Business Models for Carbon Capture, Utilization and Storage Technologies in the Steel Sector: A Qualitative Multi-Method Study

Abstract

:1. Introduction

2. Background

3. Business Model Theory

3.1. Business Models for Sustainability

3.2. CCUS Business Models

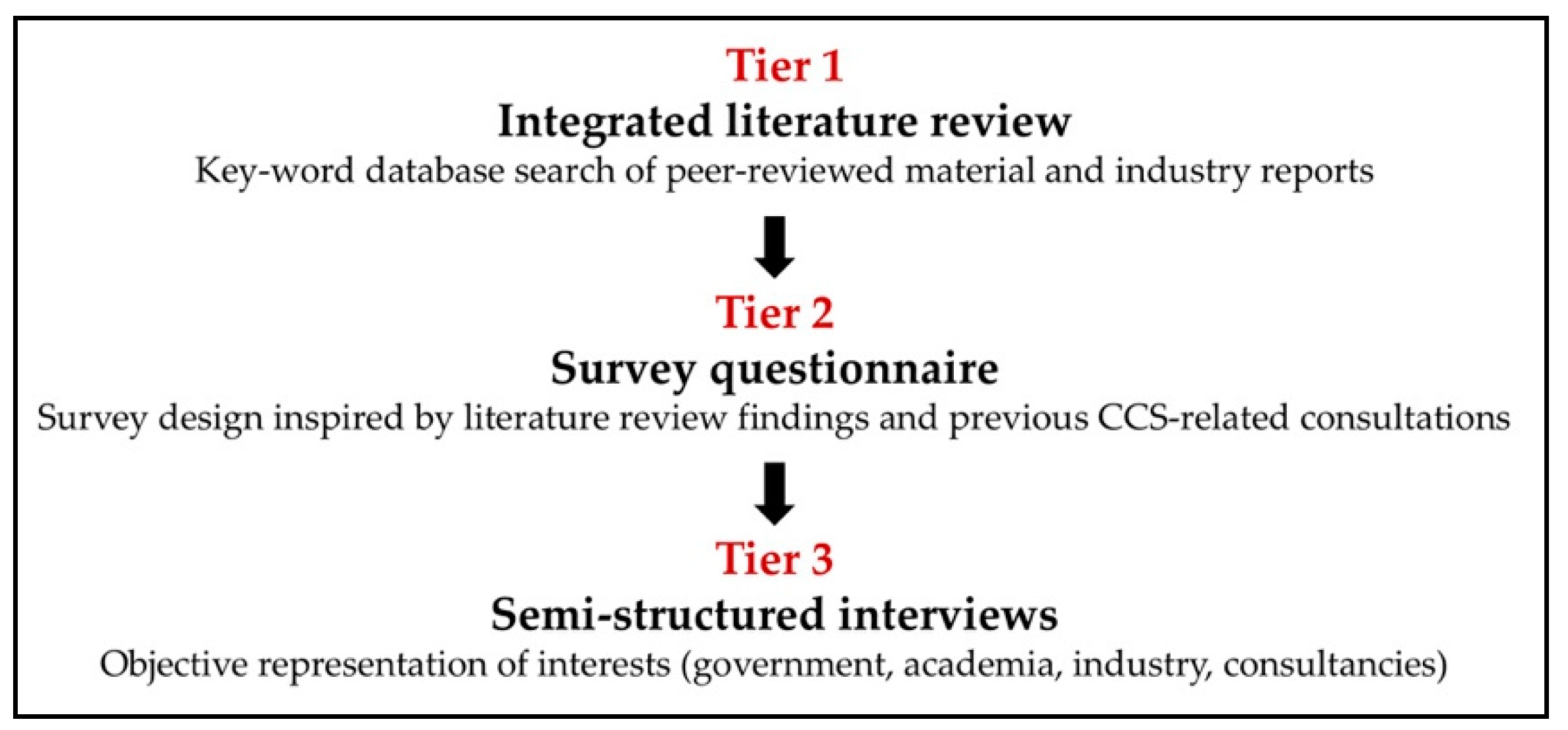

4. Materials and Methods

4.1. Review of Relevant Literature

4.2. Questionnaire Design

4.3. Semi-Structured Interviews

5. Results and Discussion

5.1. Literature on CCUS Business Models

5.2. Literature on CCUS Value Chain

5.3. Classification of CCUS Business Models

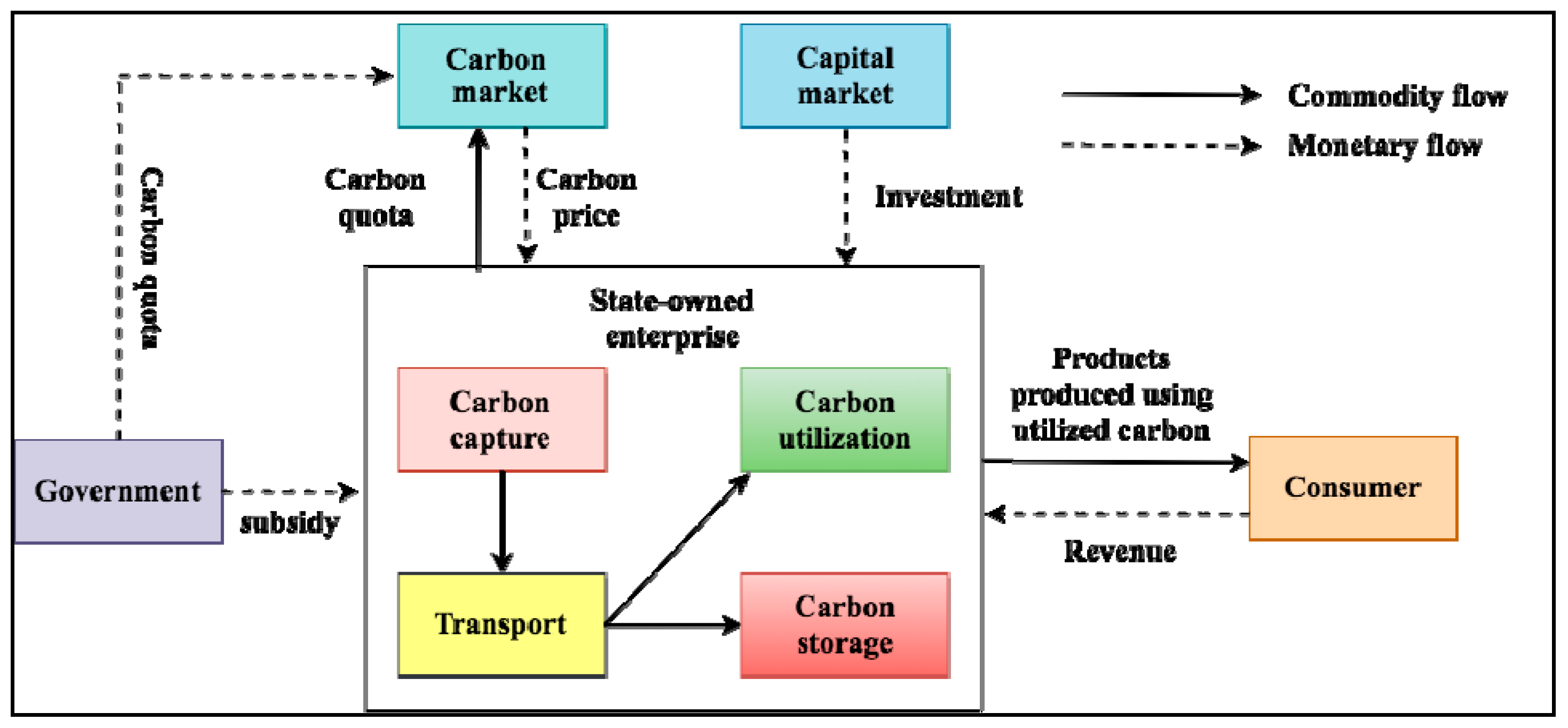

5.3.1. Vertically Integrated CCUS Business Model

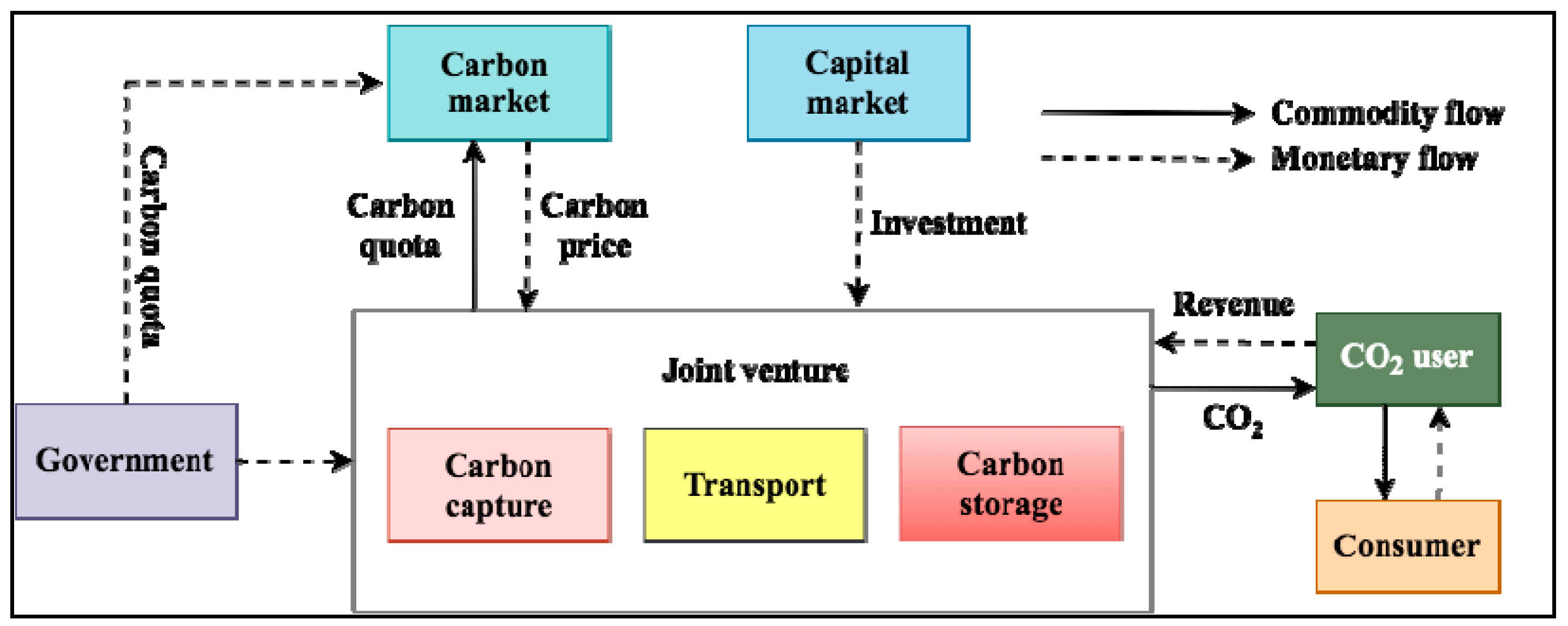

5.3.2. Joint Venture CCUS Business Model

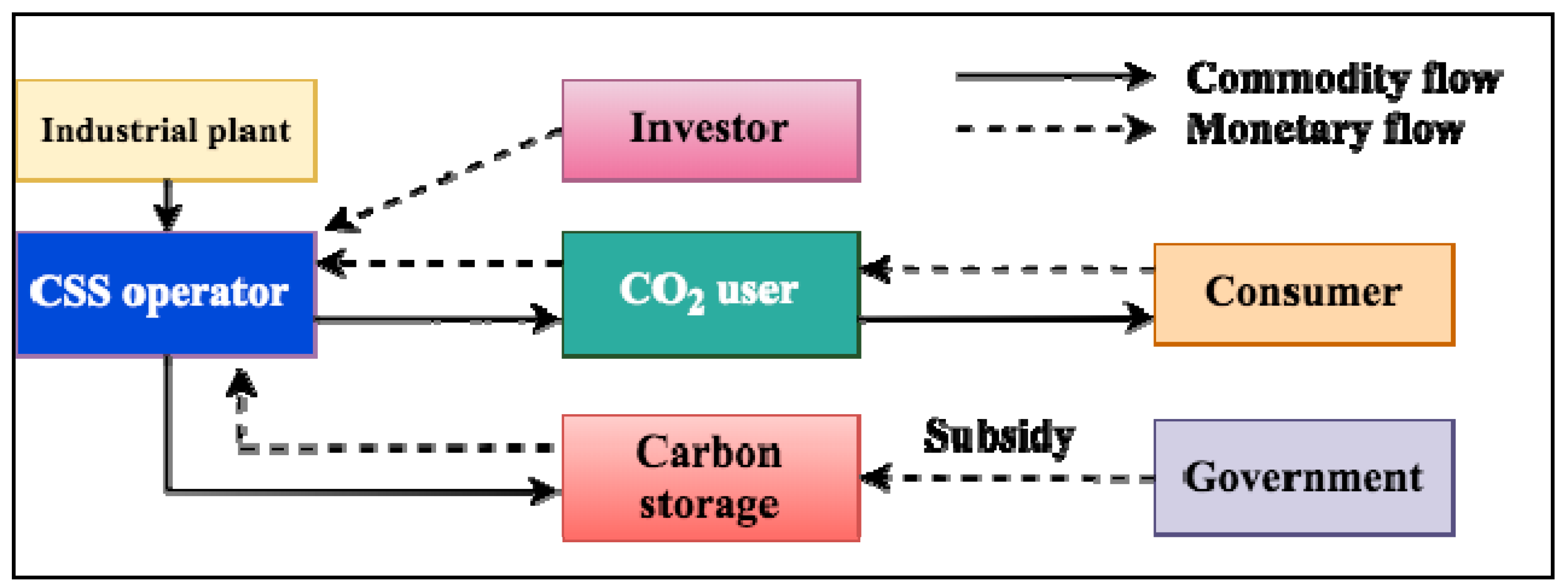

5.3.3. CCUS Operator Business Model

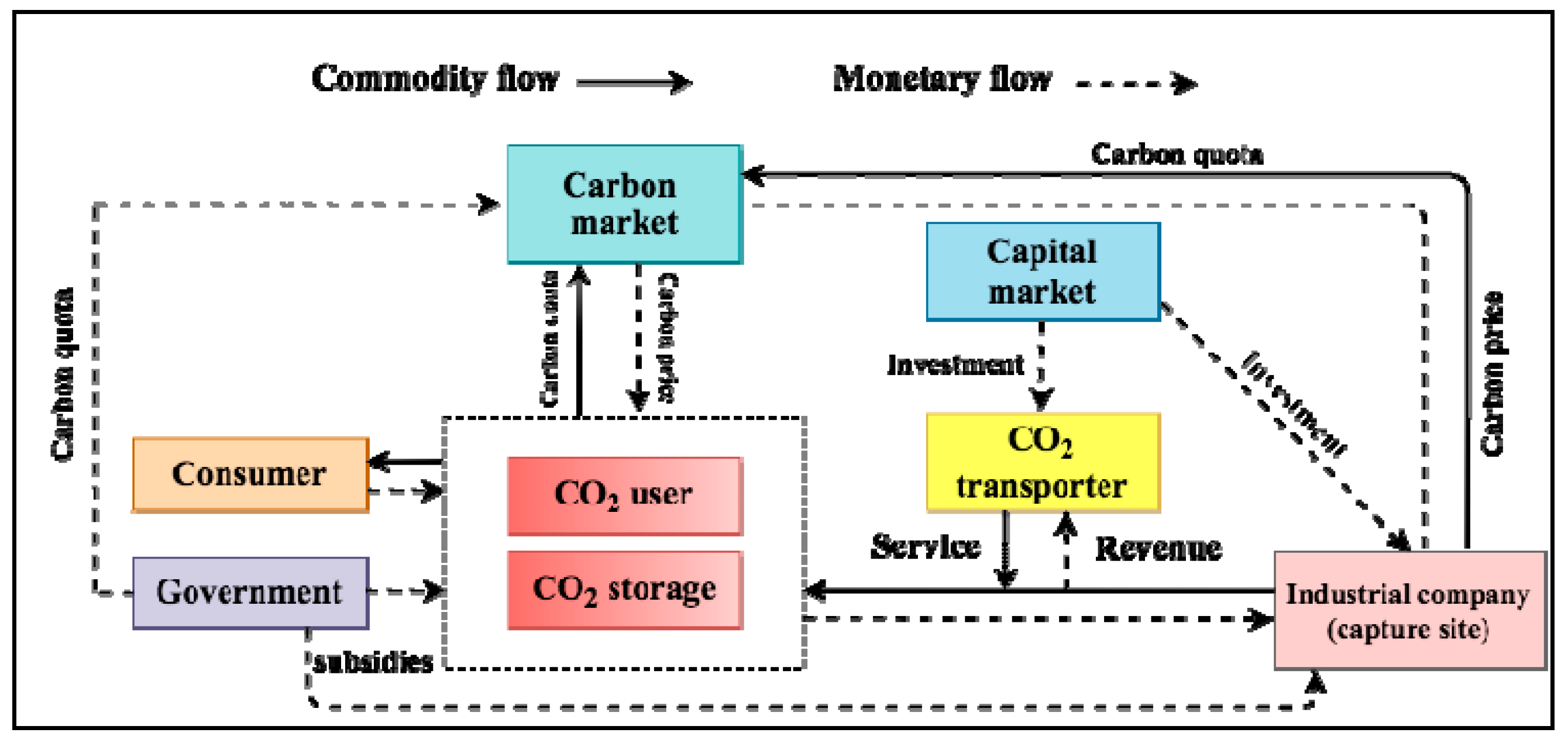

5.3.4. CCUS Transporter Business Model

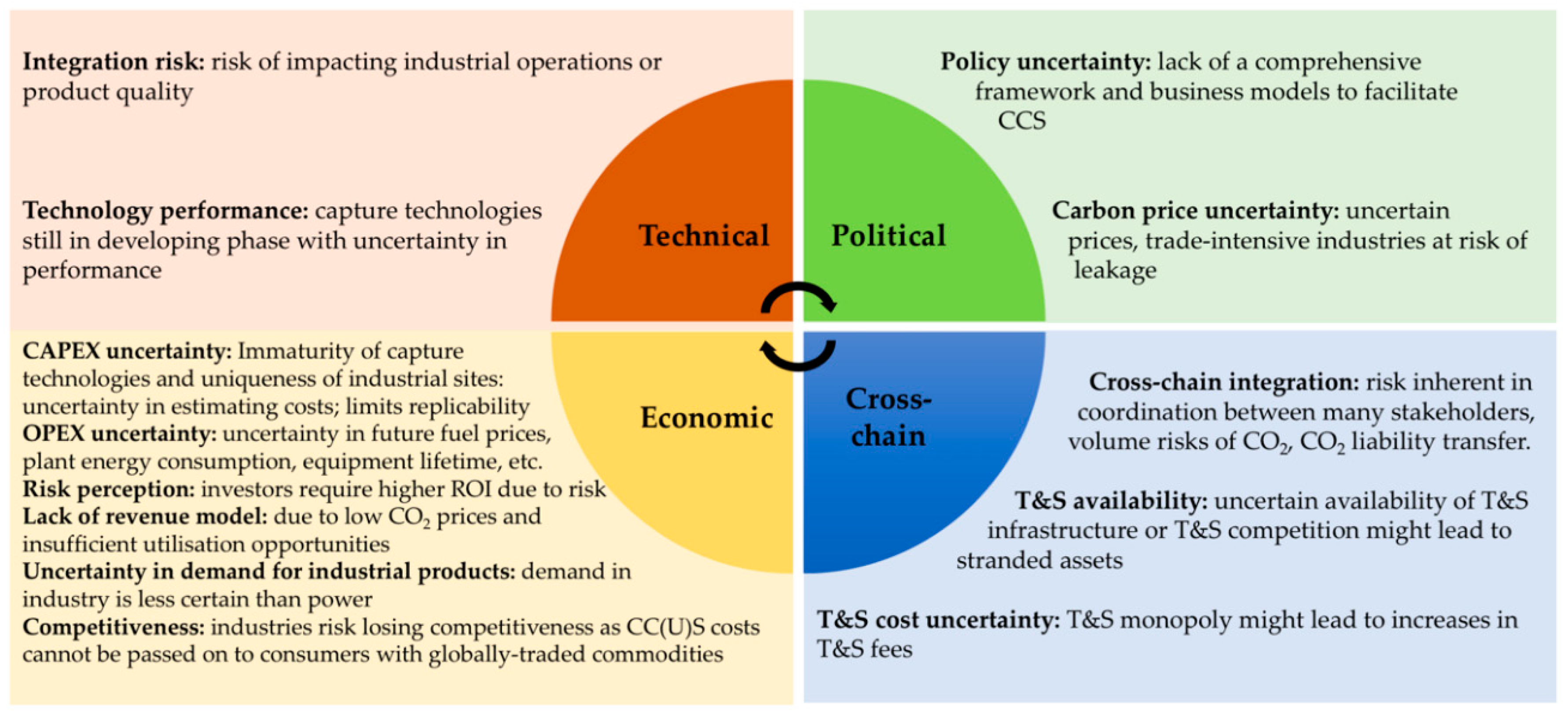

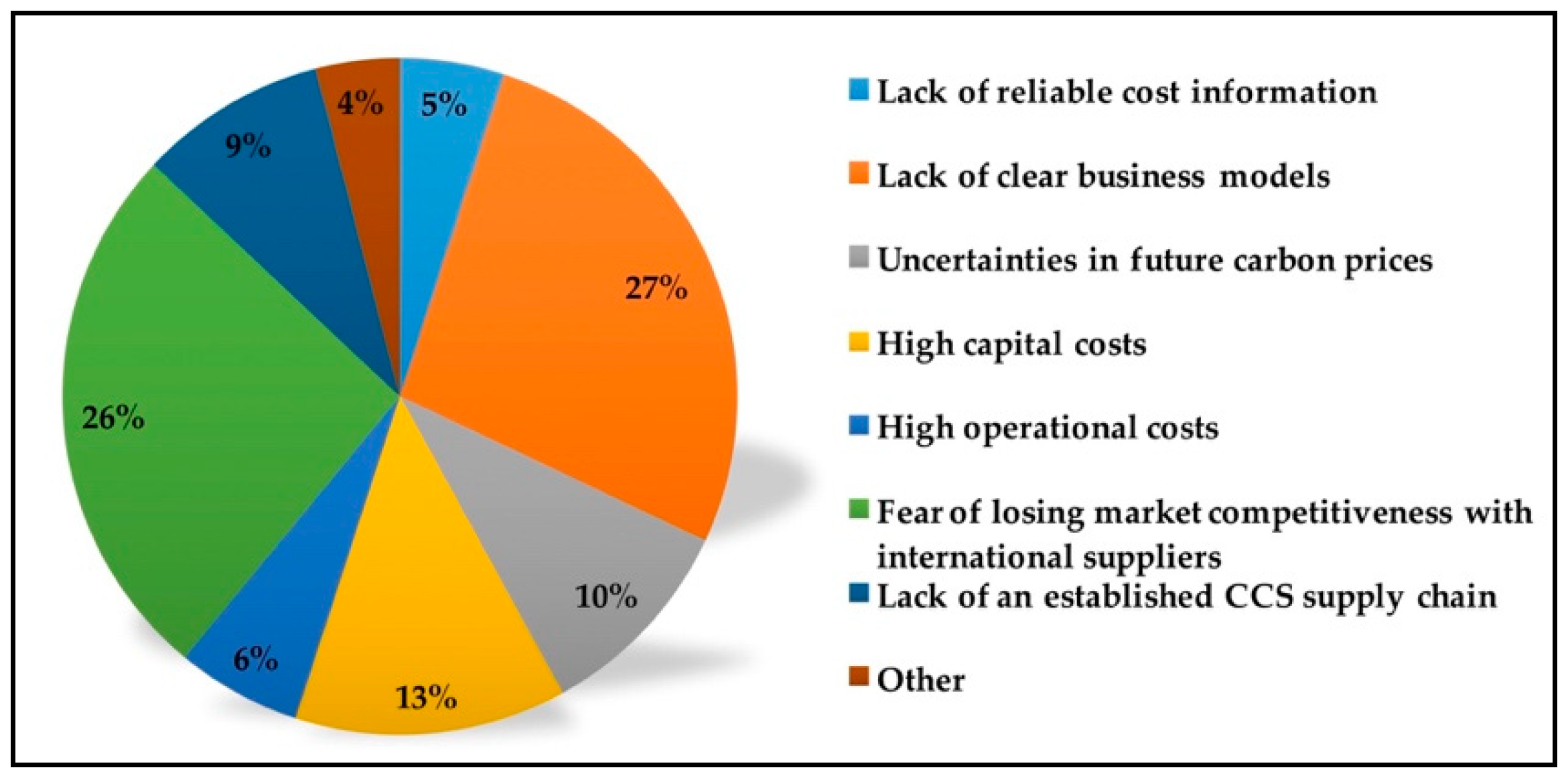

5.4. Challenges of CCUS Implementation in the Steel Sector

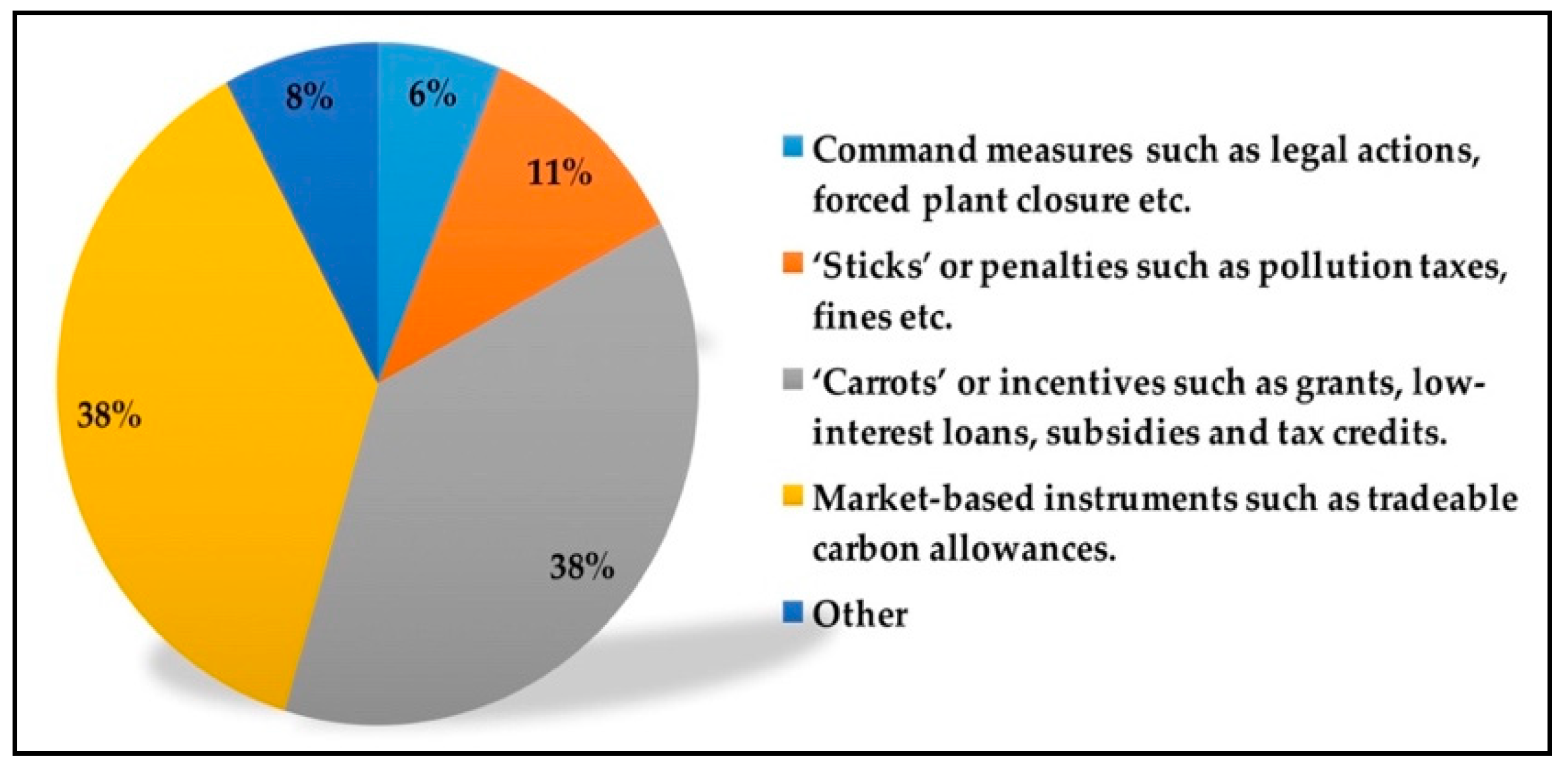

5.5. Enablers of CCUS Business Models in the Steel Sector

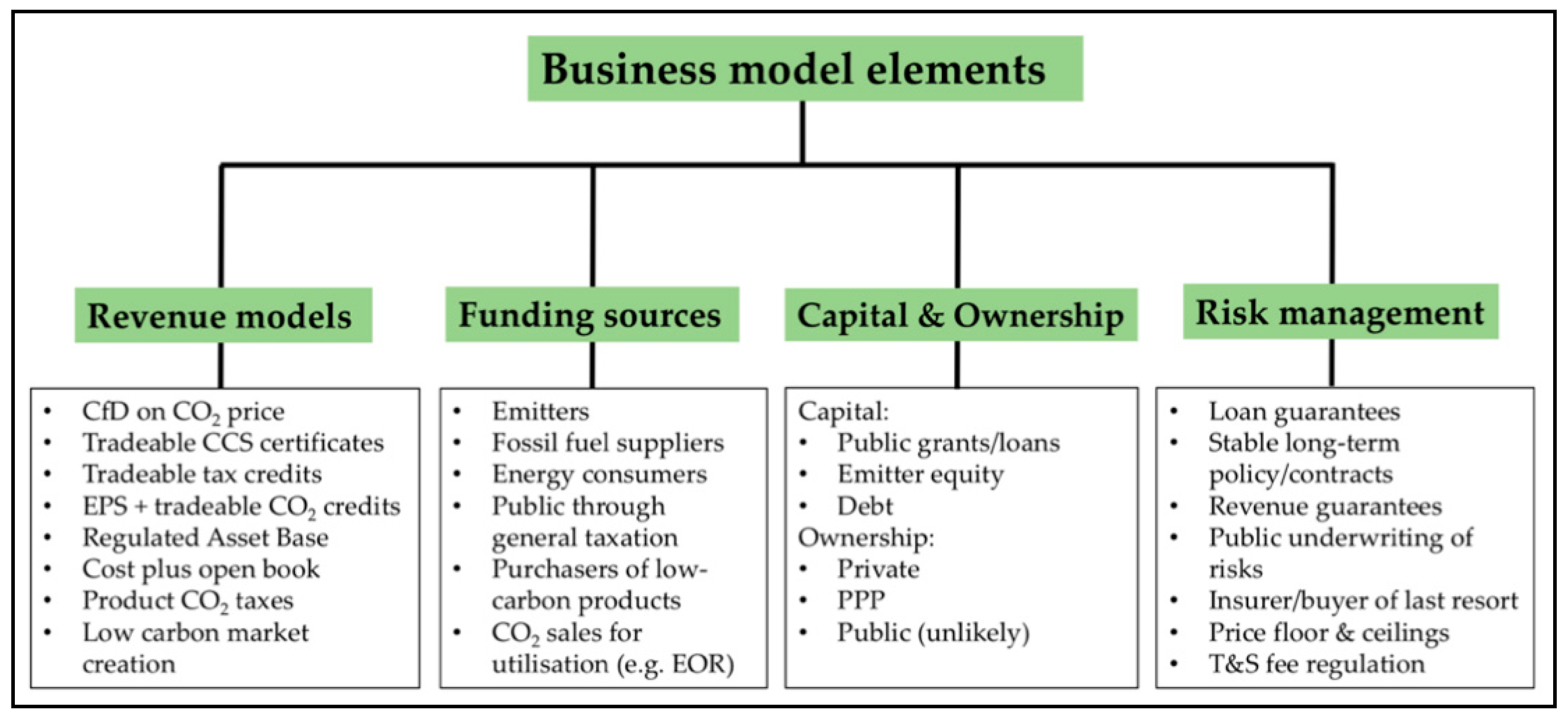

5.6. Business Model Elements

5.6.1. Revenue Models

- Contracts for Difference (CfD)

- Tax credits

- CCS certificates, with obligation

- Carbon tax

- Cost plus mechanism

- Regulated Asset Base (RAB)

- Carbon credits plus EPS

- Low-carbon product market creation

5.6.2. Funding Sources

- Emitters

- Fossil-fuel suppliers

- Gas consumers

- Industrial product consumers

- Public through general taxation

- CO2 utilization (e.g., EOR)

5.6.3. Risk Management

6. Conclusions

- A need for government support to develop a transport & storage infrastructure, as companies remain hesitant to take the first initiative in capturing emissions without guarantee of emission exit points and hence of revenue generation. This resonates with findings of recent studies and is further reflected in the UK’s move towards decoupling capture business models from T&S business models [16,91]. For industrial sectors such as steel, the move towards decoupling T&S from capture business models is especially relevant as failure to do so will translate to higher production costs and smaller profit margins, and hence to higher risks of losing international competitiveness in the absence of hedging mechanisms. Moreover, as T&S experience and knowledge of building pipeline infrastructure are more readily existent in the power sector, an opportunity emerges for industries to share infrastructure with the power sector, given a proximity of industrial clusters to geological storage sites or major users of captured CO2. The effects of these economies of scale would also be more easily captured by the steel industry in particular, as steel plants are generally located closer to the coast, while cement kilns are often located close to inland mining facilities [149].

- Creation of a clear risk-allocation system along the full CCUS chain.

- Establishment a CCUS-specific regulatory framework.

- Ensuring if CCUS becomes a mainstream technology for reducing emissions in the industrial/steel sector, that mechanisms are in place such that companies do not risk losing international competitiveness.

- Customer-driven rewards, due to increased customer demands for carbon-free material, a market for which could be established within the next 5–10 years.

- Regulator-imposed penalties, such as a stringent carbon price in the form of a carbon penalty for additional CO2 emissions emitted above a certain benchmark or per absolute tCO2 emitted.

- Shareholder-related pressures, as shareholders become more vocal about a need to decarbonize the industry.

- Defining long-term storage liability; which should be borne by the state or by an insurance company, and not by a private enterprise, as private enterprises are likely unwilling to bear such a long-term burden on their balance sheets;

- Provision of low-interest loans for an emerging industry; such as loan guarantees at reasonable rates provided by development banks; and

- Embedding R&D initiatives on individual parts of the full chain within a strategic CCUS-specific masterplan which ensures that investment streams and the industry’s efforts are in sync and are decoupled from political changes which may occur every five years.

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Rogelj, J.; Den Elzen, M.; Höhne, N.; Fransen, T.; Fekete, H.; Winkler, H.; Meinshausen, M. Paris Agreement climate proposals need a boost to keep warming well below 2 C. Nature 2016, 534, 631. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- United Nations Framework Convention on Climate Change. Report of the Conference of the Parties on its Twenty-First Session, Held in Paris from 30 November to 13 December 2015. 2016. Available online: https://unfccc.int/resource/docs/2015/cop21/eng/10.pdf (accessed on 29 March 2020).

- Global CCS Institute. Global Status of CCS 2019—Targeting Climate Change. 2019. Available online: https://www.globalccsinstitute.com/resources/global-status-report/ (accessed on 2 May 2020).

- International Energy Agency. World Energy Outlook 2019, IEA, Paris, France. 2019. Available online: https://www.iea.org/reports/world-energy-outlook-2019 (accessed on 1 May 2020).

- International Energy Agency. 20 Years of Carbon Capture and Storage—Accelerating Future Development. 2016. Available online: https://www.actu-environnement.com/media/pdf/news-28794-20-years-carbon-capture-storage.pdf (accessed on 1 May 2020).

- International Panel on Climate Change. Climate Change 2014: Synthesis Report. In Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC: Geneva, Switzerland, 2014. [Google Scholar]

- Rodrigues, C.F.A.; Dinis, M.A.P.; de Sousa, M.J.L. Review of European energy policies regarding the recent “carbon capture, utilization and storage” technologies scenario and the role of coal seams. Environ. Earth Sci. 2015, 74, 2553–2561. [Google Scholar] [CrossRef]

- Leeson, D.; Mac Dowell, N.; Shah, N.; Petit, C.; Fennell, P.S. A Techno-economic analysis and systematic review of carbon capture and storage (CCS) applied to the iron and steel, cement, oil refining and pulp and paper industries, as well as other high purity sources. Int. J. Greenh. Gas Control 2017, 61, 71–84. [Google Scholar] [CrossRef]

- Quader, M.A.; Ahmed, S.; Ghazilla, R.A.R.; Ahmed, S. A comprehensive review on energy efficient CO2 breakthrough technologies for sustainable green iron and steel manufacturing. Renew. Sustain. Energy Rev. 2015, 50, 594–614. [Google Scholar] [CrossRef]

- World Steel Association. Steel’s Contribution to a Low Carbon Future and Climate Resilient Societies. Worldsteel Position Paper. 2020. Available online: https://www.worldsteel.org/en/dam/jcr:7ec64bc1-c51c-439b-84b8-94496686b8c6/Position_paper_climate_2020_vfinal.pdf (accessed on 1 May 2020).

- Karali, N.; Xu, T.; Sathaye, J. Reducing energy consumption and CO2 emissions by energy efficiency measures and international trading: A bottom-up modeling for the US iron and steel sector. Appl. Energy 2014, 120, 133–146. [Google Scholar] [CrossRef]

- Napp, T.A.; Gambhir, A.; Hills, T.P.; Florin, N.; Fennell, P.S. A review of the technologies, economics and policy instruments for decarbonising energy-intensive manufacturing industries. Renew. Sustain. Energy Rev. 2014, 30, 616–640. [Google Scholar] [CrossRef]

- Morrow, W.R., III; Hasanbeigi, A.; Sathaye, J.; Xu, T. Assessment of energy efficiency improvement and CO2 emission reduction potentials in India’s cement and iron & steel industries. J. Clean. Prod. 2014, 65, 131–141. [Google Scholar]

- He, K.; Wang, L. A review of energy use and energy-efficient technologies for the iron and steel industry. Renew. Sustain. Energy Rev. 2017, 70, 1022–1039. [Google Scholar] [CrossRef]

- Liang, X.; Lin, Q.; Jiang, M.; Ascui, F.; Lu, D.; Muslemani, H.; Qing, S.; Ren, L.; Wang, L.; Liang, K. Lower carbon technology approaches for steel manufacturing in China. Appl. Energy 2020. under review. [Google Scholar]

- Element Energy. Industrial Carbon Capture Business Models: Report for the Department for Business, Energy and Industrial Strategy. 2018. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/759286/BEIS_CCS_business_models.pdf (accessed on 2 April 2020).

- Element Energy and Vivid Economics. Policy Mechanisms to Support the Large-Scale Deployment of Carbon Capture and Storage. 2018. Available online: http://www.element-energy.co.uk/wordpress/wp-content/uploads/2018/05/Element-Energy-Vivid-Economics-Report-CCS-Market-Mechanisms.pdf (accessed on 16 March 2020).

- Kapetaki, Z.; Scowcroft, J. Overview of carbon capture and storage (CCS) demonstration project business models: Risks and enablers on the two sides of the Atlantic. Energy Procedia 2017, 114, 6623–6630. [Google Scholar] [CrossRef]

- Pöyry and Teesside Collective. A Business Case for a UK Industrial CCS Support Mechanism. A Pöyry Report on Behalf of and in Partnership with Teesside Collective. 2017. Available online: http://www.teessidecollective.co.uk/wp-content/uploads/2017/02/0046_TVCA_ICCSBusinessModels_FinalReport_v200.pdf (accessed on 19 March 2020).

- Esposito, R.; Monroe, L.; Friedman, J.S. Deployment models for commercialized carbon capture and storage. Environ. Sci. Technol. 2011, 45, 139–146. [Google Scholar] [CrossRef] [PubMed]

- Kheshgi, H.; Crookshank, S.; Cunha, P.; Lee, A.; Bernstein, L.; Siveter, R. Carbon capture and storage business models. Energy Procedia 2009, 1, 4481–4486. [Google Scholar] [CrossRef] [Green Version]

- Yao, X.; Zhong, P.; Zhang, X.; Zhu, L. Business model design for the carbon capture utilization and storage (CCUS) project in China. Energy Policy 2018, 121, 519–533. [Google Scholar] [CrossRef]

- CCUS Advisory Group (CAG). Investment Frameworks for Development of CCUS in the UK. CAG Final Report, London, United Kingdom. 2019. Available online: http://www.ccsassociation.org/files/4615/6386/6542/CCUS_Advisory_Group_Final_Report_22_July_2019.pdf (accessed on 28 March 2020).

- Department of Business, Energy and Industrial Strategy. Business Models for Carbon Capture, Usage and Storage: A Consultation Seeking Views on Potential Business Models for Carbon Capture, Usage and Storage. 2019. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/819648/ccus-business-models-consultation.pdf (accessed on 2 February 2020).

- International Energy Agency. ETP 2015: Iron & Steel Findings. OECD Steel Committee Meeting, Paris, France. 2015. Available online: https://www.oecd.org/sti/ind/Item%208b%20-%20IEA_ETP2015_OECD%20Steel%20Committee_final.pdf (accessed on 7 February 2020).

- International Panel on Climate Change. IPCC Special Report on Carbon Dioxide Capture and Storage. In Prepared by Working Group III of the Intergovernmental Panel on Climate Change; IPCC: Cambridge, UK, 2005. [Google Scholar]

- Hasanbeigi, A.; Morrow, W.; Sathaye, J.; Masanet, E.; Xu, T. A bottom-up model to estimate the energy efficiency improvement and CO2 emission reduction potentials in the Chinese iron and steel industry. Energy. 2013, 50, 315–325. [Google Scholar] [CrossRef]

- Pardo, N.; Moya, J.A. Prospective scenarios on energy efficiency and CO2 emissions in the European Iron & Steel industry. Energy 2013, 54, 113–128. [Google Scholar]

- Environmental Protection Agency. Available and Emerging Technologies for Reducing Greenhouse Gas Emissions from the Iron and Steel Industry. North Carolina, USA. 2012. Available online: https://www.epa.gov/sites/production/files/2015-12/documents/ironsteel.pdf (accessed on 3 March 2020).

- International Energy Agency. Energy Technology Perspective 2012. Paris, France. 2012. Available online: https://www.iea.org/reports/energy-technology-perspectives-2012 (accessed on 28 February 2020).

- Integrated Pollution Prevention and Control. Best Available Techniques Reference Document for Iron and Steel Production. 2013. Available online: http://eippcb.jrc.es/reference/BREF/IS_Adopted_03_2012.pdf (accessed on 28 March 2020).

- Lin, B.; Wang, X. Carbon emissions from energy intensive industry in China: Evidence from the iron & steel industry. Renew. Sustain. Energy Rev. 2015, 47, 746–754. [Google Scholar]

- Kushnir, D.; Hansen, T.; Vogl, V.; Åhman, M. Adopting hydrogen direct reduction for the Swedish steel industry: A technological innovation system (TIS) study. J. Clean. Prod. 2020, 242, 118185. [Google Scholar] [CrossRef]

- Burchart-Korol, D.; Pichlak, M.; Kruczek, M. Innovative technologies for greenhouse gas emission reduction in steel production. Metalurgija 2016, 55, 119–122. [Google Scholar]

- Todorut, A.V.; Cirtina, D.; Cirtina, L.M. CO2 abatement in the iron and steel industry-the case for carbon capture and storage (CCS). Metalurgija 2017, 56, 259–261. [Google Scholar]

- Tan, X.; Seligsoh, D. Efficiency in the steel sector. Bus. Public Adm. Studies. 2011, 6, 59. [Google Scholar]

- Hayek, F.A. Studies in Philosophy, Politics, and Economics; University of Chicago Press: Chicago, IL, USA, 1967. [Google Scholar]

- Amit, R.; Zott, C. Value creation in e-business. Strateg. Manag. J. 2001, 22, 493–520. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons: Hoboken, NJ, USA, 2010. [Google Scholar]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Osterwalder, A. The Business Model Ontology a Proposition in a Design Science Approach. Ph.D. Thesis, Faculty of Business Studies, University of Lausanne, Lausanne, Switzerland, 2004. [Google Scholar]

- Doganova, L.; Eyquem-Renault, M. What do business models do? Innovation devices in technology entrepreneurship. Res. Policy. 2009, 38, 1559–1570. [Google Scholar] [CrossRef] [Green Version]

- Schaltegger, S.; Lüdeke-Freund, F.; Hansen, E.G. Business cases for sustainability: The role of business model innovation for corporate sustainability. Int. J. Innov. Sustain. Dev. 2012, 6, 95–119. [Google Scholar] [CrossRef]

- Brenner, S.N.; Cochran, P. The stakeholder theory of the firm: Implications for business and society theory and research. In Proceedings of the international association for business and society, Sundance, UT, USA, 22–24 March 1991; Volume 2, pp. 897–933. [Google Scholar]

- Key, S. Toward a new theory of the firm: A critique of stakeholder “theory”. Manag. Decis. 1999, 37, 317–328. [Google Scholar] [CrossRef]

- Stormer, F. Making the shift: Moving from ‘ethics pays’ to an inter-systems model of business. J. Bus. Ethics 2003, 44, 279–289. [Google Scholar] [CrossRef]

- Freeman, R.E.; Gllbert, D.R., Jr. Business, ethics and society: A critical agenda. Bus. Soc. 1992, 31, 9–17. [Google Scholar] [CrossRef]

- Shrivastava, P. Ecocentric management for a risk society. Acad. Manag. Rev. 1995, 20, 118–137. [Google Scholar] [CrossRef]

- Griffiths, A.; Petrick, J.A. Corporate architectures for sustainability. Int. J. Oper. Prod. Manag. 2001, 21, 1573–1585. [Google Scholar] [CrossRef]

- Doppelt, B. Leading Change toward Sustainability: A Change-Management Guide for Business, Government and Civil Society; Routledge: Abingdon, UK, 2017. [Google Scholar]

- Sharma, S. Research in corporate sustainability: What really matters. In Research in Corporate Sustainability: The Evolving Theory and Practice of Organizations in the Natural Environment; Edward Elgar Publishing: Cheltenham, UK, 2002; pp. 1–29. [Google Scholar]

- Stubbs, W.; Cocklin, C. Conceptualizing a “sustainability business model”. Organ. Environ. 2008, 21, 103–127. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Sindakis, S.; Walter, C. Business model innovation as lever of organizational sustainability. J. Technol. Transf. 2015, 40, 85–104. [Google Scholar] [CrossRef]

- Evans, S.; Vladimirova, D.; Holgado, M.; Van Fossen, K.; Yang, M.; Silva, E.A.; Barlow, C.Y. Business model innovation for sustainability: Towards a unified perspective for creation of sustainable business models. Bus. Strategy Environ. 2017, 26, 597–608. [Google Scholar] [CrossRef]

- Nidumolu, R.; Prahalad, C.K.; Rangaswami, M.R. Why sustainability is now the key driver of innovation. Harv. Bus. Rev. 2009, 87, 56–64. [Google Scholar]

- Bocken, N.M.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef] [Green Version]

- Porter, M.E.; Van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Greenstone, M. Estimating regulation-induced substitution: The effect of the Clean Air Act on water and ground pollution. Am. Econ. Rev. 2003, 93, 442–448. [Google Scholar] [CrossRef] [Green Version]

- Brown, J.D.; Wahlers, R.G. The environmentally concerned consumer: An exploratory study. J. Mark. Theory Pract. 1998, 6, 39–47. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The determinants of an environmentally responsive firm: An empirical approach. J. Environ. Econ. Manag. 1996, 30, 381–395. [Google Scholar] [CrossRef]

- Wheale, P.; Hinton, D. Ethical consumers in search of markets. Bus. Strategy Environ. 2007, 16, 302–315. [Google Scholar] [CrossRef]

- Orsato, R.J. Sustainability Strategies: When Does It Pay To Be Green? Palgrave Macmillan: London, UK, 2009; pp. 3–22. [Google Scholar]

- Massachusetts Institute of Technology (MIT). The Future of Coal. MIT Press. 2007. Available online: https://web.mit.edu/coal/ (accessed on 25 February 2020).

- Electric Power Research Institute (EPRI). The Power to Reduce CO2 Emissions: The full Portfolio 2009 Technical Report. 2009. Available online: https://www.epri.com/#/pages/product/1020389/?lang=en-US (accessed on 25 February 2020).

- Wu, X.D.; Yang, Q.; Chen, G.Q.; Hayat, T.; Alsaedi, A. Progress and prospect of CCS in China: Using learning curve to assess the cost-viability of a 2×600 MW retrofitted oxyfuel power plant as a case study. Renew. Sustain. Energy Rev. 2016, 60, 1274–1285. [Google Scholar] [CrossRef]

- Gaziulusoy, I.; Twomey, P. Emerging Approaches in Business Model Innovation Relevant to Sustainability and Low-Carbon Transitions. 2014. Available online: https://www.lowcarbonlivingcrc.unsw.edu.au/sites/all/files/publications_file_attachments/rp3008_emerging_approaches_in_business_model_innovation.pdf (accessed on 2 March 2020).

- Malone, E.L.; Bradbury, J.A.; Dooley, J.J. Keeping CCS stakeholder involvement in perspective. Energy Procedia 2009, 1, 4789–4794. [Google Scholar] [CrossRef] [Green Version]

- Liang, X.; Reiner, D.; Li, J. Perceptions of opinion leaders towards CCS demonstration projects in China. Appl. Energy 2011, 88, 1873–1885. [Google Scholar] [CrossRef]

- Ashworth, P.; Wade, S.; Reiner, D.; Liang, X. Developments in public communications on CCS. Int. J. Greenh. Gas Control 2015, 40, 449–458. [Google Scholar] [CrossRef]

- Gibbins, J.; Chalmers, H. Carbon capture and storage. Energy Policy 2008, 36, 4317–4322. [Google Scholar] [CrossRef] [Green Version]

- Hansson, A.; Bryngelsson, M. Expert opinions on carbon dioxide capture and storage—A framing of uncertainties and possibilities. Energy Policy 2009, 37, 2273–2282. [Google Scholar] [CrossRef]

- Herzog, H.J. Scaling up carbon dioxide capture and storage: From megatons to gigatons. Energy Econ. 2009, 33, 597–604. [Google Scholar] [CrossRef]

- Kern, F.; Gaede, J.; Meadowcroft, J.; Watson, J. The political economy of carbon capture and storage: An analysis of two demonstration projects. Technol. Forecast. Soc. Chang. 2016, 102, 250–260. [Google Scholar] [CrossRef]

- Kapetaki, Z.; Simjanović, J.; Hetland, J. European carbon capture and storage project network: Overview of the status and developments. Energy Procedia 2016, 86, 12–21. [Google Scholar] [CrossRef] [Green Version]

- Kainiemi, L.; Eloneva, S.; Toikka, A.; Levänen, J.; Järvinen, M. Opportunities and obstacles for CO2 mineralization: CO2 mineralization specific frames in the interviews of Finnish carbon capture and storage (CCS) experts. J. Clean. Prod. 2015, 94, 352–358. [Google Scholar] [CrossRef]

- Brunsting, S.; de Best-Waldhober, M.; Feenstra, C.Y.; Mikunda, T. Stakeholder participation practices and onshore CCS: Lessons from the Dutch CCS Case Barendrecht. Energy Procedia 2011, 4, 6376–6383. [Google Scholar] [CrossRef] [Green Version]

- Sala, R.; Oltra, C. Experts’ attitudes towards CCS technologies in Spain. Int. J. Greenh. Gas Control 2011, 5, 1339–1345. [Google Scholar] [CrossRef]

- Whittemore, R.; Knafl, K. The integrative review: Updated methodology. J. Adv. Nurs. 2005, 52, 546–553. [Google Scholar] [CrossRef] [PubMed]

- Torraco, R.J. Writing integrative literature reviews: Guidelines and examples. Hum. Resour. Dev. Rev. 2005, 4, 356–367. [Google Scholar] [CrossRef]

- Kohtala, C. Addressing sustainability in research on distributed production: An integrated literature review. J. Clean. Prod. 2015, 106, 654–668. [Google Scholar] [CrossRef] [Green Version]

- Kapila, R.V.; Chalmers, H.; Haszeldine, S.; Leach, M. CCS prospects in India: Results from an expert stakeholder survey. Energy Procedia 2011, 4, 6280–6287. [Google Scholar] [CrossRef] [Green Version]

- Johnsson, F.; Reiner, D.; Itaoka, K.; Herzog, H. Stakeholder attitudes on carbon capture and storage—An international comparison. Int. J. Greenh. Gas Control 2010, 4, 410–418. [Google Scholar] [CrossRef] [Green Version]

- Shackley, S.; Waterman, H.; Godfroij, P.; Reiner, D.; Anderson, J.; Draxlbauer, K.; Flach, T. Stakeholder perceptions of CO2 capture and storage in Europe: Results from a survey. Energy Policy 2007, 35, 5091–5108. [Google Scholar] [CrossRef] [Green Version]

- Bradburn, N.M.; Sudman, S.; Wansink, B. Asking Questions: The Definitive Guide to Questionnaire Design—For Market Research, Political Polls, and Social and Health Questionnaires; John Wiley & Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- Robinson, J.P.; Meadow, R. Polls Apart: A Call for Consistency in Surveys of Public Opinion on World Issues; Cabin, J.M.D., Ed.; Seven Locks Press: Santa Ana, CA, USA, 1982. [Google Scholar]

- Pätäri, S.; Sinkkonen, K. Energy service companies and energy performance contracting: Is there a need to renew the business model? Insights from a Delphi study. J. Clean. Prod. 2014, 66, 264–271. [Google Scholar] [CrossRef]

- Suhonen, N.; Okkonen, L. The energy services company (ESCO) as business model for heat entrepreneurship-a case study of north Karelia, Finland. Energy Policy 2013, 61, 783–787. [Google Scholar] [CrossRef]

- Pantaleo, A.; Candelise, C.; Bauen, A.; Shah, N. ESCO business models for biomass heating and CHP: Profitability of ESCO operations in Italy and key factors assessment. Renew. Sustain. Rev. 2014, 30, 237–253. [Google Scholar] [CrossRef]

- Spek, M.V.D.; Fernandez, E.S.; Eldrup, N.H.; Skagestad, R.; Ramirez, A.; Faaij, A. Unravelling uncertainty and variability in early stage techno-economic assessments of carbon capture technologies. Int. J. Greenh. Gas Control 2017, 56, 221–236. [Google Scholar] [CrossRef]

- Li, S.; Zhang, X.; Gao, L.; Jin, H. Learning rates and future cost curves for fossil fuel energy systems with CO2 capture: Methodology and case studies. Appl. Energy 2012, 93, 348–356. [Google Scholar] [CrossRef]

- Pale Blu Dot. CO2 Transportation and Storage Business Models: Summary Report. 2018. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/677721/10251BEIS_CO2_TS_Business_Models_FINAL.pdf (accessed on 3 February 2020).

- Višković, A.; Franki, V.; Valentić, V. CCS (carbon capture and storage) investment possibility in South East Europe: A case study for Croatia. Energy 2014, 70, 325–337. [Google Scholar] [CrossRef]

- Element Energy. Demonstrating CO2 capture in the UK cement, chemicals, iron and steel and oil refining sectors by 2025: A Techno-economic Study. DECC and BIS. 2014. Available online: http://www.element-energy.co.uk/wordpress/wp-content/uploads/2017/06/Element_Energy_DECC_BIS_Industrial_CCS_and_CCU_final_report_14052014.pdf (accessed on 2 February 2020).

- Global CCS Institute. The Global Status of CCS. Special Report: Introducing Industrial Carbon Capture and Storage. Melbourne, Australia. 2016, p. 14. Available online: https://hub.globalccsinstitute.com/sites/default/files/publications/201158/global-status-ccs-2016-summary-report.pdf (accessed on 15 March 2020).

- Zakkour, P.; Dixon, T.; Cook, G. Financing early opportunity CCS projects in emerging economies through the carbon market: Mitigation potential and costs. Energy Procedia 2011, 4, 5692–5699. [Google Scholar] [CrossRef] [Green Version]

- Pieri, T.; Nikitas, A.; Castillo-Castillo, A.; Angelis-Dimakis, A. Holistic assessment of carbon capture and utilization value chains. Environments 2018, 5, 108. [Google Scholar] [CrossRef] [Green Version]

- Jin, H.; Gao, L.; Li, S.; van Sembeek, E.; Porter, R.; Mikunda, T.; Dijkstra, J.W.; de Coninck, H.; Jansen, D. Supporting Early Carbon Capture Utilization and Storage Development in Non-Power Industrial Sectors, Shaanxi Province, China; Report No. 12; The Centre for Low Carbon Futures: Birmingham, UK, 2012. [Google Scholar]

- Centre for Low Carbon Futures. Carbon Capture and Utilization in the Green Economy: Using CO2 to Manufacture Fuel, Chemicals and Materials; The Centre for Low Carbon Futures: New York, NY, USA, 2011. [Google Scholar]

- Castillo-Castillo, A.; Angelis-Dimakis, A. Enabling CO2 reuse value chains. In Realising Long-Term Transitions towards Low Carbon Societies: Impulses from the 8th Annual Meeting of the International Research Network for Low Carbon Societies; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2017; pp. 86–87. [Google Scholar]

- Cuéllar-Franca, R.M.; Azapagic, A. Carbon capture, storage and utilisation technologies: A critical analysis and comparison of their life cycle environmental impacts. J. CO2 Util. 2015, 9, 82–102. [Google Scholar] [CrossRef]

- Muller, C. CO2 Capture and Storage CCS and the Industry of Carbon-Based Resources; ETH Zurich: Sonneggstrasse, Switzerland, 2017. [Google Scholar]

- Rubin, E.S.; Mantripragada, H.; Marks, A.; Versteeg, P.; Kitchin, J. The outlook for improved carbon capture technology. Prog. Energy Combust. Sci. 2012, 38, 630–671. [Google Scholar] [CrossRef]

- Kolster, C.; Mechleri, E.; Krevor, S.; Mac Dowell, N. The role of CO2 purification and transport networks in carbon capture and storage cost reduction. Int. J. Greenh. Gas Control 2017, 58, 127–141. [Google Scholar] [CrossRef]

- Spigarelli, B.P.; Kawatra, S.K. Opportunities and challenges in carbon dioxide capture. J. CO2 Util. 2013, 1, 69–87. [Google Scholar] [CrossRef]

- Patricio, J.; Angelis-Dimakis, A.; Castillo-Castillo, A.; Kalmykova, Y.; Rosado, L. Method to identify opportunities for CCU at regional level—Matching sources and receivers. J. CO2 Util. 2017, 22, 330–345. [Google Scholar] [CrossRef]

- Zakkour, P.; Cook, G. CCS Roadmap for Industry: High-Purity CO2 Sources; Carbon Counts Company Ltd.: London, UK, 2010. [Google Scholar]

- Fennell, P.S.; Florin, N.; Napp, T.; Hills, T. CCS from Industrial Sources. Sustainable Technologies, Systems and Policies, Carbon Capture and Storage Workshop 17. 2012. Available online: https://spiral.imperial.ac.uk/bitstream/10044/1/12706/4/2012%20-%20Sus_TSP%20CCS%20from%20industrial%20sources%20Napp%20et%20al.pdf (accessed on 24 February 2020).

- d’Amore, F.; Bezzo, F. Economic optimisation of European supply chains for CO2 capture, transport and sequestration. Int. J. Greenh. Gas Control 2017, 65, 99–116. [Google Scholar] [CrossRef]

- Kuramochi, T.; Ramírez, A.; Turkenburg, W.; Faaij, A. Comparative assessment of CO2 capture technologies for carbon-intensive industrial processes. Prog. Energy combust. Sci. 2012, 38, 87–112. [Google Scholar] [CrossRef]

- Element Energy and Carbon Counts. Demonstrating CO2 Capture in the UK Cement, Chemicals, Iron and Steel and Oil Refining Sectors by 2025: A Techno-Economic Study. PSCE, Imperial College, and University of Sheffield: Cambridge, UK. 2014. Available online: http://www.element-energy.co.uk/wordpress/wp-content/uploads/2017/06/Element_Energy_DECC_BIS_Industrial_CCS_and_CCU_final_report_14052014.pdf (accessed on 13 March 2020).

- Hassan, S.N.; Douglas, P.L.; Croiset, E. Techno-economic study of CO2 capture from an existing cement plant using MEA scrubbing. Int. J. Green Energy 2007, 4, 197–220. [Google Scholar] [CrossRef]

- Bosoaga, A.; Masek, O.; Oakey, J.E. CO2 capture technologies for cement industry. Energy Procedia 2009, 1, 133–140. [Google Scholar] [CrossRef] [Green Version]

- Davison, J.; Mancuso, L.; Ferrari, N. Costs of CO2 capture technologies in coal fired power and hydrogen plants. Energy Procedia 2014, 63, 7598–7607. [Google Scholar] [CrossRef] [Green Version]

- Kolstad, C.; Young, D. Cost Analysis of Carbon Capture and Storage for the Latrobe Valley; University of California: Santa Barbara, CA, USA, 2010; Available online: https://www.globalccsinstitute.com/archive/hub/publications/119726/cost-analysis-ccs-latrobe-valley.pdf (accessed on 21 February 2020).

- Borgert, K.J.; Rubin, E.S. Oxyfuel combustion: Technical and economic considerations for the development of carbon capture from pulverized coal power plants. Energy Procedia 2013, 37, 1291–1300. [Google Scholar] [CrossRef] [Green Version]

- Rubin, E.S.; Davison, J.E.; Herzog, H.J. The cost of CO2 capture and storage. Int. J. Greenh. Gas Control 2015, 40, 378–400. [Google Scholar] [CrossRef]

- Global CCS Institute. Accelerating the Uptake of CCS: Industrial Use of Captured Carbon Dioxide. Parsons Brickerhoff: New York, USA. 2011. Available online: https://www.globalccsinstitute.com/archive/hub/publications/14026/accelerating-uptake-ccs-industrial-use-captured-carbon-dioxide.pdf (accessed on 29 January 2020).

- Creamer, A.E.; Gao, B. Carbon Dioxide Capture: An Effective Way to Combat Global Warming, 1st ed.; Springer International Publishing: Berlin, Germany, 2015; pp. 17–24. [Google Scholar]

- Liang, X.; Lin, Q.; Muslemani, H.; Lei, M.; Liu, Q.; Li, J.; Wu, A.; Liu, M.; Ascui, F. Assessing the economics of CO2 capture in China’s iron/steel sector: A case study. Energy Procedia 2019, 158, 3715–3722. [Google Scholar]

- Abbas, Z.; Mezher, T.; Abu-Zahra, M.R. CO2 purification. Part I: Purification requirement review and the selection of impurities deep removal technologies. Int. J. Greenh. Gas Control 2013, 16, 324–334. [Google Scholar] [CrossRef]

- Abbas, Z.; Mezher, T.; Abu-Zahra, M.R. CO2 purification. Part II: Techno-economic evaluation of oxygen and water deep removal processes. Int. J. Greenh. Gas Control 2013, 16, 335–341. [Google Scholar] [CrossRef]

- Lee, J.Y.; Keener, T.C.; Yang, Y.J. Potential flue gas impurities in carbon dioxide streams separated from coal-fired power plants. J. Air Waste Manag. Assoc. 2009, 59, 725–732. [Google Scholar] [CrossRef] [PubMed]

- Wetenhall, B.; Race, J.M.; Downie, M.J. The effect of CO2 purity on the development of pipeline networks for carbon capture and storage schemes. Int. J. Greenh. Gas Control 2014, 30, 197–211. [Google Scholar] [CrossRef] [Green Version]

- Cole, I.S.; Corrigan, P.; Sim, S.; Birbilis, N. Corrosion of pipelines used for CO2 transport in CCS: Is it a real problem? Int. J. Greenh. Gas Control 2011, 5, 749–756. [Google Scholar] [CrossRef]

- Aspelund, A.; Mølnvik, M.J.; De Koeijer, G. Ship transport of CO2: Technical solutions and analysis of costs, energy utilization, exergy efficiency and CO2 emissions. Chem. Eng. Res. Des. 2006, 84, 847–855. [Google Scholar] [CrossRef]

- Morgan, D.; Grant, T. FE/NETL CO2 Transport Cost Model: Model Overview, Presentation, DOE/NETL-2014/1668; National Energy Technology Laboratory: Pittsburgh, PA, USA, 2014.

- Knoope, M.M.J.; Ramírez, A.; Faaij, A.P.C. A state-of-the-art review of techno-economic models predicting the costs of CO2 pipeline transport. Int. J. Greenh. Gas Control 2013, 16, 241–270. [Google Scholar] [CrossRef]

- Mallon, W.; Buit, L.; van Wingerden, J.; Lemmens, H.; Eldrup, N.H. Costs of CO2 transportation infrastructures. Energy Procedia 2013, 37, 2969–2980. [Google Scholar] [CrossRef] [Green Version]

- Brownsort, P. Ship Transport of CO2 for Enhanced Oil Recovery—Literature Survey; Scottish Carbon Capture & Storage: Edinburgh, UK, 2015. [Google Scholar]

- Kjärstad, J.; Skagestad, R.; Eldrup, N.H.; Johnsson, F. Ship transport—A low cost and low risk CO2 transport option in the Nordic countries. Int. J. Greenh. Gas Control 2016, 54, 168–184. [Google Scholar] [CrossRef]

- Weihs, G.F.; Kumar, K.; Wiley, D.E. Understanding the economic feasibility of ship transport of CO2 within the CCS chain. Energy Procedia 2014, 63, 2630–2637. [Google Scholar] [CrossRef] [Green Version]

- ZEP. The Costs of CO2 Capture, Transport and Storage-Post-Demonstration CCS in the EU; European Technology Platform for Zero Emission Fossil Fuel Power Plants: Brussels, Belgium, 2011. [Google Scholar]

- Aspelund, A.; Jordal, K. Gas conditioning – The interface between CO2 capture and transport. Int. J. Greenh. Gas Control 2007, 1, 343–354. [Google Scholar] [CrossRef]

- Linde. Available online: http://www.linde-gas.com/en/processes/freezing_and_cooling/metal_cooling/index.html (accessed on 12 March 2020).

- AHDB Horticulture. Available online: https://horticulture.ahdb.org.uk/sources-co2 (accessed on 27 February 2020).

- Linde. Gas Applications for the Pulp and Paper Industry; Linde North America Inc.: New York, NY, USA, 2012. [Google Scholar]

- Kuramochi, T.; Ramírez, A.; Turkenburg, W.; Faaij, A. Techno-economic prospects for CO2 capture from distributed energy systems. Renew. Sustain. Energy Rev. 2013, 19, 328–347. [Google Scholar] [CrossRef]

- Bodor, M.; Santos, R.; Gerven, T.; Vlad, M. Recent developments and perspectives on the treatment of industrial wastes by mineral carbonation—A review. Open Eng. 2013, 3, 566–584. [Google Scholar] [CrossRef] [Green Version]

- Agarwal, A.S.; Zhai, Y.; Hill, D.; Sridhar, N. The electrochemical reduction of carbon dioxide to formate/formic acid: Engineering and economic feasibility. ChemSusChem 2011, 4, 1301–1310. [Google Scholar] [CrossRef] [PubMed]

- Posten, C.; Schaub, G. Microalgae and terrestrial biomass as source for fuels—A process view. J. Biotechnol. 2009, 142, 64–69. [Google Scholar] [CrossRef] [PubMed]

- Ritter, J.A.; Ebner, A.D. State-of-the-art adsorption and membrane separation processes for hydrogen production in the chemical and petrochemical industries. Sep. Sci. Technol. 2007, 42, 1123–1193. [Google Scholar] [CrossRef]

- Société Générale. Development of an Incentive Mechanism for an Industrial CCS Project. The Teesside Collective. 2015. Available online: https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=2ahUKEwiKpLy9vZTjAhX0VBUIHeVrB_0QFjAAegQIARAC&url=http%3A%2F%2Fwww.teessidecollective.co.uk%2Fwp-content%2Fuploads%2F2015%2F06%2FTeesside-Collective-Investment-Mechanism-Report.pdf&usg=AOvVaw2U-Csspn6FnrUX-zTWae0q (accessed on 12 February 2020).

- CCUS Cost Challenge Taskforce. Delivering clean Growth: CCUS Cost Challenge Taskforce Report. 2018. Available online: https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/727040/CCUS_Cost_Challenge_Taskforce_Report.pdf (accessed on 20 February 2020).

- Chen, W.; Hu, Z.H. Using evolutionary game theory to study governments and manufacturers’ behavioral strategies under various carbon taxes and subsidies. J. Clean. Prod. 2018, 201, 123–141. [Google Scholar] [CrossRef]

- Société Générale & GCCSI. Targeted report: Financing large-scale integrated CCS demonstration projects. 2014. Available online: https://www.globalccsinstitute.com/archive/hub/publications/157868/targeted-report-financing-large-scale-integrated-ccs-demonstration-projects.pdf (accessed on 10 February 2020).

- Selma, L.; Seigo, O.; Dohle, S.; Siegrist, M. Public perception of carbon capture and storage (CCS): A review. Renew. Sustain. Energy Rev. 2014, 38, 848–863. [Google Scholar]

- Chen, Z.A.; Li, Q.; Liu, L.C.; Zhang, X.; Kuang, L.; Jia, L.; Liu, G. A large national survey of public perceptions of CCS technology in China. Appl. Energy 2015, 158, 366–377. [Google Scholar] [CrossRef]

- BEIS Select Committee. Carbon Capture Usage and Storage: Third Time Lucky? 2019. Available online: https://publications.parliament.uk/pa/cm201719/cmselect/cmbeis/1094/109402.htm (accessed on 25 February 2020).

- Oei, P.Y.; Herold, J.; Mendelevitch, R. Modeling a carbon capture, transport, and storage infrastructure for Europe. Environ. Model. Assess. 2014, 19, 515–531. [Google Scholar] [CrossRef]

| Questionnaire themes |

|---|

| Theme 1: Climate change impacts on business |

| Q1. How serious do you consider the threat of climate change to be? (Serious problem in the near future; serious problem in the distant future; moderate problem in the near future; moderate problem in the distant future; minor problem in the future; minor problem in the distant future; not a problem at all) |

| Q2. How important is the role of climate change at your organization? (Very important; important; moderately important; less important; not important; unsure) |

| Q3. Has your organization formulated an internal carbon price? (Yes, clearly formulated; yes, but under review; yes, but not publicly available; discussions underway; no, no intention in the near future; unsure) |

| Q4. How would you characterize the role that CCUS (Carbon capture, utilization, and storage) plays in the current national climate change debate in your country? (Major; significant; minor; negligible; non-existent; unsure) |

| Q5. How do you perceive the potential for global emissions reduction using CCUS technologies in the industrial sector (e.g., steel, cement) as opposed to the power sector? (Much higher; slightly higher; same; slightly lower; much lower; unsure) |

| Theme 2: Development of CCUS in the industrial sector |

| Q6. How do you perceive the development status of CCUS technologies in the industrial sector, in particular steel, at present? (Immature and impossible to implement; Research and development (R&D) is still heavily needed for most processes; partly mature but some components need R&D; very mature/technology is fully developed) |

| Q7. In your opinion, what are the major economic challenges of retrofitting industrial plants with CCUS technologies? (Lack of reliable cost information; lack of clear business models; uncertainties in future carbon prices; high capital costs; high operational costs; fear of losing market competitiveness with international suppliers; lack of an established CCUS supply chain; other) |

| Q8. In your opinion, what technical challenges most hinder the introduction of CCUS technologies into the industrial sector? (Lack of sufficient onsite space for capture equipment; complexity of integrating CCUS into production process; poor knowledge of, and expertise with, retrofit option; environmental risks; technical risks; lack of nearby storage/utilization sites; sites of carbon storage assessments; other) |

| Q9. What technical barriers exist for the application of current commercially-available carbon capture technologies in steel plants? (Technical performance of capture technologies; lack of reliable pre-treatment technologies; high maintenance costs due to existing impurities in the off-gas; pollutants generated from the capture process; other) |

| Q10. In your opinion, what are the major reason(s) why the adoption CCUS technologies has lagged behind other emissions reduction techniques in the transition towards a low-carbon economy? (Lack of supportive regulatory framework or penalties for non-compliance; stakeholder/public perception; lack of industry commitment to reducing emissions; no effective long-term incentives rewarding carbon usage/storage; other) |

| Theme 3: Financial and regulatory enablers of industrial CCUS business models |

| Q11. What is the most economical technology for large-scale CO2 utilisation in the near future? (Enhanced Oil Recovery (CO2-EOR); food-grade CO2 sales; organic transformation; microbiological culture; other) |

| Q12. Which of the following financial mechanisms do you consider most likely to support large-scale CCUS projects in the steel sector? (Command measures such as legal actions, forced plant closure etc.; ‘sticks’ or penalties such as pollution taxes, fines etc.; ‘carrots’ or incentives such as grants, low-interest loans, subsidies and tax credits; market-based instruments such as tradeable carbon allowances; other) |

| Q13. ‘CCUS readiness’ refers to a design concept requiring minimal up-front investment in the present to maintain the technical potential for CCUS retrofit in the future. To what extent do you agree with the statement: “The Government and the financing community should consider requiring CCUS readiness when providing financial support to new steel industry projects”? (Strongly agree; agree; not sure; disagree; strongly disagree, other) |

| Q14. Which of the following do you think would be the most important factor(s) in accelerating the adoption of CCUS technologies (both in industry and power sectors)? (Removal of high-risk perception through demo projects/technology proving; government funding commitment to CCUS projects; demonstrating economic feasibility through high and certain future carbon prices; more stringent national or corporate GHG emissions targets; other) |

| Q15. Which of the following do you perceive as the most urgent element(s) to be addressed in building a successful business case for CCUS steel projects? (Availability of funding sources for project development; definition of and certainty provision on revenue streams; clarity on project ownership; elimination of perceived project risks; other) |

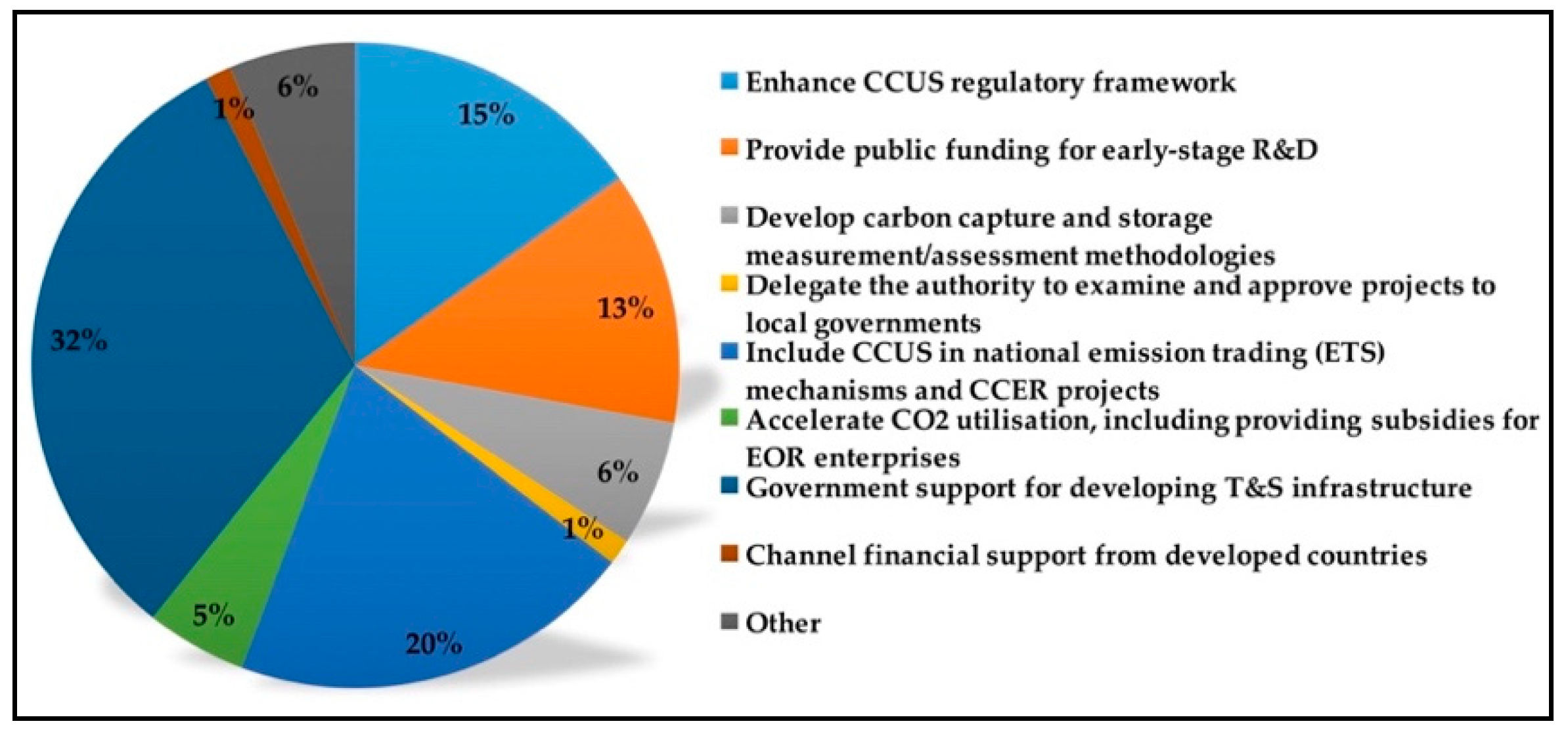

| Q16. What other regulatory/financial enablers can support the business case for first large-scale CCUS projects in the steel sector? (Enhance CCUS regulatory framework; provide public funding for early-stage R&D; develop carbon capture and storage measurement/assessment methodologies; delegate the authority to examine and approve projects to local governments; include CCUS in national emission trading (ETS) mechanisms and China Certified Emission Reduction (CCER) projects; accelerate CO2 utilization, including providing subsidies for EOR enterprises; government support for developing transport and storage (T&S) infrastructure; channel financial support from developed countries; other) |

| Q17. Which of the following support mechanisms do you perceive as most likely to support a revenue stream for CCUS steel projects? (Contracts for Difference (CfDs) with strike price set at cost of carbon abatement; tax credits such as the US 45Q credit law; carbon taxation; cost-plus mechanism; Regulated Asset Base (RAB); tradeable CCS certificates with increasing obligation over time; carbon credits + Emission Performance Standard (EPS); creation of a low-carbon product market; other) |

| Q18. Do you consider international joint investment with information being openly accessible as a viable model for financing early-stage CCUS demonstration projects? (Viable; somewhat viable; somewhat not viable; not viable; not sure, other) |

| Q19. If it became mainstream practice, who should bear the responsibility of financing CCUS applications in the steel sector? (Industrial emitters, following a ‘polluter pays’ principle through obligations or taxes; fossil fuel suppliers, through an obligation to pay for storage of a % of their carbon emissions; gas and electricity consumers; industrial product (steel) consumers; public through general taxation; other) |

| Q20. Research has shown the introduction of carbon capture technologies to the steel sector may increase costs production by up to 20%. Do you think that the establishment of a low-carbon steel product market is a viable option to subsidize the application of energy efficient technologies, particularly carbon capture technologies, within the steel production process? (Yes; no; unsure) |

| Q21. If you answered yes to the previous question, who do you perceive as the most likely option to cover the costs of low-carbon steel production? (Costs passed on to all steel consumers; costs covered by a premium paid by a group of consumers seeking value-added products; costs borne by producers through an obligation to produce % of low-carbon steel products; other) |

| Code | Position | Type of Organization |

|---|---|---|

| A | Co-founder | low-carbon energy projects consultancy |

| B | Technology Analyst | Leading international agency in CCUS research |

| C | Senior Consultant | Leading UK consultancy on industrial CCUS |

| D | Project Leader | Large industrial CCS project |

| E | Lecturer in Chemical Engineering | UK academic institution |

| F | Researcher, Environment | Global steel producer |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muslemani, H.; Liang, X.; Kaesehage, K.; Wilson, J. Business Models for Carbon Capture, Utilization and Storage Technologies in the Steel Sector: A Qualitative Multi-Method Study. Processes 2020, 8, 576. https://doi.org/10.3390/pr8050576

Muslemani H, Liang X, Kaesehage K, Wilson J. Business Models for Carbon Capture, Utilization and Storage Technologies in the Steel Sector: A Qualitative Multi-Method Study. Processes. 2020; 8(5):576. https://doi.org/10.3390/pr8050576

Chicago/Turabian StyleMuslemani, Hasan, Xi Liang, Katharina Kaesehage, and Jeffrey Wilson. 2020. "Business Models for Carbon Capture, Utilization and Storage Technologies in the Steel Sector: A Qualitative Multi-Method Study" Processes 8, no. 5: 576. https://doi.org/10.3390/pr8050576

APA StyleMuslemani, H., Liang, X., Kaesehage, K., & Wilson, J. (2020). Business Models for Carbon Capture, Utilization and Storage Technologies in the Steel Sector: A Qualitative Multi-Method Study. Processes, 8(5), 576. https://doi.org/10.3390/pr8050576