1. Introduction

The increase in production from renewable energy sources (RES) is one of the pillars of the decarbonisation of the electricity system [

1] and of the security of energy supply [

2]. It is supported by many countries through political initiatives that include the definition of RES production targets for future years and decades [

3]. The technologies for which greater development is expected are wind turbines and photovoltaic modules, in the long-term ocean energy converters could also contribute. All these technologies are characterised by non-programmable production. Traditional storage systems based on batteries could not satisfy all the offshore wind storage challenges and therefore, hydrogen production could be seen as another way to store renewable energy [

4]. Hydrogen is well-suited for storing energy over extended periods, such as seasonal variations in wind availability [

5]. While batteries are efficient for short-term storage, their performance and cost-effectiveness diminish over longer durations [

6]. Hydrogen can be produced during periods of high wind generation and stored for use during low-wind periods, ensuring a continuous energy supply [

7].

In recent years, the use of RES has been considered to produce other energy carriers, such as hydrogen and ammonia, a process known as power-to-gas. Hydrogen produced by electrolysers fed by RES electricity is generally known as “green” hydrogen [

8]. Hydrogen itself can contribute to the decarbonisation of industrial sectors such as chemicals, steel production, heavy industry, but also long-distance transport [

9]. As a result, hydrogen demand—estimated at 339 TWh in Europe in 2019—is expected to increase drastically by 2050 reaching 2300 TWh according to the European Hydrogen Backbone initiative [

10,

11], or even a quantity higher depending on the scenario followed [

12].

Italy fits into this international context with an important regulatory and strategic system. Focusing specifically on RES, the revision of the National Integrated Energy and Climate Plan [

13], submitted to the European Commission in 2023, indicates ambitious renewable production targets for 2030, including 100 TWh of annual production from solar energy and approximately 65 TWh per year from wind energy, part of which from offshore wind farms (OWFs). As regards hydrogen, the National Hydrogen Strategy [

14] was published in November 2024, which aims to promote the use of hydrogen as an integral part of Italy’s energy transition. Italy aims, among other things, to strengthen its green hydrogen production capacity. Due to favourable climatic conditions for deploying renewable energy sources (RES) such as solar and wind, the southern regions of the country have significant potential to attract investments aimed at establishing production facilities and integrating green hydrogen into industries, transportation, and power generation. The main quantitative targets for 2030 of the National Hydrogen Strategy relating to green hydrogen are the following: produce 2 million tons of green hydrogen and install at least 5 GW of electrolysis capacity to produce green hydrogen.

Among the RES that could fuel the production of green hydrogen, wind power stands out as a particularly promising candidate, especially given its anticipated substantial growth, notably through large-scale offshore installations [

15].

Offshore wind installations involve the use of fixed foundations, typically of the monopile type up to 30 m of sea depth and jackets up to 60 m. For greater water depths, which characterise most Italian marine areas suitable for hosting OWFs, floating platforms are used [

16]. They are already known in the oil and gas sector, but not yet completely mature in the wind energy sector. Demonstrative arrays of significant sizes are installed [

17,

18], and many floating wind projects are in the pipeline in many countries. For example, in Italy, as of November 2024, there are requests for connection to the grid of several dozen OWFs [

19], and a couple of projects have already concluded the complete authorisation process.

Offshore wind offers a promising pathway for large-scale green hydrogen production, harnessing abundant and consistent wind resources while minimising land use conflicts [

20]. As reported in many literature studies, the coupling of OWFs and hydrogen production can occur in several configurations [

20,

21], each with its own set of opportunities and challenges. The literature primarily distinguishes these configurations based on the placement of the electrolysers dedicated to hydrogen production—specifically, whether they are installed onshore or offshore.

In the centralised onshore configuration, the typical OWF infrastructure transmits electricity to shore via subsea export cables. Once the power reaches an onshore centralised facility equipped with electrolysers, hydrogen is produced. This solution allows the operator to manage both energy vectors effectively, even enabling the purchase of electricity from the grid to produce hydrogen during periods of very low electricity prices, providing additional load flexibility for the grid operator [

7]. Other advantages offered by this solution pertain to a simplified maintenance of the electrolyser system and the proximity to existing infrastructure.

Regarding offshore configurations, according to the literature, offshore solutions represent an emerging, yet nascent, approach [

20,

22,

23,

24] and can be further divided into two cases: centralised offshore and decentralised offshore.

In the first case, the intra-array electrical infrastructure of the OWF remains unchanged, and the energy is transmitted through intra-array cables to an offshore platform. This platform hosts the entire hydrogen production system—including the desalination and water treatment plant, electrolysers, and even living quarters for maintenance personnel [

20]. Hydrogen is then transported to shore via pipelines, eliminating the need for export submarine cables and reducing transport losses and costs for the same amount of energy transmitted [

7,

20,

25]. Despite in this configuration, as highlighted in several studies [

23,

25,

26,

27], exporting both electricity and hydrogen is not economically viable, making hydrogen the sole output of the system.

In the second case, each wind turbine is coupled with its own electrolyser system, enabling hydrogen production directly at the turbine. This configuration enhances system redundancy and reduces electricity transmission losses, though it also introduces challenges related to maintenance, space constraints, and dynamic stability.

A medium–long term time horizon is expected for the construction of these offshore plants, when the costs of offshore wind energy and hydrogen production technologies will decrease depending on their widespread diffusion.

The production of green hydrogen from offshore wind relies on several crucial technologies that present both potential and challenges. The electrolysers, as reported in [

7] are “Devices that receive Direct Current (DC) electricity and demineralized water and separates the hydrogen and oxygen atoms from the water molecule through a chemical reaction, generating high purity oxygen and hydrogen”. The choice of electrolyser technology plays a significant role in determining the system’s efficiency, cost, and operational characteristics. For instance, the alkaline electrolyser (AEL) is a mature technology known for its lower cost (employ low-cost earth metals [

20,

28]), large-scale application [

20], and long lifetime, but suffers from slower response times and limited dynamic flexibility [

7,

20,

23,

28]. In contrast, the proton exchange membrane electrolyser (PEMEL) is expected to outperform AEL in terms of efficiency and cost, facilitating the development of large-scale plants and transport infrastructure [

9].

Those offer faster start-up and dynamic response times [

13,

23,

26,

28], broad operational ranges [

13,

28], higher performance at partial load [

13,

29], higher current densities [

7,

20,

23,

28,

29], and higher hydrogen purity [

20]; however, they come with greater costs (presence of expensive and rare-earth materials [

23,

26,

28]) and durability limitations [

23], as well as higher output pressure of the hydrogen [

7,

20].

PEMELs have a lower total cost of ownership, with service costs estimated to be one-third of those of AELs [

30]. Furthermore, as highlighted by the U.S. Department of Energy, PEMELs are expected to offer significant cost advantages in balance-of-plant economics when scaled, making them a promising solution for the future of hydrogen production [

30]. In fact, according to their cost projections, the price of hydrogen is expected to decrease to 2 USD/kg by 2026 and to 1 USD/kg by 2031, with an ultimate target of 50 USD/kW for the capital cost of PEMEL stacks [

30]. Furthermore, as highlighted by Niblett et al. in [

28], the overall cost of hydrogen production is strongly influenced by capital costs—primarily driven by electrolyser materials and fabrication—along with operational expenditures (OPEX) and overall system efficiency, which depend on the integration and dynamics of renewable power sources and the electrolyser response time. As previously mentioned, PEMELs exhibit a faster response time compared to AELs [

26,

28], allowing their production rate to be adjusted across the full load range [

31]. This enables rapid adaptation to fluctuations in electrical input, such as those experienced in offshore wind applications [

26], and operation beyond nominal power levels [

7,

26,

31]. As noted by Niblett et al. [

28], efficiency remains a critical area of research for both technologies and is influenced by several key overpotentials (activation, ohmic, and concentration), which vary as current increases in an electrolyser with a fixed electrode area. Notably, electrolyser efficiency is not constant under varying loads, similar to wind energy systems. In fact, increasing the current density decreases the capital cost contribution per mass of hydrogen produced (due to increased reactor throughput) but simultaneously reduces efficiency, leading to higher OPEX [

28]. Therefore, an optimal balance must be found between energy efficiency and current density, depending on material and energy costs. Moreover, Niblett et al. [

28] indicate that PEMELs can generally achieve higher current densities at the same efficiency level as AELs. Alternatively, they can operate with greater efficiency at lower current densities, achieving efficiencies in the range of 80–90% at 1–2 A/cm

2, compared to the lower operational current density of AELs (0.5–0.7 A/cm

2) [

26].

Since both AEL and PEMEL need processed water to operate, one other crucial element for offshore hydrogen production is the seawater desalination process [

25,

32]. Reverse osmosis (RO) is commonly employed [

20], offering a cost-effective solution [

23], but pre-treatment and filtration processes are necessary to address biofouling and blockages of equipment [

25]. Emerging technologies like capacitive deionisation and forward osmosis are also being explored [

25].

Another cornerstone point of offshore green hydrogen system is the storage and transportation system. In [

32] Castillo et al. report the main challenges and opportunities of storage and transportation systems considering the delivery of hydrogen either as compressed gas or liquid or in the form of another fuel, such as ammonia. In transportation via pipelines, the hydrogen embrittlement represents the most challenging issue that requires a specific selection of materials used in pipeline transport of large quantities of hydrogen [

26].

From the economic point of view, the levelised cost of hydrogen (LCOH) is a key metric for evaluating the economic feasibility of offshore wind-to-hydrogen systems. LCOH is influenced by various factors, including wind resource availability and capacity factor, capital costs of wind farm, electrolysers, and infrastructure, operating, and maintenance expenses. The profitability (i.e., the net present value) of the systems is influenced by the electricity price, financial incentives, and policies. Scolaro and Kittner [

33] emphasise that offshore wind-based hydrogen must participate in ancillary service markets to generate positive revenues at current levels of wind generation, and that by 2030 can achieve cost competitiveness in Germany.

In the frame of a national project on renewables funded by the Ministry of Environment and Energy Security through the Ricerca di Sistema Programme, the authors have already investigated from a technical and economic point of view the possibility of coupling an offshore wind farm with an onshore energy production facility to mitigate potential wind overgeneration and contribute to produce green hydrogen [

34].

The LCOH has been calculated for different offshore sites around the Italian peninsula varying key parameters—including electrolyser size, CAPEX, financial factors, and resource availability. The study found that the LCOH for this green hydrogen production solution spans a particularly wide range, from 0.4 to 8.8 EUR/kg of H2.

The authors have also investigated the other two configurations, offshore centralised and offshore decentralised, including the transportation of hydrogen to the shore through pipelines.

The aim of this study is to evaluate the green LCOH produced in two Italian offshore sites and to understand its dependence on several technical and financial parameters. For the offshore centralised configuration, the authors decided to evaluate also the possibility of storing hydrogen offshore. This approach refers to a term scenario longer than the pipeline ones, considering the transportation of the hydrogen to shore by ships or the offshore system directly used as a refuelling station for a ship hydrogen fuelled. Due to the lower technological maturity and to the higher uncertainty on the costs of this approach with respect to the pipeline ones, the costs of transport by ship have not been evaluated in the present study. Even if the calculated LCOH for the configuration with the storage is not directly comparable to the ones with pipelines, the assessment of the CAPEX and performance of the system can be useful for example for incoming studies about the transportation of both the energy vectors through superconducting cable cooled by liquid hydrogen [

35,

36].

In this paper the methodology and the results of the technical-economic analysis carried out for offshore green hydrogen production in above mentioned configurations are reported for two study cases in Italy. The first case study corresponds to an offshore site in the Sicily region, characterised by higher average wind speeds and medium bathymetry, and the second one to an offshore site in the Emilia-Romagna region, featuring lower wind speeds and the possibility of installing bottom-fixed wind farms. The methods and materials are described in

Section 2, the results and their discussion are reported in

Section 3, and the conclusions in

Section 4.

2. Configurations, Materials and Methods

2.1. System Configurations

To produce offshore hydrogen from dedicated OWFs, the following three plant configurations have been considered according to the position of the hydrogen facilities with respect to the wind farm components and to the way of delivering hydrogen:

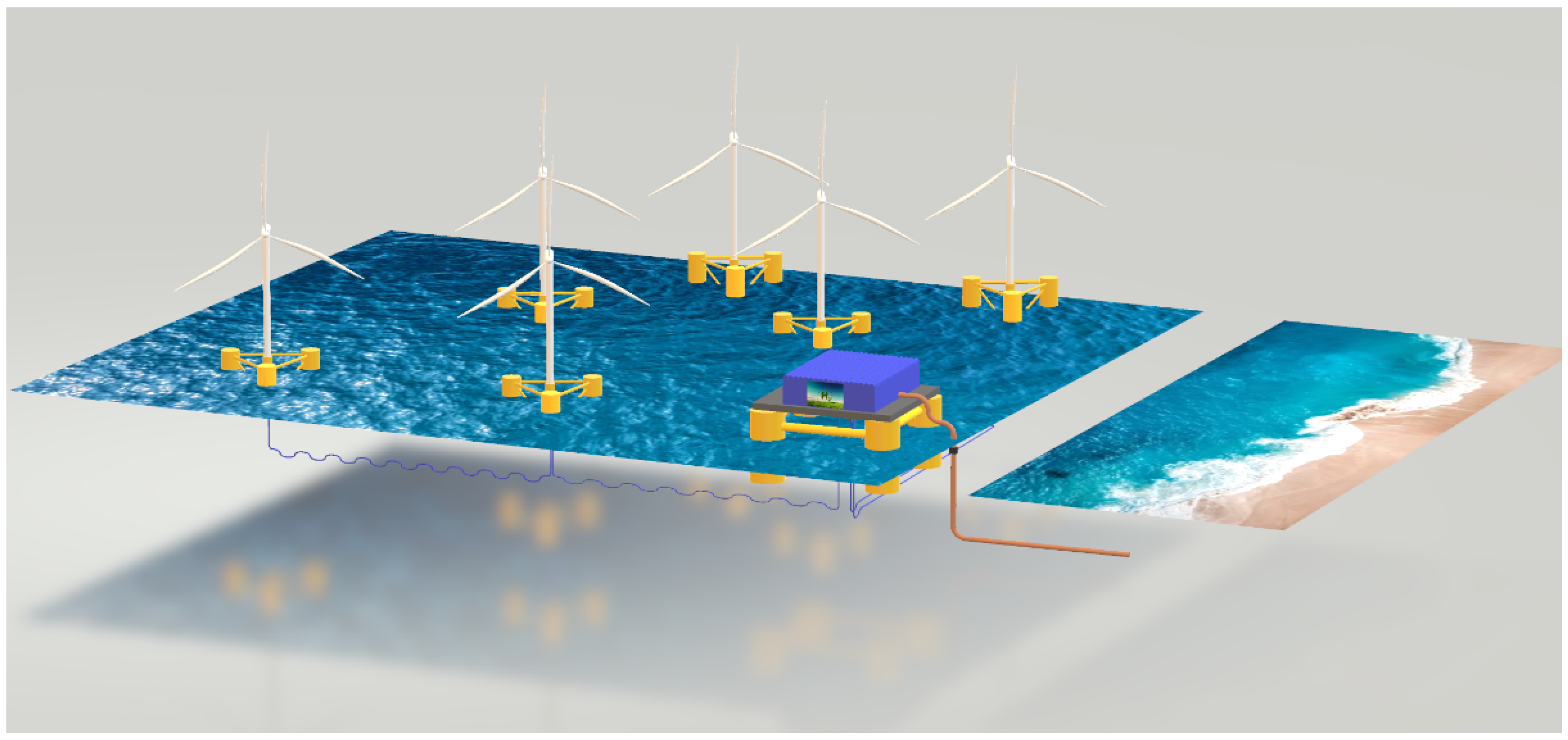

The hydrogen production system is centralised on an offshore platform (offshore substation) close to the wind farm. Hydrogen is sent to the land through a pipeline [

26]. The acronym identifying this configuration is ORCH2P (offshore renewable centralised hydrogen production with pipeline). A simplified schematic of this configuration is presented in

Figure 1. In blue, the intra-array cables are shown, connecting multiple turbines in strings. In brown, the export pipeline is depicted, transporting the hydrogen produced in the electrolyser located on the central offshore platform (represented by the blue parallelepiped).

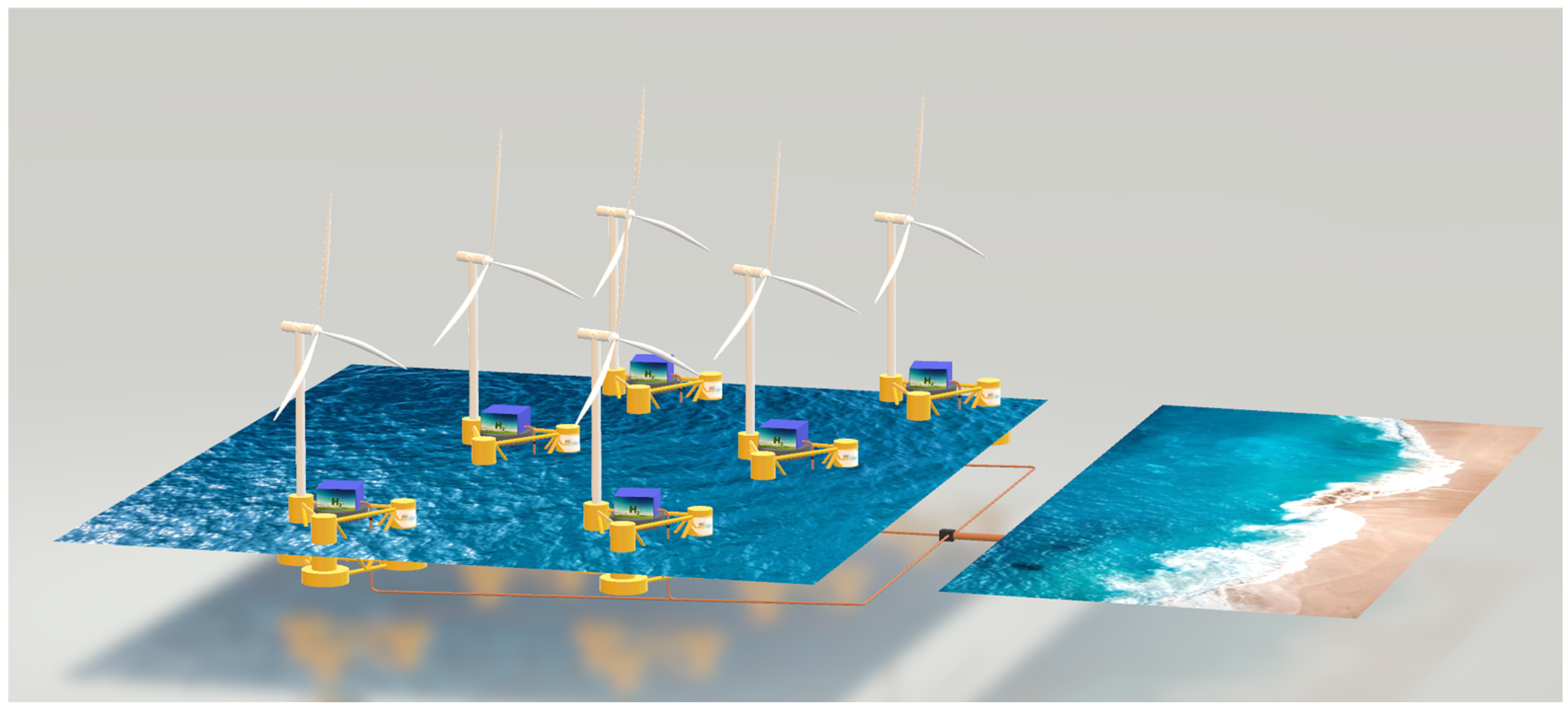

The hydrogen production system is decentralized and is directly installed on the turbine platforms/foundations. Hydrogen is transported from the turbines to a central collection point via small pipelines (shown in brown) and then delivered to shore through a larger “export” pipeline [

37]. This configuration is identified by the acronym ORDH2P (offshore renewable decentralized hydrogen production with pipeline). A simplified schematic of this setup is presented in

Figure 2.

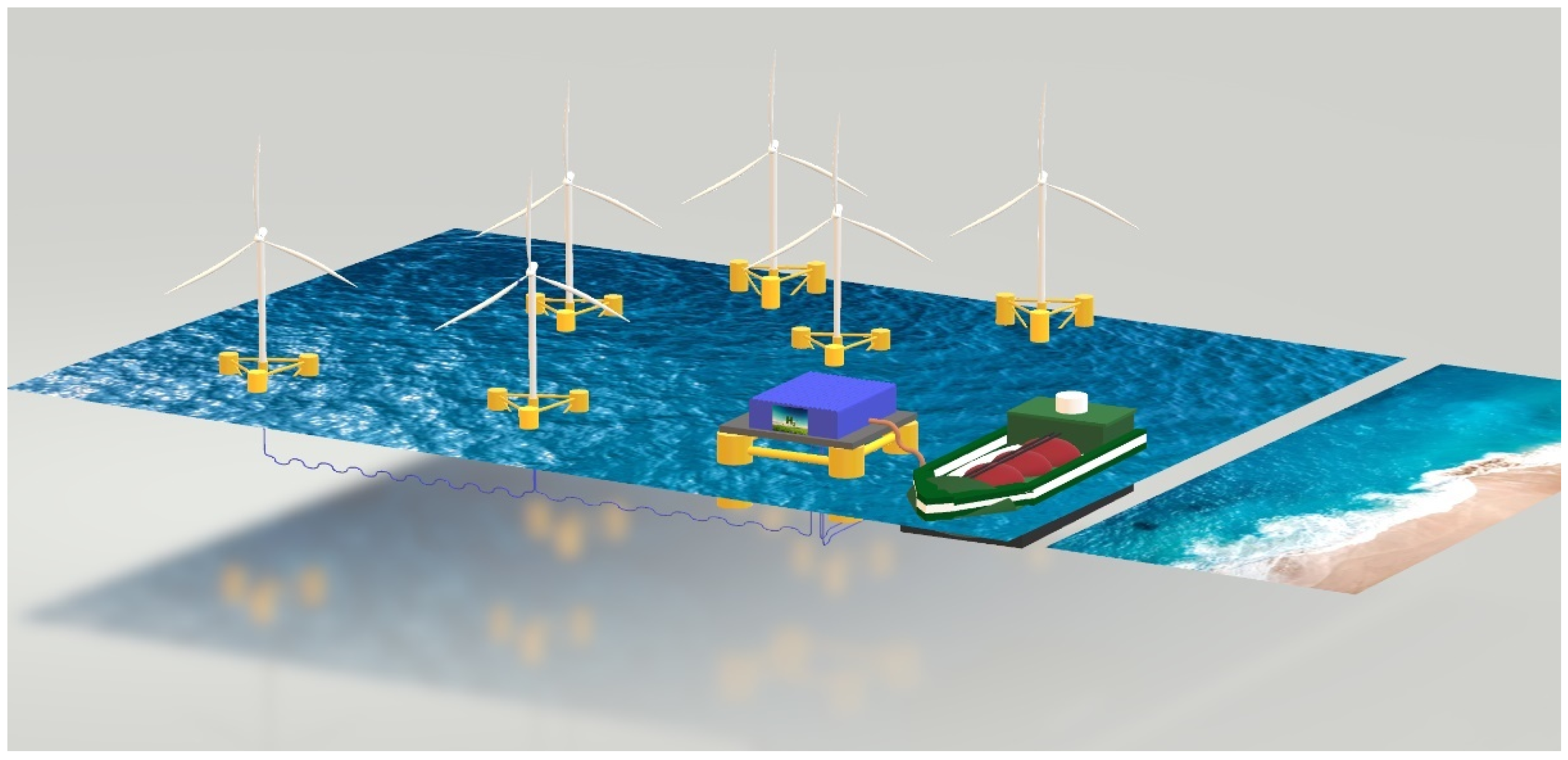

The hydrogen production system is centralised on an offshore platform located near the wind farm. Hydrogen is stored in a tank on this platform, and the configuration is denoted by the acronym ORCH2S [

15]-which stands for offshore renewable centralised hydrogen production with storage. A simplified schematic of this configuration is presented in

Figure 3, where the ship illustrates one possible transportation method, although it is not included in the techno-economic analysis.

The main components considered for the techno-economic evaluations in the three configurations are reported in

Table 1.

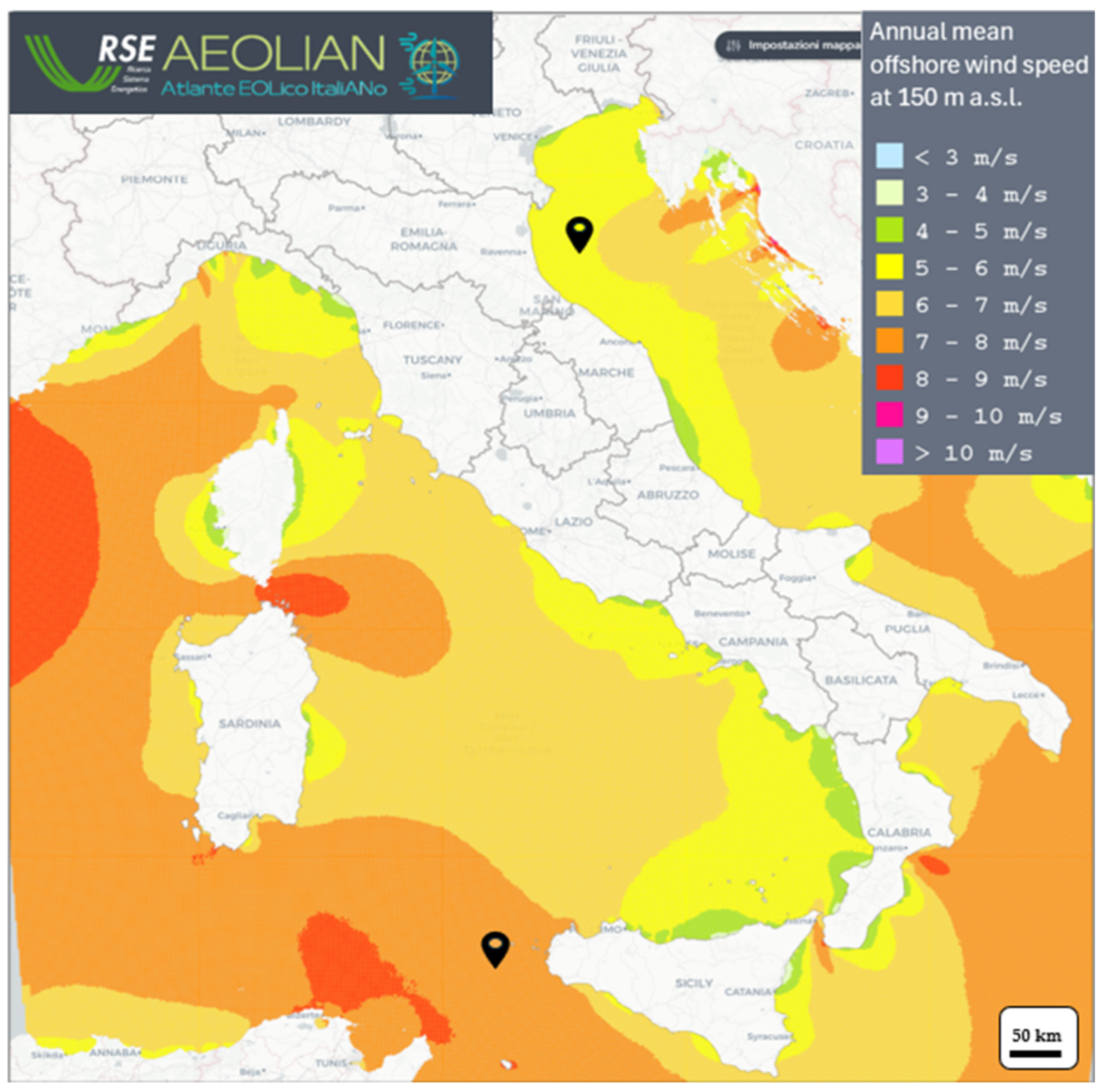

2.2. Case Studies

To conduct the initial techno-economic evaluations of offshore hydrogen production, two offshore wind sites representing different contexts in Italy were selected. These sites, located off the coast of the Sicily and Emilia-Romagna Regions, are shown in

Figure 4, along with a map of the annual average wind speed at 150 m above sea level (a.s.l.) extracted from AEOLIAN, the wind atlas of Italy developed by RSE [

38].

The selection of these sites is driven by the presence of several advanced offshore wind project proposals in these areas. Western Sicily stands out due to the exceptionally high number of connection requests, totalling 82 GW, making it particularly attractive for offshore wind development thanks to its strong wind resources and relatively moderate water depths (200–500 m). In contrast, the Emilia-Romagna case study is set in an area where a hybrid offshore project is currently in the pipeline. This project includes the installation of a bottom-fixed offshore wind farm, an offshore photovoltaic park, hydrogen production, and energy storage.

The specific characteristics of the two sites are reported in

Table 2. In particular, the wind speed reported is the average annual mean speed at 150 m a.s.l., which corresponds to the hub height of the turbine used in the analyses, i.e., the IEA-15-240-RWT [

39].

The Sicily site is characterised by high wind potential and a significant distance from the coast. Additionally, due to the presence of deep waters, floating wind technology—specifically with a semi-submersible platform design—has been considered. The Emilia-Romagna site, by contrast, features lower wind potential but benefits from a shorter distance to the coast and shallow waters. Consequently, fixed-bottom wind turbines, specifically of the monopile type, have been considered. Furthermore, on this site, there are already offshore extraction platforms at the end of their life, which are assumed to be reused for the installation of the hydrogen production system.

2.3. Models

Regarding economic models, LCOE and LCOH have been used. Due to the high uncertainty of the input parameters, a simplified version of these parameters, indicated as sLCOE [

40,

41] and sLCOH [

5,

42], has also been used. These are often employed in comparative analyses on performance and costs with the same financing approach. sLCOE and sLCOH are defined by the following equations:

In Equations (1) and (2), CAPEX represents the capital expenditure for the plant (w for wind farm and e for electrolyser), OPEX the operating expenditure (w for wind farm and e for electrolyser), Eprod the average annual energy produced by the wind farm, and H2prod the amount of hydrogen produced by the respective plants, and n the duration in years of the plant’s useful life. Due to the early stage of the sectors considered in this study, the OPEX are addressed as a percentage of CAPEX and expressed in Equations (1) and (2) with the same units.

In these “simplified” parameters, the financial part is considered through the capital recovery factor (CRF), given by the ratio between the fixed annuity and the present value at which this annuity is received over a certain period. In this type of evaluation, CRF is calculated based on the weighted average cost of capital (WACC). In the present study WACC is the same for wind farm and electrolyser, supposing that both are part of a unique offshore plant with common investors and common owner. However, this simplified approach has certain limitations. It assumes a fixed annual OPEX due to limited data availability and considers a constant cost of capital with a fixed CRF.

Moreover, as highlighted by Idel in [

43], LCOE and LCOH do not reflect the costs associated with renewable energy intermittency, as they do not account for the actual electricity/hydrogen supplied to a specific location at a given time but rather refer to a lifetime average.

Finally, it is noted that the connection between the two formulas consists in the fact that the cost of electricity (LCOE) constitutes the predominant part of the OPEXe [

44].

2.4. Technological Aspects

2.4.1. Wind Farm

In continuity with the case studies already addressed in previous research activities [

40,

45], and in agreement with the experts engaged in Task 49 of the International Energy Agency (IEA) Wind Energy Technology Collaboration Programme [

46], the current reference floating OWF consists of 67 turbines of 15 MW each. The same wind farm is considered in the case of fixed foundation wind farm.

The energy production of the OWF has been calculated from hourly wind speed data at hub height from AEOLIAN using the turbine power curve [

47] over a ten-year dataset (2010–2019). The gross annual energy production (GAEP) has been obtained through the average of the yearly productions [

45]. To calculate the net annual energy production (NAEP), the overall losses, estimated at circa 7.5% for an optimal array layout [

34] mainly due to aerodynamic losses and turbine unavailability due to failures, are subtracted to GAEP. In the centralised configurations also the electrical losses of intra-array cables are considered. The overall losses are increased by a conservative average value of 0.5% based on previous authors’ evaluations. The wind farm useful life is assumed to be 30 years [

45].

2.4.2. Electrolyser, Transport and Storage System

The PEM electrolyser technology has been chosen in the present study. This technology, thanks to the electrolyte made of solid polymers, is more compact, with lower ohmic losses, better efficiency at partial loads (high flexibility), and the ability to operate at higher pressures [

40]. The current energy efficiency is between 50 and 68% [

48]. In the same report is indicated that in 2050 energy efficiency can reach a maximum of 80%. A simplified approach has been applied to express electrolyser performances based on average yearly values.

For the techno-economic evaluations the following assumption have been made for the PEMEL:

An efficiency value of 75%, equal to 22.5 kg/MWh or 44.4 kWh/kg,

A specific production of 4000 equivalent hours (annual hours of plant operation at maximum power),

A useful life of 30 years,

One complete replacement of the electrolyser stacks during the useful life,

The replacement of the stacks occurs at present every ten years or certain number of operating hours, but the chosen value represents more performant future stacks [

49],

The average consumption of fresh water corresponds to about 9 L per kg of hydrogen produced,

The system is considered equipped with a desalination plant,

To transport the hydrogen produced offshore to the mainland underwater pipelines have been considered.

The main issues regarding hydrogen transport in pipelines are related to diffusion losses and pipeline embrittlement. Regarding maintenance, periodic cleaning is planned, and in case of breakage, the repair cost is high. To contain hydrogen leaks towards the outside in the pipelines, the operating pressure inside the pipes is limited to 50 bar.

This limitation therefore reduces the cost of compressing the gas at the time of production, given that the PEMEL considered in this study already has an outlet pressure of the produced hydrogen at similar levels [

49]. If decentralised hydrogen production is considered (ORDH2C), in the case of floating platforms, flexible pipelines are required.

As an alternative to transport by pipeline, in ORCH2S configuration liquid hydrogen can be stored and possibly transported on land by ship with a technology like that adopted for natural gas. In the case of liquid hydrogen [

50] its high volumetric capacity makes this storage method particularly promising for this type of application. The liquefaction of hydrogen is highly energy-intensive: the specific consumption of this process corresponds to approximately 10 kWh for each kg of H2 [

51]. A further problem relating to the liquefaction of hydrogen is given by the low temperatures required to maintain the liquid state. Maintaining the cryogenic state adds complexity to transportation. In this simplified approach, a detailed model for the storage system has not been considered, although the economic aspects have been included.

2.5. Economic Aspects

2.5.1. Wind Farm

The costs of the main components of a wind farm have been assessed by the authors in previous studies [

34,

40,

45] and are summarised in

Table 3. Electrical substation and export cable costs are not considered because the OWF is fully dedicated to hydrogen production.

2.5.2. Electrolyser, Transport and Storage System

The costs of the main electrolyser and pipeline components considered in the study are reported in

Table 4 together with the source of data. About the cost of the stack substitution, expressed in percentage of the CAPEXe, there is no consensus in the literature data [

49,

52], and therefore, three values, 15%, 30%, and 45%, have been adopted. Regarding the liquefaction and storage system, the costs are expressed as the cost of storage in EUR per kg of hydrogen produced. According to [

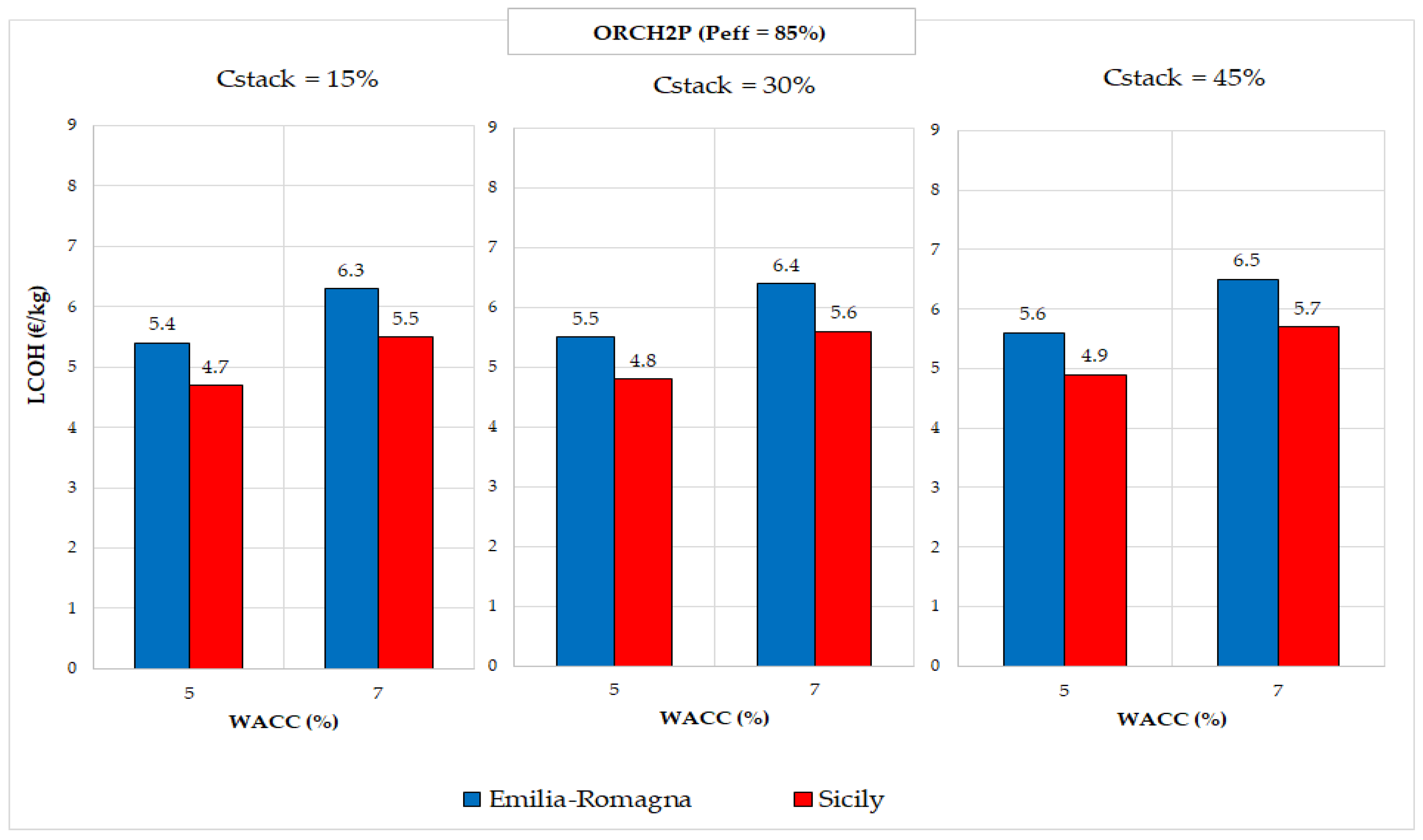

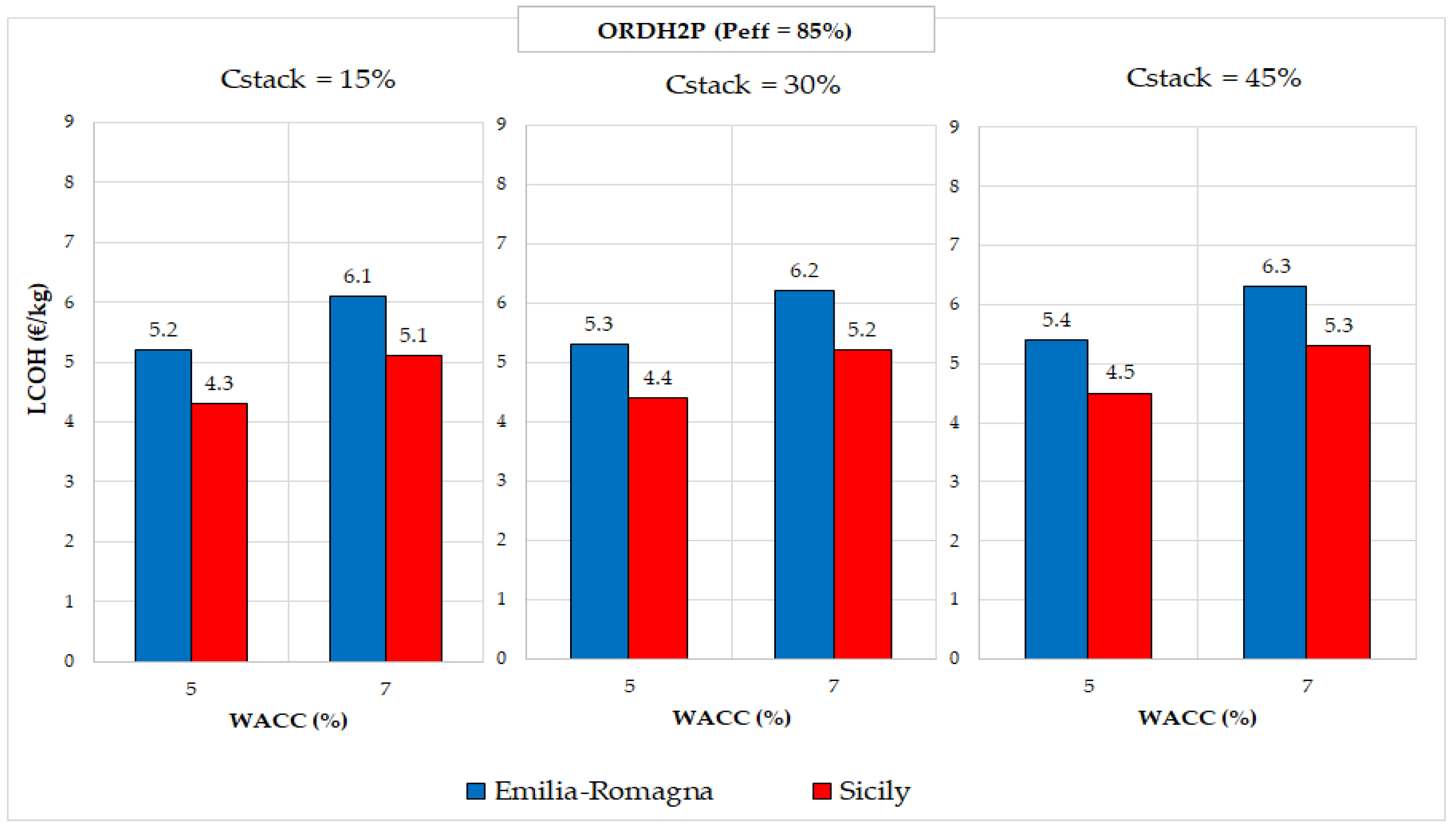

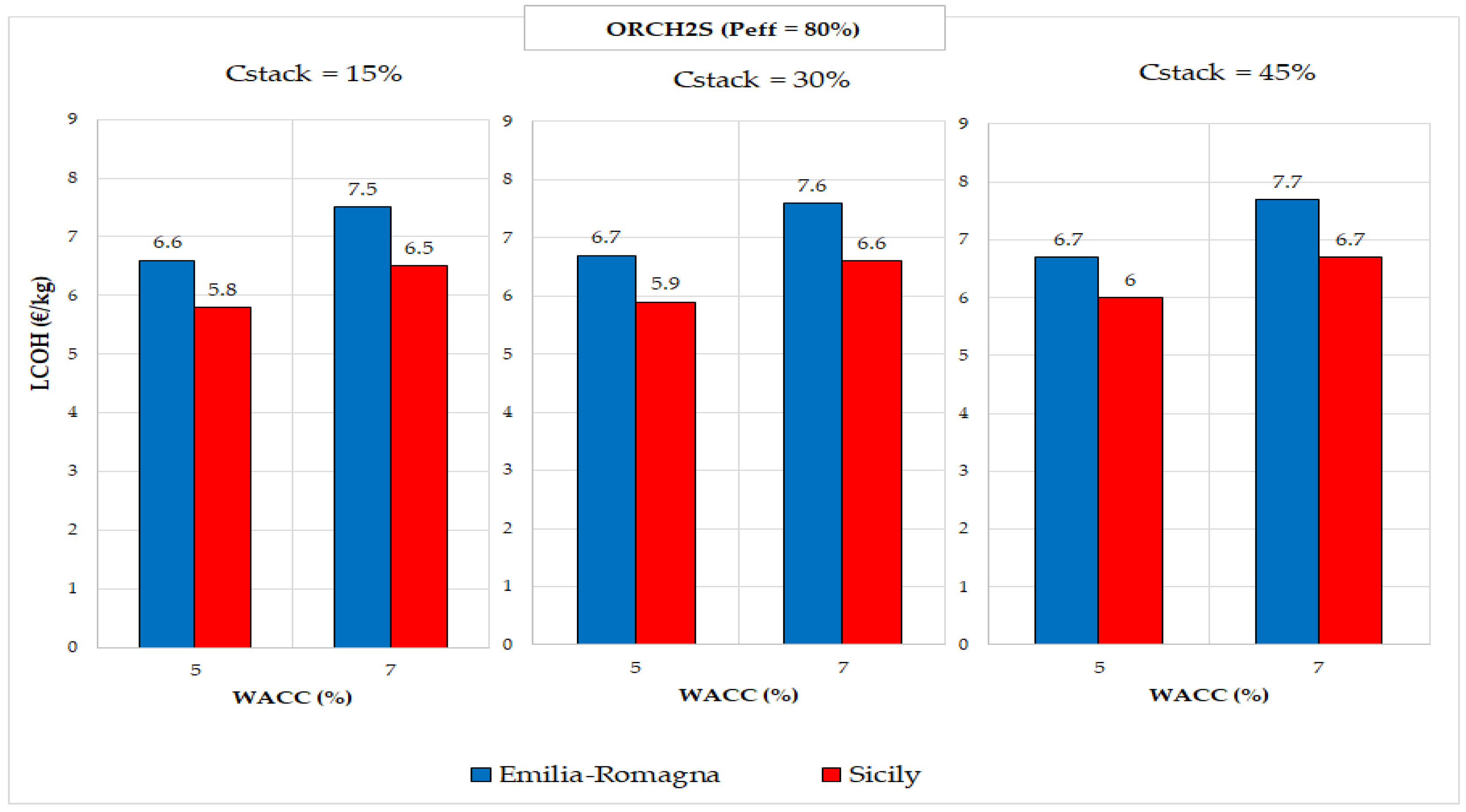

53], the value assumed for a large-scale isolated storage system for storage up to a week duration is in the range 0.05÷0.091 USD/kg, with an additional cost of for liquefaction. In this study, a total indicative value for liquefaction and storage of 0.9 EUR/kg was assumed.

All the costs for the hydrogen system components include installation.

2.6. Assumptions

To conduct technical-economic studies of emerging technologies or in any case not yet widely widespread, assumptions are made regarding the performance and the cost, for which it is not possible to make accurate predictions at the time the studies are carried out.

The first assumption made for the analyses reported here is that the electrolysers can be integrated into offshore structures (floating or not): on the single turbine platform, on the electrical substation platform, on a dedicated offshore platform, reusing an oil and gas extraction platform.

Integration issues were not studied in this study, neither from an engineering point of view, nor in terms of health, safety, performance, and ease of access for maintenance. It would also be necessary to conduct specific studies to understand the influence of the movement dynamics of the floating platform on the various equipment in the water treatment and electrolysis system.

The second assumption pertains to the ability of electrolysers to absorb all wind power not allocated to auxiliary systems. Accordingly, three different effective powers (Peff) were analysed: 75, 80, and 85%. These represent the proportion of wind farm energy specifically dedicated to hydrogen production and are based on the literature data, suggesting efficiencies exceeding 80%.

In the ORDH2S configuration, which includes liquefaction and storage systems, Peff is reduced by an additional 5% (estimated by [

55]). Consequently, the values considered in this case are 70, 75, and 80%. To better assess the efficiency of the system, models capturing the dynamics of the electrolyser and wind energy production on appropriate time scales (minutes) should be employed. Additionally, the potential integration of a wind energy storage system warrants evaluation.

It is important to note that for ORCH2P and ORDH2P configurations, the calculated hydrogen cost pertains to the point where the pipeline reaches the coast. In contrast, for the ORDH2S configuration, where hydrogen is withdrawn offshore by ship, the cost reflects liquefied hydrogen stored offshore. This latter configuration is the least technologically mature and is associated with a longer-term development timeline. Alternative solutions could also be envisioned, such as utilising the ship itself as a hydrogen storage tank or even equipping it with a complete onboard hydrogen production unit.

4. Conclusions

In this paper the methodology and results of a preliminary techno-economic analysis of OWFs dedicated entirely to the production of green hydrogen offshore are presented. Among the technologies considered in this study, floating offshore wind power and large-scale electrolysers (in the hundreds of megawatts range) are still in the process of maturation and commercial deployment.

The key contribution of this research lies in the development of a comprehensive model that accounts for the various factors influencing the cost of green hydrogen production. This model is adaptable to different configurations and case studies, offering valuable insights for future applications. Only a selection of the results of the study carried out by the authors has been reported.

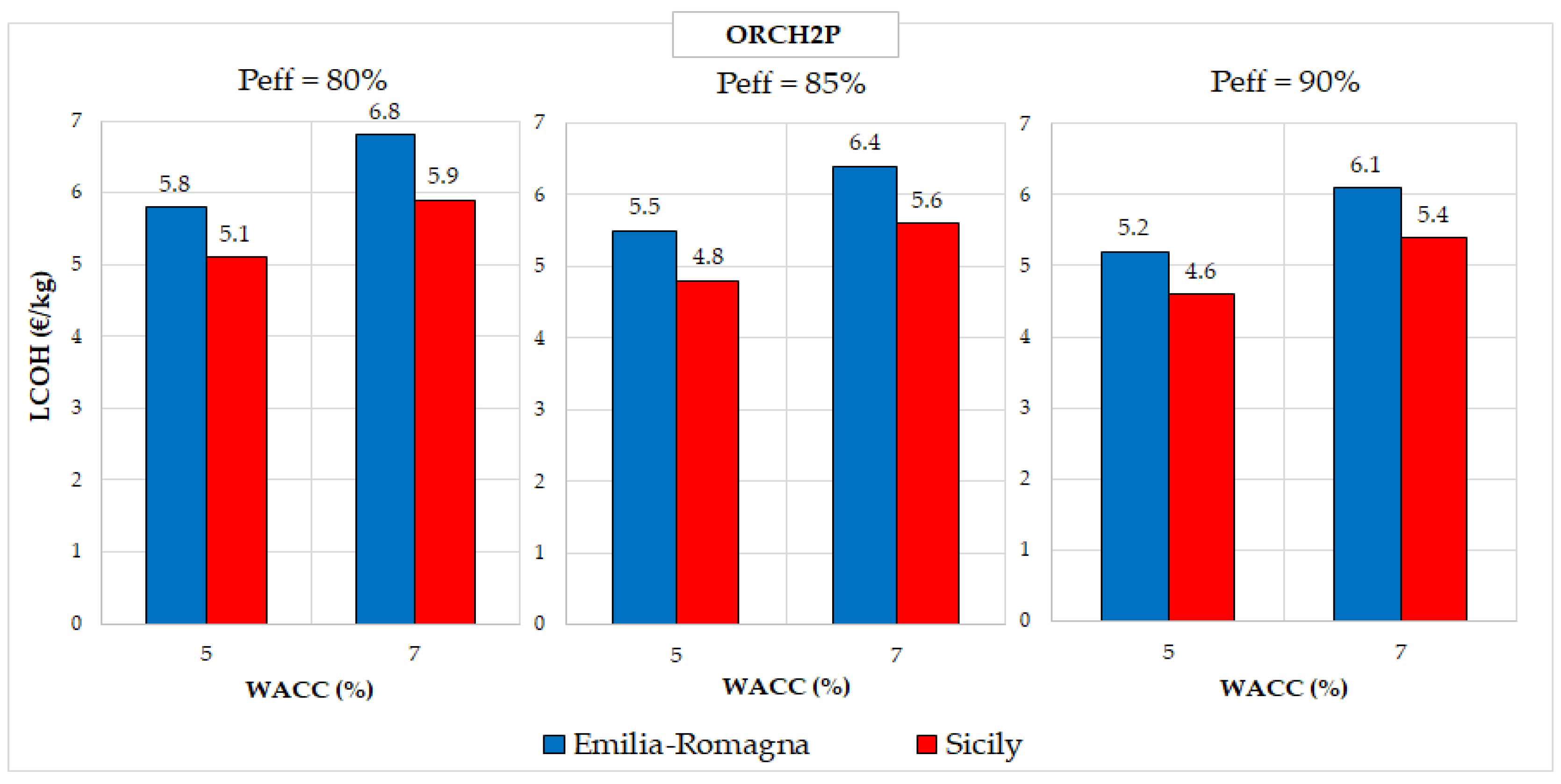

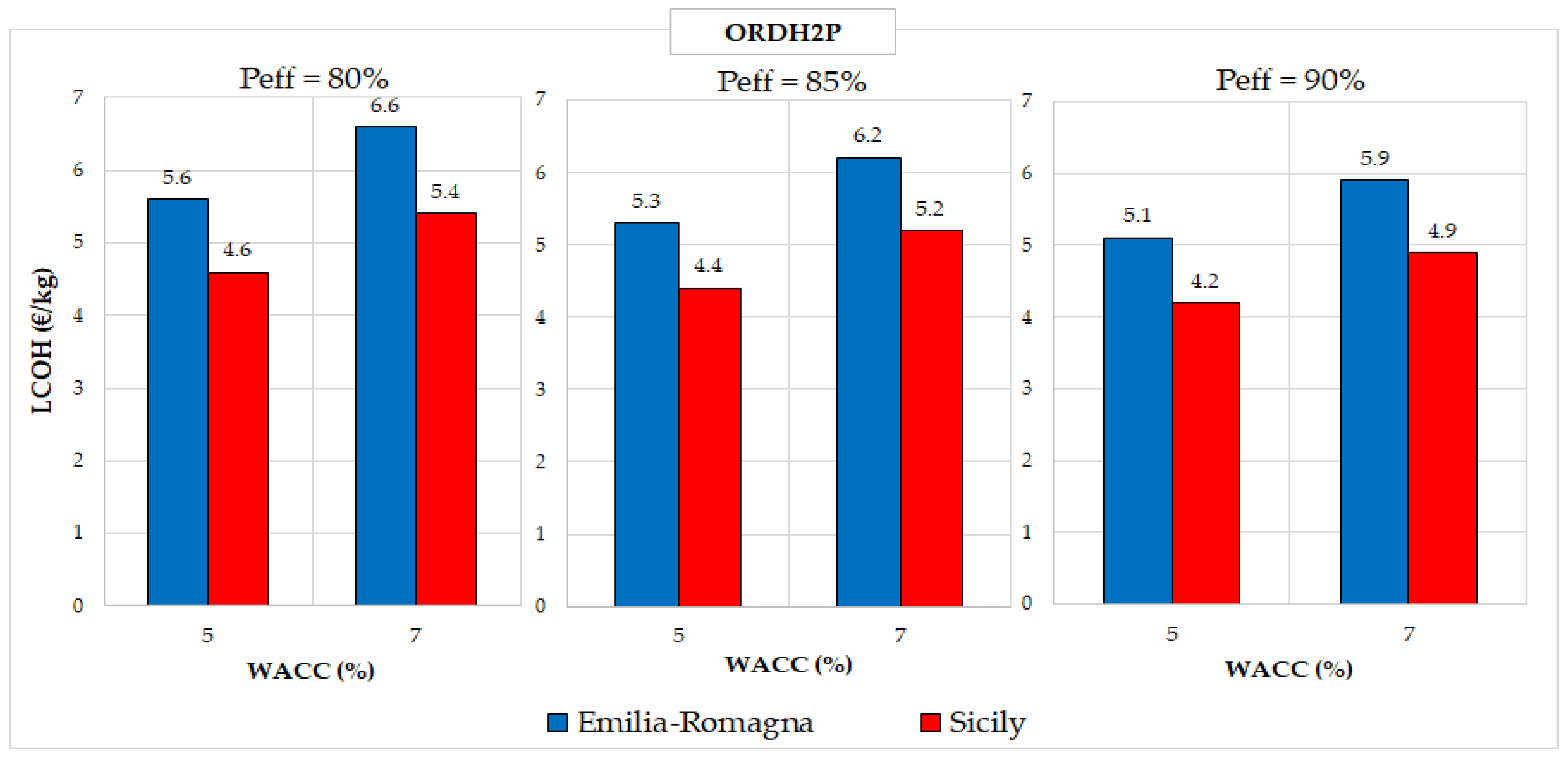

The results for two different offshore sites in Italy sites have been reported, the first one in Sicily with a high wind resource, but almost far from the coast (70 km) and using floating wind turbines, the second one in Emilia-Romagna with a lower wind resource, but closer to the coast (34 km) and using fixed wind turbines. LCOHs range from approximately 4.3 to 6.0 EUR/kg in Sicily and from 5.2 to 6.7 EUR/kg in Emilia-Romagna or WACC equal to 5%. As expected, LCOHs result on average lower in the Sicily case with higher wind resource availability than Emilia-Romagna case, despite the higher specific CAPEX costs of the system in Sicily due to higher distance from shore and water depth. Offshore decentralised configuration presents the lower LCOH; however, the feasibility of the hydrogen production system integrated in a floating wind turbine has still to be demonstrated. The weight of the stack substitution cost on LCOH is of the second order.

Many refinements could be made in the short term, such as those concerning the detailed simulation of systems at time scales of less than an hour for performance evaluation. Moreover, to have reliable cost data, it is probably necessary to wait for the development and diffusion of technologies in large sizes and large scales. An important next step to this work would be to evaluate different remuneration and possibly incentive systems.

As noted, this study evaluates the costs and performance of large-scale systems within a future commercial deployment scenario. While uncertainties remain regarding the performance and costs of such systems—mainly derived from the literature due to the limited offshore experience—the results for energy and hydrogen costs align well with findings from other sector studies. Producing green hydrogen from dedicated offshore wind farms is an exciting pathway toward a sustainable energy future. However, the realisation of this potential requires sustained innovation, technological advancements, and supportive policies. A concerted effort from researchers, industry stakeholders, and governments is essential to overcome the challenges and unlock the full potential of offshore green hydrogen production.

It is believed that the preliminary results here reported, along with similar research on emerging technologies, can provide valuable support to stakeholders across various sectors and assist decision makers at multiple levels.