully automate the delivery, then a completely new delivery process is required.” E3 affirmed that “the whole technological system would need to be adapted.”

When asking for possible changes in the logistical processes, most of the experts compared the present delivery process with the future one. E2 described this in the following way: “It would make the process completely different because at the moment an employee has a delivery area and has a daily average of parcels for a tour. If the delivery is completely autonomous, this average will change because the vehicle has to stop and has to wait for a certain amount of time until the person comes to the meeting place to pick up the parcel. So, this is something that would change the productivity.”

Moreover, E3 also presented some parts of the process which should be changed, for instance, liability (“the liability passes on from the warehouse to the driver after loading the van, in case of autonomous vehicles this have to be reconsidered, because there is no one to take over the responsibility”). Similarly, the role of distribution centers (“distribution centers will probably become more important”) and the loading/unloading activities (“if the van returns empty or with a few parcels you would have to decide what to do with those parcels, how do you want to load the vehicle again and at which gate”). E1 accentuated the importance of a control system as well: “even if you do not have drivers anymore, you still need to have a control system to control the trucks.”

The necessity of a micro hub concept was not answered in detail, but this subtopic was also mentioned briefly. E1 disclosed that “this would sure be a possibility” as they already use these types of hubs with electric tricycles: “we call these city hubs (...), and of course, we could deliver from the city hubs using autonomously driving trucks too”. E2 reflected on this question stating that “[the company] is trying out a new concept for urban areas and it is actually not a matter of vehicles but a matter of different approach to the last mile challenge (...) at the end of the day you can change the vehicle for a self-driving one, and it will probably still work”.

As we can see, the answers covered only a part of the possible changes which could happen because at this stage it is hard to say if autonomous vehicles will somehow be integrated into the existing design and only some parts must be changed or companies will have to model the new processes from scratch.

4.1.5. Estimated Timeframe

The interviewees were also asked to estimate how many years it would take to introduce self-driving trucks on the market. Every expert said that this type of delivery would take several years or even a decade to be fully implemented. This also corresponds with the findings of other researchers. Estimating the transition period and specific implementation time is crucial because this will allow companies “to plan for the upcoming future in a better way and adjust their business dynamics” [32]. Because of the complexity of urban settings and logistical processes, a fully autonomous (level 5) delivery is not expected to enter the market soon. However, the experts have stated that experimenting with different types of new technologies is the right direction for the CEP industry. It is also important to recognize early enough, which are the suitable technologies for different areas of the sector. E1, for example, believes that “autonomous driving is definitely one solution which is interesting for the CEP industry because other innovations like drones are only a marketing idea (...) it will not be used on a bigger scale, especially in urban areas”.

4.2. How Could Autonomous Trucks or Lorries (T&L) Be More Advantageous Than Traditional Delivery Methods When It Comes to Urban Areas? (RQ 1a.)

Research on the implementation of autonomous trucks for urban deliveries is limited. Nevertheless, AGVs are getting even more attention, and the existing literature indeed identifies the positive impacts of autonomous trucks. In order to answer this research question appropriately, the first part of the subchapter will describe the advantages found in the literature. In contrast, the second explains the answers given by the experts.

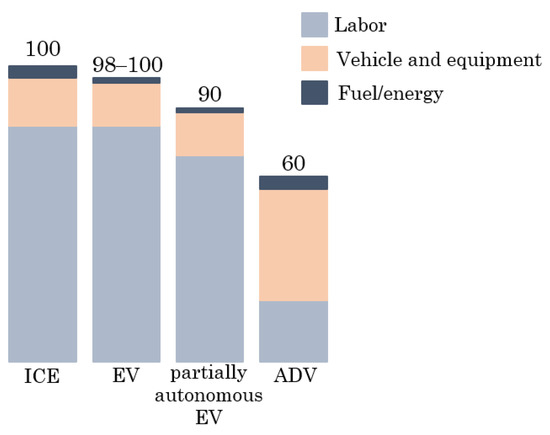

4.2.1. Cost Advantage

As B2C last-mile delivery is the most cost-expensive part of the supply chain, therefore autonomous trucks could have a substantial positive impact on the industry [33]. Delivering a parcel in an average city includes fuel or energy, vehicle and equipment, and labor costs [34]. The highest expenses are labor costs; in some rare cases, they can even reach 80% of the total costs [35]. Accordingly, based on network density, geography, and labor costs, autonomous trucks could significantly reduce delivery costs by 10% to 40% compared to the traditional delivery method, based on a study of McKinsey and Company [34].

As we can see in Figure 8, implementing autonomous trucks would increase capital costs, but these would remain cost-efficient [33]. Moreover, such a considerable saving would equal a “15 to 20 percentage point increase in profit margin” [16]. If we compare AGVs to other forms of deliveries, the outlook is the same. Van Pelt [35] claims that due to economies of scale, a drone could not compete with an autonomous delivery truck in urban areas, even if its lifespan would double or its capital costs would decrease by 50%. Considering that vehicle costs represent only 15% of all costs, electric vehicles could not cause an immense cost reduction [34]. However, cost advantages might be even higher if autonomous vehicles were fully electric and could be combined with other solutions, like night deliveries or consolidation centers [16].

Figure 8.

Last-mile delivery cost per parcel in an average city (author’s rendition: adopted form McKinsey and Company [34]).

4.2.2. Enhanced Customer Service

Without a doubt, autonomous trucks would improve the customer service of CEP companies in diverse ways. AGVs would probably open the door to new opportunities, such as new service options and unique selling points. For example, “overnight pickup” and “Sunday delivery,” two services with “superior value for customers” [16]. At the moment, these services are impossible to execute because labor laws do not allow it in most of the countries or due to residential noise concerns [16]. Identifying customers’ requirements is crucial when it comes to urban deliveries. Table 3 presents the new trends among customers.

Table 3.

Consumers’ wish list based on Accenture [36].

Based on Google’s patent, autonomous trucks could offer a higher level of convenience to end consumers. First of all, better communication and experience will ensure that customers’ needs are satisfied. The autonomous truck would send the estimated arrival time in text and another message when it is actually at the place of pick-up; delays (e.g., traffic) could also be communicated in the same way [20]. After arriving at the address, the truck will remain at the destination for a while (“dwell period”), which could also be extendable. Customers will have the opportunity to share the PIN code with other family members or persons to collect the parcel, which is another notable feature [20].

Another critical factor to mention is returnability. These days a vast number of parcels are returned as an effect of e-commerce. Thus, CEP companies should not forget about revised logistics [37]. Customers want a convenient way to return their orders, and so far, parcel lockers have proven to be very popular [38]. This trend could continue and probably gain more attention once AGVs with parcel lockers are implemented.

4.2.3. Competitive Advantage

It is worth examining how autonomous trucks would represent a competitive advantage in the CEP market. The theoretical framework of Wong and Karia [39] describes four stages of achieving competitive advantage using “resource-based view”: in the first step, a CEP company has specific resources in its portfolio; in the second stage, the firm acquires “strategic resources,” which are “valuable, rare, inimitable and non-substitutable”; after that, these strategic resources should be bundled with other resources to achieve a competitive advantage, and finally, the company could create a new portfolio for future resource acquisitions.

Autonomous trucks and lorries are road vehicles, thus physical resources. Wong and Karia [39] claim that physical resources are crucial to “create network coverage.” If a company cannot access specific physical resources, it could become challenging to fix new contracts. If autonomous trucks are bundled together appropriately with other types of resources, this could lead to a competitive advantage. Wong and Karia [39] present different strategies used by companies. For example, trucks could be integrated easily with the information system of the company thanks to their technological development. Process automation, track, and trace, or route optimization are just a few possibilities that could be realized.

Another integration strategy would imply “relational resources” [39]. This is also highlighted by McKinsey and Company [34], stating that traditional CEP companies could maintain their role on the market and gain competitive advantage through partnering up with commercial vehicle (CV) firms. A successful alliance would undoubtedly create a new business model and strengthen the position of both players [34]. Cooperation in city logistics is an essential key to success as it can lead to “a higher and efficient utilization of resources” [1]. Wong and Karia [39] mention this form of strategy as complementing “the value of a resource with another resource.”

4.2.4. Negative Externalities

As a transport, activities have a direct impact on the environment; specific adverse effects will inevitably occur. If the transport users do not take into consideration these consequences and do not cover the external costs, we talk about negative externalities [40]. There are different categorizations when it comes to negative externalities. For the last-mile logistics, these are the “air pollution, climate change, noise pollution, congestion, accidents, and infrastructure wear and tear” [41].

Due to the high number of vehicles, the high rate of deliveries, and the traffic volume, the issues of transportation can be multiplied in cities, especially in the case of last-mile deliveries in which the numerical data also suggest that, for producing 25% of the total CO2 and 35% of the NOx emissions of the whole transport sector, the urban transport of goods should definitely be taken into account when it comes to greenhouse gases [42]. Gonzalez-Feliu [42] accentuates the fact that end-consumer movements (including home-deliveries, B2C services, pickup points development, etc.) have a great significance, as they are also accountable for 50% of the road occupancy issues. The importance of the urban areas is also highlighted by the “Handbook on the external costs of transport” [40].

In order to place a limit on the adverse side effects of transport and reduce the costs in urban areas, several models are envisioned. One of these is autonomous delivery vehicles, which could bring a remarkable result [33]. If we examine the report of McKinsey and Company [16], we can see that AGVs are compatible with several other logistical solutions. Based on Ranieri et al. [41], the positive effects of AGVs on negative externalities would be even higher by combining these solutions and creating a “smart logistics system”.

One of these solutions is to use autonomous electric vehicles for deliveries. At the moment, it is not certain whether AGVs will be hybrid, electrically powered, or fuel-run. However, companies can easily experience a push for fully electric vehicles. This can come from three different sides: the first is stakeholders’ preferences (e.g., partners, customers) who focus on sustainability and desire such products; the second is the decreasing cost of innovative technologies (e.g., batteries, charging stations); the third is an emission or efficiency regulation policy [6,11]. The latter is already a discussion, as some suggest a policy that would prescribe fully electric autonomous vehicles [43]. Electric vehicles also have the significant potential to reduce noise; hence they are suitable for night-time deliveries. This is another excellent solution that can be combined with autonomous vehicles. Moreover, electric trucks could gain access to the city centers as it is restricted for internal combustion engine-based vehicles to enter those areas [37].

All in all, Berns et al. [44] claim that addressing sustainability would not only be helpful for our environment but could improve the image and the brand of the company and create unique selling propositions.

4.2.5. Most Significant Advantages

In comparison to the literature findings, the answers of the interviewees can be categorized into five different types of advantage. Some advantages were similar to the literature, like the increased cost-effectiveness, the possibility of new services, and the positive impacts autonomous trucks might have on the environment. Moreover, the experts accentuated the problems related to human resources. In their opinion, the autonomous delivery might solve the human errors which appear during a traditional delivery process and also provide a solution to the demand growth and driver shortage problem of the CEP industry. These are shown in a systematic way below. Table 4 lists some of the answers given by the interview participants.

Table 4.

Most significant advantages.

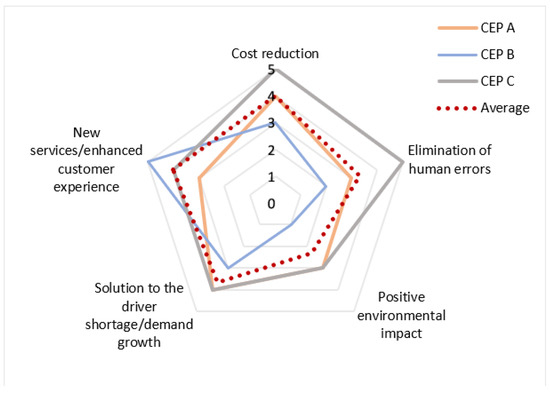

Figure 9 illustrates a radar chart of the derived advantage categories and assigns a certain point (from 1 to 5, 1 being the lowest) to the results, based on the experts’ elaboration and opinion. This shows which one of the advantages seems to be of greater importance for a particular company. The dotted average curve represents the final average values of all CEP companies.

Figure 9.

Radar chart—assessment of different advantages based on the experts’ opinion.

4.3. What Are the Possible Barriers That Could Hinder or Slow Down the Implementation of Autonomous T&L In Urban Settings? (RQ 1b.)

Besides having numerous positive effects and benefits, challenges, and barriers will possibly slow down the implementation of autonomous lorries. The change of fleets could even have temporary downsides. Despite that, the following challenges will most likely not hinder the switch to fully autonomous vehicles, and companies will try to overcome those difficulties. During the interviews, the experts were also talking carefully about the use-cases mentioned above, always listing potential risks and factors which can slow down the implementation. E2, for example, expressed some of these concerns in the following way: “This is something we have to look at carefully because maybe there are some risks too.”

4.3.1. Legislative Issues

Right now, the most cardinal challenges for companies are the legislative issues and regulations [45]. Currently, the Vienna Convention on Road Traffic restricts autonomous driving on public roads [45]. This was also brought up by E3: “The legal, regulatory environment would play a huge role because we will have to examine if the law of that particular city enables these types of autonomous delivery or not.” E1 also accentuates the fact that “autonomous driving needs special legal requirements,” especially in case of accidents (“you need to know who is responsible for that”).

However, in 2016 a new regulation was added, which states that transferring driving tasks to the vehicle is permitted if the driver can stop the system at any time [46]. In contrast, the United States has recognized the necessity of legislation. California, for instance, allows companies to test their fully autonomous cars on public roads without a safety driver [47]. This could be a massive step in the development of autonomous vehicles.

4.3.2. Infrastructure and Technology

Two other widely recognized factors by the experts during are infrastructure and technology. In this context, E3 mentions “the quality of the roads” and the possibility of “technological break-downs in the system.” E3 states that “the implementation will really depend on the presence of vehicle producers who can produce AGVs with an almost error-free technology.” Furthermore, E1 mentions the importance of the real-time information share: “there is the need to transfer data to those trucks, so you must have all technical things in place ready to work.”

Based on the literature, in the case of a real implementation of an autonomous vehicle fleet, companies would certainly need a sophisticated IT technology and infrastructure to optimize route choices [6]. Autonomous vehicles would require continuous monitoring and guidance in daily traffic. Plus, due to the interconnection of digital systems, security risks should not be neglected [3,48]. This would pose a considerable danger both to the customers and the companies, as hackers could collect personal data, sensitive information or try to take over the control of autonomous trucks [3,48].

4.3.3. Restructured Workforce

Although the interviewees did not mention it, recruiting the necessary experts and the restructuring of the workforce are other challenges that companies should consider [6]. In the stage of early adaptation, employees could work on administrative tasks. However, autonomous trucks will eventually reach full maturity, and drivers will possibly lose their jobs. There is a question as to whether retraining would help this issue or not. From another perspective, autonomous delivery vans could also create new job opportunities: CEP companies will need supervisors for their fleets [6]. It is still unforeseeable if these supervisors or fleet managers will have the same responsibilities as today. Fleet managers will most likely play a vital role, “providing a distinct and needed function (…) being managers of control centers” [49]. They will have to make sure that the deliveries are made on time by monitoring for delays. Another crucial task might be to examine if the vehicle is operating correctly. All in all, they will “need to understand trucks, but will also need to be a logistics expert” [49].

4.3.4. Altered Customer Experience

Furthermore, the participants have put an immense emphasis on the altered customer experience and the acceptance of this type of new delivery. Even though failing to meet the customer’s expectations can have severe negative impacts on a company, this issue is not addressed in detail in most of the literature. E2 highlights the importance of the topic, stating that autonomous delivery “is changing the whole customer experience completely.” These barriers are enlisted systematically in Table 5 as an overview of many different aspects all connected to the recipient. To sum it up, E3 explained that the implementation “could be solved, but this would mean that the customer has to do more.”

Table 5.

Most significant barriers.

Researching customer experience should be crucial for CEP companies in order to determine “an effective customer experience strategy” [50]. Firms have to find the right balance by delivering the necessary customer expectations but not exceeding them, as these could generate high costs and could lead to a profit loss [50].

4.4. Strength, Weakness, Opportunity, and Threat (SWOT) Analysis

Based on the findings from the literature and interviews, the following strength, weakness, opportunity and threat (SWOT) analysis in Table 6 summarises the strengths, weaknesses, opportunities, and threats related to a hypothetical introduction of a fully autonomous, electric, self-driving truck (used for B2C services) in a CEP company.

Table 6.

Strength, weakness, opportunity and threat (SWOT) analysis.

5. Discussion

5.1. Reflection on Findings

At the moment, the concept of using autonomous vehicles for urban deliveries is in an introductory phase. Currently, only a few companies are trying to test these vehicles under real conditions and circumstances. As we can see, the topic of logistical innovation seems to be of great interest to experts working in the field, especially if we talk about the B2C sector, which represents a significant challenge for CEP companies. Nevertheless, even considering this colossal interest and all the information available, right now, we cannot draw certain conclusions. We can only examine the possible effects it could have on the CEP industry. Because the logistics of the future is dependent on the decisions of the present, this paper had the primary goal of understanding how key players of the market perceive this innovation. Derived from the answers of the experts, it was assumed that autonomous vans would surely enter the market sooner or later. Of course, there are still open questions, and there is still controversy regarding AGVs, specifically autonomous vans.

On the one hand, we see a negative attitude toward this concept, which stems from the missing technology and legal environment, the complexity of last-mile delivery processes, and the needs of the customers. Primarily, this last component was brought into the center of the discussion several times during the interviews. Most of the experts used anecdotal descriptions and placed themselves in the shoes of the customers, proving that ultimately the focus point of the delivery process is the customer. E3 also mentioned the importance of the market or demand research: “I think it would be essential to do customer research to identify if the recipients are inclined toward this new form of delivery.” The literature reveals some findings regarding the customer’s reaction to new delivery concepts. For example, a study has found that 60% of customers would “be in favor of or indifferent to drones” [6]. However, there is not much research about the demand and openness of customers in the context of autonomous vans, which represents a considerable gap. The paper of Wintersberger et al. [51] examines the general attitude of consumers towards the daily and private usage of autonomous cars. Similar research could be undertaken to analyze the concerns of customers regarding autonomous vans and their overall willingness to change the process of urban delivery. Right now, companies are not questioning the technology but rather the attitude of the consumers. Once this is proved to be positive, the companies will most likely start to introduce autonomous vehicles.

On the other hand, we can also see that CEP companies are already heavily involved in logistical innovations and would like to reshape this whole sector. In a few years’ time, their resources might not be enough to serve the increasing market. The general attitude of Austrian and German experts is decisive when it comes to AVs. This is also in line with other research findings, which state that the majority of experts have a favorable opinion when it comes to business projects related to AVs [52]. The experts highlighted several advantages during the interview. For example, autonomous vehicles could open the door to a wide range of new services (e.g., night-time or scheduled delivery), which are not possible right now. As a result, autonomous vans have a huge chance to become a disruptor.

To conclude, there is still a dilemma regarding autonomous delivery. E2 condensed this idea as a “trade-off, which has two sides: it is nice, it is efficient versus it is dangerous and there are risks behind it (…) we have to find the right balance”.

5.2. Unanswered Questions

Questions about possible cooperation with vehicle producers, tech companies, or consultancies could not be answered at this stage. E1 had the following response: “they still have to work on technology, gain experience, capture data, and I think it is still too early for us as a company to step into that (…) you need to have a solution on the market already”. Future research might investigate the different cooperation possibilities and the possibility of a relational competitive advantage, also mentioned by Wong and Karia [39].

Another topic that was not brought up by any of the experts is the possibility of using autonomous vans for returning parcels. As mentioned in the literature review, this would be a real chance to revolutionize the way of sending back packets, providing easy access and a simple process for customers.

Moreover, some of the questions remaining can only be answered by conducting case studies. For example, in a particular company, it could be analyzed how significant is the percentage of small or medium-sized packages (defined by weight or the shape of the parcel) among the total of B2C orders, in order to find out whether the introduction of box trucks could cover a large part of the deliveries. Similarly, questions about possible fleet size or cost reductions will depend on a particular business case.

In other words, it is still undefined whether autonomous vans could once be used on a larger scale or if they will remain a solution that will be utilized only in case of increased demand. If a CEP company were interested in implementing such a solution, it would be imperative to work out these details meticulously.

6. Conclusions

The primary purpose of this paper was to give a general overview of the implementation of autonomous lorries. This was undertaken by investigating different perspectives of the topic, all supporting the central question, which dealt with the perception of experts regarding a possible self-driving truck introduction. However, at this stage, it is hard to say whether the positive features of AGVs will outweigh the challenges that companies will undoubtedly face as autonomous vehicles are still under ongoing developments. Using expert interviews as a data collection method proved useful for gaining insights about the attitude of market players specialized in urban deliveries, more specifically CEP service providers. The literature review and findings undoubtedly underline the importance of the topic. Gaps in current knowledge have also been revealed.

Of course, the first definitive results in the topic of autonomous vehicles will only be available in the next few years. Thus, the papers’ current aim is to provide an academic basis and a better understanding of the topic. Hopefully, the results of the research will be beneficial for both the industry and the academic world. Undoubtedly, it will be fascinating to see if these predictions are going to be correct.

Limitations of the Research

This study is designed to bring attention to the topic of using autonomous trucks in urban settings. Other autonomous vehicles like robots, droids, or drones might be mentioned at some point in the paper but do not represent the basis of the research. A combination of autonomous trucks or vans with some of these solutions was also omitted. It is necessary to mention that the topic was not investigated from a technological point of view. Instead, it describes feasibility from economic, environmental, and useability standpoints through thematic literature review and the experts’ opinion. Limited technological details were included only to understand the concept of autonomous trucks better. Because of the complexity of this topic, it was necessary to circumscribe this broad concept and put emphasis on a single type of vehicle: a fully autonomous box truck or van, which works as an autonomous pick-up station.

Moreover, the paper brings to light only international CEP or postal companies (with B2C activities) from Vienna, Austria, as an essential market player when it comes to urban deliveries. Last but not least, this paper provided a qualitative inside into the topic and not a quantitative one. Even though the number of interviews required for qualitative analysis is subjective, the authors of the study understand that three interview companies with four interviews might not sound much. However, the experts’ combined experience in CEP sector of more than 50 years gave us enough information necessary to lay out the qualitative outlay for the CEP and autonomous trucking sector for the future. Furthermore, it is evident from business and management disciplines that there are studies which have been published in reputable peer reviewed journals with as few as 3–5 interviews [53].

It is just the beginning of the research in this direction, and there is a lot more qualitative and quantitative data that are needed to nurture this area to its perfection. As these experts, most of the time, work in the top management and hold critical roles in CEP companies, they were rarely open for such a collaboration. Due to the time constraints and the current pandemic (COVID19) situation, it was not possible to reach more companies within the limits of this research paper. Nonetheless, given the actual population (i.e., the total number of international CEP companies with B2C services operating from Vienna, Austria) the selected sample size represents almost 30% of the entire population.

Of course, it would have been intriguing to work with a bigger sample size in order to gain additional empirical findings, generalize the results, and make them acceptable for a broader audience. However, opinions collected through the interviews are a good reflection of the cities with 20 or fewer CEP companies. The interviews involved three gigantic CEP organizations and experts with an ample amount of experience. Thus, the data are not only credible but also give a thorough insight into the topic under discussion. Future studies related to the same project would definitely consider conducting more interviews, increasing the data set, and undertake more quantitative analysis, especially for the impact of autonomous trucks in last-mile urban deliveries.

Author Contributions

Authors Contributed in this manuscript on an overall workload basis: E.T.K. (50%), M.A. (30%) and S.K. (20%) All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Interview guide.

Table A1.

Interview guide.

| Subtopics | Sample Questions | |

|---|---|---|

| Part 1 | • demographic questions • position and responsibilities • information about the company | Tell me something about the company you are working at? What is the focus of the company? Could you describe your position and your responsibilities in the company? |

| Part 2 | • general trends • autonomous vehicles • logistical solutions • attitude of the CEP company toward innovations • challenges of the last-mile delivery | What do you understand under the “autonomous trucks” term? Is your company interested in the topic of autonomous trucks? Do you think postal or CEP companies are suitable for implementing driverless trucks or lorries? (Why?) Are there any barriers? |

| Part 3 | • possible use cases and introduction in the CEP sector • advantages • disadvantages • implications on logistics • new services | Could you describe one (or more) specific use(s) case of the autonomous truck in the CEP industry? What would be the advantages and disadvantages of autonomous trucks in your opinion? Which prominent issues could autonomous trucks mitigate and which not? Would the implementation alter any logistical processes? Which one? Is there a new service which could be provided? |

References

- Savelsbergh, M.; van Woensel, T. 50th Anniversary Invited Article—City Logistics: Challenges and Opportunities. Transp. Sci. 2016, 50, 579–590. [Google Scholar] [CrossRef]

- DHL. Logistics Trend Radar 2018/19. Available online: https://www.logistics.dhl/global-en/home/insights-and-innovation/thought-leadership/trend-reports/logistics-trend-radar.html (accessed on 10 June 2020).

- Davies, A. The WIRED Guide to Self-Driving Cars. 2018. Available online: https://www.wired.com/story/guide-self-driving-cars/ (accessed on 10 June 2020).

- Azmat, M.; Kummer, S. Potential applications of unmanned ground and aerial vehicles to mitigate challenges of transport and logistics-related critical success factors in the humanitarian supply chain. AJSSR 2020, 5. [Google Scholar] [CrossRef]

- Slabinac, M. Innovative solutions for a “last-mile” delivery—A European experience. In Proceedings of the 15th international scientific conference Business Logistics in Modern Management, Osijek, Croatia, 15 October 2015. [Google Scholar]

- McKinsey and Company. Parcel Delivery. The Future of Last Mile. September 2016. Available online: https://www.mckinsey.com/~/media/mckinsey/%20industries/travel%20transport%20and%20logistics/our%20insights/how%20customer%20demands%20are%20reshaping%20last%20mile%20delivery/parcel_delivery_the_future_of_last_mile.ashx (accessed on 10 June 2020).

- Neuweiler, L.; Riedel, P.V. Autonomous Driving in the Logistics Industry: A Multi-Perspective View on Self-Driving Trucks, Changes in Competitive Advantages and Their Implications. Master’s Thesis, Jönköping University, Jönköping, Sweden, May 2017. Available online: https://www.diva-portal.org/smash/get/diva2:1129922/FULLTEXT01.pdf (accessed on 10 June 2020).

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 5th ed.; Pearson: Essex, UK, 2009. [Google Scholar]

- Cardenas, I.; Borbon-Galvez, Y.; Verlinden, T.; de Voorde, E.V.; Vanelslander, T.; Dewulf, W. City logistics, urban goods distribution and last mile delivery and collection. Compet. Regul. Netw. Ind. 2017, 18, 22–43. [Google Scholar] [CrossRef]

- Albino, V.; Berardi, U.; Dangelico, R.M. Smart Cities: Definitions, Dimensions, Performance, and Initiatives. J. Urban Technol. 2015, 22, 3–21. [Google Scholar] [CrossRef]

- TNT. Supplementary Report 2010. Available online: https://www.tnt.com/content/dam/corporate/archive/Images/TNT-Express-Report-2010_tcm177-540070.pdf (accessed on 10 June 2020).

- Ducret, R. Parcel deliveries and urban logistics: Changes and challenges in the courier express and parcel sector in Europe—The French case. Res. Transp. Bus. Manag. 2014, 11, 15–22. [Google Scholar] [CrossRef]

- Kumar, S. Courier, Express and Parcel (CEP) Industry and How E-Commerce is Helping the Growth of CEP Industry? 29 December 2015. Available online: https://www.linkedin.com/pulse/courier-express-parcel-cep-industry-how-e-commerce-helping-kumar/ (accessed on 10 June 2020).

- Verlinde, S.; Macharis, C.; Witlox, F. How to Consolidate Urban Flows of Goods Without Setting up an Urban Consolidation Centre? Procedia Soc. Behav. Sci. 2012, 39, 687–701. [Google Scholar] [CrossRef]

- Edwards, S. Companies Using Speed as a Competitive Advantage. 5 January 2016. Available online: https://www.entrepreneur.com/article/253372 (accessed on 10 June 2020).

- McKinsey and Company. An Integrated Perspective on the Future of Mobility, Part 2: Transforming Urban Delivery. September 2017. Available online: https://www.mckinsey.com/~/media/mckinsey/business%20functions/sustainability/our%20insights/urban%20commercial%20transport%20and%20the%20future%20of%20mobility/an-integrated-perspective-on-the-future-of-mobility.ashx (accessed on 10 June 2020).

- SMART. Definition of Necessary Vehicle and Infrastructure Systems for Automated Driving. SMART 2010/0064. Available online: https://knowledge-base.connectedautomateddriving.eu/wp-content/uploads/2019/12/SMART_2010-0064-study-report-final_V1-2.pdf (accessed on 10 June 2020).

- SAE International. Taxonomy and Definitions for Terms Related to Driving Automation Systems for On-Road Motor Vehicles. 14 January 2014. Available online: https://www.sae.org/standards/content/j3016_201806/ (accessed on 10 June 2019).

- Chen, Y. Autonomous Unmanned Ground Vehicle (UGV) Follower Design. Master’s Thesis, Ohio University, Athens, OH, USA, August 2016. Unpublished. [Google Scholar]

- Myllymaki, J. Autonomous Delivery Platform. U.S. Patent No. 9,256,852 B1, 9 February 2016. [Google Scholar]

- Curtis, S. Ford reveals ‘Autolivery’ Concept for Delivering Packages Using Drones and Self-Driving Vans at MWC 2017. 27 February 2017. Available online: https://www.mirror.co.uk/tech/ford-autolivery-concept-envisions-using-9925046 (accessed on 10 June 2020).

- Smith, L.J. Mercedes Vision Van Debuts at CES 2017—Futuristic Van Comes with Drones and Robots. 18 January 2017. Available online: https://www.express.co.uk/life-style/cars/749337/Mercedes-Vision-Van-2017-concept-CES-electric (accessed on 10 June 2020).

- Geddes, T. Charge: The Self-Drive Delivery Van That Can Be Built in Four Hours. 4 November 2016. Available online: https://dispatchweekly.com/2016/11/charge-self-drive-delivery-van-built-four-hours-set-uk-streets/ (accessed on 10 June 2020).

- Symonds, D. Tech Startup Next Unveils Automated Parcel Locker Transportation System. 13 September 2018. Available online: https://www.parcelandpostaltechnologyinternational.com/news/automation/tech-startup-next-unveils-automated-parcel-locker-transportation-system.html (accessed on 10 June 2020).

- Audebert, T. EZ-PRO, Linking Urban Mobility with the Future City. 19 September 2018. Available online: https://group.renault.com/en/news/blog-renault/ez-pro-linking-urban-mobility-with-the-future-city/ (accessed on 10 June 2020).

- Gogas, M.A.; Nathanail, E. Evaluation of Urban Consolidation Centers: A Methodological Framework. Procedia Eng. 2017, 178, 461–471. [Google Scholar] [CrossRef]

- Conway, A.; Fatisson, P.E.; Eickemeyer, P.; Cheng, J.; Peters, D. Urban Micro-Consolidation and Last Mile Goods Delivery by Freight-Tricycle in Manhattan: Opportunities and Challenges. In Proceedings of the Transportation Research Board 91st Annual Meeting, Washington, DC, USA, 22–26 January 2012. [Google Scholar]

- Easterby-Smith, M.; Thorpe, R.; Jackson, P.R.; Jaspersen, L.J. Management and Business Research, 6th ed.; SAGE: London, UK, 2018. [Google Scholar]

- Bogner, A.; Littig, B.; Menz, W. Interviewing Experts, 1st ed.; Palgrave Macmillan UK: London, UK, 2009. [Google Scholar]

- Braun, V.; Clarke, V. Using thematic analysis in psychology. Qual. Res. Psychol. 2006, 3, 77–101. [Google Scholar] [CrossRef]

- Nowell, L.S.; Norris, J.M.; White, D.E.; Moules, N.J. Thematic analysis. Int. J. Qual. Methods 2017, 16. [Google Scholar] [CrossRef]

- Azmat, M.; Kummer, S.; Moura, L.T.; Gennaro, F.D.; Moser, R. Future Outlook of Highway Operations with Implementation of Innovative Technologies Like AV, CV, IoT, and Big Data. Logistics 2019, 3, 15. [Google Scholar] [CrossRef]

- Gevaers, R.; Voorde, E.V.; Vanelslander, T. Cost Modelling and Simulation of Last-mile Characteristics in an Innovative B2C Supply Chain Environment with Implications on Urban Areas and Cities. Procedia Soc. Behav. Sci. 2014, 125, 398–411. [Google Scholar] [CrossRef]

- McKinsey and Company. Fast Forwarding Last-Mile Delivery—Implications for the Ecosystem. 27 August 2018. Available online: https://www.mckinsey.com/industries/travel-transport-and-logistics/our-insights/technology-delivered-implications-for-cost-customers-and-competition-in-the-last-mile-ecosystem (accessed on 10 June 2020).

- Van Pelt, T. Not drones, but AGVs will Forever Change Last-Mile Parcel Delivery. 24 September 2018. Available online: https://m3consultancy.nl/blog/not-drones-but-agvs-will-forever-change-last-mile-parcel-delivery (accessed on 10 June 2020).

- Accenture. Adding Value to Parcel Delivery. 2015. Available online: https://www.accenture.com/t20170227T024657Z__w__/us-en/_acnmedia/Accenture/Conversion-Assets/DotCom/Documents/Global/PDF/Dualpub_23/Accenture-Adding-Value-to-Parcel-Delivery.pdf#zoom=50 (accessed on 10 June 2020).

- Schöder, D.; Ding, F.; Campos, J.K. The Impact of E-Commerce Development on Urban Logistics Sustainability. Open J. Soc. Sci. 2016, 4, 1–6. [Google Scholar] [CrossRef]

- United States Postal Service. Riding the Returns Wave: Reverse Logistics and the U.S. Postal Service. (RARC-WP-18-00). 30 April 2018. Available online: https://www.uspsoig.gov/sites/default/files/document-library-files/2018/RARC-WP-18-008.pdf (accessed on 10 June 2020).

- Wong, C.Y.; Karia, N. Explaining the competitive advantage of logistics service providers: A resource-based view approach. Int. J. Prod. Econ. 2010, 128, 51–67. [Google Scholar] [CrossRef]

- European Commission. CE Delft. Handbook on the External Costs of Transport. 2019. Available online: https://ec.europa.eu/transport/sites/transport/files/studies/internalisation-handbook-isbn-978-92-79-96917-1.pdf (accessed on 10 June 2020).

- Ranieri, L.; Digiesi, S.; Silvestri, B.; Roccotelli, M. A Review of Last Mile Logistics Innovations in an Externalities Cost Reduction Vision. Sustainability 2018, 10, 782. [Google Scholar] [CrossRef]

- Gonzalez-Feliu, J. Traffic and CO2 emissions of urban goods deliveries under contrasted scenarios of retail location and distribution. In Proceedings of the Research and Transport Policy International Conference, Lyon, France, 18–19 March 2010. [Google Scholar]

- McMahon, J. Expert: Require Autonomous Vehicles To Be Electric. 8 October 2018. Available online: https://www.forbes.com/sites/jeffmcmahon/2018/10/08/expert-require-autonomous-vehicles-to-be-electric/ (accessed on 10 June 2020).

- MIT Sloan Management Review. The Business of Sustainability. 9 September 2009. Available online: https://sloanreview.mit.edu/projects/the-business-of-sustainability/ (accessed on 10 June 2020).

- DHL. Self-Driving Vehicles in Logistics. 2014. Available online: http://www.dhl.com/content/dam/downloads/g0/about_us/logistics_insights/dhl_self_driving_vehicles.pdf (accessed on 10 June 2020).

- UNECE. UNECE Paves the Way for Automated Driving by Updating UN International Convention. 23 March 2016. Available online: https://www.unece.org/info/media/presscurrent-press-h/transport/2016/unece-paves-the-way-for-automated-driving-by-updating-un-international-convention/doc.html (accessed on 10 June 2020).

- Hawkins, A.J. Waymo Gets the Green Light to Test Fully Driverless Cars in California. 30 October 2018. Available online: https://www.theverge.com/2018/10/30/18044670/waymo-fully-driverless-car-permit-california-dmv (accessed on 10 June 2020).

- PwC. Connected Car Study 2015: Racing Ahead with Autonomous Cars and Digital Innovation. 2015. Available online: https://www.pwc.at/de/publikationen/connected-car-study-2015.pdf (accessed on 10 June 2020).

- Neckermann, L.; LeSage, J. The Mobility Revolution: A Primer for Fleet Managers. 2018. Available online: https://www.neckermann.net/wp-content/uploads/2018/10/NAFAFoundation_MobilityWhitepaper_Neckermann-1.pdf (accessed on 12 July 2020).

- KPMG. How Much is Customer Experience Worth? Mastering the Economics of the CX Journey. September 2016. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2016/11/How-much-is-custerom-experience-worth.pdf (accessed on 12 July 2020).

- Wintersberger, S.; Azmat, M.; Kummer, S. Are We Ready to Ride Autonomous Vehicles? A Pilot Study on Austrian Consumers’ Perspective. Logistics 2019, 3, 20. [Google Scholar] [CrossRef]

- Azmat, M.; Schumayer, C.; Kummer, S. Innovation in Mobility: Austrian Expert’s Perspective on the Future of Urban Mobility with Self-Driving Cars. In Proceedings of the Quality and Business Management Conference, Dubai, UAE, 7–9 March 2016; Hbmsu Publishing House: Dubai, UAE, 2016. [Google Scholar]

- Kunz, N.; Wassenhove, L.N.; Besiou, M.; Hambye, C.; Kovács, G. Relevance of humanitarian logistics research: Best practices and way forward. Int. J. Oper. Prod. Manag. 2017, 37, 1585–1599. [Google Scholar] [CrossRef]