Gas to Liquids Techno-Economics of Associated Natural Gas, Bio Gas, and Landfill Gas

Abstract

:1. Introduction

2. Materials and Methods

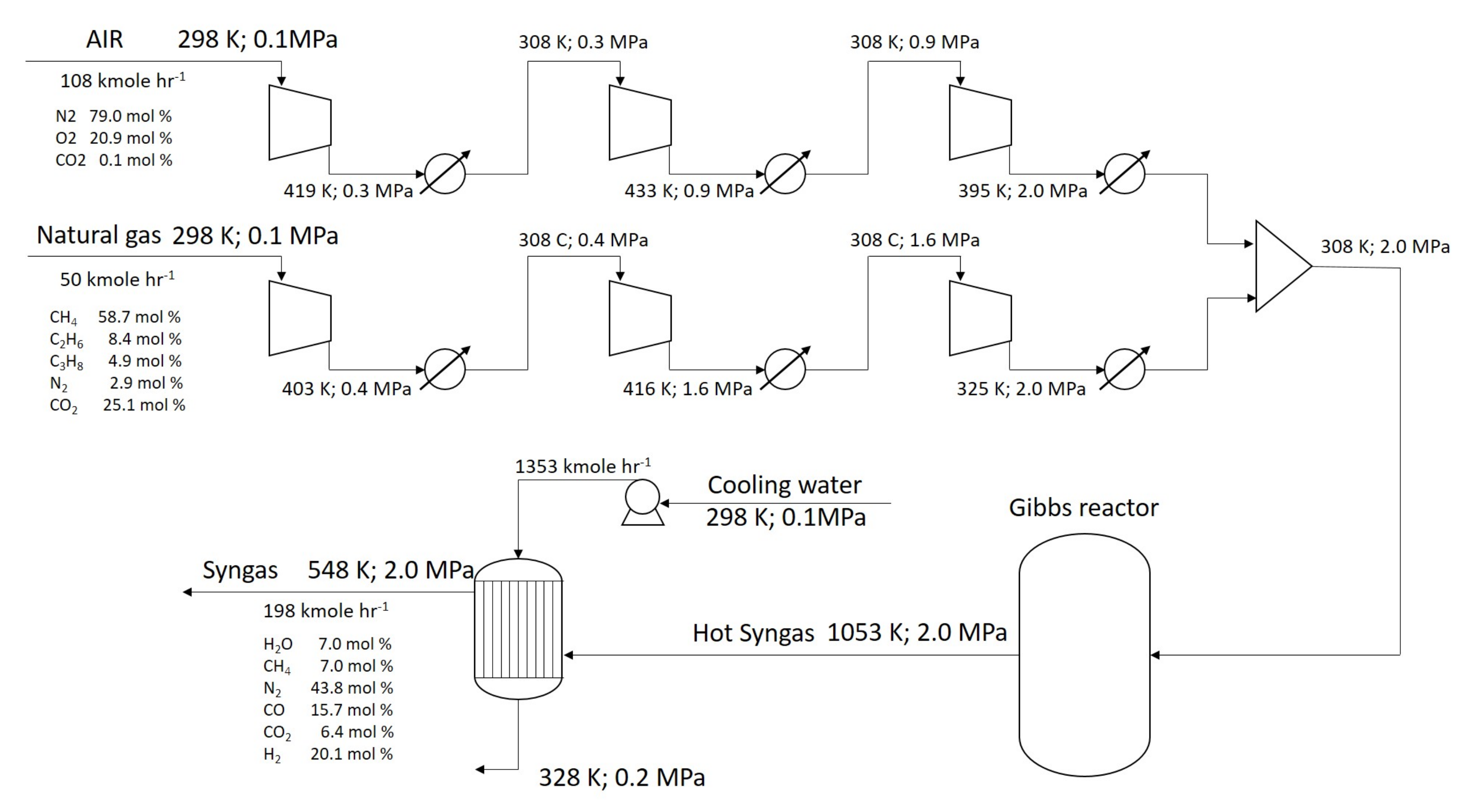

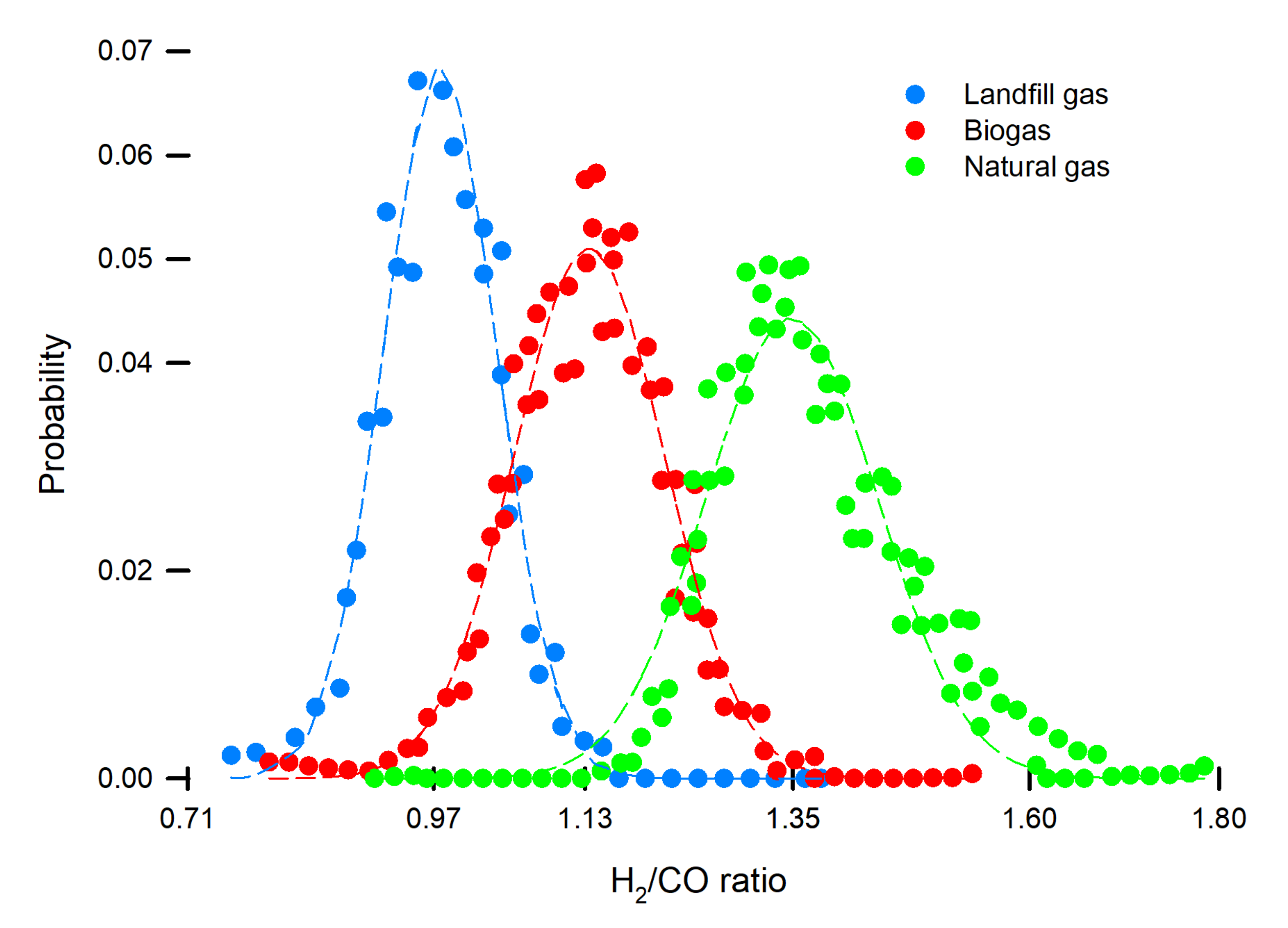

2.1. Process Simulation

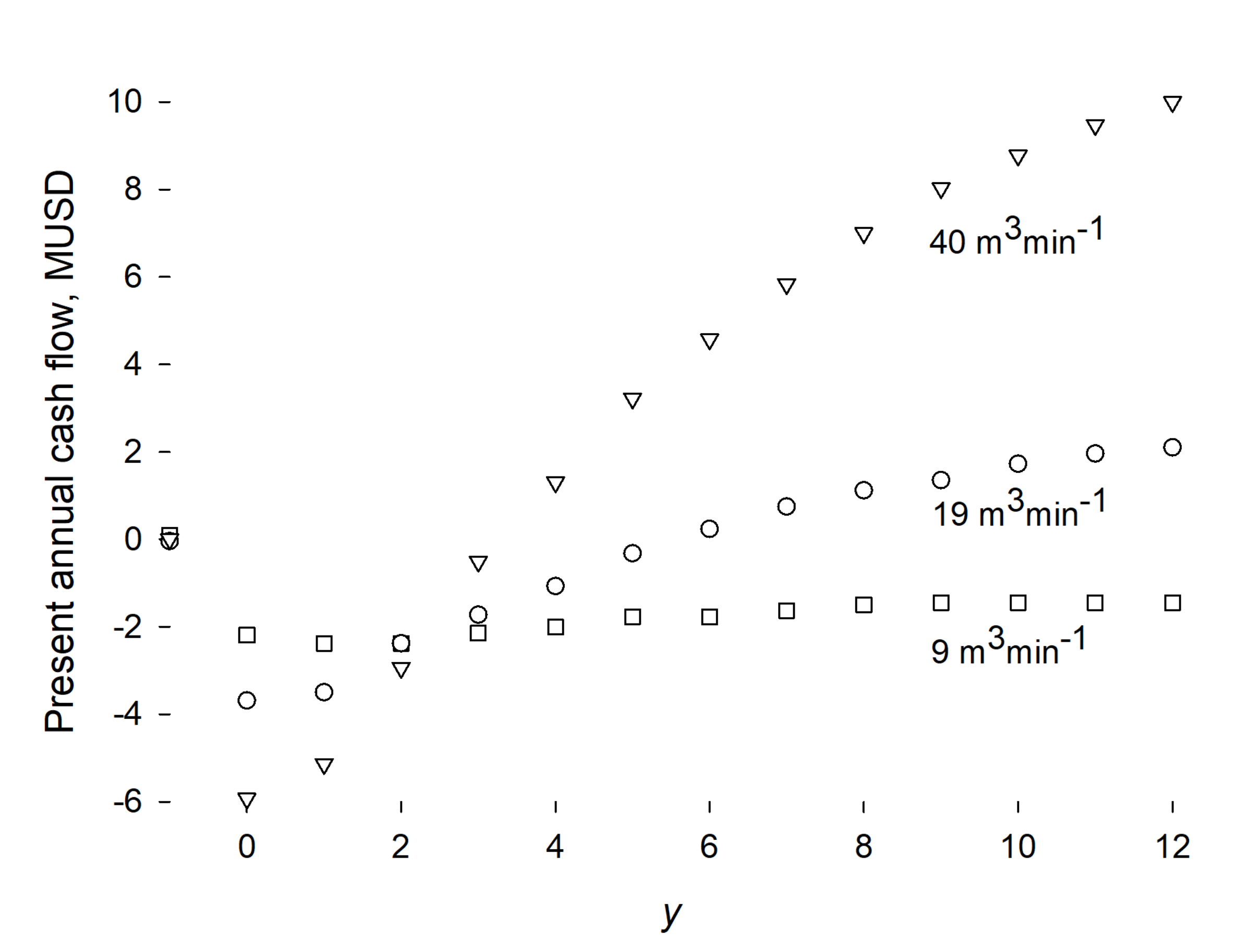

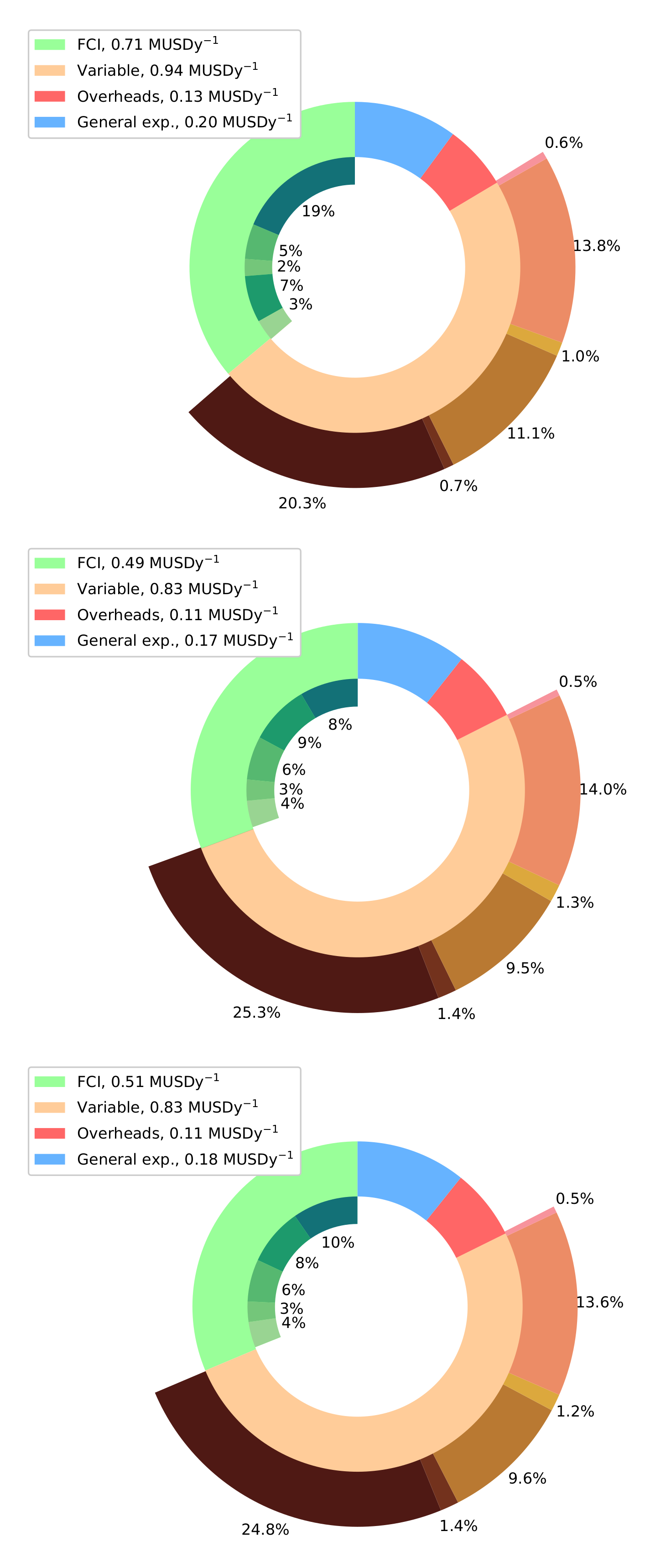

2.2. Techno-Economic Analysis

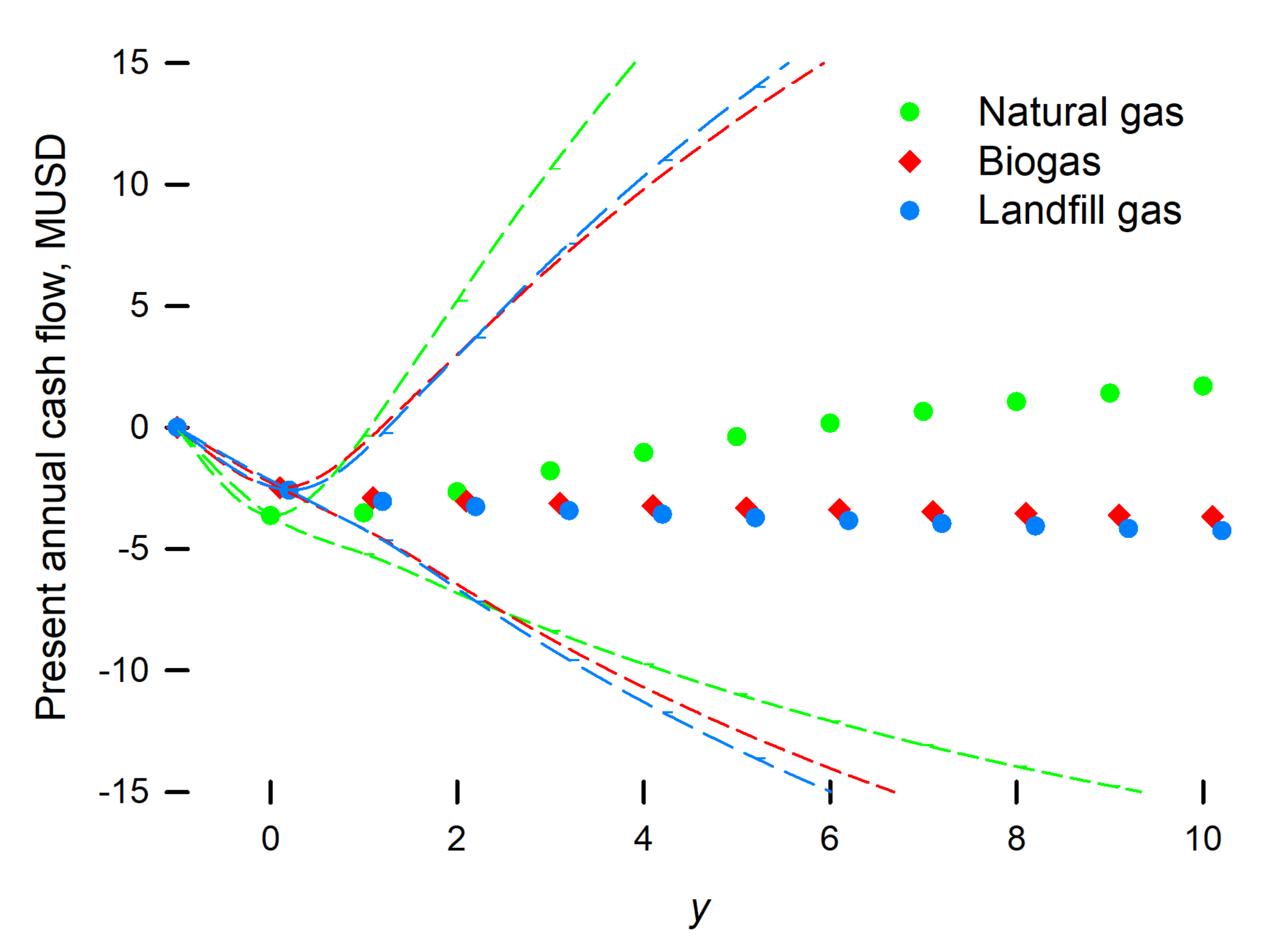

3. Results and Discussion

4. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| AER | Alberta Energy Regulator |

| ASU | Air separation Unit |

| CAPEXs | Capital expenses |

| CEPCI | Chemical engineering plant cost index |

| CPOX | Catalytic partial oxidation |

| EPA | Environmental Protection Agency |

| FCIs | Fixed capital investments |

| FT | Fischer–Tropsch |

| GtL | Gas to liquid |

| LNG | Liquefied natural gas |

| MRU | Micro refinery unit |

| NG | Natural gas |

| NPV | Net present value |

| OPEXs | Operating expenses |

| PWF | Present worth factor |

| TCI | Total capital investment |

| WGS | Water–gas shift |

References

- US Energy Information Administration. Upstream Petroleum Industry Flaring and Venting Report Industry Performance for Year Ending 31 December 2019. 2020. Available online: https://static.aer.ca/prd/documents/sts/ST60B-2020.pdf (accessed on 11 April 2021).

- Edenhofer, O. Climate Change 2014: Mitigation of Climate Change; Cambridge University Press: Cambridge, MA, USA, 2015; Volume 3. [Google Scholar]

- Derwent, R.G. Global Warming Potential (GWP) for Methane: Monte Carlo Analysis of the Uncertainties in Global Tropospheric Model Predictions. Atmosphere 2020, 11, 486. [Google Scholar] [CrossRef]

- European Commission. Reducing Greenhouse Gas Emissions: Commission Adopts EU Methane Strategy as Part of European Green Deal. 2020. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1833 (accessed on 21 July 2021).

- European Commission. Reducing Methane Emissions: Opportunities and Barriers in Waste and Agriculture through Biogas Production. 2020. Available online: https://ec.europa.eu/info/events/reducing-methane-emissions-opportunities-and-barriers-waste-and-agriculture-through-biogas-production-2020-jul-17_en (accessed on 21 July 2021).

- US Energy and Information Administration. PETROLEUM & OTHER LIQUIDS. 2021. Available online: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrfpus2&f=m (accessed on 11 April 2021).

- Skytruth. Satellite-Detected Natural Gas Flaring. 2020. Available online: https://skytruth.org/flaring/ (accessed on 7 June 2021).

- Government of Canada. How Carbon Pricing Works. 2021. Available online: https://www.canada.ca/en/environment-climate-change/services/climate-change/pricing-pollution-how-it-will-work/putting-price-on-carbon-pollution.html (accessed on 21 July 2021).

- CompactGTL. CompactGTL’s Project in Kazakhstan. 2018. Available online: http://www.compactgtl.com/about/projects/ (accessed on 17 February 2021).

- Greyrock. Technology Greyrock Chemical and Fuel Production. 2008. Available online: http://www.greyrock.com/technology/ (accessed on 17 February 2021).

- Hargreaves, N. Roll out of Smaller Scale GTL Technology at ENVIA Energy’s Plant in Oklahoma City, USA. 2017. Available online: https://www.velocys.com/press/ppt/Gastech2017_Velocys_FINAL_4.3_web.pdf (accessed on 2 March 2021).

- Infra. 2020. Available online: https://en.infratechnology.com/technology/RR# (accessed on 3 March 2021).

- Pirola, C.; Scavini, M.; Galli, F.; Vitali, S.; Comazzi, A.; Manenti, F.; Ghigna, P. Fischer–Tropsch Synthesis: EXAFS Study of Ru and Pt bimetallic Co Based Catalysts. Fuel 2014, 132, 62–70. [Google Scholar] [CrossRef]

- Di Michele, A.; Sassi, P.; Comazzi, A.; Galli, F.; Pirola, C.; Bianchi, C.L. Co- and Co(Ru)-Based Catalysts for Fischer-Tropsch Synthesis Prepared by High Power Ultrasound. Mater. Focus 2015, 4, 295–301. [Google Scholar] [CrossRef]

- Louyot, P.; Neagoe, C.; Galli, F.; Pirola, C.; Patience, G.S.; Boffito, D.C. Ultrasound-assisted impregnation for high temperature Fischer-Tropsch catalysts. Ultrason. Sonochemistry 2018, 48, 523–531. [Google Scholar] [CrossRef]

- Kanshio, S.; Agogo, H.O.; Chior, T.J. Techno-Economic Assessment of Mini-GTL Technologies for Flare Gas Monetization in Nigeria. In Proceedings of the SPE Nigeria Annual International Conference and Exhibition, Lagos, Nigeria, 1 July–2 August 2017. [Google Scholar] [CrossRef]

- Remer, D.S.; Chai, L.H. Design cost factors for scaling-up engineering equipment. Chem. Eng. Prog. 1990, 86, 77–82. [Google Scholar]

- Patience, G.S.; Boffito, D.C. Distributed production: Scale-up vs. experience. J. Adv. Manuf. Process. 2020, 2, e10039. [Google Scholar] [CrossRef]

- Mohajerani, S.; Kumar, A.; Oni, A.O. A techno-economic assessment of gas-to-liquid and coal-to-liquid plants through the development of scale factors. Energy 2018, 150, 681–693. [Google Scholar] [CrossRef]

- Collodi, G.; Azzaro, G.; Ferrari, N.; Santos, S. Demonstrating Large Scale Industrial CCS through CCU—A Case Study for Methanol Production. Energy Procedia 2017, 114, 122–138. [Google Scholar] [CrossRef]

- Banaszkiewicz, T.; Chorowski, M.; Gizicki, W. Comparative analysis of cryogenic and PTSA technologies for systems of oxygen production. AIP Conf. Proc. 2014, 1573, 1373–1378. [Google Scholar] [CrossRef]

- Dong, L.; Wei, S.; Tan, S.; Zhang, H. DGTL or LNG: Which is the best way to monetize ‘stranded’ natural gas? Pet. Sci. 2008, 5, 388–394. [Google Scholar] [CrossRef] [Green Version]

- Trevisanut, C.; Jazayeri, S.M.; Bonkane, S.; Neagoe, C.; Mohamadalizadeh, A.; Boffito, D.C.; Bianchi, C.; Pirola, C.; Visconti, C.G.; Lietti, L.; et al. Micro-syngas technology options for GtL. Can. J. Chem. Eng. 2016, 94, 613–622. [Google Scholar]

- Pauletto, G.; Mendil, M.; Libretto, N.; Mocellin, P.; Miller, J.T.; Patience, G.S. Short contact time CH4 partial oxidation over Ni based catalyst at 1.5MPa. Chem. Eng. J. 2021, 414, 128831. [Google Scholar] [CrossRef]

- Pauletto, G.; Galli, F.; Gaillardet, A.; Mocellin, P.; Patience, G.S. Techno economic analysis of a micro Gas-to-Liquid unit for associated natural gas conversion. Renew. Sustain. Energy Rev. 2021. [Google Scholar] [CrossRef]

- Zichittella, G.; Pérez-Ramírez, J. Status and prospects of the decentralised valorisation of natural gas into energy and energy carriers. Chem. Soc. Rev. 2021, 50, 2984–3012. [Google Scholar]

- Delborne, J.A.; Hasala, D.; Wigner, A.; Kinchy, A. Dueling metaphors, fueling futures: “Bridge fuel” visions of coal and natural gas in the United States. Energy Res. Soc. Sci. 2020, 61, 101350. [Google Scholar] [CrossRef]

- Yuan, X.C.; Lyu, Y.J.; Wang, B.; Liu, Q.H.; Wu, Q. China’s energy transition strategy at the city level: The role of renewable energy. J. Clean. Prod. 2018, 205, 980–986. [Google Scholar] [CrossRef]

- Baena-Moreno, F.M.; Pastor-Pérez, L.; Wang, Q.; Reina, T. Bio-methane and bio-methanol co-production from biogas: A profitability analysis to explore new sustainable chemical processes. J. Clean. Prod. 2020, 265, 121909. [Google Scholar] [CrossRef]

- Heo, J.; Lee, B.; Lim, H. Techno-economic analysis for CO2 reforming of a medium-grade landfill gas in a membrane reactor for H2 production. J. Clean. Prod. 2018, 172, 2585–2593. [Google Scholar] [CrossRef]

- Gao, R.; Zhang, C.; Lee, Y.J.; Kwak, G.; Jun, K.W.; Kim, S.K.; Park, H.G.; Guan, G. Sustainable production of methanol using landfill gas via carbon dioxide reforming and hydrogenation: Process development and techno-economic analysis. J. Clean. Prod. 2020, 272, 122552. [Google Scholar] [CrossRef]

- Statista. Leading Biogas Producing Countries in 2014. 2021. Available online: https://www.statista.com/statistics/481840/biogas-production-worldwide-by-key-country/ (accessed on 16 August 2021).

- International Energy Agency. The Outlook for Biogas and Biomethane to 2040. 2021. Available online: https://www.iea.org/reports/outlook-for-biogas-and-biomethane-prospects-for-organic-growth/the-outlook-for-biogas-and-biomethane-to-2040 (accessed on 16 August 2021).

- The World Bank. What a Waste 2.0. A Global Snapshot of Solid Waste Management to 2050. 2021. Available online: hdl.handle.net/10986/30317 (accessed on 16 August 2021).

- Mukherjee, R.; Reddy Asani, R.; Boppana, N.; El-Halwagi, M.M. Performance evaluation of shale gas processing and NGL recovery plant under uncertainty of the feed composition. J. Nat. Gas Sci. Eng. 2020, 83, 103517. [Google Scholar] [CrossRef]

- Basini, L.E.; Busto, C.; Villani, M. Process for the Production of Methanol from Gaseous Hydrocarbons. WO 2020/058859 A1, 9 July 2020. [Google Scholar]

- De Tommaso, J.; Rossi, F.; Moradi, N.; Pirola, C.; Patience, G.S.; Galli, F. Experimental methods in chemical engineering: Process simulation. Can. J. Chem. Eng. 2020, 98, 2301–2320. [Google Scholar] [CrossRef]

- US Department of Energy, Office of Oil and Natural Gas. Natural Gas Flaring and Venting: State and Federal Regulatory Overview, Trends, and Impacts. 2019. Available online: https://www.energy.gov/sites/prod/files/2019/08/f65/Natural%20Gas%20Flaring%20and%20Venting%20Report.pdf (accessed on 28 June 2021).

- Soave, G. Equilibrium constants from a modified Redlich-Kwong equation of state. Chem. Eng. Sci. 1972, 27, 1197–1203. [Google Scholar] [CrossRef]

- Mokhatab, S.; Poe, W.A. Handbook of Natural Gas Transmission and Processing; Gulf Professional Publishing: Waltham, MA, USA, 2012. [Google Scholar]

- Zhou, L.; Froment, G.F.; Yang, Y.; Li, Y. Advanced fundamental modeling of the kinetics of Fischer–Tropsch synthesis. AIChE J. 2016, 62, 1668–1682. [Google Scholar] [CrossRef]

- Johnson, M.; Kostiuk, L.; Spangelo, J. A Characterization of Solution Gas Flaring in Alberta. J. Air Waste Manag. Assoc. 2001, 51, 1167–1177. [Google Scholar] [CrossRef] [Green Version]

- Berger, S.; Dun, S.; Gavrelis, N.; Helmick, J.; Mann, J.; Nickle, R.; Perlman, G.; Warner, S.; Wilhelmi, J.; Williams, R.; et al. Landfill Gas Primer: An Overview for Environmental Health Professionals; ATSDR: Atlanta, GA, USA, 2001. [Google Scholar]

- Li, Y.; Alaimo, C.P.; Kim, M.; Kado, N.Y.; Peppers, J.; Xue, J.; Wan, C.; Green, P.G.; Zhang, R.; Jenkins, B.M.; et al. Composition and Toxicity of Biogas Produced from Different Feedstocks in California. Environ. Sci. Technol. 2019, 53, 11569–11579. [Google Scholar] [CrossRef]

- Ammenberg, J.; Bohn, I.; Feiz, R. Systematic Assessment of Feedstock for an Expanded Biogas Production: A Multi-Criteria Approach. 2017. Available online: http://www.diva-portal.org/smash/record.jsf?pid=diva2%3A1156008&dswid=4879 (accessed on 5 May 2021).

- Green, D.W.; Southard, M.Z. Perry’s Chemical Engineers’ Handbook; McGraw-Hill Education: San Francisco, CA, USA, 2019. [Google Scholar]

- Ulrich, G.D.; Vasudevan, P.T. Chemical Engineering Process Design and Economics: A Practical Guide; Process Publishing: New York, NY, USA, 2003. [Google Scholar]

- Vatavuk, W.M. Updating the CE Plant Index. 2002. Available online: https://www.chemengonline.com/Assets/File/CEPCI_2002.pdf.

- Jenkins, S. 2021 CEPCI UPDATES: FEBRUARY (PRELIM.) AND JANUARY (FINAL). 2021. Available online: https://www.chemengonline.com/2021-cepci-updates-february-prelim-and-january-final/ (accessed on 5 May 2021).

- Sönnichsen, N. Canada’s Average Industrial Electricity Prices by major City 2019 by Select City (in Canadian Cents per Kilowatt Hour). 2020. Available online: https://www.statista.com/statistics/579159/average-industrial-electricity-prices-canada-by-major-city/ (accessed on 5 May 2021).

- Town of Calgary. Landfill Rates. 2021. Available online: https://www.calgary.ca/uep/wrs/landfill-information/landfill-rates.html (accessed on 5 May 2021).

- Town of Edmonton. Waste Management Fees & Rates. 2021. Available online: https://www.edmonton.ca/programs_services/garbage_waste/rates-fees.aspx (accessed on 5 May 2021).

- Vengateson, U. Cooling Towers: Estimate Evaporation Loss and Makeup Water Requirements. 2020. Available online: https://www.chemengonline.com/cooling-towers-estimate-evaporation-loss-and-makeup-water-requirements/?printmode=1 (accessed on 5 May 2021).

- Patience, G.; Boffito, D.C. Method and Apparatus for Producing Chemicals from a Methane-Containing Gas. U.S. Patent 9,243,190, 26 January 2016. [Google Scholar]

- American Petroleum Institute. Gasoline, Diesel and Crude Oil Prices. 2021. Available online: https://gaspricesexplained.com/#/?section=gasoline-diesel-and-crude-oil-prices (accessed on 5 May 2021).

- Index Mundi. Crude Oil, Average Spot Price of Brent, Dubai and West Texas Intermediate, Equally Weighed. 2021. Available online: https://www.indexmundi.com/commodities/?commodity=crude-oil (accessed on 5 May 2021).

- TaxTips.ca. 2020 Corporate Income Tax Rates. 2021. Available online: https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2020.htm (accessed on 6 May 2021).

- Ponugoti, P.V.; Janardhanan, V.M. Mechanistic Kinetic Model for Biogas Dry Reforming. Ind. Eng. Chem. Res. 2020, 59, 14737–14746. [Google Scholar] [CrossRef]

- Raje, A.; Inga, J.R.; Davis, B.H. Fischer-Tropsch synthesis: Process considerations based on performance of iron-based catalysts. Fuel 1997, 76, 273–280. [Google Scholar] [CrossRef]

- Dancuart, L.; Steynberg, A. Fischer-Tropsch Based GTL Technology: A New Process. In Fischer-Tropsch Synthesis, Catalyst and Catalysis; Studies in Surface Science and Catalysis; Davis, B., Occelli, M., Eds.; Elsevier: Amsterdam, The Netheralnds, 2007; Volume 163, pp. 379–399. [Google Scholar] [CrossRef]

- Teimouri, Z.; Abatzoglou, N.; Dalai, A.K. Kinetics and Selectivity Study of Fischer–Tropsch Synthesis to C5+ Hydrocarbons: A Review. Catalysts 2021, 11, 330. [Google Scholar] [CrossRef]

- Bhosekar, A.; Ierapetritou, M. A framework for supply chain optimization for modular manufacturing with production feasibility analysis. Comput. Chem. Eng. 2021, 145, 107175. [Google Scholar] [CrossRef]

- Weber, R.S.; Askander, J.A.; Barclay, J.A. The scaling economics of small unit operations. J. Adv. Manuf. Process. 2021, 3, e10074. [Google Scholar]

- Okeke, I.J.; Mani, S. Techno-economic assessment of biogas to liquid fuels conversion technology via Fischer-Tropsch synthesis. Biofuels Bioprod. Biorefining 2017, 11, 472–487. [Google Scholar] [CrossRef]

- Hernandez, B.; Martin, M. Optimization for biogas to chemicals via tri-reforming. Analysis of Fischer-Tropsch fuels from biogas. Energy Convers. Manag. 2018, 174, 998–1013. [Google Scholar] [CrossRef]

- Zhao, X.; Naqi, A.; Walker, D.M.; Roberge, T.; Kastelic, M.; Joseph, B.; Kuhn, J.N. Conversion of landfill gas to liquid fuels through a TriFTS (tri-reforming and Fischer–Tropsch synthesis) process: A feasibility study. Sustain. Energy Fuels 2019, 3, 539–549. [Google Scholar]

- Galli, F.; Pirola, C.; Previtali, D.; Manenti, F.; Bianchi, C.L. Eco design LCA of an innovative lab scale plant for the production of oxygen-enriched air. Comparison between economic and environmental assessment. J. Clean. Prod. 2018, 171, 147–152. [Google Scholar] [CrossRef]

- Ramasamy, C.; Chun, T.H.; Kee, C.M.; Fong, G.T. Industrial Revolution 4.0 Contribution of chemical engineer. Turk. J. Comput. Math. Educ. (TURCOMAT) 2021, 12, 5037–5041. [Google Scholar]

| Natural Gas [42] | Landfill Gas [43] | Biogas [44,45] | |||||

|---|---|---|---|---|---|---|---|

| Min | Most Likely Value | Max | |||||

| CH4 | 19.2 | 9.0 | 99.5 | 52.5 | 2.5 | 48.0 | 5.8 |

| C2H6 | 0.0 | 9.8 | 93.5 | 0.0 | 0.0 | 0.0 | 0.0 |

| C3H8 | 0.0 | 5.8 | 41.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| N2 | 0.0 | 3.4 | 80.2 | 3.5 | 0.5 | 16.4 | 6.7 |

| CO2 | 0.0 | 2.9 | 39.7 | 50.0 | 3.3 | 31.9 | 4.1 |

| O2 | 0.0 | 0.0 | 0.0 | 0.5 | 0.2 | 3.8 | 2.1 |

| CO | 0.0 | 0.0 | 0.0 | 0.1 | 0.03 | 0.0 | 0.0 |

| Item | Fraction of Delivered Equipment, |

|---|---|

| Purchased Equipment Installation, | 0.15 |

| Instrumentation and Controls, | 0.36 |

| Piping, | 0.16 |

| Electrical Systems, | 0.10 |

| Building, | 0.00 |

| Service Facilities, | 0.30 |

| Yard Improvement | 0.00 |

| Engineering and Supervision, | 0.01 |

| Construction Expenses, | 0.34 |

| Legal Expenses, | 0.04 |

| Contractor’s Fee, | 0.17 |

| Contingency, | 0.32 |

| Case | |||

|---|---|---|---|

| Value | 1 | 2 | 3 |

| Feedstock Price | 0.23 USD kg−1 [55] | 0 | −50 tCO2eq In Feed, USD |

| Product Price (USD kg−1) | 0.2 | 0.3 | 0.4 [56] |

| Year | −1 | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| PWF | 1.2 | 1.1 | 0.9 | 0.8 | 0.7 | 0.6 | 0.5 | 0.5 | 0.4 | 0.4 | 0.3 | 0.3 | 0.2 | 0.2 |

| Case | Production, kg y | Average Payback Time, y | |

|---|---|---|---|

| 1 | - | - | |

| 2 | - | - | |

| 3 | 33.54 | 14.96 | |

| 4 | 5.68 | 0.47 | |

| 5 | 3.13 | 0.19 | |

| 6 | 2.16 | 0.12 | |

| 7 | 1.65 | 0.08 | |

| 8 | 1.33 | 0.06 | |

| 9 | 1.12 | 0.05 |

| Product Price, USD kg | |||||

| Flowrate, kmol h | 0.20 | 0.30 | 0.40 | ||

| Raw Material Price, USD kg−1 | 0.2322 | 25 | - | - | - |

| 50 | - | - | - | ||

| 100 | - | - | - | ||

| 0 | 25 | - | 13 ± 1 | 3.7 ± 0.13 | |

| 50 | 13 ± 2 | 3.1 ± 0.19 | 1.8 ± 0.09 | ||

| 100 | 4.0 ± 0.3 | 1.8 ± 0.11 | 1.2 ± 0.07 | ||

| Negative | 25 | 1.8 ± 0.11 | 1.3 ± 0.15 | 1.1 ± 0.10 | |

| 50 | 0.56 ± 0.1 | 0.49 ± 0.06 | 0.44 ± 0.05 | ||

| 100 | 0.22 ± 0.03 | 0.21 ± 0.03 | 0.20 ± 0.02 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Galli, F.; Lai, J.-J.; De Tommaso, J.; Pauletto, G.; Patience, G.S. Gas to Liquids Techno-Economics of Associated Natural Gas, Bio Gas, and Landfill Gas. Processes 2021, 9, 1568. https://doi.org/10.3390/pr9091568

Galli F, Lai J-J, De Tommaso J, Pauletto G, Patience GS. Gas to Liquids Techno-Economics of Associated Natural Gas, Bio Gas, and Landfill Gas. Processes. 2021; 9(9):1568. https://doi.org/10.3390/pr9091568

Chicago/Turabian StyleGalli, Federico, Jun-Jie Lai, Jacopo De Tommaso, Gianluca Pauletto, and Gregory S. Patience. 2021. "Gas to Liquids Techno-Economics of Associated Natural Gas, Bio Gas, and Landfill Gas" Processes 9, no. 9: 1568. https://doi.org/10.3390/pr9091568

APA StyleGalli, F., Lai, J.-J., De Tommaso, J., Pauletto, G., & Patience, G. S. (2021). Gas to Liquids Techno-Economics of Associated Natural Gas, Bio Gas, and Landfill Gas. Processes, 9(9), 1568. https://doi.org/10.3390/pr9091568