Attitudinal Determinants of Beef Consumption in Venezuela: A Retrospective Survey

Abstract

1. Introduction

2. Materials and Methods

2.1. Questionnaire Design Mode of Data Collection and Data Classification

2.1.1. Demographic Characteristics and Beef Consumption Attitudes/Habits

2.1.2. Criteria for Assessing the Quality of Raw and Cooked Beef

Intrinsic Attributes

Extrinsic Attributes

2.1.3. Consumer’s Buying/Consumption Motivations and Perceptions about Freshness

2.2. Statistical Analyses

3. Results

3.1. Demographics Characteristics and Beef Consumption Habits

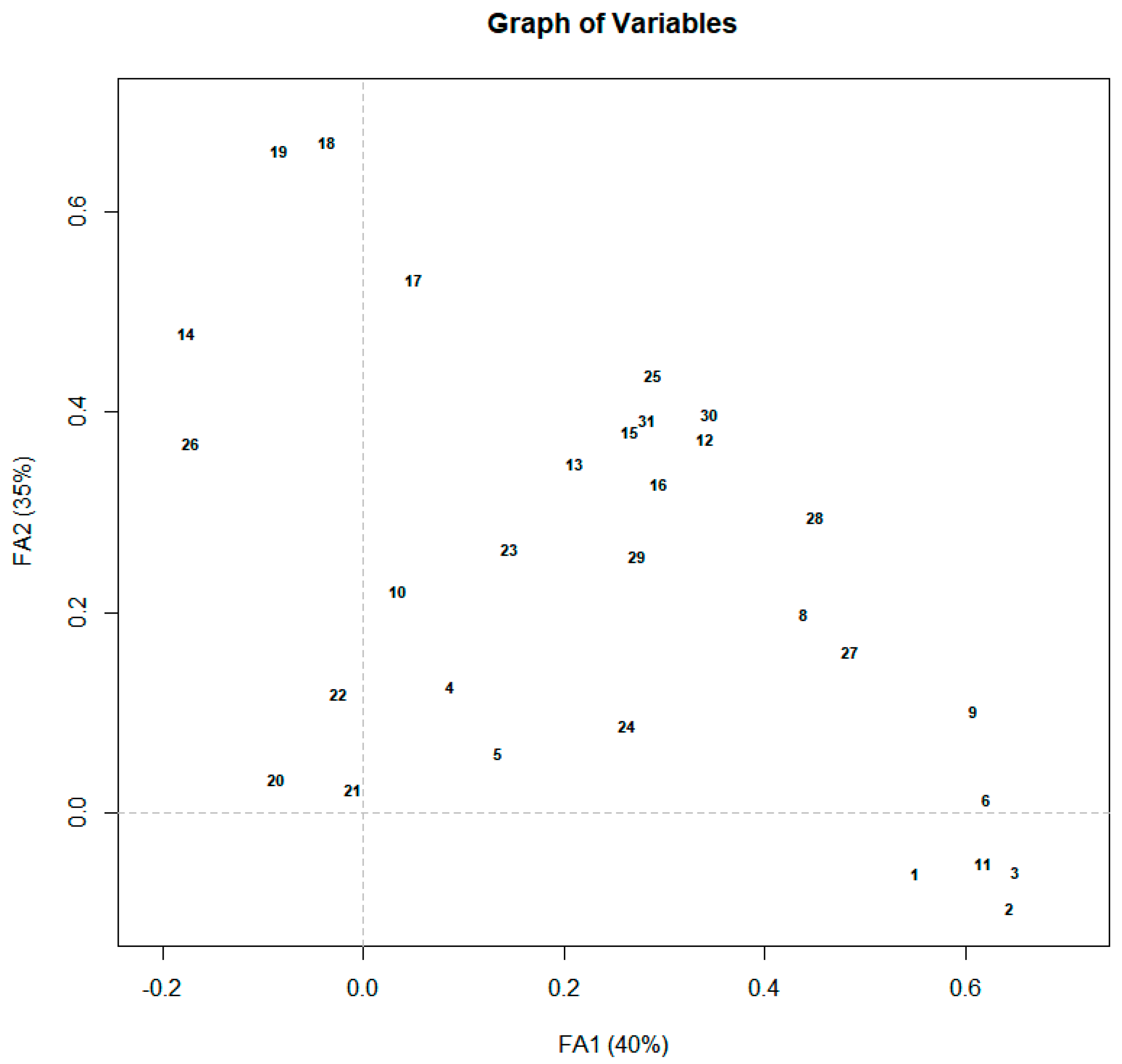

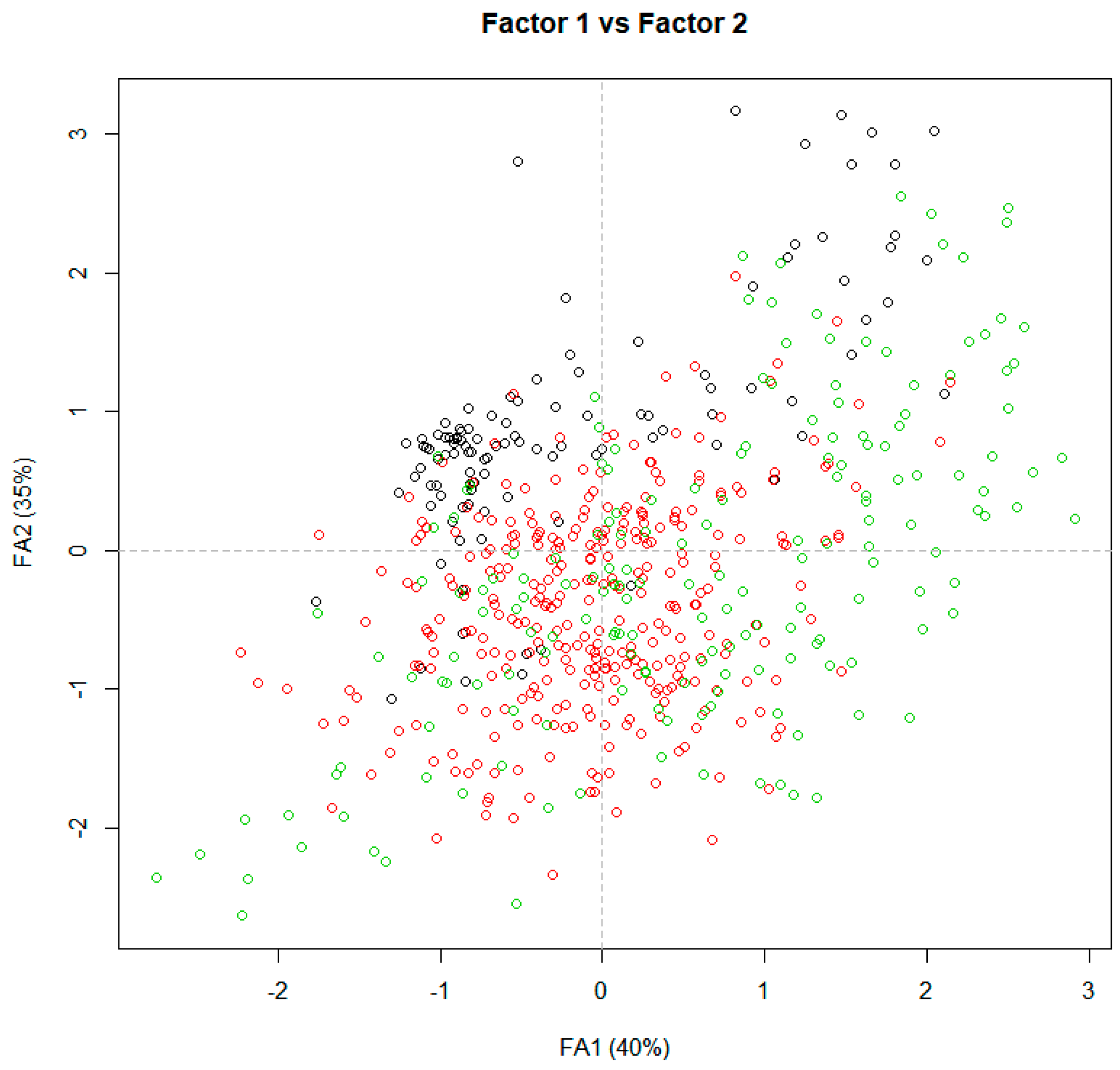

3.2. Factorial Analysis of Correspondence FA

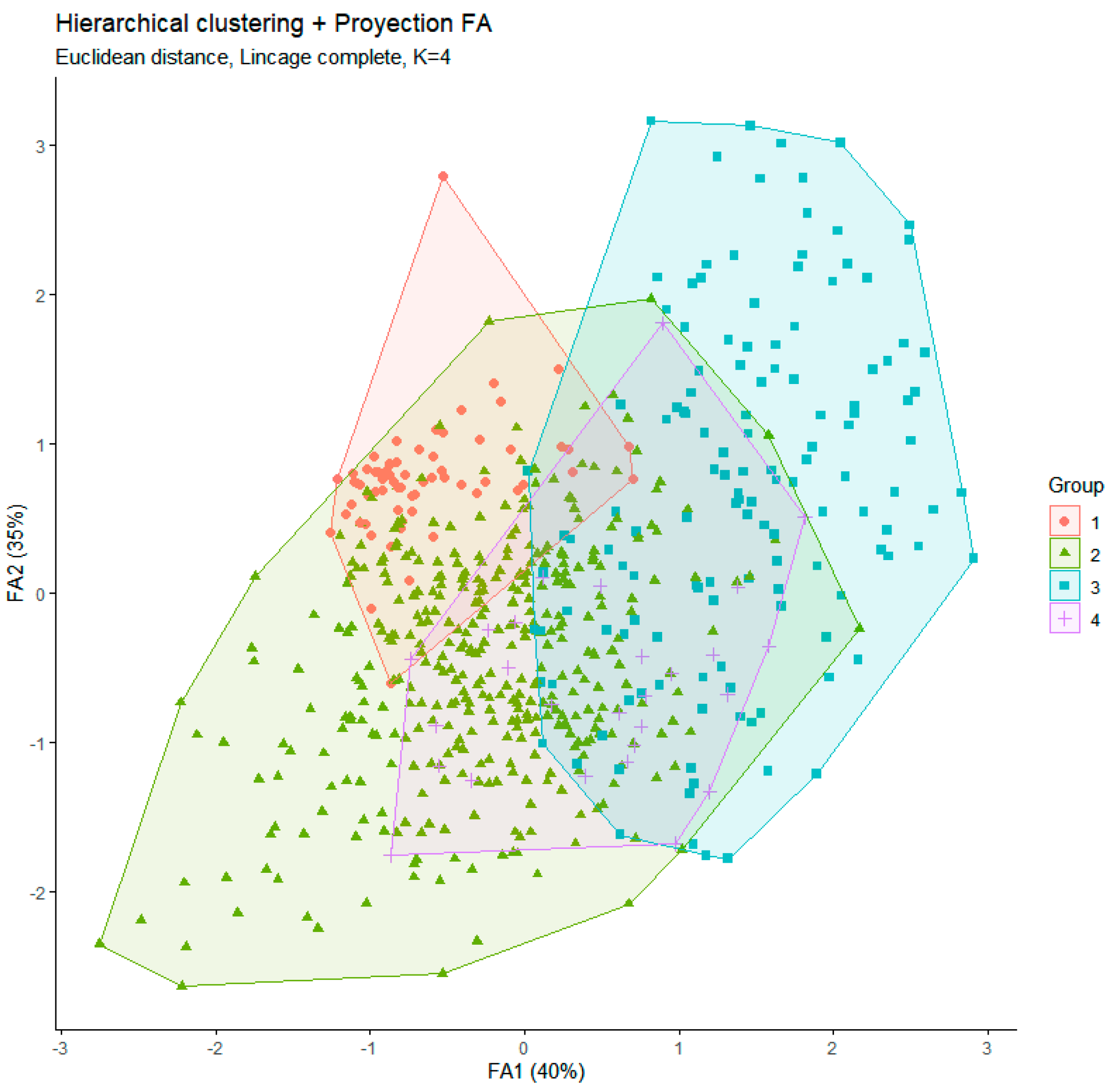

3.3. Cluster Analysis Characteristics of Different Types of Consumers

4. Discussions

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Food and Agriculture Organization of the United Nations (FAO). Meat & Meat Products, Agriculture and Consumer Protection Department, Animal Production and Health. Available online: http://www.fao.org/ag/againfo/themes/en/meat/home.html (accessed on 8 December 2019).

- Gutiérrez, B.A. La situación agroalimentaria en Venezuela: Hacia una nueva estrategia. Foro. 2019, 3, pp. 31–52. Available online: https://www.revistaforo.com/2019/0305-04 (accessed on 8 December 2019).

- FAS-USDA. Foreign Agricultural Service, United States Department of Agriculture, GAIN Report No. VE1804. Venezuela: Livestock and Products Annual. Annual Report 2018. Available online: https://apps.fas.usda.gov/newgainapi/api/report/downloadreportbyfilename?filename=Livestock%20and%20Products%20Annual_Caracas_Venezuela_8-13-2018.pdf (accessed on 7 February 2020).

- FAS-USDA. Foreign Agricultural Service, United States Department of Agriculture, GAIN Report No. VE2019-0001. Venezuela: Livestock and Products Annual. Available online: https://www.fas.usda.gov/data/venezuela-livestock-and-products-annual-1 (accessed on 9 December 2019).

- Central Intelligence Agency (CIA), United States of America. The World Factbook. Available online: https://www.cia.gov/library/publications/the-world-factbook/fields/335rank.html#VE (accessed on 5 February 2020).

- O’Neil, S.K. A Venezuelan refugee crisis. In Preparing for the Next Foreign Policy Crisis: What the United States Should Do; Stares, P.B., Ed.; Council on Foreign Relations: New York, NY, USA, 2019; pp. 77–90. [Google Scholar]

- Jerez-Timaure, N.; Arenas de Moreno, L.; Giuffrida de Mendoza, M. Que Buena es la Carne Bovina Venezolana; Landaeta de Jiménez, M., Ed.; Fundación Bengoa para la Alimentación y Nutrición: Caracas, Venezuela, 2010. [Google Scholar]

- Huerta-Leidenz, N.; Valdez-Muñoz, A.; Lopez, F.; Scott, T.; Howard, S.T.; Dixon, C.; Belk, K.E. Retail display case merchandising’s consist and price-elasticity of demand for U.S. beef and pork variety meats sold in Mexican grocery stores. Rev. Fac. Agron. (LUZ) 2017, 34, 216–235. [Google Scholar]

- Instituto Nacional de Estadística (INE). Ministerio del Poder Popular de Planificación. República Bolivariana de Venezuela. Demograficos. Available online: http://www.ine.gov.ve/index.php?option=com_content&view=category&id=98&Itemid=51 (accessed on 6 February 2020).

- Krystallis, A.; Arvanitoyannis, I.S. Investigating the concept of meat quality from consumer’s perspective: The case of Greece. Meat Sci. 2006, 72, 164–176. [Google Scholar] [CrossRef] [PubMed]

- Bernués, A.; Olaizola, A.; Corcoran, K. Labelling information demanded by European consumers and relationships with purchasing motives, quality and safety of meat. Meat Sci. 2003, 65, 1095–1106. [Google Scholar] [CrossRef]

- Core Team. R: A language and Environment for Statistical Computing. R Foundation for Statistical Computing. Available online: https://www.R-project.org/ (accessed on 12 January 2019).

- Loret-Segura, S.; Ferreres-Traver, A.; Hernandez-Baeza, A.; Tomas-Marco, I. El análisis factorial exploratorio de los ítems: Una guía práctica, revisada y actualizada. An. Psicol. 2014, 30, 1151–1169. [Google Scholar] [CrossRef]

- Fonti-i-Furnols, M.; Gerrero, L. Consumer preference, behavior and perception about meat and meat products: An overview. Meat Sci. 2014, 98, 361–371. [Google Scholar] [CrossRef]

- Villalobos, P.; Padilla, C.; Ponce, C.; Rojas, A. Beef consumer preferences in Chile: Importance of quality attribute differentiators on the purchase decision. Chil J. Agric. Res. 2009, 70, 85–94. [Google Scholar] [CrossRef][Green Version]

- Castillo, M.J.; Carpio, C.E. Demand for high-quality beef attributes in developing countries: The case of Ecuador. J. Agric. Appl. Econ. 2019, 51, 568–590. [Google Scholar] [CrossRef]

- Giacomazzi, C.M.; Talamini, E.; Kindlein, L. Relevance of brands and beef quality differentials for the consumer at the time of purchase. R. Bras. Zootec. 2017, 46, 354–365. [Google Scholar] [CrossRef]

- Segovia, E.; Contreras, D.; Marcano, D.; Pirela, R.; Albornoz, A. Conducta del consumidor de carne bovina según clase socioeconómica en el municipio Maracaibo, Estado Zulia, Venezuela. Agroalimentaria 2005, 11, 113–121. [Google Scholar]

- Pierce-Colfer, C.P.; Achdiawan, R.; Roshetko, J.M.; Mulyoutami, E.; Yuliani, E.L.; Mulyana, A.; Moeliono, M.; Adnan, H.E. The balance of power in household decision-making: Encouraging news on gender in southern Sulawesi. World Dev. 2015, 76, 147–164. [Google Scholar] [CrossRef]

- Mahbubi, A.; Uchiyama, T.; Hatanaka, K. Capturing consumer value and clustering customer preferences in the Indonesian halal beef market. Meat Sci. 2019, 156, 23–32. [Google Scholar] [CrossRef] [PubMed]

- Bhurosy, T.; Jeewon, R. Overweight and obesity epidemic in developing countries: A problem with diet, physical activity, or socioeconomic status? Sci. World J. 2014, 2014, 1–7. [Google Scholar] [CrossRef] [PubMed]

- Yee, A.Z.H.; Lwin, M.O.; Ho, S.S. The influence of parental practices on child promotive and preventive food consumption behaviors: A systematic review and meta-analysis. Int. J. Behav. Nutr. Phys. Act. 2017, 14, 1–14. [Google Scholar] [CrossRef] [PubMed]

- Bonny, S.P.F.; Gardner, G.E.; Pethick, D.W.; Allen, P.; Legrand, I.; Wierzbicki, J.; Farmer, L.J.; Polkinghorne, R.J.; Hocquette, J.F. Untrained consumer assessment of the eating quality of European beef: 2. Demographic factors have only minor effects on consumer scores and willingness to pay. Animal 2017, 11, 1399–1411. [Google Scholar] [CrossRef]

- Vilaboa-Arroniz, J.; Díaz-Rivera, P.; Ruiz-Rosado, O.; Platas-Rosado, D.; González-Muñoz, S.; Juarez-Lagunes, F. Beef consumption patterns in the Papaloapan region, Veracruz, México. Agric. Soc. Desarro 2009, 6, 145–159. [Google Scholar]

- Ngapo, T.M.; Braña Varela, D.; Rubio Lozano, M.S. Mexican consumers at the point of meat purchase. Beef choice. Meat Sci. 2017, 134, 34–43. [Google Scholar] [CrossRef]

- Corporación de Fomento Ganadero (CORFOGA). Estudio C.U.A.S Consumo, Uso y Actitudes: Carnes. Eds. AW-Investigación de Mercados. San Jose, Costa Rica. 2006. Available online: https://www.corfoga.org/carnes-de-costa-rica/ (accessed on 6 February 2019).

- Schnettler, B.; Clesia, M.; Candia, A.; Llancanpán, F.; Sepúlveda, J.; Denegri, M.; Miranda, H.; Sepúlveda, N. The Importance of colour, fat content and freshness in the purchase of beef in Temuco, La Araucanía region, Chile. Rev. Cien. FCV-LUZ 2010, 20, 623–632. [Google Scholar]

- Ardeshiri, A.; Rose, J.M. How Australian consumer value intrinsic and extrinsic attributes of beef products. Food. Qual. Prefer 2018, 65, 146–163. [Google Scholar] [CrossRef]

- Henchion, M.M.; McCarthy, M.; Resconi, V.C. Beef quality attributes: A Systematic review of consumers perspectives. Meat Sci. 2017, 128, 1–7. [Google Scholar] [CrossRef]

- Polkinghorne, R.J.; Thompson, J.M. Meat standards and grading: A world view. Meat Sci. 2016, 86, 227–235. [Google Scholar] [CrossRef]

- Byers, F.M.; Cross, H.R.; Schelling, G.T. Integrated nutrition, genetics, and growth management programs for lean beef production. In Designing Foods: Animal Product Options in the Marketplace; National Academy Press: Washington, DC, USA, 1988; pp. 283–291. [Google Scholar]

- Jerez-Timaure, N.; Huerta-Leidenz, N. Effects of breed type and supplementation during grazing on carcass traits and meat quality of bulls fattened on improved savannah. Livest. Sci. 2009, 121, 219–226. [Google Scholar] [CrossRef]

- Manchini, R.A.; Ramanathan, R. Effects of postmortem storage time on color and mitochondria in beef. Meat Sci. 2014, 98, 65–70. [Google Scholar] [CrossRef] [PubMed]

- Khan, M.I.; Jung, S.; Nam, K.C.; Jo, C. Postmortem aging of beef with a special reference to the dry aging. Korean J. Food Sci. An. 2016, 36, 159–169. [Google Scholar] [CrossRef] [PubMed]

- Bernués, A.; Olaizola, A.; Corcora, K. Extrinsic attributes of red meat as indicators of quality in Europe: An application for market segmentation. Food. Qual. Prefer 2003, 14, 265–276. [Google Scholar] [CrossRef]

- Ellies-Oury, M.P.; Lee, A.; Hocquette, J.F. Meat consumption-what French consumers feel about the quality of beef? Ital. J. Anim. Sci. 2019, 18, 646–656. [Google Scholar] [CrossRef]

| Questions | Optional Responses | Total, % | Central Region (n = 327) | Western Region (n = 181) | Eastern Region (n = 186) | p-Value |

|---|---|---|---|---|---|---|

| Age | ≤29 years old | 15.27 | 6.8 | 5.3 | 3.2 | 0.004 |

| 30–39 years old | 25.79 | 10.4 | 8.4 | 7.1 | ||

| 40–49 years Old | 26.66 | 12.4 | 5.8 | 8.5 | ||

| 50–59 years Old | 20.17 | 9.8 | 4.6 | 5.8 | ||

| ≥60 years | 9.37 | 5.6 | 1.7 | 2.0 | ||

| No response | 2.74 | 2.2 | 0.3 | 0.3 | ||

| Gender | Male | 32.85 | 13.3 | 8.6 | 11.0 | 0.01 |

| Female | 67.15 | 33.9 | 17.4 | 15.9 | ||

| Civil Status | Single | 29.97 | 15.4 | 8.2 | 6.3 | 0.14 |

| Married | 58.50 | 26.9 | 14.0 | 17.6 | ||

| Other | 11.10 | 4.5 | 3.7 | 2.9 | ||

| No response | 0.43 | 0.3 | 0.1 | 0.0 | ||

| Educational level | Elementary | 9.51 | 5.5 | 3.7 | 0.3 | <0.001 |

| High School | 36.02 | 18.9 | 11.8 | 5.3 | ||

| College | 46.69 | 18.6 | 8.8 | 19.3 | ||

| Advanced degree | 6.20 | 2.9 | 1.4 | 1.9 | ||

| No response | 1.59 | 1.3 | 0.3 | 0.0 | ||

| Occupation | Student | 6.20 | 3.0 | 2.2 | 1.0 | <0.001 |

| Full-time housewife | 20.32 | 12.7 | 5.9 | 1.7 | ||

| Working housewife | 9.22 | 1.9 | 2.4 | 4.9 | ||

| Worker | 4.47 | 2.4 | 1.3 | 0.7 | ||

| Independent Professional | 16.28 | 6.5 | 2.4 | 7.3 | ||

| Full-time employee | 25.65 | 10.7 | 6.9 | 8.1 | ||

| Part-time employee | 3.75 | 0.3 | 1.4 | 2.0 | ||

| Informal businessman | 8.07 | 5.5 | 2.3 | 0.3 | ||

| Business owner | 1.59 | 0.6 | 0.4 | 0.6 | ||

| Others | 4.47 | 3.6 | 0.7 | 0.1 | ||

| Family Size | 1 member | 4.47 | 2.0 | 0.6 | 1.9 | <0.001 |

| 2 members-couple | 11.82 | 4.9 | 2.6 | 4.3 | ||

| 3 members | 24.78 | 8.1 | 6.2 | 10.5 | ||

| 4 members | 24.78 | 12.0 | 5.8 | 7.1 | ||

| More than 4 members | 34.15 | 20.2 | 11.0 | 3.0 | ||

| Number of children at home | 0 | 36.17 | 19.6 | 8.2 | 8.4 | <0.001 |

| 1 | 28.10 | 9.7 | 8.4 | 10.1 | ||

| 2 | 21.90 | 9.7 | 5.8 | 6.5 | ||

| 3 | 8.21 | 5.3 | 1.6 | 1.3 | ||

| More than 3 | 4.90 | 2.7 | 1.7 | 0.4 | ||

| No response | 0.72 | 0.1 | 0.4 | 0.1 |

| Consumption Habits | Optional Responses | Total, % | Central Region (n = 327) | Western Region (n = 181) | Eastern Region (n = 186) | p-Value |

|---|---|---|---|---|---|---|

| Preference for beef | I love it | 15.13 | 7.9 | 4.9 | 2.3 | <0.001 |

| I like it very much | 25.22 | 5.0 | 5.9 | 14.3 | ||

| I like it | 37.90 | 21.5 | 8.5 | 8.4 | ||

| It does not matter to me/It is not the one I prefer | 9.37 | 5.2 | 3.2 | 1.0 | ||

| It is not the one I prefer | 9.22 | 6.2 | 2.6 | 0.4 | ||

| Only if I have no other option | 2.74 | 1.6 | 0.9 | 0.3 | ||

| I do not like it | 0.43 | 0.1 | 0.1 | 0.1 | ||

| Frequency of preparations od meals with beef | Daily | 9.37 | 5.3 | 3.3 | 0.7 | <0.001 |

| Every 2 or 3 days | 62.97 | 26.8 | 14.7 | 21.5 | ||

| Once a week | 19.74 | 11.1 | 5.5 | 3.6 | ||

| 1 or 2 times a month | 3.60 | 2.4 | 0.6 | 0.6 | ||

| Rarely | 4.32 | 1.4 | 2.4 | 0.4 | ||

| Frequency of eating beef as a center of the plate | Daily | 7.78 | 4.8 | 2.7 | 0.3 | <0.001 |

| Every 2 or 3 days | 56.92 | 27.1 | 13.5 | 16.3 | ||

| Once a week | 26.22 | 11.1 | 6.1 | 9.1 | ||

| 1 or 2 times a month | 5.76 | 3.2 | 2.0 | 0.6 | ||

| Rarely | 3.31 | 1.0 | 1.7 | 0.6 | ||

| Changes in the frequency of consumption due to information received about diet/health issues | Increased consumption | 2.02 | 1.6 | 0.3 | 0.1 | <0.001 |

| There has been no change | 61.53 | 32.3 | 13.0 | 16.3 | ||

| Decreased but then returned to usual | 13.26 | 1.3 | 4.3 | 7.6 | ||

| Decreased consumption | 22.19 | 11.8 | 7.6 | 2.7 | ||

| Stop consuming | 1.01 | 0.1 | 0.9 | 0.0 |

| Question/Variable | FA1 | FA2 | FA3 |

|---|---|---|---|

| Intrinsic Attributes | |||

| Beef tenderness is important | 0.52 | −0.06 | −0.04 |

| The smell of raw beef is important | 0.61 | −0.06 | −0.07 |

| Flavor is important | 0.58 | 0.10 | −0.13 |

| The color in raw beef is important | 0.61 | −0.09 | −0.06 |

| Leaner beef taste better | 0.00 | 0.22 | −0.02 |

| The amount of fat is important | 0.05 | 0.12 | −0.09 |

| Juiciness is important | 0.41 | 0.20 | −0.14 |

| Preferences for leaner beef | 0.10 | 0.06 | 0.02 |

| Freshness (appearance/conservation) is important | 0.59 | 0.01 | −0.17 |

| Extrinsic Attributes | |||

| Hygiene is a very important | 0.59 | −0.05 | −0.10 |

| Type of cut is important | 0.30 | 0.37 | −0.16 |

| Shape and size of cut is important | 0.17 | 0.35 | −0.15 |

| Beef aging is important | −0.21 | 0.48 | 0.01 |

| Animal feeding is important | 0.23 | 0.38 | −0.03 |

| Use of hormones/antibiotics is important | 0.30 | 0.36 | 0.05 |

| Beef brand is important | 0.01 | 0.53 | 0.10 |

| Traceability is important | −0.07 | 0.67 | 0.09 |

| Breed information is important | −0.12 | 0.66 | 0.05 |

| Beef imported from the USA or Canada would have a greater consumption than the domestic one? | −0.12 | 0.33 | 0.66 |

| Beef imported from Colombia would have a greater consumption than the domestic one? | −0.05 | 0.02 | 0.86 |

| Beef imported from other Latin American countries would have a greater consumption than the domestic one? | −0.06 | 0.12 | 0.78 |

| Label information is important | 0.11 | 0.26 | −0.12 |

| Domestic beef is better than the imported one | 0.23 | 0.09 | −0.34 |

| Consumer’s Purchasing Motivations | |||

| Would you pay more for a tasty beef? | 0.25 | 0.44 | 0.04 |

| Safety for my family is the most important aspect | 0.45 | 0.16 | −0.12 |

| Would you pay a better price if you are guaranteed that the beef is very safe for your family? | 0.41 | 0.29 | −0.04 |

| Leaner beef is healthier | 0.24 | 0.26 | −0.12 |

| Would you be willing to pay more for a beef certified as free of hormones, antibiotics or other additives? | 0.31 | 0.40 | 0.05 |

| Would you be willing to pay more for beef certified as Natural or Organic? | 0.28 | 0.36 | 0.17 |

| Would you be willing to pay more for a well-marbled beef? | −0.21 | 0.37 | 0.06 |

| Variance by factor (%) | 40 | 35 | 26 |

| Cumulative variance (%) | 40 | 74 | 100 |

| R-square | 0.82 | 0.81 | 0.84 |

| Question/Variable | G 1 (n = 138) | G 2 (n = 390) | G 3 (n = 138) | G 4 (n = 27) | ||||

|---|---|---|---|---|---|---|---|---|

| n | % | n | % | n | % | n | % | |

| Beef Tenderness Is Important | ||||||||

| 1 | 0 | 0.00 | 1 | 0.26 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 6 | 1.54 | 2 | 1.45 | 0 | 0.0 |

| 3 | 0 | 0.00 | 8 | 2.05 | 3 | 2.17 | 0 | 0.0 |

| 4 | 137 | 99.28 | 204 | 52.31 | 24 | 17.39 | 20 | 74.1 |

| 5 | 1 | 0.72 | 171 | 43.85 | 109 | 78.99 | 7 | 25.9 |

| Color of Raw Beef Is Important | ||||||||

| 1 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 6 | 1.54 | 0 | 0.00 | 0 | 0.0 |

| 3 | 0 | 0.00 | 10 | 2.56 | 1 | 0.72 | 0 | 0.0 |

| 4 | 133 | 96.38 | 207 | 53.08 | 23 | 16.67 | 14 | 51.9 |

| 5 | 5 | 3.62 | 167 | 42.82 | 114 | 82.61 | 13 | 48.1 |

| Smell of Raw Beef Is Important | ||||||||

| 1 | 0 | 0.00 | 1 | 0.26 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 2 | 0.51 | 0 | 0.00 | 0 | 0.0 |

| 3 | 0 | 0.00 | 5 | 1.28 | 1 | 0.72 | 0 | 0.0 |

| 4 | 117 | 84.78 | 197 | 50.51 | 20 | 14.49 | 9 | 33.3 |

| 5 | 21 | 15.22 | 185 | 47.44 | 117 | 84.78 | 18 | 66.7 |

| Freshness (Appearance/Conservation) Is Important | ||||||||

| 1 | 1 | 0.72 | 0 | 0.00 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 2 | 0.51 | 0 | 0.00 | 0 | 0.0 |

| 3 | 0 | 0.00 | 0 | 0.00 | 1 | 0.72 | 0 | 0.0 |

| 4 | 135 | 97.83 | 307 | 78.72 | 22 | 15.94 | 9 | 33.3 |

| 5 | 2 | 1.45 | 81 | 20.77 | 115 | 83.33 | 18 | 66.7 |

| Juiciness of Cooked Beef Is Important | ||||||||

| 1 | 0 | 0.00 | 1 | 0.26 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 15 | 3.85 | 5 | 3.62 | 0 | 0.0 |

| 3 | 0 | 0.00 | 19 | 4.87 | 2 | 1.45 | 0 | 0.0 |

| 4 | 134 | 97.10 | 308 | 78.97 | 47 | 34.06 | 14 | 51.9 |

| 5 | 4 | 2.9 | 47 | 12.05 | 84 | 60.87 | 13 | 48.10 |

| Good flavor is Important | ||||||||

| 1 | 0 | 0.00 | 1 | 0.26 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 2 | 0.51 | 0 | 0.00 | 0 | 0.0 |

| 3 | 0 | 0.00 | 5 | 1.28 | 0 | 0.00 | 0 | 0.0 |

| 4 | 131 | 94.93 | 285 | 73.08 | 27 | 19.57 | 2 | 7.4 |

| 5 | 7 | 5.07 | 97 | 24.87 | 111 | 80.43 | 25 | 92.6 |

| Question/Variable | G 1 (n = 138) | G 2 (n = 390) | G 3 (n = 138) | G 4 (n = 27) | ||||

|---|---|---|---|---|---|---|---|---|

| n | % | n | % | n | % | n | % | |

| Hygiene Is a Very Important Factor | ||||||||

| 1 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 1 | 0.26 | 0 | 0.00 | 0 | 0.0 |

| 3 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.0 |

| 4 | 123 | 89.13 | 179 | 45.90 | 7 | 5.07 | 2 | 7.4 |

| 5 | 15 | 10.87 | 210 | 53.85 | 131 | 94.93 | 25 | 92.6 |

| The Beef Aging Process Is Important | ||||||||

| 1 | 0 | 0.00 | 11 | 2.82 | 12 | 8.70 | 6 | 22.2 |

| 2 | 1 | 0.72 | 86 | 22.05 | 24 | 17.39 | 11 | 40.7 |

| 3 | 4 | 2.90 | 136 | 34.87 | 27 | 19.57 | 9 | 33.3 |

| 4 | 131 | 94.93 | 148 | 37.95 | 41 | 29.71 | 1 | 3.7 |

| 5 | 2 | 1.45 | 9 | 2.31 | 34 | 24.64 | 0 | 0.0 |

| Are you Concerned or Would Like to Know How Animals for Beef Production are Fed? | ||||||||

| 1 | 0 | 0.00 | 2 | 0.51 | 1 | 0.72 | 5 | 18.5 |

| 2 | 0 | 0.00 | 43 | 11.03 | 6 | 4.35 | 11 | 40.7 |

| 3 | 1 | 0.72 | 24 | 6.15 | 5 | 3.62 | 3 | 11.1 |

| 4 | 132 | 95.65 | 285 | 73.08 | 57 | 41.30 | 5 | 18.5 |

| 5 | 5 | 3.62 | 36 | 9.23 | 69 | 50.00 | 3 | 11.1 |

| Are You Concerned that Animals Intended for Meat Production Are Treated with Hormones and/or Antibiotics to Accelerate Their Growth? | ||||||||

| 1 | 0 | 0.00 | 4 | 1.03 | 2 | 1.45 | 0 | 0.0 |

| 2 | 0 | 0.00 | 35 | 8.97 | 5 | 3.62 | 0 | 0.0 |

| 3 | 1 | 0.72 | 23 | 5.90 | 3 | 2.17 | 1 | 3.7 |

| 4 | 128 | 92.75 | 280 | 71.79 | 53 | 38.41 | 18 | 66.7 |

| 5 | 9 | 6.52 | 48 | 12.31 | 75 | 54.35 | 8 | 29.6 |

| If You Are Given the Option to Buy Branded Beef, Even If it Was More Expensive, Would You be Willing to Pay for It? | ||||||||

| 1 | 0 | 0.00 | 2 | 0.51 | 7 | 5.07 | 2 | 7.4 |

| 2 | 1 | 0.72 | 101 | 25.90 | 26 | 18.84 | 7 | 25.9 |

| 3 | 1 | 0.72 | 26 | 6.67 | 10 | 7.25 | 8 | 29.6 |

| 4 | 135 | 97.83 | 246 | 63.08 | 41 | 29.71 | 7 | 25.9 |

| 5 | 1 | 0.72 | 15 | 3.85 | 54 | 39.13 | 3 | 11.1 |

| If You Knew the Region Where the Beef Was Produced, Even If It Was More Expensive, Would You be Willing to Pay for It? | ||||||||

| 1 | 0 | 0.00 | 3 | 0.77 | 8 | 5.80 | 2 | 7.4 |

| 2 | 1 | 0.72 | 168 | 43.08 | 35 | 25.36 | 13 | 48.1 |

| 3 | 3 | 2.17 | 50 | 12.82 | 7 | 5.07 | 10 | 37.0 |

| 4 | 133 | 96.38 | 163 | 41.79 | 55 | 39.86 | 1 | 3.7 |

| 5 | 1 | 0.72 | 6 | 1.54 | 33 | 23.91 | 1 | 3.7 |

| If You Knew the Breed of the Animal that Produced the Meat, Even If It Were More Expensive, Would You Still be Willing to Pay It? | ||||||||

| 1 | 0 | 0.00 | 2 | 0.51 | 12 | 8.70 | 3 | 11.1 |

| 2 | 1 | 0.72 | 161 | 41.28 | 32 | 23.19 | 12 | 44.4 |

| 3 | 4 | 2.90 | 57 | 14.62 | 11 | 7.97 | 10 | 37.0 |

| 4 | 131 | 94.93 | 162 | 41.54 | 56 | 40.58 | 1 | 3.7 |

| 5 | 2 | 1.45 | 8 | 2.05 | 27 | 19.57 | 1 | 3.7 |

| If you had the opportunity to buy at the same price imported beef vs. beef produced in Venezuela, would you willing to pay for it? | ||||||||

| 1 | 0 | 0.00 | 1 | 0.26 | 0 | 0.00 | 0 | 0.0 |

| 2 | 16 | 11.59 | 38 | 9.74 | 7 | 5.07 | 5 | 18.5 |

| 3 | 7 | 5.07 | 36 | 9.23 | 5 | 3.62 | 10 | 37.0 |

| 4 | 113 | 81.88 | 284 | 72.82 | 38 | 27.54 | 12 | 44.4 |

| 5 | 2 | 1.45 | 31 | 7.95 | 88 | 63.77 | 0 | 0.0 |

| Variable | G 1 (n = 138) | G 2 (n = 390) | G 3 (n = 138) | G 4 (n = 27) | ||||

|---|---|---|---|---|---|---|---|---|

| n | % | n | % | n | % | n | % | |

| Would you Pay a Higher Price for Beef If You Are Guaranteed that It Will be Very Tasty (Juicier, Tender, Nicer Taste and Appearance, Altogether? | ||||||||

| 1 | 0 | 0.00 | 3 | 0.77 | 2 | 1.45 | 0 | 0.0 |

| 2 | 0 | 0.00 | 46 | 11.79 | 5 | 3.62 | 0 | 0.0 |

| 3 | 1 | 0.72 | 23 | 5.90 | 3 | 2.17 | 0 | 0.0 |

| 4 | 135 | 97.83 | 295 | 75.64 | 53 | 38.41 | 22 | 81.5 |

| 5 | 2 | 1.45 | 23 | 5.90 | 75 | 54.35 | 5 | 18.5 |

| Safety for My Family Is the Most Important Aspect | ||||||||

| 1 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 17 | 4.36 | 0 | 0.00 | 0 | 0.0 |

| 3 | 0 | 0.00 | 10 | 2.56 | 0 | 0.00 | 0 | 0.0 |

| 4 | 135 | 97.83 | 272 | 69.74 | 22 | 15.94 | 10 | 37.0 |

| 5 | 3 | 2.17 | 91 | 23.33 | 116 | 84.06 | 17 | 63.0 |

| Would You be Willing to Pay More for a Certified Beef Free of Hormones, Antibiotics or Other Additives? | ||||||||

| 1 | 0 | 0.00 | 0 | 0.00 | 0 | 0.00 | 0 | 0.0 |

| 2 | 0 | 0.00 | 36 | 9.23 | 12 | 8.70 | 0 | 0.0 |

| 3 | 0 | 0.00 | 21 | 5.38 | 6 | 4.35 | 0 | 0.0 |

| 4 | 133 | 96.38 | 302 | 77.44 | 42 | 30.43 | 20 | 74.1 |

| 5 | 5 | 3.62 | 31 | 7.95 | 78 | 56.52 | 7 | 25.9 |

| Would You be Willing to Pay More for Beef Certified as Natural or Organic? | ||||||||

| 1 | 0 | 0.00 | 2 | 0.51 | 1 | 0.72 | 0 | 0.0 |

| 2 | 10 | 7.25 | 63 | 16.15 | 19 | 13.77 | 0 | 0.0 |

| 3 | 1 | 0.72 | 35 | 8.97 | 10 | 7.25 | 0 | 0.0 |

| 4 | 123 | 89.13 | 262 | 67.18 | 39 | 28.26 | 17 | 63.0 |

| 5 | 4 | 2.90 | 28 | 7.18 | 69 | 50.00 | 10 | 37.0 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arenas de Moreno, L.; Jerez-Timaure, N.; Valerio Hernández, J.; Huerta-Leidenz, N.; Rodas-González, A. Attitudinal Determinants of Beef Consumption in Venezuela: A Retrospective Survey. Foods 2020, 9, 202. https://doi.org/10.3390/foods9020202

Arenas de Moreno L, Jerez-Timaure N, Valerio Hernández J, Huerta-Leidenz N, Rodas-González A. Attitudinal Determinants of Beef Consumption in Venezuela: A Retrospective Survey. Foods. 2020; 9(2):202. https://doi.org/10.3390/foods9020202

Chicago/Turabian StyleArenas de Moreno, Lilia, Nancy Jerez-Timaure, Jonathan Valerio Hernández, Nelson Huerta-Leidenz, and Argenis Rodas-González. 2020. "Attitudinal Determinants of Beef Consumption in Venezuela: A Retrospective Survey" Foods 9, no. 2: 202. https://doi.org/10.3390/foods9020202

APA StyleArenas de Moreno, L., Jerez-Timaure, N., Valerio Hernández, J., Huerta-Leidenz, N., & Rodas-González, A. (2020). Attitudinal Determinants of Beef Consumption in Venezuela: A Retrospective Survey. Foods, 9(2), 202. https://doi.org/10.3390/foods9020202