Adjustable Robust Optimization for Planning Logistics Operations in Downstream Oil Networks

Abstract

1. Introduction

2. Problem Description

3. Two-Stage ARO Formulation

4. Adjustable Robust Mathematical Programming Model

4.1. Robust Objective Function

4.2. Equations of the Recourse Problem

4.3. Definition of Uncertainty Set

4.4. The Adaptive Robust Formulation

5. Case Study

6. Results and Discussion

6.1. Setup of the ARO Model

6.2. Comparison with the Developed Approaches

6.2.1. Computational Performance

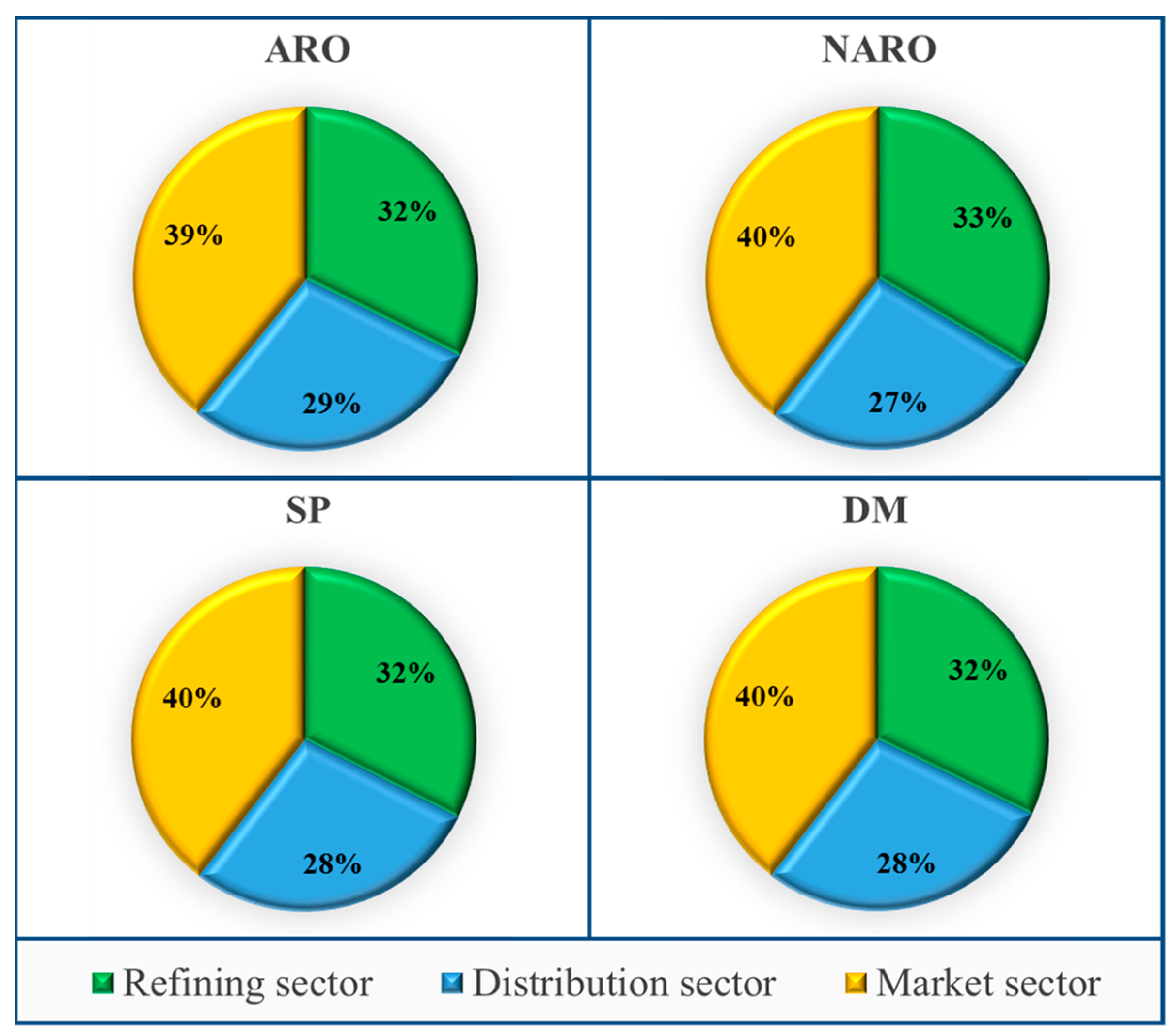

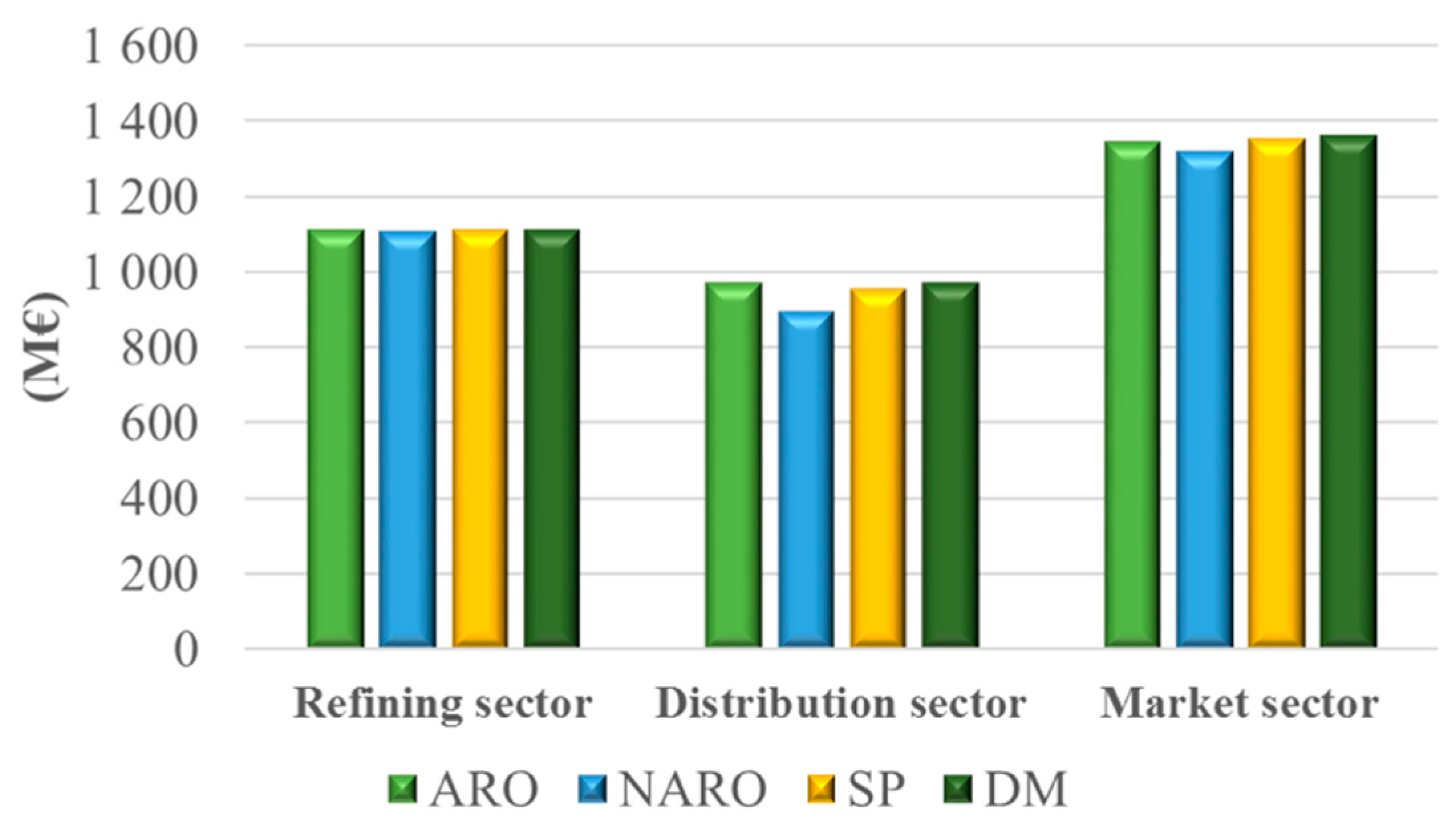

6.2.2. Insights about the Network Profitability

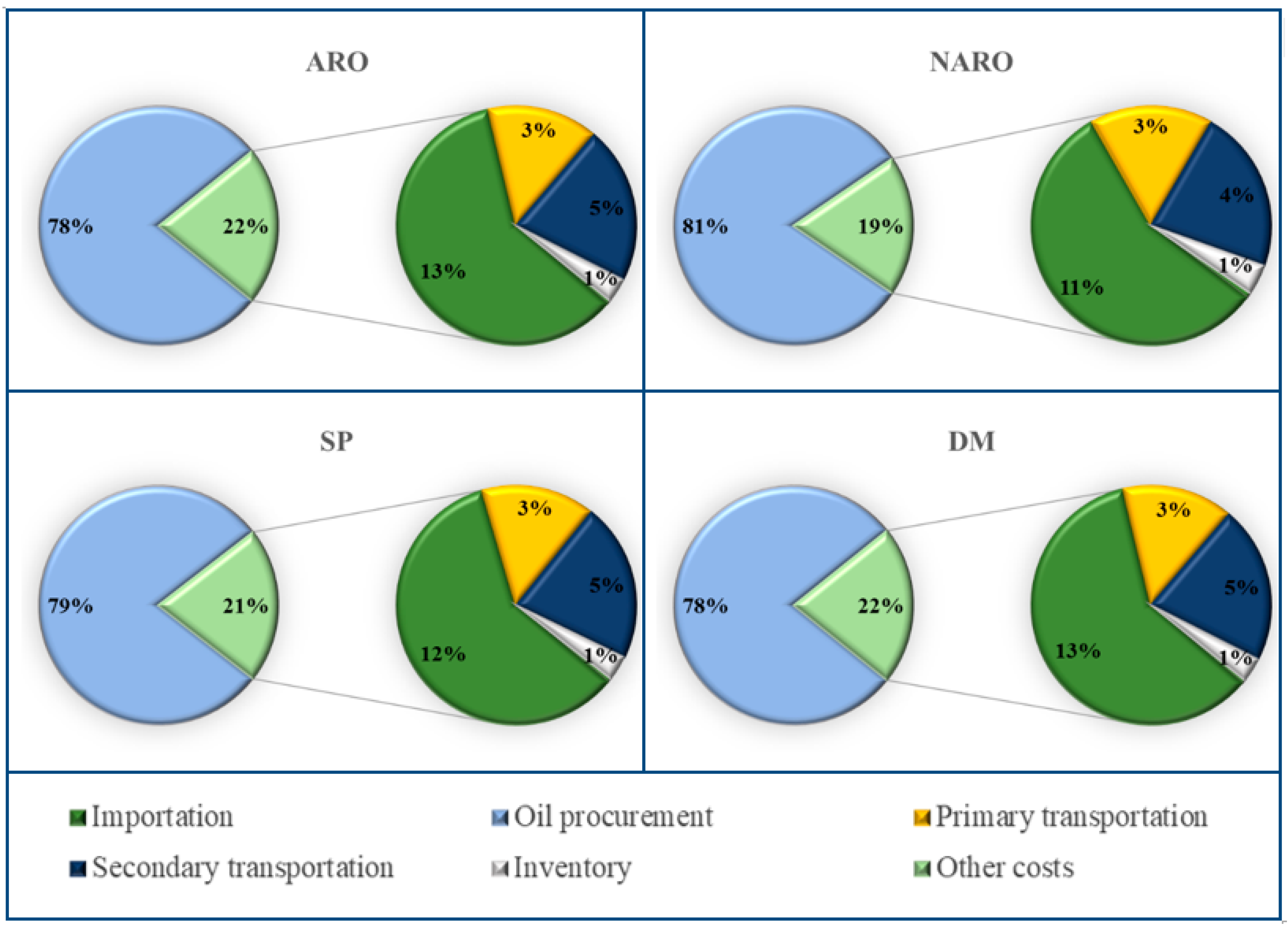

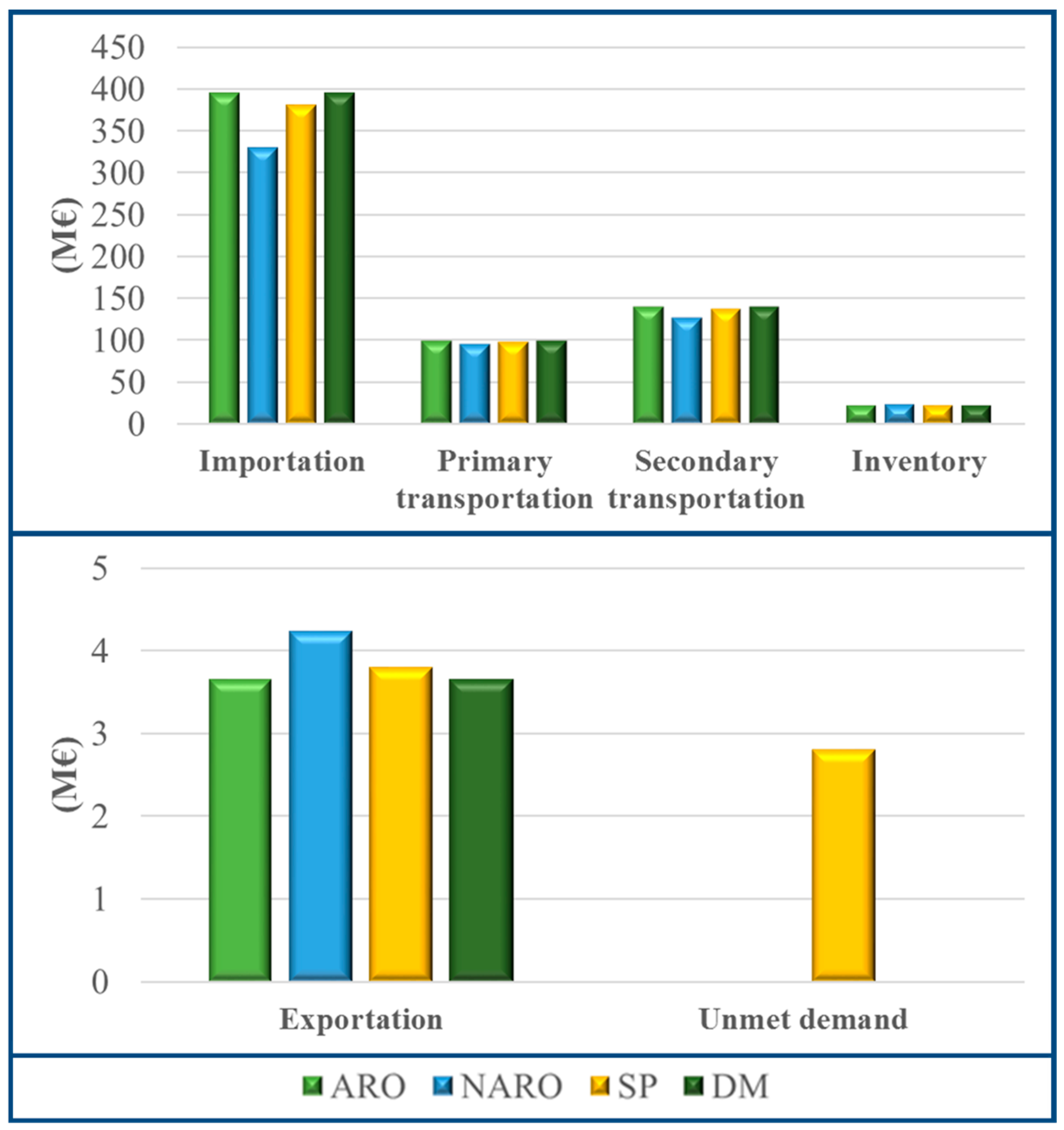

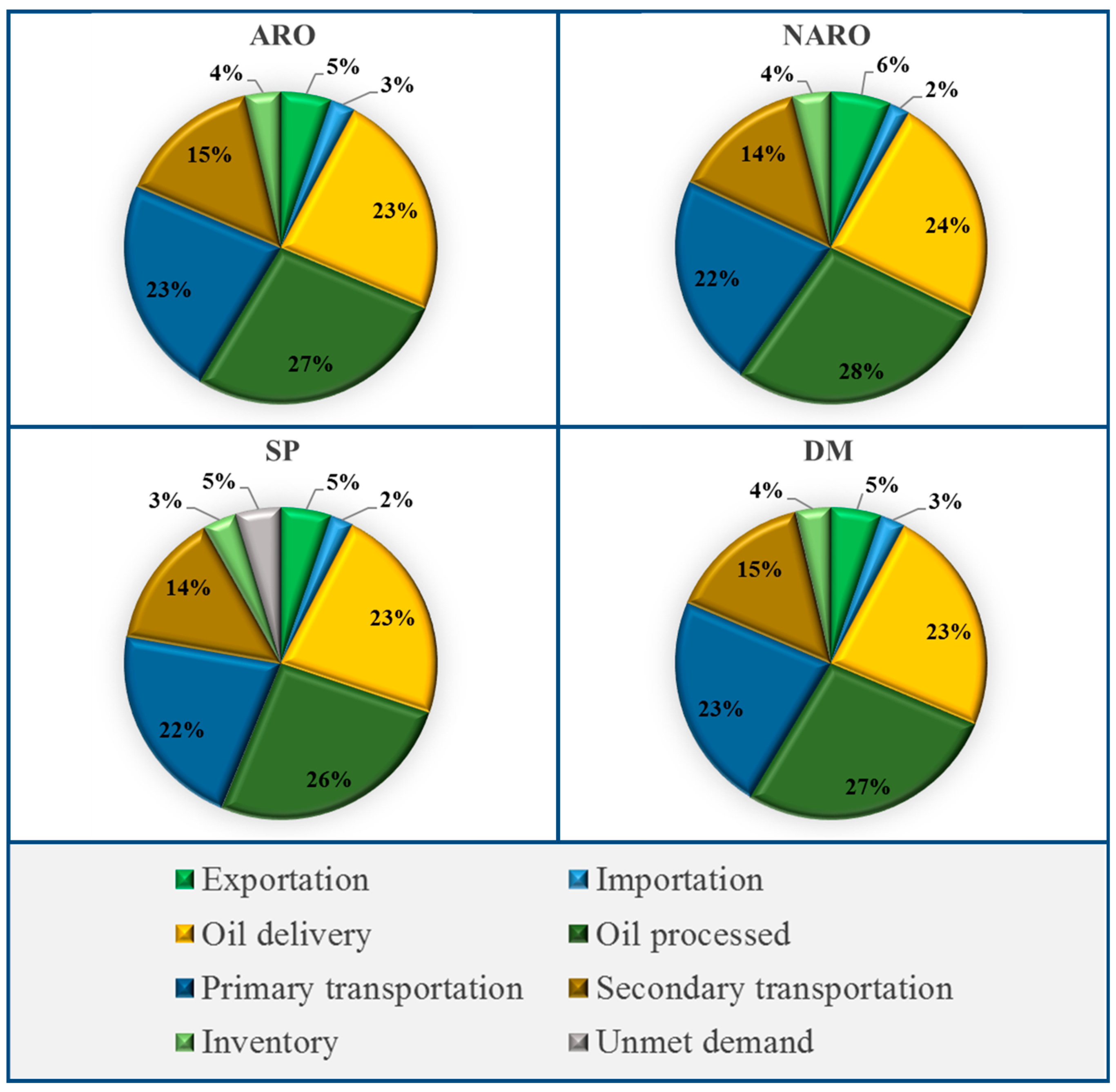

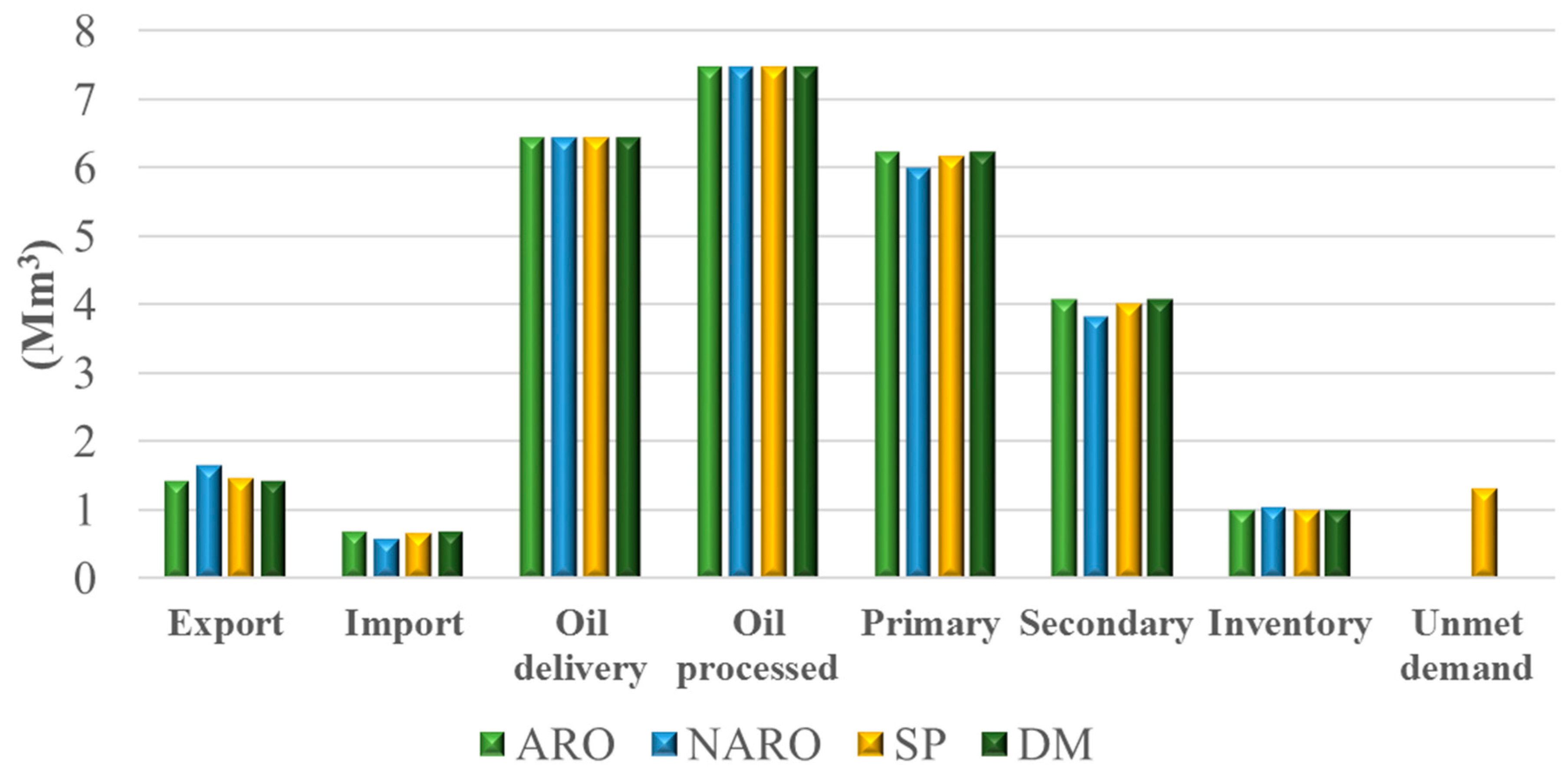

6.2.3. Network Planning for the Refined Products Distribution

6.2.4. General Aspects about the Developed Modeling Frameworks

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Nomenclature

| Sets | |

| Set of developed activities | |

| Set of route distances | |

| Set of transportation modes | |

| Set of all network nodes | |

| Set of products | |

| Set of resources and network stages | |

| Set of time points | |

| Set of vertices of the polyhedral uncertainty set | |

| Subsets | |

| Set of refineries | |

| Set of depots | |

| Set of markets | |

| Subset unions | |

| Set of refineries and depots | |

| Set of depots and markets | |

| Parameters | |

| Arc capacity between nodes n and o when transportation mode m is considered at primary distribution | |

| Arc capacity between nodes n and o when transportation mode m is considered at secondary distribution | |

| Availability of supplying product p from refinery i by transportation mode m through the primary distribution | |

| Availability of supplying product p from depot j by transportation mode m through the secondary distribution | |

| Cost of keeping inventory defined as a percentage of the inventory value | |

| Transportation cost per transportation mode m and product p | |

| Distance between nodes n and o depending on transportation mode m | |

| Demand of oil at refinery i at time point t | |

| True value of demand of product p per market k at time point t and vertice v | |

| Nominal value of demand of product p per market k at time point t and vertice v | |

| Initial stock of oil at refinery i | |

| Initial stock of product p at node n | |

| Maximum travel distance in meters allowed in the road transportation mode | |

| Processing capacity at refinery i | |

| Price of oil at time point t | |

| Price of product p at activity a at time point t | |

| Route between nodes n and o connected by transportation mode m | |

| Storage capacity of product p at node n | |

| Storage capacity of oil at refinery i | |

| Safety stock of oil at refinery i defined as a percentage of the overall oil storage capacity | |

| Safety stock of products at node n defined as a percentage of the overall storage capacity | |

| Tariff per network stage r and product p | |

| Throughput capacity multiplier per node n and product p | |

| Yield fractions by refinery i of product p per cubic meters of oil | |

| Budget of uncertainty for deviations of the demand for product p at market k | |

| Deviation of the demand of product p at local market k at time point t and vertice v | |

| Maximum deviation of the demand of product p at local market k at time point t and vertice v | |

| Positive continuous variables | |

| Cost of exporting product p by refinery i at time point t and vertice v | |

| Cost of importing product p by refinery or depot h at time point t and vertice v | |

| Cost of inventory at depot j for product p at time point t and vertice v | |

| Cost of inventory at market k for product p at time point t and vertice v | |

| Cost of inventory for oil at refinery i at time point t and vertice v | |

| Cost of inventory at refinery i for product p at time point t and vertice v | |

| Cost of primary distribution from refinery i for product p at time point t and vertice v | |

| Cost of secondary distribution from depot j for product p at time point t and vertice v | |

| Cost of unsatisfied demand for product p at market k at time point t and vertice v | |

| Inventory of product p at depot j at time point t and vertice v | |

| Inventory of product p at market k at time point t and vertice v | |

| Inventory of oil at refinery i at time point t and vertice v | |

| Inventory of product p at refinery i at time point t and vertice v | |

| Volume of crude oil received by refinery i at time point t and vertice v | |

| Volume of product p exported by refinery i at time point t and vertice v | |

| Volume of product p imported by refinery or depot h at time point t and vertice v | |

| Volume of oil processed by refinery i at time point t and vertice v | |

| Volume of product p sent by refinery i to location l by transportation mode m at time point t and vertice v | |

| Volume of product p yielded by refinery i at time point t and vertice v | |

| Volume of product p delivered to market k at time point t and vertice v | |

| Volume of product p sent by depot j to market k by transportation mode m at time point t and vertice v | |

| Volume of unsatisfied demand per market k and product p at time point t and vertice v | |

| Continuous variables | |

| Margin per depot j and product p at time point t and vertice v | |

| Margin per local market k and product p at time point t and vertice v | |

| Revenue per refinery i at time point t and vertice v | |

| The worst-case recourse profit | |

| The worst-case profit for the downstream oil network | |

Appendix B. Deterministic Mathematical Formulation

| Sets | |

| Set of developed activities | |

| Set of route distances | |

| Set of transportation modes | |

| Set of all network nodes | |

| Set of products | |

| Set of resources and network stages | |

| Set of time points | |

| Set of optimization variables: | |

| Subsets | |

| Set of refineries | |

| Set of depots | |

| Set of markets | |

| Subset unions | |

| Set of refineries and depots | |

| Set of depots and markets | |

| Parameters | |

| Arc capacity between nodes n and o when transportation mode m is considered at primary distribution | |

| Arc capacity between nodes n and o when transportation mode m is considered at secondary distribution | |

| Availability of supplying product p from refinery i by transportation mode m through the primary distribution | |

| Availability of supplying product p from depot j by transportation mode m through the secondary distribution | |

| Cost of keeping inventory defined as a percentage of the inventory value | |

| Transportation cost per transportation mode m and product p | |

| Distance between nodes n and o depending on transportation mode m | |

| Demand of oil at refinery i at time point t | |

| Demand of product p per market k at time point t | |

| Initial stock of oil at refinery i | |

| Initial stock of product p at node n | |

| Maximum travel distance in meters allowed in the road transportation mode | |

| Processing capacity at refinery i | |

| Price of oil at time point t | |

| Price of product p at activity a at time point t | |

| Route between nodes n and o connected by transportation mode m | |

| Storage capacity of product p at node n | |

| Storage capacity of oil at refinery i | |

| Safety stock of oil at refinery i defined as a percentage of the overall oil storage capacity | |

| Safety stock of products at node n defined as a percentage of the overall storage capacity | |

| Tariff per network stage r and product p | |

| Throughput capacity multiplier per node n and product p | |

| Yield fractions by refinery i of product p per cubic meters of oil | |

| Positive continuous variables | |

| Cost of exporting product p by refinery i at time point t | |

| Cost of importing product p by refinery or depot h at time point t | |

| Cost of inventory at depot j for product p at time point t | |

| Cost of inventory at market k for product p at time point t | |

| Cost of inventory for oil at refinery i at time point t | |

| Cost of inventory at refinery i for product p at time point t | |

| Cost of primary distribution from refinery i for product p at time point t | |

| Cost of secondary distribution from depot j for product p at time point t | |

| Cost of unsatisfied demand for product p at market k at time point t | |

| Inventory of product p at depot j at time point t | |

| Inventory of product p at market k at time point t | |

| Inventory of oil at refinery i at time point t | |

| Inventory of product p at refinery i at time point t | |

| Volume of crude oil received by refinery i at time point t | |

| Volume of product p exported by refinery i at time point t | |

| Volume of product p imported by refinery or depot h at time point t | |

| Volume of oil processed by refinery i at time point t | |

| Volume of product p sent by refinery i to depot or market l by transportation mode m at time point t | |

| Volume of product p yielded by refinery i at time point t | |

| Volume of product p delivered to market k at time point t | |

| Volume of product p sent by depot j to market k by transportation mode m at time point t | |

| Volume of unsatisfied demand per market k and product p at time point t | |

| Continuous variables | |

| Margin per depot j and product p at time point t | |

| Margin per consumer market k and product p at time point t | |

| Margin per refinery i at time point t | |

| Deterministic objective function | |

Appendix C. Non-Adjustable Robust Optimization (NARO) Mathematical Formulation

| Sets | |

| Set of developed activities | |

| Set of route distances | |

| Set of transportation modes | |

| Set of all network nodes | |

| Set of products | |

| Set of resources and network stages | |

| Set of time points | |

| Set of optimization variables: | |

| Subsets | |

| Set of refineries | |

| Set of depots | |

| Set of markets | |

| Auxiliary set used in the robust formulation | |

| Subset unions | |

| Set of refineries and depots | |

| Set of depots and markets | |

| Parameters | |

| Arc capacity between nodes n and o when transportation mode m is considered at primary distribution | |

| Arc capacity between nodes n and o when transportation mode m is considered at secondary distribution | |

| Availability of supplying product p from refinery i by transportation mode m through the primary distribution | |

| Availability of supplying product p from depot j by transportation mode m through the secondary distribution | |

| Cost of keeping inventory defined as a percentage of the inventory value | |

| Transportation cost per transportation mode m and product p | |

| Distance between nodes n and o depending on transportation mode m | |

| Demand of oil at refinery i at time point t | |

| Demand of product p per market k at time point t | |

| Initial stock of oil at refinery i | |

| Initial stock of product p at node n | |

| Maximum travel distance in meters allowed in the road transportation mode | |

| Processing capacity at refinery i | |

| Price of oil at time point t | |

| Price of product p at activity a at time point t | |

| Route between nodes n and o connected by transportation mode m | |

| Storage capacity of product p at node n | |

| Storage capacity of oil at refinery i | |

| Safety stock of oil at refinery i defined as a percentage of the overall oil storage capacity | |

| Safety stock of products at node n defined as a percentage of the overall storage capacity | |

| Tariff per network stage r and product p | |

| Throughput capacity multiplier per node n and product p | |

| Yield fractions by refinery i of product p per cubic meters of oil | |

| Positive continuous variables | |

| Cost of exporting product p by refinery i at time point t | |

| Cost of importing product p by refinery or depot h at time point t | |

| Cost of inventory at depot j for product p at time point t | |

| Cost of inventory at market k for product p at time point t | |

| Cost of inventory for oil at refinery i at time point t | |

| Cost of inventory at refinery i for product p at time point t | |

| Cost of primary distribution from refinery i for product p at time point t | |

| Cost of secondary distribution from depot j for product p at time point t | |

| Cost of unsatisfied demand for product p at market k at time point t | |

| Inventory of product p at depot j at time point t | |

| Inventory of product p at market k at time point t | |

| Inventory of oil at refinery i at time point t | |

| Inventory of product p at refinery i at time point t | |

| Volume of crude oil received by refinery i at time point t | |

| Volume of product p exported by refinery i at time point t | |

| Volume of product p imported by refinery or depot h at time point t | |

| Volume of oil processed by refinery i at time point t | |

| Volume of product p sent by refinery i to depot or market l by transportation mode m at time point t | |

| Volume of product p yielded by refinery i at time point t | |

| Volume of product p delivered to market k at time point t | |

| Volume of product p sent by depot j to market k by transportation mode m at time point t | |

| Volume of unsatisfied demand per market k and product p at time point t | |

| Continuous variables | |

| Profit | Profit for the downstream oil supply chain over the planning horizon |

| Margin per depot j and product p at time point t | |

| Margin per consumer market k and product p at time point t | |

| Margin per refinery i at time point t | |

| Binary variable | |

| Auxiliary variable to aid the robust formulation to handle product demand uncertainty, where | |

| Robust parameters | |

| Budget parameter to adjust the robustness of product demand | |

| Maximum variation in product demand for market k and product p at time point t | |

| Robust dual variables | |

| Dual variable associated with the establishment of the budget parameter of product demand | |

| Quantify the sensitivity to positive deviation in product demand for market k and product p at time point t | |

| Quantify the sensitivity to negative deviation in product demand for market k and product p at time point t | |

Appendix D. Stochastic Mathematical Programming Formulation

| Sets | |

| Set of activities developed | |

| Set of route distances | |

| Set of transportation modes | |

| Set of all network nodes | |

| Set of products | |

| Set of resources and network stages | |

| Set of nodes/states in the scenario tree | |

| Set of time points | |

| Set of optimization variables: | |

| Subsets | |

| Set of refineries | |

| Set of depots | |

| Set of markets | |

| Subset unions | |

| Set of refineries and depots | |

| Set of depots and markets | |

| Possible route combination between network nodes n and o connected by transportation mode m | |

| Set of predecessors of nodes/states in the scenario tree: | |

| Set of nodes/states s that belong to each time point t: | |

| Parameters | |

| Arc capacity between network nodes n and o when transportation mode m is considered at primary distribution | |

| Arc capacity between network nodes n and o when transportation mode m is considered at secondary distribution | |

| Availability of supplying product p from refinery i by transportation mode m through the primary distribution | |

| Availability of supplying product p from depot j by transportation mode m through the secondary distribution | |

| Cost of keeping inventory defined as a percentage of the inventory value | |

| Transportation cost per transportation mode m and product p | |

| Distance between network nodes n and o depending on transportation mode m | |

| Demand of oil at refinery i at time point t | |

| Demand of product p per market k | |

| Demand realization of product p for market k in time point t and state s | |

| Initial stock of oil at refinery i | |

| Initial stock of product p at network node n | |

| Maximum travel distance in meters allowed in the road transportation mode | |

| Number of time points | |

| Probability of each state s in the scenario tree approach | |

| Processing capacity at refinery i | |

| Price of oil at activity a at time point t | |

| Price of product p at activity a and time point t | |

| Storage capacity of product p at network node n | |

| Storage capacity of oil at refinery i | |

| Safety stock of oil at refinery i defined as a percentage of the overall oil storage capacity | |

| Safety stock of products at network node n defined as a percentage of the overall storage capacity | |

| Tariff per network stage r and product p | |

| Throughput capacity multiplier per network node n and product p | |

| Yield fractions by refinery i of product p per cubic meters of oil | |

| Market tendency per product p | |

| Market tendency per state s | |

| Positive continuous variables | |

| Cost of exporting product p by refinery i at time point t and state s | |

| Cost of importing product p by refinery or depot h at time point t and state s | |

| Cost of inventory at depot j for product p in time point t and state s | |

| Cost of inventory at market k for product p in time point t and state s | |

| Cost of inventory for oil at refinery i in time point t and state s | |

| Cost of inventory at refinery i for product p in time point t and state s | |

| Cost of primary transportation from refinery i for product p in time point t and state s | |

| Cost of secondary transportation from depot j for product p in time point t and state s | |

| Cost of unsatisfied demand for product p at market k in time point t and state s | |

| Inventory of product p at depot j in time point t and state s | |

| Inventory of product p at market k in time point t and state s | |

| Inventory of oil at refinery i in time point t and state s | |

| Inventory of product p at refinery i in time point t and state s | |

| Volume of crude oil received by refinery i at time point t | |

| Volume of product p exported by refinery i at time point t and state s | |

| Volume of product p imported by refinery or depot h at time point t and state s | |

| Volume of oil processed by refinery i at time point t and state s | |

| Volume of product p sent by refinery i to depot or market l by transportation mode m at time point t and state s | |

| Volume of product p yielded by refinery i at time point t and state s | |

| Volume of product p delivered to market k at time point t and state s | |

| Volume of product p sent by depot j to market k by transportation mode m at time point t and state s | |

| Volume of unsatisfied demand per market k and product p at time point t and state s | |

| Continuous variables | |

| Margin per storage depot j and product p at time point t and state s | |

| Margin per consumer market k and product p at time point t and state s | |

| Revenue per refinery i at time point t and state s | |

Appendix E. Considerations about a Typical Polyhedral Budget Uncertainty Set

References

- Lima, C.; Relvas, S.; Barbosa-Póvoa, A.P. Stochastic programming approach for the optimal tactical planning of the downstream oil supply chain. Comput. Chem. Eng. 2018, 108, 314–336. [Google Scholar] [CrossRef]

- Oliveira, F.; Gupta, V.; Hamacher, S.; Grossmann, I.E. A Lagrangean decomposition approach for oil supply chain investment planning under uncertainty with risk considerations. Comput. Chem. Eng. 2013, 50, 184–195. [Google Scholar] [CrossRef]

- Lima, C.; Relvas, S.; Barbosa-Póvoa, A.P. Downstream oil supply chain management: A critical review and future directions. Comput. Chem. Eng. 2016, 92, 78–92. [Google Scholar] [CrossRef]

- Escudero, L.F.; Quintana, F.J.; Salmerón, J. CORO, a modeling and an algorithmic framework for oil supply, transformation and distribution optimization under uncertainty. Eur. J. Oper. Res. 1999, 114, 638–656. [Google Scholar] [CrossRef]

- Birge, J.R.; Louveaux, F. Introduction to Stochastic Programming, 2nd ed.; Series in Operations Research and Financial Engineering; Springer: New York, NY, USA, 2011. [Google Scholar]

- Sahinidis, N.V. Optimization under uncertainty: State-of-the-art and opportunities. Comput. Chem. Eng. 2004, 28, 971–983. [Google Scholar] [CrossRef]

- Lorca, A.; Sun, X.A. Adaptive robust optimization with dynamic uncertainty sets for multi-period economic dispatch under significant wind. IEEE Trans. Power Syst. 2015, 30, 1702–1713. [Google Scholar] [CrossRef]

- Tong, K.; Feng, Y.; Rong, G. Planning under demand and yield uncertainties in an oil supply chain. Ind. Eng. Chem. Res. 2011, 51, 814–834. [Google Scholar] [CrossRef]

- Ning, C.; You, F. Data-driven decision making under uncertainty integrating robust optimization with principal component analysis and kernel smoothing methods. Comput. Chem. Eng. 2018, 112, 190–210. [Google Scholar] [CrossRef]

- Ning, C.; You, F. Data-driven adaptive nested robust optimization: General modeling framework and efficient computational algorithm for decision making under uncertainty. AIChE J. 2017, 63, 3790–3817. [Google Scholar] [CrossRef]

- Sahebi, H.; Nickel, S.; Ashayeri, J. Strategic and tactical mathematical programming models within the crude oil supply chain context—A review. Comput. Chem. Eng. 2014, 68, 56–77. [Google Scholar] [CrossRef]

- Dempster, M.A.H.; Pedrón, N.H.; Medova, E.A.; Scott, J.E.; Sembos, A. Planning logistics operations in the oil industry. J. Oper. Res. Soc. 2000, 51, 1271–1288. [Google Scholar] [CrossRef]

- Al-Othman, W.B.E.; Lababidi, H.M.S.; Alatiqi, I.M.; Al-Shayji, K. Supply chain optimization of petroleum organization under uncertainty in market demands and prices. Eur. J. Oper. Res. 2008, 189, 822–840. [Google Scholar] [CrossRef]

- MirHassani, S.A. An operational planning model for petroleum products logistics under uncertainty. Appl. Math. Comput. 2008, 196, 744–751. [Google Scholar] [CrossRef]

- Carneiro, M.C.; Ribas, G.P.; Hamacher, S. Risk management in the oil supply chain: A CVaR approach. Ind. Eng. Chem. Res. 2010, 49, 3286–3294. [Google Scholar] [CrossRef]

- Ribas, G.P.; Hamacher, S.; Street, A. Optimization under uncertainty of the integrated oil supply chain using stochastic and robust programming. Int. Trans. Oper. Res. 2010, 17, 777–796. [Google Scholar] [CrossRef]

- MirHassani, S.A.; Noori, R. Implications of capacity expansion under uncertainty in oil industry. J. Petrol. Sci. Eng. 2011, 77, 194–199. [Google Scholar] [CrossRef]

- Oliveira, F.; Hamacher, S. Optimization of the petroleum product supply chain under uncertainty: A case study in Northern Brazil. Ind. Eng. Chem. Res. 2012, 51, 4279–4287. [Google Scholar] [CrossRef]

- Leiras, A.; Ribas, G.; Hamacher, S. Tactical and operational planning of multirefinery networks under uncertainty: An iterative integration approach. Ind. Eng. Chem. Res. 2013, 52, 8507–8517. [Google Scholar] [CrossRef]

- Oliveira, F.; Grossmann, I.E.; Hamacher, S. Accelerating Benders stochastic decomposition for the optimization under uncertainty of the petroleum product supply chain. Comput. Oper. Res. 2014, 49, 47–58. [Google Scholar] [CrossRef]

- Tong, K.; Gong, J.; Yue, D.; You, F. Stochastic programming approach to optimal design and operations of integrated hydrocarbon biofuel and petroleum supply chains. ACS Sustain. Chem. Eng. 2014, 2, 49–61. [Google Scholar] [CrossRef]

- Ghatee, M.; Hashemi, S.M. Optimal network design and storage management in petroleum distribution network under uncertainty. Eng. Appl. Artif. Intell. 2009, 22, 796–807. [Google Scholar] [CrossRef]

- Tong, K.; Gleeson, M.J.; Rong, G.; You, F. Optimal design of advanced drop-in hydrocarbon biofuel supply chain integrating with existing petroleum refineries under uncertainty. Biomass Bioenergy 2014, 60, 108–120. [Google Scholar] [CrossRef]

- Tong, K.; You, F.; Rong, G. Robust design and operations of hydrocarbon biofuel supply chain integrating with existing petroleum refineries considering unit cost objective. Comput. Chem. Eng. 2014, 68, 128–139. [Google Scholar] [CrossRef]

- Bertsimas, D.; Litvinov, E.; Sun, X.A.; Zhao, J.; Zheng, T. Adaptive robust optimization for the security constrained unit commitment problem. IEEE Trans. Power Syst. 2013, 28, 52–63. [Google Scholar] [CrossRef]

- Ben-Tal, A.; Nemirovski, A. Robust optimization–methodology and applications. Math. Program. 2002, 92, 453–480. [Google Scholar] [CrossRef]

- Bertsimas, D.; Brown, D.B.; Caramanis, C. Theory and applications of robust optimization. SIAM Rev. 2011, 53, 464–501. [Google Scholar] [CrossRef]

- Zeng, B.; Zhao, L. Solving two-stage robust optimization problems using a column-and-constraint generation method. Oper. Res. Lett. 2013, 41, 457–461. [Google Scholar] [CrossRef]

- Gorissen, B.L.; Yanıkoğlu, İ.; Hertog, D. A practical guide to robust optimization. Omega 2015, 53, 124–137. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M.; Zhang, M. Adaptive distributionally robust optimization. Manag. Sci. 2018, 65, 604–618. [Google Scholar] [CrossRef]

- Zugno, M.; Conejo, A.J. A robust optimization approach to energy and reserve dispatch in electricity markets. Eur. J. Oper. Res. 2015, 247, 659–671. [Google Scholar] [CrossRef]

- Escudero, L.F.; Garín, A.; Merino, M.; Pérez, G. The value of the stochastic solution in multistage problems. Top 2007, 15, 48–64. [Google Scholar] [CrossRef]

- Liu, M.L.; Sahinidis, N.V. Optimization in process planning under uncertainty. Ind. Eng. Chem. Res. 1996, 35, 4154–4165. [Google Scholar] [CrossRef]

- Bertsimas, D.; Brown, D.B. Constructing uncertainty sets for robust linear optimization. Oper. Res. 2009, 57, 1483–1495. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M. The price of robustness. Oper. Res. 2004, 52, 35–53. [Google Scholar] [CrossRef]

- Fernandes, L.J.; Relvas, S.; Barbosa-Póvoa, A.P. Downstream petroleum supply chain planning under uncertainty. In Proceedings of PSE 2015 ESCAPE 25; May 31-June 4 2015; Copenhagen, Denmark. Computer Aided Chemical Engineering; Gernaey, K.V., Huusom, J.K., Gani, R., Eds.; Elsevier: Amsterdam, The Netherlands, 2015; pp. 1889–1894. [Google Scholar]

| Variables | |||||||

|---|---|---|---|---|---|---|---|

| Cases | Scenarios | Tree Nodes | Binary | Continuous | Equations | Profit (€) | Solution Time (s) |

| ARO | 1 | - | - | 4,721,774 | 2,291,857 | 2,775,311,076 | 95.300 |

| NARO | 1 | - | 1 | 395,730 | 214,388 | 2,753,378,686 | 11.880 |

| SP | 243 | 364 | - | 7,249,759 | 3,052,522 | 2,779,767,979 | 236.800 |

| DM | 1 | - | - | 393,493 | 190,999 | 2,791,797,659 | 1.484 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lima, C.; Relvas, S.; Barbosa-Póvoa, A.; Morales, J.M. Adjustable Robust Optimization for Planning Logistics Operations in Downstream Oil Networks. Processes 2019, 7, 507. https://doi.org/10.3390/pr7080507

Lima C, Relvas S, Barbosa-Póvoa A, Morales JM. Adjustable Robust Optimization for Planning Logistics Operations in Downstream Oil Networks. Processes. 2019; 7(8):507. https://doi.org/10.3390/pr7080507

Chicago/Turabian StyleLima, Camilo, Susana Relvas, Ana Barbosa-Póvoa, and Juan M. Morales. 2019. "Adjustable Robust Optimization for Planning Logistics Operations in Downstream Oil Networks" Processes 7, no. 8: 507. https://doi.org/10.3390/pr7080507

APA StyleLima, C., Relvas, S., Barbosa-Póvoa, A., & Morales, J. M. (2019). Adjustable Robust Optimization for Planning Logistics Operations in Downstream Oil Networks. Processes, 7(8), 507. https://doi.org/10.3390/pr7080507