Abstract

The proposed approach to quantitative assessment of the risk of investor’s profit in projects for the production of raw materials for bioethanol involves the implementation of eight stages. It systematically takes into account the stochastic nature of many factors that determine the amount of investments in the project, as well as the stochastic nature of the market value of raw materials. The use of the proposed approach makes it possible to obtain an accurate assessment of the level of risk of investors in projects for the production of raw materials for bioethanol, taking into account the requirements of investors. Based on the use of the developed application software, stochastic models of profit of investors in projects for the production of raw materials for wheat bioethanol and patterns of changes in their risk for the Western region of Ukraine are obtained. It is established that with the growth of the minimum expected profit of investors of projects from 10 to 70$/ton, the probability of its receipt varies from 0.89 to 0.34. According to a reasonable scale, the level of risk of making a profit by investors in projects for the production of raw materials for bioethanol from wheat varies from acceptable to high.

1. Introduction

Currently, the world’s energy resources occupy a significant share in the cost of production of certain products and provision of services [1,2,3,4]. To make them cheaper, each of the countries of the world implements its own projects to replace traditional fuels with alternative types depending on the available natural resources. Ukraine has a significant natural potential of fertile soils, which provides the production of biological raw materials for bioethanol [5,6,7,8,9]. In particular, one of the raw materials for the production of bioethanol in Ukraine is wheat. At the same time, investor’s profit in projects for the production of raw materials for bioethanol is very important for them [5,6,10,11]. Investors’ profits depend on the changing project environment, which in turn causes risk. Potential investors in projects for the production of raw materials for wheat bioethanol at the planning stage want to know the risk of predicted profit on investments [12,13,14]. During the determining the effectiveness of investments in projects for the production of raw materials for bioethanol, it is necessary to assess this risk for a given project environment [15,16,17]. Thus, qualitative forecasting of the risk of investment in projects for the production of raw materials for bioethanol is possible on the basis of tools that take into account the stochastic project environment [15,16,17,18,19,20].

Today, many scientific works are devoted to forecasting the risk of investments in projects [18,21,22,23]. Scientific works have developed tools that are used to assess the value of projects that are implemented in different fields. However, these scientific papers are mainly based on deterministic models, that does not allow to take into account the risk. They also do not take into account the peculiarities of the project environment of projects for the production of raw materials for bioethanol. All of the above indicates that they can not be fully used to determine the risk of investor’s profit of these projects.

Some of the research results that are presented in the works [13,16,24] relate to the risk assessment of projects and their project environment. The quantitative risk assessment is the basis for determining the effectiveness of these projects [25,26,27,28]. Among these scientific works, those related to the risk assessment of projects and the project environment of agricultural production deserve special attention [1,16,29,30,31]. However, they cannot be used to predict the risk of investments in projects for the production of raw materials for bioethanol due to a number of shortcomings [5,18,32,33,34]. In particular, the authors of these scientific papers do not pay attention to the peculurities of project environment of projects for the production of raw materials for bioethanol. This makes it impossible qualitative substantiation of the risk of investor’s profits in these projects. In addition, it is not expected to forecast the risk of market conditions, which significantly affects the risk of profit of investors in projects for the production of raw materials for bioethanol.

It is proposed to use the approach that is offered in the work for quality solution the problem of assessing the risk of profit of investors in projects for the production of raw materials for bioethanol [9,16,18,35]. This approach involves simulation of projects for the production of raw materials for bioethanol, which is the basis for qualitative determination of the amount of investment in these projects, taking into account the available resources and the characteristics of their design environment. This eliminates a number of shortcomings of existing methods of assessing the risk of investor’s profits. At the same time, to take into account the stochastic market value of raw materials for bioethanol, it is proposed to use statistical data of the region where the project is implemented. The use of known methods of probability theory, as well as mathematical statistics provides a justification for models of stochastic market value of raw materials for bioethanol.

The aim of the work is to substantiate the approach and develop application software for quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol.

The work should solve the following tasks:

- –

- to propose an approach and develop applied software for quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol;

- –

- on the basis of the developed application software to quantify the risk of profit of investors in projects for the production of raw materials for bioethanol for a given project environment.

2. Theoretical Background

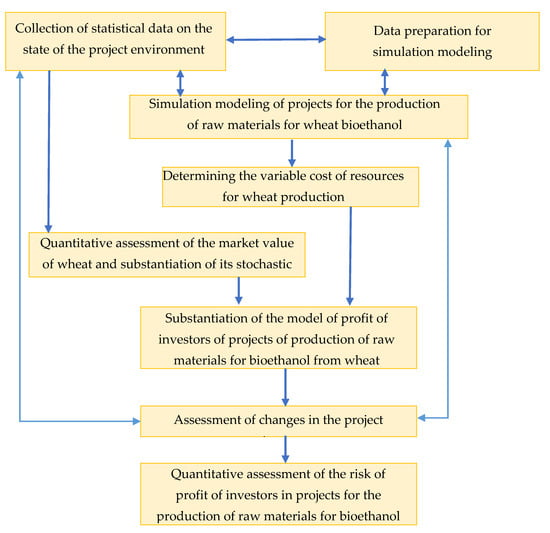

The proposed approach of quantitative assessment of the risk of profits of investors in projects for the production of raw materials for bioethanol eliminates the above shortcomings of existing tools. This approach involves the implementation of eight stages, which are presented as Figure 1.

Figure 1.

Stages of the proposed approach to quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol.

In order to determine the variable costs of resources for the implementation of projects for the production of raw materials for bioethanol, a well-known simulation model is used [12]. This model represents the performance of works in these projects, taking into account the characteristics of production conditions of the project environment (field area and projected wheat yield, distance of delivery of resources for growing wheat, etc.) and predicted climatic conditions of the region (precipitation, air temperature, humidity, wind speed, etc., that determine the changing content and timing of work in projects). This stage of research provides determination of variable durations of performance of works and expenses of resources for their performance, namely, (1) need and duration of the use of equipment, (2) daily volume of performed work and duration of the use of equipment and human resources, (3) the amount of resource costs and consumables.

The obtained quantitative values of variable durations of work and resource costs for their implementation are the basis for determining the amount of investments in these projects, taking into account the available resources and the characteristics of their project environment. In particular, by performing simulation modeling of raw material production projects for bioethanol, for individual calendar years in given production conditions and with forecasting of climatic conditions, get a set of investments in these projects for the projected changing project environment. These quantitative values provide a justification for the density of the law of distribution of investments and determine the following indicators:

- –

- mathematical expectation of the amount of investments in the projectwhere —the amount of investments in the project of production of raw materials for bioethanol for the j-th calendar year, $/ton; —empirical frequency of investment volumes; —the number of intervals of amount of investments in the project of production of raw materials for bioethanol;

- –

- frequency of amount of investments in the projectwhere —the frequency of hitting the volume of investments in the j-th interval; N—number of years of simulation modeling of projects of raw material production for bioethanol (sample size);

- –

- the number of intervals of amount of investments in the project

- –

- variance of amount of investments in the projectwhere —the average value of investment in the project for the j-th interval, $/ton;

- –

- standard deviation of investment in the project

- –

- coefficient of variation of investments in the project

The available official statistical data of the region (official website of the State Statistics Service of Ukraine) are used to quantify the market value of wheat and substantiate its stochastic model. In need of raw materials for bioethanol and its specific market value, the calculation of the market value of these raw materials for the projected j-th calendar years is performed:

where —the need for raw materials for bioethanol, t; —specific cost of -o wheat variety in the j-th calendar year, $/ton; —the number of required -x varieties of wheat, units.

The obtained values of the market value of raw materials for bioethanol for the j-th calendar years get a separate set .

This sample of values of market value of raw materials for bioethanol provides definition of density of the law of its distribution and the following characteristics:

- –

- mathematical expectation of the market value of raw materials for bioethanolwhere —market value of raw materials for bioethanol for the j-th calendar year, $/ton;

- –

- dispersion of the market value of raw materials for bioethanolwhere —the average quantitative value of the market value of raw materials for bioethanol in the j-th calendar year, $/ton;

- –

- standard deviation of the market value of raw materials for bioethanol

- –

- coefficient of variation of the market value of raw materials for bioethanol

Substantiation of the model of investor’s profits of projects of production of raw materials for bioethanol is carried out on the basis of a composition of separate normal laws of distribution [12]. In this case, the random amount of profit of investors in projects for the production of raw materials for bioethanol will also be describe by the normal distribution law. At the same time, the mathematical expectation of profit of investors in projects for the production of raw materials for bioethanol is determined by the formula:

Since there is a close correlation between quantitative values ra and in the j-th calendar year with a separate value of the correlation coefficient [36,37], the standard deviation of investors’ profits of projects for the production of raw materials for bioethanol will be:

where —correlation coefficient between quantitative values and in the j-th calendar year.

In this case, the density of distribution of the random profit of investors in projects for the production of raw materials for bioethanol will be

During quantifying assessment of the risk of investor’s profits in projects for the production of raw materials for bioethanol, it is assumed that the risk of profit , given the quantitative value of profit will be

Based on the Laplace function, we can get:

where —Laplace function, that characterizes the integral of the probability of a given profit of investors in projects for the production of raw materials for bioethanol.

Investors in projects for the production of raw materials for bioethanol will have a profit, provided—. Projects that have a quantitative value of investors’ profits are break-even and have no value for investors. Provided that the project will be unprofitable and will have no value for their investors.

For quantitative evaluation of the risk of profit of investors in projects for the production of raw materials for bioethanol, use the scale of probability of loss . The quantitative value of the degree of risk of a given profit of project of investors determines their type of risk: (1) —minimal risk ; (2) —admissible pизик ; (3) —medium risk ; (4) —high risk ; (5) —critical risk .

Therefore, the proposed approach to quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol involves the implementation of eight iterative stages. This approach takes into account the stochastic nature of many components that determine the amount of investment in projects for the production of raw materials for bioethanol, as well as the stochastic nature of the market value of these raw materials. It provides accurate results for the forecast of variable quantitative indicators of the risk of profit of investors in projects for the production of raw materials for bioethanol at a given minimum value.

3. Materials and Methods

During the research, simulation modeling of projects for the production of raw materials for bioethanol was used, that is the basis for qualitative determination of the amount of investment in these projects, taking into account the available resources and the characteristics of their project environment. To take into account the stochastic market value of raw materials for bioethanol, statistical data of the region where the project is implemented are used. Known methods of probability theory, as well as mathematical statistics have provided justification for models of stochastic market value of raw materials for bioethanol. To accelerate the quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol, based on the reasonable approach application software has been developed in Python.

4. Research Results and Discussion

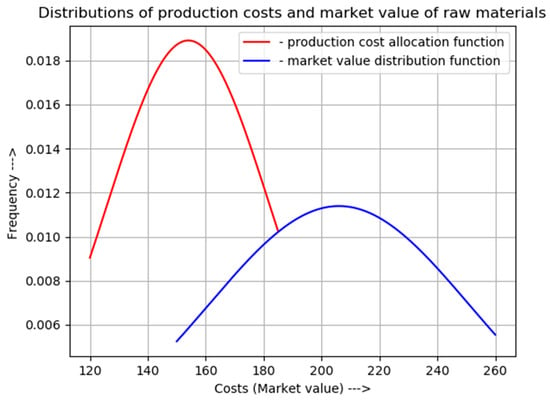

We assessed the risks of the project environment indicators of projects for the production of raw materials for wheat bioethanol in the conditions of farms in the Western region of Ukraine. Based on the simulation modeling of these projects, it is established that the distribution of the amount of investments is described by the normal distribution law, which has the following statistical characteristics: mathematical expectation—; standard deviation , coefficient of variation . The analysis of statistical data for 2016–2019 made it possible to establish that the distribution of the selling price of wheat is described by the normal distribution law, which has the following statistical characteristics: mathematical expectation—; standard deviation , coefficient of variation .

The theoretical curves of these distributions are given in Figure 2.

Figure 2.

Theoretical curves of the amount of investments in the project of production of raw materials for bioethanol from wheat and its market value.

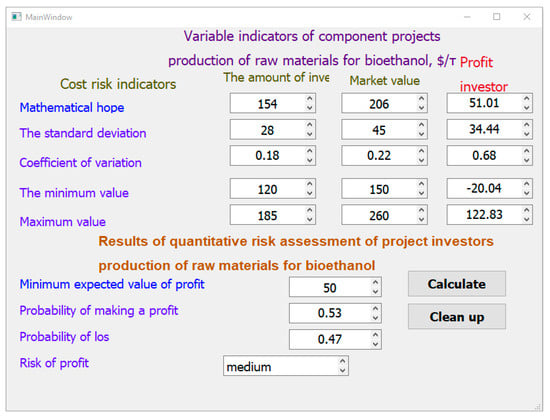

For qualitative and accelerated quantitative assessment of the risk of profits of investors in projects for the production of raw materials for bioethanol, based on the reasonable approach and the above theoretical principles developed application software in Python 3.8 (Figure 3).

Figure 3.

Application software window for quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol.

The algorithm of the proposed software is based on the proposed approach (Figure 1). For the operation of the software, first of all, collection of statistical data on the state of the project environment is carried out, which are then processed according to Equations (7)–(11) and entered into the working window. These data include statistics on the market value of raw materials in the region where it is planned to implement a project for the production of agricultural raw materials for bioethanol, as well as the costs incurred for production.

To determine these costs, simulation modeling of bioethanol raw material production projects is performed, which provides substantiation of data on the variable costs of production resources and the amount of investment in the project using Equations (4)–(6).

Simulation modeling of projects for the production of raw materials for bioethanol was performed using a computer program developed at the National Research Center “Institute of Mechanization and Electrification of Agriculture” (Ukraine). First of all, for a given scale of the project and predetermined areas of fields for growing raw crops for bioethanol formed a database of initial data: a list of works for growing individual crops; characteristics of consumables (type, specific need, and cost), scope of work; beginning and duration of works; used energy resources and agricultural machinery; production rate and specific fuel consumption; and the need for performers and tariffs for their work. Thus, terms of performance of separate works are taken from technological regulations on cultivation of raw materials, and productivity of separate machine-tractor aggregates and fuel consumption from standard norms. Basic energy resources are taken into account the scale of projects. In our example, the basic energy means are accepted—a John Deere 8335R tractor with technologically compatible agricultural machines that correspond the intensive technology of raw crops production.

In addition, this computer program makes it possible to take into account the changing climatic conditions, which are presented in the form of distributions of wet and non-rainy periods of time for work. Having performed simulation modeling of projects for the production of raw materials for bioethanol, the main system functional indicators were obtained: the duration of use of energy resources and agricultural machinery; the need for energy resources and agricultural machinery; the need for performers; the need for consumables.

Based on these indicators, we calculated the statistical characteristics of the distribution of resource costs for the production of raw materials for bioethanol, taking into account the prices of equipment, consumables and salary as of 01.06.20. Based on official statistics on the value of crops in the western region of Ukraine, the quantitative values of the market value of raw materials for bioethanol and statistical indicators that characterize its variability are substantiated.

This variability is due to changes in the natural and climatic conditions of the region, which are taken into account during this modeling. Based on the specified data with use of Equations (12) and (13) the model of investor’s profit in projects for the production of raw materials for bioethanol is proved. On the basis of this model and using Equations (14)–(16), a quantitative assessment of the risk of investor’s profit in projects for the production of raw materials for bioethanol is performed.

To assess the risk of investor’s profit R(Ps) in projects for the production of raw materials for bioethanol the loss probability scale P(Ds) is used. According to this scale, an adverse event that is characterized by a condition Ps < 0 will occur at least once in the predicted period. In this case, the quantitative value of the probability of loss P(Ds) should be considered a measure of the risk of a given profit R(Ps) for investors:

- P(Ds) = 0…0.2—minimal risk of profit R(Ps);

- P(Ds)= 0.21…0.4—allowable risk of profit R(Ps);

- P(Ds)= 0.41…0.6—average risk of profit R(Ps);

- P(Ds)= 0.61…0.8—high risk of profit R(Ps);

- P(Ds)= 0.81…1.0—critical risk of profit R(Ps).

The obtained quantitative values using known imaging methods provide a display on the PC screen results of determining the risk of profit by investors and the distribution and integrated curve of its change. The developed application software is tested for adequacy according to the Mann Utney criterion, which confirms the adequacy of the obtained forecasted indicators of risk of profit by investors of projects for the production of agricultural raw materials for bioethanol. This software is intended to evaluate projects for the production of agricultural raw materials for bioethanol at the local and regional levels.

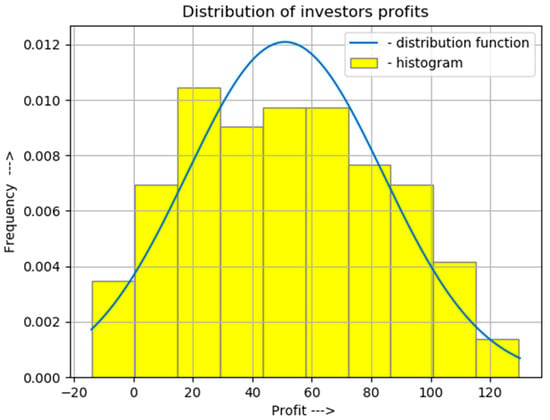

The developed application software for quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol is designed (Figure 2), using pre-justified distributions of investments in the project for the production of raw materials for bioethanol from wheat and its market value for a given project environment (Western region of Ukraine), conducting appropriate calculations and building the distribution of profits of investors in projects for the production of raw materials for bioethanol (Figure 4).

Figure 4.

Histogram and theoretical curve of profit distribution of investors of projects of production of raw materials for bioethanol from wheat.

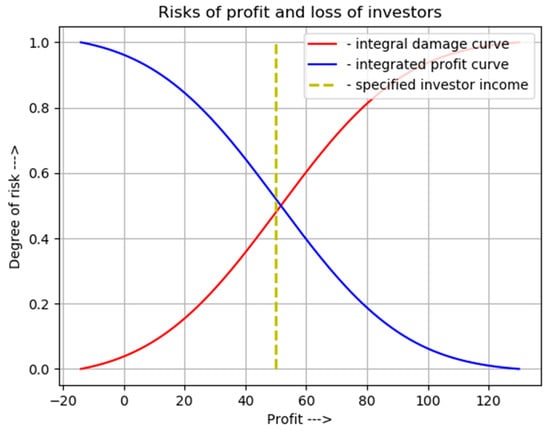

Based on the received distribution of profit of investors of projects of production of raw materials for bioethanol from wheat (Figure 4) integral curves of profit and loss for investors under the set requirements (minimum profit) are constructed (Figure 5).

Figure 5.

Integrated profit and loss curves for investors in the project of production of raw materials for bioethanol from wheat according to their requirements (minimum profit—Ps = 50$/ton).

Based on the conducted computer experiments the forecasted quantitative indicators of risk of investor’s profits in projects of production of raw materials for bioethanol from wheat for conditions of the Western region of Ukraine are established (Table 1).

Table 1.

Results of determination of the forecasted quantitative indicators of risk of profit of investors in projects of production of raw materials for bioethanol from wheat for conditions of the Western region of Ukraine.

From the received forecasted quantitative indicators of risk of investor’s profit in projects for production of raw materials for bioethanol from wheat for conditions of the Western region of Ukraine (Table 1) it is possible to tell that at growth of the minimum set profit of investors (from 10 to 70$/ton) of projects the probability of obtaining it is reduced from 0.89 to 0.34. Accordingly, the risk of profit by investors of these projects varies from the level of “acceptable” to the level of “high”.

The obtained results of the forecasted quantitative indicators of risk of investors’ profits of projects for production of raw materials for bioethanol from wheat for the conditions of the Western region of Ukraine indicate that the risk of profits by investors of these projects is variable and depends on their requirements (minimum expected investor profit). The proposed approach and the developed application software for quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol provide consideration of changing components of the project environment, substantiation of stochastic models of profit of these investors and patterns of change in their risk. The developed tools are also the basis for high-quality and accelerated management decisions to assess the level of risk of investors in projects for the production of raw materials for bioethanol.

In the proposed approach and the developed application software, the indicator of quantitative risk assessment of investors in projects for the production of raw materials for bioethanol is profit. This is due to the fact that this assessment is performed at the stage of project initiation, where it is important to convince the investor of the benefits he will receive. This is the investor’s profit. However, for a qualitative assessment of the budget for the implementation of projects for the production of raw materials for bioethanol should take into account the movement of funds over time. It is advisable for this to use an indicator such as the amount of discounted cash flows (NPV), which relates to this project. This criterion should be used during planning projects for the production of raw materials for bioethanol. Therefore, further research in this area requires the development of tools for planning projects for the production of raw materials for bioethanol, which will take into account the discounted cash flows and trends in this work to change the risk of profit by investors of these projects.

5. Discussion

The proposed approach to quantitative assessment of the risk of return of investors in projects for the production of raw materials for bioethanol involves the implementation of eight stages. In contrast to the existing tools, the proposed approach systematically takes into account the stochastic nature of many factors that determine the amount of investment in the project, as well as the stochastic nature of the market value of raw materials. Taking into account these stochastic components of the design environment of projects for the production of raw materials for bioethanol allows to obtain an accurate assessment of the level of risk of investors in projects for the production of raw materials for bioethanol, taking into account the requirements of investors.

For qualitative and accelerated quantitative assessment of the risk of profits of investors in projects for the production of raw materials for bioethanol based on a sound approach and the above theoretical principles developed application software in Python 3.8 Using the developed application software for the Western region of Ukraine investors of projects from 10 to 70 $/ton the probability of receiving it varies from 0.89 to 0.34. According to a reasonable scale, the level of risk of profit by investors of projects for the production of raw materials for bioethanol from wheat varies from acceptable to high. The developed tools are the basis for high-quality and accelerated establishing management decisions to assess the level of risk of investors in projects for the production of raw materials for bioethanol.

Further research should be conducted on establishing patterns of influence of natural-climatic and production components of the project environment on the quantitative value of the risk of profit of investors in projects for the production of raw materials for bioethanol. On their basis to coordinate the configurations of projects for the production of raw materials and biofuels in different natural and climatic conditions.

6. Conclusions

The proposed approach to quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol involves eight stages, which systematically take into account the stochastic nature of many factors that determine the amount of investment in the project and the stochastic nature of market value. Taking into account these stochastic components of the project environment of projects for the production of raw materials for bioethanol makes it possible to obtain an accurate assessment of the level of risk of investors in projects for the production of raw materials for bioethanol, taking into account the requirements of investors.

Using the developed application software of quantitative assessment of the risk of profit of investors in projects for the production of raw materials for bioethanol, stochastic models of profit of these investors and patterns of change in their risk for the Western region of Ukraine. Based on the research, it is established that the implementation of projects for the production of raw materials for wheat bioethanol with an increase in the minimum expected profit of investors of these projects from 10 to 70$/ton leads to a change in the probability of obtaining from 0.89 to 0.34. Simultaneously, according to a reasonable scale, the level of risk of profit by investors of these projects varies from acceptable to high.

Author Contributions

Conceptualization, A.T. and T.H.; methodology, I.T. and N.P.; literature review, N.K., database creation, D.K.; funding acquisition, S.T. All authors have read and agreed to the published version of the manuscript.

Funding

The article is published within the framework of the topic "Formation of Organizational and Economic Mechanism for Development Production of Biohydrogen From Biomass–Green Hydrogen" with the support of the International Visegrad Fund (www.visegradfund.org).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

20.12.2020.

Acknowledgments

Anonymous reviewers are gratefully acknowledged for their constructive review that significantly improved this manuscript and International Visegrad Fund (www.visegradfund.org).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Clerici, A.; Alimonti, G. World Energy Resources, EPJ Web of Conferences 98, 2015. Available online: https://www.epj-conferences.org/articles/epjconf/pdf/2015/17/epjconf_eps-sif_01001.pdf (accessed on 9 July 2020).

- Gupta, A.; Verna, J.P. Sustainable bio-ethanol production from agroresidues: A review. Renew. Sustain. Energy Rev. 2015, 41, 550–567. [Google Scholar] [CrossRef]

- Sahajwalla, V. Green processes: Transforming waste into valuable resources. Engineering 2018, 4, 309–310. [Google Scholar] [CrossRef]

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Boyarchuk, O.; Ftoma, O. Evaluation of Risk Value of Investors of Projects for the Creation of Crop Protection of Family Dairy Farms. Acta Univ. Agric. Silvic. Mendel. Brun. 2019, 67, 1357–1367. [Google Scholar] [CrossRef]

- Ashokkumar, V.; Salam, Z.; Tiwari, O.N.; Chinnasamy, S.; Mohammed, S.; Ani, F.N. An integrated approach for biodiesel and bioethanol production from Scenedesmus bijugatus cultivated in a vertical tubular photobioreactor. Energy Convers. Manag. 2015, 101, 778–786. [Google Scholar] [CrossRef]

- Batyuk, B.; Dyndyn, M. Coordination of configurations of complex organizational and technical systems for development of agricultural sector branches. J. Autom. Inf. Sci. 2020, 52, 63–76. [Google Scholar] [CrossRef]

- Syrotiuk, V.; Syrotyuk, S.; Ptashnyk, V.; Baranovych, S.; Gielzecki, J.; Jakubowski, T. A hybrid system with intelligent control for the processes of resource and energy supply of a greenhouse complex with application of energy renewable sources. Przegląd Elektrotechniczny 2020, 149–152. [Google Scholar] [CrossRef]

- Gródek-Szostak, Z.; Malik, G.; Kajrunajtys, D.; Szeląg-Sikora, A.; Sikora, J.; Kuboń, M.; Niemiec, M.; Kapusta-Duch, J. Modeling the Dependency between Extreme Prices of Selected Agricultural Products on the Derivatives Market Using the Linkage Function. Sustainability 2019, 11, 4144. [Google Scholar] [CrossRef]

- Szelag-Sikora, A.; Sikora, J.; Niemiec, M.; Gródek-Szostak, Z.; Kapusta-Duch, J.; Kubon, M.; Komorowska, M.; Karcz, J. Impact of Integrated and Conventional Plant Production on Selected Soil Parameters in Carrot Production. Sustainability 2019, 11, 5612. Available online: https://www.mdpi.com/2071-1050/11/20/5612 (accessed on 28 September 2020). [CrossRef]

- Kubon, M.; Kocira, S.; Kocira, A.; Leszczyńska, D. Use of Straw as Energy Source in View of Organic Matter Balance in Family Farms. In Renewable Energy Sources: Engineering, Technology, Innovation; Springer Proceedings in Energy; Springer: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Kubon, M.; Sikora, J.; Niemiec, M.; Olech, E.; Szeląg-Sikora, A. Energy Islands as a Potential Source of Securing the Energy Supply of Bio-Feedstock for Biogas Plants. In Renewable Energy Sources: Engineering, Technology, Innovation; Springer Proceedings in Energy; Springer: Cham, Switzerland, 2018; pp. 713–723. Available online: http://doi-org-443.webvpn.fjmu.edu.cn/10.1007/978-3-319-72371-6_70 (accessed on 30 September 2020).

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Ftoma, O. Forecasting of a Lifecycle of the Projects of Production of Biofuel Raw Materials With Consideration of Risks. Int. Conf. Adv. Trends Inf. Theory 2019, 420–425. [Google Scholar] [CrossRef]

- Tryhuba, A.; Boyarchuk, V.; Tryhuba, I.; Ftoma, O.; Padyuka, R.; Rudynets, M. Forecasting the risk of the resource demand for dairy farms basing on machine learning. In Proceedings of the 2nd International Workshop on Modern Machine Learning Technologies and Data Science, MoMLeT+DS 2020, Shatsk, Ukraine, 10 May 2020; Volume I, pp. 327–340. Available online: http://ceur-ws.org/Vol-2631/paper25.pdf (accessed on 26 September 2020).

- Kozina, T.; Ovcharuk, O.; Trach, I.; Levytska, V.; Ovcharuk, O.; Hutsol, T.; Mudryk, K.; Jewiarz, M.; Wrobel, M.; Dziedzic, K. Spread Mustard and Prospects for Biofuels. In Renewable Energy Sources: Engineering, Technology, Innovation; Mudryk, K., Werle, S., Eds.; Springer Proceedings in Energy; Springer: Cham, Switzerland, 2019; pp. 791–799. [Google Scholar] [CrossRef]

- Boyarchuk, V.; Tryhuba, I.; Ftoma, O.; Francik, S.; Rudynets, M. Method and Software of Planning of the Substantial Risks in the Projects of Production of raw Material for Biofuel. In Proceedings of the 1st International Workshop IT Project Management (ITPM 2020), Slavsko, Lviv Region, Ukraine, 18–20 February 2020; pp. 116–129. Available online: http://ceur-ws.org/Vol-2565/ (accessed on 25 September 2020).

- Havrylianchyk, R.; Bilyk, T.; Hutsol, T.; Osadchuk, O.; Mudryk, K.; Jewiarz, M.; Wróbel, M.; Dziedzic, K. Straw of Buckwheat as an Alternative Source of Biofuels. In Renewable Energy Sources: Engineering, Technology, Innovation; Springer Proceedings in Energy; Springer: Cham, Switzerland, 2020; pp. 323–329. [Google Scholar] [CrossRef]

- Sikora, J.; Niemiec, M.; Szeląg-Sikora, A.; Gródek-Szostak, Z.; Kubon, M.; Komorowska, M. The Effect of the Addition of a Fat Emulsifier on the Amount and Quality of the Obtained Biogas. Energies 2020, 13, 1825. [Google Scholar] [CrossRef]

- Sikora, J.; Niemiec, M.; Szelag-Sikora, A.; Kubon, M.; Olech, E.; Marczuk, A. Biogasification of wastes from industrial processing of carps. Przem. Chem. 2017, 96, 2275–2278. [Google Scholar]

- Tryhuba, A.; Ftoma, O.; Tryhuba, I.; Boyarchuk, O. Method of quantitative evaluation of the risk of benefits for investors of fodder-producing cooperatives. In Proceedings of the 14th International Scientific and Technical Conference on Computer Sciences and Information Technologies (CSIT), Lviv, Ukraine, 17–20 September 2019; Volume 3, pp. 55–58. [Google Scholar] [CrossRef]

- Korys, K.A.; Latawiec, A.E.; Grotkiewicz, K.; Kubon, M. The Review of Biomass Potential for Agricultural Biogas Production in Poland. Sustainability 2019, 11, 6515. Available online: https://www.mdpi.com/2071-1050/11/22/6515 (accessed on 30 September 2020). [CrossRef]

- Ratushny, R.; Bashynsky, O.; Ptashnyk, V. Development and Usage of a Computer Model of Evaluating the Scenarios of Projects for the Creation of Fire Fighting Systems of Rural Communities. In Proceedings of the XIth International Scientific and Practical Conference on Electronics and Information Technologies (ELIT-2019), Lviv, Ukraine, 16–18 September 2019; pp. 34–39. [Google Scholar] [CrossRef]

- Ratushny, R.; Bashynsky, O.; Shcherbachenko, O. Identification of firefighting system configuration of rural settlements, Fire and Environmental Safety Engineering. MATEC Web Conf. 2018, 247, 1–8. [Google Scholar] [CrossRef]

- Rudynets, M.; Pavlikha, N.; Kytsyuk, I.; Korneliuk, O.; Fedorchuk-Moroz, V.; Androshchuk, I.; Skorokhod, I.; Seleznov, D. Establishing patterns of change in the indicators of using milk processing shops at a community territory. East. Eur. J. Enterp. Technol. Control Process. 2019, 6, 57–65. [Google Scholar] [CrossRef]

- Hridin, O.; Slavina, N.; Mushenyk, I.; Dobrovolska, E. Managerial decisions in logistic systems of milk provision on variable production conditions. Indep. J. Manag. Prod. 2020, 11, 783–800. [Google Scholar] [CrossRef]

- Bashynskyi, O.; Medvediev, Y.; Slobodian, S.; Skorobogatov, D. Justification of models of changing project environment for harvesting grain, oilseed and legume crops. Indep. J. Manag. Prod. 2019, 10, 658–672. [Google Scholar] [CrossRef]

- Bochkovskii, A.; Gogunskii, V. Development of the method for the optimal management of occupational risks. East. Eur. J. Enterp. Technol. 2018, 3, 6–13. [Google Scholar] [CrossRef]

- Gabriel Rullo, P.; Costa-Castelló, R.; Roda, V.; Feroldi, D. Energy management strategy for a bioethanol isolated hybrid system: Simulations and experiments. Energies 2018, 11, 1362. [Google Scholar] [CrossRef]

- Kasprzak, K.; Wojtunik-Kulesza, K.; Oniszczuk, T.; Kuboń, M.; Oniszczuk, A. Secondary Metabolites, Dietary Fiber and Conjugated Fatty Acids as Functional Food Ingredients against Overweight and Obesity. Nat. Prod. Commun. 2018, 13, 1073–1082. [Google Scholar] [CrossRef]

- Bushuiev, S.; Bushuieva, N. Mechanisms of creation of value and performance of project-managerial organizations. East. Eur. J. Enterp. Technol. 2010, 43, 4–9. [Google Scholar]

- Hulida, E.; Pasnak, I.; Koval, O. Determination of the Critical Time of Fire in the Building and Ensure Successful Evacuation of People. Period. Polytech. Civ. Eng. 2019, 63, 308–316. [Google Scholar] [CrossRef]

- Sikora, J.; Niemiec, M.; Tabak, M.; Gródek-Szostak, Z.; Szeląg-Sikora, A.; Kuboń, M.; Komorowska, M. Assessment of the Efficiency of Nitrogen Slow-Release Fertilizers in Integrated Production of Carrot Depending on Fertilization Strategy. Sustainability 2020, 12, 1982. [Google Scholar] [CrossRef]

- Ahorsu, R.; Medina, F.; Constantí, M. Significance and challenges of biomass as a suitable feedstock for bioenergy and biochemical production: A review. Energies 2018, 11, 3366. [Google Scholar] [CrossRef]

- Demirbas, A. Bioethanol from cellulosic materials: A renewable motor fuel from biomass. Energy Sources 2005, 27, 327–337. [Google Scholar] [CrossRef]

- Philippidis, G.; Bartelings, H.; Helming, J.; M’barek, R.; Smeets, E.; Van Meijl, H. The good, the bad and the uncertain: Bioenergy use in the European Union. Energies 2018, 11, 2703. [Google Scholar] [CrossRef]

- Kubon, M.; Krasnodebski, A. Logistic cost in competitive strategies of enterprises. Agric. Econ. 2010, 56, 397–402. [Google Scholar] [CrossRef]

- Bashynsky, O. Coordination of dairy workshops projects on the community territory and their project environment. In Proceedings of the 14th International Scientific and Technical Conference on Computer Sciences and Information Technologies (CSIT), Lviv, Ukraine, 17–20 September 2019; Volume 3, pp. 51–54. [Google Scholar] [CrossRef]

- Kucher, O.; Hutsol, T.; Zavalniuk, K. Marketing strategies and prognoses of development of the Renewable Energy market in Ukraine. In Scientific Achievements in Agricultural Engineering, Agronomy and Veterinary Medicine; Traicon: Krakow, Poland, 2017; pp. 100–121. Available online: http://188.190.33.56:7980/jspui/handle/123456789/905 (accessed on 18 September 2020).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).